GLOBAL X FUNDS

605 3rd Avenue, 43rd Floor

New York, NY 10158

(212) 644-6440

https://www.globalxetfs.com

GLOBAL X MSCI NORWAY ETF (THE "TARGET FUND")

NYSE Arca: NORW

GLOBAL X FTSE NORDIC REGION ETF (THE "ACQUIRING FUND")

NYSE Arca: GXF

IMPORTANT SHAREHOLDER INFORMATION

The enclosed Prospectus/Information Statement is being provided to inform you that on or about October 29, 2021, the Global X MSCI Norway ETF (the "Target Fund"), a series of Global X Funds (the “Trust”), will be reorganized with and into the Global X FTSE Nordic Region ETF (the "Acquiring Fund"), also a series of the Trust (the “Reorganization”). However, upon completion of the Reorganization, the Acquiring Fund will be renamed the "Global X MSCI Norway ETF" (the "Combined Fund") and the Combined Fund surviving the Reorganization will have the same investment objective, principal investment strategies and policies, investment adviser, portfolio management team, management fee rate and performance history as the Target Fund. The Prospectus/Information Statement discusses this proposed Reorganization and provides you with information that you should consider. The Board of Trustees of the Trust approved the Reorganization and concluded that the Reorganization is in the best interests of the Target Fund and the Acquiring Fund and each of their shareholders.

Please review the information in the Prospectus/Information Statement. You do not need to take any action regarding your account. On or about October 29, 2021, your shares of the Target Fund will be converted automatically at their net asset value (“NAV”) into the shares of the Acquiring Fund.

If you have any questions, please call the Trust toll-free at 1-888-493-8631.

GLOBAL X FUNDS

605 3rd Avenue, 43rd Floor

New York, NY 10158

(212) 644-6440

PROSPECTUS/INFORMATION STATEMENT

Dated October 4, 2021

| | |

| Acquisition of the Assets of: |

GLOBAL X MSCI NORWAY ETF (THE "TARGET FUND") NYSE Arca: NORW (a series of Global X Funds) |

| By and in exchange for shares of: |

GLOBAL X FTSE NORDIC REGION ETF (THE "ACQUIRING FUND") NYSE Arca: GXF (a series of Global X Funds) |

This Prospectus/Information Statement is being furnished to shareholders of the Global X MSCI Norway ETF (the “Target Fund”), a series of Global X Funds (the “Trust”), and the shareholders of the Global X FTSE Nordic Region ETF (the “Acquiring Fund”), a series of the Trust, pursuant to an Agreement and Plan of Reorganization as described herein (the "Reorganization"). The Target Fund and the Acquiring Fund are each a “Fund” and together, the “Funds.”

The Board of Trustees of the Trust (the "Board"), on behalf of each of the Target Fund and the Acquiring Fund, has approved the Reorganization after considering the recommendation of Global X Management Company LLC, the investment adviser to each of the Target Fund and the Acquiring Fund ("Global X” or the “Adviser") and determining that the Reorganization would be in the best interests of each of the Target Fund and the Acquiring Fund. In addition, the Board has approved, to become effective immediately prior to the Reorganization, changing the investment objective and principal investment strategies of the Acquiring Fund to mirror the investment objective and principal investment strategies of the Target Fund, including tracking the same underlying index. The Board has also approved, upon completion of the Reorganization, changing the name of the Acquiring Fund from the "Global X FTSE Nordic Region ETF" to the "Global X MSCI Norway ETF" (the "Combined Fund"). Therefore, upon consummation of the Reorganization, the Combined Fund will have the same investment objective, underlying index, principal investment strategies, and be subject to the same principal risks, as the Target Fund and consequently, the Combined Fund will be identical to the Target Fund but with an anticipated larger asset size.

The primary differences between the Funds are that (i) the Acquiring Fund’s underlying index tracks companies in a larger geographic area than the Target Fund’s and the Combined Fund's underlying index, and (ii) the Acquiring Fund invests at least 80% of its total assets in securities of companies that are economically tied to Sweden, Denmark, Norway and Finland, while the Target Fund invests, and the Combined Fund will invest, at least 80% of its total assets in securities of companies that are economically tied to Norway. As a result of the fact that the Combined Fund will mirror the Target Fund in terms of its investment parameters, Acquiring Fund shareholders will have exposure to a narrower geographic region as part of the Combined Fund. However, aside from the differences related to the Funds tracking different underlying indexes and the Acquiring Fund investing in companies of a broader geographic region than the Target Fund and the Combined Fund as a result of each Fund’s respective 80% policy, the Funds’ investment objectives and principal investment strategies are substantially similar. The fundamental and non-fundamental investment restrictions of each Fund are identical.

The Funds’ principal risks are also substantially similar, although the risks have some important differences. Since the Target Fund invests – and the Combined Fund will invest – in companies with a wider range of capitalizations than the Acquiring Fund, the Target Fund and the Combined Fund are subject to the additional risks of investing in mid-capitalization companies and small-capitalization companies. The Acquiring Fund has significant exposure to the industrials sector, and

therefore, it is subject to the risk of investing in such sector. The Acquiring Fund invests in a larger geographic area than the Target Fund, which invests – and the Combined Fund which will invest – primarily in securities of companies that are only economically tied to Norway. Therefore, the Target Fund is – and the Combined Fund will be – exposed to a more limited universe of companies and narrower geographic region than the Acquiring Fund.

Each Fund is a non-diversified series of the Trust.

The Reorganization will be structured to be a tax-free reorganization under the provisions of the Internal Revenue Code of 1986, as amended (the “Code”). The Funds will receive an opinion of counsel to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Code. As a result, it is expected that neither the Target Fund nor the shareholders of the Target Fund would recognize gain or loss as a direct result of the Reorganization, except for any gain or loss that may result from the receipt by Target Fund shareholders of cash in lieu of fractional shares.

Target Fund Shares and Acquiring Fund Shares are listed for trading on NYSE Arca, Inc. (“NYSE Arca”). Reports and other information concerning the Target Fund and the Acquiring Fund can be inspected at the offices of NYSE Arca.

This Prospectus/Information Statement provides the information that you should know about the Reorganization and about an investment in the Acquiring Fund. You should retain this Prospectus/Information Statement for future reference. A Statement of Additional Information, dated October 4, 2021 (the “Statement of Additional Information”), relating to this Prospectus/Information Statement contains more information about the Acquiring Fund and the Reorganization, and has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is incorporated herein by reference.

The prospectus of the Acquiring Fund, dated March 1, 2021 (1933 Act File No. 333-151713) (the “Acquiring Fund Prospectus”), is incorporated herein by reference and is considered a part of this Prospectus/Information Statement, and is intended to provide you with information about the Acquiring Fund. A copy of the current summary prospectus for the Acquiring Fund (“Acquiring Fund Summary Prospectus”), as supplemented, and amended, accompanies this Prospectus/Information Statement. The prospectus of the Target Fund, dated March 1, 2021 (1933 Act File No. 333-151713) (the “Target Fund Prospectus”), provides additional information about the Target Fund and is incorporated herein by reference. Shareholders should consult their financial advisor about whether the Combined Fund is appropriate for the shareholder’s investment portfolio.

In addition, the Annual Report to Shareholders of each of the Acquiring Fund and the Target Fund, for the fiscal year ended October 31, 2020 (together, the “Annual Reports”), and the Semi-Annual Report to Shareholders of each of the Acquiring Fund and the Target Fund, for the period ended April 30, 2021 (together, the “Semi-Annual Reports”), are incorporated by reference.

You can request a free copy of the Statement of Additional Information, Acquiring Fund Prospectus and Target Fund Prospectus, the Annual Reports, and the Semi-Annual Reports, by calling 1-888-493-8631, or by writing to the Trust at 605 3rd Avenue, 43rd Floor, New York, NY 10158.

Additional information about the Acquiring Fund can be viewed online or downloaded from the EDGAR database without charge on the SEC’s internet site at www.sec.gov. Shareholders can obtain copies, upon payment of a duplicating fee, by sending an e-mail request to publicinfo@sec.gov or by mailing a written request to the U.S. Securities and Exchange Commission, 100 F Street, N.E., Washington, D.C. 20549-0102.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The SEC has not approved or disapproved these securities or passed upon the adequacy of this Prospectus/Information Statement. Any representation to the contrary is a criminal offense.

Shares of the Funds are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other agency of the U.S. Government, nor are shares deposits or obligations of any bank. Such shares in a Fund involve investment risks, including the loss of principal.

