|

Pricing Supplement No. ETN-20/A13†

To the Prospectus Supplement dated June 18, 2020 and

the Prospectus dated June 18, 2020 |

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-238458-02

May 20, 2022 |

16,339,800* Credit Suisse X-Links® Crude Oil Shares Covered Call ETNs due April 24, 2037** |

General

| • | The exchange traded notes (“ETNs”)

are designed for investors who seek a return linked to the performance of the price return version of the Credit Suisse Nasdaq WTI Crude

Oil FLOWSTM 106 Index (the “Index”). The Index measures the return of a “covered call” strategy

on the shares of the United States Oil Fund® (the

“Oil Fund”, and such shares the “Reference Oil Shares”) by reflecting changes in the price of the

Reference Oil Shares and the notional option premiums received from the notional sale of monthly call options on the Reference Oil Shares

less the Notional Transaction Costs incurred in connection with the implementation of the covered call strategy (as described below).

|

| • | The ETNs track the performance of the Index, as reflected by their Indicative Value, calculated as set

forth below. |

| • | The ETNs do not guarantee any return of your investment. If the Index declines, investors should be willing

to lose up to 100% of their investment. Any payment on the ETNs is subject to our ability to pay our obligations as they become due. |

| • | The ETNs will pay a variable monthly Coupon Amount based on the notional option premiums received from

the sale of monthly call options on the Reference Oil Shares, as described in this pricing supplement. Since the monthly Coupon Amount

is uncertain and could be zero, investors should not expect to receive regular periodic interest payments. |

| • | The ETNs are senior unsecured obligations of Credit Suisse AG, acting through its Nassau Branch, maturing

April 24, 2037, unless the maturity is extended at our option, as described below.** |

| • | An investment in the ETNs involves significant risks and is not appropriate for every investor. The ETNs

are intended for investors who are familiar with covered call strategies and the risks associated with options and options transactions.

Accordingly, the ETNs should be purchased only by knowledgeable investors who understand the potential consequences of investing in the

Index which implements a covered call strategy on Reference Oil Shares. Investors should consider their investment horizon as well as

potential transaction costs when evaluating an investment in the ETNs and should regularly monitor their holdings of the ETNs to ensure

that they remain consistent with their investment strategies. |

| • | The denomination and stated principal amount of each ETN is $25.00. ETNs may be issued at a price that

is higher or lower than the stated principal amount, based on the Indicative Value of the ETNs at that time. |

| • | The initial issuance of ETNs priced on April 25, 2017 (the “Inception Date”) and settled

on April 28, 2017 (the “Initial Settlement Date”). |

| • | The ETNs are subject to early redemption or acceleration, as described under “Specific Terms of

the ETNs—Payment Upon Early Redemption” and “—Optional Acceleration” in this pricing supplement. Accordingly,

you should not expect to be able to hold the ETNs to maturity. |

| • | The ETNs are subject to a Daily Investor Fee based on an annual Investor Fee Rate of 0.85%. |

| • | The Index is subject to Notional Transactional Costs which reflect the monthly transaction costs of hypothetically

buying and selling the call options and selling the Reference Oil Shares and equal 0.03%, 0.03% and 0.01%, respectively, times

the closing price of the Reference Oil Shares on the date of such notional transactions. On an annual basis, such transaction costs are

expected to be approximately 0.84%. The actual cost will vary depending on the value of the Reference Oil Shares on the date of such transactions. |

| • | The ETNs are listed on the NASDAQ exchange under the ticker symbol “USOI”. As long

as an active secondary market in the ETNs exists, we expect that investors will purchase and sell the ETNs primarily in this secondary

market. We have no obligation to maintain any listing on any exchange or quotation system. Under certain circumstances, the ETNs may be

subject to delisting by NASDAQ. We have not and do not intend to list the ETNs on any other exchange. |

| • | No PRIIPs or UK PRIIPs key information document (KID) has been prepared as the ETNs are not available

to retail investors in the European Economic Area or the United Kingdom. |

Investing in the ETNs involves significant

risks not associated with an investment in conventional debt securities. See “Risk Factors” in this pricing supplement.

Neither the Securities

and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these ETNs or passed upon

the accuracy or the adequacy of this pricing supplement or the accompanying prospectus supplement and the prospectus. Any representation

to the contrary is a criminal offense.

† This amended and restated

pricing supplement amends, restates and supersedes pricing supplement No. ETN-20/A12 dated March 23, 2022 (together with any previous

supplements or amendments) in its entirety. We refer to this amended and restated pricing supplement as the “pricing supplement”.

* Reflects the number of ETNs offered hereby.

“X-Links®” is a registered trademark of Credit Suisse Securities (USA) LLC (“CSSU”). As of May

17, 2022, there were 60,365,200 ETNs ($1,509,130,000 in stated principal amount) issued and outstanding. Additional ETNs may be issued

and sold from time to time through our affiliate CSSU (as defined below) and through one or more dealers purchasing as principal through

CSSU at a price that is higher or lower than the stated principal amount, based on the Indicative Value of the ETNs at that time. Sales

of the ETNs will be made at market prices prevailing at the time of sale, at prices related to market prices or at negotiated prices.

We expect to receive proceeds equal to 100% of the issue price to the public of the ETNs we issue and sell after the Inception Date, less

any commissions paid to CSSU or any other agent. Delivery of the ETNs in book-entry form only will be made through The Depository Trust

Company (“DTC”). However, we are under no obligation to issue or sell additional ETNs at any time, and if we do issue

and sell additional ETNs, we may limit or restrict such sales, including by adding conditions on such additional issuances and sales at

our sole discretion, and we may stop and subsequently resume selling additional ETNs at any time. If we limit, restrict or stop selling

additional ETNs or if we subsequently resume sales of such additional ETNs, the trading price and liquidity of the ETNs in the secondary

market could be materially and adversely affected.

** The scheduled Maturity Date is April 24, 2037,

but the maturity of the ETNs may be extended at our option for up to two (2) additional five-year periods, as described herein.

We sold a portion of the ETNs on the Inception

Date and received proceeds equal to 100% of their stated principal amount as of the Inception Date. The agent for this offering, CSSU,

is our affiliate. In exchange for providing certain services relating to the distribution of the ETNs, CSSU, a member of the Financial

Industry Regulatory Authority (“FINRA”), or another FINRA member may receive all or a portion of the Daily Investor

Fee. In addition, CSSU will charge investors an Early Redemption Charge per ETN of 0.125% times the Closing Indicative Value on the Early

Redemption Valuation Date on each ETN that is redeemed at the investor’s option. CSSU and its affiliates may also profit from hedging

activity related to these offerings, even if the value of the ETNs declines. Please see “Supplemental Plan of Distribution (Conflicts

of Interest)” in this pricing supplement for more information.

The ETNs are not deposit liabilities and are not

insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States, Switzerland

or any other jurisdiction.

Credit Suisse

May 20, 2022

Key Terms

| Issuer: |

Credit Suisse AG (“Credit Suisse”), acting through its Nassau Branch. |

| Index: |

The return on the ETNs is based on the performance of the price return version

of the Credit Suisse Nasdaq WTI Crude Oil FLOWSTM 106 Index (the “Index”), as reflected by their Indicative

Value, calculated as set forth below. The Index is reported on Bloomberg under ticker symbol “QUSOI <Index>”.

The

Index measures the return of a “covered call” strategy on the shares of the United States Oil Fund®

(the “Oil Fund”, and such shares the “Reference Oil

Shares”) (Bloomberg ticker symbol “USO UP <Equity>“) by reflecting changes in the price of the Reference Oil

Shares and the notional option premiums received from the notional sale of monthly call options on the Reference Oil Shares less notional

costs incurred in connection with the implementation of the covered call strategy (the “Notional Transaction Costs”).

The Notional Transaction Costs reflect the monthly transaction costs of hypothetically buying and selling the call options and selling

the Reference Oil Shares and equal 0.03%, 0.03% and 0.01%, respectively, times the closing price of the Reference Oil Shares on

the date of such notional transactions and, which, on an annual basis, are expected to be approximately 0.84%. The actual cost will vary

depending on the value of the Reference Oil Shares on the date of such transactions. The Index strategy consists of a hypothetical notional

portfolio that takes a “long” position in Reference Oil Shares and sells a succession of notional, approximately one-month,

call options on the Reference Oil Shares with a strike price of approximately 106% of the price of the Reference Oil Shares exercisable

on the option expiration date (the “Options” and together with the long position in Reference Oil Shares, the “Index

Components”). The notional sale of the Options is “covered” by the notional long position in the Reference Oil Shares.

The long position in the Reference Oil Shares and the “short” call options are held in equal notional amounts (i.e., the short

position in each Option is “covered” by the long position in the Reference Oil Shares). This strategy is intended to provide

exposure to West Texas Intermediate light sweet crude oil (“WTI crude oil”) futures contract prices through the notional

positions in the Reference Oil Shares and the Options that together seek to (i) generate periodic cash flows that a direct long-only ownership

position in the Reference Oil Shares would not, (ii) provide a limited offset to losses from downside market performance in the Reference

Oil Shares via the cash flows from option premiums and (iii) provide limited potential upside participation in the performance of the

Reference Oil Shares. The level of the Index on any day reflects the value of (i) the notional long position in the Reference Oil Shares;

(ii) the notional Option premium; and (iii) the notional short position in the Options then outstanding; net of the Notional Transaction

Costs. The ETNs will not participate in the potential upside of the Reference Oil Shares beyond the applicable strike price of the Options

and the level of the Index will be reduced by the Notional Transaction Costs. For more information on the Index, see “The Index”

in this pricing supplement. The Index is subject to the policies of the Index Sponsor and is subject to the Index Sponsor’s discretion,

including with respect to the implementation of, and changes to, the rules governing the Index methodology. |

| Index Sponsors: |

CSi and Nasdaq, Inc. |

| CUSIP | ISIN Number: |

22539T266 / US22539T2666 |

| Payment at Maturity: |

If your ETNs have not previously been redeemed

or accelerated, at maturity you will receive for each $25.00 stated principal amount of your ETNs a cash payment equal to the “Final

Indicative Value”, equal to the arithmetic average, as determined by the Calculation Agent, of the Closing Indicative Values

of such ETNs during the Final Valuation Period (the “Payment at Maturity”). The “Final Valuation Period”

shall be a period of five (5) consecutive Trading Days ending on and including the “Final Valuation Date”, which is

initially April 21, 2037, subject to extension as described below under “Valuation Date” and postponement as a result of a

Market Disruption Event as described under “Specific Terms of the ETNs—Market Disruption Events”. Any payment on the

ETNs is subject to our ability to pay our obligations as they become due. In no event will the Payment at Maturity be less than zero.

