File Numbers: 333-111067 and 811-04294

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Post-Effective Amendment Number 38

and/or

REGISTRATION STATEMENT

UNDER

THE INVESTMENT COMPANY ACT OF 1940

Post-Effective Amendment Number 361

VARIABLE ANNUITY ACCOUNT

(Exact Name of Registrant)

Minnesota Life Insurance Company

(Name of Depositor)

400 Robert Street North, St. Paul, Minnesota 55101-2098

(Address of Depositor’s Principal Executive Offices) (Zip Code)

(651) 665-3500

(Depositor’s Telephone Number, Including Area Code)

Renee D. Montz

Senior Vice President, Secretary and General Counsel

Minnesota Life Insurance Company

400 Robert Street North

St. Paul, Minnesota 55101-2098

(Name and Address of Agent for Service)

It is proposed that this filing will become effective (check appropriate box)

| ☐ | immediately upon filing pursuant to paragraph (b) |

| ☒ | on December 15, 2021 pursuant to paragraph (b) of Rule 485 |

| ☐ | 60 days after filing pursuant to paragraph (a)(i) |

| ☐ | on (date) pursuant to paragraph (a)(i) |

| ☐ | 75 days after filing pursuant to paragraph (a)(ii) |

| ☐ | on (date) pursuant to paragraph (a)(ii) of Rule 485. |

If appropriate, check the following box:

| ☐ | this post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

TITLE OF SECURITIES BEING REGISTERED

Variable Annuity Contracts

Variable Annuity Account

Cross Reference Sheet to Prospectus

Form N-4

Item Number Caption in Prospectus

| 1. | Cover Page |

| 2. | Special Terms and How To Contact Us |

| 3. | An Overview of Contract Features |

| 4. | Condensed Financial Information; Performance Data - Appendix A |

| 5. | General Information |

| 6. | Contract Charges and Fees |

| 7. | Description of the Contract |

| 8. | Annuitization Benefits and Options |

| 9. | Death Benefits |

| 10. | Description of the Contract; Purchase Payments, Purchase Payments and Value of the Contract; Contract Charges and Fees – Deferred Sales Charge. |

| 11. | Description of the Contract; Redemptions, Withdrawals and Surrender |

| 12. | Federal Tax Status |

| 13. | Not Applicable |

| 14. | Table of Contents of the Statement of Additional Information |

PART A

INFORMATION REQUIRED IN A PROSPECTUS

|

|

Supplement dated December 15, 2021 to the following Prospectuses dated May 1, 2021:

| • | Waddell & Reed Advisors Retirement Builder Variable Annuity |

| • | Waddell & Reed Advisors Retirement Builder II Variable Annuities |

| • | Waddell & Reed Advisors Accumulator Variable Universal Life |

This supplement should be read with the currently effective or last effective prospectus and statement of additional information, along with any other applicable supplements, for the above listed prospectuses.

Fund Additions

The purpose of this supplement is to inform you of two Funds that will be added as new investment options under your variable annuity contracts and variable universal life insurance policy, starting February 1, 2022, subject to availability:

| • | SFT International Bond Fund – Class 2 Shares |

| • | Goldman Sachs VIT Government Money Market Fund – Service Shares |

The cover page of the Waddell & Reed Advisors Accumulator Variable Universal Life Policy prospectus is revised to add the above-named Funds. The subsection entitled “The Funds,” within the same prospectus is revised to add the following:

| Fund Name | Investment Adviser and Sub-Adviser |

Investment Objective | ||

| SFT International Bond Fund – Class 2 Shares | Securian Asset Management, Inc.

Subadviser: Brandywine Global Investment Management, LLC |

Seeks to maximize current income, consistent with the protection of principal. | ||

| Goldman Sachs VIT Government Money Market Fund – Service Shares | Goldman Sachs Asset Management, L.P. | Seeks to maximize current income to the extent consistent with the preservation of capital and the maintenance of liquidity by investing exclusively in high quality money market instruments. |

The cover page of the Waddell & Reed Advisors Retirement Builder Variable Annuity prospectus and the cover page of the Waddell & Reed Advisors Retirement Builder II Variable Annuities prospectus are revised to add the above-named Funds. The subsection entitled “The Portfolios,” within the section entitled “Condensed Financial Information and Financial Statements,” within the same prospectuses is revised to add the following:

| Fund Name | Investment Adviser | Investment Sub-Adviser | ||

| SFT International Bond Fund – Class 2 Shares | Securian Asset Management, Inc. | Brandywine Global Investment Management, LLC | ||

| Goldman Sachs VIT Government Money Market Fund – Service Shares | Goldman Sachs Asset Management, L.P. |

Fund Liquidations

The Ivy Variable Insurance Portfolios previously announced the liquidations of the following two funds: Delaware Ivy VIP Global Bond Fund and Delaware Ivy VIP Government Money Market Fund. The liquidation date for these two Funds has been temporarily suspended until further notice. An additional communication outlining further details about the liquidations will be provided when a new liquidation date is determined.

Fund Name Change

Effective November 15, 2021, the Delaware Ivy VIP Small Cap Core Fund was renamed the Delaware Ivy VIP Smid Cap Core Fund. All references to the Delaware Ivy VIP Small Cap Core Fund are hereby replaced with the Delaware Ivy VIP Smid Cap Core Fund.

This supplement must be accompanied by, and used in conjunction with, the current variable annuity contract or variable life insurance policy prospectus. If you would like another copy of the current prospectus, please call us at 844-878-2199 (for annuity contracts) or 844-208-2412 (for life insurance policies). The prospectus and this supplement can also be found on the U.S. Securities and Exchange Commission’s website (www.sec.gov.) by search File Nos. 333-111067, 333-189593, and 333-148646.

Please retain this supplement for future reference

F98299 12-2021

Waddell & Reed Advisors Retirement Builder Variable Annuity

a variable annuity contract issued by

Minnesota Life Insurance Company

400 Robert Street North • St. Paul, Minnesota 55101-2098 • Telephone: 844-878-2199 • http://www.securian.com

This Prospectus sets forth the information that a prospective investor should know before investing. It describes an individual, flexible payment, variable annuity contract (“the contract”) offered by the Minnesota Life Insurance Company. The Waddell & Reed Advisors Retirement Builder Variable Annuity is no longer available for new sales. This contract is designed for long term investors. It may be used in connection with personal retirement plans or independent of a retirement plan.

For contracts issued after May 1, 2008, (or such later date if approved later in your state) this contract contains a feature that applies a credit enhancement to the contract value in certain circumstances. The benefit of the credit enhancement may be more than offset by the additional asset-based fees that the contract owner will pay as the result of the increased contract value due to the credit enhancements. A contract without credits may cost less.

This contract is NOT:

| ● | a bank deposit or obligation |

| ● | federally insured |

| ● | endorsed by any bank or government agency |

You may invest your contract values in our Variable Annuity Account, our General Account, or in the Guarantee Periods of the Guaranteed Term Account.

