UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03329

Variable Insurance Products Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

|

Date of fiscal year end: |

December 31 |

|

|

|

|

Date of reporting period: |

June 30, 2022 |

Item 1.

Reports to Stockholders

Contents

| Board Approval of Investment Advisory Contracts and Management Fees |

|

Top Holdings (% of Fund's net assets)

|

||

|

Exxon Mobil Corp.

|

3.0

|

|

|

The Travelers Companies, Inc.

|

2.5

|

|

|

Cigna Corp.

|

2.4

|

|

|

AstraZeneca PLC sponsored ADR

|

2.1

|

|

|

M&T Bank Corp.

|

1.9

|

|

|

Roche Holding AG (participation certificate)

|

1.9

|

|

|

T-Mobile U.S., Inc.

|

1.8

|

|

|

Centene Corp.

|

1.7

|

|

|

Canadian Natural Resources Ltd.

|

1.7

|

|

|

Jazz Pharmaceuticals PLC

|

1.6

|

|

|

20.6

|

||

|

Market Sectors (% of Fund's net assets)

|

||

|

Financials

|

18.0

|

|

|

Health Care

|

14.0

|

|

|

Industrials

|

12.8

|

|

|

Energy

|

10.5

|

|

|

Consumer Discretionary

|

9.0

|

|

|

Communication Services

|

7.4

|

|

|

Materials

|

6.2

|

|

|

Utilities

|

6.2

|

|

|

Information Technology

|

5.7

|

|

|

Real Estate

|

5.3

|

|

|

Consumer Staples

|

3.0

|

|

|

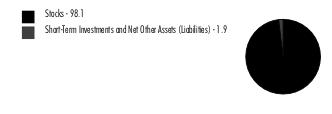

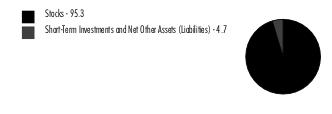

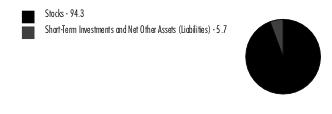

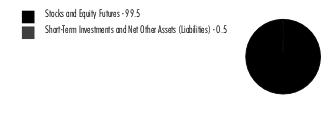

Asset Allocation (% of Fund's net assets)

|

|

|

Foreign investments - 18.8%

|

|

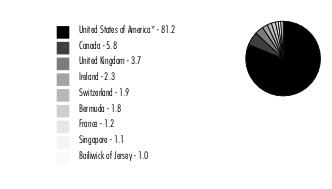

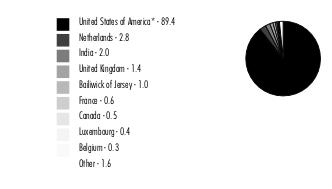

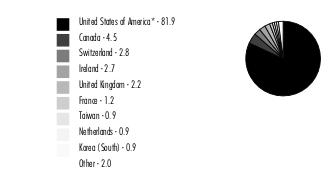

Geographic Diversification (% of Fund's net assets)

|

|

|

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

|

|

Common Stocks - 98.1%

|

|||

|

Shares

|

Value ($)

|

||

|

COMMUNICATION SERVICES - 7.4%

|

|||

|

Interactive Media & Services - 2.6%

|

|||

|

Alphabet, Inc. Class A (a)

|

3,452

|

7,522,806

|

|

|

Meta Platforms, Inc. Class A (a)

|

29,800

|

4,805,250

|

|

|

12,328,056

|

|||

|

Media - 3.0%

|

|||

|

Comcast Corp. Class A

|

85,514

|

3,355,569

|

|

|

Interpublic Group of Companies, Inc.

|

131,777

|

3,627,821

|

|

|

Liberty Broadband Corp. Class C (a)

|

31,500

|

3,642,660

|

|

|

Nexstar Broadcasting Group, Inc. Class A

|

22,300

|

3,632,224

|

|

|

14,258,274

|

|||

|

Wireless Telecommunication Services - 1.8%

|

|||

|

T-Mobile U.S., Inc. (a)

|

66,505

|

8,947,583

|

|

|

TOTAL COMMUNICATION SERVICES

|

35,533,913

|

||

|

CONSUMER DISCRETIONARY - 9.0%

|

|||

|

Auto Components - 1.4%

|

|||

|

Adient PLC (a)

|

113,800

|

3,371,894

|

|

|

Autoliv, Inc.

|

48,100

|

3,442,517

|

|

|

6,814,411

|

|||

|

Diversified Consumer Services - 0.8%

|

|||

|

Adtalem Global Education, Inc. (a)

|

113,939

|

4,098,386

|

|

|

Hotels, Restaurants & Leisure - 1.1%

|

|||

|

Caesars Entertainment, Inc. (a)

|

133,370

|

5,108,071

|

|

|

Household Durables - 1.5%

|

|||

|

Mohawk Industries, Inc. (a)

|

30,219

|

3,749,876

|

|

|

PulteGroup, Inc.

|

89,400

|

3,542,922

|

|

|

7,292,798

|

|||

|

Internet & Direct Marketing Retail - 1.0%

|

|||

|

eBay, Inc.

|

109,962

|

4,582,117

|

|

|

Multiline Retail - 1.0%

|

|||

|

Dollar Tree, Inc. (a)

|

30,433

|

4,742,983

|

|

|

Specialty Retail - 2.2%

|

|||

|

American Eagle Outfitters, Inc.

|

398,600

|

4,456,348

|

|

|

Rent-A-Center, Inc.

|

121,929

|

2,371,519

|

|

|

Victoria's Secret & Co. (a)

|

140,800

|

3,938,176

|

|

|

10,766,043

|

|||

|

TOTAL CONSUMER DISCRETIONARY

|

43,404,809

|

||

|

CONSUMER STAPLES - 3.0%

|

|||

|

Beverages - 0.6%

|

|||

|

Primo Water Corp.

|

227,787

|

3,047,790

|

|

|

Food & Staples Retailing - 1.3%

|

|||

|

U.S. Foods Holding Corp. (a)

|

199,500

|

6,120,660

|

|

|

Food Products - 1.1%

|

|||

|

Darling Ingredients, Inc. (a)

|

91,087

|

5,447,003

|

|

|

TOTAL CONSUMER STAPLES

|

14,615,453

|

||

|

ENERGY - 10.5%

|

|||

|

Energy Equipment & Services - 1.0%

|

|||

|

Halliburton Co.

|

157,400

|

4,936,064

|

|

|

Oil, Gas & Consumable Fuels - 9.5%

|

|||

|

Canadian Natural Resources Ltd.

|

151,045

|

8,116,674

|

|

|

Cenovus Energy, Inc. (Canada)

|

290,218

|

5,521,627

|

|

|

Exxon Mobil Corp.

|

166,102

|

14,224,974

|

|

|

Hess Corp.

|

59,040

|

6,254,698

|

|

|

Imperial Oil Ltd.

|

94,500

|

4,454,832

|

|

|

Tourmaline Oil Corp.

|

138,300

|

7,191,127

|

|

|

Woodside Energy Group Ltd. ADR

|

1

|

22

|

|

|

45,763,954

|

|||

|

TOTAL ENERGY

|

50,700,018

|

||

|

FINANCIALS - 18.0%

|

|||

|

Banks - 4.0%

|

|||

|

First Citizens Bancshares, Inc.

|

7,258

|

4,745,135

|

|

|

M&T Bank Corp.

|

58,411

|

9,310,129

|

|

|

Signature Bank

|

28,600

|

5,125,406

|

|

|

19,180,670

|

|||

|

Capital Markets - 3.6%

|

|||

|

Ameriprise Financial, Inc.

