FORM 1-A DISCLOSURE FORMAT

PART II

OFFERING CIRCULAR

Groundfloor Finance Inc.

One Hundred and Eight Series of Limited Recourse Obligations

Totaling $19,999,110

Dated: September 22, 2023

This Post-Qualification Offering Circular Amendment No. 3 (this “PQA”), made on the Form 1-A disclosure format, amends the offering circular of Groundfloor Finance Inc., dated October 4, 2022, as qualified on November 22, 2022, and as may be amended and supplemented from time to time (the “Offering Circular”), to add additional securities to be offered pursuant to the Offering Circular. This PQA relates to the offer and sale of up to an additional $19,999,110 in aggregate amount of Limited Recourse Obligations (the “LROs”) to be issued by Groundfloor Finance Inc. (the “Company,” “we,” “us,” or “our”). Unless otherwise defined below, capitalized terms used herein shall have the same meanings as set forth in the Offering Circular. See “Incorporation by Reference of Offering Circular” below.

We make LROs available for investment on our web-based investment platform www.groundfloor.com (the “Groundfloor Platform”). Our principal offices and mailing address are located at 600 Peachtree Street, Suite 810, Atlanta, GA 30308. The phone number for these offices is (404) 850-9225.

We will issue the LROs in distinct series, each corresponding to a real estate development project (each, a “Project”) financed by a commercial loan from us (each, a “Loan”). The borrower for each Project is a legal entity (the “Borrower”) that owns the underlying property and has been organized by one or more individuals (each, a “Principal”) that own and operate the Borrower. This PQA relates to the offer and sale of each separate series of LROs corresponding to the Projects for which we extend Loans, as described below (the “Offering”).

The LROs will be unsecured special, limited obligations of the Company. The LROs are not listed on any national securities exchange or on the over-the-counter inter-dealer quotation system. There is no market for the LROs. Our obligation to make payments on a LRO is limited to an amount equal to each holder’s pro rata share of amount of payments, if any, actually received on the corresponding Loan, net of certain fees and expenses retained by us. See the sections titled “General Terms of the LROs,” “The LROs Covered by this Offering Circular,” and “Project Summaries” of the Offering Circular, as amended hereby, for the specific terms of the LROs covered by this PQA.

We do not guarantee payment of the LROs in the amount or on the time frame expected. The LROs are not obligations of the Borrowers or their Principals, and we do not guarantee payment on the corresponding Loans. We have the authority to modify the terms of the corresponding Loans which could, in certain circumstances, reduce (or eliminate) the expected return on your investment. See the “General Terms of the LROs—Administration, Service, Collection, and Enforcement of Loan Documents” section on page 106 of the Offering Circular.

The LROs are speculative securities. Investment in the LROs involves significant risk, and you may be required to hold your investment for an indefinite period of time. You should purchase these securities only if you can afford a complete loss of your investment. See the “Risk Factors” section on page 12 of the Offering Circular.

Generally, no sale may be made to you in this offering to the extent that the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

We will commence the offering of each series of LROs promptly after the date this PQA is qualified by posting on the Groundfloor Platform a separate landing page corresponding to each particular Loan and Project (each, a “Project Summary”). The offering of each series of LROs covered by this PQA will remain open until the earlier of (1) 30 days, unless extended, or (2) the date the offering of a particular series of LROs is fully subscribed with irrevocable funding commitments (the “Offering Period”); however, we may extend the Offering Period for a particular series of LROs in our sole discretion (with notice to potential investors) up to a maximum of 45 days. We will notify investors who have previously committed funds to purchase such series of LROs of any such extension by email and will post a notice of the extension on the corresponding Project Summary on the Groundfloor Platform.

This Offering is being conducted on a “best-efforts” basis, which means that our officers will use their commercially reasonable best efforts in an attempt to sell the LROs. Such officers will not receive any commission or any other remuneration for these sales. In offering the LROs on our behalf, the officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

| Offering price to the public | Underwriting discounts and commissions | Proceeds to issuer(1)(2) | Proceeds to other persons | ||||||||||||

| Per Unit | $ | 10.00 | N/A | $ | 10.00 | N/A | |||||||||

| Total Minimum | $ | 0.00 | N/A | $ | 0.00 | N/A | |||||||||

| Total Maximum | $ | 19,999,110 | N/A | $ | 19,999,110 | N/A | |||||||||

(1) We estimate all expenses for this Offering to be approximately $1,000, which will not be financed with the proceeds of the Offering.

(2) Assumes no promotions or discounts applied to any offerings covered by this PQA.

Incorporation by Reference of Offering Circular

The Offering Circular, including this PQA, is part of an offering statement (File No. 024-10753) that we filed with the Securities and Exchange Commission. We hereby incorporate by reference into this PQA all of the information contained in the following:

| 1. | Part II of the Offering Circular, including the form of LRO Agreement beginning on page LRO-1 thereof to the extent not otherwise modified or replaced by offering circular supplement and/or post-qualification amendment. |

| 2. | Form 1-K, for Groundfloor Finance Inc., covering the periods ending December 31, 2022 and December 31, 2021. |

| 3. | Form 1-SA, for Groundfloor Finance Inc., covering the periods ending July 31, 2023 and July 31, 2022. |

Note that any statement that we make in this PQA (or have made in the Offering Circular) will be modified or superseded by any inconsistent statement made by us in a subsequent offering circular supplement or post-qualification amendment.

The LROs Covered by the Offering Circular and Use of Proceeds

The following disclosure is added on pages 109 and 110 of the Offering Circular under the table included under “The LROs Covered by this Offering Circular” and “Use of Proceeds,” respectively:

The table below lists the additional Projects covered by this PQA. Each series of LROs is denominated by the corresponding Project’s name.