The Variable Annuity Account invests in the following Fund portfolios:

Ivy Variable Insurance Portfolios

| • | Ivy VIP Asset Strategy — Class II Shares |

| • | Ivy VIP Balanced — Class II Shares |

| • | Ivy VIP Core Equity — Class II Shares |

| • | Ivy VIP Corporate Bond — Class II Shares |

| • | Ivy VIP Energy — Class II Shares |

| • | Ivy VIP Global Bond — Class II Shares |

| • | Ivy VIP Global Equity Income — Class II Shares |

| • | Ivy VIP Global Growth — Class II Shares |

| • | Ivy VIP Government Money Market — Class II Shares |

| • | Ivy VIP Growth — Class II Shares |

| • | Ivy VIP High Income — Class II Shares |

| • | Ivy VIP International Core Equity — Class II Shares |

| • | Ivy VIP Limited-Term Bond — Class II Shares |

| • | Ivy VIP Mid Cap Growth — Class II Shares |

| • | Ivy VIP Natural Resources — Class II Shares |

| • | Ivy VIP Science and Technology — Class II Shares |

| • | Ivy VIP Securian Real Estate Securities — Class II Shares |

| • | Ivy VIP Small Cap Core — Class II Shares |

| • | Ivy VIP Small Cap Growth — Class II Shares |

| • | Ivy VIP Value — Class II Shares |

| • | Ivy VIP Pathfinder Aggressive — Class II Shares |

| • | Ivy VIP Pathfinder Conservative — Class II Shares |

| • | Ivy VIP Pathfinder Moderate — Class II Shares |

| • | Ivy VIP Pathfinder Moderate — Managed Volatility — Class II Shares |

| • | Ivy VIP Pathfinder Moderately Aggressive — Class II Shares |

| • | Ivy VIP Pathfinder Moderately Aggressive — Managed Volatility — Class II Shares |

| • | Ivy VIP Pathfinder Moderately Conservative — Class II Shares |

| • | Ivy VIP Pathfinder Moderately Conservative — Managed Volatility — Class II Shares |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the shareholder reports for portfolio companies available under your contract will no longer be sent by mail, unless you specifically request paper copies of the reports from us. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from us electronically by calling our customer service line at 844-878-2199. You may elect to receive all future reports in paper free of charge. You can inform us that you wish to continue receiving paper copies of your shareholder reports by calling our customer service line at 844-878-2199. Your election to receive reports in paper will apply to all portfolio companies under your contract.

Your contract value and the amount of each variable annuity payment will vary in accordance with the performance of the investment portfolio(s) (“Portfolio(s)”) you select for amounts allocated to the Variable Annuity Account. You bear the entire investment risk for amounts you allocate to those Portfolios.

This Prospectus includes the information you should know before purchasing a contract. You should read it and keep it for future reference. A Statement of Additional Information, with the same date, contains further contract information. It has been filed with the Securities and Exchange Commission (“SEC”) and is incorporated by reference into this Prospectus. A copy of the Statement of Additional Information may be obtained without charge by calling 844-878-2199 or by writing to us at the address shown above. The table of contents for the Statement of Additional Information may be found at the end of this Prospectus. A copy of the text of this Prospectus and the Statement of Additional Information may also be found at the SEC’s web site: http://www.sec.gov, via its EDGAR database.

This Prospectus is not valid unless accompanied by a current prospectus of the Portfolios shown above.

These securities have not been approved or disapproved by the Securities and Exchange Commission, nor has the Commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

This Prospectus should be read carefully and retained for future reference.

The date of this Prospectus and of the Statement of Additional Information is: May 1, 2021.

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 13 | ||||

| 17 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 25 | ||||

| 25 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 50 | ||||

| 51 | ||||

| 53 | ||||

| 55 | ||||

| 57 | ||||

| 57 | ||||

| 57 | ||||

| 58 |

This Prospectus is not an offering in any jurisdiction in which the offering would be unlawful. We have not authorized any dealer, salesperson, representative or other person to give any information or make any representations in connection with this offering other than those contained in the Prospectus, and, if given or made, you should not rely on them.

As used in this Prospectus, the following terms have the indicated meanings:

Accumulation Unit: an accounting unit of measure used to calculate the value of a sub-account of the variable annuity account, of this contract before annuity payments begin.

Annuitant: the person who may receive lifetime benefits under the contract.

Annuity: a series of payments for life; for life with a minimum number of payments guaranteed; for the joint lifetime of the annuitant and another person and thereafter during the lifetime of the survivor; or for a period certain.

Annuity Unit: an accounting unit of measure used to calculate the value of annuity payments under a variable annuity income option.

Assumed Investment Return: the annual investment return (AIR) used to determine the amount of the initial variable annuity payment. Currently the AIR is equal to 4.5%.

Code: the Internal Revenue Code of 1986, as amended.

Commuted Value: the present value of any remaining period certain payments payable in a lump sum. The value will be based upon the then current dollar amount of one payment and the same interest rate that served as a basis for the annuity. If a commuted value is elected for a period certain on a variable annuity payment during the life of the annuitant, a deferred sales charge may apply.

Contract Owner: the owner of the contract, which could be a natural person(s), or by a corporation, trust, or custodial account that holds the contract as agent for the sole benefit of a natural person(s). The owner has all rights under this contract.

Contract Value: the sum of your values in the variable annuity account, the general account, and/or the guaranteed period(s) of the guaranteed term account.

Contract Year: a period of one year beginning with the contract date or a contract anniversary.

Fixed Annuity: an annuity providing for payments of guaranteed amounts throughout the payment period.

General Account: all of our assets other than those held in our other separate accounts.

Guarantee Period: a period of one or more years, for which the current interest rate is guaranteed. Allocation to a particular guarantee period is an allocation to the guaranteed term account.

Guaranteed Term Account: a non-unitized separate account providing guarantee periods of different lengths. Purchase payments or transfers may be allocated to one or more of the available guarantee periods within the guaranteed term account. Amounts allocated are credited with interest rates guaranteed by us for the entire guarantee period. The assets of the guaranteed term account are ours and are not subject to claims arising out of any other business of ours.

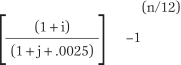

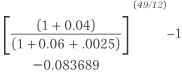

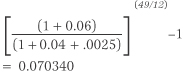

Market Value Adjustment (“MVA”): the adjustment made to any amount you withdraw, surrender, apply to provide annuity payments, or transfer from a guarantee period of the guaranteed term account prior to the renewal date. This adjustment may be positive or negative and reflects the impact of changes in applicable interest rates between the time the purchase payment, transfer, or renewal is allocated to the guaranteed term account and the time of the withdrawal, surrender, annuity payment election or transfer.

Maturity Date: The date this contract matures. The maturity date will be the first of the month following the later of: (a) the annuitant’s 85th birthday; or (b) ten years after the contract date, unless otherwise agreed to by us.

Page 1

Net Investment Factor: the net investment factor for a valuation period is the gross investment rate for such valuation period less a deduction for the charges to the variable account including any applicable optional benefit riders. The gross investment factor is a measure of the performance of the underlying fund after deductions for all charges to the variable account including those for applicable optional benefit riders.

Plan: a tax-qualified employer pension, profit-sharing, or annuity purchase plan under which benefits are to be provided by the contract.

Portfolio(s), Fund(s): the mutual funds whose separate investment portfolios we have designated as eligible investments for the variable annuity account. Each sub- account of the variable annuity account invests in a different portfolio. Currently these include the portfolios shown on the cover page of this Prospectus.

Purchase Payments: amounts paid to us under your contract in consideration of the benefits provided.

Separate Account: a separate investment account for which the investment experience of its assets is separate from that of our other assets.

Sub-Account: a division of the variable annuity account. Each sub-account invests in a different portfolio.

Valuation Date or Valuation Days: each date on which a portfolio is valued.

Variable Annuity: an annuity providing for payments varying in amount in accordance with the investment experience of the portfolios.

Variable Annuity Account: a separate investment account called the variable annuity account. The investment experience of its assets is separate from that of our other assets.

We, Our, Us: Minnesota Life Insurance Company.

You, Your: the contract owner.

Page 2

We make it easy for you to find information on your annuity. Here’s how you can get the answers you need.

On the Internet

Visit our online servicing site 24 hours a day, 7 days a week at www.securian.com/myaccount.