PROSPECTUS/INFORMATION STATEMENT

TABLE OF CONTENTS

| | | | | |

| INTRODUCTION | |

| The Reorganization | |

How do the investment objectives, principal investment strategies and policies of the Target Fund compare

against the Acquiring Fund and the post-Reorganization Combined Fund? | |

| What are the principal risks associated with investments in the Target Fund versus the Acquiring Fund and the Combined Fund? | |

| What are the general tax consequences of the Reorganization? | |

| Who manages the Funds? | |

| What are the fees and expenses of each Fund and what might they be after the Reorganization? | |

| How do the performance records of the Funds compare? | |

| Where can I find more financial information about the Funds? | |

| What are other key features of the Funds? | |

| COMPARISON OF INVESTMENT OBJECTIVES, PRINCIPAL INVESTMENT STRATEGIES, POLICIES AND PRINCIPAL RISKS | |

What are the differences between the investment objectives of the Target Fund and the Acquiring Fund and

what will the investment objective of the Combined Fund be following the Reorganization? | |

What are the most significant differences between the principal investment strategies and policies of the

Target Fund compared to the Acquiring Fund and what will be the principal investment strategies of the Combined Fund following the Reorganization? | |

| How do the fundamental investment restrictions of the Target Fund differ from the Acquiring Fund? | |

| What are the principal risk factors associated with investments in the Target Fund, the Acquiring Fund and the Combined Fund? | |

| REASONS FOR THE REORGANIZATION | |

| INFORMATION ABOUT THE REORGANIZATION AND THE AGREEMENT | |

| How will the Reorganization be carried out? | |

| Who will pay the expenses of the Reorganization? | |

| What are the tax consequences of the Reorganization? | |

| What are the capitalizations of the Funds and what might the capitalization be after the Reorganization? | |

| CONTROL PERSONS AND PRINCIPAL HOLDERS OF SHARES | |

| MORE INFORMATION ABOUT THE FUNDS | |

| EXHIBITS TO PROSPECTUS/INFORMATION STATEMENT | |

| Exhibit A - Form of Agreement and Plan of Reorganization | |

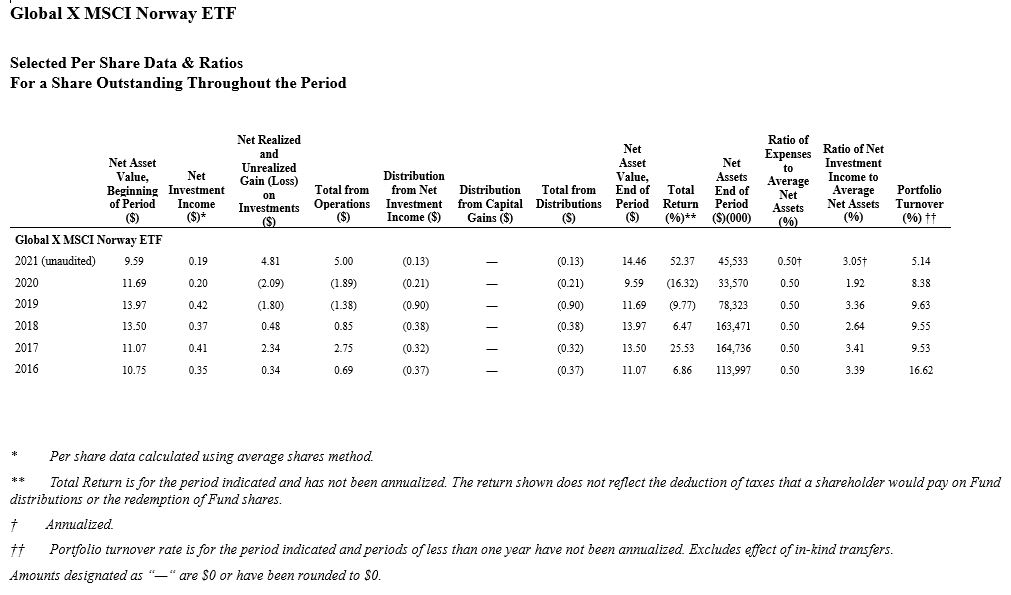

| Exhibit B - Financial Highlights | |

INTRODUCTION

This Introduction is only a summary of certain information contained in this Prospectus/Information Statement. You should read the more complete information in the rest of this Prospectus/Information Statement, including the Agreement and Plan of Reorganization (the “Agreement”), attached as Exhibit A, and the Acquiring Fund Summary Prospectus included with this Prospectus/Information Statement.

The Reorganization

The Agreement provides for: (1) the transfer of all of the assets of the Target Fund to the Acquiring Fund solely in exchange for (A) the issuance of full Acquiring Fund Shares to the Target Fund, as well as cash equal in value to fractional shares of the Acquiring Fund otherwise resulting from the Reorganization and (B) the assumption by the Acquiring Fund of all of the liabilities of the Target Fund on the Closing Date, and (2) the distribution by the Target Fund, on or promptly after the Closing Date as provided in the Agreement, of the Acquiring Fund Shares (and cash in lieu of fractional shares, if any) to the shareholders of the Target Fund in complete liquidation of the Target Fund. At a meeting held on August 4, 2021, the Board, including a majority of the Trustees who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) (the “Independent Trustees”), approved the Agreement.

At the closing of the Reorganization, all of the Target Fund’s assets will be transferred to the Acquiring Fund in exchange for the Acquiring Fund Shares equal in value to the assets of the Target Fund that are transferred to the Acquiring Fund and the Acquiring Fund will assume all of the liabilities of the Target Fund. The Acquiring Fund Shares will then be distributed pro rata to the Target Fund’s shareholders and the Target Fund will be liquidated and dissolved. As part of the Reorganization, only full shares of the Acquiring Fund will be distributed, and shareholders of the Target Fund will receive the cash value of any fractional shares of the Acquiring Fund to which they would otherwise be entitled. Following the Reorganization, the Combined Fund will change its name from the "Global X FTSE Nordic Region ETF" to the “Global X MSCI Norway ETF”. Prior to the Reorganization, the Acquiring Fund will adopt the same investment objective, underlying index, and principal investment strategies, and be subject to the same principal risks, as the Target Fund. Therefore, the Combined Fund will continue to follow the Target Fund's investment objective, principal investment strategies and policies and continue the Target Fund's performance and accounting history.

The Reorganization will result in your Target Fund Shares being exchanged for Acquiring Fund Shares (plus cash in lieu of fractional shares if any) equal in value (but having a different price per share) to your Target Fund Shares. This means that you will cease to be a shareholder of the Target Fund and will become a shareholder of the Combined Fund. This exchange will occur on the Closing Date, a date agreed upon by the parties to the Agreement, which is currently anticipated to occur on or around October 29, 2021. No sales charge or fee of any kind will be assessed to Target Fund shareholders in connection with their receipt of Acquiring Fund Shares in the Reorganization.

For the reasons set forth below under “REASONS FOR THE REORGANIZATION,” the Board has determined that the Reorganization is in the best interests of the Target Fund and the Acquiring Fund. The Board has also concluded that the interests of the existing shareholders of the Target Fund and the existing shareholders of the Acquiring Fund will not be diluted as a result of the Reorganization.

How do the investment objectives, principal investment strategies and policies of the Target Fund compare against the Acquiring Fund and the post-Reorganization Combined Fund?

Investment Objectives. Each Fund is a passively managed index exchange traded fund (“ETF”) that seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of each Fund’s respective underlying index. The Target Fund’s underlying index is the MSCI Norway IMI 25/50 Index, an index designed to represent the performance of the broad Norway equity universe, as defined by MSCI, Inc., the provider of the underlying index. The Board approved changing the Acquiring Fund’s underlying index from the

FTSE Nordic 30 Index, an index designed to reflect the equity market performance of companies in Sweden, Denmark, Norway and Finland, as defined by FTSE International Limited, the provider of the underlying index, to the MSCI Norway IMI 25/50 Index. This change is expected to be implemented immediately prior to the Reorganization. Therefore, at the time of the Reorganization, both Funds will have the same investment objective and post-Reorganization the Combined Fund's investment objective will mirror that of the Target Fund.

Principal Investment Strategies and Policies. The Board approved changing the Acquiring Fund’s underlying index from the FTSE Nordic 30 Index to the MSCI Norway IMI 25/50 Index, which is the underlying index of the Target Fund. The Board additionally approved aligning the Acquiring Fund’s 80% policy with that of the Target Fund so that the Acquiring Fund will invest at least 80% of its total assets in securities of companies that are only economically tied to Norway. These changes are expected to be implemented immediately prior to the Reorganization. Therefore, at the time of the Reorganization, the Funds will have identical principal investment strategies and policies and post-Reorganization, the Combined Fund's principal investment strategies and policies will mirror those of the Target Fund.

As of the date of this Prospectus/Information Statement (and prior to the change in the Acquiring Fund’s underlying index and 80% policy noted above), the Funds’ principal investment strategies and policies are similar, but have some important differences, largely due to the Funds tracking of different underlying indexes, each as discussed and summarized below. The primary differences between the principal investment strategies of the Target Fund/Combined Fund and the Acquiring Fund are as follows: (i) each Fund seeks investment results that track an index reflecting the performance of securities related to the Nordic region, but the Target Fund/Combined Fund’s underlying index is/will be limited to companies in the Norwegian market, while the Acquiring Fund’s underlying index consists of companies across Sweden, Denmark, Norway, and Finland, (ii) the Target Fund/Combined Fund may invest in small-, medium-, and large-capitalization companies, while the Acquiring Fund typically invests only in large-capitalization companies, and (iii) the Acquiring Fund has significant exposure to the industrials sector while the Target Fund/Combined Fund does/will not. The Funds’ fundamental investment policies are identical. The Funds’ non-fundamental investment policies differ only in that each Fund must invest at least 80% of its assets in its respective underlying index and in securities of issuers economically tied to its specified geographic region – only Norway for the Target Fund/Combined Fund, but Sweden, Denmark, Norway, and Finland for the Acquiring Fund.

