UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number

(Exact Name of Registrant as Specified in Its Charter) |

| ||

(State or Other Jurisdiction of Incorporation or Organization) |

| (I.R.S. Employer Identification No.) |

+

(Address of Principal Executive Offices and Issuer’s

Telephone Number, including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class |

| Trading Symbol |

| Name of each exchange on which registered |

None. |

| N/A |

| N/A |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☐ | Smaller reporting company | ||

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of May 6, 2022, the Company had outstanding

INTRODUCTORY COMMENTS

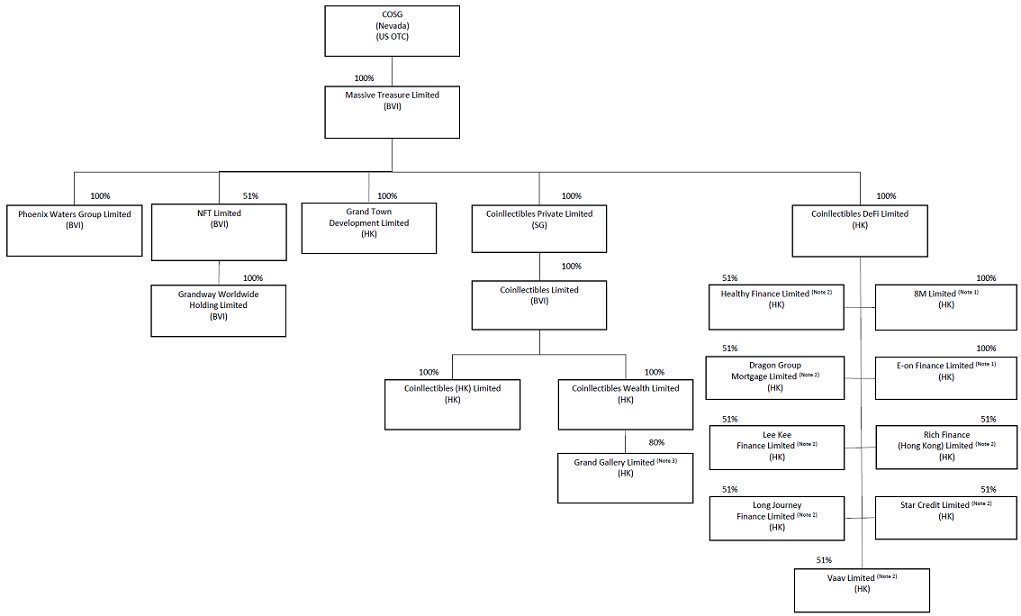

We are a Nevada holding company with operations conducted through our wholly owned subsidiaries based in Hong Kong and Singapore. Our investors hold shares of common stock in Cosmos Group Holdings Inc., the Nevada holding company. This structure presents unique risks as our investors may never directly hold equity interests in our Hong Kong subsidiary and will be dependent upon contributions from our subsidiaries to finance our cash flow needs. Our ability to obtain contributions from our subsidiaries are significantly affected by regulations promulgated by Hong Kong and Singaporean authorities. Any change in the interpretation of existing rules and regulations or the promulgation of new rules and regulations may materially affect our operations and or the value of our securities, including causing the value of our securities to significantly decline or become worthless. For a detailed description of the risks facing the Company associated with our structure, please refer to “Risk Factors – Risks Relating to Doing Business in Hong Kong.” set forth in the Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on April 15, 2022 (the “Form 10-K”).

Cosmos Group Holdings Inc. and our Hong Kong subsidiaries are not required to obtain permission or approval from the Chinese authorities including the China Securities Regulatory Commission, or CSRC, the Cybersecurity Administration Committee, or CAC, to operate our business or to issue securities to foreign investors. However, in light of the recent statements and regulatory actions by the People’s Republic of China (“the PRC”) government, such as those related to Hong Kong’s national security, the promulgation of regulations prohibiting foreign ownership of Chinese companies operating in certain industries, which are constantly evolving, and anti-monopoly concerns, we may be subject to the risks of uncertainty of any future actions of the PRC government in this regard including the risk that we inadvertently conclude that such approvals are not required, that applicable laws, regulations or interpretations change such that we are required to obtain approvals in the future, or that the PRC government could disallow our holding company structure, which would likely result in a material change in our operations, including our ability to continue our existing holding company structure, carry on our current business, accept foreign investments, and offer or continue to offer securities to our investors. These adverse actions could cause the value of our common stock to significantly decline or become worthless. We may also be subject to penalties and sanctions imposed by the PRC regulatory agencies, including the CSRC, if we fail to comply with such rules and regulations, which would likely adversely affect the ability of the Company’s securities to continue to trade on the Over-the-Counter Bulletin Board, which would likely cause the value of our securities to significantly decline or become worthless.

