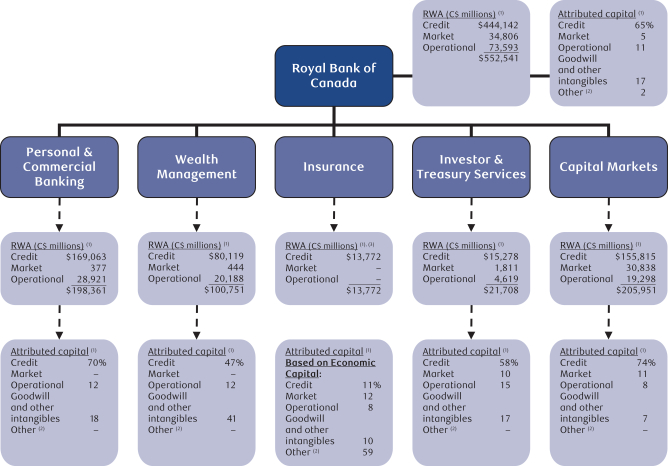

| Personal & Commercial Banking |

Personal & Commercial Banking provides a broad suite of financial products and services to individuals and businesses for their day-to-day banking, investing and financing needs. We are focused on building deep and meaningful relationships with our clients, underscored by our exceptional client experience, the breadth of our product suite, our depth of expertise, and the features of our digital solutions.

| > 14 million |

8 million |

36,675 | ||||||

| Number of clients |

Active digital users in Canada 1 |

Employees | ||||||

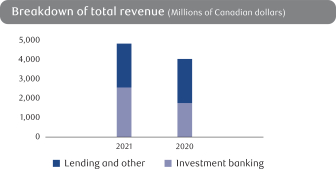

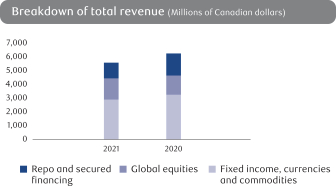

| Revenue by business lines |

We operate through two businesses – Canadian Banking and Caribbean & U.S. Banking. Canadian Banking serves our home market in Canada, where we maintain top (#1 or #2) rankings in market share for all key retail and business products. We have the largest branch network, the most ATMs and one of the largest mobile sales forces across Canada. In Caribbean & U.S. Banking, we offer a broad range of financial products and services in targeted markets. In Canada, we compete with other Schedule 1 banks, independent trust companies, foreign banks, credit unions, caisses populaires, and auto financing companies. In the Caribbean, our competition includes banks, trust companies and investment management companies serving retail and corporate clients, as well as public institutions. In the U.S., we compete primarily with other Canadian banking institutions that have U.S. operations. | |||||||

|

||||||||

2021 Operating environment

› |

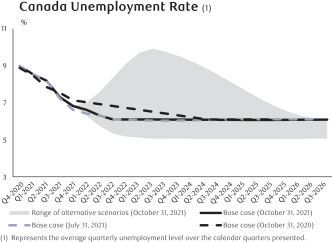

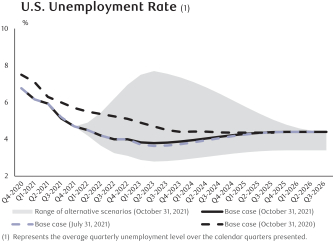

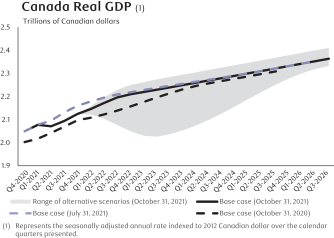

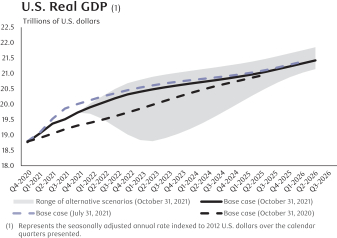

While impacts from the COVID-19 pandemic continued to persist, client activity improved driving strong volume and fee-based revenue growth throughout fiscal 2021 as economies re-opened due to progress on vaccination distribution, reduced containment measures and continued government support. Further, as businesses began re-opening, unemployment rates also improved. |

› |

Improvements in the credit environment, driven by the economic recovery from the COVID-19 pandemic, led to favourable changes in our macroeconomic and credit quality outlook, resulting in releases of provisions on performing assets. Lower provisions on impaired loans in our Canadian Banking retail portfolios also reflected the economic recovery underway and the continued impact of the COVID-19 related government support programs. |

› |

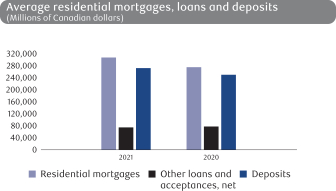

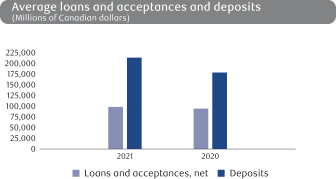

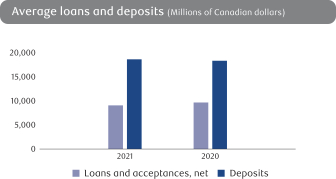

Personal and business deposits continued to see significant growth throughout fiscal 2021, reflecting clients’ preference for the safety of higher cash balances amidst the COVID-19 pandemic. |

› |

Housing activity was strong with record levels of mortgage originations in fiscal 2021. Despite the industry-wide tightening of mortgage lending criteria in the third quarter, low interest rates and demand for housing continued to support strong growth in residential mortgages. |

› |

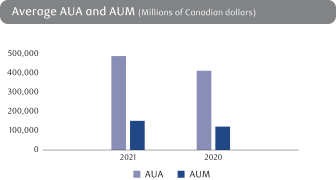

Throughout fiscal 2021, we saw favourable market conditions resulting in solid growth in mutual fund balances from a combination of market appreciation and strong net sales. We also saw significant market activity in the first half of the fiscal year which benefitted our Direct Investing business. While market activity moderated in the second half of the fiscal year, average trading volumes remained above pre-pandemic levels. |

› |

The ongoing low interest rate environment continued to be a headwind in fiscal 2021, resulting in a further decline in NIM. NIM was also negatively impacted by changes in product mix and competitive pricing pressures. |

› |

Client preferences for digital offerings continue to evolve and this shift has been accelerated due to the impact of the COVID-19 pandemic. We continued to invest in digital solutions to improve the client experience and deliver personalized advice. |

› |

Our Caribbean Banking business continued to be negatively impacted by the ongoing low interest rate environment; however, we also saw releases of provisions on performing assets. We also closed the sale of our Eastern Caribbean operations in the second quarter of 2021. |

› |

In the U.S., earnings were unfavourably impacted by the low interest rate environment and severe limitations on cross-border travel, as a result of the COVID-19 pandemic. |

1 |

Represents 90-day active clients |

Management’s Discussion and Analysis Royal Bank of Canada: Annual Report 2021 27