Each Fund is classified as “non-diversified” under the 1940 Act and may concentrate its investments (i.e., hold 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that its respective underlying index is concentrated.

For further information about the investment objectives and policies of the Funds, please see “COMPARISON OF INVESTMENT OBJECTIVES, PRINCIPAL INVESTMENT STRATEGIES, POLICIES AND PRINCIPAL RISKS” below.

What are the principal risks associated with investments in the Target Fund versus the Acquiring Fund and the Combined Fund?

As noted above, the Board has approved a change in the Acquiring Fund’s underlying index from the FTSE Nordic 30 Index to the MSCI Norway IMI 25/50 Index, which is the underlying index of the Target Fund. The Board additionally approved aligning the Acquiring Fund’s 80% policy with that of the Target Fund so that the Acquiring Fund will invest at least 80% of its total assets in securities of companies that are only economically tied to Norway. These changes are expected to be implemented immediately prior to the Reorganization. Therefore, at the time of the Reorganization, the Funds will have identical principal risks and the Combined Fund's principal risks will mirror those of the Target Fund. Prior to the changes in the Acquiring Fund’s underlying index and 80% policy taking effect, the principal risks of investing in the Funds are substantially similar, but also have some important differences. Specifically, the Funds share the following risks: Asset Class Risk, Capitalization Risk, Concentration Risk, Currency Risk, Foreign Securities Risk, Geographic Risk, International Closed Market Trading Risk, Issuer Risk, Market Risk, Non-Diversification Risk, Operational Risk, Passive Investment Risk, Reliance on Trading Partners Risk, Risks Associated with Exchange-Traded Funds, Securities Lending Risk, Trading Halt Risk, and Valuation Risk.

As of the date of this Prospectus/Information Statement, the Funds seek investment results that correspond generally to different indexes, and as a result, there are certain differences in their risk profiles. The Target Fund/ Combined Fund invests/will invest in companies with a wider range of capitalizations than the Acquiring Fund, and therefore, is subject to the following additional sub-risks: Mid-Capitalization Companies Risk and Small-Capitalization Companies Risk. The Acquiring Fund has significant exposure to the industrials sector, and therefore, is subject to the following additional sub-risk: Risks Related to Investing in the Industrials Sector. The Acquiring Fund invests in a larger geographic area than the Target Fund/Combined Fund, and therefore, is subject to the following additional geographic sub-risks: Risk of Investing in Denmark, Risk of Investing in Finland, Risk of Investing in the Nordic Region, and Risk of Investing in Sweden. The Target Fund/Combined Fund may only invest in a limited number of companies, and is therefore subject to the Investable Universe of Companies Risk. The Combined Fund will therefore be subject to different risks than the Acquiring Fund in that the Combined Fund will be subject to Mid-Capitalization Companies Risk, Small-Capitalization Companies Risk, and Investable Universe of Companies Risk, but will not be subjected to Risks Related to Investing in the Industrials Sector, Risk of Investing in Denmark, Risk of Investing in Finland, Risk of Investing in the Nordic Region, and Risk of Investing in Sweden. For a detailed comparison of each Fund’s principal risks, please see the section below entitled “COMPARISON OF INVESTMENT OBJECTIVES, PRINCIPAL INVESTMENT STRATEGIES, POLICIES AND PRINCIPAL RISKS.”

What are the general tax consequences of the Reorganization?

The Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes (although there can be no assurance that the Internal Revenue Service (“IRS”) will adopt a similar position). This means that, subject to the limited exceptions described below in “INFORMATION ABOUT THE REORGANIZATION AND THE AGREEMENT - What are the tax consequences of the Reorganization?”, the shareholders of the Target Fund will not recognize any gain or loss for federal income tax purposes as a result of the exchange of their Target Fund Shares for Acquiring Fund Shares pursuant to the Reorganization, except for any gain or loss that may result from the receipt of cash in lieu of fractional shares of Acquiring Fund Shares. Prior to and in anticipation of the closing of the Reorganization, the Target Fund will distribute to its shareholders, in one or more taxable distributions, all of its income and gains (net of available capital loss carryovers) not previously distributed for taxable years ending on or prior to the date of closing of the Reorganization. You should consult your tax advisor regarding the effect, if any, of the Reorganization in light of your individual circumstances. You should also consult your tax advisor about the state and local tax consequences of the Reorganization, if any, because the information regarding tax consequences in this Prospectus/Information Statement relates only to the federal income tax consequences of the Reorganization.

For more detailed information about the federal income tax consequences of the Reorganization, please see “INFORMATION ABOUT THE REORGANIZATION AND THE AGREEMENT – What are the tax consequences of the Reorganization?"

Who manages the Funds?

Global X serves as the investment adviser and the administrator for each Fund and will serve as the investment adviser and the administrator for the Combined Fund. Subject to the supervision of the Board, the Adviser is responsible for managing the investment activities of each Fund and each Fund’s business affairs and other administrative matters. The Adviser has been a registered investment adviser since 2008. The Adviser is a Delaware limited liability company with its principal offices located at 605 3rd Avenue, 43rd Floor, New York, New York 10158. The Adviser was organized in Delaware on March 28, 2008 as a limited liability company. On July 2, 2018, the Adviser consummated a transaction pursuant to which the Adviser became an indirect, wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae”). In this manner, the Adviser is ultimately controlled by Mirae, which is a leading financial services company in Korea and is the headquarters for the Mirae Asset Global Investments Group. As of September 1, 2021, the Adviser provided investment advisory services for assets of approximately $39 billion.

The portfolio managers of both the Target Fund and the Acquiring Fund are identical. John Belanger, Nam To, Wayne Xie, Kimberly Chan and Vanessa Yang are co-portfolio managers with joint responsibility for the day-to-day management of both Funds’ portfolios. Mr. Belanger, Mr. To, Mr. Xie, Ms. Chan, and Ms. Yang will serve as portfolio managers for the Combined Fund.

John Belanger, CFA, joined the Adviser in 2020. He currently holds the positions of Senior Vice President, Head of Product Management, Head of Portfolio Management & Portfolio Administration and Chief Operating Officer with the Adviser. Mr. Belanger served as Chief Operating Officer of REX Shares, LLC from 2014-2018. Mr. Belanger graduated from Rice University with a Bachelor of Arts in Mathematics and Philosophy in 2004 and graduated from the University of Texas School of Law in 2008.

Nam To, CFA, joined the Adviser in July 2017. Prior to that, Mr. To was a Global Economics Research Analyst at Bunge Limited from 2014 to 2017. Mr. To received his Bachelor of Arts in Philosophy and Economics from Cornell University in 2014.

Wayne Xie joined the Adviser in July 2018 as a Portfolio Management Associate. Previously, Mr. Xie was an Analyst at VanEck Associates on the Equity ETF Investment Management team from 2010 to 2018 and a Portfolio Administrator at VanEck Associates from 2007 to 2010. Mr. Xie received his Bachelor of Science from the State University of New York at Buffalo in 2002.

Kimberly Chan joined the Adviser in June 2018 and is a Portfolio Management Associate. Previously, Ms. Chan was a U.S. Associate Trader at Credit Agricole from 2016 to 2018, and an Investment Analyst at MetLife Investments from 2015 to 2016. Ms. Chan received her Bachelor of Science from New York University in 2015.

Vanessa Yang, Portfolio Management Associate, joined the Adviser in 2016 as a Portfolio Administrator. She was appointed to the portfolio management team in June 2019. Previously, Ms. Yang was a Portfolio Administrator at VanEck Associates from 2011 to 2014. Ms. Yang received her MS in Financial Engineering from Drucker School of Management in 2010 and her Bachelor of Science in Economics from Guangdong University of Foreign Studies in 2008.

The Statement of Additional Information (“SAI”) for the Funds, dated March 1, 2021, provides additional information about the portfolio managers’ compensation, other accounts managed by the portfolio managers, and the portfolio managers’ ownership of securities in the Funds. For information on how to obtain a copy of the SAI for the Funds, please see “MORE INFORMATION ABOUT THE FUNDS."

What are the fees and expenses of each Fund and what might they be after the Reorganization?

The following tables describe the fees and expenses that you may pay when buying, holding, or selling shares of the Funds, followed by those estimated to be charged with respect to Acquiring Fund Shares after the Reorganization. The operating expenses shown for the Funds are based on expenses incurred during the Funds’ 12-month period ended October 31, 2020. The tables below also include the pro forma expenses for the Combined Fund giving effect to the Reorganization. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

FEE TABLES FOR THE FUNDS

| | | | | | | | | | | |

| Target Fund | Acquiring Fund | Pro Forma Combined* |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| Management Fees | 0.50% | 0.50% | 0.50% |

| Distribution and/or Service (12b-1) Fees | None | None | None |

| Other Expenses | 0.00% | 0.01% | 0.00% |

| Total Annual Fund Operating Expenses | 0.50% | 0.51% | 0.50% |

* Pro forma information for the twelve-month period ended April 30, 2021, has been prepared to give effect to the proposed Reorganization pursuant to the Agreement as if it had been consummated on May 1, 2020.

