The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated , 2023.

American Depositary Shares

New Ruipeng Pet Group Inc.

Representing Ordinary Shares

This is an initial public offering of American depositary shares (the “ADSs”), by New Ruipeng Pet Group Inc. Each ADS represents of our ordinary shares, par value US$0.000001 per share.

Prior to this offering, there has been no public market for the ADSs or our ordinary shares. We anticipate that the initial public offering price will be between US$ and US$ per ADS. We intend to apply to list the ADSs on the Nasdaq Global Select Market under the symbol “RPET.”

We are an “emerging growth company” under applicable U.S. federal securities laws and are eligible for reduced public company reporting requirements.

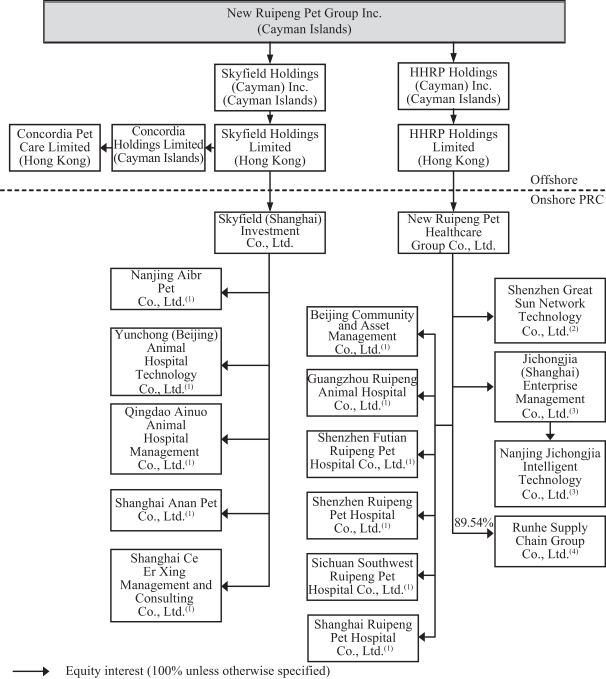

New Ruipeng Pet Group Inc. is not a Chinese operating company, but a Cayman Islands holding company with operations primarily conducted by its subsidiaries in China. We face various legal and operational risks and uncertainties associated with being based in or having our operations primarily in China and the complex and evolving PRC laws and regulations. For example, we face risks associated with the fact that the PRC government has significant authority in regulating our operations and may influence or intervene in our operations at any time, regulatory approvals on offerings conducted overseas by and foreign investment in China-based issuers, anti-monopoly regulatory actions, and oversight on cybersecurity and data security, which may impact our ability to conduct certain businesses, accept foreign investments, or list on a United States or other foreign exchange. On December 16, 2021, the PCAOB issued its report notifying the SEC of its determination that it was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China or Hong Kong, including our auditor. Under the Holding Foreign Companies Accountable Act, or the HFCAA, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for two consecutive years, the SEC shall prohibit our shares or ADSs from being traded on a national securities exchange or in the over the counter trading market in the U.S. The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. These risks could result in a material adverse change in our operations and the value of our ADSs, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause the value of such securities to significantly decline or become worthless. Furthermore, on December 2, 2021, the SEC adopted final amendments implementing the disclosure and submission requirements under the HFCAA, pursuant to which the SEC will identify a “Commission-Identified Issuer” if an issuer has filed an annual report containing an audit report issued by a registered public accounting firm that the PCAOB has determined it is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction, and will then impose a trading prohibition on an issuer after it is identified as a Commission-Identified Issuer for two consecutive years. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If the PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA. For more details, see “Risk Factors—Risks Related to Doing Business in China—The PRC government’s significant oversight and discretion over our business operation could result in a material adverse change in our operations and the value of our ADSs,” “Risk Factors—Risks Related to Doing Business in China—The PCAOB had historically been unable to inspect our auditor in relation to their audit work,” and “Risk Factors—Risks Related to Doing Business in China—Our ADSs may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

Unless otherwise indicated or the context otherwise requires, references in this prospectus to “New Ruipeng,” “we,” “us,” “our company” and “our” are to New Ruipeng Pet Group Inc., our Cayman Islands holding company, and its subsidiaries. New Ruipeng Pet Group Inc., our holding company, or the Parent, may transfer cash to our offshore intermediary holding entities in the Cayman Islands and Hong Kong, including Skyfield Holdings (Cayman) Inc. and HHRP Holdings (Cayman) Inc. and their respective subsidiaries, through capital injections and intra-group loans. Our offshore intermediary holding entities, in turn, may transfer cash to our PRC subsidiaries New Ruipeng Pet Healthcare Group Co., Ltd. and Skyfield (Shanghai) Investment Co., Ltd. through capital injections and intra-group loans. Similarly, New Ruipeng Pet Healthcare Group Co., Ltd. and Skyfield (Shanghai) Investment Co., Ltd. may transfer cash to their respective subsidiaries in the PRC through capital injections and intra-group loans. Cash may also be transferred through our organization by way of intra-group transactions. If our wholly owned subsidiaries