UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material under § 240.14a-12 |

Cadiz Inc.

_____________________________________________________

(Name of Registrant as Specified In Its Charter)

___________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

☐ |

Fee paid previously with preliminary materials. |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 12, 2022

Dear Cadiz Inc. Stockholders:

NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Stockholders (the “2022 Annual Meeting”) of Cadiz Inc., a Delaware corporation, will be held virtually on Tuesday, July 12, 2022, at 10:00 a.m., Pacific Time, via the Internet at https://www.cstproxy.com/cadiz/2022 to consider and act upon the following matters:

(1) The election of nine members of the Board of Directors, each to serve until the next annual meeting of stockholders or until their respective successors have been elected and qualified;

(2) The adoption of an amendment to our certificate of incorporation to provide additional opportunity for stockholders to call special meetings. The amendment will delete the text of Part D of Article FIFTH (governing the calling of special meetings of stockholders) thereof in its entirety and replacing same with “Intentionally Omitted”;

(3) The approval of Amendment No. 1 to the Cadiz Inc. 2019 Equity Incentive Plan to increase the total number of shares reserved for issuance under the Plan;

(4) Ratification of the selection by the Audit Committee of our Board of Directors of PricewaterhouseCoopers LLP as the Company’s independent certified public accountants for fiscal year 2022;

(5) The approval of a non-binding advisory resolution regarding the compensation of our named executive officers; and

(6) The transaction of such other business as may properly come before the meeting and any adjournments thereof.

Only stockholders of record at the close of business on May 23, 2022, are entitled to notice of and to vote at the 2022 Annual Meeting. In order to constitute a quorum for the conduct of business at the 2022 Annual Meeting, holders of a majority of all outstanding voting shares of our common stock and preferred stock must be present through virtual attendance or be represented by proxy. Holders of our common stock and our preferred stock will vote together as a single class on each proposal. Holders of our depositary shares representing interests in our Series A Preferred Stock currently have no voting rights.

To provide access for our stockholders regardless of their location and to support the health and well-being of our employees and stockholders who continue to follow social distancing practices during the global coronavirus (COVID-19) pandemic, our 2022 Annual Meeting will be held virtually online. There will not be a physical location to attend the 2022 Annual Meeting in person. However, the virtual 2022 Annual Meeting will provide substantially the same opportunities to participate as you would have at an in-person meeting, including the ability to submit questions and vote your shares. Detailed instructions on how to vote and participate at the 2022 Annual Meeting may be found in the proxy statement and online at https://www.cstproxy.com/cadiz/2022. To be able to access the virtual 2022 Annual Meeting, you must have your 12-digit control number. The control number is provided on the Notice of Internet Availability of Proxy Materials you received in the mail, on your proxy card, or through your broker or other nominee if you hold your shares in “street name”.

Whether or not you expect to attend the virtual annual meeting, we encourage you to submit your proxy as soon as possible so that your shares will be represented at the meeting. Your proxy is revocable and will not affect your right to vote at the 2022 Annual Meeting if you chose to attend virtually.

If your brokerage firm, bank, broker-dealer or other similar organization is the holder of record of your shares (i.e., your shares are held in “street name”), you will receive a voting instruction form from the holder of record. You must provide voting instructions to your brokerage firm, bank, broker-dealer or other similar organization by filling out the voting instruction form in order for your shares to be voted. We recommend that you instruct your broker or other nominee to vote your shares as promptly as possible.

If your shares are held in street name and you would like to attend the virtual annual meeting to vote your shares, you will need to contact your brokerage firm, bank, broker-dealer or other similar organization to obtain a legal proxy. Once you have your legal proxy, contact Continental Stock Transfer to have a control number generated. Continental Stock Transfer’s contact information is as follows: (917) 262-2373, or email proxy@continentalstock.com.

We are pleased to utilize the Securities and Exchange Commission rules that allow us to furnish these proxy materials including an electronic proxy card for the meeting and our 2021 Annual Report to Stockholders, which is our Annual Report on Form 10-K for the year ended December 31, 2021 to stockholders via the internet. On or about June 2, 2022, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and 2021 Annual Report and how to vote. Utilizing these rules allows us to lower the cost of delivering annual meeting materials to our stockholders and reduce the environmental impact of printing and mailing these materials.

|

By Order of the Board of Directors |

|

|

Stanley Speer |

|

|

Secretary |

Los Angeles, California

May 26, 2022

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on July 12, 2022.

Our proxy statement and the 2021 Annual Report to Stockholders on Form 10-K are available at https://www.cstproxy.com/cadiz/2022

CADIZ INC.

Annual Meeting of Stockholders

TABLE OF CONTENTS

|

Page |

|

|

1 |

|

|

Record Date, Voting Securities and Quorum |

1 |

|

Revocability of Proxies |

2 |

|

Cost of Solicitation |

3 |

|

3 |

|

|

6 |

|

|

8 |

|

|

Director Biographical Information and Highlights |

9 |

|

Executive Officer Biographical Information and Highlights |

18 |

|

18 |

|

|

Director Independence |

18 |

|

Independence of Committee Members |

19 |

|

Communications with the Board of Directors |

19 |

|

Attendance of Board of Directors at the Annual Meeting |

19 |

|

Meetings of the Board of Directors |

19 |

|

Committees of the Board of Directors |

19 |

|

Audit and Risk Committee |

19 |

|

Compensation Committee |

19 |

|

Corporate Governance and Nominating Committee |

21 |

|

Equity, Sustainability and Environmental Justice Committee |

22 |

|

26 |

|

|

26 |

|

|

26 |

|

|

27 |

|

|

28 |

|

|

Overview |

28 |

|

Compensation Philosophy |

29 |

|

Elements of Compensation |

29 |

|

Use of Peer Group |

30 |

|

Benchmarking |

31 |

|

Performance Objectives |

31 |

|

Elements of 2021 Compensation |

31 |

|

Severance and Change in Control Provisions |

33 |

|

Tax and Accounting Considerations |

33 |

|

33 |

|

|

34 |

|

|

Summary Compensation Table |

34 |

|

Grants of Plan-Based Awards |

34 |

|

Outstanding Equity Awards at Fiscal Year-End |

35 |

|

Option Exercises and Stock Vested |

36 |

|

Pension Benefits |

36 |

|

Nonqualified Deferred Compensation |

36 |

|

36 |

|

|

38 |

|

|

40 |

|

|

40 |

|

|

41 |

|

|

41 |

|

|

41 |

|

|

42 |

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

43 |

|

44 |

|

|

46 |

|

|

47 |

|

|

48 |

|

|

POLICIES AND PROCEDURES WITH RESPECT TO RELATED PARTY TRANSACTIONS |

48 |

|

PROPOSAL 2: ADOPTION OF AMENDMENT TO CERTIFICATE OF INCORPORATION |

50 |

|

PROPOSAL 3: APPROVAL OF AMENDMENT 1 TO CADIZ INC. EQUITY INCENTIVE PLAN PROPOSAL 4: APPROVAL OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM PROPOSAL 5: ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS |

53 66 67 |

|

68 |

|

|

68 |

|

|

68 |

550 S. Hope Street, Suite 2850

Los Angeles, California 90071

PROXY STATEMENT

For

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 12, 2022

INFORMATION ABOUT SOLICITATION AND VOTING

The Board of Directors of Cadiz Inc. (“the Company”) is soliciting proxies to be voted at the annual meeting of our stockholders to be held at 10:00 am Pacific Time on Tuesday, July 12, 2022 (the “2022 Annual Meeting”) for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The 2022 Annual Meeting will be conducted this year as a virtual meeting and will be accessible to stockholders of record via the Internet at the following website: https://www.cstproxy.com/cadiz/2022. This proxy statement contains information that may help you decide how to vote.

