UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Amendment No. 1)

| (Mark One) | |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For

the Fiscal Year Ended

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number:

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports)

and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files.)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| x | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Smaller reporting company | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check

mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal

control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S. 7262(b)) by the registered public

accounting firm that prepared or issued its audit report.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨

The aggregate market

value of the voting shares (based on the closing price reported on the NASDAQ Global Select Market on April 3, 2021) of Coherent, Inc.,

held by nonaffiliates was approximately $

As of December 16, 2021, 24,763,638 shares of common stock were outstanding.

DOCUMENT INCORPORATED BY REFERENCE

None.

Explanatory Note

Coherent, Inc. (“we,” “us,” “our,” “Company,” or “Coherent”) is filing this Amendment No. 1 on Form 10-K/A (“Amendment No. 1”) to amend our Annual Report on Form 10-K for the fiscal year ended October 2, 2021 (“Original Filing”), originally filed with the U.S. Securities and Exchange Commission (“SEC”) on November 30, 2021 (“Original Filing Date”), solely to include the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above referenced items to be incorporated in the Form 10-K by reference from our definitive proxy statement if such proxy statement is filed no later than 120 days after our fiscal year-end. We are filing this Amendment No. 1 to include the Part III information in our Form 10-K because we will not file a definitive proxy statement containing such information within 120 days after the end of the fiscal year covered by the Original Filing. The reference on the cover page of the Original Filing to the incorporation by reference to portions of our definitive proxy statement into Part III of the Original Filing has been deleted. This Amendment No. 1 hereby amends and restates in its entirety the cover page and Items 10 through 14 of Part III of the Original Filing.

Pursuant to Rule 12b-15 under the Exchange Act, this Amendment No. 1 also contains new certifications by the principal executive officer and the principal financial officer as required by Section 302 of the Sarbanes-Oxley Act of 2002. Accordingly, Item 15 of Part IV is amended to include the currently dated certifications as exhibits.

Except as expressly noted in this Amendment No. 1, this Amendment No. 1 does not reflect events that may have occurred subsequent to the Original Filing Date or modify or otherwise update any other disclosures contained in the Original Filing, including, without limitation, the financial statements. Accordingly, this Amendment No. 1 should be read in conjunction with the Original Filing.

1

TABLE OF CONTENTS

1

PART III

ITEM 10. Directors, Executive Officers and Corporate Governance

Our Directors

The names of our directors and certain information about them as of December 16, 2021 is set forth below. The term of office of each director will continue until our next annual meeting of stockholders or until a successor has been elected and qualified or until his or her earlier resignation or removal. There are no arrangements or understandings between any director or executive officer and any other person pursuant to which he or she is or was to be selected as a director or officer.

There are no family relationships among directors or executive officers of Coherent. Except as set forth below, each of our directors has been engaged in his or her principal occupation set forth below during the past five years.

| Name | Age | Director Since | Principal Occupation |

| Jay T. Flatley(1)(2) | 69 | 2011 | Acting Chief Executive Officer and Chairman of the Board of Zymergen Inc. |

| Pamela Fletcher(2) | 55 | 2017 | Vice President—Global Innovation at General Motors Company |

| Andreas (“Andy”) W. Mattes | 60 | 2020 | President and Chief Executive Officer |

| Beverly Kay Matthews(3) | 63 | 2019 | Retired Partner, Ernst & Young |

| Michael R. McMullen(2) | 60 | 2018 | President and Chief Executive Officer of Agilent Technologies, Inc. |

| Garry W. Rogerson(1)(3) | 69 | 2004 | Former Chief Executive Officer of Advanced Energy Industries, Inc. |

| Steve Skaggs(1)(3) | 59 | 2013 | Former Senior Vice President and Chief Financial Officer of Atmel Corporation |

| Sandeep Vij(2) | 56 | 2004 | Former President and Chief Executive Officer of MIPS Technologies, Inc. |

| (1) | Member of the Governance and Nominating Committee. |

| (2) | Member of the Compensation and HR Committee. |

| (3) | Member of the Audit Committee. |

Jay T. Flatley. Since April 2021, Mr. Flatley has served as the Chairman of the Board of Directors of Zymergen Inc., a synthetic biology company, and since August 2021, as acting Chief Executive Officer of Zymergen. From 1999 until May 2021, Mr. Flatley served as a member of the Board of Directors of Illumina, Inc. (“Illumina”), a leading developer, manufacturer and marketer of life science tools and integrated systems for the analysis of genetic variation and function, including, from January 2016 until July 2016 and from January 2020 until May 2021, as Chairman of Illumina’s Board of Directors and, from July 2016 until December 2019, as Executive Chairman of Illumina’s Board of Directors. From 1999 until July 2016, Mr. Flatley was Illumina’s Chief Executive Officer. From 1999 to December 2013, Mr. Flatley also served as Illumina’s President. Prior to joining Illumina, Mr. Flatley was President, Chief Executive Officer, and a member of the Board of Directors of Molecular Dynamics, Inc., a Nasdaq listed life sciences company focused on genetic discovery and analysis, from 1994 until its sale to Amersham Pharmacia Biotech Inc. in 1998. Additionally, he was a co-founder of Molecular Dynamics and served in various other positions there from 1987 to 1994. Mr. Flatley is also a member of the board of directors and the audit committee of Denali Therapeutics Inc., a biopharmaceutical company. Mr. Flatley previously served on the board of directors of Juno Therapeutics, Inc., a biopharmaceutical company. Mr. Flatley holds a B.A. in Economics from Claremont McKenna College and a B.S. and a M.S. in Industrial Engineering from Stanford University.

Mr. Flatley’s years of executive and management experience in the high technology industry, including serving as the chief executive officer of several public companies, his service on the boards of other publicly held companies, and his years of service as a director of Coherent, make him an invaluable member of the Board.

2

Pamela Fletcher. Ms. Fletcher has served as Vice President—Global Innovation at General Motors Company (“GM”), a global automotive company, since October 2017. Over a fifteen-plus year career with GM, Ms. Fletcher has served in various roles, including Global Executive Chief Engineer, Autonomous and Electrified Vehicles and New Technology from July 2016 to October 2017; Executive Chief Engineer, Electrified Vehicles from August 2012 to July 2016; Chief Engineer, Chevrolet Volt Propulsion System from 2009 to August 2012; and Assistant Chief Engineer, Hybrid & Electric Propulsion Systems from 2007 to 2008. She holds a B.S. in Engineering from Kettering University and an M.S. in Engineering from Wayne State University.

Ms. Fletcher’s years of executive and management experience in the automotive industry, her knowledge of advanced and emerging automotive technologies, and her years of service as a director of Coherent, make her an invaluable member of the Board.

Andy Mattes. Mr. Mattes has served as our Chief Executive Officer and President as well as a member of the Board since April 2020. Prior to joining Coherent and beginning in June 2019, he was a Senior Advisor to McKinsey & Company, a leading global management consulting firm, providing corporate and strategic consulting services to various clients of the firm. From January 2018 to May 2019, he was an independent corporate advisor. From 2013 to December 2017, he was the Chief Executive Officer and a member of the board of directors of Diebold Nixdorf Incorporated, a retail and financial services technology systems company. He also served as its President from 2013 to August 2016. Mr. Mattes was the Senior Vice President, Global Strategic Partnerships at Violin Memory, a computer storage systems company, in 2013. He has also held various senior management positions with Hewlett-Packard Co., a computer technologies company. From 2008 to 2011, he was the Senior Vice President and General Manager of Hewlett Packard’s Enterprise Services for the Americas. From 2006 to 2008, he was Hewlett Packard’s Chief Sales Officer for the Enterprise Business. Mr. Mattes spent the first 20 years of his career (between 1985 and 2005) at Siemens, holding a variety of senior leadership positions. These culminated in his role as chief executive officer of Siemens Communications Inc., USA, in Boca Raton, Florida. He received his Diplom-Kaufmann in business administration from Ludwig Maximilian University, Munich, Germany.

Mr. Mattes’ decades of experience developing and executing business strategies, his prior executive service in public companies, his extensive international experience, his recent appointment as our President and Chief Executive Officer, and his previous service on the board of another publicly held company, make him an invaluable member of the Board.

