DESCRIPTIONS OF THE

TRANSACTION DOCUMENTS

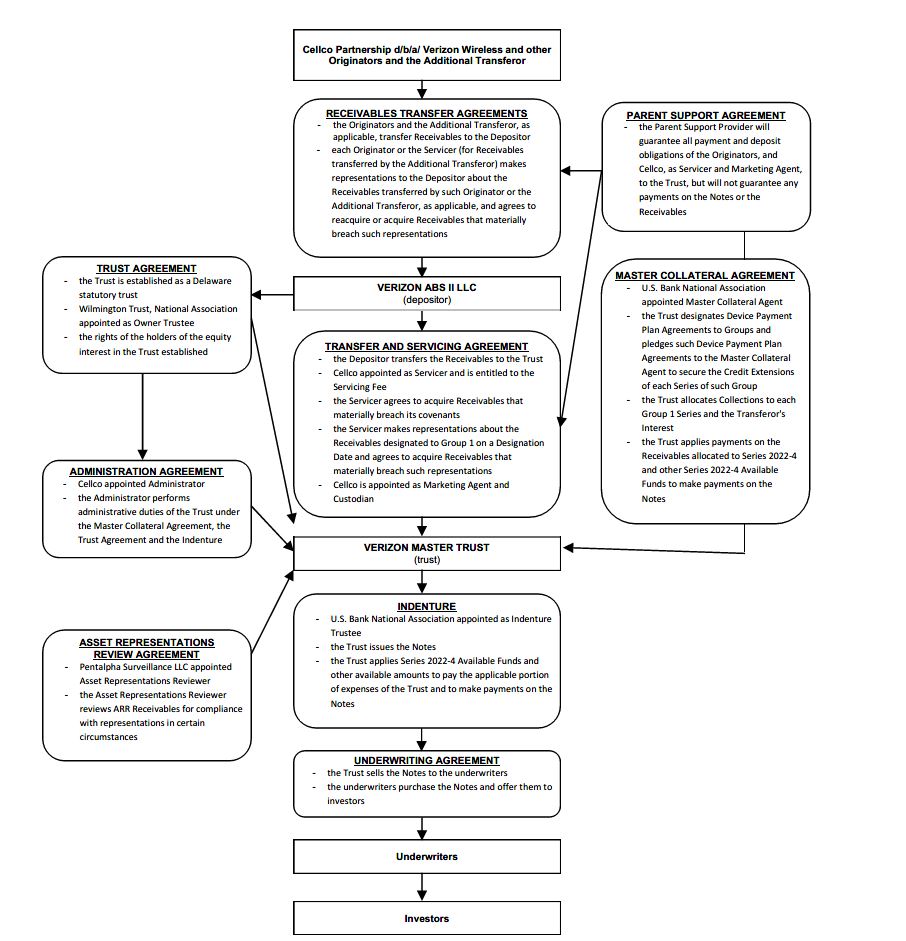

The following sections of this prospectus contain summaries of certain material terms of the transaction documents, including the Trust Agreement, the

Administration Agreement, the Master Collateral Agreement, the Transfer and Servicing Agreement, the Receivables Transfer Agreements, the Asset Representations Review Agreement and the Indenture, but these summaries are not complete descriptions of

these transaction documents. For more details about the transaction documents, you should read the Trust Agreement, the Administration Agreement, the Master Collateral Agreement, the Transfer and Servicing Agreement, the Receivables Transfer

Agreements, the Asset Representations Review Agreement and the form of Indenture that are included as exhibits to the registration statement filed with the SEC that includes this prospectus. In addition, a copy of the Indenture will be filed with

the SEC upon the filing of this prospectus.

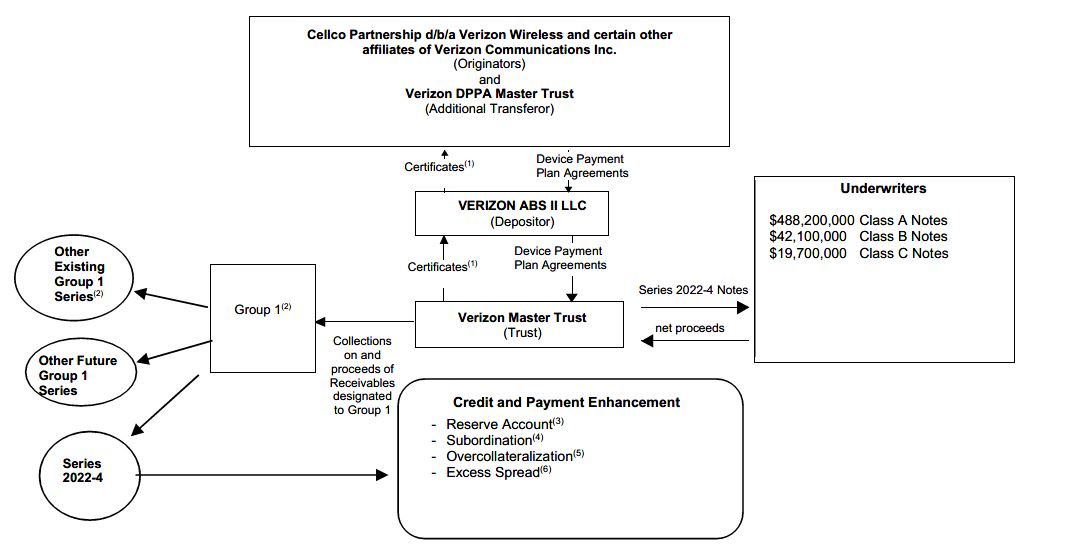

The Trust is a Delaware statutory trust governed by the Trust Agreement. The Trust’s fiscal year is the calendar year. The Trust acquired prior to the

Closing Date, and may acquire in the future, Device Payment Plan Agreements originated by the Originators.

Each Series of Credit Extensions will be secured by all Trust DPPAs. For purposes of allocations of cash flows to a particular Series, the Trust may

designate Trust DPPAs to particular Groups. Initially, all Trust DPPAs will be designated to Group 1. In the future, for purposes of allocations of cash flows, Trust DPPAs may be designated to different Groups. The Notes are secured by all of the

Trust DPPAs and will be paid from Collections on and proceeds of the Receivables that are allocated to the Notes under the Transaction Documents. The Trust, as a master trust, has issued four other Group 1 Series of notes and has entered into two

other Group 1 Series of loans. The Trust expects to issue another Group 1 Series of notes on the Closing Date, and expects to issue or enter into in the future other Group 1 Series which also will be secured by all of the Trust DPPAs and will be

paid from Collections on and proceeds of the Receivables that are allocated to such Group 1 Series under the Transaction Documents. The Notes will not be entitled to receive collections on or proceeds of any Trust DPPAs other than the Receivables,

expect in the limited circumstances described under “Description of the Notes—Events of Default—Remedies Following Event of Default.”

Trust DPPAs may be designated to Groups other than Group 1, and the Trust may issue or enter into Credit Extensions, other than the Group 1 Credit Extensions,

that will be secured by all Trust DPPAs and allocated cash flows from the Trust DPPAs designated to such other Group. No Credit Extensions that are allocated cash flows from Trust DPPAs designated to any Group (including the Group 1 Credit

Extensions with respect to Group 1) will be entitled to receive collections on or proceeds of, any assets of the Trust other than the assets designated to that Group, except to the extent Trust DPPAs designated to any other Group are sold upon the

occurrence of an Event of Default and an acceleration of the Notes in the limited circumstances described under “Description of the Notes—Events of Default—Remedies Following Event of Default.” No

information is provided in this prospectus with respect to any Trust DPPAs other than the Receivables, other than as specifically set forth under “Servicing the Receivables and the Securitization Transaction”

and in Annex A or any Credit Extensions other than the Notes, except for certain information with respect to prior securitized pools of the Sponsor set forth in Annex C and the Group 1 Credit Extensions set forth in Annex D.

The purposes of the Trust will be to:

|

• |

from time to time acquire Device Payment Plan Agreements,

|

|

• |

from time to time to issue or enter into Series, including Series 2022-4;

|

|

• |

pledge all of the Trust’s right, title and interest in Trust DPPAs (including the Receivables) to the Master Collateral Agent to secure payments on the related Credit Extensions,

|

|

• |

pledge all of the Trust’s right, title and interest in certain assets to (i) an indenture trustee or (i) to a collateral agent, in each case to secure payments on the related Credit Extensions,

|

|

• |

enter into and perform its obligations under the transaction documents and any other Series Related Documents,

|

|

• |

make payments on the Credit Extensions, and

|

|

• |

engage in other related activities to accomplish these purposes.

|

The Trust may not engage in any other activities and may not invest in any other securities (other than permitted investments) or make loans to any Persons.

The Trust has no employees and does not conduct unrelated business activities.

The Trust Agreement may be amended by the Depositor and the Owner Trustee without the consent of any Creditors, Creditor Representatives or

Certificateholders, for any of the following purposes:

|

• |

to cure any ambiguity, to correct an error or to correct or supplement any provision of the Trust Agreement that may be defective or inconsistent with the other terms of the Trust Agreement, or

|

|

• |

to evidence the acceptance of the appointment under the Trust Agreement of a successor owner trustee and to add to or change the Trust Agreement as necessary to facilitate the administration of the trusts under

the Trust Agreement by more than one owner trustee.

|

The Depositor and the Owner Trustee may, with the consent of the Certificateholders, but without the consent of any Creditors or Creditor Representatives,

enter into an amendment or amendments to the Trust Agreement for the purpose of adding any provisions to, or changing in any manner or eliminating any of the provisions of, the Trust Agreement or modifying in any manner the rights of the Creditors

under the Trust Agreement if (A) the Trust or the Administrator shall have delivered to the Master Collateral Agent and the Owner Trustee an officer’s certificate, dated the date of any such action, stating that the Trust or the Administrator, as

applicable, reasonably believes that such action will not have a material adverse effect on the interest of any Creditor or (B) the Rating Agency Condition has been satisfied for all Credit Extensions then rated by a rating agency. The Depositor and

the Owner Trustee, with the consent of the Certificateholders and the Majority Trust Creditor Representatives of each Group adversely affected thereby, may, with prior written notice to the rating agencies (if any Credit Extensions of an affected

Group are then rated by a rating agency), enter into an amendment or amendments to the Trust Agreement for the purpose of adding any provisions to or changing in any manner or eliminating any of the provisions of the Trust Agreement or of modifying

in any manner the rights of the Creditors or Certificateholders under the Trust Agreement. No amendment to the Trust Agreement, without the consent of the Certificateholders and each Creditor Representative representing each Series in each Group

adversely affected by the amendment, may modify the percentage of Creditor Representatives or Creditors, or the percentage interest of Certificates, required to consent to any action. The consent of the Master Collateral Agent will be required for

any amendment described in this paragraph that has a material adverse effect on the rights, duties, obligations, immunities or indemnities of the Master Collateral Agent.