In accordance with the rules of the Securities and Exchange Commission (“SEC”), instead of mailing a printed copy of our proxy materials to each stockholder of record, we are furnishing proxy materials, including the notice, this proxy statement, our Annual Report on Form 10-K for the year ended December 31, 2021 (the “2021 Annual Report”), including financial statements, and a proxy card for the meeting, by providing access to them on the internet to save printing costs and benefit the environment. These materials will first be available on the internet on or about May 27, 2022. We will mail a Notice of Internet Availability of Proxy Materials (the “Notice”) on or about June 2, 2022 to our stockholders of record and beneficial owners as of May 23, 2022, the record date for the meeting. This proxy statement and the Notice contain instructions for accessing and reviewing our proxy materials on the internet and for voting by proxy over the internet. If you prefer to receive printed copies of our proxy materials, the Notice contains instructions on how to request the materials by mail. You will not receive printed copies of the proxy materials unless you request them. If you elect to receive the materials by mail, you may also vote by proxy on the proxy card or voter instruction card that you will receive in response to your request.

Record Date, Voting Securities and Quorum

The Board of Directors has fixed the close of business on May 23, 2022, as the record date for determination of stockholders entitled to notice of, and to vote at, the 2022 Annual Meeting.

On the record date, 50,770,275 shares of the Company’s common stock were outstanding, 329 shares of the Company’s preferred stock were outstanding, and 2,300 shares of the Company’s 8.875% Series A Preferred Stock were outstanding. Holders of common stock are entitled to one vote per share. Holders of preferred stock are entitled to that number of votes equal to the number of shares of preferred stock held at the time the shares are voted multiplied by the voting ratio then applicable to preferred stock, which is currently 301.98 votes for each share of preferred stock; provided, however, that no beneficial owner of preferred stock shall have the right to vote in excess of 9.9% of the total number of voting shares. Holders of our common stock and our preferred stock will vote together as a single class on each proposal. Holders of depositary shares representing interests in the Series A Preferred Stock currently have no voting rights.

The candidates for director receiving a plurality of the votes of the shares present through virtual attendance or represented by proxy will be elected (Proposal 1). An affirmative vote of the majority of the outstanding shares entitled to vote at the 2022 Annual Meeting is required for the passage of the stockholder proposal to adopt an amendment to our certificate of incorporation to provide additional opportunity for stockholders to call special meetings. The amendment will delete the text of Part D of Article FIFTH (governing the calling of special meetings of stockholders) thereof in its entirety and replacing same with “Intentionally Omitted” (Proposal 2) An affirmative vote of a majority of the shares present through virtual attendance or represented by proxy and voting at the meeting is required for the approval of Amendment No. 1 to the Cadiz Inc. 2019 Equity Incentive Plan (Proposal 3), ratification of the Company’s independent registered public accounting firm (Proposal 4), and the passage of the non-binding advisory resolution approving the compensation of the Company’s named executive officers (Proposal 5). While the vote on Proposal 5 is advisory and will not be binding on the Company or our Board, the Board will review the results of the voting on this proposal and take it into consideration when making future decisions regarding executive compensation, as we have done in this and previous years.

If you return a properly completed proxy before the 2022 Annual Meeting, the persons named will vote your shares as you specify in the proxy. If you return your proxy but do not indicate how you wish your shares voted, they will be voted in accordance with the Board’s recommendations. If you do not return a proxy or submit your vote via the Internet, then your shares will not be voted unless you attend the virtual meeting and cast your vote via the online meeting platform.

To have a quorum, holders of a majority of all voting shares of our common stock and preferred stock issued and outstanding on the record date must be present and entitled to vote at the meeting, either through virtual attendance or by proxy. If you are a record holder of shares of voting stock as of the record date and you submit your proxy, regardless of whether you abstain from voting on one or more matters, your shares will be counted as present at the 2022 Annual Meeting for the purpose of determining a quorum. If your shares are held in “street name,” your shares are counted as present for purposes of determining a quorum if your bank, broker or other nominee submits a proxy covering your shares.

Brokers may not vote your shares on Proposal 1, the election of directors, in the absence of your specific instructions as to how to vote. Brokers are also not authorized to vote your shares on Proposals 2, 3 and 5. The Company encourages you to provide instructions to your broker regarding the voting of your shares on these Proposals.

Abstentions and "broker non-votes" will be counted for purposes of determining a quorum, but will be treated as neither a vote "for" nor a vote "against" the proposals. However, because Proposal 2 requires the affirmative vote of the holders of at least a majority in voting power of the Company’s outstanding capital stock as of the record date and entitled to vote on the proposal to pass, both an “abstention” and a “broker non-vote”, neither of which is a vote “for” will have the effect of a negative vote with respect to Proposal 2 and could cause the Proposal not to pass. In addition, because Proposals 3, 4 and 5 require a majority of the shares present in person or by proxy at the meeting and entitled to vote on the proposals to pass, an abstention, because it is not a vote “for,” will have the effect of a negative vote with respect to Proposals 3, 4 and 5 and could cause these Proposals not to pass.

Revocability of Proxies

You may revoke a proxy any time before the voting begins in any of the following ways:

* By giving written notice to the Company’s corporate secretary;

* By signing and delivering a later dated proxy; or

* By attending virtually and casting your vote via the online platform during the 2022 Annual Meeting.

Cost of Solicitation

The Company is paying the expenses of this solicitation. If requested, we will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in sending proxy material to principals and obtaining their instructions. In addition to solicitation by mail, our directors, officers, and employees may solicit proxies, without extra compensation, in person or by telephone, fax, e-mail, or similar means.

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why did I receive these proxy materials?

We are providing this Proxy Statement in connection with the solicitation by the Board of proxies to be voted at the 2022 Annual Meeting, or at any postponements or adjournments thereof. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the 2022 Annual Meeting. You are invited to attend the virtual Annual Meeting to vote electronically on the proposals described in this Proxy Statement. However, you do not need to attend the 2022 Annual Meeting to vote your shares. Instead, you may vote your shares using one of the other voting methods described in this Proxy Statement.

Whether or not you expect to attend the Annual Meeting, please vote your shares as soon as possible in order to ensure your representation at the Annual Meeting.

Why did I receive a notice in the mail regarding the internet availability of proxy materials?

Instead of mailing printed copies to each of our stockholders, we have elected to provide access to the proxy materials over the internet under the SEC’s “notice and access” rules. These rules allow us to make our stockholders aware of the 2022 Annual Meeting and the availability of the proxy materials by sending the Notice, which provides instructions on how to access the full set of proxy materials through the internet or make a request to have printed proxy materials delivered by mail. Accordingly, on or about June 2, 2022 we will mail the Notice to each of our stockholders. The Notice contains instructions on how to access the proxy materials, including this Proxy Statement and the 2021 Annual Report, each of which are available at https://www.cstproxy.com/cadiz/2022. The Notice also provides instructions on how to vote your shares through the internet, by telephone, by mail or at the 2022 Annual Meeting.

What is the purpose of complying with the SEC’s “notice and access” rules?

We believe compliance with the SEC’s “notice and access” rules allows us to provide our stockholders with the materials they need to make informed decisions, while lowering the costs of printing and delivering those materials and reducing the environmental impact of the 2022 Annual Meeting. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice. If you have previously elected to receive the proxy materials electronically, you will continue to receive these materials electronically unless you elect otherwise.

Can I access these proxy materials on the internet?

Yes. The Notice of Annual Meeting, Proxy Statement, and 2021 Annual Report, are available for viewing, printing, and downloading at https://www.cstproxy.com/cadiz/2022. Our 2021 Annual Report is also available under the Company — Investor Relations — Annual Reports section of our website at www.cadizinc.com and through the SEC’s EDGAR system at http://www.sec.gov. All materials will remain posted on https://www.cstproxy.com/cadiz/2022 at least until the conclusion of the meeting.

How do I vote?

