General Corporate Information

The Company was incorporated and registered in England and Wales under the Companies Act as a private company limited by shares on 20 October 2021 under the name DRVW 2022 Limited with registered number 13691224. The Company was re-registered as a public limited company (DRVW 2022 plc) on 23 February 2022 and changed its name to Haleon plc on 28 February 2022. The principal legislation under which the Company operates is the Companies Act and regulations made thereunder.

Following Separation, the principal activity of the Company is to act as the ultimate holding company of the Group.

The Company is domiciled in England and Wales with its registered and head office at Building 5, First Floor, The Heights, Weybridge, Surrey, KT13 0NY, United Kingdom. The telephone number of the Company’s registered office is +44 1932 822000 and its website is www.haleon.com. The information on the Company’s website does not form part of this prospectus.

Evolution of the Group

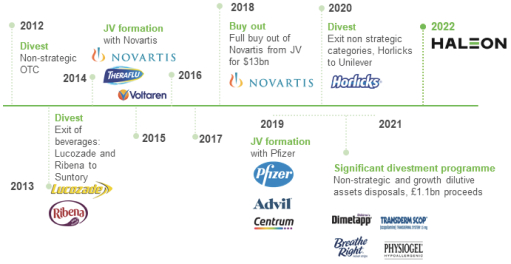

The Group has been transformed since 2012 through progressive strategic M&A and divestments to create a world leader in consumer healthcare.

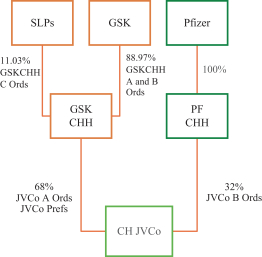

The Group’s scale has greatly expanded through the successful combination of the legacy GSK consumer healthcare business with the Novartis consumer healthcare business in 2015, and the subsequent combination of this business with the Pfizer consumer healthcare business in 2019, reaching revenue of £9.5 billion in FY 2021. In addition, the Group’s focus has been sharpened since 2012 through the progressive divestment of the GSK Group’s Nutritionals businesses (including Lucozade, Ribena and Horlicks) and the divestment by the Group of non-strategic OTC brands including its recent programme of divestments of non-strategic and growth-dilutive brands (with aggregate net proceeds from divested brands of £1.1 billion and examples of divested brands including Breathe Right, Physiogel and Venoruton) during the period from FY 2019 to FY 2021. This deliberate strategy has resulted in a portfolio more focused on higher-growth categories, markets and channels. These transactions also provided a catalyst for a broader transformation of the Group as set out below.

The key M&A milestones since 2012 in the Group’s business are summarised below:

70