| Series of LROs/Project | Aggregate Purchase Amount/Loan Principal | |||

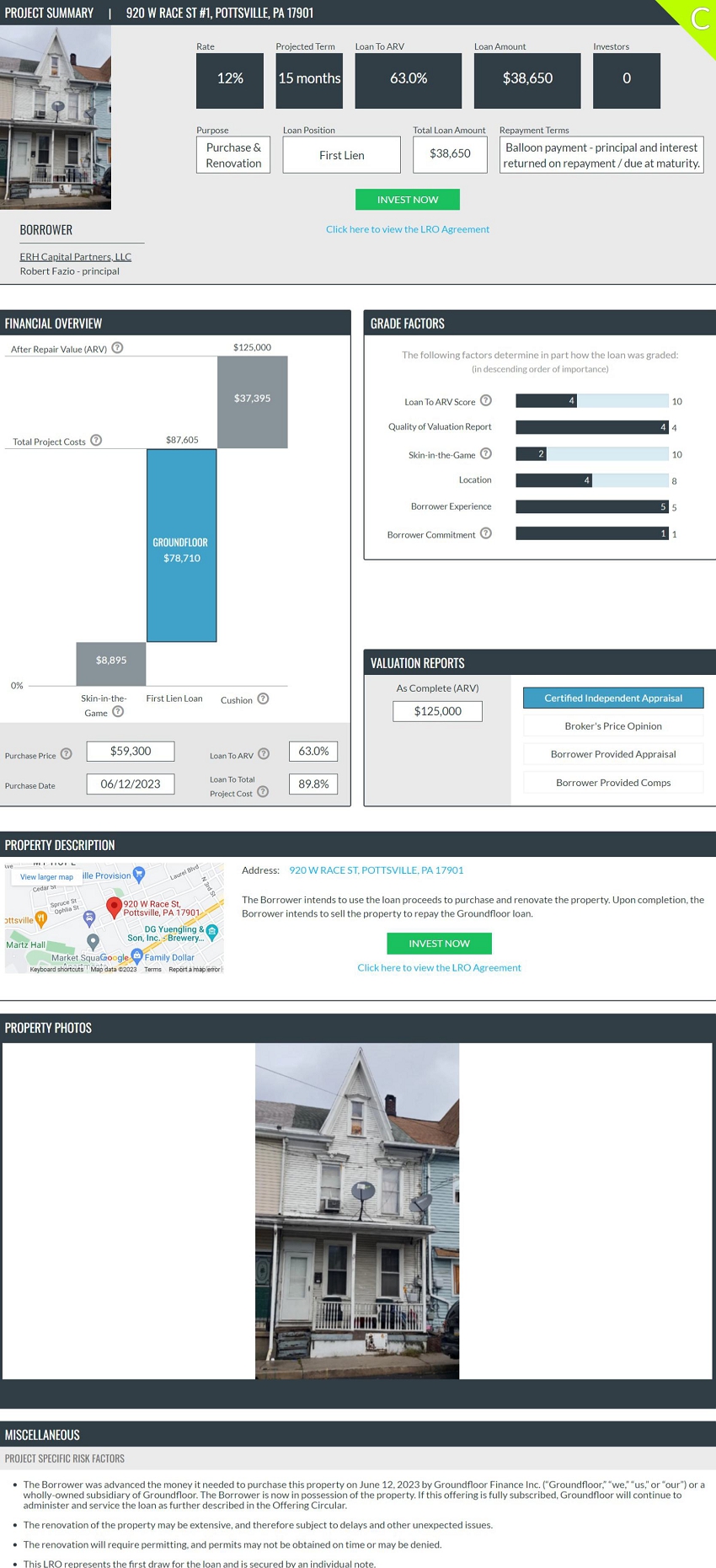

| 920 W RACE ST #1, POTTSVILLE, PA 17901 | $ | 38,650 | ||

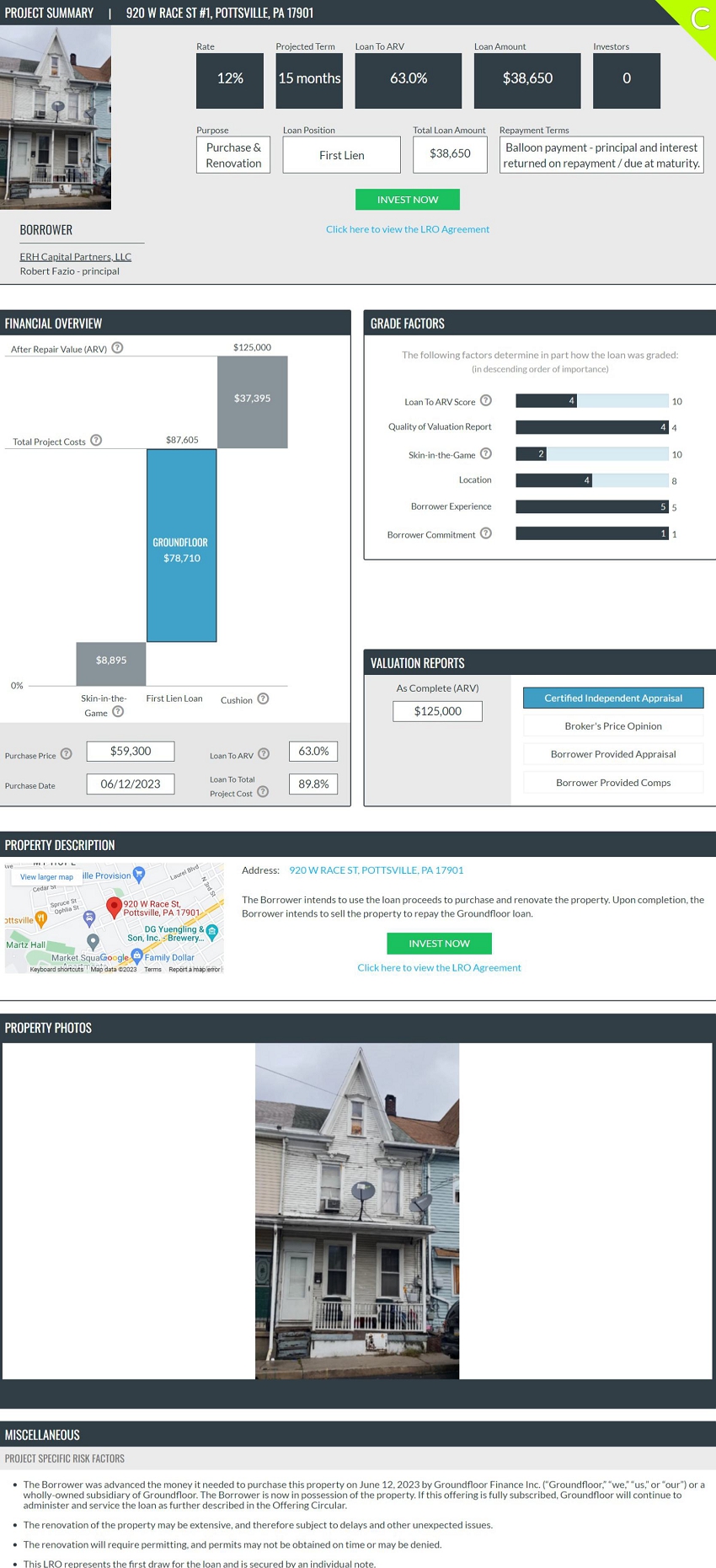

| 705 & 707 E 22ND ST #1, ANNISTON, AL 36207 | $ | 61,060 | ||

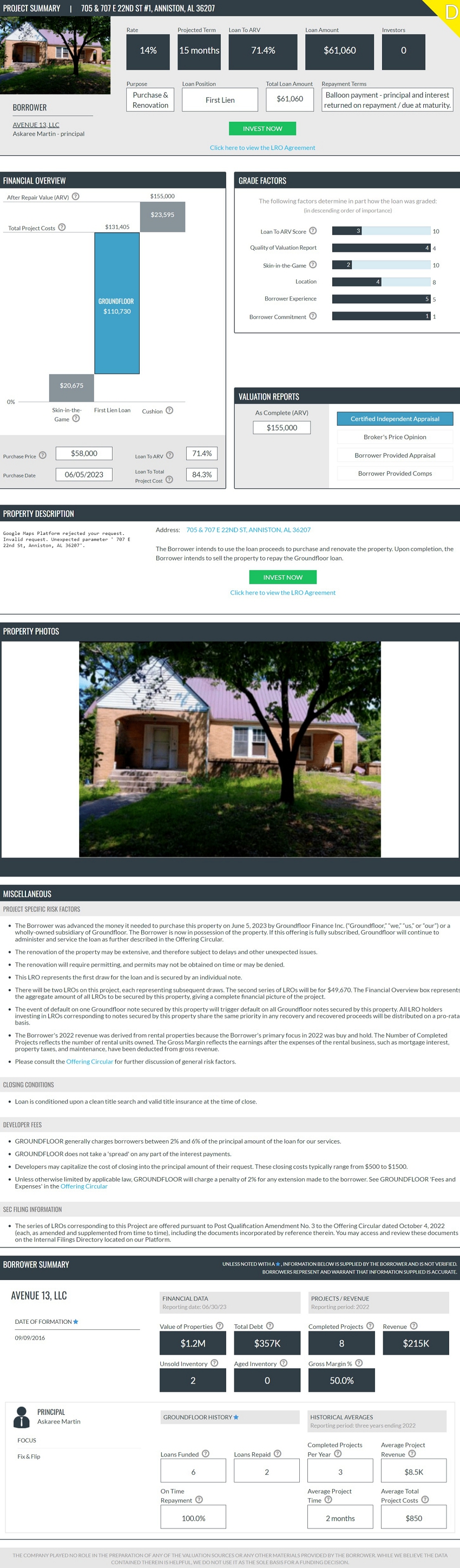

| 3173 BARRETT AVENUE (LOT 2), NAPLES, FL 34112 | $ | 64,950 | ||

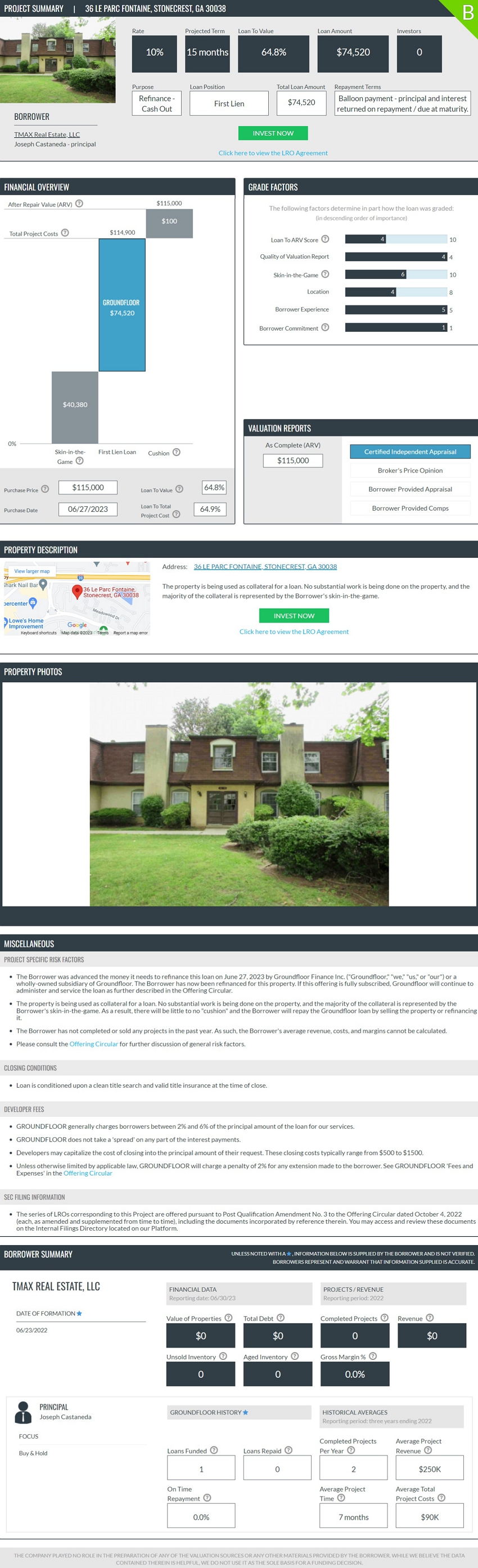

| 36 LE PARC FONTAINE, STONECREST, GA 30038 | $ | 74,520 | ||

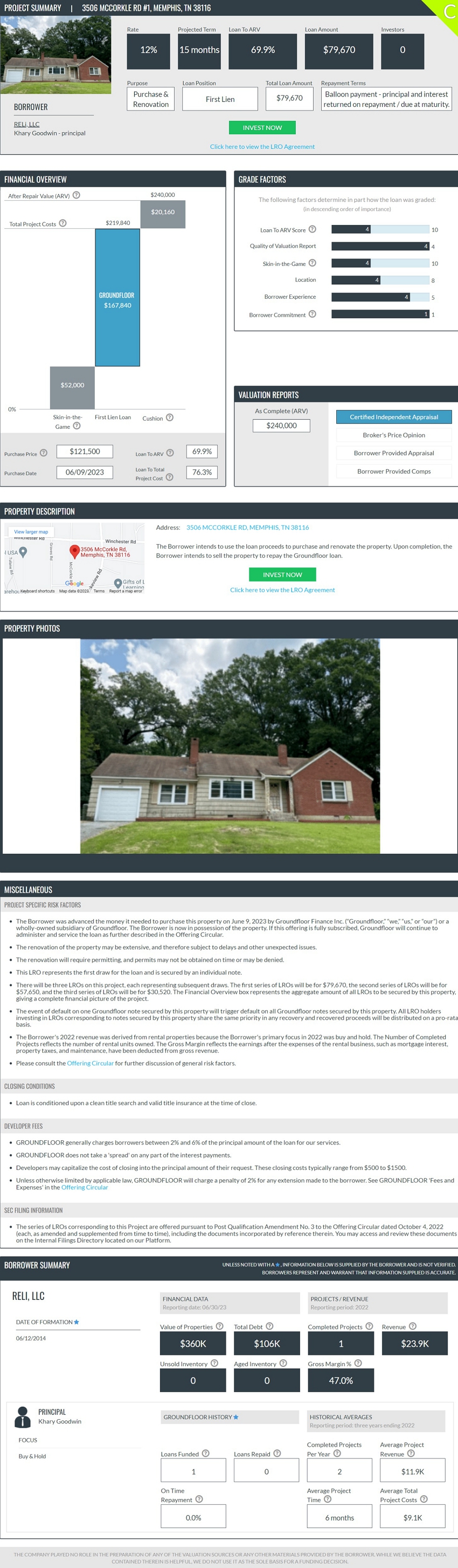

| 3506 MCCORKLE RD #1, MEMPHIS, TN 38116 | $ | 79,670 | ||

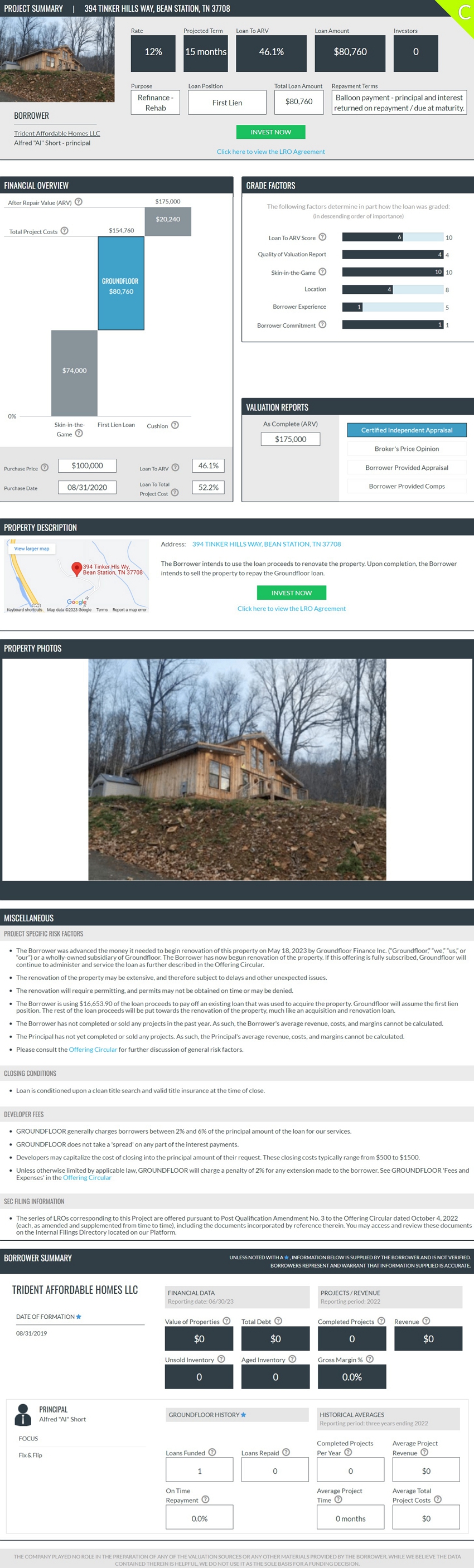

| 394 TINKER HILLS WAY, BEAN STATION, TN 37708 | $ | 80,760 | ||

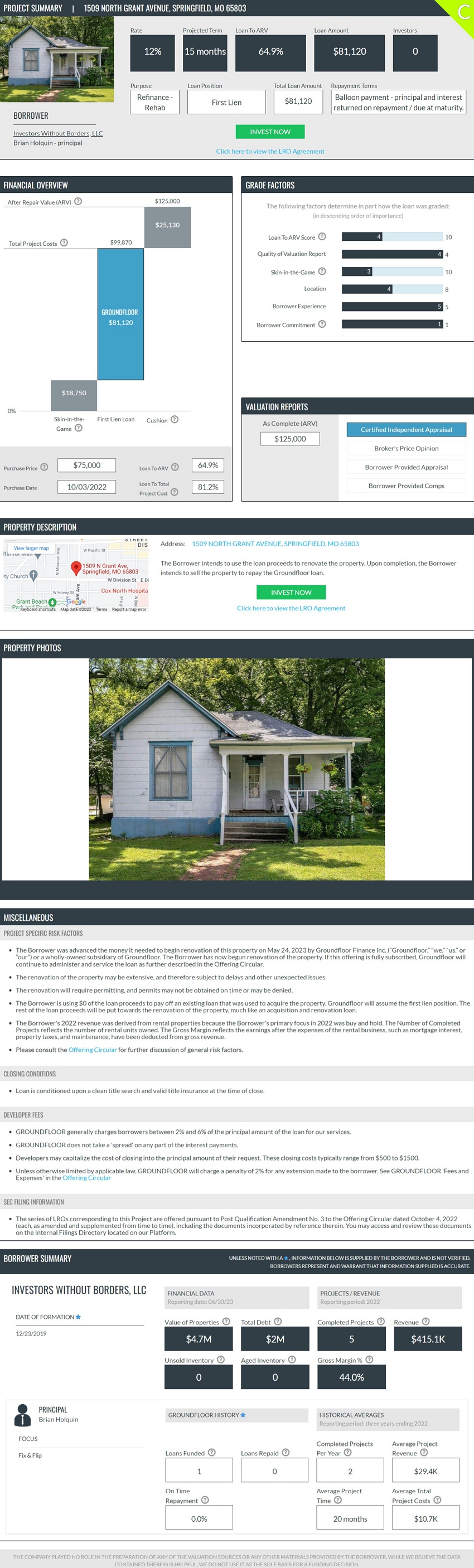

| 1509 NORTH GRANT AVENUE, SPRINGFIELD, MO 65803 | $ | 81,120 | ||

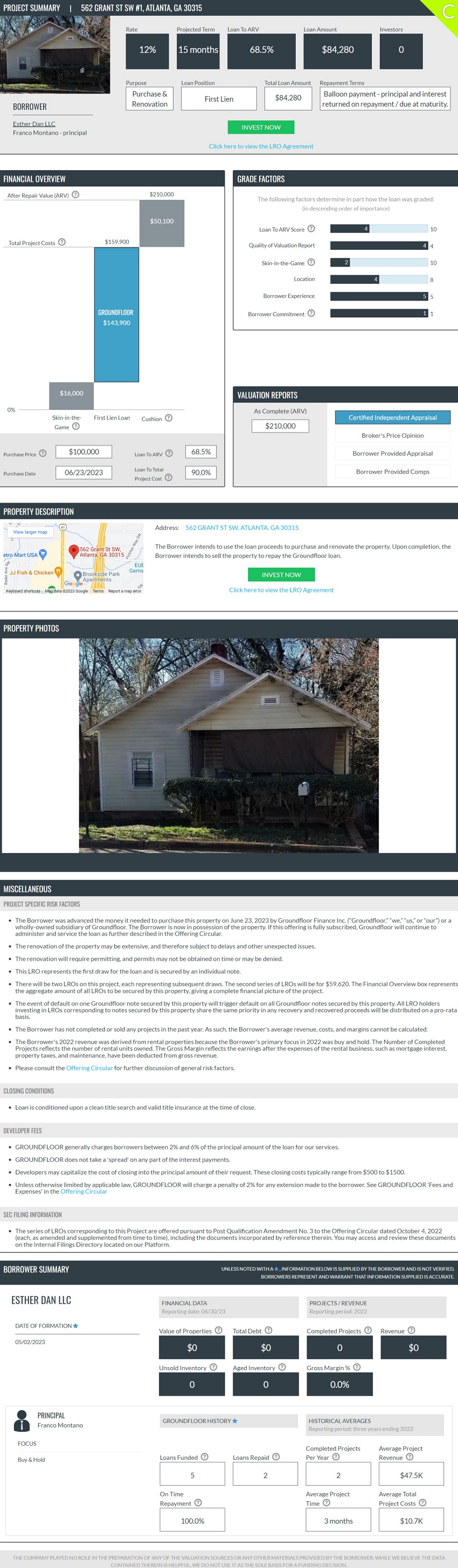

| 562 GRANT ST SW #1, ATLANTA, GA 30315 | $ | 84,280 | ||

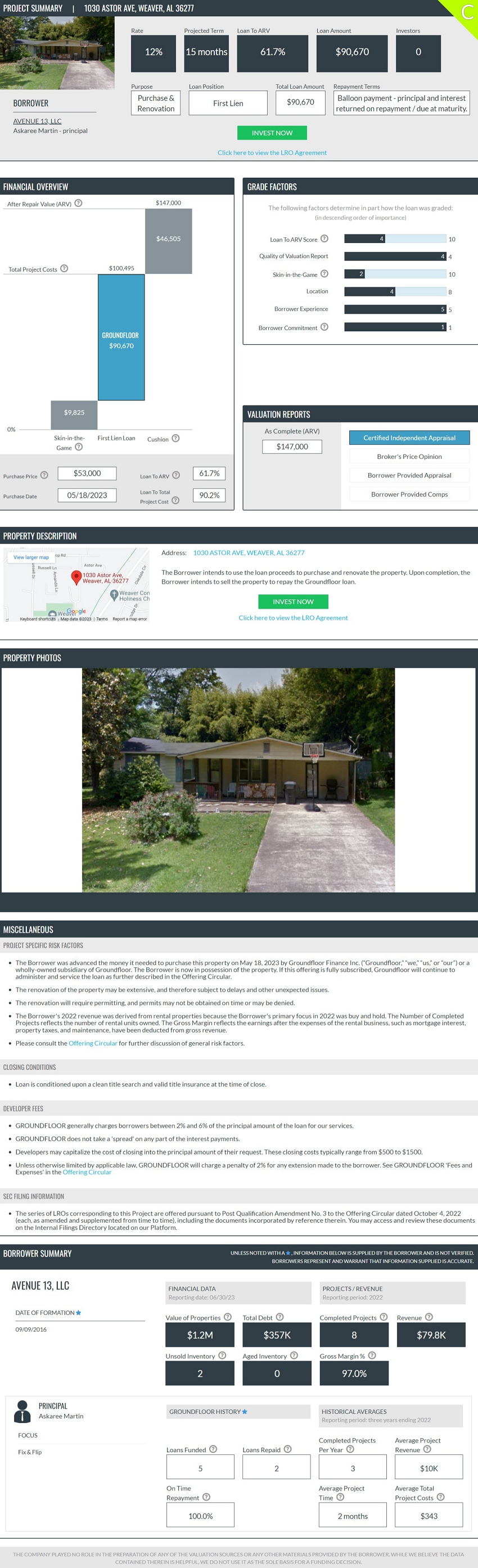

| 1030 ASTOR AVE, WEAVER, AL 36277 | $ | 90,670 | ||

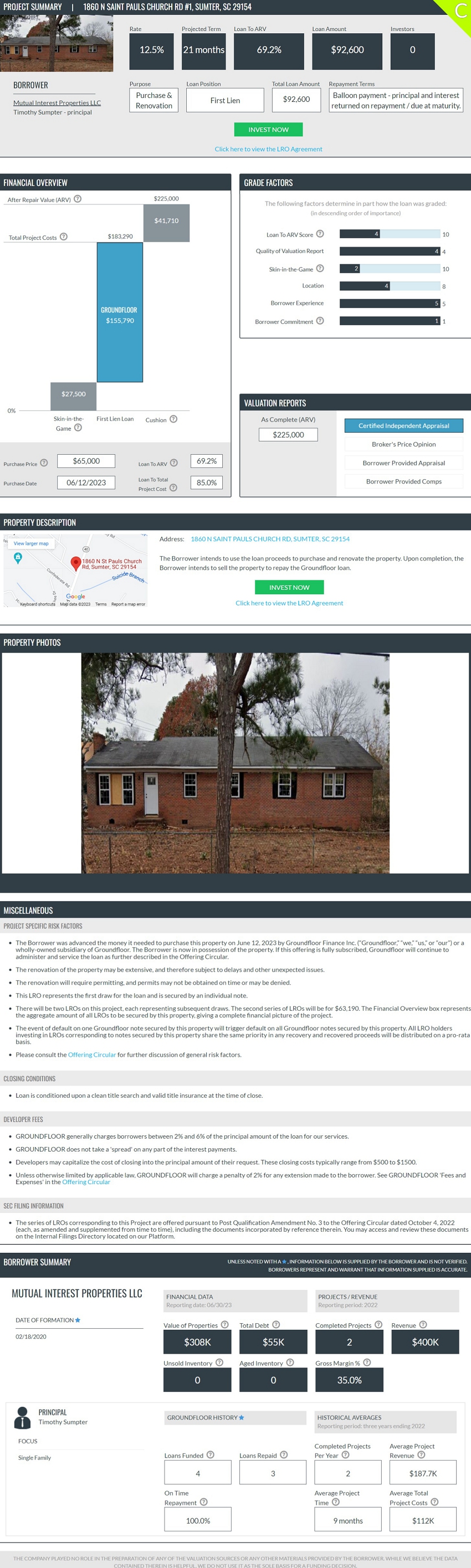