The procedures for voting are set forth below:

Stockholder of Record – Shares Registered in Your Name

If you are a stockholder of record, you may vote electronically at the virtual 2022 Annual Meeting, vote by proxy using the proxy card, vote via the internet or by telephone. Whether or not you plan to attend the 2022 Annual Meeting, we urge you to vote by proxy, via the internet or by telephone to ensure your vote is counted. You may still attend the virtual 2022 Annual Meeting and vote electronically if you have already voted by proxy, via the internet or by telephone. You may vote as follows:

|

● |

To vote electronically at the virtual 2022 Annual Meeting, go to on https://www.cstproxy.com/cadiz/2022 to attend the 2022 Annual Meeting and follow the instructions provided on the website. Once you have joined the virtual meeting, you may, just as you would be able to do so in person, vote your shares or submit a question electronically during the meeting by following the instructions available on the meeting website. |

|

● |

To vote using the proxy card, simply complete, date and sign the proxy card and return the proxy card promptly in the envelope provided if you have requested a hard copy. If you return your signed proxy card to us before the 2022 Annual Meeting, we will vote your shares as you direct. |

|

● |

To vote through the internet, go to on https://www.cstproxyvote.com and follow the instructions provided on the website. In order to cast your vote, you will be asked to provide the control number from the Notice or your proxy card. Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on July 11, 2022. Our internet voting procedures are designed to authenticate stockholders by using individual control numbers, which are located on the Notice or proxy card.

|

|

● |

To vote by phone, call (866) 894-0536, from any touch-tone telephone and follow the instructions. In order to cast your vote, you will be asked to provide the control number from the Notice or your proxy card. Telephonic voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on July 11, 2022. Our telephonic voting procedures are designed to authenticate stockholders by using individual control numbers, which are located on the Notice or proxy card. |

Beneficial Owner – Shares Registered in the Name of Broker or Bank

If you hold your shares in “street name” and thus are a beneficial owner of shares registered in the name of your broker, bank or other agent, you must vote your shares in the manner prescribed by your broker or other nominee. Your broker or other nominee has enclosed or otherwise provided a voting instruction card for you to use in directing the broker or nominee how to vote your shares. Check the voting form used by that organization to see if it offers internet or telephone voting. To vote electronically at the virtual 2022 Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a proxy form.

Can I change my vote after submitting my proxy, voting via the internet or by telephone?

Yes. You can revoke your proxy at any time before the final vote at the virtual 2022 Annual Meeting. If you are a stockholder of record, you may revoke your proxy in any one of four ways:

|

● |

You may submit another properly completed proxy card with a later date; |

|

● |

You may vote again by internet or telephone at a later time (prior to the deadline for internet or telephone voting); |

|

● |

You may send a written notice that you are revoking your proxy to: Corporate Secretary, Cadiz Inc., 550 South Hope Street, Suite 2850, Los Angeles, CA 90071 |

|

● |

You may attend the virtual 2022 Annual Meeting and vote electronically. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

If you hold your shares in street name, contact your broker or other nominee regarding how to revoke your proxy and change your vote. Your most current internet proxy, telephone proxy or proxy card will be the one that is counted at the 2022 Annual Meeting. If you send a written notice of revocation, please make sure to do so with enough time for it to arrive by mail prior to the 2022 Annual Meeting.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in our Current Report on Form 8-K within four business days after the 2022 Annual Meeting.

ELECTION OF DIRECTORS

The Board of Directors has nominated the nine persons listed below for election at the 2022 Annual Meeting to serve as directors for a term expiring at the 2023 Annual Meeting of Stockholders or until their respective successors are elected and qualified.

Susan P. Kennedy

Keith Brackpool

Stephen E. Courter

Maria Echaveste

Geoffrey Grant

Winston H. Hickox

Kenneth T. Lombard

Scott S. Slater

Carolyn Webb de Macías

Each of the nominees currently serves as a director and has agreed to serve as such for another term if elected. The Board has reviewed the background of the nominees, as set out on the following pages, and has determined to nominate each of the current Directors for re-election. Proxies may not be voted for a greater number of persons than nine, representing the number of nominees named in this proxy statement.

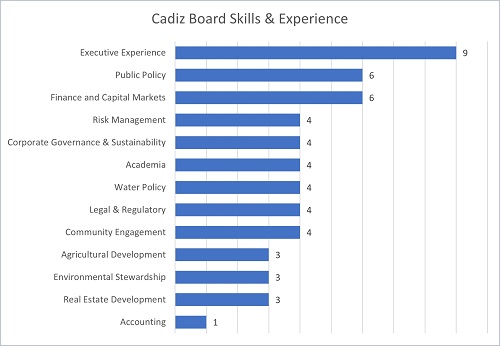

The Board believes that each nominee has valuable individual skills and experience that, taken together, provides the Board with the variety and depth of knowledge, judgment, and vision necessary to provide effective oversight of a resource development enterprise like ours. As indicated in the following biographies, the nominees have extensive and diverse experience in a variety of fields, including water policy (Mr. Brackpool, Ms. Kennedy, Mr. Lombard and Mr. Slater), agricultural development (Mr. Brackpool, Mr. Grant, and Mr. Slater), real estate development (Mr. Brackpool, Mr. Hickox and Mr. Lombard), environmental stewardship (Mr. Hickox, Ms. Kennedy and Mr. Slater), finance and capital markets (Mr. Brackpool, Mr. Courter, Mr. Grant, Mr. Hickox, Ms. Kennedy and Mr. Lombard), risk management (Mr. Courter, Ms. Echaveste, Mr. Grant and Mr. Hickox), public accounting (Mr. Courter), public policy (Mr. Brackpool, Ms. Echaveste, Mr. Hickox, Ms. Kennedy, Mr. Lombard, Mr. Slater and Ms. Webb de Macías), community engagement (Ms. Echaveste, Ms. Kennedy, Mr. Lombard and Ms. Webb de Macías), corporate governance and sustainability (Mr. Courter, Ms. Echaveste, Mr. Hickox and Ms. Webb de Macías), academia (Mr. Courter, Ms. Echaveste, Mr. Slater and Ms. Webb de Macías),and legal and regulatory oversight (Ms. Echaveste, Mr. Hickox, Ms. Kennedy and Mr. Slater).

The Board also believes that, as indicated in the biographies, the nominees have demonstrated significant leadership skills as the head of business, government and non-profit organizations, including as a chief executive officer (Mr. Brackpool, Mr. Courter, Ms. Echaveste, Mr. Grant, Mr. Hickox, Ms. Kennedy, Mr. Lombard and Mr. Slater), as high-ranking appointments in state and federal government administrations (Mr. Brackpool, Ms. Echaveste, Ms. Kennedy, Mr. Hickox, and Ms. Webb de Macías) or as chairs of community and academic foundation boards (Ms. Echaveste, Ms. Kennedy, Mr. Lombard and Ms. Webb de Macías). Further, all of the nominees have significant experience in the oversight of public companies due to their service as the Company’s directors or as directors of other companies. The Board believes that these skills and experiences qualify each nominee to serve as a director of the Company.

Proxies will be voted “FOR” the election of the nominees named above unless instructions are given to the contrary.

Required Vote.

Vote by a plurality of the shares present in person through virtual attendance or represented by proxy at the 2022 Annual Meeting and entitled to vote thereon is required for the election of directors under Proposal 1. You may vote “FOR” all Nominees, “WITHHOLD” your vote as to all Nominees, or “FOR” all Nominees except the specific nominee from whom you “WITHHOLD” your vote. There is no “against” option. A properly executed proxy marked “WITHHOLD” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Proxies may not be voted for more than nine directors and stockholders may not cumulate votes.

Should any nominee become unable to serve as a director, the persons named in the enclosed form of proxy will, unless otherwise directed, vote for the election of such other person as the present Board of Directors may designate to fill that position.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION

OF EACH NOMINEE AS A DIRECTOR.

