Filed Pursuant to Rule 424(b)(3)

Registration No. 333-213653

PROSPECTUS SUPPLEMENT NO. 2

TO THE PROSPECTUS DATED MARCH 29, 2017

Lilis Energy, Inc.

Up to 40,993,017 Shares of Common Stock

This prospectus supplement No. 2 supplements the prospectus dated March 29, 2017 (as supplemented to date), covering the resale of shares of our common stock by selling stockholders as described therein, or the prospectus, included in Post-Effective Amendment No. 1 to our Registration Statement on Form S-1 (Registration No. 333- 213653). This prospectus supplement is being filed to update and supplement the information in the prospectus with the information contained in our Current Reports on Form 8-K as filed with the Securities and Exchange Commission on (i) June 26, 2017, (ii) July 14, 2017, (iii) August 2, 2017, (iv) August 4, 2017, (v) August 14, 2017, (vi) September 12, 2017, (vii) October 10, 2017, and (viii) October 24, 2017 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017 as filed with the Securities and Exchange Commission on August 14, 2017 (each of which is attached to and a part of this prospectus supplement), only to the extent that any information contained in those documents is deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

The Prospectus and this prospectus supplement relates to the offer and sale from time to time by the selling stockholders identified in the Prospectus of up to an aggregate of 40,993,017 shares of common stock, par value $0.0001 per share, as set forth in the Prospectus.

This prospectus supplement should be read in conjunction with the Prospectus. This prospectus supplement updates and supplements the information in the Prospectus. If there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

This prospectus supplement is not complete without, and may not be delivered or utilized except in connection with, the Prospectus, including any supplements and amendments thereto.

Our common stock is currently listed on the NYSE American under the symbol “LLEX.” On November 2, 2017, the last reported sale price of shares of our common stock on the NYSE MKT was $5.11.

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock in “Risk Factors” beginning on page 5 of the Prospectus and page 20 of our annual report on Form 10-K for the year ended December 31, 2016.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November 3, 2017.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 26, 2017

LILIS ENERGY, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 001-35330 | 74-3231613 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

300 E. Sonterra Blvd. Ste. 1220 |

||

San Antonio, Texas |

78258 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(210) 999-5400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective June 26, 2017 (the “Effective Date”), Lilis Energy, Inc. (the “Company”) appointed James Linville as President of the Company. In connection with his appointment, Mr. Linville entered into an employment agreement with the Company. The initial term of the employment agreement is scheduled to end on December 31, 2018, and the employment agreement will renew automatically for additional one-year periods beginning on December 31, 2018, unless either party gives notice of non-renewal at least 180 days before the end of the then-current term.

Mr. Linville’s base salary will be $400,000 for the first year of the employment agreement and $450,000 for the second year of the employment agreement. This base salary will be reviewed periodically for increase by the Company’s Board of Directors (the “Board”). Mr. Linville will be paid a lump sum cash signing bonus of $100,000 on the first regular payroll date of the Company following the Effective Date. Mr. Linville will also be eligible to receive an additional cash bonus equal to no less than $200,000 upon the one-year anniversary of the Effective Date, subject to increase at the sole discretion of the Board, and subject to Mr. Linville’s continued employment with the Company through the payment date (the “2018 Bonus”). Mr. Linville will also be eligible to receive awards of equity and non-equity compensation and to participate in the Company’s annual and long-term incentive plans, in each case as determined by the Board in its discretion. He will also be eligible to participate in the Company’s general employee benefit and paid time off plans, and to receive reimbursement for the direct rental costs for an apartment or house in the San Antonio, Texas area.

On June 26, 2017, Mr. Linville received a conditional grant under the Company’s 2016 Omnibus Incentive Plan of (i) options to purchase 325,000 shares of common stock with an exercise price of $4.84 and (ii) 175,000 shares of restricted stock, which are in each case, subject to stockholder approval of additional shares under the 2016 Omnibus Incentive Plan at the Company’s 2017 annual meeting of stockholders. Both the options and the restricted stock are scheduled to vest over two years, with 34% vesting on the date of the grant, 33% vesting on the first anniversary of the date of the grant and 33% vesting on the second anniversary of the date of the grant, subject to continued service through each vesting date.

Under his employment agreement, Mr. Linville will be entitled to a lump sum severance payment equal to 12 months of base salary plus COBRA premiums upon a termination by the Company without cause or a termination by him for good reason (or 24 months if the termination occurs within 12 months following a change in control), in addition to any unpaid portion of his 2018 Bonus. If his employment agreement is terminated due to death or disability, he will be entitled to a lump sum severance payment equal to six months of COBRA premiums. All severance payments under Mr. Linville’s employment agreement are subject to his execution and non-revocation of a release of claims against the Company. The severance payments are also subject to reduction in order to avoid any excise tax associated with Section 280G of the Internal Revenue Code, but only if that reduction would result in Mr. Linville receiving a greater net after tax benefit as a result of the reduction.

All payments to Mr. Linville under his employment agreement will be subject to clawback to the extent required by applicable law. Further, Mr. Linville is subject to non-competition, non-solicitation, anti-raiding, and confidentiality provisions under his employment agreement.

The foregoing description of the Company’s employment agreement with Mr. Linville is not complete and is qualified in its entirety by reference to the terms of such employment agreement, a copy of which is attached as Exhibit 10.1 hereto.

Prior to his appointment as President of the Company, Mr. Linville, age 52, most recently held the position of Senior Director of Operations and Development for US Energy Development Corporation (“US Energy”) from January 2016 to June 2017, where he was a senior technical engineering, operational and resource development professional in the company. During his time at US Energy, Mr. Linville led a team of field and office staff consisting of drilling, completions, operations, engineering, reservoir, regulatory and environmental safety professionals. Additionally, Mr. Linville was a member of the Capital Committee at US Energy, tasked with deploying up to approximately $200 million annually in a portfolio of energy related investments, primarily within the Delaware Basin and Eagle Ford. Prior to US Energy, Mr. Linville was Director of Operations at American Energy Permian Basin (“AEPB”) from January 2015 to July 2015, where he managed field operations, completions, production and facilities engineering for a large Midland Basin Wolfcamp shale horizontal development program. Prior to moving into his position as Director of Operations at AEPB, Mr. Linville was Director of Acquisitions at American Energy Partners, LP (“AELP”) from February 2014 to January 2015, where he assembled and led the acquisitions team, consisting of numerous petro-professionals (Reservoir, Operations, Geoscience, Land), who were responsible for screening over 400 acquisition opportunities. While at AELP, Mr. Linville participated in and managed over 100 acquisition evaluations with aggregate value greater than $12 billion. Previously, Mr. Linville was employed at Devon Energy Corporation (“Devon”) from January 2001 to January 2014, where he held various engineering and management roles. Prior to Devon, Mr. Linville held various leadership and engineering (reservoir, production, drilling) and operational roles at Eastern American Energy, Consolidated Oil & Gas, Hallwood Petroleum, Unocal and his own firm Derrick Engineering Corporation. Mr. Linville earned his Bachelor of Science in Petroleum Engineering from New Mexico Tech and his Master of Science in Environmental Engineering from Marshall University. Throughout his career, he has held numerous leadership roles within the Society of Petroleum Engineers (SPE) and was an Industry Advisory Board member at New Mexico Tech and the Oklahoma City SPE Chapter. In addition, Mr. Linville is a Registered Professional Engineer.

| Item 7.01 | Regulation FD Disclosure. |

On June 26, 2017, the Company issued a press release announcing the appointment of Mr. Linville. A copy of that press release is attached hereto as Exhibit 99.1.

