UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM

(Mark One)

For the fiscal year ended

OR

For the transition period from to .

Commission file number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: |

Trading Symbol(s) |

Name of exchange on which registered: |

Securities registered pursuant to section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

☒ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

Smaller reporting company |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

At June 30, 2022, the aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant was approximately $

The number of shares of common stock outstanding as of January 30, 2023 was

DOCUMENTS INCORPORATED BY REFERENCE:

TABLE OF CONTENTS

|

|

PAGE REFERENCE |

Part I |

|

|

Item 1. |

3 |

|

Item 1A. |

9 |

|

Item 1B. |

21 |

|

Item 2. |

21 |

|

Item 3. |

21 |

|

Item 4. |

21 |

|

Part II |

|

|

Item 5. |

22 |

|

Item 6. |

23 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

24 |

Item 7A. |

40 |

|

Item 8. |

41 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

71 |

Item 9A. |

71 |

|

Item 9B. |

73 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

73 |

Part III |

|

|

Item 10. |

73 |

|

Item 11. |

73 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

73 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

73 |

Item 14. |

73 |

|

Part IV |

|

|

Item 15. |

74 |

|

Item 16. |

78 |

|

79 |

||

PART I

Unless the context otherwise requires, references in this Annual Report on Form 10-K to the terms “registrant” or “NNN” or the “Company” refer to National Retail Properties, Inc. and all of its consolidated subsidiaries. NNN may elect to treat certain subsidiaries as taxable real estate investment trust subsidiaries (“TRS”).

Forward-Looking Statements

Statements contained in this Annual Report on Form 10-K, including the documents that are incorporated by reference, that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). Also, when NNN uses any of the words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” or similar expressions, NNN is making forward-looking statements. Although management believes that the expectations reflected in such forward-looking statements are based upon present expectations and reasonable assumptions, NNN’s actual results could differ materially from those set forth in the forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and NNN undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause NNN's actual results to differ materially from those presented in our forward-looking statements:

1

In addition, NNN describes risks and uncertainties that could cause actual results and events to differ materially in “Risk Factors” (Part I, Item 1A of this Annual Report on Form 10-K), “Quantitative and Qualitative Disclosures about Market Risk” (Part II, Item 7A), and “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” (Part II, Item 7).

2

Item 1. Business

The Company

NNN, a Maryland corporation, is a fully integrated REIT formed in 1984. NNN's assets are primarily real estate assets. NNN's consolidated financial statements are included in "Item 8. Financial Statements and Supplementary Data" of this Annual Report on Form 10-K.

The common shares of National Retail Properties, Inc. are traded on the New York Stock Exchange (the "NYSE") under the ticker symbol "NNN."

Real Estate Assets

NNN acquires, owns, invests in and develops properties that are leased primarily to retail tenants under long-term net leases and are primarily held for investment ("Properties" or "Property Portfolio," or individually a "Property"). NNN owned 3,411 Properties with an aggregate gross leasable area of approximately 35,010,000 square feet, located in 48 states, with a weighted average remaining lease term of 10.4 years as of December 31, 2022. Approximately 99 percent of the Properties were leased as of December 31, 2022.

Competition

NNN faces active competition from many sources, both domestically and internationally, for net-lease investment opportunities in commercial properties. Competitors may be willing to accept rates of return, prices, lease terms, other transaction terms, or levels of risk that NNN finds unacceptable.

Qualification as a REIT

NNN has made an election to be taxed as a REIT under Sections 856 through 860 of the Code, and related regulations and intends to continue to operate so as to remain qualified as a REIT for federal income tax purposes. NNN generally will not be subject to federal income tax on income that it distributes to its stockholders, provided that it distributes 100 percent of its REIT taxable income and meets certain other requirements for qualifying as a REIT. If NNN fails to qualify as a REIT in any taxable year, it will be subject to federal income tax on its taxable income at regular corporate rates and will not be permitted to qualify for treatment as a REIT for federal income tax purposes for the four years following the year during which qualification is lost. Such an event could materially adversely affect NNN’s income and ability to pay dividends. NNN believes it has been structured as, and its past and present operations qualify NNN as, a REIT.

Corporate Responsibility and Environmental, Social and Governance Matters (“ESG”)

NNN is focused on achieving success for its stockholders, providing a world-class working environment for NNN associates, enriching the community and preserving environmental resources. NNN operates its business in accordance with the highest ethical standards and strives to have the best-in-class corporate governance standards. Holding NNN to such standards is critical to the long-term success of NNN’s stockholders, associates, and community.

Sustainability Team. In 2022, NNN created a Sustainability Team, which reports directly to the Executive Vice President, General Counsel and Secretary, with direct oversight by the Governance and Nominating Committee of the Board of Directors. The Sustainability Team is comprised of a group of associates from a broad spectrum of seniority levels and departments of the Company, including but not limited to human resources, legal, asset management, lease administration, accounting, underwriting and acquisitions. The team has both internal and external projects, including, but not limited to engaging with NNN’s tenants on environmental data collection and property level sustainability.

3

Human Capital Development. As of January 31, 2023, the Company employed 77 associates, all of which are full-time. NNN’s success is dependent upon the dedication and hard work of NNN’s talented associates. NNN encourages continued professional and personal development of all associates by providing hundreds of hours of in-person and online training opportunities that touch all aspects of NNN’s business. NNN also has associate mentoring and training programs and formalized talent development programs at all levels of the Company. The success of NNN’s commitment to its associates is shown in the long tenure of NNN’s associates. The executive team, department heads, and senior managers average over 21 years of experience with NNN. In addition 47% of NNN’s associates have been with NNN for 10 years or longer. The institutional knowledge and long tenure of NNN’s associates is a true competitive advantage of the Company. In addition, the Company's gender make-up is comprised of 58% females and 42% males. NNN has adopted a Human Capital Policy which is available on the Company's website at www.nnnreit.com.

Total Rewards, Benefits & Work-Life Balance. NNN also focuses on additional benefits for its associates in an effort to make sure the associates are not only well compensated, but also engaged, developed and satisfied with their work-life balance. There are six key elements to NNN’s total rewards system: Compensation, Benefits, Wellness, Work-Life Balance, Professional Development and Recognition. NNN’s programs include, but are not limited to, a 401(k) plan with a company match, flexible work schedules, college saving plans, an educational assistance program, adoption benefits, flexible spending and health savings accounts, health and wellness events, and access to a state of the art online wellness platform. NNN has been the repeat recipient of numerous wellness awards, including the prestigious Cigna Well-Being Award.

Community Service and Partnerships. NNN cares about the communities in which its associates live and work. NNN stands behind a commitment to improving education, strengthening neighborhoods, and encouraging volunteer service. NNN actively promotes volunteering by its associates by organizing and sponsoring specific volunteer days throughout the year at various charities, including Ronald McDonald House of Central Florida and Give Kids the World. Associates are encouraged to volunteer on work days during work hours. In addition to NNN’s donation of time, NNN is also a meaningful financial donor to numerous charities in the Central Florida community, including the Boys and Girls Clubs of Central Florida and Elevate Orlando (a teacher mentor program for high risk urban youth that help young women and men graduate high school with a plan for the future).

Environmental Practices and Impact. As an owner of a large number of properties throughout the United States, it is important that NNN be a good corporate citizen and steward of the environment. NNN demonstrates its commitment to good stewardship of the environment in a variety of ways both at NNN’s headquarters and at NNN’s Properties across the country. Many of NNN's tenants have programs that address environmental stewardship of the Properties they occupy and control.

NNN Corporate Headquarters. NNN’s corporate headquarters building is ENERGY STAR® certified by meeting the strict energy performance standards set by the Environmental Protection Agency ("EPA"). As stated by the EPA, on average, ENERGY STAR certified buildings use 35 percent less energy and generate 35 percent fewer greenhouse gas emissions than typical buildings.

Property Portfolio. NNN’s Properties are generally leased to tenants under long-term triple net leases with typical lease terms of 30 to 40 years including base and option terms which gives NNN’s tenants exclusive control over and the ability to institute energy conservation and environmental management programs at the Properties. NNN’s tenants are overwhelmingly large companies with sophisticated conservation and sustainability programs. These programs limit the use of resources and limit the impact of the use of NNN’s Properties on the environment, including, but not limited to, implementing green building and lighting standards, and recycling programs. NNN’s leases also typically require the tenants to fully comply with all environmental laws, rules and regulations, including any remediation requirements. NNN’s risk management associates actively monitor any environmental conditions on NNN’s Properties to make sure that the tenants are meeting their obligations to remediate or remedy any open environmental matters. On all Properties that NNN acquires, NNN obtains an environmental assessment from a licensed environmental consultant to understand any environmental risks and liabilities associated with a Property and to ensure that the tenant will address any environmental issues on the Properties. Furthermore, NNN has in place a portfolio environmental insurance policy that covers substantially all of NNN’s Properties for certain environmental risks.

