As filed with the Securities and Exchange Commission on May 18, 2022

Registration Statement No. 333-262719

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

Amendment No. 2

to

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________

Anghami Inc.

(Exact name of registrant as specified in its charter)

________________________

|

Cayman Islands |

4832 |

N/A |

||

|

(State or other jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

16th Floor, Al-Khatem Tower, WeWork Hub71

Abu Dhabi Global Market Square, Al Maryah Island, Abu Dhabi, United Arab Emirates

+971 2 443 4317

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

________________________

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19711

302-738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

________________________

Copies to:

|

Ayse Yuksel Mahfoud, Esq. |

Omar Sukarieh |

________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

____________

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the selling securityholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED May 18, 2022

PRELIMINARY PROSPECTUS

Anghami Inc.

Up to 15,900,264 Ordinary Shares

Up to 872,800 Warrants

Up to 10,872,800 Ordinary Shares Issuable Upon Exercise of Warrants

________________________

This prospectus relates to the offer and sale from time to time by the selling securityholders or their permitted transferees (collectively, the “selling securityholders”) of (i) up to 15,900,264 common ordinary shares, par value of $0.0001 per share (“ordinary shares”), of Anghami Inc. (“Anghami Inc.,” the “Company,” “we,” “us,” and “our”), which includes (a) up to 4,696,000 ordinary shares issued to certain selling securityholders concurrently with the closing of the Business Combination (as defined below), and (b) up to 11,204,264 ordinary shares currently held by certain selling securityholders; and (ii) up to 872,800 warrants exercisable for one ordinary share, which includes (a) up to 152,800 warrants exercisable for one ordinary share at $11.50 per share issued for services rendered in connection with the Business Combination (“service warrants”), (b) up to 500,000 warrants exercisable for one ordinary share at $11.50 per share originally issued by Vistas Media Acquisition Company, Inc. (“VMAC”) in a private placement (“private placement warrants”), and (c) up to 220,000 warrants exercisable for one ordinary share at $11.50 per share originally issued by VMAC as part of certain units issued by VMAC in a private placement (“private placement unit warrants” and together with the service warrants and the private placement warrants, the “private warrants”).

This prospectus also relates to the issuance by us of up to 10,872,800 ordinary shares issuable upon exercise of our warrants, which includes (i) 10,000,000 warrants exercisable for one ordinary share at $11.50 per share originally issued to the public shareholders of VMAC in its initial public offering (“public warrants” and together with the private warrants, the “warrants”) and converted into warrants to purchase ordinary shares at the closing of the Business Combination, and (ii) 872,800 ordinary shares issuable upon the exercise of our private warrants.

This prospectus also covers any additional securities that may become issuable by reason of share splits, share dividends or other similar transactions.

We are registering the offer and sale of the securities described above to satisfy certain registration rights we have granted. We are registering these securities for resale by the selling securityholders named in this prospectus, or their transferees, pledgees, donees or assignees or other successors-in-interest that receive any of the shares as a gift, distribution, or other non-sale related transfer. The selling securityholders may offer all or part of the securities for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. These securities are being registered to permit the selling securityholders to sell securities from time to time, in amounts, at prices and on terms determined at the time of offering. The selling securityholders may sell these securities through ordinary brokerage transactions, directly to market makers of our shares or through any other means described in the section titled “Plan of Distribution”. We will pay certain expenses associated with the registration of the securities covered by this prospectus, as described in the section titled “Plan of Distribution”.

All of the ordinary shares and warrants offered by the selling securityholders pursuant to this prospectus will be sold by the selling securityholders for their respective accounts. We will not receive any of the proceeds from the sale of ordinary shares or warrants by the selling securityholders or the issuance of ordinary shares by us pursuant to this prospectus, except with respect to amounts received by us upon exercise of the warrants.

Our ordinary shares are currently traded on The Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “ANGH.” Our public warrants trade on Nasdaq under the symbol “ANGHW.” Our ordinary shares and our public warrants began trading on Nasdaq on February 4, 2022. The closing price of our ordinary shares on the Nasdaq on May 13, 2022 was $7.38 per ordinary share, and the closing price of our public warrants on May 13, 2022 was $0.38. If the price of our ordinary shares remains below the exercise price of our warrants of $11.50 per ordinary share, we believe it is unlikely that any warrant holder will exercise their warrants. See the section entitled “Risk Factors — Risks Related to Our Operations — Warrant holders may not elect to exercise any of their warrants which could significantly reduce the amount of cash we could receive from the exercise of the warrants.”

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, and are therefore eligible to take advantage of certain reduced reporting requirements otherwise applicable to other public companies.

We are also a “foreign private issuer,” as defined in the Exchange Act and are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

Investing in our ordinary shares involves a high degree of risk. Before buying any ordinary shares you should carefully read the discussion of material risks of investing in such securities in “Risk Factors” beginning on page 11 of this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated , 2022.

|

Page |

||

|

1 |

||

|

2 |

||

|

3 |

||

|

9 |

||

|

10 |

||

|

11 |

||

|

45 |

||

|

46 |

||

|

47 |

||

|

48 |

||

|

56 |

||

|

57 |

||

|

58 |

||

|

65 |

||

|

96 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

105 |

|

|

127 |

||

|

129 |

||

|

138 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

141 |

|

|

143 |

||

|

146 |

||

|

149 |

||

|

150 |

||

|

150 |

||

|

ENFORCEABILITY OF CIVIL LIABILITIES UNDER U.S. SECURITIES LAWS |

150 |

|

|

151 |

||

|

F-1 |

i

This document, which forms part of a registration statement on Form F-1 filed with the U.S. Securities and Exchange Commission (the “SEC”) by Anghami, constitutes a prospectus of Anghami under Section 5 of the Securities Act. The selling securityholders may, from time to time, sell the securities offered by them described in this prospectus. We are not offering any ordinary shares for sale under this prospectus and will not receive any proceeds from the sale of the securities by such selling securityholders under this prospectus.

This document does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction or to any person to whom it would be unlawful to make such offer.

Neither we nor the selling securityholders have authorized anyone to provide you with different or additional information, other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you, and neither we nor they take any responsibility for, or provide any assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Securityholders are making an offer to sell ordinary shares in any jurisdiction where the offer or sale thereof is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of our ordinary shares.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus entitled “Where You Can Find More Information.”

For investors outside the United States: Neither we nor the selling securityholders have taken any action to permit the possession or distribution of this prospectus in any jurisdiction other than the United States where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the ordinary shares and the distribution of this prospectus outside the United States.

We are an exempted company incorporated under the laws of the Cayman Islands. Under the rules of the SEC, we are currently eligible for treatment as a “foreign private issuer.” As a foreign private issuer, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. domestic registrants whose securities are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