Any Creditor Representative consenting to any amendment will be deemed to agree that the amendment does not have a material adverse effect on it or on the

related Creditors. For any amendment, the Depositor or the Administrator will be required to deliver to the Owner Trustee an opinion of counsel stating that the amendment is authorized and permitted by the transaction documents and other applicable

Series Related Documents and that all conditions precedent to the amendment have been satisfied.

The Trust may not consolidate or merge with or into any other Person or convey or transfer substantially all of its assets unless except as permitted by the

Master Collateral Agreement. The Trust may not permit the lien of (i) the Master Collateral Agreement to not constitute a valid and perfected first priority lien on the Receivables, the other Trust DPPAs and other assets of the Trust designated to a

Group, subject to no adverse claims and (ii) the Indenture to not constitute a valid and perfected first priority lien on the assets of the Trust specifically designated to Series 2022-4, subject to no adverse claims.

The Servicer will indemnify the Trust for liabilities and damages caused by the Servicer’s willful misconduct, bad faith or gross negligence in the

performance of its duties as Servicer.

The Administrator will perform additional administrative services for the Trust and the Owner Trustee pursuant to the Administration Agreement, as further

described under “Sponsor, Servicer, Custodian, Marketing Agent and Administrator.”

In addition to the Notes, Series 2022-4 will also include the Class R Interests, which will not have a principal balance, will not accrue interest and will

only be entitled to all Series 2022-4 Available Funds on any Payment Date not needed to pay fees, expenses and indemnities of the Trust allocated to or otherwise payable by Series 2022-4 or to make interest and principal payments on the Notes,

payments, if any, required to reimburse any Letter of Credit Provider for any amounts drawn under the Letter of Credit together with interest accrued on the drawn amount, any required deposits into the Reserve Account or the Principal Funding

Account, any Additional Interest Amounts and Make-Whole Payments payable on that Payment Date. The undivided ownership interests in the Trust will be evidenced collectively by the Certificates, which are entitled to (i) distributions of the

Transferor’s Allocation on each Payment Date, (ii) any collections on or proceeds of any Trust DPPAs allocated to any other Series not needed to make payments on the related Credit Extensions, or to make any other required payments or deposits

according to the priority of payments for such Series and (iii) investment earnings on amounts held in the Collection Account or any Series Bank Accounts. The

Certificates

will be issued pursuant to

the terms of

the Trust Agreement and are governed by and shall be construed in accordance with the laws of the State of Delaware applicable to agreements made in and to be performed wholly within that jurisdiction. The

Certificates

and the Class R Interests are not being offered pursuant to this prospectus and all information presented regarding the

Certificates

and

the Class R Interests is given to further a better understanding of the Notes. For a general description of the Certificates and the Class R Interests, see “

Credit Risk Retention.”

From time to time, on each Acquisition Date, the Originators and the Additional Transferor will transfer Device Payment Plan Agreements and related property

to the Depositor, who will subsequently transfer such Device Payment Plan Agreements and related property to the Trust. The Administrator, with the assistance of each Originator and the Additional Transferor, will select each pool of Device Payment

Plan Agreements to be transferred and assigned by each Originator and the Additional Transferor, respectively, and acquired by the Depositor (and subsequently the Trust) on each such Acquisition Date. In connection with each such transfer, the Trust

(or the Administrator, on behalf of the Trust) will also select the Group to which such Trust DPPAs shall be designated. The Administrator has selected the Receivables to be designated to Group 1.

The transfers of Device Payment Plan Agreements and the designation of such Device Payment Plan Agreements as Receivables on each Acquisition Date will be

subject to the satisfaction of the following conditions on or before such Acquisition Date:

(i) Each Originator transferring Device Payment Plan Agreements on such Acquisition Date certifies solely with respect to itself that:

(A) as of such Acquisition Date, (1) such Originator is solvent and will not become insolvent as a result of the transfer of the related Device Payment Plan Agreements on the Acquisition Date, (2) such Originator does not intend to incur or

believe that it would incur debts that would be beyond the Originator’s ability to pay as the debts matured and (3) the transfer of the related Device Payment Plan Agreements is not made by such Originator with actual intent to hinder, delay or

defraud any Person; and

(B) each of such Originator’s representations and warranties in the Originator Receivables Transfer Agreement (solely with respect to the

related Device Payment Plan Agreements) will be true and correct as of the Acquisition Date; and

(ii) The Depositor is solvent as of the Acquisition Date and before giving effect to the transfer of the related Device Payment Plan Agreements.

The Administrator shall deliver to the Depositor, the Trust and the Master Collateral Agent, no later than each Payment Date an acquisition notice for the

Device Payment Plan Agreements transferred to the Trust

on each Acquisition Date occurring during the calendar month preceding the month in which such Payment Date occurs (to the extent not included on any previously delivered

acquisition notice), which acquisition notice will set forth (i) the Pool Balance, (ii) the Required Pool Balance, (iii) the Excess Concentration Amount for each Group 1 Series for which Group 1 Credit Extensions are Outstanding as of the related

Acquisition Date and (iv) the Ineligible Amount for each Group 1 Series for which Group 1 Credit Extensions are Outstanding as of the related Acquisition Date, in each case as of such Acquisition Date and after giving effect to the acquisition of

Receivables on each such Acquisition Date; provided that if such acquisition notice is delivered on the related Acquisition Date, the acquisition notice for the Device Payment Plan Agreements transferred to the Trust on that Acquisition Date will

include the information set forth above solely with respect to the Device Payment Plan Agreements transferred on such Acquisition Date).

On any Acquisition Date, the Trust (or the Servicer on its behalf) may use Collections in respect of the Receivables to pay the Receivables Transfer Amount

for the Device Payment Plan Agreements to be acquired by the Trust and designated to Group 1; provided, that neither the Trust nor the Servicer shall make any such payment unless, in either such case:

(i) no event has occurred and is continuing, or would result from such use of Collections, which constitutes (x) an Event of Default, Servicer Termination Event or amortization event for any Group 1 Series or any event that

with the giving of notice or the passage of time would constitute an Event of Default, Servicer Termination Event or amortization event for any Group 1 Series or (y) a Pool Balance Deficit;

(ii) immediately after giving effect to such acquisition of Device Payment Plan Agreements, the Trust shall be in compliance in all material respects with all representations, warranties and covenants under the transaction

documents;

(iii) the Servicer shall have delivered to the Master Collateral Agent and each Group 1 Creditor Representative the information required to be delivered by it under the Transfer and Servicing Agreement in connection therewith;

and

(iv) such Device Payment Plan Agreements are Eligible Receivables as of the related Cutoff Date.

In addition, after the related Acquisition Date, on any Designation Date, from time to time the Trust (or the Administrator, on behalf of the Trust), with the

consent of the Servicer, may re-designate Trust DPPAs previously designated to a Group that does not relate to any Outstanding Credit Extensions to Group 1. The Servicer shall represent and warrant that any Trust DPPAs re-designated to Group 1 on

any Designation Date are Eligible Receivables as of the related Cutoff Date. The Administrator shall deliver to the Depositor, the Trust and the Master Collateral Agent, no later than each Payment Date, a designation notice for the Device Payment

Plan Agreements re-designated to Group 1 on each Designation Date occurring during the calendar month preceding the month in which such Payment Date occurs, which designation notice will set forth (i) the Pool Balance, (ii) the Required Pool Balance,

(iii) the Excess Concentration Amount for each Group 1 Series for which Group 1 Credit Extensions are Outstanding as of the related Designation Date and (iv) the Ineligible Amount for each Group 1 Series for which Group 1 Credit Extensions are

Outstanding as of the related Designation Date, in each case as of such Designation Date and after giving effect to the designation of Receivables on each such Designation Date. In no event may Receivables be re-designated from Group 1 to another

Group while any Credit Extensions related to Group 1 remain Outstanding.

The Master Collateral Agent shall release Receivables from the lien of the Master Collateral Agreement upon receipt of a Trust order and an officer’s

certificate of the Administrator certifying that the following conditions have been satisfied as of the date of release (each date of transfer, a “Release Date”):

(i) no event has occurred and is continuing, or would result from such release, which constitutes (x) an Event of Default, Servicer Termination Event or amortization event for any Group 1 Series (or an event that with the giving of notice or

the passage of time would constitute an Event

of Default, Servicer Termination Event or amortization event for any Group 1 Series) or (y) a Pool Balance Deficit;

(ii) immediately after giving effect to such release of Receivables, the Trust shall be in compliance in all material respects with all representations, warranties and covenants contained in the transaction documents, except to the extent that

any such failure would not have a material adverse effect on the Group 1 Credit Extensions;

(iii) the Servicer shall have delivered the information required to be delivered by it under the Master Collateral Agreement; and

(iv) the Trust (or the Administrator, on behalf of the Trust) has not selected the Receivables for release in a manner that could be reasonably expected to adversely affect the interest of the Group 1 Creditors.

The Trust may collect, liquidate, sell or otherwise dispose of Receivables released in accordance with the foregoing.

In addition to the foregoing, upon the occurrence of an event of default and an acceleration of the Credit Extensions for any Group other than Group 1, in the

limited circumstances described under “Description of the Notes—Events of Default—Remedies Following Event of Default,” the Master Collateral Agent may cause the Trust to sell a portion of the Receivables and

other assets of the Trust designated to Group 1, so long as such sale will not result in an Event of Default or Pool Balance Deficit for Group 1, or an Amortization Event for any Group 1 Series (or an event that with the giving of notice or the

passage of time would constitute such an Event of Default or Amortization Event). The Receivables sold in any such sale described above may not be selected in a manner materially adverse to the interests of the Group 1 Creditors.

