As filed with the Securities and Exchange Commission on November 10, 2014.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Hortonworks, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 7372 | 37-1634325 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3460 W. Bayshore Road

Palo Alto, California 94303

408.916.4121

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Robert Bearden

Chief Executive Officer

Hortonworks, Inc.

3460 W. Bayshore Road

Palo Alto, California 94303

408.916.4121

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Craig M. Schmitz, Esq. Richard A. Kline, Esq. Bradley C. Weber, Esq. Goodwin Procter LLP 135 Commonwealth Drive Menlo Park, California 94025 650.752.3100 |

David M. Howard, Esq. Vice President, Legal Hortonworks, Inc. 3460 W. Bayshore Road Palo Alto, California 94303 650.388.9775 |

John L. Savva, Esq. Sullivan & Cromwell LLP 1870 Embarcadero Road Palo Alto, California 94303 650.461.5600 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate |

Amount of Registration Fee | ||

| Common Stock, $0.0001 par value per share |

$100,000,000 | $11,620 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the aggregate offering price of additional shares that the underwriters have the option to purchase. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated November 10, 2014.

Shares

Hortonworks, Inc.

Common Stock

This is an initial public offering of shares of common stock of Hortonworks, Inc. All of the shares of common stock are being sold by the company.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . Hortonworks intends to list the common stock on the NASDAQ Global Select Market under the symbol “HDP.”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, we may elect to comply with certain reduced public company reporting requirements in future reports after the completion of this offering.

See “Risk Factors” on page 13 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to Hortonworks |

$ | $ | ||||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares from Hortonworks at the initial price to the public less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , 2014.

| Goldman, Sachs & Co. | Credit Suisse | RBC Capital Markets | ||

| Pacific Crest Securities | Wells Fargo Securities | Blackstone Capital Markets | ||

Prospectus dated , 2014.

Hortonworks®

Enabling the Data-First Enterprise

| Page | ||||

| 1 | ||||

| 13 | ||||

| 37 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 44 | ||||

| 47 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

50 | |||

| 70 | ||||

| 86 | ||||

| 94 | ||||

| 106 | ||||

| 114 | ||||

| 117 | ||||

| 124 | ||||

| Certain Material U.S. Federal Income Tax Consequences to Non-U.S. Holders |

127 | |||

| 131 | ||||

| 136 | ||||

| 136 | ||||

| 136 | ||||

| F-1 | ||||

Neither we nor any of the underwriters have authorized anyone to provide any information or to make any representations other than as contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and provide no assurance as to the reliability of, any information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, the terms “Hortonworks,” “the company,” “we,” “us” and “our” in this prospectus refer to Hortonworks, Inc. and its consolidated subsidiaries.

Overview

Our mission is to establish Hadoop as the foundational technology of the modern enterprise data architecture.

We seek to advance the market adoption of Hadoop and provide enterprises with a new data management solution that enables them to harness the power of big data to transform their businesses through more effective and efficient management of their valuable data assets. A Hadoop cluster combines commodity servers with local storage and an open source software distribution to create a reliable distributed compute and storage platform for large data sets scalable up to petabytes, or PBs, with thousands of servers or nodes.

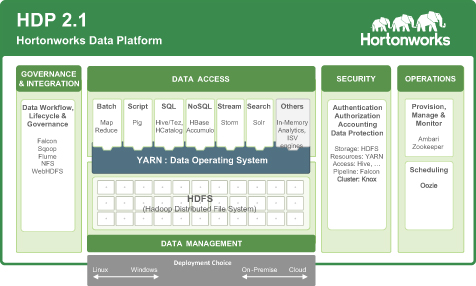

Our solution is an enterprise-grade data management platform built on a unique distribution of Apache Hadoop and powered by YARN, the next generation computing and resource management framework. We continuously drive innovation in the Apache community with a mission to further Hadoop’s development for enterprises of all types and sizes. Our platform deeply integrates with key data center technologies to support best-of-breed data architectures and enables our customers to collect, store, process and analyze increasing amounts of existing and new data types in a way that augments rather than replaces their existing data center infrastructure.

We employ a differentiated approach in that we are committed to serving the Apache Software Foundation open source ecosystem and to sharing all of our product developments with the open source community. We support the community for open source Hadoop, and employ a large number of core committers to the various Enterprise Grade Hadoop projects. We believe that keeping our business model free from architecture design conflicts that could limit the ultimate success of our customers in leveraging the benefits of Hadoop at scale is a significant competitive advantage. We are recognized as a leader in Hadoop by Forrester Research based on the strengths of our current offering and our strategy.

We were founded in 2011, and during 2012 we launched our Enterprise Grade Hadoop platform, the Hortonworks Data Platform for which we provide support subscriptions and professional services. As of September 30, 2014, we had 233 support subscription customers (which we generally define as an entity with an active support subscription) and 292 total customers, including professional services customers, across a broad array of company sizes and industries. We have entered into contracts to establish strategic relationships with Hewlett-Packard Company, Microsoft Corporation, Rackspace Hosting, Inc., Red Hat, Inc., SAP AG, Teradata Corporation and Yahoo! Inc. focused on tightly integrated development, marketing and support strategies to maximize the success of our solutions. Consistent with our open source approach, we generally make the Hortonworks Data Platform available free of charge and derive the predominant amount of our revenue from customer fees from support subscription offerings and professional services.

1

We have achieved significant growth in recent periods. For the years ended April 30, 2012 and 2013, our revenue was $1.6 million and $11.0 million, respectively. For the eight months ended December 31, 2012 and 2013, our revenue was $4.8 million and $17.9 million, respectively. For the nine months ended September 30, 2013 and 2014, our revenue was $15.9 million and $33.4 million, respectively. For the twelve months ended September 30, 2014, our revenue was $41.5 million. For the years ended April 30, 2012 and 2013, our gross billings were $11.8 million and $17.6 million, respectively. Effective May 1, 2013, we changed our fiscal year end from April 30 to December 31. For the eight months ended December 31, 2012 and 2013, our gross billings were $9.7 million and $29.1 million, respectively. For the nine months ended September 30, 2013 and 2014, our gross billings were $24.4 million and $53.2 million, respectively. For the twelve months ended September 30, 2014, our gross billings were $65.7 million. See “—Key Metric—Gross Billings” for an explanation of gross billings, a reconciliation of gross billings to total revenue, the most directly comparable GAAP financial measure, and an explanation of why management uses this non-GAAP financial measure. We experienced net losses of $11.5 million and $36.6 million for the years ended April 30, 2012 and 2013, respectively, $19.7 million and $46.2 million for the eight months ended December 31, 2012 and 2013, respectively, $48.4 million and $86.7 million for the nine months ended September 30, 2013 and 2014, respectively, and $101.5 million for the twelve months ended September 30, 2014. See “Selected Consolidated Financial Data—Key Metric – Gross Billings” for more information and a reconciliation of gross billings to total revenue.