(Key Terms continued on next page) |

| Valuation Date: |

Any Trading Day in the Final Valuation Period or the Accelerated Valuation Period and any Early Redemption Valuation Date, as applicable.*** If we exercise our option to extend the maturity of the ETNs (as described below), the Final Valuation Date for the ETNs will be the third scheduled Business Day prior to the scheduled Maturity Date, as extended. |

| Closing Indicative Value: |

The Closing Indicative Value on the Inception

Date was equal to $25.00 (the “Initial Indicative Value”).

The “Closing Indicative Value”

on each calendar day following the Inception Date will be calculated by the Index Calculation Agent and will be equal to (1) the Current

Principal Amount for such calendar day plus (2) for any day on or after the Index Distribution Date but prior to the Ex-Coupon

Date for a given month, any accrued but unpaid Coupon Amount.

The Closing Indicative Value will never be less

than zero. If the Intraday Indicative Value of the ETNs is equal to or less than zero at any time or the Closing Indicative Value is equal

to zero on any Trading Day, the Closing Indicative Value of the ETNs on that day, and all future days, will be zero. The Closing Indicative

Value is not the same as the closing price or any other trading price of the ETNs in the secondary market. The trading price of the ETNs

at any time may vary significantly from their Indicative Value at such time. See “Description of the ETNs”. If the ETNs undergo

a split or reverse split, the Closing Indicative Value (including the Current Principal Amount) of the ETNs will be adjusted accordingly

(see “Description of the ETNs—Split or Reverse Split of the ETNs” in this pricing supplement). Even if the Closing Indicative

Value or Intraday Indicative Value is equal to or less than zero at any time, the trading price of the ETNs may remain above zero. Buying

the ETNs at such a time will lead to a complete loss of your investment. See “Risk Factors—Risks Relating to the Return on

the ETNs—If the Intraday Indicative Value is equal to or less than zero at any time or the Closing Indicative Value is equal to

zero on any Trading Day, you will lose all of your investment”.

The Closing Indicative Value for the ETNs on

May 17, 2022 was $5.7572 and the closing price on May 17, 2022 on the NASDAQ (ticker symbol “USOI”) was $5.77.

The Closing Indicative Value of the ETNs is not

the closing price or any other trading price of the ETNs in the secondary market. The trading price of the ETNs at any time may vary significantly

from the Indicative Value of the ETNs at such time. See “Risk Factors—Risks Relating to the Return on the ETNs—The Intraday

Indicative Value and the Closing Indicative Value are not the same as the closing price or any other trading price of the ETNs in the

secondary market” and “Risk Factors—Risks Relating to the Return on the ETNs—The ETNs may trade at a substantial

premium to or discount from the Closing Indicative Value and/or Intraday Indicative Value” in this pricing supplement. |

| Current Principal Amount: |

The “Current Principal Amount” on each calendar day following the Inception Date will be equal to (1)(a) the Current Principal Amount on the immediately preceding calendar day times (b) the Daily Index Factor on such calendar day minus (2) the Daily Investor Fee on such calendar day. The Current Principal Amount on the Inception Date was $25.00. |

| |

*** Any Valuation Date is subject to postponement if such date is not a Trading Day or as a result of a Market Disruption Event; any Valuation Date in the Final Valuation Period or the Accelerated Valuation Period is subject to postponement if a preceding Valuation Date in the Final Valuation Period or the Accelerated Valuation Period is postponed; the Maturity Date will be postponed if the scheduled Maturity Date is not a Business Day or if the scheduled Final Valuation Date is not a Trading Day or if a Market Disruption Event occurs or is continuing on the scheduled Final Valuation Date; any Early Redemption Date will be postponed if such date is not a Business Day or a Market Disruption Event occurs or is continuing on the corresponding Early Redemption Valuation Date; and the Acceleration Date will be postponed if the last scheduled Valuation Date in the Accelerated Valuation Period is postponed, as described herein under “Specific Terms of the ETNs—Market Disruption Events”. No interest or additional payment will accrue or be payable as a result of any postponement of any Valuation Date, the Maturity Date, any Early Redemption Date or the Acceleration Date, as applicable. |

(Key Terms continued on next page)

| Intraday Indicative Value: |

The “Intraday Indicative Value”

of the ETNs will be calculated and published by the Index Calculation Agent every fifteen (15) seconds on each Trading Day during normal

trading hours so long as no Market Disruption Event has occurred or is continuing and will be disseminated over the consolidated tape

or other major market data vendor. The Intraday Indicative Value at any time is based on the most recent intraday level of the Index.

It is calculated using the same formula as the Closing Indicative Value, except that instead of using the Closing Level of the Index,

the calculation is based on the most recent reported level of the Index at the particular time (or, if the day on which such time occurs

is not a Trading Day, as determined by the Calculation Agent). If the Intraday Indicative Value of the ETNs is equal to or less than zero

at any time or the Closing Indicative Value is equal to zero on any Trading Day, the Closing Indicative Value of the ETNs on that day,

and all future days, will be zero. See “Description of the ETNs—Intraday Indicative Value” in this pricing supplement.

The Intraday Indicative Value is a calculated

value and is not the same as the trading price of the ETNs, nor is it a price at which you can buy or sell the ETNs in the secondary market.

The Intraday Indicative Value does not take into account the factors that influence the trading price of the ETNs, such as, among other

things, imbalances of supply and demand, lack of liquidity, transaction costs, credit considerations and bid-offer spreads. Because the

Intraday Indicative Value is based on the intraday levels of the Index, however, it will reflect lags and other disruptions and suspensions

that affect the Index. See “Risk Factors—Risks Relating to the Return on the ETNs—The Intraday Indicative Value and

the Closing Indicative Value are not the same as the closing price or any other trading price of the ETNs in the secondary market”

and “Risk Factors—Risks Relating to the Return on the ETNs—The ETNs may trade at a substantial premium to or discount

from the Closing Indicative Value and/or Intraday Indicative Value” in this pricing supplement. |

| Indicative Value: |

The Indicative Value of the ETNs is the Intraday

Indicative Value or the Closing Indicative Value of the ETNs, as applicable.

The “Indicative Value” for the ETNs

is designed to reflect the economic value of the ETNs at a given time. The Indicative Value is a calculated value and is not the same

as the trading price of the ETNs and is not a price at which you can buy or sell the ETNs in the secondary market. The Indicative Value

does not take into account the factors that influence the trading price of the ETNs, such as imbalances of supply and demand, lack of

liquidity and credit considerations. The actual trading price of the ETNs in the secondary market may vary significantly from their

Indicative Value. |

| Indicative Value Ticker Symbol of the ETNs: |

The Intraday Indicative Value and the Closing Indicative Value will be calculated by the Index Calculation Agent referred to below and published on each Trading Day under the Bloomberg ticker symbol “USOIIV” and may also be calculated and published by other sources. The publishing of such values by the Index Calculation Agent or by others is subject to delay or postponement and published values may be inaccurate as a result of miscalculations, human error, or systems and technology errors. Credit Suisse does not (i) guarantee the completeness or accuracy of any published Indicative Value, (ii) make any representation or warranty with regard to any published Indicative Value, or (iii) assume responsibility for losses or damages arising out of your use of any published Indicative Value or any subsequent corrections or amendments to any published Indicative Value. |

| |

Investors can compare the trading price (if such concurrent trading price is available) of the ETNs against the Indicative Value to determine whether the ETNs are trading in the secondary market at a premium or a discount to the economic value of the ETNs at any given time. Investors are cautioned that paying a premium purchase price over the Indicative Value at any time could lead to the loss of any premium in the event the investor sells the ETNs when such premium has declined or is no longer present in the market place or at maturity or upon early redemption or acceleration. It is also possible that the ETNs will trade in the secondary market at a discount below the Indicative Value and that investors would receive less than the Indicative Value if they had to sell their ETNs in the market at such time. |

| Calculation Agent: |

Credit Suisse International (“CSi”). |

| Index Calculation Agent: |

Nasdaq, Inc. |

| Daily Index Factor: |

The “Daily Index Factor” on

any Index Business Day will equal (a) the Closing Level of the Index on such Index Business Day divided by (b) the Closing Level

of the Index on the immediately preceding Index Business Day. The Daily Index Factor is deemed to be one on any day that is not an Index

Business Day.

(Key Terms continued on next page) |

| Daily Investor Fee: |

On any calendar day, the “Daily Investor

Fee” will be equal to the product of (1)(a) the Current Principal Amount on the immediately preceding calendar day times

(b) the Daily Index Factor on such calendar day times (2)(a) the Investor Fee Rate divided by (b) 365. The “Investor

Fee Rate” will be equal to 0.85%.

The Daily Investor Fee reduces the Indicative

Value of the ETNs and the amount of your payment at maturity or upon early redemption or acceleration, and therefore the level of the

Index must increase by an amount sufficient to offset the Daily Investor Fee (and the Early Redemption Charge, if you offer your ETNs

for early redemption) in order for you to receive at least your investment in the ETNs at maturity or upon early redemption or acceleration.

