As filed with the Securities and Exchange Commission on October 18, 2013

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

NIMBLE STORAGE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3572 | 26-1418899 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2740 Zanker Road

San Jose, California 95134

(408) 432-9600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Suresh Vasudevan

Chief Executive Officer

Nimble Storage, Inc.

2740 Zanker Road

San Jose, California 95134

(408) 432-9600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Gordon K. Davidson, Esq. Jeffrey R. Vetter, Esq. Mark A. Leahy, Esq. Fenwick & West LLP 801 California Street Mountain View, CA 94041 (650) 988-8500 |

Aparna Bawa, Esq. General Counsel Nimble Storage, Inc. 2740 Zanker Road San Jose, California 95134 (408) 432-9600 |

Jeffrey D. Saper, Esq. Allison B. Spinner, Esq. Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, CA 94304 (650) 493-9300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1)(2) |

Amount of Registration Fee | ||

| Common stock, $0.001 par value per share |

$150,000,000 | $19,320 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes the offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject To Completion. Dated October 18, 2013.

Shares

Common Stock

This is an initial public offering of shares of common stock of Nimble Storage, Inc.

Nimble Storage is offering of the shares to be sold in the offering.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . Nimble Storage intends to list the common stock on the New York Stock Exchange under the symbol “NMBL”.

We are an “emerging growth company” as defined under federal securities laws. See “Risk Factors” on page 13 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to Nimble Storage |

$ | $ | ||||||

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares from Nimble Storage at the initial public offering price less the underwriting discounts and commissions.

The underwriters expect to deliver the shares against payment in New York, New York on , 2013.

| Goldman, Sachs & Co. | Morgan Stanley |

| Pacific Crest Securities |

William Blair | Stifel | Oppenheimer & Co. | Needham & Company |

Prospectus dated , 2013

| Page | ||||

| 1 | ||||

| 13 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 43 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

45 | |||

| 82 | ||||

| 99 | ||||

| 107 | ||||

| 119 | ||||

| 123 | ||||

| 126 | ||||

| 132 | ||||

| Material U.S. Federal Income Tax Considerations to Non-U.S. Holders |

135 | |||

| 140 | ||||

| 144 | ||||

| 144 | ||||

| 144 | ||||

| F-1 | ||||

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Through and including , 2013 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Persons who come into possession of this prospectus and any applicable free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

i

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before making an investment in our common stock. You should carefully consider, among other things, our consolidated financial statements and the related notes and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

Nimble Storage, Inc.

Overview

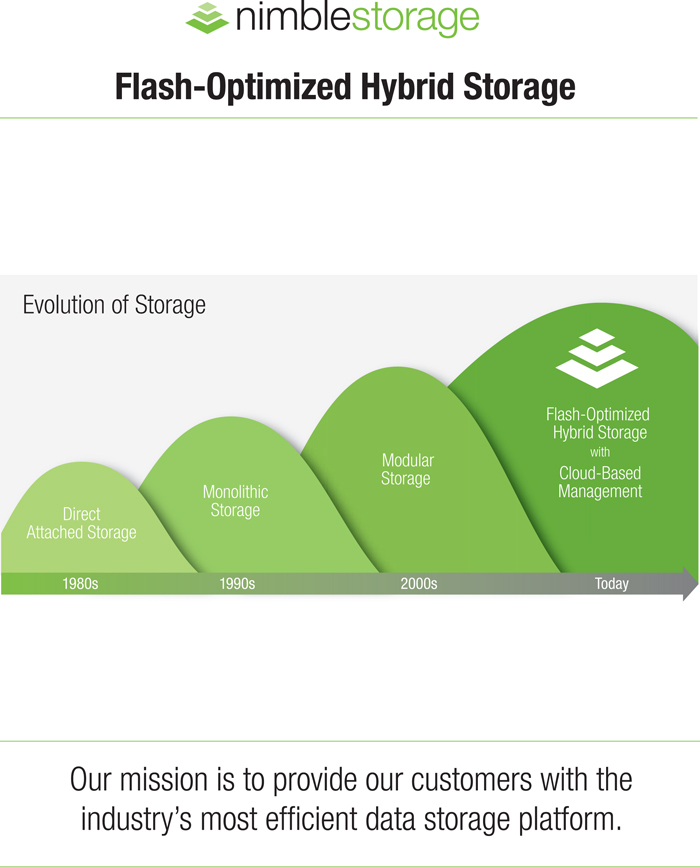

Our mission is to provide our customers with the industry’s most efficient data storage platform. We have designed and sell a flash-optimized hybrid storage platform that we believe is disrupting the market by enabling significant improvements in application performance and storage capacity with superior data protection, while simplifying business operations and lowering costs. At the core of our innovative platform is our Cache-Accelerated Sequential Layout file system software, which we call our CASL technology, and our cloud-based storage management and support service, InfoSight.

Enterprises and cloud-based service providers today are overwhelmed by numerous storage challenges including increasing costs, capacity and performance tradeoffs, management complexity and data protection issues. These challenges have been exacerbated by key trends in the data center: the rapid proliferation of applications with varying performance requirements, increased use of virtualization and the exponential growth in data. Over the last several years, major technological advancements have been made in flash storage media and data analytics, but traditional storage system providers have been unable to fully capture these improvements into system performance and efficiency at reasonable cost. We believe that a fundamental change to the software architecture underlying storage systems is required to fully take advantage of these advancements.

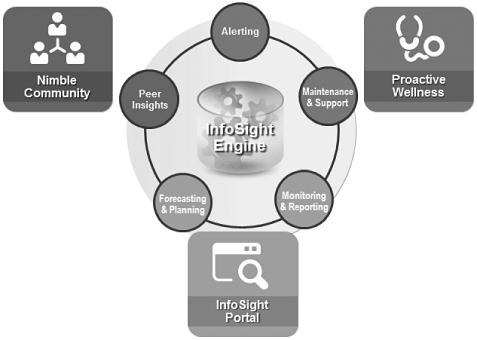

Our team is comprised of storage and software experts who recognized the opportunity to develop a platform that would transform the industry. We have built our platform from the ground up, starting with a fundamentally new file system software that takes advantage of the high performance characteristics of flash memory and the capacity and low cost of disk. Our platform’s key benefits include high performance and high capacity efficiency, superior data protection and simplified storage lifecycle management. In addition, CASL’s scale-to-fit flexibility enables non-disruptive and independent scaling of performance and capacity. We enable a new approach to storage infrastructure management by leveraging advances in data analytics. InfoSight takes advantage of deep-data analytics and other capabilities embedded across our platform to proactively monitor the health, capacity and performance of customer systems, and provide real-time operational insights to us and our end-customers.