Industry Background

Major technology innovations such as social media, mobile and cloud computing, new web-based applications, such as Software-as-a-Service, or SaaS, and the Internet of Things, in which devices with sensors and actuators transmit increasing amounts of data automatically, have created an always-on, constantly connected society that is putting increasing pressure on enterprise data center infrastructure. The increase in volume, velocity and variety of data is creating significant challenges to enterprise data management resources and is disrupting the way enterprises design their data infrastructure.

Enterprises are not only inundated with increasing amounts of data but also struggle with managing more types of data that are less easily managed by traditional data center architectures. Historically, enterprises focused primarily on managing data from dedicated and disparate data center systems and were able to utilize relational database management systems optimized for analyzing preselected, structured data stored within isolated silos.

The variety of data, including new unstructured data types such as clickstream data, geo-location data, sensor and machine data, sentiment data, server log data and other data generated by emails, documents and other file types, is fueling the exponential growth in the aggregate amount of data that has the potential to be captured and managed by the enterprise to drive business value. The higher volume, velocity and variety of context-rich data have historically not been captured, managed or analyzed by the enterprise.

As a result of the limitations of traditional data center architectures, enterprises are seeking new technologies to collect, store and access this data in a cost-effective manner, and to gain more actionable insight from their increasingly complex and growing data stores. Enterprises need to upgrade their data center architectures to enable themselves to bring large volumes of data under management and to process and analyze multiple types of data in innovative ways.

Hadoop was originally developed in the early 2000s. Partnering with the Apache Hadoop community, Yahoo! led major innovations in the technology to help tackle big data challenges and operate its business at scale. The traditional Hadoop offering (i.e., Hadoop Version 1.x) is largely a batch system that enables users to manage data at scale, but requires siloed computing clusters by

2

application with pre-selected data sets, thus limiting accessibility, interoperability and overall value. Incremental attempts to improve traditional Hadoop focused on bolting on data warehousing and analytics functionality as well as basic levels of security and operations management. This innovation demonstrated the early promise of Hadoop in enabling enterprises to address their big data requirements, but traditional Hadoop still lacks the breadth of functionality and resiliency that would enable it to be deployed more broadly by enterprises in production use cases.

To improve on this early functionality, Hortonworks engineers created the initial architecture for YARN and developed the technology for it within the Apache Hadoop community, leading to the release of YARN in October 2013. This technology advancement transformed Hadoop (i.e., Hadoop Version 2.x) into a platform that allows for multiple ways of interacting with data, including interactive structured query language, or SQL, processing, real-time processing and online data processing, along with its traditional batch data processing. YARN eliminates the need to silo data sets and enables a single cluster to store a wide range of shared data sets on which mixed workloads can simultaneously process with predictable service levels. YARN is designed to serve as a common data operating system that enables the Hadoop ecosystem to natively integrate applications and leverage existing technologies and skills while extending consistent security, governance and operations across the platform. With these capabilities, YARN can facilitate mainstream Hadoop adoption by enterprises of all types and sizes for production use cases at scale.

Our Opportunity

Enterprises are facing an increasing need to adopt big data strategies that will help them modernize their data center architectures, control costs and transform their businesses to succeed in an increasingly digital world. Inherent in this shift is a move from the post-transaction, reactive analysis of subsets of data to a new model of pre-transaction, interactive insights across a comprehensive and integrated dataset. We believe that enterprises that successfully adopt a big data strategy will succeed, whereas enterprises that fail to implement a modern data architecture will struggle to sustain competitive advantages.

We believe that an enterprise-grade Hadoop solution must meet certain requirements to create and accelerate widespread market adoption and enable the modern data center architecture. We refer to this set of requirements as Enterprise Grade Hadoop, and believe they include:

| • | capability to centrally manage new and existing data types; |

| • | ability to run multiple applications on a common data architecture; |

| • | high availability and enterprise-grade security, management and governance; |

| • | interoperability with new and existing data center infrastructure investments; |

| • | stability and dependability; |

| • | scalability and affordability; |

| • | predictive and real-time analytic capability; and |

| • | deployment flexibility. |

We believe that only with a platform that addresses each of these needs will enterprises be able to transform their businesses by adopting a modern data architecture that solves their increasing data management requirements. Enterprise Grade Hadoop is fundamental to this architectural shift and can turn what was traditionally viewed as a cost center into a revenue generator by enabling new business applications that harness the power of big data. According to Allied Market Research, the global Hadoop market spanning hardware, software and services is expected to grow from $2.0 billion in 2013 to $50.2 billion by 2020, representing a compound annual growth rate, or CAGR, of 58%.

3

Our Solution

We are a leading provider and distributor of an enterprise-grade Hadoop solution that is enabling a re-platforming of data center architectures to harness the power of big data for the enterprise. We provide support subscription offerings and related professional services around the Hortonworks Data Platform, which is our open source software distribution of Apache Hadoop. We developed the Hortonworks Data Platform to address the limitations of traditional Hadoop. The Hortonworks Data Platform provides the following benefits:

| • | Maximizes data access to drive business transformation. Our solution integrates all data types into “data lakes” that allow our customers to increase the scope and quality of their data management. Our solution breaks down traditional data silos and allows enterprises to store and process their data in native formats and enables the combination of multiple context-rich data types. |

| • | Common data operating system that powers big data applications. The Hortonworks Data Platform leverages the benefits of YARN to create a common data operating system that natively integrates with Hadoop. Our solution also enables new and existing applications to integrate seamlessly with Hadoop. |

| • | Purpose-built for the enterprise. We engineer and certify Apache Hadoop with a focus on extending traditional Hadoop with the robust capabilities required by the enterprise such as high availability, governance, security, provisioning, management and performance monitoring. |

