UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR | |

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 |

| OR | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR | |

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. — ELETROBRAS |

| (exact name of registrant as specified in its charter) |

| BRAZILIAN ELECTRIC POWER COMPANY |

| (translation of registrant’s name into English) |

| Federative Republic of Brazil |

| (jurisdiction of incorporation or organization) |

| Rua da Quitanda 196, 9th floor, Centro, CEP 20091-005, Rio de Janeiro, RJ, Brazil |

| (address of principal executive offices) |

|

Elvira Baracuhy Cavalcanti Presta Chief Financial Officer and Chief Investor Relations Officer (55 21) 2514-6435 — df@eletrobras.com.br Rua da Quitanda 196, 24th floor, 20091-005 - Rio de Janeiro — RJ — Brazil |

| (Name, telephone, e-mail and/or facsimile number and address of company contact person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered | |||

| American Depositary Shares, evidenced by American Depositary Receipts, each representing one Common Share | EBR | New York Stock Exchange | |||

| Common Shares, no par value* | New York Stock Exchange | ||||

| American Depositary Shares, evidenced by American Depositary Receipts, each representing one Class B Preferred Share | EBR-B |

New York Stock Exchange | |||

| Preferred Shares, no par value* | New York Stock Exchange |

* Not for trading but only in connection with the registration of the American Depositary Shares pursuant to the requirements of the SEC.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2019 was:

| 1,087,050,297 Common Shares | |

| 146,920 Class A Preferred Shares | |

| 265,436,883 Class B Preferred Shares |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes ¨ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes x No

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Emerging growth company ¨ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards* provided pursuant to Section 13(a) of the Exchange Act. ¨

*The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board x | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b 2 of the Exchange Act.).

¨ Yes x No

EXPLANATORY NOTE

This Annual Report on Form 20-F for the fiscal year ended December 31, 2019 (the “2019 Annual Report”) is being filed pursuant to the order of the Securities and Exchange Commission contained in SEC Release No. 34-88465, dated March 25, 2020 (the “Order”). We furnished a Form 6-K on April 30, 2020, the original due date of the Form 20-F, indicating our reliance on the relief granted by the Order. As set out in the Form 6-K, we were unable to file the 2019 Annual Report within the prescribed time period as our day-to-day administrative activities were disrupted as a result of certain measures put in place to combat the effects of the novel coronavirus (“COVID-19”).

i

TABLE OF CONTENTS

ii

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

In this annual report, unless otherwise indicated or the context otherwise requires, all references to “we,” “our,” “ours,” “us” or similar terms refer to Centrais Elétricas Brasileiras S.A.—Eletrobras and its consolidated subsidiaries.

We have prepared our consolidated annual financial statements as of December 31, 2019 and 2018 and for each of the three years in the period ended December 31, 2019 (“Consolidated Financial Statements”) in compliance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

For certain statutory purposes, such as providing reports to our shareholders located in Brazil and determining dividend payments, other profit distributions and tax liabilities in Brazil, we also prepare, as is required, a parent company and consolidated statutory financial statements in accordance with accounting practices adopted in Brazil and with IFRS as issued by the IASB, which must be filed with the CVM within three months after the year end and approved by our shareholders general ordinary meeting to comply with the Brazilian Corporate Law.

We revised our income statement for the year ended December 31, 2018 to (a) correct an error in the classification of the provision for the CCC Account arising from inspections of previous years at the distribution companies between Operational Expenses and Profit (loss) from discontinued operations; and (b) adjust the comparative period to the change of accounting policies related to the fair value of RBSE, as presented in note 3.2.1 to our Consolidated Financial Statements. The error in the comparative period did not impact the previously reported Net Income for the year ended December 31, 2018 and is considered immaterial by us. Additionally, these revisions solely changed line items in the income statement.

From January 1, 2019 we were required to adopt IFRS 16. IFRS 16 establishes the principles for the recognition, measurement, presentation and disclosure of lease transactions and requires that lessees account for all leases according to a single balance sheet model, similar to accounting for financial leases applied in accordance with CPC 06 (R1)/IAS 17. We opted for the modified retrospective approach, applying the effects of the initial adoption of the standard as adjustments to the opening balance of retained earnings as of January 1, 2019 without the restatement of comparative information. We did not restate our financial statements as of and for the years ended December 31, 2018 and 2017 for the adoption of IFRS 16. Accordingly, our financial statements as of and for the year ended December 31, 2019 and for the years ended December 31, 2018 and 2017 are not directly comparable. For more information, see note 4.2.2 to our Consolidated Financial Statements.

From January 1, 2018, we were required to adopt IFRS 9 and IFRS 15. We are not required to retrospectively apply IFRS 9 and IFRS 15 to any periods prior to January 1, 2018. IFRS 9 introduced changes to the measurement and classification of financial instruments, as well as changes to the method for calculating impairment of financial instruments. IFRS 15 established a new method to recognize revenue from contracts with customers by applying a five-step analysis, including contract identification, performance obligation identification, transaction price determination, transaction price allocation and recognition of revenue. Our financial statements as of and for the years ended December 31, 2019 and December 31, 2018 reflect the adoption of IFRS 9 and IFRS 15. We did not restate our financial statements as of and for the years ended December 31, 2017 and 2016 for the adoption of IFRS 9 and IFRS 15. Accordingly, our financial statements as of and for the years ended December 31, 2019 and 2018 and our financial statements as of and for the year ended December 31, 2017 are not directly comparable.

Our 2015 consolidated financial statements included the accounting of subsequent events that had a quantitative impact under IAS 10 — Events after the Reporting Period, as they provided evidence of conditions that existed at the reporting date (i.e. year ended December 31, 2015). Our 2015 consolidated financial statements reflect the conclusions of the Independent Investigation which resulted in the expensing of R$15.996 million of costs in 2015 that had been improperly capitalized to our assets and a reversal of impairment losses recorded of R$132.443 million in 2015. We reflected this subsequent event in our 2016 statutory financial statements filed with CVM. We did not restate or adjust our 2015 financial statements filed with the CVM in Brazil, which speak as of their respective date of authorization for their issue. As we made a number of adjustments to our statutory accounts for 2016, our consolidated financial statements included herein as of and for the year ended December 31, 2016 differ from our statutory financial statements for that year. As the event mentioned above was already reflected in our statutory financial statements and the financial statements included herein on or prior to December 31, 2016, our shareholders equity as of December 31, 2016 and all other information derived from our financial statements as from January 1, 2017 is the same in both sets of financial statements.

The table set out below describes the differences between our Profit as per our statutory Brazilian consolidated financial statements filed with the CVM and our Profit as per our consolidated financial statements included herein as of and for the year ended December 31, 2016:

1

| 12/31/2016 | ||||

| (R$ thousands) | ||||

| Profit for the year under statutory Consolidated Financial Statements (CVM Filed) | 3,513,276 | |||

| Reversal Impairment Angra III - 2014 | (129,799 | ) | ||

| Reversal Impairment Simplicio - 2014 | (2,644 | ) | ||

| Reversal Impairment Angra III - 2015 | (11,514 | ) | ||

| Investigation Findings Angra III | 141,313 | |||

| Investigation Findings Simplicio | 2,644 | |||

| Investigation Findings Maua 3 | 67,166 | |||

| Investigation Findings - equity (SPEs) | 91,464 | |||

| Total | 158,630 | |||

| Profit for the year under Consolidated Financial Statements (SEC Filed) | 3,671,906 | |||

On February 23, 2018, our Board of Directors approved the sale of interests owned by us and our subsidiaries Chesf, Furnas, Eletronorte and Eletrosul in 71 SPEs divided into eighteen lots. The corresponding auction took place on September 27, 2018 on the B3 and as a result we sold eleven of the eighteen lots offered to the market and raised R$1,296.9 million (as of December 31, 2018). The lots with wind generation SPEs located in Rio Grande do Sul, Piauí and Rio Grande do Norte and the lots with transmission SPEs in Goiás, Amazonas and Pará did not receive any bids. The sale of the SPEs is subject to approval by banks who are creditors of these companies, CADE, ANEEL and the non-exercise of pre-emption rights by the SPE’s shareholders. Of the R$1,296.9 (as of December 31, 2018) million sold at the auction, we have already received R$1,286.6 million for the 25 SPEs already transferred and we received R$44.8 million in January 2020 after the transfer of the remaining SPE, Companhia de Transmissão Centro Oeste de Minas S.A.