| 1860 N SAINT PAULS CHURCH RD #1, SUMTER, SC 29154 | $ | 92,600 | ||

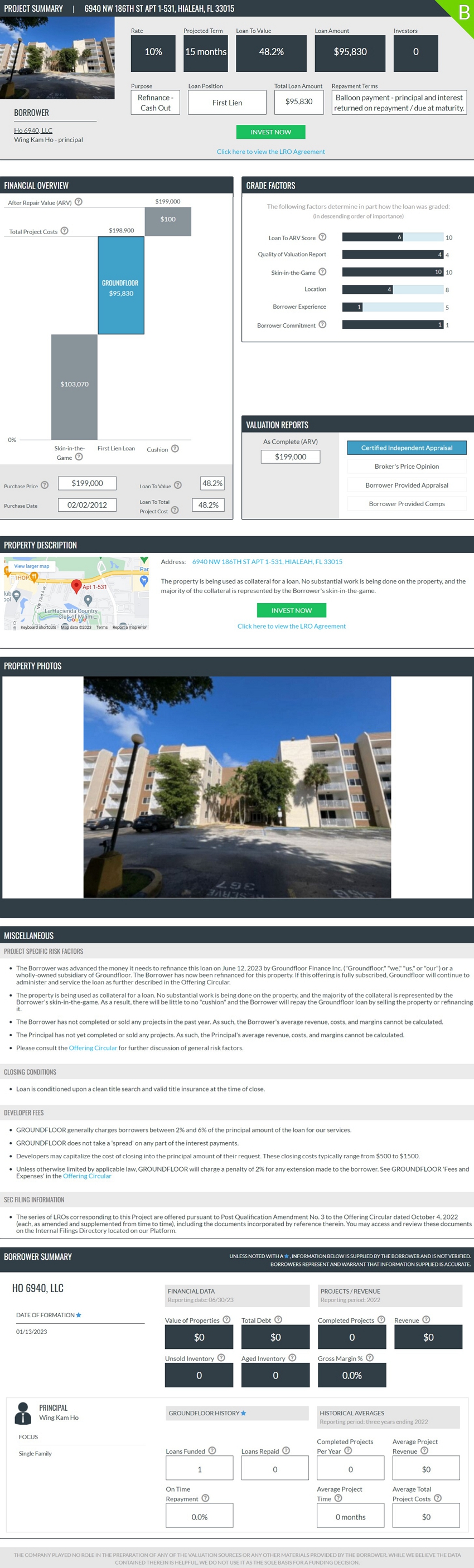

| 6940 NW 186TH ST APT 1-531, HIALEAH, FL 33015 | $ | 95,830 | ||

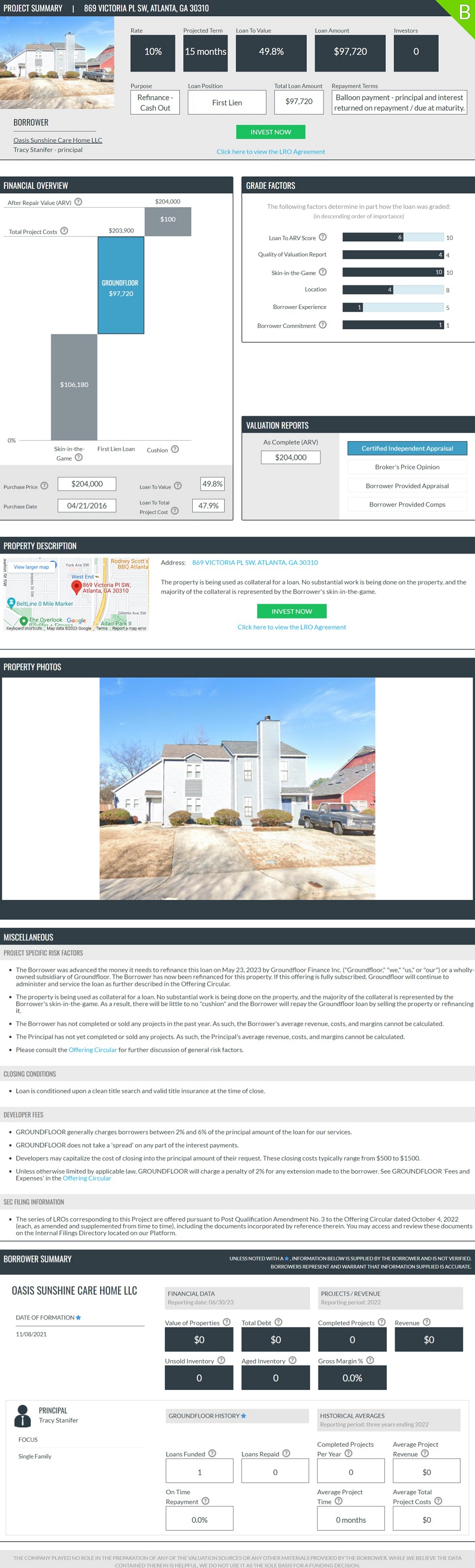

| 869 VICTORIA PL SW, ATLANTA, GA 30310 | $ | 97,720 | ||

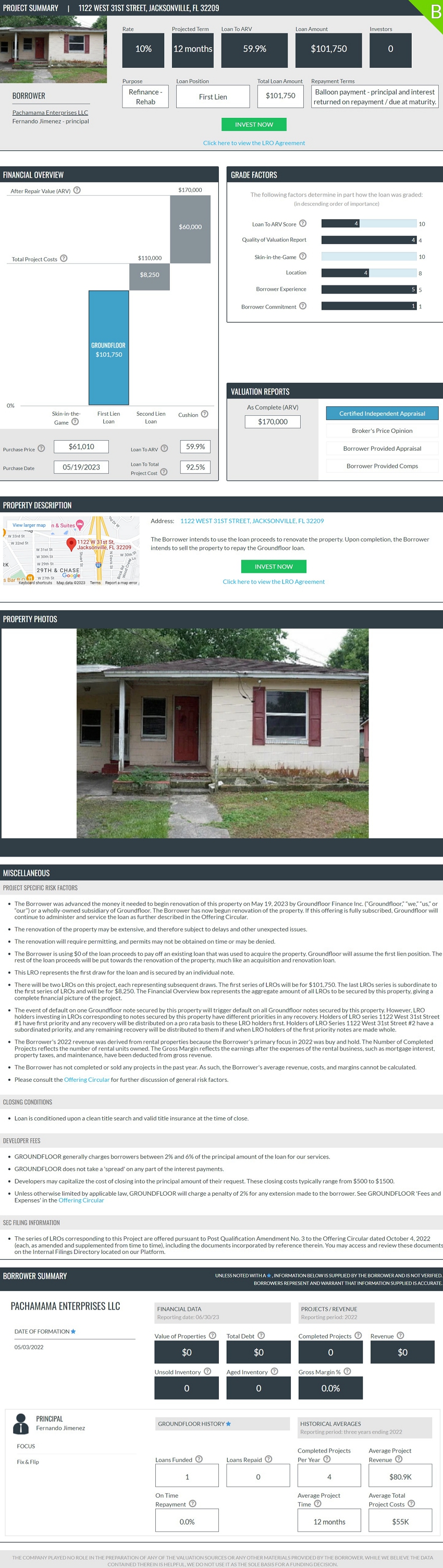

| 1122 WEST 31ST STREET, JACKSONVILLE, FL 32209 | $ | 101,750 | ||

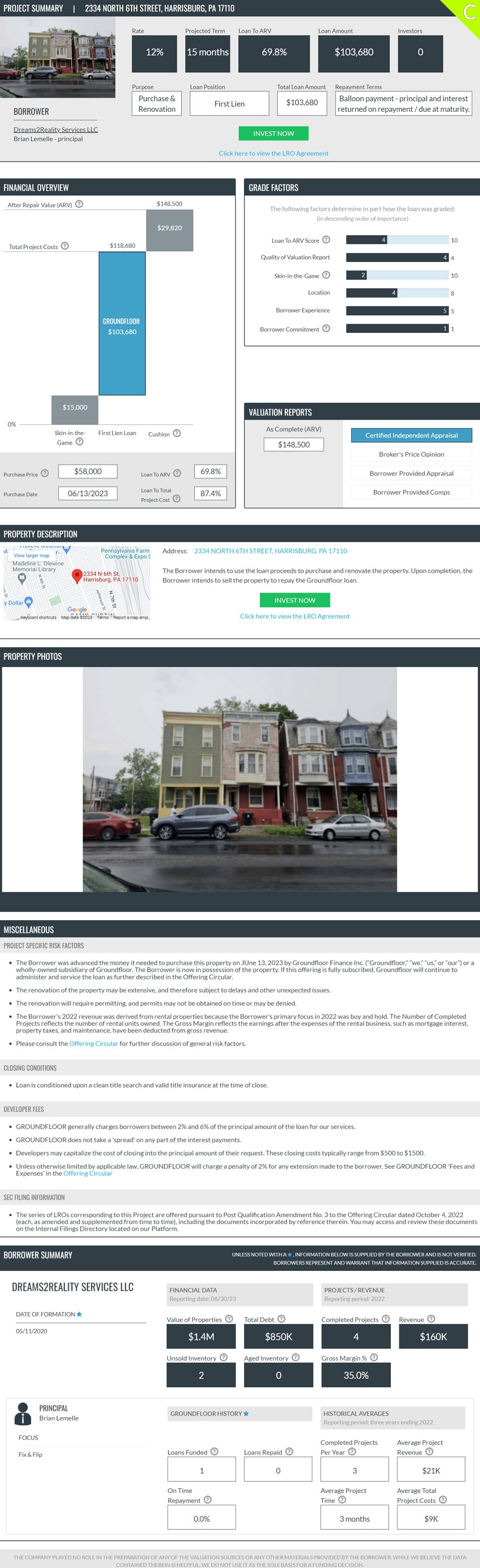

| 2334 NORTH 6TH STREET, HARRISBURG, PA 17110 | $ | 103,680 | ||

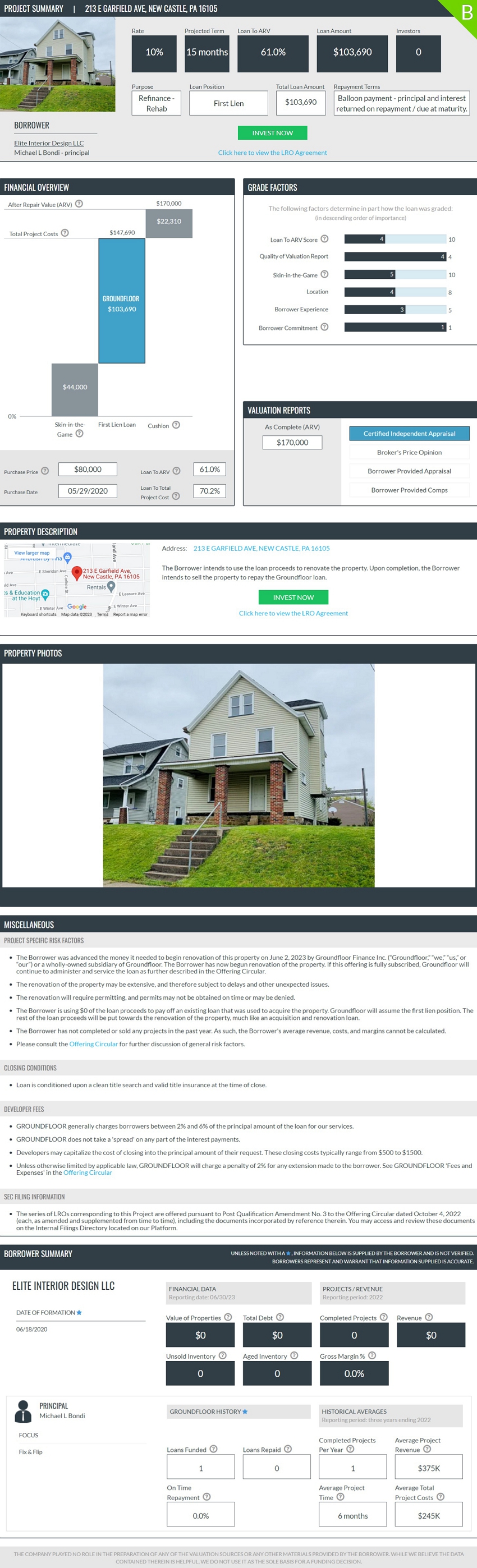

| 213 E GARFIELD AVE, NEW CASTLE, PA 16105 | $ | 103,690 | ||

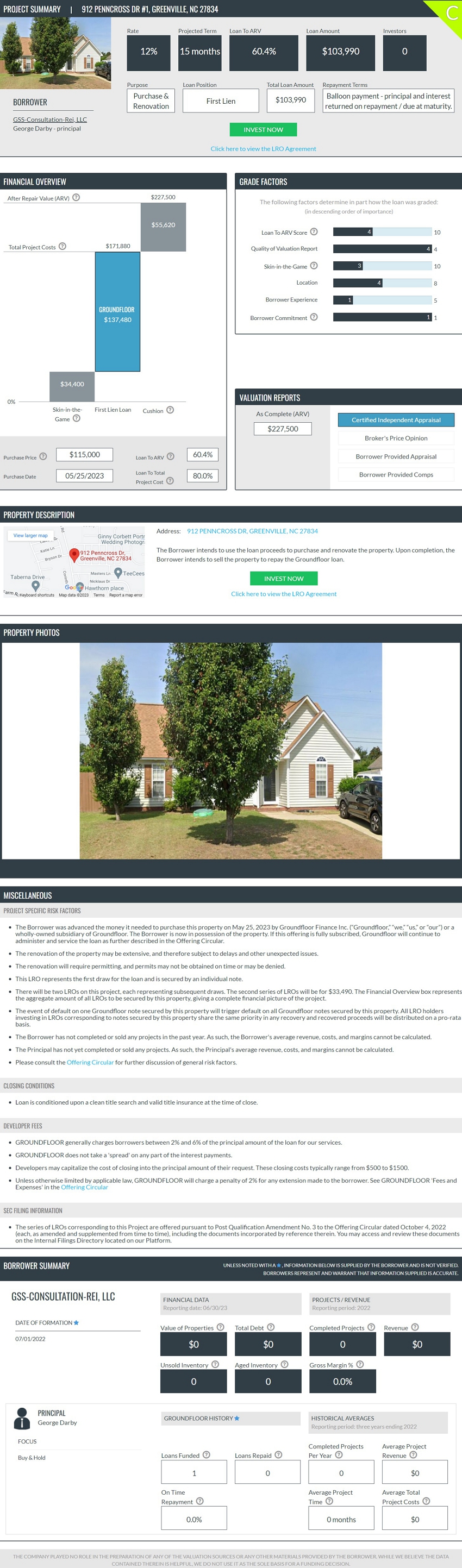

| 912 PENNCROSS DR #1, GREENVILLE, NC 27834 | $ | 103,990 | ||

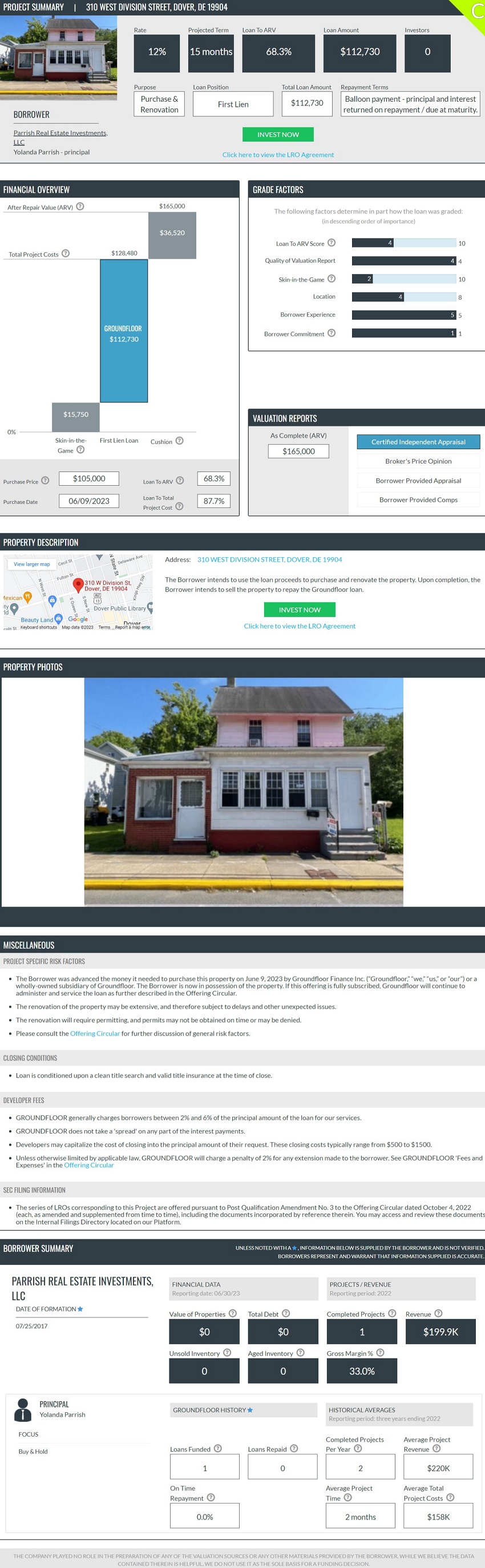

| 310 WEST DIVISION STREET, DOVER, DE 19904 | $ | 112,730 | ||

| 2080 W 45TH ST #1, CLEVELAND, OH 44102 | $ | 120,320 | ||

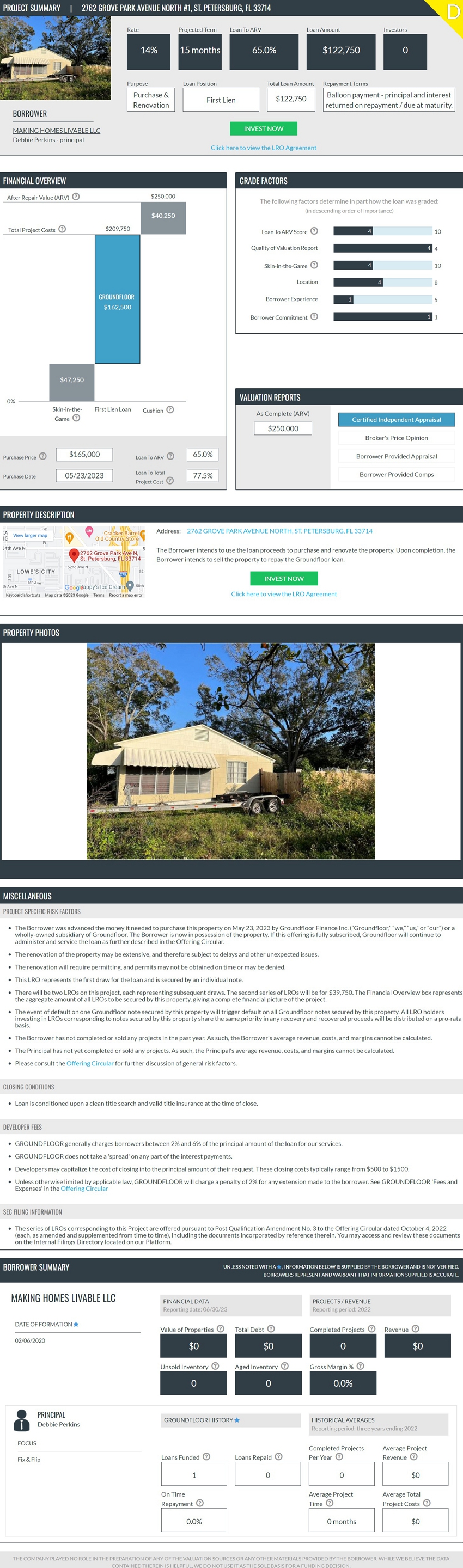

| 2762 GROVE PARK AVENUE NORTH #1, ST. PETERSBURG, FL 33714 | $ | 122,750 | ||

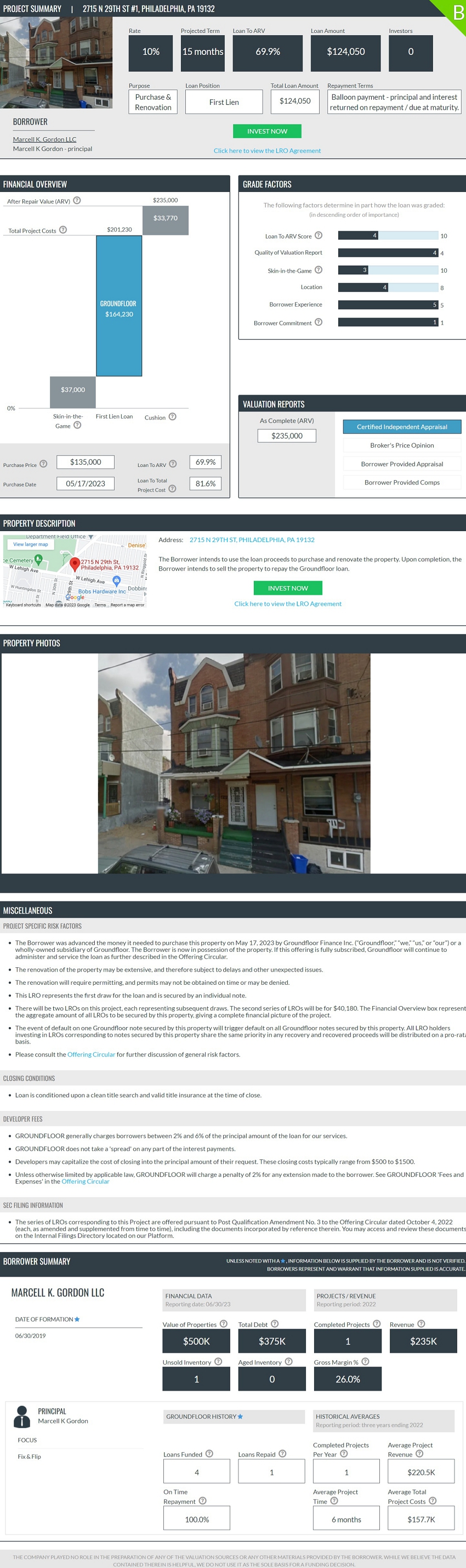

| 2715 N 29TH ST #1, PHILADELPHIA, PA 19132 | $ | 124,050 | ||

