Guidehouse Review of Holiday Inn Club Vacations Whole Loan Purchase Portfolio

Prepared for:

January 26, 2023

Presented by:

For Discussion Purposes Only

Confidential

Table of Contents

|

Section I

|

Project Overview and Scope

|

2

|

|

Section II

|

Summary of Initial Review Procedures

|

3

|

|

Section III

|

Summary of Review

|

5

|

|

Section IV

|

Conclusion – Guidehouse Overall Observations

|

10

|

|

Appendices

|

11

|

|

Appendix A – Scope Document Provided By Waterfall

|

11

|

|

Appendix B – Review Observations

|

15

|

|

I. Document Validation

|

15

|

|

II. Re-age Policy

|

16

|

| |

|

|

|

|

For Discussion Purposes Only

|

Page 1

|

Confidential

| Section I |

Project Overview and Scope

|

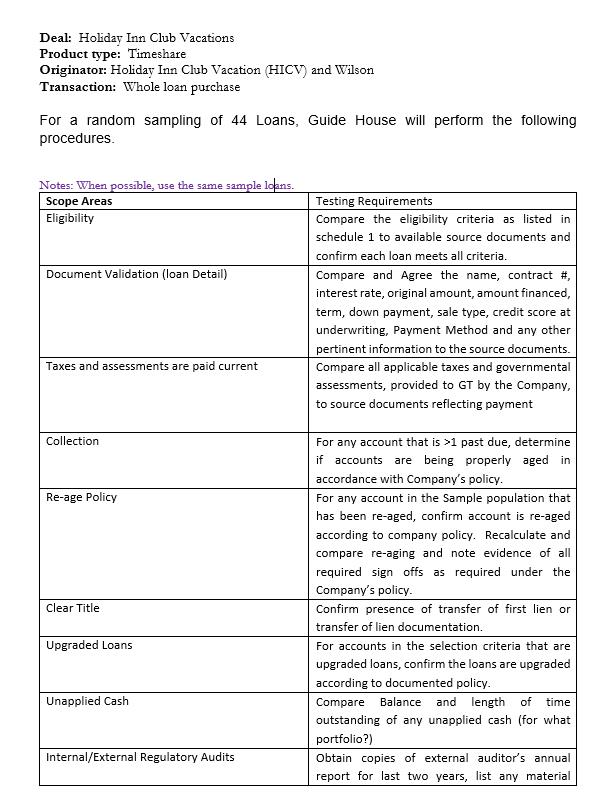

Waterfall Asset Management, LLC (Waterfall) engaged Guidehouse, Inc. (Guidehouse) to support the Holiday Inn Club Vacations (HICV) deal by reviewing 11 areas and sampling, as required, related to

timeshare whole loan purchases originated by HICV and Wilson. This review was limited to HICV only, as Wilson documentation was not available for Guidehouse’s review.

Guidehouse performed agreed upon procedures that were scoped by Waterfall. This was a limited review of the below 11 areas.

|

2. |

Document Validation (Loan Detail)

|

|

3. |

Taxes and Assessments Validation

|

|

9. |

Internal/External Regulatory Audits

|

Guidehouse’s review was limited in nature and performed at the direction of Waterfall. Additionally, Guidehouse did not perform validation of accuracy of any external reviews, including HICV’s financial audit.

The scope includes review of loans originated from January to November 2022.