Issuance of Additional Group 1 Series

The Trust has issued four other Group 1 Series of notes and has entered into two other Group 1 Series of loans. In addition, the Trust expects to issue

another Group 1 Series of notes on the Closing Date. The main terms of each such Group 1 Series are summarized in Annex D.

The Trust is a master trust that may from time to time issue or enter into additional Group 1 Series which are also entitled to receive Collections on and

proceeds of the Receivables. The following conditions must be satisfied prior to the Trust, in its sole discretion, issuing or entering into any additional Group 1 Series:

(i) the Trust shall have given prior written notice of such additional Group 1 Series in accordance with the Master Collateral Agreement;

(ii) the Trust shall have delivered the operative agreements for such additional Group 1 Series in accordance with the Master Collateral Agreement;

(iii) the Trust (or the Administrator on behalf of the Trust) shall have delivered to the Master Collateral Agent an officer’s certificate to the effect that, based upon the facts known to such

officer, the consummation of such additional Group 1 Series will not (x) result in the occurrence of (1) an amortization event with respect to any other Group 1 Series or (2) an Event of Default or (y) materially and adversely affect the amount of

distributions to be made to the Creditors of any other Group 1 Series pursuant to the transaction documents and other Series Related Documents, in each case, as determined in accordance with the Master Collateral Agreement;

(iv) no Pool Balance Deficit is continuing or will result from issuing or entering into such additional Group 1 Series, as evidenced by an officer’s certificate of the Servicer delivered to the Master Collateral Agent;

(v) the Trust shall have delivered to the Master Collateral Agent and each Group 1 Creditor Representative (with a copy to each rating agency engaged to rate any Group 1 Credit

Extensions, if any) a tax opinion, dated the applicable closing date with respect to such additional Group 1 Series;

(vi) the Trust shall have delivered to the Master Collateral Agent and each Group 1 Creditor Representative an opinion of counsel substantially to the effect that:

(A) all conditions precedent to issuing or entering into such additional Group 1 Series have been complied with;

(B) the operative agreement for such additional Group 1 Series has been duly authorized, executed and delivered by the Trust; and

(C) the operative agreement for such additional Group 1 Series constitutes the legal, valid and binding obligation of the Trust, entitled to the benefits of the Master Collateral Agreement and enforceable in accordance with

its terms, subject to bankruptcy, insolvency, reorganization, moratorium and other similar laws affecting creditors’ rights generally and to general principles of equity;

(vii) the Trust shall have delivered such other documents, instruments, certifications, agreements or other items as the Master Collateral Agent may reasonably require;

(viii) the Group 1 Creditor Representative appointed in connection with such additional Group 1 Series shall become party to the Master Collateral Agreement by executing and delivering a joinder thereto; and

(ix) the Trust shall have satisfied such other conditions, if any, to the designation of any additional Group 1 Series as set forth in the operative agreement for any Group 1 Series.

No Group 1 Series (or any Group 1 Creditor Representative with respect thereto) or Group 1 Creditor (including any Noteholder) will have the right to consent

to the Trust issuing or entering into any additional Group 1 Series if the conditions set forth above are satisfied. For the avoidance of doubt, borrowings and increases in the principal amount of “variable funding” Group 1 Credit Extensions up to

an applicable existing maximum commitment amount will not constitute the Trust issuing or entering into an additional Group 1 Series that separately needs to satisfy the requirements above. The Group 1 Credit Extensions of all Outstanding Group 1

Series shall be equally and ratably entitled to the benefits of the Master Collateral Agreement without preference, priority or distinction. Each Group 1 Series will only be entitled to a portion of the Collections on the Receivables based on the

Series Allocation Percentage for such Group 1 Series, as described under “Description of the Notes—Allocation of Group 1 Available Funds.”

Verizon ABS II LLC is a Delaware limited liability company created in August 2016. Cellco is the sole member of the Depositor. The Depositor has the limited

purpose of acquiring Device Payment Plan Agreements and all payments on or under and all proceeds of the Device Payment Plan Agreements from the Originators and the Additional Transferor and transferring the Device Payment Plan Agreements and all

payments on or under and all proceeds of the Device Payment Plan Agreements to the Trust, and other issuing entities substantially similar to the Trust, for securitization transactions.

The Depositor must enforce each Originator’s reacquisition obligation described under “The Originators” and the

Servicer’s acquisition obligation described under “Receivables—Obligation to Acquire or Reacquire Receivables; Obligation to Make Credit Payments and Upgrade Prepayments.” The Depositor will have no other

ongoing duties with respect to the Trust.

Wilmington Trust, National Association will act as Owner Trustee under the Trust Agreement. WTNA is a national banking association with trust powers

incorporated in 1995. The Owner Trustee’s principal place

of business is located at 1100 North Market Street, Wilmington, Delaware 19890. WTNA is an affiliate of Wilmington Trust Company and both WTNA and Wilmington Trust Company are

subsidiaries of Wilmington Trust Corporation. Since 1998, Wilmington Trust Company has served as trustee in numerous asset-backed securities transactions.

WTNA is subject to various legal proceedings that arise from time to time in the ordinary course of business. WTNA does not believe that the ultimate

resolution of any of these proceedings will have a materially adverse effect on its services as Owner Trustee.

WTNA has provided the above information for purposes of complying with Regulation AB. Other than the information above, WTNA has not participated in the

preparation of, and is not responsible for, any other information contained in this prospectus.

The Owner Trustee’s main duties will be:

|

• |

distributing amounts allocable to the Certificateholders under the transaction documents, and

|

|

• |

executing documents on behalf of the Trust.

|

The Owner Trustee will not be liable for any action, omission or error in judgment unless it is caused by the willful misconduct, bad faith or gross

negligence of the Owner Trustee. The Owner Trustee will not be required to (i) take any action under a transaction document if the Owner Trustee reasonably determines, or is advised by counsel, that the action is likely to result in liability on the

part of the Owner Trustee, is contrary to a transaction document or is not permitted by applicable law or (ii) pay or risk funds or incur any financial liability in the performance of its rights or powers under a transaction document if the Owner

Trustee has reasonable grounds for believing that payment of such funds or adequate indemnity against the risk or liability is not reasonably assured or given to it. The Owner Trustee will not have any obligation or responsibility to monitor or

enforce the Sponsor’s compliance with any risk retention requirements and shall not be charged with knowledge of the U.S. Risk Retention Rules, nor shall it be liable to any Group 1 Creditor, Certificateholder or other party for violation of the U.S.

Risk Retention Rules now or hereafter in effect, except as otherwise may be explicitly required by law, rule or regulation.

Each of the Servicer and the Marketing Agent will indemnify the Owner Trustee for liabilities and damages caused by its willful misconduct, bad faith or gross

negligence in the performance of its duties as Servicer or Marketing Agent, as applicable. The Trust will indemnify the Owner Trustee for all liabilities and damages arising out of the Owner Trustee’s performance of its duties under the Trust

Agreement unless caused by the willful misconduct, bad faith or gross negligence of the Owner Trustee or as a result of any breach of representations made by the Owner Trustee in the Trust Agreement.

The Owner Trustee will be entitled to a fee in connection with the performance of its duties under the transaction documents. The Trust will pay the fees of

the Owner Trustee, reimburse the Owner Trustee for expenses incurred in performing its duties, and pay any indemnities due to the Owner Trustee, in each case, in connection with the performance of its duties under the transaction documents. The

Trust will pay the Series 2022-4 Group Allocated Percentage of such amounts from Series 2022-4 Available Funds on each Payment Date in accordance with the priorities set forth under “Description of the Notes—Priority

of Payments.” If the Notes have been accelerated after the occurrence of an Event of Default, the Trust will pay the Series 2022-4 Group Allocated Percentage of such amounts from Series 2022-4 Available Funds on each Payment Date in

accordance with the priorities set forth under “Description of the Notes—Post-Acceleration Priority of Payments.”

The Owner Trustee may resign at any time by notifying the Depositor and the Administrator at least thirty (30) days in advance. The Administrator may remove

the Owner Trustee at any time and for any reason with at least thirty (30) days’ notice, and must remove the Owner Trustee if the Owner Trustee becomes legally unable to act, becomes subject to a bankruptcy or is no longer eligible to act as Owner

Trustee under the Trust Agreement because of changes in its legal status, financial condition or specific rating conditions. No resignation or removal of the Owner Trustee will be effective until a successor owner trustee is in place. If not paid

by the Trust, the Administrator will reimburse the Owner Trustee and the successor owner trustee for any expenses associated with the replacement of the Owner Trustee.

The Trust Agreement will terminate on the later of the date when:

|

• |

the last Trust DPPA has been paid in full, settled, sold or written-off and all cash collections and other cash proceeds (whether in the form of cash, wire transfer or check) in respect of the Trust DPPAs (other

than recoveries on written-off Trust DPPAs, including any proceeds from the sale of a wireless device securing a Trust DPPA) have been received by the Servicer during the period and applied, and

|

|

• |

the Trust has paid all Credit Extensions in full, and all other amounts payable by it under the transaction documents.

|

Upon termination of the Trust Agreement, any remaining Trust assets will be distributed to the Certificateholders and the Trust will be terminated.

MASTER COLLATERAL AGENT AND INDENTURE TRUSTEE

U.S. Bank National Association, a national banking association, will act as Master Collateral Agent under the Master Collateral Agreement and as Indenture

Trustee under the Indenture.

U.S. Bank N.A. has made a strategic decision to reposition its corporate trust business by transferring substantially all of its corporate trust business to

its affiliate, U.S. Bank Trust Company, National Association (“U.S. Bank Trust Co.”), a non-depository trust company. (U.S. Bank N.A. and U.S. Bank Trust Co. are collectively referred to herein as “U.S. Bank”). Upon U.S. Bank Trust Co.’s succession to the business of U.S. Bank N.A., it has become a wholly owned subsidiary of U.S. Bank N.A. U.S. Bank will continue to act as Master Collateral Agent and as

Indenture Trustee pursuant to the Transaction Documents until the conditions precedent to the transfer of U.S. Bank N.A.’s roles to U.S. Bank Trust Co. have been satisfied. After such transfer, the Master Collateral Agent will maintain the

Collection Account in the name of the Master Collateral Agent and the Indenture Trustee will maintain the Series Bank Accounts in the name of the Indenture Trustee, in each case, at U.S. Bank N.A., and the Master Collateral Agent and the Indenture

Trustee, as applicable, will administer the Transaction Documents from the same location and using the same systems and employees as U.S. Bank N.A. has for this transaction and prior transactions of Verizon ABS II LLC.

U.S. Bancorp, with total assets exceeding $573 billion as of December 31, 2021, is the parent company of U.S. Bank, the fifth largest commercial bank in the

United States. As of December 31, 2021, U.S. Bancorp operated over 2,200 branch offices in 26 states. A network of specialized U.S. Bancorp offices across the nation provides a comprehensive line of banking, brokerage, insurance, investment,

mortgage, trust and payment services products to consumers, businesses, and institutions.

U.S. Bank has one of the largest corporate trust businesses in the country with office locations in 48 domestic and 2 international cities. The Indenture

will be administered from U.S. Bank’s corporate trust office located at 190 South LaSalle Street, 7th floor, Mail code MK-IL-SL7C, Chicago, IL 60603, and its office for certificate transfer purposes is at 111 Fillmore Avenue, St. Paul, Minnesota

55107, Attention: Bondholder Services – Verizon Master Trust Series 2022-4.

U.S. Bank has provided corporate trust services since 1924. As of December 31, 2021, U.S. Bank was acting as trustee with respect to over 118,000 issuances

of securities with an aggregate outstanding principal balance of over $5.2 trillion. This portfolio includes corporate and municipal bonds, mortgage-backed and asset-backed securities and collateralized debt obligations.

The Indenture Trustee shall make each monthly statement available to the holders via the Indenture Trustee’s internet website at https://pivot.usbank.com.

Holders with questions may direct them to the Indenture Trustee’s bondholder services group at (800) 934-6802.

As of December 31, 2021, U.S. Bank (and its affiliate U.S. Bank Trust National Association) was acting as indenture trustee on 10 issuances of device payment

plan asset-backed securities with an outstanding aggregate principal balance of approximately $9,930,115,704.53.

U.S. Bank and other large financial institutions have been sued in their capacity as trustee or successor trustee for certain residential mortgage backed

securities ("RMBS") trusts. The complaints, primarily filed by investors or investor groups against U.S. Bank and similar institutions, allege the trustees caused losses to investors as a result of alleged

failures by the sponsors, mortgage loan sellers and servicers to comply with the governing agreements for these RMBS trusts. Plaintiffs generally assert causes of action based upon the trustees’ purported failures to enforce repurchase obligations

of mortgage loan sellers for alleged breaches of representations and warranties, notify securityholders of purported events of default allegedly caused by breaches of servicing standards by mortgage loan servicers and abide by a heightened standard

of care following alleged events of default.

U.S. Bank denies liability and believes that it has performed its obligations under the RMBS trusts in good faith, that its actions were not the cause of

losses to investors, that it has meritorious defenses, and it has contested and intends to continue contesting the plaintiffs’ claims vigorously. However, U.S. Bank cannot assure you as to the outcome of any of the litigation, or the possible impact

of these litigations on the trustee or the RMBS trusts.

On March 9, 2018, a law firm purporting to represent fifteen Delaware statutory trusts (the “DSTs”) that issued

securities backed by student loans (the “Student Loans”) filed a lawsuit in the Delaware Court of Chancery against U.S. Bank in its capacities as indenture trustee and successor special servicer, and three

other institutions in their respective transaction capacities, with respect to the DSTs and the Student Loans. This lawsuit is captioned The National Collegiate Student Loan Master Trust I, et al. v. U.S. Bank

National Association, et al., C.A. No. 2018-0167-JRS (Del. Ch.) (the “NCMSLT Action”). The complaint, as amended on June 15, 2018, alleged that the DSTs have been harmed as a result of purported

misconduct or omissions by the defendants concerning administration of the trusts and special servicing of the Student Loans. Since the filing of the NCMSLT Action, certain Student Loan borrowers have made assertions against U.S. Bank concerning

special servicing that appear to be based on certain allegations made on behalf of the DSTs in the NCMSLT Action.

U.S. Bank has filed a motion seeking dismissal of the operative complaint in its entirety with prejudice pursuant to Chancery Court Rules 12(b)(1) and

12(b)(6) or, in the alternative, a stay of the case while other prior filed disputes involving the DSTs and the Student Loans are litigated. On November 7, 2018, the Court ruled that the case should be stayed in its entirety pending resolution of

the first-filed cases. On January 21, 2020, the Court entered an order consolidating for pretrial purposes the NCMSLT Action and three other lawsuits pending in the Delaware Court of Chancery concerning the DSTs and the Student Loans, which remains

pending.

U.S. Bank denies liability in the NCMSLT Action and believes it has performed its obligations as indenture trustee and special servicer in good faith and in

compliance in all material respects with the terms of the agreements governing the DSTs and that it has meritorious defenses. It has contested and intends to continue contesting the plaintiffs’ claims vigorously.

As further set forth in the Master Collateral Agreement, the Master Collateral Agent’s main duties with respect to Group 1 will be:

|

• |

holding the security interest in the Trust assets on behalf of the Group 1 Creditors,

|

|

• |

administering the Collection Account and making required remittances of amounts on deposit in the Collection Account to each Group 1 Series, in accordance with the Master Collateral Agreement,

|

|

• |

following an Event of Default and acceleration of any Group 1 Credit Extensions, (i) instituting proceedings for the collection of all amounts then payable on the applicable Group 1 Credit Extensions, enforcing

any judgment obtained and collecting from the Trust any amounts due, (ii) taking any appropriate action to protect and enforce the rights and remedies of the Master Collateral Agent and the Group 1 Creditors and (iii) causing the Trust to

sell the Receivables and other assets of the Trust designated to Group 1 (and, in the limited circumstances described under “Description of the Notes—Events of Default—Remedies Following Event of

|

Default,” other Trust DPPAs designated to any other Group) in accordance with the Master Collateral Agreement, and

|

• |

providing written notice to the Parent Support Provider of the failure of any Originator, the Servicer or the Marketing Agent, as applicable, to make required payments in respect of the Receivables under the

transaction documents.

|

The Master Collateral Agent will not have the authority to, and will not, exercise any remedies upon the occurrence of an Event of Default unless directed in

writing by the relevant Group 1 Creditor Representatives in accordance with the terms of the Master Collateral Agreement, and provided further that the Master Collateral Agent will not have the authority to, and will not, cause the Trust to sell the

Receivables and other assets of the Trust designated to Group 1 (and, in the limited circumstances described under “Description of the Notes—Events of Default—Remedies Following Event of Default,” other Trust

DPPAs designated to any other Group) unless the conditions set forth under “Description of the Notes—Events of Default—Remedies Following Event of Default” have been satisfied.

The Master Collateral Agent shall not be charged with knowledge of an Event of Default, amortization event under any Group 1 Series or Servicer Termination

Event, or any event that with the giving of notice or passage of time would constitute an Event of Default, amortization event under any Group 1 Series or Servicer Termination Event, unless a responsible person of the Master Collateral Agent obtains

actual knowledge of such event or the Master Collateral Agent receives written notice of such event from the Trust, the Servicer or a Group 1 Creditor Representative, as applicable.

For a description of the rights and duties of the Master Collateral Agent after an Event of Default and upon acceleration of the Notes you

should read “Description of the Notes—Events of Default.”

The Master Collateral Agent is only obligated to perform such duties as are specifically set forth in the Master Collateral Agreement. Under the Master

Collateral Agreement, the Master Collateral Agent shall solely be liable for its own grossly negligent action, its own grossly negligent failure to act, its grossly negligent action or failure to act in the handling of funds or its own willful

misconduct; provided that the Master Collateral Agent will not be liable (i) for any error of judgment made in good faith by an officer or employee of the Master Collateral Agent unless it is proved that the Master Collateral Agent was grossly

negligent in determining the relevant facts and (ii) with respect to any action taken or not taken in good faith in accordance with a direction received by it pursuant to the Master Collateral Agreement.

The Master Collateral Agent will not be required to expend or risk its own funds or otherwise incur financial liability in the performance of any of its

duties under the Master Collateral Agreement or in the exercise of any of its rights or powers thereunder if it reasonably believes that repayments of such funds or adequate indemnity satisfactory to it against any loss, liability or expense is not

reasonably assured to it. The Master Collateral Agent also will not be required to take action in response to requests or directions of any Group 1 Creditors, other than requests or directions from Public Group 1 Noteholders with respect to

forwarding notices set forth under the dispute resolution procedures described under “Receivables—Dispute Resolution,” the Asset Representations Review procedures described under “Receivables—Asset Representations Review” and the Noteholder communication procedures described under “Description of the Notes—Noteholder Communications,” unless those Group 1 Creditors have

offered reasonable security or indemnity satisfactory to the Master Collateral Agent to protect it against the reasonable costs and expenses that it may incur in complying with the request or direction. The Master Collateral Agent may exercise its

rights or powers under the Master Collateral Agreement or perform its obligations thereunder either directly or by or through agents or attorneys or a custodian or nominee. The Master Collateral Agent will not have any obligation or responsibility

to monitor or enforce the Sponsor’s compliance with any risk retention requirements and shall not be charged with knowledge of the U.S. Risk Retention Rules, nor shall it be liable to any Group 1 Creditor, Certificateholder or other party for

violation of the U.S. Risk Retention Rules now or hereafter in effect, except as otherwise may be explicitly required by law, rule or regulation.