Annuity Service Line

|

● Call our service line at 844-878-2199 to speak with one of our customer service representatives. They’re available Monday through Friday from 7:30 a.m. to 4:30 p.m. Central Time during normal business days. |

By Mail

|

● Purchase Payments, service requests, and inquiries sent by regular mail should be sent to: Minnesota Life Annuity Services P.O. Box 64628 St. Paul, MN 55164-0628

● All overnight express mail should be sent to: Annuity Services A3-9999 400 Robert Street North St. Paul, MN 55101-2098 |

| ● | To receive a current copy of the W&R Advisors Retirement Builder Variable Annuity Statement of Additional Information (SAI) without charge, call 844-878-2199, or complete and detach the following and send it to: |

Minnesota Life Insurance Company

Annuity Services

P.O. Box 64628

St. Paul, MN 55164-0628

| Name

Address

City State Zip |

Page 3

An Overview of Contract Features

Annuity Contracts

An annuity is a series of payments for life; for life with a minimum number of payments guaranteed; for the joint lifetime of the annuitant and another person; or for a specified period of time. An annuity with payments which are guaranteed as to amount during the payment period is a fixed annuity. An annuity with payments which vary with the investment experience of a separate account is a variable annuity. An annuity contract may also be “deferred” or “immediate”. An immediate annuity contract is one in which annuity payments begin right away, generally within a month or two after our receipt of your purchase payment. A deferred annuity contract delays your annuity payments until a later date. During this deferral period, also known as the accumulation period, your annuity purchase payments and any earnings accumulate on a tax deferred basis. Guarantees provided by the insurance company as to the benefits promised in the annuity contract are subject to the claims paying ability of the insurance company and are subject to the risk that the insurance company may default on its obligations under those guarantees.

Type of Contract

The contract is a variable annuity contract which provides for monthly annuity payments. These payments may begin immediately or at a future date you specify. Below is a summary of certain contract features and expenses. Please see the corresponding section of the Prospectus for complete details, restrictions or limitations that may apply. Your contract has a right of cancellation which is described in detail in the section entitled “Right of Cancellation or Free-look.” Charges that apply to your contract may be found in the section titled “Contract Charges and Fees”. State variations of certain features may exist. See your registered representative for more information and to help determine if this product is right for you.

Purchase Payments:*

| Initial Minimum |

$10,000 | |

| $2,000 for IRAs and qualified plans | ||

| Subsequent payment minimum |

$500 | |

| ($100 for automatic payment plans) | ||

| * | Please note: If you intend to use this contract as part of a qualified retirement plan or IRA, the qualified plan or IRA may have contribution minimums which are different than those that apply to this contract. In addition you will receive no additional benefit from the tax deferral feature of the annuity since the retirement plan or IRA is already tax deferred. You should consult your tax advisor to ensure that you meet all the requirements and limitations, and to be sure this contract is appropriate for your situation. |

Credit Enhancement:

For contracts issued after May 1, 2008, (or such later date if approved later than this date in your state) when you make a purchase payment to your contract, we will add an amount, called a credit enhancement, to your contract value if your cumulative net purchase payments meet or exceed $250,000. Cumulative net purchase payments are the total of all purchase payments we have received for this contract less any prior withdrawals from contract value (including associated charges). No credit enhancement will be applied if your cumulative purchase payments are less than $250,000.

When we receive a purchase payment, we will evaluate whether your contract is eligible for a credit enhancement based on your cumulative net purchase payments. The credit enhancement will be added to your contract value and allocated to the sub-accounts of the variable account, the general account,

Page 4

and the guaranteed term account options in the same proportion as the purchase payment that triggers the credit enhancement calculation. Credit enhancements, and any gains or losses attributable to the credit enhancements are not a purchase payment and will be considered earnings under the contract.

We will take back, or recapture, all credit enhancements if you elect to terminate the contract under the right to examine (or “free look”) provision. In addition, we will recapture any credit enhancements applied to your contract within 12 months of the date any amounts are paid out as a death benefit or within 12 months of the date you apply amounts to provide annuity payments.

We will not recapture any amounts paid out as a death benefit or applied to provide annuity payments more than 12 months after the last credit enhancement was added to the contract.

For a detailed discussion, including how the credit enhancement is calculated and applied, please refer to the section entitled “Credit Enhancement and Recapture”. The credit enhancement feature may not be available in all states. Ask your representative if this is available in your state.

Investment Options:

| Fixed Account |

Minnesota Life General Account | |

| Guaranteed Term Account |

3 year guarantee period* | |

| 5 year guarantee period* | ||

| 7 year guarantee period* | ||

| 10 year guarantee period* | ||

| Variable Annuity Account |

See the list of portfolios on the cover page | |

| * | Subject to market value adjustment on early withdrawal — see “General Information Section” for additional details. The 3 year period is not currently available. |

Withdrawals:

| Minimum withdrawal amount |

$250 |

(Withdrawals and surrenders may be subject to deferred sales charges and/or market value adjustment depending upon how your contract value is allocated.)

In certain cases the deferred sales charge (“DSC”) is waived on withdrawal or surrender. The following DSC waivers are included in this contract if the withdrawal or surrender is after the first contract anniversary:

| • | Nursing Home Waiver |

| • | Terminal Illness Waiver |

| • | Unemployment Waiver |

State variations may apply to these waivers. See your representative and the section titled “Contract Charges and Fees” for more details. The DSC is also waived at death and upon annuitization.

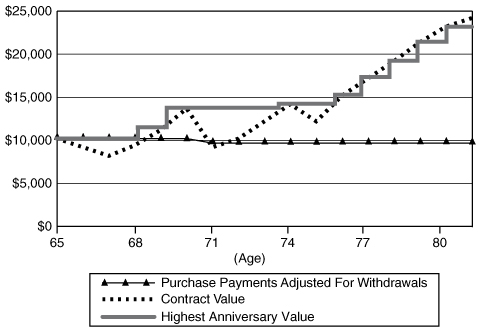

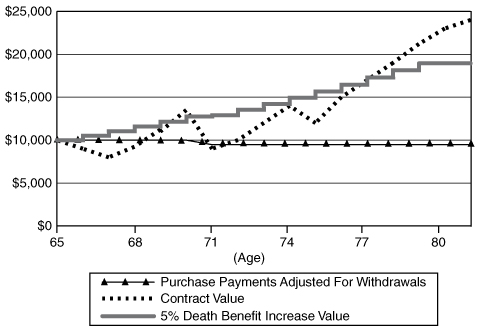

Death Benefit and Optional Death Benefits

Effective December 7, 2012, the following optional death benefit riders are no longer available for you to elect: Highest Anniversary Value (HAV) Death Benefit Option, 5% Death Benefit Increase (5% DBI) Option, Premier Death Benefit (PDB) Option, and Estate Enhancement Benefit (EEB) Option.

Your contract provides a death benefit. The death benefit included with the contract is known as the Guaranteed Minimum Death Benefit.

Page 5

Certain optional death benefits may also be selected and may provide the opportunity for a larger death benefit. The optional death benefits include: the HAV II Death Benefit Option and the PDB II Option. If these options are not available in your state, you may elect the HAV Death Benefit Option, 5% DBI Option, or the PDB Option instead.

In addition, you may also elect the EEB II Option. If that is not available in your state, you may elect the EEB Option instead. These contract options provide for an additional amount to be included in the death benefit proceeds when the death benefit proceeds become payable under your contract. It is intended to provide additional amounts to help offset expenses that may be due upon your death, such as federal and state taxes that may be payable on any taxable gains in your contract.

In order to elect one or more of these optional death benefits you must be less than 76 years old and you may only elect to purchase an optional death benefit when the contract is issued. Once you elect an option it may not be cancelled or terminated. Each of these optional choices has a specific charge associated with it.

Allocation of Contract Values

You can change your allocation of future purchase payments by giving us written notice or a telephone call notifying us of the change. Before annuity payments begin, you may transfer all or a part of your contract value among the portfolios and/or the general account and/or one or more of the guarantee periods of the guaranteed term account. A market value adjustment may apply if you move amounts from the guaranteed term account prior to the end of a guarantee period. After annuity payments begin, you may instruct us to transfer amounts held as annuity reserves among the variable annuity sub-accounts or to a fixed annuity, subject to some restrictions. During the annuity period, annuity reserves may only be transferred from a variable annuity to a fixed annuity.

Available Annuity Options

The annuity options available include a life annuity; a life annuity with a period certain of 120 months, 180 months, or 240 months; a joint and last survivor annuity; and a period certain annuity. Each annuity option may be elected as a variable or fixed annuity or a combination of the two. Other annuity options may be available from us on request.