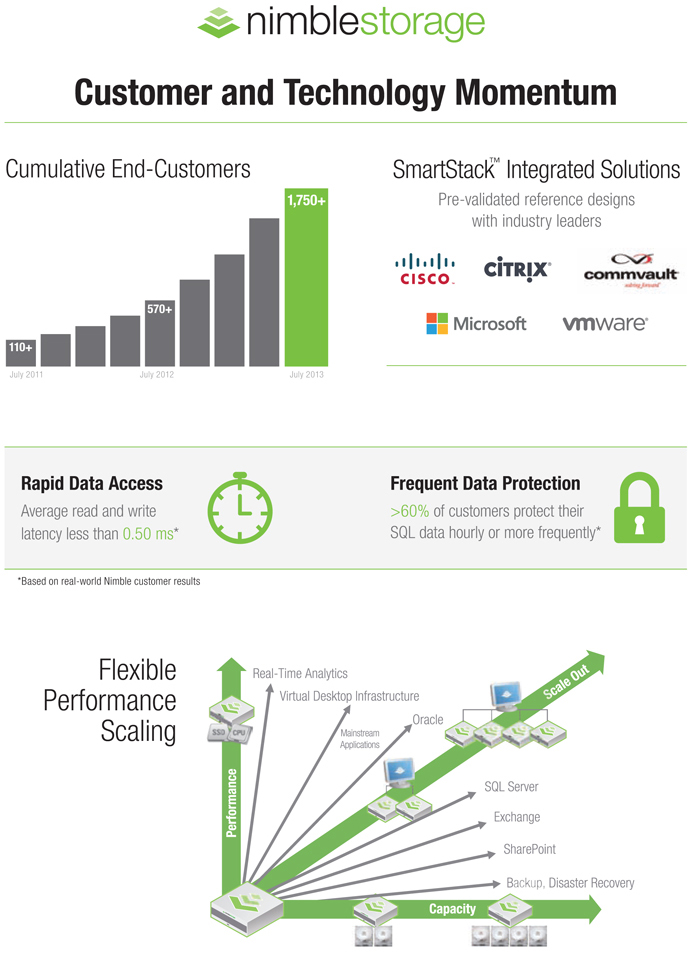

We serve a broad array of enterprises and cloud-based service providers, and our software and storage systems effectively handle mainstream applications, including virtual desktops, databases, email, collaboration and analytics. Since shipping our first product in August 2010, our end-customer base has grown rapidly. We had over 40, 270 and 1,090 end-customers as of January 31, 2011, 2012 and 2013 and, as of July 31, 2013, we had over 1,750 end-customers. Our end-customers span a range of industries such as cloud-based service providers, education, financial services, healthcare, manufacturing, state and local government and technology.

1

We sell our products through our network of value added resellers and distributors, and also engage our end-customers through our global sales force. As of July 31, 2011, 2012 and 2013, we had over 70, 220 and 600 value added resellers that offered our solutions worldwide. Additionally, we leverage our “land and expand” business model to sell additional products to our existing end-customers. For example, in the three months ended July 31, 2011, 2012 and 2013, approximately 19%, 22% and 28% of the dollar amount of orders received was from existing end-customers. As of July 31, 2013, the top 25 of our 117 end-customers that have been with us for at least two years, on average, made additional purchases that were approximately three times the initial dollar purchase amount in the two years following the initial sale.

We have experienced significant growth in recent periods with total revenue of $1.7 million, $14.0 million, $53.8 million and $50.6 million in the years ended January 31, 2011, 2012 and 2013 and the six months ended July 31, 2013. Our net loss was $6.8 million, $16.8 million, $27.9 million and $19.8 million in the years ended January 31, 2011, 2012 and 2013 and the six months ended July 31, 2013. As our sales and customer base have grown, we have also experienced growth in our deferred revenue from $2.0 million as of January 31, 2012 to $10.9 million as of January 31, 2013 and to $19.9 million as of July 31, 2013. Our gross margin has improved from approximately 55% for the year ended January 31, 2012 to 62% for the year ended January 31, 2013 and to 63% for the six months ended July 31, 2013. As a percentage of total revenue, our operating expenses have declined from 175% for the year ended January 31, 2012 to 114% for the year ended January 31, 2013 and to 101% for the six months ended July 31, 2013.

Industry Background

Data has become a key strategic resource for modern businesses and consequently, data storage has become a mission-critical element of IT infrastructure. IDC estimates that enterprises will spend approximately $42.5 billion worldwide on data storage systems in 2017, while Gartner estimates an additional $21.3 billion in worldwide spend on storage software in 2017. To maximize the benefits from investments in data storage infrastructure and applications, enterprises and cloud-based service providers generally require data storage systems that provide cost-effective storage capacity, high performance, comprehensive data protection, optimized footprint and cost of operations, and simplified management. These requirements have become increasingly difficult to address through traditional storage systems, particularly with the recent changes within enterprise and cloud-based service provider data centers. Specifically, the rapid adoption of virtualization technologies, proliferation of a diverse set of applications and enormous increase in the amount of data gathered and analyzed by organizations are resulting in substantially greater challenges for storage infrastructure than ever before.

Current storage products remain inadequate for meeting the broad demands of modern enterprises and cloud-based service providers due to the following limitations:

Existing Storage System Architectures Use File Systems that Are Not Optimized for Today’s Storage Demands and Available Technology. File system software is the foundation of the enterprise storage system. File systems define the manner in which data is laid out on the underlying storage media, which in turn governs the performance, capacity, scalability and management functionality of the storage system. Traditional storage architectures relied on hard disk drives as the only underlying storage medium, and their file systems were designed using a basic approach of mapping application data to locations on hard disk drives. However, over the last decade, hard disk drive performance has not kept up with server compute performance improvements, resulting in ever-slower storage system read and write performance. This problem has become even more acute with the rapid adoption of virtualization. To meet application performance requirements, traditional

2

storage systems have had to resort to significant over-provisioning of hard disk drives, which results in only modest performance improvements, inefficiently using storage capacity and increasing total cost.

Existing “Hybrid” Architectures Do Not Efficiently Utilize Flash Technology. To improve input/output, or I/O, performance, some storage vendors have simply “bolted on” flash to existing hard disk drive-based systems, an approach that does not optimize for the unique characteristics of flash. These “hybrid” systems generally require over-provisioning of flash, are complex to manage and typically require more expensive high-endurance flash, all of which significantly increase total cost.

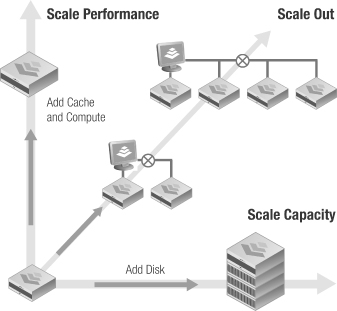

Scaling Limitations. Traditional storage systems are limited in their ability to cost-effectively scale capacity, performance or both as storage user needs evolve. “Scale-up” architectures typically do not allow the aggregation or sharing of resources or the management of multiple systems in a unified manner. An alternative “scale-out” model, which can aggregate individual systems into one clustered, multi-node system, generally forces IT departments to scale both capacity and performance even if only one is required.

Inadequate Data Protection. Traditional approaches to data backup are time-intensive and as a result, most enterprises typically take only one backup per day, risking substantial data loss in the event of a storage system failure. In addition, today’s remote replication solutions consume a significant amount of expensive network bandwidth, forcing enterprises to replicate only a small portion of their data for disaster recovery and rely on off-site tape copies to protect the rest.

Operational Complexity. Existing storage systems are complex and time consuming to manage, resulting in high operating costs. With legacy storage systems, IT departments can be challenged to identify and address root causes of problems and have difficulty predicting future performance and capacity demands and preventing future service disruptions.