There are prominent legal and operational risks associated with our operations being in Hong Kong. For example, as a U.S.-listed Hong Kong public company, we may face heightened scrutiny, criticism and negative publicity, which could result in a material change in our operations and the value of our common stock. It could also significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. We are subject to risks arising from the legal system in China where there are risks and uncertainties regarding the enforcement of laws including where the Chinese government can change the rules and regulations in China and Hong Kong, including the enforcement and interpretation thereof, at any time with little to no advance notice and can intervene at any time with little to no advance notice. Changes in Chinese internal regulatory mandates, such as the M&A rules, Anti-Monopoly Law, and Data Security Law, may target the Company's corporate structure and impact our ability to conduct business in Hong Kong, accept foreign investments, or list on an U.S. or other foreign exchange. By way of example, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. In April 2020, the Cyberspace Administration of China and certain other PRC regulatory authorities promulgated the Cybersecurity Review Measures, which became effective in June 2020. Pursuant to the Cybersecurity Review Measures, operators of critical information infrastructure must pass a cybersecurity review when purchasing network products and services which do or may affect national security. On July 10, 2021, the Cyberspace Administration of China issued a revised draft of the Measures for Cybersecurity Review for public comments (“Draft Measures”), which required that, in addition to “operator of critical information infrastructure,” any “data processor” carrying out data processing activities that affect or may affect national security should also be subject to cybersecurity review, and further elaborated the factors to be considered when assessing the national security risks of the relevant activities, including, among others, (i) the risk of core data, important data or a large amount of personal information being stolen, leaked, destroyed, and illegally used or exited the country; and (ii) the risk of critical information infrastructure, core data, important data or a large amount of personal information being affected, controlled, or maliciously used by foreign governments after listing abroad. The Cyberspace Administration of China has said that under the proposed rules companies holding data on more than 1,000,000 users must now apply for cybersecurity approval when seeking listings in other nations because of the risk that such data and personal information could be “affected, controlled, and maliciously exploited by foreign governments,” The cybersecurity review will also investigate the potential national security risks from overseas IPOs. On January 4, 2022, the CAC, in conjunction with 12 other government departments, issued the New Measures for Cybersecurity Review (the "New Measures") on January 4, 2022. The New Measures amends the Draft Measures released on July 10, 2021 and became effective on February 15, 2022.

| 2 |

The business of our subsidiaries are not subject to cybersecurity review with the Cyberspace Administration of China, given that: (i) we do not have one million individual online users of our products and services in Hong Kong; (ii) we do not possess a large amount of personal information in our business operations. In addition, we are not subject to merger control review by China’s anti-monopoly enforcement agency due to the level of our revenues which provided from us and audited by our auditor and the fact that we currently do not expect to propose or implement any acquisition of control of, or decisive influence over, any company with revenues within China of more than Renminbi (“RMB”) 400 million. Currently, these statements and regulatory actions have had no impact on our daily business operations, the ability to accept foreign investments and list our securities on an U.S. or other foreign exchange. However, since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list our securities on an U.S. or other foreign exchange. For a detailed description of the risks the Company is facing and the offering associated with our operations in Hong Kong, please refer to “Risk Factors – Risks Relating to Doing Business in Hong Kong.” set forth in the Form 10-K.

The recent joint statement by the SEC and Public Company Accounting Oversight Board (“PCAOB”), and the Holding Foreign Companies Accountable Act (“HFCAA”) all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. Trading in our securities may be prohibited under the HFCAA if the PCAOB determines that it cannot inspect or investigate completely our auditor, and that as a result, an exchange may determine to delist our securities. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act which would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years to two thus reducing the time before our securities may be prohibited from trading or being delisted. On December 2, 2021, the SEC adopted rules to implement the HFCAA. Pursuant to the HFCAA, the PCAOB issued its report notifying the Commission that it is unable to inspect or investigate completely accounting firms headquartered in mainland China or Hong Kong due to positions taken by authorities in mainland China and Hong Kong. Our auditor is based in Kuala Lumpur, Malaysia and is subject to PCAOB’s inspection. It is not subject to the determinations announced by the PCAOB on December 16, 2021. However, in the event the Malaysian authorities subsequently take a position disallowing the PCAOB to inspect our auditor, then we would need to change our auditor to avoid having our securities delisted. Furthermore, due to the recent developments in connection with the implementation of the HFCAA, we cannot assure you whether the SEC or other regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of our financial statements. The requirement in the HFCAA that the PCAOB be permitted to inspect the issuer’s public accounting firm within two or three years, may result in the delisting of our securities from applicable trading markets in the U.S, in the future if the PCAOB is unable to inspect our accounting firm at such future time. Please see “Risk Factors- The Holding Foreign Companies Accountable Act requires the Public Company Accounting Oversight Board (PCAOB) to be permitted to inspect the issuer's public accounting firm within three years. This three-year period will be shortened to two years if the Accelerating Holding Foreign Companies Accountable Act is enacted. There are uncertainties under the PRC Securities Law relating to the procedures and requisite timing for the U.S. securities regulatory agencies to conduct investigations and collect evidence within the territory of the PRC. If the U.S. securities regulatory agencies are unable to conduct such investigations, they may suspend or de-register our registration with the SEC and delist our securities from applicable trading market within the U.S.” set forth in the Form 10-K.

| 3 |

In addition to the foregoing risks, we face various legal and operational risks and uncertainties arising from doing business in Hong Kong as summarized below and in “Risk Factors — Risks Relating to Doing Business in Hong Kong.” set forth in the Form 10-K.

Adverse changes in economic and political policies of the PRC government could have a material and adverse effect on overall economic growth in China and Hong Kong, which could materially and adversely affect our business. Please see “Risk Factors-We face the risk that changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in Hong Kong and the profitability of such business.” and “Substantial uncertainties and restrictions with respect to the political and economic policies of the PRC government and PRC laws and regulations could have a significant impact upon the business that we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition.” set forth in the Form 10-K.