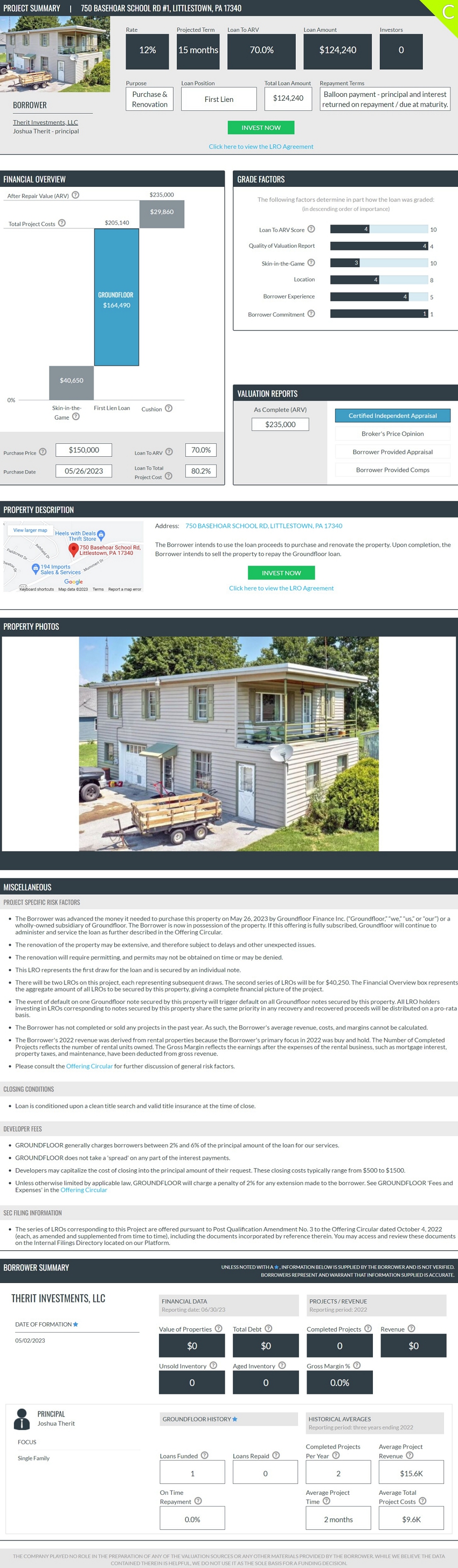

| 750 BASEHOAR SCHOOL RD #1, LITTLESTOWN, PA 17340 | $ | 124,240 | ||

| 310 LINCOLN AVE, MICHIGAN CITY, IN 46360 | $ | 127,020 | ||

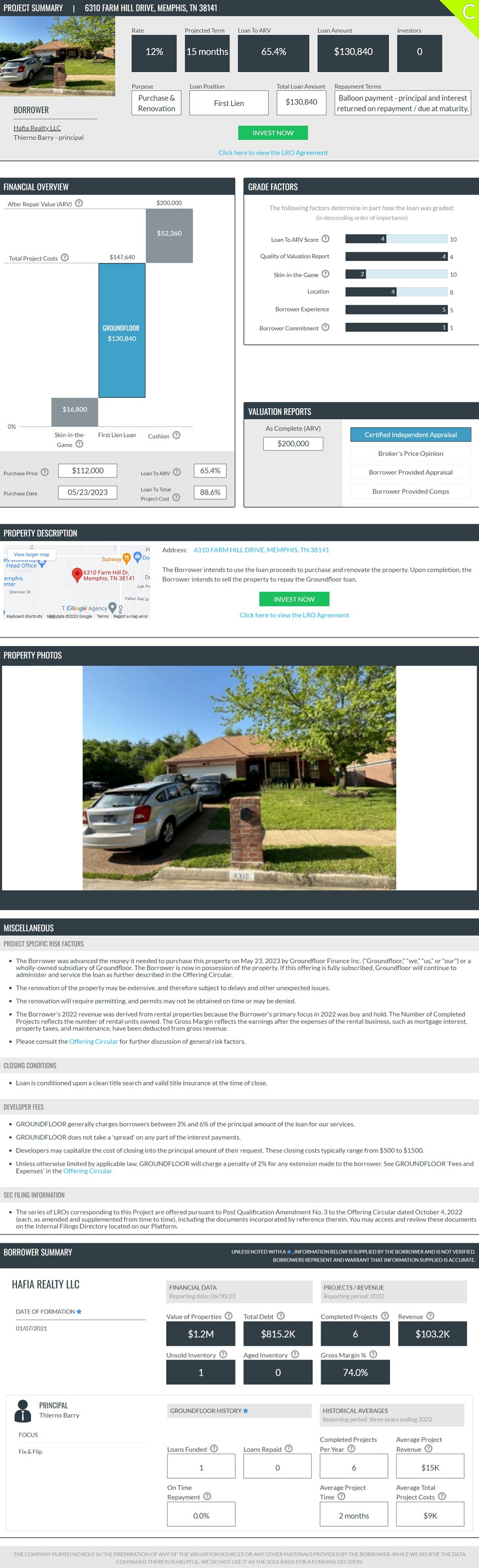

| 6310 FARM HILL DRIVE, MEMPHIS, TN 38141 | $ | 130,840 | ||

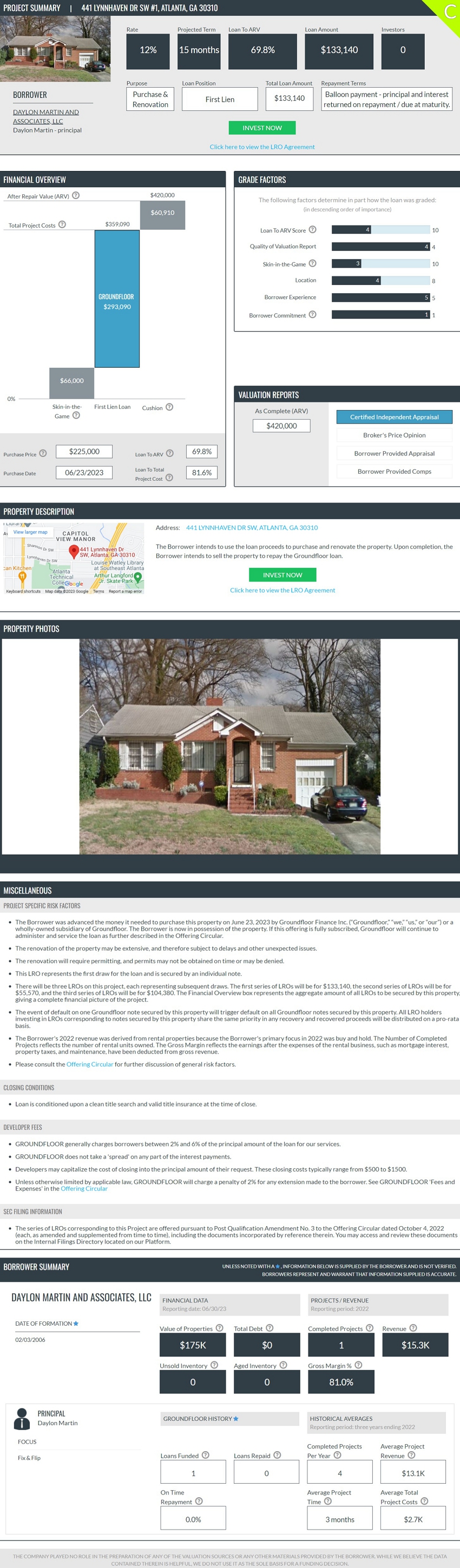

| 441 LYNNHAVEN DR SW #1, ATLANTA, GA 30310 | $ | 133,140 | ||

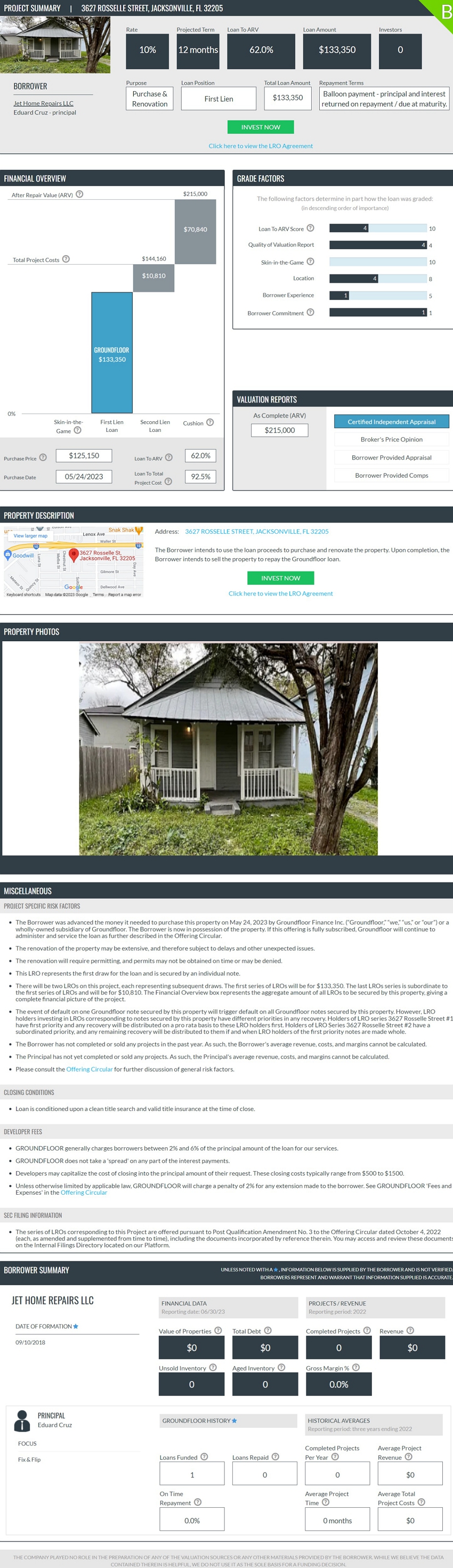

| 3627 ROSSELLE STREET, JACKSONVILLE, FL 32205 | $ | 133,350 | ||

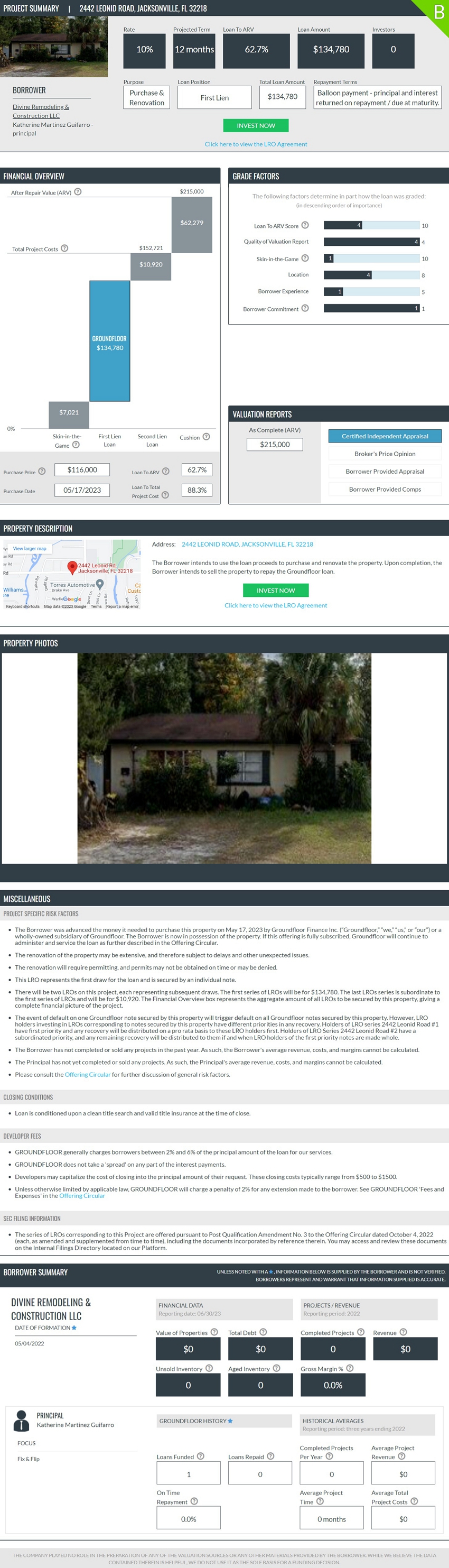

| 2442 LEONID ROAD, JACKSONVILLE, FL 32218 | $ | 134,780 | ||

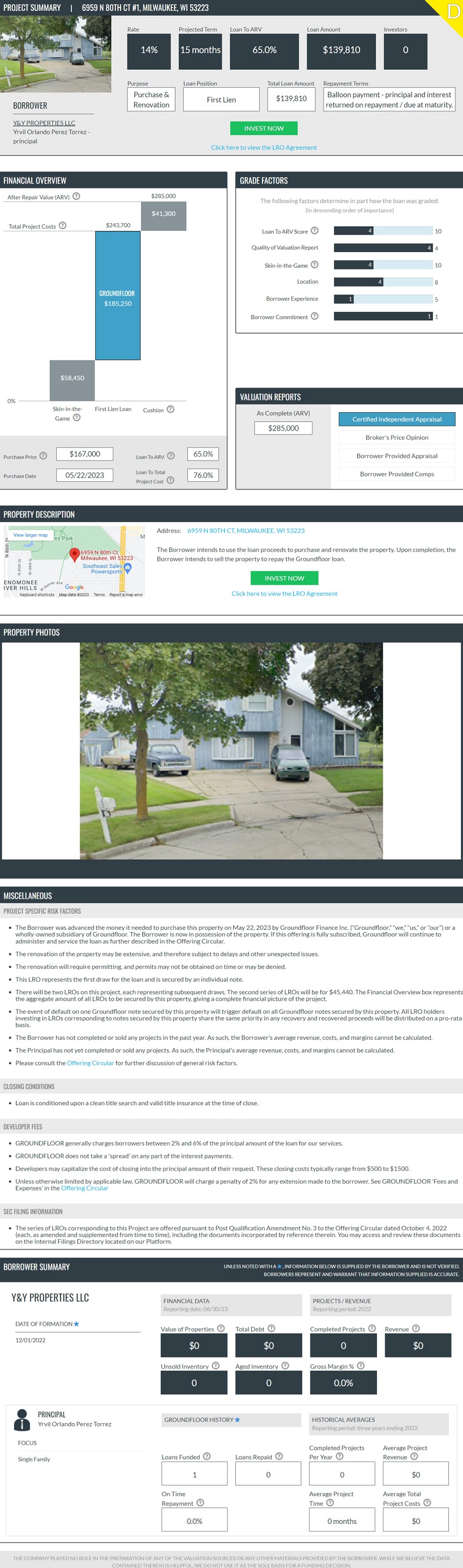

| 6959 N 80TH CT #1, MILWAUKEE, WI 53223 | $ | 139,810 | ||

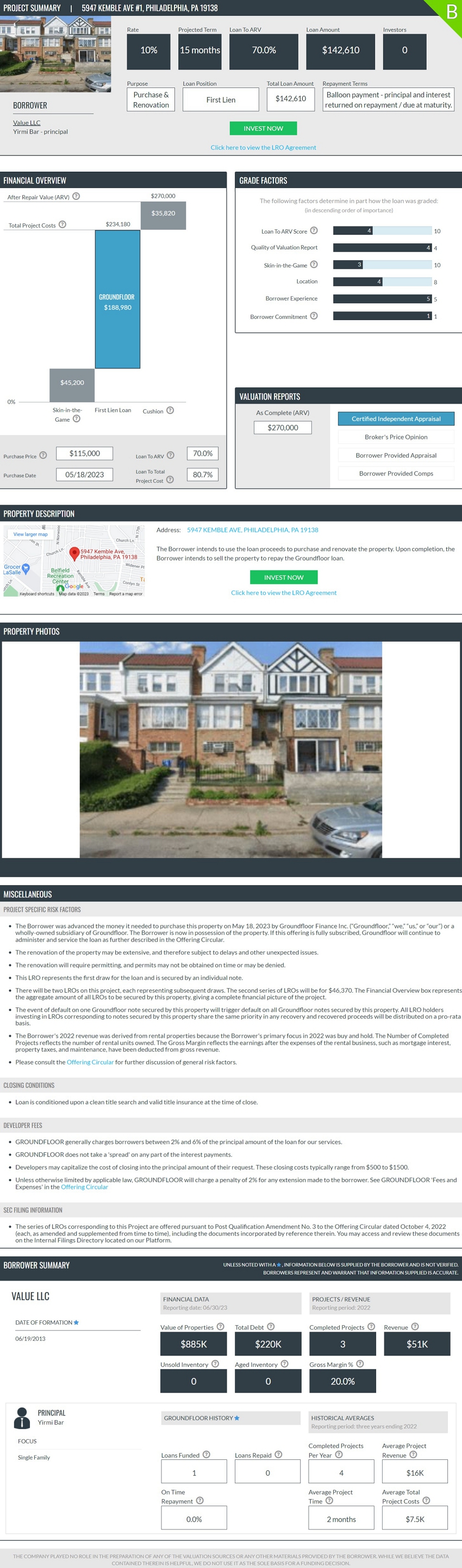

| 5947 KEMBLE AVE #1, PHILADELPHIA, PA 19138 | $ | 142,610 | ||

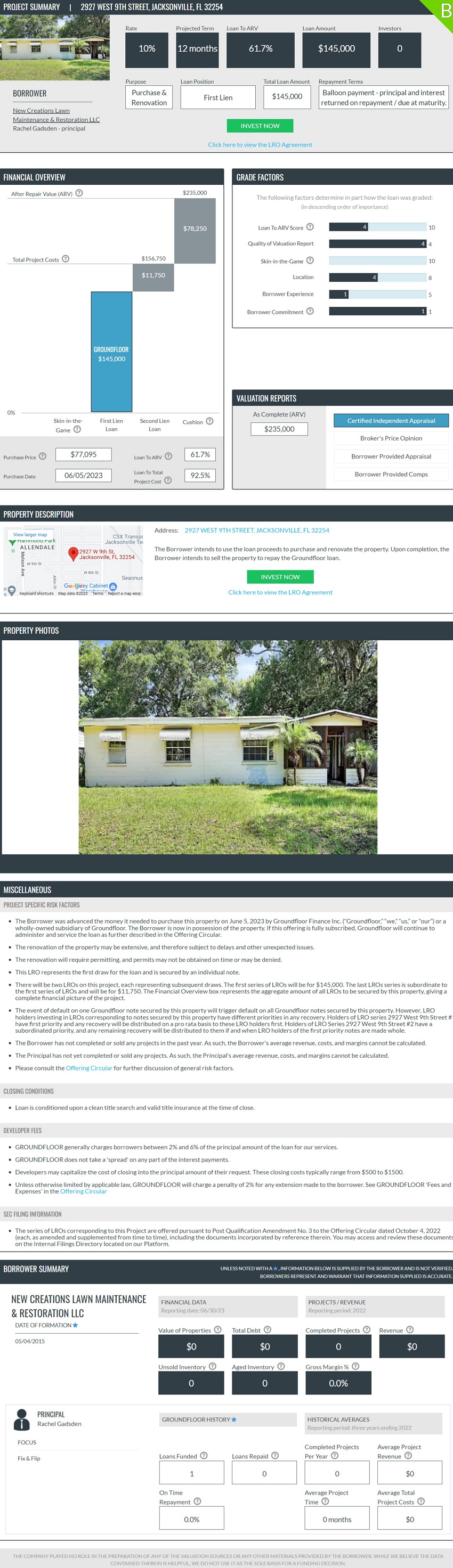

| 2927 WEST 9TH STREET, JACKSONVILLE, FL 32254 | $ | 145,000 | ||

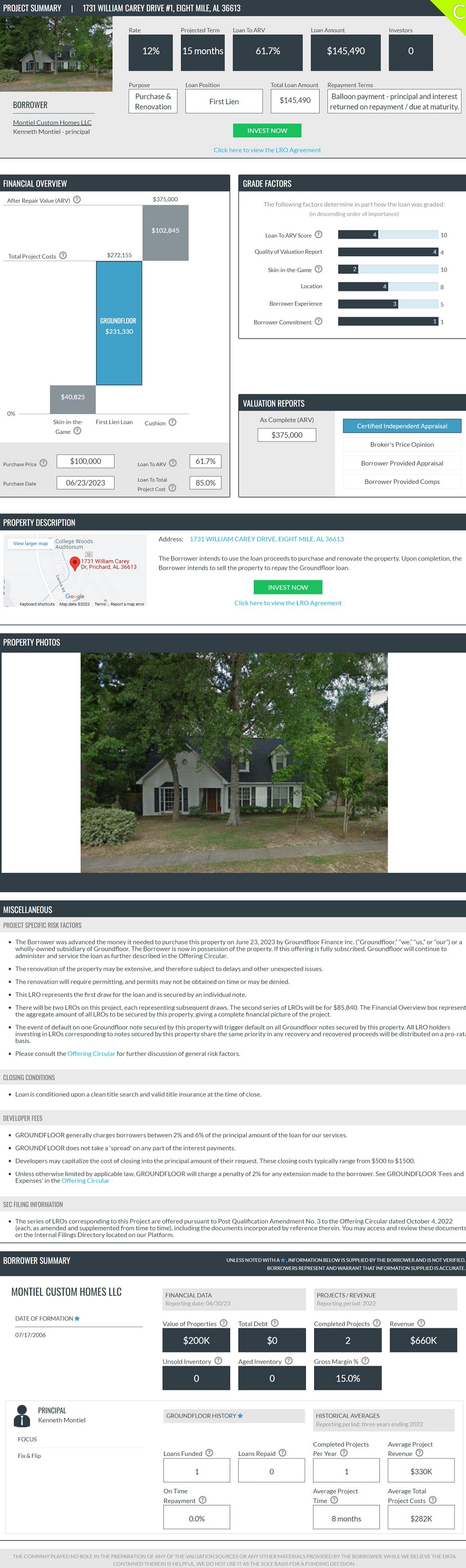

| 1731 WILLIAM CAREY DRIVE #1, EIGHT MILE, AL 36613 | $ | 145,490 | ||

| 6781 GRACE LANE, JACKSONVILLE, FL 32205 | $ | 146,510 | ||