Guidehouse worked with HICV to request and obtain necessary documentation to support analyses and to provide feedback on any initial review observations.

|

|

For Discussion Purposes Only

|

Page 2

|

Confidential

| Section II |

Summary of Initial Review Procedures

|

All review procedures are based on HICV company policies and testing requirements provided to Guidehouse by Waterfall Asset Management. The testing requirements included below

encompass initial testing procedures. In communication with HICV team and Waterfall management, the observations section notes any subsequent changes in the procedures and scope.

|

#

|

Scope Area

|

Testing Requirements

|

|

1

|

Eligibility

|

Compare the eligibility criteria as listed in schedule 11 to available source documents and confirm each loan meets all criteria.

|

|

2

|

Document Validation (Loan Detail)

|

Compare and Agree the name, contract #, interest rate, original amount, amount financed, term, down payment, sale type, credit score at underwriting, Payment Method and any

other pertinent information to the source documents.

|

|

3

|

Taxes and Assessments Validation

|

Compare all applicable taxes and governmental assessments, provided to GT by the Company, to source documents reflecting payment

|

|

4

|

Collection

|

For any account that is >1 past due, determine if accounts are being properly aged in accordance with Company’s policy.

|

|

5

|

Re-age Policy

|

For any account in the Sample population that has been re-aged, confirm account is re-aged according to company policy. Recalculate and compare re-aging and note evidence of

all required sign offs as required under the Company’s policy.

|

|

6

|

Clear Title

|

Confirm presence of transfer of first lien or transfer of lien documentation.

|

|

7

|

Upgraded Loans

|

For accounts in the selection criteria that are upgraded loans, confirm the loans are upgraded according to documented policy.

|

|

8

|

Unapplied Cash

|

Compare Balance and length of time outstanding of any unapplied cash.

|

|

9

|

Internal/External Regulatory Audits

|

Obtain copies of external auditor’s annual report for last two years, list any material weaknesses identified and remediation steps taken.

|

|

|

For Discussion Purposes Only

|

Page 3

|

Confidential

|

#

|

Scope Area

|

Testing Requirements

|

|

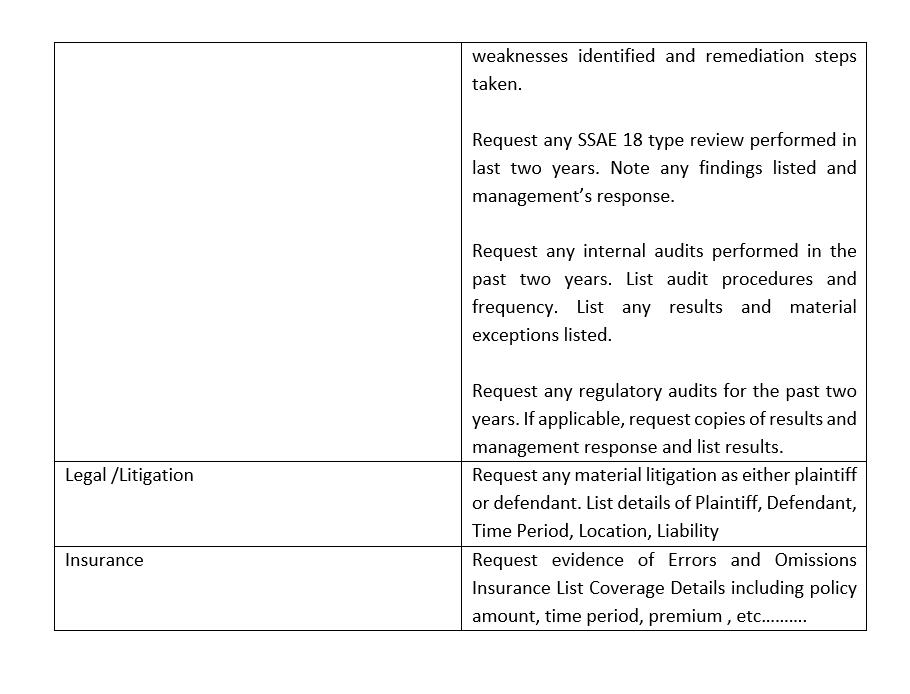

10

|

Legal /Litigation

|

Request any material litigation as either plaintiff or defendant. List details of Plaintiff, Defendant, Time Period, Location, Liability.

|

|

11

|

Insurance

|

Request evidence of Errors and Omissions Insurance List Coverage Details including policy amount, time period, premium, etc.