If the level of the Index decreases or does not increase sufficiently to offset the Daily Investor Fee (and in the case of early redemption,

the Early Redemption Charge) over the term of the ETNs, you will receive less, and possibly significantly less, at maturity or upon early

redemption or acceleration of the ETNs than the amount of your investment. |

| Closing Level: |

The “Closing Level” of the Index on any Trading Day will be the closing level published on Bloomberg under the ticker symbol “QUSOI <Index>” or any successor page on Bloomberg or any successor service, as applicable; provided that in the event a Market Disruption Event exists on a Valuation Date, the Calculation Agent will determine the Closing Level of the Index for such Valuation Date, if necessary, as described below in “Specific Terms of the ETNs—Market Disruption Events”. |

| Coupon Amount: |

On each Coupon Payment Date, for each $25.00 stated principal amount of the ETNs, you will be entitled to receive a variable cash payment equal to the Closing Indicative Value on the Index Business Day immediately preceding the relevant Index Distribution Date multiplied by the Coupon Percentage for that Index Distribution Date (the “Coupon Amount”. No Coupon Amount will be due or payable in the event you elect to offer your ETNs for early redemption or we accelerate the maturity of the ETNs. The initial Index Distribution Date was May 15, 2017 and the initial Coupon Payment Date was May 25, 2017. |

| Coupon Percentage; Distribution: |

The “Coupon Percentage” in respect of an Index Distribution Date will be the Distribution for such Index Distribution Date divided by the Closing Level of the Index on the Index Business Day immediately preceding the Index Distribution Date. The “Distribution” represents the notional monthly call premium earned on the sale of the call options written on the Reference Oil Shares during the immediately preceding Index Rebalancing Period pursuant to the Index methodology described in this pricing supplement. |

| Index Distribution Date: |

The date on which the Distribution is subtracted from the level of the Index pursuant to the rules of the Index, which will occur on the last Roll Date of a given Index Rebalancing Period. The initial Index Distribution Date was May 15, 2017. |

| Coupon Payment Date: |

The later of (a) the 25th day of each calendar month, provided that, if such day is not a Business Day, the Coupon Amount will be paid on the first following Business Day, unless the first following Business Day is in the next calendar month, in which case the Coupon Amount will be paid on the immediately preceding day that is a Business Day, and (b) the day that is six (6) Business Days following the Index Distribution Date; provided that, in the event that any adjustment is made to the Coupon Payment Date, the relevant Coupon Amount shall not be affected by such adjustment and no additional amount will accrue or be payable in respect of such originally scheduled Coupon Payment Date. The initial Coupon Payment Date was May 25, 2017. |

| Coupon Record Date: |

With respect to each Coupon Payment Date, the third scheduled Business Day prior to such Coupon Payment Date. |

| Ex-Coupon Date: |

With respect to each Coupon Amount, the first Trading Day on which the ETNs trade without the right to receive such Coupon Amount. |

| Splits; Reverse Splits: |

If the ETNs undergo a split or reverse split,

the Current Principal Amount, Closing Indicative Value and Intraday Indicative Value of the ETNs will be adjusted accordingly (see “Description

of the ETNs—Split or Reverse Split of the ETNs” in this pricing supplement).

Neither the Closing Indicative Value nor the

Intraday Indicative Value is the same as the closing price or any other trading price of the ETNs in the secondary market. The trading

price of the ETNs at any time may vary significantly from the Closing Indicative Value and Intraday Indicative Value of the ETNs at such

time.

(Key Terms continued on next page)

|

| Secondary Market: |

The ETNs are listed on the NASDAQ exchange under the ticker symbol “USOI”. As long as an active secondary market in the ETNs exists, we expect that investors will purchase and sell the ETNs primarily in this secondary market. We have no obligation to maintain any listing on any exchange or quotation system. Under certain circumstances, the ETNs may be subject to delisting by NASDAQ. We have not and do not intend to list the ETNs on any other exchange. No PRIIPs or UK PRIIPs key information document (KID) has been prepared as the ETNs are not available to retail investors in the European Economic Area or the United Kingdom. |

| Early Redemption: |

You may, subject to certain restrictions described below, offer at least the applicable minimum number of your ETNs to us for redemption on an Early Redemption Date during the term of the ETNs until April 14, 2037 (or, if the maturity of the ETNs is extended, five (5) scheduled Trading Days prior to the scheduled Final Valuation Date, as extended). Notwithstanding the foregoing, we will not accept a Redemption Notice submitted to us on any day after the Trading Day preceding the start of the Accelerated Valuation Period related to the acceleration of all outstanding ETNs. If you elect to offer your ETNs for redemption, and the requirements for acceptance by us are met, you will be entitled to receive a cash payment per ETN on the Early Redemption Date equal to the Early Redemption Amount. Any payment on the ETNs is subject to our ability to pay our obligations as they become due. |

| |

You must offer for redemption at least 50,000 ETNs

at one time in order to exercise your right to cause us to redeem your ETNs on any Early Redemption Date (the “Minimum Redemption

Amount”); provided that we or CSi, as the Calculation Agent, may from time to time reduce, in whole or in part, the Minimum

Redemption Amount. Any such reduction will be applied on a consistent basis for all holders of the ETNs at the time the reduction becomes

effective. If the ETNs undergo a split or reverse split, the minimum number of ETNs needed to exercise your right to cause us to redeem

your ETNs will remain the same.

Because the Early Redemption Amount you will receive

for each ETN will not be determined until the close of trading on the applicable Early Redemption Valuation Date, you will not know the

applicable Early Redemption Amount at the time you exercise your redemption right and will bear the risk that your ETNs will decline in

value between the time of your exercise and the time at which the Early Redemption Amount is determined. |

| Early Redemption Mechanics: |

You may exercise your early redemption right by causing your broker or other person with whom you hold your ETNs to deliver a Redemption Notice (as defined herein) to Credit Suisse. If your Redemption Notice is delivered prior to 4:00 p.m. New York City time, on any Business Day, the immediately following Trading Day will be the applicable “Early Redemption Valuation Date”. Otherwise, the second following Trading Day will be the applicable Early Redemption Valuation Date. See “Specific Terms of the ETNs—Procedures for Early Redemption” in this pricing supplement. |

| Early Redemption Date: |

The third Business Day following an Early Redemption Valuation Date.*** |

| Early Redemption Amount: |

A cash payment per ETN equal to the greater of (A) zero and (B)(1) the Closing Indicative Value on the applicable Early Redemption Valuation Date minus (2) the Early Redemption Charge. |

| Early Redemption Charge: |

The “Early Redemption Charge” per ETN will equal 0.125% times the Closing Indicative Value on the Early Redemption Valuation Date. |

| Optional Acceleration: |

On any Business Day on or after May 9, 2017, we have the right to accelerate all, but not less than all, of the issued and outstanding ETNs (an “Optional Acceleration”). Upon an Optional Acceleration, you will be entitled to receive a cash payment per ETN in an amount (the “Accelerated Redemption Amount”) equal to the arithmetic average, as determined by the Calculation Agent, of the Closing Indicative Values of such ETNs during the Accelerated Valuation Period. |

| |

The “Accelerated Valuation Period” shall be a period of five (5) consecutive Trading Days specified in our notice of Optional Acceleration, the first Trading Day of which shall be at least two (2) Business Days after the date on which we give notice of such Optional Acceleration. The Accelerated Redemption Amount will be payable on the third Business Day following the last Trading Day in the Accelerated Valuation Period (such payment date the “Acceleration Date”). We will give notice of any Optional Acceleration of the ETNs through customary channels used to deliver notices to holders of exchange traded notes. |

| Trading Day: |

A day which is (i) an Index Business Day, (ii) an ETN Business Day and (iii) an Index Component Business Day for each of the Index Components. |

| Index Business Day: |

A day on which the level of the Index is calculated and published. |

| Index Component Business Day: |

With respect to any Index Component, a day on which trading is generally conducted on any markets on which such Index Component is traded. |

| ETN Business Day: |

A day on which trading is generally conducted on the New York Stock Exchange, NYSE Arca and NASDAQ. |

| Business Day: |

A Monday, Tuesday, Wednesday, Thursday or Friday that is not a day on which banking institutions in New York City or London, England generally are authorized or obligated by law, regulation or executive order to close. |

TABLE OF CONTENTS

You should read this pricing

supplement together with the accompanying prospectus supplement dated June 18, 2020 and the prospectus dated June 18, 2020, relating to

our Medium-Term Notes of which these ETNs are a part. This pricing supplement amends, restates, and supersedes pricing supplement No.

ETN-20/A12 dated March 23, 2022 (together with any previous supplements or amendments) in its entirety. You should rely only on the information

contained or incorporated by reference in this pricing supplement No. ETN-20/A13 and the documents listed below in making your decision

to invest in the ETNs. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by

reviewing our filings for the relevant date on the SEC website):

Prospectus supplement

and prospectus dated June 18, 2020:

https://www.sec.gov/Archives/edgar/data/1053092/000110465920074474/tm2019510-8_424b2.htm

Our Central Index Key,

or CIK, on the SEC website is 1053092.

This pricing supplement,

together with the documents listed above, contains the terms of the ETNs and supersedes all other prior or contemporaneous oral statements

as well as any other written materials, including preliminary or indicative pricing terms, fact sheets, correspondence, trade ideas, structures

for implementation, sample structures, brochures or other educational materials of ours. We may, without the consent of the registered

holder of the ETNs and the owner of any beneficial interest in the ETNs, amend the ETNs to conform to its terms as set forth in this pricing

supplement and the documents listed above, and the trustee is authorized to enter into any such amendment without any such consent. You

should carefully consider, among other things, the matters set forth in “Risk Factors” in this pricing supplement, “Foreign

Currency Risks” in the accompanying prospectus, and any risk factors we describe in the combined Annual Report on Form 20-F of Credit

Suisse Group AG and us incorporated by reference therein, and any additional risk factors we describe in future filings we make with the

SEC under the Securities Exchange Act of 1934, as amended, as the ETNs involve risks not associated with conventional debt securities.