Opportunity for a Next Generation Storage Platform

Enterprises and cloud-based service providers today are overwhelmed by the growing inefficiency, cost and complexity of storage. However, recent technology advances such as the emergence of high performance flash storage media, cloud-based monitoring capabilities and predictive data analytics software have created a unique opportunity to fundamentally disrupt the storage market and significantly improve storage system capabilities. Our innovative platform, built on software designed from the ground up, leverages the strengths of both flash and disk to provide transformative benefits in application performance and data protection while simplifying business operations.

We believe we have a significant market opportunity. According to IDC, the worldwide market for storage systems with a cost greater than $15,000 is $23.5 billion in 2013 and growing to approximately $28.0 billion in 2017. Gartner estimates the worldwide market for software in Core Storage Management, Data Replication and Device Resource Management to be an additional $6.3 billion in 2013 and up to $7.9 billion in 2017. We believe the combination represents our addressable markets.

Our Solution

Our team of storage and software technology experts built our flash-optimized hybrid storage platform to leverage the strengths of both flash and disk and to simplify business operations. We believe our key technological differentiator is the software that underlies our disruptive CASL file system and our cloud-based InfoSight service. CASL enables our platform to deliver high performance and capacity efficiency with integrated data protection. InfoSight transforms storage lifecycle management, enabling us and our end-customers to manage and support their storage infrastructure from the cloud.

3

The key benefits of our platform include:

Enhanced Performance and High Capacity Efficiency. CASL optimizes storage system performance and capacity by collecting random write I/Os and writing them as large coalesced sequential I/Os to low-cost hard disk drives. This allows us to effectively accelerate the write performance of a low-cost disk. For read performance, CASL caches copies of active data into flash-based solid state drives, so I/Os can be delivered in real time. The use of flash as a read cache is much more efficient since it eliminates the need for redundant provisioning of extra flash to protect against loss of data. Further, CASL enables all data stored on flash and on hard disk drives to be compressed in real time, further lowering costs. In total, CASL enables us to deliver significantly better performance with far less hardware and at lower cost than traditional solutions.

Flexible “Scale-to-Fit” Capability. Our systems have a modular architecture that allows our end-customers to “scale-to-fit” system performance, capacity or both by adding compute, flash or hard disk drives as needed in small, discrete increments. This allows our systems to scale cost effectively. For demanding environments, our systems enable scaling of both performance and capacity beyond a single system by combining multiple systems into scale-out storage clusters.

Superior Data Protection. Our platform enables our end-customers to take thousands of point-in-time snapshots without impacting system performance or consuming a large amount of space. Consequently, when they encounter accidental deletions, database corruptions or other logical failures, the amount of data at risk is significantly less than with traditional data protection approaches. In addition, there is no need to copy data between primary and backup storage, resulting in materially faster recovery times and significantly higher application availability. To mitigate physical failures, our platform replicates data between systems by transferring only compressed block-level changes, making disaster recovery easy and affordable.

Innovative Cloud-Enabled, Multi-Tenant Storage Lifecycle Management. Built on powerful deep-data analytics, InfoSight monitors systems deployed across our end-customer base from the cloud to deliver a complete and insightful perspective of the overall health of our storage systems at individual end-customers and across our end-customer community. We believe InfoSight also provides an unmatched level of proactive support with alerts, comprehensive dashboard views, capacity forecasting and performance planning, enabling our end-customers to significantly reduce the time they have to invest in managing their storage infrastructure.

Our Strategy

Our growth strategies include the following:

Extend Our Technology Leadership. We intend to extend our technology leadership by continuing to innovate and investing in research and development to expand the breadth of our platform into additional markets and deliver more cloud-based management services.

Drive Greater Penetration into Our Installed Base of End-Customers. Our large installed base of end-customers provides us a strong foundation in which to drive incremental sales through our “land and expand” model. We plan to continue to assist our end-customers to migrate additional workloads and applications to our storage platform. We also plan to continue to use InfoSight’s predictive capabilities to help our end-customers identify potential expansion needs in their storage environments, thereby driving greater sales of our systems.

4

Expand and Deepen Our Channel Presence to Accelerate New End-Customer Acquisition. We have carefully and systematically cultivated a strong channel partner network that has been a key contributor to our rapid customer growth. We intend to grow and deepen our value added reseller network and expand our channel model across a broad range of industries and geographies to increase our rate of new end-customer acquisition.

Continue to Build Our Sales Organization to Fuel Our Growth and Acquire New End-Customers. We will continue to expand our sales organization with additional teams focused on field sales, enterprise, government, and our channel partners. We also believe we have significant opportunities for international expansion and are continuing to invest in key markets.

Expand Our Integration with Alliance Partners. We have invested heavily in our SmartStack reference architecture initiative and have been focused on improving integration with industry-leading applications, hypervisors and servers from Cisco Systems, Inc., Citrix Systems, Inc., CommVault Systems, Inc., Microsoft Corporation and VMware, Inc. to make it easier to deploy our storage systems. We intend to continue to develop SmartStack solutions with our existing technology partners, as well as invest in new alliance relationships.

Risks Affecting Us

Our business is subject to numerous risks and uncertainties, including those highlighted in the section entitled “Risk Factors” immediately following this prospectus summary. These risks include, but are not limited to, the following:

| Ÿ | We have a history of losses and we may not be able to achieve or maintain profitability; |

| Ÿ | Our limited operating history makes it difficult to evaluate our current business and future prospects; |

| Ÿ | If the market for storage products does not grow as we anticipate, our revenue may not grow; |

| Ÿ | Our revenue growth rate in recent periods may not be indicative of our future performance; |

| Ÿ | Our quarterly operating results may fluctuate significantly; |

| Ÿ | We have limited visibility into future sales; |

| Ÿ | Adverse economic conditions or reduced IT spending may adversely impact our business; |

| Ÿ | We are dependent on a small number of product lines; |

| Ÿ | If our products have defects, failures occur or end-customer data is lost or corrupted, our reputation and business could be harmed; |

| Ÿ | We receive a substantial portion of our total revenue from a limited number of channel partners; |

| Ÿ | We face intense competition in our market, especially from larger, well-established companies; |

| Ÿ | We rely on a limited number of suppliers; |

| Ÿ | We depend on third-party manufacturers to build our products; and |

| Ÿ | Our directors, officers and principal stockholders will beneficially own approximately % of our outstanding stock after this offering and therefore will have the ability, acting together, to determine the outcome of all matters requiring stockholder approval. |

See “Risk Factors” beginning on page 13.

5

Corporate Information

We were incorporated in November 2007 as Nimble Storage, Inc., a Delaware corporation. Our principal executive offices are located at 2740 Zanker Road, San Jose, California 95134, and our telephone number is (408) 432-9600. Our website address is www.nimblestorage.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus. Unless the context indicates otherwise, as used in this prospectus, the terms “Nimble Storage,” “we,” “us” and “our” refer to Nimble Storage, Inc., a Delaware corporation, and its subsidiaries taken as a whole. We have registered the trademark Nimble Storage in the United States, the European Union and Japan and we have a pending trademark application for the trademark Nimble Storage in other jurisdictions. We have registered the trademark CASL in the United States and the European Union. We also have pending trademark applications for the trademark InfoSight in the United States and the European Union and for NimbleConnect in the United States. The “Nimble Storage” logo, SmartStack and certain product names contained in this prospectus are our common law trademarks. This prospectus contains additional trade names, trademarks and service marks of other companies that are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

JOBS Act

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We will remain an emerging growth company until the earlier of the last day of the fiscal year following the fifth anniversary of the completion of this offering, the last day of the fiscal year in which we have total annual gross revenue of at least $1.0 billion, the date on which we are deemed to be a large accelerated filer (this means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the end of the second quarter of that fiscal year), or the date on which we have issued more than $1.0 billion in nonconvertible debt securities during the prior three-year period.