The Trust will indemnify the Master Collateral Agent and its officers, directors, employees, agents, successors and assigns against any and all losses,

liabilities, claims, damages, actions, suits, stamp or similar taxes, fees, penalties, disbursements and reasonable and documented out-of-pocket costs or expenses (including, but not limited to, reasonable attorneys’ fees and expenses, including

reasonable legal fees and expenses in connection with the enforcement of its rights (including rights of indemnification)

under the Master Collateral Agreement) of whatever kind or nature regardless of merit, demanded, asserted or claimed against or incurred by them to the extent related to or

arising out of the administration of the Master Collateral Agreement and the performance of its duties thereunder or under the transaction documents, including the costs and expenses of enforcing the Master Collateral Agreement against the Trust and

defending itself against or investigating any claims (whether asserted by the Trust, any Creditor or any other Person), not resulting from the gross negligence, bad faith or willful misconduct by the Person seeking indemnification.

The Administrator will indemnify U.S. Bank N.A., in its capacity as Master Collateral Agent and each of its other capacities under the transaction documents

for any amounts not paid by the Trust; provided that U.S. Bank N.A. will reimburse the Administrator for any indemnified amounts paid to it by the Administrator to the extent that it subsequently receives payment or reimbursement of those amounts

from the Trust. Each of the Servicer and the Marketing Agent will indemnify U.S. Bank N.A., in its capacity as Master Collateral Agent and each of its other capacities under the transaction documents for damages caused by that party’s willful

misconduct, bad faith or gross negligence in the performance of its duties as Servicer or Marketing Agent, as applicable.

The Master Collateral Agent will be entitled to a fee in connection with the performance of its duties under the transaction documents. The Trust will pay

the fees of the Master Collateral Agent, reimburse the Master Collateral Agent for expenses incurred in performing its duties, and pay any indemnities due to the Master Collateral Agent, in each case, in connection with the performance of its duties

under the transaction documents. The Trust will pay the Series 2022-4 Group Allocated Percentage of such amounts from Series 2022-4 Available Funds on each Payment Date in accordance with the priorities set forth under “Description of the Notes—Priority of Payments.” If the Notes have been accelerated after the occurrence of an Event of Default, the Trust will pay the Series 2022-4 Group Allocated Percentage of such amounts from Series 2022-4

Available Funds on each Payment Date in accordance with the priorities set forth under “Description of the Notes—Post-Acceleration Priority of Payments.”

The Master Collateral Agent may resign at any time by giving ninety (90) days written notice to the Trust and each Creditor Representative. The Majority Trust

Creditor Representatives may remove the Master Collateral Agent by so notifying the Master Collateral Agent in writing and may appoint a successor Master Collateral Agent (and, so long as no Servicer Termination Event or Event of Default exists at

such time, with the consent of the Trust, such consent not to be unreasonably withheld, delayed or conditioned). The Trust shall remove the Master Collateral Agent if: (i) the Master Collateral Agent fails to satisfy the eligibility requirements

under the Master Collateral Agreement; (ii) the Master Collateral Agent is subject to an insolvency event; (iii) a receiver or other public officer takes charge of the Master Collateral Agent or its property; or (iv) the Master Collateral Agent

otherwise becomes incapable of acting or it becomes unlawful for it to do so.

If the Master Collateral Agent resigns or is removed or if a vacancy exists in the office of the Master Collateral Agent for any reason, the Trust or Majority

Trust Creditor Representatives shall promptly appoint a successor master collateral agent.

No resignation or removal of the Master Collateral Agent will be effective until a successor master collateral agent is in place; provided, however, that if

no successor master collateral agent has been appointed within sixty (60) days after the Master Collateral Agent resigns or is removed, the retiring Master Collateral Agent, the Trust or Majority Trust Creditor Representatives may petition a court of

competent jurisdiction to appoint a successor master collateral agent.

As further set forth in the Indenture, the Indenture Trustee’s main duties will be:

|

• |

holding the security interest in any assets specifically designated to Series 2022-4 on behalf of the Noteholders,

|

|

• |

administering the Series Bank Accounts and, in its capacity as Paying Agent, making payments from the Series Bank Accounts to the Noteholders and others,

|

|

• |

acting as Creditor Representative for Series 2022-4,

|

|

• |

voting or directing the Master Collateral Agent under the Master Collateral Agreement, as Group 1 Creditor Representative for Series 2022-4, as to all matters on which Group 1 Creditor Representatives may vote

or direct the Master Collateral Agent under the Master Collateral Agreement,

|

|

• |

following an Event of Default and acceleration of the Notes, (i) instituting proceedings for the collection of all amounts then payable on the Notes, enforcing any judgment obtained and collecting from the Trust

any amounts due, (ii) taking any appropriate action to protect and enforce the rights and remedies of the Indenture Trustee and the Noteholders and (iii) voting, as the Group 1 Creditor Representative for Series 2022-4, to cause the Master

Collateral Agent to direct the Trust to sell the Receivables and other assets of the Trust designated to Group 1 (and, in the limited circumstances described under “Description of the Notes—Events of

Default—Remedies Following Event of Default,” other Trust DPPAs designated to any other Group) in accordance with the Master Collateral Agreement;

|

|

• |

acting as note registrar to maintain a record of the Noteholders and provide for the registration, transfer, exchange and replacement of the Notes, and

|

|

• |

except in limited circumstances, notifying the Noteholders of an Event of Default.

|

Except in limited circumstances, if an officer in the corporate trust office of the Indenture Trustee having direct responsibility for the administration of

the transaction documents has actual knowledge of or receives written notice of an event that with notice or the lapse of time or both would become an Event of Default, it must provide written notice to the Noteholders within ninety (90) days. If an

officer in the corporate trust office of the Indenture Trustee having direct responsibility for the administration of the transaction documents has actual knowledge of an Event of Default, it must notify the Noteholders within five (5) Business

Days. If the Notes have been accelerated, the Indenture Trustee may, and at the direction of the holders of a majority of the Note Balance of the Controlling Class must, begin proceedings for the collection of amounts payable on the Notes and

enforce any judgment obtained and, in some circumstances, direct the Master Collateral Agent to sell the Receivables and other assets of the Trust designated to Group 1 (and, in the limited circumstances described under “Description of the Notes—Events of Default—Remedies Following Event of Default,” other Trust DPPAs designated to any other Group).

The Indenture Trustee’s standard of care changes depending on whether an Event of Default has occurred. Prior to an Event of Default, the Indenture Trustee

will not be liable for any action or omission unless that act or omission constitutes willful misconduct, bad faith or negligence by the Indenture Trustee. The Indenture Trustee will not be liable for an error of judgment made in good faith unless

it is proved that the Indenture Trustee was negligent in determining the relevant facts. Following an Event of Default, the Indenture Trustee must exercise its rights and powers under the Indenture using the same degree of care and skill that a

prudent person would use under the circumstances in conducting his or her own affairs. Following an Event of Default, the Indenture Trustee may assert claims on behalf of the Trust and the Noteholders against the Depositor, any Originator, the

Servicer or the Additional Transferor.

For a description of the rights and duties of the Indenture Trustee after an Event of Default and upon acceleration of the Notes you

should read “Description of the Notes—Events of Default.”

The Indenture Trustee will transmit an annual report to the Noteholders if certain events identified in the Trust Indenture Act have occurred during the prior

year, including a change to the Indenture Trustee’s eligibility under the Trust Indenture Act, a conflict of interest under the Trust Indenture Act and any action taken by the Indenture Trustee that has a material adverse effect on the Notes.

The Indenture Trustee will not be required to expend or risk its own funds or otherwise incur financial liability in the performance of any of its duties

under the Indenture or in the exercise of any of its rights or powers thereunder if it reasonably believes that repayments of such funds or adequate indemnity satisfactory to it against any loss, liability or expense is not reasonably assured to it.

The Indenture Trustee also will not be required to take action in response to requests or directions of any Noteholders unless those Noteholders have offered reasonable security or indemnity satisfactory to the Indenture Trustee to protect

it against the reasonable costs and expenses that it may incur in complying with the request or direction. The Indenture Trustee may exercise its

rights or powers under the Indenture or perform its obligations thereunder either directly or by or through agents or attorneys or a custodian or nominee. The Indenture Trustee will not have any obligation or responsibility to monitor or

enforce the Sponsor’s compliance with any risk retention requirements and shall not be charged with knowledge of the U.S. Risk Retention Rules, nor shall it be liable to any Noteholder or other party for violation of the U.S. Risk Retention Rules now

or hereafter in effect, except as otherwise may be explicitly required by law, rule or regulation.

The Trust will indemnify U.S. Bank N.A., in its capacity as Indenture Trustee and each of its other capacities under the transaction documents, and its

officers, directors, employees and agents for all losses, liabilities, expenses (including reasonable attorney’s fees and expenses), damages, costs and disbursements incurred in connection with, arising out of or resulting from the administration of

Notes issued under the Indenture and the performance of its obligations under the Indenture and the other transaction documents (including any amounts incurred by the Indenture Trustee in connection with (x) defending itself against any claim, legal

action or proceeding, or (y) the enforcement of any indemnification or other obligation of the Trust, the Servicer or any other transaction party) unless caused by the willful misconduct, bad faith or negligence of the Indenture Trustee or as a

result of any breach of representations made by the Indenture Trustee in the Indenture. The Administrator will indemnify U.S. Bank N.A., in its capacity as Indenture Trustee and each of its other capacities under the transaction documents for any

amounts not paid by the Trust; provided that U.S. Bank N.A. will reimburse the Administrator for any indemnified amounts paid to it by the Administrator to the extent that it subsequently receives payment or reimbursement of those amounts from the

Trust. Each of the Servicer and the Marketing Agent will indemnify U.S. Bank N.A., in its capacity as Indenture Trustee and each of its other capacities under the transaction documents for damages caused by that party’s willful misconduct, bad faith

or gross negligence in the performance of its duties as Servicer or Marketing Agent, as applicable.

The Indenture Trustee will be entitled to a fee in connection with the performance of its duties under the Indenture. The Trust will pay the fees of the

Indenture Trustee, reimburse the Indenture Trustee for expenses incurred in performing its duties, and pay any indemnities due to the Indenture Trustee, in each case, in connection with the performance of its duties under the Indenture. The Trust

will pay these amounts from Series 2022-4 Available Funds on each Payment Date in accordance with the priorities set forth under “Description of the Notes—Priority of Payments.” If the Notes have been

accelerated after the occurrence of an Event of Default, the Trust will pay such amounts from Series 2022-4 Available Funds on each Payment Date in accordance with the priorities set forth under “Description of the

Notes—Post-Acceleration Priority of Payments.”

The Indenture Trustee may resign at any time by providing thirty (30) days’ prior written notice to the Trust and the Administrator. The holders of a

majority of the Note Balance of the Controlling Class may remove the Indenture Trustee upon thirty (30) days’ prior written notice for any reason by notifying the Indenture Trustee and the Trust. The Trust must remove the Indenture Trustee if the

Indenture Trustee becomes legally unable to act or becomes subject to a bankruptcy or is no longer eligible to act as Indenture Trustee under the Indenture because of changes in its legal status, financial condition or specific rating conditions. If

the Indenture Trustee resigns or is removed or if a vacancy exists in the office of the Indenture Trustee, the Trust or the holders of a majority of the Note Balance of the Controlling Class are required to appoint a successor indenture trustee

promptly. No resignation or removal of the Indenture Trustee will be effective until a successor indenture trustee is in place; provided, however, that if no successor indenture trustee has been appointed within sixty (60) days after the Indenture

Trustee resigns or is removed, the Indenture Trustee, the Trust or the holders of a majority of the Note Balance of the Controlling Class may petition a court of competent jurisdiction to appoint a successor indenture trustee. If not paid by the

Trust, the Administrator will reimburse the Indenture Trustee and the successor indenture trustee for any expenses associated with the replacement of the Indenture Trustee.

Under the Trust Indenture Act, the Indenture Trustee may be considered to have a conflict of interest and be required to resign as Indenture Trustee for the

Notes or any class of Notes if a default occurs under the Indenture. In these circumstances, separate successor indenture trustees will be appointed for each class of Notes. Even if separate indenture trustees are appointed, only the Indenture

Trustee acting on behalf of the Controlling Class will have the right to exercise remedies and only the Controlling Class will have the right to direct or consent to any action to be taken, including a sale of the Receivables and other assets of the

Trust designated to Group 1 (and, in the limited circumstances described under “Description

of the Notes—Events of Default—Remedies Following Event of Default,” other Trust DPPAs designated to any other Group).

ASSET REPRESENTATIONS REVIEWER

Pentalpha Surveillance LLC (“Pentalpha”), a Delaware limited liability company, will serve as the Asset

Representations Reviewer pursuant to the terms of an Asset Representations Review Agreement.

Pentalpha is a privately held firm founded in 2005 that is primarily dedicated to providing independent oversight of loan securitization trusts’ ongoing

operations. Pentalpha and its affiliates have been engaged by individual securitization trusts, financial institutions, institutional investors as well as agencies of the U.S. government. Pentalpha’s platform utilizes compliance checking software and

a team of industry specialists focused on loan origination and servicing oversight, with engagements in surveillance, valuation, collections optimization, representation and warranty failures, derivative contract errors, litigation support and expert

testimony as well as other advisory assignments.

As of February 28, 2022, Pentalpha has been engaged as the asset representations reviewer or independent reviewer on more than 300 asset-backed and commercial

and residential mortgage securitization transactions since 2010.

Pentalpha satisfies each of the eligibility requirements for the asset representations reviewer set forth in the Asset Representations Review Agreement. The

Asset Representations Reviewer is not and will not be affiliated with any of the Sponsor, the Depositor, the Trust, the Servicer, the Administrator, the Marketing Agent, the Originators, the Additional Transferor, the Parent Support Provider, the

Master Collateral Agent, the Indenture Trustee, the Owner Trustee, any Letter of Credit Provider, if applicable, or any of their respective affiliates, and may not be an affiliate of any Person that was engaged by Cellco or any underwriter of the

Notes to perform any due diligence on the Receivables prior to the Closing Date.

The Asset Representations Reviewer’s main obligations will be to:

|

• |

review all ARR Receivables for compliance with the eligibility representations made with respect to those Receivables following receipt of a review notice from the Master Collateral Agent, and

|

|

• |

provide a report on the results of the review to the Administrator, the Depositor, the Trust, the Servicer and the Master Collateral Agent.

|

For a description of the review to be performed by the Asset Representations Reviewer, you should read “Receivables — Asset

Representations Review.”

The Asset Representations Reviewer will be entitled to a fee in connection with the performance of its duties under the Asset Representations Review

Agreement. The Trust will pay the fees of the Asset Representations Reviewer, reimburse the Asset Representations Reviewer for expenses incurred in performing its duties, and pay any indemnities due to the Asset Representations Reviewer, in each

case, in connection with the performance of its duties under the Asset Representations Review Agreement. The Trust will pay the Series 2022-4 ARR Series Allocation Percentage of such amounts from Series 2022-4 Available Funds on each Payment Date in

accordance with the priorities set forth under “Description of the Notes—Priority of Payments.” If the Notes have been accelerated after the occurrence of an Event of Default, the Trust will pay the Series

2022-4 ARR Series Allocation Percentage of such amounts from Series 2022-4 Available Funds on each Payment Date in accordance with the priorities set forth under “Description of the Notes—Post-Acceleration Priority

of Payments.”

In the event an Asset Representations Review occurs, the Asset Representations Reviewer will be entitled to a fee equal of $50,000. With respect to Series

2022-4, the Trust will pay the Series 2022-4 ARR Series Allocation Percentage of such amounts from Series 2022-4 Available Funds on each Payment Date in accordance with the priorities set forth under “Description of

the Notes—Priority of Payments.” If the Notes have been accelerated after the occurrence of an Event of Default, the Trust will pay the Series 2022-4 ARR Series Allocation Percentage of such amounts from Series 2022-4 Available Funds on

each

Payment Date in accordance with the priorities set forth under “Description of the Notes—Post-Acceleration Priority of Payments.”

The Asset Representations Reviewer may not resign unless it determines, in its sole discretion that (a) it is legally unable to perform its obligations under

the Asset Representations Review Agreement and (b) there is no reasonable action that it could take to make the performance of its obligations under the Asset Representations Review Agreement permitted under applicable law. If the Asset

Representations Reviewer breaches any of its representations, warranties, covenants or obligations under the Asset Representations Review Agreement, becomes the subject of a bankruptcy or similar proceeding, or no longer satisfies the applicable

eligibility criteria, the Trust may remove the Asset Representations Reviewer and terminate its obligations under the Asset Representations Review Agreement. The Trust will be obligated to engage a successor asset representations reviewer after any

resignation or removal. No resignation or removal of the Asset Representations Reviewer will be effective, and the Asset Representations Reviewer will continue to perform its obligations under the Asset Representations Review Agreement, until a

successor asset representations reviewer has accepted its engagement.

The Asset Representations Reviewer is not contractually obligated to pay the reasonable expenses incurred in the transfer of its rights and obligations under

the Asset Representations Review Agreement. To the extent expenses incurred in connection with the replacement of the Asset Representations Reviewer are not paid by the Asset Representations Reviewer that is being replaced, the Trust will be

responsible for the payment of those expenses. If not paid by the Trust, the Administrator will reimburse the Asset Representations Reviewer and the successor asset representations reviewer for any expenses associated with the replacement of the

Asset Representations Reviewer. Any resignation, removal, replacement or substitution of the Asset Representations Reviewer, or the appointment of a new asset representations reviewer, will be reported by the Administrator in the Form 10-D related

to the Collection Period in which the change occurs, together with a description of the circumstances surrounding the change and, if applicable, information regarding the new asset representations reviewer.

The Asset Representations Reviewer will not be liable to any Person or entity for any action taken, or not taken, in good faith under the Asset

Representations Review Agreement or for errors in judgment. However, the Asset Representations Reviewer will be liable for its willful misconduct, bad faith or gross negligence in performing its obligations under the Asset Representations Review

Agreement. The Asset Representations Reviewer and its officers, directors, employees and agents will be indemnified by the Trust for fees, expenses, losses, damages, liabilities, reasonable attorney’s fees and other related legal costs resulting

from the performance of its obligations under the Asset Representations Review Agreement (including the fees and expenses of defending itself against any loss, damage or liability), but excluding any fee, expense, loss, damage or liability resulting

from (i) the Asset Representations Reviewer’s willful misconduct, bad faith or gross negligence or (ii) the Asset Representations Reviewer’s breach of any of its representations or warranties in the Asset Representations Review Agreement. The Asset

Representations Reviewer will indemnify each of the Trust, the Depositor, the Administrator, the Servicer, the Owner Trustee and the Master Collateral Agent and their respective directors, officers, employees and agents for all fees, expenses,

losses, damages, liabilities, reasonable attorney’s fees and other related legal costs resulting from (a) the willful misconduct, bad faith or gross negligence of the Asset Representations Reviewer in performing its obligations under the Asset

Representations Review Agreement or (b) the Asset Representations Reviewer’s breach of any of its representations or warranties in the Asset Representations Review Agreement.

SPONSOR, SERVICER, CUSTODIAN, MARKETING AGENT AND ADMINISTRATOR

Verizon Communications is a holding company that, acting through its subsidiaries, is one of the world’s leading providers of technology, communications,

information and entertainment products and services to consumers, businesses and government entities. Verizon has two reportable segments that it operates and manages as strategic business units, Verizon Consumer Group and Verizon Business Group,

and Verizon offers wireless services and equipment to customers of both. Verizon’s wireless services are provided across one of the most extensive wireless networks in the United States. As of March 31, 2022, the Verizon Consumer Group had

approximately 91.4 million wireless retail postpaid connections and the

Verizon Business Group had approximately 27.8 million wireless retail postpaid connections. Verizon had consolidated revenues of $133.6 billion for the year ended December 31,

2021. As of March 31, 2022, Verizon had approximately 118,500 employees.

Cellco is an indirect wholly-owned subsidiary of Verizon Communications. Cellco is a Delaware general partnership formed on October 4, 1994. The address of

Cellco’s principal executive office is One Verizon Way, Basking Ridge, New Jersey 07920. Cellco services all of Cellco’s and other Verizon Communications subsidiary originators’ wireless accounts, including the Device Payment Plan Agreements.