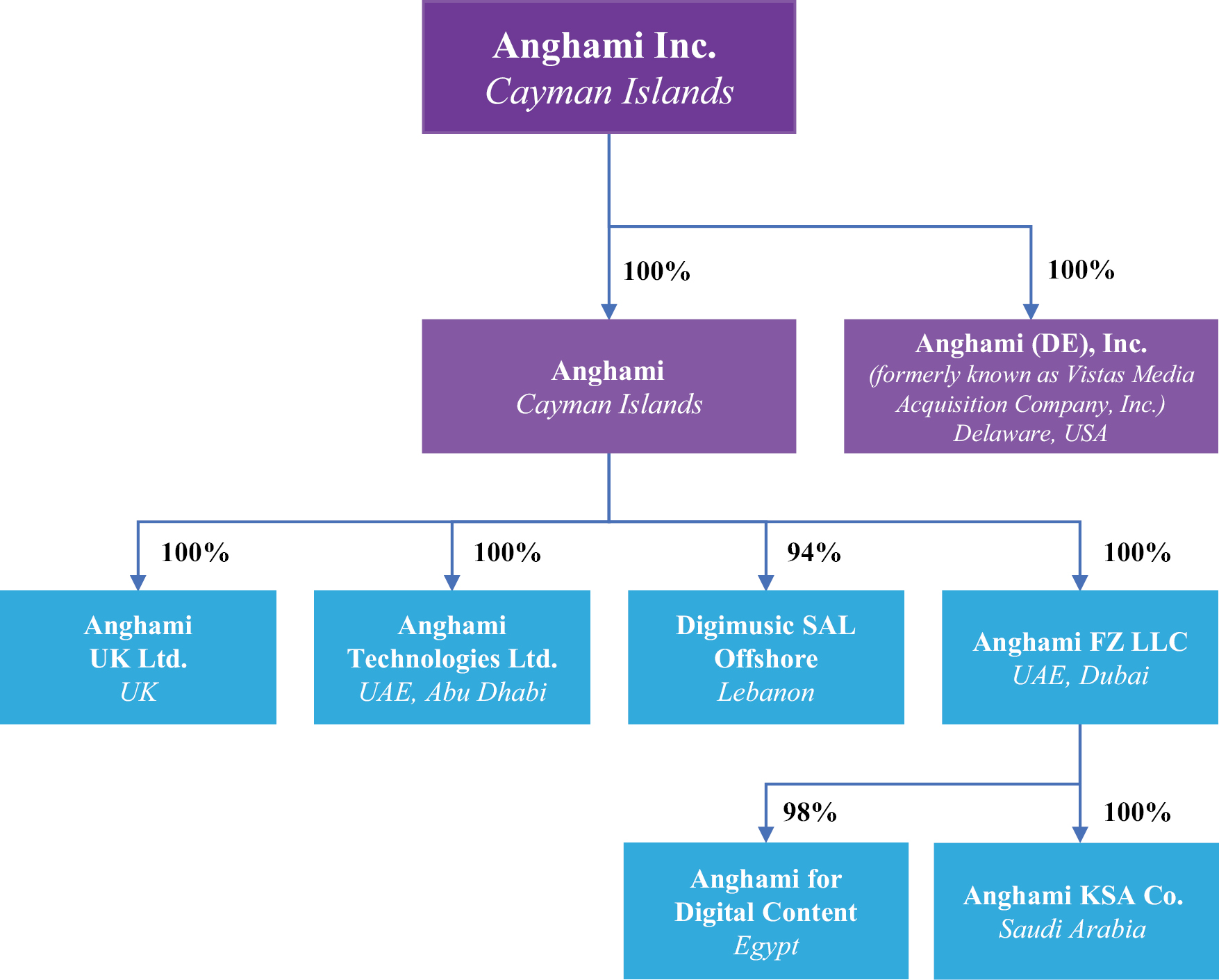

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to the term “Anghami” refer to Anghami, a Cayman Islands exempted company, together with its subsidiaries prior to the closing (“Closing”) of the Business Combination with Vistas Media Acquisition Company Inc. and all references to the term the “Company,” “Anghami Inc.,” “Pubco,” “we,” “us,” “our” and similar terms refer to Anghami Inc., together with its subsidiaries after the Closing. The term “VMAC” refers to Vistas Media Acquisition Company Inc., a Delaware corporation, pre-Closing, that in connection with the Business Combination merged with and into Anghami Vista 1, a Cayman Islands exempted company and wholly owned subsidiary of Anghami Inc., with VMAC being the surviving company and continuing as a wholly-owned subsidiary of Anghami Inc. Upon the consummation of the merger of the merger of VMAC and Anghami Vista 1, VMAC changed its name to Anghami (DE), Inc.

This prospectus includes trademarks, tradenames and service marks, certain of which belong to us or Anghami and others that are the property of other organizations. Solely for convenience, trademarks, tradenames and service marks referred to in this prospectus appear without the ®, TM and SM symbols, but the absence of those symbols is not intended to indicate, in any way, that we will not assert our or their rights or that the applicable owner will not assert its rights to these trademarks, tradenames and service marks to the fullest extent under applicable law. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

1

This prospectus contains estimates, projections, and other information concerning our industry and business, as well as data regarding market research, estimates, and forecasts prepared by our management. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors.” Unless otherwise expressly stated, we obtained this industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by market research firms and other third parties, industry and general publications, government data, and similar sources. In some cases, we do not expressly refer to the sources from which this data is derived. When we refer to one or more sources of data in any paragraph, you should assume that other data of the same type appearing in the same paragraph is derived from such sources, unless otherwise expressly stated or the context otherwise requires. While we have compiled, extracted, and reproduced industry data from third-party sources (including any sources that we may have paid for, sponsored, or conducted), we have not independently verified the data. Forecasts and other forward-looking information with respect to industry, business, market, and other data are subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

2

This summary highlights selected information from this prospectus and does not contain all of the information that is important to you. You should read this entire prospectus carefully, including the annexes. See also the section entitled “Where You Can Find More Information.” Certain figures included in this section have been rounded for ease of presentation and, as a result, percentages may not sum to 100%.

Overview

Anghami Inc.