In addition, the JOBS Act provides that an emerging growth company can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

6

THE OFFERING

| Shares of common stock offered by us |

shares |

| Over-allotment option to be offered by us |

shares |

| Shares of common stock to be outstanding immediately after this offering |

shares ( shares if the over-allotment option is exercised in full) |

| Use of proceeds |

We intend to use the net proceeds that we receive in this offering for working capital and other general corporate purposes. We may use a portion of the proceeds to acquire other complementary businesses or technologies. See “Use of Proceeds.” |

| Risk factors |

You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| Proposed New York Stock Exchange symbol |

“NMBL” |

The number of shares of our common stock to be outstanding after this offering is based on 61,835,683 shares of our common stock outstanding as of July 31, 2013, and excludes:

| Ÿ | 15,452,223 shares of common stock issuable upon the exercise of options outstanding as of July 31, 2013, with a weighted-average exercise price of $2.37 per share; |

| Ÿ | 75,000 shares of common stock issuable upon vesting of restricted stock units outstanding as of July 31, 2013; |

| Ÿ | 1,895,600 shares of common stock issuable upon the exercise of options granted after July 31, 2013, with a weighted-average exercise price of $7.49 per share; |

| Ÿ | 115,000 shares of common stock issuable upon vesting of restricted stock units granted after July 31, 2013; and |

| Ÿ | shares of common stock reserved for future issuance under our stock-based compensation plans as of July 31, 2013, consisting of (a) 3,117,888 shares of common stock reserved for future issuance under our 2008 Equity Incentive Plan (including the options to purchase shares of our common stock and shares of common stock issuable upon vesting of restricted stock units granted after July 31, 2013), (b) shares of common stock reserved for future issuance under our 2013 Equity Incentive Plan, which will become effective on the date immediately prior to the date of this prospectus, and (c) shares of common stock reserved for future issuance under our 2013 Employee Stock Purchase Plan, which will become effective on the date of this prospectus. Upon completion of this offering, any remaining shares available for issuance under our 2008 Equity Incentive Plan will be added to the shares reserved under our 2013 Equity Incentive Plan and we will cease granting |

7

| awards under our 2008 Equity Incentive Plan. Our 2013 Equity Incentive Plan and 2013 Employee Stock Purchase Plan also provide for automatic annual increases in the number of shares reserved under the plans each year, as more fully described in “Executive Compensation—Employee Benefit and Stock Plans.” |

Except as otherwise indicated, all share numbers referred to are calculated following our 3-for-2 forward stock split, which became effective October 22, 2012, and all information in this prospectus assumes:

| Ÿ | the automatic conversion of all outstanding shares of our redeemable convertible preferred stock as of July 31, 2013 into an aggregate of 38,867,647 shares of common stock immediately prior to the completion of this offering; |

| Ÿ | the effectiveness of our restated certificate of incorporation in connection with the completion of this offering; |

| Ÿ | no exercise of outstanding stock options or settlement of outstanding restricted stock units; and |

| Ÿ | no exercise of the underwriters’ over-allotment option. |

8

SUMMARY CONSOLIDATED FINANCIAL DATA

The summary consolidated statements of operations data presented below for the years ended January 31, 2011, 2012 and 2013 are derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of operations data for the six months ended July 31, 2012 and 2013 and our consolidated balance sheet data as of July 31, 2013 are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated financial statements were prepared on a basis consistent with our audited consolidated financial statements and reflect, in the opinion of management, all adjustments of a normal recurring nature that are necessary for the fair presentation of the financial statements. The following summary consolidated financial data should be read with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in any future period and the results for the six months ended July 31, 2013 are not necessarily indicative of results to be expected for the full year. The summary consolidated financial data in this section are not intended to replace the consolidated financial statements and are qualified in their entirety by the consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended January 31, | Six Months Ended July 31, | |||||||||||||||||||

| 2011 | 2012 | 2013 | 2012 | 2013 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Revenue: |

||||||||||||||||||||

| Product |

$ | 1,632 | $ | 13,113 | $ | 49,765 | $ | 17,731 | $ | 45,766 | ||||||||||

| Support and service |

49 | 900 | 4,075 | 1,378 | 4,836 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

1,681 | 14,013 | 53,840 | 19,109 | 50,602 | |||||||||||||||

| Cost of revenue: |

||||||||||||||||||||

| Product(1) |

604 | 5,233 | 17,266 | 6,073 | 15,375 | |||||||||||||||

| Support and service(1) |

230 | 1,045 | 3,184 | 995 | 3,466 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total cost of revenue |

834 | 6,278 | 20,450 | 7,068 | 18,841 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total gross profit |

847 | 7,735 | 33,390 | 12,041 | 31,761 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development(1) |

4,415 | 7,903 | 16,135 | 6,714 | 14,376 | |||||||||||||||

| Sales and marketing(1) |

2,934 | 12,863 | 39,851 | 13,868 | 31,428 | |||||||||||||||

| General and administrative(1) |

325 | 3,756 | 5,168 | 1,999 | 5,342 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

7,674 | 24,522 | 61,154 | 22,581 | 51,146 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(6,827 | ) | (16,787 | ) | (27,764 | ) | (10,540 | ) | (19,385 | ) | ||||||||||

| Interest income |

5 | 6 | 32 | 12 | 22 | |||||||||||||||

| Other expense, net |

— | (4 | ) | (26 | ) | (28 | ) | (295 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before provision for income taxes |

(6,822 | ) | (16,785 | ) | (27,758 | ) | (10,556 | ) | (19,658 | ) | ||||||||||

| Provision for income taxes |

— | 5 | 99 | 12 | 176 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

(6,822 | ) | (16,790 | ) | (27,857 | ) | (10,568 | ) | (19,834 | ) | ||||||||||

| Accretion of redeemable convertible preferred stock |

(16 | ) | (23 | ) | (34 | ) | (14 | ) | (21 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to common stockholders |

$ | (6,838 | ) | $ | (16,813 | ) | $ | (27,891 | ) | $ | (10,582 | ) | $ | (19,855 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per share attributable to common stockholders, basic and diluted |

$ | (0.47 | ) | $ | (1.04 | ) | $ | (1.53 | ) | $ | (0.60 | ) | $ | (0.98 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted-average shares used to compute net loss per share attributable to common stockholders, basic and diluted |

14,457 | 16,226 | 18,236 | 17,546 | 20,172 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited)(2) |

$ | (0.51 | ) | $ | (0.34 | ) | ||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Weighted-average shares used to compute pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited)(2) |

54,887 | 59,040 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

(footnotes on next page)