Beverly Kay Matthews. Ms. Matthews is a certified public accountant (Texas) and she retired from Ernst & Young, LLP (“EY”), a global accounting firm, in June 2019, where she served as Vice Chair and Managing Partner of the West Region since 2008. She joined EY in 1983 and held a number of leadership positions, including Chief Operating Officer and Managing Partner of the Americas’ Assurance and Advisory Business Services from 2005 to 2008; Managing Partner of the Assurance Practice of the Gulf Coast Region from 2001 to 2005; Managing Partner of the Austin Office from 1998 to 2001; and served as an audit partner for privately and publicly held companies in the technology, transportation and healthcare industries. She is also a member of the board of directors and audit, compensation, and risk committees of SVB Financial Group, the parent company of Silicon Valley Bank, a member of the board of directors and the audit committee of Main Street Capital Corporation, and a member of the Texas Tech University Jerry S. Rawls College of Business Advisory Council. Ms. Matthews holds a Bachelors of Business Administration in Accounting from Texas Tech University.

Ms. Matthews’ years in the public accounting industry working with public companies in the technology, transportation and healthcare industries, as well as her service on the boards of other publicly held companies, make her an invaluable member of the Board.

Michael R. McMullen. Mr. McMullen has served as Chief Executive Officer of Agilent Technologies, Inc. (“Agilent”), a global leader in Life Sciences and Diagnostics, since March 2015 and as President of Agilent since September 2014. From September 2014 to March 2015, he also served as Agilent’s Chief Operating Officer. From September 2009 to September 2014, he served as Senior Vice President of Agilent and President, Chemical Analysis Group at Agilent. From January 2002 to September 2009, he served as Agilent’s Vice President and General Manager of the Chemical Analysis Solutions Unit of the Life Sciences and Chemical Analysis Group. Prior to assuming this position, from March 1999 to December 2001, Mr. McMullen served as Country Manager for Agilent’s China, Japan and Korea Life Sciences and Chemical Analysis Group. Prior to this position, Mr. McMullen served as the Controller for the Hewlett-Packard Company and Yokogawa Electric Joint Venture from July 1996 to March 1999. Mr. McMullen is also a member of the board of directors of Agilent. Mr. McMullen holds a bachelor’s degree in economics and business administration from the University of Delaware and an MBA from the Wharton School of Business.

3

Mr. McMullen’s years of executive and management experience in the high technology industry, including serving as the chief executive officer and on the board of another publicly held company, make him an invaluable member of the Board.

Garry W. Rogerson. Mr. Rogerson has served as Coherent’s Chairman of the Board since June 2007. Since September 2015, Mr. Rogerson has been a private investor. From August 2011 to September 2015, Mr. Rogerson was Chief Executive Officer and a member of the Board of Directors of Advanced Energy Industries, Inc., a provider of power and control technologies for thin film manufacturing and solar-power generation, after which he agreed to serve as a special advisor for a period of time. He was Chairman and Chief Executive Officer of Varian, Inc., a major supplier of scientific instruments and consumable laboratory supplies, vacuum products and services, from February 2009 and 2004, respectively, until the purchase of Varian by Agilent Technologies, Inc. in May 2010. Mr. Rogerson served as Varian’s Chief Operating Officer from 2002 to 2004, as Senior Vice President, Scientific Instruments from 2001 to 2002, and as Vice President, Analytical Instruments from 1999 to 2001. Mr. Rogerson received an honours degree and Ph.D. in biochemistry as well as an honorary doctoral science degree from the University of Kent at Canterbury.

Mr. Rogerson’s years of executive and management experience in the high technology industry, including serving as the chief executive officer of several public companies, his service on the boards of other publicly held companies, and his years of service as a director of Coherent, make him an invaluable member of the Board.

Steve Skaggs. Mr. Skaggs has been a private investor since April 2016. From May 2013 to April 2016, Mr. Skaggs was Senior Vice President and Chief Financial Officer of Atmel Corporation, a leading supplier of microcontrollers, until its acquisition by Microchip Technology Incorporated. Mr. Skaggs has more than 25 years of experience in the semiconductor industry, including serving as President, Chief Executive Officer and Chief Financial Officer of Lattice Semiconductor Corporation (“Lattice”), a supplier of programmable logic devices and related software. He was also previously a member of the board of directors of Lattice. Prior to Lattice, Mr. Skaggs was employed by Bain & Company, a global management consulting firm, where he specialized in high technology product strategy, mergers and acquisitions and corporate restructurings. He currently also serves as Director and Audit Committee Chair of IDEX Biometrics, ASA. Mr. Skaggs holds an MBA degree from the Harvard Business School and a B.S. degree in Chemical Engineering from the University of California, Berkeley.

Mr. Skaggs’ years of executive and management experience in the high technology industry, including serving as the chief executive officer and chief financial officer of other public companies, his prior service on the board of another publicly held company and his years of service as a director of Coherent, make him an invaluable member of the Board.

Sandeep Vij. Mr. Vij has been a private investor since February 2013. Previously, he held the position of President and Chief Executive Officer and was a member of the board of directors of MIPS Technologies, Inc., a leading provider of processor architectures and cores, from January 2010 until its sale in February 2013. In addition, Mr. Vij had been the Vice President and General Manager of the Broadband and Consumer Division of Cavium Networks, Inc., a provider of highly integrated semiconductor products from May 2008 to January 2010. Prior to that, he held the position of Vice President of Worldwide Marketing, Services and Support for Xilinx Inc. (“Xilinx”), a digital programmable logic device provider, from 2007 to April 2008. From 2001 to 2006, he held the position of Vice President of Worldwide Marketing at Xilinx. From 1997 to 2001, he served as Vice President and General Manager of the General Products Division at Xilinx. Mr. Vij joined Xilinx in 1996 as Director of FPGA Marketing. He is a graduate of General Electric’s Edison Engineering Program and Advanced Courses in Engineering. He holds an MSEE from Stanford University and a BSEE from San Jose State University.

Mr. Vij’s years of executive and management experience in the high technology industry, including serving as the chief executive officer of another public company, his service on the board of another publicly held company, and his years of service as a director of Coherent, make him an invaluable member of the Board.

4

Our Executive Officers

The name, age, position and a brief account of the business experience of our executive officers as of December 16, 2021 are set forth below:

| Name | Age | Office Held |

| Andreas (“Andy”) W. Mattes | 60 | President and Chief Executive Officer |

| Kevin Palatnik | 64 | Executive Vice President and Chief Financial Officer |

| Mark Sobey | 61 | Executive Vice President and Chief Operating Officer |

| Bret DiMarco | 53 | Executive Vice President, Chief Legal Officer and Corporate Secretary |

Please see “—Our Directors” above for Mr. Mattes’ biographical information.

Kevin Palatnik. Mr. Palatnik has served as our Executive Vice President and Chief Financial Officer since February 2016. Prior to that from August 2011 until its acquisition by Knowles Corporation in July 2015, Mr. Palatnik served as the Chief Financial Officer of Audience, Inc., a provider of intelligent voice and audio solutions for mobile devices. Prior to that from June 2001 to November 2010, Mr. Palatnik held various roles at Cadence Design Systems, Inc., an electronic design automation software company, including as its senior vice president and chief financial officer. Mr. Palatnik is a member of the board of directors and chair of the audit committee of Parabellum Acquisition Corp., a special purpose acquisition company. Mr. Palatnik also served as a member of the board of directors and chair of the audit committee of Adesto Technologies, Inc., a provider of innovative, application-specific semiconductors and embedded systems that comprise the essential building blocks of Internet of Things (IoT) edge devices from September 2015 until July 2020 when the company was sold to Dialog Semiconductor. Mr. Palatnik received a B.S. in Industrial Engineering and Operations Research and a M.B.A. from Syracuse University.