DIRECTORS AND EXECUTIVE OFFICERS

The following sets forth certain biographical information, the present occupation and the business experience for the past five years or more of each director who will stand for re-election at our 2022 Annual Meeting of Stockholders and for each executive officer who is not also a director.

Nominees for Director:

|

Name |

Age |

Position with Cadiz |

|

Susan P. Kennedy |

61 |

Chair of the Board (1) |

|

Keith Brackpool |

64 |

Director (1) |

|

Stephen E. Courter |

67 |

Director |

|

Maria Echaveste |

67 |

Director |

|

Geoffrey Grant |

61 |

Director |

|

Winston H. Hickox |

79 |

Director |

|

Kenneth T. Lombard |

66 |

Director |

|

Scott S. Slater |

64 |

Director, President and Chief Executive Officer |

|

Carolyn Webb de Macías |

74 |

Director |

|

1. |

Ms. Kennedy was appointed to serve as Chair of the Board, an executive officer role, effective February 4, 2022, replacing Mr. Brackpool in that position. Mr. Brackpool continues to serve on the Board in a non-executive role. |

Executive Officers not also on the Board of Directors:

|

Name |

Age |

Position with Cadiz |

|

Stanley Speer |

61 |

Chief Financial Officer and Secretary |

Director Biographical Information and Highlights

|

Susan P. Kennedy Chair of the Board of Directors |

Director Since: 2021 |

Age: 61 |

|

|

Biography

Susan P. Kennedy was appointed a director of the Company on March 24, 2021. Ms. Kennedy is an accomplished executive, policymaker and strategist with a distinguished career as founder and chief executive of a clean energy company, top advisor to two California Governors, former Commissioner of the California Public Utilities Commission, and advisor to high-profile governing boards in the corporate, regulatory, government, and non-profit sectors. She recently served as a Senior Executive at Lyft, Inc. Previously, Ms. Kennedy founded California energy storage start-up Advanced Microgrid Solutions, serving as chief executive officer and board chair from 2013-2020 until it was acquired by Fluence (NASDAQ: FLNC) in 2020. Prior to entering the private sector, Ms. Kennedy served for two decades at the highest levels of government, including chief of staff to Governor Arnold Schwarzenegger (2006-2011) and cabinet secretary and deputy chief of staff to Governor Gray Davis (1999-2003). From 2003 to 2006, Ms. Kennedy served as Commissioner of the California Public Utilities Commission (CPUC), which regulates the state’s investor-owned electricity, gas, telecommunications, and water utilities. In this role, she oversaw the CPUC’s efforts to ensure water utilities deliver clean, safe, and reliable water to their customers at reasonable rates. In addition to her service on the CPUC, Ms. Kennedy was confirmed by the California Senate to serve on the California Bay-Delta Authority, the statewide body responsible for overseeing one of the largest water projects in the world — the $8 billion,10-year restoration of the San Francisco Bay Delta ecosystem. In this role, Ms. Kennedy was responsible for agreements among environmentalists, agricultural interests, and urban water users for multi-billion-dollar co-investments in water storage facilities, water use efficiency, and restoration of impaired waterways and fisheries. Ms. Kennedy holds a B.A. in Management from Saint Mary’s College of California.

|

|||

|

Skills & Qualifications

Ms. Kennedy’s vast public service experience, including as the Commissioner of the California Public Utilities Commission, and experience founding and leading her own renewable energy company enable her to provide key leadership, public policy, strategy, and industry expertise to the Board.

|

Cadiz Board Committees

N/A |

||

|

Keith Brackpool Director, Former Chair of the Board of Directors |

Director Since: 1986 |

Age: 64 |

|

|

Biography

Keith Brackpool is a co-founder of the Company. Mr. Brackpool served as Chair of the Board from 2001 to 2022. Mr. Brackpool was first appointed to the Board of Directors in 1986 and previously served as CEO from 1991 – 2013. In addition to his role with Cadiz, Mr. Brackpool is currently a principal of 1334 Partners L.P., a partnership that owns and develops a portfolio of destination hospitality properties in California. Mr. Brackpool has extensive public policy experience, particularly in California, and served as Co-Chair of the California Commission on Building for the 21st Century, a diverse panel that developed long-term policy proposals to meet the state’s future water, housing, technology and transportation needs from 2001 – 2002. Mr. Brackpool also served as Chair of the California Horse Racing Board from 2010 – 2013, after which he went on to serve as the Chair of west coast operations for The Stronach Group, an entertainment and real estate company in North America focused on Thoroughbred horse racing and pari-mutual wagering from 2013 – 2018. Earlier in his career, Mr. Brackpool served as director and chief executive officer of North American Operations for Albert Fisher Group, a multi-billion dollar food company.

|

|||

|

Skills & Qualifications

Mr. Brackpool’s experience as a co-founder and former CEO of the Company, in addition to his extensive public and water policy experience, enables him to provide key leadership, industry, and policy perspectives to the Board.

|

Cadiz Board Committees

N/A |

||

|

Stephen E. Courter |

Director Since: 2008 |

Age: 67 |

|

|

Biography

Stephen E. Courter was appointed a director of the Company effective October 9, 2008. Mr. Courter was originally appointed to the Board as a designee of LC Capital Master Fund for a term expiring at the 2009 annual meeting of stockholders. Mr. Courter is currently on the faculty of the McCombs School of Business, University of Texas at Austin where he teaches MBA courses in strategy and new venture creation. He also serves as a director of Upland Software, a business process software company. Mr. Courter has over 30 years of experience in management positions in the technology/telecommunications industry, serving most recently as CEO of Broadwing Communications from 2006 to 2007 and CEO of NEON Communications from 2000 to 2006. Mr. Courter has also previously served as a director on several corporate boards, including NEON Communications from 2001-2006, Broadwing Communications from 2006-2007, and GLOBIX from 2006-2007. Mr. Courter began his career as an officer in the U.S. Army and has also held various executive positions, both in the U.S. and Europe, at several major corporations including KPMG, IBM and Sprint. Mr. Courter holds an MBA from George Washington University and a B.S. in Finance from Pennsylvania State University.

|

|||

|

Skills & Qualifications

Mr. Courter’s experience in the technology industry and his extensive executive and leadership experience enable him to provide valuable leadership, strategy, finance, and risk management insights to the Board.

|

Cadiz Board Committees

● Audit & Risk (Chair) ● Corporate Governance & Nominating

|

||

|

Maria Echaveste |

Director Since: 2019 |

Age: 67 |

|

|

Biography

Maria Echaveste was elected as a director at the Company’s 2019 Annual Meeting. Ms. Echaveste is a scholar with a distinguished career working as a community leader, public policy advisor, lecturer, senior White House official, and attorney. She is presently President and CEO of the Opportunity Institute, a non-profit working to increase economic and social mobility focused on equity for the most vulnerable communities. Ms. Echaveste has been affiliated with UC Berkeley in various capacities since 2004 including: lecturing at the School of Law and in the undergraduate division on immigration and education; serving as program and policy director of the Law School’s Chief Justice Earl Warren Institute on Law and Social Policy from 2006 -2012; serving as a Senior Fellow at UC Berkeley’s Center for Latin American Studies since 2008; and as a Visiting Scholar with the Berkeley Food Institute from 2015-2016. Previously, from 1998 to 2001 Ms. Echaveste served as Assistant to the President and Deputy Chief of Staff for President Bill Clinton focused on issues relating to immigration, civil rights, education, finance, Mexico and Latin America. From 1993 to 1997 she served as Administrator of the Wage and Hour Division at the US Department of Labor. In 2009, then-Secretary of State Hillary Clinton appointed Ms. Echaveste as a special representative to Bolivia. From 2015-2017, Ms. Echaveste served as vice-chair of the California International Trade and Investment Advisory Committee, an appointment by Governor Brown. Ms. Echaveste presently serves on the board of directors of the Level Playing Field Institute, Mi Familia Vota and UCSF Benioff Children’s Hospitals.