| • | Rigorously tested and hardened for deployment at scale. Our strategic relationships with leading cloud scale companies enable us to test and harden our platform in the most demanding production environments, assuring high quality and resilient releases at scale. We deliver value to support subscription customers by reducing implementation risk, accelerating time-to-value and helping these customers scale more rapidly. |

| • | Enables best-of-breed data center architectures. We designed our data management platform to be fully open and integrate with new and existing investments in data center infrastructure. Our solution is designed to work with new big data technologies that are complementary to Hadoop. |

| • | Compelling return on investment. Our solution enables our customers to modernize their data architectures while leveraging existing investments and increased use of commodity hardware. For example, the annual cost of managing a raw terabyte, or TB, of data with our platform and commodity hardware can be 10 to 100 times less expensive than using high-end storage arrays. |

| • | Real-time, predictive and interactive analytics. Our solution enables our customers to move from post-transaction, reactive analysis of subsets of data stored in silos to a world of pre-transaction, interactive insights across all data with the potential to enhance competitive advantages and transform businesses. |

| • | Superior deployment flexibility. Our focus on deep integration with existing data center technologies enables the leaders in the data center to easily adapt and extend their platforms. We are differentiated in our ability to natively support deployments across Linux, Windows, hardware appliances and public and private cloud platforms. |

We are committed to serving the Apache Software Foundation open source ecosystem and to sharing all of our product developments with the open source community. We support the community for open source Hadoop, and employ a large number of core committers to the various Enterprise

4

Grade Hadoop projects. This commitment allows us to drive the innovation of Hadoop’s core open source technology, define a roadmap for the future, ensure predictable and reliable enterprise quality releases and provide comprehensive, enterprise-class support.

Our Strategy

We intend to grow our business by focusing on the following strategies:

| • | continue to innovate and extend Hadoop’s enterprise data platform capabilities; |

| • | establish Hadoop as the industry standard for the modern enterprise data architecture and Hortonworks as the trusted Enterprise Grade Hadoop provider; |

| • | continue to support and foster growth in the Hadoop ecosystem; |

| • | focus on renewing and extending existing customer deployments; |

| • | grow our sales force directly and indirectly through our reseller and original equipment manufacturer, or OEM, partners; |

| • | grow our customer base across new vertical markets and geographies; |

| • | pursue selective acquisitions to further enhance and build out the critical components of the Hortonworks Data Platform; and |

| • | continue international expansion. |

Risks Affecting Us

Our business is subject to numerous risks and uncertainties, including those highlighted in “Risk Factors” immediately following this prospectus summary. These risks include, but are not limited to, the following:

| • | We have a history of losses, and we may not become profitable in the future. |

| • | We have a limited operating history, which makes it difficult to predict our future results of operations. |

| • | We do not have an adequate history with our support subscription offerings or pricing models to accurately predict the long-term rate of support subscription customer renewals or adoption, or the impact these renewals and adoption will have on our revenues or results of operations. |

| • | Because we derive substantially all of our revenues and cash flows from supporting the Hortonworks Data Platform and services and training related to it, failure of these offerings to satisfy customer requirements or to achieve increased market acceptance would harm our business, results of operations, financial condition and growth prospects. |

| • | Our success is highly dependent on our ability to penetrate the existing market for open source distributed data platforms as well as the growth and expansion of the market for open source distributed data platforms. |

| • | If we are unable to maintain successful relationships with our partners, our business, results of operations and financial condition could be harmed. |

| • | If we are unable to effectively compete, our business and operating results could be harmed. |

| • | The competitive position of the Hortonworks Data Platform depends in part on its ability to operate with third-party products and services, including those of our partners, and, if we are |

5

| not successful in maintaining and expanding the compatibility of the Hortonworks Data Platform with such products and services, our business will suffer. |

| • | If open source software programmers, many of whom we do not employ, do not continue to develop and enhance open source technologies, we may be unable to develop new technologies, adequately enhance our existing technologies or meet customer requirements for innovation, quality and price. |

| • | Our subscription-based business model may encounter customer resistance or we may experience a decline in the demand for our offerings. |

Corporate Information

We were incorporated in Delaware in April 2011. Our principal executive offices are located at 3460 W. Bayshore Road, Palo Alto, California 94303, and our telephone number is (408) 916-4121. Our website address is www.hortonworks.com. Information contained on or that can be accessed through our website does not constitute part of this prospectus and inclusions of our website address in this prospectus are inactive textual references only.

“Hortonworks” is our registered trademark in the United States and in certain other jurisdictions. “Hadoop” is a registered trademark of the Apache Software Foundation. Other trademarks and trade names referred to in this prospectus are the property of their respective owners.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise applicable generally to public companies. These provisions include:

| • | a requirement to have only two years of audited financial statements and only two years of related management’s discussion and analysis; |

| • | an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over financial reporting; |

| • | an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| • | reduced disclosure about our executive compensation arrangements; and |

| • | exemptions from the requirements to obtain a non-binding advisory vote on executive compensation or stockholder approval of any golden parachute arrangements. |

We will remain an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.0 billion in annual revenue; the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day of the fiscal year ending after the fifth anniversary of this offering. We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act. We are choosing to irrevocably “opt out” of the extended transition periods available under the JOBS Act for complying with new or revised accounting standards, but we intend to take advantage of the other exemptions discussed above. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

6

THE OFFERING

| Common stock offered by us |

shares |

| Common stock to be outstanding after this offering |

shares |

| Option to purchase additional shares from us |

We have granted the underwriters an option, exercisable for 30 days after the date of this prospectus, to purchase up to an additional shares from us. |

| Use of proceeds |

We estimate that the net proceeds from the sale of shares of our common stock that we are selling in this offering will be approximately $ million (or approximately $ million if the underwriters’ option to purchase additional shares in this offering is exercised in full), based upon an assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| We intend to use the net proceeds of this offering for working capital or other general corporate purposes, including funding our growth strategies discussed in this prospectus. These uses include the expansion of our sales organization, international expansion, further development of the Hortonworks Data Platform and general and administrative matters. We may also use a portion of the net proceeds to acquire complementary businesses, products, services, technologies or other assets. |

| See “Use of Proceeds” for additional information. |

| Concentration of Ownership |

Upon completion of this offering, our executive officers and directors, and their affiliates, will beneficially own, in the aggregate, approximately % of our outstanding shares of common stock. |

| Proposed NASDAQ Global Select Market trading symbol |

“HDP” |

The number of shares of our common stock that will be outstanding after this offering is based on 69,762,019 shares outstanding as of September 30, 2014, including the conversion into common stock of 43,899,075 shares of preferred stock upon the completion of this offering, and excludes:

| • | 27,481,340 shares of our common stock issuable upon the exercise of options to purchase common stock that were outstanding as of September 30, 2014, with a weighted average |

