Will you incur expenses in soliciting proxies?

We will pay all of the costs of soliciting these proxies. We have engaged Broadridge Investor Communication Solutions, Inc. (“Broadridge”) to, among other

things, assist us in distributing proxy materials and soliciting proxies. We expect to pay Broadridge aggregate fees of approximately $27,500 to distribute and solicit proxies plus other fees and expenses for other services related to this proxy

solicitation, including distributing proxy materials; disseminating brokers’ search cards; distributing proxy materials; operating online and telephone voting systems; and receiving of executed proxies. In compliance with the regulations of the

SEC, we will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses to the extent they forward proxy

and solicitation materials to our stockholders. Our directors and officers and employees of affiliates of our advisor, Benefit Street Partners L.L.C. (the “Advisor”), may also solicit proxies on our behalf in person, via the Internet, by

telephone or by any other electronic means of communication we deem appropriate, for which they will not receive any additional compensation.

Is this Proxy Statement the only way that proxies are being solicited?

No. In addition to our mailing proxy solicitation material, our directors and officers and employees of Broadridge and affiliates of the Advisor may also solicit proxies

in person, via the Internet, by telephone or by any other electronic means of communication we deem appropriate.

What does it mean if I

receive more than one proxy card or Notice of Internet Availability of Proxy Materials?

Some of your shares may be registered differently or held in a

different account and/or you may hold shares of Common Stock and Preferred Stock. You should authorize a proxy to vote the shares in each of your accounts and all classes of securities held by mail, by telephone or via the Internet. If you mail

proxy cards, please sign, date and return each proxy card to guarantee that all of your shares are voted. If you hold your shares in registered form and wish to combine your stockholder accounts in the future, you should call our Investor Relations

department at (844) 785-4393. Combining accounts reduces excess printing and mailing costs, resulting in cost savings to us that benefit you as a stockholder.

What if I receive only one set of proxy materials although there are multiple stockholders at my address?

The SEC has adopted a rule concerning the delivery of documents filed by us with the SEC, including proxy statements and annual reports. The rule allows us and brokers to

send a single set of proxy materials, including proxy statements and notices, to any household at which two or more stockholders reside if they share the same last name or we reasonably believe they are members of the same family. This procedure is

referred to as “Householding.” This rule benefits both you and us. It reduces the volume of duplicate information received at your household and helps us reduce expenses.

We will promptly deliver, upon written or oral request, a copy of our 2021 annual report or this proxy statement, as applicable, to a stockholder at a shared address to

which a single copy was previously delivered. If your household received a single set of disclosure documents for this year, but you would prefer to receive your own copy, you may direct requests for separate copies by calling our Investor Relations

department at (844) 785-4393 or by mailing a request to Franklin BSP Realty Trust, Inc., 1345 Avenue of the Americas, Suite 32A, New York, New York 10105, Attention: Investor Relations. Likewise, if your

household currently receives multiple sets of notices or disclosure documents and you would like to receive one set, please contact us.

Where can I find more information?

You may

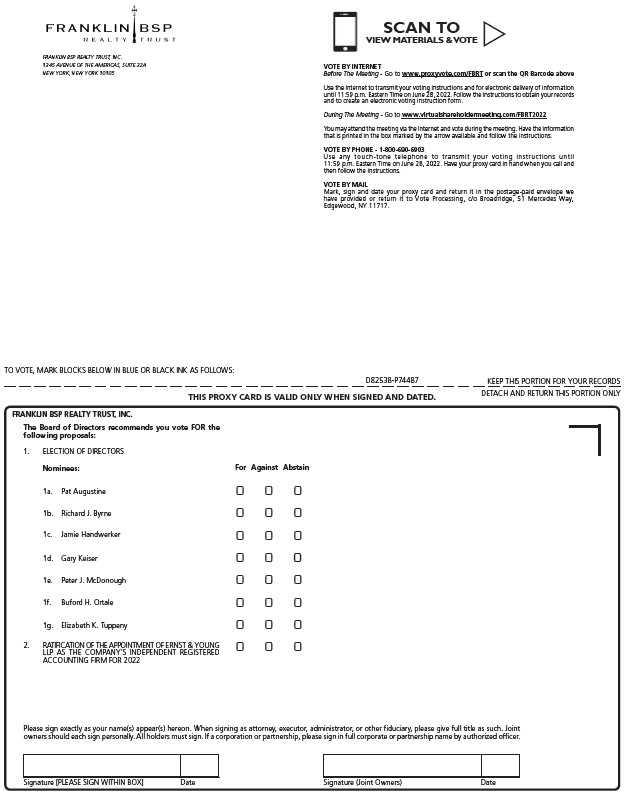

access, read and print copies of the proxy materials for this year’s Annual Meeting, including this Proxy Statement, form of proxy card, and annual report to stockholders, at the following website: www.proxyvote.com/FBRT.

You can request a paper or electronic copy of the proxy materials, free of charge:

| • |

|

via Internet, at www.proxyvote.com/FBRT; |

| • |

|

via telephone, at (800) 579-1639; or |

| • |

|

via e-mail, at sendmaterial@proxyvote.com. |

We also file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any reports, statements or other

information we file with the SEC on the web site maintained by the SEC at www.sec.gov.

|

|

|

|

|

| FRANKLIN BSP REALTY TRUST |

|

5 |

|

2022 PROXY STATEMENT |