Of the remaining 45 SPEs from the January 2018 auction, 39 of them, with a book value of R$1.5 billion (as of December 31, 2019), were put up for sale through the Competitive Sale Procedure (Procedimento Competitivo de Alienação) No. 01/2019, supported by Decree 9.188/17, grouped into six lots, five of them relating to wind power generation and one to transmission. We opened the sales process on July 30, 2019, received offers from bidders on October 31, 2019 and are currently negotiating with potential buyers.

On February 8, 2018, at our 170th Extraordinary Shareholders Meeting, our shareholders ratified their decision taken in 2016 to sell our six distribution companies, except we would retain one common share, as well as the assumption by us of these distribution companies’ rights to the CCC Account and the CDE Account of R$8.5 billion, as adjusted, as of the base date of June 30, 2017. The assets (and related liabilities) of Eletroacre, Ceron, Cepisa and Boa Vista Energia were put up for sale as of December 31, 2017, while those of Ceal and Amazonas D were set for sale as of December 31, 2018, in accordance with IFRS 5.

Through auctions on the B3, we auctioned, on July 26, 2018, our participation in Cepisa to Equatorial Energia for R$45.5 thousand (representing no gain over the auction price set by BNDES, and recognizing 100% of tariff flexibility losses and costs with people, materials, third-party services and other expenses, in addition to the granting of a bonus of R$95 million). In addition, we auctioned our respective participations in Eletroacre and Ceron to Energisa and our participation in Boa Vista Energia to the Oliveira Energia & Atem Consortium, for R$45.5 thousand (representing no gain over the auction price set by BNDES), respectively, on August 30, 2018 and our participation in Amazonas D to the Oliveira Energia & Atem Consortium for R$45.5 thousand (representing no gain over the auction price set by BNDES) on December 10, 2018. Equatorial Energia won the auction for the sale of our participation in Ceal on December 28, 2018 for R$45.5 thousand (representing no gain over the auction price set by BNDES). The transfer of control of the six distribution companies occurred in October 2018 (Cepisa and Ceron), December 2018 (Eletroacre and Boa Vista Energia), March 2019 (Ceal) and April 2019 (Amazonas D). The transfer of Ceal and Amazonas D impacted our results of operations and financial conditions as of and for the year ended December 31, 2019.

The assets (and related liabilities) of Eletroacre, Ceron, Cepisa and Boa Vista Energia were classified as assets held for sale as of December 31, 2017, while Ceal and Amazonas D were classified as assets held for sale as of December 31, 2018, in accordance with IFRS 5.

On February 14, 2017, we entered into a sale and purchase agreement with Companhia Celg de Participações—CELGPAR and Enel Brasil S.A. and sold our shares in CELG-D for R$1,525 million.

In this annual report, the term “Brazil” refers to the Federative Republic of Brazil and the phrase “Brazilian Government” refers to the federal government of Brazil. The term “Central Bank” refers to the Brazilian Central Bank. The terms “real” and “reais” and the symbol “R$” refer to the legal currency of Brazil. The terms “U.S. dollar” and “U.S. dollars” and the symbol “U.S.$” refer to the legal currency of the United States of America.

Certain figures in this document have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

2

Terms contained within this annual report have the following meanings:

| · | AFAC: Advance for Future Capital Increase; |

| · | Amazonas D: Amazonas Distribuidora de Energia S.A., a distribution company operating in the state of Amazonas; |

| · | Amazonas GT: Amazonas Geração e Transmissão de Energia S.A., a generation and transmission company operating in the state of Amazonas; |

| · | ANEEL: Agência Nacional de Energia Elétrica, the Brazilian Electric Power Agency; |

| · | B3: B3 S.A.—Brasil, Bolsa Balcão, the São Paulo Stock Exchange, formerly known as the BM&F Bovespa; |

| · | Basic Network: interconnected transmission lines, dams, energy transformers and equipment with voltage equal to or higher than 230 kV, or installations with lower voltage as determined by ANEEL; |

| · | BNDES: Banco Nacional de Desenvolvimento Econômico e Social, the Brazilian Development Bank; |

| · | Boa Vista Energia: Boa Vista Energia S.A., a distribution company operating in the city of Boa Vista, in the state of Roraima; |

| · | Brazilian Anticorruption Law: Collectively, Law No. 12,846/13 and Decree No. 8,420/15; |

| · | Brazilian Corporate Law: Law No. 6,404/76, as amended; |

| · | BRR: Base de Remuneração Regulatória, Regulatory Remuneration Base; |

| · | CADE: Conselho Administrativo de Defesa Econômica, the Brazilian Antitrust Authority; |

| · | Capacity charge: the charge for purchases or sales based on contracted firm capacity whether or not consumed; |

| · | CCC Account: Conta de Consumo de Combustivel, or Fuel Consumption Account; |

| · | CCEAR: Contratos de Comercialização de Energia no Ambiente Regulado, contracts for the commercialization of energy in the Regulated Market; |

| · | CCEE: Câmara de Comercialização de Energia Elétrica, the Brazilian electric energy trading chamber; |

| · | CDE Account: Conta de Desenvolvimento Energetico, the energy development account; |

| · | CEA: Companhia de Eletricidade do Amapá S.A.; |

| · | Ceal: Companhia Energética de Alagoas, a distribution company operating in the state of Alagoas; |

| · | CELG-D: CELG-Distribuição S.A., a former distribution subsidiary of Eletrobras; |

| · | CELPE: Companhia Energética de Pernambuco S.A. (CELPE); |

| · | Cepel: Centro de Pesquisas de Energia Elétrica, a research center of the Brazilian electric sector; |

| · | Cepisa: Companhia Energética de Piauí, a distribution company operating in the state of Piauí; |

| · | Ceron: Centrais Elétricas de Rondônia, a distribution company operating in the state of Rondônia; |

| · | CERR: Companhia Energética de Roraima — CERR, a generation and distribution company operating in the state of Roraima; |

| · | CESP: Companhia Energética de São Paulo a generation subsidiary of Eletrobras; |

3

| · | CGE: Câmara de Gestão da Crise de Energia Elétrica, the Brazilian Energy Crisis Management Committee; |

| · | CGT Eletrosul: Companhia de Geração e Transmissão de Energia Elétrica do Sul do Brasil, a subsidiary of Eletrobras, which is the resulting entity following the merger of CGTEE into Eletrosul; |

| · | CGTEE: Companhia de Geração Térmica de Energia Elétrica, a former generation subsidiary of Eletrobras; |

| · | Chesf: Companhia Hidro Elétrica do São Francisco, a generation and transmission subsidiary of Eletrobras; |

| · | CMN: Conselho Monetario Nacional, the highest authority responsible for Brazilian monetary and financial policy; |

| · | CNEN: Comissão Nacional de Energia Nuclear S.A., the Brazilian national commission for nuclear energy; |

| · | CNPE: Conselho Nacional de Política Energética, the advisory agency to the President of the Republic of Brazil for the formulation of policies and guidelines in the energy sector; |

| · | Code of Ethical Conduct and Integrity: Código de Ética das Empresas Eletrobras, our Code of Ethical Conduct and Integrity published in 2016; |

| · | Concessionaires or concessionaire companies: companies to which the Brazilian Government transfers rights to supply electrical energy services (generation, transmission, distribution) to a particular region in accordance with agreements entered into between the companies and the Brazilian Government pursuant to Law No. 8,987/95 and Law No. 9,074/95 (together, the “Concessions Laws”); |

| · | CPPI: Conselho do Programa de Parcerias de Investimentos, the council of the investment partnership program; |

| · | CTEEP: Companhia de Transmissão de Energia Elétrica Paulista - CTEEP, a transmission affiliate of Eletrobras; |

| · | CVM: Comissão de Valores Mobiliarios, the Brazilian Securities and Exchange Commission; |

| · | Distribution: the transfer of electricity from the transmission lines at grid supply points and its delivery to consumers through a distribution system. Electricity reaches consumers such as residential consumers, small industries, commercial properties and public utilities at a voltage of 220/127 volts; |

| · | Distributor: an entity supplying electrical energy to a group of customers by means of a distribution network; |

| · | DoJ: the U.S. Department of Justice; |

| · | EIA — Estudo de Impacto Ambiental; |

| · | Electricity Regulatory Law: Law No. 10,848/04 (Lei do Novo Modelo do Setor Elétrico), enacted on March 15, 2004, which regulates the operations of companies in the electricity industry; |

| · | Eletroacre: Companhia de Eletricidade de Acre, a distribution company operating in the state of Acre; |

| · | Eletrobras: Centrais Elétricas Brasileiras S.A. — Eletrobras; |

| · | Eletronorte: Centrais Elétricas do Norte do Brasil S.A., a generation and transmission subsidiary of Eletrobras; |

| · | Eletronuclear: Eletrobras Termonuclear S.A., a generation subsidiary of Eletrobras; |

| · | Eletropar: Eletrobras Participações S.A., a holding company subsidiary created to hold equity investments (formerly, Light Participações S.A. — LightPar); |

| · | Eletrosul: Eletrosul Centrais Elétricas S.A., a former generation and transmission subsidiary of Eletrobras; |

| · | Energy charge: the variable charge for purchases or sales based on actual electricity consumed; |

| · | EPE: Empresa de Pesquisa Energética, the Brazilian Energy Research Company; |