7

| exercise price of $3.70 per share (which excludes 5,187,290 restricted shares issued under the 2011 Stock Option and Grant Plan); |

| • | 675,000 shares of our common stock issuable upon the exercise of options to purchase common stock granted after September 30, 2014, with a weighted average exercise price of $9.88 per share; |

| • | 12,000,000 shares of our common stock reserved for future issuance under our 2014 Stock Option and Incentive Plan, which will become effective upon completion of this offering, which contains provisions that automatically increase its share reserve each year and includes shares of common stock that were reserved under our 2011 Stock Option and Grant Plan; |

| • | 5,000,000 shares of our common stock reserved for issuance under our 2014 Employee Stock Purchase Plan, which will become effective upon the completion of this offering and contains provisions that automatically increase its share reserve each year; |

| • | 6,500,000 shares of our common stock issuable upon the exercise of a warrant to purchase shares of our Series A preferred stock outstanding as of September 30, 2014, with an exercise price of $0.005 per share that will be exercisable for common stock upon the completion of this offering; and |

| • | 952,736 shares of our common stock, subject to further adjustment in the event that we sell any additional shares of Series D preferred stock or warrants to purchase Series D preferred stock prior to the completion of this offering or other liquidation event, issuable upon the exercise of a warrant to purchase shares of our common stock with an exercise price of $4.23 per share. |

Except as otherwise indicated, all information in this prospectus assumes:

| • | the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 43,899,075 shares of our common stock, the conversion of which will occur upon the completion of this offering; |

| • | the filing and effectiveness of our amended and restated certificate of incorporation in Delaware and the adoption of our amended and restated bylaws, each of which will occur immediately prior to the completion of this offering; and |

| • | no exercise by the underwriters of their option to purchase up to an additional shares of our common stock from us in this offering. |

8

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize our historical financial data. Commencing with the fiscal year ended December 31, 2013, we changed our fiscal year end from April 30 to December 31. We have derived the summary consolidated statement of operations data for the years ended April 30, 2012 and 2013 and the eight months ended December 31, 2013 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary consolidated statement of operations data for the nine months ended September 30, 2013 and 2014 and the eight months ended December 31, 2012 and the summary consolidated balance sheet data as of September 30, 2014 from our unaudited interim and comparative transition period consolidated financial statements included elsewhere in this prospectus. The unaudited interim and comparative transition period consolidated financial statements reflect, in the opinion of management, all adjustments of a normal, recurring nature that are necessary for the fair presentation of the consolidated financial statements. Our historical results are not necessarily indicative of the results that may be expected in the future, and the results for the nine months ended September 30, 2014 are not necessarily indicative of results to be expected for the full year or any other period. The following summary consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended April 30, | Eight Months Ended December 31, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2012 | 2013 | 2012 | 2013 | 2013 | 2014 | |||||||||||||||||||

| (In thousands, except share and per share amounts) | ||||||||||||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||||||||||

| Support subscription |

$ | 1,276 | $ | 7,739 | $ | 3,643 | $ | 11,415 | $ | 10,212 | $ | 19,190 | ||||||||||||

| Professional services |

370 | 3,259 | 1,135 | 6,450 | 5,726 | 14,198 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total support subscription and professional services revenue(1) |

1,646 | 10,998 | 4,778 | 17,865 | 15,938 | 33,388 | ||||||||||||||||||

| Cost of revenue: |

||||||||||||||||||||||||

| Cost of support subscription |

421 | 5,071 | 2,880 | 3,720 | 4,995 | 2,875 | ||||||||||||||||||

| Cost of professional services |

974 | 5,862 | 3,053 | 9,990 | 8,493 | 19,125 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total cost of revenue(2) |

1,395 | 10,933 | 5,933 | 13,710 | 13,488 | 22,000 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross profit (loss) |

251 | 65 | (1,155 | ) | 4,155 | 2,450 | 11,388 | |||||||||||||||||

| Operating expenses:(2) |

||||||||||||||||||||||||

| Sales and marketing |

2,589 | 17,187 | 8,403 | 21,357 | 21,584 | 44,553 | ||||||||||||||||||

| Research and development |

6,881 | 12,070 | 6,768 | 14,621 | 13,752 | 26,270 | ||||||||||||||||||

| General and administrative |

2,384 | 7,598 | 3,487 | 14,368 | 15,583 | 17,634 | ||||||||||||||||||

| Contribution of acquired technology to the Apache Software Foundation |

— | — | — | — | — | 3,971 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating expenses |

11,854 | 36,855 | 18,658 | 50,346 | 50,919 | 92,428 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Loss from operations |

(11,603 | ) | (36,790 | ) | (19,813 | ) | (46,191 | ) | (48,469 | ) | (81,040 | ) | ||||||||||||

| Interest and other income |

84 | 215 | 159 | 152 | 159 | 381 | ||||||||||||||||||

| Other expense |

(1 | ) | (52 | ) | (49 | ) | (129 | ) | (56 | ) | (7,269 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Loss before income tax expense (benefit) |

(11,520 | ) | (36,627 | ) | (19,703 | ) | (46,168 | ) | (48,366 | ) | (87,928 | ) | ||||||||||||

| Income tax expense (benefit) |

1 | 11 | 8 | 45 | 34 | (1,196 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss |

$ | (11,521 | ) | $ | (36,638 | ) | $ | (19,711 | ) | $ | (46,213 | ) | $ | (48,400 | ) | $ | (86,732 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss per share of common stock, basic and diluted(3) |

$ | (37.15 | ) | $ | (15.14 | ) | $ | (8.48 | ) | $ | (9.09 | ) | $ | (14.37 | ) | $ | (10.40 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Weighted average shares used in computing net loss per share of common stock, basic and diluted(3) |

310,105 | 2,419,502 | 2,323,761 | 5,083,600 | 3,368,335 | 8,336,102 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Pro forma net loss per share of common stock, basic and diluted(4) |

