UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04015

Eaton Vance Mutual Funds Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

March 31, 2022

Date of Reporting Period

Item 1. Reports to Stockholders

| % Average Annual Total Returns1,2 | Class

Inception Date |

Performance

Inception Date |

Six Months | One Year | Five Years | Ten Years |

| Class A at NAV | 11/17/2009 | 11/17/2009 | (5.48)% | (2.73)% | 3.16% | 3.46% |

| Class A with 4.75% Maximum Sales Charge | — | — | (10.00) | (7.38) | 2.17 | 2.96 |

| Class C at NAV | 11/17/2009 | 11/17/2009 | (5.75) | (3.38) | 2.39 | 2.84 |

| Class C with 1% Maximum Sales Charge | — | — | (6.68) | (4.32) | 2.39 | 2.84 |

| Class I at NAV | 11/17/2009 | 11/17/2009 | (5.28) | (2.41) | 3.42 | 3.72 |

|

| ||||||

| Bloomberg U.S. Aggregate Bond Index | — | — | (5.92)% | (4.15)% | 2.14% | 2.24% |

| % Total Annual Operating Expense Ratios3 | Class A | Class C | Class I |

| Gross | 0.82% | 1.57% | 0.57% |

| Net | 0.74 | 1.49 | 0.49 |

| 1 | Bloomberg U.S. Aggregate Bond Index is an unmanaged index of domestic investment-grade bonds, including corporate, government and mortgage-backed securities. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares.Effective November 5, 2020, Class C shares automatically convert to Class A shares eight years after purchase. The average annual total returns listed for Class C reflect conversion to Class A shares after eight years. Prior to November 5, 2020, Class C shares automatically converted to Class A shares ten years after purchase.Effective May 1, 2015, the Fund changed its investment objective and policies. Prior to May 1, 2015, the Fund invested primarily in Build America Bonds. Performance prior to May 1, 2015 reflects the Fund’s performance under its former investment objective and policies. |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 1/31/23. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. Performance reflects expenses waived and/or reimbursed, if applicable. Without such waivers and/or reimbursements, performance would have been lower. |

| Fund profile subject to change due to active management. |

| Beginning

Account Value (10/1/21) |

Ending

Account Value (3/31/22) |

Expenses

Paid During Period* (10/1/21 – 3/31/22) |

Annualized

Expense Ratio | |

| Actual | ||||

| Class A | $1,000.00 | $ 945.20 | $3.59** | 0.74% |

| Class C | $1,000.00 | $ 942.50 | $7.22** | 1.49% |

| Class I | $1,000.00 | $ 947.20 | $2.38** | 0.49% |

| Hypothetical | ||||

| (5% return per year before expenses) | ||||

| Class A | $1,000.00 | $1,021.24 | $3.73** | 0.74% |

| Class C | $1,000.00 | $1,017.50 | $7.49** | 1.49% |

| Class I | $1,000.00 | $1,022.49 | $2.47** | 0.49% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on September 30, 2021. |

| ** | Absent an allocation of certain expenses to an affiliate, expenses would be higher. |

| Forward Foreign Currency Exchange Contracts (OTC) | |||||||

| Currency Purchased | Currency Sold | Counterparty | Settlement

Date |

Unrealized

Appreciation |

Unrealized

(Depreciation) | ||

| USD | 2,182,218 | CAD | 2,799,001 | State Street Bank and Trust Company | 5/31/22 | $ — | $ (56,382) |

| $ — | $(56,382) | ||||||

| Futures Contracts | |||||

| Description | Number

of Contracts |

Position | Expiration

Date |

Notional

Amount |

Value/Unrealized

Appreciation (Depreciation) |

| Interest Rate Futures | |||||

| U.S. 2-Year Treasury Note | 375 | Long | 6/30/22 | $ 79,470,704 | $ (1,067,013) |

| U.S. 5-Year Treasury Note | 97 | Long | 6/30/22 | 11,124,688 | (291,146) |

| U.S. 10-Year Treasury Note | 21 | Long | 6/21/22 | 2,580,375 | (79,443) |

| U.S. Long Treasury Bond | 11 | Long | 6/21/22 | 1,650,687 | (52,958) |

| U.S. Ultra-Long Treasury Bond | (65) | Short | 6/21/22 | (11,513,125) | 412,753 |

| U.S. Ultra 10-Year Treasury Note | (314) | Short | 6/21/22 | (42,537,188) | 1,410,444 |

| $ 332,637 | |||||

| Abbreviations: | |

| LIBOR | – London Interbank Offered Rate |

| OTC | – Over-the-counter |

| SOFR | – Secured Overnight Financing Rate |

| Currency Abbreviations: | |

| CAD | – Canadian Dollar |

| IDR | – Indonesian Rupiah |

| MXN | – Mexican Peso |

| USD | – United States Dollar |

| March 31, 2022 | |

| Assets | |

| Unaffiliated investments, at value (identified cost $770,538,686) | $ 723,777,917 |

| Affiliated investments, at value (identified cost $25,067,988) | 22,995,549 |

| Cash | 133,465 |

| Deposits for derivatives collateral — financial futures contracts | 1,086,233 |

| Dividends and interest receivable | 4,233,743 |

| Interest and dividends receivable from affiliated investments | 66,038 |

| Receivable for investments sold | 624,216 |

| Receivable for Fund shares sold | 2,873,596 |

| Receivable from affiliate | 91,654 |

| Total assets | $755,882,411 |

| Liabilities | |

| Payable for investments purchased | $ 551,102 |

| Payable for when-issued securities | 3,156,000 |

| Payable for Fund shares redeemed | 4,333,292 |

| Payable for variation margin on open futures contracts | 83,125 |

| Payable for open forward foreign currency exchange contracts | 56,382 |

| Distributions payable | 9,908 |

| Due to custodian — foreign currency, at value (identified cost $89) | 88 |

| Payable to affiliates: | |

| Investment adviser fee | 287,078 |

| Distribution and service fees | 56,233 |

| Accrued expenses | 247,304 |

| Total liabilities | $ 8,780,512 |

| Net Assets | $747,101,899 |

| Sources of Net Assets | |

| Paid-in capital | $ 799,157,673 |

| Accumulated loss | (52,055,774) |

| Net Assets | $747,101,899 |

| Class A Shares | |

| Net Assets | $ 100,461,340 |

| Shares Outstanding | 8,769,748 |

| Net

Asset Value and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) |

$ 11.46 |

| Maximum

Offering Price Per Share (100 ÷ 95.25 of net asset value per share) |

$ 12.03 |

| Class C Shares | |

| Net Assets | $ 39,536,969 |

| Shares Outstanding | 3,453,380 |

| Net

Asset Value and Offering Price Per Share* (net assets ÷ shares of beneficial interest outstanding) |

$ 11.45 |

| Class I Shares | |

| Net Assets | $ 607,103,590 |

| Shares Outstanding | 53,042,142 |

| Net

Asset Value, Offering Price and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) |

$ 11.45 |

| On sales of $50,000 or more, the offering price of Class A shares is reduced. | |

| * | Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge. |

| Six Months Ended | |

| March 31, 2022 | |

| Investment Income | |

| Dividend income | $ 301,909 |

| Dividend income from affiliated investment | 7,883 |

| Interest income (net of foreign taxes, $609) | 11,893,617 |

| Interest income from affiliated investments | 537,289 |

| Total investment income | $ 12,740,698 |

| Expenses | |

| Investment adviser fee | $ 1,850,217 |

| Distribution and service fees: | |

| Class A | 135,112 |

| Class C | 224,456 |

| Trustees’ fees and expenses | 21,900 |

| Custodian fee | 104,013 |

| Transfer and dividend disbursing agent fees | 240,889 |

| Legal and accounting services | 13,136 |

| Printing and postage | 58,225 |

| Registration fees | 45,231 |

| Miscellaneous | 21,823 |

| Total expenses | $ 2,715,002 |

| Deduct: | |

| Allocation of expenses to affiliate | $ 342,165 |

| Total expense reductions | $ 342,165 |

| Net expenses | $ 2,372,837 |

| Net investment income | $ 10,367,861 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss): | |

| Investment transactions | $ (2,557,068) |

| Investment transactions - affiliated investments | (40,238) |

| Futures contracts | 3,102,787 |

| Foreign currency transactions | (20,601) |

| Forward foreign currency exchange contracts | 33,810 |

| Net realized gain | $ 518,690 |

| Change in unrealized appreciation (depreciation): | |

| Investments (including net decrease in accrued foreign capital gains taxes of $64,922) | $ (53,203,803) |

| Investments - affiliated investments | (690,142) |

| Futures contracts | (1,248,533) |

| Foreign currency | 7,098 |

| Forward foreign currency exchange contracts | (56,382) |

| Net change in unrealized appreciation (depreciation) | $(55,191,762) |

| Net realized and unrealized loss | $(54,673,072) |

| Net decrease in net assets from operations | $(44,305,211) |

| Six

Months Ended March 31, 2022 (Unaudited) |

Year

Ended September 30, 2021 | |

| Increase (Decrease) in Net Assets | ||

| From operations: | ||

| Net investment income | $ 10,367,861 | $ 19,603,368 |

| Net realized gain | 518,690 | 8,413,857 |

| Net change in unrealized appreciation (depreciation) | (55,191,762) | 23,331,636 |