Mark Sobey. Dr. Sobey has served as our Executive Vice President and Chief Operating Officer since April 2020. Dr. Sobey previously served as our Executive Vice President and General Manager of OEM Laser Sources (OLS) from November 2016 to April 2020, Executive Vice President and General Manager of Specialty Laser Systems (SLS) from April 2010 to November 2016, and Senior Vice President and General Manager of SLS from joining Coherent in July 2007 until April 2010. Prior to Coherent, Dr. Sobey spent over 20 years in the Laser and Fiber Optics Telecommunications industries, including Senior Vice President roles in Product Management at Cymer and Global Sales at JDS Uniphase. He received his PhD in Engineering and BSc in Physics from the University of Strathclyde in Scotland.

Bret DiMarco. Mr. DiMarco has served as our Executive Vice President and Chief Legal Officer since October 2020. Mr. DiMarco previously served as our Executive Vice President and General Counsel from June 2006 to October 2020 and he has served as our Corporate Secretary since February 2007. From February 2003 until May 2006, Mr. DiMarco was a member and from October 1995 until January 2003 was an associate at Wilson Sonsini Goodrich & Rosati, P.C., a law firm. Mr. DiMarco received a Bachelor’s degree from the University of California at Irvine and a Juris Doctorate degree from the Law Center at the University of Southern California. Additionally, Mr. DiMarco is a member and chair of the Nasdaq Listing and Hearing Review Council and an adjunct professor at the University of California, Hastings College of the Law.

Business Conduct Policy

We have adopted a worldwide Business Conduct Policy that applies to the members of our Board of Directors, executive officers and other employees. This policy is posted on our Website at www.coherent.com and may be found as follows:

| 1. | From our main Web page, first click on “Company”. |

| 2. | Next, click on “Business Conduct Policy”. |

We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to, or waiver from, a provision of this Business Conduct Policy by posting such information on our Website, at the address and location specified above.

5

Stockholders may request free printed copies of our worldwide Business Conduct Policy from:

Coherent, Inc.

Attention: Investor Relations

5100 Patrick Henry Drive

Santa Clara, California 95054

Audit Committee

The Audit Committee consists of directors Skaggs (Chair), Matthews and Rogerson. The Audit Committee held nine (9) meetings during fiscal year 2021. The Board has determined that directors Skaggs, Matthews and Rogerson are “audit committee financial experts” as that term is defined in the rules of the SEC. Among other things, the Audit Committee has the sole authority for appointing and supervising our independent registered public accounting firm and is primarily responsible for approving the services performed by our independent registered public accounting firm and for reviewing and evaluating our accounting principles and our system of internal accounting controls.

Process for Stockholders to Recommend Candidates for Election to the Board of Directors

The Governance and Nominating Committee will consider nominees properly recommended by stockholders. A stockholder that desires to recommend a candidate for election to the Board must direct the recommendation in writing to us at our principal executive offices (Attention: Corporate Secretary) and must include the candidate’s name, age, home and business contact information, principal occupation or employment, the number of shares beneficially owned by the nominee and the stockholder making the recommendation, whether any hedging transactions have been entered into by the nominee or on his or her behalf, information regarding any arrangements or understandings between the nominee and the stockholder nominating the nominee or any other persons relating to the nomination, a written statement by the nominee acknowledging that the nominee will owe a fiduciary duty to Coherent if elected, a written statement of the nominee that such nominee, if elected, intends to tender, promptly following such nominee’s election or re-election, an irrevocable resignation effective upon such nominee’s failure to receive the required vote for re-election at the next meeting at which such nominee would face re-election and upon acceptance of such resignation by the Board in accordance with Coherent’s guidelines or policies, and any other information required to be disclosed about the nominee if proxies were to be solicited to elect the nominee as a director.

For a stockholder recommendation to be considered by the Governance and Nominating Committee as a potential candidate at a meeting of stockholders, nominations must be received on or before the deadline for receipt of stockholder proposals for such meeting. In the event a stockholder decides to nominate a candidate for director and solicits proxies for such candidate, the stockholder will need to follow the rules set forth by the SEC and in our bylaws.

The Governance and Nominating Committee’s criteria and process for evaluating and identifying the candidates that it approves as director nominees are as follows:

| • | the Governance and Nominating Committee regularly reviews the current composition and size of the Board; |

| • | the Governance and Nominating Committee reviews the qualifications of any candidates who have been properly recommended by a stockholder, as well as those candidates who have been identified by management, individual members of the Board or, if the Governance and Nominating Committee determines, a search firm. Such review may, in the Governance and Nominating Committee’s discretion, include a review solely of information provided to the Governance and Nominating Committee or may also include discussions with persons familiar with the candidate, an interview with the candidate or other actions that the committee deems proper; |

| • | the Governance and Nominating Committee evaluates the performance of the Board as a whole and evaluates the qualifications of individual members of the Board eligible for re-election at the annual meeting of stockholders; |

6

| • | the Governance and Nominating Committee considers the suitability of each candidate, including the current members of the Board, in light of the current size and composition of the Board. Except as may be required by rules promulgated by the Nasdaq Stock Market or the SEC, it is the current belief of the Governance and Nominating Committee that there are no specific, minimum qualifications that must be met by any candidate for the Board, nor are there specific qualities or skills that are necessary for one or more of the members of the Board to possess. In evaluating the qualifications of the candidates, the Governance and Nominating Committee considers many factors, including, issues of character, judgment, independence, age, expertise, diversity of experience, length of service, other commitments and the like. While Coherent does not have a formal policy with regard to the consideration of diversity in identifying director nominees, as noted above, diversity of experience is one of many factors that the committee considers; |

| • | the Governance and Nominating Committee considers each individual candidate in the context of the current perceived needs of the Board as a whole. While the Governance and Nominating Committee has not established specific minimum qualifications for director candidates, the committee believes that candidates and nominees must reflect a Board that is comprised of directors who (i) are predominantly independent, (ii) are of high integrity, (iii) have qualifications that will increase the overall effectiveness of the Board, and (iv) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to audit committee members; |

| • | in evaluating and identifying candidates, the Governance and Nominating Committee has the authority to retain and terminate any third party search firm that is used to identify director candidates and has the authority to approve the fees and retention terms of any search firm; and |

| • | after such review and consideration, the Governance and Nominating Committee recommends the slate of director nominees to the full Board for its approval. |

The Governance and Nominating Committee will endeavor to notify, or cause to be notified, all director candidates, including those recommended by a stockholder, of its decision as to whether to nominate such individual for election to the Board.

Our corporate governance guidelines require that upon a member of the Board turning 72 years old, he or she shall submit a conditional resignation to the Governance and Nominating Committee effective upon the next annual meeting of stockholders. The committee then determines whether to recommend that the Board accept such resignation.

7

ITEM 11. EXECUTIVE COMPENSATION

Fiscal Year 2021 Director Compensation

During fiscal year 2021, we paid our non-employee directors an annual cash retainer (depending upon position) for service on the Board as follows:

| Position | Annual

Retainer | |

| Board Member | $ | 60,000 |

| Board Chair | $ | 60,000 |

| Audit Committee Chair | $ | 34,000 |

| Compensation and HR Committee Chair | $ | 20,000 |

| Governance and Nominating Committee Chair | $ | 13,500 |

| Audit Committee member (non-Chair) | $ | 12,500 |

| Compensation and HR Committee member (non-Chair) | $ | 10,000 |

| Governance and Nominating Committee member (non-Chair) | $ | 6,500 |

In addition to annual cash retainers, non-employee directors are compensated with a fixed value of time-based RSUs for service on the Board. The Governance and Nominating Committee annually reviews Board and committee compensation with the assistance of an independent compensation consultant, which for fiscal year 2021 was Compensia. Compensia is separately compensated for this work from the work it does as the Compensation and HR Committee’s independent consultant for executive compensation. The annual review includes a comparison to peer companies (which are the same as used for executive compensation) and market pay practices for service on boards of directors. Compensia advised the committee that the design and pay levels of the director compensation program were aligned with peer market practices. Compensia has not provided any other service for the Company other than as directed by a committee of the Board.

