UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________

SCHEDULE 14A

________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant |

☒ |

|

|

Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

CREATD, INC.

(Name of Registrant as Specified in its Charter)

_________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

419 Lafayette Street, 6th Floor

New York, NY 10003

Telephone: (201) 2584-3770

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on January 9, 2023

Dear Stockholder:

The 2022 Annual Meeting of the Stockholders (the “Annual Meeting”) of Creatd Inc., a Nevada corporation (together with its subsidiaries, “Company”, “Creatd”, “we”, “us” or “our”), will be held on January 9, 2023, at 2:00 pm local time virtually at http://annualgeneralmeetings.com/creatd/.

In addition to voting by submitting your proxy prior to the annual meeting, you also will be able to vote your shares electronically during the annual meeting. Further details regarding the virtual meeting are included in the accompanying proxy statement. At the annual meeting, the holders of our outstanding common stock will act on the following matters:

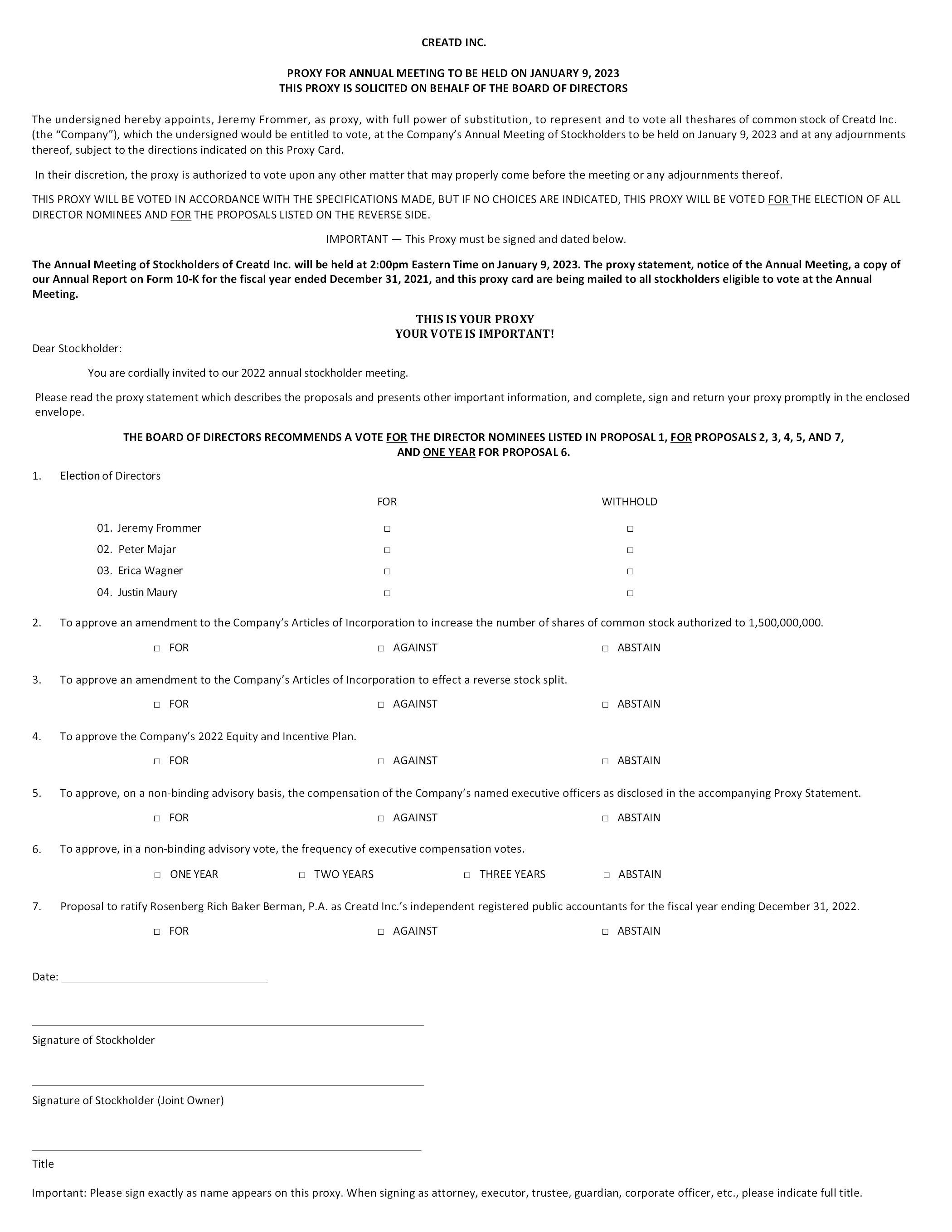

1. To elect four directors to serve until the next annual meeting of stockholders and until their respective successors shall have been duly elected and qualified (Proposal No. 1);

2. To approve an amendment to the Company’s Articles of Incorporation (the “Articles”) to increase the number of shares of common stock authorized (Proposal No. 2);

3. To approve an amendment to the Articles to effect a reverse stock split at a ratio not less than 1-for-2 and not greater than 1-for-500, with the exact ratio to be set within that range at the discretion of our board of directors without further approval or authorization of our stockholders (Proposal No. 3.),

4. To approve the Company’s 2022 Omnibus Securities and Incentive Plan (Proposal No. 4);

5. To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in the accompanying Proxy Statement (Proposal No. 5.);

6. To recommend, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of the Company’s named executive officers (Proposal No. 6);

7. To ratify the selection of Rosenberg Rich Baker Berman, P.A the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal No. 7); and

8. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Our board of directors has fixed November 18, 2022 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournment or postponement of the meeting.

All stockholders are cordially invited to attend the Annual Meeting. Whether or not you expect to attend the annual meeting, please complete, sign and date the enclosed proxy and return it promptly. If you plan to attend the annual meeting and wish to vote your shares personally, you may do so at any time before the proxy is voted.

To be admitted to the Annual Meeting at http://annualgeneralmeetings.com/Creatd/ you must have your control number available and follow the instructions found on your proxy card or voting instruction form. You may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting. Please allow sufficient time to complete the online check-in process. Your vote is very important.

BY ORDER OF THE BOARD OF DIRECTORS

|

/s/ Jeremy Frommer |

||

|

Jeremy Frommer |

||

|

Chief Executive Officer and Chairman of the |

||

|

New York |

||

|

November 30, 2022 |

Whether or not you expect to attend the Annual Meeting in person, we urge you to vote your shares via proxy at your earliest convenience. This will ensure the presence of a quorum at the Annual Meeting. Promptly voting your shares will save Creatd the expenses and extra work of additional solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option. Your vote is important, so please act today!

419 Lafayette Street, 6th Floor

New York, NY 10003

Telephone: (201) 2584-3770

PROXY STATEMENT FOR THE

2022 ANNUAL MEETING OF STOCKHOLDERS

To be held on January 9, 2023

The Board of Directors (the “Board” or “Board of Directors”) of Creatd, Inc. (“Creatd” or the “Company”) is soliciting your proxy to vote at the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on January 9, 2023, at 2:00 pm Eastern Time, in a virtual format online by accessing http://annualgeneralmeetings.com/Creatd/.