We are a holding company with operations conducted through our wholly owned subsidiaries based in Hong Kong and Singapore. This structure presents unique risks as our investors may never directly hold equity interests in our Hong Kong and Singapore subsidiaries and will be dependent upon contributions from our subsidiaries to finance our cash flow needs. Any limitation on the ability of our subsidiaries to make payments to us could have a material adverse effect on our ability to conduct business. We do not anticipate paying dividends in the foreseeable future; you should not buy our stock if you expect dividends. Please see “Risk Factors- Because our holding company structure creates restrictions on the payment of dividends, our ability to pay dividends is limited.” set forth in the Form 10-K.

There is a possibility that the PRC could prevent our cash maintained in Hong Kong from leaving or the PRC could restrict the deployment of the cash into our business or for the payment of dividends. We rely on dividends from our Hong Kong subsidiaries for our cash and financing requirements, such as the funds necessary to service any debt we may incur. Any such controls or restrictions may adversely affect our ability to finance our cash requirements, service debt or make dividend or other distributions to our shareholders. Please see “Risk Factors - PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds we receive from offshore financing activities to make loans to or make additional capital contributions to our Hong Kong subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand business.”; “Risk Factors - Because our holding company structure creates restrictions on the payment of dividends or other cash payments, our ability to pay dividends or make other payments is limited.” and “Transfers of Cash to and from our Subsidiaries.” set forth in the Form 10-K.

PRC regulation of loans to and direct investments in PRC entities by offshore holding companies may delay or prevent us from using the proceeds of this offering to make loans or additional capital contributions to our operating subsidiaries in Hong Kong. Substantial uncertainties exist with respect to the interpretation of the PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations. Please see “Risk Factors- PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds we receive from offshore financing activities to make loans to or make additional capital contributions to our Hong Kong subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand business.” set forth in the Form 10-K.

In light of China’s extension of its authority into Hong Kong, the Chinese government can change Hong Kong’s rules and regulations at any time with little or no advance notice, and can intervene and influence our operations and business activities in Hong Kong. We are currently not required to obtain approval from Chinese authorities to list on U.S. exchanges. However, if our subsidiaries or the holding company were required to obtain approval in the future, or we erroneously conclude that approvals were not required, or we were denied permission from Chinese authorities to operate or to list on U.S. exchanges, we will not be able to continue listing on a U.S. exchange and the value of our common stock would likely significantly decline or become worthless, which would materially affect the interest of the investors. There is a risk that the Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in Hong Kong-based issuers, which could result in a material change in our operations and/or the value of our securities. Further, any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers would likely significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Please see “Risk Factors-We face the risk that changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the Hong Kong and the profitability of such business.” and “Substantial uncertainties and restrictions with respect to the political and economic policies of the PRC government and PRC laws and regulations could have a significant impact upon the business that we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition.” and “The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S. exchanges. However, to the extent that the Chinese government exerts more control over offerings conducted overseas and/or foreign investment in China-based issuers over time and if our PRC subsidiaries or the holding company were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange and the value of our common stock may significantly decline or become worthless, which would materially affect the interest of the investors.” set forth in the Form 10-K.

| 4 |

Governmental control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment.

We may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. We may be liable for improper use or appropriation of personal information provided by our customers. Please see “Risk Factors- The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S exchanges. However, to the extent that the Chinese government exerts more control over offerings conducted overseas and/or foreign investment in China-based issuers over time and if our PRC subsidiaries or the holding company were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange and the value of our common stock may significantly decline or become worthless, which would materially affect the interest of the investors.” set forth in the Form 10-K.

Under the Enterprise Income Tax Law of the PRC (“EIT Law”), we may be classified as a “Resident Enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC shareholders. Please see “Risk Factors- Our global income may be subject to PRC taxes under the PRC Enterprise Income Tax Law, which could have a material adverse effect on our results of operations.” set forth in the Form 10-K.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident Shareholders to personal liability, may limit our ability to acquire Hong Kong and PRC companies or to inject capital into our Hong Kong subsidiary, may limit the ability of our Hong Kong subsidiaries to distribute profits to us or may otherwise materially and adversely affect us.

You may be subject to PRC income tax on dividends from us or on any gain realized on the transfer of shares of our common stock. Please see “Risk Factors- Dividends payable to our foreign investors and gains on the sale of our shares of common stock by our foreign investors may become subject to tax by the PRC.” set forth in the Form 10-K.

We face uncertainties with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies. Please see “Risk Factors- We and our shareholders face uncertainties with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies.” set forth in the Form 10-K.

We are organized under the laws of the State of Nevada as a holding company that conducts its business through a number of subsidiaries organized under the laws of foreign jurisdictions such as Hong Kong, Singapore and the British Virgin Islands. This may have an adverse impact on the ability of U.S. investors to enforce a judgment obtained in U.S. Courts against these entities, bring actions in Hong Kong against us or our management or to effect service of process on the officers and directors managing the foreign subsidiaries. Please see “Risk Factors- It may be difficult for stockholders to enforce any judgment obtained in the United States against us, which may limit the remedies otherwise available to our stockholders.” set forth in the Form 10-K.

| 5 |

U.S. regulatory bodies may be limited in their ability to conduct investigations or inspections of our operations in China.

There are significant uncertainties under the EIT Law relating to the withholding tax liabilities of our PRC subsidiary, and dividends payable by our PRC subsidiary to our offshore subsidiaries may not qualify to enjoy certain treaty benefits. Please see “Risk Factors- Our global income may be subject to PRC taxes under the PRC Enterprise Income Tax Law, which could have a material adverse effect on our results of operations.” set forth in the Form 10-K.