Following the recommendation of the Governance and Nominating Committee (based upon review by Compensia) in February 2017, the Board adopted resolutions automatically granting each year without any discretion to each non-employee director an award of RSUs (rounded down to the nearest whole share) valued at $225,000 (based on the average trailing thirty day closing price of the Company’s common stock on the Nasdaq Stock Market measured from the last trading day prior to the date of grant) upon the director’s election to the Board at the Company’s annual meeting. In addition, the Board determined that upon the initial appointment of a non-employee director, such director will receive an award of RSUs valued at $225,000 (based on the average trailing thirty day closing price of the Company’s common stock on the Nasdaq Stock Market measured from the last trading day prior to the date of grant), which RSUs shall vest over two years (fifty percent on each anniversary of the date of grant). Such awards of RSUs are currently granted under the Coherent Equity Incentive Plan.

The chart below presents information concerning the total compensation of our non-employee directors for service (including the Board and, where applicable, committee service) during fiscal year 2021:

| Name | Fees

Earned or Paid in Cash ($)(1) |

Stock

Awards ($)(2)(3) |

Option

Awards ($)(4) |

Total ($) |

| Jay T. Flatley | 76,500 | 217,030 | — | 293,530 |

| Pamela Fletcher | 70,000 | 217,030 | — | 287,030 |

| Beverly Kay Matthews | 72,500 | 217,030 | — | 289,530 |

| Michael R. McMullen | 70,000 | 217,030 | — | 287,030 |

| Garry W. Rogerson | 146,000 | 217,030 | — | 363,030 |

| Steve Skaggs | 100,500 | 217,030 | — | 317,530 |

| Sandeep Vij | 80,000 | 217,030 | — | 297,030 |

8

| (1) | The chart below summarizes the gross cash amounts earned by non-employee directors for service during fiscal year 2021 on the Board and its committees: |

| Name | Annual Board Service ($) |

Audit Committee ($) |

Compensation and HR Committee ($) |

Governance and Nominating Committee ($) |

Total ($) |

| Jay T. Flatley | 60,000 | — | 10,000 | 6,500 | 76,500 |

| Pamela Fletcher | 60,000 | — | 10,000 | — | 70,000 |

| Beverly Kay Matthews | 60,000 | 12,500 | — | — | 72,500 |

| Michael R. McMullen | 60,000 | — | 10,000 | — | 70,000 |

| Garry W. Rogerson | 120,000 | 12,500 | — | 13,500 | 146,000 |

| Steve Skaggs | 60,000 | 34,000 | — | 6,500 | 100,500 |

| Sandeep Vij | 60,000 | — | 20,000 | — | 80,000 |

| (2) | These amounts do not reflect compensation actually received. Rather, these amounts represent the aggregate grant date fair value computed in accordance with ASC 718, for restricted stock units (“RSUs”) which were granted in fiscal year 2021. The assumptions used to calculate the value of these RSUs are set forth in Note 12, “Employee Stock Award and Benefit Plans” of the Notes to the Consolidated Financial Statements in the Original Filing. |

| (3) | The aggregate number of shares underlying unvested RSUs held by each of our non-employee directors as of the end of fiscal year 2021 (including the grants made to our non-employee directors during fiscal year 2021) was as follows: |

| Name | Shares(a) |

| Jay T. Flatley | 856 |

| Pamela Fletcher | 856 |

| Beverly Kay Matthews | 856 |

| Michael R. McMullen | 856 |

| Garry W. Rogerson | 856 |

| Steve Skaggs | 856 |

| Sandeep Vij | 856 |

| (a) | The shares underlying the RSUs are scheduled to vest on February 15, 2022, subject to continued service through such date. |

| (4) | No stock options have been granted to our non-employee directors since 2011. As of the end of fiscal year 2021, none of our non-employee directors held any stock options. |

9

Option Exercises and Stock Vested during Fiscal Year 2021

The table below sets forth certain information for each non-employee director regarding the exercise of options and the vesting of stock awards during fiscal year 2021, including the aggregate value realized upon such exercise or vesting.

Option Awards |

Stock Awards | |||

| Name | Number

of Shares Acquired on Exercise (#) |

Value

Realized on Exercise ($) |

Number

of Shares Acquired on Vesting (#) |

Value

Realized on Vesting ($)(1) |

| Jay T. Flatley | — | — | 2,148 | 554,163 |

| Pamela Fletcher | — | — | 2,148 | 554,163 |

| Beverly Kay Matthews | — | — | 2,898 | 748,638 |

| Michael R. McMullen | — | — | 2,148 | 554,163 |

| Garry W. Rogerson | — | — | 2,148 | 554,163 |

| Steve Skaggs | — | — | 2,148 | 554,163 |

| Sandeep Vij | — | — | 2,148 | 554,163 |

| (1) | Reflects the market price of our common stock on the vesting date or the last day on which our common stock traded prior to the vesting date if trading did not occur on the vesting date. |

10

Compensation Discussion and Analysis

Introduction

In this section, we describe the material components of our executive compensation program for our “Named Executive Officers” or “NEOs” for fiscal year 2021: Messrs. Mattes, Palatnik, Sobey, and DiMarco.

We also provide an overview of our executive compensation philosophy, principal compensation policies and practices by which the Compensation and HR Committee, or the committee, arrives at its decisions regarding NEO compensation. Significantly the committee is advised by an independent compensation consultant with regards to its NEO compensation decisions.

Our executive compensation program for our Named Executive Officers for fiscal year 2021 was generally established prior to Coherent’s entry into agreements providing for the acquisition of Coherent, including the Agreement and Plan of Merger (the “Merger Agreement”), dated March 25, 2021, by and among Coherent, II-VI Incorporated (“II-VI”), and Watson Merger Sub Inc., a wholly-owned subsidiary of II-VI.

Mr. Palatnik, the Company’s Executive Vice President and Chief Financial Officer, had entered into as of August 20, 2020 a transition agreement with the Company pursuant to which Mr. Palatnik would retire from the Company no later than February 28, 2021 and be a special advisor to the Company in connection with the appointment of his successor. In light of the foregoing acquisition, the Company considered it important to retain Mr. Palatnik in his role and such transition agreement was terminated effective January 18, 2021. In January 2021, Mr. Palatnik was provided a special equity grant in connection with his agreement to certain restrictive covenants as described below.

NEO Compensation Overview

The following chart sets forth our compensation philosophy and design principles:

| Compensation Philosophy | Compensation Design Principles |

| Retain

and hire talented executives |

Our executives should have market competitive compensation and the committee orients our target total compensation generally near the 50th percentile of the committee’s selected peer group, with actual compensation falling above or below depending upon our financial performance and the performance of our stock price against the performance of the stock price of companies within an index over a three-year vesting period. Compensation components may be above or below such percentile target and vary by individual executive. |

| Pay

for performance, with both short and long-term measurements |

A significant portion of the annual compensation of our executives is designed to vary with annual business performance and a significant portion of long-term equity compensation is based on the long-term relative performance of our stock price in comparison to the stock price of companies within the Russell 1000 Index (“Russell Index”), by way of a single three-year vesting period. |

| Tie

compensation to performance of our core business |

Payouts under our fiscal year 2021 annual cash incentive plan were dependent upon corporate achievement of two performance targets: revenue and Adjusted EBITDA dollars. The committee determined that these were the most effective metrics for tying management’s compensation directly to our core operating results for fiscal year 2021. In fiscal year 2021, the Company’s financial results met the challenging targets established by the committee and, as a result, a 200% payout under our annual cash incentive plan was made to our NEOs. |

| Align

compensation with stockholder interests |

We generally believe that having a significant portion of compensation tied to equity with both time and performance-based vesting requirements directly aligns management to stockholder returns. Performance-based RSUs make up the largest potential portion of the equity grants for our CEO, and generally make up half of the equity grants of our other NEOs at target. The grants are fully at risk and the executive may not receive any shares at the end of the vesting period. Grants of performance-based RSUs in fiscal year 2021 have a single vesting date three years from grant solely dependent upon the performance of our stock price measured against the performance of the stock price of companies within the Russell Index. |

11

The following chart sets forth our principal elements of NEO compensation:

