UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number : 811-08549

Oak Associates Funds

(Exact name of registrant as specified in charter)

3875 Embassy Parkway, Suite 250

Akron, Ohio 44333

(Address of principal executive offices) (Zip code)

Charles A. Kiraly

3875 Embassy Parkway, Suite 250

Akron, Ohio 44333

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-888-462-5386

Date of fiscal year end: October 31

Date of reporting period: April 30, 2022

Item 1. Reports to Stockholders.

|

| TABLE of CONTENTS |

|

| Performance Update | 1 |

| White Oak Select Growth Fund | 1 |

| Pin Oak Equity Fund | 2 |

| Rock Oak Core Growth Fund | 3 |

| River Oak Discovery Fund | 4 |

| Red Oak Technology Select Fund | 5 |

| Black Oak Emerging Technology Fund | 6 |

| Live Oak Health Sciences Fund | 7 |

| Important Disclosures | 8 |

| Disclosure of Fund Expenses | 11 |

| Financial Statements | |

| Schedules of Investments | 13 |

| Statements of Assets & Liabilities | 34 |

| Statements of Operations | 36 |

| Statements of Changes in Net Assets | 38 |

| Financial Highlights | 44 |

| Notes to Financial Statements | 48 |

| Board Considerations in Approving the Renewal of the Advisory Agreement | 60 |

| White Oak Select Growth Fund | Performance Update |

| All data below as of April 30, 2022 (Unaudited) |

| Fund Data | Top 10 Holdings^ | ||||

| Ticker | WOGSX | 1 | Alphabet, Inc. | 13.1% | |

| Share Price | $115.39 | 2 | Amazon.com, Inc. | 10.4% | |

| Total Net Assets | $373.6M | 3 | Charles Schwab Corp. (The) | 7.2% | |

| Portfolio Turnover | 2% | 4 | Cisco Systems, Inc. | 6.4% | |

| 5 | Lowe’s Cos., Inc. | 5.7% | |||

| Sector Allocation^ | 6 | Amgen, Inc. | 5.1% | ||

| Technology | 25.6% | 7 | Chubb Ltd. | 5.1% | |

| Health Care | 20.2% | 8 | KLA Corp. | 5.0% | |

| Financials | 18.0% | 9 | JPMorgan Chase & Co. | 5.0% | |

| Communications | 16.7% | 10 | QUALCOMM, Inc. | 4.6% | |

| Consumer Discretionary | 16.3% | ||||

| Real Estate | 2.8% | ||||

| Cash & Other Assets | 0.4% | ||||

| ^ | Percentages are based on net assets. Holdings are subject to change. |

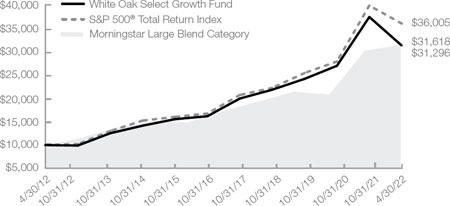

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Average Annual Total Return | ||||

| 1 Year | 3 Year | 5 Year | 10 Year | |

| Return | Return | Return | Return | |

| White Oak Select Growth Fund | (9.92)% | 8.54% | 11.11% | 12.09% |

| S&P 500® Total Return Index1 | 0.21% | 13.85% | 13.66% | 13.67% |

| Morningstar Large Blend Category2 | (1.68)% | 12.17% | 11.99% | 12.20% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 0.89%

Gross/Net Expense Ratio (as of the six months ended April 30, 2022): 0.90%

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Standard & Poor’s is the source and owner of the S&P Index data. |

| 2 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 8 and 9 for additional disclosure. |

| 1-888-462-5386 | www.oakfunds.com | 1 |

| Pin Oak Equity Fund | Performance Update |

| All data below as of April 30, 2022 (Unaudited) |

| Fund Data | Top 10 Holdings^ | ||||

| Ticker | POGSX | 1 | Alphabet, Inc. | 12.8% | |

| Share Price | $71.28 | 2 | Amazon.com, Inc. | 8.6% | |

| Total Net Assets | $147.4M | 3 | McKesson Corp. | 7.2% | |

| Portfolio Turnover | —% | 4 | Charles Schwab Corp. (The) | 6.3% | |

| 5 | Gentex Corp. | 5.0% | |||

| Sector Allocation^ | 6 | Assurant, Inc. | 4.8% | ||

| Health Care | 26.9% | 7 | Visa, Inc. - Class A | 4.5% | |

| Consumer Discretionary | 24.0% | 8 | Amdocs Ltd. | 4.4% | |

| Technology | 18.2% | 9 | eBay, Inc. | 4.2% | |

| Communications | 16.1% | 10 | KLA Corp. | 4.0% | |

| Financials | 13.9% | ||||

| Cash & Other Assets | 0.9% | ||||

| ^ | Percentages are based on net assets. Holdings are subject to change. |

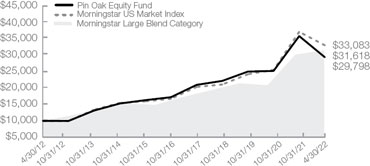

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Average Annual Total Return | ||||

| 1 Year | 3 Year | 5 Year | 10 Year | |

| Return | Return | Return | Return | |

| Pin Oak Equity Fund | (12.25)% | 6.46% | 8.09% | 11.40% |

| Morningstar US Market Index1 | (2.93)% | 13.14% | 13.12% | 13.33% |

| Morningstar Large Blend Category1 | (1.68)% | 12.17% | 11.99% | 12.20% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 0.91%

Gross/Net Expense Ratio (as of the six months ended April 30, 2022): 0.93%

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 8 and 9 for additional disclosure. |

| 2 | Semi-Annual Report | April 30, 2022 |

| Rock Oak Core Growth Fund | Performance Update |

| All data below as of April 30, 2022 (Unaudited) |

| Fund Data | Top 10 Holdings^ | ||||

| Ticker | RCKSX | 1 | Carlisle Cos., Inc. | 5.9% | |

| Share Price | $15.96 | 2 | Hartford Financial Services Group, Inc. (The) | 5.8% | |

| Total Net Assets | $10.9M | 3 | Ubiquiti Networks, Inc. | 5.5% | |

| Portfolio Turnover | —% | 4 | Jazz Pharmaceuticals PLC | 5.4% | |

| 5 | Seagate Technology PLC | 4.3% | |||

| Sector Allocation^ | 6 | F5 Networks, Inc. | 4.3% | ||

| Technology | 25.8% | 7 | Gentex Corp. | 4.2% | |

| Health Care | 23.5% | 8 | Cognizant Technology Solutions Corp. - Class A | 4.1% | |

| Consumer Discretionary | 15.1% | 9 | NetApp, Inc. | 3.9% | |

| Industrials | 14.1% | 10 | Republic Services, Inc. | 3.8% | |

| Financials | 8.8% | ||||

| Materials | 5.9% | ||||

| Energy | 2.6% | ||||

| Cash & Other Assets | 4.2% | ||||

| ^ | Percentages are based on net assets. Holdings are subject to change. |

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Fee waivers are in effect; if they had not been in effect, performance would have been lower.

| Average Annual Total Return | ||||

| 1 Year | 3 Year | 5 Year | 10 Year | |

| Return | Return | Return | Return | |

| Rock Oak Core Growth Fund | (11.82)% | 4.62% | 7.76% | 8.91% |

| Morningstar US Mid Cap Index1 | (3.97)% | 11.72% | 11.67% | 12.71% |

| Morningstar Mid Blend Category1 | (5.53)% | 9.55% | 9.09% | 10.53% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 1.40%/1.25%

Gross/Net Expense Ratio (as of the six months ended April 30, 2022): 1.44%/1.25%

The Adviser has contractually agreed for a period of one year from February 28, 2022, the date of the Fund’s Prospectus, to waive all or a portion of its fee for the Fund (and to reimburse expenses to the extent necessary) in order to limit total annual Fund operating expenses after fee waivers and/or expense reimbursements, if any, to an annual rate of not more than 1.25% of average daily net assets. This contractual fee waiver may only be terminated subject to approval by the Board of Trustees of the Trust.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 8 and 9 for additional disclosure. |

| 1-888-462-5386 | www.oakfunds.com | 3 |

| River Oak Discovery Fund | Performance Update |

| All data below as of April 30, 2022 (Unaudited) |

| Fund Data | Top 10 Holdings^ | ||||

| Ticker | RIVSX | 1 | Silicon Motion Technology Corp. - ADR | 4.6% | |

| Share Price | $15.24 | 2 | Kulicke & Soffa Industries, Inc. | 4.1% | |

| Total Net Assets | $22.4M | 3 | Cirrus Logic, Inc. | 3.9% | |

| Portfolio Turnover | 9% | 4 | AllianceBernstein Holding LP | 3.8% | |

| 5 | Asbury Automotive Group, Inc. | 3.5% | |||

| Sector Allocation^ | 6 | Verint Systems, Inc. | 3.4% | ||

| Technology | 36.3% | 7 | Mandiant, Inc. | 3.4% | |

| Industrials | 17.7% | 8 | Korn Ferry | 3.2% | |

| Consumer Discretionary | 14.3% | 9 | Taylor Morrison Home Corp. | 3.2% | |

| Financials | 14.1% | 10 | Advanced Energy Industries, Inc. | 3.2% | |

| Consumer Staples | 2.9% | ||||

| Communications | 2.1% | ||||

| Cash & Other Assets | 12.6% | ||||

| ^ | Percentages are based on net assets. Holdings are subject to change. |

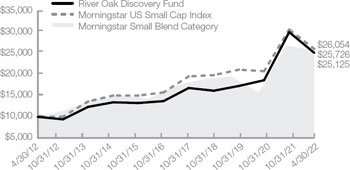

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Fee waivers are in effect; if they had not been in effect, performance would have been lower.

| Average Annual Total Return | ||||

| 1 Year | 3 Year | 5 Year | 10 Year | |

| Return | Return | Return | Return | |

| River Oak Discovery Fund | (11.08)% | 14.55% | 9.94% | 9.65% |

| Morningstar US Small Cap Index1 | (14.22)% | 6.89% | 7.29% | 10.05% |

| Morningstar Small Blend Category1 | (9.66)% | 7.99% | 7.41% | 9.91% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 1.18%

Gross/Net Expense Ratio (as of the six months ended April 30, 2022): 1.18%

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 8 and 9 for additional disclosure. |

| 4 | Semi-Annual Report | April 30, 2022 |

| Red Oak Technology Select Fund | Performance Update |

| All data below as of April 30, 2022 (Unaudited) |

| Fund Data | Top 10 Holdings^ | ||||

| Ticker | ROGSX | 1 | Alphabet, Inc. | 9.6% | |

| Share Price | $34.11 | 2 | Apple, Inc. | 8.6% | |

| Total Net Assets | $543.6M | 3 | Amazon.com, Inc. | 7.0% | |

| Portfolio Turnover | —% | 4 | Microsoft Corp. | 5.7% | |

| 5 | Cisco Systems, Inc. | 5.5% | |||

| Sector Allocation^ | 6 | Meta Platforms, Inc. - Class A | 5.3% | ||

| Technology | 70.3% | 7 | Intel Corp. | 4.5% | |

| Communications | 15.0% | 8 | Broadcom, Inc. | 4.3% | |

| Consumer Discretionary | 10.1% | 9 | Oracle Corp. | 4.3% | |

| Real Estate | 2.7% | 10 | KLA Corp. | 4.1% | |

| Cash & Other Assets | 1.9% | ||||

| ^ | Percentages are based on net assets. Holdings are subject to change. |

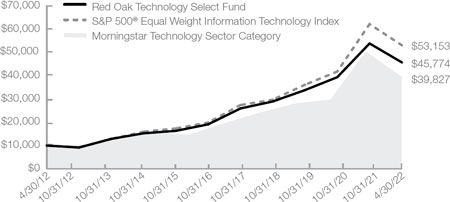

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Average Annual Total Return | ||||

| 1 Year | 3 Year | 5 Year | 10 Year | |

| Return | Return | Return | Return | |

| Red Oak Technology Select Fund | (8.76)% | 11.06% | 15.18% | 16.43% |

| S&P 500® Equal Weight Information Technology Index1 | (5.73)% | 14.40% | 17.73% | 18.18% |

| Morningstar Technology Sector Category2 | (19.61)% | 12.85% | 16.14% | 15.80% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 0.90%

Gross/Net Expense Ratio (as of the six months ended April 30, 2022): 0.91%

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Standard & Poor’s is the source and owner of the S&P Index data. |

| 2 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 8 and 9 for additional disclosure. |

| 1-888-462-5386 | www.oakfunds.com | 5 |

| Black Oak Emerging Technology Fund | Performance Update |

| All data below as of April 30, 2022 (Unaudited) |

| Fund Data | Top 10 Holdings^ | ||||

| Ticker | BOGSX | 1 | Apple, Inc. | 5.7% | |

| Share Price | $6.89 | 2 | Cirrus Logic, Inc. | 4.6% | |

| Total Net Assets | $55.6M | 3 | SolarEdge Technologies, Inc. | 4.5% | |

| Portfolio Turnover | 8% | 4 | Palo Alto Networks, Inc. | 4.2% | |

| 5 | Kulicke & Soffa Industries, Inc. | 4.1% | |||

| Sector Allocation^ | 6 | QUALCOMM, Inc. | 3.9% | ||

| Technology | 76.3% | 7 | KLA Corp. | 3.9% | |

| Industrials | 10.0% | 8 | Advanced Energy Industries, Inc. | 3.7% | |

| Energy | 4.5% | 9 | Nordson Corp. | 3.7% | |

| Consumer Discretionary | 3.8% | 10 | Illumina, Inc. | 3.4% | |

| Health Care | 3.5% | ||||

| Communications | 0.9% | ||||

| Cash & Other Assets | 1.0% | ||||

| ^ | Percentages are based on net assets. Holdings are subject to change. |

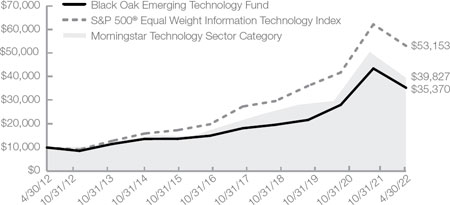

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Average Annual Total Return | ||||

| 1 Year | 3 Year | 5 Year | 10 Year | |

| Return | Return | Return | Return | |

| Black Oak Emerging Technology Fund | (9.11)% | 17.46% | 15.85% | 13.47% |

| S&P 500® Equal Weight Information Technology Index1 | (5.73)% | 14.40% | 17.73% | 18.18% |

| Morningstar Technology Sector Category2 | (19.61)% | 12.85% | 16.14% | 15.80% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 1.01%

Gross/Net Expense Ratio (as of the six months ended April 30, 2022): 1.00%

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Standard & Poor’s is the source and owner of the S&P Index data. |

| 2 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 8 and 9 for additional disclosure. |

| 6 | Semi-Annual Report | April 30, 2022 |

| Live Oak Health Sciences Fund | Performance Update |

| All data below as of April 30, 2022 (Unaudited) |

| Fund Data | Top 10 Holdings^ | ||||

| Ticker | LOGSX | 1 | UnitedHealth Group, Inc. | 7.3% | |

| Share Price | $20.31 | 2 | Cigna Corp. | 5.7% | |

| Total Net Assets | $54.5M | 3 | McKesson Corp. | 5.1% | |

| Portfolio Turnover | 16% | 4 | Anthem, Inc. | 5.0% | |

| 5 | United Therapeutics Corp. | 4.4% | |||

| Sector Allocation^ | 6 | Amgen, Inc. | 4.4% | ||

| Health Care | 99.1% | 7 | Jazz Pharmaceuticals PLC | 4.2% | |

| Cash & Other Assets | 0.9% | 8 | Regeneron Pharmaceuticals, Inc. | 3.9% | |

| 9 | Medtronic PLC | 3.6% | |||

| 10 | Illumina, Inc. | 3.4% | |||

| ^ | Percentages are based on net assets. Holdings are subject to change. |

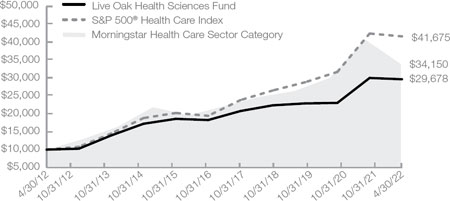

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Average Annual Total Return | ||||

| 1 Year | 3 Year | 5 Year | 10 Year | |

| Return | Return | Return | Return | |

| Live Oak Health Sciences Fund | 3.50% | 12.08% | 7.55% | 11.49% |

| S&P 500® Health Care Index1 | 9.16% | 15.64% | 13.65% | 15.34% |

| Morningstar Health Care Sector Category2 | (13.95)% | 8.83% | 8.85% | 13.01% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 1.00%

Gross/Net Expense Ratio (as of the six months ended April 30, 2022): 1.00%

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Standard & Poor’s is the source and owner of the S&P Index data. |

| 2 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 8 and 9 for additional disclosure. |

| 1-888-462-5386 | www.oakfunds.com | 7 |

| Important Disclosures |

| All data below As of April 30, 2022 (Unaudited) |

Index Definitions and Disclosures

All indices are unmanaged and index performance figures include reinvestment of dividends but do not reflect any fees, expenses or taxes. Investors cannot invest directly in an index.

Oak Associates Funds (the “Funds) are not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation or warranty, express or implied, to individuals who invest in the Funds or any member of the public regarding the advisability of investing in equity securities generally or in the Funds in particular or the ability of the Funds to track the Morningstar Indices or general equity market performance. THE MORNINGSTAR ENTITIES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE FUNDS OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. One cannot invest directly in an index

Morningstar Health Care Category - Health portfolios focus on the medical and health-care industries. Most invest in a range of companies, buying everything from pharmaceutical and medical-device makers to HMOs, hospitals, and nursing homes. A few portfolios concentrate on just one industry segment, such as service providers or biotechnology firms.

Morningstar Large Blend Category - Large-blend portfolios are fairly representative of the overall U.S. stock market in size, growth rates, and price. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large-cap. The blend style is assigned to portfolios where neither growth nor value characteristics predominate. These portfolios tend to invest across the spectrum of U.S. industries, and owing to their broad exposure, the portfolios’ returns are often similar to those of the S&P 500 Index.

Morningstar Mid Blend Category - The typical mid-cap blend portfolio invests in U.S. stocks of various sizes and styles, giving it a middle-of-the-road profile. Most shy away from high-priced growth stocks, but aren’t so price-conscious that they land in value territory. The U.S. mid-cap range for market capitalization typically falls between $1 billion-$8 billion and represents 20% of the total capitalization of the U.S. equity market. The blend style is assigned to portfolios where neither growth nor value characteristics predominate.

Morningstar Small Blend Category - Small-blend portfolios favor U.S. firms at the smaller end of the market-capitalization range. Some aim to own an array of value and growth stocks while others employ a discipline that leads to holdings with valuations and growth rates close to the small-cap averages. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small-cap. The blend style is assigned to portfolios where neither growth nor value characteristics predominate.

Morningstar Technology Category - Technology portfolios buy high-tech businesses in the U.S. or outside of the U.S. Most concentrate on computer, semiconductor, software, networking, and Internet stocks. A few also buy medical-device and biotechnology stocks and some concentrate on a single technology industry.

Morningstar U.S. Market Index – Measures the performance of US securities and targets 97% market capitalization coverage of the investable universe. It is a diversified broad market index. This Index does not incorporate Environmental, Social, or Governance (ESG) criteria.

| 8 | Semi-Annual Report | April 30, 2022 |

| Important Disclosures |

| All data below As of April 30, 2022 (Unaudited) |

Morningstar U.S. Mid Cap Index – Tracks the performance of U.S. mid-cap stocks that fall between 70th and 90th percentile in market capitalization of the investable universe. In aggregate the Mid-Cap Index represents 20 percent of the investable universe.

Morningstar U.S. Small Cap Index – Measures the performance of U.S. small-cap stocks. These stocks fall between the 90th and 97th percentile in market capitalization of the investable universe. In aggregate, the Small-Cap Index represents 7 percent of the investable universe. This Index does not incorporate Environmental, Social, or Governance (ESG) criteria.

Standard & Poor’s is the source and owner of the S&P Index data contained in this material and all trademarks and copyrights related thereto. Any further dissemination or redistribution is strictly prohibited. Standard & Poor’s is not responsible for the formatting or configuration of this material or for any inaccuracy in Oak Associates Funds’ presentation thereof.

S&P 500® Index – is a commonly-recognized, market capitalization weighted index of 500 widely held equity securities, designed to measure broad U.S. equity performance.

S&P 500® Equal Weight Information Technology Index – The S&P 500® Equal Weight Information Technology Index is an unmanaged equal weighted version of the S&P 500® Information Technology Index that consists of the common stocks of the following industries: internet equipment, computers and peripherals, electronic equipment, office electronics and instruments, semiconductor equipment and products, diversified telecommunication services, and wireless telecommunication services that comprise the Information Technology sector of the S&P 500® Index.

S&P 500® Health Care Index – The S&P 500® Health Care Index is a capitalization-weighted index that encompasses two main industry groups. The first includes companies who manufacture health care equipment and supplies or provide health care related services, including distributors of health care products, providers of basic health care services, and owners and operators of health care facilities and organizations. The second group consists of companies primarily involved in the research, development, production and marketing of pharmaceuticals and biotechnology products.

S&P 500® Total Return Index – The S&P 500® Total Return Index is a commonly recognized, market capitalization weighted index of 500 widely held equity securities, designed to measure broad U.S. equity performance.

Investment Definitions

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization based indices. Smart beta emphasizes capturing investment factors of market inefficiencies in a rules-based and transparent way.

Correlation is a statistic that measures the degree to which two securities move in relation to each other.

The P/E is the ratio for valuing a company that measures its current share price relative to its per share earnings. The price-earnings ratio can be calculated as market value per share divided by earnings per share.

| 1-888-462-5386 | www.oakfunds.com | 9 |

| Important Disclosures |

| All data below is as of April 30, 2022 (Unaudited) |

Book value of an asset is the value at which the asset is carried on a balance sheet and calculated by taking the cost of an asset minus the accumulated depreciation. Book value is also the net asset value of a company, calculated as total assets minus intangible assets and liabilities.

Free cash flow yield is an overall return evaluation ratio of a stock, which standardizes the free cash flow per share a company is expected to earn against its market price per share. The ratio is calculated by taking the free cash flow per share divided by the share price.

| 10 | Semi-Annual Report | April 30, 2022 |

| Disclosure of Fund Expenses |

| As of April 30, 2022 (Unaudited) |

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from November 1, 2021 through April 30, 2022.

Actual Expenses

The first line of the table for each Fund provides information about actual account values and actual expenses. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table for each Fund provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table for each class is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| 1-888-462-5386 | www.oakfunds.com | 11 |

| Disclosure of Fund Expenses |

| As of April 30, 2022 (Unaudited) |

| Beginning | Ending | |||

| Account Value | Account Value | Annualized | Expenses | |

| November 1, | April 30, | Expense | Paid During | |

| 2021 | 2022 | Ratio | Period(a) | |

| White Oak Select Growth Fund | ||||

| Actual Return | $1,000.00 | $ 836.60 | 0.90% | $4.08 |

| Hypothetical 5% Return | $1,000.00 | $1,020.35 | 0.90% | $4.49 |

| Pin Oak Equity Fund | ||||

| Actual Return | $1,000.00 | $ 820.00 | 0.93% | $4.20 |

| Hypothetical 5% Return | $1,000.00 | $1,020.18 | 0.93% | $4.66 |

| Rock Oak Core Growth Fund | ||||

| Actual Return | $1,000.00 | $ 891.20 | 1.25% | $5.86 |

| Hypothetical 5% Return | $1,000.00 | $1,018.60 | 1.25% | $6.26 |

| River Oak Discovery Fund | ||||

| Actual Return | $1,000.00 | $ 836.50 | 1.18% | $5.37 |

| Hypothetical 5% Return | $1,000.00 | $1,018.95 | 1.18% | $5.90 |

| Red Oak Technology Select Fund | ||||

| Actual Return | $1,000.00 | $ 849.00 | 0.91% | $4.15 |

| Hypothetical 5% Return | $1,000.00 | $1,020.30 | 0.91% | $4.54 |

| Black Oak Emerging Technology Fund | ||||

| Actual Return | $1,000.00 | $ 812.50 | 1.00% | $4.51 |

| Hypothetical 5% Return | $1,000.00 | $1,019.81 | 1.00% | $5.03 |

| Live Oak Health Sciences Fund | ||||

| Actual Return | $1,000.00 | $ 988.00 | 1.00% | $4.94 |

| Hypothetical 5% Return | $1,000.00 | $1,019.82 | 1.00% | $5.02 |

| (a) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period) |

| 12 | Semi-Annual Report | April 30, 2022 |

| Schedule of Investments | White Oak Select Growth Fund |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS — 99.62% | ||||||||

| COMMUNICATIONS — 16.75% | ||||||||

| Internet Media & Services — 16.75% | ||||||||

| Alphabet, Inc. - Class A(a) | 8,337 | $ | 19,026,618 | |||||

| Alphabet, Inc. - Class C(a)(b) | 13,000 | 29,891,290 | ||||||

| Meta Platforms, Inc. - Class A(a) | 68,150 | 13,662,030 | ||||||

| 62,579,938 | ||||||||

| CONSUMER DISCRETIONARY — 16.19% | ||||||||

| E-Commerce Discretionary — 10.45% | ||||||||

| Amazon.com, Inc.(a) | 15,705 | 39,036,819 | ||||||

| Retail - Discretionary — 5.74% | ||||||||

| Lowe’s Cos., Inc. | 108,390 | 21,431,955 | ||||||

| FINANCIALS — 17.98% | ||||||||

| Asset Management — 7.17% | ||||||||

| Charles Schwab Corp. (The) | 404,100 | 26,803,953 | ||||||

| Banking — 4.97% | ||||||||

| JPMorgan Chase & Co. | 155,565 | 18,568,238 | ||||||

| Institutional Financial Services — 0.76% | ||||||||

| State Street Corp. | 42,200 | 2,826,134 | ||||||

| Insurance — 5.08% | ||||||||

| Chubb Ltd. | 91,890 | 18,970,691 | ||||||

| HEALTH CARE — 20.18% | ||||||||

| Biotech & Pharma — 11.93% | ||||||||

| Amgen, Inc. | 82,460 | 19,228,847 | ||||||

| Novartis AG - ADR | 134,060 | 11,801,302 | ||||||

| Pfizer, Inc. | 275,700 | 13,528,599 | ||||||

| 44,558,748 | ||||||||

| Health Care Facilities & Services — 3.07% | ||||||||

| Laboratory Corp. of America Holdings(a) | 47,770 | 11,478,176 | ||||||

| 1-888-462-5386 | www.oakfunds.com | 13 |

| White Oak Select Growth Fund | Schedule of Investments |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| Medical Equipment & Devices — 5.18% | ||||||||

| Alcon, Inc.(b) | 138,000 | $ | 9,826,980 | |||||

| Zimmer Biomet Holdings, Inc. | 77,390 | 9,344,842 | ||||||

| Zimvie, Inc.(a) | 7,739 | 174,128 | ||||||

| 19,345,950 | ||||||||

| REAL ESTATE — 2.87% | ||||||||

| REIT — 2.87% | ||||||||

| Digital Realty Trust, Inc. | 73,490 | 10,738,359 | ||||||

| TECHNOLOGY — 25.65% | ||||||||

| Semiconductors — 14.41% | ||||||||

| KLA Corp. | 58,835 | 18,783,662 | ||||||

| NXP Semiconductors NV | 63,125 | 10,788,062 | ||||||

| QUALCOMM, Inc. | 122,300 | 17,084,087 | ||||||

| Skyworks Solutions, Inc. | 63,196 | 7,160,107 | ||||||

| 53,815,918 | ||||||||

| Software — 2.65% | ||||||||

| Salesforce.com, Inc.(a) | 56,375 | 9,918,618 | ||||||

| Technology Hardware — 6.42% | ||||||||

| Cisco Systems, Inc. | 490,000 | 24,000,200 | ||||||

| Technology Services — 2.17% | ||||||||

| Cognizant Technology Solutions Corp. - Class A | 100,000 | 8,090,000 | ||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $203,167,109) | 372,163,697 | |||||||

| 14 | Semi-Annual Report | April 30, 2022 |

| Schedule of Investments | White Oak Select Growth Fund |

| As of April 30, 2022 (Unaudited) |

| Shares or | Fair | |||||||

| Principal ($) | Value | |||||||

| SHORT-TERM INVESTMENTS — 8.62% | ||||||||

| REPURCHASE AGREEMENTS — 0.31% | ||||||||

| Tri-Party Repurchase Agreement with South Street Securities LLC and Bank of New York Mellon, 0.14%, dated 4/29/2022 and maturing 5/2/2022, collateralized by U.S. Treasury Securities with rates ranging from 0.13% to 2.25% and maturity dates ranging from 9/15/2023 to 8/15/2029 with a par value of $1,263,165 and a collateral value of $1,182,919 | 1,159,717 | $ | 1,159,717 | |||||

| COLLATERAL FOR SECURITIES LOANED — 8.31% | ||||||||

| Mount Vernon Liquid Assets Portfolio, LLC, 0.45%(c) | 31,048,562 | 31,048,562 | ||||||

| TOTAL SHORT-TERM INVESTMENTS | ||||||||

| (Cost $32,208,279) | 32,208,279 | |||||||

| TOTAL INVESTMENTS — 108.24% | ||||||||

| (Cost $235,375,388) | 404,371,976 | |||||||

| Liabilities in Excess of Other Assets — (8.24)% | (30,787,764 | ) | ||||||

| NET ASSETS — 100.00% | $ | 373,584,212 | ||||||

| (a) | Non-income producing security. |

| (b) | Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $29,395,616. |

| (c) | Rate disclosed is the seven day effective yield as of April 30, 2022. |

ADR — American Depositary Receipt.

The accompanying notes are an integral part of the financial statements.

| 1-888-462-5386 | www.oakfunds.com | 15 |

| Pin Oak Equity Fund | Schedule of Investments |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS — 99.09% | ||||||||

| COMMUNICATIONS — 16.07% | ||||||||

| Internet Media & Services — 16.07% | ||||||||

| Alphabet, Inc. - Class A(a) | 2,085 | $ | 4,758,366 | |||||

| Alphabet, Inc. - Class C(a)(b) | 6,150 | 14,140,879 | ||||||

| Meta Platforms, Inc. - Class A(a) | 23,900 | 4,791,233 | ||||||

| 23,690,478 | ||||||||

| CONSUMER DISCRETIONARY — 23.98% | ||||||||

| Automotive — 5.03% | ||||||||

| Gentex Corp.(b) | 252,500 | 7,410,875 | ||||||

| E-Commerce Discretionary — 12.88% | ||||||||

| Amazon.com, Inc.(a) | 5,120 | 12,726,426 | ||||||

| eBay, Inc. | 120,500 | 6,256,360 | ||||||

| 18,982,786 | ||||||||

| Home Construction — 5.25% | ||||||||

| M/I Homes, Inc.(a) | 103,901 | 4,600,736 | ||||||

| Taylor Morrison Home Corp.(a) | 120,000 | 3,142,800 | ||||||

| 7,743,536 | ||||||||

| Leisure Facilities & Services — 0.82% | ||||||||

| DraftKings, Inc. - Class A(a)(b) | 88,555 | 1,211,432 | ||||||

| FINANCIALS — 13.93% | ||||||||

| Asset Management — 6.26% | ||||||||

| Charles Schwab Corp. (The) | 139,101 | 9,226,569 | ||||||

| Institutional Financial Services — 2.87% | ||||||||

| Bank of New York Mellon Corp. (The) | 100,745 | 4,237,335 | ||||||

| Insurance — 4.80% | ||||||||

| Assurant, Inc. | 38,900 | 7,075,132 | ||||||

| HEALTH CARE — 26.86% | ||||||||

| Biotech & Pharma — 7.65% | ||||||||

| Amgen, Inc. | 18,500 | 4,314,015 | ||||||

| Gilead Sciences, Inc. | 32,085 | 1,903,924 | ||||||

| GlaxoSmithKline PLC - ADR(b) | 111,760 | 5,060,493 | ||||||

| 11,278,432 | ||||||||

| 16 | Semi-Annual Report | April 30, 2022 |

| Schedule of Investments | Pin Oak Equity Fund |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| Health Care Facilities & Services — 8.58% | ||||||||

| McKesson Corp. | 34,400 | $ | 10,650,584 | |||||

| Quest Diagnostics, Inc. | 15,000 | 2,007,600 | ||||||

| 12,658,184 | ||||||||

| Medical Equipment & Devices — 10.63% | ||||||||

| Illumina, Inc.(a) | 18,655 | 5,534,006 | ||||||

| Intuitive Surgical, Inc.(a) | 20,620 | 4,934,366 | ||||||

| Medtronic PLC | 49,845 | 5,201,824 | ||||||

| 15,670,196 | ||||||||

| TECHNOLOGY — 18.25% | ||||||||

| Semiconductors — 4.01% | ||||||||

| KLA Corp. | 18,498 | 5,905,672 | ||||||

| Technology Services — 14.24% | ||||||||

| Amdocs Ltd. | 81,587 | 6,501,668 | ||||||

| Paychex, Inc. | 43,649 | 5,531,638 | ||||||

| PayPal Holdings, Inc.(a) | 26,230 | 2,306,404 | ||||||

| Visa, Inc. - Class A(b) | 31,220 | 6,653,918 | ||||||

| 20,993,628 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $90,141,622) | 146,084,255 | |||||||

| 1-888-462-5386 | www.oakfunds.com | 17 |

| Pin Oak Equity Fund | Schedule of Investments |

| As of April 30, 2022 (Unaudited) |

| Shares or | Fair | |||||||

| Principal ($) | Value | |||||||

| SHORT-TERM INVESTMENTS — 20.96% | ||||||||

| REPURCHASE AGREEMENTS — 0.43% | ||||||||

| Tri-Party Repurchase Agreement with South Street Securities LLC and Bank of New York Mellon, 0.14%, dated 4/29/2022 and maturing 5/2/2022, collateralized by U.S. Treasury Securities with rates ranging from 0.13% to 2.25% and maturity dates ranging from 9/15/2023 to 8/15/2029 with a par value of $692,976 and a collateral value of $648,953 | 636,225 | $ | 636,225 | |||||

| COLLATERAL FOR SECURITIES LOANED — 20.53% | ||||||||

| Mount Vernon Liquid Assets Portfolio, LLC, 0.45%(c) | 30,264,396 | 30,264,396 | ||||||

| TOTAL SHORT-TERM INVESTMENTS | ||||||||

| (Cost $30,900,621) | 30,900,621 | |||||||

| TOTAL INVESTMENTS — 120.05% | ||||||||

| (Cost $121,042,243) | 176,984,876 | |||||||

| Liabilities in Excess of Other Assets — (20.05)% | (29,555,762 | ) | ||||||

| NET ASSETS — 100.00% | $ | 147,429,114 | ||||||

| (a) | Non-income producing security. |

| (b) | Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $28,716,072. |

| (c) | Rate disclosed is the seven day effective yield as of April 30, 2022. |

ADR - American Depositary Receipt.

The accompanying notes are an integral part of the financial statements.

| 18 | Semi-Annual Report | April 30, 2022 |

| Schedule of Investments | Rock Oak Core Growth Fund |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS — 95.82% | ||||||||

| CONSUMER DISCRETIONARY — 15.08% | ||||||||

| Automotive — 4.23% | ||||||||

| Gentex Corp. | 15,785 | $ | 463,290 | |||||

| Home Construction — 3.37% | ||||||||

| PulteGroup, Inc. | 8,820 | 368,323 | ||||||

| Leisure Facilities & Services — 1.22% | ||||||||

| DraftKings, Inc. - Class A(a)(b) | 9,745 | 133,312 | ||||||

| Leisure Products — 2.44% | ||||||||

| Thor Industries, Inc.(b) | 3,490 | 267,159 | ||||||

| Wholesale - Discretionary — 3.82% | ||||||||

| Pool Corp.(b) | 1,030 | 417,377 | ||||||

| ENERGY — 2.57% | ||||||||

| Renewable Energy — 2.57% | ||||||||

| SolarEdge Technologies, Inc.(a) | 1,120 | 280,459 | ||||||

| FINANCIALS — 8.84% | ||||||||

| Insurance — 8.84% | ||||||||

| Assurant, Inc. | 1,830 | 332,840 | ||||||

| Hartford Financial Services Group, Inc. (The) | 9,065 | 633,916 | ||||||

| 966,756 | ||||||||

| HEALTH CARE — 23.57% | ||||||||

| Biotech & Pharma — 13.31% | ||||||||

| Exelixis, Inc.(a) | 18,149 | 405,449 | ||||||

| Jazz Pharmaceuticals PLC(a)(b) | 3,655 | 585,604 | ||||||

| Neurocrine Biosciences Inc.(a) | 3,080 | 277,292 | ||||||

| Viatris, Inc. | 18,120 | 187,180 | ||||||

| 1,455,525 | ||||||||

| Health Care Facilities & Services — 8.20% | ||||||||

| Cardinal Health, Inc. | 5,770 | 334,948 | ||||||

| Medpace Holdings, Inc.(a) | 1,186 | 158,414 | ||||||

| Quest Diagnostics, Inc. | 3,015 | 403,528 | ||||||

| 896,890 | ||||||||

| 1-888-462-5386 | www.oakfunds.com | 19 |

| Rock Oak Core Growth Fund | Schedule of Investments |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| Medical Equipment & Devices — 2.06% | ||||||||

| Illumina, Inc.(a) | 760 | $ | 225,454 | |||||

| INDUSTRIALS — 14.08% | ||||||||

| Aerospace & Defense — 2.91% | ||||||||

| TransDigm Group, Inc.(a) | 535 | 318,223 | ||||||

| Commercial Support Services — 3.84% | ||||||||

| Republic Services, Inc. | 3,130 | 420,265 | ||||||

| Machinery — 7.33% | ||||||||

| Enovis Corp.(a) | 3,618 | 234,700 | ||||||

| Esab Corp.(a) | 3,618 | 170,046 | ||||||

| Nordson Corp. | 1,839 | 396,654 | ||||||

| 801,400 | ||||||||

| MATERIALS — 5.89% | ||||||||

| Construction Materials — 5.89% | ||||||||

| Carlisle Cos., Inc. | 2,485 | 644,509 | ||||||

| TECHNOLOGY — 25.79% | ||||||||

| Software — 1.85% | ||||||||

| Citrix Systems, Inc.(b) | 2,015 | 201,702 | ||||||

| Technology Hardware — 18.06% | ||||||||

| F5, Inc.(a) | 2,820 | 472,096 | ||||||

| NetApp, Inc. | 5,805 | 425,216 | ||||||

| Seagate Technology PLC | 5,760 | 472,551 | ||||||

| Ubiquiti Networks, Inc.(b) | 2,145 | 605,426 | ||||||

| 1,975,289 | ||||||||

| Technology Services — 5.88% | ||||||||

| Amdocs Ltd. | 2,475 | 197,233 | ||||||

| Cognizant Technology Solutions Corp. - Class A | 5,507 | 445,516 | ||||||

| 642,749 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $8,124,944) | 10,478,682 | |||||||

| 20 | Semi-Annual Report | April 30, 2022 |

| Schedule of Investments | Rock Oak Core Growth Fund |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| SHORT-TERM INVESTMENTS — 19.93% | ||||||||

| COLLATERAL FOR SECURITIES LOANED — 19.93% | ||||||||

| Mount Vernon Liquid Assets Portfolio, LLC, 0.45%(c) | 2,179,162 | $ | 2,179,162 | |||||

| TOTAL SHORT-TERM INVESTMENTS | ||||||||

| (Cost $2,179,162) | 2,179,162 | |||||||

| TOTAL INVESTMENTS — 115.75% | ||||||||

| (Cost $10,304,106) | 12,657,844 | |||||||

| Liabilities in Excess of Other Assets — (15.75)% | (1,722,731 | ) | ||||||

| NET ASSETS — 100.00% | $ | 10,935,113 | ||||||

| (a) | Non-income producing security. |

| (b) | Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $2,095,266. |

| (c) | Rate disclosed is the seven day effective yield as of April 30, 2022. |

The accompanying notes are an integral part of the financial statements.

| 1-888-462-5386 | www.oakfunds.com | 21 |

| River Oak Discovery Fund | Schedule of Investments |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS — 87.37% | ||||||||

| COMMUNICATIONS — 2.06% | ||||||||

| Advertising & Marketing — 0.76% | ||||||||

| QuinStreet, Inc.(a) | 17,875 | $ | 169,991 | |||||

| Internet Media & Services — 1.30% | ||||||||

| Eventbrite, Inc. - Class A(a) | 27,530 | 291,268 | ||||||

| CONSUMER DISCRETIONARY — 14.26% | ||||||||

| Consumer Services — 4.69% | ||||||||

| Aaron’s Co., Inc. (The) | 3,000 | 61,590 | ||||||

| Adtalem Global Education, Inc.(a)(b) | 19,770 | 579,459 | ||||||

| American Public Education, Inc.(a) | 21,012 | 408,473 | ||||||

| 1,049,522 | ||||||||

| Home Construction — 6.06% | ||||||||

| M/I Homes, Inc.(a) | 14,386 | 637,012 | ||||||

| Taylor Morrison Home Corp.(a) | 27,416 | 718,025 | ||||||

| 1,355,037 | ||||||||

| Retail - Discretionary — 3.51% | ||||||||

| Asbury Automotive Group, Inc.(a)(b) | 4,275 | 785,360 | ||||||

| CONSUMER STAPLES — 2.95% | ||||||||

| Household Products — 2.95% | ||||||||

| Edgewell Personal Care Co.(b) | 17,322 | 660,661 | ||||||

| FINANCIALS — 14.11% | ||||||||

| Asset Management — 6.18% | ||||||||

| AllianceBernstein Holding LP | 21,518 | 856,632 | ||||||

| Artisan Partners Asset Management, Inc. - Class A(b) | 16,381 | 526,485 | ||||||

| 1,383,117 | ||||||||

| Banking — 2.81% | ||||||||

| Atlantic Union Bancshares Corp. | 4,000 | 135,120 | ||||||

| Dime Community Bancshares, Inc. | 15,671 | 492,696 | ||||||

| 627,816 | ||||||||

| Insurance — 4.07% | ||||||||

| CNO Financial Group, Inc.(b) | 17,345 | 418,708 | ||||||

| Selective Insurance Group, Inc. | 5,960 | 490,866 | ||||||

| 909,574 | ||||||||

| 22 | Semi-Annual Report | April 30, 2022 |

| Schedule of Investments | River Oak Discovery Fund |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| Specialty Finance — 1.05% | ||||||||

| PROG Holdings, Inc.(a)(b) | 8,850 | $ | 234,259 | |||||

| INDUSTRIALS — 17.70% | ||||||||

| Commercial Support Services — 7.77% | ||||||||

| Barrett Business Services, Inc. | 6,101 | 439,089 | ||||||

| Korn Ferry | 11,772 | 723,272 | ||||||

| Vectrus, Inc.(a) | 15,923 | 574,820 | ||||||

| 1,737,181 | ||||||||

| Electrical Equipment — 3.20% | ||||||||

| Advanced Energy Industries, Inc. | 9,353 | 715,691 | ||||||

| Industrial Support Services — 2.20% | ||||||||

| Applied Industrial Technologies, Inc. | 4,694 | 491,415 | ||||||

| Machinery — 3.09% | ||||||||

| Kadant, Inc. | 3,740 | 691,900 | ||||||

| Transportation Equipment — 1.44% | ||||||||

| Meritor, Inc.(a) | 9,000 | 323,190 | ||||||

| TECHNOLOGY — 36.29% | ||||||||

| Semiconductors — 17.36% | ||||||||

| Cirrus Logic, Inc.(a) | 11,397 | 863,893 | ||||||

| Cohu, Inc.(a) | 21,455 | 569,845 | ||||||

| Diodes, Inc.(a) | 6,870 | 501,716 | ||||||

| Kulicke & Soffa Industries, Inc.(b) | 19,620 | 910,564 | ||||||

| Silicon Motion Technology Corp. - ADR | 13,665 | 1,037,583 | ||||||

| 3,883,601 | ||||||||

| Software — 14.28% | ||||||||

| Calix, Inc.(a)(b) | 14,095 | 562,531 | ||||||

| Cerence, Inc.(a)(b) | 15,147 | 446,836 | ||||||

| Mandiant, Inc.(a) | 34,558 | 759,585 | ||||||

| NextGen Healthcare, Inc.(a) | 35,190 | 663,332 | ||||||

| Verint Systems, Inc.(a) | 13,948 | 761,003 | ||||||

| 3,193,287 | ||||||||

| 1-888-462-5386 | www.oakfunds.com | 23 |

| River Oak Discovery Fund | Schedule of Investments |

| As of April 30, 2022 (Unaudited) |

| Shares or | Fair | |||||||

| Principal ($) | Value | |||||||

| Technology Services — 4.65% | ||||||||

| CSG Systems International, Inc. | 7,000 | $ | 430,290 | |||||

| Perficient, Inc.(a)(b) | 6,121 | 608,489 | ||||||

| 1,038,779 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $16,878,010) | 19,541,649 | |||||||

| SHORT-TERM INVESTMENTS — 34.83% | ||||||||

| REPURCHASE AGREEMENTS — 10.26% | ||||||||

| Tri-Party Repurchase Agreement with South Street Securities LLC and Bank of New York Mellon, 0.14%, dated 4/29/2022 and maturing 5/2/2022, collateralized by U.S. Treasury Securities with rates ranging from 0.13% to 2.25% and maturity dates ranging from 9/15/2023 to 8/15/2029 with a par value of $2,499,583 and a collateral value of $2,340,791 | 2,294,879 | 2,294,879 | ||||||

| COLLATERAL FOR SECURITIES LOANED — 24.57% | ||||||||

| Mount Vernon Liquid Assets Portfolio, LLC, 0.45%(c) | 5,494,961 | 5,494,961 | ||||||

| TOTAL SHORT-TERM INVESTMENTS | ||||||||

| (Cost $7,789,840) | 7,789,840 | |||||||

| TOTAL INVESTMENTS — 122.20% | ||||||||

| (Cost $24,667,850) | 27,331,489 | |||||||

| Liabilities in Excess of Other Assets — (22.20)% | (4,964,615 | ) | ||||||

| NET ASSETS — 100.00% | $ | 22,366,874 | ||||||

| (a) | Non-income producing security. |

| (b) | Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $5,249,648. |

| (c) | Rate disclosed is the seven day effective yield as of April 30, 2022. |

ADR — American Depositary Receipt.

The accompanying notes are an integral part of the financial statements.

| 24 | Semi-Annual Report | April 30, 2022 |

| Schedule of Investments | Red Oak Technology Select Fund |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS — 98.03% | ||||||||

| COMMUNICATIONS — 14.89% | ||||||||

| Internet Media & Services — 14.89% | ||||||||

| Alphabet, Inc. - Class A(a) | 5,517 | $ | 12,590,842 | |||||

| Alphabet, Inc. - Class C(a)(b) | 17,236 | 39,631,252 | ||||||

| Meta Platforms, Inc. - Class A(a) | 143,225 | 28,712,316 | ||||||

| 80,934,410 | ||||||||

| CONSUMER DISCRETIONARY — 10.13% | ||||||||

| E-Commerce Discretionary — 10.13% | ||||||||

| Amazon.com, Inc.(a) | 15,400 | 38,278,702 | ||||||

| eBay, Inc. | 324,030 | 16,786,176 | ||||||

| 55,064,878 | ||||||||

| REAL ESTATE — 2.71% | ||||||||

| REIT — 2.71% | ||||||||

| Digital Realty Trust, Inc. | 100,770 | 14,724,512 | ||||||

| TECHNOLOGY — 70.30% | ||||||||

| Semiconductors — 23.41% | ||||||||

| Broadcom, Inc. | 42,220 | 23,406,346 | ||||||

| Intel Corp. | 557,915 | 24,319,515 | ||||||

| KLA Corp. | 69,809 | 22,287,221 | ||||||

| NXP Semiconductors NV | 113,550 | 19,405,695 | ||||||

| QUALCOMM, Inc. | 153,200 | 21,400,508 | ||||||

| Skyworks Solutions, Inc. | 145,135 | 16,443,795 | ||||||

| 127,263,080 | ||||||||

| Software — 20.76% | ||||||||

| Akamai Technologies, Inc.(a)(b) | 136,780 | 15,357,659 | ||||||

| Check Point Software Technologies Ltd.(a) | 58,700 | 7,413,223 | ||||||

| Citrix Systems, Inc.(b) | 13,280 | 1,329,328 | ||||||

| Microsoft Corp. | 111,403 | 30,916,561 | ||||||

| Oracle Corp. | 316,171 | 23,206,951 | ||||||

| Synopsys, Inc.(a) | 69,970 | 20,066,696 | ||||||

| VMware, Inc. - Class A | 135,470 | 14,582,953 | ||||||

| 112,873,371 | ||||||||

| Technology Hardware — 16.40% | ||||||||

| Apple, Inc. | 296,786 | 46,788,313 | ||||||

| Cisco Systems, Inc. | 609,245 | 29,840,820 | ||||||

| NetApp, Inc. | 170,690 | 12,503,042 | ||||||

| 89,132,175 | ||||||||

| 1-888-462-5386 | www.oakfunds.com | 25 |

| Red Oak Technology Select Fund | Schedule of Investments |

| As of April 30, 2022 (Unaudited) |

| Shares or | Fair | |||||||

| Principal ($) | Value | |||||||

| Technology Services — 9.73% | ||||||||

| Accenture PLC - Class A | 40,580 | $ | 12,188,609 | |||||

| Cognizant Technology Solutions Corp. - Class A | 135,000 | 10,921,500 | ||||||

| Global Payments, Inc. | 93,157 | 12,760,646 | ||||||

| Visa, Inc. - Class A(b) | 80,000 | 17,050,400 | ||||||

| 52,921,155 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $244,301,684) | 532,913,581 | |||||||

| SHORT-TERM INVESTMENTS — 10.46% | ||||||||

| REPURCHASE AGREEMENTS — 1.06% | ||||||||

| Tri-Party Repurchase Agreement with South Street Securities LLC and Bank of New York Mellon, 0.14%, dated 4/29/2022 and maturing 5/2/2022, collateralized by U.S. Treasury Securities with rates ranging from 0.13% to 2.25% and maturity dates ranging from 9/15/2023 to 8/15/2029 with a par value of $6,305,494 and a collateral value of $5,904,920 | 5,789,102 | 5,789,102 | ||||||

| COLLATERAL FOR SECURITIES LOANED — 9.40% | ||||||||

| Mount Vernon Liquid Assets Portfolio, LLC, 0.45%(c) | 51,095,587 | 51,095,587 | ||||||

| TOTAL SHORT-TERM INVESTMENTS | ||||||||

| (Cost $56,884,689) | 56,884,689 | |||||||

| TOTAL INVESTMENTS — 108.49% | ||||||||

| (Cost $301,186,373) | 589,798,270 | |||||||

| Liabilities in Excess of Other Assets — (8.49)% | (46,153,687 | ) | ||||||

| NET ASSETS — 100.00% | $ | 543,644,583 | ||||||

| (a) | Non-income producing security. |

| (b) | Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $48,400,799. |

| (c) | Rate disclosed is the seven day effective yield as of April 30, 2022. |

The accompanying notes are an integral part of the financial statements.

| 26 | Semi-Annual Report | April 30, 2022 |

| Schedule of Investments | Black Oak Emerging Technology Fund |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS — 99.00% | ||||||||

| COMMUNICATIONS — 0.91% | ||||||||

| Internet Media & Services — 0.91% | ||||||||

| Meta Platforms, Inc. - Class A(a) | 2,525 | $ | 506,187 | |||||

| CONSUMER DISCRETIONARY — 3.79% | ||||||||

| Automotive — 3.03% | ||||||||

| Tesla, Inc.(a) | 1,939 | 1,688,404 | ||||||

| Leisure Facilities & Services — 0.76% | ||||||||

| DraftKings, Inc. - Class A(a)(b) | 30,740 | 420,523 | ||||||

| ENERGY — 4.53% | ||||||||

| Renewable Energy — 4.53% | ||||||||

| SolarEdge Technologies, Inc.(a) | 10,055 | 2,517,872 | ||||||

| HEALTH CARE — 3.43% | ||||||||

| Medical Equipment & Devices — 3.43% | ||||||||

| Illumina, Inc.(a) | 6,435 | 1,908,943 | ||||||

| INDUSTRIALS — 10.02% | ||||||||

| Electrical Equipment — 3.71% | ||||||||

| Advanced Energy Industries, Inc.(b) | 26,957 | 2,062,750 | ||||||

| Industrial Support Services — 2.63% | ||||||||

| Applied Industrial Technologies, Inc. | 14,000 | 1,465,660 | ||||||

| Machinery — 3.68% | ||||||||

| Nordson Corp. | 9,500 | 2,049,055 | ||||||

| TECHNOLOGY — 76.32% | ||||||||

| Information Technology — 2.46% | ||||||||

| Paylocity Holdings Corp.(a)(b) | 7,220 | 1,369,128 | ||||||

| 1-888-462-5386 | www.oakfunds.com | 27 |

| Black Oak Emerging Technology Fund | Schedule of Investments |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| Semiconductors — 30.83% | ||||||||

| Ambarella, Inc.(a) | 16,604 | $ | 1,362,856 | |||||

| Cirrus Logic, Inc.(a) | 33,492 | 2,538,694 | ||||||

| Cohu, Inc.(a)(b) | 59,077 | 1,569,085 | ||||||

| Diodes, Inc.(a) | 25,770 | 1,881,983 | ||||||

| KLA Corp. | 6,750 | 2,155,005 | ||||||

| Kulicke & Soffa Industries, Inc.(b) | 49,645 | 2,304,024 | ||||||

| Lam Research Corp. | 2,785 | 1,297,142 | ||||||

| QUALCOMM, Inc. | 15,497 | 2,164,776 | ||||||

| Silicon Motion Technology Corp. - ADR | 24,734 | 1,878,053 | ||||||

| 17,151,618 | ||||||||

| Software — 20.73% | ||||||||

| Calix, Inc.(a)(b) | 16,424 | 655,482 | ||||||

| Citrix Systems, Inc.(b) | 7,595 | 760,259 | ||||||

| Cognyte Software Ltd.(a) | 17,933 | 121,586 | ||||||

| Concentrix Corp.(b) | 12,000 | 1,889,760 | ||||||

| Fortinet, Inc.(a) | 4,160 | 1,202,282 | ||||||

| NextGen Healthcare, Inc.(a) | 88,315 | 1,664,738 | ||||||

| Palo Alto Networks, Inc.(a)(b) | 4,125 | 2,315,280 | ||||||

| Salesforce.com, Inc.(a) | 7,480 | 1,316,031 | ||||||

| Verint Systems, Inc.(a) | 29,477 | 1,608,265 | ||||||

| 11,533,683 | ||||||||

| Technology Hardware — 10.80% | ||||||||

| Apple, Inc. | 20,120 | 3,171,918 | ||||||

| F5, Inc.(a) | 7,705 | 1,289,894 | ||||||

| SYNNEX Corp.(b) | 4,000 | 400,360 | ||||||

| Ubiquiti Networks, Inc.(b) | 4,067 | 1,147,911 | ||||||

| 6,010,083 | ||||||||

| Technology Services — 11.50% | ||||||||

| Cognizant Technology Solutions Corp. - Class A | 9,600 | 776,640 | ||||||

| CSG Systems International, Inc. | 10,000 | 614,700 | ||||||

| Jack Henry & Associates, Inc. | 8,120 | 1,539,390 | ||||||

| PayPal Holdings, Inc.(a) | 16,125 | 1,417,871 | ||||||

| Perficient, Inc.(a)(b) | 11,652 | 1,158,325 | ||||||

| Science Applications International Corp.(b) | 10,665 | 887,648 | ||||||

| 6,394,574 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $30,796,023) | 55,078,480 | |||||||

| 28 | Semi-Annual Report | April 30, 2022 |

| Schedule of Investments | Black Oak Emerging Technology Fund |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| SHORT-TERM INVESTMENTS — 31.12% | ||||||||

| COLLATERAL FOR SECURITIES LOANED — 31.12% | ||||||||

| Mount Vernon Liquid Assets Portfolio, LLC, 0.45%(c) | 17,312,656 | $ | 17,312,656 | |||||

| TOTAL SHORT-TERM INVESTMENTS | ||||||||

| (Cost $17,312,656) | 17,312,656 | |||||||

| TOTAL INVESTMENTS — 130.12% | ||||||||

| (Cost $48,108,679) | 72,391,136 | |||||||

| Liabilities in Excess of Other Assets — (30.12)% | (16,757,518 | ) | ||||||

| NET ASSETS — 100.00% | $ | 55,633,618 | ||||||

| (a) | Non-income producing security. |

| (b) | Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $16,422,808. |

| (c) | Rate disclosed is the seven day effective yield as of April 30, 2022. |

ADR - American Depositary Receipt.

The accompanying notes are an integral part of the financial statements.

| 1-888-462-5386 | www.oakfunds.com | 29 |

| Live Oak Health Sciences Fund | Schedule of Investments |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS — 99.13% | ||||||||

| HEALTH CARE — 99.13% | ||||||||

| Biotech — 21.16% | ||||||||

| Amgen, Inc. | 10,240 | $ | 2,387,866 | |||||

| Biogen, Inc.(a) | 5,006 | 1,038,445 | ||||||

| Exelixis, Inc.(a) | 66,265 | 1,480,360 | ||||||

| Gilead Sciences, Inc. | 15,390 | 913,243 | ||||||

| Regeneron Pharmaceuticals, Inc.(a) | 3,190 | 2,102,561 | ||||||

| United Therapeutics Corp.(a)(b) | 13,650 | 2,423,694 | ||||||

| Vertex Pharmaceuticals, Inc.(a)(b) | 4,315 | 1,178,944 | ||||||

| 11,525,113 | ||||||||

| Health Care Services — 6.84% | ||||||||

| Charles River Laboratories International, Inc.(a)(b) | 5,073 | 1,225,180 | ||||||

| Medpace Holdings, Inc.(a)(b) | 8,169 | 1,091,133 | ||||||

| Quest Diagnostics, Inc. | 10,545 | 1,411,343 | ||||||

| 3,727,656 | ||||||||

| Health Care Supply Chain — 16.80% | ||||||||

| AmerisourceBergen Corp. | 10,684 | 1,616,382 | ||||||

| Cardinal Health, Inc.(b) | 28,409 | 1,649,143 | ||||||

| Cigna Corp. | 12,487 | 3,081,542 | ||||||

| McKesson Corp.(b) | 9,051 | 2,802,280 | ||||||

| 9,149,347 | ||||||||

| Large Pharmaceuticals — 13.16% | ||||||||

| GlaxoSmithKline PLC - ADR(b) | 33,490 | 1,516,427 | ||||||

| Johnson & Johnson | 7,688 | 1,387,377 | ||||||

| Merck & Co., Inc.(b) | 18,800 | 1,667,372 | ||||||

| Novartis AG - ADR | 11,600 | 1,021,148 | ||||||

| Pfizer, Inc. | 32,264 | 1,583,194 | ||||||

| 7,175,518 | ||||||||

| Life Science & Diagnostics — 6.44% | ||||||||

| Illumina, Inc.(a) | 6,224 | 1,846,350 | ||||||

| Thermo Fisher Scientific, Inc. | 3,000 | 1,658,760 | ||||||

| 3,505,110 | ||||||||

| Managed Care — 14.31% | ||||||||

| Anthem, Inc.(b) | 5,415 | 2,717,951 | ||||||

| Humana, Inc. | 2,500 | 1,111,400 | ||||||

| UnitedHealth Group, Inc. | 7,800 | 3,966,690 | ||||||

| 7,796,041 | ||||||||

| 30 | Semi-Annual Report | April 30, 2022 |

| Schedule of Investments | Live Oak Health Sciences Fund |

| As of April 30, 2022 (Unaudited) |

| Shares or | Fair | |||||||

| Principal ($) | Value | |||||||

| Medical Devices — 9.04% | ||||||||

| Medtronic PLC | 18,746 | $ | 1,956,332 | |||||

| Stryker Corp. | 7,060 | 1,703,296 | ||||||

| Zimmer Biomet Holdings, Inc. | 10,460 | 1,263,045 | ||||||

| 4,922,673 | ||||||||

| Medical Equipment — 5.38% | ||||||||

| Alcon, Inc.(b) | 20,995 | 1,495,054 | ||||||

| Intuitive Surgical, Inc.(a) | 6,015 | 1,439,389 | ||||||

| 2,934,443 | ||||||||

| Specialty & Generic Pharmaceuticals — 6.00% | ||||||||

| Jazz Pharmaceuticals PLC(a)(b) | 14,387 | 2,305,085 | ||||||

| Neurocrine Biosciences Inc.(a)(b) | 10,706 | 963,861 | ||||||

| 3,268,946 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $35,881,995) | 54,004,847 | |||||||

| SHORT-TERM INVESTMENTS — 22.05% | ||||||||

| REPURCHASE AGREEMENTS — 0.90% | ||||||||

| Tri-Party Repurchase Agreement with South Street Securities LLC and Bank of New York Mellon, 0.14%, dated 4/29/2022 and maturing 5/2/2022, collateralized by U.S. Treasury Securities with rates ranging from 0.13% to 2.25% and maturity dates ranging from 9/15/2023 to 8/15/2029 with a par value of $534,482 and a collateral value of $500,527 | 490,710 | 490,710 | ||||||

| COLLATERAL FOR SECURITIES LOANED — 21.15% | ||||||||

| Mount Vernon Liquid Assets Portfolio, LLC, 0.45%(c) | 11,525,631 | 11,525,631 | ||||||

| TOTAL SHORT-TERM INVESTMENTS | ||||||||

| (Cost $12,016,341) | 12,016,341 | |||||||

| 1-888-462-5386 | www.oakfunds.com | 31 |

| Live Oak Health Sciences Fund | Schedule of Investments |

| As of April 30, 2022 (Unaudited) |

| Fair | ||||

| Value | ||||

| TOTAL INVESTMENTS — 121.18% | ||||

| (Cost $47,898,336) | $ | 66,021,188 | ||

| Liabilities in Excess of Other Assets — (21.18)% | (11,538,444 | ) | ||

| NET ASSETS — 100.00% | $ | 54,482,744 | ||

| (a) | Non-income producing security. |

| (b) | Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $11,102,904. |

| (c) | Rate disclosed is the seven day effective yield as of April 30, 2022. |

ADR — American Depositary Receipt.

The accompanying notes are an integral part of the financial statements.

| 32 | Semi-Annual Report | April 30, 2022 |

| OAK ASSOCIATES FUNDS |

| This Page Intentionally Left Blank |

| Statements of Assets & Liabilities |

| April 30, 2022 (Unaudited) |

| White Oak Select | Pin Oak | |||||||

| Growth Fund | Equity Fund | |||||||

| ASSETS | ||||||||

| Investment securities at value (cost, $235,375,388, $121,042,243, $10,304,106, $24,667,850, $301,186,373, $48,108,679 and $47,898,336), including , $29,395,616, $28,716,072, $2,095,266, $5,249,648, $48,400,799, $16,422,808 and $11,102,904 and of securities on loan | $ | 404,371,976 | $ | 176,984,876 | ||||

| Cash | 155,565 | 32,227 | ||||||

| Receivable for fund shares sold | 29,007 | 105,973 | ||||||

| Receivable for investments sold | 329,785 | 690,520 | ||||||

| Dividends and interest receivable | 86,721 | 34,258 | ||||||

| Tax reclaims receivable | 161,062 | — | ||||||

| Prepaid expenses | 24,595 | 19,806 | ||||||

| Total Assets | 405,158,711 | 177,867,660 | ||||||

| LIABILITIES | ||||||||

| Payable for fund shares redeemed | 130,021 | 6,552 | ||||||

| Payable for investments purchased | — | — | ||||||

| Payable for collateral upon return of securities loaned | 31,048,562 | 30,264,396 | ||||||

| Investment advisory fees payable | 248,514 | 97,768 | ||||||

| Administration fees payable | 30,640 | 12,763 | ||||||

| Transfer agent fees payable | 12,032 | 6,287 | ||||||

| Trustee fees payable | 11,443 | 4,767 | ||||||

| Other accrued expenses | 93,287 | 46,013 | ||||||

| Total Liabilities | 31,574,499 | 30,438,546 | ||||||

| NET ASSETS | $ | 373,584,212 | $ | 147,429,114 | ||||

| Net Assets consist of: | ||||||||

| Paid-in capital (unlimited authorization - no par value) | $ | 192,036,527 | $ | 80,843,426 | ||||

| Accumulated earnings | 181,547,685 | 66,585,688 | ||||||

| Net Assets | $ | 373,584,212 | $ | 147,429,114 | ||||

| Total shares outstanding at end of period | 3,237,679 | 2,068,326 | ||||||

| Net asset value, offering and redemption price per share (net assets/shares outstanding) | $ | 115.39 | $ | 71.28 | ||||

| 34 | Semi-Annual Report | April 30, 2022 |

| Red Oak | Black Oak | |||||||||||||||||

| Rock Oak Core | River Oak | Technology | Emerging | Live Oak Health | ||||||||||||||

| Growth Fund | Discovery Fund | Select Fund | Technology Fund | Sciences Fund | ||||||||||||||

| $ | 12,657,844 | $ | 27,331,489 | $ | 589,798,270 | $ | 72,391,136 | $ | 66,021,188 | |||||||||

| 463,058 | — | — | 432,986 | 2,510 | ||||||||||||||

| 250 | 13,648 | 26,577 | 24,123 | 13,610 | ||||||||||||||

| — | 529,336 | 6,151,963 | 644,003 | — | ||||||||||||||

| — | 990 | 39,408 | 3,000 | 4 | ||||||||||||||

| — | — | — | — | 14,410 | ||||||||||||||

| 12,297 | 16,845 | 26,561 | 13,264 | 17,849 | ||||||||||||||

| 13,133,449 | 27,892,308 | 596,042,779 | 73,508,512 | 66,069,571 | ||||||||||||||

| 6 | — | 720,865 | 8,252 | — | ||||||||||||||

| — | — | — | 483,552 | — | ||||||||||||||

| 2,179,162 | 5,494,961 | 51,095,587 | 17,312,656 | 11,525,631 | ||||||||||||||

| 4,823 | 14,180 | 356,695 | 36,045 | 34,819 | ||||||||||||||

| 797 | 1,647 | 45,109 | 4,334 | 3,648 | ||||||||||||||

| 2,723 | 2,760 | 10,117 | 5,548 | 3,679 | ||||||||||||||

| — | 291 | 17,158 | 1,273 | 1,081 | ||||||||||||||

| 10,825 | 11,595 | 152,665 | 23,234 | 17,969 | ||||||||||||||

| 2,198,336 | 5,525,434 | 52,398,196 | 17,874,894 | 11,586,827 | ||||||||||||||

| $ | 10,935,113 | $ | 22,366,874 | $ | 543,644,583 | $ | 55,633,618 | $ | 54,482,744 | |||||||||

| $ | 8,327,540 | $ | 20,000,285 | $ | 227,553,207 | $ | 30,122,245 | $ | 35,494,122 | |||||||||

| 2,607,573 | 2,366,589 | 316,091,376 | 25,511,373 | 18,988,622 | ||||||||||||||

| $ | 10,935,113 | $ | 22,366,874 | $ | 543,644,583 | $ | 55,633,618 | $ | 54,482,744 | |||||||||

| 685,077 | 1,467,681 | 15,936,763 | 8,075,329 | 2,682,549 | ||||||||||||||

| $ | 15.96 | $ | 15.24 | $ | 34.11 | $ | 6.89 | $ | 20.31 | |||||||||

The accompanying notes are an integral part of the financial statements.

| 1-888-462-5386 | www.oakfunds.com | 35 |

| Statements of Operations |

| For the six months ended April 30, 2022 (Unaudited) |

| White Oak Select | Pin Oak | |||||||

| Growth Fund | Equity Fund | |||||||

| INVESTMENT INCOME | ||||||||

| Dividends | $ | 2,927,513 | $ | 826,882 | ||||

| Securities lending income | 17,213 | 9,610 | ||||||

| Interest | 241 | 147 | ||||||

| Less: Foreign withholding tax | (10,549 | ) | (1,676 | ) | ||||

| Total Investment Income | 2,934,418 | 834,963 | ||||||

| EXPENSES | ||||||||

| Investment adviser | 1,638,756 | 656,889 | ||||||

| Administration | 92,803 | 38,111 | ||||||

| Sub transfer agent | 61,373 | 31,148 | ||||||

| Transfer agent | 36,913 | 19,187 | ||||||

| Trustee | 33,992 | 13,876 | ||||||

| Legal | 30,644 | 12,825 | ||||||

| Report printing | 13,930 | 6,053 | ||||||

| Registration | 12,702 | 12,044 | ||||||

| Insurance | 11,673 | 5,355 | ||||||

| Custodian | 9,470 | 3,940 | ||||||

| Audit | 8,182 | 8,182 | ||||||

| Pricing | 162 | 168 | ||||||

| Miscellaneous | 30,249 | 16,804 | ||||||

| Total Expenses | 1,980,849 | 824,582 | ||||||

| Less: Investment advisory fees waived | — | — | ||||||

| Net Expenses | 1,980,849 | 824,582 | ||||||

| Net Investment Income (Loss) | 953,569 | 10,381 | ||||||

| Realized and Unrealized Gain (Loss) on Investments | ||||||||

| Net realized gain (loss) on investment securities transactions | 11,630,513 | 10,682,368 | ||||||

| Net change in unrealized depreciation of investment securities | (86,768,521 | ) | (44,584,440 | ) | ||||

| Net Realized and Unrealized Loss on Investments | (75,138,008 | ) | (33,902,072 | ) | ||||

| Net Decrease in Net Assets from Operations | $ | (74,184,439 | ) | $ | (33,891,691 | ) | ||

| 36 | Semi-Annual Report | April 30, 2022 |

| Red Oak | Black Oak | |||||||||||||||||

| Rock Oak Core | River Oak | Technology | Emerging | Live Oak Health | ||||||||||||||

| Growth Fund | Discovery Fund | Select Fund | Technology Fund | Sciences Fund | ||||||||||||||

| $ | 66,246 | $ | 102,304 | $ | 7,672,480 | $ | 164,560 | $ | 352,071 | |||||||||

| 1,004 | 2,064 | 103,567 | 6,450 | 3,400 | ||||||||||||||

| 7 | 47,342 | 739 | 25 | 53 | ||||||||||||||

| — | (68 | ) | (23,973 | ) | (133 | ) | (6,923 | ) | ||||||||||

| 67,257 | 151,642 | 7,752,813 | 170,902 | 348,601 | ||||||||||||||

| 43,732 | 91,640 | 2,377,562 | 239,171 | 198,760 | ||||||||||||||

| 2,449 | 4,836 | 135,643 | 13,290 | 10,856 | ||||||||||||||

| 912 | 1,070 | 165,698 | 7,345 | 5,732 | ||||||||||||||

| 8,320 | 8,479 | 30,953 | 16,968 | 11,268 | ||||||||||||||

| 899 | 1,774 | 49,545 | 4,909 | 3,977 | ||||||||||||||

| 860 | 1,587 | 45,107 | 4,336 | 3,671 | ||||||||||||||

| 1,537 | 1,716 | 19,629 | 3,204 | 2,334 | ||||||||||||||

| 10,096 | 11,164 | 12,590 | 10,251 | 11,976 | ||||||||||||||

| 319 | 579 | 17,771 | 1,634 | 1,401 | ||||||||||||||

| 305 | 457 | 14,132 | 1,585 | 1,068 | ||||||||||||||

| 8,182 | 8,182 | 8,182 | 8,182 | 8,182 | ||||||||||||||

| 187 | 225 | 173 | 241 | 198 | ||||||||||||||

| 7,516 | 7,754 | 31,152 | 13,208 | 9,977 | ||||||||||||||

| 85,314 | 139,463 | 2,908,137 | 324,324 | 269,400 | ||||||||||||||

| (11,500 | ) | — | — | — | — | |||||||||||||

| 73,814 | 139,463 | 2,908,137 | 324,324 | 269,400 | ||||||||||||||

| (6,557 | ) | 12,179 | 4,844,676 | (153,422 | ) | 79,201 | ||||||||||||

| 270,398 | (329,967 | ) | 27,290,116 | 1,417,704 | 1,354,916 | |||||||||||||

| (1,611,044 | ) | (3,907,239 | ) | (129,611,242 | ) | (14,129,775 | ) | (2,086,790 | ) | |||||||||

| (1,340,646 | ) | (4,237,206 | ) | (102,321,126 | ) | (12,712,071 | ) | (731,874 | ) | |||||||||

| $ | (1,347,203 | ) | $ | (4,225,027 | ) | $ | (97,476,450 | ) | $ | (12,865,493 | ) | $ | (652,673 | ) | ||||

The accompanying notes are an integral part of the financial statements.

| 1-888-462-5386 | www.oakfunds.com | 37 |

| Statements of Changes in Net Assets |

| White Oak Select | ||||||||

| Growth Fund | ||||||||

| For the | ||||||||

| Six Months | ||||||||

| Ended | For the | |||||||

| April 30, | Year Ended | |||||||

| 2022 | October 31, | |||||||

| (Unaudited) | 2021 | |||||||

| INVESTMENT ACTIVITIES | ||||||||

| Net investment income (loss) | $ | 953,569 | $ | 1,121,690 | ||||

| Net realized gain on investment securities transactions and foreign currency translations | 11,630,513 | 23,023,697 | ||||||

| Net change in unrealized appreciation (depreciation) of investments securities | (86,768,521 | ) | 108,185,545 | |||||

| Net Increase (Decrease) in Net Assets Resulting from Operations | (74,184,439 | ) | 132,330,932 | |||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | ||||||||

| Earnings | (23,574,884 | ) | (9,851,894 | ) | ||||

| Total Distributions | (23,574,884 | ) | (9,851,894 | ) | ||||

| CAPITAL TRANSACTIONS | ||||||||

| Proceeds from shares sold | 19,260,706 | 10,800,437 | ||||||

| Reinvestment of distributions | 22,616,161 | 9,362,811 | ||||||

| Amount paid for shares redeemed | (30,081,518 | ) | (33,076,631 | ) | ||||

| Net Increase (Decrease) in Net Assets Resulting from Capital Transactions | 11,795,349 | (12,913,383 | ) | |||||

| Total Increase (Decrease) in Net Assets | (85,963,974 | ) | 109,565,655 | |||||

| NET ASSETS | ||||||||

| Beginning of period | 459,548,186 | 349,982,531 | ||||||

| End of period | $ | 373,584,212 | $ | 459,548,186 | ||||

| SHARE TRANSACTIONS | ||||||||

| Shares sold | 137,013 | 83,076 | ||||||

| Shares issued in reinvestment of distributions | 154,958 | 79,252 | ||||||

| Shares redeemed | (223,697 | ) | (257,305 | ) | ||||

| Net Increase (Decrease) in Shares Outstanding | 68,274 | (94,977 | ) | |||||

| 38 | Semi-Annual Report | April 30, 2022 |

| Pin Oak | Rock Oak Core | |||||||||||||

| Equity Fund | Growth Fund | |||||||||||||

| For the | For the | |||||||||||||

| Six Months | Six Months | |||||||||||||

| Ended | For the | Ended | For the | |||||||||||

| April 30, | Year Ended | April 30, | Year Ended | |||||||||||

| 2022 | October 31, | 2022 | October 31, | |||||||||||

| (Unaudited) | 2021 | (Unaudited) | 2021 | |||||||||||

| $ | 10,381 | $ | 22,171 | $ | (6,557 | ) | $ | (20,396 | ) | |||||

| 10,682,368 | 20,810,196 | 270,398 | 560,363 | |||||||||||

| (44,584,440 | ) | 44,243,177 | (1,611,044 | ) | 2,423,772 | |||||||||

| (33,891,691 | ) | 65,075,544 | (1,347,203 | ) | 2,963,739 | |||||||||

| (19,354,347 | ) | (8,125,501 | ) | (525,505 | ) | (1,690,245 | ) | |||||||

| (19,354,347 | ) | (8,125,501 | ) | (525,505 | ) | (1,690,245 | ) | |||||||

| 1,913,797 | 6,124,511 | 65,337 | 494,765 | |||||||||||

| 18,365,328 | 7,571,016 | 519,071 | 1,520,187 | |||||||||||

| (21,047,759 | ) | (32,276,209 | ) | (408,245 | ) | (735,273 | ) | |||||||

| (768,634 | ) | (18,580,682 | ) | 176,163 | 1,279,679 | |||||||||

| (54,014,672 | ) | 38,369,361 | (1,696,545 | ) | 2,553,173 | |||||||||

| 201,443,786 | 163,074,425 | 12,631,658 | 10,078,485 | |||||||||||

| $ | 147,429,114 | $ | 201,443,786 | $ | 10,935,113 | $ | 12,631,658 | |||||||

| 22,666 | 71,014 | 3,774 | 27,103 | |||||||||||

| 211,631 | 96,348 | 28,773 | 89,317 | |||||||||||

| (256,620 | ) | (375,694 | ) | (23,704 | ) | (40,142 | ) | |||||||

| (22,323 | ) | (208,332 | ) | 8,843 | 76,278 | |||||||||

The accompanying notes are an integral part of the financial statements.

| 1-888-462-5386 | www.oakfunds.com | 39 |

| Statements of Changes in Net Assets |

| River Oak | ||||||||

| Discovery Fund | ||||||||

| For the | ||||||||

| Six Months | ||||||||

| Ended | For the | |||||||

| April 30, | Year Ended | |||||||

| 2022 | October 31, | |||||||

| (Unaudited) | 2021 | |||||||

| INVESTMENT ACTIVITIES | ||||||||

| Net investment income (loss) | $ | 12,179 | $ | (93,695 | ) | |||

| Net realized gain (loss) on investment securities transactions and foreign currency translations | (329,967 | ) | 3,712,992 | |||||

| Net change in unrealized appreciation (depreciation) of investments securities | (3,907,239 | ) | 5,207,191 | |||||

| Net Increase (Decrease) in Net Assets Resulting from Operations | (4,225,027 | ) | 8,826,488 | |||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | ||||||||

| Earnings | (3,510,455 | ) | (2,560,738 | ) | ||||

| Total Distributions | (3,510,455 | ) | (2,560,738 | ) | ||||

| CAPITAL TRANSACTIONS | ||||||||

| Proceeds from shares sold | 4,397,587 | 3,045,704 | ||||||

| Reinvestment of distributions | 3,505,905 | 1,755,146 | ||||||

| Amount paid for shares redeemed | (1,505,728 | ) | (1,862,724 | ) | ||||

| Net Increase (Decrease) in Net Assets Resulting from Capital Transactions | 6,397,764 | 2,938,126 | ||||||

| Total Increase (Decrease) in Net Assets | (1,337,718 | ) | 9,203,876 | |||||

| NET ASSETS | ||||||||

| Beginning of period | 23,704,592 | 14,500,716 | ||||||

| End of period | $ | 22,366,874 | $ | 23,704,592 | ||||

| SHARE TRANSACTIONS | ||||||||

| Shares sold | 251,987 | 153,868 | ||||||

| Shares issued in reinvestment of distributions | 188,489 | 99,838 | ||||||