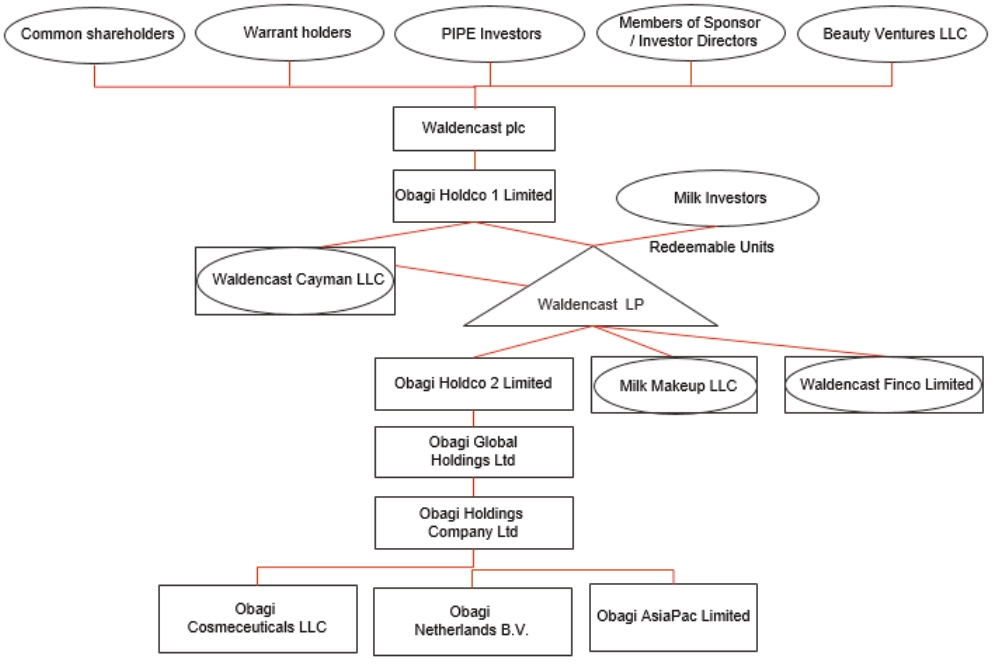

On November 15, 2021, the Company entered into the Obagi Sponsor Support Agreement, by and among the Sponsor, Obagi, Waldencast and the Investor Directors, pursuant to which the Sponsor and the Investor Directors agreed to, among other things, vote in favor of the Obagi Merger Agreement and the transactions contemplated thereby, in each case, subject to the terms and conditions contemplated by the Obagi Sponsor Support Agreement.

On November 15, 2021, the Company entered into the Milk Sponsor Support Agreement, by and among the Sponsor, the Equityholder Representative, Waldencast and the Investor Directors , pursuant to which the Sponsor and the Investor Directors agreed to, among other things, vote in favor of the Milk Equity Purchase Agreement and the transactions contemplated thereby, in each case, subject to the terms and conditions contemplated by the Milk Sponsor Support Agreement.

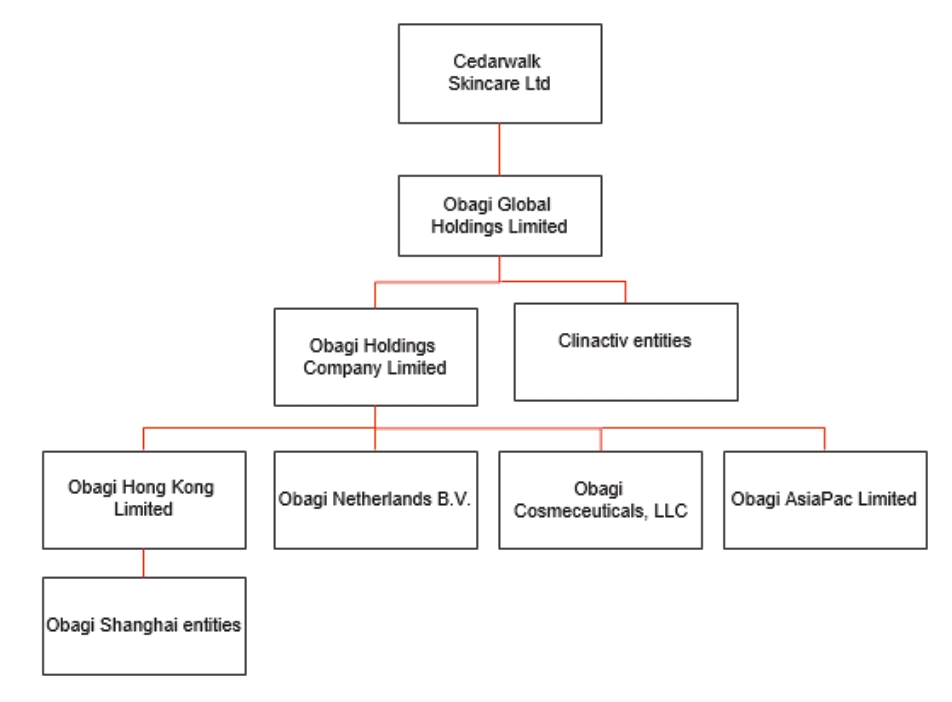

On November 15, 2021, the Company also entered into the Stockholder Support Agreement, by and among Waldencast , Obagi and Cedarwalk. Pursuant to the Stockholder Support Agreement, Cedarwalk agreed to, among other things, within two (2) business days after the Registration Statement is declared effective by the SEC and delivered or otherwise made available to Waldencast shareholders, execute and deliver the Written Consent with respect to the outstanding ordinary shares of Obagi held by Cedarwalk adopting the Obagi Merger Agreement and related transactions and approving the Business Combination.

For more information on these related agreements, please see the section of this proxy statement/prospectus entitled “BCA Proposal — Related Agreements to the Obagi Merger and Milk Transaction.”

Results of Operations

We have neither engaged in any operations nor generated any operating revenues to date. Our only activities through March 31, 2022 were organizational activities and those necessary to prepare for the initial public offering, the search for a prospective initial business combination, and the negotiation and execution of the proposed Obagi Merger Agreement and Milk Equity Purchase Agreement. We do not expect to generate any operating revenues until after the completion of a Business Combination. We expect to generate non-operating income in the form of interest income on marketable securities held after the initial public offering. We expect that we will incur increased expenses as a result of being a public company (for legal, financial reporting, accounting and auditing compliance), as well as for due diligence expenses in connection with searching for, and completing, the Business Combination.

For the year ended March 31, 2022, we had a net income of $3,022,915, which consisted of operating costs of $4,003,477, offset by a non-cash change in fair value of warrant derivative liabilities and FPA liabilities of $4,358,333 and $2,664,000, respectively, and interest income from operating bank account of $439 and interest income on marketable securities held in the Trust Account of $3,620.

For the three months ended March 31, 2021, we had a net loss of $1,183,957, which included a loss from operations of $117,515, offering cost expense allocated to warrants of $719,201, a loss from the change in fair value of warrant liabilities of $348,666, and interest income from operating bank account of $131, and interest income on marketable securities held in the Trust Account of $1,294.

For the period from December 8, 2020 (inception) through December 31, 2020, we had a net loss of $10,951, which consisted of operating costs of $10,951.

Liquidity and Capital Resources

On March 18, 2021, we consummated the initial public offering of 34,500,000 units, at $10.00 per unit, generating gross proceeds of $345.0 million, which is discussed in Note 3. Simultaneously with the closing of our initial public offering, Waldencast consummated the sale of 5,933,333 warrants , at a price of $1.50 per private placement warrant, which is discussed in Note 4 in the Financial Statements.

Following the initial public offering and the sale of the warrants, a total of $345.0 million was placed in the Trust Account. We incurred $20,169,599 in transaction costs, including $6.9 million of underwriting fees, $12,075,000 of deferred underwriting fees and $1,194,599 of other costs.

As of March 31, 2022, cash used in operating activities was $414,788. Net income of $3,022,915 was affected by non-cash changes in the deferred legal fees of $2,112,194, the fair value of warrant derivative liabilities, and FPA liabilities of $4,358,333 and $2,664,000, respectively, and interest earned on marketable securities held in the Trust Account of $3,620. Changes in current assets and liabilities provided $1,476,056 of cash for operating activities.