Executive Compensation Program Overview—Elements of Compensation

| Element | Variability | Objective | How Established | Fiscal Year 2021 for NEOs |

| Base Salary | Fixed | Provide a competitive fixed component of compensation that, as part of a total cash compensation package, enables us to attract and retain top talent. | Reviewed against executive officer’s skill, experience and responsibilities, and for competitiveness against our compensation peer group. | Base salary remained unchanged as compared to fiscal year 2020. |

| Annual

Cash Incentive |

Performance Based | Offer a variable cash compensation opportunity once per fiscal year generally based upon the level of achievement of corporate performance targets. | Target payouts set by measuring total cash compensation opportunity against the peer group. Corporate performance targets based on meeting operational goals tied to the Company’s operating budget for the applicable fiscal year. Individual NEOs may have a component of their bonus determined by key strategic initiatives for that NEO. |

Annual bonus measurement period in fiscal year 2021 was tied to revenue and Adjusted EBITDA achievement. Revenue achievement was weighted at 25% and Adjusted EBITDA achievement was weighted at 75%. Total payout could range from 0% to 200% of target. For fiscal year 2021, the Company met the performance targets, resulting in a 200% payout. The key strategic indicator bonus component of gross margin percentage for one NEO paid out at 100%. |

| RSUs—Service

Based |

Value Tied to Stock Price | Align long-term management and stockholder interests and strengthen retention with three-year vesting. Service-based awards create long-term retention. | Target total value of annual awards using market data (reviewed against our compensation peer group for competitiveness) and the executive officer’s responsibilities, contributions and criticality to ongoing success. | Fiscal year 2021 service-based awards vest 1/3 per year over three years, with the first vesting date occurring on the one-year anniversary of the grant date. |

12

| Element | Variability | Objective | How Established | Fiscal Year 2021 for NEOs |

| RSUs— Performance Based |

Performance Based—Value Tied to Stock Price and Based on Relative Performance to Companies within Russell Index

|

At-risk performance-based awards provide an incentive opportunity based upon the performance of our stock price against the stock performance of the companies within the Russell Index. This component directly aligns NEO pay to our stockholders’ interests.

|

Target total value of annual awards using market data (reviewed against our compensation peer group for competitiveness) and the executive officer’s responsibilities, contributions and criticality to ongoing success.

|

Performance award measured by comparing our stock price performance against that of companies in the Russell Index. To achieve 100% payout of the awards, our stock price must achieve 55th percentile rank. To achieve the maximum payout of 200% payout our stock price must achieve 90th percentile rank. If Coherent’s absolute TSR over the performance period is negative, the payout will be capped at 100% regardless of Coherent’s percentile ranking. Additionally, the payout cannot exceed 5 times the beginning average value of the target number of shares (5x value cap).

|

| Other Benefits | Primarily Fixed | Provide competitive employee benefits. We do not view this as a significant component of our executive compensation program. | Reviewed for competitiveness. | No significant changes for fiscal year 2021 program. |

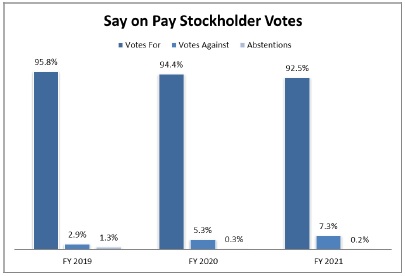

Stockholder Engagement

The committee considers feedback from our stockholders regarding our executive compensation program, including as expressed by the results of our annual advisory vote on executive compensation, which our stockholders have historically strongly supported. We have strong pay for performance alignment, and the say-on-pay proposal for fiscal year 2020 compensation was approved by holders of a significant majority of our outstanding common stock.

Beyond the results of our annual say-on-pay vote, our stockholder engagement program is designed to foster an on-going dialogue with our stockholders. The principal form of engagement in this program consists of our CEO and CFO regularly meeting with our stockholders throughout the year. These meetings are primarily focused on financial and business matters related to the Company, and they allow our stockholders the opportunity to raise questions on a variety of topics, including our executive compensation design philosophy and principles. We believe this regular engagement has been productive and has allowed for a helpful exchange of ideas and perspectives for both management and our stockholders.

The Board, the committee and the Company’s management greatly value the feedback from those meetings, and consider such feedback in deliberations on important topics, such as executive compensation design and principles, throughout the year.

Also, as part of our stockholder engagement program, we encourage our stockholders to directly express their views to the committee. The committee welcomes direct stockholder feedback and considers such feedback as well as our historical “say-on-pay” results in its deliberations on executive compensation.

13

Executive Summary

Our Business

Founded in 1966, Coherent, Inc. is one of the leading providers of lasers and laser-based technology for scientific, commercial and industrial customers. Our common stock is listed on the Nasdaq Global Select Market and is part of several indexes, including the Russell 1000 and Standard & Poor’s MidCap 400 Index. For more information about our business, please read the sections captioned “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Original Filing.

Selected Business Highlights

We experienced a significant growth in revenue, Adjusted EBITDA and non-GAAP earnings per share in fiscal year 2021, which exceeded our own internal growth targets. As a result, you will see in the coming pages that our performance-related executive compensation in our annual corporate cash program yielded a 200% payout in fiscal year 2021.

Set forth below are tables reflecting several performance metrics from the last three fiscal years that impact the compensation for our NEOs.

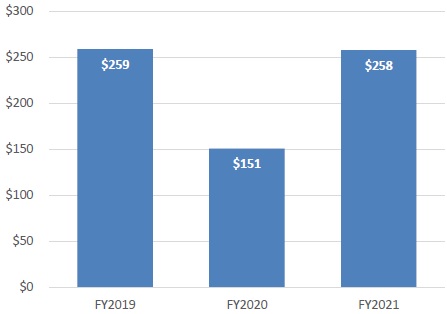

Our revenue decreased 14% from fiscal year 2019 to fiscal year 2020 and increased 21% from fiscal year 2020 to fiscal year 2021 (dollars in millions):

ANNUAL REVENUE

14

Our Adjusted EBITDA decreased 42% from fiscal year 2019 to fiscal year 2020 and increased 71% from fiscal year 2020 to fiscal year 2021 (dollars in millions):

ADJUSTED EBITDA*

Our non-GAAP earnings per share decreased 49% from fiscal year 2019 to fiscal year 2020 and increased 103% from fiscal year 2020 to fiscal year 2021:

NON-GAAP EARNINGS PER SHARE*

* For a reconciliation of earnings per share on a GAAP basis to a non-GAAP basis and net income (loss) on a GAAP basis to Adjusted EBITDA, please refer to the “Reconciliation Table” at the end of this section.

Compensation Overview

Compensation Philosophy. We tie executive total compensation to stockholder value with two measures: our operational results and the comparative performance of our stock price. This approach provides strong alignment between executive pay and performance and focuses executives on making decisions that enhance our stockholder value in both the short and long-term. We design our executive compensation program to achieve the following goals:

15

| • | Retain and hire talented executives—Our executives should have market competitive compensation, and the committee orients our target total compensation generally near the 50th percentile of the committee’s selected peer group (as noted below), with actual compensation falling above or below depending upon Coherent’s financial performance. Additionally, certain compensation components may be above or below such percentile target and vary by individual executive. |

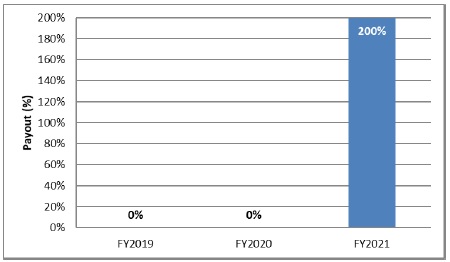

| • | Pay for performance, with both short and long-term measurements—A significant portion of the annual compensation of our executives is designed to vary with annual business performance and the long-term relative performance of Coherent’s stock price in comparison to the stock price of companies within the Russell Index (by way of a single three-year vesting period). The committee and management set demanding performance targets. There was generally 200% annual cash bonus paid out for fiscal year 2021 as explained below. There was generally no annual cash bonus paid out for fiscal year 2020 and fiscal year 2019. |

The following chart shows the payout percentages as compared to the committee’s selected financial targets for each of the last three fiscal years under our annual cash incentive plan:

PAYOUT PERCENTAGE UNDER

ANNUAL CASH INCENTIVE PLAN

Excludes special strategic operating plan incentive paid to Mr. Mattes in fiscal year 2020.

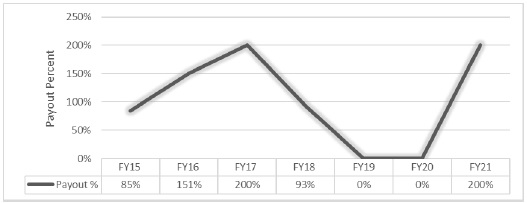

Payouts under our annual cash incentive plan, or VCP, over the last seven years have ranged from 0% to 200% as shown in the following chart:

VCP Payout Percentage

| • | Tie compensation to performance of our core business— Our fiscal year 2021 annual cash incentive plan was dependent upon Coherent’s achievement against two criteria: Adjusted EBITDA and revenue. The committee determined that these were the most effective metrics for tying management’s compensation directly to Coherent’s core operating results for fiscal year 2021. |

16

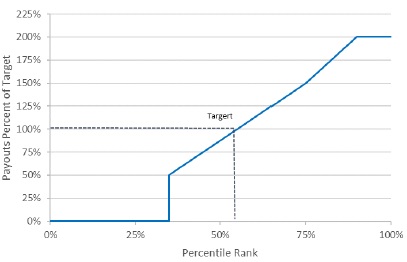

| • | Align compensation with stockholder interests—We believe that having a significant portion of compensation tied to equity, with both time and performance-based vesting requirements, directly aligns management to stockholder interests. The performance-based RSUs make up the largest potential portion of the equity grants for our CEO. Grants of performance-based RSUs have a single vesting date three years from grant solely dependent upon the performance of Coherent’s common stock price percentile ranked against companies in the Russell Index. Performance-based RSU grants made in the first quarter of fiscal year 2021 measure company stock performance against the stock performance of the companies within the Russell Index requiring Company stock performance to be at the 55th percentile (above the median) with respect to the companies within the Russell Index to achieve target vesting. Fiscal year 2021 performance-based RSU design also included two payout caps: (1) the maximum value of performance-based RSUs at vesting is capped at five times the average grant date stock price (5x Value Cap) and (2) the vesting of performance-based RSUs is capped at 100% of target amount if the total stockholder return for the Company is not positive (greater than 0). |

The table and chart below illustrate this structure:

FISCAL YEAR 2021 PERFORMANCE RSU VESTING

| Total Stockholder Return Percentile Rank | Vesting* |

| 90% or greater | Maximum Amount (200% Target Amount)** |

| Between 75% - 90% | 150% Target Amount + 3-1/3% Target Amount for Every 1% Total Stockholder Return Percentile Rank above 75%** |

| 75% | 150% Target Amount** |

| Between 55% - 75% | 100% Target Amount + 2-1/2% Target Amount for Every 1% Total Stockholder Return Percentile Rank above 55%** |

| 55% | 100% Target Amount |

| Between 35% - 55% | 50% Target Amount + 2-1/2% Target Amount for Every 1% Total Stockholder Return Percentile Rank above 35% |

| 35% | 50% Target Amount |

| Below 35% | 0% Target Amount |

*The amount vesting is capped such that the number of performance-based RSUs vesting will not have a value exceeding five times the value of the Target Amount based on an average grant date stock price (5x Value Cap).

**Provided that Total Stockholder Return for the Company is greater than zero (“Positive TSR”); otherwise vesting is capped at 100% of Target Amount.

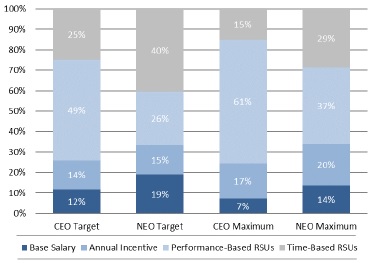

Elements of Executive Compensation. During fiscal year 2021, the compensation of our NEOs primarily consisted of (i) base salary, (ii) participation in our annual variable compensation plan (referred to herein as our “annual cash incentive plan” or “VCP”), and (iii) long-term equity incentive awards divided between time-based RSUs and performance-based RSUs. For fiscal year 2021 approximately 88% of our CEO’s target compensation and, on average, approximately 81% of our other NEOs’ target compensation was delivered through our annual cash incentive plan and long-term equity incentives (both time and performance RSUs).

17

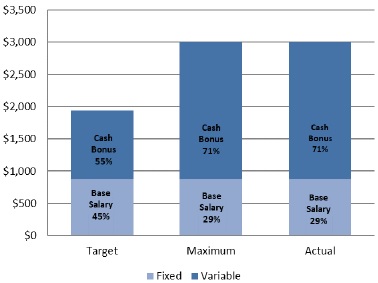

As a demonstration of how executive cash compensation is tied to company performance, the cash compensation for our CEO during fiscal year 2021 at target, maximum and actual can be illustrated as follows (dollars in thousands):

CEO FY2021 CASH PAY MIX

Compensation Governance. “Pay for performance” has been and remains at the core of Coherent’s executive compensation coupled with appropriately managing risk and aligning our compensation programs with long-term stockholder interests. We accomplish this primarily by having a majority of our NEOs’ potential compensation being “at risk” through a combination of (i) an annual cash incentive plan tied to achievement of financial metrics and (ii) equity award vesting tied to achievement of a performance metric. The committee monitors and considers evolving governance approaches and standards in executive compensation, as well as communications it receives directly from stockholders.

As more fully discussed below, recent examples of how this philosophy is applied and changes made pursuant to compensation practices as well as governance practices in effect during fiscal year 2021, include:

| • | We have minimum share ownership requirements for our CEO and members of the Board as well as Executive Vice Presidents and Senior Vice Presidents who report to the CEO; |

| • | Our performance-based RSU program is measured by the Company’s stock price achievement against the performance of companies within the Russell Index over a three-year period, which the committee believes is a direct connection to long-term total stockholder interests. Fiscal year 2021 grants require achievement of 55th percentile rank with respect to companies within the Russell Index to achieve target payout; |

| • | The committee is composed entirely of directors who satisfy the standards of independence in Coherent’s Corporate Governance Guidelines and Nasdaq listing standards; |

| • | The committee made decisions regarding CEO compensation without the CEO present; |

| • | Executive incentive compensation programs include limits on maximum payouts to contain the risk of excessive payouts; |

| • | The committee utilizes an independent compensation consultant; |

| • | We have eliminated material historical perquisites as an element of compensation for our NEOs; |

| • | We have a recoupment or “claw-back” policy for all individuals with the title Senior Vice President and above who report directly to our CEO, as described below; |

18

| • | We have in place a policy prohibiting executive officers and directors from hedging or pledging Company stock; |

| • | Change-of-control payments occur solely in “double-trigger” circumstances, that is a change of control coupled with a termination of employment within a defined time period; |

| • | None of our NEOs are entitled to any “gross-up” to offset the impact of IRS Code Sections 280G or 4999 in connection with a change of control; and |

| • | Our stockholders have historically strongly supported our executive compensation philosophy and design as seen in the significant majorities approving our “say-on-pay” proposal (does not include broker non-votes; rounded). |

Role of Management

The committee regularly met with the CEO to obtain recommendations with respect to the compensation programs, practices and packages for our NEOs other than the CEO. Additionally, Mr. Palatnik, our Executive Vice President and Chief Financial Officer, Mr. DiMarco, our Executive Vice President, Chief Legal Officer and Corporate Secretary, and members of our human resources department are regularly invited to meetings of the committee or otherwise asked to assist the committee.

The assistance of these individuals includes providing financial information and analysis for the committee and its compensation consultant, taking minutes of the meeting or providing legal advice, developing compensation proposals for consideration, and providing insights regarding our employees (executive and otherwise) and the business context for the committee’s decisions. NEOs attend portions of committee meetings when invited by the committee, but leave the meetings when matters potentially affecting them are discussed.

Role of the Committee’s Compensation Consultant

The committee utilizes the services of an independent compensation consultant and in fiscal year 2021, engaged Compensia as its independent compensation consultant. Compensia assisted the committee by:

| • | Reviewing and analyzing our executive compensation program, including providing NEO tally sheets to the committee; |

| • | Providing market data for fiscal year 2021 compensation; and |

| • | Providing further insight on compensation governance trends. |

The independent compensation consultant serves at the discretion of the committee and is not permitted to do other work for Coherent unless expressly authorized by the committee. Since retention, Compensia has not performed any work for Coherent other than its work with the committee, the Board or other committees of the Board, such as work with the Governance and Nominating Committee with respect to compensation for service on the Board and its committees. The committee is focused on maintaining the independence of its compensation consultant and, accordingly, does not anticipate having its consultant perform any other work for the Company in addition to its direct work for the committee, the Board, or another committee of the Board. The committee has assessed the independence of Compensia and concluded that no conflict of interest exists.

19

The Company also participates in and maintains a subscription to the Radford Global Technology and Sales surveys. These surveys provide benchmark data and compensation practices reports of a broad cross-section of technology companies similar in size to Coherent to assist us with employee compensation generally.

Pay Positioning Strategy and Benchmarking of Compensation

Philosophically the committee initially orients target total compensation for our NEOs generally near the 50th percentile of our peers (as measured by our designated peer group and compiled by the committee’s independent compensation consultant and, when applicable, including, for example, when there are few comparable positions reported in the proxy data of our peer group companies, data from the Radford Global Technology Survey), resulting in targeted total compensation that is competitive for performance that meets the objectives established by the committee. Each NEO’s actual salary, cash incentive compensation opportunity and equity compensation grant value may fall below or above the target position based on the individual’s performance, contributions, scope of role, experience, skills and knowledge, as well as the historical pay structure for each executive, Company performance and the proportion of compensation at risk. These factors are weighed by the committee in its judgment, and no single factor takes precedence over others nor is any formula used in making these decisions nor was the impact of any factor on the determination of compensation quantifiable. In general, the committee will balance between cash and equity compensation elements to have more compensation in equity for each NEO in order to more closely align NEO compensation directly with that of the performance of the Company and with stockholders’ interests. In fiscal year 2021, the committee also asked its independent compensation consultant to review and report on internal pay equity between the CEO and the other NEOs as a factor when approving compensation.

The CEO’s review of the performance of the other NEOs is considered by the committee in making individual pay decisions. With respect to the CEO, the committee additionally considers the performance of Coherent as a whole and the views of other members of the Board regarding the CEO’s performance. Actual realized pay is higher or lower than the targeted amounts for each individual based primarily on the Company’s performance.

In analyzing our executive compensation program relative to target market positioning, the committee reviews information provided by its independent compensation consultant, which includes an analysis of data from peer companies’ proxy filings with respect to similarly situated individuals at the peer companies (when available) and the Radford Global Technology Survey (as a supplement when peer group company data is unavailable). It is important to note that these are the peers selected by the committee. The committee uses criteria as described below in determining the appropriate peer group. There are proxy advisory services that use their own criteria to select peers for the Company and, accordingly, stockholders should be aware that these advisory services do not, in fact, follow the same methodology of the committee and there may be wide variances between the different peer groups used by these services. Any comparison of company performance or market data for executive compensation using a completely different peer group will, therefore, naturally result in a different analysis.

For pay decisions made for fiscal year 2021, after consulting with its independent compensation consultant, the committee determined that the following companies comprise the peer group for fiscal year 2021:

| Cabot Microelectronics (CCMP) | MKS Instruments (MKSI) |

| Ciena Corporation (CIEN) | National Instruments (NATI) |

| Diodes (DIOD) | Nuance Communications (NUAN) |

| Dolby Laboratories (DLB) | OSI Systems (OSIS) |

| Entegris (ENTG) | Pure Storage (PSTG) |

| F5 Networks (FFIV) | Synaptics (SNYA) |

| FLIR Systems (FLIR) | Teradyne (TER) |

| II-VI Incorporated (IIVI) | Trimble Inc. (TRMB) |

| Itron, Inc. (ITRI) | ViaSat (VSAT) |

| Lumentum Holdings, Inc. (LITE) | Viavi Solutions (VIAV) |

20

Several factors are considered in selecting the peer group, the most important of which are:

Primary Criteria

| • | Industry (primarily companies in the Electronic equipment, Semiconductor and communications equipment sub-industry classifications defined by the Global Industry Classification Standard (GICS) system); and |

| • | Revenue level (primarily companies with annual revenues between 0.5x-2.0x that of Coherent). |

Secondary Criteria

| • | Market capitalization between 0.25x and 3.0x of Coherent; |

| • | Market capitalization as a multiple of revenues of greater than 1.5x; and |

| • | A disclosed peer of a peer company. |

The committee reviews the composition of the peer group annually to ensure it is the most relevant set of companies in light of the foregoing criteria to use for comparison purposes, but does not necessarily remove a peer company from the peer group the first year it ceases to meet the criteria. Cabot Microelectronics, Diodes, Pure Storage, and Viavi Solutions were added to the companies comprising the Company’s peer group for fiscal year 2021 replacing three companies (Cypress Semiconductor and Finisar, due to acquisition, and Keysight Technologies, due to being above revenue and market cap ranges for two years in a row) from the fiscal year 2020 peer group.

Components of Our Executive Compensation Program

The principal components of our executive officer compensation and employment arrangements during fiscal year 2021 included:

| • | Base salary; |

| • | Annual cash incentive plan; |

| • | Equity awards; and |

| • | Other benefits. |

These components were selected because the committee believes that a combination of salary, incentive pay and benefits is necessary to help us attract and retain the executive talent on which Coherent’s success depends. The following table shows the components of total direct compensation at target and maximum for our NEOs as a group for fiscal year 2021. In maintaining the design for fiscal year 2021, the committee recognized the significant support received from the Company’s stockholders for the compensation program design, as reflected in the continued strong vote totals in favor of our executive compensation through our annual “say-on-pay” proposal.

21

CEO

AND NEO (OTHER THAN CEO) FY2021

DIRECT COMPENSATION MIX

Base Salary

Base salary is the foundation to providing an appropriate total cash compensation package. We use base salary to fairly and competitively compensate our executives for the jobs we ask them to perform. This is the most stable component of our executive compensation program, as this amount is not at risk. The committee reviewed market data information provided by Compensia with respect to similarly situated individuals to assist it in determining the base salary for each NEO, depending upon the particular executive’s experience, skills, knowledge, performance and contribution. According to information provided by the committee’s compensation consultant, our CEO’s base salary was approximately at the 50th percentile of our peer group companies. The base salaries for our other NEOs ranged from approximately the 40th percentile to the 60th percentile of our peer group companies.

Variable Cash Incentive Compensation

A substantial portion of each individual’s potential short-term compensation is in the form of variable incentive cash compensation tied to committee-established goals. In fiscal year 2021, Coherent maintained one incentive cash program under which executive officers were eligible to receive annual cash incentives, the 2021 Variable Compensation Plan (“2021 VCP”).

2021 VCP

The 2021 VCP was designed as an “at risk” bonus compensation program to promote a focus on Coherent’s growth and profitability. It provided an incentive compensation opportunity in line with targeted market rates to our NEOs. Under the 2021 VCP, participants were eligible to receive a bonus based on annual fiscal year performance. In setting the performance goals at the beginning of the fiscal year, the committee assessed the anticipated difficulty and importance to Coherent’s success of achieving the performance goals.

The actual awards (if any) payable for the annual period depend on the extent to which actual performance met, exceeded or fell short of the goals approved by the committee. The 2021 VCP goals were tied to Coherent achieving targeted levels of revenue and Adjusted EBITDA dollars, with revenue weighted at 25% and Adjusted EBITDA weighted at 75%. Each performance metric is measured and paid out independently, but the revenue payout is capped at 100% achievement until Adjusted EBITDA reaches a minimum dollar threshold. Adjusted EBITDA is defined as operating income adjusted for VCP payouts, depreciation, amortization, stock compensation expenses, major restructuring charges and certain non-operating income or expense items, such as costs related to acquisitions. The committee also reviews the financial impact of mergers and acquisitions to determine if any adjustments in VCP are required.