The information in this Item 7.01 is being furnished and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in this Item 7.01 shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements & Exhibits. |

(d) Exhibits

| Exhibit No. |

Description | |

| 10.1 |

Employment Agreement, dated June 26, 2017, between James Linville and Lilis Energy, Inc. | |

| 99.1 |

Press Release of Lilis Energy, Inc. dated June 26, 2017. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: June 26, 2017 | LILIS ENERGY, INC. | ||

| By: | /s/ Joseph C. Daches | ||

| Chief Financial Officer | |||

EXHIBIT INDEX

| Exhibit No. |

Description | |

| 10.1 |

Employment Agreement, dated June 26, 2017, between James Linville and Lilis Energy, Inc. | |

| 99.1 |

Press Release of Lilis Energy, Inc. dated June 26, 2017. |

Exhibit 10.1

EXECUTIVE EMPLOYMENT AGREEMENT

This Executive Employment Agreement (“Agreement”) is entered into as of June 26, 2017 (the “Effective Date”), by and between Lilis Energy, Inc. (the “Company”) and Jim Linville (“Executive”). Executive and the Company are each referred to individually as a “Party” and collectively as the “Parties.”

NOW, THEREFORE, in consideration of the mutual covenants, representations, warranties and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1. Employment. Executive’s employment with the Company is subject to the terms set forth herein.

2. Term. Subject to the remaining terms of this Section 2, this Agreement shall be for an initial term that begins on the Effective Date and continues in effect through December 31, 2018 (the “Initial Term”) and, unless terminated sooner as herein provided, shall continue on a year-to-year basis after the Initial Term (each year, a “Renewal Term,” and each Renewal Term together with the Initial Term, the “Term”). If either Party elects not to renew this Agreement for a Renewal Term, such Party must give a written Notice of Termination to the other Party at least 180 days before the expiration of the then-current Initial Term or Renewal Term, as applicable. In the event that one Party provides the other with a Notice of Termination pursuant to this Section 2, no further automatic extensions shall occur and this Agreement shall terminate at the end of the then-existing Initial Term or Renewal Term, as applicable, and such Termination shall not result in any entitlement to compensation pursuant to Section 6 or otherwise.

3. Position. During the Term, Executive shall be employed as and hold the title of President of the Company, with such duties and responsibilities that are customary in that position for public companies. Executive’s principal place of employment shall be at the main business offices of Company in San Antonio, Texas.

4. Scope of Services. During the Term, Executive shall devote substantially all of Executive’s business time, energy and best efforts to carry out Executive’s responsibilities with respect to the business and affairs of the Company and its affiliates. In addition, the Parties acknowledge that Executive may (i) engage in and manage Executive’s passive personal investments, (ii) engage in charitable and civic activities and (iii) engage in such other activities that the Parties mutually agree to; provided, however, that such activities shall be permitted so long as such activities do not conflict with the business and affairs of the Company or interfere with the performance of Executive’s duties hereunder.

5. Compensation and Benefits. In each case during the Term:

5.1 Base Salary. The Company shall pay, or cause to be paid, to Executive a base salary (the “Base Salary”) as established by or pursuant to authority granted by the Company’s Board of Directors (the “Board”) at the following rates:

(a) $400,000 for services rendered from the Effective Date to the one-year anniversary of the Effective Date; and

(b) $450,000 for services rendered from the one-year anniversary of the Effective Date to the two-year anniversary of the Effective Date.

The Base Salary shall be reviewed annually by or pursuant to authority granted by the Board in connection with its annual review of executive compensation to determine if such Base Salary should be increased (but not decreased) for the following year in recognition of services to the Company. The Base Salary shall be payable at such intervals in conformity with the Company’s prevailing practice as such practice shall be established or modified from time to time.

1

5.2 Signing Bonus. Executive shall be paid a lump sum cash signing bonus of $100,000 on the first regular payroll date of the Company following the Effective Date.

5.3 Performance Bonus. Executive shall receive a lump sum cash bonus payment equal to no less than $200,000 upon the one-year anniversary of the Effective Date (the “Performance Bonus”), subject to increase at the sole discretion of the Board, and subject to Executive’s continued employment with the Company through the payment date.

5.4 Annual Bonuses; Additional Compensation. Without limitation of Section 5.1, Executive shall be eligible to receive bonuses and awards of equity and non-equity compensation and to participate in annual and long-term compensation plans of the Company in accordance with any plan or decision that the Board, or any committee or other person authorized by the Board, may in its sole discretion determine from time to time.

5.5 Welfare and Benefit Plans. (i) Executive shall be entitled to participate in all savings and retirement plans, practices, policies and programs of the Company and (ii) Executive and Executive’s family, as the case may be, shall be eligible to participate in, and shall receive all benefits under, all welfare benefit plans, practices, policies and programs provided by the Company (including, to the extent provided, medical, prescription, dental, vision, disability, life, accidental death and travel accident insurance plans and programs) (all such plans, practices, policies and programs, the “Plans”), in each case pursuant to all terms and conditions of the Plans. Except as provided herein, the Company shall not be required to establish or continue the Plans or take any action to cause Executive to be eligible for any Plans on a basis more favorable than that applicable to its other executive-level employees generally.

5.6 Reimbursement. The Company shall reimburse Executive (or, in the Company’s sole discretion, shall pay directly), upon presentation of vouchers and other supporting documentation as the Company may reasonably require, for reasonable out-of-pocket expenses incurred by Executive relating to the business or affairs of the Company or the performance of Executive’s duties hereunder, including reasonable expenses with respect to mileage, entertainment, travel and similar items, dues for membership in professional organizations, and similar professional development expenses, provided that the incurring of such expenses shall have been approved in accordance with the Company’s regular reimbursement procedures and practices in effect from time to time.

5.7 Vacation. In addition to statutory holidays, Executive shall be entitled to no less than 20 days of paid vacation each calendar year during the Term. Vacation shall accrue pursuant to the Company’s vacation accrual policy applicable to all employees of the Company, provided that no more than 20 vacation days may be carried over from one calendar year to a subsequent calendar year.

5.8 Apartment. The Company shall reimburse Executive (or, in the Company’s sole discretion, shall pay directly), upon presentation of vouchers or other supporting documentation as the Company may reasonably require, for mutually agreed upon reasonable expenses incurred by Executive for the direct rental costs for an apartment or house in the San Antonio, Texas area.

5.9 Reservation of Rights. The Company reserves the right to modify, suspend or discontinue any and all of its employee benefit plans, practices, policies and programs at any time in its sole discretion without recourse by Executive so long as such changes are similarly applicable to executive employees at a similar level.