|

|||

|

Skills & Qualifications

Ms. Echaveste’s accomplished career in public service and extensive community leadership enables her to provide valuable public policy and stakeholder insights to the Board.

|

Cadiz Board Committees

● Corporate Governance & Nominating (Chair) ● Equity, Sustainability & Environmental Justice |

||

|

Geoffrey Grant |

Director Since: 2007 |

Age: 61 |

|

|

Biography

Geoffrey Grant was appointed a director of the Company effective January 22, 2007. Mr. Grant is presently a private investor. In 2012, Mr. Grant retired from Grant Capital Partners, an asset management firm founded by Mr. Grant in 2008, where he was the Managing Partner and the Chief Investment Officer. Prior to founding Grant Capital Partners, Mr. Grant was a Managing Partner and the Chief Investment Officer of Peloton Partners LLP, a global asset management firm. Mr. Grant co-founded Peloton Partners LLP in 2005. Mr. Grant’s career in financial markets spans 35 years beginning at Morgan Stanley in 1982 in foreign exchange options and currency derivatives, then with Goldman Sachs from 1989 to 2004 where he ultimately served as Head of Global Foreign Exchange and Co-head of the Proprietary Trading Group in London.

|

|||

|

Skills & Qualifications

Mr. Grant’s experience leading several asset management firms enables him to provide valuable leadership, finance, and investment perspectives to the Board.

|

Cadiz Board Committees

● Compensation ● Audit & Risk

|

||

|

Winston Hickox Lead Independent Director |

Director Since: 2006 |

Age: 79 |

|

|

Biography

Winston Hickox was appointed a director of the Company in October 2006. Mr. Hickox is currently a partner at the public policy consulting firm California Strategies, a position he has held since 2006, Mr. Hickox also currently serves as a Member of the Strategic Advisory Group of Paladin Capital Group. Previously, from 2007 until 2012, Mr. Hickox chaired the FTSE Environmental Markets Committee responsible for bi-annual reset of the FTSE Environmental Markets Index Series. From 2004 – 2006, Mr. Hickox served as Senior Portfolio Manager with the California public Employees’ Retirement System (CalPERS), designing its environmentally-oriented impact investment initiatives for the fund’s now $477.3 billion investment portfolio. Prior to CalPers, from 1999 – 2003, Mr. Hickox served as Secretary of the California Environmental Protection Agency (CalEPA) and a member of the Governor’s cabinet. Earlier in his career, Mr. Hickox’s additional private sector experience includes head of Portfolio Management, Managing Director and Partner at Lasalle Investment Management from 1987 to 1998, where he managed a $2B real estate portfolio, and President of his own securities brokerage firm, the Hickox Financial Corporation. Mr. Hickox has also served on numerous corporate boards, including Thomas Properties Group, a publicly traded full service real estate investment firm, and GRIDiant Corporation, a privately held corporation in the energy technology sector. Mr. Hickox’s prior government service includes the Board of the $12.6 billion Sacramento County Employees’ Retirement System (SCERS) from 1998 – 2012, Chair of the Market Advisory Committee, which helped prepare for the implementation of AB 32 California’s sweeping effort to address climate change, and seven years as a Special Assistant to the Governor for Environmental Affairs as well as a Deputy Secretary for Environmental Affairs. From April 1997 to January 1999, Hickox also served as one of the California Assembly Speaker’s appointees to the California Coastal Commission. Mr. Hickox holds an MBA from Golden Gate University and a B.S. from California State University.

|

|||

|

Skills & Qualifications

Mr. Hickox’s vast investment experience and roles with the State of California and other industry groups enable him to provide valuable leadership, public policy, investment, finance, and industry expertise to the Board.

|

Cadiz Board Committees

● Compensation (Chair) ● Audit & Risk ● Equity, Sustainability & Environmental Justice

|

||

|

Kenneth T. Lombard |

Director Since: 2022 |

Age: 66 |

|

|

Biography

Kenneth T. Lombard is presently President & CEO of BRIDGE Housing, a leading nonprofit developer, owner, and manager of affordable housing. He joined BRIDGE in November 2021. Over a career that spans three decades, Mr. Lombard joined BRIDGE following positions at Seritage Growth Properties (NYSE: SRG), where he served most recently as Special Advisor; he was an original Board member when Seritage went public in 2015 and subsequently served as Seritage’s EVP and COO. Seritage is a self-administered and self-managed REIT with properties totaling approximately 39 million square feet of space across 49 states and Puerto Rico. Earlier, Mr. Lombard was President of MacFarlane Partners, an investment management firm that acquires, develops, and manages real estate assets on behalf of pensions and institutional investors. Prior to joining MacFarlane Partners, Mr. Lombard served as Vice Chairman, Partner, and head of investments for Capri Capital Partners, and President of the Capri Urban Fund, which invested in more than $1 billion in commercial, residential, and mixed-use development, redevelopment, and repositioning projects in densely populated urban markets of the U.S. From 2004 to 2008, Mr. Lombard was President of Starbucks Entertainment, where he managed the collaboration with Concord Music to form a new Starbucks music label. In 1992, Mr. Lombard co-founded Johnson Development Corporation and spent 12 years as the President and Partner of the firm, creating a legacy of economic improvement in underserved communities of color in 65 cities and 17 states. Mr. Lombard holds a B.A. in Communication from the University of Washington.

|

|||

|

Skills & Qualifications

Mr. Lombard has garnered extensive experience in business development, management, investment banking, economic development, corporate expansion, and real estate investment.

|

Cadiz Board Committees

● Audit & Risk |

||

|

Scott Slater Chief Executive Officer (CEO) |

Director Since: 2012 |

Age: 64 |

|

|

Biography

Scott S. Slater is the Company’s President and Chief Executive Officer, appointed to the role of President in April 2011 and Chief Executive Officer effective February 1, 2013. In addition, Mr. Slater has been a member of the Company’s Board of Directors since February 2012. Mr. Slater is an accomplished water rights transactional attorney and litigator and, in addition to his role at the Company, is a shareholder in Brownstein Hyatt Farber Schreck LLP, the nation’s leading water law firm. For nearly 40 years, Mr. Slater has focused on negotiation of agreements and enacting policy related to the acquisition, distribution, and treatment of water. He has served as lead negotiator on a number of important water transactions, including the negotiation of the largest conservation-based water transfer in U.S. history on behalf of the San Diego County Water Authority. Mr. Slater serves on the Limoneira Company Board of Directors (NASDAQ: LMNR) and sits on its Executive and Risk Committees. Mr. Slater also has an extensive background in state, federal and international water policy and is the author of California Water Law and Policy, the state’s leading treatise on the subject. He has taught water law and policy courses at University of California, Santa Barbara, Pepperdine University, and the University of Western Australia, (China) among others. He is presently advising the nation of Tunisia on water policy.

|

|||

|

Skills & Qualifications

Mr. Slater’s experience as the Company’s CEO and as an accomplished water rights lawyer enable him to provide the Board with valuable leadership, strategy, legal, and industry perspectives.