|

24,433

|

5,807,235

|

|

|

Lazard Ltd. Class A

|

127,787

|

4,141,577

|

|

|

LPL Financial

|

39,088

|

7,210,954

|

|

|

17,159,766

|

|||

|

Consumer Finance - 1.9%

|

|||

|

OneMain Holdings, Inc.

|

126,700

|

4,736,046

|

|

|

SLM Corp.

|

268,912

|

4,286,457

|

|

|

9,022,503

|

|||

|

Diversified Financial Services - 2.0%

|

|||

|

Apollo Global Management, Inc.

|

121,296

|

5,880,430

|

|

|

Berkshire Hathaway, Inc. Class B (a)

|

14,200

|

3,876,884

|

|

|

9,757,314

|

|||

|

Insurance - 5.5%

|

|||

|

American Financial Group, Inc.

|

25,090

|

3,482,743

|

|

|

Assurant, Inc.

|

38,488

|

6,652,651

|

|

|

Reinsurance Group of America, Inc.

|

40,000

|

4,691,600

|

|

|

The Travelers Companies, Inc.

|

70,609

|

11,942,100

|

|

|

26,769,094

|

|||

|

Thrifts & Mortgage Finance - 1.0%

|

|||

|

Walker & Dunlop, Inc.

|

49,500

|

4,768,830

|

|

|

TOTAL FINANCIALS

|

86,658,177

|

||

|

HEALTH CARE - 14.0%

|

|||

|

Biotechnology - 0.7%

|

|||

|

United Therapeutics Corp. (a)

|

13,700

|

3,228,268

|

|

|

Health Care Providers & Services - 6.5%

|

|||

|

AdaptHealth Corp. (a)

|

177,200

|

3,196,688

|

|

|

Centene Corp. (a)

|

98,410

|

8,326,470

|

|

|

Cigna Corp.

|

44,638

|

11,763,006

|

|

|

Laboratory Corp. of America Holdings

|

19,738

|

4,625,798

|

|

|

Tenet Healthcare Corp. (a)

|

63,800

|

3,353,328

|

|

|

31,265,290

|

|||

|

Pharmaceuticals - 6.8%

|

|||

|

AstraZeneca PLC sponsored ADR

|

152,280

|

10,061,140

|

|

|

Jazz Pharmaceuticals PLC (a)

|

49,740

|

7,759,937

|

|

|

Roche Holding AG (participation certificate)

|

27,124

|

9,067,549

|

|

|

Sanofi SA sponsored ADR

|

119,463

|

5,976,734

|

|

|

32,865,360

|

|||

|

TOTAL HEALTH CARE

|

67,358,918

|

||

|

INDUSTRIALS - 12.8%

|

|||

|

Aerospace & Defense - 0.9%

|

|||

|

The Boeing Co. (a)

|

31,800

|

4,347,696

|

|

|

Air Freight & Logistics - 1.3%

|

|||

|

FedEx Corp.

|

27,951

|

6,336,771

|

|

|

Building Products - 1.6%

|

|||

|

Builders FirstSource, Inc. (a)

|

82,106

|

4,409,092

|

|

|

Jeld-Wen Holding, Inc. (a)

|

215,800

|

3,148,522

|

|

|

7,557,614

|

|||

|

Commercial Services & Supplies - 0.8%

|

|||

|

The Brink's Co.

|

65,904

|

4,001,032

|

|

|

Construction & Engineering - 0.9%

|

|||

|

Willscot Mobile Mini Holdings (a)

|

138,223

|

4,481,190

|

|

|

Electrical Equipment - 0.8%

|

|||

|

Regal Rexnord Corp.

|

34,400

|

3,905,088

|

|

|

Industrial Conglomerates - 1.1%

|

|||

|

General Electric Co.

|

81,200

|

5,170,004

|

|

|

Machinery - 2.9%

|

|||

|

Allison Transmission Holdings, Inc.

|

62,100

|

2,387,745

|

|

|

Crane Holdings Co.

|

41,813

|

3,661,146

|

|

|

Flowserve Corp.

|

65,806

|

1,884,026

|

|

|

Kennametal, Inc.

|

127,400

|

2,959,502

|

|

|

Timken Co.

|

59,000

|

3,129,950

|

|

|

14,022,369

|

|||

|

Professional Services - 0.8%

|

|||

|

Manpower, Inc.

|

50,000

|

3,820,500

|

|

|

Road & Rail - 0.8%

|

|||

|

XPO Logistics, Inc. (a)

|

80,700

|

3,886,512

|

|

|

Trading Companies & Distributors - 0.9%

|

|||

|

Beacon Roofing Supply, Inc. (a)

|

79,670

|

4,091,851

|

|

|

TOTAL INDUSTRIALS

|

61,620,627

|

||

|

INFORMATION TECHNOLOGY - 5.7%

|

|||

|

Electronic Equipment & Components - 1.1%

|

|||

|

Flex Ltd. (a)

|

367,985

|

5,324,743

|

|

|

IT Services - 3.2%

|

|||

|

Concentrix Corp.

|

29,659

|

4,022,947

|

|

|

Fidelity National Information Services, Inc.

|

61,300

|

5,619,371

|

|

|

SS&C Technologies Holdings, Inc.

|

97,756

|

5,676,691

|

|

|

15,319,009

|

|||

|

Software - 1.4%

|

|||

|

NCR Corp. (a)

|

150,600

|

4,685,166

|

|

|

NortonLifeLock, Inc.

|

106,600

|

2,340,936

|

|

|

7,026,102

|

|||

|

TOTAL INFORMATION TECHNOLOGY

|

27,669,854

|

||

|

MATERIALS - 6.2%

|

|||

|

Chemicals - 2.5%

|

|||

|

Axalta Coating Systems Ltd. (a)

|

202,600

|

4,479,486

|

|

|

Olin Corp.

|

88,227

|

4,083,146

|

|

|

Tronox Holdings PLC

|

218,000

|

3,662,400

|

|

|

12,225,032

|

|||

|

Containers & Packaging - 1.4%

|

|||

|

Berry Global Group, Inc. (a)

|

53,800

|

2,939,632

|

|

|

Crown Holdings, Inc.

|

40,509

|

3,733,715

|

|

|

6,673,347

|

|||

|

Metals & Mining - 2.3%

|

|||

|

Arconic Corp. (a)

|

224,900

|

6,308,445

|

|

|

Glencore Xstrata PLC

|

866,200

|

4,691,717

|

|

|

11,000,162

|

|||

|

TOTAL MATERIALS

|

29,898,541

|

||

|

REAL ESTATE - 5.3%

|

|||

|

Equity Real Estate Investment Trusts (REITs) - 3.1%

|

|||

|

Crown Castle International Corp.

|

16,500

|

2,778,270

|

|

|

CubeSmart

|

113,106

|

4,831,888

|

|

|

Equity Lifestyle Properties, Inc.

|

39,101

|

2,755,447

|

|

|

Ventas, Inc.

|

85,100

|

4,376,693

|

|

|

14,742,298

|

|||

|

Real Estate Management & Development - 2.2%

|

|||

|

Anywhere Real Estate, Inc. (a)

|

82,435

|

810,336

|

|

|

Cushman & Wakefield PLC (a)

|

240,500

|

3,665,220

|

|

|

Jones Lang LaSalle, Inc. (a)

|

20,600

|

3,602,116

|

|

|

WeWork, Inc. (a)(b)

|

519,300

|

2,606,886

|

|

|

10,684,558

|

|||

|

TOTAL REAL ESTATE

|

25,426,856

|

||

|

UTILITIES - 6.2%

|

|||

|

Electric Utilities - 3.6%

|

|||

|

Constellation Energy Corp.