Examples

These Examples are intended to help you compare the costs of investing in Target Fund Shares with the cost of investing in Acquiring Fund Shares of the comparable class, both before and after the Reorganization. The Examples assume that you invest $10,000 in the applicable Fund for the time periods indicated and then sell all of your shares at the end of those time periods. The Examples assume a 5% return each year and no change in expenses. Although your actual costs may be higher or lower, based on these assumptions, the costs would be:

| | | | | | | | | | | | | | |

| 1 Year | 3 Years | 5 Years | 10 Years |

| Target Fund | $51 | $160 | $280 | $628 |

| Acquiring Fund | $52 | $164 | $285 | $640 |

| Pro forma Acquiring Fund (after the Reorganization with Target Fund)* | $51 | $160 | $280 | $628 |

* Pro forma information for the twelve-month period ended April 30, 2021, has been prepared to give effect to the proposed Reorganization pursuant to the Agreement as if it had been consummated on May 1, 2020.

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when you hold Fund shares in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Examples above, affect each Fund’s performance. For the fiscal year ending October 31, 2020, the portfolio turnover rates of the Target Fund and Acquiring Fund were 8.38% and 4.90%, respectively, of the average value the Fund’s portfolio. Based on portfolio assets as of September 14, 2021, the Adviser currently estimates that the repositioning of the Acquiring Fund in connection with its investment objective and principal investment strategy changes will result in a portfolio turnover rate of approximately 94.14%. The Adviser will bear all of the transaction costs associated with the repositioning of the Acquiring Fund’s portfolio. In addition, the repositioning of the Acquiring Fund’s portfolio securities may result in the realization of capital gains. However, absent any unanticipated, unusual and significant market dynamics, it is not anticipated that the portfolio repositioning will result in any amounts of capital gains to be distributed to Acquiring Fund shareholders.

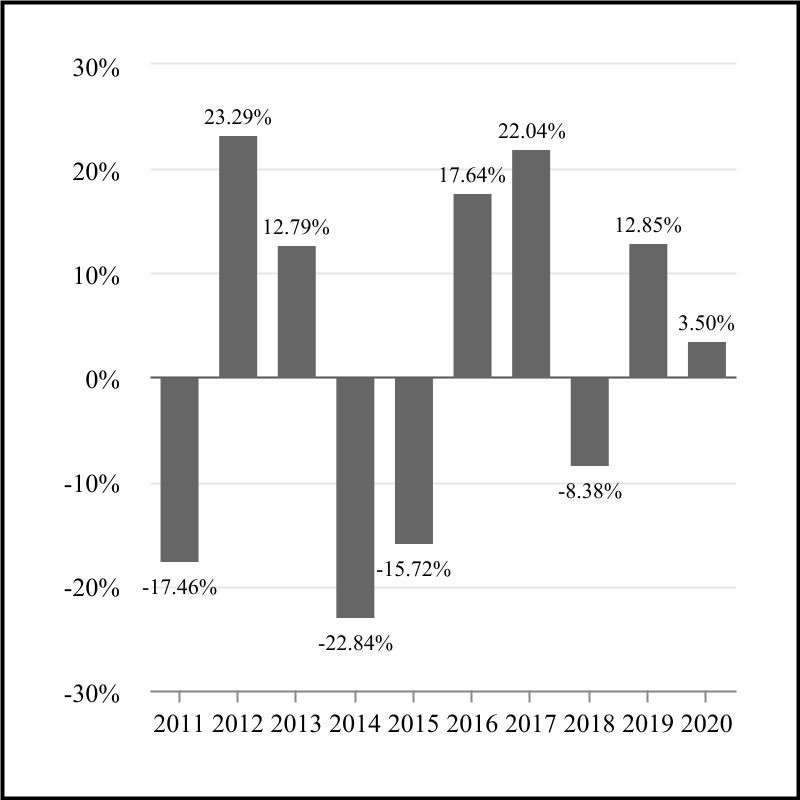

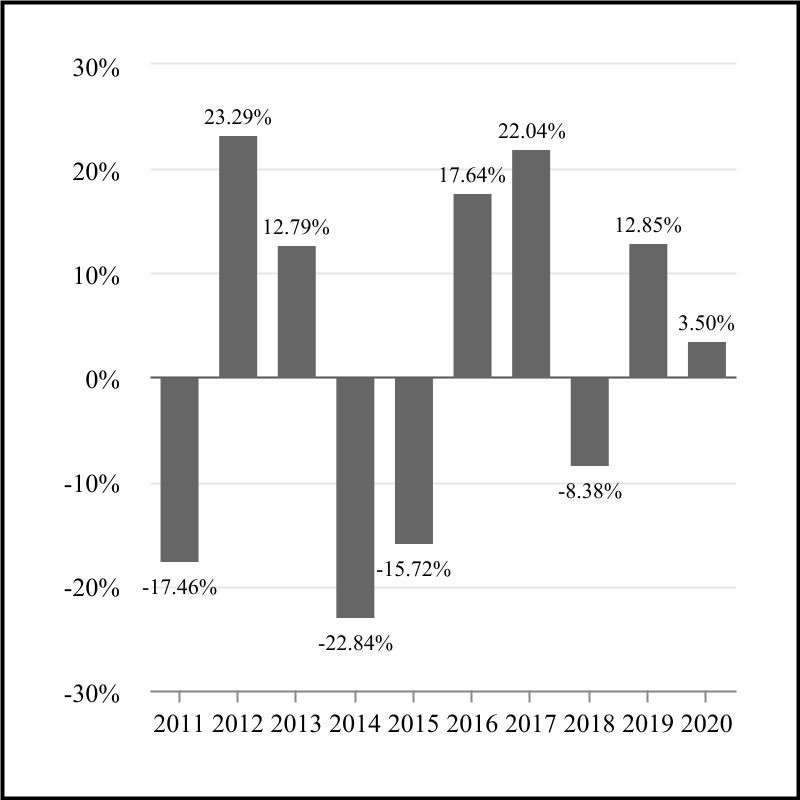

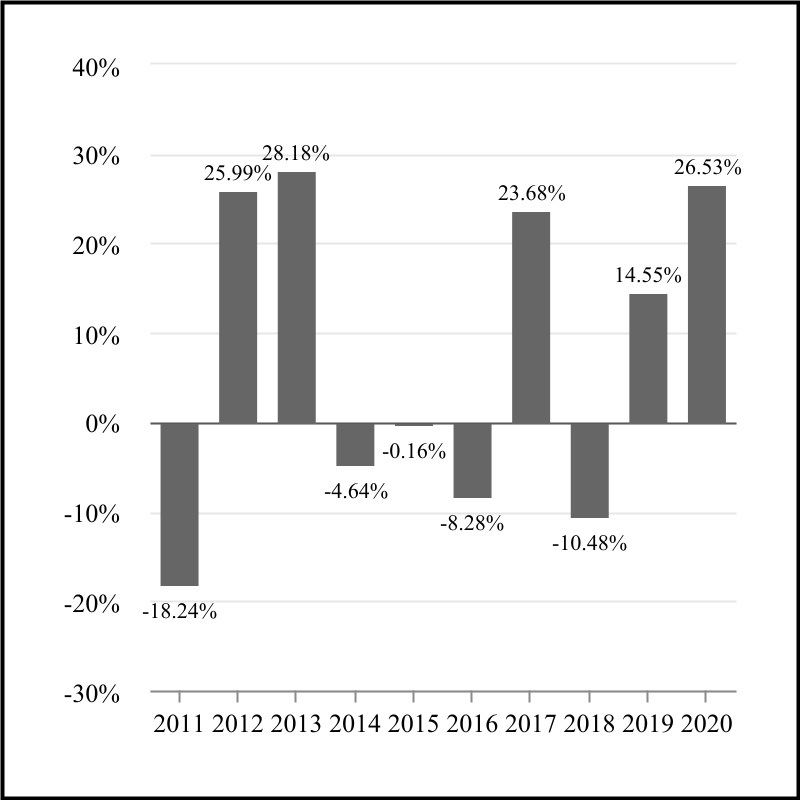

How do the performance records of the Funds compare?

The performance information shown below will help you analyze each Fund’s investment risks in light of their historical returns. For each Fund, the bar chart and performance table below illustrate the risks of an investment in the Fund by showing the Fund’s performance from year to year and by showing how the Fund’s average annual total returns for 1, 5, and 10 year periods compare with those of the Fund’s underlying index and a broad measure of

market performance. Of course, each Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future.