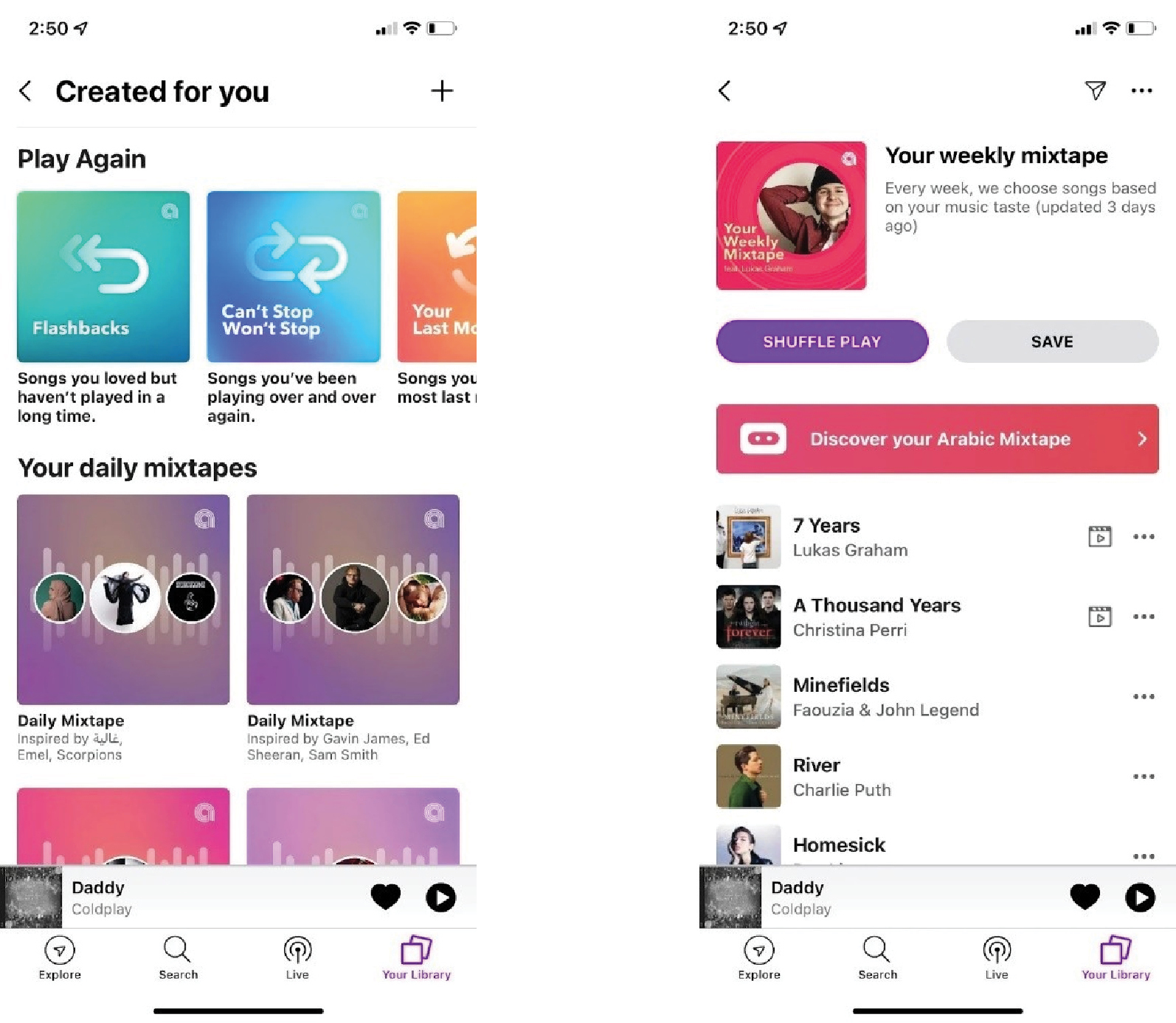

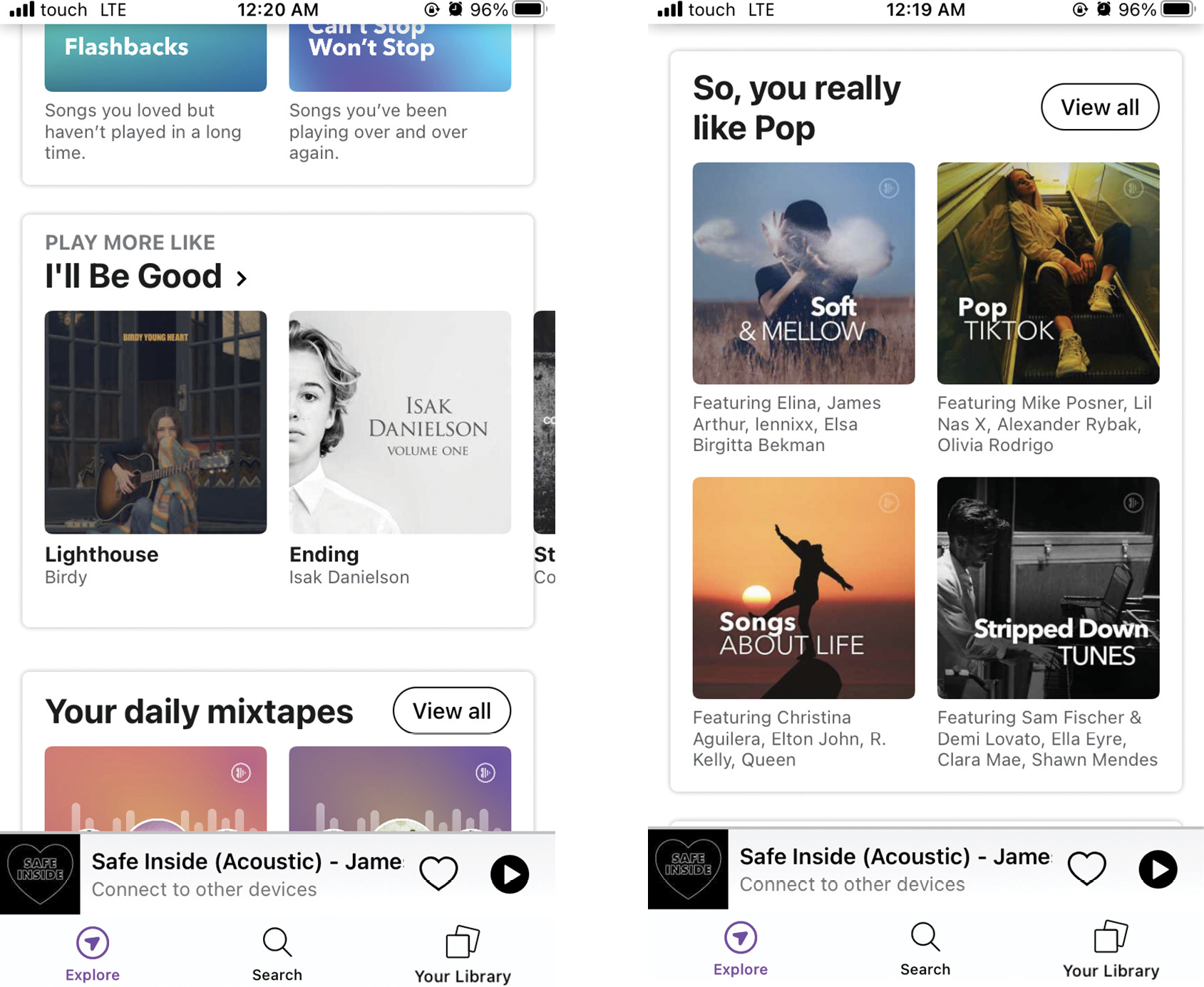

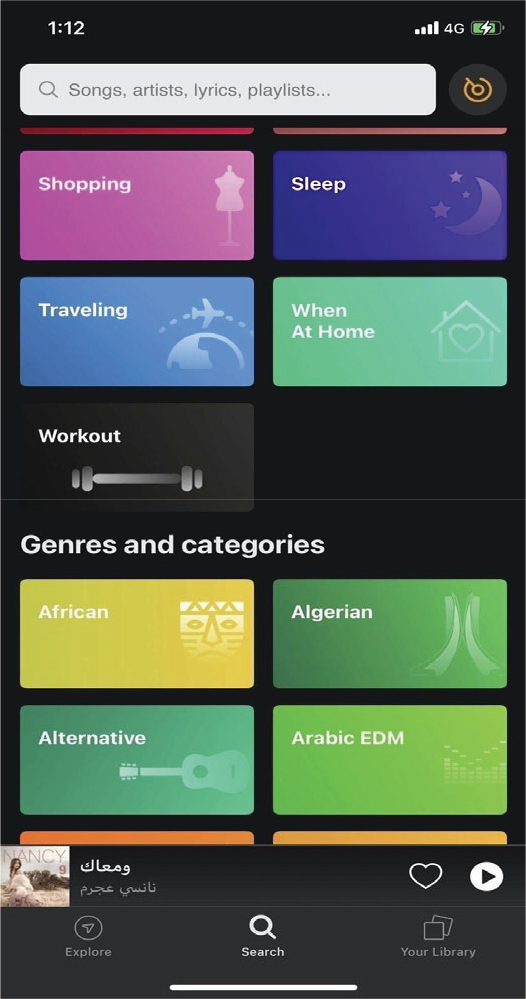

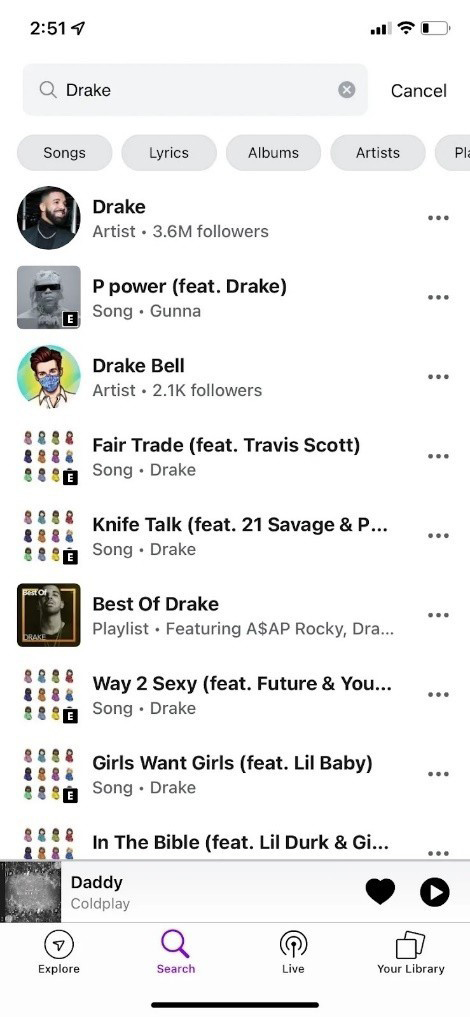

We are a music application and platform that offers listeners in 16 countries in the MENA Region Arabic and international music to stream and download. We are currently the leading regional digital music entertainment technology platform in the MENA Operating Area, with the largest catalogue, offering approximately 60 million songs to more than 100 million registered users as of December 31, 2021, 1.44 million paid subscribers and 18.3 million active users, with more than 9.2 billion streams per year in 2021.

Recent Developments

The Business Combination with Vistas Media Acquisition Company Inc.