|

60,633

|

3,471,846

|

|

|

Edison International

|

77,181

|

4,880,926

|

|

|

Entergy Corp.

|

40,800

|

4,595,712

|

|

|

PG&E Corp. (a)

|

440,016

|

4,391,360

|

|

|

17,339,844

|

|||

|

Independent Power and Renewable Electricity Producers - 1.9%

|

|||

|

The AES Corp.

|

286,300

|

6,015,163

|

|

|

Vistra Corp.

|

127,000

|

2,901,950

|

|

|

8,917,113

|

|||

|

Multi-Utilities - 0.7%

|

|||

|

Sempra Energy

|

22,700

|

3,411,129

|

|

|

TOTAL UTILITIES

|

29,668,086

|

||

|

TOTAL COMMON STOCKS

(Cost $430,544,930)

|

472,555,252

|

||

|

Money Market Funds - 2.8%

|

|||

|

Shares

|

Value ($)

|

||

|

Fidelity Cash Central Fund 1.58% (c)

|

10,921,548

|

10,923,732

|

|

|

Fidelity Securities Lending Cash Central Fund 1.58% (c)(d)

|

2,725,683

|

2,725,956

|

|

|

TOTAL MONEY MARKET FUNDS

(Cost $13,649,688)

|

13,649,688

|

||

|

TOTAL INVESTMENT IN SECURITIES - 100.9%

(Cost $444,194,618)

|

486,204,940

|

|

NET OTHER ASSETS (LIABILITIES) - (0.9)%

|

(4,356,065)

|

|

NET ASSETS - 100.0%

|

481,848,875

|

|

(a)

|

Non-income producing

|

|

(b)

|

Security or a portion of the security is on loan at period end.

|

|

(c)

|

Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

|

|

(d)

|

Investment made with cash collateral received from securities on loan.

|

|

Affiliate

|

Value,

beginning

of period ($)

|

Purchases ($)

|

Sales

Proceeds ($)

|

Dividend

Income ($)

|

Realized

Gain (loss) ($)

|

Change in

Unrealized

appreciation

(depreciation) ($)

|

Value,

end

of period ($)

|

%ownership,

end

of period

|

|

Fidelity Cash Central Fund 1.58%

|

3,889,486

|

114,316,912

|

107,282,666

|

29,113

|

-

|

-

|

10,923,732

|

0.0%

|

|

Fidelity Securities Lending Cash Central Fund 1.58%

|

14,027,163

|

79,737,265

|

91,038,472

|

48,101

|

-

|

-

|

2,725,956

|

0.0%

|

|

Total

|

17,916,649

|

194,054,177

|

198,321,138

|

77,214

|

-

|

-

|

13,649,688

|

|

Valuation Inputs at Reporting Date:

|

||||

|

Description

|

Total ($)

|

Level 1 ($)

|

Level 2 ($)

|

Level 3 ($)

|

|

Investments in Securities:

|

||||

|

Equities:

|

||||

|

Communication Services

|

35,533,913

|

35,533,913

|

-

|

-

|

|

Consumer Discretionary

|

43,404,809

|

43,404,809

|

-

|

-

|

|

Consumer Staples

|

14,615,453

|

14,615,453

|

-

|

-

|

|

Energy

|

50,700,018

|

50,700,018

|

-

|

-

|

|

Financials

|

86,658,177

|

86,658,177

|

-

|

-

|

|

Health Care

|

67,358,918

|

58,291,369

|

9,067,549

|

-

|

|

Industrials

|

61,620,627

|

61,620,627

|

-

|

-

|

|

Information Technology

|

27,669,854

|

27,669,854

|

-

|

-

|

|

Materials

|

29,898,541

|

25,206,824

|

4,691,717

|

-

|

|

Real Estate

|

25,426,856

|

25,426,856

|

-

|

-

|

|

Utilities

|

29,668,086

|

29,668,086

|

-

|

-

|

|

Money Market Funds

|

13,649,688

|

13,649,688

|

-

|

-

|

|

Total Investments in Securities:

|

486,204,940

|

472,445,674

|

13,759,266

|

-

|

|

Statement of Assets and Liabilities

|

||||

|

June 30, 2022

(Unaudited)

|

||||

|

Assets

|

||||

|

Investment in securities, at value (including securities loaned of $2,606,384) - See accompanying schedule:

|

$472,555,252

|

|||

|

Unaffiliated issuers (cost $430,544,930)

|

||||

|

Fidelity Central Funds (cost $13,649,688)

|

13,649,688

|

|||

|

Total Investment in Securities (cost $444,194,618)

|

$

|

486,204,940

|

||

|

Cash

|

21,108

|

|||

|

Foreign currency held at value (cost $39,396)

|

39,396

|

|||

|

Receivable for investments sold

|

2,558,092

|

|||

|

Receivable for fund shares sold

|

1,092,186

|

|||

|

Dividends receivable

|

543,339

|

|||

|

Distributions receivable from Fidelity Central Funds

|

44,181

|

|||

|

Total assets

|

490,503,242

|

|||

|

Liabilities

|

||||

|

Payable for investments purchased

|

$5,033,016

|

|||

|

Payable for fund shares redeemed

|

573,087

|

|||

|

Accrued management fee

|

221,320

|

|||

|

Distribution and service plan fees payable

|

7,296

|

|||

|

Other affiliated payables

|

62,111

|

|||

|

Other payables and accrued expenses

|

31,737

|

|||

|

Collateral on securities loaned

|

2,725,800

|

|||

|

Total Liabilities

|

8,654,367

|

|||

|

Net Assets

|

$

|

481,848,875

|

||

|

Net Assets consist of:

|

||||

|

Paid in capital

|

$

|

424,034,583

|

||

|

Total accumulated earnings (loss)

|

57,814,292

|

|||

|

Net Assets

|

$

|

481,848,875

|

||

|

Net Asset Value and Maximum Offering Price

|

||||

|

Initial Class :

|

||||

|

Net Asset Value

, offering price and redemption price per share ($132,420,117 ÷ 8,052,474 shares)

|

$

|

16.44

|

||

|

Service Class :

|

||||

|

Net Asset Value

, offering price and redemption price per share ($305,087 ÷ 18,558 shares)

|

$

|

16.44

|

||

|

Service Class 2 :

|

||||

|

Net Asset Value

, offering price and redemption price per share ($34,775,911 ÷ 2,158,792 shares)

|

$

|

16.11

|

||

|

Investor Class :

|

||||

|

Net Asset Value

, offering price and redemption price per share ($314,347,760 ÷ 19,170,491 shares)

|

$

|

16.40

|

||

|

Statement of Operations

|

||||

|

Six months ended

June 30, 2022

(Unaudited)

|

||||

|

Investment Income

|

||||

|

Dividends

|

$

|

3,554,585

|

||

|

Non-Cash dividends

|

396,497

|

|||

|

Income from Fidelity Central Funds (including $48,101 from security lending)

|

77,214

|

|||

|

Total Income

|

4,028,296

|

|||

|

Expenses

|

||||

|

Management fee

|

$

|

1,319,616

|

||

|

Transfer agent fees

|

275,575

|

|||

|

Distribution and service plan fees

|

36,865

|

|||

|

Accounting fees

|

95,825

|

|||

|

Custodian fees and expenses

|

8,925

|

|||

|

Independent trustees' fees and expenses

|

829

|

|||

|

Audit

|

27,028

|

|||

|

Legal

|

1,737

|

|||

|

Miscellaneous

|

851

|

|||

|

Total expenses before reductions

|

1,767,251

|

|||

|

Expense reductions

|

(7,122)