Other Optional Riders

We have suspended the availability of the following optional riders:

| • | Guaranteed Minimum Income Benefit (effective October 4, 2013) |

| • | Encore Lifetime Income-Single (effective October 4, 2013) |

| • | Encore Lifetime Income-Joint (effective October 4, 2013) |

| • | Ovation Lifetime Income II-Single (effective October 4, 2013) |

| • | Ovation Lifetime Income II-Joint (effective October 4, 2013) |

| • | Ovation Lifetime Income-Single (effective May 15, 2012) |

| • | Ovation Lifetime Income-Joint (effective May 15, 2012) |

| • | Guaranteed Lifetime Withdrawal Benefit (effective August 1, 2010) |

| • | Guaranteed Lifetime Withdrawal Benefit II-Single Option (effective May 15, 2009) |

| • | Guaranteed Lifetime Withdrawal Benefit II-Joint Option (effective May 15, 2009) |

Page 6

| • | Guaranteed Minimum Withdrawal Benefit (effective May 15, 2009) |

| • | Guaranteed Income Provider Benefit (effective March 1, 2010) |

Certain other contract options may be available to you. These are sometimes referred to as “living benefits.” Only one living benefit may be elected on a contract. When you elect a living benefit rider (except for the Guaranteed Income Provider Benefit) your investment choices will be limited and you must allocate your entire contract value to an asset allocation plan or model approved for use with the rider you elect. Purchase payment amounts after your initial purchase payment may also be limited. Each contract feature may or may not be beneficial to you depending on your specific circumstances and how you intend to use your contract. For example, if you take withdrawals in excess of the annual guaranteed amount(s) it may adversely effect the benefit of the rider. These descriptions are brief overviews of the optional riders. Please refer to the section entitled “Other Contract Options” for a complete description of each rider, its benefits and its limitations and restrictions, read the prospectus section(s) carefully and consult your tax advisor and your representative before you elect any optional contract features. These options may not be available in every state and we reserve the right to stop offering any option(s) at any time. Each Option has a Charge that Applies to it. The Charges are Discussed in the Section Entitled “Optional Contract Rider Charges.”

Guaranteed Minimum Income Benefit (GMIB)

Effective October 4, 2013, this option is no longer available.

This contract option provides for a guaranteed minimum fixed annuity benefit, when elected on certain benefit dates, to protect against negative investment performance you may experience during your contract’s accumulation period. If you do not annuitize your contract, you will not utilize the guaranteed fixed annuity benefit this option provides. If you do not intend to annuitize, this option may not be appropriate for you. The GMIB annuity payout rates are conservative so the annuity payments provided by this rider may be less than the same annuity payment option available under the base contract, even if the benefit base is greater than the contract value. Once you elect this option it cannot be canceled. This rider does not guarantee an investment return in your contract or a minimum contract value. Withdrawals from your contract will reduce the benefit you receive if you annuitize under this rider and there are limitations on how your contract value may be allocated if you purchase this rider. If your contract is not eligible for the automatic payment phase, any withdrawal or charge that reduces your contract value to zero terminates the rider and the contract. If you anticipate having to make numerous withdrawals from the contract, this rider may not be appropriate. See the section of this Prospectus entitled ‘Other Contract Options (Living Benefits)’ for a complete description of the GMIB rider.

Encore Lifetime Income-Single (Encore-Single)

Effective October 4, 2013, this option is no longer available.

Encore-Single is a guaranteed lifetime withdrawal benefit. This contract option is designed to provide a benefit that guarantees the contract owner a minimum annual withdrawal amount, generally over the contract owner’s life, regardless of underlying sub-account performance. The amount received will be in the form of a withdrawal of contract value, if the contract value is greater than zero, or in the form of annuity payments. In each contract year, beginning on the later of the rider issue date or the contract anniversary following the 59th birthday of the oldest owner (or annuitant in the case of a non-natural owner) (the “benefit date”), you may elect to receive an amount up to the Guaranteed Annual Income (GAI) until the contract owner’s death (or in the case of joint owners, until the first death). The GAI amount is based on the age of the oldest contract owner and ranges from 4% to 6% of

Page 7

the benefit base. Since the benefits of this rider are accessed through withdrawals from the contract, if you do not intend to take withdrawals from the contract, then this option may not be appropriate for you. Withdrawals taken prior to the benefit date or in excess of the GAI reduce the benefits this rider provides and may prematurely terminate the contract and the rider. This rider does not guarantee any investment return in your contract value. If you purchase this rider, there are limitations on how funds may be invested and the entire contract value must be allocated to an approved allocation plan. See the section of this Prospectus entitled ‘Other Contract Options (Living Benefits)’ for important details about approved allocation plans, investment and withdrawal limitations and other restrictions when purchasing the Encore-Single rider.

This rider differs, in part, from the GLWB rider in that the Encore-Single benefit base, on which the GAI is based, has the potential to increase annually; while the GLWB provides the potential for the GAI to increase every 3 years.

Encore Lifetime Income-Joint (Encore-Joint)

Effective October 4, 2013, this option is no longer available.

Encore-Joint is also a guaranteed lifetime withdrawal benefit. Unlike Encore-Single, however, this rider is designed to provide a benefit that guarantees the contract owner a minimum annual withdrawal amount beginning on the later of the rider issue date or the contract anniversary following the 59th birthday of the youngest “Designated Life” and continuing over the lifetime of two “Designated Lives” regardless of underlying sub-account performance. The amount received will be in the form of a withdrawal of contract value, if the contract value is greater than zero, or in the form of annuity payments. In each contract year, beginning on the later of the rider issue date or the contract anniversary following the 59th birthday of the youngest Designated Life (the “benefit date”) you may elect to receive an amount up to the Guaranteed Annual Income (GAI) until the death of both Designated Lives. The GAI amount is based on the age of the youngest Designated Life and ranges from 4% to 6% of the benefit base. Since the benefits of this rider are accessed through withdrawals from the contract, if you do not intend to take withdrawals from the contract, then this option may not be appropriate for you. Withdrawals taken prior to the benefit date or in excess of the GAI reduce the benefits this rider provides and may prematurely terminate the contract and the rider. This rider does not guarantee any investment return in your contract value. If you purchase this rider, there are limitations on how funds may be invested and the entire contract value must be allocated to an approved allocation plan. See the section of this Prospectus entitled ‘Other Contract Options (Living Benefits)’ for important details about approved allocation plans, investment and withdrawal limitations and other restrictions when purchasing the Encore-Joint rider.

This rider differs, in part, from the GLWB rider in that GLWB does not offer a “joint” version of the rider and the Encore-Joint benefit base, on which the GAI is based, has the potential to increase annually as opposed to the GAI under GLWB which has the potential to increase every 3 years.

Ovation Lifetime Income II-Single (Ovation II-Single)

Effective October 4, 2013, this option is no longer available.

Ovation II-Single is a guaranteed lifetime withdrawal benefit. This contract option is designed to provide a benefit that guarantees the contract owner a minimum annual withdrawal amount, generally over the contract owner’s life, regardless of underlying sub-account performance. The amount received will be in the form of a withdrawal of contract value if the contract value is greater than zero and will

Page 8

be pursuant to the automatic payment phase if the contract value falls to zero. In each contract year, beginning on the later of the rider effective date or the contract anniversary following the 59th birthday of the oldest owner (or annuitant in the case of a non-natural owner) (the “benefit date”), you may elect to receive an amount up to the Guaranteed Annual Income (GAI) until the contract owner’s death (or in the case of joint owners, until the first death). The GAI amount is based on the age of the oldest contract owner and ranges from 4.5% to 6.5% of the benefit base. Once you elect this rider it cannot be cancelled. Since the benefits of this rider are accessed through withdrawals from the contract, if you do not intend to take withdrawals from the contract, then this option may not be appropriate for you. Withdrawals taken prior to the benefit date or in excess of the GAI reduce the benefits this rider provides (including terminating the 200% benefit base guarantee) and may prematurely terminate the contract and the rider. This rider does not guarantee any investment return in your contract value. If you purchase this rider, there are limitations on how funds may be invested and the entire contract value must be allocated to an approved allocation plan. See the section of this Prospectus entitled ‘Other Contract Options (Living Benefits)’ for important details about approved allocation plans, investment and withdrawal limitations and other restrictions when purchasing the Ovation II-Single rider.