4

NNN’s form leases contain "green lease clauses" which require the tenants to report energy usage and emissions and NNN actively negotiates with tenants in all new acquisitions for their acceptance of green lease clauses.

Climate Preparedness. NNN regularly monitors the status of impending natural disasters and the impact of such disasters on the Property Portfolio. In the substantial majority of leases, NNN’s tenants are required to carry full replacement cost coverage on all improvements located on the Properties. For those Properties located in a nationally designated flood zone, NNN typically requires the tenants to carry flood insurance pursuant to the federal flood insurance program. For those Properties located in an area of high earthquake risk, NNN typically requires the tenants to carry earthquake insurance above what is typically covered in an extended coverage policy. In addition, NNN also carries a contingent extended coverage policy on the Property Portfolio, which also provides coverage for certain casualty events, including fire and windstorm. In cases where NNN’s tenants do not provide coverage, or if a Property is vacant, NNN carries the necessary direct insurance coverage.

Business Strategies and Policies

The following is a discussion of NNN’s operating strategy and certain of its investment, financing and other policies. These strategies and policies have been set by management and the Board of Directors and, in general, may be amended or revised from time to time by management and the Board of Directors without a vote of NNN’s stockholders.

Operating Strategies

NNN’s strategy is to invest primarily in retail real estate that is typically well located within each local market for its tenants’ retail lines of trade. Management believes that these types of properties, generally leased pursuant to triple-net leases, provide attractive opportunities for stable current returns and the potential for increased returns and capital appreciation. Triple-net leases typically require the tenant to pay property operating expenses such as insurance, utilities, repairs, maintenance, capital expenditures and real estate taxes and assessments. Initial lease terms are generally 10 to 20 years.

NNN holds each Property until it determines that the sale of such Property is advantageous in view of NNN’s investment objectives. In deciding whether to sell a Property, factors NNN may consider include, but are not limited to, potential capital appreciation, net cash flow, tenant credit quality, tenant's line of trade, tenant's lease renewal probability, the composition of the Property Portfolio, market lease rates, local market conditions, future uses of the Property, potential use of sale proceeds and federal income tax considerations.

NNN’s management team focuses on certain key indicators to evaluate the financial condition and operating performance of NNN. These key indicators for NNN include items such as: the composition of the Property Portfolio (such as tenant, geographic and line of trade diversification), the occupancy rate of the Property Portfolio, certain financial performance ratios and profitability measures, industry trends, and industry performance compared to that of NNN.

NNN evaluates the creditworthiness of its significant current and prospective tenants. This evaluation may include reviewing available financial statements, store level financial performance, press releases, public credit ratings from major credit rating agencies, industry news publications and financial market data (debt and equity pricing). NNN may also evaluate the business and operations of its significant tenants, including past payment history and periodically meeting with senior management of certain tenants.

The operating strategies employed by NNN have allowed NNN to increase the annual dividend (paid quarterly) per common share for 33 consecutive years. NNN has the third longest record of consecutive annual dividend increases of all publicly traded REITs.

5

Investment in Real Estate or Interests in Real Estate

NNN’s management believes that single tenant, freestanding net lease retail properties will continue to provide attractive investment opportunities and that NNN is well suited to take advantage of these opportunities because of its experience in accessing capital markets, and its ability to source, underwrite and acquire such properties.

In evaluating a particular acquisition, management may consider a variety of factors, including but not limited to:

NNN intends to engage in future investment activities in a manner that is consistent with the maintenance of its status as a REIT for federal income tax purposes. Additionally, NNN does not intend to engage in activities that will make NNN an investment company under the Investment Company Act of 1940, as amended.

Investments in Real Estate Mortgages and Securities of or Interests in Entities Engaged in Real Estate Activities

While NNN’s primary business objectives emphasize retail properties, NNN may invest in (i) a wide variety of property and tenant types, (ii) leases, mortgages and other types of real estate interests, (iii) loans secured by personal property, (iv) loans secured by partnership or membership interests in partnerships or limited liability companies, respectively, or (v) securities of other REITs, or other issuers, including for the purpose of exercising control over such entities.

Financing Strategy

NNN’s financing objective is to manage its capital structure effectively in order to provide sufficient capital to execute its operating strategy while servicing its debt requirements, maintaining its investment grade credit ratings, staggering debt maturities and providing value to NNN's stockholders. NNN's capital resources have and will continue to include, if available, (i) proceeds from the issuance of public or private equity or debt capital market transactions; (ii) secured or unsecured borrowings from banks or other lenders; (iii) proceeds from the sale of Properties; and (iv) to a lesser extent, by internally generated funds as well as undistributed funds from operations. However, there can be no assurance that additional financing or capital will be available, or that the terms will be acceptable or advantageous to NNN.

NNN typically expects to fund its short-term liquidity requirements, including investments in additional Properties, with cash and cash equivalents, cash provided from operations and advances from its unsecured revolving credit facility ("Credit Facility"). As of December 31, 2022, NNN had $2,505,000 of cash and cash equivalents and $933,800,000 was available for future borrowings under the Credit Facility.

6

As of December 31, 2022, NNN’s ratio of total debt to total gross assets (before accumulated depreciation and amortization) was approximately 40 percent and the ratio of secured debt to total gross assets was less than one percent. The ratio of total debt to total market capitalization was approximately 33 percent. Certain financial agreements to which NNN is a party contain covenants that limit NNN’s ability to incur additional debt under certain circumstances. The organizational documents of NNN do not limit the absolute amount or percentage of debt that NNN may incur. Additionally, NNN may change its financing strategy.

Strategies and Policy Changes

Any of NNN’s strategies or policies described above may be changed at any time by NNN without notice to or a vote of NNN’s stockholders.

Property Portfolio

As of December 31, 2022, NNN owned 3,411 Properties with an aggregate gross leasable area of approximately 35,010,000 square feet, located in 48 states, with a weighted average remaining lease term of 10.4 years. Approximately 99 percent of total Properties were leased as of December 31, 2022.

The following table summarizes the Property Portfolio as of December 31, 2022 (in thousands):

|

|

Size(1) |

|

|

Total Dollars Invested(2) |

|

||||||||||||||||||

|

|

High |

|

|

Low |

|

|

Average |

|

|

High |

|

|

Low |

|

|

Average |

|

||||||

Land |

|

|

6,586 |

|

|

|

5 |

|

|

|

101 |

|

|

$ |

11,899 |

|

|

$ |

5 |

|

|

$ |

794 |

|

Building |

|

|

179 |

|

|

|

1 |

|

|

|

10 |

|

|

|

45,286 |

|

|

|

30 |

|

|

|

2,090 |

|

Leases

The following is a summary of the general structure of the leases in the Property Portfolio, although the specific terms of each lease can vary significantly. Generally, the Property leases provide for initial terms of 10 to 20 years. As of December 31, 2022, the weighted average remaining lease term of the Property Portfolio was approximately 10.4 years. The Properties are generally leased under triple-net leases, which require the tenant to pay all property taxes and assessments, to maintain the interior and exterior of the property, and to carry property and liability insurance coverage. NNN's leases provide for annual base rental payments (generally payable in monthly installments) ranging from $7,000 to $4,085,000 (average of $227,000), and generally provide for increases in rent as a result of increases in the Consumer Price Index ("CPI") or fixed increases.

Generally, NNN's leases provide the tenant with one or more multi-year renewal options subject to generally the same terms and conditions provided under the initial lease term. Some of the leases also provide that in the event NNN wishes to sell the Property subject to that lease, NNN first must offer the lessee the right to purchase the Property on the same terms and conditions as any offer which NNN intends to accept for the sale of the Property. See "Results of Operations – Property Analysis."