This proxy statement contains information relating to the Annual Meeting. This year’s annual meeting of shareholders will be held as a virtual meeting. Shareholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend and participate in the annual meeting online via a live webcast by visiting http://annualgeneralmeetings.com/Creatd/. In addition to voting by submitting your proxy prior to the annual meeting, you also will be able to vote your shares electronically during the annual meeting.

Shareholders of record at the close of Business on November 18, 2022 are entitled to notice of and are cordially invited to, attend this Annual Meeting, or any adjournments or postponements thereof. Whether or not you are able to attend the Annual Meeting, please assure the representation of your shares and vote your proxy via the Internet, fax, or, if you request to receive printed proxy materials, by mailing a proxy using the instructions detailed on the Notice of Internet Availability of Proxy Materials (the “Notice”) that you received in the mail.

The notice was mailed to shareholders on or about November 30, 2022.

i

Creatd Inc.

419 Lafayette Street, Sixth Floor

New York, NY 1003

Telephone: (201) 258 3770

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JANUARY 9, 2023

GENERAL INFORMATION ABOUT THE PROXY

STATEMENT AND ANNUAL MEETING

General

The enclosed proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Creatd Inc., (the “Company,” “we” or “us”), for use at the 2022 Annual Meeting of the Company’s stockholders (the “Annual Meeting”) to be held at 419 Lafayette Street, 6th Floor, New York, NY 10003, on January 9, 2023, at 2:00pm local time, and at any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. Accompanying this Proxy Statement is a proxy/voting instruction form (the “Proxy”) for the Annual Meeting, which you may use to indicate your vote as to the proposals contained in this Proxy Statement. Whether or not you expect to attend the meeting in person, please submit your Proxy to vote your shares as promptly as possible to ensure that your vote is counted. It is contemplated that this Proxy Statement and the accompanying form of Proxy will first be mailed to the Company’s stockholders on or about November 30, 2022.

Revocability of Proxies

All Proxies which are properly completed, signed and returned prior to the Annual Meeting, and which have not been revoked, will be voted in favor of the proposals described in this Proxy Statement unless otherwise directed. A stockholder may revoke his or her Proxy at any time before it is voted either by filing with the Chief Executive Officer of the Company, at its principal executive offices located at 419 Lafayette Street, 6th Floor, New York, NY 10003, a written notice of revocation or a duly-executed Proxy bearing a later date or by attending the Annual Meeting and voting in person.

Solicitation of Proxies

The Company will solicit stockholders by mail through its regular employees and will request banks and brokers and other custodians, nominees and fiduciaries, to solicit their customers who have stock of the Company registered in the names of such persons and will reimburse them for reasonable, out-of-pocket costs. In addition, the Company may use the service of its officers and directors to solicit proxies, personally or by telephone, without additional compensation.

Record Date November 18, 2022

The holders of record of the outstanding shares of Common Stock at the close of business on November 18, 2022 (the “Record Date”), will be entitled to receive notice of, attend and vote at the meeting.

Voting Securities

The presence in person or by proxy of the holders of a majority in interest of all stock of the Company issued and outstanding and entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. In the absence of a quorum at the meeting, the meeting may be adjourned from time to time without notice, other than announcement at the meeting, until a quorum is formed. The enclosed Proxy reflects the number of shares that you are entitled to vote pursuant to such Proxy. For purposes of the quorum and the discussion below regarding the vote necessary to take stockholder action, stockholders of record who are present at the Annual Meeting in person or by proxy and who abstain, including broker non-votes (as described below), are considered stockholders who are present for purposes of determining the presence of a quorum.

1

QUESTIONS AND ANSWERS ABOUT THIS PROXY STATEMENT AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board is soliciting your proxy to vote at the Annual Meeting of Shareholders. According to our records, you were a shareholder of the Company as of the end of business on November 18, 2022.

You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules adopted by the SEC, we may furnish proxy materials, including this proxy statement and our Annual Report on Form 10-K, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice, which was mailed to the holders of our common stock, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

The proxy statement and our Annual Report on Form 10-K are available at http://annualgeneralmeetings.com/Creatd/

To access the materials, you must enter the control number included on your Notice.

The Notice is being made available to you by the Company in connection with its solicitation of proxies for use at the 2022 Annual Meeting of Shareholders of the Company (the “Annual Meeting”) to be held at 2:00pm Eastern Time on January 9, 2023 and/or any adjournments or postponements thereof. The Notice was first given or sent to shareholders on or about November 30, 2022. This proxy statement gives you information on these proposals so that you can make an informed decision.

What is a proxy?

A proxy is the legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card.

What is a proxy card?

By completing a proxy card, as more fully described herein, you are designating Jeremy Frommer, our Chief Executive Officer as your proxies for the Annual Meeting and you are authorizing Mr. Frommer to vote your shares at the Annual Meeting as you have instructed them on the proxy card. This way, your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting virtually, we urge you to vote in one of the ways described below so that your vote will be counted even if you are unable or decide not to attend the Annual Meeting.

What is a proxy statement?

A proxy statement is a document that we are required by regulations of the U.S. Securities and Exchange Commission, or “SEC,” to give you when we ask you to sign a proxy card designating Mr. Frommer as proxy to vote on your behalf.

Why did you send me this proxy statement?

We sent you this proxy statement and the enclosed proxy card because our Board is soliciting your proxy to vote at the 2022 Annual Meeting of stockholders. This proxy statement summarizes information related to your vote at the Annual Meeting. All stockholders who find it convenient to do so are cordially invited to attend the Annual Meeting virtually. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card or vote over the Internet.

2

What Does it Mean if I Receive More than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please complete, sign, and return each proxy card to ensure that all of your shares are voted.

I share the same address with another Creatd, Inc. shareholder. Why has our household only received one set of proxy materials?

The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our shareholders. This practice, known as “householding,” is intended to reduce the Company’s printing and postage costs. We have delivered only one set of proxy materials to shareholders who hold their shares through a bank, broker or other holder of record and share a single address, unless we received contrary instructions from any shareholder at that address. However, any such street name holder residing at the same address who wishes to receive a separate copy of the proxy materials may make such a request by contacting the bank, broker or other holder of record, or, 619 Lafayette Street, Sixth Floor, New York, NY 10003 Attn: Corporate Secretary. Street name holders residing at the same address who would like to request householding of Company materials may do so by contacting the bank, broker or other holder of record or the Corporate Secretary at the phone number or address listed above.

How do I attend the Annual Meeting?

The Annual Meeting will be held on January 9, 2023, at 2:00pm Eastern Time in a virtual format online by accessing http://annualgeneralmeetings.com/Creatd/. Information on how to vote in person at the Annual Meeting is discussed below.

Who is Entitled to Vote?

The Board has fixed the close of business on November 18, 2022 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. On the Record Date, there were shares of common stock outstanding. Each share of common stock represents one vote that may be voted on each proposal that may come before the Annual Meeting.

What is the Difference Between Holding Shares as a Record Holder and as a Beneficial Owner (Holding Shares in Street Name)?

If your shares are registered in your name with our transfer agent, Pacific Stock Transfer, you are the “record holder” of those shares. If you are a record holder, these proxy materials have been provided directly to you by the Company.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials have been forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct this organization on how to vote your shares.

Who May Attend the Annual Meeting?

Only record holders and beneficial owners of our common stock, or their duly authorized proxies, may attend the Annual Meeting held in virtual format.