This rider differs, in part, from the Encore-Single rider in that the Ovation II-Single rider has increased GAI percentages and the potential to provide a greater benefit base for those who delay withdrawals which may result in the ability to take larger guaranteed withdrawals. However, the Encore-Single rider may provide for the return of any remaining benefit base in the event of death, while the Ovation II-Single rider does not provide any benefit at death.

This rider differs, in part, from the GMIB rider in that the Ovation II-Single rider provides for guaranteed lifetime withdrawals from the contract, while the GMIB rider provides for guaranteed lifetime income through fixed annuity payments. The GMIB rider is an annuitization benefit, not a withdrawal benefit like Ovation II-Single. Lifetime withdrawal benefits allow you to retain more flexibility in the underlying contract, such as the ability to make additional purchase payments and to adjust the amount and frequency of withdrawals. Annuitization does not provide as much flexibility, but may provide a larger amount of income, depending on the option elected. If you intend to take regular withdrawals from your contract, which do not exceed the GAI, then the Ovation II-Single rider may be more appropriate for you than the GMIB rider. Your choice of a rider is based on your particular circumstances, so you should consult with your financial professional.

Ovation Lifetime Income II-Joint (Ovation II-Joint)

Effective October 4, 2013, this option is no longer available.

Ovation II-Joint is also a guaranteed lifetime withdrawal benefit. Unlike Ovation II-Single, however, this rider is designed to provide a benefit that guarantees the contract owner a minimum annual withdrawal amount beginning on the later of the rider effective date or the contract anniversary following the 59th birthday of the youngest “Designated Life” and continuing over the lifetime of two “Designated Lives” regardless of underlying sub-account performance. The amount received will be in the form of a withdrawal of contract value if the contract value is greater than zero and will be pursuant to the automatic payment phase if the contract value falls to zero. In each contract year, beginning on the later of the rider effective date or the contract anniversary following the 59th birthday of the youngest Designated Life (the “benefit date”) you may elect to receive an amount up to the Guaranteed Annual Income (GAI) until the death of both Designated Lives. The GAI amount is based on the age of the youngest Designated Life and ranges from 4.0% to 6.0% of the benefit base. Once you elect this rider it cannot be cancelled. Since the benefits of this rider are accessed through withdrawals from the contract, if you do not intend to take withdrawals from the contract, then this

Page 9

option may not be appropriate for you. Withdrawals taken prior to the benefit date or in excess of the GAI reduce the benefits this rider provides (including terminating the 200% benefit base guarantee) and may prematurely terminate the contract and the rider. This rider does not guarantee any investment return in your contract value. If you purchase this rider, there are limitations on how funds may be invested and the entire contract value must be allocated to an approved allocation plan. See the section of this Prospectus entitled ‘Other Contract Options (Living Benefits)’ for important details about approved allocation plans, investment and withdrawal limitations and other restrictions when purchasing the Ovation II-Joint rider.

This rider differs, in part, from the Encore-Joint rider in that the Ovation II-Joint rider has a lower current charge and the potential to provide a greater benefit base for those who delay withdrawals which may result in the ability to take larger guaranteed withdrawals in the future. However, the Encore-Joint rider may provide for the return of any remaining benefit base in the event of the death of both Designated Lives, while the Ovation II-Joint rider does not provide any benefit at death and has a higher maximum charge than the Encore-Joint rider.

This rider differs, in part, from the GMIB rider in that the Ovation II-Joint rider provides for guaranteed lifetime withdrawals from the contract, while the GMIB rider provides for guaranteed lifetime income through fixed annuity payments. The GMIB rider is an annuitization benefit, not a withdrawal benefit like Ovation II-Joint. Lifetime withdrawal benefits allow you to retain more flexibility in the underlying contract, such as the ability to make additional purchase payments and to adjust the amount and frequency of withdrawals. Annuitization does not provide as much flexibility, but may provide a larger amount of income, depending on the option elected. If you intend to take regular withdrawals from your contract, which do not exceed the GAI, then the Ovation II-Joint rider may be more appropriate for you than the GMIB rider. Your choice of a rider is based on your particular circumstances, so you should consult with your financial professional.

Ovation Lifetime Income-Single (Ovation-Single)

Effective May 15, 2012, this option is no longer available.

Ovation-Single is a guaranteed lifetime withdrawal benefit. This contract option is designed to provide a benefit that guarantees the contract owner a minimum annual withdrawal amount, generally over the contract owner’s life, regardless of underlying sub-account performance. The amount received will be in the form of a withdrawal of contract value if the contract value is greater than zero and will be pursuant to the automatic payment phase if the contract value falls to zero. In each contract year, beginning on the later of the rider effective date or the contract anniversary following the 59th birthday of the oldest owner (or annuitant in the case of a non-natural owner) (the “benefit date”), you may elect to receive an amount up to the Guaranteed Annual Income (GAI) until the contract owner’s death (or in the case of joint owners, until the first death). The GAI amount is based on the age of the oldest contract owner and ranges from 4.5% to 6.5% of the benefit base. Once you elect this rider it cannot be cancelled. Since the benefits of this rider are accessed through withdrawals from the contract, if you do not intend to take withdrawals from the contract, then this option may not be appropriate for you. Withdrawals taken prior to the benefit date or in excess of the GAI reduce the benefits this rider provides and may prematurely terminate the contract and the rider. This rider does not guarantee any investment return in your contract value. If you purchase this rider, there are limitations on how funds may be invested and the entire contract value must be allocated to an approved allocation plan. See the section of this Prospectus entitled ‘Other Contract Options (Living Benefits)’ for important details about approved allocation plans, investment and withdrawal limitations and other restrictions when purchasing the Ovation-Single rider.

Page 10

This rider differs, in part, from the Encore-Single rider in that the Ovation-Single rider has increased GAI percentages and the potential to provide a greater benefit base for those who delay withdrawals which may result in the ability to take larger guaranteed withdrawals. However, the Encore-Single rider may provide for the return of any remaining benefit base in the event of death, while the Ovation-Single rider does not provide any benefit at death.

This rider also differs, in part, from the GMIB rider in that the Ovation-Single rider provides for guaranteed lifetime withdrawals from the contract, while the GMIB rider provides for guaranteed lifetime income through fixed annuity payments. The GMIB rider is an annuitization benefit, not a withdrawal benefit like Ovation-Single. Lifetime withdrawal benefits allow you to retain more flexibility in the underlying contract, such as the ability to make additional purchase payments and to adjust the amount and frequency of withdrawals. Annuitization does not provide as much flexibility, but may provide a larger amount of income, depending on the option elected. If you intend to take regular withdrawals from your contract, which do not exceed the GAI, then the Ovation-Single rider may be more appropriate for you than the GMIB rider. Your choice of a rider is based on your particular circumstances, so you should consult with your financial professional.

Ovation Lifetime Income-Joint (Ovation-Joint)

Effective May 15, 2012, this option is no longer available.