4

| · | ERP: Integrated Management System |

| · | Exchange Act: the U.S. Securities Exchange Act of 1934, as amended; |

| · | Final consumer (end user): a party who uses electricity for its own needs; |

| · | FND: Fundo National do Desestatização, the national privatization fund; |

| · | Free consumers: customers that were connected to the system after July 8, 1995 and have a contracted demand above 3 MW at any voltage level; or customers that were connected to the system prior to July 8, 1995 and have a contracted demand above 3 MW at voltage level higher than or equal to 69 kV; |

| · | Free Market: Ambiente de Contratação Livre, the Brazilian unregulated energy market; |

| · | Furnas: Furnas Centrais Elétricas S.A., a generation and transmission subsidiary of Eletrobras; |

| · | GAG Melhoria: Custo da Gestão dos Ativos de Geração, Generation Asset Management Costs; |

| · | Gigawatt (GW): one billion watts; |

| · | Gigawatt hour (GWh): one gigawatt of power supplied or demanded for one hour, or one billion watt hours; |

| · | High voltage: a class of nominal system voltages equal to or greater than 100,000 volts (100 kVs) and less than 230,000 volts (230 kVs); |

| · | Hydroelectric plant or hydroelectric facility or hydroelectric power unity (HPU): a generating unit that uses water power to drive the electric generator; |

| · | IBAMA: Instituto Brasileiro do Meio Ambiente e Recursos Naturais Renováveis, the Brazilian Environmental Authority; |

| · | IBGC: Instituto Brasileiro de Governança Corporativa, the Brazilian Institute of Corporate Governance; |

| · | IBGE: Instituto Brasileiro de Geografia e Estatística, the Brazilian Institute of Geography and Statistics; |

| · | IFRS: International Financial Reporting Standards as issued by the International Accounting Standards Board; |

| · | IGP-M: Indice Geral de Preços-Mercado, the Brazilian general market price index, similar to the retail price index; |

| · | Independent Investigation: the independent internal investigation carried out by the law firm, Hogan Lovells US LLP, for the purpose of assessing the potential existence of irregularities, including violations of the FCPA, the Brazilian Anticorruption Law and our Code of Ethical Conduct and Integrity; |

| · | Installed capacity: the level of electricity which can be delivered from a particular generating unit on a full-load continuous basis under specified conditions as designated by the manufacturer; |

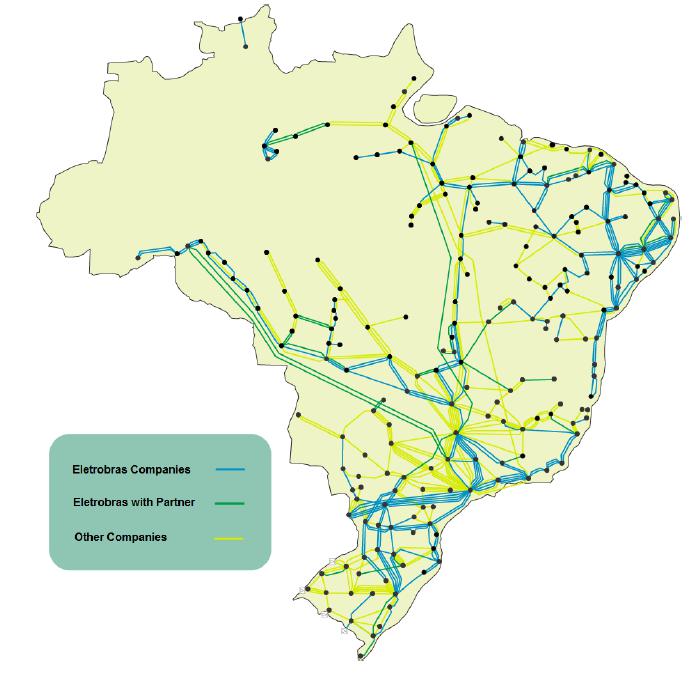

| · | Interconnected Power System: Sistema Interligado Nacional, the system or network for the transmission of energy, connected together by means of one or more links (lines and/or transformers); |

| · | Isolated System: generation facilities in the North of Brazil not connected to the Interconnected Power System; |

| · | Itaipu: Itaipu Binacional, the hydroelectric generation facility owned equally by Brazil and Paraguay; |

| · | Kilovolt (kV): one thousand volts; |

| · | Kilowatt (kW): 1,000 watts; |

| · | Kilowatt Hour (kWh): one kilowatt of power supplied or demanded for one hour; |

5

| · | Lava Jato Investigation: see “Item 3.D. Key Information—Risk Factors—Risks Relating to our Company,” “Item 3.D. Key Information—Risk Factors—Risks Relating to Brazil,” “Item 4.E. Information on the Company—Compliance,” “Item 15. Controls and Procedures” and “Item 18. Financial Statements;” |

| · | Law of Government-Controlled Companies: Law No. 13,303/16; |

| · | LI: Licença de Instalação, Installation License; |

| · | LO: Licença de Operação, Operating License; |

| · | LP: Licença Prévia, Preliminary License; |

| · | Megawatt (MW): one million watts; |

| · | Megawatt hour (MWh): one megawatt of power supplied or demanded for one hour, or one million watt hours; |

| · | Mixed capital company: pursuant to Brazilian Corporate Law, a company with public and private sector shareholders, but controlled by the public sector; |

| · | MME: Ministério de Minas e Energia, the Brazilian Ministry of Mines and Energy; |

| · | MRE: Mecanismo de Realocação de Energia, the Energy Reallocation Mechanism; |

| · | National Environmental Policy Act: Law No. 6,938/81, as amended; |

| · | Northeast region: the states of Alagoas, Bahia, Ceará, Maranhão, Paraíba, Pernambuco, Piauí, Rio Grande do Norte and Sergipe; |

| · | Odebrecht: Odebrecht S.A., a Brazilian conglomerate that provides engineering and infrastructure construction services; |

| · | OECD: the Organisation for Economic Co-operation and Development; |

| · | ONS: Operador Nacional do Sistema Elétrico, the national electricity system operator; |

| · | PDC: Plano de Demissão Consensual (PDC), the Consensual Dismissal Plan launched by Eletrobras; |

| · | PDNG: Plano Diretor de Negócio de Gestão, the Management Business Master Plan; |

| · | PIEs: Independent Power Producers; |

| · | PPI: Programa de Parceria de Investimentos da Presidência da República, the investments partnership program of the Brazilian Government created to expand and accelerate the partnerships between the Brazilian Government and private entities; |

| · | Procel: Programa Nacional de Combate ao Desperdício de Energia Elétrica, the national electrical energy conservation program; |

| · | Proinfa: Programa de Incentivo as Fontes Alternativas de Energia, the program for incentives to develop alternative energy sources; |

| · | RAP: Receita Anual Permitida, the annual permitted revenues; |

| · | RBNI: Rede Básica Novas Instalações, the Basic Network of New Installations; |

| · | RBSE: Rede Básica do Sistema Existente, the Basic Network of the Existing System; |

| · | Regulated Market: Ambiente de Contratação Regulada, the Brazilian regulated energy market; |