9

| (1) | Includes stock-based compensation expense as follows: |

| Year Ended January 31, | Six Months Ended July 31, | |||||||||||||||||||

| 2011 | 2012 | 2013 | 2012 | 2013 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Cost of product revenue |

$ | — | $ | 10 | $ | 48 | $ | 8 | $ | 78 | ||||||||||

| Cost of support and service revenue |

5 | 31 | 114 | 46 | 131 | |||||||||||||||

| Research and development |

46 | 268 | 874 | 348 | 914 | |||||||||||||||

| Sales and marketing |

37 | 244 | 1,029 | 397 | 1,121 | |||||||||||||||

| General and administrative |

16 | 267 | 539 | 236 | 538 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total stock-based compensation expense |

$ | 104 | $ | 820 | $ | 2,604 | $ | 1,035 | $ | 2,782 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (2) | Pro forma net loss per share attributable to common stockholders for the year ended January 31, 2013 and the six months ended July 31, 2013 have been calculated assuming the conversion of all outstanding shares of our redeemable convertible preferred stock into shares of our common stock, as though the conversion had occurred as of the beginning of the period presented or the original date of issue, if later. |

Our consolidated balance sheet as of July 31, 2013 is presented on:

| Ÿ | an actual basis; |

| Ÿ | a pro forma basis, giving effect to the automatic conversion of all outstanding shares of our convertible preferred stock into 38,867,647 shares of common stock and the effectiveness of our restated certificate of incorporation as of immediately prior to the completion of this offering, as if such conversion had occurred and our restated certificate of incorporation had become effective on July 31, 2013; and |

| Ÿ | a pro forma as adjusted basis, giving effect to the pro forma adjustments and the sale of shares of common stock by us in this offering, based on an assumed initial public offering price of $ per share, the midpoint of the price range reflected on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

The pro forma as adjusted information set forth in the table below is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing.

| As of July 31, 2013 | ||||||||||||

| Actual | Pro Forma | Pro Forma As Adjusted(1) |

||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 36,720 | $ | 36,720 | $ | |||||||

| Working capital |

33,400 | 33,400 | ||||||||||

| Total assets |

70,545 | 70,545 | ||||||||||

| Deferred revenue, current and non-current |

19,931 | 19,931 | ||||||||||

| Redeemable convertible preferred stock |

98,580 | — | ||||||||||

| Total stockholders’ (deficit) equity |

(69,256 | ) | 29,324 | |||||||||

| (1) | Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the price range reflected on the cover page of this prospectus, would increase (decrease) our cash and cash equivalents, working capital, total assets and total stockholders’ (deficit) equity by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting the estimated underwriting discounts and commissions. |

10

| Six Months Ended | ||||||||||||||||||||

| Year Ended or as of January 31, | or as of July 31, | |||||||||||||||||||

| 2011 | 2012 | 2013 | 2012 | 2013 | ||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

| Key Business Metrics: |

||||||||||||||||||||

| Total revenue |

$ | 1,681 | $ | 14,013 | $ | 53,840 | $ | 19,109 | $ | 50,602 | ||||||||||

| Year-over-year percentage increase |

nm | 734 | % | 284 | % | 337 | % | 165 | % | |||||||||||

| Gross margin |

50.4 | % | 55.2 | % | 62.0 | % | 63.0 | % | 62.8 | % | ||||||||||

| Total deferred revenue(1) |

227 | 2,028 | 10,896 | 4,972 | 19,931 | |||||||||||||||

| Net cash used in operating activities |

(7,584 | ) | (14,841 | ) | (18,754 | ) | (9,741 | ) | (8,656 | ) | ||||||||||

| Non-GAAP Net Loss |

(6,718 | ) | (15,970 | ) | (25,253 | ) | (9,533 | ) | (17,052 | ) | ||||||||||

| Adjusted EBITDA (non-GAAP) |

(6,681 | ) | (15,802 | ) | (24,068 | ) | (9,187 | ) | (15,390 | ) | ||||||||||

| (1) | Our deferred revenue consists of amounts that have been either invoiced or prepaid but have not yet been recognized as revenue as of the period end. The majority of our deferred revenue consists of the unrecognized portion of revenue from sales of our support and service contracts. We monitor our deferred revenue balance because it represents a portion of revenue to be recognized in future periods. |

Non-GAAP Financial Measures

To provide investors with additional information regarding our financial results, we have disclosed in this prospectus the following two financial measures that are not calculated in accordance with generally accepted accounting principles in the United States, or GAAP: Non-GAAP Net Loss and Adjusted EBITDA.

We define Non-GAAP Net Loss as our net loss adjusted to exclude the effects of stock-based compensation. We define Adjusted EBITDA as our net loss, adjusted to exclude stock-based compensation, interest income, provision for income taxes, and depreciation and amortization. We have provided a reconciliation below of Non-GAAP Net Loss and Adjusted EBITDA to net loss, the most directly comparable GAAP financial measure.

We have included Non-GAAP Net Loss and Adjusted EBITDA in this prospectus because they are key measures used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short-term and long-term operational and compensation plans. In particular, the exclusion of certain expenses in calculating Non-GAAP Net Loss and Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Accordingly, we believe that Non-GAAP Net Loss and Adjusted EBITDA provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

Our use of Non-GAAP Net Loss and Adjusted EBITDA have limitations as analytical tools, and you should not consider these measures in isolation or as substitutes for analysis of our results as reported under GAAP. Some of these limitations are:

| Ÿ | Non-GAAP Net Loss and Adjusted EBITDA do not consider the potentially dilutive impact of equity-based compensation, which is an ongoing expense for us; |

| Ÿ | Adjusted EBITDA does not reflect cash capital expenditure requirements; |

| Ÿ | Adjusted EBITDA does not reflect tax payments that may represent a reduction in cash available to us; and |

| Ÿ | Other companies, including companies in our industry, may calculate Non-GAAP Net Loss and Adjusted EBITDA differently, which reduces their usefulness as comparative measures. |

11

Because of these limitations, you should consider Non-GAAP Net Loss and Adjusted EBITDA alongside other financial performance measures, including various cash flow metrics, net loss and our other GAAP results. We compensate for these limitations by also reviewing our GAAP financial statements.

A reconciliation of Non-GAAP Net Loss and Adjusted EBITDA to net loss is provided below:

| Year Ended January 31, | Six Months Ended July 31, |

|||||||||||||||||||

| 2011 | 2012 | 2013 | 2012 | 2013 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net loss |

$ | (6,822 | ) | $ | (16,790 | ) | $ | (27,857 | ) | $ | (10,568 | ) | $ | (19,834 | ) | |||||

| Stock-based compensation |

104 | 820 | 2,604 | 1,035 | 2,782 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non-GAAP Net Loss |

(6,718 | ) | (15,970 | ) | (25,253 | ) | (9,533 | ) | (17,052 | ) | ||||||||||

| Interest income |

(5 | ) | (6 | ) | (32 | ) | (12 | ) | (22 | ) | ||||||||||

| Provision for income taxes |

— | 5 | 99 | 12 | 176 | |||||||||||||||

| Depreciation and amortization |

42 | 169 | 1,118 | 346 | 1,508 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | (6,681 | ) | $ | (15,802 | ) | $ | (24,068 | ) | $ | (9,187 | ) | $ | (15,390 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

12

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before investing in our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. If any of the following risks occur, our business, operating results and prospects could be materially harmed. In that event, the price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business and Our Industry

We have a history of losses, anticipate increasing our operating expenses in the future, and may not be able to achieve or maintain profitability. If we cannot become profitable or maintain our profitability in the future, our business and operating results may suffer.

We have incurred net losses in all fiscal years since our inception, including net losses of $6.8 million, $16.8 million and $27.9 million in the years ended January 31, 2011, 2012 and 2013. As of July 31, 2013, we had an accumulated deficit of $77.8 million. We anticipate that our operating expenses will increase in the foreseeable future as we continue to develop our technology, enhance our product and service offerings, expand our sales channels, expand our operations and hire additional employees. These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenue sufficiently, or at all, to offset these higher expenses. In future periods, our profitability could be adversely affected for a number of possible reasons, including slowing demand for our products or services, increasing competition, a decrease in the growth of our overall market or general economic conditions. If we are unable to meet these risks and challenges as we encounter them, our business and operating results may suffer.

Our limited operating history makes it difficult to evaluate our current business and future prospects.

We were incorporated in November 2007 and shipped our first products in August 2010. The majority of our revenue growth has occurred in the years ended January 31, 2012 and 2013 and the six months ended July 31, 2013. Our limited operating history makes it difficult to evaluate our current business and our future prospects, including our ability to plan for and model future growth. We have encountered and will continue to encounter risks and difficulties frequently experienced by rapidly growing companies in constantly evolving industries, including the risks described in this prospectus. If we do not address these risks successfully, our business and operating results will be adversely affected, and our stock price could decline. Further, we have limited historical financial data. As such, any predictions about our future revenue and expenses may not be as accurate as they would be if we had a longer operating history or operated in a more predictable market.

If the market for storage products does not grow as we anticipate, our revenue may not grow and our operating results would be harmed.

We are vulnerable to fluctuations in overall demand for storage products. Our business plan assumes that the demand for storage products will increase as organizations collect, process and store an increasing amount of data. However, if storage markets experience downturns or grow more slowly than anticipated, or if demand for our products does not grow as quickly as we anticipate, whether as a result of competition, product obsolescence, budgetary constraints of our end-customers, technological changes, unfavorable economic conditions, uncertain geopolitical environments or other factors, we

13

may not be able to increase our revenue sufficiently to ever achieve profitability and our stock price would decline.

Our revenue growth rate in recent periods may not be indicative of our future performance.

You should not consider our revenue growth rate in recent periods as indicative of our future performance. While we have recently experienced significant revenue growth rates in the years ended January 31, 2012 and 2013, we do not expect to achieve similar revenue growth rates in future periods. You should not rely on our revenue growth rates for any prior periods as any indication of our future revenue or revenue growth rates.

Our quarterly operating results may fluctuate significantly, which could cause the trading price of our common stock to decline.

Our operating results have historically fluctuated and may continue to fluctuate from quarter to quarter, and we expect that this trend will continue as a result of a number of factors, many of which are outside of our control and may be difficult to predict, including:

| Ÿ | the budgeting cycles and purchasing practices of end-customers; |

| Ÿ | our ability to attract and retain new channel partners and end-customers; |

| Ÿ | our ability to sell additional products to existing channel partners and end-customers; |

| Ÿ | changes in end-customer requirements or market needs and our inability to make corresponding changes to our business; |

| Ÿ | any potential disruption in our sales channels or termination of our relationship with important channel partners; |

| Ÿ | potential seasonality in the markets we serve; |

| Ÿ | the timing and success of new product and service introductions by us or our competitors or any other change in the competitive landscape, including consolidation among our competitors or end-customers; |

| Ÿ | deferral of orders in anticipation of new products or product enhancements announced by us or our competitors; |

| Ÿ | our inability to provide adequate support to our end-customers; |

| Ÿ | our ability to control the costs of manufacturing our products, including the cost of components; |

| Ÿ | our inability to fulfill our customers’ orders due to supply chain delays or events that impact our manufacturers or their suppliers; |

| Ÿ | our inability to adjust certain fixed costs and expenses, particularly in research and development, for changes in demand; |

| Ÿ | price competition; |

| Ÿ | the timing of certain payments and related expenses, such as sales commissions; |

| Ÿ | increases or decreases in our revenue and expenses caused by fluctuations in foreign currency exchange rates, as an increasing portion of our revenue is collected and expenses are incurred and paid in currencies other than the U.S. dollar; |

| Ÿ | general economic conditions, both domestically and in our foreign markets; |

| Ÿ | the cost of and potential outcomes of existing and future claims or litigation, which could have a material adverse effect on our business; and |

| Ÿ | future accounting pronouncements and changes in our accounting policies. |

14

Any one of the factors above or the cumulative effect of some of the factors referred to above may result in significant fluctuations in our operating results. In particular, because we have historically received a substantial portion of sales orders during the last few weeks of each fiscal quarter, we are particularly vulnerable to any delay in order fulfillment, failure to close anticipated orders or any other problems encountered during the last few weeks of each fiscal quarter. This variability and unpredictability could result in our failure to meet our revenue or other operating result expectations or those of investors for a particular period. If we fail to meet or exceed such expectations for these or any other reasons, the market price of our common stock could fall substantially, and we could face costly lawsuits, including securities class action suits.

We have limited visibility into future sales, which makes it difficult to forecast our future operating results.

Because of our limited visibility into end-customer demand, our ability to accurately forecast our future revenue is limited. We sell our products primarily through our network of channel partners that accounted for 82% and 89% of our total revenue in the years ended January 31, 2012 and 2013. We place orders with our third-party manufacturers based on our forecasts of our end-customers’ requirements and forecasts provided by our channel partners. These forecasts are based on multiple assumptions, each of which might cause our estimates to be inaccurate, affecting our ability to provide products to our end-customers. When demand for our products increases significantly, we may not be able to meet it on a timely basis, and we may need to expend a significant amount of time working with our customers to allocate limited supply and maintain positive customer relations, or we may incur additional costs to accelerate the manufacture and delivery of additional products. If we or our channel partners underestimate end-customer demand, we may forego revenue opportunities, lose market share and damage our end-customer relationships. Conversely, if we overestimate demand for our products and consequently purchase significant amounts of components or hold inventory, we could incur additional costs and potentially incur related charges, which could adversely affect our operating results.

Adverse economic conditions or reduced IT spending may adversely impact our business.

Our business depends on the overall demand for IT and on the economic health of our current and prospective customers. In general, worldwide economic conditions remain unstable, and these conditions make it difficult for our current and prospective customers and us to forecast and plan future business activities accurately, and they could cause our customers or prospective customers to reevaluate their decision to purchase our products. Weak global economic conditions, or a reduction in IT spending even if economic conditions improve, could adversely impact our business and operating results in a number of ways, including longer sales cycles, lower prices for our products, reduced bookings and lower or no growth.