| Net increase (decrease) in net assets from operations | $ (44,305,211) | $ 51,348,861 |

| Distributions to shareholders: | ||

| Class A | $ (2,024,558) | $ (3,322,201) |

| Class C | (672,253) | (1,205,585) |

| Class I | (13,490,908) | (18,168,241) |

| Total distributions to shareholders | $ (16,187,719) | $ (22,696,027) |

| Transactions in shares of beneficial interest: | ||

| Class A | $ 1,040,425 | $ (33,713,494) |

| Class C | (5,652,889) | (7,972,469) |

| Class I | 26,001,304 | 77,171,244 |

| Net increase in net assets from Fund share transactions | $ 21,388,840 | $ 35,485,281 |

| Net increase (decrease) in net assets | $ (39,104,090) | $ 64,138,115 |

| Net Assets | ||

| At beginning of period | $ 786,205,989 | $ 722,067,874 |

| At end of period | $747,101,899 | $786,205,989 |

| Class A | ||||||

| Year Ended September 30, | ||||||

| Six

Months Ended March 31, 2022 (Unaudited) |

2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of period | $ 12.340 | $ 11.820 | $ 11.990 | $ 11.570 | $ 11.930 | $ 11.630 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $ 0.142 | $ 0.330 | $ 0.395 | $ 0.427 | $ 0.402 | $ 0.367 |

| Net realized and unrealized gain (loss) | (0.797) | 0.573 | (0.143) | 0.451 | (0.344) | 0.319 |

| Total income (loss) from operations | $ (0.655) | $ 0.903 | $ 0.252 | $ 0.878 | $ 0.058 | $ 0.686 |

| Less Distributions | ||||||

| From net investment income | $ (0.152) | $ (0.323) | $ (0.413) | $ (0.458) | $ (0.409) | $ (0.322) |

| From net realized gain | (0.073) | (0.060) | (0.009) | — | (0.009) | — |

| Tax return of capital | — | — | — | — | — | (0.064) |

| Total distributions | $ (0.225) | $ (0.383) | $ (0.422) | $ (0.458) | $ (0.418) | $ (0.386) |

| Net asset value — End of period | $ 11.460 | $ 12.340 | $ 11.820 | $ 11.990 | $11.570 | $11.930 |

| Total Return(2)(3) | (5.48)% (4) | 7.72% | 2.21% | 7.76% | 0.50% | 6.01% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $100,461 | $107,380 | $136,688 | $137,889 | $ 43,503 | $ 33,927 |

| Ratios (as a percentage of average daily net assets): | ||||||

| Expenses (3) | 0.74% (5) | 0.74% | 0.74% | 0.74% | 0.74% | 0.77% |

| Net investment income | 2.36% (5) | 2.70% | 3.38% | 3.62% | 3.43% | 3.13% |

| Portfolio Turnover | 75% (4)(6) | 85% (6) | 89% | 75% | 43% | 61% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | The investment adviser and administrator reimbursed certain operating expenses (equal to 0.08%, 0.08%, 0.11%, 0.11%, 0.22% and 0.36% of average daily net assets for the six months ended March 31, 2022 and the years ended September 30, 2021, 2020, 2019, 2018 and 2017, respectively). Absent this reimbursement, total return would be lower. |

| (4) | Not annualized. |

| (5) | Annualized. |

| (6) | Includes the effect of To-Be-Announced (TBA) transactions. |

| Class C | ||||||

| Year Ended September 30, | ||||||

| Six

Months Ended March 31, 2022 (Unaudited) |

2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of period | $ 12.330 | $ 11.820 | $ 11.990 | $ 11.560 | $ 11.920 | $ 11.620 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $ 0.096 | $ 0.238 | $ 0.307 | $ 0.344 | $ 0.313 | $ 0.282 |

| Net realized and unrealized gain (loss) | (0.797) | 0.564 | (0.142) | 0.456 | (0.343) | 0.317 |

| Total income (loss) from operations | $ (0.701) | $ 0.802 | $ 0.165 | $ 0.800 | $ (0.030) | $ 0.599 |

| Less Distributions | ||||||

| From net investment income | $ (0.106) | $ (0.232) | $ (0.326) | $ (0.370) | $ (0.321) | $ (0.249) |

| From net realized gain | (0.073) | (0.060) | (0.009) | — | (0.009) | — |

| Tax return of capital | — | — | — | — | — | (0.050) |

| Total distributions | $ (0.179) | $ (0.292) | $ (0.335) | $ (0.370) | $ (0.330) | $ (0.299) |

| Net asset value — End of period | $11.450 | $12.330 | $11.820 | $11.990 | $11.560 | $11.920 |

| Total Return(2)(3) | (5.75)% (4) | 6.83% | 1.45% | 7.05% | (0.25)% | 5.23% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $ 39,537 | $ 48,423 | $ 54,189 | $ 52,001 | $ 20,926 | $ 19,197 |

| Ratios (as a percentage of average daily net assets): | ||||||

| Expenses (3) | 1.49% (5) | 1.49% | 1.49% | 1.49% | 1.49% | 1.52% |

| Net investment income | 1.60% (5) | 1.95% | 2.63% | 2.93% | 2.67% | 2.41% |

| Portfolio Turnover | 75% (4)(6) | 85% (6) | 89% | 75% | 43% | 61% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | The investment adviser and administrator reimbursed certain operating expenses (equal to 0.08%, 0.08%, 0.11%, 0.11%, 0.22% and 0.36% of average daily net assets for the six months ended March 31, 2022 and the years ended September 30, 2021, 2020, 2019, 2018 and 2017, respectively). Absent this reimbursement, total return would be lower. |

| (4) | Not annualized. |

| (5) | Annualized. |

| (6) | Includes the effect of To-Be-Announced (TBA) transactions. |

| Class I | ||||||

| Year Ended September 30, | ||||||

| Six

Months Ended March 31, 2022 (Unaudited) |

2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of period | $ 12.330 | $ 11.810 | $ 11.990 | $ 11.560 | $ 11.920 | $ 11.620 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $ 0.157 | $ 0.356 | $ 0.423 | $ 0.457 | $ 0.440 | $ 0.399 |

| Net realized and unrealized gain (loss) | (0.798) | 0.578 | (0.152) | 0.460 | (0.352) | 0.316 |

| Total income (loss) from operations | $ (0.641) | $ 0.934 | $ 0.271 | $ 0.917 | $ 0.088 | $ 0.715 |

| Less Distributions | ||||||

| From net investment income | $ (0.166) | $ (0.354) | $ (0.442) | $ (0.487) | $ (0.439) | $ (0.346) |

| From net realized gain | (0.073) | (0.060) | (0.009) | — | (0.009) | — |

| Tax return of capital | — | — | — | — | — | (0.069) |

| Total distributions | $ (0.239) | $ (0.414) | $ (0.451) | $ (0.487) | $ (0.448) | $ (0.415) |

| Net asset value — End of period | $ 11.450 | $ 12.330 | $ 11.810 | $ 11.990 | $ 11.560 | $11.920 |

| Total Return(2)(3) | (5.28)% (4) | 8.00% | 2.37% | 8.12% | 0.74% | 6.28% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $607,104 | $630,403 | $531,191 | $622,727 | $152,363 | $ 41,563 |

| Ratios (as a percentage of average daily net assets): | ||||||

| Expenses (3) | 0.49% (5) | 0.49% | 0.49% | 0.49% | 0.49% | 0.52% |

| Net investment income | 2.61% (5) | 2.92% | 3.62% | 3.89% | 3.77% | 3.40% |

| Portfolio Turnover | 75% (4)(6) | 85% (6) | 89% | 75% | 43% | 61% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (3) | The investment adviser and administrator reimbursed certain operating expenses (equal to 0.08%, 0.08%, 0.11%, 0.11%, 0.22% and 0.36% of average daily net assets for the six months ended March 31, 2022 and the years ended September 30, 2021, 2020, 2019, 2018 and 2017, respectively). Absent this reimbursement, total return would be lower. |