6

| · | RGR Fund: Reserva Global de Reversão, a fund we administer, funded by consumers and providing compensation to all concessionaires for non-renewal or expropriation of their concessions used as source of funds for the expansion and improvement of the electrical energy sector; |

| · | SEC: the U.S. Securities and Exchange Commission; |

| · | Securities Act: the U.S. Securities Act of 1933; |

| · | SELIC rate: an official overnight government rate applied to funds traded through the purchase and sale of public debt securities established by the special system for custody and settlement; |

| · | Small hydroelectric power plants: power plants with capacity from 1 MW to 30 MW; |

| · | SPEs: Eletrobras’ special purpose entities; |

| · | STF: Supremo Tribunal Federal, the Brazilian Federal Supreme Court; |

| · | STJ: Superior Tribunal de Justiça, the Brazilian Superior Court of Justice; |

| · | Substation: an assemblage of equipment which switches and/or changes or regulates the voltage of electricity in a transmission and distribution system; |

| · | TCU: Tribunal de Contas da União, the Brazilian Federal Audit Court; |

| · | TFSEE: Taxa de Fiscalização de Serviços de Energia Elétrica, the fee for the supervision of electricity energy services; |

| · | Thermoelectric plant or thermoelectric power unity (TPU): a generating unit which uses combustible fuel, such as coal, oil, diesel natural gas or other hydrocarbon as the source of energy to drive the electric generator; |

| · | Transmission: the bulk transfer of electricity from generating facilities to the distribution system at load center station by means of the transmission grid (in lines with capacity between 69 kV and 525 kV); |

| · | TUSD: a tariff for the use of the distribution system; |

| · | TUST: is a tariff for the use of the transmission system; |

| · | U.S. GAAP: United States generally accepted accounting principles; |

| · | UBP Fund: Fundo de Uso de Bem Publico, the public asset use fund; |

| · | Volt (V): the basic unit of electric force analogous to water pressure in pounds per square inch; and |

| · | Watt: the basic unit of electrical power. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This annual report includes certain forward-looking statements, including statements regarding our intent, belief or current expectations or those of our officers with respect to, among other things, our financing plans, trends affecting our financial condition or results of operations and the impact of future plans and strategies. These forward-looking statements are subject to risks, uncertainties and contingencies including, but not limited to, the following:

| · | general economic, regulatory, political and business conditions in Brazil and abroad; |

| · | interest rate fluctuations, inflation and the value of the real in relation to the U.S. dollar; |

| · | changes in volumes and patterns of customer electricity usage; |

7

| · | our ability to maintain our current market share; |

| · | the impact of widespread health developments, such as the Coronavirus (COVID-19), and the governmental, commercial, consumer and other responses thereto; |

| · | the consequences of a capital increase that is under discussion, which would dilute the Brazilian Government’s ownership of our common shares or any other model that is being discussed that might result in our further privatization; |

| · | competitive conditions in Brazil’s electricity generation market and transmission market through auctions; |

| · | our level of debt and ability to obtain financing; |

| · | the likelihood that we will receive payment in connection with account receivables; |

| · | changes in rainfall and the water levels in the reservoirs used to run our hydroelectric power generation facilities; |

| · | our financing and capital expenditure plans; |

| · | our ability to serve our customers on a satisfactory basis; |

| · | our ability to execute our business strategy, including our growth strategy; |

| · | existing and future governmental regulation as to electricity rates, electricity usage, competition in our concession area, hydroelectric risk and other matters; |

| · | adoption of measures by the granting authorities in connection with our concession agreements; |

| · | changes in other laws and regulations, including, among others, those affecting tax and environmental matters; |

| · | future actions that may be taken by the Brazilian Government, our controlling shareholder, with respect to our Board of Directors, acquisition and disposition of subsidiaries and affiliated entities, selling parts or all of their investment in us, and other matters; |

| · | the outcome of the ongoing corruption investigations and any new facts or information that may arise in relation to the Lava Jato Investigation, or any other corruption-related investigations in Brazil, including any accounting, legal, reputational and political effects; |

| · | our ability to renew our concessions; |

| · | the likelihood that we will receive all payments that we claimed under the CCC Account; |

| · | the likelihood that we make payments in respect of compulsory loans; |

| · | the outcome of our tax, civil and other legal proceedings, including class actions or enforcement or other proceedings brought by governmental and regulatory agencies; and |

| · | other risk factors as described in “Item 3.D Key Information—Risk Factors.” |

The forward-looking statements referred to above also include information with respect to our capacity expansion projects that are in the planning and development stages. In addition to the above risks and uncertainties, our potential expansion projects involve engineering, construction, regulatory and other significant risks, which may:

| · | delay or prevent successful completion of one or more projects; |

| · | increase the costs of projects; and |

| · | result in the failure of facilities to operate or generate income in accordance with our expectations. |

The words “believe,” “may,” “will,” “could,” “should,” “would,” “plan,” “potential,” “estimate,” “project,” “target,” “continue,” “anticipate,” “intend,” “expect” and similar words are intended to identify forward-looking statements. We undertake no obligation to update publicly or revise any forward-looking statements as a result of new information, future events or otherwise. In light of these risks and uncertainties, the forward-looking information, events and circumstances discussed in this annual report might not occur. Our actual results and performance could differ substantially from those anticipated in our forward-looking statements.

8

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

Background

The tables below present our selected financial data as of and for years ended December 31, 2019, 2018, 2017, 2016 and 2015 as applicable.

Our selected financial data as of December 31, 2019 and 2018 as applicable, and for each of the years in the three-year period ended December 31, 2019 were derived from our Consolidated Financial Statements, which appear elsewhere in this annual report prepared in accordance with IFRS, as issued by the IASB. The selected consolidated financial data set out below as of December 31, 2017, 2016 and 2015, and for the years ended December 31, 2016 and 2015, were derived from our consolidated financial statements as of and for the years ended December 31, 2017, 2016 and 2015 that are not included in this annual report.

On February 23, 2018, our Board of Directors approved the sale of interests owned by us and our subsidiaries Chesf, Furnas, Eletronorte and Eletrosul in 71 SPEs divided into eighteen lots. The corresponding auction took place on September 27, 2018 on the B3 and as a result we sold eleven of the eighteen lots offered to the market and raised R$1,296.9 million (as of December 31, 2018). The lots with wind generation SPEs located in Rio Grande do Sul, Piauí and Rio Grande do Norte and the lots with transmission SPEs in Goiás, Amazonas and Pará did not receive any bids. The sale of the SPEs is subject to approval by banks who are creditors of these companies, CADE, ANEEL and the non-exercise of pre-emption rights by the SPE’s shareholders. Of the R$1,296.9 (as of December 31, 2018) million sold at the auction, we have already received R$1,286.6 million for the 25 SPEs already transferred and we received R$44.8 million in January 2020 after the transfer of the remaining SPE, Companhia de Transmissão Centro Oeste de Minas S.A.

Of the remaining 45 SPEs from the January 2018 auction, 39 of them, with a book value of R$1.5 billion (as of December 31, 2019), were put up for sale through the Competitive Sale Procedure (Procedimento Competitivo de Alienação) No. 01/2019, supported by Decree 9.188/17, grouped into six lots, five of them relating to wind power generation and one to transmission. We opened the sales process on July 30, 2019, received offers from bidders on October 31, 2019 and are currently negotiating with potential buyers.

On February 2018, at the 170th Extraordinary Shareholders Meeting, our shareholders ratified their decision taken in 2016 to sell our six distribution companies, except we would retain one common share, as well as the assumption by us of these distribution companies’ rights to the CCC Account and the CDE Account in the total amount of R$8.4 billion recognized in their respective financial statements considering adjustments through June 30, 2017. The sales occurred in 2018. On April 24, 2019, Provisional Measure No. 879/19 was published. Provisional Measure No. 879/19, among other issues, deals with the recognition of expenses reimbursement rights associated with certain distribution concessions, amending Law No. 10,438/02 and Law No. 12,119/09. The contracts for the purchase and sale of shares of CEAL and Amazonas D were not signed before December 31, 2018 and, therefore, the assets and liabilities of these companies were classified as assets held for sale in accordance with note 46 to our Consolidated Financial Statements.

On February 14, 2017, we entered into a sale and purchase agreement with Companhia Celg de Participações—CELGPAR and Enel Brasil S.A. and sold our shares in CELG-D for R$1,525 million.

The paragraphs above discuss some important features of the presentation of the selected financial data and our consolidated financial statements. These features should be considered when evaluating the selected financial data. For further information, see “Presentation of Financial and Other Information.”

A. Selected Financial Data

The following tables present our selected consolidated financial and operating information prepared in accordance with IFRS/IASB as issued by the IASB as of the dates and for each of the periods indicated. You should read the following information in conjunction with our Consolidated Financial Statements and their related notes and the information under “Presentation of Financial Information” and “Item 5. Operating and Financial Review and Prospects” in this annual report.