|

|

|

For Discussion Purposes Only

|

Page 4

|

Confidential

| Section III |

Summary of Review

|

The below summarizes our review by scope area. The sample sizes below were determined and provided by Waterfall.

|

#

|

Scope Area

|

Sample Size Tested

|

Review Scope Updates

|

Review Observations

|

|

1

|

Eligibility

|

43

|

1. Guidehouse review of the payment method against source documentation was

limited to two accounts, as per communication with HICV, providing support for the sample accounts appears to require additional time. No issues identified

2. Per Waterfall guidance, validation of compliance with the minimum

weighted average original FICO score threshold was excluded from Guidehouse review.

3. Validation of the weighted average coupon of all purchased receivables

was not part of Guidehouse review, as it appears Waterfall is verifying compliance with the criteria.

4. Following Waterfall guidance, Guidehouse did not make any additional

requests regarding eligibility validation of domestic accounts without FICO scores.

5. Following the initial Scope Document, Waterfall provided Guidehouse a

threshold of $100,000 to validate the “Total maximum outstanding principal balance of all Purchased Receivables (in the aggregate) relating to any one Obligor or related parties or Affiliates of such Obligor”.

|

No issues identified.

|

|

|

For Discussion Purposes Only

|

Page 5

|

Confidential

|

#

|

Scope Area

|

Sample Size Tested

|

Review Scope Updates

|

Review Observations

|

| |

|

|

6. The above requirement was later modified by Waterfall with guidance being

to verify if the threshold amount is met per loan, as opposed to the obligor.

7. Validation of the “due on sale” clause in the Timeshare Note was excluded

from Guidehouse review, per Waterfall guidance.

8. Aside from the below confirmation from HICV (in italics), Guidehouse did

not validate the bankruptcy/delinquency history of the borrowers, as agreed with Waterfall.

“If an owner has defaulted on a past HICV loan, we will not let them purchase another loan in the future”

|

|

|

2

|

Document Validation (Loan Detail)

|

43

|

Based on the limitation indicated by HICV below, Guidehouse review of the sales type within the portfolio listing was based on comparison against values in the system for a sample of two

accounts. No issues identified.

“None of the agreements that owners sign as part of the timeshare purchase process validate the sales type indicator. That’s something that gets done once the account gets

entered into TSW (our contract software). We’d have to search account history in TSW to see notes on each contract.”

|

Based on Guidehouse review, 7 accounts required additional follow-up with HICV due to variances within the available supporting documentation. The 7 accounts pertain to the following 3 areas.

1. Based on the provided documentation, Guidehouse was unable to tie the

maturity date in the Note and portfolio listing for 5 accounts. HICV indicated that the maturity date variance is due to owners exceeding the standard period of 21 days to complete the loans, resulting in adjustment of the first payment

date and therefore the maturity date.

Guidehouse confirmed the first payment date for the 5 accounts occurred beyond

|

|

|

For Discussion Purposes Only

|

Page 6

|

|

#

|

Scope Area

|

Sample Size Tested

|

Review Scope Updates

|

Review Observations

|

| |

|

|

|

the noted standard period of 21 days.

2. For one account, Guidehouse noted a variance in the state of the obligor

within supporting documentation. HICV indicated that the variance in the state of the obligor was addressed with US Bank in August 2022, and information was updated in May 2022 in HICV’s internally used system, Daybreak.

3. For one account, Guidehouse noted that the signed last name does not match

the printed last name. However, the printed last name was consistent throughout the reviewed documents.

|

|

3

|

Taxes and Assessments Validation

|

N/A

|

Waterfall deemed the following response from HICV (in italics) sufficient and no further review is necessary.

"Real estate taxes are paid by the HOAs and are part of annual maintenance fees billed to owners. Tax assessments are not a separate billing.”

|

N/A

|

|

4

|

Collection

|

N/A

|

HICV team indicated there are no aged loans in the sample population. Therefore, no testing was performed, which was communicated with and agreed by Waterfall.

|

N/A

|

|

5

|

Re-age Policy

|

3

|

HICV team indicated there were no loan modifications of the sample accounts. However, following communication with HICV confirmed there were at least three accounts with loan modifications

within the portfolio Waterfall is purchasing.

|

Guidehouse was unable to confirm that HICV was following the Re-Age Policy requirements for three accounts in two areas.

1. Guidehouse was unable to confirm if the Re-Age/Extension Form is in

accordance with Re-Age Policy requirements, as

|

|

|

For Discussion Purposes Only

|

Page 7

|

|

#

|

Scope Area

|

Sample Size Tested

|

Review Scope Updates

|

Review Observations

|

| |

|

|

|

the provided documents did not have the Director Approval section dated (only electronically signed). This impacted

three accounts.

2. Guidehouse was unable

to identify a re-age fee charged for one of the accounts after follow-up. Therefore, Guidehouse was unable to confirm HICV followed Re-Age Policy requirements.

|

|

6

|

Clear Title

|

43

|

Following communication with Waterfall, Guidehouse scope of review included content validation of the Loan Policy of Title Insurance (i.e. borrower name,

loan amount and validating there is no verbiage indicating additional liens).

|

No issues were identified. For one loan, the insured amount equaled the sale price, however, for the remaining loans the insured amount equaled the loan

amount.

|

|

7

|

Upgraded Loans

|

N/A

|

HICV team indicated that upgraded loans are treated as new loan originations. Therefore, they were not separately reviewed and were included as part of the

Eligibility and Document Validation testing areas, which was agreed by Waterfall.

|

N/A

|

|

8

|

Unapplied Cash

|

N/A

|

Waterfall indicated their team will cover the scope of Unapplied Cash. Therefore, the Guidehouse team did not perform any further reviews.

|

N/A

|

|

9

|

Internal/External Regulatory Audits

|

N/A

|

Guidehouse reviewed the below reports and no issues were identified.

• USAP Report (FY

2020 & 2021)

• External Audit

Report FY 2021

• MD&A (Q1-Q3

2022)

|

N/A

|

|

|

For Discussion Purposes Only

|

Page 8

|

|

#

|

Scope Area

|

Sample Size Tested

|

Review Scope Updates

|

Review Observations

|

|

10

|

Legal /Litigation

|

N/A

|

Based on the below response from the HICV team (in italics) and communication with Waterfall, Guidehouse confirmed no additional requests and review are necessary.

“Our legal teams track all litigation, however there is no ongoing material litigation that we would disclose in our financial statements.”

|

N/A

|

|

11

|

Insurance

|

N/A

|

Guidehouse obtained and reviewed the below blanket policies, and confirmed the policy details such as the insurer and insured name, policy amount, coverage, premium and time period. Following

discussion with Waterfall confirmed no additional review is necessary.

• Professional Liability and General Liability Insurance

• Crime Policy

|

N/A

|

|

|

For Discussion Purposes Only

|

Page 9

|

Confidential

| Section IV |

Conclusion – Guidehouse Overall Observations

|

The HICV team was responsive in providing information and responding to inquiries. Guidehouse documented observations in this report and were limited to our review of the above. Guidehouse worked

closely with Waterfall throughout our review to determine any required changes in scope, discussed HICV responses, and reviewed initial Guidehouse observations.

|

|

For Discussion Purposes Only

|

Page 10

|

Confidential

Appendices

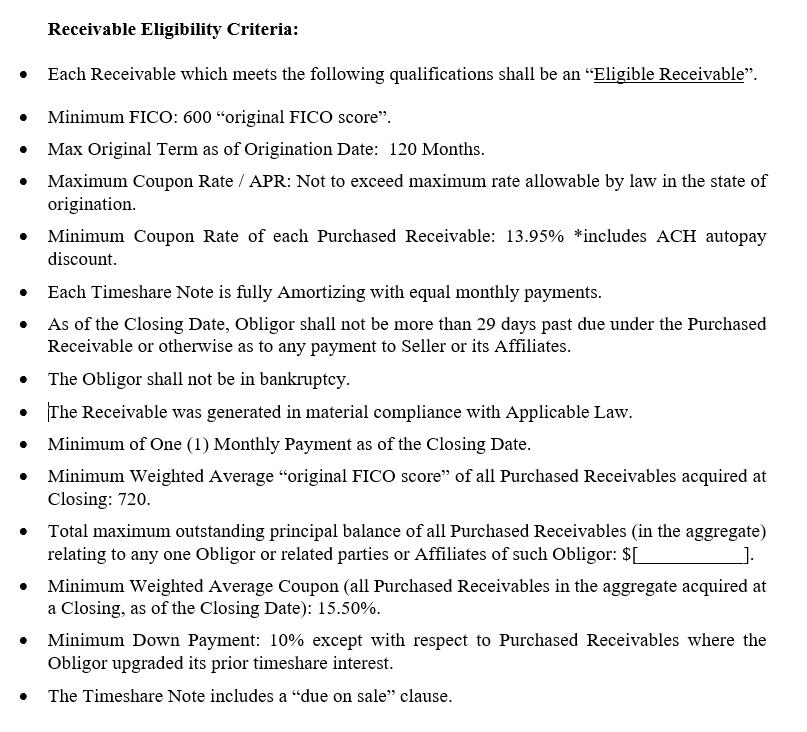

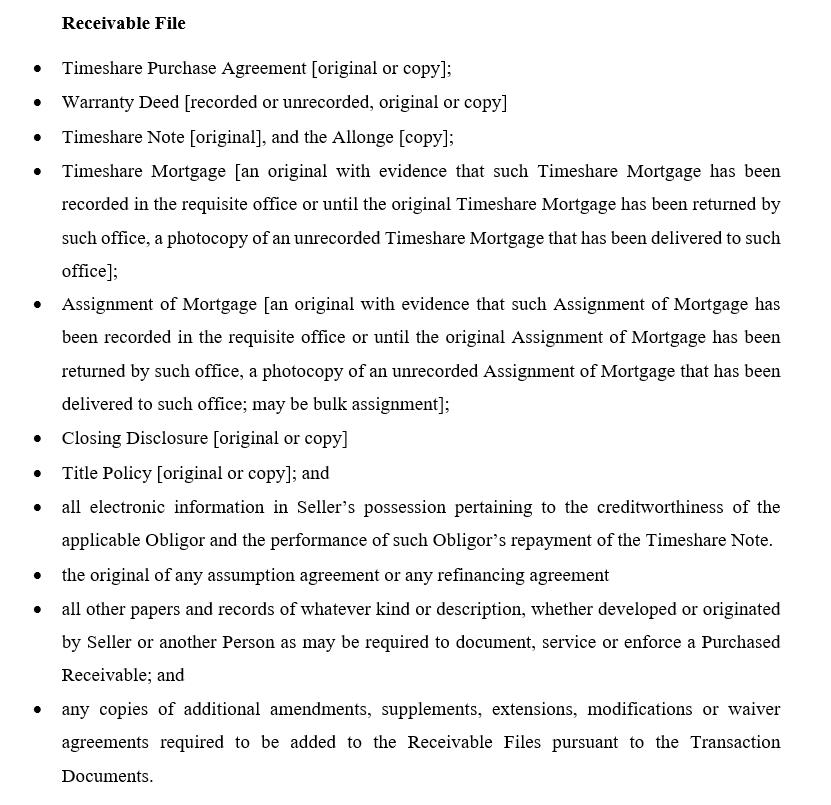

Appendix A – Scope Document Provided By Waterfall

|

|

For Discussion Purposes Only

|

Page 11

|

Confidential

|

|

For Discussion Purposes Only

|

Page 12

|

Confidential

|

|

For Discussion Purposes Only

|

Page 13

|

Confidential

|

|

For Discussion Purposes Only

|

Page 14

|

Confidential

Appendix B – Review Observations

|

#

|

Account No.

|

Observation

|

HICV Response

|

|

1

|

6861397

|

Guidehouse noticed variance in maturity date within supporting documentation.