| (4) | Not annualized. |

| (5) | Annualized. |

| (6) | Includes the effect of To-Be-Announced (TBA) transactions. |

| Aggregate cost | $ 797,116,471 |

| Gross unrealized appreciation | $ 3,755,091 |

| Gross unrealized depreciation | (53,821,841) |

| Net unrealized depreciation | $ (50,066,750) |

| Average Daily Net Assets | Annual Fee Rate |

| Up to $1 billion | 0.450% |

| $1 billion but less than $2.5 billion | 0.425 |

| $2.5 billion but less than $5 billion | 0.410 |

| Over $5 billion | 0.400 |

| Purchases | Sales | |

| Investments (non-U.S. Government) | $ 221,957,298 | $ 153,899,681 |

| U.S. Government and Agency Securities | 428,115,654 | 452,175,380 |

| $650,072,952 | $606,075,061 |

| Six

Months Ended March 31, 2022 (Unaudited) |

Year

Ended September 30, 2021 | ||||

| Shares | Amount | Shares | Amount | ||

| Class A | |||||

| Sales | 1,473,217 | $ 17,812,803 | 1,767,058 | $ 21,649,585 | |

| Issued to shareholders electing to receive payments of distributions in Fund shares | 164,558 | 1,986,891 | 266,441 | 3,253,050 | |

| Redemptions | (1,619,867) | (19,364,964) | (5,191,095) | (62,232,559) | |

| Converted from Class C shares | 50,047 | 605,695 | 298,148 | 3,616,430 | |

| Net increase (decrease) | 67,955 | $ 1,040,425 | (2,859,448) | $ (33,713,494) | |

| Class C | |||||

| Sales | 207,651 | $ 2,518,774 | 776,166 | $ 9,493,517 | |

| Issued to shareholders electing to receive payments of distributions in Fund shares | 55,385 | 669,464 | 98,682 | 1,203,189 | |

| Redemptions | (685,943) | (8,235,432) | (1,236,193) | (15,052,745) | |

| Converted to Class A shares | (50,070) | (605,695) | (298,222) | (3,616,430) | |

| Net decrease | (472,977) | $ (5,652,889) | (659,567) | $ (7,972,469) | |

| Class I | |||||

| Sales | 17,665,418 | $ 213,334,964 | 21,841,638 | $ 267,564,797 | |

| Issued to shareholders electing to receive payments of distributions in Fund shares | 1,115,534 | 13,460,183 | 1,485,630 | 18,138,739 | |

| Redemptions | (16,867,790) | (200,793,843) | (17,164,251) | (208,532,292) | |

| Net increase | 1,913,162 | $ 26,001,304 | 6,163,017 | $ 77,171,244 | |

| Fair Value | |||

| Risk | Derivative | Asset Derivative | Liability Derivative |

| Foreign Exchange | Forward foreign currency exchange contracts | $ — | $ (56,382)(1) |

| Interest Rate | Futures contracts | 1,823,197 (2) | (1,490,560) (2) |

| Total | $1,823,197 | $(1,546,942) | |

| Derivatives not subject to master netting or similar agreements | $1,823,197 | $(1,490,560) | |

| Total Derivatives subject to master netting or similar agreements | $ — | $ (56,382) | |

| (1) | Statement of Assets and Liabilities location: Payable for open forward foreign currency exchange contracts. |

| (2) | Only the current day’s variation margin on open futures contracts is reported within the Statement of Assets and Liabilities as Receivable or Payable for variation margin on open futures contracts, as applicable. |

| Counterparty | Derivative

Liabilities Subject to Master Netting Agreement |

Derivatives

Available for Offset |

Non-cash

Collateral Pledged(a) |

Cash

Collateral Pledged(a) |

Net

Amount of Derivative Liabilities(b) |

| State Street Bank and Trust Company | $(56,382) | $ — | $ — | $ — | $(56,382) |

| (a) | In some instances, the total collateral received and/or pledged may be more than the amount shown due to overcollateralization. |

| (b) | Net amount represents the net amount payable to the counterparty in the event of default. |

| Risk | Derivative | Realized

Gain (Loss) on Derivatives Recognized in Income(1) |

Change

in Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income(2) |

| Foreign Exchange | Forward foreign currency exchange contracts | $ 33,810 | $ (56,382) |

| Interest Rate | Futures contracts | 3,102,787 | (1,248,533) |

| Total | $3,136,597 | $(1,304,915) | |

| (1) | Statement of Operations location: Net realized gain (loss): Futures contracts and Forward foreign currency exchange contracts, respectively. |

| (2) | Statement of Operations location: Change in unrealized appreciation (depreciation): Futures contracts and Forward foreign currency exchange contracts, respectively. |

| Futures

Contracts — Long |

Futures

Contracts — Short |

Forward

Foreign Currency Exchange Contracts* |

| $67,862,000 | $87,002,000 | $623,000 |

| * | The average notional amount of forward foreign currency exchange contracts is based on the absolute value of notional amounts of currency purchased and currency sold. |

| Name | Value,

beginning of period |

Purchases | Sales

proceeds |

Net

realized gain (loss) |

Change

in unrealized appreciation (depreciation) |

Value,

end of period |

Interest/

Dividend income |

Principal

amount/ Units, end of period |

| Commercial Mortgage-Backed Securities | ||||||||

| Morgan Stanley Bank of America Merrill Lynch Trust: | ||||||||

| Series 2016-C29, Class C, 4.729%, 5/15/49 | $ 4,420,922 | $ — | $ — | $ — | $ (386,788) | $ 4,034,134 | $ 99,320 | $4,198,800 |

| Series 2016-C29, Class D, 3.00%, 5/15/49 | 6,171,758 | — | (3,378,281) | (37,253) | (230,776) | 2,542,929 | 115,529 | 3,047,635 |

| Series 2016-C32, Class D, 3.396%, 12/15/49 | 4,156,243 | — | — | — | (306,967) | 3,865,481 | 101,104 | 5,000,000 |

| Morgan Stanley Capital I Trust: | ||||||||

| Series 2016-UBS12, Class D, 3.312%, 12/15/49 | 4,135,435 | — | — | — | 49,381 | 4,212,798 | 146,386 | 7,150,000 |

| Series 2019-BPR, Class B, 2.497%, (1 mo. USD LIBOR + 2.10%), 5/15/36 | 3,760,855 | — | — | — | 96,230 | 3,862,820 | 50,245 | 3,960,000 |

| Series 2019-BPR, Class C, 3.447%, (1 mo. USD LIBOR + 3.05%), 5/15/36 | 1,388,682 | — | — | — | 88,478 | 1,477,160 | 24,705 | 1,540,000 |

| Short-Term Investments | ||||||||

| Eaton Vance Cash Reserves Fund, LLC | 28,815,045 | 182,338,780 | (208,150,912) | (2,985) | 300 | 3,000,228 | 7,883 | 3,000,528 |

| Totals | $(40,238) | $(690,142) | $22,995,550 | $545,172 | ||||

| • | Level 1 – quoted prices in active markets for identical investments |

| • | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including a fund's own assumptions in determining the fair value of investments) |

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Asset-Backed Securities | $ — | $ 120,477,023 | $ — | $ 120,477,023 |

| Asset Description (continued) | Level 1 | Level 2 | Level 3 | Total |

| Collateralized Mortgage Obligations | $ — | $ 30,689,103 | $ — | $ 30,689,103 |

| Commercial Mortgage-Backed Securities | — | 102,112,760 | — | 102,112,760 |

| Convertible Bonds | — | 4,328,126 | — | 4,328,126 |

| Corporate Bonds | — | 259,421,221 | — | 259,421,221 |

| Preferred Stocks | 7,967,112 | — | — | 7,967,112 |

| Senior Floating-Rate Loans | — | 8,896,073 | — | 8,896,073 |

| Sovereign Government Bonds | — | 10,674,815 | — | 10,674,815 |

| U.S. Government Agency Mortgage-Backed Securities | — | 1,206,032 | — | 1,206,032 |

| U.S. Treasury Obligations | — | 198,000,973 | — | 198,000,973 |

| Short-Term Investments | — | 3,000,228 | — | 3,000,228 |

| Total Investments | $ 7,967,112 | $ 738,806,354 | $ — | $ 746,773,466 |

| Futures Contracts | $ 1,823,197 | $ — | $ — | $ 1,823,197 |

| Total | $ 9,790,309 | $ 738,806,354 | $ — | $ 748,596,663 |

| Liability Description | ||||

| Forward Foreign Currency Exchange Contracts | $ — | $ (56,382) | $ — | $ (56,382) |

| Futures Contracts | (1,490,560) | — | — | (1,490,560) |

| Total | $ (1,490,560) | $ (56,382) | $ — | $ (1,546,942) |

| Officers | |

| Eric

A. Stein President |

Jill R.

Damon Secretary |

| Deidre

E. Walsh Vice President and Chief Legal Officer |

Richard F.