|

|||

|

Total expenses after reductions

|

1,760,129

|

|||

|

Net Investment income (loss)

|

2,268,167

|

|||

|

Realized and Unrealized Gain (Loss)

|

||||

|

Net realized gain (loss) on:

|

||||

|

Investment Securities:

|

||||

|

Unaffiliated issuers

|

14,764,747

|

|||

|

Foreign currency transactions

|

25,278

|

|||

|

Total net realized gain (loss)

|

14,790,025

|

|||

|

Change in net unrealized appreciation (depreciation) on:

|

||||

|

Investment Securities:

|

||||

|

Unaffiliated issuers

|

(65,044,575)

|

|||

|

Assets and liabilities in foreign currencies

|

(11,856)

|

|||

|

Total change in net unrealized appreciation (depreciation)

|

(65,056,431)

|

|||

|

Net gain (loss)

|

(50,266,406)

|

|||

|

Net increase (decrease) in net assets resulting from operations

|

$

|

(47,998,239)

|

||

|

Statement of Changes in Net Assets

|

||||

|

Six months ended

June 30, 2022

(Unaudited)

|

Year ended

December 31, 2021

|

|||

|

Increase (Decrease) in Net Assets

|

||||

|

Operations

|

||||

|

Net investment income (loss)

|

$

|

2,268,167

|

$

|

6,779,873

|

|

Net realized gain (loss)

|

14,790,025

|

62,491,051

|

||

|

Change in net unrealized appreciation (depreciation)

|

(65,056,431)

|

34,951,052

|

||

|

Net increase (decrease) in net assets resulting from operations

|

(47,998,239)

|

104,221,976

|

||

|

Distributions to shareholders

|

(6,404,580)

|

(57,416,733)

|

||

|

Share transactions - net increase (decrease)

|

59,085,667

|

98,615,092

|

||

|

Total increase (decrease) in net assets

|

4,682,848

|

145,420,335

|

||

|

Net Assets

|

||||

|

Beginning of period

|

477,166,027

|

331,745,692

|

||

|

End of period

|

$

|

481,848,875

|

$

|

477,166,027

|

|

Value Portfolio Initial Class

|

|

Six months ended

(Unaudited) June 30, 2022

|

Years ended December 31, 2021

|

2020

|

2019

|

2018

|

2017

|

|||||||

|

Selected Per-Share Data

|

||||||||||||

|

Net asset value, beginning of period

|

$

|

18.28

|

$

|

15.96

|

$

|

15.78

|

$

|

13.08

|

$

|

16.36

|

$

|

14.74

|

|

Income from Investment Operations

|

||||||||||||

|

Net investment income (loss)

A,B

|

.09

|

.31

|

.19

|

.26

|

.21

|

.21

C

|

||||||

|

Net realized and unrealized gain (loss)

|

(1.69)

|

4.41

|

.75

|

3.74

|

(2.41)

|

2.07

|

||||||

|

Total from investment operations

|

(1.60)

|

4.72

|

.94

|

4.00

|

(2.20)

|

2.28

|

||||||

|

Distributions from net investment income

|

-

|

(.32)

|

(.20)

|

(.27)

|

(.18)

|

(.21)

|

||||||

|

Distributions from net realized gain

|

(.24)

|

(2.07)

|

(.56)

|

(1.03)

|

(.90)

|

(.45)

|

||||||

|

Total distributions

|

(.24)

|

(2.40)

D

|

(.76)

|

(1.30)

|

(1.08)

|

(.66)

|

||||||

|

Net asset value, end of period

|

$

|

16.44

|

$

|

18.28

|

$

|

15.96

|

$

|

15.78

|

$

|

13.08

|

$

|

16.36

|

|

Total Return

E,F,G

|

(8.88)%

|

30.07%

|

6.33%

|

32.13%

|

(13.84)%

|

15.58%

|

||||||

|

Ratios to Average Net Assets

B,H,I

|

||||||||||||

|

Expenses before reductions

|

.64%

J

|

.64%

|

.67%

|

.67%

|

.67%

|

.68%

|

||||||

|

Expenses net of fee waivers, if any

|

.64%

J

|

.64%

|

.67%

|

.67%

|

.67%

|

.68%

|

||||||

|

Expenses net of all reductions

|

.64%

J

|

.64%

|

.65%

|

.66%

|

.66%

|

.67%

|

||||||

|

Net investment income (loss)

|

.97%

J

|

1.62%

|

1.48%

|

1.78%

|

1.36%

|

1.34%

C

|

||||||

|

Supplemental Data

|

||||||||||||

|

Net assets, end of period (000 omitted)

|

$

|

132,420

|

$

|

159,917

|

$

|

131,037

|

$

|

116,401

|

$

|

110,203

|

$

|

130,365

|

|

Portfolio turnover rate

K

|

63%

J

|

68%

|

81%

|

67%

|

64%

|

55%

|

|

Value Portfolio Service Class

|

|

Six months ended

(Unaudited) June 30, 2022

|

Years ended December 31, 2021

|

2020

|

2019

|

2018

|

2017

|

|||||||

|

Selected Per-Share Data

|

||||||||||||

|

Net asset value, beginning of period

|

$

|

18.28

|

$

|

15.96

|

$

|

15.78

|

$

|

13.08

|

$

|

16.36

|

$

|

14.73

|

|

Income from Investment Operations

|

||||||||||||

|

Net investment income (loss)

A,B

|

.08

|

.29

|

.18

|

.24

|

.20

|

.19

C

|

||||||

|

Net realized and unrealized gain (loss)

|

(1.68)

|

4.40

|

.75

|

3.75

|

(2.42)

|

2.08

|

||||||

|

Total from investment operations

|

(1.60)

|

4.69

|

.93

|

3.99

|

(2.22)

|

2.27

|

||||||

|

Distributions from net investment income

|

-

|

(.30)

|

(.19)

|

(.25)

|

(.15)

|

(.20)

|

||||||

|

Distributions from net realized gain

|

(.24)

|

(2.07)

|

(.56)

|

(1.03)

|

(.90)

|

(.45)

|

||||||

|

Total distributions

|

(.24)

|

(2.37)

|

(.75)

|

(1.29)

D

|

(1.06)

D

|

(.64)

D

|

||||||

|

Net asset value, end of period

|

$

|

16.44

|

$

|

18.28

|

$

|

15.96

|

$

|

15.78

|

$

|

13.08

|

$

|

16.36

|

|

Total Return

E,F,G

|

(8.88)%

|

29.92%

|

6.23%

|

32.01%

|

(13.97)%

|

15.53%

|

||||||

|

Ratios to Average Net Assets

B,H,I

|

||||||||||||

|

Expenses before reductions

|

.74%

J

|

.74%

|

.77%

|

.77%

|

.77%

|

.78%

|

||||||

|

Expenses net of fee waivers, if any

|

.74%

J

|

.74%

|

.77%

|

.77%

|

.77%

|

.78%

|

||||||

|

Expenses net of all reductions

|

.74%

J

|

.74%

|

.75%

|

.76%

|

.76%

|

.77%

|

||||||

|

Net investment income (loss)

|

.87%

J

|

1.52%

|

1.38%

|

1.68%

|

1.26%

|

1.24%

C

|

||||||

|

Supplemental Data

|

||||||||||||

|

Net assets, end of period (000 omitted)

|

$

|

305

|

$

|

337

|

$

|

275

|

$

|

270

|

$

|

233

|

$

|

368

|

|

Portfolio turnover rate

K

|

63%

J

|

68%

|

81%

|

67%

|

64%

|

55%

|

|

Value Portfolio Service Class 2

|

|

Six months ended

(Unaudited) June 30, 2022

|

Years ended December 31, 2021

|

2020

|

2019

|

2018

|

2017

|

|||||||

|

Selected Per-Share Data

|

||||||||||||

|

Net asset value, beginning of period

|

$

|

17.93

|

$

|

15.70

|

$

|

15.55

|

$

|

12.91

|

$

|

16.15

|

$

|

14.55

|

|

Income from Investment Operations

|

||||||||||||

|

Net investment income (loss)