Governmental Regulations Affecting Properties

Property Environmental Considerations

Subject to a determination of the level of risk and potential cost of remediation, NNN may acquire a property with some level of environmental contamination. Investments in real property create a potential for substantial environmental liability for the owner of such property from the presence or discharge of hazardous materials on the property or the improper disposal of hazardous materials emanating from the property, regardless of fault. In order to mitigate exposure to environmental liability, NNN maintains an environmental insurance policy which provides some environmental liability coverage for substantially all of the Properties. As a part of its acquisition due diligence process, NNN obtains an environmental site assessment for each property. In such cases where NNN intends to acquire a property where some level of contamination may exist, NNN generally

7

requires the seller or tenant to (i) remediate the problem, (ii) indemnify NNN for environmental liabilities, and/or (iii) agree to other arrangements deemed appropriate by NNN, including, under certain circumstances, the purchase of environmental insurance to address environmental conditions at the property. NNN may incur costs if the seller or tenant does not comply with these requirements.

As of January 30, 2023, NNN had 71 Properties currently under some level of environmental remediation and/or monitoring. In general, the responsible party (which may include the seller, a previous owner, the tenant or an adjacent or former land owner) is liable for the cost of the environmental remediation for each of these Properties.

Americans with Disabilities Act of 1990 and Similar Local and State Laws

The Properties, as commercial facilities, are required to comply with Title III of the Americans with Disabilities Act of 1990 and similar state and local laws and regulations (collectively, the "ADA"). The tenants will typically have primary responsibility for complying with the ADA, but NNN may incur costs if the tenant does not comply. As of January 30, 2023, NNN had not been notified by any governmental authority of, nor is NNN’s management aware of, any non-compliance with the ADA that NNN’s management believes would have a material adverse effect on its business, financial position or results of operations.

Other Regulations, Rules and Laws

State and local governmental entities regulate the use of the Properties. NNN’s leases generally require each tenant to undertake primary responsibility for complying with all regulations, rules and laws, but failure to comply could result in fines by governmental authorities, awards of damages to private litigants, or restrictions on the ability to conduct business on such Properties.

Additional Information

NNN’s corporate headquarters are located at 450 South Orange Avenue, Suite 900, Orlando, Florida 32801, and its telephone number is (407) 265–7348.

NNN’s website is located at www.nnnreit.com. NNN intends to comply with the requirements of Item 5.05 of Form 8-K regarding amendments to and waivers under the code of business conduct and ethics applicable to its Chief Executive Officer, Principal Financial Officer and Principal Accounting Officer by providing such information on its website within four days after effecting any amendment to, or granting any waiver under, that code, and NNN will maintain such information on its website for at least twelve months. The information contained on NNN’s website does not constitute part of this Form 10-K.

On NNN’s website you can also obtain, free of charge, a copy of this Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as amended, as soon as reasonably practicable, after NNN files such material electronically with, or furnish it to, the Securities and Exchange Commission ("Commission" or "SEC"). The public may read and obtain a copy of any materials NNN files electronically with the Commission at www.sec.gov.

Additional information on NNN’s website includes the guiding policies adopted by NNN, which include NNN’s Corporate Governance Guidelines, Code of Business Conduct Policy and Whistleblower Policy, as well as NNN’s stance on corporate governance and risk management, social responsibility and environmental practices and their impact in the Corporate Responsibility and Sustainability Report.

8

Item 1A. Risk Factors

Carefully consider the following risks and all of the other information set forth in this Annual Report on Form 10-K, including the consolidated financial statements and the notes thereto. If any of the events or developments described below were actually to occur, NNN’s business, financial condition or results of operations could be adversely affected.

Risks Related to NNN’s Business and Operations

Changes in financial and economic conditions, including inflation may have an adverse impact on NNN, its tenants, and commercial real estate in general.

Financial and economic conditions can be challenging and volatile and any worsening of such conditions, including any disruption in the capital markets, or an inflationary economic environment, both real or anticipated, could adversely affect NNN’s business and results of operations. Such conditions could also affect the financial condition of NNN’s tenants, developers, borrowers, lenders or the institutions that hold NNN’s cash balances and short-term investments, which may expose NNN to increased risks of default by these parties.

There can be no assurance that actions of the United States Government, the Federal Reserve or other government and regulatory bodies attempting to stabilize the economy or financial markets will achieve their intended effect. Additionally, some of these actions may adversely affect financial institutions, capital providers, retailers, consumers, NNN’s financial condition, NNN's results of operations or the trading price of NNN’s shares.

Potential consequences of challenging and volatile financial and economic conditions include:

Loss of rent from tenants would reduce NNN’s cash flow.

NNN's tenants encounter significant macroeconomic, governmental and competitive forces. Adverse changes in consumer spending or consumer preferences for particular goods, services or store based retailing could severely impact their ability to pay rent. Shifts from in-store to online shopping could increase due to changing consumer shopping patterns as well as the increase in consumer adoption and use of mobile electronic devices. This expansion of e-commerce could have an adverse impact on NNN's tenants' ongoing viability and the size, type and location of space tenants lease in the future. NNN cannot predict with certainty what tenants will want or what the impact will be on market rents. The default, financial distress, bankruptcy or liquidation of one or more of NNN’s tenants could cause substantial vacancies in the Property Portfolio. Vacancies reduce NNN’s revenues, increase property expenses and could decrease the value of each vacant Property. Upon the expiration of a lease, the tenant may choose not to renew the lease and NNN may not be able to re-lease the vacant Property at a comparable lease rate. Furthermore, NNN may incur additional expenditures in connection with such renewal or re-leasing.

9

A significant portion of the source of the Property Portfolio annual base rent is concentrated in specific industry classifications, tenants and geographic locations.

As of December 31, 2022, approximately,

Any financial hardship and/or economic changes in these lines of trade, tenants or states could have an adverse effect on NNN’s results of operations.

NNN may not be able to successfully execute its acquisition or development strategies.

NNN may not be able to implement its investment strategies successfully. Additionally, NNN cannot assure that its Property Portfolio will expand at all, or if it will expand at any specified rate or to any specified size. In addition, investment in additional real estate assets is subject to a number of risks. Because NNN expects to invest in markets other than the ones in which its current Properties are located or properties which may be leased to tenants other than those to which NNN has historically leased properties, NNN will also be subject to the risks associated with investment in new markets, new lines of trade or with new tenants that may be relatively unfamiliar to NNN’s management team.

NNN’s development activities are subject to, without limitation, risks relating to the availability and timely receipt of zoning and other regulatory approvals, the cost and timely completion of construction (including risks from factors beyond NNN’s control, such as weather, labor conditions or material shortages), the risk of finding tenants for the properties and the ability to obtain both construction and permanent financing on favorable terms. These risks could result in substantial unanticipated delays or expenses and, under certain circumstances, could prevent completion of development activities once undertaken or provide a tenant the opportunity to delay rent commencement, reduce rent or terminate a lease. Any of these situations may delay or eliminate proceeds or cash flows NNN expects from these projects, which could have an adverse effect on NNN’s financial condition.

NNN may not be able to dispose of properties consistent with its operating strategy.

NNN may be unable to sell Properties targeted for disposition under favorable terms due to adverse market conditions or possible prohibitive tax liability. This may adversely affect, among other things, NNN’s ability to sell under favorable terms, execute its operating strategy, achieve target earnings or returns, retire or repay debt or pay dividends.

Certain provisions of NNN’s leases or loan agreements may be unenforceable.

NNN’s rights and obligations with respect to its leases, mortgage loans or other loans are governed by written agreements. A court could determine that one or more provisions of such an agreement are unenforceable, such as a particular remedy, a master lease covenant, a loan prepayment provision or a provision governing NNN’s security interest in the underlying collateral of a borrower or lessee. NNN could be adversely impacted if this were to happen with respect to an asset or group of assets.

10

Competition from numerous other REITs, commercial developers, real estate limited partnerships and other investors may impede NNN’s ability to grow.

NNN may not complete suitable property acquisitions or developments on advantageous terms, if at all, due to competition for such properties with others engaged in real estate investment activities or lack of properties for sale on terms deemed acceptable to NNN. NNN’s inability to successfully acquire or develop new properties may affect NNN’s ability to achieve anticipated return on investment or realize its investment strategy, which could have an adverse effect on its results of operations.

A natural disaster or impacts of weather or other event resulting in an uninsured loss may adversely affect the operations of NNN’s tenants and therefore the ability of NNN’s tenants to pay rent, NNN’s operating results and asset values of NNN’s Property Portfolio.