• Maturity Date Per Portfolio Listing: 3/26/2032

• Maturity Date Per Note: 12/26/2031

|

“For the accounts with different maturity dates, the owners took longer than the standard period (21 days) to complete, therefore the first payment date had to be adjusted

causing the Maturity Date to be pushed back.”

|

|

2

|

6876097

|

Guidehouse noticed variance in maturity date within supporting documentation.

• Maturity Date Per Portfolio Listing: 6/11/2032

• Maturity Date Per Note: 1/11/2032

|

|

3

|

6878459

|

Guidehouse noticed variance in maturity date within supporting documentation.

• Maturity Date Per Portfolio Listing: 3/16/2032

• Maturity Date Per Note: 2/16/2032

|

|

4

|

6879954

|

Guidehouse noticed variance in maturity date within supporting documentation.

• Maturity Date Per Portfolio Listing: 5/5/2032

• Maturity Date Per Note: 3/5/2032

|

|

5

|

6909563

|

Guidehouse noticed variance in maturity date within supporting documentation.

• Maturity Date Per Portfolio Listing: 10/3/2032

• Maturity Date Per Note: 9/3/2032

|

|

6

|

6883356

|

Guidehouse noticed variance in the state of the obligor within supporting documentation.

• State of Obligor Per Portfolio Listing: IN

• State of Obligor Per Documentation2: IA

|

“The original address (IA) was wrong which caused a Collateral Exception. Once the State was corrected (IN) the exception was cured. We submitted the

information to US Bank in August 2022, letting them know that the property address changed for the owners on our end, and the exception was removed subsequently from US Bank. The property address was updated in Daybreak in May 2022. Note

that the state of obligor is excluded from the custodial agreement with respect to the timeshare loan review vs. the schedule of timeshare loans, therefore this shouldn’t be part of your review.”

|

2 Closing Disclosure, Note and Purchase Agreement.

|

|

For Discussion Purposes Only

|

Page 15

|

Confidential

|

#

|

Account No.

|

Observation

|

HICV Response

|

|

7

|

6875294

|

Guidehouse noticed a variance between the signed and printed last name for one of the borrowers due to a missing “n”.

• Last Name Per

Written Signature: Oxendine

• Last Name Per

Documentation3: Oxedine

|

Discussed with Waterfall and deemed no additional follow-up with HICV is required.

|

|

#

|

Account No.

|

Observation

|

HICV Response

|

|

1

|

6882824, 6898636 and 6898636

|

Guidehouse was unable to confirm if the Re-Age/Extension Form was fully executed as the Director Approval section was electronically signed, however not dated.

|

“For re-aged loans, we don’t have any other proof of director approval date. Our collectors have a shared folder where they add anything that is pending the director’s

approval. She goes into that folder and signs and the agents are then responsible from moving all of the approved PDF to another folder. The date stamp from when she last saved will be reflected in the file, however if someone goes in and

saves on top of it then that would get lost.”

|

|

2

|

6882824

|

Based on Guidehouse review, the re-age fee, in the amount of $30.00, was not charged as required by the Re-Age Policy (requirement below).

“A 30 re-age/extension fee will be charged upon processing as a separate charge in Daybreak postdates on the 1st of the next following month.”.

|

“For account 6882824, this owner’s re-age fee was technically their $25 late charge. The charge per the re-age form agrees to the payment applied in Daybreak.”

|

3 Closing Disclosure, Note, Mortgage, Purchase Agreement and Title Policy.

|

|

For Discussion Purposes Only

|

Page 16

|