What am I Voting on?

There are seven matters scheduled for a vote:

1. To elect four directors to serve until the next annual meeting of stockholders and until their respective successors shall have been duly elected and qualified (Proposal No. 1);

2. To approve an amendment to the Company’s Articles of Incorporation (the “Articles”) to increase the number of shares of common stock authorized (Proposal No. 2);

3

3. To approve an amendment to the Articles to effect a reverse stock split at a ratio not less than 1-for-2 and not greater than 1-for-500, with the exact ratio to be set within that range at the discretion of our board of directors without further approval or authorization of our stockholders (Proposal No. 3.),

4. To approve the Company’s 2022 Omnibus Securities and Incentive Plan (Proposal No. 4);

5. To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in the accompanying Proxy Statement (Proposal No. 5.);

6. To recommend, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of the Company’s named executive officers (Proposal No. 6);

7. To ratify the selection of Rosenberg Rich Baker Berman, P.A the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal No. 7); and

8. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

What if another matter is properly brought before the Annual Meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How Do I Vote?

Stockholders of Record

For your convenience, record holders of our common stock have three methods of voting:

1. Vote by Internet. The website address for Internet voting is on your vote instruction form;

2. Vote by mail. Mark, date, sign and promptly mail the proxy card; or

3. Vote at the Meeting. Attend and vote at the Annual Meeting held in virtual format.

Beneficial Owners of Shares Held in Street Name

For your convenience, beneficial owners of our common stock have three methods of voting:

1. Vote by Internet. The website address for Internet voting is on your vote instruction form;

2. Vote by mail. Mark, date, sign and promptly mail your vote instruction form; or

3. Vote at the Meeting. Obtain a valid legal proxy from the organization that holds your shares and attend and vote at the Annual Meeting held in virtual format.

All shares entitled to vote and represented by a properly completed and executed proxy received before the Annual Meeting and not revoked will be voted at the Annual Meeting as instructed in a proxy delivered before the Annual Meeting. We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How Many Votes do I Have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the close of business on the Record Date.

4

Is My Vote Confidential?

Yes, your vote is confidential. Only the inspector of elections, individuals who help with processing and counting your votes and persons who need access for legal reasons will have access to your vote. This information will not be disclosed, except as required by law.

What Constitutes a Quorum?

To carry on business at the Annual Meeting, we must have a quorum. A quorum is present when a majority of the shares entitled to vote, as of the Record Date, are represented in person or by proxy. Thus, 6,997,355 shares must be represented in person or by proxy to have a quorum at the Annual Meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. Shares owned by us are not considered outstanding or considered to be present at the Annual Meeting. If there is not a quorum at the Annual Meeting, either the chairperson of the Annual Meeting or our stockholders entitled to vote at the Annual Meeting may adjourn the Annual Meeting.

How Will my Shares be Voted if I Give No Specific Instruction?

We must vote your shares as you have instructed. If there is a matter on which a stockholder of record has given no specific instruction but has authorized us generally to vote the shares, they will be voted as follows:

1. To elect four directors to serve until the next annual meeting of stockholders and until their respective successors shall have been duly elected and qualified (Proposal No. 1);

2. To approve an amendment to the Company’s Articles of Incorporation (the “Articles”) to increase the number of shares of common stock authorized (Proposal No. 2);

3. To approve an amendment to the Articles to effect a reverse stock split at a ratio not less than 1-for-2 and not greater than 1-for-500, with the exact ratio to be set within that range at the discretion of our board of directors without further approval or authorization of our stockholders (Proposal No. 3.),

4. To approve the Company’s 2022 Omnibus Securities and Incentive Plan (Proposal No. 4);

5. To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in the accompanying Proxy Statement (Proposal No. 5.);

6. To recommend, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of the Company’s named executive officers (Proposal No. 6);

7. To ratify the selection of Rosenberg Rich Baker Berman, P.A the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal No. 7); and

8. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

If other matters properly come before the Annual Meeting and you do not provide specific voting instructions, your shares will be voted at the discretion of Mr. Frommer, the Board’s designated proxies.

If your shares are held in street name, see “What is a Broker Non-Vote?” below regarding the ability of banks, brokers and other such holders of record to vote the uninstructed shares of their customers or other beneficial owners in their discretion.

Uninstructed Shares

All proxies that are executed or are otherwise submitted over the internet, by mail or in person will be voted on the matters set forth in the accompanying notice of Annual Meeting in accordance with the instructions set forth herein. However, if no choice is specified on a proxy as to one or more of the proposals, the proxy will be voted in accordance with the Board of Directors’ recommendations on such proposals as set forth in this proxy statement.

5

How are Votes Counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, for the election of directors, “For,” “Withhold” and broker non-votes; and, with respect to the other proposals, votes “For” and “Against,” abstentions and broker non-votes. Broker non-votes will not be included in the tabulation of the voting results of any of the proposals and, therefore, will have no effect on such proposals.

What is a Broker Non-Vote?

A “broker non-vote” occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a proposal because (1) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker lacks the authority to vote the shares at their discretion.

Under current Nasdaq rules and interpretations that govern broker non-votes: Proposal No. 1 for the election of directors is considered a non-discretionary matter, and a broker will lack the authority to vote uninstructed shares at their discretion on such proposal; and Proposal No 7. for the ratification of the appointment of Rosenberg Rich Baker Berman, P.A. as our independent registered public accounting firm for our fiscal year ending December 31, 2022 is considered a discretionary matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on the proposal.

How many votes are required to approve each proposal?

The table below summarizes the proposals that will be voted on, the vote required to approve each item and how votes are counted:

|

Proposal |

Votes Required |

Voting Options |

||

|

Proposal No. 1: Election of Directors |

The plurality of the votes cast. This means that the nominees receiving the highest number of affirmative “FOR” votes will be elected as directors. |

“FOR” “WITHHOLD” |

||

|

Proposal No. 2: To Approve an Amendment to the Company’s Articles of Incorporation to Increase the Number of Shares of Common Stock Authorized |

The affirmative vote of the holders of a majority of the outstanding shares of our common stock is required to approve this proposal. |

“FOR” “AGAINST” “ABSTAIN” |

||

|

Proposal No. 3: To Approve an Amendment to the Articles to Effect a Reverse Stock Split |

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the Annual Meeting by the holders entitled to vote thereon. |

“FOR” “AGAINST” “ABSTAIN” |

||

|

Proposal No. 4: To Approve the Company’s 2022 Omnibus Securities and Incentive Plan |

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the Annual Meeting by the holders entitled to vote thereon. |

“FOR” “AGAINST” “ABSTAIN” |

||

|

Proposal No. 5: To Approve, on a Non-binding Advisory Basis, the Compensation of the Company’s Named Executive Officers |

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the Annual Meeting by the holders entitled to vote thereon. |

“FOR” “AGAINST” “ABSTAIN” |

||

|

Proposal No. 6: Advisory Vote on the Frequency of the Advisory Vote on Executive Compensation |

The plurality of all votes cast. This means that the choice receiving the highest number of affirmative “FOR” votes will be elected. |

“1 YEAR” “2 YEARS” “3 YEARS” “ABSTAIN” |

||

|

Proposal No. 7: To Ratify the Selection of Rosenberg Rich Baker Berman, P.A., the Company’s Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2022 |

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the Annual Meeting by the holders entitled to vote thereon. |

“FOR” “AGAINST” “ABSTAIN” |

6

What is an Abstention?