You should consult your investment, legal, tax, accounting and other advisers before deciding to invest in the ETNs. You should rely only

on the information contained in this document or in any documents to which we have referred you. We have not authorized anyone to provide

you with information that is different. This document may only be used where it is legal to sell these ETNs. The information in this document

may only be accurate on the date of this document.

The distribution of this

pricing supplement and the accompanying prospectus supplement and prospectus and the offering of the ETNs in some jurisdictions may be

restricted by law. If you possess this pricing supplement, you should find out about and observe these restrictions.

PRIIPS REGULATION / PROHIBITION

OF SALES TO EEA RETAIL INVESTORS:

The ETNs are not intended

to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor

in the European Economic Area (“EEA”). For these purposes, a retail investor means a person who is one (or more) of:

(i) a retail client

as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or

(ii) a customer within

the meaning of Directive (EU) 2016/97 (as amended, the “Insurance Distribution Directive”), where that customer would not

qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or

(iii) not a qualified

investor as defined in Regulation (EU) 2017/1129 (as amended, the “Prospectus Regulation”). Consequently no key information

document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the ETNs or

otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the ETNs or otherwise

making them available to any retail investor in the EEA may be unlawful under the PRIIPS Regulation.

UK PRIIPS REGULATION / PROHIBITION

OF SALES TO UK RETAIL INVESTORS:

The ETNs are not intended

to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor

in the United Kingdom (“UK”). For these purposes, a retail investor means a person who is one (or more) of:

(i) a retail client,

as defined in point (8) of Article 2 of Regulation (EU) no 2017/565 as it forms part of domestic law by virtue of the European Union (Withdrawal)

Act 2018 (“EUWA”);

(ii) a customer within

the meaning of the provisions of the UK Financial Services and Markets Act 2000 (“FSMA”) and any rules or regulations made

under the FSMA to implement the Insurance Distribution Directive, where that customer would not qualify as a professional client, as defined

in point (8) of Article 2(1) of Regulation (EU) no 600/2014 as it forms part of domestic law by virtue of the EUWA; or

(iii) not a qualified

investor as defined in Article 2 of the Prospectus Regulation as it forms part of domestic law by virtue of the EUWA. Consequently no

key information document required by the PRIIPs Regulation as it forms part of domestic law by virtue of the EUWA (the “UK PRIIPs

Regulation”) for offering or selling the ETNs or otherwise making them available to retail investors in the UK has been prepared

and therefore offering or selling the ETNs or otherwise making them available to any retail investor in the UK may be unlawful under the

UK PRIIPs Regulation.

The ETNs are currently

listed on the NASDAQ under the ticker symbol “USOI”. As long as an active secondary market in the ETNs exists, we expect that

investors will purchase and sell the ETNs primarily in this secondary market. Although the ETNs are currently listed on the NASDAQ, a

trading market for your ETNs may not continue for the term of the ETNs. We have no obligation to maintain any listing on the NASDAQ or

any other exchange or quotation system. Under certain circumstances, the ETNs may be subject to delisting by the NASDAQ. We have not and

do not intend to list the ETNs on any other exchange. No PRIIPs or UK PRIIPs key information document (KID) has been prepared as the ETNs

are not available to retail investors in the EEA or the United Kingdom.

In this pricing supplement

and the accompanying prospectus supplement and prospectus, unless otherwise specified or the context otherwise requires, references to

“Credit Suisse”, the “Company”, “we”, “us” and “our” are to Credit Suisse

AG, acting through its Nassau Branch, and references to “dollars” and “$” are to United States dollars.

SUMMARY

The following is a summary

of terms of the ETNs, as well as a discussion of risks and other considerations you should take into account when deciding whether to

invest in the ETNs. References to the “prospectus” mean our accompanying prospectus, dated June 18, 2020, and references to

the “prospectus supplement” mean our accompanying prospectus supplement, dated June 18, 2020.

We may, without providing

you notice or obtaining your consent, create and issue ETNs in addition to those offered by this pricing supplement having the same terms

and conditions as the ETNs. We may consolidate the additional ETNs to form a single class with the outstanding ETNs. However, we are under

no obligation to issue or sell additional ETNs at any time, and if we do sell additional ETNs, we may limit or restrict such sales, including

by adding conditions on such additional issuances and sales at our sole discretion, and we may stop and subsequently resume selling additional

ETNs at any time. If we limit, restrict or stop sales of such additional ETNs, or if we subsequently resume sales of such additional ETNs,

the trading price and liquidity of the ETNs in the secondary market could be materially and adversely affected. Unless we indicate otherwise,

if we suspend selling additional ETNs, we reserve the right to resume selling additional ETNs at any time, which might result in the reduction

or elimination of any premium in the trading price.

Additionally, a suspension

of additional issuances of the ETNs could result in a significant reduction in the number of outstanding ETNs if investors subsequently

exercise their right to have the ETNs redeemed by us. Accordingly, the number of outstanding ETNs could vary substantially over the term

of the ETNs and adversely affect the liquidity of the ETNs.

What are the ETNs and how do they work?

The ETNs are medium-term

notes of Credit Suisse AG (“Credit Suisse”), the return on which is linked to the performance of the price return version

of the Credit Suisse Nasdaq WTI Crude Oil FLOWSTM 106 Index (the “Index”), as reflected by their Indicative

Value.

The ETNs provide for a

variable monthly Coupon Amount based on the Index distribution of the notional premium received in connection with the notional sale of

the Options as described in this pricing supplement. Since the monthly Coupon Amount is uncertain and could be zero, investors should

not expect to receive regular periodic interest payments.

The ETNs do not have a

minimum payment at maturity or upon early redemption or acceleration and are fully exposed to any decline in the underlying Index. A decline

in the level of the Index will reduce the payment at maturity or upon early redemption or acceleration of your ETNs, and you could lose

your entire investment.

For a description of how

the Coupon Amount, payment at maturity or upon early redemption or acceleration is calculated, please refer to the “Specific Terms

of the ETNs—Coupon Amount,” “—Payment at Maturity,” “—Payment Upon Early Redemption” and

“—Optional Acceleration” sections in this pricing supplement.

The denomination and stated

principal amount of each ETN is $25.00. ETNs may be issued at a price that is higher or lower than the stated principal amount, based

on the Indicative Value of the ETNs at that time. You will not have the right to receive physical certificates evidencing your ownership

except under limited circumstances. Instead, we will issue the ETNs in the form of a global certificate, which will be held by DTC or

its nominee. Direct and indirect participants in DTC will record beneficial ownership of the ETNs by individual investors. Accountholders

in the Euroclear or Clearstream Banking clearance systems may hold beneficial interests in the ETNs through the accounts those systems

maintain with DTC. You should refer to the section “Description of Notes—Book-Entry, Delivery and Form” in the accompanying

prospectus supplement and the section “Description of Certain Provisions Relating to Debt Securities and Contingent Convertible

Securities—Book-Entry System” in the accompanying prospectus.

The ETNs may be subject

to a split or reverse split with a corresponding adjustment to the Closing Indicative Value, the Intraday Indicative Value, the Coupon

Amount(s) and the Payment at Maturity due with respect to each ETN which is subject to a split or reverse split. A split or reverse split

of the ETNs will not affect the aggregate stated principal amount of ETNs held by an investor, other than to the extent of any “partial”

ETNs, but it will affect the number of ETNs an investor holds, the Current Principal Amount, the denominations used for trading purposes

and the trading price, and may affect the liquidity, of the ETNs on the exchange. See “Description of the ETNs—Split or Reverse

Split of the ETNs”.

An investment in the ETNs

involves significant risks and is not appropriate for every investor. The ETNs are intended for investors who are familiar with covered

call strategies and the risks associated with options and options transactions. Accordingly, the ETNs should be purchased only by knowledgeable

investors who understand the potential consequences of investing in the Index which implements a covered call strategy on Reference Oil

Shares. Investors should consider their investment horizon as well as potential transaction costs when evaluating an investment in the

ETNs and should regularly monitor their holdings of the ETNs to ensure that they remain consistent with their investment strategies.

What is the Index and who publishes the

level of the Index?

The ETNs are linked to

the price return version of the Credit Suisse Nasdaq WTI Crude Oil FLOWSTM 106 Index. The level of the Index will be published

by Nasdaq, Inc., as Index Calculation Agent. See “The Index”.

The Index measures the

return of a “covered call” strategy on the Reference Oil Shares by reflecting changes in the price of the Reference Oil Shares

and the notional option premiums received from the notional sale of monthly call options on the Reference Oil Shares. The Index strategy

consists of a hypothetical notional portfolio that takes a “long” position in Reference Oil Shares and sells a succession

of notional, approximately one-month, call options on the Reference Oil Shares with a strike price of approximately 106% of the price

of the Reference Oil Shares exercisable on the option expiration date (the “Options” and, together with the long position

in Reference Oil Shares, the “Index Components”). The notional sale of the Options is “covered” by the

notional long position in the Reference Oil Shares. The long position in the Reference Oil Shares and the “short” call options

are held in equal notional amounts (i.e., the short position in each Option is “covered” by the long position in the Reference

Oil Shares).