|

Cadiz Board Committees

N/A |

||

|

Carolyn Webb de Macías |

Director Since: 2019 |

Age: 74 |

|

|

Biography

Carolyn Webb de Macías was elected as a director at the Company’s 2019 Annual Meeting. Carolyn Webb de Macías is a community leader with an extensive career in public policy and higher education. Ms. Webb de Macías currently serves as Board Chair for the Partnership for Los Angeles Schools, a non-profit organization that manages 20 schools through a Memorandum Of Understanding with the Los Angeles Unified School District, and as Member of the Board of the Community Coalition of South Los Angeles, a community education and advocacy organization. Previously Ms. Webb de Macías served as Chief of Staff in the Office of Elementary and Secondary Education in the US Department of Education as an appointee of President Barack Obama from 2010-2012. From 1997 – 2008, Ms. Webb de Macías served in various roles at the University of Southern California including adjunct faculty member in the USC Rossier School of Education, associate provost from 1997 – 2002 and vice president for external relations from 2002 – 2008. Upon retirement from USC in 2008, Ms. Webb de Macías was granted the title of Vice President Emeritus. From 1991 – 1997 Ms. Webb de Macías served as chief of staff for Los Angeles City Councilman Mark Ridley-Thomas. Ms. Webb de Macías’ strong record of community service includes roles as founding member of the Board for the Alliance for Regional Collaboration to Heighten Educational Success (ARCHES), member of the Boards of the Los Angeles African American Women’s Public Policy Institute and the International Black Women’s Public Policy Institute, member of the Central City Association Executive Committee, and founding president of the Education Consortium of Central Los Angeles. Ms. Webb de Macías has been honored for her work as a founding member of Young Black Scholars of Los Angeles and named a Black Woman of Achievement by the NAACP Legal Defense and Education Fund.

|

|||

|

Skills & Qualifications

Ms. Webb de Macías’ long history of public service and role as a community leader in Southern California enables her to provide valuable public policy expertise and California community insights to the Board.

|

Cadiz Board Committees

● Compensation ● Corporate Governance & Nominating ● Equity, Sustainability & Environmental Justice (Chair)

|

||

Executive Officer Biographical Information and Highlights

|

Stanley Speer Chief Financial Officer (CFO) |

Appointed: 2020 |

Age: 61 |

|

|

Biography

Stanley Speer was appointed Chief Financial Officer (CFO) on May 5, 2020. In addition to his role at the Company, Mr. Speer is the principal of Speer and Associates, LLC, a consulting firm he founded in 2012 to provide practical operational, financial and strategic financial solutions to public and private businesses. Mr. Speer is also a member of the Board of Directors of Sunworks (NASDAQ: SUNW) and the Chair of its Audit Committee. Previously, Mr. Speer was a Managing Director with Alvarez & Marsal (“A&M”), a global professional services firm specializing in advising and assisting boards of directors, investment groups, management groups and lenders in a wide range of turnaround, restructuring and reorganization situations. Prior to joining A&M, Mr. Speer served as Chief Financial Officer for Cadiz from 1997 to 2003 and its subsidiary Sun World International, a fully-integrated agriculture company. Earlier, Mr. Speer was a partner with Coopers & Lybrand (now PricewaterhouseCoopers), where he spent 14 years in the Los Angeles office specializing in business reorganizations. Mr. Speer earned his bachelor’s degree in business administration from the University of Southern California.

|

|||

As enshrined in the Company’s bylaws, all business and affairs of the Company shall be managed by or under the direction of the Board of Directors. The Board of Directors is responsible for the Company’s management and strategic direction and for establishing our broad corporate policies, including our leadership structure. The Board also oversees and reviews key aspects of the Company’s risk management efforts and annually reviews our strategic business plans, which includes evaluating the objectives of and risks associated with these plans.

Directors of the Company hold office until the next annual meeting of stockholders or until their successors are elected and qualified. There are no family relationships between any directors or current officers of the Company. Officers serve at the discretion of the Board of Directors.

Director Independence

Messrs. Courter, Grant, Hickox, and Lombard and Mses. Echaveste and Webb de Macías have all been affirmatively determined by the Board to be “independent” under all relevant securities and other laws and regulations, including those set forth in SEC and regulations and pertinent listing standards of the NASDAQ Global Market, as in effect from time to time. Immediately following the 2021 Annual Meeting, Mr. Hickox became the Company’s lead independent director, after four years of service in this role by Mr. Grant. The objective of the lead independent director is to further enhance independent board oversight of management and to provide a board liaison to stockholder interests independent of management.

The Company's independent directors meet routinely in executive session without the presence of management. Independent directors met in executive session at each regularly scheduled meeting of the Board, at least four (4) times annually, in each case outside the presence of any director who also serves as an executive officer. In addition to regularly scheduled board meetings, the Board of Directors and various committees of the Board regularly meet to receive and discuss operating and financial reports presented by the Chief Executive Officer and other members of management as well as reports by experts and other advisors.

Independence of Committee Members

All standing committees of the Board of Directors are comprised entirely of directors whom the Board has affirmatively determined to be independent, as they meet the objective requirements set forth by the NASDAQ Global Market and the SEC, and each of whom have no relationship, direct or indirect, to the Company other than as stockholders or through their service on the Board.

Each Board committee is chaired by an independent director and maintains a written charter detailing its authority and responsibilities. These charters are reviewed periodically as legislative and regulatory developments and business circumstances warrant and are available in their entirety on the Company’s website at https://www.cadizinc.com/corporate-governance/ and to any stockholder otherwise requesting a copy.

Communications with the Board of Directors

Stockholders wishing to communicate with the Board, or with a specific Board member, may do so by writing to the Board, or to the particular Board member, and delivering the communication in person or mailing it to: Board of Directors c/o Stanley Speer, Corporate Secretary, Cadiz Inc., 550 S. Hope Street, Suite 2850, Los Angeles, California 90071.

Attendance of Board of Directors at the Annual Meeting

A majority of the members of the Board shall attend each annual stockholder meeting. At the 2021 Annual Meeting of Stockholders, all 8 then members of the Board were present.

During annual stockholder meetings, stockholders shall have the right to ask questions, both orally and in writing, and, where appropriate, receive answers and discussion from the members of the Board and CEO with such discussion to take place regardless of whether those questions have been submitted in advance. Instructions regarding how to ask a question at the 2022 Annual Meeting will be provided in the virtual meeting room to those stockholders who register online to attend virtually.

Meetings of the Board of Directors

During the year ended December 31, 2021, the Board of Directors held four formal meetings, conferred on a number of occasions through telephone conferences, and took action, when appropriate, by unanimous written consent. All incumbent members of the Board of Directors were present at each meeting, with the exception of Ms. Webb de Macías, who was unable to attend one meeting. Ms. Kennedy was not named to the Board until March 2021 and therefore did not attend one meeting in 2021.

Committees of the Board of Directors

The Audit and Risk Committee

The Audit and Risk Committee reviews and discusses with management and advises and makes recommendations to the Board of Directors regarding the financial, investment and accounting procedures and practices followed by the Company. The Audit and Risk Committee also conducts regular assessment of enterprise risk related to the operation of the business, including litigation, regulatory and financial risks as well as information security and technology risks that are managed and addressed by the Company. In this capacity the Audit and Risk Committee also reviews the Company’s risk assessment and risk management policies.

In February 2017, the Board designated the Audit Committee to act concomitantly as the Company’s Risk Committee and assume risk management responsibilities. In March 2021, the Board renamed the Committee the “Audit and Risk Committee” and amended and restated its charter. The Audit and Risk Committee may also be referred to as the Audit Committee throughout this proxy statement.

The Audit and Risk Committee is responsible for the following duties: (i) considering the adequacy of the Company’s internal accounting control procedures, (ii) overseeing the Company’s compliance with and management of risks related to legal, regulatory, and reporting requirements, (iii) reviewing the independent auditor’s qualifications and independence, (iv) the appointment, compensation and oversight of all work performed by the independent registered public accounting firm, and (v) overseeing the accounting and financial reporting processes of the Company and the audits of the financial statements of the Company. The Audit and Risk Committee also identifies material risks relating to the Company’s compliance and prepares a written report to the Board whenever a material risk relating to the Company’s compliance is identified. Finally, the Audit and Rick Committee also monitors compliance with the Company’s Code of Business Conduct and Ethics and reports to the Compensation Committee on an annual basis regarding the CEO’s and Chief Financial Officer’s contributions to and their effectiveness and dedication to ensuring the Company’s compliance with the Company’s culture of ethics and all applicable laws, rules, and regulations. The charter is available on the Company’s website at https://www.cadizinc.com/governance/ and to any stockholder otherwise requesting a copy.