On February 3, 2022, we consummated the previously announced business combination (the “Business Combination”) pursuant to the Business Combination Agreement (the “Business Combination Agreement”), dated March 3, 2021, by and among the Company, VMAC, Anghami, an exempted company incorporated under the laws of the Cayman Islands (“Anghami”), Anghami Vista 1, a Cayman Islands exempted company and wholly-owned subsidiary of the Company (“Vistas Merger Sub”), and Anghami Vista 2, a Cayman Islands exempted company and wholly-owned subsidiary of the Company (“Anghami Merger Sub”). Pursuant to the Business Combination Agreement, each of the following transactions occurred at the closing of the Business Combination in the following order:

• immediately prior to the consummation of the Business Combination, VMAC sold 4,056,000 shares of its Class A common stock, par value $0.0001 per share (“VMAC Class A Common Stock”) for gross proceeds of $40,560,000 to the subscribers in the private placement (the “PIPE”);

• immediately prior to the consummation of the Business Combination, VMAC issued 540,000 shares (the “Share Based Payments”) of VMAC Class A Common Stock and 152,800 warrants to purchase VMAC Class A Common Stock at an exercise price of $11.50 per share to certain service providers for services rendered in connection with the Business Combination, and VMAC also issued 100,000 shares (the “Extension Payment”) of VMAC Class A Common Stock to Vistas Media Sponsor, LLC (“Sponsor”) as the result of the conversion the $1,000,000 loan that Sponsor made to VMAC to fund extension payment to extend the period of time that VMAC had to consummate its initial business combination;

• VMAC and Vistas Merger Sub consummated the merger of Vistas Merger Sub with and into VMAC, with VMAC being the surviving company and continuing as a wholly-owned subsidiary of the Company known as Anghami (DE), Inc. (the “Vistas Merger”);

• Anghami and Anghami Merger Sub consummated the merger of Anghami Merger Sub with and into Anghami, with Anghami being the surviving company and continuing as a wholly-owned subsidiary of Anghami Inc.;

• each outstanding share of VMAC’s Class A Common Stock, including the PIPE shares, the Share Based Payment shares, the Extension Payment shares, and Class B common stock, par value $0.0001 per share, was exchanged for one ordinary share of the Company;

• each issued and outstanding VMAC warrant to purchase VMAC Class A Common Stock ceased to represent a right to acquire shares of VMAC Class A Common Stock and was converted into the right to acquire the same number of ordinary shares, at the same exercise price and on the same terms as in effect immediately prior to the closing of the Business Combination; and

• all ordinary shares of Anghami were exchanged for ordinary shares.

3

Following the closing of the Business Combination, the Company had 25,768,967 ordinary shares issued and outstanding, 10,947,800 warrants to purchase ordinary shares at an exercise price of $11.50 per share issued and outstanding and 500,000 warrants to purchase ordinary shares at an exercise price of $12.00 per share issued and outstanding. As of May 12, 2022, the Company had 26,005,654 ordinary shares issued and outstanding, 10,872,800 warrants to purchase ordinary shares at an exercise price of $11.50 per share issued and outstanding, and no warrants to purchase ordinary shares at an exercise price of $12.00 per share issued and outstanding.

As a result of the Business Combination, Anghami and VMAC have become wholly-owned subsidiaries of the Company. On February 4, 2022, the Company’s ordinary shares commenced trading on the Nasdaq Global Market under the symbol “ANGH” and the VMAC warrants to purchase VMAC Class A Common Stock that were converted into warrants to purchase ordinary shares of Anghami at an exercise price of $11.50 per share (“public warrants”) commenced trading on the Nasdaq Capital Market under the symbol “ANGHW.”

Corporate Information

Anghami Inc. was incorporated as a Cayman Islands exempted company on March 1, 2021 with its registered office at Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. The mailing address of our principal executive office is 16th Floor, Al-Khatem Tower, WeWork Hub71, Abu Dhabi Global Market Square, Al Maryah Island, Abu Dhabi, United Arab Emirates and our telephone number is +971 2 443 4317.

Our website is www.anghami.com. The information on, or that can be accessed through, our website is not part of this prospectus, and you should not consider information contained on our website in deciding whether to purchase our ordinary shares.

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

Emerging Growth Company

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We will be an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.07 billion in annual revenues; the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day of the fiscal year ending after the fifth anniversary of the closing of the Business Combination.

As an emerging growth company, we may take advantage of certain exemptions from various reporting requirements that are applicable to other publicly traded entities that are not emerging growth companies. These exemptions include: (i) the option to present only two years of audited financial statements and related discussion in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus; (ii) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002; (iii) not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board, or PCAOB, regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); (iv) not being required to submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay,” “say-on-frequency,” and “say-on-golden parachutes”; and (v) not being required to disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of these accounting standards until they would otherwise apply to private companies.

We have elected not to opt out of, and instead to take advantage of, such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with certain other public companies difficult or impossible because of the potential differences in accounting standards used.

4

Foreign Private Issuer

We report under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we are exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including: (i) the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; (ii) the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and (iii) the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specific information, and current reports on Form 8-K upon the occurrence of specified significant events.

Foreign private issuers are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation and other disclosures required of companies that are neither an emerging growth company nor a foreign private issuer.

5

THE OFFERING

|

Securities offered by the selling securityholders |

We are registering the resale by the selling securityholders named in this prospectus, or their permitted transferees, of an aggregate of 15,900,264 ordinary shares and warrants to purchase 872,800 ordinary shares. In addition, we are registering up to 10,872,800 ordinary shares that are issuable upon the exercise of the warrants. |

|

|

Shares outstanding prior to the offering |

As of May 12, 2022, we had 26,005,654 ordinary shares issued and outstanding. The number of ordinary shares outstanding excludes 10,872,800 warrants to purchase ordinary shares at an exercise price of $11.50 per share issued and outstanding. |

|

|

Use of proceeds |

All of the ordinary shares and warrants offered by the selling securityholders pursuant to this prospectus will be sold by the selling securityholders for their respective accounts. We will not receive any of the proceeds from such sales. We would receive up to an aggregate of approximately $125,037,200 from the exercise of the warrants, assuming the exercise in full of all such warrants for cash. We expect to use the net proceeds from the exercise of the warrants for general corporate purposes, which may include the repayment of indebtedness. See “Use of Proceeds.” The closing price of our ordinary shares on the Nasdaq on May 13, 2022 was $7.38 per ordinary share, and the closing price of our public warrants on May 13, 2022 was $0.38. If the price of our ordinary shares remains below the exercise price of our warrants of $11.50 per ordinary share, we believe it is unlikely that any warrant holder will exercise their warrants. See the section entitled “Risk Factors — Risks Related to Our Operations — Warrant holders may not elect to exercise any of their warrants which could significantly reduce the amount of cash we could receive from the exercise of the warrants.” |

|

|

Redemption |

The warrants are redeemable in certain circumstances. See “Description of Securities — Warrants” for further discussion. |

|

|

Risk factors |

See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our ordinary shares. |

6

Risk Factors

You should consider all the information contained in this prospectus in deciding whether to invest in our ordinary shares. In particular, you should consider the risk factors described under “Risk Factors” in this prospectus. Such risks include, but are not limited to, the following:

Risks Related to Our Business Model, Strategy, and Performance

• We face significant competition that might prohibit us from attracting and retaining users or monetizing our products.

• We face operational risks associated with our growth, including attracting, retaining and motivating qualified personnel and obtaining rights to stream content on favourable terms.

• Our business focus on innovation and emphasizes long-term user engagement over short-term results which might not be in-line with the market’s expectations.

• We may not be able to generate sufficient revenue to become profitable, or to generate positive cash flow. In addition, our revenue growth rate may decline due to various economic and political conditions.

• Failure to convince advertisers of the benefits of our advertising offerings could harm our advertising revenue and thus meeting our targeted growth.

• We may be subject to disputes or liabilities associated with content made available on our platform.

• Our major content providers have the ability to unilaterally affect our access to music and other content.

• We are a party to complex license agreements and have a complex royalty payment schedule, which increases the difficulty of estimating the amount payable under our license agreements or relevant statutes.

• We are a party to revenue share agreements with telcos which have complex technical integration process and delayed credit terms. This might hinder our ability to scale and puts pressure on our financial position and cash flows.

• Financial commitments under certain license agreements may increase our financial leverage and ultimately impact our cashflows.

• Interruptions, delays, or discontinuations in service arising from our own systems or from third parties could harm our business.

• Our business is subject to complex and evolving laws and regulations, including those related to copyright, privacy and data security, which may increase future compliance costs and legal fees.

