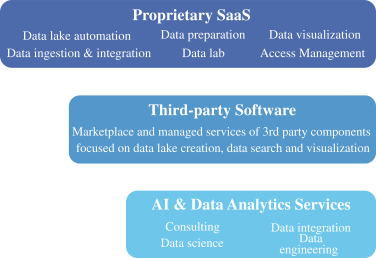

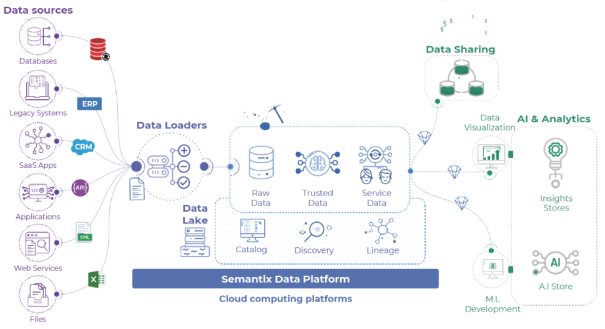

data in the form of a data lake, then providing easy access to such data for exploration and interaction and, finally, creating reports, dashboards and algorithms fueled by the data to enhance business performance.

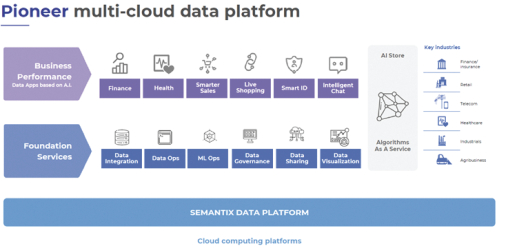

The graphic below highlights the key features and competitive advantages of SDP:

| Q: | What equity stake will current Alpha shareholders and Semantix shareholders have in New Semantix after the Closing? |

| A: | As of the date of this proxy statement/prospectus, there are (i) 23,000,000 Alpha Class A Ordinary Shares outstanding underlying units issued in the IPO and (ii) 5,750,000 Alpha Class B Ordinary Shares outstanding (all of which are held by the Sponsor). As of the date of this proxy statement/prospectus, there are 7,000,000 private placement warrants outstanding (all of which are held by the Sponsor) and 11,500,000 public warrants outstanding. Each whole warrant entitles the holder thereof to purchase one Alpha Class A Ordinary Shares and will entitle the holder thereof to purchase one New Semantix Ordinary Share. Therefore, as of the date of this proxy statement/prospectus (without giving effect to the Business Combination and assuming that none of Alpha’s outstanding public shares are redeemed in connection with the Business Combination), Alpha’s fully diluted share capital, giving effect to the exercise of all of the private placement warrants and public warrants, would be 47,250,000 ordinary shares. |

Alpha cannot predict how many of the public Alpha shareholders will exercise their right to have their Alpha Class A Ordinary Shares redeemed for cash. As a result, Alpha has elected to provide the unaudited pro forma condensed combined financial information under three different redemption scenarios of Alpha shares into cash, each of which produce different allocations of total Alpha equity between holders of Alpha Ordinary Shares. The following table illustrates varying estimated ownership levels in New Semantix immediately following the consummation of the Business Combination, based on the varying levels of redemptions by the public shareholders and the following additional assumptions:

| Share Ownership in New Semantix(1) | ||||||||||||

| No Redemptions(2) | Interim Redemptions(3) |

Maximum Redemptions(4) | ||||||||||

| Percentage of Outstanding Shares |

Percentage of Outstanding Shares |

Percentage of Outstanding Shares |

||||||||||

| Alpha shareholders (other than the Sponsor and Innova)(5) |

20.7 | % | 11.5 | % | — | |||||||

| Sponsor and Innova(5)(6) |

8.0 | % | 9.0 | % | 10.1 | % | ||||||

| PIPE Investors (other than the Semantix shareholders) |

3.2 | % | 3.6 | % | 4.1 | % | ||||||

| Semantix shareholders(7) |

68.1 | % | 75.9 | % | 85.8 | % | ||||||

| (1) | As of immediately following the consummation of the Business Combination and in each case, in consideration of PIPE Investors that are also existing shareholders of Semantix. Percentages may not add to |

14