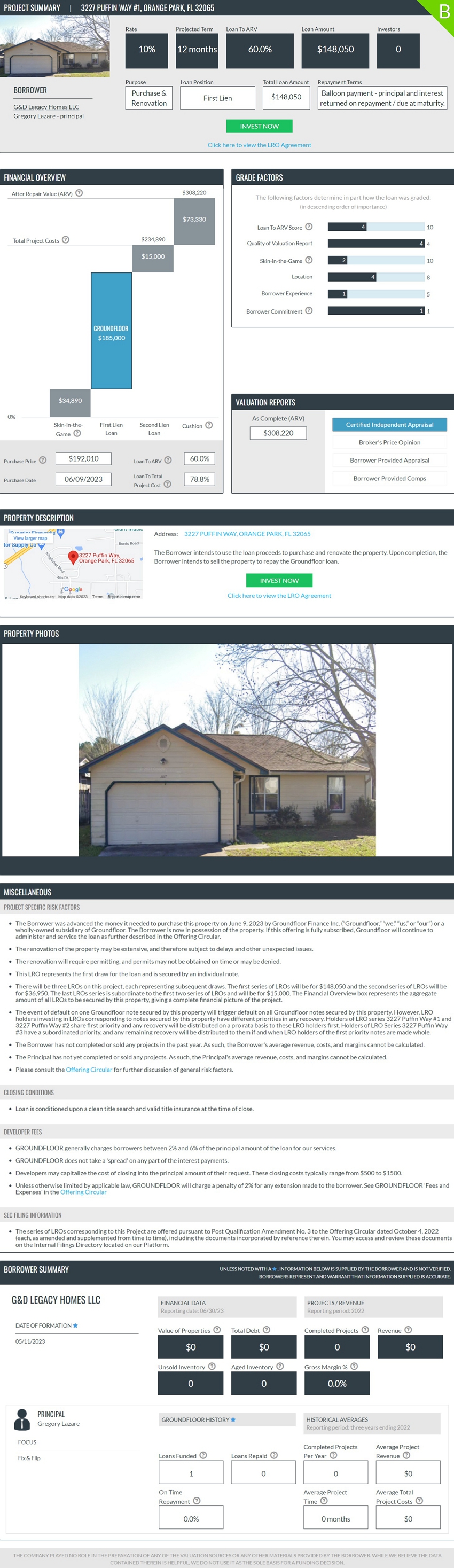

| 3227 PUFFIN WAY #1, ORANGE PARK, FL 32065 | $ | 148,050 | ||

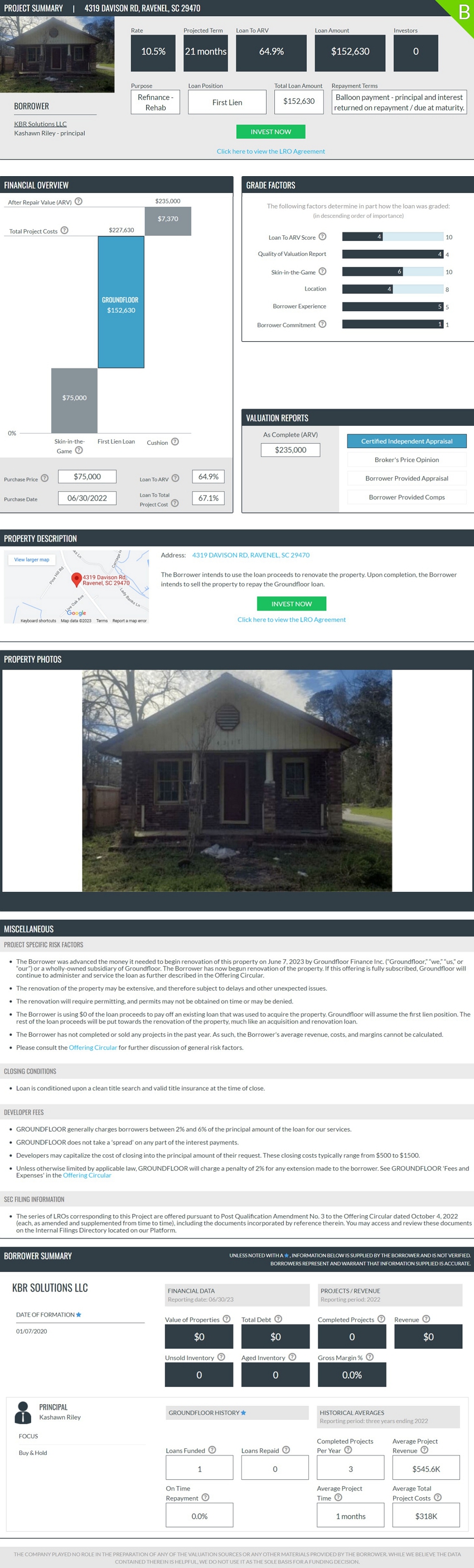

| 4319 DAVISON RD, RAVENEL, SC 29470 | $ | 152,630 | ||

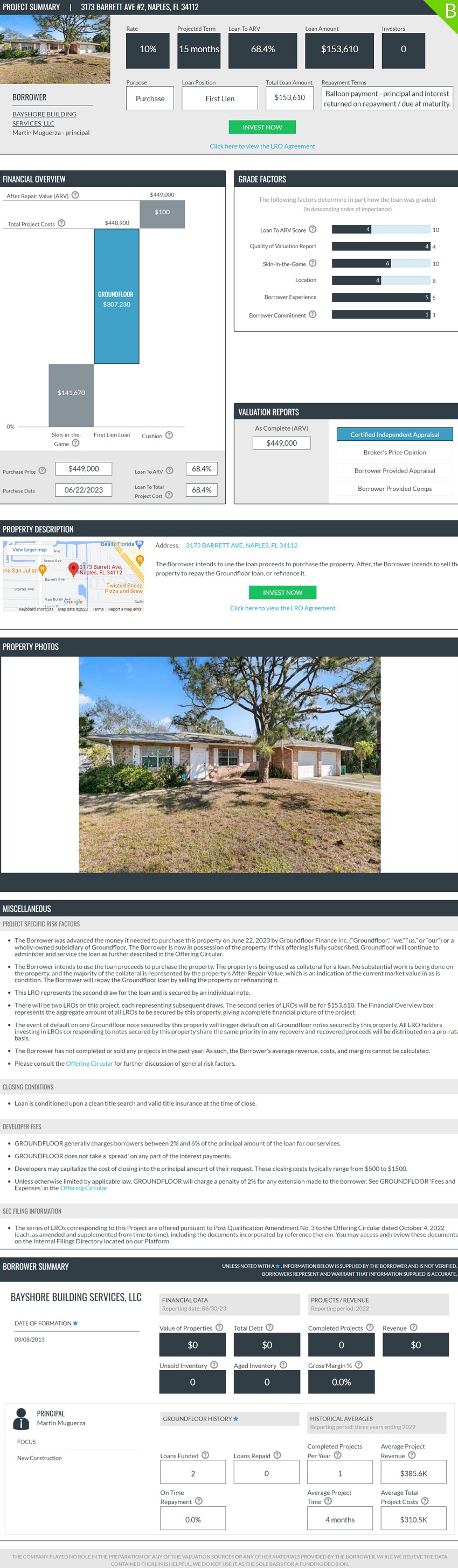

| 3173 BARRETT AVE #2, NAPLES, FL 34112 | $ | 153,610 | ||

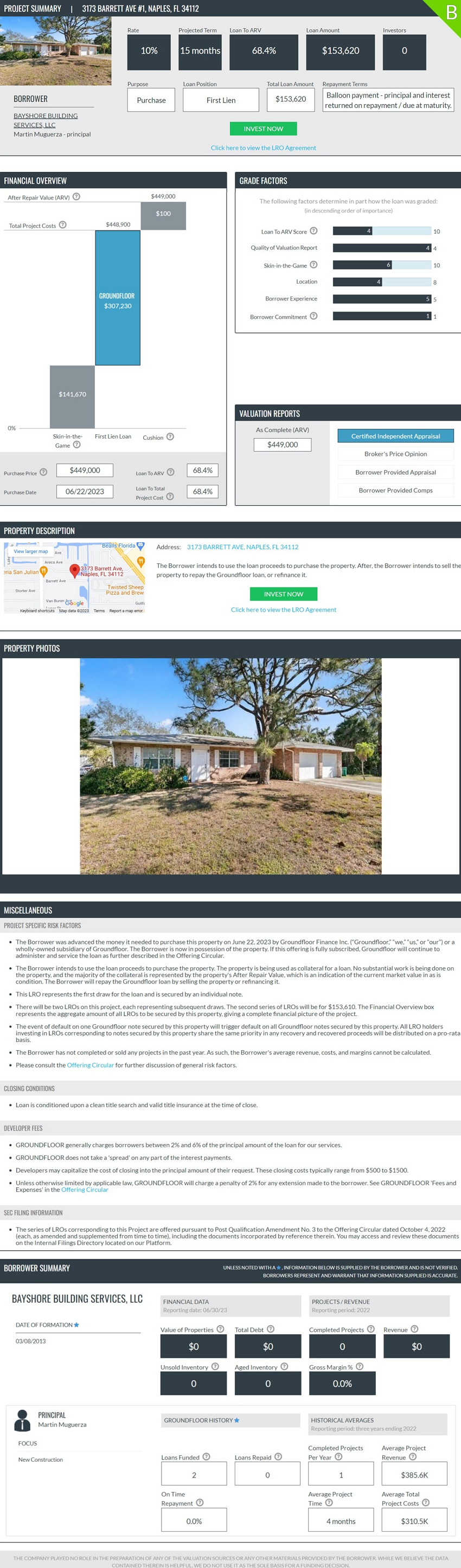

| 3173 BARRETT AVE #1, NAPLES, FL 34112 | $ | 153,620 | ||

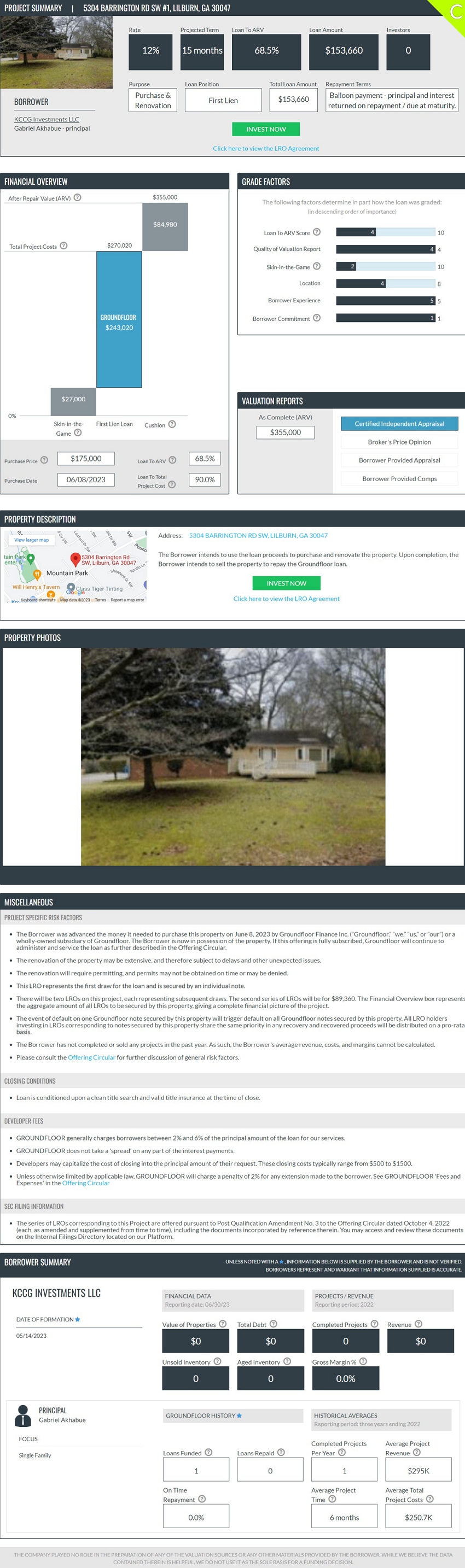

| 5304 BARRINGTON RD SW #1, LILBURN, GA 30047 | $ | 153,660 | ||

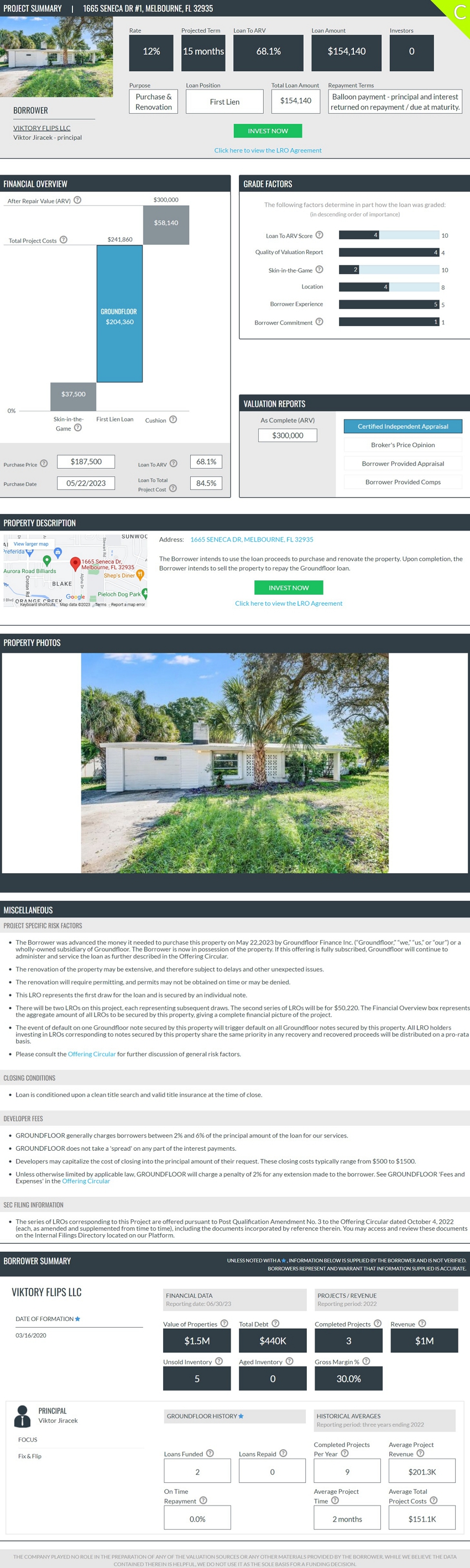

| 1665 SENECA DR #1, MELBOURNE, FL 32935 | $ | 154,140 | ||

| 1349 IDA STREET, JACKSONVILLE, FL 32208 | $ | 156,380 | ||

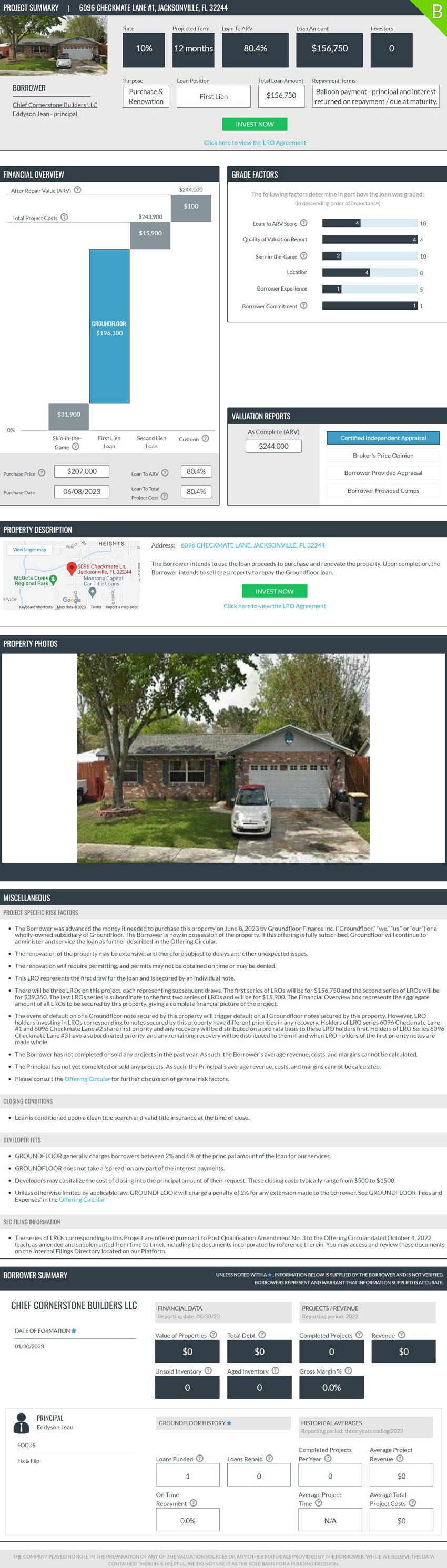

| 6096 CHECKMATE LANE #1, JACKSONVILLE, FL 32244 | $ | 156,750 | ||

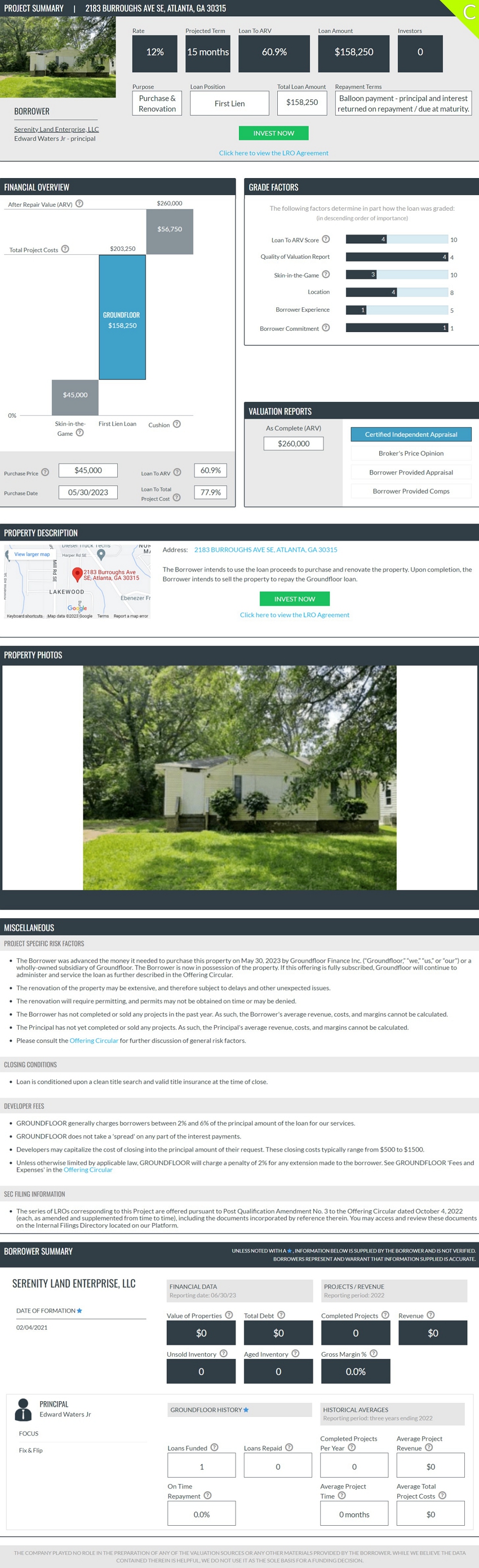

| 2183 BURROUGHS AVE SE, ATLANTA, GA 30315 | $ | 158,250 | ||

| 6421 TOWNSEND ROAD, JACKSONVILLE, FL 32244 | $ | 161,850 | ||

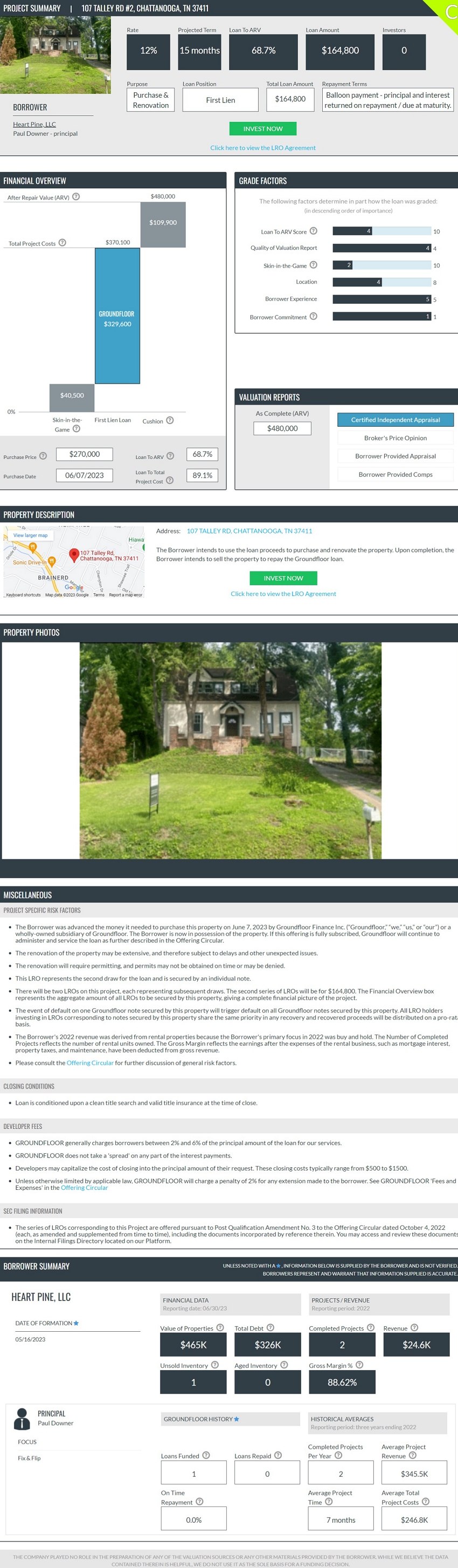

| 107 TALLEY RD #2, CHATTANOOGA, TN 37411 | $ | 164,800 | ||