9

The selected consolidated financial data set out below as of December 31, 2019 and 2018, and for the years ended December 31, 2019, 2018 and 2017, were derived from our Consolidated Financial Statements included elsewhere in this annual report. The selected consolidated financial data set out below as of December 31, 2016 and 2015, and for the years ended December 31, 2016 and 2015, were derived from our consolidated financial statements as of and for the years ended December 31, 2016 and 2015 that are not included in this annual report.

Selected Consolidated Balance Sheet Data

| As of December 31, | ||||||||||||||||||||

| 2019(1)(2) | 2018(1) | 2017 | 2016 | 2015 | ||||||||||||||||

| (R$ thousands) | ||||||||||||||||||||

| Assets | ||||||||||||||||||||

| Cash and cash equivalents | 335,307 | 583,352 | 792,252 | 495,855 | 1,393,973 | |||||||||||||||

| Marketable securities | 10,426,370 | 6,408,104 | 6,924,358 | 5,681,791 | 6,842,774 | |||||||||||||||

| Accounts receivable | 5,281,333 | 4,079,221 | 4,662,368 | 4,402,278 | 4,137,501 | |||||||||||||||

| Financial assets - Concessions and Itaipu | 5,927,964 | 6,013,891 | 7,224,354 | 2,337,513 | 965,212 | |||||||||||||||

| Financing and loans | 3,473,393 | 3,903,084 | 2,471,960 | 3,025,938 | 3,187,226 | |||||||||||||||

| Reimbursement rights | 48,458 | 454,139 | 1,567,794 | 1,657,962 | 2,265,242 | |||||||||||||||

| Assets held for sale | 3,543,519 | 15,424,359 | 5,825,879 | 4,406,213 | 4,623,785 | |||||||||||||||

| Other receivables | 11,682,119 | 9,979,263 | 7,889,762 | 7,265,102 | 6,021,683 | |||||||||||||||

| Total current assets | 40,718,463 | 46,845,413 | 37,358,727 | 29,272,652 | 29,437,396 | |||||||||||||||

| Total non-current assets | 136,748,252 | 134,364,795 | 135,616,632 | 141,226,775 | 120,049,383 | |||||||||||||||

| Total assets | 177,466,715 | 181,210,208 | 172,975,359 | 170,499,429 | 149,486,779 | |||||||||||||||

| Liabilities and shareholders’ equity | ||||||||||||||||||||

| Current liabilities | 25,638,057 | 36,523,971 | 34,186,952 | 31,138,510 | 28,099,643 | |||||||||||||||

| Non-current liabilities | 80,434,512 | 88,677,289 | 96,035,875 | 95,295,992 | 79,806,543 | |||||||||||||||

| Capital stock | 31,305,331 | 31,305,331 | 31,305,331 | 31,305,331 | 31,305,331 | |||||||||||||||

| Non-controlling shareholding | 487,345 | 466,042 | 413,155 | (138,543 | ) | (352,792 | ) | |||||||||||||

| Other shareholders’ equity | 39,601,470 | 24,237,575 | 11,034,046 | 12,898,139 | 10,628,054 | |||||||||||||||

| Total liabilities and shareholders’ equity | 177,466,715 | 181,210,208 | 172,975,359 | 170,499,429 | 149,486,779 | |||||||||||||||

| (1) | We adopted IFRS 15 and IFRS 9 on January 1, 2018, but we did not adjust our results of the comparative periods for 2017, 2016 and 2015. |

(2) We adopted IFRS 16 on January 1, 2019, but we did not adjust our results of the comparative periods for 2018, 2017, 2016 and 2015.

| 2019(1) | 2018(2) | 2017(3) | 2016(3) | |||||||||||||

| (R$ thousands) | ||||||||||||||||

| Net operating revenue(4) | 27,725,527 | 25,772,305 | 29,441,332 | 50,400,113 | ||||||||||||

| Operating expenses/costs | 20,441,343 | (9,852,006 | ) | (25,914,836 | ) | (33,568,368 | ) | |||||||||

| Financial result | (2,081,026 | ) | (1,374,631 | ) | (1,736,116 | ) | (1,216,563 | ) | ||||||||

| Profit before results of equity investments, taxes, and social contributions | 5,203,158 | 14,545,668 | 1,790,380 | 15,615,182 | ||||||||||||

| Results of equity method investments | 1,140,733 | 1,384,850 | 1,167,484 | 3,201,248 | ||||||||||||

| Other revenues and expenses | 24,715 | — | — | — | ||||||||||||

| Profit (loss) before income tax and social contribution | 6,368,606 | 15,930,518 | 2,957,864 | 18,816,429 | ||||||||||||

| Income tax and Social Contribution | 1,090,262 | (2,483,718 | ) | (1,510,634 | ) | (8,510,819 | ) | |||||||||

| Net income of Continued Operations | 7,458,868 | 13,446,800 | 1,447,230 | 10,305,610 | ||||||||||||

| Net income (loss) of Discontinued Operations | 3,284,975 | (99,223 | ) | (3,172,921 | ) | (6,633,706 | ) | |||||||||

| Attributable to controlling shareholders | 3,284,975 | 18,955 | (3,163,563 | ) | (6,659,748 | ) | ||||||||||

| Attributable to non-controlling shareholders | — | (118,178 | ) | (9,358 | ) | 26,043 | ||||||||||

| Net income (loss) for the period | 10,743,843 | 13,347,577 | (1,725,691 | ) | 3,671,905 | |||||||||||

10

| (1) | For 2019 we adopted IFRS 16, but we did not adjust our results, 2018, 2017 and 2016. |

| (2) | For 2018 we adopted IFRS 15 and IFRS 9, but we did not adjust our results for 2017 and 2016. We revised our income statement for the year ended December 31, 2018 to (a) correct an error in the classification of the provision for the CCC Account arising from inspections of previous years at the distribution companies between Operational Expenses and Profit (loss) from discontinued operations; and (b) adjust the comparative period for the change in accounting policies related to the fair value of RBSE. For further details, see note 3.2.1 to our Consolidated Financial Statements. |

| (3) | Data for the year ended December 31, 2017 and 2016 have been reclassified to reflect our distribution segment as discontinued operations. |

| (4) | Our net operating revenue for 2019, 2018 and 2017 includes R$4.1 billion, R$4.5 billion and R$4.9 billion, respectively, attributable to the transmission RBSE receivable asset. |

| 2015(1) | ||||

| (R$ thousands | ) | |||

| Net operating revenue | 32,180,843 | |||

| Operating expenses/costs | (42,630,214 | ) | ||

| Investigation Findings | (15,996 | ) | ||

| Financial result | (1,273,103 | ) | ||

| Result/(loss) before participation in associates and other investments | (11,738,470 | ) | ||

| Result of participation in associates and other investments | 531,446 | |||

| Income/(loss) before income tax and social contribution | (11,207,024 | ) | ||

| Income tax and Social Contribution | (710,112 | ) | ||

| Net income (loss) for the year | (11,917,136 | ) | ||

| Attributable to controlling shareholders | (11,405,085 | ) | ||

| Attributable to non-controlling shareholders | (512,051 | ) |

| (1) | Data for the year ended December 31, 2015 does not include the reclassification to reflect our distribution segment as discontinued operations, and as such is not comparable with the data for the years ended December 2019, 2018, 2017 and 2016. |

Brazilian Corporate Law and our by-laws provide that we must pay our shareholders mandatory dividends equal to at least 25% of our adjusted net income for the preceding fiscal year, subject to certain discretionary measures proposed by the Board of Directors and approved by shareholders in the Annual Meeting. In addition, our by-laws require us to give: (i) class “A” preferred shares a priority in the distribution of dividends, at 8% each year over the capital linked to those shares; and (ii) class “B” preferred shares that were issued on or after June 23, 1969 a priority in the distribution of dividends, at 6% each year over the capital linked to those shares. In addition, preferred shares must receive a dividend at least 10% higher than the dividend paid to the common shares. For further information regarding dividend payments and circumstances in which dividend payments may not be made, see “Item 3.D. Key Information—Risk Factors—Risks Relating to our Shares and ADS—Shareholders of any class may not receive dividend payments if we incur net losses or our net profit does not reach certain levels.”

11

Earnings (loss) per share

The table below shows our earnings (loss) per share and weighted average number of shares.