References in this registration statement to the “Company,” “COSG,” “we,” “us” and “our” refer to Cosmos Group Holdings Inc., a Nevada company and all of its subsidiaries on a consolidated basis. Where reference to a specific entity is required, the name of such specific entity will be referenced.

Transfers of Cash to and from Our Subsidiaries

Cosmos Group Holdings Inc. is a Nevada holding company with no operations of its own. We conduct our operations in Hong Kong primarily through our subsidiaries in Hong Kong and Singapore. We may rely on dividends or other transfers of cash or assets to be made by our Hong Kong and Singapore subsidiaries to fund our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses. If our Hong Kong and Singapore subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us. To date, our subsidiaries have not made any transfers, dividends or distributions to Cosmos Group Holdings Inc. and Cosmos Group Holdings Inc. has not made any transfers, dividends or distributions of cash flows or other assets to our subsidiaries.

We do not intend to make dividends or distributions to investors of Cosmos Group Holdings Inc. in the foreseeable future.

We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments.

Cosmos Group Holdings Inc. (Nevada corporation)

Subject to the Nevada Revised Statutes and our bylaws, our board of directors may authorize and declare a dividend to shareholders at such time and of such an amount as they think fit if they are satisfied, on reasonable grounds, that immediately following the dividend the value of our assets will exceed our liabilities and we will be able to pay our debts as they become due. There is no further Nevada statutory restriction on the amount of funds which may be distributed by us by dividend. Accordingly, Cosmos Group Holdings Inc. is permitted under the Nevada laws to provide funding to our subsidiaries in Singapore and Hong Kong through loans or capital contributions without restrictions on the amount of the funds, subject to satisfaction of applicable government registration, approval and filing requirements.

Singapore and Hong Kong Subsidiaries

Our Hong Kong subsidiaries and our Singapore subsidiary are also permitted under the laws of Hong Kong and Singapore to provide funding to Cosmos Group Holdings Inc. through dividend distribution without restrictions on the amount of the funds. If our Hong Kong and Singapore subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us. To date, our subsidiaries have not made any transfers, dividends or distributions to Cosmos Group Holdings Inc. and Cosmos Group Holdings Inc. has not made any transfers, dividends or distributions to our subsidiaries.

| 6 |

Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us. The laws and regulations of the PRC do not currently have any material impact on transfer of cash from Cosmos Group Holdings Inc. to our Hong Kong subsidiaries or from our Hong Kong subsidiaries to Cosmos Group Holdings Inc. There are no restrictions or limitation under the laws of Hong Kong imposed on the conversion of Hong Kong dollar (“HKD”) into foreign currencies and the remittance of currencies out of Hong Kong or across borders and to U.S. investors.

There is a possibility that the PRC could prevent our cash maintained in Hong Kong from leaving or the PRC could restrict the deployment of the cash into our business or for the payment of dividends. Any such controls or restrictions may adversely affect our ability to finance our cash requirements, service debt or make dividend or other distributions to our shareholders. Please see “Risk Factors - “Risk Factors - PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds we receive from offshore financing activities to make loans to or make additional capital contributions to our Hong Kong subsidiary, which could materially and adversely affect our liquidity and our ability to fund and expand business.”; “Risk Factors - Because our holding company structure creates restrictions on the payment of dividends or other cash payments, our ability to pay dividends or make other payments is limited.” set forth in the Form 10-K.

Current PRC regulations permit PRC subsidiaries to pay dividends to Hong Kong subsidiaries only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each of such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation. As of the date of this report, we do not have any PRC subsidiaries.

The PRC government imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency to finance our cash requirements, service debt or make dividend or other distributions to our shareholders. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations, we may be unable to pay dividends on our common stock.

Cash dividends, if any, on our common stock will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to 10%.

If in the future we have PRC subsidiaries, certain payments from such PRC subsidiaries to Hong Kong subsidiaries will be subject to PRC taxes, including business taxes and VAT. As of the date of this report, we do not have any PRC subsidiaries and our Hong Kong subsidiaries have not made any transfers, dividends or distributions nor do we expect to make such transfers, dividends or distributions in the foreseeable future.

Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, the 10% withholding tax rate may be lowered to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC entity. However, the 5% withholding tax rate does not automatically apply and certain requirements must be satisfied, including, without limitation, that (a) the Hong Kong entity must be the beneficial owner of the relevant dividends; and (b) the Hong Kong entity must directly hold no less than 25% share ownership in the PRC entity during the 12 consecutive months preceding its receipt of the dividends. In current practice, a Hong Kong entity must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the Double Taxation Arrangement with respect to dividends to be paid by a PRC subsidiary to its immediate holding company. As of the date of this report, we do not have a PRC subsidiary. In the event that we acquire or form a PRC subsidiary in the future and such PRC subsidiary desires to declare and pay dividends to our Hong Kong subsidiary, our Hong Kong subsidiary will be required to apply for the tax resident certificate from the relevant Hong Kong tax authority. In such event, we plan to inform the investors through SEC filings, such as a current report on Form 8-K, prior to such actions. See “Risk Factors – Risks Relating to Doing Business in Hong Kong.” set forth in the Form 10-K.

| 7 |

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical facts, included in this Form 10-Q including, without limitation, statements in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding the Company’s financial position, business strategy and the plans and objectives of management for future operations, events or developments which the Company expects or anticipates will or may occur in the future, including such things as future capital expenditures (including the amount and nature thereof); expansion and growth of the Company’s business and operations; and other such matters are forward-looking statements. These statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate under the circumstances. However, whether actual results or developments will conform with the Company’s expectations and predictions is subject to a number of risks and uncertainties, including general economic, market and business conditions; the business opportunities (or lack thereof) that may be presented to and pursued by the Company; changes in laws or regulation and other factors, most of which are beyond the control of the Company.