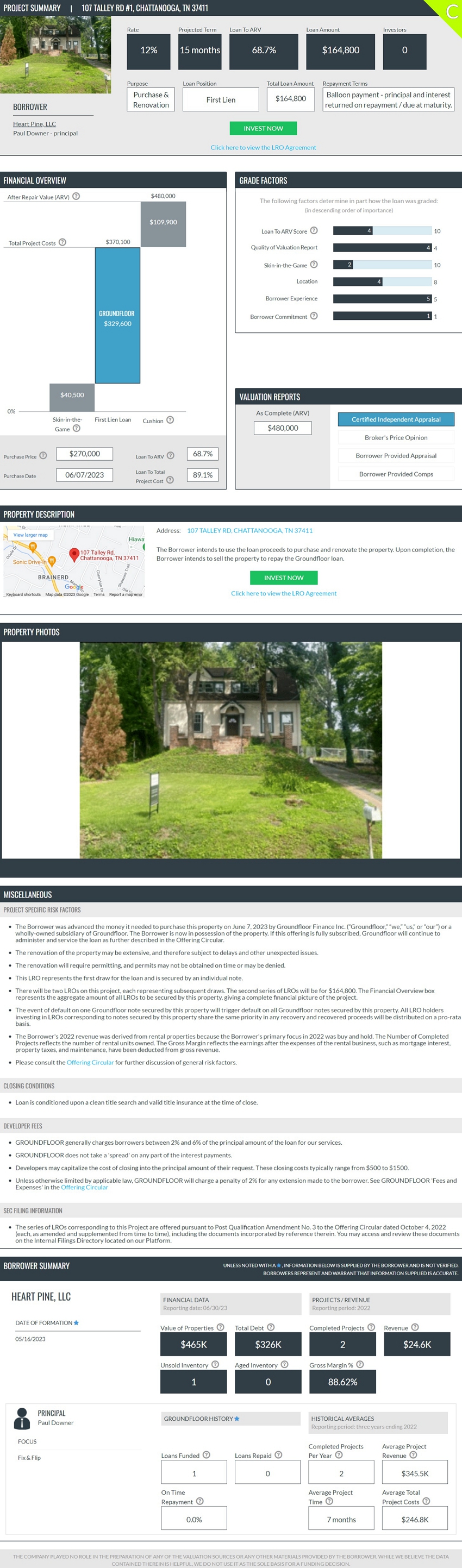

| 107 TALLEY RD #1, CHATTANOOGA, TN 37411 | $ | 164,800 | ||

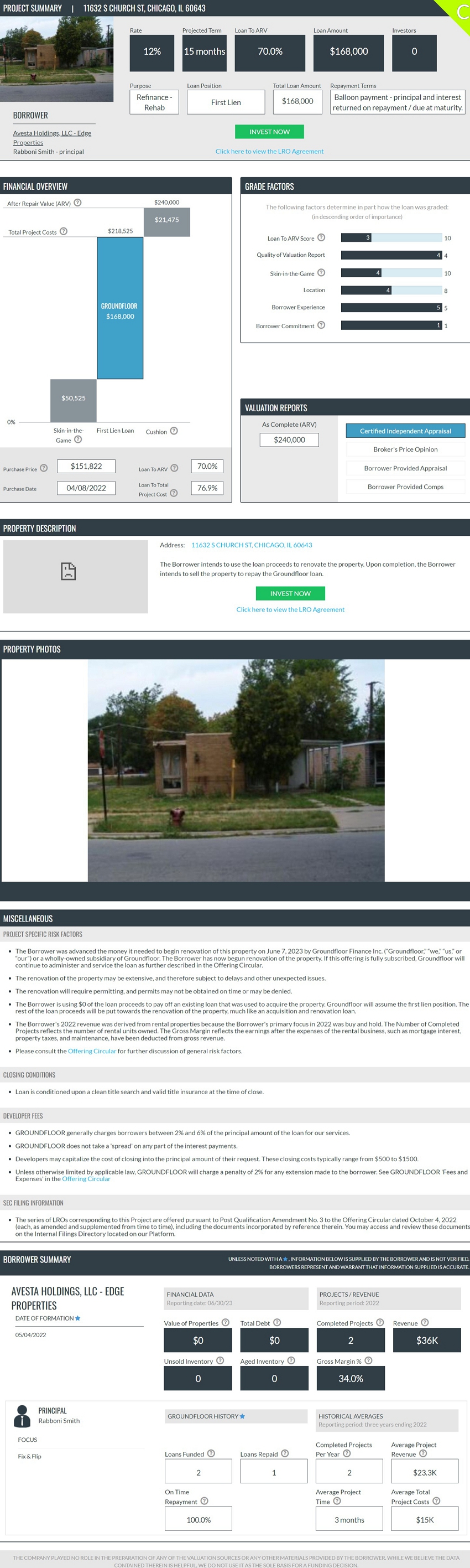

| 11632 S CHURCH ST, CHICAGO, IL 60643 | $ | 168,000 | ||

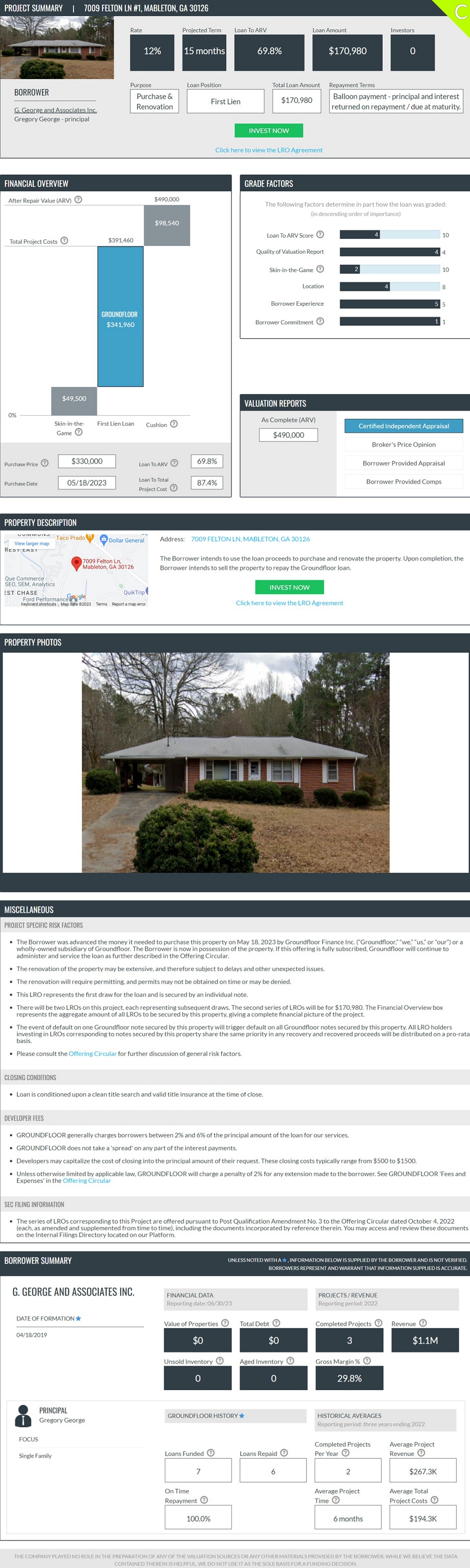

| 7009 FELTON LN #1, MABLETON, GA 30126 | $ | 170,980 |

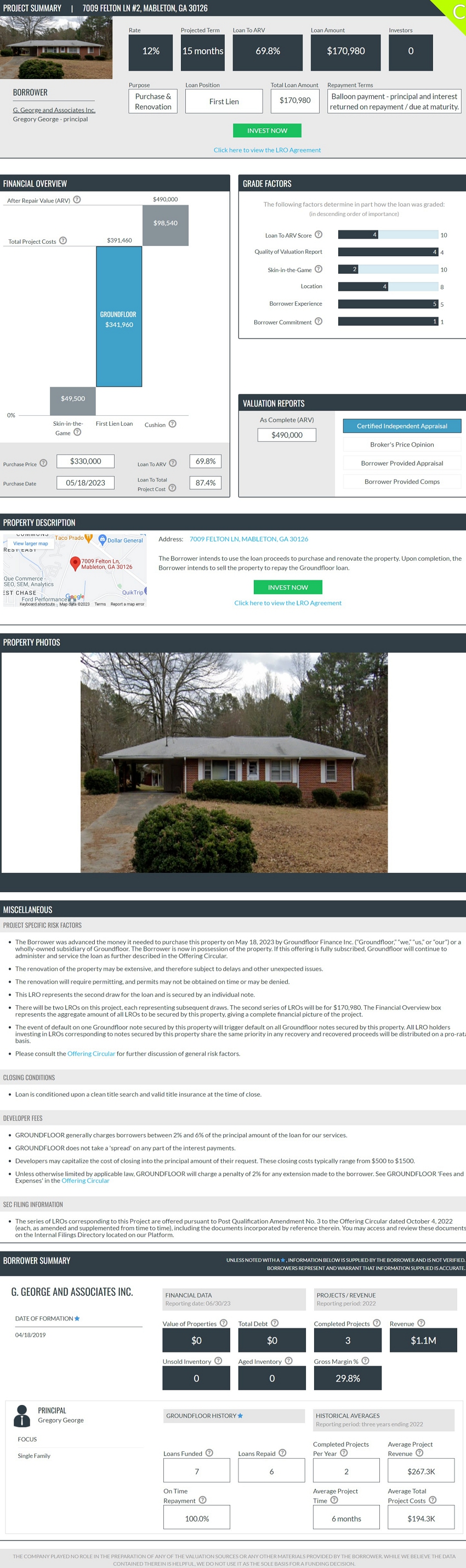

| 7009 FELTON LN #2, MABLETON, GA 30126 | $ | 170,980 | ||

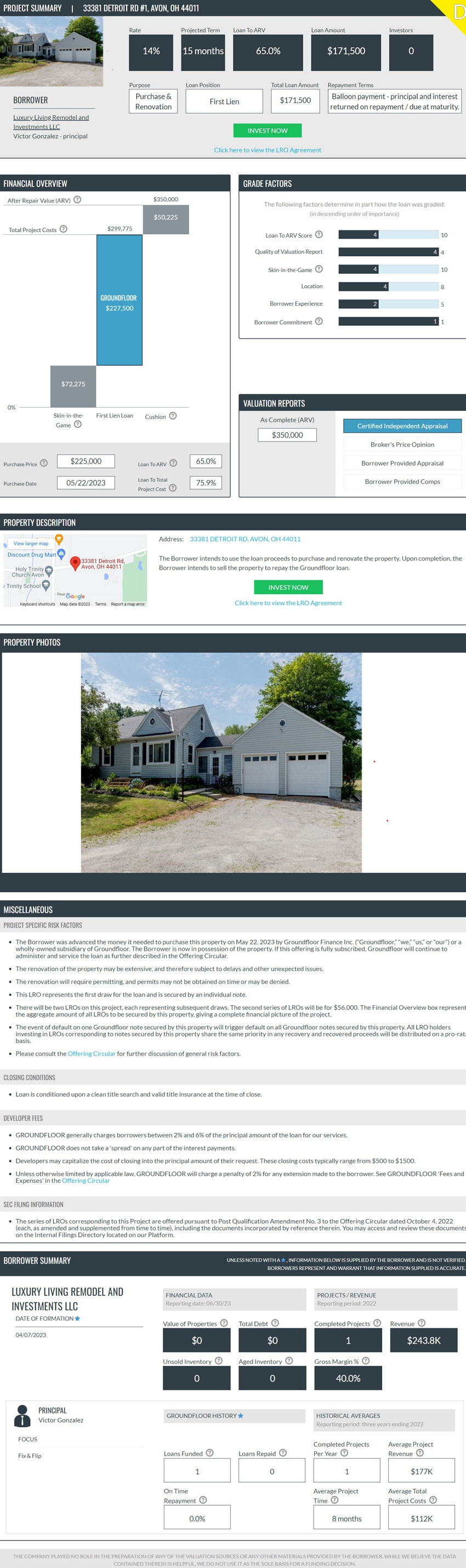

| 33381 DETROIT RD #1, AVON, OH 44011 | $ | 171,500 | ||

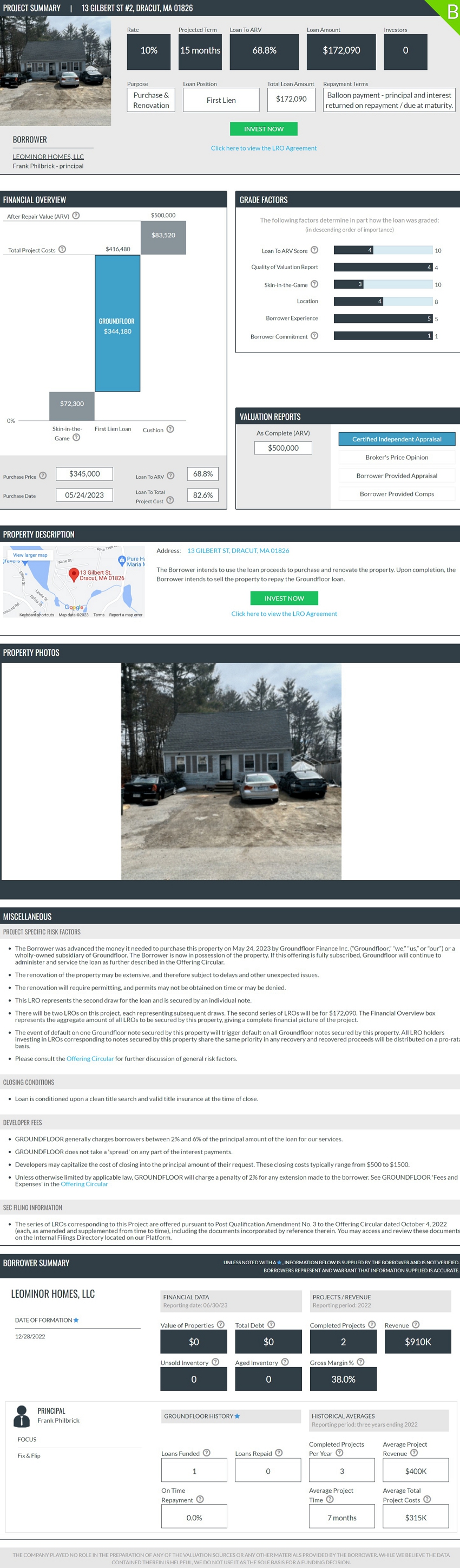

| 13 GILBERT ST #2, DRACUT, MA 01826 | $ | 172,090 | ||

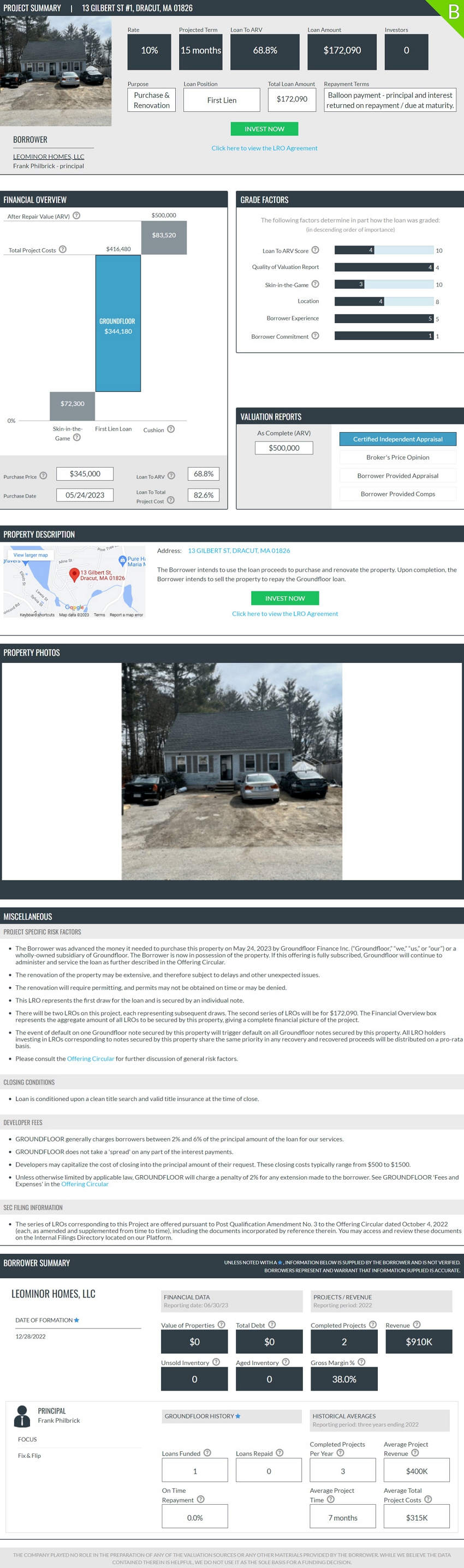

| 13 GILBERT ST #1, DRACUT, MA 01826 | $ | 172,090 | ||

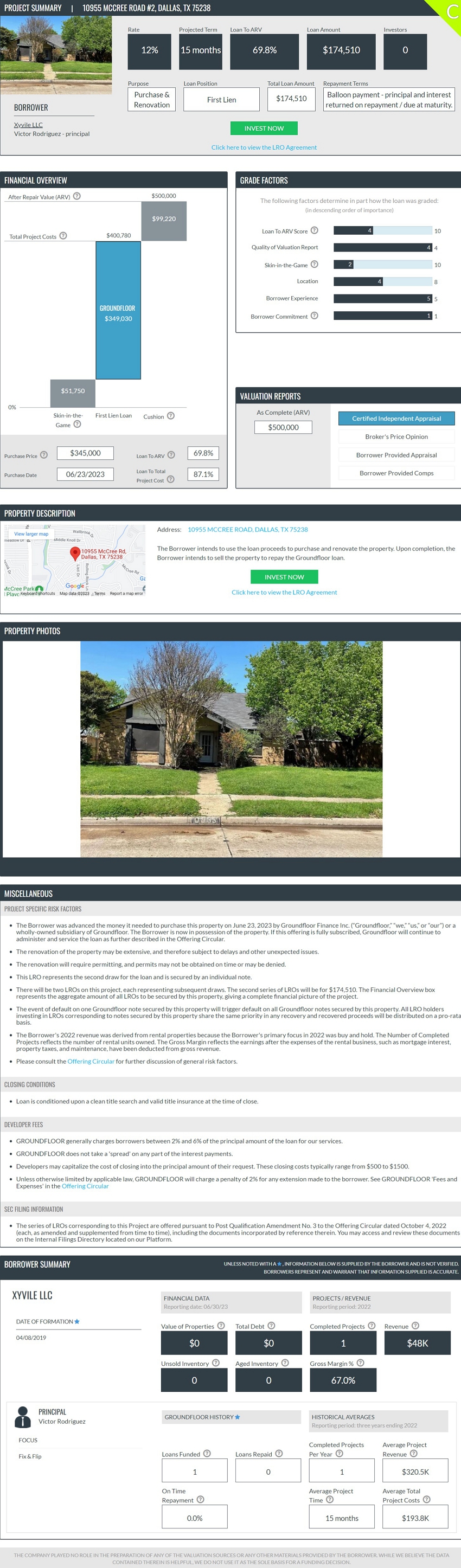

| 10955 MCCREE ROAD #2, DALLAS, TX 75238 | $ | 174,510 | ||

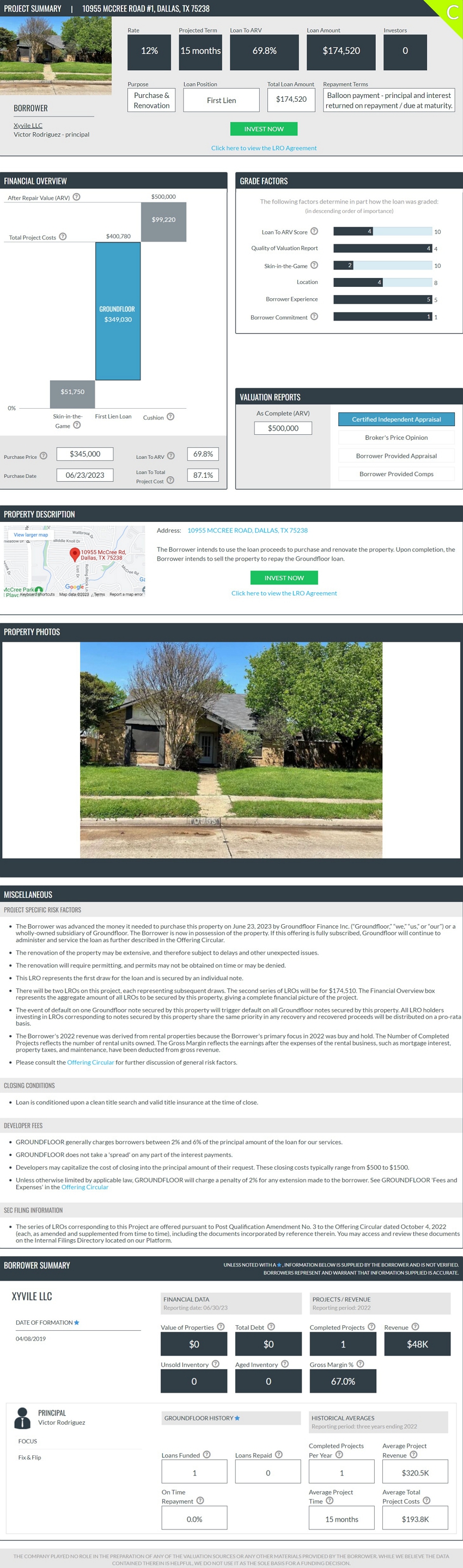

| 10955 MCCREE ROAD #1, DALLAS, TX 75238 | $ | 174,520 | ||

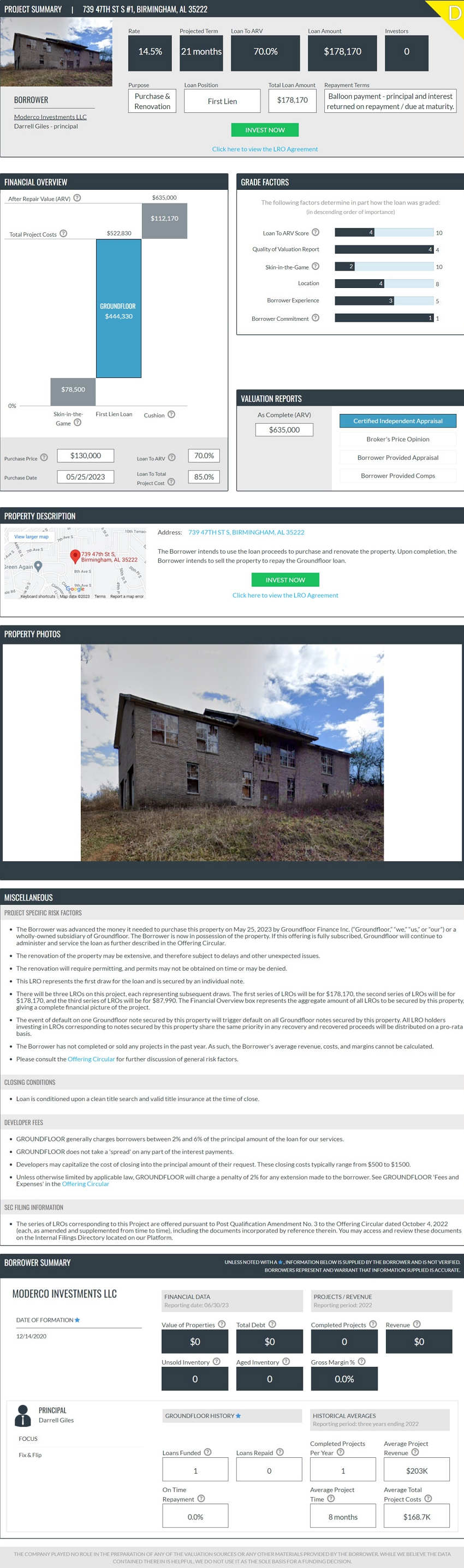

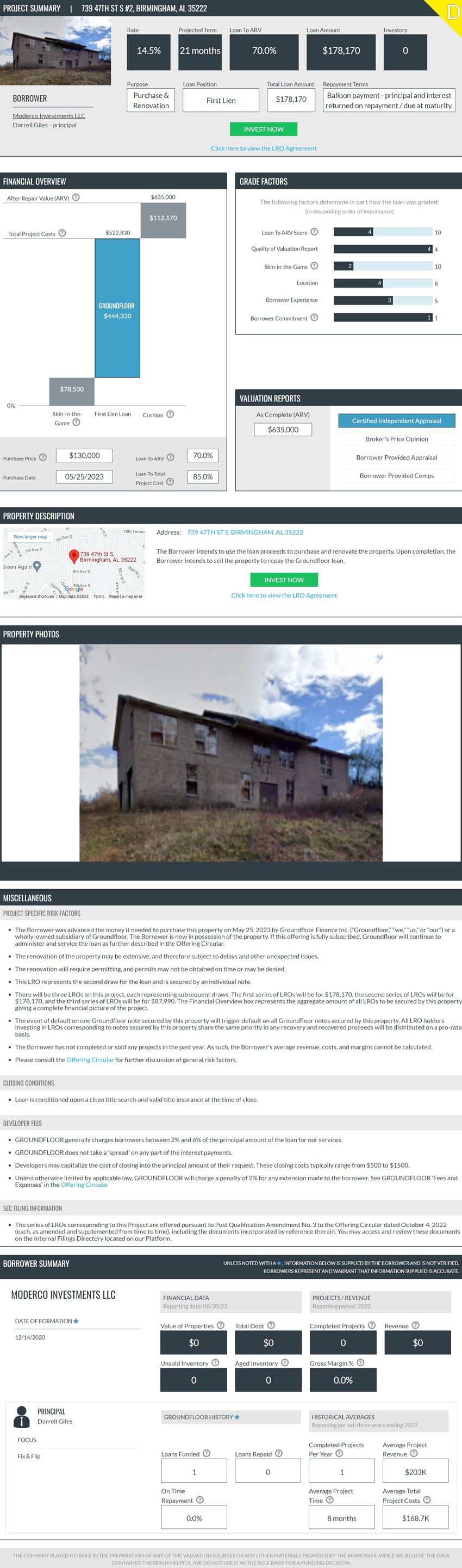

| 739 47TH ST S #1, BIRMINGHAM, AL 35222 | $ | 178,170 | ||