Year ended December 31 | ||||||||||||||||||||||||

Profit or Loss Per Share | 2019 | 2018(1) | 2017 | |||||||||||||||||||||

| Earnings (loss) per share | Weighted average number of shares | Earnings (loss) per share | Weighted average number of shares | Earnings (loss) per share | Weighted average number of shares | |||||||||||||||||||

| (Reais) | (thousands) | (Reais) | (thousands) | (Reais) | (thousands) | |||||||||||||||||||

| Profit (Loss) basic per share (ON) | 7.76 | 1,087,050 | 9.62 | 1,087,050 | (1.30 | ) | 1,087,050 | |||||||||||||||||

| Profit (Loss) basic per share (PN) | 8.53 | 265,437 | 10.58 | 265,437 | (1.30 | ) | 265,437 | |||||||||||||||||

| Profit (Loss) diluted per share (ON) | 6.65 | 1,288,843 | 9.52 | 1,087,050 | (1.30 | ) | 1,087,050 | |||||||||||||||||

| Profit (Loss) diluted per share (PN) | 7.31 | 279,941 | 10.48 | 265,437 | (1.30 | ) | 265,437 | |||||||||||||||||

| Continued Operation | ||||||||||||||||||||||||

| Profit (Loss) basic per share (ON) | 5.37 | 1,087,050 | 9.60 | 1,087,050 | 1.02 | 1,087,050 | ||||||||||||||||||

| Profit (Loss) basic per share (PN) | 5.91 | 265,437 | 10.56 | 265,437 | 1.02 | 265,437 | ||||||||||||||||||

| Profit (Loss) diluted per share (ON) | 4.61 | 1,288,843 | 9.51 | 1,087,050 | 1.02 | 1,087,050 | ||||||||||||||||||

| Profit (Loss) diluted per share (PN) | 5.07 | 279,941 | 10.46 | 265,437 | 1.02 | 265,437 | ||||||||||||||||||

(1) We revised our income statement for the year ended December 31, 2018 as set out in note 3.2.1 to our Consolidated Financial Statements, thus changing the earnings per share calculation.

On March 27, 2020, we released our financial statements for the year ended December 31, 2019 and, on the same date, the call notice for our 60th Annual General Meeting and 178th Extraordinary General Meeting, as well as our management proposals. Due to the COVID-19 pandemic, Provisional Measure No. 931/2020 and CVM Resolution No. 849/20, among other measures, authorized companies to held their annual meetings up to a period of seven months from the end of the fiscal year. Considering the current restrictions on the movement and gathering of people due to COVID-19, our Board of Directors, upon the recommendation of our Executive Board, decided to postpone our Ordinary and Extraordinary General Meetings scheduled for April 30, 2020. We have not determined the new date for holding these meetings, but we expect them to be held no later than July 31, 2020.

Due to the net gain in the year ended December 31, 2018, our dividend declared per share for the periods is presented below on the date declared.

Dividend per Share

| Declared | Paid | ||||||||||||||

| On 12/31/2015 | On 6/30/2016 | |||||||||||||||

| R$ | U.S.$ | R$ | U.S.$ | |||||||||||||

| Common | — | — | — | — | ||||||||||||

| Preferred A | — | — | — | — | ||||||||||||

| Preferred B | — | — | — | — |

| Declared | Paid(1) | Declared | Paid | |||||||||||||||||||||||||||||

| On 12/31/2016 | On 12/19/2017 | On 12/31/2017 | 2018 | |||||||||||||||||||||||||||||

| R$ | U.S.$ | R$ | U.S.$ | R$ | U.S.$ | R$ | U.S.$ | |||||||||||||||||||||||||

| Common | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| Preferred A | 2.17825658673 | 0.66842291 | 2.38969340156 | 0.72672609 | — | — | — | — | ||||||||||||||||||||||||

| Preferred B | 1.63369244005 | 0.50131718 | 1.79227005117 | 0.545044567 | — | — | — | — | ||||||||||||||||||||||||

| Declared | Paid(1) | Declared(2) | Paid | |||||||||||||||||||||||||||||

| On 12/31/2018 | On 12/19/2019 | On 12/31/2019 | 2020 | |||||||||||||||||||||||||||||

| R$ | U.S.$ | R$ | U.S.$ | R$ | U.S.$ | R$ | U.S.$ | |||||||||||||||||||||||||

| Common | 0.81057158320 | 0.30094349 | 0.858825948 | 0.21137729 | 1.59085138595 | 0.39473849 | — | — | ||||||||||||||||||||||||

| Preferred A | 1.85151809872 | 0.47787278 | 1.961741344 | 0.48283075 | 2.24782042101 | 0.55775244 | — | — | ||||||||||||||||||||||||

| Preferred B | 1.38863857404 | 0.35840459 | 1.471306007 | 0.36212306 | 1.74993652455 | 0.43421234 | — | — | ||||||||||||||||||||||||

| (1) | Adjusted by the SELIC rate. |

| (2) | If we record a net profit in an amount sufficient to make dividend payments, as a rule, at least the mandatory dividend is payable to holders of our preferred and common shares. Based on our profit for the year ended December 31, 2019, our mandatory dividend amounts to R$2.5 billion, representing 25% of our adjusted net profit for the period. This dividend is to be approved by our Annual General Meeting, which we have not yet rescheduled or, on an exceptional basis, by our Board of Directors pursuant to the COVID-19 emergency measure provided by Provisional Measure No. 931/20, which is yet to be approved. |

12

*Values shown in U.S.$ are the average of the exchange rates of purchases and sales of the relevant date.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Risks Relating to our Company

Our financial and operating performance may be adversely affected by epidemics, natural disasters and other catastrophes, such as the recent outbreak of the novel coronavirus.

Our operations could be adversely affected by epidemics, natural disasters and other catastrophes, such as a widespread outbreak of contagious disease, including the recent outbreak of respiratory illness caused by a novel coronavirus known as COVID-19 which was first identified in Wuhan, Hubei Province, China. Since then the virus has spread to over 200 countries and territories, including China, the U.S., the European Union, and Brazil and, on March 11, 2020, the World Health Organization confirmed that its spread and severity had escalated to the point of a pandemic. The outbreak of COVID-19 has resulted in authorities around the world implementing numerous measures to try to contain the spread of the virus, such as travel bans and restrictions, curfews, quarantines and shut downs, which has led to increased volatility and declines in financial markets and severe economic downturns in many countries. The response to the COVID-19 outbreak in many Brazilian states has involved declaring periods of quarantine which has resulted in restrictions on opening hours, and in many cases closures, of plants and stores, leading to prolonged closures of workplaces and reduced business activity, which will likely have a material adverse effect on the Brazilian economy.

As a result, GDP may contract this year as the impacts of COVID-19 on the world economy may be significant and lasting, with forecasts of a global recession. The Central Bank predicts a retraction of 3.3% in 2020. Considering the correlation between GDP growth and electric energy consumption, the downward revision of this estimate, or even an eventual recession, indicates potential reduction in energy consumption in some sectors, such as industrial and commercial. In addition, consumers may not be able to pay their bills to distribution companies. Consumer default and decrease in demand may generate cash flow mismatches for distribution companies and lead them to suspend or delay payments to us, which in turn could lead to cash flow mismatches for us.

Our generation revenue comes from businesses carried out on (i) the Regulated Market (including the plants under the quota regime), (ii) the Free Market and (iii) the short-term market, in which the differences between the amounts generated, contracted and consumed are settled. Due to the reduction in economic activity, there may be instances of defaults by our counterparties.

We are also managers of the Itaipu and Proinfa commercialization accounts. If either account becomes negative, we use our own resources to meet the obligations and reestablish the balance of the accounts, which should be compensated through the tariff the following year (with respect to Itaipu) or through revised quotas (with respect to Proinfa). Any material default in any of these accounts could negatively impact our cash flows.

Considering the possible decrease in our revenues, we might be required to record an impairment, particularly in the case of SPEs that sell significant amounts of energy on the Free Market. Other factors that may contribute to us having to record impairments are the increase in certain costs (especially those indexed in foreign currency) and/or possible difficulties with material suppliers.

In addition, as of the date of this annual report, we also expect low liquidity in the energy trading market, which may lead to difficulties for transacting business on favorable terms in this market. Future energy auctions may also be postponed for an indefinite amount of time depending on the determination of the MME.

In the transmission segment, our earnings are derived from tariffs defined by ANEEL (i.e. the RAP), established at the time of the concession auction, with periodic reviews defined in specific regulations. Accordingly, we currently see no indications that the outbreak of COVID-19 will have a significant impact on the revenues of our transmission assets, since these are related to the availability of the assets in the Interconnected System, and not to the flow of energy transmitted. Despite low historical default rates, the current adverse scenarios, magnified by over-contracting by the distribution companies and exchange rate devaluations, may lead to increased defaults in the transmission segment.