• Other risks such as failure to protect our brand, payments-related risks, fluctuation of our operating results, failure to implement and maintain effective internal control over financial reporting, lack of additional capital to support our growth a global public health crisis such as COVID-19, changes of worldwide economic conditions and significant fluctuations of exchange rates, may adversely affect our business, operating results, and financial condition.

Risks Related to Intellectual Property

• Assertions by third parties of infringement or other violation by us of their intellectual property rights could harm our business, operating results, and financial condition.

• Our user metrics and other estimates are subject to inherent challenges in measurement, and real or perceived inaccuracies may harm and negatively affect our reputation and our business.

• Failure to effectively manage and remediate attempts to manipulate stream counts and attempts to gain or provide unauthorized access to certain features of our Service could undermine investor confidence.

7

• Claims that Anghami does not hold necessary third-party licenses (content or publishing) may materially adversely our business and financial position.

Risks Related to Our Operations

• We may require additional capital to support business growth and objectives, and this capital might not be available on acceptable terms, if at all.

• Our products are highly technical and may contain undetected errors, bugs, or vulnerabilities, which could manifest in ways that could seriously harm our reputation and our business.

• Various regulations related to privacy and data security concerns pose the threat of lawsuits and other liability, require us to expend significant resources, and may harm our business, operating results, and financial condition.

Risks Related to Tax

• We are a multinational company that faces complex taxation regimes in various jurisdictions. Audits, investigations, and tax proceedings could have a material adverse effect on our business, operating results, and financial condition.

• We face complex taxation regimes in various jurisdictions. Audits, investigations, tax proceedings and changes to tax laws, including new proposals on taxing digital companies, in any of the jurisdictions we operate, could have a material adverse effect on our business, operating results, and financial condition.

Risks Related to Doing Business in Jurisdictions in Which We Operate

• We face geopolitical risk in the MENA Region that may have adverse impact on our business.

• We are subject to economic and political conditions of operating in an emerging and continued instability in the Middle East.

Risks Related to Owning Our Securities

• The trading price of our ordinary shares has been and will likely continue to be volatile.

• We do not expect to pay cash dividends in the foreseeable future.

Risks Related to Our Status as a Foreign Private Issuer

• As a foreign private issuer, we are exempt from a number of U.S. securities laws and rules promulgated thereunder and the rights of our shareholders may differ from those of shareholders of a U.S. corporation.

• We are organized under the laws of Cayman Islands and our assets are not located in the United States. It may be difficult for you to obtain or enforce judgments or bring original actions against us or the members of our board of directors in the United States.

8

SELECTED HISTORICAL FINANCIAL DATA

The following set forth summary financial data for Anghami’s business. This information is only a summary and should be read in conjunction with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Anghami’s audited financial statements, and the notes related thereto, which are included elsewhere in this prospectus. Anghami’s historical results are not necessarily indicative of future results.

Anghami’s statement of financial position data as of December 31, 2021 and December 31, 2020 and statement of comprehensive income data for the years ended December 31, 2021, 2020 and 2019 are derived from Anghami’s audited consolidated financial statements included elsewhere in this prospectus.

All numbers given below are in US dollars except for the number of shares outstanding. Certain amounts that appear in this section may not sum due to rounding.

|

Statement of comprehensive income data |

Year Ended |

Year Ended |

Year Ended |

||||||

|

$ |

$ |

$ |

|||||||

|

Revenue |

35,504,392 |

|

30,518,356 |

|

31,227,649 |

|

|||

|

Cost of revenue |

(26,462,637 |

) |

(22,346,521 |

) |

(21,321,616 |

) |

|||

|

Gross profit |

9,041,755 |

|

8,171,835 |

|

9,906,033 |

|

|||

|

Selling and marketing expenses |

(8,013,933 |

) |

(5,284,152 |

) |

(8,232,405 |

) |

|||

|

General and administrative expenses |

(17,138,259 |

) |

(5,435,996 |

) |

(6,923,949 |

) |

|||

|

Government grants |

2,546,360 |

|

— |

|

— |

|

|||

|

Operating loss |

(13,564,077 |

) |

(2,548,313 |

) |

(5,250,321 |

) |

|||

|

Net finance cost and others |

(4,146,227 |

) |

(2,693,639 |

) |

(1,057,107 |

) |

|||

|

Loss before tax |

(17,710,304 |

) |

(5,241,952 |

) |

(6,307,428 |

) |

|||

|

Income tax |

(340,003 |

) |

(501,238 |

) |

(638,965 |

) |

|||

|

Total Comprehensive Loss for the |

(18,050,307 |

) |

(5,743,190 |

) |

(6,946,393 |

) |

|||

|

Basic and diluted loss per share attributable to equity holders of the parent |

(206.90 |

) |

(68.27 |

) |

(83.05 |

) |

|||

|

Weighted average shares outstanding–basic and diluted |

85,966 |

|

81,823 |

|

81,222 |

|

|||

|

Statement of financial position data |

As of December 31, 2021 |

As of December 31, 2020 |

||||

|

$ |

$ |

|||||

|

Total assets |

13,025,327 |

|

14,257,298 |

|

||

|

Total liabilities |

40,988,748 |

|

32,170,171 |

|

||

|

Deficiency of assets |

(27,963,421 |

) |

(17,912,873 |

) |

||

9

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this prospectus may include, for example, statements about:

• our growth strategy, future operations, financial position, estimated revenues and losses, projected capex, prospects and plans;

• our strategic advantages and the impact those advantages will have on future financial and operational results;

• the implementation, market acceptance and success of our platform and new offerings;

• our approach and goals with respect to technology;

• our expectations regarding our ability to obtain and maintain intellectual property protection and not infringe on the rights of others;

• the impact of the COVID-19 pandemic on our business;

• changes in applicable laws or regulations; and

• the outcome of any known and unknown litigation and regulatory proceedings.

We caution you against placing undue reliance on forward-looking statements, which reflect current beliefs and are based on information currently available as of the date a forward-looking statement is made. Forward-looking statements set forth herein speak only as of the date of this prospectus. We do not undertake any obligation to revise forward-looking statements to reflect future events, changes in circumstances, or changes in beliefs. In the event that any forward-looking statement is updated, no inference should be made that we will make additional updates with respect to that statement, related matters, or any other forward-looking statements. Any corrections or revisions and other important assumptions and factors that could cause actual results to differ materially from forward-looking statements, including discussions of significant risk factors, may appear, in our public filings with the SEC, which are or will be (as appropriate) accessible at www.sec.gov, and which you are advised to consult. For additional information, please see the section titled “Where You Can Find More Information” in this prospectus.

Market, ranking and industry data used throughout this prospectus, including statements regarding market size and technology adoption rates, is based on the good faith estimates of our management, which in turn are based upon our management’s review of internal surveys, independent industry surveys and publications, and other third party research and publicly available information. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we are not aware of any misstatements regarding the industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus.

10

Investing in our securities involves risks. In considering purchasing our securities, you should carefully consider the following information about these risks, as well as the other information included in this prospectus, including our consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Results of Operations and Financial Condition.” The risks and uncertainties described below are those significant risk factors, currently known and specific to us, that we believe are relevant to an investment in our securities. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also harm us and adversely affect our shares.

Risks Related to Our Business Model, Strategy, and Performance

If our efforts to attract prospective users, retain existing users, and effectively monetize our products and services are not successful, our growth prospects and revenue will be adversely affected.

Our ability to grow our business and generate revenue depends on retaining, expanding, and effectively monetizing our total user base, including by increasing the number of Premium service users and the number of users of our ad-supported service and finding ways to monetize content across the platform. We must convince prospective users of the benefits of our platform and our existing users of the continuing value of our platform. Our ability to attract new users, retain existing users, and convert Ad-Supported Free service users to Premium service users depends in large part on our ability to continue to offer exceptional technologies and products, compelling content, superior functionality, and an engaging user experience. Some of our competitors, including Apple, Google, and Amazon, have developed, and are continuing to develop, devices for which their music streaming services are preloaded, which puts us at a significant competitive disadvantage. As consumer tastes and preferences change on the internet and with mobile devices and other internet-connected products, we will need to enhance and improve our existing service, introduce new features, and maintain our competitive position with additional technological advances and an adaptable platform. If we fail to keep pace with technological advances or fail to offer compelling product offerings and state-of-the-art delivery platforms to meet consumer demands, our ability to grow or sustain the reach of our service, attract and retain users, and increase Premium service users may be adversely affected.