| 739 47TH ST S #2, BIRMINGHAM, AL 35222 | $ | 178,170 | ||

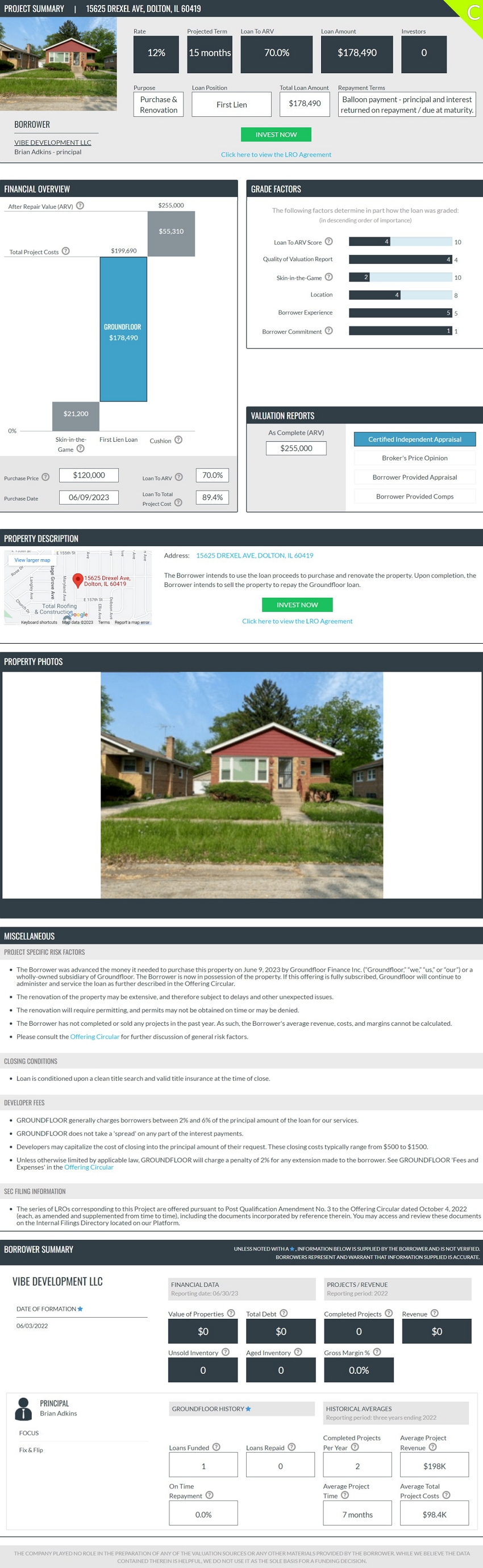

| 15625 DREXEL AVE, DOLTON, IL 60419 | $ | 178,490 | ||

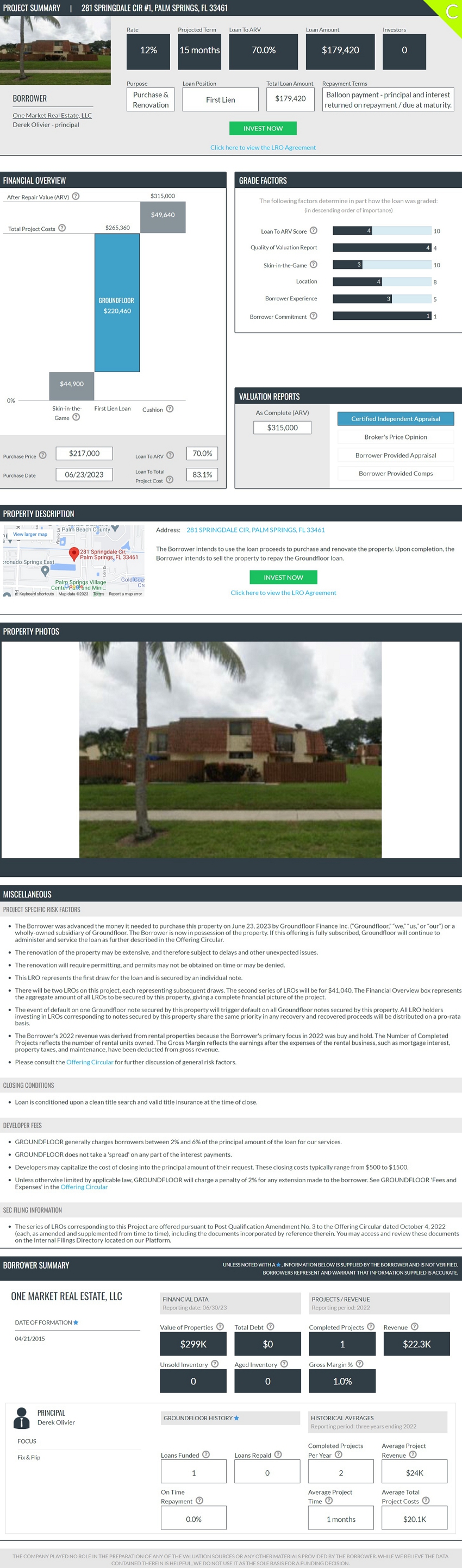

| 281 SPRINGDALE CIR #1, PALM SPRINGS, FL 33461 | $ | 179,420 | ||

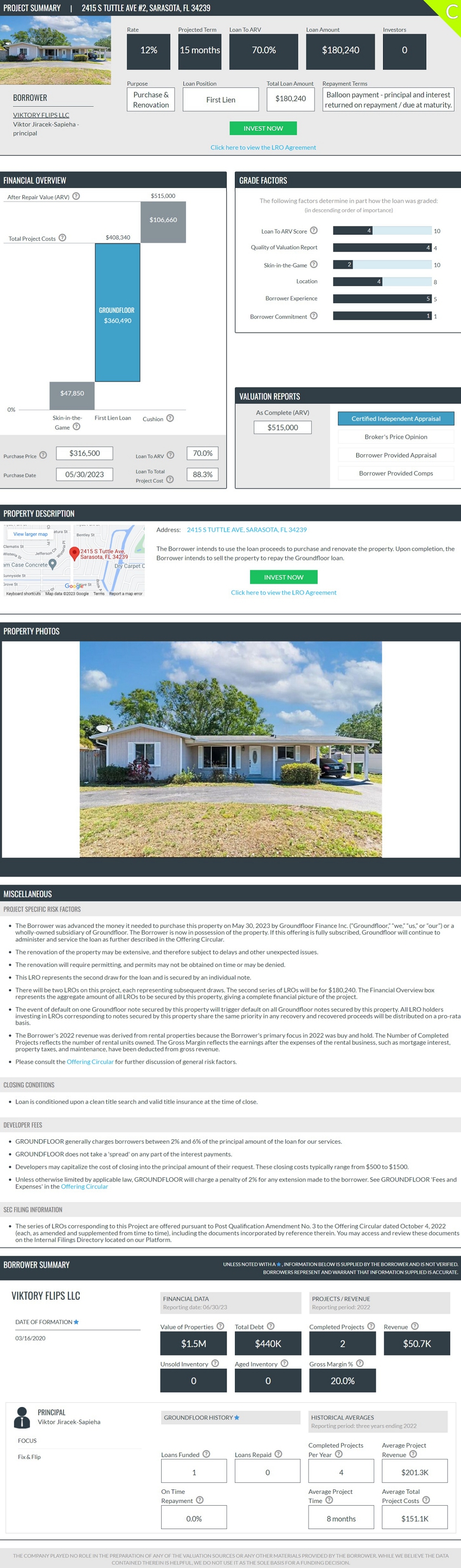

| 2415 S TUTTLE AVE #2, SARASOTA, FL 34239 | $ | 180,240 | ||

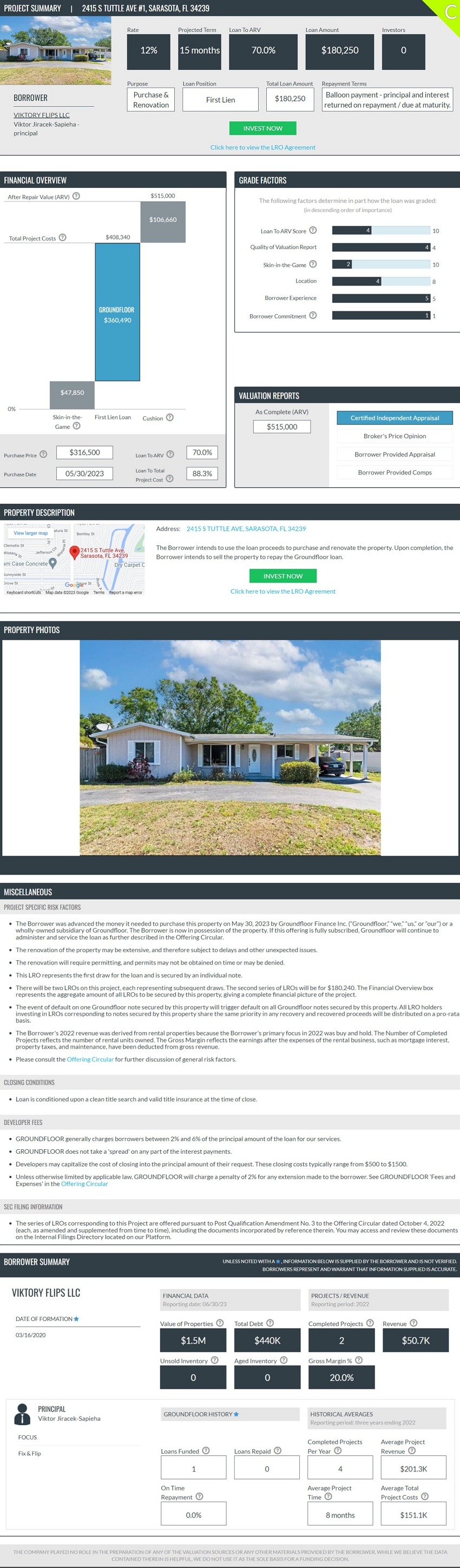

| 2415 S TUTTLE AVE #1, SARASOTA, FL 34239 | $ | 180,250 | ||

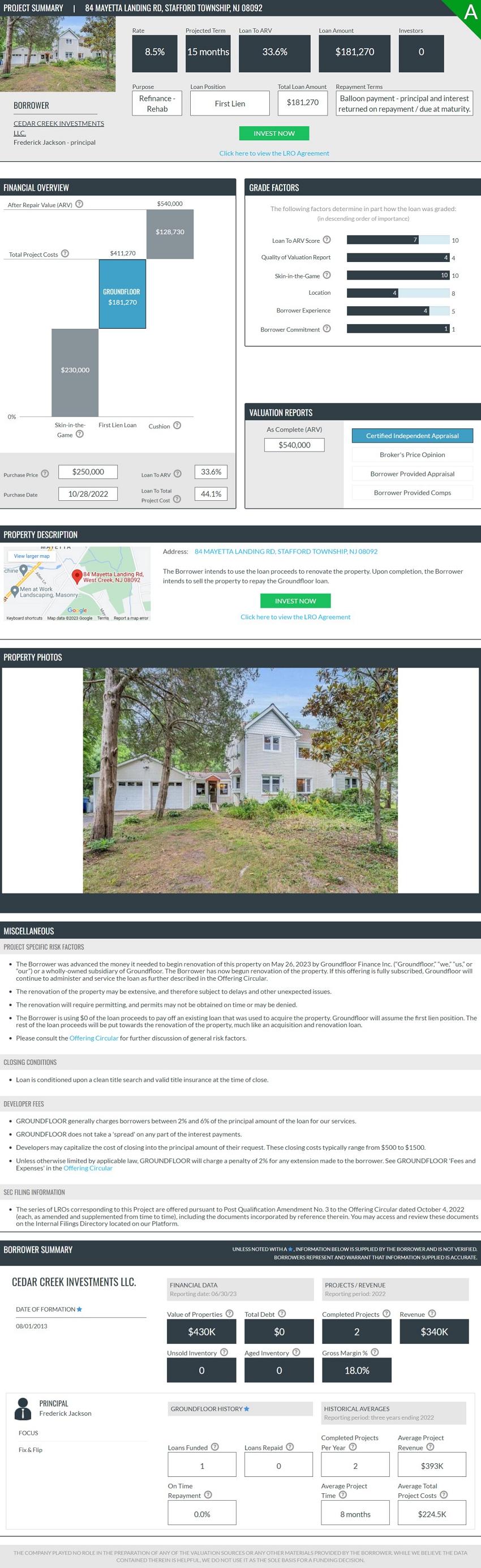

| 84 MAYETTA LANDING RD, STAFFORD TOWNSHIP, NJ 08092 | $ | 181,270 | ||

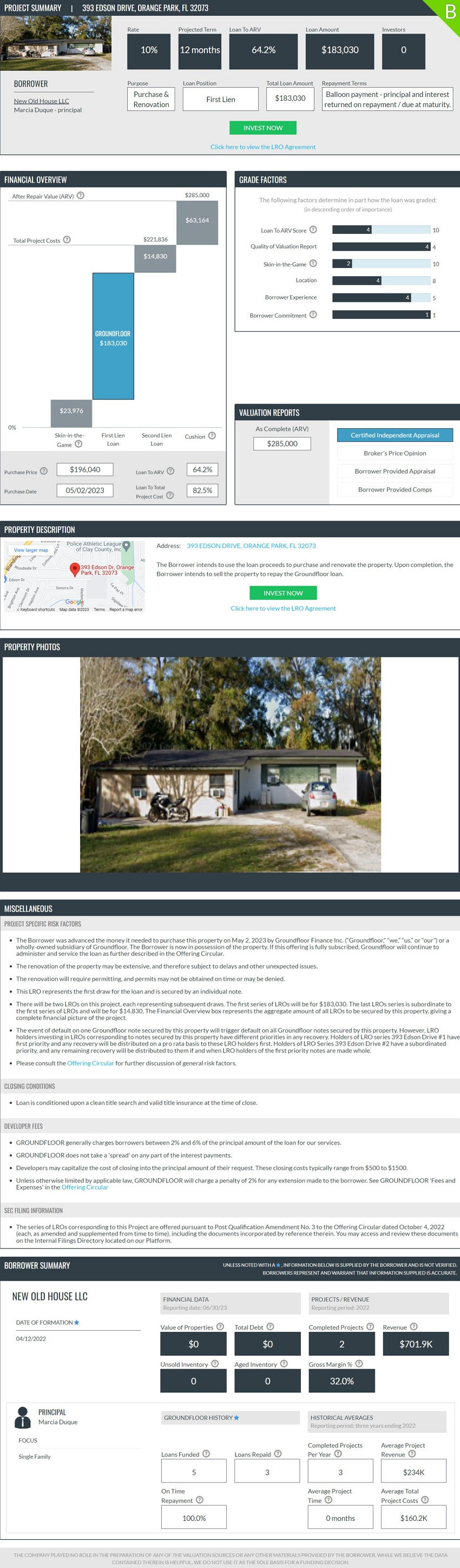

| 393 EDSON DRIVE, ORANGE PARK, FL 32073 | $ | 183,030 | ||

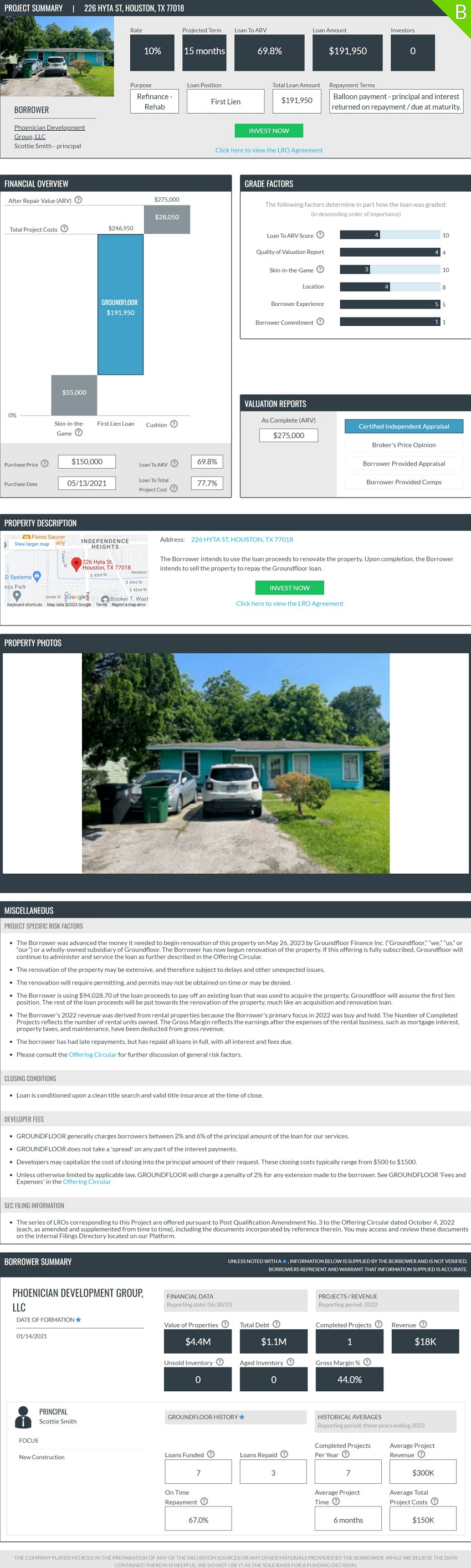

| 226 HYTA ST, HOUSTON, TX 77018 | $ | 191,950 | ||

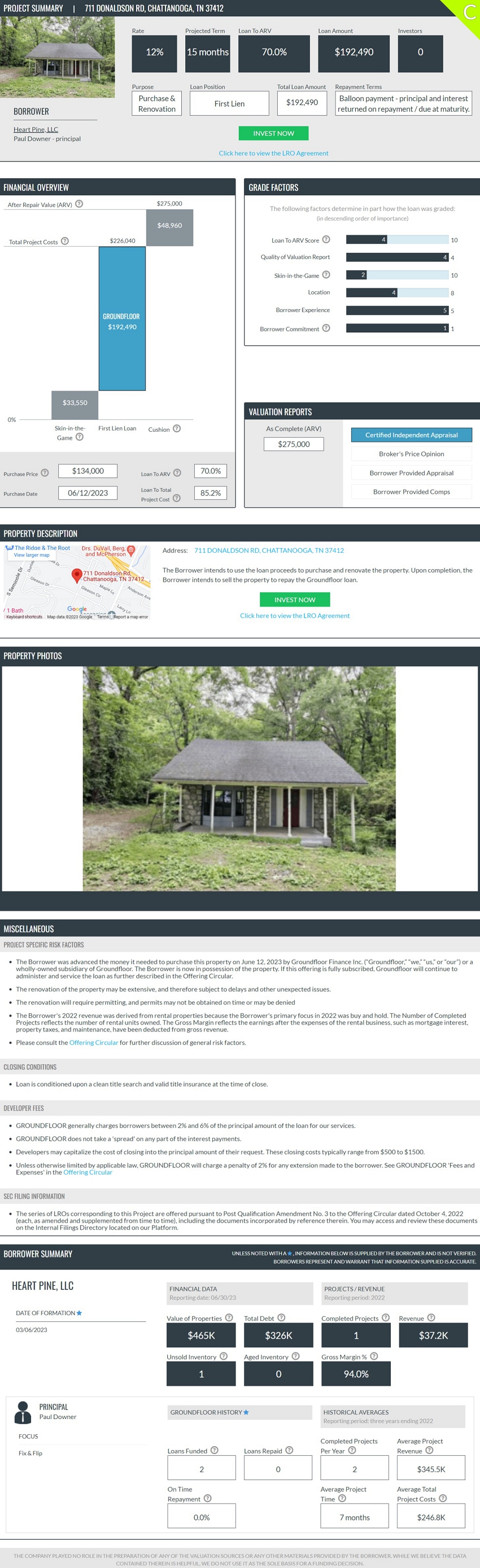

| 711 DONALDSON RD, CHATTANOOGA, TN 37412 | $ | 192,490 | ||

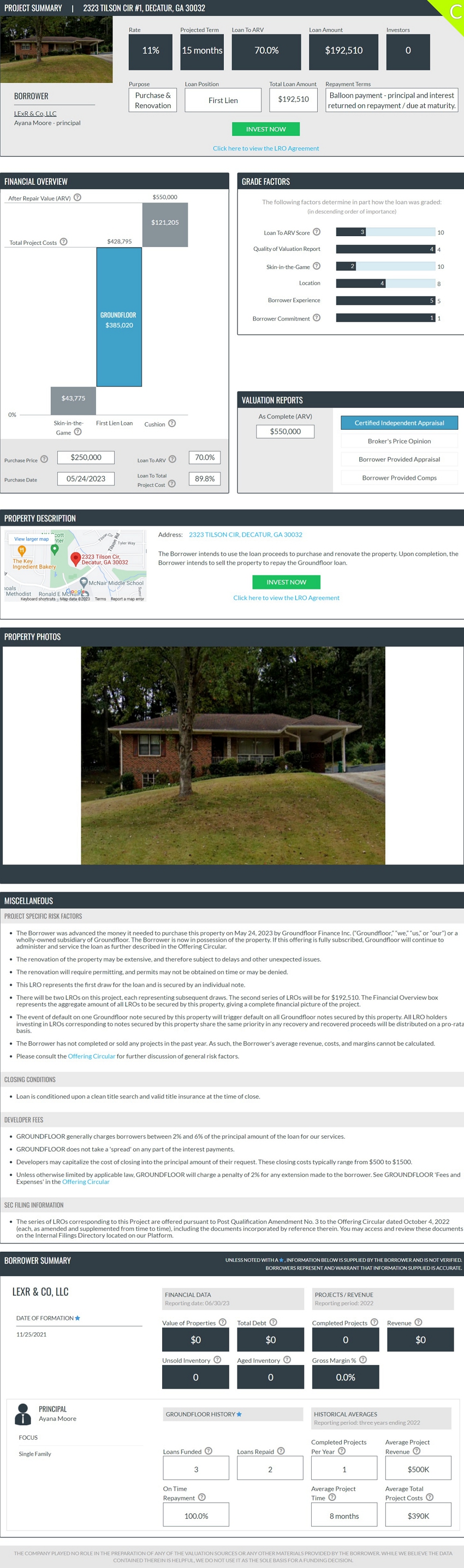

| 2323 TILSON CIR #1, DECATUR, GA 30032 | $ | 192,510 | ||

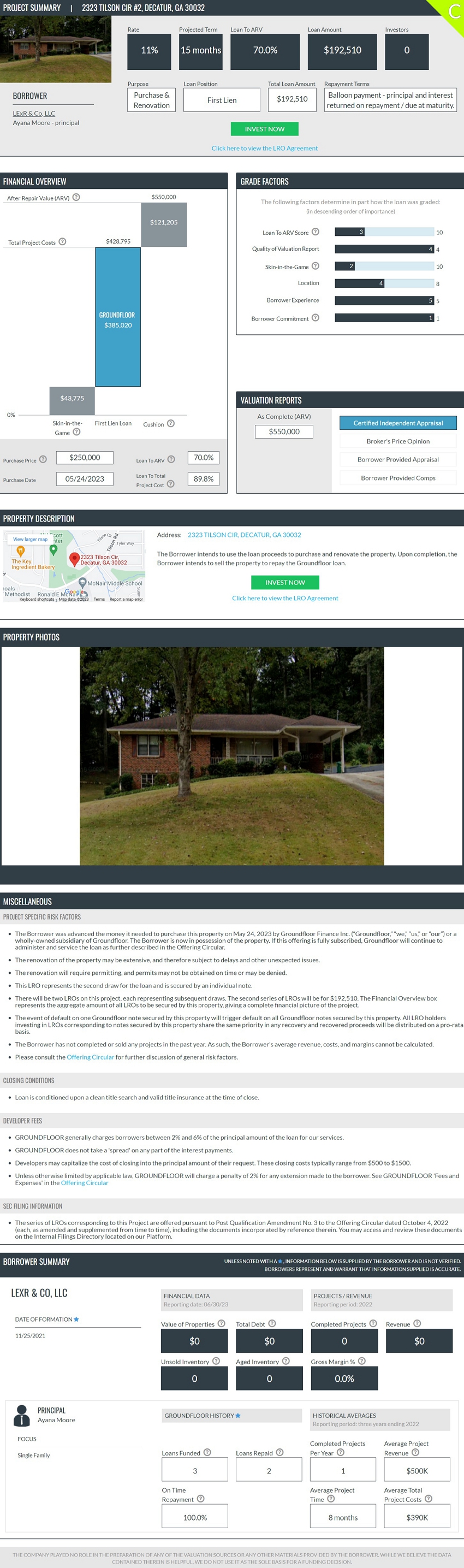

| 2323 TILSON CIR #2, DECATUR, GA 30032 | $ | 192,510 | ||