The impacts of a natural disaster or weather event on NNN’s Property Portfolio are highly uncertain. Such impacts may result from natural disasters, including floods, droughts, wind and fire. The Properties are generally covered by comprehensive liability, fire, and extended insurance coverage. NNN believes that the insurance carried on its Properties is adequate and in accordance with industry standards. There are, however, types of losses (such as from hurricanes, floods, earthquakes or other types of natural disasters or wars, terrorism or other acts of violence) which may be uninsurable, self-insured by tenants, or the cost of insuring against these losses may not be economically justifiable in the opinion of tenants or NNN. If an uninsured loss occurs or a loss exceeds policy limits, NNN could lose both its invested capital and anticipated revenues from the Property, thereby reducing NNN’s cash flow and asset value.

NNN’s ability to fully control the management of its net-leased properties may be limited.

The tenants of net-leased properties are responsible for maintenance and other day-to-day management of the Properties. If a Property is not adequately maintained in accordance with the terms of the applicable lease, NNN may incur expenses for deferred maintenance expenditures or other liabilities when the lease expires. While NNN’s leases generally provide for recourse against the tenant in these instances, a bankrupt or financially troubled tenant may be more likely to defer maintenance and it may be more difficult to enforce remedies against such a tenant. Although NNN endeavors to monitor compliance by tenants with their lease obligations, NNN may not always be able to ascertain or forestall deterioration in the condition of a property or the financial circumstances of a tenant.

Vacant properties or bankrupt tenants could adversely affect NNN’s business or financial condition.

As of December 31, 2022, NNN owned 21 vacant, un-leased Properties, which accounted for approximately one percent of total Properties held in the Property Portfolio. NNN is actively marketing these Properties for sale or lease but may not be able to sell or lease these Properties on favorable terms or at all. As of January 30, 2023, less than one percent of total Properties, and less than one percent of aggregate gross leasable area held in the Property Portfolio, was leased to one tenant that is currently in bankruptcy under Chapter 11 of the U.S. Bankruptcy Code. As a result, this tenant has the right to reject or affirm their leases with NNN.

Cybersecurity risks and cyber incidents as well as other significant disruptions of NNN’s information technology networks and related systems and resources, could adversely affect NNN's business, disrupt operations and expose NNN to liabilities to tenants, employees, capital providers, governmental regulators, and other third parties.

NNN uses information technology and other computer resources to carry out important operational activities and to maintain its business records. As part of NNN’s normal business activities, (i) NNN allows associates to perform some or all of their business activities remotely, and (ii) NNN collects and stores certain personal identifying and confidential information relating to its tenants, employees, vendors and suppliers, and (iii) maintains operational and financial information related to NNN’s business.

11

NNN faces risks associated with security breaches through cyber-attacks or cyber-intrusions, malware, computer viruses and malicious codes, ransomware, attachments to e-mail, unauthorized access attempts, denial of service attacks, phishing, social engineering, persons with access to systems inside NNN’s organization, and other significant disruptions of NNN’s information technology networks and related systems. The risk of a security breach has generally increased as the frequency, intensity and sophistication of attempted attacks and intrusions from around the world have increased. Even the most well protected information, networks, systems and facilities remain potentially vulnerable because the techniques, tools and tactics used in such attempted security breaches evolve and generally are not recognized until launched against a target, and in some cases are designed to not be detected and, in fact, may not be detected. Accordingly, NNN may be unable to anticipate these techniques or to implement adequate security barriers, disaster recovery or other preventative or corrective measures, and thus it is impossible for NNN to entirely counteract this risk or fully mitigate the harms after such an attack.

NNN has implemented systems and processes intended to address ongoing and evolving cybersecurity risks, secure its information technology, applications and computer systems, and prevent unauthorized access to or loss of sensitive, confidential and personal data. Although NNN and its service providers employ what NNN believes are adequate security, disaster recovery and other preventative and corrective measures, NNN’s security measures, taken as a whole, may not be sufficient for all possible situations and may be vulnerable to, among other things, fraud, hacking, employee error, system error, and faulty password management.

NNN’s ability to conduct its business may be impaired if its information technology networks, systems or resources, including its websites or e-mail systems, are compromised, degraded, damaged or fail, whether due to a virus or other harmful circumstance, fraud, intentional penetration or disruption of its information technology resources by:

A significant and extended disruption could damage NNN’s business or reputation and cause:

The release of confidential information may also lead to litigation or other proceedings against NNN by affected individuals, business partners and/or regulators, and the outcome of such proceedings, which could include losses, penalties, fines, injunctions, expenses and charges recorded against NNN’s earnings and cause NNN reputational harm, could have a material and adverse effect on NNN’s business, financial position or results of operations.

In addition, the costs of maintaining adequate protection against data security threats, based on considerations of their evolution, increasing sophistication, pervasiveness and frequency and/or government-mandated standards or obligations regarding protective efforts, could be material to NNN’s financial position, results of operations, cash flows, and the market price of NNN's common stock in a particular period or over various periods.

12

Future investment in international markets could subject NNN to additional risks.

If NNN expands its operating strategy to include investment in international markets, NNN could face additional risks, including foreign currency exchange rate fluctuations, operational risks due to local economic and political conditions and laws and policies of the United States affecting foreign investment.

NNN may suffer a loss in the event of a default or bankruptcy of a borrower.

As of December 31, 2022, NNN held mortgages receivable of $1,530,000, which represented less than one percent of total assets. If a borrower defaults on a mortgage or other loan made by NNN, and does not have sufficient assets to satisfy the loan, NNN may suffer a loss of principal and interest. In the event of the bankruptcy of a borrower, NNN may not be able to recover against all or any of the assets of the borrower, or the collateral may not be sufficient to satisfy the balance due on the loan. In addition, certain of NNN’s loans may be subordinate to other debt of a borrower. These investments are typically loans secured by a borrower’s pledge of its ownership interests in the entity that owns the real estate or other assets and are typically subordinated to senior loans encumbering the underlying real estate or assets. Subordinated positions are generally subject to a higher risk of nonpayment of principal and interest than the more senior loans. If a borrower defaults on the debt senior to NNN’s loan, or in the event of the bankruptcy of a borrower, NNN’s loan will be satisfied only after the borrower’s senior creditors’ claims are satisfied. Where debt senior to NNN’s loans exists, the presence of intercreditor arrangements may limit NNN’s ability to amend loan documents, assign the loans, accept prepayments, exercise remedies and control decisions made in bankruptcy proceedings relating to borrowers. Bankruptcy proceedings and litigation can significantly increase the time needed for NNN to acquire underlying collateral, if any, in the event of a default, during which time the collateral may decline in value. In addition, there are significant costs and delays associated with the foreclosure process.

Property ownership through joint ventures and partnerships could limit NNN’s control of those investments.

Joint ventures or partnerships involve risks not otherwise present for direct investments by NNN. It is possible that NNN’s co-venturers or partners may have different interests or goals than NNN at any time and they may take actions contrary to NNN’s requests, policies or objectives, including NNN’s policy with respect to maintaining its qualification as a REIT. Other risks of joint venture or partnership investments include impasses on decisions because in some instances no single co-venturer or partner has full control over the joint venture or partnership, respectively, or the co-venturer or partner may become insolvent, bankrupt or otherwise unable to contribute to the joint venture or partnership, respectively. Further, disputes may develop with a co-venturer or partner over decisions affecting the property, joint venture or partnership that may result in litigation, arbitration or some other form of dispute resolution.

Risks Related to Financing NNN’s Business

NNN may be unable to obtain debt or equity capital on favorable terms, if at all.

NNN may be unable to obtain capital on favorable terms, if at all, to further its business objectives or meet its existing obligations. Nearly all of NNN’s debt, including the Credit Facility, is subject to balloon principal payments due at maturity. These maturities range between 2023 and 2052. NNN's ability to make these scheduled principal payments may be adversely impacted by NNN’s inability to extend or refinance the Credit Facility, the inability to dispose of assets at an attractive price or the inability to obtain additional debt or equity capital. Capital that may be available may be materially more expensive or available under terms that are materially more restrictive which would have an adverse impact on NNN’s business, financial condition and results of operations.

13

The amount of debt NNN has and the restrictions imposed by that debt could adversely affect NNN’s business and financial condition.

As of December 31, 2022, NNN had outstanding debt, including mortgages payable of $9,964,000, total unsecured notes payable of $3,739,890,000 and $166,200,000 outstanding on the Credit Facility. NNN’s organizational documents do not limit the level or amount of debt that it may incur. If NNN incurs additional debt and permits a higher degree of leverage, debt service requirements would increase and could adversely affect NNN’s financial condition and results of operations, as well as NNN’s ability to pay principal and interest on the outstanding debt or cash dividends to its stockholders. In addition, increased leverage could increase the risk that NNN may default on its debt obligations.