As the Sponsor of the securitization transaction in which the Notes will be issued, Cellco will be responsible for structuring the securitization transaction

and selecting the transaction parties. Cellco and its affiliates will be responsible for paying the costs and expenses of issuing the Notes, legal fees of some transaction parties, rating agency fees for rating the Notes and other transaction

expenses. The Sponsor and the other Originators have transferred prior to the Closing Date Device Payment Plan Agreements to the Depositor and from time to time after the Closing Date, the Sponsor, the other Originators and the Additional Transferor

will transfer additional Device Payment Plan Agreements to the Depositor.

Cellco has had an active securitization program since 2016. The Notes are the fifth Group 1 Series of Publicly Registered Notes issued by the Trust. In

addition to the four Group 1 Series of Publicly Registered Notes previously issued by the Trust, the Trust has also entered into two Group 1 Series of loans (Loan Series 2021-A and Loan Series 2021-B). Cellco also has sponsored 13 term

securitization trusts, including 7 public term securitization trusts, backed by Device Payment Plan Agreements. None of the asset-backed securities offered in this securitization program have experienced any losses or events of default and none of

Cellco, the other Originators or the Servicer has ever taken any action out of the ordinary in any transaction to prevent losses or events of default. During the three-year period ended December 31, 2020, none of Cellco, the other Originators or the

Servicer has ever received a demand for any Device Payment Plan Agreement backing asset-backed securities offered in a securitization program sponsored by the Sponsor to be acquired or reacquired, as applicable, due to a breach of representations

made about the related Device Payment Plan Agreements. Cellco, as the sponsor and securitizer, discloses all reacquisition and acquisition demands and related activity on SEC Form ABS-15G. Cellco filed its most recent Form ABS-15G with the SEC on

February 4, 2022. Cellco’s CIK number is 0001175215.

U.S. Credit Risk Retention

The U.S. Risk Retention Rules require the Sponsor, either directly or through one or more of its majority-owned affiliates, to

retain an economic interest of at least 5% in the credit risk of the Receivables.

The Sponsor, the other Originators, the Additional Transferor and the True-up Trust are under the common control of Verizon Communications, and therefore, the

True-up Trust is a majority-owned affiliate of the Sponsor.

The True-up Trust, as a majority-owned affiliate of the Sponsor, will retain the required economic interest in the credit risk of the Receivables in

satisfaction of the Sponsor’s obligations under the U.S. Risk Retention Rules, in the form of a qualifying “seller’s interest” consisting of the Transferor’s Interest (which, among other things, is represented by the Certificates), as wholly offset

by an “eligible horizontal residual interest” in Series 2022-4 consisting of the Class R Interest. The amount of the Transferor’s Interest on the Closing Date and at each subsequent monthly measurement date is required to equal not less than 5% of

the aggregate unpaid principal balance of all outstanding investor ABS interests in Group 1, as wholly offset by the percentage represented by the fair value of the Class R Interest, as Series EHRI, of the fair value of all outstanding ABS interests

in Series 2022-4 on the Closing Date. The Certificates represent the interest in each Group not represented by any Series of that Group and are entitled to, among other things, with respect to Group 1, distributions in respect of the Transferor’s

Interest on each Payment Date. In general, the Class R Interest represents the right to all Series 2022-4 Available Funds on any Payment Date not needed to pay fees, expenses and indemnities of the Trust allocated to or otherwise payable by Series

2022-4 or to make interest and principal payments on the Notes, payments, if any, required to reimburse any Letter of Credit Provider for any amounts drawn under the related Letter of Credit together with interest

accrued on the drawn amount, any required deposits into the Reserve Account or the Principal Funding Account, any Additional Interest Amounts and Make-Whole Payments payable on

that Payment Date.

None of the Sponsor, the Depositor, the Originators, the Additional Transferor, the True-up Trust or any of their affiliates may hedge, sell or transfer the

required retention except to the extent permitted by the U.S. Risk Retention Rules.

The Master Collateral Agent, the Indenture Trustee and the Owner Trustee will not have any obligation or responsibility to monitor or enforce the Sponsor’s

compliance with any risk retention requirements and shall not be charged with knowledge of the U.S. Risk Retention Rules, nor shall they be liable to any Noteholder, other Creditor or other party for violation of the U.S. Risk Retention Rules now or

hereafter in effect, except as otherwise may be explicitly required by law, rule or regulation.

For more information regarding the risk retention regulations and the Sponsor’s method of compliance with those regulations, see “Credit

Risk Retention.”

Servicer, Custodian, Marketing Agent and Administrator

Cellco is the Servicer of the Receivables under the Transfer and Servicing Agreement, as further described under “Servicing

the Receivables and the Securitization Transaction.” So long as Cellco is the Servicer, the Servicer is permitted to contract with others, which may be affiliates of Cellco or third-parties, to perform all or a portion of its servicing

obligations at the Servicer’s expense. No such delegation or contracting will relieve the Servicer of its obligations or liability for servicing and administering the Receivables in accordance with the provisions of the Transfer and Servicing

Agreement. Cellco has been the servicer for its securitization program since its inception in 2016 and has acted as servicer in 13 term securitization transactions backed by Device Payment Plan Agreements. The following table shows the size and

growth of Cellco’s managed portfolio of Device Payment Plan Agreements since December 31, 2017.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Device Payment Plan Agreements outstanding (in thousands)

|

46,350

|

|

43,242

|

|

45,403

|

|

43,786

|

|

46,013

|

|

45,701

|

|

45,588

|

|

Aggregate Principal Balance of Device Payment Plan Agreements outstanding (in millions)