Ovation-Joint is also a guaranteed lifetime withdrawal benefit. Unlike Ovation-Single, however, this rider is designed to provide a benefit that guarantees the contract owner a minimum annual withdrawal amount beginning on the later of the rider effective date or the contract anniversary following the 59th birthday of the youngest “Designated Life” and continuing over the lifetime of two “Designated Lives” regardless of underlying sub-account performance. The amount received will be in the form of a withdrawal of contract value if the contract value is greater than zero and will be pursuant to the automatic payment phase if the contract value falls to zero. In each contract year, beginning on the later of the rider effective date or the contract anniversary following the 59th birthday of the youngest Designated Life (the “benefit date”) you may elect to receive an amount up to the Guaranteed Annual Income (GAI) until the death of both Designated Lives. The GAI amount is based on the age of the youngest Designated Life and ranges from 4.5% to 6.5% of the benefit base. Once you elect this rider it cannot be cancelled. Since the benefits of this rider are accessed through withdrawals from the contract, if you do not intend to take withdrawals from the contract, then this option may not be appropriate for you. Withdrawals taken prior to the benefit date or in excess of the GAI reduce the benefits this rider provides and may prematurely terminate the contract and the rider. This rider does not guarantee any investment return in your contract value. If you purchase this rider, there are limitations on how funds may be invested and the entire contract value must be allocated to an approved allocation plan. See the section of this Prospectus entitled ‘Other Contract Options (Living Benefits)’ for important details about approved allocation plans, investment and withdrawal limitations and other restrictions when purchasing the Ovation-Joint rider.

This rider differs, in part, from the Encore-Joint rider in that the Ovation-Joint rider has increased GAI percentages and the potential to provide a greater benefit base for those who delay withdrawals which may result in the ability to take larger guaranteed withdrawals in the future. However, the Encore-Joint rider may provide for the return of any remaining benefit base in the event of the death of both Designated Lives, while the Ovation-Joint rider does not provide any benefit at death.

This rider also differs, in part, from the GMIB rider in that the Ovation-Joint rider provides for guaranteed lifetime withdrawals from the contract, while the GMIB rider provides for guaranteed

Page 11

lifetime income through fixed annuity payments. The GMIB rider is an annuitization benefit, not a withdrawal benefit like Ovation-Joint. Lifetime withdrawal benefits allow you to retain more flexibility in the underlying contract, such as the ability to make additional purchase payments and to adjust the amount and frequency of withdrawals. Annuitization does not provide as much flexibility, but may provide a larger amount of income, depending on the option elected. If you intend to take regular withdrawals from your contract, which do not exceed the GAI, then the Ovation-Joint rider may be more appropriate for you than the GMIB rider. Your choice of a rider is based on your particular circumstances, so you should consult with your financial professional.

Guaranteed Lifetime Withdrawal Benefit (GLWB)

Effective August 1, 2010, this option is no longer available.

This contract option is designed to provide a benefit that guarantees the contract owner a minimum withdrawal amount, generally over their life regardless of underlying sub-account performance. It allows a contract owner to take withdrawals from their contract each contract year up to a specified maximum amount known as the Guaranteed Annual Income (GAI) amount. The annual GAI amount will be set based on the age of the oldest contract owner on the GLWB effective date and it will range from 4.0% to 6.0% of the Guaranteed Withdrawal Benefit (GWB). This option allows a contract owner to take these withdrawals from the contract for the longer of: a) the duration of the contract owner’s life (or in the case of joint owners, the lifetime of the first joint owner to die) or, b) until the Guaranteed Withdrawal Benefit (GWB) is reduced to zero. Since this benefit is accessed through withdrawals from the contract, if you do not intend to take withdrawals from your contract, then this option may not be appropriate for you. This rider does not guarantee an investment return in your contract value.

This optional rider differs, in part, from either of the GLWB II riders (single or joint) below in that the GAI amount is based on the age of the oldest contract owner and has a range of 4.0% to 6.0%; while the GLWB II riders have a set GAI amount of 5.0%.

Guaranteed Lifetime Withdrawal Benefit II - Single (GLWB II - Single)

Effective May 15, 2009, this option is no longer available.

This contract option is also designed to provide a benefit that guarantees the contract owner a minimum annual withdrawal amount, generally over the contract owner’s life, regardless of underlying sub-account performance. Beginning on the later of the contract anniversary following the contract owner’s 59(th) birthday or the date this contract option is added, it allows a contract owner to take withdrawals from the contract each contract year up to a specified maximum amount known as the Guaranteed Annual Income (GAI) amount. The GAI amount will be 5% of the Guaranteed Withdrawal Benefit (GWB). The GWB amount is equal to the initial purchase payment if this rider is added at contract issue. If the rider is added on a subsequent anniversary, the initial GWB will be equal to the contract value on the effective date of the rider. This option allows a contract owner to take these withdrawals from the contract for the longer of: a) the duration of the contract owner’s life (or in the case of joint owners, the lifetime of the first joint owner to die) or, b) until the GWB is reduced to zero. Since this benefit is accessed through withdrawals from the contract, if you do not intend to take withdrawals from your contract, then this option may not be appropriate for you. This rider does not guarantee an investment return in your contract value.

Page 12

Guaranteed Lifetime Withdrawal Benefit II-Joint (GLWB II - Joint)

Effective May 15, 2009, this option is no longer available.

This contract option is also designed to provide a benefit that guarantees the contract owner a minimum annual withdrawal amount, and it works very similar to the Guaranteed Lifetime Withdrawal Benefit II — Single Life Option. However its guarantee is over the lifetime of both “designated lives”, (instead of a single life) regardless of underlying sub-account performance.

Beginning on the later of the contract anniversary following the 59(th) birthday of the youngest designated life or the date this contract option is added, it allows a contract owner to take withdrawals from the contract each contract year up to a specified maximum amount known as the Guaranteed Annual Income (GAI) amount. The GAI amount will be 5% of the Guaranteed Withdrawal Benefit (GWB). The GWB amount is equal to the initial purchase payment if this rider is added at contract issue. If the rider is added at a subsequent anniversary, the initial GWB will be equal to the contract value on the effective date of this rider. This option allows a contract owner to take these withdrawals from the contract for the longer of: a) the duration of both designated lives, or, b) until the GWB is reduced to zero. Since this benefit is accessed through withdrawals from the contract, if you do not intend to take withdrawals from your contract, then this option may not be appropriate for you. This rider does not guarantee an investment return in your contract value.

Guaranteed Minimum Withdrawal Benefit (GMWB)

Effective May 15, 2009, this option is no longer available.

This contract option provides for a guarantee that allows a contract owner to withdraw an amount from the contract each contract year up to a specified maximum amount, known as the Guaranteed Annual Withdrawal, until the Guaranteed Withdrawal Benefit is reduced to zero. A detailed explanation of how these amounts are calculated is provided in the section of this Prospectus describing this contract option. Since this benefit is accessed through withdrawals from the contract, if you do not intend to take withdrawals from your contract, then this option may not be appropriate for you. This rider does not guarantee an investment return in your contract value.

Guaranteed Income Provider Benefit (GIPB)

Effective March 1, 2010, this option is no longer available.

This contract option provides for a guaranteed minimum fixed income benefit if you elect certain annuity options. It is designed to provide a guaranteed level of annuity income regardless of the actual investment performance that you experience during your accumulation period. If you do not intend to annuitize your contract, you will not receive the benefit of this option, and therefore this option may not be appropriate for you. once you elect this contract option you may not change or terminate the option. This rider does not guarantee an investment return in your contract value.

The following contract expense information is intended to illustrate the expenses of the contract. All expenses shown are rounded to the nearest dollar.

The following tables describe the fees and expenses that you will pay when buying, owning, and surrendering the contract. The first table describes the fees and expenses that you will pay at the time

Page 13

that you buy the contract, surrender the contract, or transfer cash value between investment options. State premium taxes may also be deducted and range from 0% to 3.5%, depending on applicable law.