13

In addition, as certain of our transmission projects are in the implementation phase, we might suffer delays in their construction as a result of a complete shutdown or in the re-deployment of construction teams. Restrictions of this nature may also cause us or our contractors to miss milestones on projects and experience operational delays, delay the delivery of electrical infrastructure and other supplies that we source from around the globe, delay the connection of electric service to new customers, prolong the time period necessary to perform maintenance on our infrastructure, and significantly reduce the use of electricity by commercial and industrial customers.

Further, while we have modified certain business and workforce practices (including employee travel, employee work locations, and cancellation of physical participation in meetings, events, and conferences) to conform to government restrictions and best practices proposed by government and regulatory authorities, we have a limited number of highly skilled operators for some of our critical power plants and our grid operations centers. Our operations would be disrupted if any of our employees or employees of our business partners were suspected of having COVID-19, which could require quarantine of some or all such employees or closure of our facilities for disinfection. Also, as a result of these measures, our day-to-day administrative activities have been disrupted, including limiting our access to our facilities and certain technology systems and disrupting normal interactions with accounting personnel, external auditors and others involved in the preparation of this annual report. If this pandemic continues, there may also be an impact on our future reports.

Accordingly, it is possible that the generation, transmission and commercialization of electric energy segments, in which we operate, will suffer material negative impacts. We cannot predict the duration of these restrictions or the exact impact that they will have on our business. Therefore, we currently cannot estimate the potential impact to our financial position, results of operations and cash flows.

Additionally, we may need to recognize material actuarial liabilities if the equity in the pension funds that we and our subsidiaries sponsor fluctuates as a result of the decrease in economic activity and its impact on the financial and capital markets.

We cannot predict what policies or actions the Brazilian government may take in the future as a response to the COVID-19 pandemic and how they might affect the economy or our business or financial performance. The overall trend suggests that COVID-19 may affect the electricity industry as a result of lower economic activity.

If we do not remedy the material weakness in our internal controls, the reliability of our financial statements may be materially affected.

Pursuant to SEC regulations, we evaluate through our internal auditors the effectiveness of our controls and procedures, including the effectiveness of our internal controls over financial reporting, aiming to ensure the reliability of the information disclosed to the market and compliance with applicable accounting principles.

We design our internal controls over financial reporting to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with generally accepted accounting principles. The internal controls department works in partnership with the managers of our business to identify the processes that are under their responsibility and to implement controls to mitigate risks identified by the risk management department.

During the 2019 certification process, we and our independent auditor conducted independent tests and identified deficiencies in our internal controls, which resulted in four material weaknesses included in our 2019 annual report filed on Form 20-F.

The material weaknesses in internal control over financial reporting existed as of December 31, 2019 related to: (i) lack of an effective control environment and monitoring of controls, which led to: (a) a failure to monitor that control deficiencies were not remediated in a timely manner, (b) a failure to maintain effective controls over the completeness and accuracy of key spreadsheets and system-generated reports used in controls, and (c) a failure to design and maintain controls in response to risks of material misstatement related to business processes in scope; (ii) a failure to design and maintain controls over the period-end financial reporting, which led to: (a) the incompleteness of assets that should be considered for impairment analysis and inaccuracy of impairment calculations, and (b) incomplete and inaccurate accounting for deferred taxes; (iii) a failure to design and maintain controls related to review and approval of ERP transactions that could lead to non-authorized manual journal entries; and (iv) a failure to design and maintain controls related to access granting procedures and segregation of duties.

During the course of 2020, we will attempt to remedy these material weaknesses by hiring a consulting firm to assist in the implementation and evaluation of remedial steps designed by the managers of each respective process. These action plans will be designed based on (i) controls classified as ineffective in the previous year, and (ii) tests carried out by our management. Our internal controls department is responsible for overseeing the implementation of these action plans and reports periodically to the Board of Directors and the Audit and Risks Committee.

14

If our future efforts are not sufficient to remedy all the inconsistencies identified, we could continue to experience material weaknesses in our internal controls in future periods.

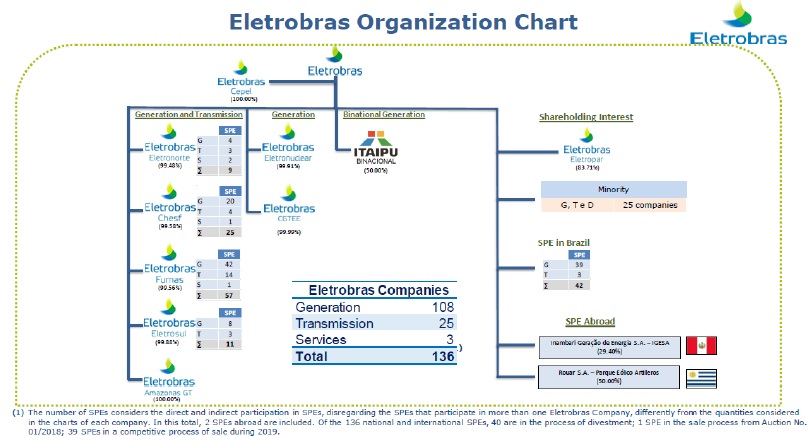

Our operational and consolidated financial results are partially dependent on the results of the SPEs, affiliates and consortia in which we invest.

We conduct our business mainly through our generation and transmission operating subsidiaries. In addition, we and our subsidiaries conduct some of our business through SPEs, which are created specifically to participate in public auctions for enterprises in the generation and transmission segments. Our SPEs are typically structured in partnership with other companies to exploit new energy sources and transmission lines. Also, we have an equity interest in 25 affiliates that explore generation, transmission and distribution activities. Therefore, our ability to meet our financial obligations is related, in part, to the cash flow generated by and earnings of our subsidiaries, affiliates and SPEs and the distribution or other transfers of earnings to us in the form of dividends, loans or other advances and payments.

As we generally do not control the SPEs and their affiliates, accounting for them under the equity method of accounting, their practices may not be fully aligned with ours. Since the SPEs are not government-controlled, they are not required to follow operational and financial processes applicable to government-controlled entities.

Additionally, as the SPEs and the affiliates are separate legal entities, any right we may have to receive assets of any SPE or other payments upon their liquidation or reorganization will be effectively subordinated to the claims of the creditors of that SPE (including tax authorities and trade creditors).

In order to standardize the management and monitoring of the financial and operational performance of the SPEs, we have instituted internal controls and established a specific department dedicated to the management of participations in the SPEs, with the aim of improving the flow of information and management. The guidelines and the applied principles are set out in the SPEs Manual (Manual de SPEs) approved by our Board of Directors.

Due to the high level of financial leverage of our subsidiaries and the difficulties in obtaining financing mainly as a result of our reduced cash flow following the implementation of Law No. 12,783/13, our prior and current Business and Management Plan (Plano Diretor de Negócios e Gestão) 2020-2024 contemplated the sale of our shares in certain SPEs, in order to reduce our consolidated indebtedness and increase our cash flows. In order to facilitate the sale of these SPEs, we transferred the ownership of these SPEs from our subsidiaries to our holding company. We do not have the control of the management of the SPE, which may lead to operational issues. We created a specific working group to oversee the sale of these SPEs. On September 27, 2018, we sold 26 of the 71 auctioned SPEs, with a spread of 2% over the minimum price. As of the date of this annual report, we have already received R$1,330 million related to sale of 26 SPEs. Of the remaining 45 SPEs from the January 2018 auction, 39 of them, with a book value of R$1.5 billion (as of December 31, 2019), were put up for sale through the Competitive Sale Procedure (Procedimento Competitivo de Alienação) No. 01/2019, supported by Decree 9,188/17, grouped into six lots, five relating to wind power generation and one to transmission. On July 30, 2019, we commenced the sales process and received offers from bidders on October 31, 2019. As of the date of this annual report, we have completed the negotiation phase and are awaiting the receive the fairness opinions. Although there is a possibility of retaining the value of 5% of the firm economic proposal, the COVID-19 pandemic may cause the companies that offered the bid to review their cash position and their strategic positioning in the market, possibly requesting postponement of terms or even the cancellation of the purchase transaction.

We cannot assure investors that these sales will not be contested by third parties such as the TCU or the CGU. Similarly, although we rely on the support of external advisors, we cannot ensure that the sale of the remaining SPEs will be successful, and sale prices may be lower than we expect. Further, as a result of auctioning the SPEs, we incurred a loss of R$553 million for the year ended December 31, 2018, resulting from the difference between the book value and the sale value (based on the auction price) of certain SPEs that were classified as held for sale. If any of these risks materialize, it may have a material effect on our results of operations and financial position. Additionally, with the sale of the foregoing assets, we cannot guarantee that we will maintain our current market share in generation and transmission in Brazil.