This strategy is intended

to provide exposure to WTI crude oil futures contract prices through the notional positions in the Reference Oil Shares and the Options

that together seek to (i) generate periodic cash flows that a direct long-only ownership position in the Reference Oil Shares would not,

(ii) provide a limited offset to losses from downside market performance in the Reference Oil Shares via the cash flows from option premiums

and (iii) provide limited potential upside participation in the performance of the Reference Oil Shares. The level of the Index on any

day reflects the value of (i) the notional long position in the Reference Oil Shares; (ii) the notional Option premium; and (iii) the

notional short position in the Options then outstanding; net of the Notional Transaction Costs. The Index and, as a result, the ETNs will

not participate in the potential upside of the Reference Oil Shares beyond the applicable strike price of the Options. As a result, the

monthly appreciation of the Index is limited by the strike price of each Option during its term, which appreciation may be partially offset

by the Notional Transaction Costs in implementing the covered call strategy. The Notional Transaction Costs reflect the monthly transaction

costs of hypothetically buying and selling the call options and selling the Reference Oil Shares and equal 0.03%, 0.03% and 0.01%, respectively,

times the closing price of the Reference Oil Shares on the date of such notional transactions and, which, on an annual basis, are

expected to be approximately 0.84%. The actual cost will vary depending on the value of the Reference Oil Shares on the date of such transactions.

By contrast, the Index’s exposure to any decline in the price of the Reference Oil Shares is not limited. In addition, because the

notional Option premiums will be notionally distributed out of the Index each month (rather than being reinvested in the Index), the level

of the Index and the value of the ETNs should be expected to decline each month in connection with the Index Distribution and Coupon Amount.

The Index measures the

performance of the Index Components by incorporating the value of the option premiums deemed received from selling notional call options

on the Reference Oil Shares, which value is paid to holders of the ETNs in the form of a variable monthly Coupon Amount based on the Index

distribution of the notional premium received in connection with the sale of the Options. The premiums generated from the notional sales

of the Options will be subtracted monthly from the Index at the end of the following roll period and paid to holders of the ETNs in the

form of a Coupon Amount.

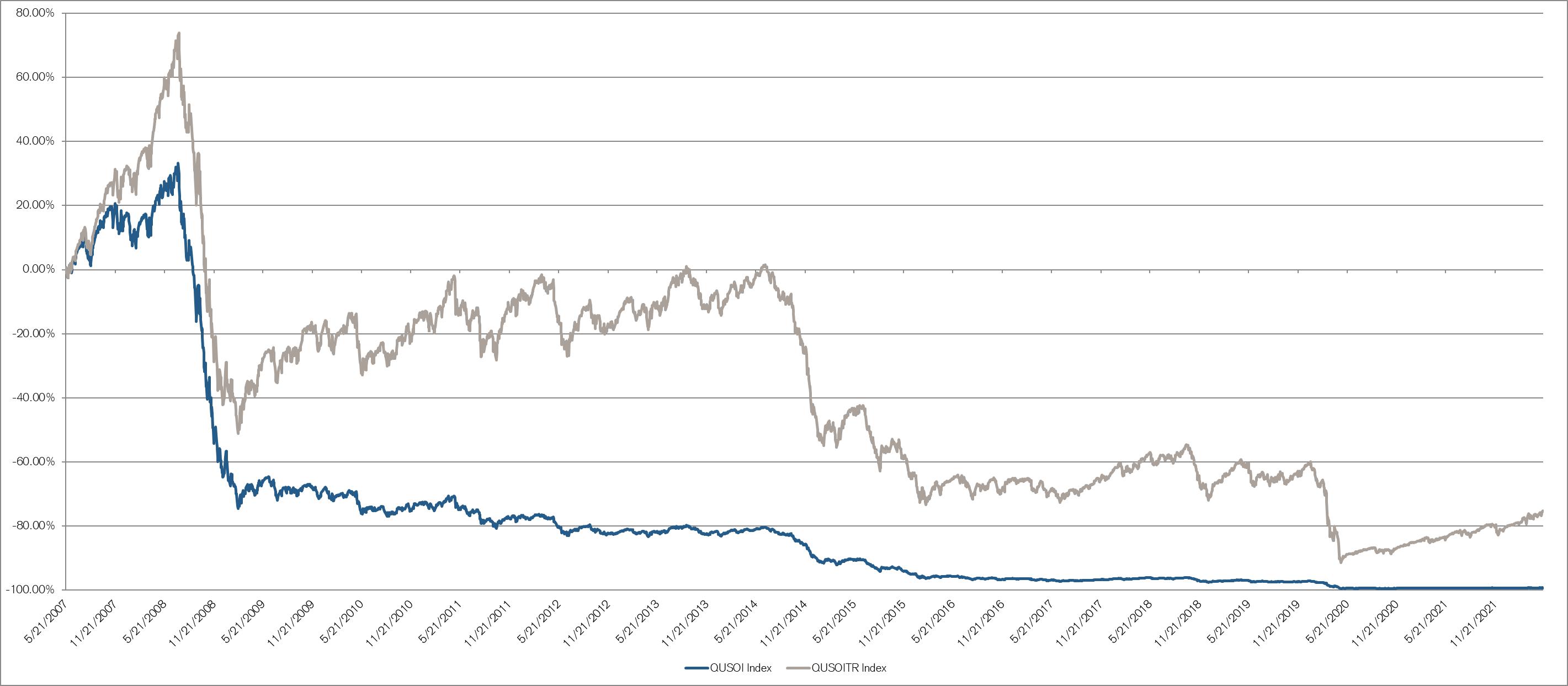

The rules for the Index

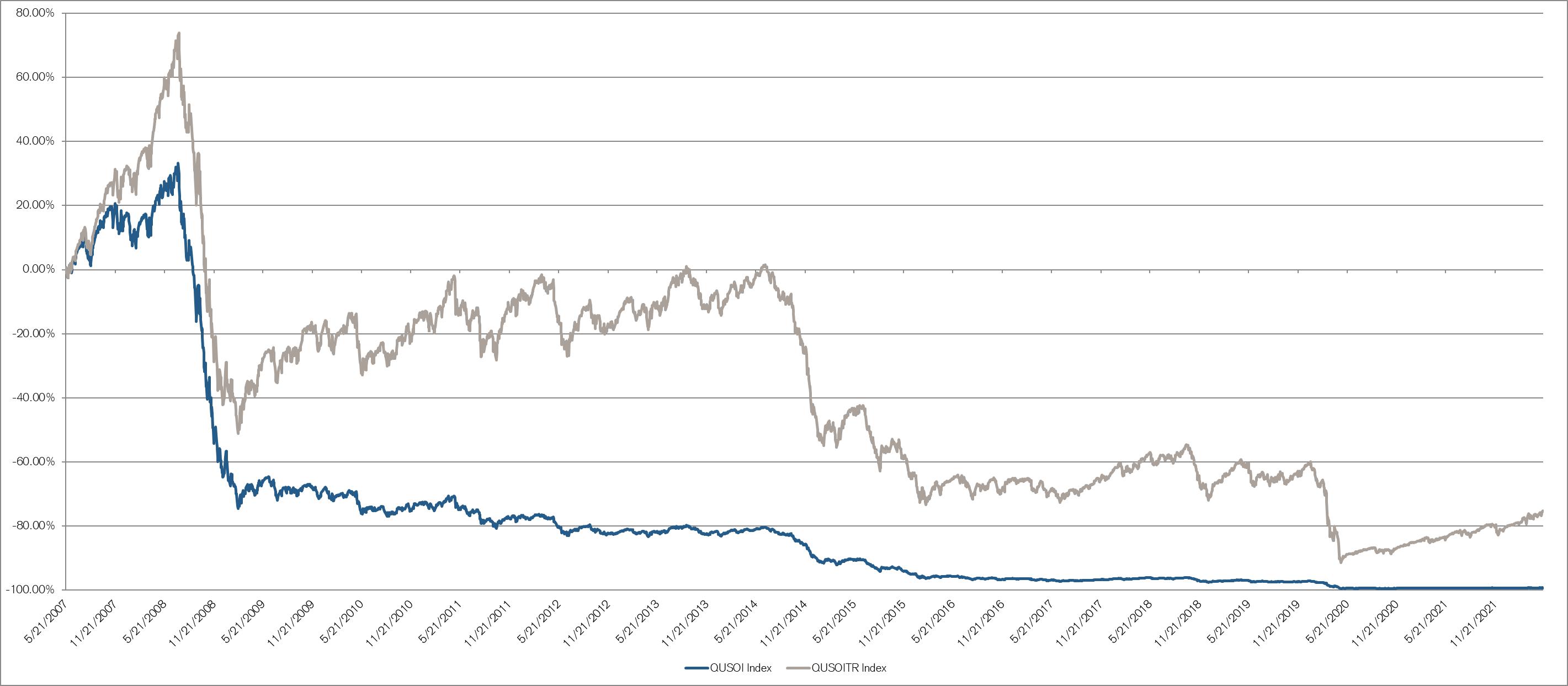

were developed by CSi and Nasdaq, Inc.(the “Index Sponsors”). The Index was established on September 26, 2016 (the

“Index Inception Date”) with a base date of May 21, 2007 (the “Index Base Date”) and a base value

of 10,000.

Nasdaq, Inc., or another

party designated by the Index Sponsors, will act as the index calculation agent (the “Index Calculation Agent”) and

will be responsible for the calculation of the level of the Index, using the data and methodologies described herein and as determined

by the Index Sponsors. The Index is reported on Bloomberg under the ticker symbol “QUSOI <Index>” and the Closing Level

of the Index for each Trading Day is published by 5:00 p.m. (New York City time) on each such day. For more information, please refer

to “The Index” in this pricing supplement.