A,B

|

.06

|

.26

|

.16

|

.22

|

.17

|

.17

C

|

||||||

|

Net realized and unrealized gain (loss)

|

(1.64)

|

4.33

|

.72

|

3.68

|

(2.37)

|

2.05

|

||||||

|

Total from investment operations

|

(1.58)

|

4.59

|

.88

|

3.90

|

(2.20)

|

2.22

|

||||||

|

Distributions from net investment income

|

-

|

(.28)

|

(.17)

|

(.23)

|

(.14)

|

(.17)

|

||||||

|

Distributions from net realized gain

|

(.24)

|

(2.07)

|

(.56)

|

(1.03)

|

(.90)

|

(.45)

|

||||||

|

Total distributions

|

(.24)

|

(2.36)

D

|

(.73)

|

(1.26)

|

(1.04)

|

(.62)

|

||||||

|

Net asset value, end of period

|

$

|

16.11

|

$

|

17.93

|

$

|

15.70

|

$

|

15.55

|

$

|

12.91

|

$

|

16.15

|

|

Total Return

E,F,G

|

(8.94)%

|

29.72%

|

6.02%

|

31.77%

|

(14.02)%

|

15.36%

|

||||||

|

Ratios to Average Net Assets

B,H,I

|

||||||||||||

|

Expenses before reductions

|

.89%

J

|

.89%

|

.92%

|

.92%

|

.92%

|

.93%

|

||||||

|

Expenses net of fee waivers, if any

|

.89%

J

|

.89%

|

.92%

|

.92%

|

.92%

|

.93%

|

||||||

|

Expenses net of all reductions

|

.89%

J

|

.89%

|

.91%

|

.91%

|

.91%

|

.92%

|

||||||

|

Net investment income (loss)

|

.72%

J

|

1.37%

|

1.22%

|

1.53%

|

1.11%

|

1.09%

C

|

||||||

|

Supplemental Data

|

||||||||||||

|

Net assets, end of period (000 omitted)

|

$

|

34,776

|

$

|

26,890

|

$

|

10,204

|

$

|

9,262

|

$

|

7,764

|

$

|

9,474

|

|

Portfolio turnover rate

K

|

63%

J

|

68%

|

81%

|

67%

|

64%

|

55%

|

|

Value Portfolio Investor Class

|

|

Six months ended

(Unaudited) June 30, 2022

|

Years ended December 31, 2021

|

2020

|

2019

|

2018

|

2017

|

|||||||

|

Selected Per-Share Data

|

||||||||||||

|

Net asset value, beginning of period

|

$

|

18.23

|

$

|

15.92

|

$

|

15.75

|

$

|

13.06

|

$

|

16.33

|

$

|

14.71

|

|

Income from Investment Operations

|

||||||||||||

|

Net investment income (loss)

A,B

|

.08

|

.29

|

.18

|

.25

|

.20

|

.20

C

|

||||||

|

Net realized and unrealized gain (loss)

|

(1.67)

|

4.40

|

.74

|

3.73

|

(2.40)

|

2.07

|

||||||

|

Total from investment operations

|

(1.59)

|

4.69

|

.92

|

3.98

|

(2.20)

|

2.27

|

||||||

|

Distributions from net investment income

|

-

|

(.31)

|

(.19)

|

(.26)

|

(.16)

|

(.20)

|

||||||

|

Distributions from net realized gain

|

(.24)

|

(2.07)

|

(.56)

|

(1.03)

|

(.90)

|

(.45)

|

||||||

|

Total distributions

|

(.24)

|

(2.38)

|

(.75)

|

(1.29)

|

(1.07)

D

|

(.65)

|

||||||

|

Net asset value, end of period

|

$

|

16.40

|

$

|

18.23

|

$

|

15.92

|

$

|

15.75

|

$

|

13.06

|

$

|

16.33

|

|

Total Return

E,F,G

|

(8.85)%

|

29.98%

|

6.20%

|

32.01%

|

(13.88)%

|

15.52%

|

||||||

|

Ratios to Average Net Assets

B,H,I

|

||||||||||||

|

Expenses before reductions

|

.72%

J

|

.72%

|

.74%

|

.75%

|

.75%

|

.76%

|

||||||

|

Expenses net of fee waivers, if any

|

.71%

J

|

.72%

|

.74%

|

.75%

|

.75%

|

.76%

|

||||||

|

Expenses net of all reductions

|

.71%

J

|

.72%

|

.73%

|

.74%

|

.74%

|

.75%

|

||||||

|

Net investment income (loss)

|

.89%

J

|

1.55%

|

1.40%

|

1.70%

|

1.28%

|

1.26%

C

|

||||||

|

Supplemental Data

|

||||||||||||

|

Net assets, end of period (000 omitted)

|

$

|

314,348

|

$

|

290,021

|

$

|

190,229

|

$

|

197,903

|

$

|

170,228

|

$

|

204,443

|

|

Portfolio turnover rate

K

|

63%

J

|

68%

|

81%

|

67%

|

64%

|

55%

|

|

Fidelity Central Fund

|

Investment Manager

|

Investment Objective

|

Investment Practices

|

Expense Ratio

A

|

|

Fidelity Money Market Central Funds

|

Fidelity Management & Research Company LLC (FMR)

|

Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity.

|

Short-term Investments

|

Less than .005%

|

|

Dividend Income

|

Net Unrealized Appreciation (Depreciation)

|

|

|

VIP Value Portfolio

|

$(1,209,983)

|

$1,209,983

|

|

Gross unrealized appreciation

|

$79,080,101

|

|

Gross unrealized depreciation

|

(37,731,104)

|

|

Net unrealized appreciation (depreciation)

|

$41,348,997

|

|

Tax cost

|

$444,855,943

|

|

Purchases ($)

|

Sales ($)

|

|

|

VIP Value Portfolio

|

197,600,916

|

154,316,990

|

|

Service Class

|

$160

|

|

Service Class 2

|

36,705

|

|

$36,865

|

|

Amount

|

% of Class-Level Average Net Assets

A

|

|

|

Initial Class

|

$47,027

|

.06

|

|

Service Class

|

99

|

.06

|

|

Service Class 2

|

9,116

|

.06

|

|

Investor Class

|

219,333

|

.14

|

|

$275,575

|

|

% of Average Net Assets

|

|

|

VIP Value Portfolio

|

.04

|

|

Amount

|

|

|

VIP Value Portfolio

|

$4,160

|

|

Purchases ($)

|

Sales ($)

|

Realized Gain (Loss) ($)