Global X MSCI Norway ETF

Annual Total Returns (Years Ended December 31)

Best Quarter: 12/31/2020 24.12%

Worst Quarter: 3/31/2020 -37.23%

Year-to-Date Total Return as of June 30, 2021: 13.69%

Global X FTSE Nordic Region ETF

Annual Total Returns (Years Ended December 31)

Best Quarter: 6/30/2020 17.47%

Worst Quarter: 9/30/2011 -25.12%

Year-to-Date Total Return as of June 30, 2021: 12.47%

| | | | | | | | | | | |

| Average Annual Total Returns for the Periods Ended December 31, 2020 |

| 1 Year | 5 Years | 10 Years |

| Global X MSCI Norway ETF | | | |

| Return before taxes | 3.50% | 8.97% | 1.38% |

Return after taxes on distributions1 | 3.03% | 8.20% | 0.65% |

Return after taxes on distributions and sale of Fund shares1 | 2.49% | 7.06% | 1.04% |

| Global X FTSE Nordic Region ETF | | | |

| Return before taxes | 26.53% | 8.04% | 6.35% |

Return after taxes on distributions1 | 26.14% | 7.40% | 5.80% |

Return after taxes on distributions and sale of Fund shares1 | 15.90% | 6.19% | 5.07% |

| Performance Benchmarks for Target Fund | | | |

Hybrid MSCI Norway IMI 25/50 Index (net)2, 3 | 3.85% | 9.27% | 2.14% |

MSCI EAFE Index (net)3 | 7.82% | 7.45% | 5.50% |

| Performance Benchmarks for Acquiring Fund | | | |

FTSE Nordic 30 Index (net)3 | 26.47% | 8.50% | 6.51% |

MSCI EAFE Index (net)3 | 7.82% | 7.45% | 5.51% |

| | | |

1 After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your specific tax situation and may differ from those shown above. After-tax returns are not relevant to investors who hold shares of a Fund through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts (IRAs).

2 Hybrid Index performance reflects the performance of the FTSE Norway 30 Index through July 14, 2014 and the MSCI Norway IMI 25/50 Index thereafter.

3 Index returns reflect invested dividends net of withholding taxes, but reflect no deduction for fees, expenses, or other taxes.

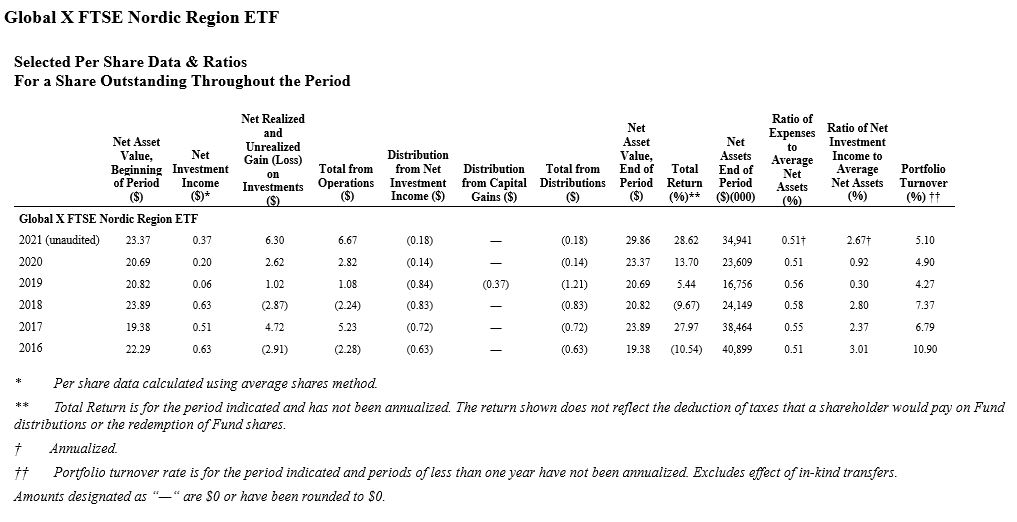

Where can I find more financial information about the Funds?

The Funds’ Annual Reports contain a discussion of each Fund’s performance during their fiscal year ending October 31, 2020, and show per share information for each of the previous five fiscal years or since inception, if less than five fiscal years. These documents are available upon request. (Please see “MORE INFORMATION ABOUT THE FUNDS.")

What are other key features of the Funds?

Investment Advisory Fees. Global X is the investment adviser of each Fund. Global X has entered into an investment advisory agreement relating to the Funds (the “Investment Advisory Agreement”). Under the Investment Advisory Agreement between the Trust and the Adviser, the Adviser is responsible for the management of the investment portfolio of each Fund.

Additionally, pursuant to a Supervision and Administration Agreement between the Trust and Global X, Global X oversees the operation of the Funds, provides or causes to be furnished the advisory, supervisory, administrative, distribution, transfer agency, custody and all other services necessary for the Funds to operate, and exercises day-to-day oversight over the Funds’ service providers. Under the Supervision and Administration Agreement, the Adviser also bears all the fees and expenses incurred in connection with its obligations under the Supervision and Administration Agreement, including, but not limited to, the costs of various third-party services required by the Funds, including audit, certain custody, portfolio accounting, legal, transfer agency and printing costs, except those fees and expenses specifically assumed by the Trust on behalf of each Fund.

Each Fund pays Global X a fee (“Management Fee”) for the advisory, supervisory, administrative and other services it requires under an all-in fee structure. Each Fund pays a monthly Management Fee to Global X at the annual rate (stated as a percentage of each Fund’s respective average daily net assets) of 0.50%. In addition, each Fund bears other fees and expenses that are not covered by the Supervision and Administration Agreement, which may vary and will affect the total expense ratio of a Fund, such as taxes, brokerage fees, commissions and other transaction expenses, interest and extraordinary expenses (such as litigation and indemnification expenses). Global X may earn a profit on the Management Fees paid by the Funds. Also, Global X, and not shareholders of the Funds, would benefit from any price decreases in third-party services, including decreases resulting from an increase in net assets.

Global X and its related companies may pay broker-dealers or other financial intermediaries (such as a bank) for the sale of each Fund’s shares and related services. These payments may create a conflict of interest by influencing your broker-dealer, sales persons or other intermediary or its employees or associated persons to recommend the Funds over another investment. Ask your financial adviser or visit your financial intermediary’s website for more information.

Distribution Services. SEI Investments Distribution Co. (“Distributor”) distributes aggregated blocks of Fund shares (“Creation Units”) for each Fund on an agency basis. The Distributor authorizes large institutional investors (“Authorized Participants”) to purchase and redeem Creation Units pursuant to legal requirements pursuant to which the Funds offer and redeem shares. The Distributor does not maintain a secondary market in each Fund’s shares. The Distributor has no role in determining the policies of the Funds or the securities that are purchased or sold by each Fund. The Distributor’s principal address is One Freedom Valley Drive, Oaks, PA 19456. The Distributor is not affiliated with Global X.

Rule 12b-1 Plans. The Board of the Trust has adopted a Distribution and Services Plan pursuant to Rule 12b-1 under the 1940 Act (the “Rule 12b-1 Plan”). Under the Rule 12b-1 Plan, each Fund is authorized to pay distribution fees in connection with the sale and distribution of its shares and pay service fees in connection with the provision of ongoing services to shareholders of each class and the maintenance of shareholder accounts in an amount up to 0.25% of its average daily net assets each year. No Rule 12b-1 fees are currently paid by each Fund, and there are no current plans to impose these fees. However, in the event Rule 12b-1 fees are charged in the future, because these fees are paid out of each Fund’s assets on an ongoing basis, these fees will increase the cost of your investment in a Fund. By purchasing shares subject to distribution fees and service fees, you may pay more over time than you would by purchasing shares with other types of sales charge arrangements. Long-term shareholders may pay more than the economic equivalent of the maximum front-end sales charge permitted by the rules of FINRA. The net income attributable to shares of a Fund will be reduced by the amount of distribution fees and service fees and other expenses of the Fund.

Purchase and Sale of Fund Shares. The Funds’ procedures for the purchase and sale of Fund shares are identical. The Funds offer and issue shares at NAV per share only in aggregations of a specified number of shares (each, a “Creation Unit” or a “Creation Unit Aggregation”), generally in exchange for a basket of securities included in each Fund’s underlying index, together with the deposit of a specified cash payment (“Cash Component”). The shares of the Funds are traded on NYSE Arca. Shares trade in the secondary market and elsewhere at market prices that may be at, above or below NAV. Shares are redeemable only in Creation Unit Aggregations and, generally, in exchange for portfolio securities and a Cash Component. Each Fund has 10,000 shares per Creation Unit.

Dividends, Distributions and Taxes. Each Fund’s procedures with regard to dividends, distributions and taxes are identical. You may refer to the prospectus for the Funds under the sections entitled “DIVIDENDS AND DISTRIBUTIONS" and "TAXES." In summary, dividends from net investment income, including any net foreign currency gains, generally are declared and paid at least annually and any net realized capital gains are distributed at least annually. Dividends and other distributions on shares are distributed on a pro rata basis to beneficial owners of such shares. Any net realized capital gains of each Fund will be declared and paid to shareholders at least annually.