$ | (1.34 | ) | $ | (1.31 | ) | $ | (1.86 | ) | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Weighted average shares used in computing pro forma net loss per share of common stock, basic and diluted(4) |

27,302,310 | 35,278,181 | 46,719,827 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

9

| (1) | Total support subscription and professional services revenue for the eight months ended December 31, 2013 and nine months ended September 30, 2014 includes contra-revenue adjustments recognized for equity securities issued to an affiliate of AT&T, which is a customer, as follows: |

| Eight Months Ended December 31, |

Nine Months Ended September 30, |

Twelve Months Ended September 30, |

||||||||||

| 2013 | 2014 | 2014 | ||||||||||

| Gross support and subscription and professional services revenue: |

||||||||||||

| Support subscription |

$ | 11,782 | $ | 21,151 | $ | 26,768 | ||||||

| Professional services |

6,465 | 14,277 | 17,188 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total support subscription and professional services revenue |

18,247 | 35,428 | 43,956 | |||||||||

| Contra-support subscription and professional services revenue: |

||||||||||||

| Support subscription |

(367 | ) | (1,961 | ) | (2,328 | ) | ||||||

| Professional services |

(15 | ) | (79 | ) | (93 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total contra-support subscription and professional services revenue |

(382 | ) | (2,040 | ) | (2,421 | ) | ||||||

| Net support subscription and professional services revenue: |

||||||||||||

| Support subscription |

11,415 | 19,190 | 24,440 | |||||||||

| Professional services |

6,450 | 14,198 | 17,095 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total net support subscription and professional services revenue |

$ | 17,865 | $ | 33,388 | $ | 41,535 | ||||||

|

|

|

|

|

|

|

|||||||

| (2) | Stock-based compensation was allocated as follows: |

| Year Ended April 30, | Eight Months Ended December 31, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2012 | 2013 | 2012 | 2013 | 2013 | 2014 | |||||||||||||||||||

| Cost of revenue |

$ | 14 | $ | 45 | $ | 44 | $ | 132 | $ | 83 | $ | 320 | ||||||||||||

| Research and development |

140 | 244 | 140 | 468 | 327 | 1,146 | ||||||||||||||||||

| Sales and marketing |

18 | 234 | 110 | 321 | 270 | 978 | ||||||||||||||||||

| General and administrative |

150 | 239 | 122 | 406 | 342 | 3,048 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total stock-based compensation |

$ | 322 | $ | 762 | $ | 416 | $ | 1,327 | $ | 1,022 | $ | 5,492 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (3) | See Note 11 to our consolidated financial statements for an explanation of the method used to calculate basic and diluted net loss per share attributable to common stockholders and the weighted average number of shares used in the computation of the per share amounts. |

| (4) | See Note 12 to our consolidated financial statements for an explanation of the method used to calculate pro forma basic and diluted net loss per share attributable to common stockholders and the weighted average number of shares used in the computation of the per share amounts. |

| As of September 30, 2014 | ||||||||||||

| Actual | Pro Forma(1) | Pro Forma as Adjusted(2) |

||||||||||

| (In thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents and short-term investments |

$ | 111,614 | $ | 111,614 | $ | |||||||

| Working capital |

90,470 | 90,470 | ||||||||||

| Property and equipment, net |

2,201 | 2,201 | ||||||||||

| Total assets |

160,335 | 160,335 | ||||||||||

| Deferred revenue |

47,720 | 47,720 | ||||||||||

| Additional paid-in capital |

13,946 | 266,556 | ||||||||||

| Accumulated deficit |

(181,104 | ) | (181,104 | ) | ||||||||

| Total stockholders’ equity (deficit) |

(167,322 | ) | 85,292 | |||||||||

10

| (1) | The pro forma column in the consolidated balance sheet data table above reflects the automatic conversion of all outstanding shares of our convertible preferred stock as of September 30, 2014 into an aggregate of 43,899,075 shares of our common stock which conversion will occur upon the completion of this offering, as if such conversion had occurred on September 30, 2014. |

| (2) | The pro forma as adjusted column in the consolidated balance sheet table above gives effect to the pro forma adjustments set forth in footnote 1 above and the sale and issuance by us of shares of our common stock in this offering at an assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma as adjusted information set forth above is illustrative only and does not take into consideration the impact of capitalized offering costs. We capitalized $ of our offering costs as of , 2014 in connection with the preparation of the registration statement of which this prospectus forms a part, of which $ remained unpaid as of , 2014. |

The pro forma as adjusted information presented in the consolidated balance sheet data is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing. Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase or decrease, as applicable, each of our pro forma as adjusted cash and cash equivalents and short-term investments, working capital, total assets, additional paid-in capital and total stockholders’ equity (deficit) by approximately $ , assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions. An increase or decrease by one million shares in the number of shares offered by us would increase or decrease, as applicable, the amount of our pro forma as adjusted cash and cash equivalents and short-term investments, working capital, total assets, additional paid-in capital and total stockholders’ equity (deficit) by approximately $ , assuming that the initial public offering price of $ per share, remains the same and after deducting estimated underwriting discounts and commissions.

Yahoo! Preferred Stock Warrant

In July 2011, we issued a warrant to purchase 6,500,000 shares of Series A preferred stock at an exercise price of $0.005 per share to Yahoo!, a related party. Upon consummation of the offering, the warrant will be exercisable for common stock and the fair value of the warrant will be recognized as a reduction in revenue up to the cumulative amount of revenue recognized to date from Yahoo!, which was approximately $3.3 million as of September 30, 2014, and any excess of such fair value over such cumulative revenue will be recognized in cost of sales, in the quarter in which the offering is consummated. The reduction in revenue and increase in cost of sales resulting from vesting of the warrant is estimated at $ million in the aggregate (comprised of $ million as a reduction in revenue and $ million as an increase in cost of sales), assuming that the offering had been consummated on September 30, 2014, based on an assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and would result in an increase of $ in additional paid-in capital and a net increase of $ million in accumulated deficit. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview.” The warrant will not have an impact on our revenue or expenses in periods subsequent to the period in which this offering is consummated.