6. Payments upon Termination.

6.1 Accrued but Unpaid Salary and Bonus. In the event of a Termination for any reason during the Term, the Company shall pay to Executive (or, in the event of Executive’s death, to Executive’s estate or named beneficiary) (a) any Base Salary, vacation pay and expense reimbursements that are accrued but unpaid as of the date of Termination and (b) (except upon a Termination by the Company for Cause) any earned but unpaid bonus for any prior or current year.

2

6.2 Severance.

(a) Upon an Involuntary Termination during the Term and either prior to a Change in Control or more than one year following a Change in Control, contingent upon Executive’s execution, delivery and non-revocation of a release in form and substance satisfactory to the Company and consistent with the Company’s standard release agreement, which contains a full release of all claims against the Company and certain other provisions, including a reaffirmation of the covenants in Section 12 and Section 13 (the “Release Agreement”), Executive shall be entitled to (1) a lump sum severance payment in an amount equal to 12 months of Base Salary in effect immediately prior to the date of Termination, (2) a lump sum payment equal to 12 months of COBRA premiums based on the terms of Company’s group health plan and Executive’s coverage under such plan as of the date of Termination (regardless of any COBRA election actually made by Executive or the actual COBRA coverage period under the Company’s group health plan) and (3) a lump sum payment equal to (i) $200,000 (representing an amount equal to the unpaid Performance Bonus) and (ii) any additional amounts due but unpaid under Sections 5.3 or 5.4, if the date of Termination is prior to the one-year anniversary of the Effective Date.

(b) Upon an Involuntary Termination during the Term and within one year following a Change in Control, contingent upon Executive’s execution, delivery and non-revocation of the Release Agreement, Executive shall be entitled to (1) a lump sum severance payment in an amount equal to 24 months of Base Salary in effect immediately prior to the date of Termination, (2) a lump sum payment equal to 24 months of COBRA premiums based on the terms of Company’s group health plan and Executive’s coverage under such plan as of the date of Termination (regardless of any COBRA election actually made by Executive or the actual COBRA coverage period under the Company’s group health plan) and (3) a lump sum payment equal to (i) $200,000 (representing an amount equal to the unpaid Performance Bonus) and (ii) any additional amounts due but unpaid under Sections 5.3 or 5.4, if the date of Termination is prior to the one-year anniversary of the Effective Date.

(c) Upon a Termination due to Disability during the Term, contingent upon Executive’s execution, delivery and non-revocation of the Release Agreement, Executive shall be entitled to a lump sum payment equal to six months of COBRA premiums based on the terms of the Company’s group health plan and Executive’s coverage under such plan as of the date of Termination (regardless of any COBRA election actually made by Executive or the actual COBRA coverage period under the Company’s group health plan).

(d) The Company’s obligations under this Section 6.2 are subject to the requirements and time periods set forth in this Section 6.2 and in the Release Agreement. Prior to receiving the payments described in this Section 6.2, Executive shall execute the Release Agreement on or before the date 21 days (or such longer period to the extent required by law) after the date of Termination. If Executive fails to timely execute and remit the Release Agreement, Executive waives any right to the payments provided under this Section 6.2. Payments under this Section 6.2 shall be made within fifteen 15 days of Executive’s execution and delivery of the Release Agreement, provided that Executive does not revoke the Release Agreement.

(e) Executive’s rights following a Termination under the terms of any Plan, whether tax-qualified or not, which are not specifically addressed in this Agreement, shall be subject to the terms of such Plan, and this Agreement shall have no effect upon such terms except as specifically provided herein.

(f) Except as specifically provided under Section 6.1 and Section 6.2, the Company shall have no further obligations to Executive under this Agreement following a Termination. Without limitation of the foregoing, Executive shall not be entitled to any severance benefits under this Agreement in the event of a Termination other than an Involuntary Termination (except as provided in Section 6.1). The foregoing shall not limit any of Executive’s rights with regard to any rights to indemnification, advancement or payment of legal fees and costs, and coverage under directors and officers liability insurance.

(g) Notwithstanding anything in this Agreement to the contrary, the Company shall have the right to terminate all payments and benefits owing to Executive pursuant to Section 6.2 upon the Company’s discovery of any material breach by Executive of Executive’s obligations under the Release Agreement or Section 12 or Section 13.

3

7. Definitions. Capitalized terms used in this Agreement but not otherwise defined herein shall have the meaning hereby assigned to them as follows:

7.1 “Cause” means a determination by the Board that Executive has:

(a) in the performance of Executive’s duties with respect to the Company or any of its affiliates, engaged in reckless or willful misconduct or has violated the law, provided that no act or failure to act shall be deemed “willful” unless done, or omitted to be done, by Executive not in good faith and without reasonable belief that Executive’s action or omission was in the best interest of the Company;

(b) refused without proper legal reason to perform Executive’s duties and responsibilities to the Company or any of its affiliates, which continues after notice from the Company to perform such duties and responsibilities (for the purposes of this clause, the phrase “proper legal reason” shall include Executive’s delivery of a Notice of Termination for Good Reason where the assertion by Executive of Termination for Good Reason is for an event that constitutes Good Reason under the terms of this Agreement);

(c) willfully and materially breached any material provision of this Agreement;

(d) committed an act of fraud, embezzlement or breach of a fiduciary duty to the Company or an affiliate of the Company (including the unauthorized disclosure of material confidential or proprietary information of the Company or an affiliate of the Company);

(e) been convicted of (or pleaded no contest to) a felony (other than a crime involving the operation of a motor vehicle not involving a serious injury or death to an individual); or

(f) entered into a cease and desist order with the U.S. Securities and Exchange Commission alleging violation of U.S. or foreign securities laws.

Executive shall have 30 days from the date on which Executive receives the Company’s Notice of Termination for Cause under clause (a), (b) or (c) above to remedy any such occurrence otherwise constituting Cause under such clause.

In connection with a determination of Cause, a majority of the Board shall make such determination at a meeting of the Board called and held for such purpose (after reasonable notice to Executive and an opportunity for Executive, together with counsel, to be heard before the Board).

A Termination for Cause shall be deemed to include a determination by the Board following a Termination that circumstances existing prior to the Termination would have entitled the Company to have terminated Executive’s service for Cause.

All rights Executive has or may have under this Agreement shall be suspended automatically during the pendency of any investigation by the Board, or during any negotiations between the Board and Executive, regarding any actual or alleged act or omission by Executive of the type described in this definition of Cause.

7.2 “Change in Control” has the meaning given to such term in the Lilis Energy, Inc. 2016 Omnibus Incentive Plan or any successor plan thereto.

7.3 “Disability” means, if, during the Term, Executive is unable to perform substantially and continuously the duties assigned to him due to a disability (as such term is defined or used for purposes of the Company’s long-term disability plan then in effect, or, if no such plan is in effect, by virtue of ill health or other disability for more than 180 consecutive or non-consecutive days out of any consecutive 12-month period).

4

7.4 “Good Reason” means the occurrence of any of the following events without Executive’s consent:

(a) a material diminution in Executive’s Base Salary; or

(b) a material diminution in Executive’s authority, duties or responsibilities as an officer, or the Board fails to re-nominate Executive for election to the Board if Executive is a Board member as of the Effective Date or becomes a Board member thereafter;

(c) the relocation of Executive’s principal place of employment by more than 25 miles from the location of Executive’s principal place of employment as of the Effective Date; or

(d) a material breach by the Company of a material provision of this Agreement.