|

|

|

VIP Value Portfolio

|

30,771,624

|

23,054,155

|

2,008,947

|

|

Amount

|

|

|

VIP Value Portfolio

|

$394

|

|

Total Security Lending Fees Paid to NFS

|

Security Lending Income From Securities Loaned to NFS

|

Value of Securities Loaned to NFS at Period End

|

|

|

VIP Value Portfolio

|

$5,253

|

$-

|

$-

|

|

Six months ended

June 30, 2022

|

Year ended

December 31, 2021

|

|

|

VIP Value Portfolio

|

||

|

Distributions to shareholders

|

||

|

Initial Class

|

$2,057,790

|

$19,591,894

|

|

Service Class

|

4,350

|

40,837

|

|

Service Class 2

|

346,323

|

3,281,098

|

|

Investor Class

|

3,996,117

|

34,502,904

|

|

Total

|

$6,404,580

|

$57,416,733

|

|

Shares

|

Shares

|

Dollars

|

Dollars

|

|

|

Six months ended June 30, 2022

|

Year ended December 31, 2021

|

Six months ended June 30, 2022

|

Year ended December 31, 2021

|

|

|

VIP Value Portfolio

|

||||

|

Initial Class

|

||||

|

Shares sold

|

2,943,478

|

2,560,940

|

$52,678,472

|

$47,739,910

|

|

Reinvestment of distributions

|

115,223

|

1,074,650

|

2,057,790

|

19,591,894

|

|

Shares redeemed

|

(3,755,033)

|

(3,099,696)

|

(66,710,606)

|

(57,424,040)

|

|

Net increase (decrease).

|

(696,332)

|

535,894

|

$(11,974,344)

|

$9,907,764

|

|

Service Class

|

||||

|

Shares sold

|

13,984

|

-

|

$239,677

|

$-

|

|

Reinvestment of distributions

|

183

|

1,642

|

3,266

|

29,932

|

|

Shares redeemed

|

(14,053)

|

(449)

|

(247,344)

|

(8,891)

|

|

Net increase (decrease).

|

114

|

1,193

|

$(4,401)

|

$21,041

|

|

Service Class 2

|

||||

|

Shares sold

|

1,288,423

|

1,266,412

|

$22,045,693

|

$23,516,757

|

|

Reinvestment of distributions

|

19,767

|

183,243

|

346,323

|

3,281,098

|

|

Shares redeemed

|

(648,808)

|

(600,350)

|

(10,951,770)

|

(11,324,848)

|

|

Net increase (decrease).

|

659,382

|

849,305

|

$11,440,246

|

$15,473,007

|

|

Investor Class

|

||||

|

Shares sold

|

4,595,798

|

5,101,753

|

$82,975,889

|

$96,130,989

|

|

Reinvestment of distributions

|

224,254

|

1,896,770

|

3,996,117

|

34,502,904

|

|

Shares redeemed

|

(1,555,420)

|

(3,041,764)

|

(27,347,840)

|

(57,420,613)

|

|

Net increase (decrease).

|

3,264,632

|

3,956,759

|

$59,624,166

|

$73,213,280

|

|

Fund

|

Affiliated %

|

|

VIP Value Portfolio

|

64%

|

|

Fund

|

% of shares held

|

|

VIP Value Portfolio

|

27%

|

|

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2022 to June 30, 2022).

|

|

Annualized Expense Ratio-

A

|

Beginning Account Value January 1, 2022

|

Ending Account Value June 30, 2022

|

Expenses Paid During Period-

C

January 1, 2022 to June 30, 2022

|

|||||||

|

Value Portfolio

|

||||||||||

|

Initial Class

|

.64%

|

|||||||||

|

Actual

|

$ 1,000

|

$ 911.20

|

$ 3.03

|

|||||||

|

Hypothetical-

B

|

$ 1,000

|

$ 1,021.62

|

$ 3.21

|

|||||||

|

Service Class

|

.74%

|

|||||||||

|

Actual

|

$ 1,000

|

$ 911.20

|

$ 3.51

|

|||||||

|

Hypothetical-

B

|

$ 1,000

|

$ 1,021.12

|

$ 3.71

|

|||||||

|

Service Class 2

|

.89%

|

|||||||||

|

Actual

|

$ 1,000

|

$ 910.60

|

$ 4.22

|

|||||||

|

Hypothetical-

B

|

$ 1,000

|

$ 1,020.38

|

$ 4.46

|

|||||||

|

Investor Class

|

.71%

|

|||||||||

|

Actual

|

$ 1,000

|

$ 911.50

|

$ 3.37

|

|||||||

|

Hypothetical-

B

|

$ 1,000

|

$ 1,021.27

|

$ 3.56

|

|||||||

|

Contents

| Board Approval of Investment Advisory Contracts and Management Fees |

|

Top Holdings (% of Fund's net assets)

|

||

|

Nestle SA (Reg. S) (Switzerland, Food Products)

|

3.5

|

|

|

Roche Holding AG (participation certificate) (Switzerland, Pharmaceuticals)

|

2.7

|

|

|

LVMH Moet Hennessy Louis Vuitton SE (France, Textiles, Apparel & Luxury Goods)

|

2.6

|

|

|

ASML Holding NV (Netherlands) (Netherlands, Semiconductors & Semiconductor Equipment)

|

2.4

|

|

|

TotalEnergies SE (France, Oil, Gas & Consumable Fuels)

|

2.2

|

|

|

AIA Group Ltd. (Hong Kong, Insurance)

|

2.2

|

|

|

Diageo PLC (United Kingdom, Beverages)

|

2.1

|

|

|

Sony Group Corp. (Japan, Household Durables)

|

1.6

|

|

|

Wolters Kluwer NV (Netherlands, Professional Services)

|

1.6

|

|

|

Compass Group PLC (United Kingdom, Hotels, Restaurants & Leisure)

|

1.5

|

|

|

22.4

|

||

|

Market Sectors (% of Fund's net assets)

|

||

|

Industrials

|

21.2

|

|

|

Financials

|

20.8

|

|

|

Information Technology

|

14.8

|

|

|

Health Care

|

13.1

|

|

|

Consumer Discretionary

|

9.7

|

|

|

Consumer Staples

|

7.0

|

|

|

Materials

|

4.4

|

|

|

Energy

|

2.2

|

|

|

Real Estate

|

1.2

|

|

|

Communication Services

|

0.9

|

|

|

Asset Allocation (% of Fund's net assets)

|

|

|

Foreign investments - 88.6%

|

|

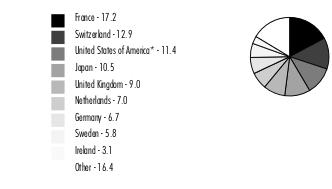

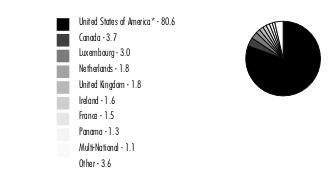

Geographic Diversification (% of Fund's net assets)

|

|

|

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

|

|

Common Stocks - 95.2%

|

|||

|

Shares

|

Value ($)

|

||

|

Bailiwick of Jersey - 1.3%

|

|||

|

Ferguson PLC

|

154,100

|

17,235,395

|

|

|

JTC PLC (a)

|

514,500

|

3,695,175

|

|

|

TOTAL BAILIWICK OF JERSEY

|

20,930,570

|

||

|

Belgium - 1.0%

|

|||

|

Azelis Group NV

|

105,900

|

2,317,219

|

|

|

KBC Group NV

|

230,099

|

12,945,597

|

|

|

TOTAL BELGIUM

|

15,262,816

|

||

|

Bermuda - 0.4%

|

|||

|

Hiscox Ltd.

|

595,251

|

6,828,621

|

|

|

Canada - 1.5%

|

|||

|

Constellation Software, Inc.

