The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2023

PRELIMINARY PROSPECTUS

TRANSACTION PROPOSED

JBS N.V.

567,493,236 Class A Common Shares (including Class A Common Shares in the form of Brazilian Depositary Receipts) Up to 345,681,599 Class B Common Shares

Dear JBS S.A. Shareholder:

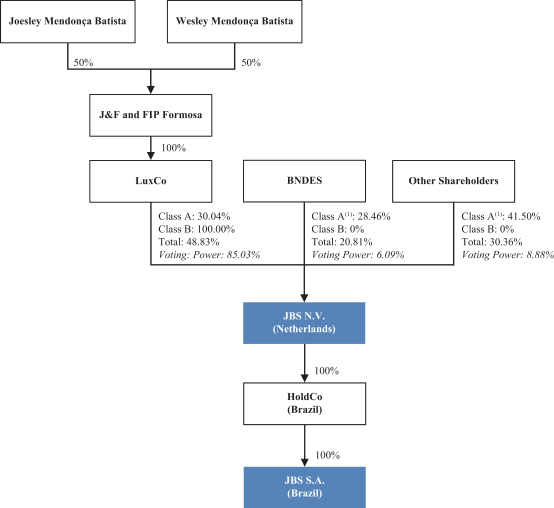

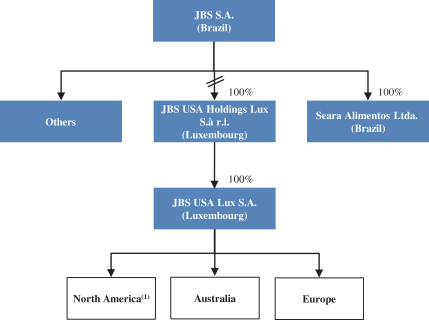

This prospectus relates to: (1) 567,493,236 Class A common shares, par value €0.01 per share (“JBS N.V. Class A Common Shares”), of JBS N.V. (as JBS B.V. is expected to be known upon its renaming and conversion into a public limited liability company (naamloze vennootschap) under Dutch law, or “JBS N.V.”, which definition is meant to include JBS B.V. prior to the conversion of the company into a Dutch public limited liability company), including JBS N.V. Class A Common Shares in the form of Brazilian Depositary Receipts (“BDRs”), each representing one JBS N.V. Class A Common Share (“JBS N.V. BDRs”), to be issued to holders of common shares of JBS S.A. (“JBS S.A. Common Shares”), a Brazilian corporation (sociedade anônima) (“JBS S.A.”) listed on the São Paulo Stock Exchange (B3 S.A.—Brasil, Bolsa, Balcão) (“B3”), pursuant to the terms of the Proposed Transaction (as defined below) and subject to the satisfaction of certain conditions described in this prospectus; and (2) up to 345,681,599 Class B common shares, par value €0.10 per share (“JBS N.V. Class B Common Shares” and, together with the JBS N.V. Class A Common Shares, the “JBS N.V. Common Shares”), of JBS N.V. into which JBS N.V. Class A Common Shares may be converted during the Class A Conversion Period (as defined below), which will take place after the completion of the Proposed Transaction. References to “the JBS Group” are to: (i) JBS S.A. and its consolidated subsidiaries prior to the completion of the Proposed Transaction; and (ii) JBS N.V. and its consolidated subsidiaries (including JBS S.A.), following the completion of the Proposed Transaction, unless the context otherwise requires or otherwise indicated.

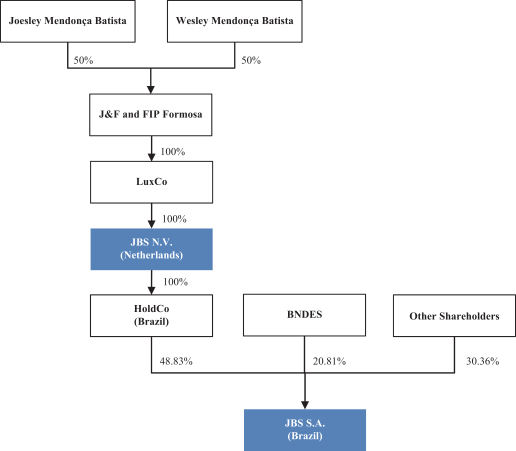

The Proposed Transaction is part of a corporate restructuring of the JBS Group with the purpose of listing the JBS N.V. Class A Common Shares on the New York Stock Exchange (“NYSE”) and the JBS N.V. BDRs on the B3. Prior to the Closing Date (as defined in the section “Certain Defined Terms”), the controlling shareholders of JBS S.A. (as defined in the section “Certain Defined Terms”) will transfer their interest in JBS S.A. to JBS N.V. Following the completion of the Proposed Transaction, JBS S.A. will be an indirect wholly-owned subsidiary of JBS N.V., and the JBS S.A. Common Shares will no longer be publicly traded.

Pursuant to the Proposed Transaction, holders of JBS S.A. Common Shares (“JBS S.A. Shareholders”) will receive JBS N.V. BDRs and a cash dividend on the terms defined below. The proposed transaction will consist of the three steps below (collectively, the “Proposed Transaction”):

| • | Merger of Shares. Subject to approval at the general meeting of shareholders of JBS S.A. scheduled for , 2023 (“JBS S.A. General Meeting”), on the Closing Date, the merger of shares will be implemented through an incorporação de ações under the Brazilian Corporation Law (as defined in the section “Certain Defined Terms”) (the “Merger of Shares”). Pursuant to the Merger of Shares, every two JBS S.A. Common Shares issued and outstanding on the last day the JBS S.A. Common Shares will trade on the B3 (the “Last Trading Day”) that are not held by JBS Participações Societárias S.A., a Brazilian corporation (sociedade por ações) (“HoldCo”) that will be wholly owned by JBS N.V. prior to the Closing Date, will be automatically contributed for their book value into HoldCo in exchange for one newly issued mandatorily redeemable preferred share of HoldCo (“HoldCo Redeemable Shares”), determined pursuant to the Exchange Ratio (as defined in the section “Certain Defined Terms”), and JBS S.A. will become a wholly-owned subsidiary of HoldCo. The HoldCo Redeemable Shares are mandatorily redeemable for JBS N.V. BDRs. |

| • | Redemption. Immediately after the Merger of Shares is approved at the JBS S.A. General Meeting, JBS N.V., as sole shareholder of HoldCo, will approve at a general meeting of shareholders of HoldCo |