These forward-looking statements can be identified by the use of predictive, future-tense or forward-looking terminology, such as “believes,” “anticipates,” “expects,” “estimates,” “plans,” “may,” “will,” or similar terms. These statements appear in a number of places in this filing and include statements regarding the intent, belief or current expectations of the Company, and its directors or its officers with respect to, among other things: (i) trends affecting the Company’s financial condition or results of operations for its limited history; (ii) the Company’s business and growth strategies; and, (iii) the Company’s financing plans. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Such factors that could adversely affect actual results and performance include, but are not limited to, the Company’s limited operating history, potential fluctuations in quarterly operating results and expenses, government regulation, technological change and competition. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to our filings with the SEC under the Exchange Act and the Securities Act of 1933, as amended, including our Current Report on Form 10-K filed with the Securities and Exchange Commission on April 15, 2022.

Consequently, all of the forward-looking statements made in this Form 10-Q are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence to or effects on the Company or its business or operations. The Company assumes no obligations to update any such forward-looking statements.

| 8 |

TABLE OF CONTENTS.

|

|

| Page | |

|

|

|

|

|

|

|

| ||

|

|

|

|

|

| 10 |

| ||

|

|

|

|

|

| Unaudited Condensed Consolidated Balance Sheets as of March 31, 2022 and December 31, 2021 |

| F-2 |

|

|

|

|

|

|

|

| F-3 |

| |

|

|

|

|

|

|

| F-4 |

| |

|

|

|

|

|

|

| F-5 |

| |

|

|

|

|

|

| Notes to Unaudited Condensed Consolidated Financial Statements |

| F-6 - F26 |

|

|

|

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 11 |

| |

|

|

|

|

|

| 23 |

| ||

|

|

|

|

|

| 23 |

| ||

|

|

|

|

|

|

|

| ||

|

|

|

|

|

| 24 |

| ||

|

|

|

|

|

| 24 |

| ||

|

|

|

|

|

| 24 |

| ||

|

|

|

|

|

| 24 |

| ||

|

|

|

|

|

| 24 |

| ||

|

|

|

|

|

| 24 |

| ||

|

|

|

|

|

| 25 |

| ||

|

|

|

|

|

| 26 |

| ||

| 9 |

| Table Of Contents |

PART I FINANCIAL INFORMATION

ITEM 1 Financial Statements

| 10 |

| Table Of Contents |

COSMOS GROUP HOLDINGS INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Currency expressed in United States Dollars (“US$”), except for number of shares)

|

| March 31, |

|

| December 31, |

| ||

|

| 2022 |

|

| 2021 |

| ||

ASSETS |

|

|

| (Audited) |

| |||

Current asset: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ |

|

| $ |

| ||

Digital assets |

|

|

|

|

|

| ||

Loan receivables, net |

|

|

|

|

|

| ||

Loan interest and fee receivables, net |

|

|

|

|

|

| ||

Inventories |

|

|

|

|

|

| ||

Prepayment and other receivables |

|

|

|

|

|

| ||

Right-of-use assets, net |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

|

|

|

| ||

Intangible assets, net |

|

|

|

|

|

| ||

Goodwill |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

| $ |

|

| $ |

| ||

Accrued liabilities and other payables |

|

|

|

| ||||

Accrued consulting and service fee |

|

|

|

|

|

| ||

Loan payables |

|

|

|

|

|

| ||

Amounts due to related parties |

|

|

|

|

|

| ||

Income tax payable |

|

|

|

|

|

| ||

Operating lease liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

Operating lease liabilities: |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ (DEFICIT) EQUITY |

|

|

|

|

|

|

|

|

Common stock, $ |

|

|

|

|

|

| ||

Common stock to be issued |

|

|

|

|

|

| ||

Additional paid-in capital |

|

|

|

|

|

| ||

Accumulated other comprehensive loss |

|

| ( | ) |

|

| ( | ) |

Accumulated deficit |

|

| ( | ) |

|

| ( | ) |

|

|

| ( | ) |

|

|

| |

Noncontrolling interest |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Stockholders’ (deficit) equity |

|

| ( | ) |

|

|

| |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY |

| $ |

|

| $ |

| ||

See accompanying notes to unaudited condensed consolidated financial statements.