The amount of debt outstanding at any time could have important consequences to NNN’s stockholders. For example, it could:

NNN’s ability to make scheduled payments of principal or interest on its debt, or to retire or refinance such debt will depend primarily on its future performance, which to a certain extent is subject to the creditworthiness of its tenants, competition, and economic, financial, and other factors beyond its control. There can be no assurance that NNN’s business will continue to generate sufficient cash flow from operations in the future to service its debt or meet its other cash needs. If NNN is unable to generate sufficient cash flow from its business, it may be required to refinance all or a portion of its existing debt, sell assets or obtain additional financing to meet its debt obligations and other cash needs.

NNN cannot assure stockholders that any such refinancing, sale of assets or additional financing would be possible or, if possible, on terms and conditions, including but not limited to the interest rate, which NNN would find acceptable or would not result in a material decline in earnings.

NNN is obligated to comply with financial and other covenants in its debt instruments that could restrict its operating activities, and the failure to comply with such covenants could result in defaults that accelerate the payment of such debt.

As of December 31, 2022, NNN had approximately $3,916,054,000 of outstanding debt, of which approximately $9,964,000 was secured debt. NNN’s unsecured debt instruments contain various restrictive covenants which include, among others, provisions restricting NNN’s ability to:

14

NNN’s secured debt instruments generally contain customary covenants, including, among others, provisions:

In addition, NNN’s debt instruments may contain cross-default provisions, in which case a default of NNN under one debt instrument will be a default of NNN under multiple or all debt instruments of NNN.

NNN’s ability to meet some of its debt covenants, including covenants related to the condition of the property or payment of real estate taxes, may be dependent on the performance by NNN’s tenants under their leases.

In addition, certain covenants in NNN’s debt instruments, including its Credit Facility, require NNN, among other things, to:

NNN’s failure to comply with certain of its debt covenants could result in defaults that accelerate the payment under such debt and limit the dividends paid to NNN’s common and preferred stockholders which would likely have a material adverse impact on NNN’s financial condition and results of operations. In addition, these defaults could impair its access to the debt and equity markets.

NNN’s ability to pay dividends in the future is subject to many factors.

NNN’s ability to pay dividends may be impaired if any of the risks described in this section were to occur. In addition, payment of NNN’s dividends depends upon NNN’s earnings, financial condition, maintenance of NNN’s REIT status and other factors as NNN’s Board of Directors may deem relevant from time to time.

Risks Related to – Real Estate Ownership

Owning real estate and indirect interests in real estate carries inherent risks.

NNN’s financial performance and the value of its real estate assets are subject to the risk that if the Properties do not generate revenues sufficient to meet its operating expenses, and debt service, NNN’s cash flow and ability to pay distributions to its stockholders will be adversely affected. NNN is susceptible to the following real estate industry risks, which are beyond its control:

All of these factors could result in decreases in market rental rates and increases in vacancy rates, which could adversely affect NNN’s results of operations.

15

NNN’s real estate investments are illiquid.

Because real estate investments are relatively illiquid, NNN’s ability to adjust the portfolio promptly in response to economic or other conditions is limited. Certain significant expenditures generally do not change in response to economic or other conditions, including: (i) debt service, (ii) real estate taxes, and (iii) operating and maintenance costs. This combination of variable revenue and relatively fixed expenditures may result, under certain market conditions, in reduced earnings and could have an adverse effect on NNN’s financial condition.

NNN may be subject to known or unknown environmental liabilities and risks, including but not limited to liabilities and risks resulting from the existence of hazardous materials on or under Properties owned by NNN.

There may be known or unknown environmental liabilities associated with Properties owned or acquired in the future by NNN. Certain particular uses of some Properties may also have a heightened risk of environmental liability because of the hazardous materials used in performing services on those Properties, such as convenience stores with underground petroleum storage tanks or auto parts and auto service businesses using petroleum products, paint and machine solvents. Some of the Properties may contain asbestos or asbestos-containing materials, or may contain or may develop mold or other bio-contaminants.

Asbestos-containing materials must be handled, managed and removed in accordance with applicable governmental laws, rules and regulations. Mold and other bio-contaminants can produce airborne toxins, may cause a variety of health issues in individuals and must be remediated in accordance with applicable governmental laws, rules and regulations.

As part of its due diligence process, NNN generally obtains an environmental site assessment for each Property it acquires. In cases where NNN intends to acquire real estate where evidence of some level of known contamination may exist, NNN generally requires the seller or tenant to (i) remediate the contamination in accordance with applicable laws, rules and regulations, (ii) indemnify NNN for environmental liabilities, and/or (iii) agree to other arrangements deemed appropriate by NNN, including, under certain circumstances, the purchase of environmental insurance. Although sellers or tenants may be contractually responsible for remediating hazardous materials on a property and may be responsible for indemnifying NNN for any liability resulting from the use of a Property and for any failure to comply with any applicable environmental laws, rules or regulations, NNN has no assurance that sellers, tenants or any other responsible party shall be able to meet their remediation and indemnity obligations to NNN. A tenant, seller or any other responsible party may not have the financial ability to meet its remediation and indemnity obligations to NNN when required. Furthermore, NNN may have strict liability to governmental agencies or third parties as a result of the existence of hazardous materials on Properties, whether or not NNN knew about or caused such hazardous materials to exist.

As of January 30, 2023, NNN had 71 Properties currently under some level of environmental remediation and/or monitoring. In general, the responsible party (which may include the seller, a previous owner, the tenant or an adjacent or former land owner) is liable for the cost of the environmental remediation for each of these Properties.

If NNN is responsible for hazardous materials located on its Properties, NNN’s liability may include investigation and remediation costs, property damage to third parties, personal injury to third parties, and governmental fines and penalties. Furthermore, the presence of hazardous materials on a Property may adversely impact the Property value or NNN’s ability to sell the Property. Significant environmental liability could impact NNN’s results of operations, ability to make distributions to stockholders, and its ability to meet its debt obligations.

In order to mitigate exposure to environmental liability, NNN maintains an environmental insurance policy which provides environmental insurance coverage for substantially all of its Properties. However, the policy is subject to exclusions and limitations and does not cover all of the Properties owned by NNN. For those Properties covered under the policy, insurance may not fully compensate NNN for any environmental liability. NNN has no assurance that the insurer on its environmental insurance policy will be able to meet its obligations under the policy. NNN may not desire to renew the environmental insurance policy in place upon expiration or a replacement policy may not be available at a reasonable cost, if at all.

16

Risks Related to – Tax Matters

NNN’s failure to qualify as a REIT for federal income tax purposes could result in significant tax liability.

NNN intends to operate in a manner that will allow NNN to continue to qualify as a REIT. NNN believes it has been organized as, and its past and present operations qualify NNN as a REIT. However, the Internal Revenue Service (“IRS”) could successfully assert that NNN is not qualified as such. In addition, NNN may not remain qualified as a REIT in the future. Qualification as a REIT involves the application of highly technical and complex provisions of the Code for which there are only limited judicial or administrative interpretations and involves the determination of various factual matters and circumstances not entirely within NNN’s control. Furthermore, new tax legislation, administrative guidance or court decisions, in each instance potentially with retroactive effect, could make it more difficult or impossible for NNN to qualify as a REIT or avoid significant tax liability.

If NNN fails to qualify as a REIT, it would not be allowed a deduction for dividends paid to stockholders in computing taxable income and would become subject to federal income tax at regular corporate rates. In this event, NNN could be subject to potentially significant tax liabilities and penalties. Unless entitled to relief under certain statutory provisions, NNN would also be disqualified from treatment as a REIT for the four taxable years following the year during which the qualification was lost.

Compliance with REIT requirements, including distribution requirements, may limit NNN’s flexibility and may negatively affect NNN’s operating decisions.

To maintain its status as a REIT for United States federal income tax purposes, NNN must meet certain requirements on an on-going basis, including requirements regarding its sources of income, the nature and diversification of its assets, the amounts NNN distributes to its stockholders and the ownership of its shares. NNN may also be required to make distributions to its stockholders when it does not have funds readily available for distribution or at times when NNN’s funds are otherwise needed to fund expenditures or debt service requirements. NNN generally will not be subject to federal income taxes on amounts distributed to stockholders, so long as it distributes 100 percent of its REIT taxable income and meets certain other requirements for qualifying as a REIT. For each of the years in the three-year period ended December 31, 2022, NNN believes it has qualified as a REIT. Notwithstanding NNN’s qualification for taxation as a REIT, NNN is subject to certain state and local income, franchise and excise taxes.