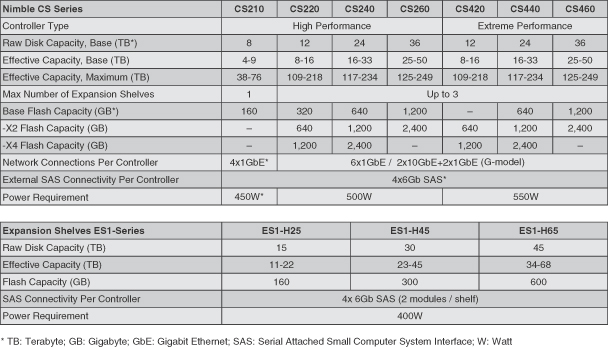

We are dependent on a small number of product lines, and the lack of continued market acceptance of these product lines, particularly our CS Series of storage products, would result in lower revenue.

Our CS Series of storage products, or CS products, account for a majority of our total revenue and we anticipate that these products will continue to do so for the foreseeable future. As a result, our revenue could be reduced as a result of:

| Ÿ | any decline in demand for these products; |

| Ÿ | the introduction of products and technologies by competitors that serve as a replacement or substitute for, or represent an improvement over, our CS products; |

15

| Ÿ | technological innovations or new communications standards that our CS products do not address; |

| Ÿ | our failure or inability to predict changes in our industry or end-customers’ demands or to design products or enhancements that meet end-customers’ increasing demands; and |

| Ÿ | our inability to release enhanced versions of our CS products on a timely basis. |

Our products handle mission-critical data for our end-customers and are highly technical in nature. If our products have defects, failures occur or end-customer data is lost or corrupted, our reputation and business could be harmed.

Our products are highly technical and complex and are involved in storing and replicating mission-critical data for our end-customers. Our products may contain undetected defects and failures when they are first introduced or as new versions are released. We have in the past and may in the future discover software errors in new versions of our existing products, new products or product enhancements after their release or introduction, which could result in lost revenue. Despite testing by us and by current and potential end-customers, errors might not be found in new releases or products until after commencement of commercial shipments, resulting in loss of or delay in market acceptance. Our products may have security vulnerabilities and be subject to intentional attacks by viruses that seek to take advantage of these bugs, errors or other weaknesses. If defects or failures occur in our products, a number of negative effects in our business could result, including:

| Ÿ | lost revenue or lost end-customers; |

| Ÿ | increased costs, including warranty expense and costs associated with end-customer support; |

| Ÿ | delays, cancellations, reductions or rescheduling of orders or shipments; |

| Ÿ | product returns or discounts; |

| Ÿ | diversion of management resources; |

| Ÿ | legal claims for breach of contract, product liability, tort or breach of warranty; and |

| Ÿ | damage to our reputation and brand. |

Because our end-customers use our products to manage and protect their data, we could face claims resulting from any loss or corruption of our end-customers’ data due to a product defect. While our sales contracts contain provisions relating to warranty disclaimers and liability limitations, these provisions might not be upheld. Defending a lawsuit, regardless of its merit, is costly and may divert management’s attention and could result in public perception that our products are not effective, even if the occurrence is unrelated to the use of our products. In addition, our business liability insurance coverage might not be adequate to cover such claims. If any data is lost or corrupted in connection with the use or support of our products, our reputation could be harmed and market acceptance of our products could suffer.

We rely on third-party channel partners to sell substantially all of our products, and if our partners fail to perform, our ability to sell and distribute our products and services will be limited, and our operating results will be harmed.

We depend on value added resellers, or VARs, and distributors to sell our products. Our contracts with channel partners typically have a term of one year and are terminable without cause upon written notice to the other party. Our channel partner agreements do not prohibit them from offering competitive products or services and do not contain any purchase commitments. Many of our

16

channel partners also sell our competitors’ products. If our channel partners give higher priority to our competitors’ storage products, we may be unable to grow our revenue and our net loss could increase. Further, in order to develop and expand our channels, we must continue to scale and improve our processes and procedures that support our channel partners, including investments in systems and training, and those processes and procedures may become increasingly complex and difficult to manage. If we fail to maintain existing channel partners or develop relationships with new channel partners, our revenue opportunities will be reduced.

We receive a substantial portion of our total revenue from a limited number of channel partners, and the loss of, or a significant reduction in, orders from one or more of our major channel partners would harm our business.

We receive a substantial portion of our total revenue from a limited number of channel partners. For the years ended January 31, 2011, 2012 and 2013 our top ten channel partners accounted for 68%, 43% and 37% of our total revenue. In particular, Advanced Media Services, which buys our products for resale by CDW Corporation, accounted for more than 10% of our revenue in the year ended January 31, 2013 and the six months ended July 31, 2013. We anticipate that we will continue to depend upon a limited number of channel partners for a substantial portion of our total revenue for the foreseeable future and, in some cases, the portion of our revenue attributable to individual channel partners may increase in the future. The loss of one or more key channel partners or a reduction in sales through any major channel partner would reduce our revenue.

We face intense competition in our market, especially from larger, well-established companies, and we may lack sufficient financial or other resources to maintain or improve our competitive position.

A number of very large corporations have historically dominated the storage market. We consider our primary competitors to be companies that provide enterprise storage products, including Dell, Inc., EMC Corporation, Hewlett-Packard Company and NetApp, Inc. We also compete to a lesser extent with a number of other smaller companies and certain well-established companies. Some of our competitors have made acquisitions of businesses that allow them to offer more directly competitive and comprehensive solutions than they had previously offered. We expect to encounter new competitors domestically and internationally as other companies enter our market or if we enter new markets.

Many of our existing competitors have, and some of our potential competitors could have, substantial competitive advantages such as:

| Ÿ | potential for broader market acceptance of their storage architectures and solutions; |

| Ÿ | greater name recognition and longer operating histories; |

| Ÿ | larger sales and marketing and customer support budgets and resources; |

| Ÿ | broader distribution and established relationships with distribution partners and end-customers; |

| Ÿ | the ability to bundle storage products with other technology products and services to better fit certain customers’ needs; |

| Ÿ | lower labor and development costs; |

| Ÿ | larger and more mature intellectual property portfolios; |

| Ÿ | substantially greater financial, technical and other resources; and |

| Ÿ | greater resources to make acquisitions. |

17

We rely on a limited number of suppliers, and in some cases single-source suppliers, and any disruption or termination of these supply arrangements or failure to successfully manage our relationships with our key suppliers could delay shipments of our products and damage our channel partner or end-customer relationships.

We rely on a limited number of suppliers, and in some cases single-source suppliers, for several key components of our products. We generally purchase components on a purchase order basis and do not have long-term supply contracts with our suppliers. Our reliance on key suppliers reduces our control over the manufacturing process and exposes us to risks, including reduced control over product quality, production costs, timely delivery and capacity. It also exposes us to the potential inability to obtain an adequate supply of required components because we do not have long-term supply commitments. In particular, replacing the single-source suppliers of our solid state drives and chassis would require a product re-design that could take months to implement.

We generally maintain minimal inventory for repairs, evaluation and demonstration units and acquire components only as needed. We do not enter into long-term supply contracts for these components. As a result, our ability to respond to channel partner or end-customer orders efficiently may be constrained by the then-current availability, terms and pricing of these components. Our industry has experienced component shortages and delivery delays in the past, and we may experience shortages or delays of critical components in the future as a result of strong demand in the industry or other factors. If we or our suppliers inaccurately forecast demand for our products or we ineffectively manage our enterprise resource planning processes, our suppliers may have inadequate inventory, which could increase the prices we must pay for substitute components or result in our inability to meet demand for our products, as well as damage our channel partner or end-customer relationships.