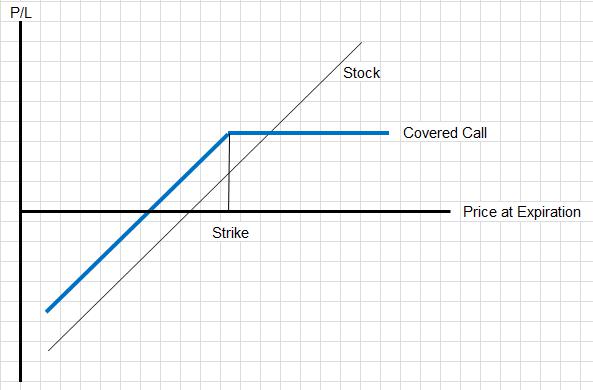

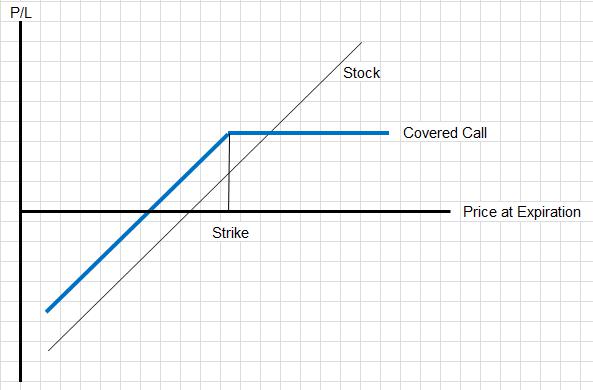

What is a covered call?

Generally, call options

give the purchaser of the call option the right to buy an underlying asset, such as the Reference Oil Shares, for a fixed price (the “strike”

or “exercise” price) on a certain date (the “expiration”). The buyer of a call option is long the underlying asset

at the strike price. A covered call is a transaction in which a seller of call options owns a corresponding amount of the underlying asset,

such as the Reference Oil Shares. The option seller’s long position in the underlying asset is said to provide the “cover”

as the underlying asset can be delivered to the buyer of the call if the buyer decides to exercise its call option. Writing or selling

a call option generates income in the form of the premium paid by the option buyer.

If the price of the underlying

asset ends up at or below the strike price, the return (compared to a long-only position in the underlying asset) is increased by the

premium received. If the price of the underlying asset ends up above the strike price then the return is capped at a price equivalent

to the strike plus the premium received. However, the market risk of the underlying asset is not eliminated. Covered call strategies are

not appropriate for all market environments. In a consistently upward-trending market or in an extremely volatile market, a covered call

strategy can underperform a long-only investment in the underlying asset, because it will fail to capture all of the potential upside

and can miss out on significant gains. Additionally, if the underlying asset price declines, a covered call strategy may result in a loss.

How will the Coupon Amounts be determined

for the ETNs?

On each Coupon Payment

Date, for each $25.00 stated principal amount of the ETNs, you will be entitled to receive a variable cash payment equal to the Closing

Indicative Value on the Index Business Day immediately preceding the relevant Index Distribution Date multiplied by the Coupon Percentage

for that Index Distribution Date. The Coupon Amount will be paid on the Coupon Payment Date to the holder of record on the applicable

Coupon Record Date. No Coupon Amount will be due or payable in the event you elect to offer your ETNs for early redemption or we accelerate

the maturity of the ETNs. The initial Index Distribution Date was May 15, 2017 and the initial Coupon Payment Date was May 25, 2017.

The Coupon Percentage in

respect of an Index Distribution Date will be the Distribution for such Index Distribution Date divided by the Closing Level of

the Index on the Index Business Day immediately preceding the Index Distribution Date. The Distribution represents the notional monthly

call premium earned on the sale of the call options written on the Reference Oil Shares during the immediately preceding Index Rebalancing

Period pursuant to the Index methodology described herein.

The premiums generated

from the notional sales of the Options will be subtracted monthly from the Index and paid to holders of the ETNs in the form of a Coupon

Amount, the amount of which is determined based on the notional premiums received from the sale of the Options during the preceding Index

Rebalancing Period as described below.

The “Index Rebalancing

Period” refers to the five (5) consecutive Index Calculation Days beginning on and including the Index Calculation Day that

is ten (10) calendar days prior to the Expiry Date (as defined below under “The Index—The Index Rebalancing Period”)

of the relevant Options (each, a “Roll Date”). The Index will be rebalanced at the end of each Roll Date in accordance

with the following steps:

| · | First, on the Index Calculation Day (as defined herein) preceding the first Roll Date of each month, the

strike price of the new Option is determined. The strike price will be the lowest listed strike price that is above 106% (the “Target

Strike”) multiplied by the price per Reference Oil Share as of 4:00 p.m. New York City time on such date of determination.

Then, the Index will roll its monthly exposure over the next five (5) consecutive Index Calculation Days. The roll percentage is the proportion

of the expiring position being rolled into a new position on each Roll Date and generally will equal 20%. In the event that one or more

roll disruptions result in there being fewer than five (5) scheduled Index Calculation Days prior to Option expiration, the roll percentage

will be greater than 20%, and in the event of an extraordinary roll disruption, the roll percentage may be up to 100%. |

| · | At the end of the first Roll Date, and on each successive Roll Date of such Index Rebalancing Period,

the Index will notionally sell the new Option. Additionally, as of the end of each such Roll Date, the Index will hypothetically close

out through repurchase 20% (or such greater amount in the event roll disruptions) of the Options notionally sold during the previous Index

Rebalancing Period (the expiring Options); the Index will notionally liquidate Reference Oil Shares in an amount sufficient to fund the

notional repurchase. |

| · | Finally, on the last Roll Date of such Index Rebalancing Period, the Index will determine the amount of

the notional Option premium, which will, on the close of the last Roll Date of the next following Index Rebalancing Period, be subtracted

from the Index as a Distribution and paid to holders of the ETNs in the form of the Coupon Amount. |

When will the Coupon Amount be paid?

The “Coupon Payment

Date” will be the later of (a) the 25th day of each calendar month, provided that, if such day is not a Business Day, the Coupon

Amount will be paid on the first following Business Day, unless the first following Business Day is in the next calendar month, in which

case the Coupon Amount will be paid on the immediately preceding day that is a Business Day, and (b) the day that is six (6) Business

Days following the Index Distribution Date; provided that in the event that any adjustment is made to the Coupon Payment Date, the relevant

Coupon Amount shall not be affected by such adjustment and no additional amount will accrue or be payable in respect of such originally

scheduled Coupon Payment Date. The Coupon Amount will be paid on the Coupon Payment Date to the holder of record on the applicable Coupon

Record Date. The “Coupon Record Date” will be the third scheduled Business Day prior to such Coupon Payment Date. The

initial Index Distribution Date was May 15, 2017 and the initial Coupon Payment Date was May 25, 2017.

An “Index Distribution

Date” will be the date on which the Distribution is subtracted from the level of the Index pursuant to the rules of the Index,

which will occur on the last Roll Date of a given Index Rebalancing Period.

The Coupon Amount is calculated

by reference to the notional Distribution from the Index, which will decrease the level of the Index (and, therefore, the value of the

ETNs), as the Distribution comes directly from the notional portfolio reflected by the Index Components. When the Distribution is subtracted

from the Index on the Index Distribution Date, the Coupon Amount will be added to the Closing Indicative Value and the Intraday Indicative

Value of the ETNs up to the Ex-Coupon Date. At the market opening on the Ex-Coupon Date, the ETNs will trade on an ex-coupon basis, adjusted

for the Coupon Amount, meaning that the Coupon Amount will no longer be included in the Closing Indicative Value or the Intraday Indicative

Value of the ETNs. For a holder to receive the upcoming Coupon Amount, the holder must own the ETNs on the Coupon Record Date.

The “Ex-Coupon

Date”, with respect to each Coupon Amount, will be the first Trading Day on which the ETNs trade without the right to receive

such Coupon Amount.

Will I receive fixed periodic interest on

the ETNs?

No. We will not make any

fixed periodic payments of interest during the term of the ETNs, although you will be entitled to receive variable monthly Coupon Amounts

based on the Index distribution of the notional option premiums received from the notional sale of monthly call options on the Reference

Oil Shares, as described in this pricing supplement. Since the monthly Coupon Amount is uncertain and could be zero, investors should

not expect to receive regular periodic interest payments.

Unless the ETNs are redeemed

or accelerated, you will not receive any other payments on the ETNs prior to maturity of the ETNs. In addition, no Coupon Amount will

be due or payable in the event you elect to offer your ETNs for early redemption or we accelerate the maturity of the ETNs.

Will a “covered call” strategy

track the performance of the underlying asset?

A covered call strategy

limits participation in the appreciation of the underlying asset, in this case the Reference Oil Shares. The maximum gain on the appreciation

of Reference Oil Shares that comprise the Index is limited, and thus will affect the value of your ETNs. The Options included in the Index

limit the Index’s participation in the appreciation of the Reference Oil Shares to the strike price of each Option during its term.

In general, if the price of the Reference Oil Shares increases above the strike price of the Options by an amount that exceeds the premium

received from the sale of the Options, the value of the covered call strategy will be less than the value of a direct investment in the

Reference Oil Shares. You will not benefit from any increase in the Reference Oil Shares above the call strike price. As a result, the

monthly appreciation of the Index is limited by the strike price of each Option during its term, which appreciation may be partially offset

by the Notional Transaction Costs in implementing the covered call strategy. Consequently, the Index will not participate as fully in

the appreciation of the Reference Oil Shares as would an investment linked directly to the Reference Oil Shares. The Index’s exposure

to any decline in the price of the Reference Oil Shares is not limited.