|

14,795

|

21,963,426

|

|

|

Topicus.Com, Inc. (b)

|

23,814

|

1,343,700

|

|

|

TOTAL CANADA

|

23,307,126

|

||

|

Cayman Islands - 0.4%

|

|||

|

Parade Technologies Ltd.

|

159,000

|

6,150,974

|

|

|

Denmark - 1.7%

|

|||

|

DSV A/S

|

160,872

|

22,621,390

|

|

|

GN Store Nord A/S

|

138,243

|

4,844,071

|

|

|

TOTAL DENMARK

|

27,465,461

|

||

|

Finland - 0.9%

|

|||

|

Nordea Bank ABP

|

1,567,303

|

13,788,926

|

|

|

France - 17.2%

|

|||

|

Air Liquide SA (c)

|

144,320

|

19,425,882

|

|

|

ALTEN

|

111,181

|

12,093,959

|

|

|

Antin Infrastructure Partners SA

|

40,800

|

962,873

|

|

|

BNP Paribas SA

|

392,100

|

18,754,917

|

|

|

Capgemini SA

|

129,265

|

22,141,469

|

|

|

Dassault Systemes SA

|

79,880

|

2,958,825

|

|

|

Edenred SA

|

429,442

|

20,238,017

|

|

|

EssilorLuxottica SA (c)

|

133,194

|

19,946,075

|

|

|

Legrand SA

|

255,500

|

18,970,494

|

|

|

LVMH Moet Hennessy Louis Vuitton SE

|

66,130

|

40,529,625

|

|

|

Pernod Ricard SA

|

117,842

|

21,648,239

|

|

|

Safran SA

|

167,600

|

16,687,179

|

|

|

Teleperformance

|

74,924

|

23,028,920

|

|

|

TotalEnergies SE (c)

|

669,512

|

35,241,082

|

|

|

TOTAL FRANCE

|

272,627,556

|

||

|

Germany - 6.7%

|

|||

|

Allianz SE

|

109,586

|

21,008,766

|

|

|

Brenntag SE

|

193,700

|

12,683,133

|

|

|

Deutsche Borse AG

|

110,572

|

18,567,998

|

|

|

Hannover Reuck SE

|

104,125

|

15,112,814

|

|

|

Merck KGaA

|

132,000

|

22,390,014

|

|

|

Siemens Healthineers AG (a)

|

330,400

|

16,845,893

|

|

|

TOTAL GERMANY

|

106,608,618

|

||

|

Hong Kong - 2.2%

|

|||

|

AIA Group Ltd.

|

3,140,400

|

34,313,800

|

|

|

Chervon Holdings Ltd.

|

137,100

|

770,519

|

|

|

TOTAL HONG KONG

|

35,084,319

|

||

|

India - 1.0%

|

|||

|

HDFC Bank Ltd.

|

927,691

|

15,892,032

|

|

|

Ireland - 3.1%

|

|||

|

Flutter Entertainment PLC (b)

|

51,790

|

5,197,345

|

|

|

ICON PLC (b)

|

69,800

|

15,125,660

|

|

|

Kingspan Group PLC (Ireland)

|

201,600

|

12,126,710

|

|

|

Linde PLC

|

58,768

|

16,897,563

|

|

|

TOTAL IRELAND

|

49,347,278

|

||

|

Italy - 2.4%

|

|||

|

FinecoBank SpA

|

1,017,699

|

12,179,403

|

|

|

GVS SpA (a)

|

109,736

|

894,683

|

|

|

Moncler SpA

|

229,000

|

9,822,404

|

|

|

Recordati SpA

|

360,119

|

15,665,322

|

|

|

TOTAL ITALY

|

38,561,812

|

||

|

Japan - 10.5%

|

|||

|

Capcom Co. Ltd.

|

204,900

|

4,976,013

|

|

|

FUJIFILM Holdings Corp.

|

239,200

|

12,852,561

|

|

|

Hoya Corp.

|

223,811

|

19,110,042

|

|

|

Iriso Electronics Co. Ltd.

|

97,729

|

2,315,734

|

|

|

Misumi Group, Inc.

|

339,360

|

7,153,373

|

|

|

NOF Corp.

|

183,411

|

6,799,509

|

|

|

Olympus Corp.

|

695,888

|

14,102,305

|

|

|

Persol Holdings Co. Ltd.

|

468,603

|

8,516,915

|

|

|

Recruit Holdings Co. Ltd.

|

417,171

|

12,285,871

|

|

|

Relo Group, Inc.

|

367,574

|

5,924,855

|

|

|

SMC Corp.

|

31,085

|

13,837,163

|

|

|

Sony Group Corp.

|

314,333

|

25,635,987

|

|

|

Suzuki Motor Corp.

|

220,276

|

6,925,021

|

|

|

TIS, Inc.

|

330,374

|

8,656,247

|

|

|

Tokyo Electron Ltd.

|

49,832

|

16,264,833

|

|

|

TOTAL JAPAN

|

165,356,429

|

||

|

Kenya - 0.3%

|

|||

|

Safaricom Ltd.

|

19,349,700

|

4,094,784

|

|

|

Luxembourg - 0.9%

|

|||

|

Eurofins Scientific SA

|

177,100

|

13,934,243

|

|

|

Netherlands - 7.0%

|

|||

|

Akzo Nobel NV

|

89,800

|

5,872,732

|

|

|

ASM International NV (Netherlands)

|

49,100

|

12,277,007

|

|

|

ASML Holding NV (Netherlands)

|

79,039

|

37,341,022

|

|

|

Euronext NV (a)

|

137,289

|

11,207,629

|

|

|

IMCD NV

|

133,726

|

18,351,092

|

|

|

Wolters Kluwer NV

|

260,417

|

25,259,994

|

|

|

TOTAL NETHERLANDS

|

110,309,476

|

||

|

Spain - 1.4%

|

|||

|

Amadeus IT Holding SA Class A (b)

|

320,007

|

17,918,524

|

|

|

Cellnex Telecom SA (a)

|

102,455

|

3,975,827

|

|

|

TOTAL SPAIN

|

21,894,351

|

||

|

Sweden - 5.7%

|

|||

|

Addlife AB

|

541,224

|

8,126,494

|

|

|

AddTech AB (B Shares)

|

748,409

|

9,759,550

|

|

|

ASSA ABLOY AB (B Shares)

|

840,056

|

17,926,834

|

|

|

Atlas Copco AB (A Shares)

|

1,570,476

|

14,699,727

|

|

|

Hexagon AB (B Shares)

|

1,755,294

|

18,341,163

|

|

|

Indutrade AB

|

877,841

|

16,008,332

|

|

|

Kry International AB (b)(d)(e)

|

587

|

136,243

|

|

|

Nordnet AB

|

347,100

|

4,536,501

|

|

|

TOTAL SWEDEN

|

89,534,844

|

||

|

Switzerland - 12.9%

|

|||

|

Compagnie Financiere Richemont SA Series A

|

167,810

|

18,050,178

|

|

|

Julius Baer Group Ltd.

|

270,275

|

12,538,080

|

|

|

Lonza Group AG

|

3,674

|

1,962,421

|

|

|

Nestle SA (Reg. S)

|

476,135

|

55,647,213

|

|

|

Partners Group Holding AG

|

13,100

|

11,803,928

|

|

|

Roche Holding AG (participation certificate)

|

126,091

|

42,152,202

|

|

|

Sika AG

|

90,344

|

20,854,763

|

|

|

Sonova Holding AG

|

58,074

|

18,493,161

|

|

|

Zurich Insurance Group Ltd.