Notwithstanding the foregoing provisions of this Section 7.4 or any other provision in this Agreement to the contrary, any assertion by Executive of a Termination for Good Reason shall not be effective unless all of the following conditions are satisfied: (1) Executive provides written notice to the Company of such condition within 45 days of Executive gaining knowledge of the initial existence of the condition, (2) the condition specified in the notice remains uncured for 30 days after receipt of the notice by the Company and (3) the date of Termination occurs within 30 days after the expiration of the cure period set forth in (2) immediately above.

7.5 “Involuntary Termination” means a Termination by the Company without Cause or by Executive for Good Reason.

7.6 “Notice of Termination” means a written notice delivered by either Party to the other Party indicating the specific Termination provision in this Agreement relied upon for Termination and the date of Termination, and that sets forth in reasonable detail the facts and circumstances claimed to provide a basis for Termination under the provision so indicated.

7.7 “Termination” means termination of Executive’s employment with the Company and all affiliates.

8. Removal from any Boards and Positions. Unless otherwise agreed to in writing by the Parties at the time of Termination, upon a Termination, Executive shall be deemed to resign (i) if a member, from the Board and the board of directors of any affiliate and any other board to which Executive has been appointed or nominated by or on behalf of the Company or an affiliate, (ii) from each position with the Company and any affiliate, including as an officer of the Company or an affiliate and (iii) as a fiduciary of any employee benefit plan of the Company and any affiliate.

9. Adjustments to Payments.

9.1 Notwithstanding anything in this Agreement to the contrary, in the event that any payment or distribution by the Company to Executive or for Executive's benefit (whether paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise) (the “Payments”) would be subject to the excise tax imposed by Section 4999 of the Internal Revenue Code of 1986 (the “Code”), or any interest or penalty is incurred by Executive with respect to such excise tax (such excise tax, together with any such interest and penalties, the “Excise Tax”), then the Payments shall be reduced (but not below zero) if and to the extent that such reduction would result in Executive retaining a larger amount, on an after-tax basis (taking into account federal, state and local income taxes and the imposition of the Excise Tax), than if Executive received all of the Payments. The Company shall reduce or eliminate the Payments, by first reducing or eliminating the portion of the Payments that are not payable in cash and then by reducing or eliminating cash payments, in each case in reverse order beginning with payments or benefits that are to be paid the farthest in time from the determination.

5

9.2 All determinations required to be made under this Section 9, including whether and when an adjustment to any Payments is required and, if applicable, which Payments are to be so adjusted, shall be made by an independent accounting firm selected by the Company from among the four largest accounting firms in the United States or any nationally recognized financial planning and benefits consulting company (the “Accounting Firm”), which shall provide detailed supporting calculations to both Parties within 15 business days of the receipt of notice from Executive that there has been a Payment, or such earlier time as is requested by the Company. In the event that the Accounting Firm is serving as accountant or auditor for the individual, entity or group effecting the relevant change in control, Executive shall appoint another nationally recognized accounting firm to make the determinations required hereunder (which accounting firm shall then be referred to as the Accounting Firm hereunder). All fees and expenses of the Accounting Firm shall be borne solely by the Company. If the Accounting Firm determines that no Excise Tax is payable by Executive, it shall furnish Executive with a written opinion that failure to report the Excise Tax on Executive's applicable federal income tax return would not result in the imposition of a negligence or similar penalty. Any determination by the Accounting Firm shall be binding upon the Parties.

10. Clawback. Notwithstanding anything in this Agreement to the contrary, if any provision of this Agreement or any applicable statute, law, regulation or regulatory interpretation or other guidance legally requires the Company or any affiliate to seek or demand repayment or return of any payments made to Executive for any reason, Executive shall repay to the Company the aggregate amount of any such payments, with such repayment to occur no later than 30 days following Executive’s receipt of a written notice from the Company indicating that payments received by Executive are subject to repayment or return under this Section 10.

11. Withholding. The Company may withhold from Executive’s compensation, under this Agreement or otherwise, all applicable amounts required by law.

12. Non-Competition; Non-Solicitation; Anti-Raiding.

12.1 Executive hereby covenants that during the period of Executive’s employment by the Company, and for a period of six months following a Termination, Executive shall not, without the prior written consent of the Board, accept a position to perform duties similar to those performed by Executive while at the Company, directly or indirectly (whether as proprietor, stockholder, director, partner, employee, agent, independent contractor, consultant, trustee or in any other capacity), with respect to any property, drilling program, oil or gas leasehold, project or field, in which the Company participates, or has any investment or other business interest in, within five miles of the boundary of any existing Company leasehold in the United States in which the Company has conducted business at any time within the one-year period immediately preceding Termination (a “Competing Enterprise”); provided, however, that Executive shall not be deemed to be participating or engaging in a Competing Enterprise solely by virtue of Executive’s ownership of not more than 4.9% of any class of stock or other securities which are publicly traded on a national securities exchange or in a recognized over-the-counter market.

12.2 Executive may not avoid the purpose and intent of Section 12.1 by engaging in conduct within the geographically limited area from a remote location through means such as telecommunications, written correspondence, computer-generated or assisted communications or other similar methods.

6

13. Confidential Information.

13.1 For the purposes of this Agreement, “Confidential Information” means all proprietary information, data, knowledge and know-how relating, directly or indirectly, to the Company and its business, including: (a) business plans and strategies, prospect information, financial information, investment plans, marketing plans and strategies and financial plans and strategies; (b) confidential personnel or human resources data; (c) technical and business information, whether patentable or not, which is of a confidential, trade secret or proprietary character; (d) the identity of customers; (e) existing or prospective oil or gas properties, investors, participation agreements, working, royalty or other interests; (f) contract terms; (g) bidding information and strategies; (h) pricing methods or information; (i) computer software; (j) computer software methods and documentation; (k) hardware; (l) methods of operation; (m) procedures, forms and techniques used in servicing accounts or properties; (n) seismic, geophysical, petrophysical or geological data; (o) well logs and other well data; and (p) any other documents, information or data that the Company requires to be maintained in confidence for the Company’s business success or that constitutes material non-public information. The list set forth above is not intended by the Company to be a comprehensive list of Confidential Information. All Confidential Information shall be treated as Confidential Information regardless of whether it pertains to the Company or its customers and regardless of whether it is stamped as “confidential.”

13.2 Executive acknowledges that the success of the Company depends in large part on the protection of the Confidential Information. Executive further acknowledges that in the course of Executive’s employment with the Company, Executive will become familiar with the Company’s Confidential Information. Executive recognizes and acknowledges that the Confidential Information is a valuable, special and unique asset of the Company’s business, access to and knowledge of which are essential to the performance of Executive’s duties hereunder. Executive acknowledges that use or disclosure of the Confidential Information outside the performance of Executive’s job duties for the Company would cause harm and/or damage to the Company.