In addition, in order to increase advertising revenue, we also seek to increase the listening time that our Ad-Supported Free service users spend on the Ad-Supported Free service. The more content we stream under this service, the more advertising inventory we will have to sell. Generally, any increase in Ad-Supported Free service user base increases the size and scope of user pools targeted by advertisers, which improves our ability to deliver relevant advertising to those users in a manner that maximizes our advertising customers’ return on investment. This, in turn, illustrates the effectiveness of our advertising solutions and justifies our pricing structure. If we fail to grow our Ad-Supported Free service user base, the amount of content streamed, and the listening time spent by these users, we may be unable to grow Ad-Supported revenue. Moreover, since we primarily source Premium service users from the conversion of our Ad-Supported Free service users, any failure to grow the Ad-Supported Free service user base or convert them to Premium service users may negatively impact our revenue.

We face many risks associated with our international operations.

We have significant international operations and plan to continue to grow internationally. However, managing our business and offering our products and services internationally involves numerous risks and challenges, including:

• difficulties in obtaining licenses to stream content from rights organizations and individual copyright owners in countries around the world on favorable terms;

• lack of well-functioning copyright collective management organizations that are able to grant us music licenses, process reports, and distribute royalties in markets;

• fragmentation of rights ownership in various markets causing lack of transparency of rights coverage and overpayment or underpayment to record labels, music publishers, artists, performing rights organizations, and other copyright owners;

• difficulties in obtaining license rights to local content;

11

• increased risk of disputes with and/or lawsuits filed by rights holders in connection with our expansion into new markets;

• difficulties in achieving market acceptance of our products or services in different geographic markets with different tastes and interests;

• difficulties in achieving viral marketing growth in certain other countries where we commit fewer sales and marketing resources;

• difficulties in effectively monetizing our growing international user base;

• difficulties in managing operations due to language barriers, distance, staffing, user behavior and spending capability, cultural differences, business infrastructure constraints, and laws regulating corporations that operate internationally;

• application of different laws and regulations of other jurisdictions, including corporate governance, labor and employment, privacy, telecommunications and media, cybersecurity, content moderation, environmental, health and safety, consumer protection, liability standards and regulations, as well as intellectual property laws;

• potential adverse tax consequences associated with foreign operations and revenue;

• complex foreign exchange fluctuation and associated issues;

• increased competition from local websites and audio content providers, some with financial power and resources to undercut the market or enter into exclusive deals with local content providers to decrease competition;

• credit risk and higher levels of payment fraud;

• political and economic instability in some countries;

• region-specific effects of the COVID-19 pandemic;

• compliance with the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act, and similar laws in other jurisdictions;

• import and export controls and economic sanctions administered by the U.S. Department of Commerce’s Bureau of Industry and Security and the U.S. Department of the Treasury’s Office of Foreign Assets Control;

• restrictions on international monetary flows; and

• reduced or ineffective protection of our intellectual property rights in some countries.

If we are unable to manage the complexity of our global operations and continue to grow internationally as a result of these obstacles, our business, operating results, and financial condition could be adversely affected.

Our business emphasizes rapid innovation and prioritizes long-term user engagement over short-term financial condition or results of operations. That strategy may yield results that sometimes do not align with the market’s expectations. If that happens, our stock price may be negatively affected.

Our business is growing and becoming more complex, and our success depends on our ability to quickly develop and launch new and innovative products. We believe our culture fosters this goal. Our focus on innovations and quick reactions could result in unintended outcomes or decisions that are poorly received by our users, advertisers, or partners. We have made, and expect to continue to make, significant investments to develop and launch new products, services, and initiatives, which may involve significant risks and uncertainties, including the fact that such offerings may not be commercially viable for an indefinite period of time or at all, or may not result in adequate return of capital on our investments. No assurance can be given that such new offerings will be successful and will not adversely affect our reputation, operating results, and financial condition. Our culture also prioritizes our long-term user engagement over short-term financial condition or results of operations. We frequently make

12

decisions that may reduce our short-term revenue or profitability if we believe that the decisions benefit the aggregate user experience and will thereby improve our financial performance over the long term. These decisions may not produce the long-term benefits that we expect, in which case our user growth and engagement, our relationships with advertisers and partners, as well as our business, operating results, and financial condition could be seriously harmed.

We may not be able to generate sufficient revenue to be profitable, or to generate positive cash flow on a sustained basis. In addition, our revenue growth rate may decline.

If we cannot successfully earn revenue at a rate that exceeds the operational costs, including royalty and other licensing expenses, associated with our platform, we will not be able to achieve or sustain profitability or generate positive cash flow on a sustained basis.

Furthermore, we cannot assure you that the growth in revenue we have experienced over the past few years will continue at the same rate or even continue to grow at all. We expect that, in the future, our revenue growth rate may decline because of a variety of factors, including increased competition and the maturation of our business. You should not consider our historical revenue growth or operating expenses as indicative of our future performance. If our revenue growth rate declines or our operating expenses exceed our expectations, our financial performance may be adversely affected.

Additionally, we also expect our costs to increase in future periods, which could negatively affect our future operating results and ability to achieve profitability. We expect to continue to expend substantial financial and other resources on:

• securing top quality audio and video content from leading record labels, distributors, aggregators, and podcast creators, as well as the publishing right to any underlying musical compositions;

• creating new forms of original content;

• our technology infrastructure, including website architecture, development tools, scalability, availability, performance, security, and disaster recovery measures;

• research and development, including investments in our research and development team and the development of new features;

• sales and marketing, including a significant expansion of our field sales organization;

• international operations in an effort to maintain and increase our member base, engagement, and sales;

• capital expenditures that we will incur to grow our operations and remain competitive; and

• general administration, including legal and accounting expenses.

These investments may not result in increased revenue or growth in our business. If we fail to continue to grow our revenue and overall business, our business, operating results, and financial condition would be harmed.

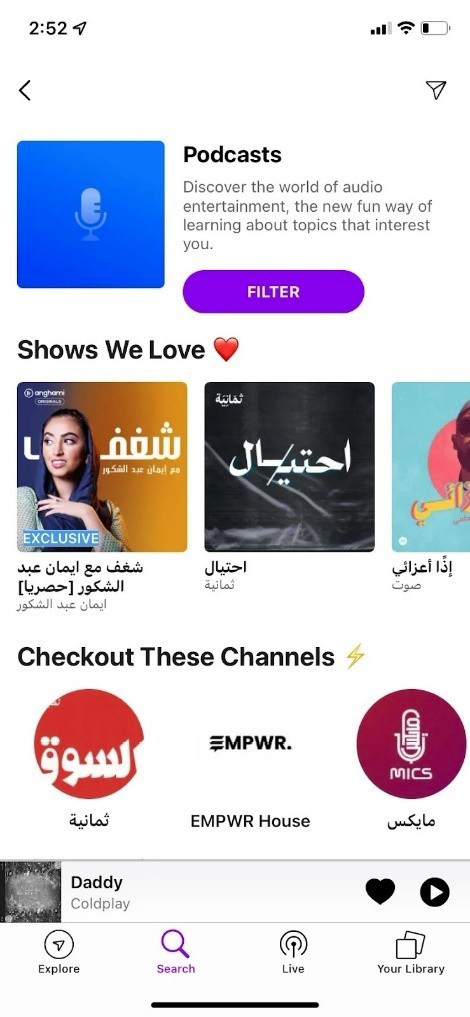

Failure to successfully monetize and generate revenues from podcasts and other non-music content could adversely affect our business, operating results, and financial condition.

Delivering podcasts and other non-music content involves numerous risks and challenges, including increased capital requirements, competition, and the need to develop strategic relationships. Growth in these areas may require additional changes to our existing business model and cost structure, modifications to our infrastructure, and exposure to new regulatory, legal and reputational risks, including infringement liability, any of which may require additional expertise that we currently do not have. There is no guarantee that we will be able to generate sufficient revenue from podcasts or other non-music content to offset the costs of creating or acquiring this content. Failure to successfully monetize and generate revenues from such content, including failure to obtain or retain rights to podcasts or other non-music content on acceptable terms, or at all, or to effectively manage the numerous risks and challenges associated with such expansion, could adversely affect our business, operating results, and financial condition.