Contract Owner Transaction Expenses

Sales Load Imposed on Purchases

| (as a percentage of purchase payments) |

None |

Deferred Sales Charge

| * | Deferred Sales Charges may apply to withdrawals, partial surrenders and surrenders. |

(as a percentage of each purchase payment)

| Years Since Purchase Payment | ||||||

| 0-1 | 8% | |||||

| 1-2 | 8% | |||||

| 2-3 | 7% | |||||

| 3-4 | 6% | |||||

| 4-5 | 6% | |||||

| 5-6 | 5% | |||||

| 6-7 | 4% | |||||

| 7-8 | 3% | |||||

| 8 and thereafter | 0% | |||||

| Surrender Fees |

None | |||||

| Transfer Fee |

None | |||||

The next table describes the fees and expenses that you will pay periodically during the time that you own the contract, not including Portfolio company fees and expenses.

| Annual Maintenance Fee** |

$ | 50 |

| ** | (Applies only to contracts where the greater of the contract value or purchase payments, less withdrawals, is less than $50,000 on the contract anniversary and at surrender. Does not apply after annuitization.) |

Separate Account Annual Expenses (as a percentage of average account value)

Before Annuity Payments Commence

Base Contract Only

| Mortality and Expense Risk Fees |

Total Separate Account Annual Expenses (Base Contract) |

|||||||

| 1.25 | % | 1.25 | % | |||||

Optional Death Benefits

| Death Benefit Charge |

Total Separate Account Annual Expenses (Death Benefit + Base Contract) |

|||||||

| Highest Anniversary Value (HAV)* |

0.15 | % | 1.40 | % | ||||

| 5% Death Benefit Increase (5% DBI)* |

0.25 | % | 1.50 | % | ||||

| Premier Death Benefit (PDB)* |

0.35 | % | 1.60 | % | ||||

| Estate Enhancement Benefit (EEB)* |

0.25 | % | 1.50 | % | ||||

| Estate Enhancement Benefit II (EEB II) |

0.25 | % | 1.50 | % | ||||

| * | Effective December 7, 2012, you are no longer able to elect these options. |

Page 14

Other Contract Options

| Charge for Option |

Total Separate Account Annual Expenses (This option only + Base Contract) |

|||||||

| Guaranteed Income Provider Benefit (GIPB) |

0.50 | % | 1.75 | % | ||||

Maximum Possible Separate Account Charges

Base (1.25%) + PDB (.35%) + EEB (.25%) + GIPB (.50%) = 2.35%

| • | The GIPB option may not be elected after March 1, 2010. |

| • | Effective December 7, 2012, you are no longer able to elect PDB or EEB. |

| • | (The HAV II, PDB II, GMIB, GMWB, GLWB, GLWB II, Encore, Ovation, and Ovation II options are not included with the above charges because the charges are calculated on a different basis than the above — described charges.) |

Other Optional Benefit Charges

| Optional Rider | Current Benefit Charge Annual Percentage |

Maximum Possible Charge Annual Percentage |

To determine the amount to be deducted, the Annual Charge Percentage is multiplied by the: |

The Benefit Charge is deducted on each: | ||||||||

|

Optional Death Benefit Riders | ||||||||||||

| Highest Anniversary Value II (HAV II) Death Benefit Charge |

0.30 | % | 0.30 | % | Death Benefit | Quarterly Contract Anniversary | ||||||

| Premier II Death Benefit (PDB II) Charge |

0.80 | % | 0.80 | % | Death Benefit | Quarterly Contract Anniversary | ||||||

|

Optional Living Benefit Riders | ||||||||||||

|

Guaranteed Minimum Income Benefit |

0.95 | % | 1.50 | % | Benefit Base | Contract Anniversary | ||||||

| Encore Lifetime Income — Single (Encore-Single) Charge |

1.10 | % | 1.75 | % | Greater of Contract Value or Benefit Base |

Quarterly Contract Anniversary | ||||||

| Encore Lifetime Income — Joint (Encore-Joint) Charge |

1.30 | % | 2.00 | % | Greater of Contract Value or Benefit Base |

Quarterly Contract Anniversary | ||||||

| Ovation Lifetime Income II — Single Charge |

1.20 | % | 2.25 | % | Greater of Contract Value or Benefit Base |

Quarterly Contract Anniversary | ||||||

| Ovation Lifetime Income II — Joint Charge |

1.20 | % | 2.50 | % | Greater of Contract Value or Benefit Base |

Quarterly Contract Anniversary | ||||||

|

Guaranteed Minimum Withdrawal Benefit (GMWB) Charge |

0.50 | % | 1.00 | % | Guaranteed Withdrawal Benefit |

Quarterly Contract Anniversary | ||||||

|

Guaranteed Lifetime Withdrawal Benefit (GLWB) Charge |

0.60 | % | 0.60 | % | Contract Value | Quarterly Contract Anniversary | ||||||

Page 15

| Optional Rider | Current Benefit Charge Annual Percentage |

Maximum Possible Charge Annual Percentage |

To determine the amount to be deducted, the Annual Charge Percentage is multiplied by the: |

The Benefit Charge is deducted on each: | ||||||||

|

Guaranteed Lifetime Withdrawal Benefit II — Single (GLWB II-Single) Charge |

0.60 | % | 1.00 | % | Greater of Contract Value or Guaranteed Withdrawal Benefit |

Quarterly Contract Anniversary | ||||||

|

Guaranteed Lifetime Withdrawal Benefit II — Joint (GLWB II-Joint) Charge |

0.75 | % | 1.15 | % | Greater of Contract Value or Guaranteed Withdrawal Benefit |

Quarterly Contract Anniversary | ||||||

| Ovation Lifetime Income-Single (Ovation-Single) Charge |

1.15 | % | 1.75 | % | Greater of Contract Value or Benefit Base |

Quarterly Contract Anniversary | ||||||

| Ovation

Lifetime Income — Joint |

1.65 | % | 2.50 | % | Greater of Contract Value or Benefit Base |

Quarterly Contract Anniversary | ||||||

The next item shows the minimum and maximum total operating expenses charged by the portfolios (before any waivers or reimbursements) that you may pay periodically during the time that you own the contract. More detail concerning each of the portfolio’s fees and expenses is contained in the prospectus for each portfolio.

| Minimum | Maximum | |||||||

| Total Annual Portfolio Company Operating Expenses |

0.47 | % | 1.46 | % | ||||

| (expenses that are deducted from portfolio assets, including management fees, distribution and/or service (12b-1) fees, and other expenses) | ||||||||

Contract Owner Expense Example

This Example is intended to help you compare the cost of investing in the contract with the cost of investing in other variable annuity contracts. These costs include contract owner transaction expenses, annual maintenance fees, separate account annual expenses, and Portfolio company fees and expenses.

Please note:

| • | You may elect only one optional living benefit rider on the contract. |

| • | If you elect the PDB, PDB II, 5% DBI, EEB, or EEB II, you may not elect any currently offered optional living benefit rider. |

The Example assumes that you invest $10,000 in the contract for the time periods indicated. The Example also assumes that your investment has a 5% return each year, and uses the separate account annual expenses before annuity payments commence. The Example is shown using both the least expensive Portfolio (Minimum Fund Expenses) and the most expensive Portfolio (Maximum Fund Expenses) before any reimbursements, with the most expensive contract design over the time period:

| • | Base + HAV II + Ovation II — Joint |

Page 16

Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| If you surrendered your contract at the end of the applicable time period |

If you annuitize at the end of the available time period or you do not surrender your contract |

|||||||||||||||||||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||

| Maximum Fund Expenses |

||||||||||||||||||||||||||||||||

| Base + HAV II + Ovation II — Joint |

$ | 1,345 | $ | 2,368 | $ | 3,436 | $ | 5,976 | $ | 545 | $ | 1,668 | $ | 2,836 | $ | 5,976 | ||||||||||||||||

| Minimum Fund Expenses |

||||||||||||||||||||||||||||||||

| Base + HAV II + Ovation II — Joint |

$ | 1,257 | $ | 2,105 | $ | 3,010 | $ | 5,192 | $ | 457 | $ | 1,405 | $ | 2,410 | $ | 5,192 | ||||||||||||||||

Note: In the above example, the charge for Ovation II — Joint is based on the maximum annual fee rate of 2.50% for each of the years. If your rider charge is not at the maximum annual fee rate, then your expenses would be less than those shown above.