The annual award had a potential payout range between zero and 200%.

22

Fiscal Year 2021 Variable Compensation Plan Scale for NEOs

Revenue achievement for fiscal year 2021 was $1,487.5 million, with a corresponding cash bonus payout of 200% of target. Adjusted EBITDA achievement for fiscal year 2021 was $293.7 million, with a corresponding cash bonus payout of 200% of target.

Fiscal Year 2021 VCP Scale

| Revenue $ (in millions) | Payout |

| $1,487.5 (actual) | 200% (actual) |

| $1,080.0 (threshold) | 0% |

| $1,270.0 (target) | 100% |

| $1,461.0 | 200% |

| Adjusted EBITDA $ (in millions) | Payout |

| $293.7 (actual) | 200% (actual) |

| $148.0 (threshold) | 0% |

| $185.0 (target) | 100% |

| $222.0 | 200% |

20% of Dr. Sobey’s target bonus was based upon a key strategic indicator, gross margin percentage. For fiscal year 2021, our gross margin percentage achievement was approximately 100% of target (40% as set forth in our annual operating plan), resulting in a total bonus payment at 180% of target for Dr. Sobey.

The table below describes for each NEO under the 2021 VCP (i) the target percentage of base salary and (ii) the actual award earned for fiscal year 2021. The potential award range for each NEO is 0% to 200% of the target award percentage of base salary.

Fiscal Year 2021

| Named Executive Officer | Target Percentage of Salary |

Actual Payout ($) |

Actual Payout as a Percentage of Target |

| Andy Mattes | 120% | 2,116,808 | 200% |

| Kevin Palatnik | 75% | 793,728 | 200% |

| Mark Sobey(1) | 80% | 747,279 | 180% |

| Bret DiMarco | 70% | 639,825 | 200% |

| (1) | 20% of Dr. Sobey’s target bonus was based upon a key strategic indicator, gross margin percentage. For fiscal year 2021, our gross margin percentage achievement was 100% of target (40% as set forth in our annual operating plan), resulting in a total bonus payment at 180% of target for Dr. Sobey. |

Equity Awards

We believe that equity awards provide a strong alignment between the interests of our executives and our stockholders. We seek to provide equity award opportunities that are consistent with our compensation philosophy, with the potential for increase for exceptional financial performance, consistent with the reasonable management of overall equity compensation expense and stockholder dilution. Finally, we believe that long-term equity awards are an essential tool in promoting executive retention. For fiscal year 2021, our long-term incentive program included the grant of time-based RSUs and performance-based RSUs. These components provide a reward for individual performance and an incentive for future performance.

Our performance-based RSU grants are tied to the Company’s performance and, as a result, may fluctuate from no vesting to vesting up to a maximum of 200% of target. The committee reviews a compensation overview prepared by its compensation consultant reflecting the intrinsic value of unvested equity awards and performance-based RSUs at target and projected values for all of the NEOs.

23

Fiscal Year 2021 Equity Grants

For fiscal year 2021, the committee based the annual equity program on a combination of time-based and performance-based RSUs over a three-year period. In particular, the committee determined to measure achievement for the performance RSUs by percentile rank performance of Coherent’s stock price in comparison to that of the other companies in the Russell Index. The committee believed that using the Russell Index (in which Coherent was a member at the time of grant) as a proxy of total stockholder return directly aligns executive compensation with stockholder interests. The committee determined that both the performance-based and time-based RSU grants strengthen retention in that the time-based grants generally vest over three years with pro rata annual vesting and the performance-based RSU grants vest, assuming the performance threshold is met, in a single cliff vesting after a three-year period.

Performance-based RSU grants in fiscal year 2021 vest solely upon the performance of Coherent’s common stock price percentile ranked against each company in the Russell Index. To achieve 100% vesting of the awards, our stock price must achieve a percentile rank among companies in the Russell Index of 55% (above median). If 90th percentile rank is achieved vesting is at 200%, which is the maximum. If percentile rank is below the 35th percentile there is no payout and 0% of shares vest. If Coherent’s absolute TSR over the performance period is negative, the payout will be capped at 100% regardless of Coherent’s percentile ranking. Additionally, the payout cannot exceed 5 times the value of the target number of shares based on an average grant date stock price (5x value cap).

The following table summarizes some of the key features of our annual fiscal year 2021 equity grants:

Fiscal Year 2021 Equity Grants

| Type | RSUs and performance-based RSUs (PRSUs) |

| Vesting for RSUs | One-third each grant anniversary |

| Vesting for PRSUs | Single vesting date three years from grant |

| 100% tied to percentile ranking among companies in the Russell Index | |

| Minimum vest: zero | |

| PRSU Metrics | Target vest: 55th percentile rank |

| Maximum vest: 200% of target |

For our CEO, more than half of his total equity awards are performance-based. Approximately 66% of his equity awards granted in fiscal 2021 are performance-based and at maximum achievement that percentage increases to approximately 80%.

As an example, our performance-based design was seen in the vesting of the PRSU grants made in November 2017, which vested in the first quarter of fiscal year 2021. Our common stock declined 50.6% as compared to the Russell Index, which gained 34.5% over the defined measurement periods at the beginning and end of the three-year vesting period. This under-performance resulted in zero (0%) PRSU vesting. Under the PRSU grants made in November 2018, which vested in the first quarter of fiscal year 2022, our common stock price gained 53.7% as compared to the Russell Index, which gained 59.8% over the defined measurement periods at the beginning and end of the three-year vesting period. This performance resulted in 72% PRSU vesting.

In the event of a change of control of the Company, the performance-based grants will be measured, with respect to performance periods not yet completed, by the stock performance of Coherent in comparison to the Russell Index (or companies therein) through the date of the change of control and such performance-based shares would, subject to the terms of the Change of Control Plan (described below), then convert to time-based vesting with a single vesting date at the three year anniversary of the grant.

The following charts show the aggregate composition of equity grants for fiscal year 2021 to our CEO, at target and at maximum achievement under the terms of the performance-based grants:

24

FY 2021 CEO EQUITY GRANT COMPONENTS

The following table reflects equity grants made to the NEOs during fiscal year 2021. Since Mr. Palatnik had entered into a transition agreement pursuant to which he would have retired no later than February 28, 2021, no time-based or performance-based RSUs were granted to him when equity grants were made to the other NEOs in October, 2020. Mr. Palatnik’s time-based RSUs were granted to him in January 2021 in connection with an agreement to certain restrictive covenants including a noncompete for 18 months. Mr. Palatnik’s 5,514 time-based RSUs granted on January 20, 2021 have a vest date as to 2,757 RSUs of the earlier of the closing date of the acquisition of the Company or January 20, 2022 and a vest date as to the remaining 2,757 RSUs of January 20, 2023.

| Named Executive Officer | Time-Based

RSU Grants |

Performance-Based

RSU Grants at Target |

Performance-Based

RSU Grants Range (vesting dependent upon achievement) |

| Andy Mattes | 16,599 | 31,141 | 0 - 62,282 |

| Kevin Palatnik | 5,514 | — | — |

| Mark Sobey | 12,584 | 11,804 | 0 - 23,608 |

| Bret DiMarco | 6,067 | 5,691 | 0 - 11,382 |

25

Equity Award Practices

Equity grants to our employees are driven by our annual review process. Grant guidelines are based on competitive market practices. Typically, an eligible employee is granted equity at the first committee meeting after beginning employment and may be eligible for periodic grants thereafter. Eligibility for and the size of grants are influenced by the then-current guidelines for non-executive officer grants and the individual’s performance or particular requirements at the time of hire. No option grants have been made to an employee since fiscal year 2010.

In fiscal year 2021 the committee and the Equity Committee granted an aggregate of 358,343 shares subject to time-based and performance-based restricted stock units (at maximum), representing approximately 1.72% of Coherent’s outstanding common stock as of October 2, 2021 (excluding automatic and initial grants to directors). With the assistance of Compensia, the committee has reviewed this burn rate relative to peer practices and proxy advisory firm guidance and found that the total dilution was consistent with the median of peer practices and such guidance.