The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission and the applicable state securities commissions is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus Dated June 23, 2022

PROSPECTUS

APOLLO REALTY INCOME SOLUTIONS, INC.

Maximum Offering of $5,000,000,000—Minimum Offering of $100,000,000

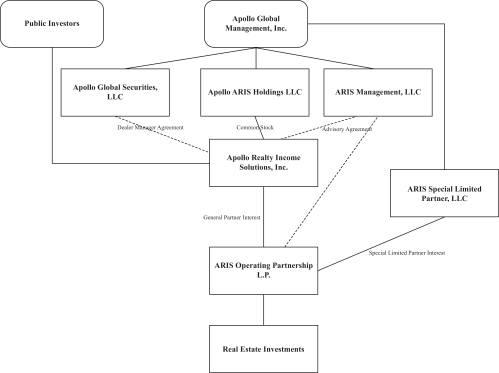

Apollo Realty Income Solutions, Inc. is a newly organized corporation formed to invest primarily in a portfolio of diversified institutional quality, income-oriented commercial real estate primarily in the United States. We are externally managed by our adviser, ARIS Management, LLC, a Delaware limited liability company (the “Adviser”). The Adviser is an affiliate of our sponsor, Apollo Global Management, Inc. (together with its affiliates, our “sponsor”), a global, high-growth alternative asset manager. We intend to qualify as a real estate investment trust (“REIT”) for U.S. federal income tax purposes. We are not a mutual fund and do not intend to register as an investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”).

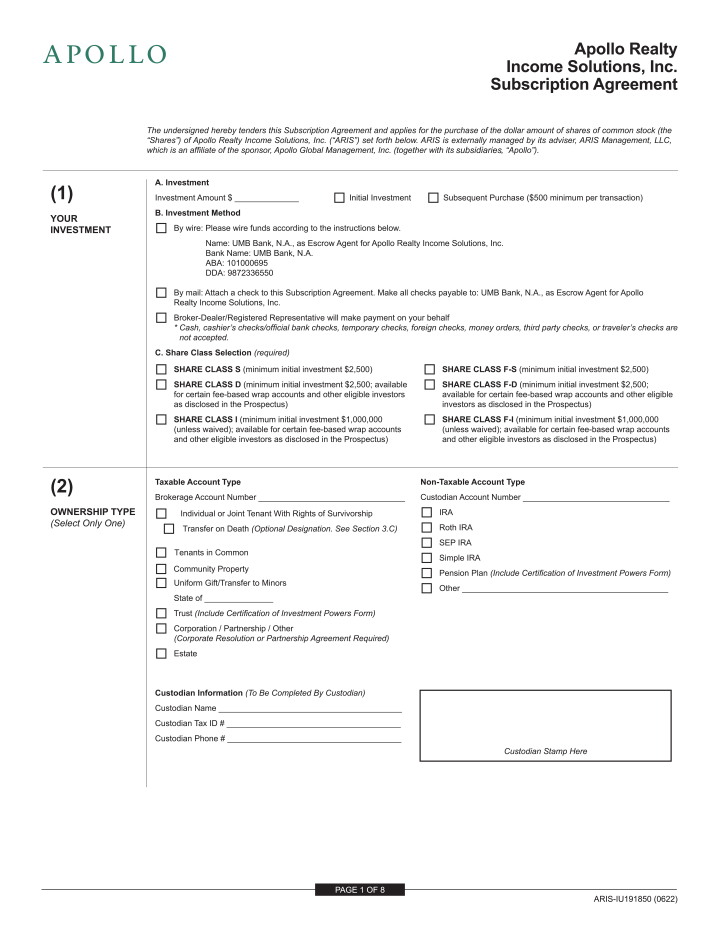

We are offering on a continuous basis up to $5,000,000,000 in shares of common stock, consisting of up to $4,000,000,000 in shares in our primary offering and up to $1,000,000,000 in shares pursuant to our distribution reinvestment plan. We are offering to sell any combination of six classes of shares of our common stock, Class S common stock (“Class S shares”), Class D common stock (“Class D shares”), Class I common stock (“Class I shares”), Class F-S common stock (“Class F-S shares”), Class F-D common stock (“Class F-D shares”) and Class F-I common stock (“Class F-I shares”), with a dollar value up to the maximum offering amount. During the six-month period beginning on the date of the commencement of this offering (the “initial founder shares offering period”), the Class F-S shares, Class F-D shares and Class F-I shares (collectively, the “founder shares”) will be offered to all investors in this offering, subject to the minimum investment requirement for each founder shares class as described herein. Following the initial founder shares offering period, the founder shares will be offered only to investors that held, or clients of a financial intermediary that in the aggregate held, at least $100,000,000 in founder shares as of the end of initial founder shares offering period (the “minimum founder shares holding requirement”), unless such minimum founder shares holding requirement is waived by the Dealer Manager. The minimum founder shares holding requirement does not apply to purchases made by holders of founder shares under our distribution reinvestment plan. We reserve the right to extend the initial founder shares offering period in our sole discretion. The share classes have different upfront selling commissions and dealer manager fees, and different ongoing stockholder servicing fees. Until the release of proceeds from escrow, the per share purchase price for shares of our common stock in our primary offering will be $20.00 per share plus applicable upfront selling commissions and dealer manager fees. Thereafter, the purchase price per share for each class of common stock will vary and will generally equal our prior month’s net asset value (“NAV”) per share, as determined monthly, plus applicable upfront selling commissions and dealer manager fees. We may offer shares at a price that we believe reflects the NAV per share of such stock more appropriately than the prior month’s NAV per share in cases where we believe there has been a material change (positive or negative) to our NAV per share since the end of the prior month. This is a “best efforts” offering, which means that Apollo Global Securities, LLC, the dealer manager for this offering, will use its best efforts to sell shares, but is not obligated to purchase or sell any specific amount of shares in this offering.

Although we do not intend to list our shares of common stock for trading on an exchange or other trading market, in an effort to provide our stockholders with liquidity in respect of their investment in our shares, we have adopted a share repurchase plan whereby, subject to certain limitations, stockholders may request on a monthly basis that we repurchase all or any portion of their shares. We may choose to repurchase all, some or none of the shares that have been requested to be repurchased at the end of any particular month, in our discretion, subject to any limitations in the share repurchase plan. Subject to deductions for early repurchase, the repurchase price per share for each class of common stock would be equal to the then-current offering price before applicable selling commissions and dealer manager fees (the “transaction price”), as determined monthly, for such class.

We will accept purchase orders and hold investors’ funds in an interest-bearing escrow account until we receive purchase orders for at least $100,000,000, including any shares purchased by our sponsor, its affiliates and our directors and officers, in any combination of purchases of Class S shares, Class D shares, Class I shares, Class F-S shares, Class F-D shares and Class F-I shares and our board of directors has authorized the release to us of funds in the escrow account. Pennsylvania has a higher minimum offering amount. See “Plan of Distribution—Special Notice to Pennsylvania Investors” for the special escrow arrangement for Pennsylvania investors.