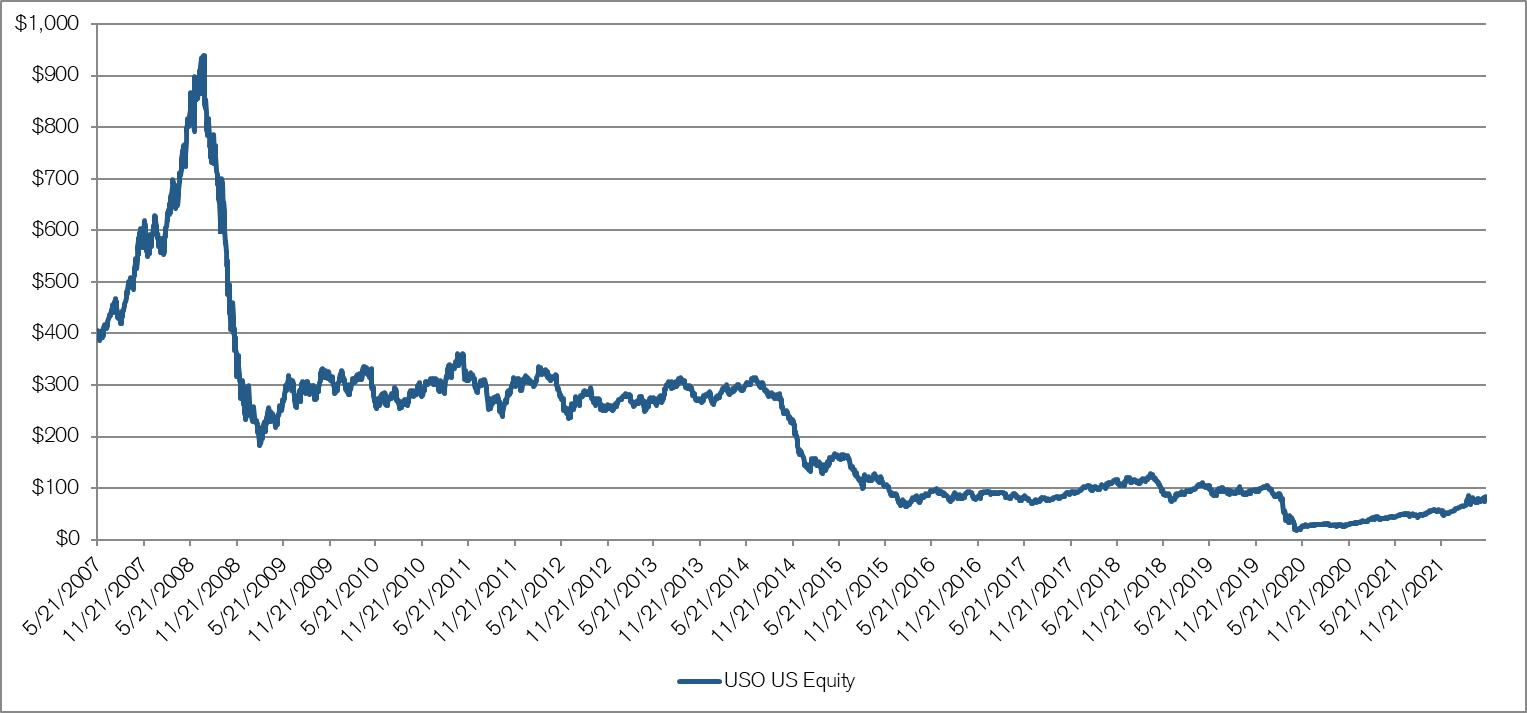

Will my investment track the performance

of the Reference Oil Shares or the spot price of WTI crude oil?

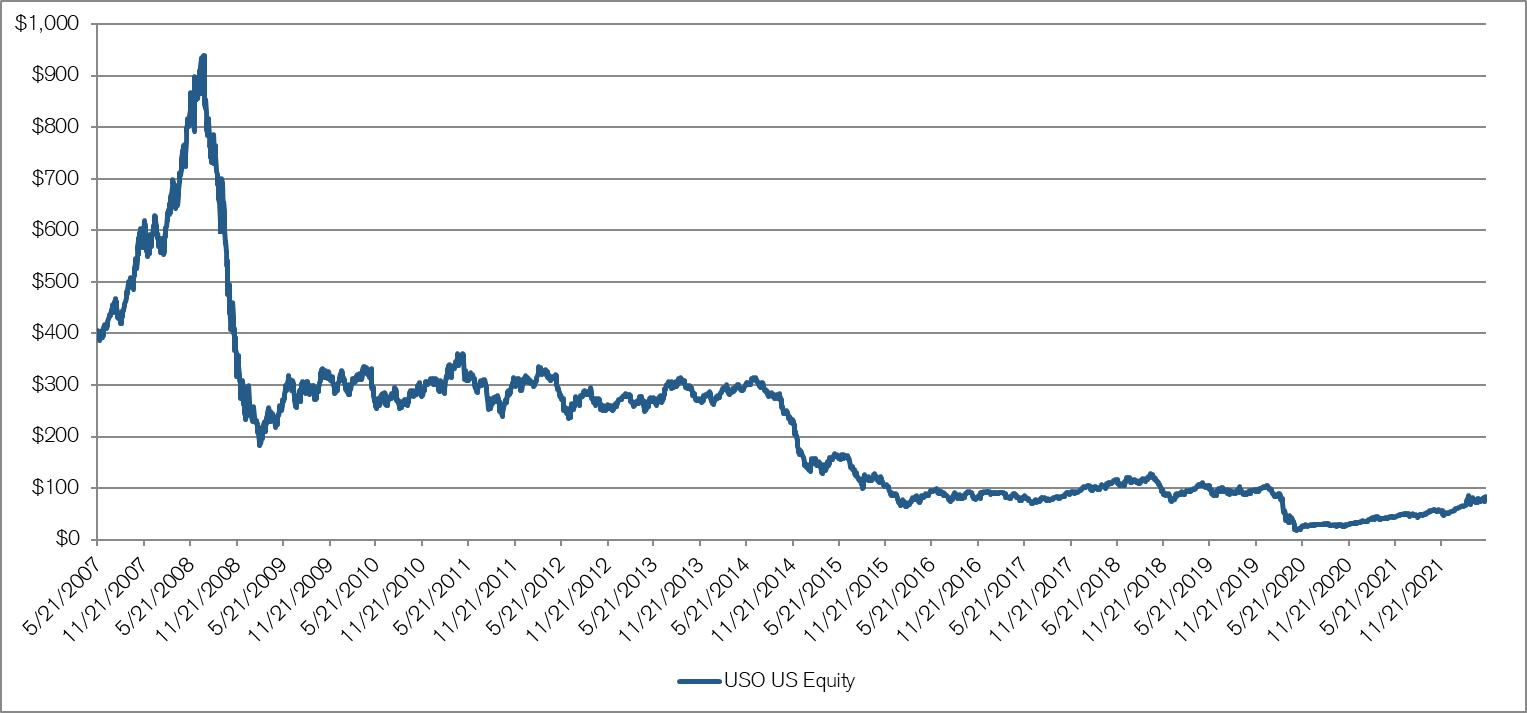

The value of the ETNs is

linked to the performance of the Index, as reflected by their Indicative Value. The Daily Investor Fee, based on an annual Investor Fee

Rate of 0.85%, reduces the Indicative Value of the ETNs and the amount of your payment at maturity or upon early redemption or acceleration.

The amount of your payment upon early redemption is further reduced by the Early Redemption Charge. The Index measures the return of a

“covered call” strategy on Reference Oil Shares and is comprised of notional long positions in Reference Oil Shares and notional

short positions in the Options. The Index reflects price changes in the Reference Oil Shares (up to the strike price of the related Options)

and the Option premiums generated from the notional sale of monthly call options on the Reference Oil Shares, less the Notional Transaction

Costs incurred in connection with the implementation of the covered call strategy. Furthermore, the Reference Oil Shares are subject to

expenses which accrue daily. The annual expense ratio of the Oil Fund for the year ended December 31, 2019 was 0.79%. Accordingly, the

value of the ETNs will not track the performance of the Reference Oil Shares.

In addition, changes in

the value of the Reference Oil Shares reflected in the Index may not correlate with changes in the spot price of WTI crude oil. The assets

of the Oil Fund consist primarily of investments in WTI crude oil futures contracts and include futures contracts for light, sweet crude

oil, other types of crude oil, heating oil, gasoline, natural gas, and other petroleum-based fuels and other oil interests such as cash-settled

options on such oil futures contracts, forward contracts for oil, and over-the-counter transactions that are based on the price of oil,

other petroleum based fuels, oil futures contracts and indices based on the foregoing. The correlation between changes in prices of the

Reference Oil Shares and the spot price of WTI crude oil may at times be only approximate. The degree of imperfection of correlation depends

upon supply and demand for the Reference Oil Shares in the secondary market, circumstances such as variations in the speculative oil market,

supply of and demand for WTI crude oil futures contracts and other oil-related investments, and technical influences in oil futures trading.

The ETNs should not be

expected to track the performance of the Reference Oil Shares or the spot price of WTI crude oil because of the fees and expenses applied

to each of the Reference Oil Shares and the ETN, the design of the Index methodology which includes Notional Transaction Costs and limits

upside participation in any appreciation of the Reference Oil Shares, as well as lack of correlation between changes in prices of the

Reference Oil Shares and the spot price of WTI crude oil. The Index, the Reference Oil Shares and the ETNs are each subject to fees and

costs. The level of the Index is reduced by the Notional Transaction Costs. The expenses of the Reference Oil Shares are accrued daily.

The annual expense ratio of the Oil Fund for the year ended December 31, 2019 was 0.79%. The Indicative Value of the ETNs and the amount

of your payment at maturity or upon early redemption or acceleration are reduced by the Daily Investor Fee and in the case of an early

redemption, your payment is further reduced by the Early Redemption Charge. In addition, the level of the Index and, therefore, the value

of the ETNs will decline each month in connection with the Index Distribution and Coupon Amount.

For all of the foregoing

reasons, the performance of the ETNs should not be expected to mirror the performance of the Reference Oil Shares or the spot price of

WTI crude oil.

How will payment at maturity or upon early

redemption or acceleration be determined for the ETNs?

Unless your ETNs have been

previously redeemed or accelerated, the ETNs will mature on April 24, 2037 (the “Maturity Date”), provided that the

maturity of the ETNs may be extended at our option as described herein under “Specific Terms of the ETNs—Payment at Maturity”.