Different fees and expenses not reflected in the examples above apply after annuity payments commence. Please see the section entitled “Contract Charges and Fees” for a discussion of those expenses. The examples contained in this table should not be considered a representation of past or future expenses. Actual expenses may be greater or less than those shown.

Expenses After Annuity Payments Commence

The next section shows the fees and charges that apply to your contract after you have annuitized it.

| Separate Account Based Charges |

||

| Mortality and Expense Risk Fee |

1.35% | |

| Optional Death Benefit Charges |

Not Applicable | |

| Other Optional Separate Account Charges |

Not Applicable | |

| Other Charges |

||

| Other Optional Benefit Charges taken from Contract Value |

Not Applicable | |

Condensed Financial Information and Financial Statements

The financial history of each sub-account may be found in the Appendix under the heading “Condensed Financial Information.” The complete financial statements of the Variable Annuity Account and Minnesota Life are included in the Statement of Additional Information.

The Portfolios

Below is a list of the portfolios and their investment adviser and investment sub-adviser. The prospectus for the portfolios must accompany this Prospectus and contain more detailed information about each portfolio. The portfolio’s investment objectives are contained within the portfolio’s prospectus. No assurance can be given that a portfolio will achieve its investment objective. You should carefully read the prospectus before investing in the contract. If you received a summary prospectus for a portfolio listed below, please follow the directions on the first page of the summary prospectus to obtain a copy of the full fund prospectus.

| Fund/Portfolio |

Investment |

Investment | ||

| Ivy Variable Insurance Portfolios |

||||

| Ivy VIP Asset Strategy — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Balanced — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Core Equity — Class II Shares |

Ivy Investment Management Company (IICO) |

Page 17

| Fund/Portfolio |

Investment |

Investment | ||

| Ivy Variable Insurance Portfolios |

||||

| Ivy VIP Corporate Bond — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Energy — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Global Bond — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Global Equity Income — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Global Growth — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Government Money Market — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Growth — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP High Income — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP International Core Equity — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Limited-Term Bond — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Mid Cap Growth — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Natural Resources — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Science and Technology — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Securian Real Estate Securities — Class II Shares |

Ivy Investment Management Company (IICO) | Securian Asset Management, Inc. | ||

| Ivy VIP Small Cap Core — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Small Cap Growth — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Value — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Pathfinder Aggressive — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Pathfinder Conservative — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Pathfinder Moderate — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Pathfinder Moderate — Managed Volatility — Class II Shares |

Ivy Investment Management Company (IICO) | Securian Asset Management, Inc. | ||

| Ivy VIP Pathfinder Moderately Aggressive — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Pathfinder Moderately Aggressive — Managed Volatility — Class II Shares |

Ivy Investment Management Company (IICO) | Securian Asset Management, Inc. | ||

| Ivy VIP Pathfinder Moderately Conservative — Class II Shares |

Ivy Investment Management Company (IICO) | |||

| Ivy VIP Pathfinder Moderately Conservative — Managed Volatility — Class II Shares |

Ivy Investment Management Company (IICO) | Securian Asset Management, Inc. |

Page 18

Your contract may be used in connection with all types of tax-qualified plans, state deferred compensation plans or individual retirement annuities adopted by, or on behalf of individuals. It may also be purchased by individuals not as a part of any retirement plan. The contract provides for a variable annuity or a fixed annuity to begin at some future date.

You must complete an application and submit it to us. We will review your application form for compliance with our issue criteria, and if it is accepted, we will issue the contract to you. In some states you may be able to purchase the contract through an automated electronic transmission process. Ask your representative about availability and details. The annuitant must be the same as the owner except in situations where the owner is other than a natural person, such as a trust, corporation or similar entity or where otherwise agreed to by us.

Right of Cancellation or “Free Look”

You should read your contract carefully as soon as you receive it. You may cancel your contract within twenty days after its delivery, for any reason, by giving us written notice at: Annuity Services P.O. Box 64628 St. Paul, MN 55164-0628. If you cancel and return your contract during the “free look period”, we will refund to you the amount required by your state. This amount is either your contract value less the amount of any credit enhancement(s) which were credited to your contract plus any premium tax charges that may have been deducted, or your purchase payments at the time you exercise your free look right. Purchase payments will be invested in accordance with your allocation instructions during the free look period. You may bear the investment risk for your purchase payments during this period.

Payment of the requested refund will be made to you within seven days after we receive notice of cancellation. In some states, the free look period may be longer. See your contract for complete details regarding your right to cancel.

1035 Exchanges or Replacements

If you are considering the purchase of this contract with the proceeds of another annuity or life insurance contract, also referred to as a “Section 1035 Exchange” or “Replacement”, it may or may not be advantageous to replace your existing contract with this contract. You should compare both contracts carefully. You may have to pay surrender charges on your old contract and there is a deferred sales charge period for this contract. In addition, the charges for this contract may be higher (or lower) and the benefits or investment options may be different from your old contract. You should not exchange another contract for this one unless you determine, after knowing all of the facts, that the exchange is in your best interest. For additional information regarding the tax impact in Section 1035 Exchanges, see “Federal Tax Status — Section 1035 Exchanges.”

You choose when to make purchase payments. Your initial purchase payment must be at least equal to the following and must be in U.S. dollars:

| $10,000 | ||

| $2,000 for IRAs and Qualified Retirement Plans |

We may reduce the initial purchase payment requirement if you purchase this contract through a 1035 exchange or qualified plan, direct transfer from a contract issued by another carrier and at the time of application the value of the other contract(s) meets or exceeds the applicable minimum initial purchase

Page 19

payment for this contract; but prior to receipt by us of the proceeds from the other contract(s), the value drops below the minimum initial purchase payment requirement due to market conditions.

You must submit this amount along with your application. There may also be limits on the maximum contributions that you can make to retirement plans. Be sure to review your retirement plan’s contribution rules applicable to your situation.

We will return your initial payment or any subsequent payment within five business days if: (1) your application or instructions fail to specify which Portfolios you desire, or are otherwise incomplete, or (2) you do not consent to our retention of your payment until the application or instructions are made complete and in “good order.”

Purchase payments subsequent to your initial payment must be at least $500 regardless of the type of contract you purchase or the retirement plan with which it is used. Total purchase payments may not exceed $5,000,000, for the benefit of the same owner or annuitant except with our consent. In addition, total aggregate purchase payments (or transfers) allocated to the General Account and each of the Guarantee Periods of the Guaranteed Term Account, may not exceed $250,000, without our prior consent. For purposes of these limitations, we may aggregate other Minnesota Life annuity contracts with this one. Additional purchase payments will not be accepted while either the owner or joint owner qualifies under the nursing home or terminal illness provisions for the waiver of any deferred sales charges.

Credit Enhancement and Recapture

For contracts issued after May 1, 2008, when you make a purchase payment to your contract, we will add an amount, called a credit enhancement, to your contract value if your cumulative net purchase payments meet or exceed $250,000. Cumulative net purchase payments are the total of all purchase payments we have received for this contract less any prior withdrawals from contract value (including associated charges). No credit enhancement will be applied if your cumulative purchase payments are less than $250,000.

When we receive a purchase payment, we will evaluate whether your contract is eligible for a credit enhancement based on your cumulative net purchase payments, according to the following schedule:

| Cumulative Net Purchase Payments |

Credit Enhancement Percentage | |

| $250,000-$499,999.99 | 0.25% | |

| $500,000-$749,999.99 | 0.50% | |

| $750,000-$999,999.99 | 0.75% | |

| $1,000,000 or more | 1.00% |

The amount of the credit enhancement will be calculated as follows:

| a. | cumulative net purchase payments; multiplied by |

| b. | the applicable credit enhancement percentage from the table above; minus |

| c. | any credit enhancements previously applied to contract value |

The credit enhancement will be added to your contract value and allocated to the sub-accounts of the variable account, the general account and the guaranteed term account options in the same proportion as the purchase payment that triggers the credit enhancement calculation.

Page 20

We will take back, or recapture, credit enhancements in the following circumstances: