“K&E” means Kirkland & Ellis LLP.

“Knowledge” with respect to: (i) the Company, means the knowledge of the individuals set forth on Section 10.01-B of the Company Disclosure Letter; and (ii) the Purchaser, means the knowledge of the individuals set forth on Section 10.01-C of the Purchaser Disclosure Letter, in each case, as such individuals would have acquired in the exercise of a reasonable inquiry of direct reports.

“Labor Agreement” has the meaning specified in Section 4.13(a)(xi).

“Latham” has the meaning specified in Section 9.14(a)(ii).

“Law” means any federal, state, local, municipal, foreign or other constitution, law, statute, act, legislation, principle of common law, ordinance, code, edict, decree, proclamation, treaty, convention, rule, regulation, directive, requirement, writ, injunction, settlement, ordinance, regulation, Order or Consent, in each case, issued, enacted, adopted, passed, approved, promulgated, made, implemented or otherwise put into effect by or under the authority of any Governmental Authority.

“Leased Real Property” has the meaning specified in Section 4.16(b).

“Legal Proceeding” means any notice of noncompliance or violation, or any claim, demand, charge, action, suit, litigation, audit, settlement, complaint, stipulation, assessment, examination, mediation or arbitration, or any request (including any request for information), inquiry, hearing, proceeding (whether at law or in equity) or investigation, by or before any Governmental Authority.

“Legally Privileged Communications” means all legally privileged communications made in connection with the negotiation, preparation, execution, delivery and performance under, or any dispute or Legal Proceeding arising out of or relating to, this Agreement, the Ancillary Documents, or the Transactions.

“Liabilities” means all liabilities, Indebtedness, Legal Proceedings or obligations of any nature (whether absolute, accrued, contingent or otherwise, whether known or unknown, whether direct or indirect, whether matured or unmatured, whether due or to become due and whether or not required to be recorded or reflected on a balance sheet under GAAP or other applicable accounting standards).

“Lien” means any mortgage, pledge, deed of trust, lease, sublease, license, security interest, attachment, right of first refusal, option, proxy, voting trust, encumbrance, lien or charge of any kind whether consensual, statutory or otherwise (including any conditional sale or other title retention agreement or lease in the nature of any mortgage, pledge, deed of trust, lease, sublease, license, security interest, attachment, right of first refusal, option, proxy, voting trust, encumbrance, lien or charge of any kind), restriction (whether on voting, sale, transfer, disposition or otherwise), any subordination arrangement in favor of another Person, or any filing or agreement to file a financing statement as debtor under the Uniform Commercial Code or any similar Law.

“Lock-Up Agreements” has the meaning specified in the Recitals.

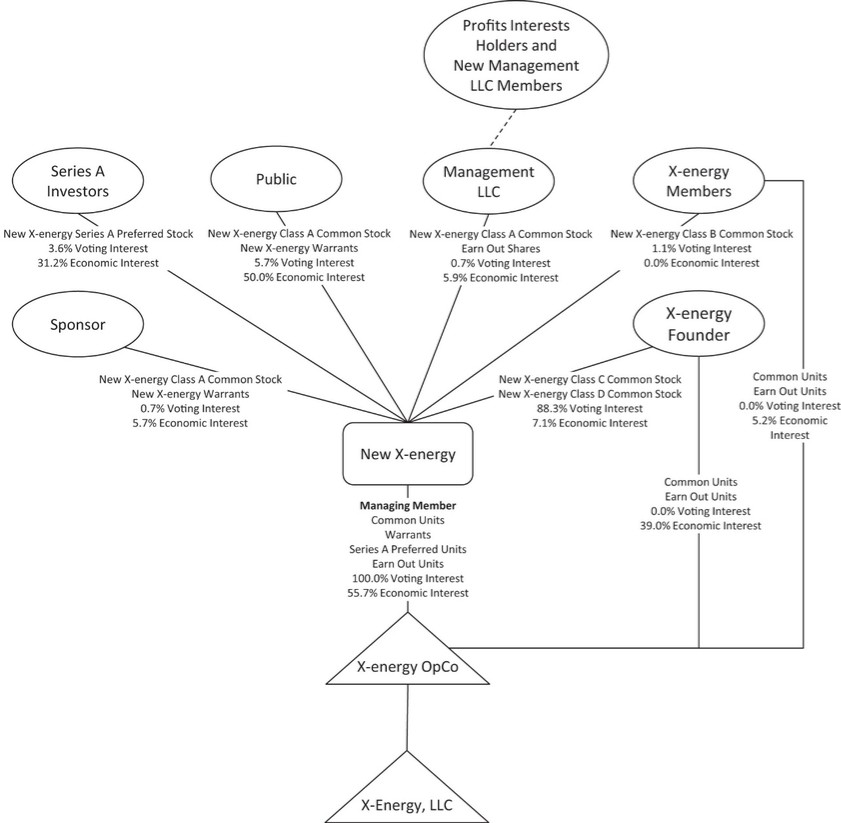

“Management LLC” has the meaning specified in the Preamble.

“Material Current Government Contract” has the meaning specified in Section 4.10.

“Member Support Agreement” means the Member Support Agreement, dated as of the date of this Agreement (as it may be amended or supplemented from time to time), by and between the Purchaser, the Company and the Requisite Members.

“Mirror Securities,” if Alternative Financing Securities are issued in a PIPE Investment, means securities issued by the Company to the Purchaser having terms and provisions substantially equivalent to the terms and provisions of such Alternative Financing Securities.

“Modification in Recommendation” has the meaning specified in Section 6.13(b)(i).

“Non-Converted Securities Value” means an amount equal to the aggregate value (inclusive of principal and interest accrued as of the Closing, if applicable) of all Equity Securities that are not converted into Company Common Units in connection with or prior to the Closing, which amount shall: (i) be equal to the value of the Company Common Units that would have been issued to such holder