13.3 Both during and after the Term, Executive shall not, except in the ordinary course of Executive’s employment with the Company, disclose any Confidential Information to any person, firm, business, company, corporation, association or any other entity for any reason or purpose whatsoever. Executive shall not make use of any Confidential Information for Executive’s own purposes or for the benefit of any person, firm, business, company, corporation or any other entity (except the Company) under any circumstances during or after the Term. Executive shall consider and treat as confidential all Confidential Information in any way relating to the Company’s business and affairs, whether created by Executive or otherwise coming into Executive’s possession before, during, or after the Term. Executive shall secure and protect the Confidential Information in a manner designed to prevent all access and uses thereof contrary to the terms of this Agreement. Executive shall use Executive’s best efforts to assist the Company in identifying and preventing any use or disclosure of the Confidential Information contrary to this Agreement.

13.4 Executive represents and warrants that, upon Termination (whether during or after the Term), and without any request by the Company, Executive shall return to Company any and all property, documents and files (including all recorded media, such as papers, computer disks or other data storage devices, copies, photographs, maps, transparencies and microfiche) that contain Confidential Information or relate in any way to the Company or its business. To the extent Executive possesses any files, data or information relating in any way to the Company or its business on any personal computer, Executive shall delete such files, data or information (and shall retain no copies in any form). Executive also shall return any Company tools, equipment, calling cards, credit cards, access cards or keys, any keys to any filing cabinets or vehicles and all other Company property in any form prior to Termination (whether during or after the Term).

14. Equitable Remedies. The services to be rendered by Executive and the Confidential Information entrusted to Executive as a result of Executive’s employment by the Company are of a unique and special character, and, notwithstanding anything in this Agreement to the contrary, any breach by Executive of this Agreement, including a breach of Section 12 or Section 13, will cause the Company immediate and irreparable injury and damage, for which monetary relief would be inadequate or difficult to quantify. The Company shall be entitled to, in addition to all other remedies available to it, injunctive relief, specific performance or any other equitable relief to prevent a breach and to secure the enforcement of the provisions of this Agreement. The provisions of Section 12 and Section 13 are separate from and independent of the remainder of this Agreement and these provisions are specifically enforceable by the Company notwithstanding any claim made by Executive against the Company. Injunctive relief may be granted immediately upon the commencement of any such action, and the Company need not post a bond to obtain temporary or permanent injunctive relief.

7

15. Business Opportunities. Executive shall promptly disclose to the Company all business ideas, prospects, proposals and other opportunities pertaining to any aspect of the Company’s business that are originated by any third parties and brought to the attention of Executive after the Effective Date and before Termination.

16. Representations and Warranties. Executive hereby represents and warrants to the Company, and acknowledges, as follows.

16.1 The success of the Company’s business depends in large part on the protection of the Confidential Information and trade secrets.

16.2 Executive’s access to the Confidential Information, coupled with the personal relationships and goodwill between the Company and its customers, would enable Executive to compete unfairly against the Company.

16.3 Executive has full power, authority and capacity to enter into this Agreement and to perform Executive’s obligations hereunder.

16.4 This Agreement has been voluntarily executed by Executive and constitutes a valid and binding agreement of Executive.

16.5 Executive has read this Agreement and has had the opportunity to have this Agreement reviewed by Executive’s legal counsel.

16.6 Given the nature of the business in which the Company is engaged, the restrictions in Section 12 and Section 13, including their geographic scope and duration, are reasonable and necessary to protect the legitimate business interests of the Company.

16.7 Executive’s continued employment with the Company is sufficient consideration for this Agreement.

16.8 Executive is among the Company’s executive personnel, management personnel or officers and employees who constitute professional staff to executive and management personnel.

16.9 This Agreement is intended to protect the Company’s trade secrets and Confidential Information.

16.10 To the best of Executive’s knowledge, Executive’s employment with the Company will not (a) conflict with or result in a breach of, (b) constitute a default under, (c) result in the violation of, (d) give any third party the right to terminate or to accelerate any obligation under, or (e) require any authorization, consent, approval, execution or other action by or notice to any court or other governmental body under, the provisions of any other agreement or instrument to which Executive is a party.

16.11 Executive has not previously and shall not in the future disclose to the Company any proprietary information, trade secrets or other confidential information belonging to any previous employer.

16.12 Executive shall notify business partners and future employers of Executive’s obligations under this Agreement.

8

17. Waivers and Amendments. The respective rights and obligations of the Parties under this Agreement may be waived (either generally or in a particular instance, either retroactively or prospectively and either for a specified period of time or indefinitely) or amended only with the written consent of a duly authorized representative of the Parties. The waiver by either Party of a breach of any provision of this Agreement by the other Party shall not operate or be construed as a waiver of any subsequent breach by such other Party. The failure of either Party to insist upon strict performance of any of the terms or conditions of this Agreement shall not constitute a waiver of any of such Party’s rights hereunder.

18. Successors and Assigns. The provisions hereof shall inure to the benefit of, and be binding upon and assignable to, successors of the Company by way of merger, consolidation or sale. Executive may not assign or delegate to any third person Executive’s obligations under this Agreement. The rights and benefits of Executive under this Agreement are personal to Executive (or, in the event of Executive’s death or Disability, Executive’s personal representative, heirs or beneficiaries), and no such right or benefit shall be subject to voluntary or involuntary alienation, assignment or transfer.

19. Entire Agreement. This Agreement constitutes the full and entire understanding and agreement of the Parties with regard to the subjects hereof and supersedes and cancels in its entirety all other or prior or contemporaneous agreements, whether oral or written, with respect thereto, including any prior employment agreements between Executive and the Company in their entirety.

20. Notices. Any notices, consents or other communications required to be sent or given hereunder by either of the Parties shall in every case be in writing and shall be deemed properly served if (i) delivered personally, (ii) sent by registered or certified mail, in all such cases with first class postage prepaid, return receipt requested, or (iii) delivered by a nationally recognized overnight courier service to the Parties at the following addresses: if to the Company, to its principal headquarters; and if to Executive, to Executive’s current address listed in the Company’s records.

21. Governing Law; Consent to Jurisdiction; Consent to Venue; Service of Process. This Agreement shall be construed and interpreted in accordance with the internal laws of the State of Texas without regard to principles of conflicts of law thereof, or principles of conflicts of laws of any other jurisdiction that could cause the application of the laws of any jurisdiction other than the State of Texas. For purposes of resolving any dispute that arises directly or indirectly from the relationship of the Parties evidenced by this Agreement, the Parties hereby submit to and consent to the non-exclusive jurisdiction of the State of Texas and agree that any related litigation shall be conducted solely in the courts of Bexar County, Texas or the federal courts for the United States for the Western District of Texas, where this Agreement is made and/or to be performed, and no other courts. Each Party may be served with process in any manner permitted under State of Texas law, or by United States registered or certified mail, return receipt requested.

22. Waiver of Jury Trial. EACH OF THE PARTIES HEREBY VOLUNTARILY AND IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY ACTION OR OTHER PROCEEDING BROUGHT IN CONNECTION WITH THIS AGREEMENT OR ANY OF THE TRANSACTIONS CONTEMPLATED HEREBY.

9

23. Code Section 409A. It is intended that this Agreement comply with Code Section 409A (“Section 409A”), to the extent applicable. This Agreement shall be administered in a manner consistent with this intent, and any provision that would cause this Agreement to fail to satisfy Section 409A shall have no force or effect until amended to comply with Section 409A. Notwithstanding anything in this Agreement to the contrary, in the event any payment or benefit hereunder is determined to constitute nonqualified deferred compensation subject to Section 409A, then to the extent necessary to comply with Section 409A, such payment or benefit shall not be made, provided or commenced until six months after Executive’s separation from service. Lump sum payments shall be made, without interest, as soon as administratively practicable following the six-month delay. Any installments otherwise due during the six-month delay shall be paid in a lump sum, without interest, as soon as administratively practicable following the six-month delay, and the remaining installments shall be paid in accordance with the original schedule. For purposes of Section 409A, the right to a series of installment payments shall be treated as a right to a series of separate payments. Each separate payment in the series of separate payments shall be analyzed separately for purposes of determining whether such payment is subject to, or exempt from compliance with, the requirements of Section 409A. Notwithstanding anything in this Agreement to the contrary, to the extent required in order to avoid accelerated taxation and/or additional taxes under Section 409A, amounts reimbursable to Executive under this Agreement shall be paid to Executive on or before the last day of the year following the year in which the expense was incurred and the amount of expenses eligible for reimbursement (and in-kind benefits provided to Executive) during any one year may not effect amounts reimbursable or provided in any subsequent year. The Company makes no representations or warranties that the payments provided under this Agreement comply with, or are exempt from, Section 409A, and in no event shall the Company be liable for any portion of any taxes, penalties, interest or other expenses that may be incurred by Executive on account of non-compliance with Section 409A.

24. Severability. In case any provision of this Agreement shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions of this Agreement shall not in any way be affected or impaired thereby. In the event any provision is held invalid, illegal or unenforceable, such provision shall be limited or revised by a court of competent jurisdiction so as to give effect to the provision to the fullest extent permitted by applicable law. If any of the covenants in Section 12 are held to be unreasonable, arbitrary or against public policy, such covenants shall be considered divisible with respect to scope, time and geographic area, and in such lesser scope, time and geographic area, shall be effective, binding and enforceable against Executive to the greatest extent possible.

25. Construction. In this Agreement, unless otherwise stated, the following uses apply: (i) references to a statute or law refer to the statute or law and any amendments and any successor statutes or laws, and to all valid and binding governmental regulations, court decisions and other regulatory and judicial authority issued or rendered thereunder, as amended, or their successors, as in effect at the relevant time; (ii) in computing periods from a specified date to a later specified date, the words “from” and “commencing on” (and the like) mean “from and including,” and the words “to,” “until” and “ending on” (and the like) mean “to and including”; (iii) indications of time of day shall be based upon the time applicable to the location of the principal headquarters of the Company; (iv) the words “include,” “includes” and “including” (and the like) mean “include, without limitation,” “includes, without limitation” and “including, without limitation” (and the like), respectively; (v) all references to articles and sections are to articles and sections in this Agreement; (vi) all words used shall be construed to be of such gender or number as the circumstances and context require; (vii) the captions and headings of articles and sections have been inserted solely for convenience of reference and shall not be considered a part of this Agreement, nor shall any of them affect the meaning or interpretation of this Agreement or any of its provisions; (viii) any reference to an agreement, plan, policy, form, document or set of documents, and the rights and obligations of the parties under any such agreement, plan, policy, form, document or set of documents, shall mean such agreement, plan, policy, form, document or set of documents as amended from time to time, and any and all modifications, extensions, renewals, substitutions or replacements thereof; and (ix) all accounting terms not specifically defined shall be construed in accordance with generally accepted accounting principles.

26. Survival. The provisions of Section 12 and Section 13 shall survive the termination of this Agreement.

27. Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original, and all of which together shall constitute one and the same Agreement.

10

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement on the date first above specified.

| COMPANY | EXECUTIVE | ||||

| Sign Name: | /s/ Abraham Mirman | Sign Name: | /s/ James Linville | ||

| Print Name: | Abraham Mirman | Print Name: | James Linville | ||

| Title: | Chief Executive Officer | ||||

11

Exhibit 99.1

LLEX:NYSE MKT

LILIS ENERGY NAMES JAMES LINVILLE PRESIDENT

SAN ANTONIO, TEXAS – June 26, 2017 – Lilis Energy, Inc. (NYSE MKT: LLEX), an exploration and development company operating in the Permian Basin of West Texas, today announced that James Linville has joined the company as its new President, effective today. He will report directly to the Chief Executive Officer, Avi Mirman.

Throughout his 30-year career, Mr. Linville, a petroleum engineer by background, has led and managed oil and gas development projects in the majority of the major unconventional U.S. basins for companies including U.S. Energy Development Corporation, American Energy Partners, and Devon Energy (NYSE:DVN). Amongst his key career accomplishments are evaluating over $12 billion of acquisitions, with over $5 billion completed; co-managing approximately $850 million multi-rig horizontal development programs, and overseeing drilling of over 500 wells.

“Lilis is one of the top performing and highest-growth upstream energy companies in 2017. To help achieve our goal of continued growth, we are continuing to expand our core management team to selectively add talented executives with experience in high growth companies. With over three decades of experience, Jim is the right man for the job. Not only has he built an impressive track record of oil and gas operational excellence, most recently in the Delaware and Midland basins of the Permian, but he also has substantial experience with growing companies through acquisitions and strategic divestitures,” said Mr. Mirman. “The weakening commodity climate, coupled with our strong financial position, provides an exceptional timing opportunity for us to continue to expand our position in the Permian and strengthen our foundation.”

Prior to joining Lilis, Mr. Linville was Senior Director, Operations and Development for U.S. Energy Development Corporation, where he also served as a member of the Capital Committee tasked with deploying up to $200 million annually primarily within the Delaware Basin and Eagle Ford. Previously, he served as Director-Acquisitions for American Energy Partners and subsequently as Director-Operations, for American Energy Partners’ Permian Basin affiliate. During his tenure, Mr. Linville was responsible for assembling and leading the technical team that screened over 400 acquisition opportunities. Two of Mr. Linville’s key evaluations resulted in the successful creation of $4.25 billion in Permian and Marcellus platform companies for American Energy Partners.

“I am very excited to join Lilis Energy and look forward to working with the management and technical teams to help take the Company to the next level. Lilis has first-class assets in the core of the Delaware Basin, and is well capitalized and positioned to benefit from opportunities caused by weak market conditions. I am confident that we will continue to maximize shareholder value through a disciplined growth and development strategy,” said Mr. Linville.

Mr. Linville’s career includes serving in various engineering and leadership roles at Devon Energy from January 2001 to January 2014. From 2007-2014, Mr. Linville was Devon’s Operations Manager-Rockies, where he managed a $300 million capital budget with 50 horizontal wells drilled per year; oversaw 2,700 producing wells, and supervised 200 employees. Prior positions with Devon included serving as Supervisor-Business Process Transformation Team, an 18-month special project; Senior Reservoir Engineering Advisor-Permian New Mexico, and Senior Operations Engineer-Permian New Mexico. Mr. Linville’s background also includes serving as New Zealand Drilling Manager and Senior District Petroleum Engineer-Appalachian Basin for Eastern American Energy & Westech International; Senior Production Operations Engineer for Consolidated Oil and Gas; Petroleum Engineer: Permian, Rockies, Midcontinent & Gulf Coast for Hallwood Petroleum, and Drilling Engineer and Rig Supervisor for UNOCAL.