The share ownership restrictions of the Code for REITs and the 9.8% share ownership limit in NNN’s charter may inhibit market activity in NNN’s shares of stock and restrict NNN’s business combination opportunities.

In order to qualify as a REIT, five or fewer individuals, as defined in the Code, may not own, actually or constructively, more than 50% in value of NNN’s issued and outstanding shares of stock at any time during the last half of each taxable year, other than the first year for which a REIT election is made. Attribution rules in the Code determine if any individual or entity actually or constructively owns NNN’s shares of stock under this requirement. Additionally, at least 100 persons must beneficially own NNN’s shares of stock during at least 335 days of a taxable year for each taxable year, other than the first year for which a REIT election is made. To help ensure that NNN meets these tests, among other purposes, NNN’s charter restricts the acquisition and ownership of NNN’s shares of stock.

NNN’s charter, with certain exceptions, authorizes NNN’s Board of Directors to take such actions as are necessary and desirable to preserve NNN’s qualification as a REIT while NNN so qualifies. Unless exempted by the Board of Directors, for so long as NNN qualifies as a REIT, NNN’s charter prohibits, among other limitations on ownership and transfer of shares of NNN’s stock, any person from beneficially or constructively owning (applying certain attribution rules under the Code) more than 9.8% in value of the aggregate of NNN’s outstanding shares of stock and more than 9.8% (in value or in number of shares, whichever is more restrictive) of any class or series of NNN’s shares of stock. The Board of Directors, in its sole discretion and upon receipt of certain representations and undertakings, may exempt a person (prospectively or retrospectively) from the ownership limits. However, the Board of Directors may not, among other limitations, grant an exemption from these ownership restrictions to any proposed transferee whose ownership, direct or indirect, in excess of the 9.8% ownership limit would result in the termination of NNN’s qualification as a REIT. These restrictions on transferability and ownership will not apply, however, if the Board of Directors determines that it is no longer in NNN’s best interest to continue to qualify as a REIT or that

17

compliance with the restrictions is no longer required in order for NNN to continue to so qualify as a REIT. These ownership limits could delay or prevent a transaction or a change in control that might involve a premium price for NNN's common stock or otherwise be in the best interest of NNN’s stockholders.

Risks Related to – Governmental Laws and Regulations

Costs of complying with changes in governmental laws and regulations may adversely affect NNN’s results of operations.

NNN cannot predict what laws or regulations will be enacted in the future, how future laws or regulations will be administered or interpreted, or how future laws or regulations will affect NNN, its Properties or its tenants, including, but not limited to environmental laws and regulations. Compliance with new laws or regulations, or stricter interpretation of existing laws, may require NNN, its tenants, or consumers to incur significant expenditures, impose significant liability, restrict or prohibit business activities and could cause a material adverse effect on NNN’s results of operation.

Non-compliance with Title III of the Americans with Disabilities Act of 1990 could have an adverse effect on NNN's business and operating results.

The Properties, as commercial facilities, are required to comply with the ADA. NNN's tenants will typically have primary responsibility for complying with the ADA, but NNN may incur costs if the tenant does not comply. As of January 30, 2023, NNN had not been notified by any governmental authority of, nor is NNN’s management aware of, any non-compliance with the ADA that NNN’s management believes would have a material adverse effect on its business, financial position or results of operations.

General Risks

NNN's loss of key management personnel could adversely affect performance and the value of its securities.

NNN is dependent on the efforts of its key management. The executive team, department heads, and senior managers average over 21 years of experience with NNN. Competition for senior management personnel can be intense and NNN may not be able to retain its key management. Although NNN believes qualified replacements could be found for any departures of key management, the loss of their services could adversely affect NNN's performance and the value of its securities.

NNN’s failure to maintain effective internal control over financial reporting could have a material adverse effect on its business, operating results and the market value of NNN's securities.

Section 404 of the Sarbanes-Oxley Act of 2002 requires annual management assessments of the effectiveness of the Company’s internal control over financial reporting. If NNN fails to maintain the adequacy of its internal control over financial reporting, as such standards may be modified, supplemented or amended from time to time, NNN may not be able to ensure that it can conclude on an ongoing basis that it has effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002. Moreover, effective internal control over financial reporting, particularly those related to revenue recognition, are necessary for NNN to produce reliable financial reports and to maintain its qualification as a REIT and are important in helping to prevent financial fraud. If NNN cannot provide reliable financial reports or prevent fraud, its business and operating results could be harmed, REIT qualification could be jeopardized, investors could lose confidence in the Company’s reported financial information, the company's access to capital could be impaired, and the trading price of NNN’s shares could drop significantly.

An epidemic or pandemic (such as the outbreak and worldwide spread of COVID-19), and the measures that international, federal, state and local governments, agencies, law enforcement and/or health authorities implement to address it, may precipitate or materially exacerbate one or more of the other risks, and may significantly disrupt NNN's tenants' ability to operate their businesses and/or pay rent to NNN or prevent NNN from operating its business in the ordinary course for an extended period.

18

An epidemic or pandemic could have a material and adverse effect on or cause disruption to NNN’s business or financial condition, results of operations, cash flows and the market value and trading price of NNN's securities due to, among other factors:

A prolonged continuation of or repeated temporary business closures, reduced capacity at businesses or other social-distancing practices, and quarantine orders may adversely impact NNN's tenants’ ability to generate sufficient revenues to meet financial obligations, and could force tenants to default on their leases, or result in the bankruptcy of tenants, which would diminish the rental revenue NNN receives under its leases. Additionally, an increase in the number of vacant properties would increase NNN's real estate expenses, including expenses associated with ongoing maintenance and repairs, utilities, property taxes, and property and liability insurance.

The rapid development and fluidity of an epidemic or pandemic precludes any prediction as to the ultimate adverse impact on NNN. Nevertheless, an epidemic or pandemic would present a material uncertainty and risk with respect to NNN’s performance, business or financial condition, results of operations and cash flows. While NNN's leases generally do not allow tenants to withhold rent if the tenants are not operating on its Properties, some tenants may pay rent under protest, not pay rent at all, request rent deferrals, and assert legal or equitable claims in the courts that such tenants are not obligated to pay rent while closed or while operating at reduced capacity, because of an epidemic or pandemic. While NNN believes such claims would be without merit it has no assurances on how courts would rule on such claims, if any.

Acts of violence, terrorist attacks or war may affect NNN's properties, the markets in which NNN operates and NNN’s results of operations.

Terrorist attacks or other domestic acts of violence may negatively affect NNN’s operations. There can be no assurance that there will not be attacks against businesses within the United States. These attacks may directly or indirectly impact NNN’s physical facilities or the businesses or the financial condition of its tenants, developers, borrowers, lenders or financial institutions with which NNN has a relationship. The United States is engaged in armed conflict, which could have an impact on these parties. The consequences of armed conflict are unpredictable, and NNN may not be able to foresee events that could have an adverse effect on its business or be insured for such.

19

More generally, any of these events or threats of these events could cause consumer confidence and spending to decrease or result in increased volatility in the United States and worldwide financial markets and economies. They also could result in, or cause a deepening of, economic recession in the United States or abroad. Any of these occurrences could have an adverse impact on NNN’s financial condition or results of operations.

Changes in accounting pronouncements could adversely impact NNN’s or NNN’s tenants’ reported financial performance.

Accounting policies and methods are fundamental to how NNN records and reports its financial condition and results of operations. From time to time the Financial Accounting Standards Board (“FASB”) and the Commission, who create and interpret appropriate accounting standards, may change the financial accounting and reporting standards or their interpretation and application of these standards that govern the preparation of NNN’s financial statements. These changes could have a material impact on NNN’s reported financial condition and results of operations. In some cases, NNN could be required to apply a new or revised standard retroactively, resulting in restating prior period financial statements. Similarly, these changes could have a material impact on NNN’s tenants’ reported financial condition or results of operations and affect their preferences regarding leasing real estate.

The market value of NNN’s equity and debt securities is subject to various factors that may cause significant fluctuations or volatility.

As with other publicly traded securities, the market price of NNN’s equity and debt securities depends on various factors, which may change from time-to-time and/or may be unrelated to NNN’s financial condition, operating performance or prospects that may cause significant fluctuations or volatility in such prices. These factors, among others, include:

Even if NNN remains qualified as a REIT, NNN faces other tax liabilities that reduce operating results and cash flow.