An abstention is a stockholder’s affirmative choice to decline to vote on a proposal. Under Nevada law, abstentions are counted as shares present and entitled to vote at the Annual Meeting. Generally, unless provided otherwise by applicable law, our Amended and Restated Bylaws provide that an action of our stockholders (other than the election of directors) is approved if a majority of the number of shares of stock entitled to vote thereon and present (either in person or by proxy) vote in favor of such action. Therefore, votes that are “WITHHELD” will have the same effect as an abstention and will not count as a vote “FOR” or “AGAINST” a director, because directors are elected by plurality voting. A vote marked as “ABSTAIN” is not considered a vote cast and will, therefore, not affect the outcome in Proposal No. 1.

What Are the Voting Procedures?

In voting by proxy with regard to the election of directors, you may vote in favor of all nominees, withhold your votes as to all nominees, or withhold your votes as to specific nominees. With regard to other proposals, you may vote in favor of or against the proposal, or you may abstain from voting on the proposal. You should specify your respective choices on the accompanying proxy card or your vote instruction form.

Is My Proxy Revocable?

If you are a registered stockholder, you may revoke or change your vote at any time before the proxy is voted by filing with our Corporate Secretary, at 2050 Center Avenue, Suite 640, Fort Lee, NJ 07024, either a written notice of revocation or a duly executed proxy bearing a later date. If you attend the live webcast of the Annual Meeting you may revoke your proxy or change your proxy vote by voting electronically at the meeting. Your attendance at the annual meeting will not by itself revoke a previously granted proxy.

If your shares are held in street name or you hold shares through a retirement or savings plan or other similar plan, please check your voting instruction card or contact your broker, nominee, trustee or administrator to determine whether you will be able to revoke or change your vote.

Who is Paying for the Expenses Involved in Preparing this Proxy Statement?

All of the expenses involved in preparing and assembling these proxy materials and mailing the Notice (and any paper materials, if requested) and all costs of soliciting proxies will be paid by us. In addition to the solicitation by mail, proxies may be solicited by our officers and other employees by telephone or in person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in forwarding solicitation materials.

Do I Have Dissenters’ Rights of Appraisal?

Creatd stockholders do not have appraisal rights under Nevada law or under Creatd’s governing documents with respect to the matters to be voted upon at the Annual Meeting.

How can I Find out the Results of the Voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be disclosed in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Current Report on Form 8-K to publish the final results.

7

When are Stockholder Proposals Due for the 2023 Annual Meeting?

Stockholders who intend to have a proposal considered for inclusion in our proxy materials for presentation at our 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”) must submit the proposal to us at our corporate headquarters no later than May 15, 2023, which proposal must be made in accordance with the provisions of Rule 14a-8 of the Exchange Act. Pursuant to our Amended and Restated Bylaws, nothing in the procedure described in the sentence above shall be deemed to affect the rights of stockholders to request inclusion of proposals in our proxy statement pursuant to Rule l4a-8 under the Exchange Act.

Stockholders who intend to present a proposal at our 2023 Annual Meeting of Stockholders without inclusion of the proposal in our proxy materials are required to provide notice of such proposal to our Corporate Secretary so that such notice is received by our Corporate Secretary at our principal executive offices on or after March 15, 2023 but no later than May 15, 2023. We reserve the right to reject, rule out of order or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

Excluding Proposal 1 (Election of Directors), Do the Company’s Executive Officers and Directors have an Interest in Any of the Matters to Be Acted Upon at the Annual Meeting?

Members of the Board and executive officers of Creatd do not have any substantial interest, direct or indirect, other than Proposal No. 1.

Are any of the proposals conditioned on one another?

No.

8

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

Our Board currently consists of four (4) directors, and their terms will expire at the Annual Meeting. Directors are elected at the annual meeting of stockholders each year and hold office until such director’s successor is elected and qualified, or until such director’s earlier death, resignation or removal.

Jeremy Frommer, Peter Majar, Erica Wagner, and Justin Maury have each been nominated to serve as directors and have agreed to stand for election. If these nominees are elected at the Annual Meeting, then each nominee will serve for a one-year term expiring at the 2023 annual meeting of stockholders and until his or her successor is duly elected and qualified. Directors are elected by a plurality of the votes cast at the election. This means that the nominees receiving the highest number of affirmative “FOR” votes will be elected as directors.

If no contrary indication is made, proxies will be voted “FOR” all nominees listed below or, in the event that any such individual is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), for any nominee who is designated by our Board to fill the vacancy.

Board Recommendation

The board of directors unanimously recommends a vote “FOR” the election of all of our director nominees.

Nominees for Election to the Board

|

Name |

Age |

Positions |

||

|

Jeremy Frommer |

55 |

Chief Executive Officer, Director |

||

|

Peter Majar |

58 |

Director |

||

|

Erica Wagner |

55 |

Director |

||

|

Justin Maury |

33 |

President, Chief Operating Officer, Director |

Nominees for Election to the Board for a Term Expiring at the 2023 Annual Meeting of Stockholders

Jeremy Frommer — Executive Chairman and Chief Executive Officer

Mr. Frommer was appointed Executive Chairman in February 2022 and has been a member of our board of directors since February 2016. Previously, he served as our Chief Executive Officer from February 2016 to August 2021, and Co-Chief Executive Officer from August 2021 to February 2022. Mr. Frommer has over 20 years of experience in the financial technology industry. Previously, Mr. Frommer held key leadership roles in the investment banking and trading divisions of large financial institutions. From 2009 to 2012, Mr. Frommer was briefly retired until beginning concept formation for Jerrick Ventures which he officially founded in 2013. From 2007 to 2009, Mr. Frommer was Managing Director of Global Prime Services at RBC Capital Markets, the investment banking arm of the Royal Bank of Canada, the largest financial institution in Canada, after the sale of Carlin Financial Group, a professional trading firm. From 2004 to 2007, Mr. Frommer was the Chief Executive Officer of Carlin Financial Group after the sale of NextGen Trading, a software development company focused on building equity trading platforms. From 2002 to 2004, Mr. Frommer was Founder and Chief Executive Officer of NextGen Trading. From 2000 to 2002, he was Managing Director of Merger Arbitrage Trading at Bank of America, a financial services firm. Mr. Frommer was also a director of LionEye Capital, a hedge fund from June 2012 to June 2014. He holds a B.A. from the University of Albany. We believe Mr. Frommer is qualified to serve on our board of directors due to his financial and leadership experience.

Peter Majar — Director

Peter Majar, age 58, Founder and Managing Member of Majar Advisors, combines over 25 years of experience in investment banking, financial services and technology, and management consulting, having held numerous senior management and executive positions including Chief Financial Officer, Head of Financial Technology, Head of Strategy, as well as several Managing Director positions. From 2015 to 2017, Mr. Majar served as Managing Director in Investment Banking and co-Head of Diversified Financial Services at Piper Jaffray & Co. (now Piper Sandler Companies). From 2017 to 2018, Mr. Majar provided management consulting services through his self-established firm, Majar Advisors LLC, which remains in operation through the present. From 2018 to 2021, Mr. Majar served as Managing Director, Head of Financial Technology at New York-based investment banking and financial advisory firm,

9

TAP Advisors, LLC. Between 2021 and 2022, Mr. Majar served as Chief Financial Officer at information technology company Hoyos Integrity Corp., having previously served as a longtime advisor to the firm. Mr. Majar holds an undergraduate degree from University of Washington and an MBA from Columbia University.

Erica Wagner — Director

Ms. Wagner, age 55, combines over 25 years of experience as a journalist, broadcaster, editor and author. From 2016 through 2021, Ms. Wagner was a Lecturer, and later Senior Lecturer, at Goldsmith’s College, University of London, where she taught creative writing. Ms. Wagner was previously Lead Editorial Innovator for Creatd, Inc., has previously and currently held roles as a freelance editor, journalist, and contributing writer for numerous outlets both in the U.K. and the U.S., including The New Statesman, Harper’s Bazaar, the Economist, the Observer, the New York Times. Ms. Wagner is also a freelance literary and creative consultant for Chanel, as well as the host of their branded podcast. She has twice been a judge of the Booker Prize and has been judge and Chair of the Goldsmiths Prize. In 2015, Ms. Wagner was awarded an Honorary PhD by the University of East Anglia, and currently Goldsmith’s College Distinguished Writers’ Centre Fellow. She has an undergraduate degree from University of Cambridge, a Master’s degree from University of East Anglia, and an Honorary PhD from the University of East Anglia.

Justin Maury — Chief Operating Office, Director & President

Mr. Maury has served as our President since January 2019, and was appointed Chief Operating Officer in August 2021. He is a full stack design director with an expertise in product development. With over ten years of design and product management experience in the creative industry, Mr. Maury’s passion for the creative arts and technology ultimately resulted in the vision for Vocal. Since joining Creatd in 2013, Maury has overseen the development and launch of the company’s flagship product, Vocal, an innovative platform that provides storytelling tools and engaged communities for creators and brands to get discovered while funding their creativity. Under Maury’s supervision, Vocal has achieved growth to over 380,000 creators across 34 genre-specific communities in its first two years since launch.

Family Relationships

There are no other family relationships among any of our current or former directors or executive officers.

Director Terms; Qualifications

Members of our board of directors serve until the next annual meeting of stockholders, or until their successors have been duly elected.

When considering whether directors and nominees have the experience, qualifications, attributes and skills to enable the board of directors to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the board of directors focuses primarily on the industry and transactional experience, and other background, in addition to any unique skills or attributes associated with a director.

Director or Officer Involvement in Certain Legal Proceedings

There are no material proceedings to which any director or officer, or any associate of any such director or officer, is a party that is averse to our Company or any of our subsidiaries or has a material interest adverse to our Company or any of our subsidiaries. No director or executive officer has been a director or executive officer of any business which has filed a bankruptcy petition or had a bankruptcy petition filed against it during the past ten years. No director or executive officer has been convicted of a criminal offense or is the subject of a pending criminal proceeding during the past ten years. No director or executive officer has been the subject of any order, judgment or decree of any court permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities during the past ten years. No director or officer has been found by a court to have violated a federal or state securities or commodities law during the past ten years.

10

Directors and Officers Liability Insurance

The Company has directors’ and officers’ liability insurance insuring its directors and officers against liability for acts or omissions in their capacities as directors or officers, subject to certain exclusions. Such insurance also insures the Company against losses, which it may incur in indemnifying its officers and directors. In addition, officers and directors also have indemnification rights under applicable laws, and the Company’s Second Amended and Restated Articles of Incorporation and Amended and Restated Bylaws.

Director Independence

The listing rules of The Nasdaq Stock Market LLC (“Nasdaq”) require that independent directors must comprise a majority of a listed company’s board of directors. In addition, the rules of Nasdaq require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and governance committees be independent. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. Under the rules of Nasdaq, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our board of directors has undertaken a review of the independence of our directors and considered whether any director has a material relationship with it that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning his background, employment and affiliations, including family relationships, the board of directors has determined that Peter Majar is “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing standards of Nasdaq. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director has with the Company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of the Company’s capital stock by each non-employee director, and any transactions involving them described in the section captioned “— Certain relationships and related transactions and director independence.”

Board Committees

The Company’s Board has established three standing committees: Audit, Compensation, and Nominating and Corporate Governance. Each of the committees operates pursuant to its charter. The committee charters will be reviewed annually by the Nominating and Corporate Governance Committee. If appropriate, and in consultation with the chairs of the other committees, the Nominating and Corporate Governance Committee may propose revisions to the charters. The responsibilities of each committee are described in more detail below.

Audit Committee

The Audit Committee, among other things, will be responsible for:

• appointing; approving the compensation of; overseeing the work of; and assessing the independence, qualifications, and performance of the independent auditor;

• reviewing the internal audit function, including its independence, plans, and budget;

• approving, in advance, audit and any permissible non-audit services performed by our independent auditor;

• reviewing our internal controls with the independent auditor, the internal auditor, and management;

• reviewing the adequacy of our accounting and financial controls as reported by the independent auditor, the internal auditor, and management;

• overseeing our financial compliance system; and

• overseeing our major risk exposures regarding the Company’s accounting and financial reporting policies, the activities of our internal audit function, and information technology.

11

The board of directors has affirmatively determined that each member of the Audit Committee meets the additional independence criteria applicable to audit committee members under SEC rules and Nasdaq listing rules. The board of directors has adopted a written charter setting forth the authority and responsibilities of the Audit Committee. The Board has affirmatively determined that each member of the Audit Committee is financially literate, and that Mr. Standish meets the qualifications of an Audit Committee financial expert.

The Audit Committee consists of Mr. Majar, who chairs the Audit Committee. A third independent director must be added to the Audit Committee for it to comply with the applicable requirements of the rules and regulations of the Nasdaq listing rules and the SEC.

Compensation Committee

The Compensation Committee will be responsible for:

• reviewing and making recommendations to the Board with respect to the compensation of our officers and directors, including the CEO;

• overseeing and administering the Company’s executive compensation plans, including equity-based awards;

• negotiating and overseeing employment agreements with officers and directors; and

• overseeing how the Company’s compensation policies and practices may affect the Company’s risk management practices and/or risk-taking incentives.

The board of directors has adopted a written charter setting forth the authority and responsibilities of the Compensation Committee.

The Compensation Committee consists of Ms. Wagner and Mr. Majar, who serves as chair of the Compensation Committee. The board of directors has affirmatively determined that each member of the Compensation Committee meets the independence criteria applicable to compensation committee members under SEC rules and Nasdaq listing rules. A third independent director must be added to the Compensation Committee for it to comply with the applicable requirements of the rules and regulations of the Nasdaq listing rules and the SEC.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee, among other things, is responsible for:

• reviewing and assessing the development of the executive officers and considering and making recommendations to the Board regarding promotion and succession issues;

• evaluating and reporting to the Board on the performance and effectiveness of the directors, committees and the Board as a whole;

• working with the Board to determine the appropriate and desirable mix of characteristics, skills, expertise and experience, including diversity considerations, for the full Board and each committee;

• annually presenting to the Board a list of individuals recommended to be nominated for election to the Board;

• reviewing, evaluating, and recommending changes to the Company’s Corporate Governance Principles and Committee Charters;

• recommending to the Board individuals to be elected to fill vacancies and newly created directorships;

• overseeing the Company’s compliance program, including the Code of Conduct; and

• overseeing and evaluating how the Company’s corporate governance and legal and regulatory compliance policies and practices, including leadership, structure, and succession planning, may affect the Company’s major risk exposures.

12

The board of directors has adopted a written charter setting forth the authority and responsibilities of the Corporate Governance/Nominating Committee.

The Nominating and Corporate Governance Committee consists of Mr. Majar and Ms. Wagner, who serves as chair. The Company’s board of directors has determined that each member of the Nominating and Corporate Governance Committee is independent within the meaning of the independent director guidelines of Nasdaq listing rules.

Compensation Committee Interlocks and Insider Participation

None of the Company’s executive officers serves, or in the past has served, as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of the Company’s board of directors or its compensation committee. None of the members of the Company’s compensation committee is, or has ever been, an officer or employee of the company.

Code of Business Conduct and Ethics

The Company’s Board of Directors has adopted a code of business conduct and ethics applicable to its employees, directors and officers, in accordance with applicable U.S. federal securities laws and the corporate governance rules of Nasdaq. The code of business conduct and ethics will be publicly available on the Company’s website. Any substantive amendments or waivers of the code of business conduct and ethics or code of ethics for senior financial officers may be made only by the Company’s board of directors and will be promptly disclosed as required by applicable U.S. federal securities laws and the corporate governance rules of Nasdaq.

Corporate Governance Guidelines

The Company’s board of directors has adopted corporate governance guidelines in accordance with the corporate governance rules of Nasdaq.

13

EXECUTIVE OFFICERS

The following are biographical summaries of our executive officers and their ages, except for Mr. Frommer and Mr. Maury, whose biographies are included under the heading “Proposal 1: Election of Directors” set forth above:

|

Name |

Age |

Positions |

||

|

Jeremy Frommer |

55 |

Chief Executive Officer |

||

|

Chelsea Pullano |

31 |

Chief Financial Officer |

||

|

Justin Maury |

33 |

Chief Operating Officer and President |

Chelsea Pullano. Ms. Pullano has been our Chief Financial Officer since June 2020. She has a long history of leadership at Creatd, serving as a member of the Company’s Management Committee for four years. Prior to her current role, Ms. Pullano was an integral member of our finance department since 2017, most recently serving as our Head of Corporate Finance, a role in which she coordinated our periodic reports under the Exchange Act and other financial matters. Prior to joining the Finance Department, Ms. Pullano was a member of our operations team from 2015 to 2017. She holds a B.A. from the State University of New York College at Geneseo.

14

EXECUTIVE COMPENSATION

The following information is related to the compensation paid, distributed or accrued by us for the years ended December 31, 2021 and December 31, 2020 for our Chief Executive Officer (principal executive officer) serving during the year ended December 31, 2021 and the three other executive officers serving at December 31, 2021 whose total compensation exceeded $100,000 (the “Named Executive Officers”).

|

Name and Principal Position |

Year |

Salary |

Bonus |

Stock |

Option Awards |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings |

All Other |

Total |

|||||||||||||||||

|

Laurie Weisberg |

2021 |

$ |

313,750 |

$ |

25,000 |

$ |

20,226 |

|

$ |

763,894 |

— |

— |

$ |

24,925 |

(1) |

$ |

1,147,795 |

|||||||||

|

Chief Executive Officer |

2020 |

$ |

60,577 |

$ |

— |

|

— |

|

|

— |

— |

— |

$ |

7,875 |

(2) |

$ |

68,452 |

|||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Justin Maury |

2021 |

$ |

306,923 |

$ |

5,000 |

|

— |

|

$ |

1,479,328 |

— |

— |

$ |

7,919 |

(3) |

$ |

1,799,170 |

|||||||||

|

President & Chief Operating Officer |

2020 |

$ |

147,009 |

|

— |

$ |

412,204 |

(9) |

$ |

713,563 |

— |

— |

$ |

7,920 |

(4) |

$ |

1,280,696 |

|||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Chelsea Pullano |

2021 |

$ |

207,616 |

$ |

— |

|

— |

|

$ |

610,052 |

— |

— |

$ |

7,632 |

(5) |

$ |

825,300 |

|||||||||

|

Chief Financial Officer |

2020 |

$ |

123,500 |

|

— |

$ |

38,050 |

(10) |

$ |

522,121 |

— |

— |

$ |

1,908 |

(6) |

$ |

685,579 |

|||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Jeremy Frommer |

2021 |

$ |

665,433 |

$ |

200,000 |

|

— |

|

$ |

1,709,628 |

— |

— |

$ |

98,237 |

(7) |

$ |

2,673,298 |

|||||||||

|

Executive Chairman |

2020 |

$ |

234,231 |

$ |

182,000 |

$ |

469,255 |

(11) |

$ |

931,339 |

— |

— |

$ |

86,686 |

(8) |

$ |

1,903,511 |

|||||||||

____________

(1) The $24,925 includes payment to Ms. Weisberg for health insurance.

(2) The $7,875 includes payment to Ms. Weisberg for health insurance.

(3) The $7,919 includes payment to Mr. Maury for health insurance.

(4) The $7,920 includes payment to Mr. Maury for health insurance.

(5) The $7,632 includes payment to Ms. Pullano for health insurance.

(6) The $1,908 includes payment to Ms. Pullano for health insurance.

(7) The $98,237 includes payment to Mr. Frommer for living expenses, health insurance and a vehicle allowance.

(8) The $86,686 includes payment to Mr. Frommer for living expenses, health insurance and a vehicle allowance.

(9) On May 13, 2020, the Company exchanged 167,955 stock options for 251,933 shares of Common Stock. $403,604 is attributable to this exchange. $8,660 of this amount is attributable to the issuance of shares in lieu of wages.

(10) On May 13, 2020, the Company exchanged 14,205 stock options for 21,308 shares of Common Stock.

(11) On May 13, 2020, the Company exchanged 200,000 stock options for 300,000 shares of Common Stock. $456,134 is attributable to this exchange. $12,121 of this amount is attributable to the issuance of shares in lieu of wages.

Employment Agreements

As of December 31, 2021, the Company had not entered into any employment agreements, but has entered into such agreements with its Chief Executive Officer, Executive Chairman, President & Chief Operating Officer, and Chief Financial Officer subsequent to December 31, 2021.

15

Outstanding Equity Awards at Fiscal Year-End 2021

At December 31, 2021, we had outstanding equity awards as follows:

|

Name |

Number of |

Number of |

Equity |

Weighted |

Expiration Date |

Number of |

Market |

Equity |

Equity |

|||||||||||

|

Jeremy Frommer(1) |

210,188 |

400,000 |

— |

$ |

5.94 |

February 19, 2028(5) |

— |

$ |

— |

— |

— |

|||||||||

|

Laurie Weisberg(2) |

137,667 |

87,083 |

— |

$ |

7.13 |

February 19, 2028(6) |

— |

$ |

— |

— |

— |

|||||||||

|

Justin Maury(3) |

149,333 |

374,000 |

— |

$ |

5.93 |

February 19, 2028(7) |

— |

$ |

— |

— |

— |

|||||||||

|

Chelsea Pullano(4) |

87,000 |

150,000 |

— |

$ |

4.37 |

February 19, 2028(8) |

— |

$ |

— |

— |

— |

|||||||||

____________

(1) Effective February 5, 2016, to August 13, 2021, Jeremy Frommer was appointed as our Chief Executive Officer. Starting August 13, 2021, Jeremy Frommer was appointed Co-Chief Executive Officer with Laurie Weisberg. On February 17, 2022, the Company restructured its senior management team, eliminating the Co-Chief Executive Officer position, and Mr. Frommer was appointed Executive Chairman at such time.