Froio Chief Compliance Officer |

| James

F. Kirchner Treasurer |

|

| Trustees |

| * | Mr. Bowser and Ms. Wiser began serving as Trustees effective April 4, 2022. |

| ** | Interested Trustee |

| Privacy Notice | April 2021 |

| FACTS | WHAT

DOES EATON VANCE DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The

types of personal information we collect and share depend on the product or service you have with us. This information can include:■ Social Security number and income ■ investment experience and risk tolerance ■ checking account number and wire transfer instructions |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Eaton Vance chooses to share; and whether you can limit this sharing. |

| Reasons

we can share your personal information |

Does

Eaton Vance share? |

Can

you limit this sharing? |

| For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes — to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | No | We don’t share |

| For our investment management affiliates’ everyday business purposes — information about your transactions, experiences, and creditworthiness | Yes | Yes |

| For our affiliates’ everyday business purposes — information about your transactions and experiences | Yes | No |

| For our affiliates’ everyday business purposes — information about your creditworthiness | No | We don’t share |

| For our investment management affiliates to market to you | Yes | Yes |

| For our affiliates to market to you | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| To

limit our sharing |

Call toll-free 1-800-262-1122 or email: EVPrivacy@eatonvance.comPlease note:If you are a new customer, we can begin sharing your information 30 days from the date we sent this notice. When you are no longer our customer, we continue to share your information as described in this notice. However, you can contact us at any time to limit our sharing. |

| Questions? | Call toll-free 1-800-262-1122 or email: EVPrivacy@eatonvance.com |

| Privacy Notice — continued | April 2021 |

| Who we are | |

| Who is providing this notice? | Eaton Vance Management, Eaton Vance Distributors, Inc., Eaton Vance Trust Company, Eaton Vance Management (International) Limited, Eaton Vance Advisers International Ltd., Eaton Vance Global Advisors Limited, Eaton Vance Management’s Real Estate Investment Group, Boston Management and Research, Calvert Research and Management, Eaton Vance and Calvert Fund Families and our investment advisory affiliates (“Eaton Vance”) (see Investment Management Affiliates definition below) |

| What we do | |

| How

does Eaton Vance protect my personal information? |

To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. We have policies governing the proper handling of customer information by personnel and requiring third parties that provide support to adhere to appropriate security standards with respect to such information. |

| How

does Eaton Vance collect my personal information? |

We

collect your personal information, for example, when you■ open an account or make deposits or withdrawals from your account ■ buy securities from us or make a wire transfer ■ give us your contact informationWe also collect your personal information from others, such as credit bureaus, affiliates, or other companies. |

| Why can’t I limit all sharing? | Federal

law gives you the right to limit only■ sharing for affiliates’ everyday business purposes — information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to youState laws and individual companies may give you additional rights to limit sharing. See below for more on your rights under state law. |

| Definitions | |

| Investment

Management Affiliates |

Eaton Vance Investment Management Affiliates include registered investment advisers, registered broker- dealers, and registered and unregistered funds. Investment Management Affiliates does not include entities associated with Morgan Stanley Wealth Management, such as Morgan Stanley Smith Barney LLC and Morgan Stanley & Co. |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies.■ Our affiliates include companies with a Morgan Stanley name and financial companies such as Morgan Stanley Smith Barney LLC and Morgan Stanley & Co. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies.■ Eaton Vance does not share with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you.■ Eaton Vance doesn’t jointly market. |

| Other important information | |

| Vermont: Except as permitted by law, we will not share personal information we collect about Vermont residents with Nonaffiliates unless you provide us with your written consent to share such information.California: Except as permitted by law, we will not share personal information we collect about California residents with Nonaffiliates and we will limit sharing such personal information with our Affiliates to comply with California privacy laws that apply to us. | |

| % Average Annual Total Returns1,2 | Class

Inception Date |

Performance

Inception Date |

Six Months | One Year | Five Years | Ten Years |

| Class A at NAV | 01/06/1998 | 03/16/1978 | (6.19)% | (4.71)% | 2.33% | 3.09% |

| Class A with 4.75% Maximum Sales Charge | — | — | (10.61) | (9.22) | 1.34 | 2.58 |

| Class C at NAV | 05/02/2006 | 03/16/1978 | (6.58) | (5.46) | 1.57 | 2.46 |

| Class C with 1% Maximum Sales Charge | — | — | (7.50) | (6.39) | 1.57 | 2.46 |

| Class I at NAV | 03/16/1978 | 03/16/1978 | (6.14) | (4.47) | 2.58 | 3.34 |

|

| ||||||

| Bloomberg Municipal Bond Index | — | — | (5.55)% | (4.47)% | 2.52% | 2.88% |

| % Total Annual Operating Expense Ratios3 | Class A | Class C | Class I |

| 0.80% | 1.55% | 0.55% |

| % Distribution Rates/Yields4 | Class A | Class C | Class I |

| Distribution Rate | 2.50% | 1.74% | 2.76% |

| Taxable-Equivalent Distribution Rate | 4.23 | 2.94 | 4.66 |

| SEC 30-day Yield | 1.67 | 1.00 | 2.01 |

| Taxable-Equivalent SEC 30-day Yield | 2.84 | 1.69 | 3.41 |

| % Total Leverage5 | |

| Residual Interest Bond (RIB) Financing | 5.76% |

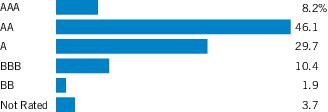

| Credit Quality (% of total investments)*,** |

| * | For purposes of the Fund’s rating restrictions, ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”), as applicable. If securities are rated differently by the ratings agencies, the highest rating is applied. Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P or Fitch (Baa or higher by Moody’s) are considered to be investment-grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

| ** | The chart includes the municipal bonds held by a trust that issues residual interest bonds, consistent with the Portfolio of Investments. |

| % Average Annual Total Returns1,2 | Class

Inception Date |

Performance

Inception Date |

Six Months | One Year | Five Years | Ten Years |

| Class A at NAV | 04/05/1994 | 12/19/1985 | (5.68)% | (4.70)% | 2.69% | 3.42% |

| Class A with 4.75% Maximum Sales Charge | — | — | (10.13) | (9.19) | 1.69 | 2.92 |

| Class C at NAV | 12/03/1993 | 12/19/1985 | (6.04) | (5.41) | 1.93 | 2.80 |

| Class C with 1% Maximum Sales Charge | — | — | (6.97) | (6.34) | 1.93 | 2.80 |

| Class I at NAV | 07/01/1999 | 12/19/1985 | (5.56) | (4.46) | 2.94 | 3.67 |

|

| ||||||

| Bloomberg Municipal Bond Index | — | — | (5.55)% | (4.47)% | 2.52% | 2.88% |

| % Total Annual Operating Expense Ratios3 | Class A | Class C | Class I |

| 0.63% | 1.38% | 0.38% |

| % Distribution Rates/Yields4 | Class A | Class C | Class I |

| Distribution Rate | 2.28% | 1.52% | 2.54% |

| Taxable-Equivalent Distribution Rate | 3.86 | 2.57 | 4.29 |

| SEC 30-day Yield | 1.73 | 1.06 | 2.07 |

| Taxable-Equivalent SEC 30-day Yield | 2.94 | 1.80 | 3.51 |

| % Total Leverage5 | |

| RIB Financing | 2.87% |

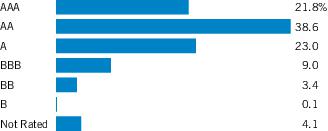

| Credit Quality (% of total investments)*,** |

| * | For purposes of the Fund’s rating restrictions, ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”), as applicable. If securities are rated differently by the ratings agencies, the highest rating is applied. Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P or Fitch (Baa or higher by Moody’s) are considered to be investment-grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

| ** | The chart includes the municipal bonds held by a trust that issues residual interest bonds, consistent with the Portfolio of Investments. |

| 1 | Bloomberg Municipal Bond Index is an unmanaged index of municipal bonds traded in the U.S. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares.Effective November 5, 2020, Class C shares automatically convert to Class A shares eight years after purchase. The average annual total returns listed for Class C reflect conversion to Class A shares after eight years. Prior to November 5, 2020, Class C shares automatically converted to Class A shares ten years after purchase. |

| 3 | Source: Fund prospectus. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| 4 | The Distribution Rate is based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV at the end of the period. The Fund’s distributions may be comprised of amounts characterized for federal income tax purposes as tax-exempt income, qualified and non-qualified ordinary dividends, capital gains and nondividend distributions, also known as return of capital. The Fund will determine the federal income tax character of distributions paid to a shareholder after the end of the calendar year. This is reported on the IRS form 1099- DIV and provided to the shareholder shortly after each year-end. The Fund’s distributions are determined by the investment adviser based on its current assessment of the Fund’s long-term return potential. As portfolio and market conditions change, the rate of distributions paid by the Fund could change. Taxable-equivalent performance is based on the highest combined federal and state income tax rates, where applicable. Lower tax rates would result in lower tax-equivalent performance. Actual tax rates will vary depending on your income, exemptions and deductions. Rates do not include local taxes. The SEC Yield is a standardized measure based on the estimated yield to maturity of a fund’s investments over a 30-day period and is based on the maximum offer price at the date specified. The SEC Yield is not based on the distributions made by the Fund, which may differ. |

| 5 | Fund employs RIB financing. The leverage created by RIB investments provides an opportunity for increased income but, at the same time, creates special risks (including the likelihood of greater volatility of NAV). The cost of leverage rises and falls with changes in short-term interest rates. See “Floating Rate Notes Issued in Conjunction with Securities Held” in the notes to the financial statements for more information about RIB financing. RIB leverage represents the amount of Floating Rate Notes outstanding at period end as a percentage of Fund net assets plus Floating Rate Notes. |