| F-2 |

| Table Of Contents |

COSMOS GROUP HOLDINGS INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

(Currency expressed in United States Dollars (“US$”))

|

| Three months ended March 31, |

| |||||

|

| 2022 |

|

| 2021 |

| ||

Revenue, net |

|

|

|

| (Restated) |

| ||

|

|

|

|

|

|

| ||

Interest income |

| $ |

|

| $ |

| ||

Arts and collectibles technology income |

|

|

|

|

|

| ||

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

|

|

|

|

|

|

Interest expense |

|

| ( | ) |

|

| ( | ) |

Arts and collectibles technology expense |

|

| ( | ) |

|

|

| |

|

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing expenses |

|

| ( | ) |

|

| ( | ) |

Corporate development expense |

|

| ( | ) |

|

|

| |

Technology and development expense |

|

| ( | ) |

|

|

| |

General and administrative expenses |

|

| ( | ) |

|

| ( | ) |

Total operating expenses |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

(LOSS) INCOME FROM OPERATION |

|

| ( | ) |

|

|

| |

|

|

|

|

|

|

|

|

|

Other (expense) income: |

|

|

|

|

|

|

|

|

Interest income |

|

|

|

|

|

| ||

Impairment loss on digital assets |

|

| ( | ) |

|

|

| |

Imputed interest expense |

|

| ( | ) |

|

|

| |

Sundry income |

|

|

|

|

|

| ||

Total other income (expense), net |

|

| ( | ) |

|

|

| |

|

|

|

|

|

|

|

|

|

(LOSS) INCOME BEFORE INCOME TAXES |

|

| ( | ) |

|

|

| |

|

|

|

|

|

|

|

|

|

Income tax expense |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

NET (LOSS) INCOME |

|

| ( | ) |

|

|

| |

|

|

|

|

|

|

|

|

|

Net loss attributable to noncontrolling interest |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Net (loss) income attributable to common shareholders |

|

| ( | ) |

|

|

| |

|

|

|

|

|

|

|

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

Foreign currency adjustment loss |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

COMPREHENSIVE (LOSS) INCOME |

| $ | ( | ) |

| $ |

| |

|

|

|

|

|

|

|

|

|

Net (loss) income per share: |

|

|

|

|

|

|

|

|

– Basic |

| $ | ( | ) |

| $ | |

|

– Diluted |

| $ | ( | ) |

| $ | |

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

– Basic |

|

|

|

|

|

| ||

– Diluted |

|

|

|

|

|

| ||

#: less than 0.01

See accompanying notes to unaudited condensed consolidated financial statements.

| F-3 |

| Table Of Contents |

COSMOS GROUP HOLDINGS INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Currency expressed in United States Dollars (“US$”))

|

| Three months ended March 31, |

| |||||

|

| 2022 |

|

| 2021 |

| ||

Cash flows from operating activities: |

|

|

|

|

|

| ||

Net (loss) income |

| $ | ( | ) |

| $ |

| |

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net (loss) income to net cash used in operating activities |

|

|

|

|

|

|

|

|

Depreciation of property and equipment |

|

|

|

|

|

| ||

Amortization of intangible assets |

|

|

|

|

|

| ||

Imputed interest expense |

|

|

|

|

|

| ||

Digital assets received as revenue |

|

| ( | ) |

|

|

| |

Digital assets paid for expense |

|

|

|

|

|

| ||

Impairment loss on digital assets |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Loan receivables |

|

| ( | ) |

|

| ( | ) |

Loan interest and fee receivables |

|

|

|

|

| ( | ) | |

Inventories |

|

|

|

|

|

| ||

Prepayment and other receivables |

|

|

|

|

| |||

Accrued liabilities and other payables |

|

| ( | ) |

|

| ( | ) |

Accrued consulting and service fee |

|

|

|

|

|

|

| |

Right-of-use assets and operating lease liabilities |

|

| ( | ) |

|

|

| |

Income tax payable |

|

|

|

|

|

| ||

Net cash provided by (used in) operating activities |

|

|

|

|

| ( | ) | |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Receive from disposal of property and equipment |

|

|

|

|

|

| ||

Payment to acquire intangible assets |

|

| ( | ) |

|

|

| |

Cash from acquisition of subsidiary |

|

|

|

|

|

| ||

Net cash provided by investing activities |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Proceeds from loan payables |

|

|

|

|

|

| ||

(Repayment of) advance from related parties |

|

| ( | ) |

|

|

| |

Net cash provided by (used in) financing activities |

|

| ( | ) |

|

|

| |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

BEGINNING OF PERIOD |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

END OF PERIOD |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

Cash paid for income taxes |

| $ |

|

| $ |

| ||

Cash paid for interest |

| $ |

|

| $ |

| ||

See accompanying notes to unaudited condensed consolidated financial statements.

| F-4 |

| Table Of Contents |

COSMOS GROUP HOLDINGS INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

|

| Common stock |

|

| Common stock |

|

| Additional paid- |

|

| Accumulated other |

|

| (Accumulated losses) |

|

| Non- |

|

| Total stockholders’ |

| |||||||||||

|

| No. of shares |

|

| Amount |

|

| to be issued |

|

| in capital |

|

| comprehensive loss |

|

| retained earnings |

|

| controlling interest |

|

| (deficit) equity |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Balance as of January 1, 2021 (restated) |

|

|

|

| $ |

|

| $ |

|

|

|

|

| $ | ( | ) |

| $ | ( | ) |

| $ |

|

| $ | ( | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

| ( | ) | |||||

Net income for the period |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2021 |

|

|

|

| $ |

|

| $ |

|

|

|

|

| $ | ( | ) |

| $ | ( | ) |

| $ |

|

| $ |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2022 |

|

|

|

| $ |

|

| $ |

|

|

|

|

| $ | ( | ) |

| $ | ( | ) |

| $ |

|

| $ | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

| ( | ) | |||||

Imputed interest on related party loans |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Commitment Share issued for private placement |

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Share issued for acquired subsidiary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Net loss for the period |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) |

|

| ( | ) | ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2022 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ | ( | ) |

| $ |

|

| $ | ( | ) | |||||

See accompanying notes to unaudited condensed consolidated financial statements.

| F-5 |

| Table Of Contents |

COSMOS GROUP HOLDINGS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

NOTE 1 - BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared by management in accordance with both accounting principles generally accepted in the United States (“GAAP”), and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Certain information and note disclosures normally included in audited financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to those rules and regulations, although the Company believes that the disclosures made are adequate to make the information not misleading.

In the opinion of management, the consolidated balance sheet as of December 31, 2021 which has been derived from audited financial statements and these unaudited condensed consolidated financial statements reflect all normal and recurring adjustments considered necessary to state fairly the results for the periods presented. The results for the period ended March 31, 2022 are not necessarily indicative of the results to be expected for the entire fiscal year ending December 31, 2022 or for any future period.

NOTE 2 - ORGANIZATION AND BUSINESS BACKGROUND

Cosmos Group Holdings Inc. (the “Company” or “COSG”) was incorporated in the state of Nevada on August 14, 1987.

The Company currently offers financial and money lending services in Hong Kong and operates online platform for the sale and distribution of arts and collectibles around the world, with the use of blockchain technologies and minting token.

| F-6 |

| Table Of Contents |

COSMOS GROUP HOLDINGS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

Description of subsidiaries

Company name |

| Place of incorporation and kind of legal entity |

| Principal activities and place of operation |

| Particulars of registered/ paid up share capital |

| Effective interest held |

Massive Treasure Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Coinllectibles (HK) Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Coinllectibles Wealth Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Coinllectibles DeFi Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Coinllectibles Private Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Coinllectibles Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Healthy Finance Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

8M Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Dragon Group Mortgage Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

E-on Finance Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Lee Kee Finance Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Rich Finance (Hong Kong) Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Long Journey Finance Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Vaav Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Star Credit Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

NFT Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Grandway Worldwide Holding Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Grand Town Development Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Grand Gallery Limited |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

Phoenix Waters Group Limited |

|

|

|

|

| F-7 |

| Table Of Contents |

COSMOS GROUP HOLDINGS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

The Company and its subsidiaries are hereinafter referred to as (the “Company”).

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying condensed consolidated financial statements reflect the application of certain significant accounting policies as described in this note and elsewhere in the accompanying condensed consolidated financial statements and notes.

· | Basis of presentation |

These accompanying condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

· | Use of estimates and assumptions

|

· | Basis of consolidation |

The condensed consolidated financial statements include the accounts of COSG and its subsidiaries. All significant inter-company balances and transactions within the Company have been eliminated upon consolidation.

· | Segment reporting |

Accounting Standard Codification (“ASC”) Topic 280, Segment Reporting establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organization structure as well as information about geographical areas, business segments and major customers in condensed consolidated financial statements. Currently, the Company operates in two reportable operating segments in Hong Kong and Singapore.

· | Cash and cash equivalents |

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

· | Inventories |

Inventories are stated at the lower of cost (first-in, first-out method) or net realizable value. The cost includes the purchase cost of arts and collectibles from related party and independent artists and the costs associated with token minting for collectible pieces. The Company will reduce inventory on hand to its net realizable value on an item-by-item basis when it is apparent that the expected realizable value of an inventory item falls below its original cost. A charge to cost of sales results when the estimated net realizable value of specific inventory items declines below cost. Management regularly reviews the Company’s inventories for such declines in value. Although inventories are classified as current assets in the accompanying balance sheets, the Company anticipates that certain inventories will be sold beyond twelve months from March 31, 2022.

· | Digital assets |

| F-8 |

| Table Of Contents |

COSMOS GROUP HOLDINGS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

The Company’s cryptocurrencies are deemed to have an indefinite useful life, therefore amounts are not amortized, but rather are assessed for impairment.

· | Loan receivables, net |

Loans receivables are carried at unpaid principal balances, less the allowance for loan losses and charge-offs. The loans receivables portfolio consists of real estate mortgage loans, commercial and personal loans.

Loans are placed on nonaccrual status when they are past due 180 days or more as to contractual obligations or when other circumstances indicate that collection is not probable. When a loan is placed on nonaccrual status, any interest accrued but not received is reversed against interest income. Payments received on a nonaccrual loan are either applied to protective advances, the outstanding principal balance or recorded as interest income, depending on an assessment of the ability to collect the loan. A nonaccrual loan may be restored to accrual status when principal and interest payments have been brought current and the loan has performed in accordance with its contractual terms for a reasonable period (generally six months).

If the Company determines that a loan is impaired, the Company next determines the amount of the impairment. The amount of impairment on collateral dependent loans is charged off within the given fiscal quarter. Generally, the amount of the loan and negative escrow in excess of the appraised value less estimated selling costs, for the fair value of collateral valuation method, is charged off. For all other loans, impairment is measured as described below in Allowance for Loan Losses.

· | Allowance for loan losses (“ALL”) |

The adequacy of the Company’s ALL is determined, in accordance with ASC Topic 450-20 Loss Contingencies includes management’s review of the Company’s loan portfolio, including the identification and review of individual problem situations that may affect a borrower’s ability to repay. In addition, management reviews the overall portfolio quality through an analysis of delinquency and non-performing loan data, estimates of the value of underlying collateral, current charge-offs and other factors that may affect the portfolio, including a review of regulatory examinations, an assessment of current and expected economic conditions and changes in the size and composition of the loan portfolio.