COMPARISON OF INVESTMENT OBJECTIVES, PRINCIPAL INVESTMENT STRATEGIES, POLICIES AND PRINCIPAL RISKS

The table below provides a comparison of the investment objectives, principal investment strategies and principal risks of the Target Fund, the Acquiring Fund and the Combined Fund, post-Reorganization. The Combined Fund's features are identical to the corresponding features of the Target Fund. For a complete description of the Combined Fund’s principal investment strategies, policies and principal risks, you should read the supplement to the Acquiring Fund Summary Prospectus, which is included with this Prospectus/Information Statement.

| | | | | | | | | | | |

| Target Fund | Acquiring Fund | Combined Fund, Post-Reorganization |

| Investment Objective | The Global X MSCI Norway ETF ("Fund") seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Norway IMI 25/50 Index ("Target Fund Underlying Index"). | The Global X FTSE Nordic Region ETF ("Fund") seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the FTSE Nordic 30 Index ("Acquiring Fund Underlying Index"). | The Global X MSCI Norway ETF ("Fund") seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Norway IMI 25/50 Index ("Combined Fund Underlying Index"). |

| Principal Investment Strategies | The Fund invests at least 80% of its total assets in the securities of the Target Fund Underlying Index and in American Depositary Receipts ("ADRs") and Global Depositary Receipts ("GDRs") based on the securities in the Target Fund Underlying Index. The Fund also invests at least 80% of its total assets in securities of companies that are economically tied to Norway. The Fund's 80% investment policies are non-fundamental and require 60 days prior written notice to shareholders before they can be changed. The Fund may lend securities representing up to one-third of the value of the Fund’s total assets (including the value of the collateral received).

The Target Fund Underlying Index is designed to represent the performance of the broad Norway equity universe, as defined by MSCI, Inc. ("MSCI"), the provider of the Target Fund Underlying Index ("Index Provider"). The broad Norway equity universe includes securities that are classified in Norway according to the MSCI Global Investable Market Index Methodology. The Fund's investment objective and Target Fund Underlying Index may be changed without shareholder approval.

| The Fund invests at least 80% of its total assets in the securities of the Acquiring Fund Underlying Index and in American Depositary Receipts ("ADRs") and Global Depositary Receipts ("GDRs") based on the securities in the Acquiring Fund Underlying Index. The Fund also invests at least 80% of its total assets in securities of companies that are economically tied to Sweden, Denmark, Norway and Finland. The Fund's 80% investment policies are non-fundamental and require 60 days prior written notice to shareholders before they can be changed. The Fund may lend securities representing up to one-third of the value of the Fund’s total assets (including the value of the collateral received).

The Acquiring Fund Underlying Index is designed to reflect the equity market performance of companies in Sweden, Denmark, Norway and Finland, as defined by FTSE International Limited ("FTSE"), the provider of the Acquiring Fund Underlying Index ("Index Provider"). The starting universe of the Acquiring Fund Underlying Index is the FTSE All-World Index - Nordic Region. The Acquiring Fund Underlying Index tracks the equity performance of among the 30 largest and most liquid companies in Sweden, Denmark, Norway and Finland. The Fund's investment objective and Acquiring Fund Underlying Index may be changed without shareholder approval. | The Fund invests at least 80% of its total assets in the securities of the Combined Fund Underlying Index and in American Depositary Receipts ("ADRs") and Global Depositary Receipts ("GDRs") based on the securities in the Combined Fund Underlying Index. The Fund also invests at least 80% of its total assets in securities of companies that are economically tied to Norway. The Fund's 80% investment policies are non-fundamental and require 60 days prior written notice to shareholders before they can be changed. The Fund may lend securities representing up to one-third of the value of the Fund’s total assets (including the value of the collateral received).

The Combined Fund Underlying Index is designed to represent the performance of the broad Norway equity universe, as defined by MSCI, Inc. ("MSCI"), the provider of the Combined Fund Underlying Index ("Index Provider"). The broad Norway equity universe includes securities that are classified in Norway according to the MSCI Global Investable Market Index Methodology. The Fund's investment objective and Combined Fund Underlying Index may be changed without shareholder approval.

|

| | | | | | | | | | | |

| Target Fund | Acquiring Fund | Combined Fund, Post-Reorganization |

| The Fund concentrates its investments (i.e., holds 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Target Fund Underlying Index is concentrated. As of December 31, 2020, the Target Fund Underlying Index was not concentrated in any industry. | The Fund concentrates its investments (i.e., holds 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Acquiring Fund Underlying Index is concentrated. As of December 31, 2020, the Acquiring Fund Underlying Index had significant exposure to the industrials sector. | The Fund concentrates its investments (i.e., holds 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Combined Fund Underlying Index is concentrated. As of December 31, 2020, the Combined Fund Underlying Index was not concentrated in any industry. |

| Principal Risks | •Asset Class Risk ▪Equity Securities Risk •Capitalization Risk ▪Large-Capitalization Companies Risk ▪Mid-Capitalization Companies Risk ▪Small-Capitalization Companies Risk •Concentration Risk •Currency Risk •Foreign Securities Risk •Geographic Risk ◦Risk of Investing in Developed Markets ◦Risk of Investing in Norway •International Closed Market Trading Risk •Investable Universe of Companies Risk •Issuer Risk •Market Risk •Non-Diversification Risk •Operational Risk •Passive Investment Risk ◦Index-Related Risk ◦Management Risk ◦Tracking Error Risk •Reliance on Trading Partners Risk •Risks Associated with Exchange-Traded Funds ◦Authorized Participants Concentration Risk ◦Large Shareholder Risk ◦Listing Standards Risk ◦Market Trading Risks and Premium/Discount Risks •Securities Lending Risk •Trading Halt Risk •Valuation Risk

| •Asset Class Risk ◦Equity Securities Risk •Capitalization Risk ◦Large-Capitalization Companies Risk •Concentration Risk ◦Risks Related to Investing in the Industrials Sector •Currency Risk •Foreign Securities Risk •Geographic Risk ◦Risk of Investing in Denmark ◦Risk of Investing in Developed Markets ◦Risk of Investing in Finland ◦Risk of Investing in the Nordic Region ◦Risk of Investing Norway ◦Risk of Investing in Sweden •International Closed Market Trading Risk •Issuer Risk •Market Risk •Non-Diversification Risk •Operational Risk •Passive Investment Risk ◦Index-Related Risk ◦Management Risk ◦Tracking Error Risk •Reliance on Trading Partners Risk •Risks Associated with Exchange-Traded Funds ◦Authorized Participants Concentration Risk ◦Large Shareholder Risk ◦Listing Standards Risk ◦Market Trading Risks and Premium/Discount Risks •Securities Lending Risk •Trading Halt Risk •Valuation Risk | •Asset Class Risk ▪Equity Securities Risk •Capitalization Risk ▪Large-Capitalization Companies Risk ▪Mid-Capitalization Companies Risk ▪Small-Capitalization Companies Risk •Concentration Risk •Currency Risk •Foreign Securities Risk •Geographic Risk ◦Risk of Investing in Developed Markets ◦Risk of Investing in Norway •International Closed Market Trading Risk •Investable Universe of Companies Risk •Issuer Risk •Market Risk •Non-Diversification Risk •Operational Risk •Passive Investment Risk ◦Index-Related Risk ◦Management Risk ◦Tracking Error Risk •Reliance on Trading Partners Risk •Risks Associated with Exchange-Traded Funds ◦Authorized Participants Concentration Risk ◦Large Shareholder Risk ◦Listing Standards Risk ◦Market Trading Risks and Premium/Discount Risks •Securities Lending Risk •Trading Halt Risk •Valuation Risk

|

What are the differences between the investment objectives of the Target Fund and the Acquiring Fund and what will the investment objective of the Combined Fund be following the Reorganization?

The investment objectives of the Funds are substantially similar, except for each Fund’s tracking of a different underlying index. Both Funds are passively managed index ETFs that seek investment results that correspond generally to the price and yield performance, before fees and expenses, of each Fund’s respective underlying index. The Target Fund’s underlying index is the MSCI Norway IMI 25/50 Index, an index designed to represent the performance of the broad Norway equity universe, as defined by MSCI, Inc., the provider of the underlying index. Each Fund’s investment objective may be changed without shareholder approval. The Board approved changing the Acquiring Fund’s underlying index from the FTSE Nordic 30 Index, an index designed to reflect the equity market performance of companies in Sweden, Denmark, Norway and Finland, as defined by FTSE International Limited, the provider of the Acquiring Fund’s underlying index, to the MSCI Norway IMI 25/50 Index. This change is expected to be implemented immediately prior to the Reorganization. Therefore, upon consummation of the Reorganization, the Combined Fund will have the same investment objective as the Target Fund.

What are the most significant differences between the principal investment strategies and policies of the Target Fund compared to the Acquiring Fund and what will be the principal investment strategies of the Combined Fund following the Reorganization?

The principal investment strategies of the Funds are similar with some important differences. The Board has approved a change in the Acquiring Fund’s underlying index from the FTSE Nordic 30 Index to the MSCI Norway IMI 25/50 Index, which is the underlying index of the Target Fund and will be the underlying index of the Combined Fund. These changes are expected to be implemented immediately prior to the Reorganization. Therefore, at the time of the Reorganization, the Funds will have identical principal investment strategies and policies. The similarities and differences between the Funds’ principal investment strategies and policies prior to the change in the Acquiring Fund’s underlying index taking effect are discussed below.

Each Fund uses a “passive” or indexing approach to try to achieve the Fund’s investment objective. Neither Fund attempts to outperform its respective underlying index or seeks temporary defensive positions when markets decline or appear overvalued. Each Fund uses a replication strategy, which is an indexing strategy that involves investing in the securities of its respective underlying index in approximately the same proportions as in such underlying index. However, each Fund may utilize a representative sampling strategy with respect to its underlying index when a replication strategy might be detrimental or disadvantageous to shareholders, such as when there are practical difficulties or substantial costs involved in compiling a portfolio of equity securities to replicate its underlying index, in instances in which a security in such underlying index becomes temporarily illiquid, unavailable or less liquid, or as a result of legal restrictions or limitations (such as tax diversification requirements) that apply to the Fund but not its underlying index. The Adviser expects that, over time, the correlation between each Fund’s performance and that of its underlying index, before fees and expenses, will exceed 95%. A correlation percentage of 100% would indicate perfect correlation.