11

Key Metric – Gross Billings

We have included gross billings, a non-GAAP financial measure, in this prospectus because it is a key measure used by our board of directors and management to monitor our near term cash flows and manage our business. Gross billings is calculated as total revenue plus the change in deferred revenue for the same period. As we have not yet established vendor-specific objective evidence of fair value for our support subscriptions, we recognize revenue ratably over the period beginning when both the support subscription and professional services have commenced for customers with agreements that purchase both a support subscription and professional services. Most of our customer agreements include both support subscription and professional services. The accounting treatment for such agreements causes our revenue to trail the impact of these customer agreements and creates significant deferred revenue balances.

We have provided a reconciliation between total revenue, the most directly comparable GAAP financial measure, and gross billings in the table below. Accordingly, we believe gross billings provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our board of directors and management.

| Year Ended April 30, |

Eight Months Ended December 31, |

Nine Months Ended September 30, |

Twelve Months Ended September 30, |

|||||||||||||||||||||||||

| 2012 | 2013 | 2012 | 2013 | 2013 | 2014 | 2014 | ||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||

| Gross billings: |

||||||||||||||||||||||||||||

| Total revenue |

$ | 1,646 | $ | 10,998 | $ | 4,778 | $ | 17,865 | $ | 15,938 | $ | 33,388 | $ | 41,535 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total deferred revenue, end of period |

10,148 | 16,730 | 15,096 | 27,928 | 23,573 | 47,720 | 47,720 | |||||||||||||||||||||

| Less: Total deferred revenue, beginning of period |

— | (10,148 | ) | (10,148 | ) | (16,730 | ) | (15,096 | ) | (27,928 | ) | (23,573 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total change in deferred revenue |

10,148 | 6,582 | 4,948 | 11,198 | 8,477 | 19,792 | 24,147 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Gross billings |

$ | 11,794 | $ | 17,580 | $ | 9,726 | $ | 29,063 | $ | 24,415 | $ | 53,180 | $ | 65,682 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

12

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, before making a decision to invest in our common stock. If any of the risks actually occur, our business, financial condition, results of operations and prospects could be harmed. In that event, the trading price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business

We have a history of losses, and we may not become profitable in the future.

We have incurred net losses in each year since our inception, including net losses of $11.5 million in the year ended April 30, 2012, $36.6 million in the year ended April 30, 2013 and $46.2 million in the eight months ended December 30, 2013. As a result, we had an accumulated deficit of $181.1 million at September 30, 2014. These losses and our accumulated deficit will be further increased as a result of the accounting for the Yahoo! preferred stock warrant described in “Prospectus Summary—Yahoo! Preferred Stock Warrant.” Because the market for our solution is rapidly evolving and has not yet reached widespread adoption, it is difficult for us to predict our future results of operations. We may not achieve sufficient revenue to attain and maintain profitability. We expect our operating expenses to increase over the next several years as we hire additional personnel, particularly in sales and marketing, expand and improve the effectiveness of our distribution channels, and continue to invest in the development of the Hortonworks Data Platform. In addition, as we grow and as we become a newly public company, we will incur additional significant legal, accounting and other expenses that we did not incur as a private company. As a result of these increased expenses, we will have to generate and sustain increased revenue to be profitable in future periods. Any failure by us to sustain or increase profitability on a consistent basis could cause the value of our common stock to decline.

We have a limited operating history, which makes it difficult to predict our future results of operations.

We were incorporated in 2011 and introduced our first solution in 2012. As a result of our limited operating history, our ability to forecast our future results of operations is limited and subject to a number of uncertainties, including our ability to plan for and model future growth. Our historical revenue growth has been inconsistent, has benefited from transactions with related parties and should not be considered indicative of our future performance. Further, in future periods, our revenue growth could slow or our revenues could decline for a number of reasons, including slowing demand for our support subscription offerings and our professional services, increasing competition, a decrease in the growth of our overall market, or our failure, for any reason, to continue to capitalize on growth opportunities. We have also encountered and will encounter risks and uncertainties frequently experienced by growing companies in rapidly changing industries, such as the risks and uncertainties described herein. If our assumptions regarding these risks and uncertainties and our future revenue growth (each of which we use to plan our business) are incorrect or change, or if we do not address these risks successfully, our operating and financial results could differ materially from our expectations and our business could suffer.

We do not have an adequate history with our support subscription offerings or pricing models to accurately predict the long-term rate of support subscription customer renewals or adoption, or the impact these renewals and adoption will have on our revenues or results of operations.

We have limited experience with respect to determining the optimal prices for our support subscription offerings. As the market for open source distributed data platforms matures, or as new

13

competitors introduce new products or services that compete with ours, we may be unable to attract new support subscription customers at the same price or based on the same pricing model as we have used historically. Moreover, large support subscription customers, which are the focus of our sales efforts, may demand greater price concessions. As a result, in the future we may be required to reduce our prices, which could harm our revenues, gross margins, financial position and cash flows. Furthermore, while the terms of our support subscription agreements limit the number of supported nodes or the size of supported data sets, such limitations may be improperly circumvented or otherwise bypassed by certain users.

We expect to derive a significant portion of our revenue from renewals of existing support subscription agreements. As a result, achieving a high renewal rate of our support subscription agreements will be critical to our business. Our support subscription customers have no obligation to renew their support subscriptions after the expiration of the initial subscription period, and may renew for fewer elements of our support subscription offerings or on different pricing terms. We have limited historical data with respect to rates of support subscription customer renewals, and to date, the majority of our support subscription agreements have not reached the end of their original term, so we cannot accurately predict support subscription customer renewal rates. Our support subscription customers’ renewal rates may decline or fluctuate as a result of a number of factors, including their dissatisfaction with our pricing or the Hortonworks Data Platform and their ability to continue their operations and spending levels. If our support subscription customers do not renew their support subscriptions on similar pricing terms, our revenues may decline and our business could suffer. In addition, over time the average term of our contracts could change based on renewal rates or for other reasons.

Because we derive substantially all of our revenues and cash flows from supporting the Hortonworks Data Platform and services and training related to it, failure of these offerings to satisfy customer requirements or to achieve increased market acceptance would harm our business, results of operations, financial condition and growth prospects.

We derive and expect to continue to derive substantially all of our revenues and cash flows from customer fees for support subscription offerings and professional services in support of the Hortonworks Data Platform. As such, the market acceptance of the Hortonworks Data Platform is critical to our continued success. Demand for the Hortonworks Data Platform is affected by a number of factors beyond our control, including market acceptance of open source distributed data platforms by referenceable accounts for existing and new use cases, the continued enhancement of the Hortonworks Data Platform to incorporate features and functionality desired by our support subscription customers, the timing of development and release of new products by our competitors, technological change and growth or contraction in our market. We expect the proliferation of unstructured data to lead to an increase in the data storage and processing demands of our customers, and the Hortonworks Data Platform may not be able to perform to meet those demands. If we are unable to continue to meet support subscription customer requirements or to achieve more widespread market acceptance of the Hortonworks Data Platform, our business, results of operations, financial condition and growth prospects will be harmed.