Given the need to make the electricity generation and transmission projects viable, we, as a state-owned company, are the guarantor of several projects structured as SPEs. If the loans related to such projects are not paid, we may suffer material adverse financial impacts and our results of operations may be adversely affected.

15

Over the past several years, we have acted as guarantor in respect of several SPE projects in which our subsidiaries were minority shareholders in order to support the construction of electricity generation and transmission projects. As of December 31, 2019, the value of these guarantees was R$30.6 billion. Among the SPEs to which we currently provide guarantees are: Norte Energia; Santo Antônio; Teles Pires; BMTE; São Manoel; Jirau; and others. If the loans related to these projects are not paid, we may suffer material adverse financial impacts and our results of operations may be adversely affected.

If any of the SPEs default on their obligations, the guarantees we provided may be called upon, impacting our financial position. Even if a default occurs with only one lender, it may trigger cross default clauses in the financing contracts of other SPEs, which could lead to other creditors requesting the acceleration of the debts with us, which would impact the enforcement of the guarantees provided by us and could negatively impact our financial condition.

There are certain risks associated with the sale of our six distribution subsidiaries located in the North and Northeast region of Brazil.

Through auctions on the B3 during 2018, we auctioned our participations in (i) Cepisa and Ceal to Equatorial Energia, (ii) Eletroacre and Ceron to Energisa S.A., and (iii) Boa Vista Energia and Amazonas D to the Oliveira Energia & Atem Consortium. Various labor unions initiated proceedings to stop the sales of certain of the distribution companies prior to their auctions, and we cannot ensure that similar entities will not bring further legal actions against us, the distribution companies or the purchasers in the future.

In connection with the sale of our distribution companies, we agreed to assume debt owed by the distribution companies to Petróleo Brasileiro S.A. — Petrobras (“Petrobras”) and certain of its subsidiaries, including Amazonas D (R$10.5 billion), Ceron (R$2.1 billion), Boa Vista Energia (R$0.3 billion) and Eletroacre (R$0.3 billion). We also agreed to pledge certain receivables to Petrobras as security for the debt and to assume R$0.9 billion debt of Amazonas D owed to Cigás. Currently, there are ongoing discussions with Cigás in relation to this matter aiming at formalizing such settlement.

In exchange for the assumption of the debt, we are due to receive certain credits from the CCC Account. However, the receipt of these credits is uncertain because they are credits subject to ANEEL’s approval and, to date, the amount of credits recognized by ANEEL is lower than those granted by the distribution companies.

For a further discussion, see “—Risks Relating to our Company—We may not receive the full value of receivables from the CCC Account transferred during the sale process of our distribution companies.”

In addition, the distribution companies we sold in the auction process owe us R$6.4 billion as of December 31, 2019. We cannot ensure that we will receive those amounts, even if we take legal action to enforce our rights, as it would depend on the credit worthiness of each distribution company.

We may not receive the full value of receivables from the CCC Account transferred during the sale process of our distribution companies.

At our 170th Extraordinary Shareholders’ Meeting held on February 8, 2018, we ratified the decision to sell our distribution companies and approved the capitalization of these companies, in accordance with the CPPI’s guidelines. Our shareholders also approved an amount of R$8.5 billion of receivables, which were assumed from the distribution companies’ balance sheets, considering adjustments through June 30, 2017. As these receivables relate to the CCC Account, they have been the subject of discussions with ANEEL.

Currently, ANEEL is examining the distribution companies regarding the credits they hold in respect of the CCC Account for the period from July 2009 to June 2016 (first round inspection) in order to identify any asset or liability pursuant to Resolution No. 427/11. ANEEL has already prepared a technical note on the review process for Amazonas D; Eletroacre; Ceron; and Boa Vista Energia. This technical note questioned the amounts paid by the CCC Account to these companies and the method of processing and composition of the total generation costs to be reimbursed to these companies. We, as managers of the CCC Account during the monitoring period, together with the distribution companies, challenged the decision issued by ANEEL and the criteria they applied. See note 11 to our Consolidated Financial Statements for a further description of the receivables from the CCC Account.

On March 7, 2018, the technical notes of ANEEL noted a credit of R$163 million in favor of Eletroacre, and a credit of R$1.6 billion in favor of Ceron, as of December 31, 2017. On April 16, 2018, ANEEL issued technical note No. 65/18 establishing that the final amount to be reimbursed to Boa Vista after the review is R$69.6 million (as adjusted to December 31, 2017). ANEEL also affirmed that, due to the “inefficiency” cost of Boa Vista’s fuel, the Brazilian National Treasury should pay Boa Vista R$20 million, subject to adjustment.

16

ANEEL has not yet disclosed new technical notes on the first inspection period for Boa Vista Energia. As for Ceron, on August 20, 2019, ANEEL issued a technical note No. 134/2019 for the first inspection period, incorporating some of the distributor’s and our requests and increasing the total amount to be paid to us, which is now R$1,904 million, adjusted by the IPCA index for July 2019. With respect to the first inspection period of CCC refunds to Eletroacre, ANEEL issued technical note No. 149/2019 on September 3, 2019. This technical note converted the amount to be paid into R$191.6 million, adjusted by the IPCA index for July 2019.

At the meeting held on March 10, 2020, ANEEL’s Board of Directors decided to complete the process of inspecting refunds from the CCC Account to Eletroacre and Ceron, both in respect of the first inspection period. ANEEL acknowledged that Ceron is due to receive R$1.9 billion as of July 2019 from the from CCC Account. Eletroacre is due to receive R$192 million as of July 2019 from the CCC Account. These amounts deliberated by ANEEL are the same as those mentioned in Technical Notes No. 134/2019 and No. 149/2019, regarding the first period of the CCC Account inspection process reimbursed to Ceron and Eletroacre, respectively. The regulatory agency has not yet issued technical notes on the second inspection period for Ceron and Eletroacre.

On March 19, 2019, ANEEL concluded its process of inspection and processing of the benefits reimbursed by the CCC Account to Amazonas D, for the period between July 30, 2009 and June 30, 2016, partially complying with the litigation and administrative processes filed by us and Amazonas D. Pursuant to ANEEL’s technical note No. 60/2019-SFF-SFG-SRG/ANEEL, as of April 18, 2019, the CCC Account owed Amazonas D R$1,621.9 million. These credits were transferred by Amazonas D to us during the privatization. Additionally, ANEEL will determine the value of the “fuel inefficiency” with the Ministry of Economy that was calculated to be R$1,357.8 million (historical cost) between July 2009 to April 2016 (already accounted for), to be paid by the Brazilian National Treasury. Even though Provisional Measure No. 855/18 and Provisional Measure No. 879/19 have not been converted into law, we understand that Laws No. 13,299/2016 and No. 13,360/2016 maintain Amazonas D and Boa Vista’s rights to receive the “inefficiency” rates from the Brazilian National Treasury for the period from July 2009 to April 2016.

In addition, Bill No. 5,877/2019, which discusses the proposal for our privatization, recognizes our right to use the “fuel inefficiency” values to offset the payment amount of any new power generation concessions granted to our companies in the process of not taxing our plants. For more information on the risks involving this matter, see “—Risks Relating to our Company—We are controlled by the Brazilian Government, the policies and priorities of which directly affect our operations and may conflict with the interests of our investors.”

There has been no decision on how the amount of the “fuel inefficiency” may be adjusted. However, if it is adjusted by the SELIC rate, as is typical, the adjusted amount would be R$2,394.2 million (adjusted to December 2019) for Amazonas D and R$40.1 million (as of December 31, 2019) for Boa Vista, for the period from July 2009 to April 30, 2016. In our financial statements for the year ended December 31, 2019, we considered the adjustment by the SELIC rate as a credit to be paid by the Brazilian Government.

Regarding the second period of inspection of reimbursements from the CCC Account to Amazonas D (from July 2016 to April 2017), ANEEL decided, at a Board Meeting held on March 10, 2020, to return the amount of R$2.1 billion (as of March 2019) to the CCC Fund. Accordingly, Amazonas D has finalized its entire inspection process, as ANEEL’s Board of Directors had already deliberated, on March 19, 2019, the result of the first inspection period of reimbursements from the CCC Account to Amazonas D, with the company being entitled to receive the amount of R$1.6 billion (as of September 2018).