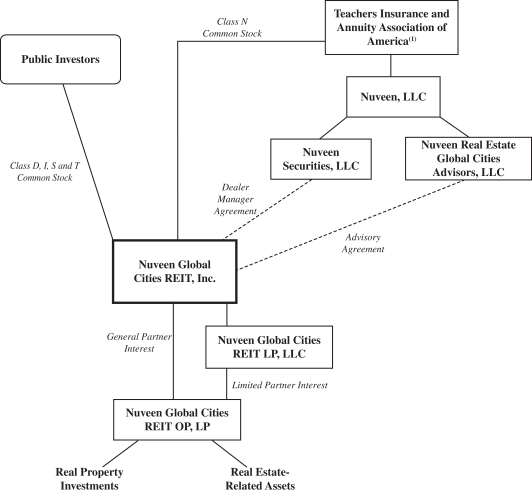

| (1) | Certain intermediate wholly owned subsidiaries of TIAA have been excluded for convenience of presentation. |

| Q: | What is the role of your board of directors? |

| A: | We operate under the direction of our board of directors, the members of which are accountable to us and our stockholders as fiduciaries. We have seven directors, four of whom have been determined to be independent. Our independent directors are responsible for reviewing the performance of the Advisor and approving the compensation paid to the Advisor and its affiliates. |

Our board of directors has approved investment guidelines that delegate to the Advisor authority to execute acquisitions and dispositions of investments in real properties and real estate-related assets, in each case so long as such acquisitions and dispositions are consistent with the investment guidelines adopted by our board of directors. In addition, under our investment guidelines, our board of directors is required to approve any acquisition of a single property or group of related properties requiring a net equity investment that exceeds the greater of (i) $250 million or (ii) if our NAV exceeds $1 billion, 25% of our total NAV at the time of acquisition. Our board of directors will at all times have ultimate oversight over the Advisor and our investments, and may change from time to time the scope of authority delegated to the Advisor with respect to acquisition and disposition transactions.

10