Our success is highly dependent on our ability to penetrate the existing market for open source distributed data platforms as well as the growth and expansion of the market for open source distributed data platforms.

The market for Hadoop and open source distributed data platforms is relatively new, rapidly evolving and unproven. Our future success will depend in large part on Hadoop’s ability to penetrate the existing market for open source distributed data platforms, as well as the continued growth and expansion of the market for open source distributed data platforms. It is difficult to predict support subscription customer adoption and renewal rates, support subscription customer demand for our

14

offerings, the size, growth rate and expansion of these markets, the entry of competitive products or the success of existing competitive products. Our ability to penetrate the existing market and any expansion of the market depends on a number of factors, including the cost, performance and perceived value associated with our offerings, as well as support subscription customers’ willingness to adopt an alternative approach to data storage and processing. Furthermore, many potential support subscription customers have made significant investments in legacy data storage and processing software and may be unwilling to invest in new solutions. If the market for open source distributed data platforms fails to grow or expand or decreases in size, our business would be harmed.

If we are unable to maintain successful relationships with our partners, our business, results of operations and financial condition could be harmed.

In addition to our direct sales force and our website, we use strategic partners, such as distribution partners and resellers, to sell our support subscription offerings and our professional services. We expect that sales through partners will continue to grow as a proportion of our revenues for the foreseeable future.

Our agreements with our partners are generally non-exclusive, meaning our partners may offer customers the products and services of several different companies, including products and services that compete with ours, or may themselves be or become competitors. If our partners do not effectively market and sell our support subscription offerings and our professional services, choose to use greater efforts to market and sell their own products and services or those of our competitors, or fail to meet the needs of our customers, our ability to grow our business and sell our support subscription offerings and our professional services may be harmed. Our partners may cease marketing our support subscription offerings or professional services with limited or no notice and with little or no penalty. The loss of a substantial number of our partners, our possible inability to replace them, or the failure to recruit additional partners could harm our results of operations.

Our ability to achieve revenue growth in the future will depend in part on our success in maintaining successful relationships with our partners, and in helping our partners enhance their ability to independently sell our support subscription offerings and our professional services. If we are unable to maintain our relationships with these partners, or otherwise develop and expand our indirect distribution channel, our business, results of operations, financial condition or cash flows could be harmed.

If we are unable to effectively compete, our business and operating results could be harmed.

We face substantial competition from Hadoop distribution vendors such as Cloudera and MapR Technologies, as well as enterprise software and infrastructure vendors that offer Hadoop distributions such as IBM Corporation, Oracle Corporation and Pivotal Software, Inc. Further, other established system providers not currently focused on Hadoop, including traditional data warehouse solution providers such as Teradata Corporation, SAP SE and EMC Corporation, or open source distributed data platform providers, including non-relational NoSQL database providers such as MongoDB Inc. and DataStax, Inc., may expand their products and services to compete with us. Additionally, some potential customers may elect to implement and support Hadoop deployments internally. Some of the companies that compete with us, or that may compete with us in the future, have greater name recognition, substantially greater financial, technical, marketing and other resources, the ability to devote greater resources to the promotion, sale and support of their solutions, more extensive customer bases and broader customer relationships and longer operating histories than we have.

We expect competition to increase as other companies continue to evolve their offerings and as new companies enter our market. Increased competition is likely to result in pricing pressures on our support subscription offerings and our professional services, which could negatively impact our gross

15

margins. If we are unable to effectively compete, our revenue could decline and our business, operating results and financial condition could be adversely affected.

The competitive position of the Hortonworks Data Platform depends in part on its ability to operate with third-party products and services, including those of our partners, and, if we are not successful in maintaining and expanding the compatibility of the Hortonworks Data Platform with such products and services, our business will suffer.

The competitive position of the Hortonworks Data Platform depends in part on its ability to operate with products and services of third parties, including software companies that offer applications designed for various business intelligence applications, software services and infrastructure, and it must be continuously modified and enhanced to adapt to changes in hardware, software, networking, browser and database technologies. In the future, one or more technology companies, whether our partners or otherwise, may choose not to support the operation of their software, software services and infrastructure with the Hortonworks Data Platform, or the Hortonworks Data Platform may not support the capabilities needed to operate with such software, software services and infrastructure. In addition, to the extent that a third party were to develop software or services that compete with ours, that provider may choose not to support the Hortonworks Data Platform. We intend to facilitate the compatibility of the Hortonworks Data Platform with various third-party software, software services and infrastructure offerings by maintaining and expanding our business and technical relationships. If we are not successful in achieving this goal, our business, financial condition and results of operations may suffer.

If open source software programmers, many of whom we do not employ, do not continue to develop and enhance open source technologies, we may be unable to develop new technologies, adequately enhance our existing technologies or meet customer requirements for innovation, quality and price.

We rely to a significant degree on a number of independent open source software programmers, or Hadoop committers and contributors, to develop and enhance Apache Hadoop and its related technologies. Additionally, members of the corresponding Apache Software Foundation Project Management Committees, many of whom are not employed by us, are primarily responsible for the oversight and evolution of the codebases of Hadoop and its related technologies. If the Hadoop committers and contributors fail to adequately further develop and enhance open source technologies, or if the Project Management Committees fail to oversee and guide the evolution of Hadoop-related technologies in the manner that we believe is appropriate to maximize the market potential of our offerings, then we would have to rely on other parties, or we would need to expend additional resources, to develop and enhance our offerings. We cannot predict whether further developments and enhancements to these technologies would be available from reliable alternative sources. In either event, our development expenses could be increased and our technology release and upgrade schedules could be delayed. Delays in developing, completing or delivering new or enhanced offerings could cause our offerings to be less competitive, impair customer acceptance of our offerings and result in delayed or reduced revenue for our offerings.

Our subscription-based business model may encounter customer resistance or we may experience a decline in the demand for our offerings.