Mr. Linville earned a Bachelor of Science in Petroleum Engineering from New Mexico Tech, and a Master of Environmental Management from Marshall University. He is a member of the Petroleum Advisory Board of New Mexico Tech, and has previously served as a board member, section chairman, and regional meeting chairman of the Society of Petroleum Engineers. Mr. Linville is a registered professional engineer with the State of Colorado.

About Lilis Energy, Inc.

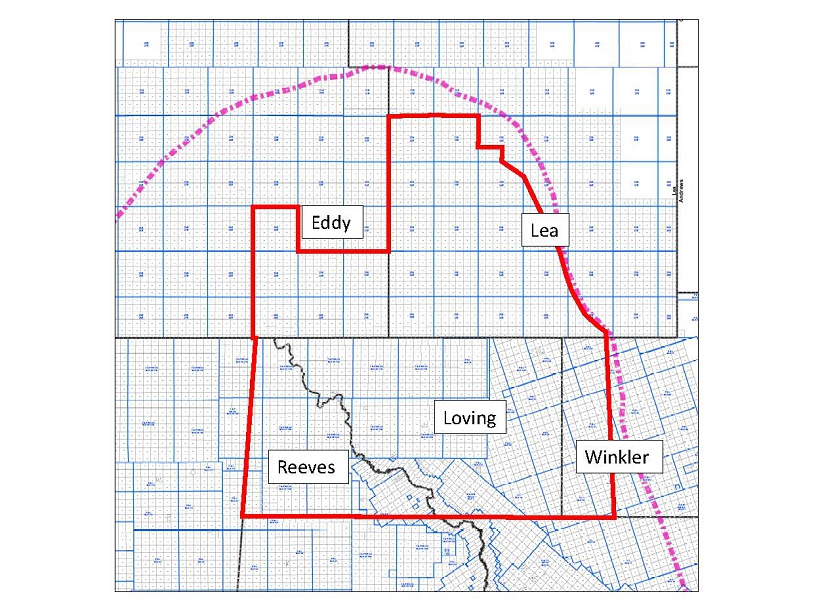

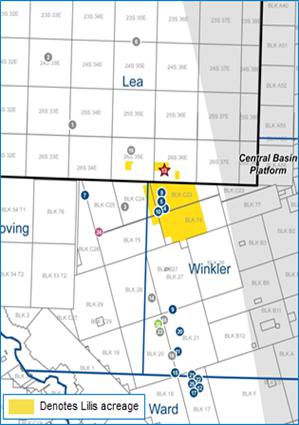

Lilis Energy, Inc. is a San Antonio-based oil and gas exploration and production company that operates in the Permian’s Delaware Basin, considered among the leading resource plays in North America. Lilis’s total net acreage in the Permian Basin is over 10,000 acres. Lilis Energy's focus is to grow current reserves and production and pursue strategic acquisitions inthe Delaware Basin. For more information, please visit www.lilisenergy.com.

Forward-Looking Statements:

This press release contains forward-looking statements within the meaning of the federal securities laws. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. These risks include, but are not limited to the ability to finance our continued exploration, drilling operations and working capital needs, all the other uncertainties, costs and risks involved in exploration and development activities; and the other risks identified in the Company’s Annual Report on Form 10-K and its other filings with the Securities and Exchange Commission (the “SEC”). Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. The forward-looking statements in this press release are made as of the date hereof, and the Company does not undertake any obligation to update the forward-looking statements as a result of new information, future events or otherwise.

Contact:

Wobbe Ploegsma

V.P. Investor Relations & Capital Markets

210-999-5400, ext. 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 13, 2017

LILIS ENERGY, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 001-35330 | 74-3231613 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

|

300 E. Sonterra Blvd. Ste. 1220 San Antonio, Texas |

| |

| (Address of Principal Executive Officer) | (Zip Code) |

(210) 999-5400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(e) 2016 Omnibus Incentive Plan

At the 2017 Annual Meeting of Stockholders (the “Annual Meeting”) of Lilis Energy, Inc. (the “Company”) held on July 13, 2017, the Company’s stockholders approved the second amendment (the “Second Amendment”) to its 2016 Omnibus Incentive Plan (the “2016 Plan”) to increase the number of shares of common stock available for grant under the 2016 Plan from 10,000,000 to 13,000,000 shares. The Company’s Board of Directors (the “Board”) and the Compensation Committee of the Board previously approved the Second Amendment, subject to such stockholder approval.

A more detailed summary of the principal features of the 2016 Plan and the text of the Second Amendment can be found in the Company’s definitive proxy statement for the Annual Meeting, as filed with the Securities and Exchange Commission on June 19, 2017, as supplemented (the “Proxy”). The foregoing description does not purport to be complete and is qualified in its entirety by reference to such summary and the full text of the Second Amendment and the 2016 Plan filed as Annexes B and C to the Proxy, respectively, both of which are incorporated herein by reference.

| Item 5.07 | Submission of Matters to a Vote of Security Holders |

As described in Item 5.02(e) above, the Company held the Annual Meeting on July 13, 2017. Six proposals were voted upon at the Annual Meeting, each of which is described briefly below and in detail in the Proxy. The matters voted upon and the number of votes cast for or against (or withheld in the case of proposal 3), as well as the number of abstentions and broker non-votes (as applicable) as to such matters, were as follows:

Proposal 1: To approve (a) the potential issuance of 20% or more of the Company’s outstanding common stock pursuant to the Second Lien Credit Agreement and (b) any “change of control” that may result from the issuance of shares of common stock pursuant to the Second Lien Credit Agreement;

| FOR | AGAINST | ABSTAINED |

| 37,541,134 | 19,626 | 1,954 |

Proposal 2: To approve and adopt an amendment to the Company’s amended and restated articles of incorporation to increase the authorized number of shares of common stock;

| FOR | AGAINST | ABSTAINED |

| 41,809,804 | 221,544 | 1,925 |

Proposal 3: Election of Directors:

The following nominees, each of whom was nominated for election by the Board and included in the Proxy, were elected by the stockholders at the Annual Meeting to serve on the Board until the 2018 annual meeting of stockholders and their successors are elected and qualified:

| FOR | WITHHELD | ||

| Abraham Mirman | 25,316,575 | 12,246,139 | |

| Ronald D. Ormand | 23,969,806 | 13,592,908 | |

| Nuno Brandolini | 21,170,344 | 16,392,370 | |

| R. Glenn Dawson | 23,609,173 | 13,953,541 | |

| General Merrill McPeak | 24,362,740 | 13,204,974 | |

| Peter Benz | 37,031,219 | 531,495 |

Proposal 4: To approve, on an advisory basis, the compensation of the Company’s named executive officers;

| FOR | AGAINST | ABSTAINED |

| 37,295,307 | 206,320 | 61,087 |

Proposal 5: To ratify the selection of BDO USA, LLP as the Company’s independent registered public accountants for the fiscal year ending December 31, 2017;

| FOR | AGAINST | ABSTAINED |

| 42,012,325 | 19,829 | 1,119 |

Proposal 6: To approve and adopt an amendment to the Company’s 2016 Omnibus Incentive Plan to increase the authorized number of shares of common stock available and reserved for issuance under such plan by 3,000,000 shares to an aggregate of 13,000,000 shares;

| FOR | AGAINST | ABSTAINED |

| 36,834,512 | 676,049 | 52,153 |

There were 4,470,559 broker non-votes cast with respect to each of proposals 1, 3, 4 and 6.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 14, 2017 |