| Fund profiles subject to change due to active management. |

| Beginning

Account Value (10/1/21) |

Ending

Account Value (3/31/22) |

Expenses

Paid During Period* (10/1/21 – 3/31/22) |

Annualized

Expense Ratio | |

| Actual | ||||

| Class A | $1,000.00 | $ 938.10 | $3.91 | 0.81% |

| Class C | $1,000.00 | $ 934.20 | $7.52 | 1.56% |

| Class I | $1,000.00 | $ 938.60 | $2.71 | 0.56% |

| Hypothetical | ||||

| (5% return per year before expenses) | ||||

| Class A | $1,000.00 | $1,020.89 | $4.08 | 0.81% |

| Class C | $1,000.00 | $1,017.15 | $7.85 | 1.56% |

| Class I | $1,000.00 | $1,022.14 | $2.82 | 0.56% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on September 30, 2021. |

| Beginning

Account Value (10/1/21) |

Ending

Account Value (3/31/22) |

Expenses

Paid During Period* (10/1/21 – 3/31/22) |

Annualized

Expense Ratio | |

| Actual | ||||

| Class A | $1,000.00 | $ 943.20 | $3.05 | 0.63% |

| Class C | $1,000.00 | $ 939.60 | $6.67 | 1.38% |

| Class I | $1,000.00 | $ 944.40 | $1.84 | 0.38% |

| Hypothetical | ||||

| (5% return per year before expenses) | ||||

| Class A | $1,000.00 | $1,021.79 | $3.18 | 0.63% |

| Class C | $1,000.00 | $1,018.05 | $6.94 | 1.38% |

| Class I | $1,000.00 | $1,023.04 | $1.92 | 0.38% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on September 30, 2021. |

| Futures Contracts | |||||

| Description | Number

of Contracts |

Position | Expiration

Date |

Notional

Amount |

Value/Unrealized

Appreciation (Depreciation) |

| Interest Rate Futures | |||||

| U.S. Long Treasury Bond | (925) | Short | 6/21/22 | $(138,807,813) | $ 3,683,808 |

| $3,683,808 | |||||

| Abbreviations: | |

| AGC | – Assured Guaranty Corp. |

| AGM | – Assured Guaranty Municipal Corp. |

| AMBAC | – AMBAC Financial Group, Inc. |

| AMT | – Interest earned from these securities may be considered a tax preference item for purposes of the Federal Alternative Minimum Tax. |

| BAM | – Build America Mutual Assurance Co. |

| LOC | – Letter of Credit |

| NPFG | – National Public Finance Guarantee Corp. |

| PSF | – Permanent School Fund |

| SIFMA | – Securities Industry and Financial Markets Association Municipal Swap Index |

| SOFR | – Secured Overnight Financing Rate |

| SPA | – Standby Bond Purchase Agreement |

| March 31, 2022 | ||

| AMT-Free Fund | National Fund | |

| Assets | ||

| Investments: | ||

| Identified cost | $ 324,960,487 | $ 3,620,614,335 |

| Unrealized appreciation (depreciation) | 3,299,188 | (3,425,521) |

| Investments, at value | $328,259,675 | $3,617,188,814 |

| Cash | $ 3,780,904 | $ 115,786,892 |

| Deposits for derivatives collateral — futures contracts | — | 3,237,550 |

| Interest receivable | 3,855,751 | 37,473,812 |

| Receivable for investments sold | 1,783,804 | 40,064,348 |

| Receivable for Fund shares sold | 324,174 | 7,982,208 |

| Total assets | $338,004,308 | $3,821,733,624 |

| Liabilities | ||

| Payable for floating rate notes issued | $ 18,691,319 | $ 104,190,442 |

| Payable for investments purchased | — | 8,712,477 |

| Payable for when-issued/delayed delivery securities | 12,417,482 | 156,030,472 |

| Payable for Fund shares redeemed | 790,542 | 20,183,995 |

| Payable for variation margin on open futures contracts | — | 578,092 |

| Distributions payable | 98,650 | 1,194,250 |

| Payable to affiliates: | ||

| Investment adviser fee | 106,072 | 916,535 |

| Distribution and service fees | 36,709 | 365,894 |

| Interest expense and fees payable | 43,559 | 239,419 |

| Accrued expenses | 99,080 | 650,534 |

| Total liabilities | $ 32,283,413 | $ 293,062,110 |

| Net Assets | $305,720,895 | $3,528,671,514 |

| Sources of Net Assets | ||

| Paid-in capital | $ 331,010,704 | $ 3,731,688,520 |

| Accumulated loss | (25,289,809) | (203,017,006) |

| Net Assets | $305,720,895 | $3,528,671,514 |

| Class A Shares | ||

| Net Assets | $ 139,671,724 | $ 1,372,164,219 |

| Shares Outstanding | 16,224,470 | 142,650,794 |

| Net

Asset Value and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) |

$ 8.61 | $ 9.62 |

| Maximum

Offering Price Per Share (100 ÷ 95.25 of net asset value per share) |

$ 9.04 | $ 10.10 |

| Class C Shares | ||

| Net Assets | $ 7,492,783 | $ 75,917,689 |

| Shares Outstanding | 875,352 | 7,893,231 |

| Net

Asset Value and Offering Price Per Share* (net assets ÷ shares of beneficial interest outstanding) |

$ 8.56 | $ 9.62 |

| March 31, 2022 | ||

| AMT-Free Fund | National Fund | |

| Class I Shares | ||

| Net Assets | $158,556,388 | $2,080,589,606 |

| Shares Outstanding | 16,864,597 | 216,317,494 |

| Net

Asset Value, Offering Price and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) |

$ 9.40 | $ 9.62 |

| On sales of $50,000 or more, the offering price of Class A shares is reduced. | |

| * | Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge. |

| Six Months Ended March 31, 2022 | ||

| AMT-Free Fund | National Fund | |

| Investment Income | ||

| Interest income | $ 5,433,617 | $ 47,170,690 |

| Total investment income | $ 5,433,617 | $ 47,170,690 |

| Expenses | ||

| Investment adviser fee | $ 669,426 | $ 5,611,321 |

| Distribution and service fees: | ||

| Class A | 190,090 | 1,866,382 |

| Class C | 42,272 | 437,684 |

| Trustees’ fees and expenses | 8,950 | 54,250 |

| Custodian fee | 40,782 | 338,470 |

| Transfer and dividend disbursing agent fees | 51,260 | 694,393 |

| Legal and accounting services | 32,794 | 90,722 |

| Printing and postage | 3,886 | 60,055 |

| Registration fees | 39,476 | 80,299 |

| Interest expense and fees | 67,650 | 358,852 |

| Miscellaneous | 27,392 | 119,007 |

| Total expenses | $ 1,173,978 | $ 9,711,435 |

| Net investment income | $ 4,259,639 | $ 37,459,255 |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss): | ||

| Investment transactions | $ (2,798,110) | $ (64,509,457) |

| Futures contracts | — | 8,845,583 |

| Net realized loss | $ (2,798,110) | $ (55,663,874) |

| Change in unrealized appreciation (depreciation): | ||

| Investments | $ (22,065,254) | $ (199,152,560) |

| Futures contracts | — | (339,648) |

| Net change in unrealized appreciation (depreciation) | $(22,065,254) | $(199,492,208) |

| Net realized and unrealized loss | $(24,863,364) | $(255,156,082) |

| Net decrease in net assets from operations | $(20,603,725) | $(217,696,827) |

| Six Months Ended March 31, 2022 (Unaudited) | ||

| AMT-Free Fund | National Fund | |

| Increase (Decrease) in Net Assets | ||

| From operations: | ||

| Net investment income | $ 4,259,639 | $ 37,459,255 |

| Net realized loss | (2,798,110) | (55,663,874) |

| Net change in unrealized appreciation (depreciation) | (22,065,254) | (199,492,208) |

| Net decrease in net assets from operations | $ (20,603,725) | $ (217,696,827) |

| Distributions to shareholders: | ||

| Class A | $ (1,840,846) | $ (16,004,854) |

| Class C | (70,506) | (608,441) |

| Class I | (2,372,750) | (27,543,260) |

| Total distributions to shareholders | $ (4,284,102) | $ (44,156,555) |

| Transactions in shares of beneficial interest: | ||

| Class A | $ (7,090,432) | $ (85,708,351) |

| Class C | (915,998) | (13,167,404) |

| Class I | (12,383,746) | (111,045,305) |

| Net decrease in net assets from Fund share transactions | $ (20,390,176) | $ (209,921,060) |

| Net decrease in net assets | $ (45,278,003) | $ (471,774,442) |

| Net Assets | ||

| At beginning of period | $ 350,998,898 | $ 4,000,445,956 |

| At end of period | $305,720,895 | $3,528,671,514 |

| Year Ended September 30, 2021 | ||

| AMT-Free Fund | National Fund | |

| Increase (Decrease) in Net Assets | ||

| From operations: | ||

| Net investment income | $ 9,214,288 | $ 85,910,593 |

| Net realized gain | 1,787,813 | 23,602,415 |

| Net change in unrealized appreciation (depreciation) | (339,343) | 2,780,570 |

| Net increase in net assets from operations | $ 10,662,758 | $ 112,293,578 |

| Distributions to shareholders: | ||

| Class A | $ (4,300,571) | $ (36,519,653) |

| Class C | (208,934) | (1,594,901) |

| Class I | (5,185,414) | (51,964,079) |

| Total distributions to shareholders | $ (9,694,919) | $ (90,078,633) |

| Transactions in shares of beneficial interest: | ||

| Class A | $ (1,156,043) | $ (74,309,751) |

| Class C | (6,154,882) | (37,545,612) |

| Class I | 15,406,188 | 541,213,178 |

| Net increase in net assets from Fund share transactions | $ 8,095,263 | $ 429,357,815 |

| Net increase in net assets | $ 9,063,102 | $ 451,572,760 |

| Net Assets | ||

| At beginning of year | $ 341,935,796 | $ 3,548,873,196 |

| At end of year | $350,998,898 | $4,000,445,956 |

| AMT-Free Fund — Class A | ||||||

| Year Ended September 30, | ||||||

| Six

Months Ended March 31, 2022 (Unaudited) |

2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of period | $ 9.290 | $ 9.250 | $ 9.250 | $ 8.870 | $ 9.130 | $ 9.430 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $ 0.110 | $ 0.236 | $ 0.274 | $ 0.317 | $ 0.336 | $ 0.351 |

| Net realized and unrealized gain (loss) | (0.680) | 0.053 | 0.011 (2) | 0.381 | (0.262) | (0.298) |

| Total income (loss) from operations | $ (0.570) | $ 0.289 | $ 0.285 | $ 0.698 | $ 0.074 | $ 0.053 |

| Less Distributions | ||||||

| From net investment income | $ (0.110) | $ (0.249) | $ (0.285) | $ (0.318) | $ (0.334) | $ (0.353) |

| Total distributions | $ (0.110) | $ (0.249) | $ (0.285) | $ (0.318) | $ (0.334) | $ (0.353) |

| Net asset value — End of period | $ 8.610 | $ 9.290 | $ 9.250 | $ 9.250 | $ 8.870 | $ 9.130 |

| Total Return(3) | (6.19)% (4) | 3.14% | 3.12% | 8.02% | 0.83% | 0.64% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $139,672 | $157,981 | $158,729 | $150,853 | $139,623 | $155,589 |

| Ratios (as a percentage of average daily net assets): | ||||||

| Expenses excluding interest and fees | 0.77% (5) | 0.76% | 0.78% | 0.81% | 0.81% | 0.82% |

| Interest and fee expense(6) | 0.04% (5) | 0.04% | 0.14% | 0.23% | 0.24% | 0.16% |

| Total expenses | 0.81% (5) | 0.80% | 0.92% | 1.04% | 1.05% | 0.98% |

| Net investment income | 2.41% (5) | 2.53% | 2.97% | 3.51% | 3.74% | 3.86% |

| Portfolio Turnover | 22% (4) | 32% | 58% | 33% | 18% | 33% |

| (1) | Computed using average shares outstanding. |

| (2) | The per share amount is not in accord with the net realized and unrealized gain (loss) for the period because of the timing of Fund share transactions and the amount of the per share realized and unrealized gains and losses at such time. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (4) | Not annualized. |

| (5) | Annualized. |

| (6) | Interest and fee expense relates to the liability for floating rate notes issued in conjunction with residual interest bond transactions (see Note 1H). |

| AMT-Free Fund — Class C | ||||||

| Year Ended September 30, | ||||||

| Six

Months Ended March 31, 2022 (Unaudited) |

2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of period | $ 9.240 | $ 9.200 | $ 9.200 | $ 8.820 | $ 9.080 | $ 9.380 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $ 0.075 | $ 0.167 | $ 0.204 | $ 0.249 | $ 0.267 | $ 0.281 |

| Net realized and unrealized gain (loss) | (0.679) | 0.051 | 0.011 (2) | 0.380 | (0.262) | (0.298) |

| Total income (loss) from operations | $(0.604) | $ 0.218 | $ 0.215 | $ 0.629 | $ 0.005 | $ (0.017) |

| Less Distributions | ||||||

| From net investment income | $ (0.076) | $ (0.178) | $ (0.215) | $ (0.249) | $ (0.265) | $ (0.283) |

| Total distributions | $(0.076) | $(0.178) | $ (0.215) | $ (0.249) | $ (0.265) | $ (0.283) |

| Net asset value — End of period | $ 8.560 | $ 9.240 | $ 9.200 | $ 9.200 | $ 8.820 | $ 9.080 |

| Total Return(3) | (6.58)% (4) | 2.38% | 2.36% | 7.24% | 0.06% | (0.12)% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $ 7,493 | $ 9,017 | $15,094 | $19,715 | $32,545 | $39,099 |

| Ratios (as a percentage of average daily net assets): | ||||||

| Expenses excluding interest and fees | 1.52% (5) | 1.51% | 1.53% | 1.56% | 1.56% | 1.57% |

| Interest and fee expense(6) | 0.04% (5) | 0.04% | 0.14% | 0.23% | 0.24% | 0.16% |

| Total expenses | 1.56% (5) | 1.55% | 1.67% | 1.79% | 1.80% | 1.73% |

| Net investment income | 1.66% (5) | 1.80% | 2.23% | 2.78% | 2.99% | 3.11% |

| Portfolio Turnover | 22% (4) | 32% | 58% | 33% | 18% | 33% |

| (1) | Computed using average shares outstanding. |

| (2) | The per share amount is not in accord with the net realized and unrealized gain (loss) for the period because of the timing of Fund share transactions and the amount of the per share realized and unrealized gains and losses at such time. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (4) | Not annualized. |

| (5) | Annualized. |

| (6) | Interest and fee expense relates to the liability for floating rate notes issued in conjunction with residual interest bond transactions (see Note 1H). |

| AMT-Free Fund — Class I | ||||||

| Year Ended September 30, | ||||||

| Six

Months Ended March 31, 2022 (Unaudited) |

2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of period | $ 10.150 | $ 10.110 | $ 10.100 | $ 9.680 | $ 9.970 | $ 10.300 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $ 0.132 | $ 0.283 | $ 0.323 | $ 0.370 | $ 0.391 | $ 0.407 |

| Net realized and unrealized gain (loss) | (0.749) | 0.055 | 0.023 (2) | 0.422 | (0.292) | (0.327) |

| Total income (loss) from operations | $ (0.617) | $ 0.338 | $ 0.346 | $ 0.792 | $ 0.099 | $ 0.080 |

| Less Distributions | ||||||

| From net investment income | $ (0.133) | $ (0.298) | $ (0.336) | $ (0.372) | $ (0.389) | $ (0.410) |

| Total distributions | $ (0.133) | $ (0.298) | $ (0.336) | $ (0.372) | $ (0.389) | $ (0.410) |

| Net asset value — End of period | $ 9.400 | $ 10.150 | $ 10.110 | $ 10.100 | $ 9.680 | $ 9.970 |

| Total Return(3) | (6.14)% (4) | 3.36% | 3.48% | 8.34% | 1.02% | 0.87% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $158,556 | $184,002 | $168,113 | $145,788 | $132,313 | $154,177 |

| Ratios (as a percentage of average daily net assets): | ||||||

| Expenses excluding interest and fees | 0.52% (5) | 0.51% | 0.53% | 0.56% | 0.56% | 0.57% |

| Interest and fee expense(6) | 0.04% (5) | 0.04% | 0.14% | 0.23% | 0.24% | 0.16% |

| Total expenses | 0.56% (5) | 0.55% | 0.67% | 0.79% | 0.80% | 0.73% |

| Net investment income | 2.66% (5) | 2.77% | 3.21% | 3.76% | 3.98% | 4.09% |

| Portfolio Turnover | 22% (4) | 32% | 58% | 33% | 18% | 33% |

| (1) | Computed using average shares outstanding. |

| (2) | The per share amount is not in accord with the net realized and unrealized gain (loss) for the period because of the timing of Fund share transactions and the amount of the per share realized and unrealized gains and losses at such time. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (4) | Not annualized. |

| (5) | Annualized. |

| (6) | Interest and fee expense relates to the liability for floating rate notes issued in conjunction with residual interest bond transactions (see Note 1H). |

| National Fund — Class A | ||||||

| Year Ended September 30, | ||||||

| Six

Months Ended March 31, 2022 (Unaudited) |

2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of period | $ 10.310 | $ 10.240 | $ 10.140 | $ 9.650 | $ 9.930 | $ 10.170 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $ 0.091 | $ 0.223 | $ 0.265 | $ 0.322 | $ 0.350 | $ 0.366 |