Payment at Maturity

If your ETNs have not been

previously redeemed or accelerated, at maturity you will be entitled to receive a cash payment per ETN equal to the “Final Indicative

Value”, which will be the arithmetic average, as determined by the Calculation Agent, of the Closing Indicative Value on each

of the immediately preceding five (5) Trading Days to and including the Final Valuation Date (the “Final Valuation Period”).

We refer to the amount of such payment as the “Payment at Maturity”. If the Final Indicative Value is zero, the

Payment at Maturity will be zero. If the scheduled Maturity Date is not a Business Day, the Maturity Date will be postponed to the

first Business Day following the scheduled Maturity Date. If the scheduled Final Valuation Date is not a Trading Day, the Final Valuation

Date will be postponed to the next following Trading Day, in which case the Maturity Date will be postponed to the third Business Day

following the Final Valuation Date as so postponed. In addition, if a Market Disruption Event occurs or is continuing on the Final Valuation

Date, the Maturity Date will be postponed until the date three (3) Business Days following the Final Valuation Date, as postponed. No

interest or additional payment will accrue or be payable as a result of any postponement of the Maturity Date. Any payment on the

ETNs is subject to our ability to pay our obligations

as they become due. In no event will the Payment at Maturity be less than zero.

The “Closing Indicative

Value” on the Inception Date was $25.00 (the “Initial Indicative Value”). The Closing Indicative Value on

each calendar day following the Inception Date will be calculated by the Index Calculation Agent and will be equal to (1) the Current

Principal Amount for such calendar day plus (2) for any day on or after the Index Distribution Date but prior to the Ex-Coupon

Date for a given month, any accrued but unpaid Coupon Amount. The Closing Indicative Value will never be less than zero. If the Intraday

Indicative Value of the ETNs is equal to or less than zero at any time or the Closing Indicative Value is equal to zero on any Trading

Day, the Closing Indicative Value of the ETNs on that day, and all future days, will be zero. If the ETNs undergo a split or reverse

split, the Closing Indicative Value (including the Current Principal Amount) of the ETNs will be adjusted accordingly (see “Description

of the ETNs—Split or Reverse Split of the ETNs” in this pricing supplement). Even if the Closing Indicative Value or Intraday

Indicative Value is equal to or less than zero at any time, the trading price of the ETNs may remain above zero. Buying the ETNs at such

a time will lead to a complete loss of your investment. See “Risk Factors—Risks Relating to the Return on the ETNs—If

the Intraday Indicative Value is equal to or less than zero at any time or the Closing Indicative Value is equal to zero on any Trading

Day, you will lose all of your investment”. Such adjustment may adversely affect the trading price and liquidity of the ETNs. The

Index Calculation Agent is responsible for computing and disseminating the Closing Indicative Value.

The “Current Principal

Amount” on each calendar day following the Inception Date will be equal to (1)(a) the Current Principal Amount on the immediately

preceding calendar day times (b) the Daily Index Factor on such calendar day minus (2) the Daily Investor Fee on such calendar

day. On the Inception Date, the Current Principal Amount was $25.00.

The “Intraday

Indicative Value” of the ETNs will be calculated and published by the Index Calculation Agent every fifteen (15) seconds on

each Trading Day during normal trading hours so long as no Market Disruption Event has occurred or is continuing and will be disseminated

over the consolidated tape or other major market data vendor. The Intraday Indicative Value at any time is based on the most recent intraday

level of the Index. It is calculated using the same formula as the Closing Indicative Value, except that instead of using the Closing

Level of the Index, the calculation is based on the most recent reported level of the Index at the particular time (or, if the day on

which such time occurs is not a Trading Day, as determined by the Calculation Agent). At any time at which a Market Disruption Event has

occurred and is continuing, there shall be no Intraday Indicative Value. If the Intraday Indicative Value of the ETNs is equal to or

less than zero at any time or the Closing Indicative Value is equal to zero on any Trading Day, the Closing Indicative Value of the ETNs

on that day, and all future days, will be zero. See “Description of the ETNs—Intraday Indicative Value” in this

pricing supplement.

If the ETNs undergo a split

or reverse split, the Current Principal Amount, Closing Indicative Value and Intraday Indicative Value of the ETNs will be adjusted accordingly

(see “Description of the ETNs—Split or Reverse Split of the ETNs” in this pricing supplement). Neither the Closing Indicative

Value nor the Intraday Indicative Value is the same as the closing price or any other trading price of the ETNs in the secondary market.

The trading price of the ETNs at any time may vary significantly from the Closing Indicative Value and Intraday Indicative Value of the

ETNs at such time.

The “Daily Index

Factor” on any Index Business Day will equal (a) the Closing Level of the Index on such Index Business Day divided by

(b) the Closing Level of the Index on the immediately preceding Index Business Day. The Daily Index Factor is deemed to be one on any

day that is not an Index Business Day.

A “Business Day”

is a Monday, Tuesday, Wednesday, Thursday or Friday that is not a day on which banking institutions in New York City or London, England

generally are authorized or obligated by law, regulation or executive order to close.

A “Trading Day”

is a day which is (i) an Index Business Day, (ii) an ETN Business Day and (iii) an Index Component Business Day for each of

the Index Components.

An “Index Business

Day” is a day on which the level of the Index is calculated and published.

With respect to any Index

Component, an “Index Component Business Day” is a day on which trading is generally conducted on any markets on which

such Index Component is traded.

An “ETN Business

Day” is a day on which trading is generally conducted on the New York Stock Exchange, NYSE Arca and NASDAQ.

On any calendar day, the

“Daily Investor Fee” will be equal to the product of (1)(a) the Current Principal Amount on the immediately preceding

calendar day times (b) the Daily Index Factor on such calendar day times (2)(a) the Investor Fee Rate divided by

(b) 365. The “Investor Fee Rate” will be equal to 0.85%.

The ETNs do not guarantee

any return of your investment. If the level of the Index decreases or does not increase sufficiently to offset the Daily Investor Fee

(and in the case of early redemption, the Early Redemption Charge) over the term of the ETNs, you will receive less, and possibly significantly

less, at maturity or upon early redemption or acceleration of the ETNs than the amount of your investment.

See “Hypothetical

Examples” and “Risk Factors—Risks Relating to the Return on the ETNs—Even if the Closing Level of the Index on

the applicable Valuation Date exceeds the initial Closing Level of the Index on the date of your investment, you may receive less than

your investment amount of your ETNs” in this pricing supplement for additional information on how the Daily Investor Fee affects

the overall value of the ETNs.

The “Closing Level”

of the Index on any Trading Day will be the closing level published on Bloomberg under the ticker symbol “QUSOI <Index>”

or any successor page on Bloomberg or any successor service, as applicable; provided that, in the event a Market Disruption Event exists

on a Valuation Date, the Calculation Agent will determine the Closing Level of the Index for such Valuation Date, if necessary, as described

below in “Specific Terms of the ETNs—Market Disruption Events”.

Any payment you will be entitled

to receive is subject to our ability to pay our obligations as they become due.

For a further description

of how your Payment at Maturity will be calculated, see “Hypothetical Examples” and “Specific Terms of the ETNs”

in this pricing supplement.

Payment Upon Early Redemption

Prior to maturity, you

may, subject to certain restrictions described below, offer at least the applicable Minimum Redemption Amount or more of your ETNs to

us for redemption on an Early Redemption Date during the term of the ETNs until April 14, 2037 (or, if the maturity of the ETNs is extended,

five (5) scheduled Trading Days prior to the scheduled Final Valuation Date, as extended). Notwithstanding the foregoing, we will not

accept a Redemption Notice submitted to us on any day after the Trading Day preceding the start of the Accelerated Valuation Period related

to the acceleration of all outstanding ETNs. If you elect to offer your ETNs for redemption, and the requirements for acceptance by us

are met, you will be entitled to receive a cash payment per ETN on the Early Redemption Date equal to the Early Redemption Amount. Any

payment you will be entitled to receive on the ETNs is subject to our ability to pay our obligations as they become due.

You may exercise your early

redemption right by causing your broker or other person with whom you hold your ETNs to deliver a Redemption Notice (as defined herein)

to Credit Suisse. If your Redemption Notice is delivered prior to 4:00 p.m., New York City time, on any Business Day, the immediately

following Trading Day will be the applicable “Early Redemption Valuation Date”. Otherwise, the second following Trading

Day will be the applicable Early Redemption Valuation Date. See “Specific Terms of the ETNs—Procedures for Early Redemption”

in this pricing supplement.

You must offer for redemption

at least 50,000 ETNs at one time in order to exercise your right to cause us to redeem your ETNs on any Early Redemption Date (the “Minimum

Redemption Amount”); provided that we or the Calculation Agent may from time to time reduce, in whole or in part, the Minimum

Redemption Amount. Any such reduction will be applied on a consistent basis for all holders of the ETNs at the time the reduction becomes

effective. If the ETNs undergo a split or reverse split, the minimum number of ETNs needed to exercise your right to cause us to redeem

your ETNs will remain the same.

The “Early Redemption

Date” is the third Business Day following an Early Redemption Valuation Date.

The “Early Redemption

Charge” per ETN will equal 0.125% times the Closing Indicative Value on the Early Redemption Valuation Date.

The “Early Redemption

Amount” is a cash payment per ETN equal to the greater of (A) zero and (B)(1) the Closing Indicative Value on the applicable

Early Redemption Valuation Date minus (2) the Early Redemption Charge, calculated by the Calculation Agent.

Payment Upon Optional Acceleration

On

any Business Day on or after May 9, 2017, we have the right to accelerate all, but not less than all, of the issued and outstanding ETNs

(an “Optional Acceleration”). Upon an Optional Acceleration, you will be entitled to receive a cash payment per ETN

in an amount (the “Accelerated Redemption Amount”) equal to the arithmetic average, as determined by the Calculation