We provide our support subscription offerings under annual or multi-year subscriptions. A support subscription generally entitles a support subscription customer to a specified scope of support, as well as security updates, fixes, functionality enhancements and upgrades to the technology and new versions of the software, if and when available, and compatibility with an ecosystem of certified hardware and software applications. We may encounter support subscription customer resistance to this distribution model or support subscription customers may fail to honor the terms of our support

16

subscription agreements. To the extent we are unsuccessful in promoting or defending this distribution model, our business, financial condition, results of operations and cash flows could be harmed.

Demand for our offerings may fluctuate based on numerous factors, including the spending levels and growth of our current and prospective support subscription customers, and general economic conditions. In addition, our support subscription customers generally undertake a significant evaluation process that may result in a prolonged sales cycle. We spend substantial time, effort and money on our sales efforts, including developing and implementing appropriate go-to-market strategies and training our sales force and ecosystem partners in order to effectively market new solutions, without any assurance that our efforts will produce any sales. The purchase of our offerings may be discretionary and can involve significant expenditures. If our current and prospective support subscription customers cut costs, then they may significantly reduce their enterprise software expenditures.

As technologies and the markets for our offerings change, our subscription-based business model may no longer meet the needs of our support subscription customers. Consequently, we may need to develop new and appropriate marketing and pricing strategies for our solutions. If we are unable to adapt our business model to changes in the marketplace or if demand for our solutions declines, our business, financial condition, results of operations and cash flows could be harmed.

If we are unable to expand sales to existing customers, our growth could be slower than we expect and our business and results of operations may be harmed.

Our future growth depends in part upon expanding sales of our support subscription offerings and our professional services to our existing customers. If our existing customers do not purchase additional support subscription offerings and professional services, our revenues may grow more slowly than expected, may not grow at all or may decline. Additionally, increasing incremental sales to our current customer base requires increasingly sophisticated and costly sales efforts. There can be no assurance that our efforts will result in increased sales to existing customers and additional revenues. If our efforts to expand sales to our existing customers are not successful, our business and operating results would be harmed.

Revenue from our largest customers has accounted for a significant percentage of our revenues, and the loss of one or more of our significant customers would harm our business.

A significant portion of our revenue has been concentrated among a relatively small number of large customers. For example, Microsoft Corporation historically accounted for 55.3% of our total revenue for the year ended April 30, 2013, 37.8% of our total revenue for the eight months ended December 31, 2013 and 22.4% of our total revenue for the nine months ended September 30, 2014. The revenue from our three largest customers as a group accounted for 71.0% of our total revenue for the year ended April 30, 2013, 50.5% of our total revenue for the eight months ended December 31, 2013 and 37.4% of our total revenue for the nine months ended September 30, 2014. While we expect that the revenue from our largest customers will decrease over time as a percentage of our total revenue as we generate more revenue from other customers, we expect that revenue from a relatively small group of customers will continue to account for a significant portion of our revenue, at least in the near term. Our customer agreements generally do not contain long-term commitments from our customers, and our customers may be able to terminate their agreements with us prior to expiration of the term. For example, the current term of our agreement with Microsoft expires in July 2015, and automatically renews thereafter for two successive twelve-month periods unless terminated earlier. The agreement may be terminated by Microsoft prior to the end of its term. Accordingly, the agreement with Microsoft may not continue for any specific period of time.

We may not be able to continue our relationships with any of our largest customers on the same or more favorable terms in future periods or our relationships may not continue beyond the terms of our

17

existing contracts with them. Our revenue and operating results would suffer if, among other things, any of our largest customers were to renegotiate, terminate, renew on less favorable terms or fail to renew their agreements with us.

Our future results of operations may fluctuate significantly, and our recent results of operations may not be a good indication of our future performance.

Our revenue and results of operations could vary significantly from period to period as a result of various factors, many of which are outside of our control. At the beginning of each quarter, we do not know the number of support subscriptions that we will enter into during the quarter. In addition, the contract value of our support subscriptions varies substantially among customers, and a single, large support subscription in a given period could distort our results of operations. Comparing our revenue and results of operations on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance.

We may not be able to accurately predict our future revenue or results of operations on a quarterly or longer-term basis. We base our current and future expense levels on our operating plans and sales forecasts, and our operating costs are expected to be relatively fixed in the short-term. As a result, we may not be able to reduce our costs sufficiently to compensate for an unexpected shortfall in revenue, and even a small shortfall in revenue in a quarter could harm our financial results for that quarter and cause our financial results to fall short of analyst expectations, which could cause the market price of our common stock to decline substantially.

In addition to other risk factors described in this “Risk Factors” section, factors that may cause our results of operations to fluctuate from quarter to quarter include:

| • | the timing of new customer contracts for support subscription offerings and professional services, and the extent to which we earn additional revenue from existing customers as they expand their deployment of the Hortonworks Data Platform; |

| • | the renewal rates of our customers; |

| • | changes in the competitive dynamics of our market; |

| • | customers delaying purchasing decisions in anticipation of new software or software enhancements; |

| • | the timing of satisfying revenue recognition criteria and our ability to obtain vendor-specific objective evidence of fair value, or VSOE, for our support subscription offerings; |

| • | our ability to control costs, including our operating expenses; |

| • | the proportion of revenue attributable to larger transactions as opposed to smaller transactions and the impact that a change in such proportion may have on the overall average selling price of our support subscription offerings; |

| • | the proportion of revenue attributable to support subscription offerings and professional services, which may impact our gross margins and operating income; |

| • | the reduction or elimination of support of the Apache Hadoop Project by the Apache Software Foundation, migration of Hadoop technology to an organization other than the Apache Software Foundation, or any other actions taken by the Apache Software Foundation or the Apache Hadoop Project that may impact our business model; |

| • | changes in customers’ budgets and in the timing of their purchasing decisions; |

| • | the collectability of receivables from customers and resellers, which may be hindered or delayed if these customers or resellers experience financial distress; and |

18

| • | general economic conditions, both domestically and internationally, as well as economic conditions specifically affecting industries in which our customers participate. |

Many of these factors are outside of our control, and the variability and unpredictability of such factors could result in our failing to meet or exceed our financial expectations for a given period. We believe that quarter-to-quarter comparisons of our revenue, results of operations and cash flows may not necessarily be indicative of our future performance.

Our sales cycle is long and unpredictable, particularly with respect to large support subscription customers, and our sales efforts require considerable time and expense.