The Audit and Risk Committee is currently composed of Mr. Courter, Mr. Grant, Mr. Hickox and Mr. Lombard. Mr. Courter is currently the Audit and Risk Committee Chair. The Board has determined that all members of its Audit and Risk Committee are independent. The Board of Directors has determined that Mr. Courter is an “audit committee financial expert” as that term is defined in Item 407(d)(5) of Regulation S-K under the Securities Act.

The Audit and Risk Committee met four times during the year ended December 31, 2021. All then serving members of the Audit and Risk Committee were present at each meeting. Mr. Grant was not appointed to the Audit and Risk Committee until March 2021 and therefore did not attend one meeting held in 2021. Each member of the Audit and Risk Committee receives quarterly training from the Company’s independent auditors, with such training to include coverage of compliance with Generally Accepted Accounting Principles, the Sarbanes Oxley Act, corporate governance, assessment of risk, compliance auditing, and reporting requirements for publicly-traded corporations.

The Compensation Committee

The Compensation Committee oversees compensation structure and policy for the Company’s executives, including the Chief Executive Officer, key executives and senior management. The Compensation Committee also oversees the Company’s human capital management and regulatory compliance with compensation rules and regulations of the Securities and Exchange Commission (“SEC”) and other corporate law and regulatory policies applicable to the Company.

The duties and responsibilities of the Compensation Committee include: (i) establish the Company’s general compensation philosophy and oversee the development and implementation of compensation programs, (ii) advise and make recommendations to the Board of Directors regarding the compensation of directors and executive officers, (ii) produce an annual report on executive compensation for inclusion in the Company’s proxy statement, (iii) review and approve compensation programs for members of the Board, (iv) review the results of any advisory stockholder votes on executive compensation and consider adjustments as a result of such votes, and (v) oversee the Company’s workforce strategy and process for training, development, recruitment, organizational health and safety policies, and succession planning, among other duties.

The Committee operates in accordance with a written charter adopted by the Board of Directors, and amended in 2021. The charter is available on the Company’s website at https://www.cadizinc.com/governance/ and to any stockholder otherwise requesting a copy.

The Compensation Committee is currently composed of Mr. Hickox, Mr. Grant, and Ms. Webb de Macías. Mr. Hickox is the Compensation Committee Chair. The Board has determined that all members of its Compensation Committee are independent. In 2021, the Compensation Committee met two times, and took action, when appropriate, by unanimous written consent. All then serving members of the Compensation Committee were present at the meetings with the exception of Mr. Courter, who was unable to attend one in-person meeting.

The Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee is responsible for developing and recommending to the Board corporate governance policies and principles applicable to the Company to ensure oversight and evaluation of the Board and management. The Corporate Governance and Nominating Committee is also responsible for the identification and recommendation to the Board of qualified candidates for nomination to the Board and its committees.

In particular, the duties and responsibilities of the Corporate Governance and Nominating Committee include: (i) make recommendations to the Board from time to time as to changes that the Corporate Governance and Nominating Committee believes to be desirable to the size of the Board or any committee thereof; (ii) identify individuals believed to be qualified to become Board members, and to recommend to the Board the nominees to stand for election as directors at the annual meeting of stockholders or, if applicable, at a special meeting of stockholders, or in the case of a vacancy in the office of a director; (iii) develop and recommend to the Board standards to be applied in making determinations as to the absence of material relationships between the Company and a director; (iv) identify and recommend Board members qualified to fill vacancies on any committee of the Board; (v) establish procedures for the Corporate Governance and Nominating Committee to exercise oversight of the governance practices and policies of the Board and management; (vi) develop and recommend to the Board a set of corporate governance principles applicable to the Company, and review those principles at least once a year; and (vii) prepare and issue to the Board an annual evaluation performance evaluation of the Corporate Governance and Nominating Committee.

The Corporate Governance and Nominating Committee is currently composed of Ms. Echaveste, Mr. Courter, and Ms. Webb de Macías. Ms. Echaveste is the Corporate Governance and Nominating Committee Chair. The Board has determined that all members of its Corporate Governance and Nominating Committee are independent. In 2021, the Corporate Governance and Nominating Committee met one time, and took action, when appropriate, by unanimous written consent. All then serving members of the Corporate Governance and Nominating Committee were present at the meeting.

The Corporate Governance and Nominating Committee operates under a written charter adopted by the Board, which is available on the Company’s website at https://www.cadizinc.com/governance/ and to any stockholder otherwise requesting a copy.

Nomination Process

The Corporate Governance and Nominating Committee does not currently have a formal policy regarding the process for identifying and evaluating nominees for directors (including nominees recommended by stockholders). The Corporate Governance and Nominating Committee regularly considers director refreshment opportunities to ensure the Board has the skills necessary to guide the Company’s business plan over time and will consider new nominations from time-to-time throughout the year. When such need arises, they will be considered by the Corporate Governance and Nominating Committee, which will then make a recommendation to the Board.

The Corporate Governance and Nominating Committee will consider director candidates recommended by stockholders to be named in the Proxy Statement provided the nominations are received on a timely basis and contain all information relating to such nominee as is required to be disclosed in the Bylaws, including such person’s written consent to being named as a nominee and to serve as a director if elected, the name and address of such stockholder or beneficial owner on whose behalf the proposed nomination is being made, and the class and number of shares of the Company owned beneficially and of record by such stockholder or beneficial owner.

The Corporate Governance and Nominating Committee will consider nominees suggested by management, stockholders, or any stakeholders on the same terms as described in the charter of the Corporate Governance and Nominating Committee.

Nominee Qualifications

The Corporate Governance and Nominating Committee believes that nominees for election to the Board must possess certain minimum qualifications and be a well-rounded member able to contribute to the company’s overall success with an independent view of operations from management. The Corporate Governance and Nominating Committee will consider a candidate’s judgment, skill, ethics, expertise, experience with businesses and other organizations of comparable size, financial background, beneficial ownership of the Company and the interplay of the candidate’s experience with the experience of other Board members, among other factors, in assessing a candidate.

Furthermore, Board members should possess skills in relevant industries and subject matter areas, so that they are well suited to the task of overseeing both the risks and the strategy of the Company. The Corporate Governance and Nominating Committee also seeks Board members able to contribute the time and energy required to attend to decision-making and who are willing to both challenge and support the management team.

The Equity, Sustainability and Environmental Justice Committee

The Equity, Sustainability and Environmental Justice Committee was created by the Board in March 2022 to ensure the Company’s projects, programs, and policies are sustainable and continue to be supportive of communities that lack equitable access to water and the many quality-of-life benefits reliable water provides. The Equity, Sustainability and Environmental Justice Committee is specifically responsible for overseeing the Company’s development, implementation, and maintenance of policies, programs, and practices with respect to sustainability, environmental protection, environmental justice, equity, diversity, inclusion, and community engagement.

Previously, the monitoring, review and guidance of these policies, programs and practices were addressed in part by the Corporate Governance and Nominating Committee, but were elevated by the Board to a separate committee given their integral role to the fulfillment of the Company’s mission.

The duties and responsibilities of the Equity, Sustainability and Environmental Justice Committee include: (i) Provide review of and guidance for the Company’s policies, programs, and practices with respect to sustainability, particularly corporate environmental, social, and governance (“ESG”) commitments and metrics, environmental compliance and management; (ii) Provide review and monitoring of regulatory and public affairs policies and practices of interest to the Company, including matters before environmental, regulatory or other government agencies that may affect business operations or material financial performance of the Company; (iii) Review the Company’s policies and practices related to environmental justice, and engagement with underserved and disadvantaged communities; (iv) Advise on the Company’s policies related to diversity, equity, inclusion, and human capital management practices; and (v) Review and make recommendations to the Company regarding community relations, public relations and outreach programs, including community engagement, corporate social responsibility and philanthropy practices.

