Filed Pursuant to Rule 424(b)(3)

Registration No. 333-257190

PROSPECTUS

BLUE OWL CAPITAL INC.

1,320,591,340 SHARES OF CLASS A COMMON STOCK

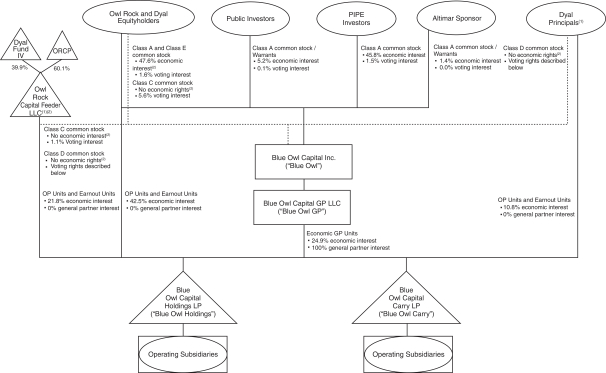

This prospectus relates to: (i) 159,964,103 shares of Class A stock, par value $0.0001 per share (“Class A common stock”), that may be issuable by us under the Business Combination Agreement, dated as of December 23, 2020 (as the same has been or may be amended, modified, supplemented or waived from time to time, the “BCA” or the “Business Combination Agreement”), by and among Altimar, Owl Rock Capital Group LLC (“Owl Rock Group”), Owl Rock Capital Feeder LLC (“Owl Rock Feeder”), Owl Rock Capital Partners LP (“Owl Rock Capital Partners”) and Neuberger Berman Group LLC (“Neuberger”) to the former equityholders of Owl Rock Group (the “Owl Rock Equityholders”), the former equityholders (the “Dyal Equityholders”) of the Dyal Capital Partners division of Neuberger (“Dyal”), Altimar Sponsor LLC (“Altimar Sponsor”) and the former directors of Altimar, (ii) 617,093,768 shares of Class A common stock issuable upon the exchange of Blue Owl Operating Group Units (as defined below) and the cancellation of an equal number of shares of Class C common stock issued to former Electing Owl Rock Equityholders and Electing Dyal Equityholders (each as defined below), (iii) 294,656,373 shares of Class A common stock issuable upon the sale of shares of Class B common stock issuable to the Owl Rock Principals and Dyal Principals (each as defined herein) upon the exchange of Blue Owl Operating Group Units and the cancellation of an equal number of shares of Class D common stock, (iv) 14,954,302 shares of Class A common stock issuable in respect of the Seller Earnout Shares (as defined herein) upon the satisfaction of certain vesting conditions, (v) 59,447,040 shares of Class A common stock issuable to certain Owl Rock Equityholders and Dyal Equityholders upon the exchange of Blue Owl Operating Group Units and the cancellation of an equal number of shares of Class C common stock, which are issuable in respect of the Seller Earnout Units upon the satisfaction of certain vesting conditions, and (vi) 24,475,754 shares of Class A common stock issuable upon the sale of shares of Class B common stock issuable to the former Owl Rock Principals and Dyal Principals upon the exchange of Blue Owl Operating Group Units and the cancellation of an equal number of Class D common stock which are issuable in respect of the Seller Earnout Units upon the satisfaction of certain vesting conditions.

This prospectus also relates to the offer and sale from time to time by the selling stockholders who purchased shares in the subscription agreements dated as of December 23, 2020 (collectively, the “PIPE Investors” and, together with the Owl Rock Equityholders, the Dyal Equityholders and Altimar Sponsor, the “Selling Holders”) of 150,000,000 shares of Class A common stock, par value $0.0001 per share (“Class A common stock”). We will not receive any proceeds from the sale of shares of Class A common stock by the Selling Holders pursuant to this prospectus; however, we will bear all costs, expenses and fees in connection with the registration of the securities and will not receive any proceeds from the sale of the securities. The Selling Holders will bear all commissions and discounts, if any, attributable to their respective sales of the securities.

Our registration of the securities covered by this prospectus does not mean that either we or the Selling Holders will issue, offer or sell, as applicable, any of the Class A common stock. The Selling Holders may offer and sell the securities covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Holders may sell the shares in the section entitled “Plan of Distribution.”

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our Class A common stock.

Our shares of Class A common stock are listed on the New York Stock Exchange (“NYSE”) under the symbols “OWL”. On July 30, 2021, the closing price of our Class A common stock was $14.25 per share.

We are an “emerging growth company,” as that term is defined under the federal securities laws and, as such, are subject to certain reduced public company reporting requirements.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 22 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 2, 2021.