Component quality is particularly important with respect to disk drives. We have in the past and may in the future experience disk drive failures, which could cause our reputation to suffer, our competitive position to be impaired and our end-customers to select other vendors. To meet our product performance requirements, we must obtain disk drives of extremely high quality and capacity. In addition, there are periodic supply-and-demand issues for disk drives and flash memory that could result in component shortages, selective supply allocations and increased prices of such components. We may not be able to obtain our full requirements of components, including disk drives, that we need for our storage products or the prices of such components may increase.

If we fail to effectively manage our relationships with our key suppliers, or if our key suppliers increase prices of components, experience delays, disruptions, capacity constraints, or quality control problems in their manufacturing operations, our ability to ship products to our channel partners or end-customers could be impaired and our competitive position and reputation could be adversely affected. Qualifying a new key supplier is expensive and time-consuming. If we are required to change key suppliers or assume internal manufacturing operations, we may lose revenue and damage our channel partner or end-customer relationships.

Because we depend on third-party manufacturers to build our products, we are susceptible to manufacturing delays and pricing fluctuations that could prevent us from shipping orders on time, if at all, or on a cost-effective basis, which would cause our business to suffer.

We outsource the manufacturing of our products to third-party manufacturers, including Flextronics and Synnex, our contract manufacturers. Our reliance on these third-party manufacturers reduces our control over the manufacturing process and exposes us to risks, including reduced control over quality assurance, product costs and product supply and timing. Any manufacturing disruption by these third-party manufacturers could severely impair our ability to fulfill orders. Generally, our orders

18

represent a relatively small percentage of the overall orders received by Flextronics and Synnex from their customers; therefore, fulfilling our orders may not be a priority in the event those manufacturers are constrained in their ability to fulfill all of their customer obligations. If we are unable to manage our relationships with these third-party manufacturers effectively, or if these third-party manufacturers suffer delays or disruptions for any reason, experience increased manufacturing lead-times, capacity constraints or quality control problems in their manufacturing operations, or fail to meet our future requirements for timely delivery, our ability to ship products to our end-customers would be impaired, and our business and operating results would be harmed.

We rely on a limited number of manufacturers and any disruption or termination of our manufacturing arrangements could delay shipments of our products and harm our business.

Our current agreements with Flextronics and Synnex do not contain any minimum commitments to manufacture our products, and are terminable at will or upon short notice by the manufacturer. Furthermore, any orders are fulfilled only after a purchase order has been delivered and accepted. As a result, Flextronics and Synnex may stop taking new orders or fulfilling our orders on short notice or limiting our allocations of products. If this were to occur, we would need to find alternative vendors and we could experience delays in shipping orders, which could harm our business.

Our business and operations have experienced rapid growth in recent periods. If we do not effectively manage any future growth or are unable to improve our systems and processes, our operating results could be harmed.

We have experienced rapid growth over the last few years. Our employee headcount and number of end-customers have increased significantly, and we expect to continue to grow our headcount significantly over the next 12 months. For example, from January 31, 2011 to July 31, 2013, our headcount increased from 47 to 464 employees. Since we initially launched our products in August 2010, our number of end-customers grew to 1,750 as of July 31, 2013. The growth and expansion of our business and product and service offerings places a continuous significant strain on our management, operational and financial resources.

To manage any future growth effectively, we must continue to improve and expand our information technology, or IT, and financial infrastructure, our operating and administrative systems and controls, our enterprise resource planning systems and processes and our ability to manage headcount, capital and processes in an efficient manner. In addition, our systems and processes may not prevent or detect all errors, omissions, or fraud. Our failure to improve our systems and processes, or their failure to operate in the intended manner, may result in our inability to manage the growth of our business and to accurately forecast our revenue and expenses, or to prevent losses. Our productivity and the quality of our products and services may also be adversely affected if we do not integrate and train our new employees quickly and effectively. Failure to manage any future growth effectively could result in increased costs, negatively impact our end-customers’ satisfaction and harm our operating results.

Our ability to sell our products is dependent on the quality of our technical support services, and our failure to offer high quality technical support services could have a material adverse effect on our sales, operating results and end-customers’ satisfaction with our products and services.

Once our products are deployed within our end-customers’ networks, our end-customers depend on our technical support services to resolve any issues relating to our products. We may be unable to respond quickly enough to accommodate short-term increases in end-customer demand for support

19

services. We also may be unable to modify the format of our support services to compete with changes in support services provided by competitors. Increased end-customer demand for these services, without corresponding revenue, could increase costs and adversely affect our operating results. Any failure by us to effectively help our end-customers quickly resolve post-deployment issues or provide high-quality technical support, or a market perception that we do not maintain high-quality support, could harm our reputation and adversely affect our ability to sell our solutions to existing and prospective customers.

If we do not successfully anticipate market needs and develop products and product enhancements that meet those needs, or if those products do not gain market acceptance, our business will suffer.

The storage market is characterized by rapidly evolving technology, customer needs and industry standards. We might not be able to anticipate future market needs or changes in existing technologies, and we might not be able to develop new products or product enhancements to meet such needs, either in a timely manner or at all. For example, if changes in technology result in a significant reduction in the price for flash memory, enterprises may not need to utilize flash-optimized storage in order to cost effectively protect their data. Also, one or more new technologies could be introduced that compete favorably with our storage products or that cause our storage products to no longer be of significant benefit to our end-customers.

The process of developing new technology is complex and uncertain, and we may not be able to develop our products in a manner that enables us to successfully address the changing needs of our end-customers. We must commit significant resources to developing new products and product enhancements before knowing whether our investments will result in products the market will accept. Additionally, we may not achieve the cost savings or the anticipated performance improvements we expect, and we may take longer to generate revenue, or generate less revenue, than we anticipate. If we are not able to successfully identify new product opportunities, develop and bring new products to market in a timely manner, or achieve market acceptance of our products, our business and operating results will be harmed.

Our future growth plan depends in part on expanding outside of the United States, and we are therefore subject to a number of risks associated with international sales and operations.

As part of our growth plan, we intend to expand our operations globally. We have a limited history of marketing, selling and supporting our products and services internationally. International sales and operations are subject to a number of risks, including the following:

| Ÿ | greater difficulty in enforcing contracts and accounts receivable collection and longer collection periods; |

| Ÿ | increased expenses incurred in establishing and maintaining office space and equipment for our international operations; |

| Ÿ | fluctuations in exchange rates between the U.S. dollar and foreign currencies in markets where we do business; |

| Ÿ | management communication and integration problems resulting from cultural and geographic dispersion; |

| Ÿ | difficulties in attracting and retaining personnel with experience in international operations; |

| Ÿ | risks associated with trade restrictions and foreign legal requirements, including the importation, certification and localization of our products required in foreign countries; |

| Ÿ | greater risk of unexpected changes in regulatory practices, tariffs, and tax laws and treaties; |

20

| Ÿ | the uncertainty of protection for intellectual property rights in some countries; |

| Ÿ | greater risk of a failure of foreign employees to comply with both U.S. and foreign laws, including antitrust regulations, the U.S. Foreign Corrupt Practices Act and any trade regulations ensuring fair trade practices; and |

| Ÿ | general economic and political conditions in these foreign markets. |