|

$21,915.40

|

|

$17,787.94

|

|

$21,290.96

|

|

$17,867.27

|

|

$19,399.03

|

|

$19,201.60

|

|

$17,622.42

|

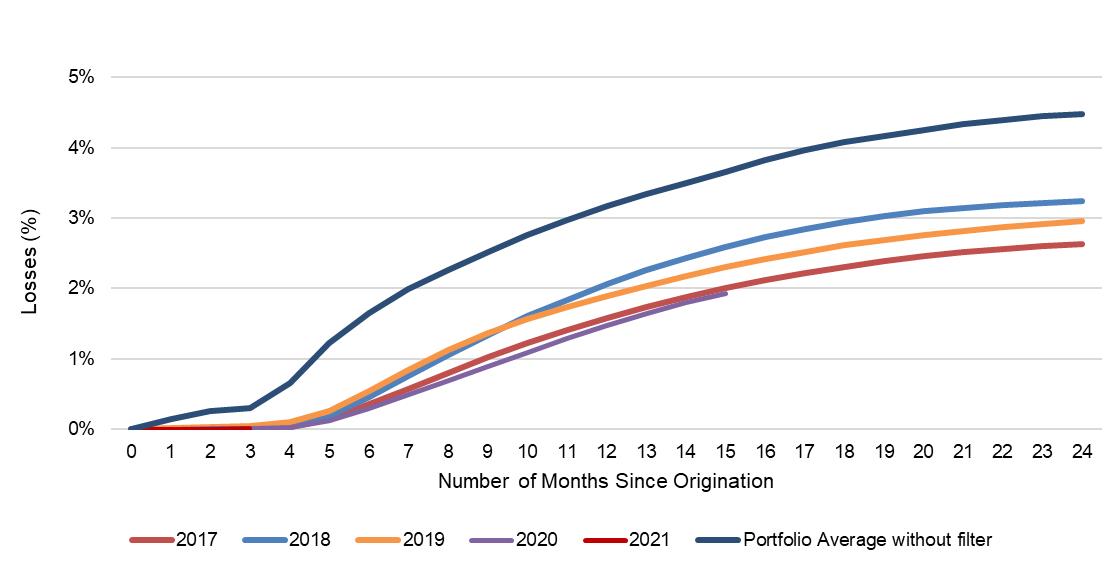

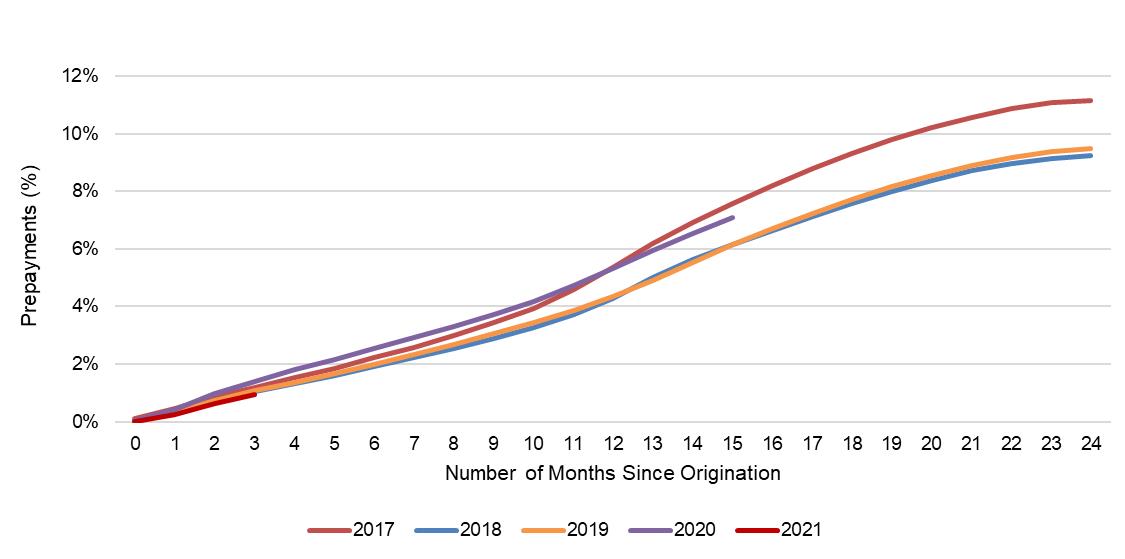

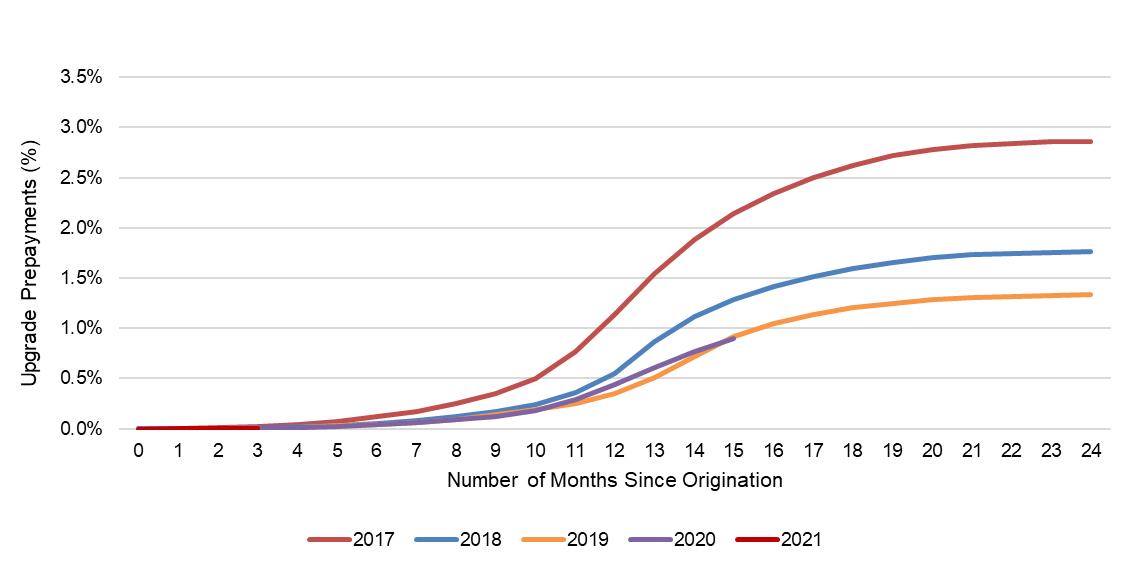

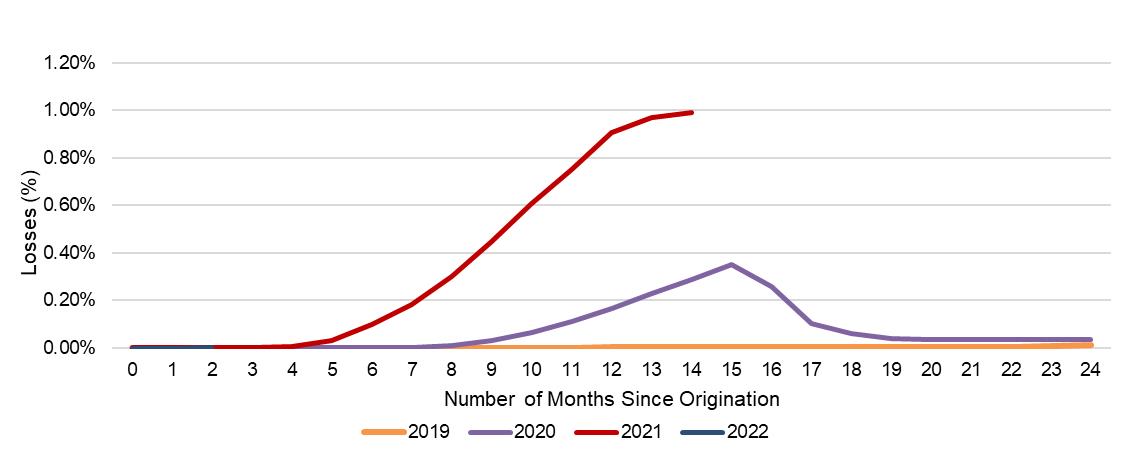

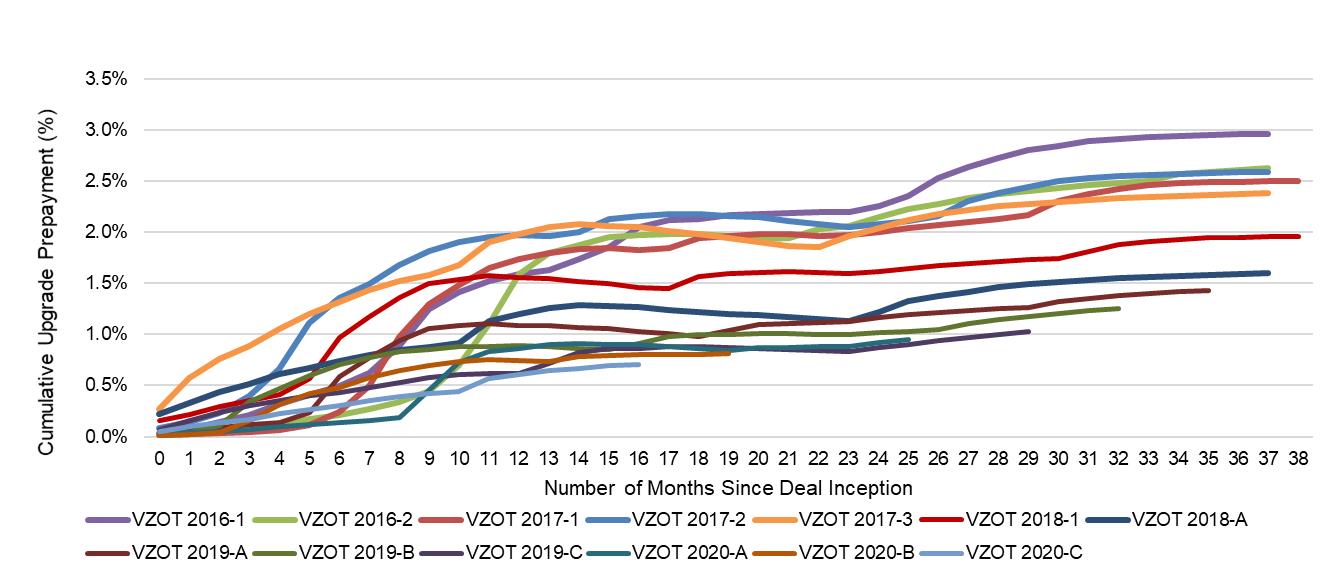

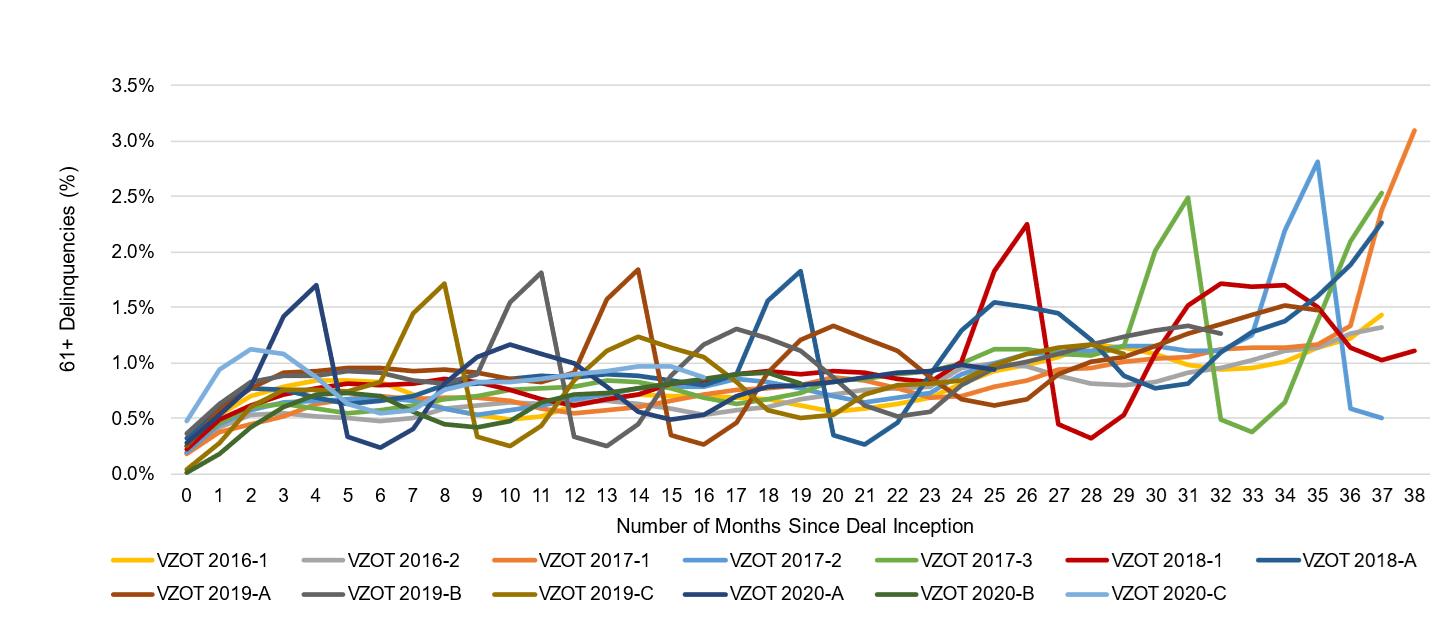

The tables under “Servicing the Receivables and the Securitization Transaction—Delinquency and Write-Off Experience” and on Annex A,

Annex B and Annex C show Cellco’s servicing experience for (1) the entire portfolio of Device Payment Plan Agreements that Cellco services, (2) the Receivables (as such term is defined in Annex B) and (3) prior securitized pools of Device Payment

Plan Agreements for Consumer Obligors. Cellco has not had any material instances of noncompliance with the servicing criteria in its public securitization program.

Cellco is the Custodian for the Trust and will maintain electronically a Receivable file for each Receivable. A Receivable file will include originals or

copies of the Device Payment Plan Agreement. For more information on Cellco’s obligations as Custodian, see “Servicing the Receivables and the Securitization Transaction—Custodial Obligations of Cellco.”

Cellco is the Marketing Agent and in this capacity, will be required to remit, or to cause the related Originators to remit, certain payments to the Trust or

take certain actions with respect to the Receivables, as described under “Receivables—Obligation to Acquire or Reacquire Receivables; Obligation to Make Credit Payments and Upgrade Prepayments.” Any fees and