Even if NNN remains qualified for taxation as a REIT, NNN is subject to certain federal, state and local taxes on its income and assets, including taxes on any undistributed income, tax on income from some activities conducted as a result of a foreclosure, and state or local income, franchise, property and transfer taxes. Any increase of these taxes would decrease earnings and cash available for distribution to stockholders. In addition, in order to meet certain REIT qualification requirements, NNN may elect to own some of its assets in a TRS.

Adverse legislative or regulatory tax changes could reduce NNN’s earnings and cash flow and the market value of NNN’s securities.

At any time, the federal and state tax laws or the administrative interpretations of those laws may change. Any such changes may have current and retroactive effects, and could adversely affect NNN or its stockholders. Legislation could cause shares in non-REIT entities to be a more attractive investment to individual investors than shares in REITs, and could have an adverse effect on the value of NNN’s securities.

20

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Please refer to Item 1. “Business" and Item 7. "Management's Discussion and Analysis of Financial Conditions and Results of Operations."

Item 3. Legal Proceedings

In the ordinary course of its business, NNN is a party to various legal actions that management believes are routine in nature and incidental to the operation of the business of NNN. Management does not believe that any of these proceedings are material.

Item 4. Mine Safety Disclosures

None.

21

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information.

The common stock of NNN currently is traded on the NYSE under the symbol “NNN.”

Performance Graphs.

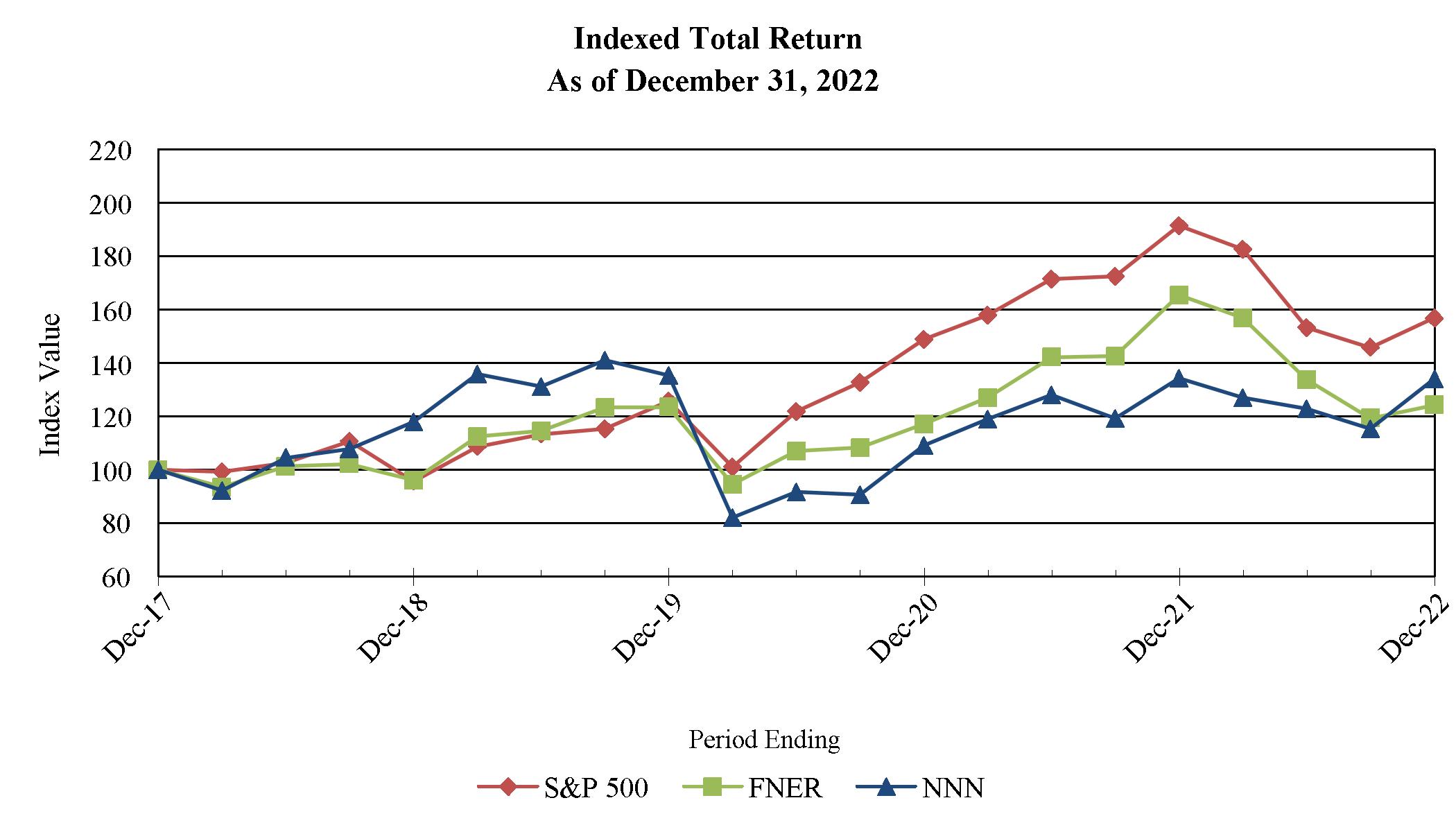

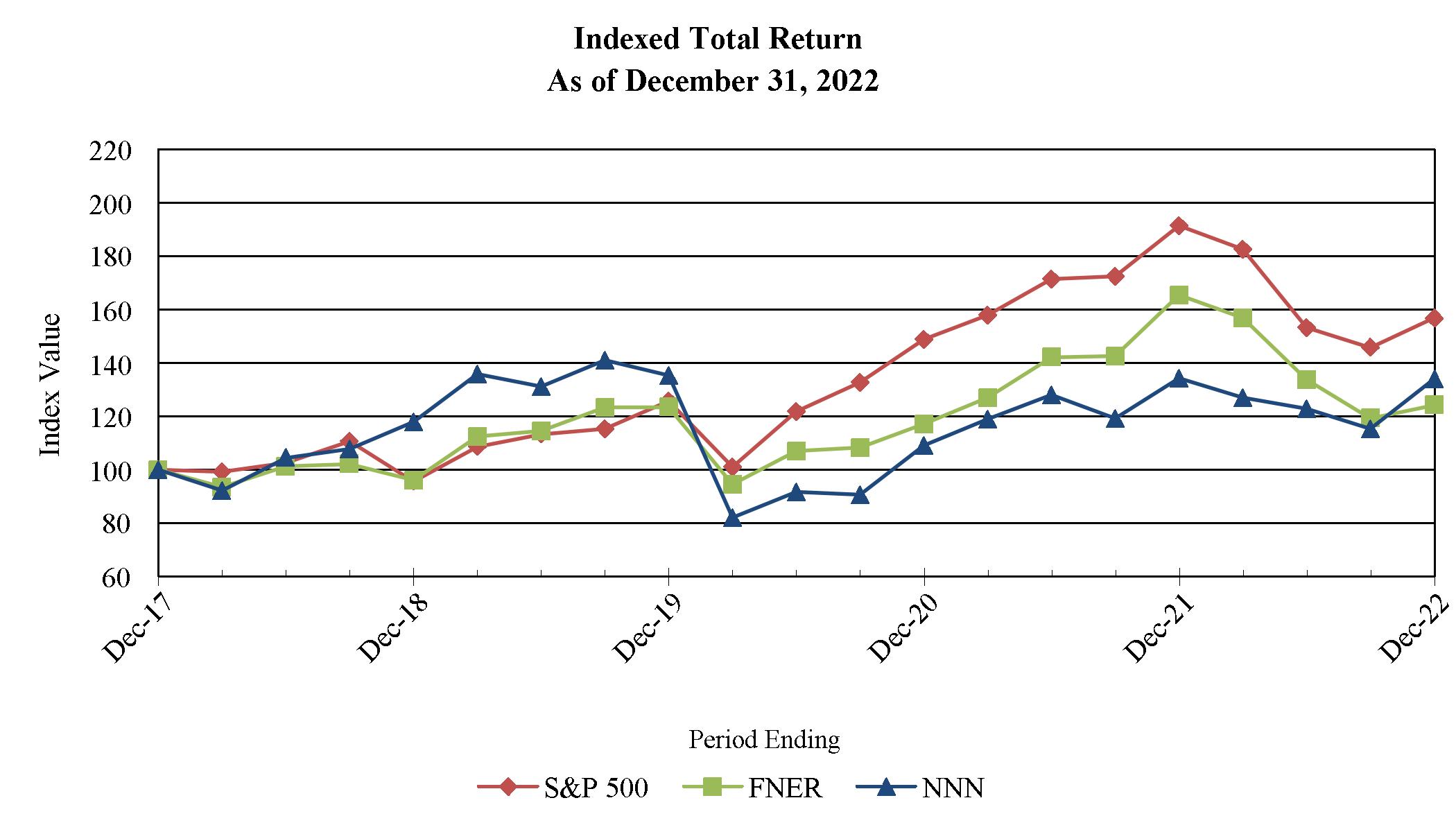

Set forth below is a line graph comparing the cumulative total stockholder return on NNN’s common stock, based on the market price of the common stock and assuming reinvestment of dividends, with the FTSE National Association of Real Estate Investment Trusts Equity Index (“FNER”) and the S&P 500 Index (“S&P”) for the five-year period commencing December 31, 2017 and ending December 31, 2022. The graph assumes an investment of $100 on December 31, 2017.