(2) Effective September 28, 2020, to August 13, 2021, Laurie Weisberg was appointed as our Chief Operating Officer. Starting August 13, 2021, Laurie Weisberg was appointed Co-Chief Executive Officer with Jeremy Frommer. On February 17, 2022, the Company restructured its senior management team, eliminating the Co-Chief Executive Officer position, and Ms. Weisberg was appointed Chief Executive Officer at such time. Ms. Weisberg resigned from the Chief Executive Officer position effective September 2, 2022.

(3) Effective January 31, 2019, to August 13, 2021, Justin Maury was appointed as our President. Starting August 13, 2021, Justin Maury was appointed Chief Operating Officer in addition to President.

(4) Effective June 29, 2020, Chelsea Pullano was appointed Chief Financial Officer.

(5) 121,000 options expire on October 28, 2026, 200,000 options expire on February 19, 2027, 200,000 options expire on February 19, 2028.

(6) 53,750 options expire on February 4, 2026, 121,000 options expire on October 28, 2026, 25,000 options expire on February 19, 2027, 25,000 options expire on February 19, 2028.

(7) 81,000 options expire on October 28, 2026, 187,000 options expire on February 19, 2027, 187,000 options expire on February 19, 2028.

(8) 37,000 options expire on October 28, 2026, 75,000 options expire on February 19, 2027, 75,000 options expire on February 19, 2028.

Director Compensation

The following table presents the total compensation for each person who served as a non-employee member of our board of directors and received compensation for such service during the fiscal year ended December 31, 2021. Other than as set forth in the table and described more fully below, we did not pay any compensation, make any equity awards or non-equity awards to, or pay any other compensation to any of the non-employee members of our board of directors in 2021.

|

Director |

Option |

Fees Earned or |

Total |

||||||

|

Mark Standish(4) |

$ |

340,414 |

$ |

— |

$ |

340,414 |

|||

|

Mark Patterson(2) |

$ |

131,845 |

$ |

— |

$ |

131,845 |

|||

|

Leonard Schiller(4) |

$ |

171,453 |

$ |

— |

$ |

171,453 |

|||

|

LaBrena Martin(4) |

$ |

169,078 |

$ |

— |

$ |

169,078 |

|||

|

Laurie Weisberg(3) |

$ |

763,894 |

$ |

— |

$ |

763,894 |

|||

____________

(1) Amounts shown in this column do not reflect dollar amounts actually received by our non-employee directors. Instead, these amounts represent the aggregate grant date fair value of stock option awards determined in accordance with FASB ASC Topic 718.

16

(2) Mark Patterson resigned from the board of directors effective July 31, 2021.

(3) Laurie Weisberg resigned from the board of directors effective September 2, 2022.

(4) Mark Standish, Leonard Schiller, and LaBrena Martin resigned from the board of directors subsequent to December 31, 2021.

Vote Required

The five nominees for director receiving the highest number of votes “FOR” election will be elected as directors. This is called a plurality. Withholding a vote from a director nominee will not be voted with respect to the director nominee indicated and will have no impact on the election of directors although it will be counted for the purposes of determining whether there is a quorum. Broker non-votes will have no effect on the outcome of this proposal.

Recommendation of our Board

OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES FOR DIRECTORS.

17

PROPOSAL NO. 2:

AMENDMENT TO OUR ARTICLES OF INCORPORATION TO INCREASE AUTHORIZED STOCK

Our current Articles of Incorporation authorize the Board to issue 100,000,000 shares of common stock. This proposed Amendment will increase the Company’s shares of authorized Common Stock to 1,500,000,000 pursuant to the Articles.

Our Board believes that it is advisable and in the best interests of the Company and its stockholders to effect the Increase of Authorized Shares in order to provide additional shares that could be issued for raising of additional equity capital or other financing activities, stock dividends or the exercise of stock options and warrants and to provide additional shares that could be issued in an acquisition or other form of business combination and to better position the Company for future trading should a transaction be entered into and completed. The future issuance of additional shares of Common Stock on other than a pro rata basis to existing stockholders will dilute the ownership of the current stockholders, as well as their proportionate voting rights.

Attached as Annex A and incorporated herein by reference is the text of the Certificate of Amendment to Articles of Incorporation (the “Certificate of Amendment”) as approved by the Majority Stockholder. The Increase in Authorized Shares will be affected by filing the Certificate of Amendment with the Secretary of State of Nevada, which is expected to occur approximately twenty (20) days after the mailing of this Information Statement. The Increase in Authorized Shares will become effective upon such filing.

Required Vote of Stockholders

The affirmative vote of the holders of a majority of the outstanding shares of our common stock is required to approve this proposal.

Board Recommendation

The board of directors unanimously recommends a vote “FOR” Proposal 2.

Effects of Amendment.

The following table summarizes the principal effects of the Increase in the Authorized Shares:

|

Pre-Increase |

Post-Increase |

|||

|

Common Shares |

||||

|

Issued and Outstanding |

29,768,242 |

29,768,242 |

||

|

Authorized |

100,000,000 |

1,500,000,000 |

Potential Anti-Takeover Effects of the Increase in Authorized Shares.

THE OVERALL EFFECT OF THE COMMON STOCK INCREASE MAY BE TO RENDER MORE DIFFICULT THE CONSUMMATION OF MERGERS WITH THE COMPANY OR THE ASSUMPTION OF CONTROL BY A PRINCIPAL STOCKHOLDER, AND THUS MAKE IT DIFFICULT TO REMOVE MANAGEMENT.

The implementation of the Increase in Authorized Shares will have the effect of increasing the proportion of unissued authorized shares to issued shares. Under certain circumstances this may have an anti-takeover effect. These authorized but unissued shares could be used by the Company to oppose a hostile takeover attempt or to delay or prevent a change of control or changes in or removal of the Board, including a transaction that may be favored by a majority of our stockholders or in which our stockholders might receive a premium for their shares over then-current market prices or benefit in some other manner. For example, without further stockholder approval, the Board could issue and sell shares, thereby diluting the stock ownership of a person seeking to effect a change in the composition of our Board or to propose or complete a tender offer or business combination involving us and potentially strategically placing shares with purchasers who would oppose such a change in the Board or such a transaction.

18

Although an increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have a potential anti-takeover effect, the proposed amendments to our Articles of Incorporation is not in response to any effort of which we are aware to accumulate the shares of our Common Stock or obtain control of the Company. There are no plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover consequences.

The Board does not intend to use the consolidation as a part of or a first step in a “going private” transaction pursuant to Rule 13e-3 under the Securities Exchange Act of 1934, as amended. Moreover, we are currently not engaged in any negotiations or otherwise have no specific plans to use the additional authorized shares for any acquisition, merger or consolidation.

Dissenters’ Rights.

No dissenters’ or appraisal rights are available to our stockholders under the Nevada Revised Statutes or in the Company’s Articles of Incorporation or Bylaws in connection with the proposed amendment to our Articles of Incorporation to affect the Increase in Authorized Shares.

19

PROPOSAL NO. 3:

AMENDMENT TO OUR ARTICLES OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

Our Board has determined it may be advisable and in the best interest of the Company and its stockholders and is submitting to the stockholders for their approval a proposed amendment to our Articles of Incorporation that would allow the Board, if the Board determined that such action would be in the best interests of the Company in light of the factors discussed below, to effect a reverse stock split of our issued and outstanding common stock and treasury stock (the “Reverse Split”) at a ratio ranging from 1-for-2 to 1-for-500, with the final ratio to be determined by the Board in its discretion following the approval by the stockholders.

If the Board, following the approval by the stockholders, decides in its discretion to effect the Reverse Split, it would set the Reverse Split ratio from the range described above and the Articles would be further amended accordingly. Approval of this Reverse Split proposal will authorize the Board in its discretion to effect the Reverse Split at any ratio within the range described above, or to not effect the Reverse Split. A form of Amendment to the Articles that would be filed with the Secretary of State of Nevada (the “Nevada Secretary”) to effect the Reverse Split is set forth in Appendix A (the “Amendment”). However, such form is subject to modification to include such changes as may be required by the office of the Nevada Secretary or as the Board deems necessary and advisable to effect the Reverse Split. If at any time prior to the effectiveness of the filing of the Amendment with the Nevada Secretary, the Board determines that it would not be in the best interests of the Company and its stockholders to effect the Reverse Split, in accordance with Nevada law and notwithstanding the approval by the stockholders, the Board may abandon the Reverse Split without further action by the stockholders.

We believe that giving the Board the discretion to set the ratio within the stated range will provide us with the flexibility to implement the Reverse Split in a manner designed to maximize the anticipated benefits for our stockholders. By voting in favor of the Reverse Split, you are expressly authorizing the Board to select one ratio from among the ratios fitting within the range set forth above. If stockholders approve this proposal, the Board would effect the Reverse Split only upon the Board’s determination that the Reverse Split would be in the best interest of the Company and its stockholders at that time. In determining whether to implement the Reverse Split and selecting the Reverse Split ratio, our Board will consider several factors, including:

• the initial listing requirements of The Nasdaq Stock Market (“Nasdaq”) and The New York Stock Exchange (“NYSE”), including the minimum bid price requirement;

• the historical trading price and trading volume of our common stock;

• the then-prevailing trading price and trading volume for our common stock;

• the anticipated impact of the Reverse Split on the trading price of and market for our common stock; and

• the prevailing general market and economic conditions.

If approved by the stockholders, the authorization to effect the Reverse Split will remain effective until our common stock is listed on a national securities exchange or one year from the date of the Annual Meeting, whichever is earlier.

Appendix A hereto does not purport to be a complete description of the entirety of the Articles, and merely provides the terms of the Amendment. Such descriptions of the Amendment are qualified in their entirely by reference to the full Articles in effect as of the date hereof.

Reasons for the Reverse Split

The purpose of the Reverse Split is to increase the market price of our common stock in connection with the potential listing of our Common Stock on Nasdaq or NYSE. The Board intends to implement the Reverse Split only if it believes that a decrease in the number of shares outstanding is likely to improve the trading price for our common stock on a split-adjusted basis.

20

The Board believes that effecting the Reverse Split may be desirable for a number of reasons, including:

• List our Common Stock on Nasdaq. Our common stock is currently quoted on the OTCQB market under the symbol “CRTD”. The high and low sales prices of our common stock over the past thirty days were $1.74 and $0.45 per share. We intend to apply to have our common stock listed on Nasdaq or NYSE. We expect that the Reverse Split will increase the market price of our common stock so that we will be able to meet the minimum bid price requirements of the listing rules of Nasdaq.

• Broaden our Investor Base. We believe the Reverse Split may increase the price of our common stock and thus may provide a broader range of institutional investors with the ability to invest in our common stock. For example, many funds and institutions have investment guidelines and policies that prohibit them from investing in stocks trading below a certain threshold. We believe that increased institutional investor interest in the Company and our common stock will potentially increase the overall market for our common stock.

• Increase Analyst and Broker Interest. We believe the Reverse Split would help increase analyst and broker-dealer interest in our common stock as many brokerage and investment advisory firms’ policies can discourage analysts, advisors, and broker-dealers from following or recommending companies with low stock prices. Because of the trading volatility and lack of liquidity often associated with lower-priced stocks, many broker-dealers have adopted investment guidelines, policies and practices that either prohibit or discourage them from investing in or trading such stocks or recommending them to their customers. Some of those guidelines, policies and practices may also function to make the processing of trades in lower-priced stocks economically unattractive to broker-dealers. While we recognize that we will remain a “penny stock” under the SEC rules, if our common stock is not listed on the Nasdaq, we expect the increase in the stock price resulting from the Reverse Split will position us better if our business continues to grow as we anticipate. Additionally, because brokers’ commissions and dealer mark-ups/mark-downs on transactions in lower-priced stocks generally represent a higher percentage of the stock price than commissions and mark-ups/mark-downs on higher-priced stocks, the current average price per share of our common stock can result in stockholders or potential stockholders paying transaction costs representing a higher percentage of the total share value than would otherwise be the case if the share price were substantially higher.

Certain Risks Associated with the Reverse Split

If the Reverse Split does not result in a proportionate increase in the price of our common stock, we may not be able to list our common stock on Nasdaq or NYSE.

We expect that the Reverse Split will increase the market price of our common stock so that we will be able to meet the minimum bid price requirements for listing on Nasdaq or NYSE. However, the effect of Reverse Split upon the market price of our common stock cannot be predicted with certainty, and the results of reverse stock splits by companies in similar circumstances have been varied. It is possible that the market price of our common stock following the Reverse Split will not increase sufficiently for us to be in compliance with Nasdaq’s or NYSE’s minimum bid price requirement. If we are unable meet the minimum bid price requirement, we may be unable to list our shares on Nasdaq or NYSE.

Even if the Reverse Split achieves the requisite increase in the market price of our common stock, we cannot assure you that we will be able to continue to comply with the minimum bid price requirement of Nasdaq or NYSE.

Even if the Reverse Split achieves the requisite increase in the market price of our common stock to be in compliance with the minimum bid price of Nasdaq or NYSE, there can be no assurance that the market price of our common stock following the Reverse Split will remain at the level required for continuing compliance with Nasdaq or NYSE listing requirements. It is not uncommon for the market price of a company’s common stock to decline in the period following a reverse stock split. If the market price of our common stock declines following the effectuation of the Reverse Split, the percentage decline may be greater than would occur in the absence of a reverse stock split. In any event, other factors unrelated to the number of shares of our common stock outstanding, such as negative financial or operational results, could adversely affect the market price of our common stock and jeopardize our ability to meet or maintain Nasdaq’s or NYSE’s minimum bid price requirement.

21

Even if the Reverse Split increases the market price of our common stock, and we are able to achieve listing with Nasdaq or NYSE, our stock price could fall, and we could be delisted from such exchange.