|

51,630

|

22,514,471

|

|

|

TOTAL SWITZERLAND

|

204,016,417

|

||

|

Taiwan - 1.0%

|

|||

|

Taiwan Semiconductor Manufacturing Co. Ltd.

|

986,600

|

15,815,057

|

|

|

United Kingdom - 9.0%

|

|||

|

Beazley PLC

|

903,392

|

5,487,498

|

|

|

Bridgepoint Group Holdings Ltd. (a)

|

782,300

|

2,300,742

|

|

|

Compass Group PLC

|

1,184,039

|

24,309,968

|

|

|

Dechra Pharmaceuticals PLC

|

212,135

|

8,929,660

|

|

|

Diageo PLC

|

762,422

|

32,931,078

|

|

|

Diploma PLC

|

305,335

|

8,281,126

|

|

|

Dr. Martens Ltd.

|

166,800

|

482,030

|

|

|

RELX PLC (London Stock Exchange)

|

889,948

|

24,163,299

|

|

|

Rentokil Initial PLC

|

2,699,789

|

15,597,507

|

|

|

Smith & Nephew PLC

|

306,336

|

4,284,043

|

|

|

St. James's Place PLC

|

724,000

|

9,716,610

|

|

|

Volution Group PLC

|

1,405,597

|

5,757,627

|

|

|

TOTAL UNITED KINGDOM

|

142,241,188

|

||

|

United States of America - 6.7%

|

|||

|

Ares Management Corp.

|

173,165

|

9,846,162

|

|

|

CBRE Group, Inc. (b)

|

173,100

|

12,741,891

|

|

|

Equifax, Inc.

|

69,600

|

12,721,488

|

|

|

Intercontinental Exchange, Inc.

|

132,251

|

12,436,884

|

|

|

Marsh & McLennan Companies, Inc.

|

143,376

|

22,259,124

|

|

|

Moody's Corp.

|

46,000

|

12,510,620

|

|

|

Pool Corp.

|

15,500

|

5,444,065

|

|

|

S&P Global, Inc.

|

54,921

|

18,511,672

|

|

|

TOTAL UNITED STATES OF AMERICA

|

106,471,906

|

||

|

TOTAL COMMON STOCKS

(Cost $1,313,200,138)

|

1,505,524,804

|

||

|

Nonconvertible Preferred Stocks - 0.1%

|

|||

|

Shares

|

Value ($)

|

||

|

Sweden - 0.1%

|

|||

|

Kry International AB Series E (b)(d)(e)

(Cost $1,550,731)

|

3,392

|

787,283

|

|

|

Money Market Funds - 5.5%

|

|||

|

Shares

|

Value ($)

|

||

|

Fidelity Cash Central Fund 1.58% (f)

|

56,052,874

|

56,064,085

|

|

|

Fidelity Securities Lending Cash Central Fund 1.58% (f)(g)

|

30,950,278

|

30,953,373

|

|

|

TOTAL MONEY MARKET FUNDS

(Cost $87,017,458)

|

87,017,458

|

||

|

TOTAL INVESTMENT IN SECURITIES - 100.8%

(Cost $1,401,768,327)

|

1,593,329,545

|

|

NET OTHER ASSETS (LIABILITIES) - (0.8)%

|

(12,420,267)

|

|

NET ASSETS - 100.0%

|

1,580,909,278

|

|

(a)

|

Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $38,919,949 or 2.5% of net assets.

|

|

(b)

|

Non-income producing

|

|

(c)

|

Security or a portion of the security is on loan at period end.

|

|

(d)

|

Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $923,526 or 0.1% of net assets.

|

|

(e)

|

Level 3 security

|

|

(f)

|

Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

|

|

(g)

|

Investment made with cash collateral received from securities on loan.

|

|

Additional information on each restricted holding is as follows:

|

||

|

Security

|

Acquisition Date

|

Acquisition Cost ($)

|

|

Kry International AB

|

5/14/21

|

254,938

|

|

Kry International AB Series E

|

5/14/21

|

1,550,731

|

|

Affiliate

|

Value,

beginning

of period ($)

|

Purchases ($)

|

Sales

Proceeds ($)

|

Dividend

Income ($)

|

Realized

Gain (loss) ($)

|

Change in

Unrealized

appreciation

(depreciation) ($)

|

Value,

end

of period ($)

|

%ownership,

end

of period

|

|

Fidelity Cash Central Fund 1.58%

|

36,218,372

|

276,470,695

|

256,624,982

|

107,596

|

-

|

-

|

56,064,085

|

0.1%

|

|

Fidelity Securities Lending Cash Central Fund 1.58%

|

-

|

122,512,220

|

91,558,847

|

119,547

|

-

|

-

|

30,953,373

|

0.1%

|

|

Total

|

36,218,372

|

398,982,915

|

348,183,829

|

227,143

|

-

|

-

|

87,017,458

|

|

Valuation Inputs at Reporting Date:

|

||||

|

Description

|

Total ($)

|

Level 1 ($)

|

Level 2 ($)

|

Level 3 ($)

|

|

Investments in Securities:

|

||||

|

Equities:

|

||||

|

Communication Services

|

13,046,624

|

13,046,624

|

-

|

-

|

|

Consumer Discretionary

|

157,113,217

|

41,662,438

|

115,450,779

|

-

|

|

Consumer Staples

|

110,226,530

|

21,648,239

|

88,578,291

|

-

|

|

Energy

|

35,241,082

|

-

|

35,241,082

|

-

|

|

Financials

|

329,720,843

|

173,185,182

|

156,535,661

|

-

|

|

Health Care

|

205,965,531

|

104,228,653

|

101,736,878

|

-

|

|

Industrials

|

336,885,021

|

183,009,931

|

153,875,090

|

-

|

|

Information Technology

|

229,596,044

|

107,180,533

|

121,491,985

|

923,526

|

|

Materials

|

69,850,449

|

23,697,072

|

46,153,377

|

-

|

|

Real Estate

|

18,666,746

|

18,666,746

|

-

|

-

|

|

Money Market Funds

|

87,017,458

|

87,017,458

|

-

|

-

|

|

Total Investments in Securities:

|

1,593,329,545

|

773,342,876

|

819,063,143

|

923,526

|

|

Statement of Assets and Liabilities

|

||||

|

June 30, 2022

(Unaudited)

|

||||

|

Assets

|

||||

|

Investment in securities, at value (including securities loaned of $23,646,839) - See accompanying schedule:

|

$1,506,312,087

|

|||

|

Unaffiliated issuers (cost $1,314,750,869)

|

||||

|

Fidelity Central Funds (cost $87,017,458)

|

87,017,458

|

|||

|

Total Investment in Securities (cost $1,401,768,327)

|

$

|

1,593,329,545

|

||

|

Foreign currency held at value (cost $2,178,220)

|

2,176,992

|

|||

|

Receivable for investments sold

|

4,227,608

|

|||

|

Receivable for fund shares sold

|

9,333,621

|

|||

|

Dividends receivable

|

748,519

|

|||

|

Reclaims receivable

|

4,638,297

|

|||

|

Distributions receivable from Fidelity Central Funds

|

67,886

|

|||

|

Other receivables

|

158,753

|

|||

|

Total assets

|

1,614,681,221

|

|||

|

Liabilities

|

||||

|

Payable for investments purchased

|

$712,285

|

|||

|

Payable for fund shares redeemed

|

740,330

|

|||

|

Accrued management fee

|

881,961

|

|||

|

Distribution and service plan fees payable

|

70,532

|

|||

|

Other affiliated payables

|

168,066

|

|||

|

Other payables and accrued expenses

|

245,396

|

|||

|

Collateral on securities loaned

|