Comparison to Five-Year Cumulative Total Return

22

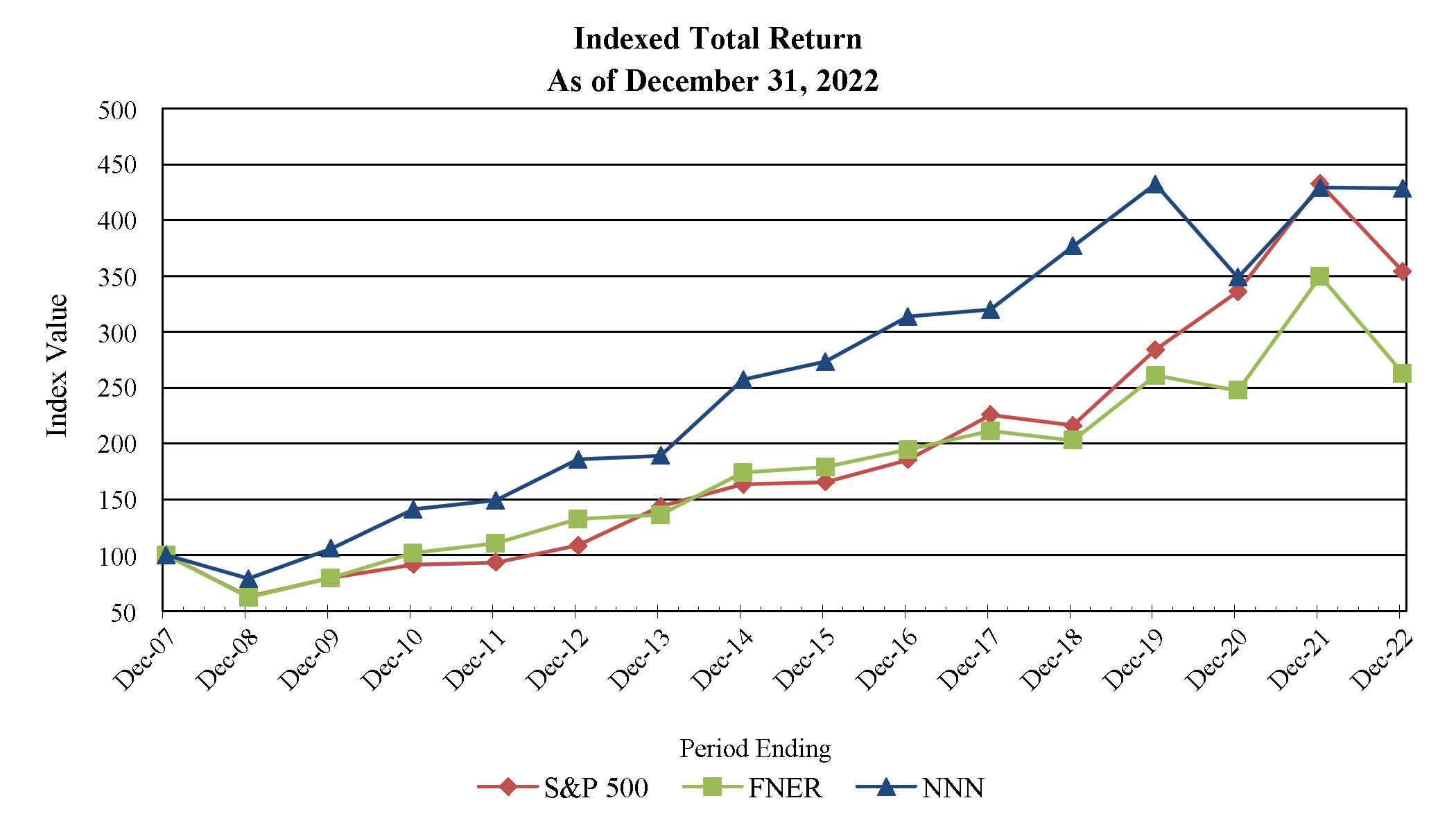

Set forth below is a line graph comparing the cumulative total stockholder return on NNN’s common stock, based on the market price of the common stock and assuming reinvestment of dividends, with the FNER and the S&P for the fifteen-year period commencing December 31, 2007 and ending December 31, 2022. The graph assumes an investment of $100 on December 31, 2007.

Comparison to Fifteen-Year Cumulative Total Return

Dividends.

NNN intends to pay regular quarterly dividends to its stockholders, although all future distributions will be declared and paid at the discretion of the Board of Directors and will depend upon cash generated by operating activities, NNN’s financial condition, capital requirements, annual distribution requirements under the REIT provisions of the Code and such other factors as the Board of Directors deems relevant.

In January 2023, NNN declared dividends payable to its stockholders of $99,401,000, or $0.550 per share, of common stock.

Holders.

On January 30, 2023, there were 1,562 registered holders of record of NNN's common stock. Many of NNN's shares of common stock are held by brokers and institutions on behalf of stockholders, NNN is unable to estimate the total number of stockholders represented by these record holders.

Securities Authorized for Issuance Under Equity Compensation Plans.

None.

Sale of Unregistered Securities.

None.

Issuer Purchases of Equity Securities.

None.

Item 6. [Reserved]

23

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This section generally discusses 2022 and 2021 items and year-to-year comparisons between 2022 and 2021. Discussions of 2020 items and year-to-year comparisons between 2021 and 2020 that are not included in this annual report on Form 10-K can be found in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of the Annual Report on Form 10-K for the year ended December 31, 2021 filed with the Commission on February 9, 2022.

The term "NNN" or the "Company" refers to National Retail Properties, Inc. and all of its consolidated subsidiaries. NNN may elect to treat certain subsidiaries as taxable real estate investment trust subsidiaries, ("TRS").

Forward-Looking Statements

The following discussion and analysis should be read in conjunction with the consolidated financial statements and related notes included elsewhere in this Annual Report on Form 10-K. NNN makes statements in this section that are forward-looking statements within the meaning of the federal securities laws. For a complete discussion of forward-looking statements, see the section in this report entitled “Forward-Looking Statements.” Certain risks may cause NNN’s actual results, performance or achievements to differ materially from those expressed or implied by the following discussion. For a discussion of such risk factors, see “Item 1A. Risk Factors.”

Overview

NNN, a Maryland corporation, is a fully integrated real estate investment trust ("REIT") formed in 1984. NNN's assets are primarily real estate assets. NNN acquires, owns, invests in and develops properties that are leased primarily to retail tenants under long-term net leases and are primarily held for investment ("Properties," or "Property Portfolio," or individually a "Property").

NNN owned 3,411 Properties with an aggregate gross leasable area of approximately 35,010,000 square feet, located in 48 states, with a weighted average remaining lease term of 10.4 years as of December 31, 2022. Approximately 99 percent of the Properties were leased as of December 31, 2022.

NNN’s management team focuses on certain key indicators to evaluate the financial condition and operating performance of NNN. The key indicators for NNN include items such as: the composition of the Property Portfolio (such as tenant, geographic and line of trade diversification), the occupancy rate of the Property Portfolio, certain financial performance ratios and profitability measures, industry trends and industry performance compared to that of NNN.

NNN evaluates the creditworthiness of its significant current and prospective tenants. This evaluation may include reviewing available financial statements, store level financial performance, press releases, public credit ratings from major credit rating agencies, industry news publications and financial market data (debt and equity pricing). NNN may also evaluate the business and operations of its significant tenants, including past payment history and periodically meeting with senior management of certain tenants.