The primary differences between the Funds are that they seek investment results that correspond to different underlying indexes and the Acquiring Fund invests at least 80% of its total assets in securities of companies that are economically tied to Sweden, Denmark, Norway and Finland, while the Target Fund invests, and the Combined Fund will invest, at least 80% of its total assets in securities of companies that are economically tied to Norway. The Acquiring Fund seeks investment results that correspond generally to the FTSE Nordic 30 Index, which tracks the equity performance among the 30 largest and most liquid companies in Sweden, Denmark, Norway and Finland. The Target Fund and the Combined Fund seeks/will seek investment results that correspond generally to the MSCI Norway IMI 25/50 Index, which is designed to represent the performance of companies across different capitalization segments of the Norwegian market. Therefore, the Target Fund invests, and the Combined Fund will invest, in small-, medium-, and large-capitalization companies, while the Acquiring Fund typically invests only in large--capitalization companies. As a result, each of the Target Fund and the Combined Fund has/will have a larger

universe of companies in which it may invest than the Acquiring Fund. Each Fund’s underlying index may be changed without shareholder approval.

The Funds’ fundamental investment policies are identical. The Funds’ non-fundamental investment policies differ only in that the Target Fund and the Combined Fund must invest at least 80% of its total assets in securities of the MSCI Norway IMI 25/50 Index, and 80% of its total assets in securities of companies that are economically tied to Norway, while the Acquiring Fund must invest at least 80% of its total assets in the securities of the FTSE Nordic 30 Index, and 80% of its total assets in securities of companies that are economically tied to Sweden, Denmark, Norway and Finland. The Funds’ 80% policies are non-fundamental and require 60 days prior written notice to shareholders before they may be changed.

Each Fund is classified as “non-diversified” under applicable federal law, which means that, with respect to 75% of its total assets, each Fund may invest more than 5% of such assets in any one issuer or may hold more than 10% of the outstanding securities of any one issuer. Each Fund may concentrate its investments (i.e., hold 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that its underlying index is concentrated. As of April 30, 2021, the Target Fund did not concentrate its investments in a particular industry, while the Acquiring Fund was concentrated in the industrials sector.

How do the fundamental investment restrictions of the Target Fund differ from the Acquiring Fund?

The Funds have adopted identical fundamental investment restrictions. Neither Fund may change any of its fundamental investment restrictions without the vote of the majority of the outstanding shares of the Fund for which a change is proposed. The vote of the majority of the outstanding shares means the vote of (A) 67% or more of the voting securities present at a meeting, if the holders of more than 50% of the outstanding voting securities are present or represented by proxy or (B) a majority of the outstanding voting securities, whichever is less. The Acquiring Fund’s fundamental investment restrictions are listed in the Acquiring Fund’s Statement of Additional Information dated March 1, 2021 (1933 Act File No. 333-151713), which is incorporated by reference into the SAI relating to this Prospectus/Information Statement and is available upon request. What are the principal risk factors associated with investments in the Target Fund, the Acquiring Fund and the Combined Fund?

Like all investments, an investment in the Target Fund, the Acquiring Fund or the Combined Fund involves risk. There is no assurance that the Target Fund, the Acquiring Fund or the Combined Fund will meet their respective investment objectives. The Target Fund's, the Acquiring Fund's or the Combined Fund's ability to achieve its objective will depend, among other things, on the portfolio managers’ analytical and portfolio management skills. If the value of the Target Fund's, the Acquiring Fund's or the Combined Fund's investments goes down, you may lose money.

As noted above, the Board has approved a change in the Acquiring Fund’s underlying index from the FTSE Nordic 30 Index to the MSCI Norway IMI 25/50 Index, which is the underlying index of the Target Fund. The Board additionally approved aligning the Acquiring Fund’s 80% policy so that the Fund will invest at least 80% of its total assets in securities of companies that are only economically tied to Norway. These changes are expected to be implemented immediately prior to the Reorganization. Therefore, at the time of the Reorganization, the Combined Fund will have identical principal risks to the Target Fund. The similarities and differences between the Funds’ principal risk factors prior to the change in the Acquiring Fund’s underlying index taking effect are discussed below.

Although many of the principal risks applicable to an investment in the Acquiring Fund are also applicable to an investment in the Target Fund/the Combined Fund, there are some differences in the risks applicable to the Acquiring Fund and the Target Fund/the Combined Fund. As of the date of this Prospectus/Information Statement, the Acquiring Fund invests in a larger geographic area than the Target Fund/the Combined Fund, making the Acquiring Fund more susceptible to risks across the entire Nordic Region. The Acquiring Fund also has significant

exposure to the industrials sector making the Acquiring Fund, as of the date of this Prospectus/Information Statement, more susceptible to risks associated with that sector than funds without such significant holdings, such as the Target Fund and the Combined Fund. The Target Fund and the Combined Fund invests/will invest in mid- and small-capitalization companies, making each fund more susceptible to risks associated such companies than funds that do not invest in such companies, such as the Acquiring Fund. The universe of companies that the Target Fund and the Combined Fund may invest/will invest in may be limited, making it more susceptible to the risks posed by having a smaller universe of companies to invest in than that of a fund without such a limitation, such as the Acquiring Fund.

The principal risks of investing in the Acquiring Fund, the Target Fund/the Combined Fund are indicated below. Each risk applies to the Acquiring Fund, the Target Fund and the Combined Fund unless otherwise noted.

Asset Class Risk: Securities and other assets in each Fund’s underlying index or otherwise held in the Fund’s portfolio may underperform in comparison to the general securities markets, a particular securities market or other asset classes.

Equity Securities Risk: Equity securities are subject to changes in value, and their values may be more volatile than other asset classes, as a result of such factors as a company’s business performance, investor perceptions, stock market trends and general economic conditions.

Capitalization Risk: Investing in issuers within the same market capitalization category carries the risk that the category may be out of favor due to current market conditions or investor sentiment.

Large-Capitalization Companies Risk: Large-capitalization companies may trail the returns of the overall stock market. Large-capitalization stocks tend to go through cycles of doing better – or worse – than the stock market in general. These periods have, in the past, lasted for as long as several years.

Mid-Capitalization Companies Risk (Applicable to the Target Fund and the Combined Fund): Mid-capitalization companies may have greater price volatility, lower trading volume and less liquidity than large-capitalization companies. In addition, mid-capitalization companies may have smaller revenues, narrower product lines, less management depth and experience, smaller shares of their product or service markets, fewer financial resources and less competitive strength than large-capitalization companies.

Small-Capitalization Companies Risk (Applicable to the Target Fund and the Combined Fund): Compared to mid- and large-capitalization companies, small-capitalization companies may be less stable and more susceptible to adverse developments, and their securities may be more volatile and less liquid.

Concentration Risk: To the extent that a Fund’s underlying index concentrates in investments related to a particular industry or group of industries, a Fund will also concentrate its investments to approximately the same extent. Similarly, if the underlying index has significant exposure to one or more sectors, a Fund’s investments will likely have significant exposure to such sectors. In such event, a Fund’s performance will be particularly susceptible to adverse events impacting such industry or sector, which may include, but are not limited to, the following: general economic conditions or cyclical market patterns that could negatively affect supply and demand; competition for resources; adverse labor relations; political or world events; obsolescence of technologies; and increased competition or new product introductions that may affect the profitability or viability of companies in a particular industry or sector. As a result, the value of a Fund’s investments may rise and fall more than the value of shares of a fund that invests in securities of companies in a broader range of industries or sectors.

Risks Related to Investing in the Industrials Sector (Applicable to the Acquiring Fund): Companies in the industrials sector are subject to fluctuations in supply and demand for their specific product or service. The products of manufacturing companies may face product obsolescence due to rapid technological developments. Government regulation, world events and economic conditions affect the performance of companies in the industrials sector. Companies also may be adversely affected by environmental damage and product liability claims. Companies in the industrials sector face increased risk from trade agreements between countries that develop these

technologies and countries in which customers of these technologies are based. Lack of resolution or potential imposition of trade tariffs may hinder on the companies’ ability to successfully deploy their inventories.

Currency Risk: The Funds may invest in securities denominated in foreign currencies. Because each Fund’s NAV is determined in U.S. dollars, a Fund’s NAV could decline if the currency of a Nordic country (in the case of the Acquiring Fund) or the currency of Norway (in the case of the Target Fund and the Combined Fund) currency depreciates against the U.S. dollar or if there are delays or limits on repatriation of such currency. Currency exchange rates can be very volatile and can change quickly and unpredictably. As a result, a Fund’s NAV may change quickly and without warning, which could have a significant negative impact on the Fund.

Foreign Securities Risk: The Funds may invest, within U.S. regulations, in foreign securities. The Funds’ investments in foreign securities can be riskier than U.S. securities investments. Investments in the securities of foreign issuers (including investments in ADRs and GDRs) are subject to the risks associated with investing in those foreign markets, such as heightened risks of inflation or nationalization. The prices of foreign securities and the prices of U.S. securities have, at times, moved in opposite directions. In addition, securities of foreign issuers may lose value due to political, economic and geographic events affecting a foreign issuer or market. During periods of social, political or economic instability in a country or region, the value of a foreign security traded on U.S. exchanges could be affected by, among other things, increasing price volatility, illiquidity, or the closure of the primary market on which the security (or the security underlying the ADR or GDR) is traded. You may lose money due to political, economic and geographic events affecting a foreign issuer or market.

Geographic Risk: A natural, biological or other disaster could occur in a geographic region (including a single country) in which the Funds invest, which could affect the economy or particular business operations of companies in the specific geographic region, causing an adverse impact on the Funds’ investments in the affected region or in a region economically tied to the affected region. The securities in which the Funds invest and, consequently, the Funds are also subject to specific risks as a result of their business operations, including, but not limited to:

Risk of Investing in Denmark (Applicable to the Acquiring Fund): Investments in Danish issuers subject the Fund to legal, regulatory, political, currency, security, and economic risks specific to Denmark. Denmark’s economy has also been characterized by slow growth and is facing demographic challenges, including an aging population, that could lead to labor supply shortages in the near future.

Risk of Investing in Developed Markets: The Funds’ investment in a developed country issuer may subject the Funds to regulatory, political, currency, security, economic and other risks associated with developed countries. Developed countries tend to represent a significant portion of the global economy and have generally experienced slower economic growth than some less developed countries. Certain developed countries have experienced security concerns, such as terrorism and strained international relations. Incidents involving a country’s or region’s security may cause uncertainty in its markets and may adversely affect its economy and the Funds’ investments. In addition, developed countries may be impacted by changes to the economic conditions of certain key trading partners, regulatory burdens, debt burdens and the price or availability of certain commodities.

Risk of Investing in Finland (Applicable to the Acquiring Fund): Investments in Finnish issuers may subject the Fund to legal, regulatory, political, currency, security, and economic risks specific to Finland. Finland’s economy, among other things, depends on imported raw materials, energy and components for its manufactured products. As a result, Finland is dependent on trading relationships with certain key trading partners, including Germany, Sweden and Russia.

Risk of Investing in the Nordic Region (Applicable to the Acquiring Fund): Investments of the Acquiring Fund are concentrated in companies in Sweden, Denmark, Norway and Finland. The Nordic economies are heavily dependent on natural resources and trade amongst one another and with the members of the European Union and have historically maintained generous welfare programs. Decreasing European imports, new trade regulations, changes in exchange rates, a recession in Europe, or a slowing of economic

growth in this region could have an adverse impact on the securities in which the Fund invests. Secessionist movements, such as the Catalan movement in Spain and the independence movement in Scotland, may have an adverse effect on Nordic economies. Likewise, the exit of the United Kingdom from the European Union or other events in Europe could also adversely affect the Nordic countries’ economies.

Risk of Investing in Norway: Investments in Norwegian issuers may subject the Funds to legal, regulatory, political, currency, security, and economic risks specific to Norway. Norway is a major producer of oil and gas, and Norway’s economy is subject to the risk of fluctuations on oil and gas prices. The high value of the Norwegian krone as compared to other currencies could have a damaging effect on Norwegian exports and investments. In recent years, labor costs in Norway have increased faster than those of its major trading partners, eroding industrial competitiveness.

Risk of Investing in Sweden (Applicable to the Acquiring Fund): Investments in Swedish issuers may subject the Acquiring Fund to legal, regulatory, political, currency, security and economic risks specific to Sweden. Sweden has a highly developed welfare system and the level of union membership in Sweden is substantial. These factors can negatively impact the Swedish economy by causing increased government spending, higher production costs and lower productivity, among other things.

International Closed Market Trading Risk: To the extent that the underlying investments held by the Funds trade on foreign exchanges that may be closed when the securities exchange on which the Funds’ shares trade is open, there are likely to be deviations between the current price of such an underlying security and the last quoted price for the underlying security (i.e., a Fund’s quote from the closed foreign market). These deviations could result in premiums or discounts to a Fund’s NAV that may be greater than those experienced by other ETFs.

Investable Universe of Companies Risk (Applicable to the Target Fund and the Combined Fund): The investable universe of companies in which the Target Fund and the Combined Fund may invest may be limited. If a company no longer meets MSCI Inc.’s criteria for inclusion in the Acquiring Fund’s underlying index, the Fund may need to reduce or eliminate its holdings in that company. The reduction or elimination of the Fund’s holdings in the company may have an adverse impact on the liquidity of the Fund’s overall portfolio holdings and on Fund performance.

Issuer Risk: Fund performance depends on the performance of individual companies in which a Fund invests. Changes to the financial condition of any of those companies may cause the value of such company’s securities to decline.

Market Risk: Turbulence in the financial markets and reduced liquidity may negatively affect issuers, which could have an adverse effect on the Funds. If the securities held by the Funds experience poor liquidity, the Funds may be unable to transact at advantageous times or prices, which may decrease the Funds’ returns. In addition, there is a risk that policy changes by central governments and governmental agencies, including the Federal Reserve or the European Central Bank, which could include increasing interest rates, could cause increased volatility in financial markets and lead to higher levels of Fund redemptions from Authorized Participants, which could have a negative impact on the Funds. Furthermore, local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on a Fund and its investments and trading of its shares. For example, the rapid and global spread of a highly contagious novel coronavirus respiratory disease, designated COVID-19, has resulted in extreme volatility in the financial markets and severe losses; reduced liquidity of many instruments; restrictions on international and, in some cases, local travel; significant disruptions to business operations (including business closures); strained healthcare systems; disruptions to supply chains, consumer demand and employee availability; and widespread uncertainty regarding the duration and long-term effects of this pandemic. Some sectors of the economy and individual issuers have experienced particularly large losses. In addition, the COVID-19 pandemic may result in a sustained economic downturn or a global recession, domestic and foreign political and social instability, damage to diplomatic and international trade relations and increased volatility and/or decreased liquidity in the securities markets. The NAV of each Fund could decline over short periods due to short-term market movements and over longer periods during market downturns.

Non-Diversification Risk: The Funds are classified as “non-diversified” investment companies under the 1940 Act. As a result, the Funds are subject to the risk that they may be more volatile than a diversified fund because the Funds may invest their assets in a smaller number of issuers or may invest a larger proportion of their assets in a single issuer. As a result, the gains and losses on a single investment may have a greater impact on each Fund’s NAV and may make the Fund more volatile than more diversified funds.

Operational Risk: The Funds are exposed to operational risk arising from a number of factors, including but not limited to human error, processing and communication errors, errors of the Funds’ service providers, counterparties or other third-parties, failed or inadequate processes and technology or systems failures. Additionally, cyber security failures or breaches of the electronic systems of the Funds, the Adviser, and the Funds’ other service providers, market makers, Authorized Participants or the issuers of securities in which the Funds invest have the ability to cause disruptions and negatively impact the Funds’ business operations, potentially resulting in financial losses to the Funds and their shareholders. The Funds and the Adviser seek to reduce these operational risks through controls and procedures. However, these measures do not address every possible risk and may be inadequate for those risks that they are intended to address.

Passive Investment Risk: The Funds are not actively managed, and the Adviser does not attempt to take defensive positions in declining markets. Unlike many investment companies, the Funds do not seek to outperform their respective underlying index. Therefore, the Funds would not necessarily buy or sell a security unless that security is added or removed, respectively, from its respective underlying index, even if that security generally is underperforming. Additionally, if a constituent of the underlying index were removed, even outside of a regular rebalance of the underlying index, the Adviser anticipates that a Fund would sell such security. Maintaining investments in securities regardless of market conditions or the performance of individual securities could cause the Funds’ returns to be lower than if the Funds employed an active strategy.

Index-Related Risk: There is no guarantee that the Funds will achieve a high degree of correlation to their applicable underlying indexes and therefore achieve their respective investment objectives. Market disruptions and regulatory restrictions could have an adverse effect on the Funds’ ability to adjust their exposure to the required levels in order to track their respective underlying indexes. Errors in index data, index computations and/or the construction of their respective underlying index in accordance with its methodology may occur from time to time and may not be identified and corrected by each Fund’s index provider for a period of time or at all, which may have an adverse impact on the Funds and their shareholders.

Management Risk: The Funds may not fully replicate their respective underlying index and may hold securities not included in their respective underlying index. The Adviser’s investment strategies for each Fund, the implementation of which is subject to a number of constraints, may cause the Fund to underperform the market or their relevant benchmark or adversely affect the ability of the Fund to achieve its respective investment objective.

Tracking Error Risk: Tracking error may occur because of differences between the instruments held in each Fund’s portfolio and those included in each Fund’s respective underlying index, pricing differences, transaction costs incurred by each Fund, each Fund’s holding of uninvested cash, size of each Fund, differences in timing of the accrual of or the valuation of dividends or interest, tax gains or losses, changes to either Fund’s underlying index or the costs to each Fund of complying with various new or existing regulatory requirements. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because each Fund incurs fees and expenses, while its respective underlying index does not.