| Net realized and unrealized gain (loss) | (0.672) | 0.082 | 0.119 | 0.491 | (0.277) | (0.242) |

| Total income (loss) from operations | $ (0.581) | $ 0.305 | $ 0.384 | $ 0.813 | $ 0.073 | $ 0.124 |

| Less Distributions | ||||||

| From net investment income | $ (0.109) | $ (0.235) | $ (0.284) | $ (0.323) | $ (0.353) | $ (0.364) |

| Total distributions | $ (0.109) | $ (0.235) | $ (0.284) | $ (0.323) | $ (0.353) | $ (0.364) |

| Net asset value — End of period | $ 9.620 | $ 10.310 | $ 10.240 | $ 10.140 | $ 9.650 | $ 9.930 |

| Total Return(2) | (5.68)% (3) | 2.99% | 3.84% | 8.57% | 0.76% | 1.31% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $1,372,164 | $1,558,418 | $1,620,505 | $1,605,407 | $1,419,239 | $1,600,127 |

| Ratios (as a percentage of average daily net assets): | ||||||

| Expenses excluding interest and fees | 0.61% (4) | 0.61% | 0.64% | 0.68% | 0.69% | 0.68% |

| Interest and fee expense(5) | 0.02% (4) | 0.02% | 0.05% | 0.12% | 0.19% | 0.16% |

| Total expenses | 0.63% (4) | 0.63% | 0.69% | 0.80% | 0.88% | 0.84% |

| Net investment income | 1.80% (4) | 2.15% | 2.61% | 3.26% | 3.58% | 3.71% |

| Portfolio Turnover | 54% (3) | 56% | 105% | 89% | 67% | 70% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | Not annualized. |

| (4) | Annualized. |

| (5) | Interest and fee expense relates to the liability for floating rate notes issued in conjunction with residual interest bond transactions (see Note 1H). |

| National Fund — Class C | ||||||

| Year Ended September 30, | ||||||

| Six

Months Ended March 31, 2022 (Unaudited) |

2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of period | $10.310 | $ 10.240 | $ 10.140 | $ 9.650 | $ 9.930 | $ 10.170 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $ 0.053 | $ 0.146 | $ 0.190 | $ 0.252 | $ 0.276 | $ 0.292 |

| Net realized and unrealized gain (loss) | (0.672) | 0.081 | 0.119 | 0.488 | (0.276) | (0.242) |

| Total income (loss) from operations | $ (0.619) | $ 0.227 | $ 0.309 | $ 0.740 | $ — | $ 0.050 |

| Less Distributions | ||||||

| From net investment income | $ (0.071) | $ (0.157) | $ (0.209) | $ (0.250) | $ (0.280) | $ (0.290) |

| Total distributions | $ (0.071) | $ (0.157) | $ (0.209) | $ (0.250) | $ (0.280) | $ (0.290) |

| Net asset value — End of period | $ 9.620 | $10.310 | $ 10.240 | $ 10.140 | $ 9.650 | $ 9.930 |

| Total Return(2) | (6.04)% (3) | 2.22% | 3.08% | 7.77% | 0.01% | 0.56% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $75,918 | $ 94,851 | $131,330 | $172,417 | $363,026 | $462,269 |

| Ratios (as a percentage of average daily net assets): | ||||||

| Expenses excluding interest and fees | 1.36% (4) | 1.36% | 1.39% | 1.43% | 1.44% | 1.43% |

| Interest and fee expense(5) | 0.02% (4) | 0.02% | 0.05% | 0.12% | 0.19% | 0.16% |

| Total expenses | 1.38% (4) | 1.38% | 1.44% | 1.55% | 1.63% | 1.59% |

| Net investment income | 1.05% (4) | 1.41% | 1.87% | 2.57% | 2.83% | 2.96% |

| Portfolio Turnover | 54% (3) | 56% | 105% | 89% | 67% | 70% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | Not annualized. |

| (4) | Annualized. |

| (5) | Interest and fee expense relates to the liability for floating rate notes issued in conjunction with residual interest bond transactions (see Note 1H). |

| National Fund — Class I | ||||||

| Year Ended September 30, | ||||||

| Six

Months Ended March 31, 2022 (Unaudited) |

2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of period | $ 10.310 | $ 10.240 | $ 10.140 | $ 9.650 | $ 9.930 | $ 10.170 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $ 0.104 | $ 0.248 | $ 0.289 | $ 0.341 | $ 0.374 | $ 0.390 |

| Net realized and unrealized gain (loss) | (0.673) | 0.082 | 0.120 | 0.495 | (0.277) | (0.241) |

| Total income (loss) from operations | $ (0.569) | $ 0.330 | $ 0.409 | $ 0.836 | $ 0.097 | $ 0.149 |

| Less Distributions | ||||||

| From net investment income | $ (0.121) | $ (0.260) | $ (0.309) | $ (0.346) | $ (0.377) | $ (0.389) |

| Total distributions | $ (0.121) | $ (0.260) | $ (0.309) | $ (0.346) | $ (0.377) | $ (0.389) |

| Net asset value — End of period | $ 9.620 | $ 10.310 | $ 10.240 | $ 10.140 | $ 9.650 | $ 9.930 |

| Total Return(2) | (5.56)% (3) | 3.24% | 4.10% | 8.83% | 1.01% | 1.56% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $2,080,590 | $2,347,177 | $1,797,038 | $1,348,563 | $756,446 | $777,063 |

| Ratios (as a percentage of average daily net assets): | ||||||

| Expenses excluding interest and fees | 0.36% (4) | 0.36% | 0.39% | 0.43% | 0.44% | 0.43% |

| Interest and fee expense(5) | 0.02% (4) | 0.02% | 0.05% | 0.12% | 0.19% | 0.16% |

| Total expenses | 0.38% (4) | 0.38% | 0.44% | 0.55% | 0.63% | 0.59% |

| Net investment income | 2.05% (4) | 2.39% | 2.85% | 3.45% | 3.83% | 3.95% |

| Portfolio Turnover | 54% (3) | 56% | 105% | 89% | 67% | 70% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (3) | Not annualized. |

| (4) | Annualized. |

| (5) | Interest and fee expense relates to the liability for floating rate notes issued in conjunction with residual interest bond transactions (see Note 1H). |

| AMT-Free

Fund |

National

Fund | |

| Floating Rate Notes Outstanding | $18,691,319 | $104,190,442 |

| Interest Rate or Range of Interest Rates (%) | 0.54 | 0.53 - 0.60 |

| Collateral for Floating Rate Notes Outstanding | $28,499,276 | $140,432,472 |

| AMT-Free

Fund |

National

Fund | |

| Average Floating Rate Notes Outstanding | $18,675,000 | $104,175,000 |

| Average Interest Rate | 0.73% | 0.69% |

| AMT-Free

Fund |

National

Fund | |

| Deferred capital losses: | ||

| Short-term | $15,332,582 | $103,411,907 |

| Long-term | $11,225,671 | $ 35,004,618 |

| AMT-Free

Fund |

National

Fund | |

| Aggregate cost | $306,281,090 | $3,522,919,787 |

| Gross unrealized appreciation | $ 12,044,030 | $ 82,705,243 |

| Gross unrealized depreciation | (8,756,764) | (88,942,850) |

| Net unrealized appreciation (depreciation) | $ 3,287,266 | $ (6,237,607) |

| Total Daily Net Assets | Annual

Asset Rate |

Daily

Income Rate |

| Up to $500 million | 0.300% | 3.000% |

| $500 million but less than $1 billion | 0.275 | 2.750 |

| $1 billion but less than $1.5 billion | 0.250 | 2.500 |

| $1.5 billion but less than $2 billion | 0.225 | 2.250 |

| $2 billion but less than $3 billion | 0.200 | 2.000 |

| $3 billion and over | 0.175 | 1.750 |

| AMT-Free

Fund |

National

Fund | |

| Investment Adviser Fee | $669,426 | $5,611,321 |

| Effective Annual Rate | 0.40% | 0.29% |

| AMT-Free

Fund |

National

Fund | |

| EVM's Sub-Transfer Agent Fees | $5,706 | $87,528 |

| EVD's Class A Sales Charges | $3,003 | $31,187 |

| Morgan Stanley affiliated broker-dealers’ Class A Sales Charges | $ — | $10,641 |