LILIS ENERGY, INC. | |

| By: | /s/ Joseph C. Daches | |

| Chief Financial Officer | ||

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2017

LILIS ENERGY, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 001-35330 | 74-3231613 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

| 300 E. Sonterra Blvd, Suite #1220 | ||

| San Antonio, TX | 78258 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(210) 999-5400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On August 1, 2017, the Securities and Exchange Commission (the “Commission”) filed a civil complaint against multiple parties, including our Chief Executive Officer Abraham Mirman. The allegations in the complaint are unrelated to the business of Lilis Energy, Inc. (the “Company”), and predate Mr. Mirman’s tenure with the Company. We understand that Mr. Mirman denies the Commission’s allegations, and intends to vigorously defend this matter. The Board of Directors of the Company will continue to evaluate this matter and any future developments as necessary.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: August 2, 2017 | LILIS ENERGY, INC. | |

| By: | /s/ Joseph C. Daches | |

| Chief Financial Officer | ||

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2017

LILIS ENERGY, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 001-35330 | 74-3231613 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

| 300 E. Sonterra Blvd., Suite No. 1220 | ||

| San Antonio, TX | 78258 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(210) 999-5400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Departure of Chief Executive Officer and Director

On August 3, 2017, Abraham Mirman notified Lilis Energy, Inc. (the “Company”) of his resignation as Chief Executive Officer, and as a member of the Company’s Board of Directors (the “Board”), effective as of August 4, 2017 (the “Separation Date”). Mr. Mirman also resigned from all positions held with the Company’s subsidiaries. Mr. Mirman’s decision to resign was not the result of any disagreement with the Company, the Board, or management, or any matter relating to the Company’s operations, policies or practices.

In connection with Mr. Mirman’s resignation, the Company entered into a Separation and Consulting Agreement with Mr. Mirman on August 3, 2017 (the “Agreement”), setting forth the terms of Mr. Mirman’s separation from the Company and his prospective consulting services.

Pursuant to the terms of the Agreement, in satisfaction of any and all obligations under his employment agreement, and provided that Mr. Mirman does not exercise his right to revoke the Agreement within eight days of its execution, Mr. Mirman will receive the following severance payments, subject to applicable employer and employee withholding by the Company: (1) accrued benefits (including base salary, vacation pay and reimbursements) that are unpaid as of the Separation Date, (2) a lump-sum cash payment of $1,000,000, (3) premium payments for continuing COBRA coverage for eighteen months or until Mr. Mirman obtains alternative coverage, whichever is earlier, and (4) reimbursement of reasonable attorneys’ fees incurred in connection with his separation. Any unvested shares of restricted stock or unvested stock options which were previously awarded to Mr. Mirman will vest on August 12, 2017.

In addition, the Company engaged Mr. Mirman as an independent consultant to provide services of a consulting or advisory nature as the Company may reasonably request with respect to its business. Mr. Mirman’s consultancy will commence on the day following the Separation Date and will terminate on August 5, 2018, unless terminated earlier or extended by mutual agreement in accordance with the terms of the Agreement. In consideration for his consulting services, the Company will pay Mr. Mirman a monthly consulting fee of $41,660.67.

The Agreement contains other standard provisions contained in agreements of this nature, including restrictive covenants concerning confidentiality, non-competition, non-solicitation and non-disparagement, and a general release of any and all claims Mr. Mirman may have against the Company, its directors, officers and associated persons. The foregoing description of the terms of the Agreement is not complete and is qualified in its entirety by reference to the full text thereof, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Appointment of Chief Executive Officer

Following Mr. Mirman’s resignation, the Board appointed Jim Linville, currently the Company’s President, to serve as Chief Executive Officer, effective as of August 4, 2017.

Mr. Linville, age 52, has been the Company’s President since June 26, 2017. Previously, he was the Senior Director of Operations and Development for US Energy Development Corporation (“US Energy”) from January 2016 to June 2017, where he was a senior technical engineering, operational and resource development professional in the company. During his time at US Energy, Mr. Linville led a team of field and office staff consisting of drilling, completions, operations, engineering, reservoir, regulatory and environmental safety professionals. Additionally, Mr. Linville was a member of the Capital Committee at US Energy, tasked with deploying up to approximately $200 million annually in a portfolio of energy related investments, primarily within the Delaware Basin and Eagle Ford. Prior to US Energy, Mr. Linville was Director of Operations at American Energy Permian Basin (“AEPB”) from January 2015 to July 2015, where he managed field operations, completions, production and facilities engineering for a large Midland Basin Wolfcamp shale horizontal development program. Prior to moving into his position as Director of Operations at AEPB, Mr. Linville was Director of Acquisitions at American Energy Partners, LP (“AELP”) from February 2014 to January 2015, where he assembled and led the acquisitions team, consisting of numerous petro-professionals (Reservoir, Operations, Geoscience, Land), who were responsible for screening over 400 acquisition opportunities. While at AELP, Mr. Linville participated in and managed over 100 acquisition evaluations with aggregate value greater than $12 billion. Previously, Mr. Linville was employed at Devon Energy Corporation (“Devon”) from January 2001 to January 2014, where he held various engineering and management roles. Prior to Devon, Mr. Linville held various leadership and engineering (reservoir, production, drilling) and operational roles at Eastern American Energy, Consolidated Oil & Gas, Hallwood Petroleum, Unocal and his own firm Derrick Engineering Corporation. Mr. Linville earned his Bachelor of Science in Petroleum Engineering from New Mexico Tech and his Master of Science in Environmental Engineering from Marshall University. Throughout his career, he has held numerous leadership roles within the Society of Petroleum Engineers (SPE) and was an Industry Advisory Board member at New Mexico Tech and the Oklahoma City SPE Chapter. In addition, Mr. Linville is a Registered Professional Engineer.

There are no arrangements or understandings between Mr. Linville and any other persons pursuant to which Mr. Linville was selected to be an officer of the Company. Mr. Linville does not have any family relationships subject to disclosure under Item 401(d) of Regulation S-K or any direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

In connection with Mr. Linville’s appointment as the Company’s Chief Executive Officer, the Company and Mr. Linville entered into an amendment to his employment agreement on August 4, 2017 (the “Amendment”), reflecting his appointment as the Company’s Chief Executive Officer. The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text thereof, which is filed as Exhibit 10.2 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 7.01 | Regulation FD Disclosure. |

On August 4, 2017, the Company issued a press release announcing certain of the matters described in Item 5.02 of this Current Report on Form 8-K. A copy of the press release is included as Exhibit 99.1 to this Current Report on Form 8-K.