13

In addition, we enter into multi-year commitments for original content that we produce or commission. Given the multiple-year duration and largely fixed-cost nature of such commitments, if our user growth and retention do not meet our expectations, our margins may be adversely impacted. Payment terms for certain content that we produce or commission will typically require more upfront cash payments than other content licenses or arrangements whereby we do not pay for the production of such content. To the extent our user and/or revenue growth do not meet our expectations, our liquidity and results of operations could be adversely affected as a result of such content commitments. The long-term and fixed-cost nature of certain original content commitments may also limit our flexibility in planning for or reacting to changes in our business, as well as our ability to adjust our content offering if our users do not react favorably to the content we produce. Any such event could adversely impact our business, operating results, and financial condition.

To secure the rights to stream sound recordings and the musical compositions embodied therein, we enter into license agreements to obtain licenses from rights holders such as record labels, music publishers, performing rights organizations, collecting societies, and other copyright owners or their agents, and pays royalties to such parties or their agents around the world. We work diligently to obtain all necessary licenses to stream sound recordings and the musical compositions embodied therein, however, there is no guarantee that the licenses available to us now will continue to be available in the future at rates and on terms that are favorable or commercially reasonable or at all. The terms of these licenses, including the royalty rates that we are required to pay pursuant to them, may change as a result of changes in our bargaining power, changes in the industry, changes in the law, or for other reasons. Increases in royalty rates or changes to other terms of these licenses may materially impact our business, operating results, and financial condition.

We have entered into license agreements to obtain rights to stream sound recordings, including from the major international record labels who hold the rights to stream a significant number of sound recordings such as Universal Music Group, Sony Music Entertainment, and Warner Music Group, as well as regional record labels, such as Qanawat Nile Production and Stars for Art production & distribution Offshore. If we fail to retain these licenses, the size and quality of our catalogue may be materially impacted and our business, operating results, and financial condition could be materially harmed.

We generally obtain licenses for two types of rights with respect to musical compositions: mechanical rights and public performance rights. We obtain mechanical and performance licenses for musical compositions either through local collecting societies representing publishers or from publishers directly, or a combination thereof.

With respect to mechanical rights, in Algeria, Bahrain, Egypt, Iraq, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Sudan, Tunisia and UAE (together, our “MENA Operating Area”), we pay various rights owners through a ratemaking process conducted on a case-by-case basis based on negotiating each deal. There are cases of publishing deals which are represented by bodies which combine both mechanical and public performance rights, such as SOLAR which represents mechanical rights of Sony Music Publishing and public performance rights from PRS and International Copyright Enterprise Services Limited among others. Since in many countries in the Middle East & North Africa (“MENA Region”), there are no collection societies, we cannot guarantee that our licenses with the existing few collecting societies and/or our direct licenses with publishers provide full coverage for all of the musical compositions we make available to our users in such countries. As such there is a fragmented copyright licensing landscape which leads to publishers, songwriters, and other rights holders choosing not to be represented by collecting societies and that adversely impacts our ability to secure favorable licensing arrangements in connection with musical compositions that such rights holders own or control, including increasing the costs of licensing such musical compositions, or subjecting us to significant liability for copyright infringement.

In the United States, the rates we incur for mechanical rights are a function of ratemaking procedure conducted by an administrative agency, Copyright Royalty Board. The most recent proceeding before the Copyright Royalty Board (the “Phonorecords III Proceedings”) set the rates for the Section 115 compulsory license for calendar years 2018 to 2022. The Copyright Royalty Board issued its initial written determination on January 26, 2018 and set up the Mechanical Licensing Collective (the “MLC”). The MLC is a nonprofit organization designated by the U.S. Copyright Office pursuant to the Music Modernization Act of 2018. In January 2021, the MLC began administering blanket mechanical licenses to eligible streaming and download services (digital service providers or DSPs) in the United States, which we opted for and obtained a blanket license for mechanical rights in the U.S. The MLC collects the royalties due under those licenses from the DSPs and pay songwriters, composers, lyricists, and music

14

publishers. We currently believe that the current rates will not materially impact our business, operating results, and financial condition in the U.S. as although the U.S. is our biggest market outside of the MENA Operating Area, it is currently not a significant market. However, if we do decide to expand our business (with both Arabic and international music) in the U.S., and we do not grow in revenues and users as expected or if the rates are modified to be higher than the proposed rates, our content acquisition costs could increase and impact our ability to obtain content on pricing terms favorable, which could negatively harm our business, operating results, and financial condition and hinder our ability to provide interactive features in our services, or cause one or more of our services not to be economically viable in U.S.

In the U.S., performing rights organizations (“PROs”) generally provide public performance rights, which negotiate blanket licenses with copyright users for the public performance of compositions, collect royalties, and distribute those royalties to rights owners. The royalty rates that apply to us today may be subject to changes in the future. Licenses provided by two of these PROs, the American Society of Composers, Authors and Publishers and Broadcast Music, Inc. are governed by consent decrees which are subject to terms which could be unfavorable to us in the future. This could affect our financial viability in the future in the U.S.

We cannot guarantee that our licenses with collecting societies and our direct licenses with publishers provide full coverage for all of the musical compositions that we make available on our platform.

There also is no guarantee that we have or will have all of the licenses we need to stream content, as the process of obtaining such licenses involves many rights holders, some of whom are unknown, and myriad complex legal issues across many jurisdictions, including open questions of law as to when and whether particular licenses are needed. Additionally, there is a risk that aspiring rights holders, their agents, or legislative or regulatory bodies will create or attempt to create new rights that could require us to enter into license agreements with, and pay royalties to, newly defined groups of rights holders, some of which may be difficult or impossible to identify. See also “Risk Factors — Risks Related to Our Business Model, Strategy, and Performance — Difficulties in obtaining accurate and comprehensive information necessary to identify the compositions embodied in sound recordings on our platform and the ownership thereof may impact our ability to perform our obligations under our licenses, affect the size of our catalogue, impact our ability to control content acquisition costs, and lead to potential copyright infringement claims.”

Further, we cannot guarantee that such agreements will continue to be renewed indefinitely. For example, from time to time, license agreements with certain rights holders and/or their agents may expire while we are still negotiating their renewals, and, per industry custom and practice, we may enter into brief contract extension (for example, month-, week-, or even days-long) and/or continue to operate as if the license agreement had been extended. During these periods, we may not have assurance of long-term access to such rights holders’ content, which could have a material adverse effect on our business and could lead to potential copyright infringement claims. It also is possible that such agreements will never be renewed at all. The lack of renewal, or termination, of one or more of our license agreements, or the renewal of a license agreement on less favorable terms, also could have a material adverse effect on our business, financial condition, and results of operations.

We are a party to many license agreements which are complex and impose numerous obligations upon us which may make it difficult to operate our business, and a breach of such agreements could adversely affect our business, operating results, and financial condition.

Our license agreements are primarily complex and impose numerous obligations on it, including obligations to, among other things:

• meet certain user and conversion targets in order to secure certain licenses and royalty rates;

• calculate and make payments based on complex royalty structures, which requires tracking usage of content on our service that may have inaccurate or incomplete metadata necessary for such calculation;

• provide periodic reports on the exploitation of the content in specified formats;

• represent that we will obtain all necessary publishing licenses and consents and pay all associated fees, royalties, and other amounts due for the licensing of musical compositions;

• provide advertising inventory;

15

• comply with certain marketing and advertising restrictions; and

• comply with certain security and technical specifications.

Some of our license agreements grant the licensor the right to audit our compliance with the terms and conditions of such agreements. Some of the license agreements also include so-called “most favored nations” provisions which require that certain terms (including potentially the material terms) of such agreements are no less favorable than those provided to any similarly situated licensor. If triggered, these most favored nations provisions could cause our payments or other obligations under those agreements to escalate substantially. Additionally, some license agreements require consent to undertake certain business initiatives and without such consent, our ability to undertake new business initiatives may be limited and in turn could hurt our competitive position.