The Equity, Sustainability and Environmental Justice Committee is currently composed of Ms. Echaveste, Mr. Hickox, and Ms. Webb de Macías. Ms. Webb de Macías is the Equity, Sustainability and Environmental Justice Committee Chair. The Board has determined that all members of its Equity, Sustainability and Environmental Justice Committee are independent. The Committee began meeting in April 2022.

The Equity, Sustainability and Environmental Justice Committee operates under a written charter adopted by the Board, which is available on the Company’s website at https://www.cadizinc.com/governance/ and to any stockholder otherwise requesting a copy.

|

Our Directors have extensive and diverse experience in a variety of fields relevant to the Company’s natural resources development and environmental sustainability focused goals and initiatives, including:

|

|||||||||

|

|

Kennedy |

Brackpool |

Courter |

Echaveste |

Grant |

Hickox |

Lombard |

Slater |

Webb de Macías |

|

Executive Experience |

X |

X |

X |

X |

X |

X |

X |

X |

X |

|

Water Policy |

X |

X |

X |

X |

|||||

|

Agricultural Development |

X |

X |

X |

||||||

|

Real Estate Development |

X |

X |

X |

||||||

|

Environmental Stewardship |

X |

X |

X |

||||||

|

Finance and Capital Markets |

X |

X |

X |

X |

X |

X |

|||

|

Risk Management |

X |

X |

X |

X |

|||||

|

Accounting |

X |

||||||||

|

Public Policy |

X |

X |

X |

X |

X |

X |

X |

||

|

Community Engagement |

X |

X |

X |

X |

|||||

|

Corporate Governance & Sustainability |

X |

X |

X |

X |

|||||

|

Academia |

X |

X |

X |

X |

|||||

|

Legal & Regulatory |

X |

X |

X |

X |

|||||

The Directors also have demonstrated significant leadership experience in the following roles at Cadiz or other companies or organizations:

|

● |

Chief executive officer: (Mr. Brackpool, Mr. Courter, Ms. Echaveste, Mr. Grant, Mr. Hickox, , Ms. Kennedy, Mr. Lombard and Mr. Slater), |

|

● |

Government Leaders, including high-ranking appointments in state and federal government administrations: (Mr. Brackpool, Ms. Echaveste, Mr. Hickox, Ms. Kennedy, and Ms. Webb de Macías), |

|

● |

Chairs of community and academic foundation boards: (Ms. Echaveste, Mr. Lombard and Ms. Webb de Macías). |

The Board believes that these combined skills and experiences are important for the success of the current Board of Directors.

The diversity of our Board members, including gender, ethnic, cultural and racial diversity as well as diversity of thought and perspectives, is also an important factor in determining board composition to ensure that our Board can offer management the benefit of different experiences and viewpoints to best inform Company practices and strategic goals, and to ensure Board members reflect the diversity of the areas in which we operate. Beginning in 2019, the Board has been undergoing a progressive refreshment primarily due to retirements and has augmented the gender, racial, ethnic, skill and background diversity of our Board. Four of the nine director nominees for the 2022 Annual Meeting are either women and/or racially and ethnically diverse.

|

Board Diversity Matrix (as of May 23, 2022) |

||||

|

Board Size: |

||||

|

Total number of Directors |

9 |

|||

|

Female |

Male |

Non-Binary |

Did not Disclose Gender |

|

|

Gender: |

||||

|

Directors |

3 |

6 |

- |

- |

|

Number of Directors who identify in Any of the Categories Below: |

||||

|

African American or Black |

1 |

1 |

- |

- |

|

Alaskan Native or Native American |

- |

- |

- |

- |

|

Asian (other than South Asian) |

- |

- |

- |

- |

|

South Asian |

- |

- |

- |

- |

|

Hispanic or Latinx |

1 |

- |

- |

- |

|

Native Hawaiian or Pacific Islander |

- |

- |

- |

- |

|

White |

1 |

5 |

- | - |

|

Two or More Races or Ethnicities |

- |

- |

- |

- |

|

LGBTQ+ |

1 |

|||

|

Persons with Disabilities |

- |

|||

The Company has adopted a code of conduct and ethics that applies to all of our employees, including the CEO and CFO. A copy of the code of conduct and ethics may be found on the Company’s website at http://www.cadizinc.com.

The code of conduct and ethics defines and prohibits conflicts of interest and provides for means for communicating potential conflicts. It also prohibits using corporate opportunities, property, information, or position for personal gain. The code of conduct and ethics also includes confidentiality restrictions, rules for protection and proper use of Company assets, fair dealing requirements for interactions with customers, suppliers, and competitors and requirements for compliance with applicable law, including insider trading laws.

Any employee who becomes aware of any existing or potential violation of the code of conduct and ethics is required to report it. Any waivers from and amendments to the code of ethics granted to directors or executive officers will be promptly disclosed on the Company’s website at http://www.cadizinc.com. There are no waivers from the code of conduct and ethics applicable to any employee at this time.

ANTI-BRIBERY AND ANTI-CORRUPTION POLICY

Pursuant to our Anti-Bribery and Anti-Corruption Policy Statement, we prohibit all of our directors, officers, employees, and consultants from acts of bribery or corruption as defined by the policy statement. The Anti-Bribery and Anti-Corruption policy also defines conflicts of interest and requirements to minimize such conflicts. In addition, the policy defines and prohibits facilitation payments and outlines guidelines for acceptable behavior.

Pursuant to our Whistleblower Policy Statement, we encourage and enable employees and others to raise serious concerns internally so that any inappropriate conduct and actions can be addressed and corrected. It is the responsibility of all board members, officers, employees, contractors and volunteers to report concerns about violations of the Company’s code of conduct and ethics or suspected violations of law or regulations that govern the Company’s operations. The Whistleblower policy statement includes a non-retaliation policy and reporting procedures which provides information on how to contact the Chairman of the Audit and Risk Committee directly. The Audit and Risk Committee oversees treatment of all complaints.

ANTI-HEDGING AND PLEDGING POLICY

Pursuant to our Policy Statement Regarding Insider Trading and Confidentiality, we prohibit all of our directors, officers, employees, and consultants from hedging their ownership of our stock, including trading in options, puts, calls, or other derivative instruments related to our stock or debt which are designed to hedge or offset any potential decrease in market value. Such persons are prohibited from purchasing our stock on margin, borrowing against our stock held in a margin account, or pledging our stock as collateral for a loan, unless approved by a designated official following consultation with our General Counsel.

COMPENSATION DISCUSSION AND ANALYSIS

Overview

The Company’s compensation policies and practices are developed and implemented through the Compensation Committee of the Board of Directors. It is the Committee’s responsibility to review and consider annually the performance of the Company’s named executive officers in achieving both corporate and individual goals and objectives, and to assure that the Company’s compensation policies and practices are competitive and effective in incentivizing management.

The Compensation Discussion and Analysis section provides a description of the primary elements of the Company’s fiscal year 2021 compensation program and policies for the following individuals, who are referred to throughout this proxy statement as our current and former 2021 named executive officers:

|

● |

Susan Kennedy, Chair of the Board (effective February 2022) |

|

● |

Scott Slater, President and Chief Executive Officer |

|

● |

Stanley Speer, Chief Financial Officer |

|

● |

Keith Brackpool, Former Chair of the Board (non-executive director effective February 2022) |

It is an important recommendation of the Board that the roles of Chief Executive Officer (“CEO”) and Chair of the Board be held by two different individuals. As CEO, Mr. Slater manages the day-to-day operation of the Company and the development of its projects and Ms. Kennedy holds the essential role of advising management regarding its project development strategy as Chair of the Board.