| AMT-Free

Fund |

National

Fund | |

| Class A Distribution and Service Fees | $190,090 | $1,866,382 |

| AMT-Free

Fund |

National

Fund | |

| Class C Distribution Fees | $31,704 | $328,263 |

| AMT-Free

Fund |

National

Fund | |

| Class C Service Fees | $10,568 | $109,421 |

| AMT-Free

Fund |

National

Fund | |

| Class A | $500 | $40,700 |

| Class C | $500 | $ 1,500 |

| AMT-Free

Fund |

National

Fund | |

| Purchases | $77,830,541 | $2,107,053,857 |

| Sales | $93,835,210 | $2,240,795,039 |

| AMT-Free Fund | ||||||

| Six

Months Ended March 31, 2022 (Unaudited) |

Year

Ended September 30, 2021 | |||||

| Shares | Amount | Shares | Amount | |||

| Class A | ||||||

| Sales | 439,205 | $ 4,038,581 | 2,641,027 | $ 24,766,387 | ||

| Issued to shareholders electing to receive payments of distributions in Fund shares | 168,820 | 1,531,619 | 391,532 | 3,658,118 | ||

| Redemptions | (1,419,912) | (12,936,991) | (3,720,359) | (34,629,729) | ||

| Converted from Class C shares | 30,520 | 276,359 | 541,353 | 5,049,181 | ||

| Net decrease | (781,367) | $ (7,090,432) | (146,447) | $ (1,156,043) | ||

| Class C | ||||||

| Sales | 26,886 | $ 246,416 | 132,529 | $ 1,235,057 | ||

| Issued to shareholders electing to receive payments of distributions in Fund shares | 7,629 | 68,817 | 21,623 | 200,701 | ||

| Redemptions | (104,591) | (954,872) | (274,046) | (2,541,459) | ||

| Converted to Class A shares | (30,691) | (276,359) | (544,356) | (5,049,181) | ||

| Net decrease | (100,767) | $ (915,998) | (664,250) | $ (6,154,882) | ||

| AMT-Free Fund (continued) | ||||||

| Six

Months Ended March 31, 2022 (Unaudited) |

Year

Ended September 30, 2021 | |||||

| Shares | Amount | Shares | Amount | |||

| Class I | ||||||

| Sales | 1,889,236 | $ 18,906,666 | 5,087,241 | $ 52,068,921 | ||

| Issued to shareholders electing to receive payments of distributions in Fund shares | 209,443 | 2,075,711 | 434,152 | 4,431,087 | ||

| Redemptions | (3,369,789) | (33,366,123) | (4,019,286) | (41,093,820) | ||

| Net increase (decrease) | (1,271,110) | $(12,383,746) | 1,502,107 | $ 15,406,188 | ||

| National Fund | ||||||

| Six

Months Ended March 31, 2022 (Unaudited) |

Year

Ended September 30, 2021 | |||||

| Shares | Amount | Shares | Amount | |||

| Class A | ||||||

| Sales | 3,057,009 | $ 30,999,900 | 11,047,967 | $ 114,627,273 | ||

| Issued to shareholders electing to receive payments of distributions in Fund shares | 1,349,125 | 13,605,878 | 2,984,855 | 30,945,109 | ||

| Redemptions | (13,206,461) | (133,651,276) | (24,540,436) | (254,580,665) | ||

| Converted from Class C shares | 330,988 | 3,337,147 | 3,351,755 | 34,698,532 | ||

| Net decrease | (8,469,339) | $ (85,708,351) | (7,155,859) | $ (74,309,751) | ||

| Class C | ||||||

| Sales | 263,984 | $ 2,692,480 | 1,859,069 | $ 19,296,295 | ||

| Issued to shareholders electing to receive payments of distributions in Fund shares | 54,436 | 548,813 | 137,455 | 1,423,778 | ||

| Redemptions | (1,292,828) | (13,071,550) | (2,272,863) | (23,567,153) | ||

| Converted to Class A shares | (330,984) | (3,337,147) | (3,351,767) | (34,698,532) | ||

| Net decrease | (1,305,392) | $ (13,167,404) | (3,628,106) | $ (37,545,612) | ||

| Class I | ||||||

| Sales | 40,392,377 | $ 408,012,855 | 90,354,141 | $ 938,155,202 | ||

| Issued to shareholders electing to receive payments of distributions in Fund shares | 2,224,567 | 22,432,016 | 4,167,096 | 43,217,465 | ||

| Redemptions | (53,922,632) | (541,490,176) | (42,427,981) | (440,159,489) | ||

| Net increase (decrease) | (11,305,688) | $(111,045,305) | 52,093,256 | $ 541,213,178 | ||

| National

Fund | |

| Asset Derivatives | |

| Futures contracts | $ 3,683,808(1) |

| Total | $3,683,808 |

| (1) | Only the current day’s variation margin on open futures contracts is reported within the Statement of Assets and Liabilities as Receivable or Payable for variation margin on open futures contracts, as applicable. |

| National

Fund | |

| Realized Gain (Loss) on Derivatives Recognized in Income | $8,845,583 (1) |

| Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income | $ (339,648)(2) |

| (1) | Statement of Operations location: Net realized gain (loss) - Futures contracts. |

| (2) | Statement of Operations location: Change in unrealized appreciation (depreciation) - Futures contracts. |

| National

Fund | |

| Average Notional Cost: | |

| Futures Contracts — Short | $146,724,000 |

| • | Level 1 – quoted prices in active markets for identical investments |

| • | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including a fund's own assumptions in determining the fair value of investments) |

| AMT-Free Fund | ||||

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Tax-Exempt Mortgage-Backed Securities | $ — | $ 1,065,056 | $ — | $ 1,065,056 |

| Tax-Exempt Municipal Obligations | — | 327,194,619 | — | 327,194,619 |

| Total Investments | $ — | $328,259,675 | $ — | $328,259,675 |

| National Fund | ||||

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Corporate Bonds | $ — | $ 46,404,126 | $ — | $ 46,404,126 |

| Tax-Exempt Municipal Obligations | — | 3,403,050,798 | — | 3,403,050,798 |

| Taxable Municipal Obligations | — | 167,733,890 | — | 167,733,890 |

| Total Investments | $ — | $ 3,617,188,814 | $ — | $3,617,188,814 |

| Futures Contracts | $ 3,683,808 | $ — | $ — | $ 3,683,808 |

| Total | $ 3,683,808 | $ 3,617,188,814 | $ — | $3,620,872,622 |

| Officers | |

| Eric

A. Stein President |

Jill R.

Damon Secretary |

| Deidre

E. Walsh Vice President and Chief Legal Officer |

Richard F.

Froio Chief Compliance Officer |

| James

F. Kirchner Treasurer |

|

| Trustees |

| * | Mr. Bowser and Ms. Wiser began serving as Trustees effective April 4, 2022. |

| ** | Interested Trustee |

| Privacy Notice | April 2021 |

| FACTS | WHAT

DOES EATON VANCE DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The

types of personal information we collect and share depend on the product or service you have with us. This information can include:■ Social Security number and income ■ investment experience and risk tolerance ■ checking account number and wire transfer instructions |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Eaton Vance chooses to share; and whether you can limit this sharing. |

| Reasons

we can share your personal information |

Does

Eaton Vance share? |

Can

you limit this sharing? |

| For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes — to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | No | We don’t share |

| For our investment management affiliates’ everyday business purposes — information about your transactions, experiences, and creditworthiness | Yes | Yes |

| For our affiliates’ everyday business purposes — information about your transactions and experiences | Yes | No |

| For our affiliates’ everyday business purposes — information about your creditworthiness | No | We don’t share |

| For our investment management affiliates to market to you | Yes | Yes |

| For our affiliates to market to you | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| To

limit our sharing |

Call toll-free 1-800-262-1122 or email: EVPrivacy@eatonvance.comPlease note:If you are a new customer, we can begin sharing your information 30 days from the date we sent this notice. When you are no longer our customer, we continue to share your information as described in this notice. However, you can contact us at any time to limit our sharing. |

| Questions? | Call toll-free 1-800-262-1122 or email: EVPrivacy@eatonvance.com |

| Privacy Notice — continued | April 2021 |

| Who we are | |

| Who is providing this notice? | Eaton Vance Management, Eaton Vance Distributors, Inc., Eaton Vance Trust Company, Eaton Vance Management (International) Limited, Eaton Vance Advisers International Ltd., Eaton Vance Global Advisors Limited, Eaton Vance Management’s Real Estate Investment Group, Boston Management and Research, Calvert Research and Management, Eaton Vance and Calvert Fund Families and our investment advisory affiliates (“Eaton Vance”) (see Investment Management Affiliates definition below) |

| What we do | |

| How

does Eaton Vance protect my personal information? |

To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. We have policies governing the proper handling of customer information by personnel and requiring third parties that provide support to adhere to appropriate security standards with respect to such information. |

| How

does Eaton Vance collect my personal information? |

We

collect your personal information, for example, when you■ open an account or make deposits or withdrawals from your account ■ buy securities from us or make a wire transfer ■ give us your contact informationWe also collect your personal information from others, such as credit bureaus, affiliates, or other companies. |

| Why can’t I limit all sharing? | Federal

law gives you the right to limit only■ sharing for affiliates’ everyday business purposes — information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to youState laws and individual companies may give you additional rights to limit sharing. See below for more on your rights under state law. |

| Definitions | |

| Investment

Management Affiliates |