If we materially breach any of these obligations or any other obligations set forth in any of the license agreements, or if we use content in ways that are found to exceed the scope of such agreements, we could be subject to monetary penalties and our rights under such license agreements could be terminated, either of which could have a material adverse effect on our business, operating results, and financial condition.

We have no control over the providers of our content, and our business may be adversely affected if the access to music is limited or delayed. The concentration of control of content by our major providers means that even one entity, or a small number of entities working together, may unilaterally affect our access to music and other content.

We rely on music rights holders, over whom we have no control, for the content we make available on our service. We cannot guarantee that these parties will always choose to license to it. The music industry has a high level of concentration, which means that one or a small number of entities may, on their own, take actions that adversely affect our business. For example, with respect to sound recordings, the music licensed to us under our agreements with Universal Music Group, Sony Music Entertainment, and Warner Music Group, constitutes a large portion of music consumed on our service. For the year ended December 31, 2021, this content accounted for approximately 33.95% of streams.

Our business may be adversely affected if our access to music is limited or delayed because of deterioration in our relationships with one or more of these rights holders or if they choose not to license to us for any other reason. Rights holders also may attempt to take advantage of their market power to seek onerous financial terms from us, which could have a material adverse effect on our financial condition and results of operations. In 2019, Rotana Audio and Video (“Rotana”) terminated their license agreement. We initiated an arbitration proceeding at the Commercial Courts in Beirut against Rotana for breach of the provisions of the license agreement. In October 2019, Rotana filed a suit against us before Beirut First Instance Court, claiming that we have been illegally distributing content owned by Rotana without a license. Rotana also initiated a legal claim against us before the Cyber Crime Bureau in September 2020, alleging that we kept some content owned by Rotana without a license.

In April 2022, both parties have dropped their lawsuits and a new licensing agreement was signed to bring back Rotana content to Anghami app.

Even if we are able to secure rights to sound recordings from record labels and other copyright owners, artists and/or artist groups may object and may exert public or private pressure on third parties to discontinue licensing rights to us, hold back content from it, or increase royalty rates. As a result, our ability to continue to license rights to sound recordings is subject to convincing a broad range of stakeholders of the value and quality of our service.

To the extent that we are unable to license a large amount of content or the content of certain popular artists, our business, operating results, and financial condition could be materially adversely affected.

Our royalty payment arrangements are complex, and it is difficult to estimate the amount payable under license agreements.

Under our license agreements, we have to pay a royalty to record labels, music publishers, and other copyright owners in order to stream content. The determination of the amount and timing of such payments is complex and subject to a number of variables, including the revenue generated, the type of content streamed and the

16

country in which it is streamed, the service tier such content is streamed on, identification of the appropriate license holder, size of user base, ratio of Ad-Supported Free service users to Premium service users, and any applicable advertising fees, app stores and telecom operators fees and discounts, among other variables.

Additionally, for new licensing agreements, we have certain arrangements because of which royalty costs are paid in advance or are subject to minimum guaranteed amounts. An accrual is estimated at the higher of the actual royalty costs to be incurred during a contractual period or the minimum guarantee.

Additionally, we also have license agreements that include so-called “most favored nations” provisions that require that the material terms of such agreements are the most favorable material terms provided to any music licensor, which, if triggered, could cause our royalty payments under those agreements to escalate substantially. An accrual and expense is recognized when it is probable that we will make additional royalty payments under these terms. Historically, we never incurred additional provisions relating to most favored nations provisions.

Determining royalty payments is complex. As a result, we may underpay or overpay the royalty amounts payable to record labels, music publishers, and other copyright owners. Underpayment could result in (i) litigation or other disputes with record labels, music publishers, and other copyright owners, (ii) the unexpected payment of additional royalties in material amounts, and (iii) damage to business relationships with record labels, music publishers, other copyright owners, and artists and/or artist groups. If we overpay royalties, we may be unable to reclaim such overpayments, and our profits will suffer. Failure to accurately pay royalties may adversely affect our business, operating results, and financial condition.

Minimum guarantees required under certain of our license agreements for sound recordings and underlying musical compositions may limit our operations and may adversely affect our business, operating results, and financial condition.

Certain of our license agreements for sound recordings and musical compositions (both for mechanical rights and public performance rights) contain minimum guarantees and/or require that we make minimum guarantee payments. As of December 31, 2021, we had estimated future minimum guarantee commitments of $7,115,551 over the next 2 years. Such minimum guarantees related to content acquisition costs are not always tied to our number of users, Premium service users, or the number of sound recordings and musical compositions used on our service. Accordingly, our ability to achieve and sustain profitability and operating leverage on our service depends, in part, on our ability to increase revenue through increased sales of Premium service and advertising sales on terms that maintain an adequate gross margin. The duration of license agreements that contain minimum guarantees is typically between one and two years, but Premium service users may cancel their subscriptions at any time. If our forecasts of Premium service user acquisition do not meet our expectations or the number or advertising sales decline significantly during the term of the license agreements, our margins may be materially and adversely affected. To the extent Premium service revenue growth or advertising sales do not meet our expectations, our business, operating results, and financial condition also could be adversely affected as a result of such minimum guarantees. In addition, the fixed cost nature of these minimum guarantees may limit our flexibility in planning for, or reacting to, changes in our business and the market segments in which we operate.

We rely on estimates of the market share of licensable content controlled by each content provider, as well as its own user growth and forecasted advertising revenue, to forecast whether such minimum guarantees could be recouped against our actual content acquisition costs incurred over the duration of the license agreement. To the extent that these revenue and/or market share estimates underperform relative to our expectations, leading to content acquisition costs that do not exceed such minimum guarantees, our margins may be materially and adversely affected.

Difficulties in obtaining accurate and comprehensive information necessary to identify the compositions embodied in sound recordings on our platform and the ownership thereof may impact our ability to perform our obligations under our licenses, affect the size of our catalogue, impact our ability to control content acquisition costs, and lead to potential copyright infringement claims.

Comprehensive and accurate ownership information for the musical compositions embodied in sound recordings is often unavailable to us or difficult or, in some cases, impossible for us to obtain, often times because it is withheld by the owners or administrators of such rights. We currently rely on the assistance of third parties to determine this information. If the information provided to us or obtained by such third parties does not comprehensively

17

or accurately identify the ownership of musical compositions, or if we are unable to determine which musical compositions correspond to specific sound recordings, it may be difficult or impossible to identify the appropriate rights holders to whom to pay royalties. This may make it difficult to comply with the obligations of any agreements with those rights holders.

These challenges, and others concerning the licensing of musical compositions embodied in sound recordings on our service, may subject us to significant liability for copyright infringement, breach of contract, or other claims.

If our security systems are breached, we may face civil liability, and public perception of our security measures could be diminished, either of which would negatively affect our ability to attract and retain Premium service users, Ad-Supported Free service users, advertisers, content providers, and other business partners.

Techniques used to gain unauthorized access to data and software are constantly evolving, and we may be unable to anticipate or prevent unauthorized access to data pertaining to our users, including credit card and debit card information and other personal data about our users, business partners, and employees. Like all internet services, our service, which is supported by our own systems and those of third parties that we work with, is vulnerable to software bugs, computer viruses, internet worms, break-ins, phishing attacks, attempts to overload servers with denial-of-service, or other attacks and similar disruptions from unauthorized use of our and third-party computer systems, any of which could lead to system interruptions, delays, or shutdowns, causing loss of critical data or the unauthorized access to personal data. Computer malware, viruses, and computer hacking and phishing attacks have become more prevalent in the music subscription industry, and may occur on our systems in the future. Because of our prominence, we believe that it is a particularly attractive target for such attacks. Though it is difficult to determine what, if any, harm may directly result from any specific interruption or attack, any failure to maintain performance, reliability, security, and availability of our products and technical infrastructure to the satisfaction of our users may harm our reputation and ability to retain existing users and attract new users. Although we have developed systems and processes that are designed to protect our data and user data, to prevent data loss, to disable undesirable accounts and activities on the platform, and to prevent or detect security breaches, such measures may not provide absolute security, may fail, or may fail to stop such data loss or activities, and they may incur significant costs in protecting against or remediating cyber-attacks.