The ALL reflects management’s evaluation of the loans presenting identified loss potential, as well as the risk inherent in various components of the portfolio. There is significant judgment applied in estimating the ALL. These assumptions and estimates are susceptible to significant changes based on the current environment. Further, any change in the size of the loan portfolio or any of its components could necessitate an increase in the ALL even though there may not be a decline in credit quality or an increase in potential problem loans.

· | Property and equipment |

Property and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis over the following expected useful lives from the date on which they become fully operational and after taking into account their estimated residual values:

|

| Expected useful life |

|

Computer and office equipment |

|

|

Expenditure for repairs and maintenance is expensed as incurred. When assets have retired or sold, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is recognized in the results of operations.

Depreciation expense for the periods ended March 31, 2022 and 2021 totaled $

| F-9 |

| Table Of Contents |

COSMOS GROUP HOLDINGS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

· | Business Combination |

We allocate the fair value of purchase consideration to the tangible assets acquired, liabilities assumed and intangible assets acquired based on their estimated fair values. The excess of the fair value of purchase consideration over the fair values of these identifiable assets and liabilities is recorded as goodwill to reporting units based on the expected benefit from the business combination. Allocation of purchase consideration to identifiable assets and liabilities affects the amortization expense, as acquired finite-lived intangible assets are amortized over the useful life, whereas any indefinite-lived intangible assets, including goodwill, are not amortized. During the measurement period, which is not to exceed one year from the acquisition date, we record adjustments to the assets acquired and liabilities assumed, with the corresponding offset to goodwill. Upon the conclusion of the measurement period, any subsequent adjustments are recorded to earnings. Acquisition-related expenses are recognized separately from business combinations and are expensed as incurred.

· | Goodwill |

We allocate goodwill to reporting units based on the expected benefit from business combinations. We evaluate our reporting units annually, as well as when changes in our operating segments occur. For changes in reporting units, we reassign goodwill using a relative fair value allocation approach. Goodwill is tested for impairment at the reporting unit level annually or more frequently if events or changes in circumstances would more likely than not reduce the fair value of a reporting unit below its carrying value. We have two reporting units subject to goodwill impairment testing. As of March 31, 2022, no impairment of goodwill has been identified.

· | Intangible assets |

Intangible assets represented the acquired technology software, licensed technology know-how, trademark and trade names for its internal use to facilitate and support its platform operation. They are stated at the purchase cost and are amortized based on their economic benefit expected to be realized.

· | Impairment of long-lived assets |

In accordance with the provisions of ASC Topic 360, Impairment or Disposal of Long-Lived Assets, all long-lived assets such as property and equipment and intangible assets owned and held by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is evaluated by a comparison of the carrying amount of an asset to its estimated future undiscounted cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amounts of the assets exceed the fair value of the assets.

· | Revenue recognition |

ASC Topic 606, Revenue from Contracts with Customers (“ASC 606”), establishes principles for reporting information about the nature, amount, timing and uncertainty of revenue and cash flows arising from the entity’s contracts to provide goods or services to customers.

The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements:

· | identify the contract with a customer; |

· | identify the performance obligations in the contract; |

· | determine the transaction price; |

· | allocate the transaction price to performance obligations in the contract; and |

· | recognize revenue as the performance obligation is satisfied. |

| F-10 |

| Table Of Contents |

COSMOS GROUP HOLDINGS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

Revenue is recognized when the Company satisfies its performance obligation under the contract by transferring the promised product to its customer that obtains control of the product and collection is reasonably assured. A performance obligation is a promise in a contract to transfer a distinct product or service to a customer. Most of the Company’s contracts have a single performance obligation, as the promise to transfer products or services is not separately identifiable from other promises in the contract and, therefore, not distinct.

Lending Business

The Company is licensed to originate personal loan, company loan and mortgage loan in Hong Kong. During the three months ended March 31, 2022 and 2021, the Company originated loans generally ranging from $

Arts and Collectibles Technology Business

Commencing from October 1, 2021, the Company launched its online platform in the sale and distribution of arts and collectibles, with the use of blockchain technologies and minting tokens. The item of arts and collectibles is individually monetized as non-interchangeable unit of data stored on a blockchain, which is a form of digital ledger that can be sold, in the form of a minting token on the online platform. The Company involves with the following activities to earn its revenue in this segment:

Sale of arts and collectibles products: The Company recognizes revenue derived from the sales of the arts and collectibles when the Company has transferred the risks and rewards to the customers.

The minted item of the individual art or collectibles which are sold in crypto asset transaction is the only performance obligation under the fixed-fee arrangements. The corresponding fees received upon each sale transaction is recognized as revenue, is recognized when the designated token, minted with the corresponding art and collectibles is delivered to the end user, together with the transfer of both digital and official title.

Transaction fee income:

The Company also generates revenue through transaction fees transacted on its platform or other marketplaces. The Company charges a fee to individual customer at the secondary transaction level, which is allocated to the single performance obligation. The transaction fee is collected from the customer in digital assets, with revenue measured based on a certain percentage of the value of digital assets at the time the transaction is executed.

The Company’s service is comprised of a single performance obligation to provide a platform facilitating the transfer of its DOTs. The Company considers its performance obligation satisfied, and recognizes revenue, at the point in time the transaction is processed.

| F-11 |

| Table Of Contents |

COSMOS GROUP HOLDINGS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)