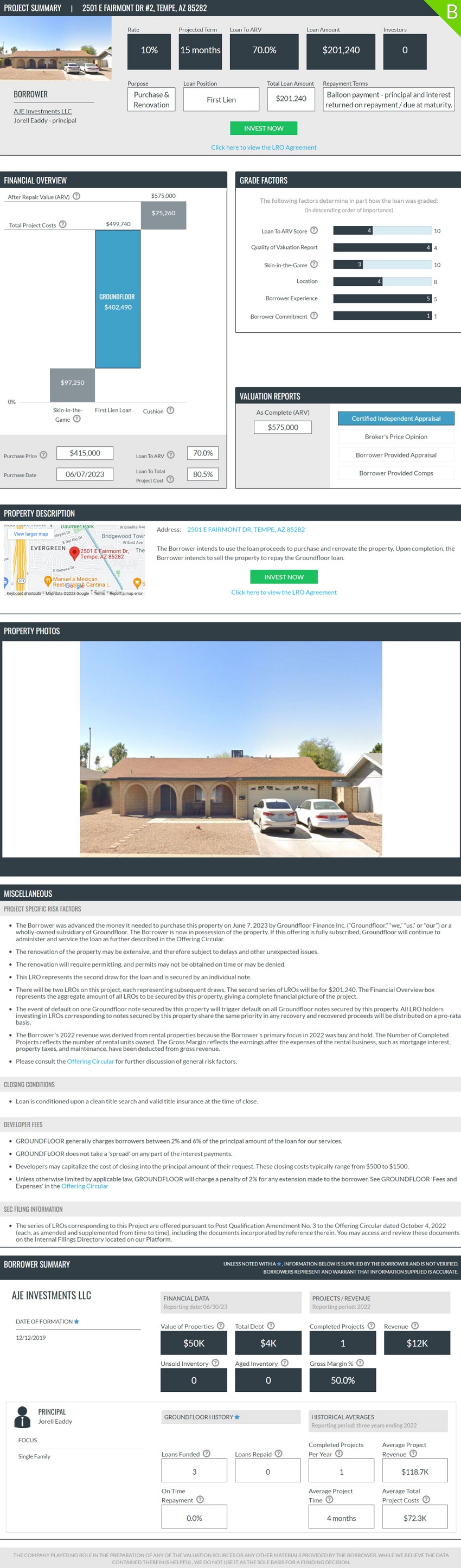

| 2501 E FAIRMONT DR #2, TEMPE, AZ 85282 | $ | 201,240 | ||

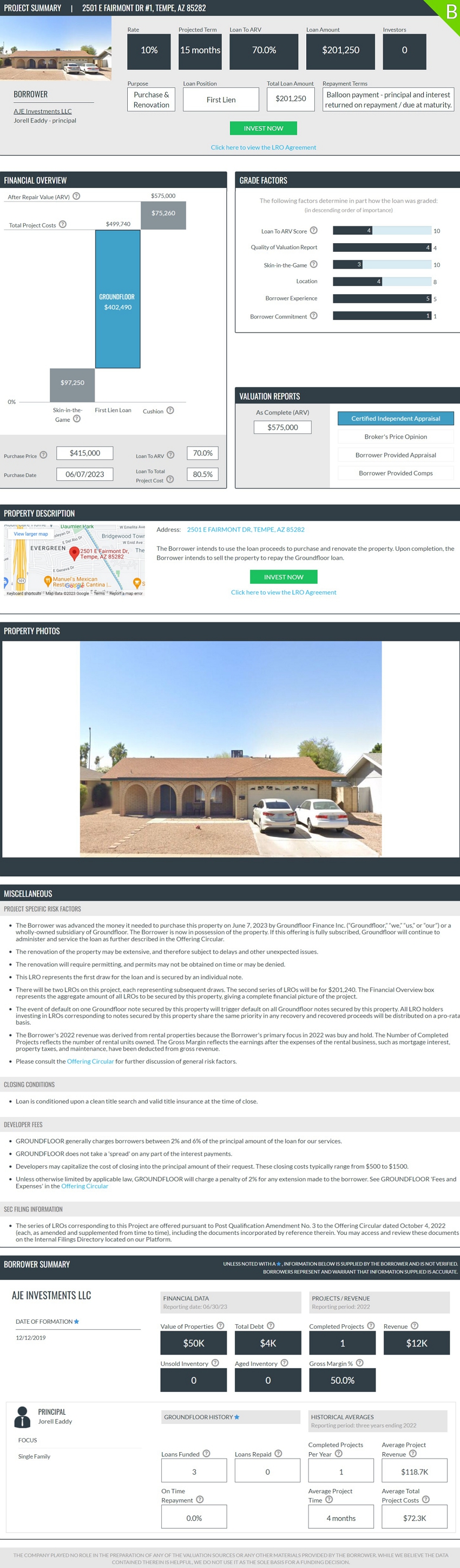

| 2501 E FAIRMONT DR #1, TEMPE, AZ 85282 | $ | 201,250 | ||

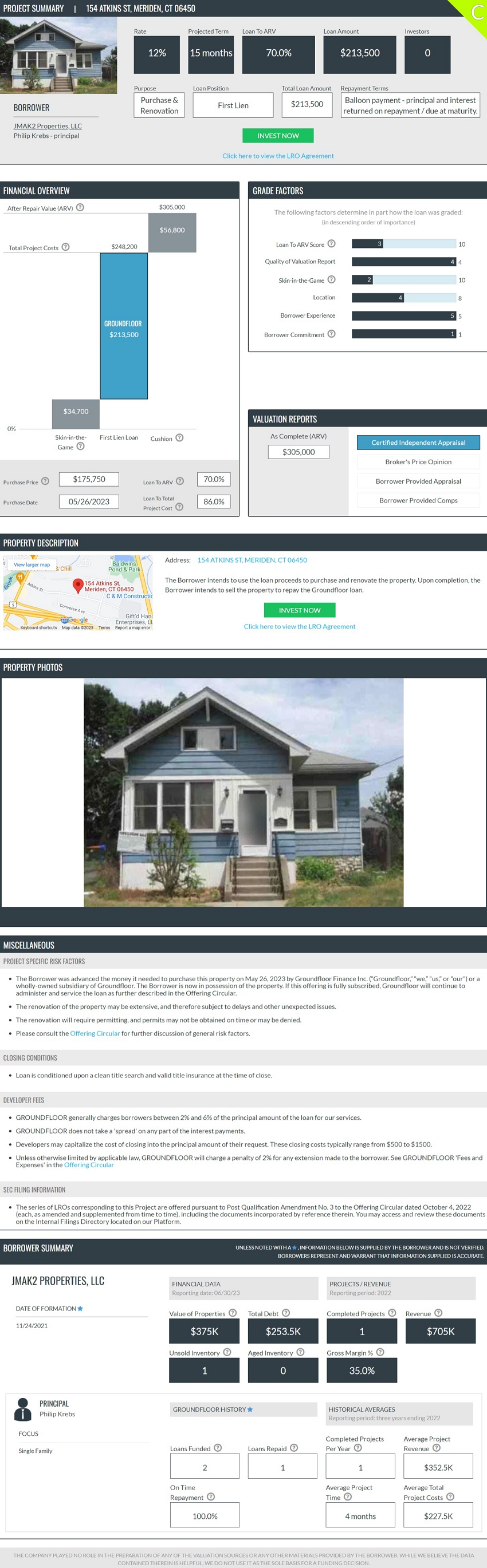

| 154 ATKINS ST, MERIDEN, CT 06450 | $ | 213,500 | ||

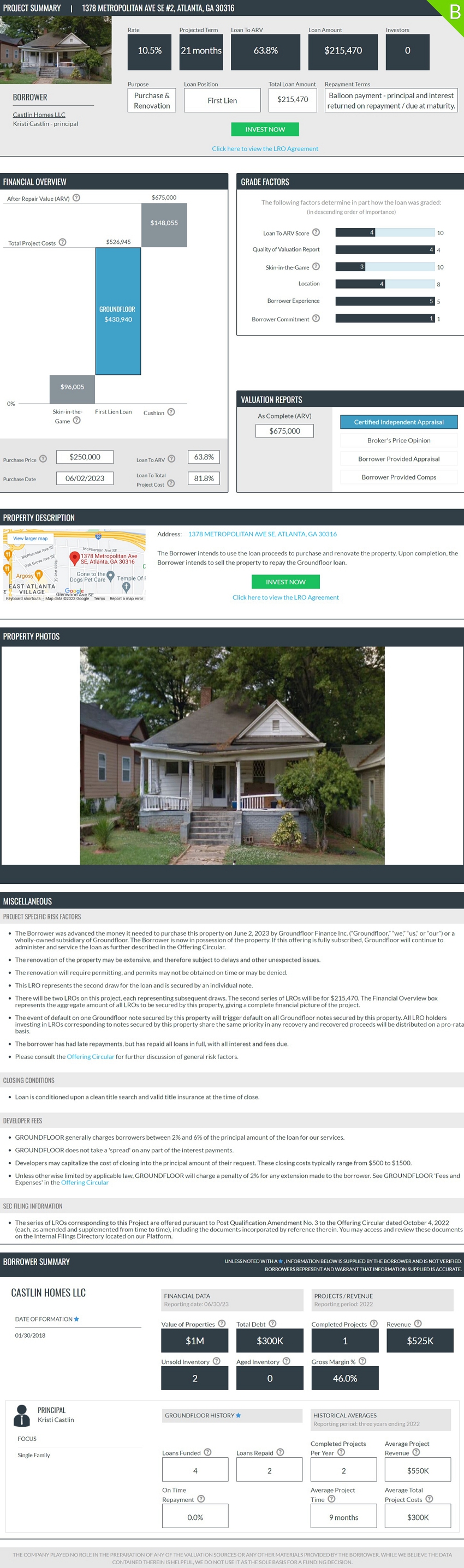

| 1378 METROPOLITAN AVE SE #2, ATLANTA, GA 30316 | $ | 215,470 | ||

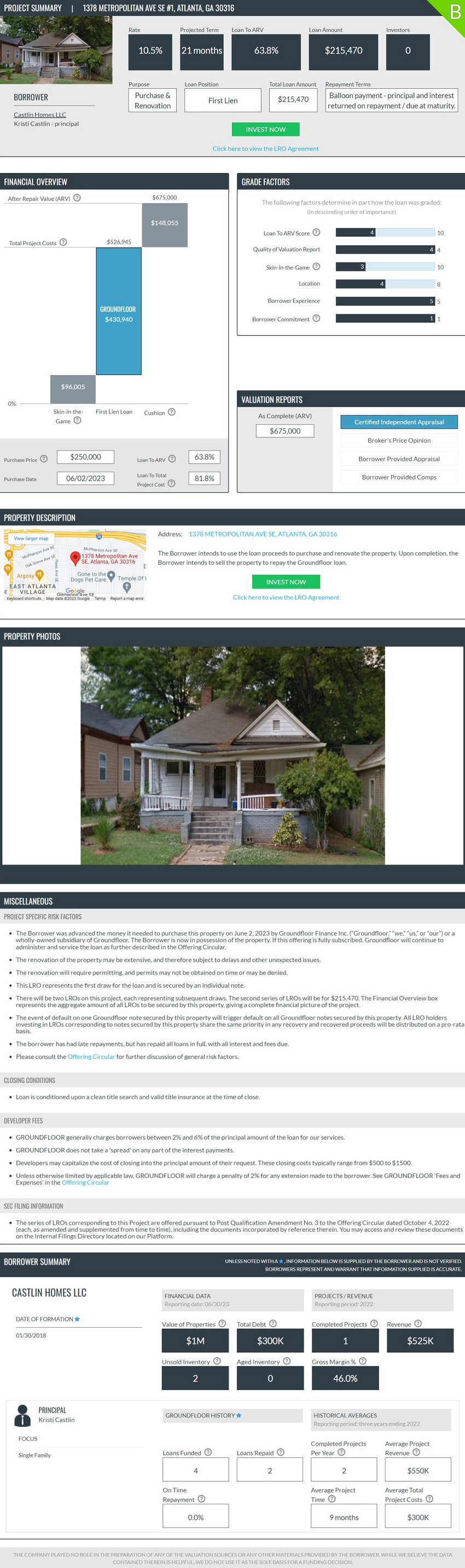

| 1378 METROPOLITAN AVE SE #1, ATLANTA, GA 30316 | $ | 215,470 | ||

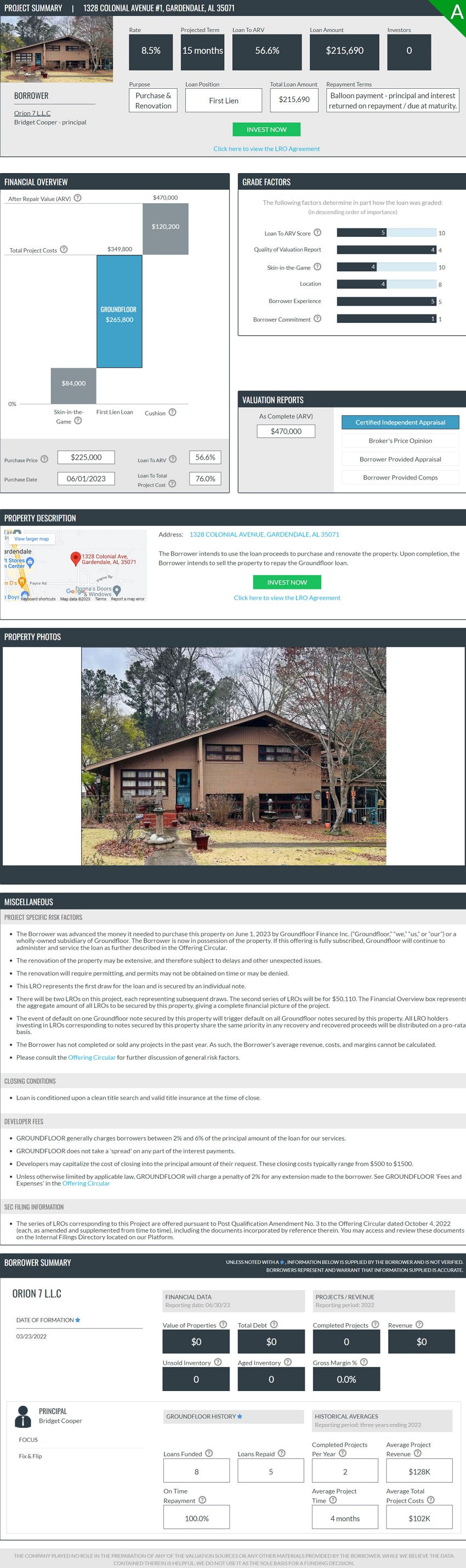

| 1328 COLONIAL AVENUE #1, GARDENDALE, AL 35071 | $ | 215,690 | ||

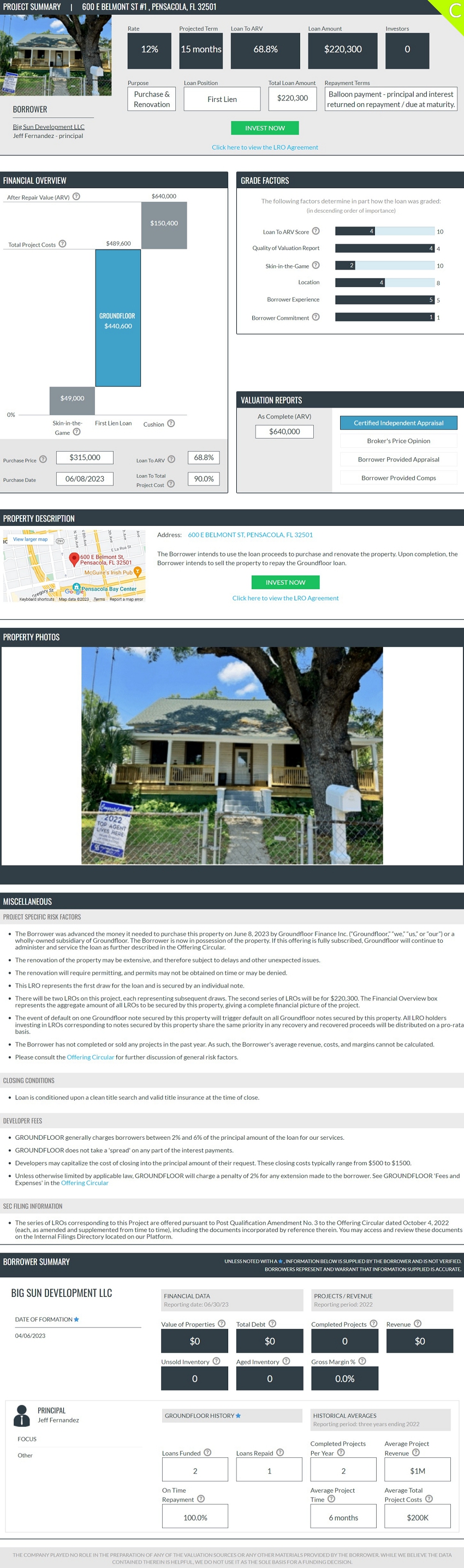

| 600 E BELMONT ST #1 , PENSACOLA, FL 32501 | $ | 220,300 | ||

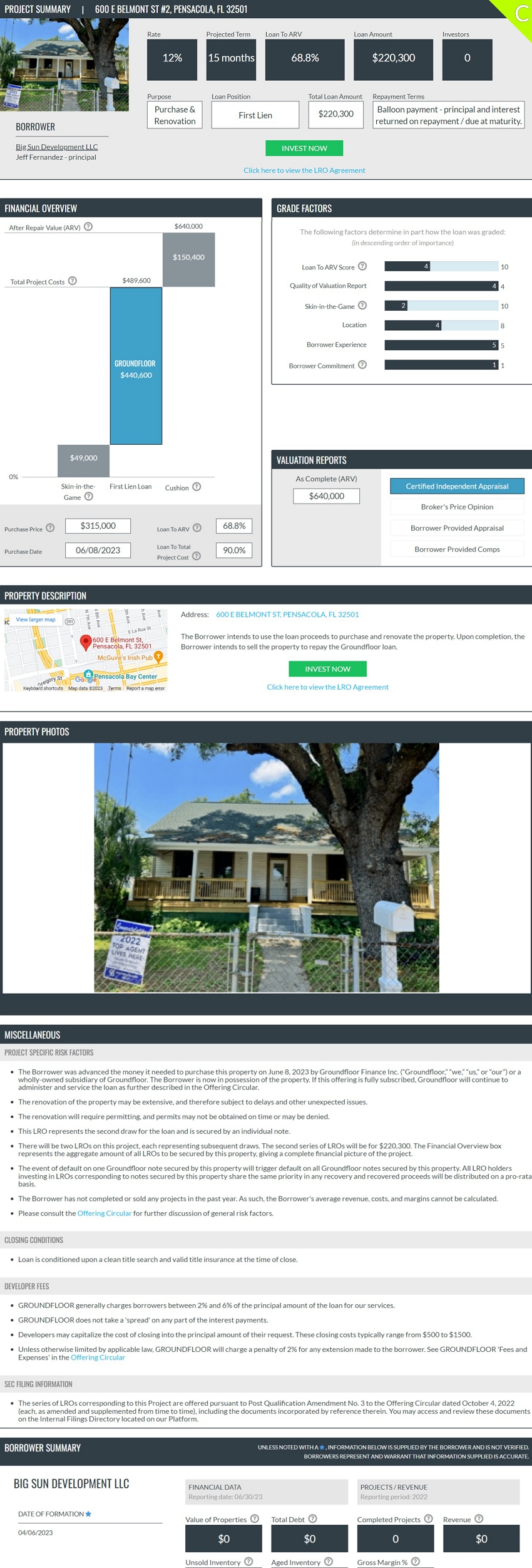

| 600 E BELMONT ST #2, PENSACOLA, FL 32501 | $ | 220,300 | ||

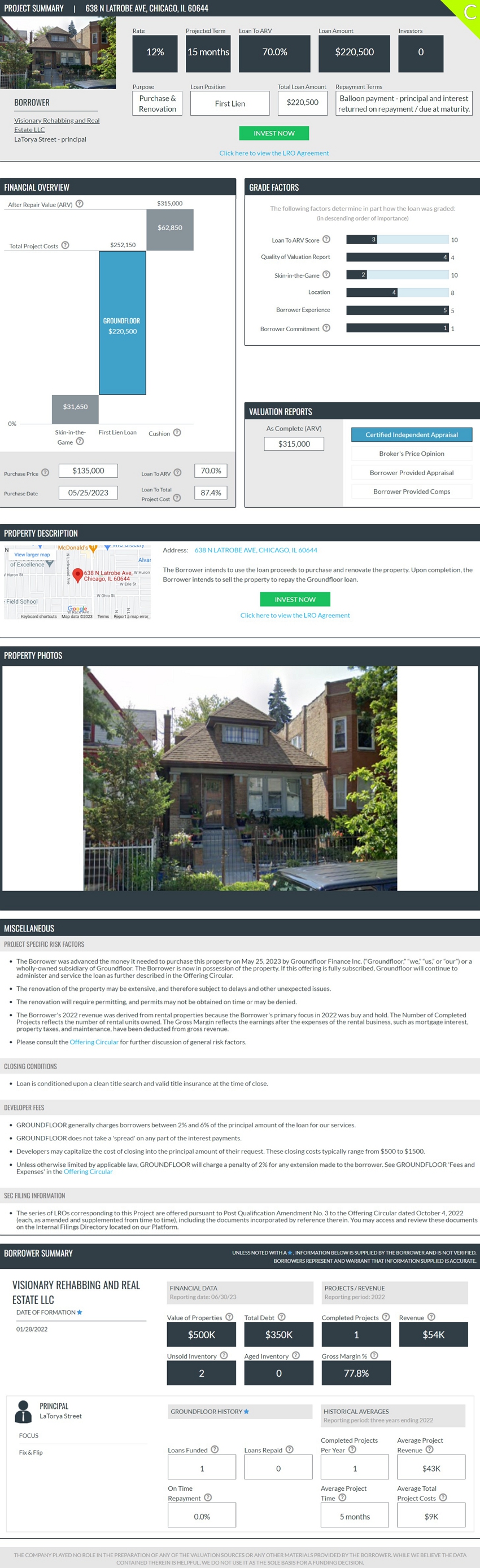

| 638 N LATROBE AVE, CHICAGO, IL 60644 | $ | 220,500 | ||

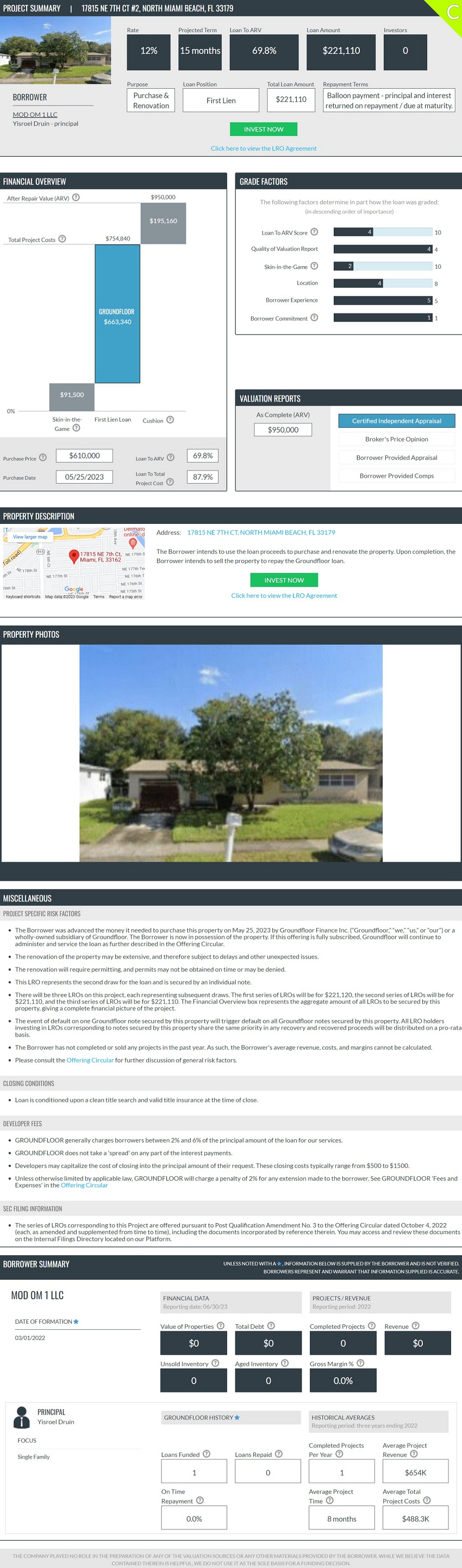

| 17815 NE 7TH CT #2, NORTH MIAMI BEACH, FL 33179 | $ | 221,110 | ||

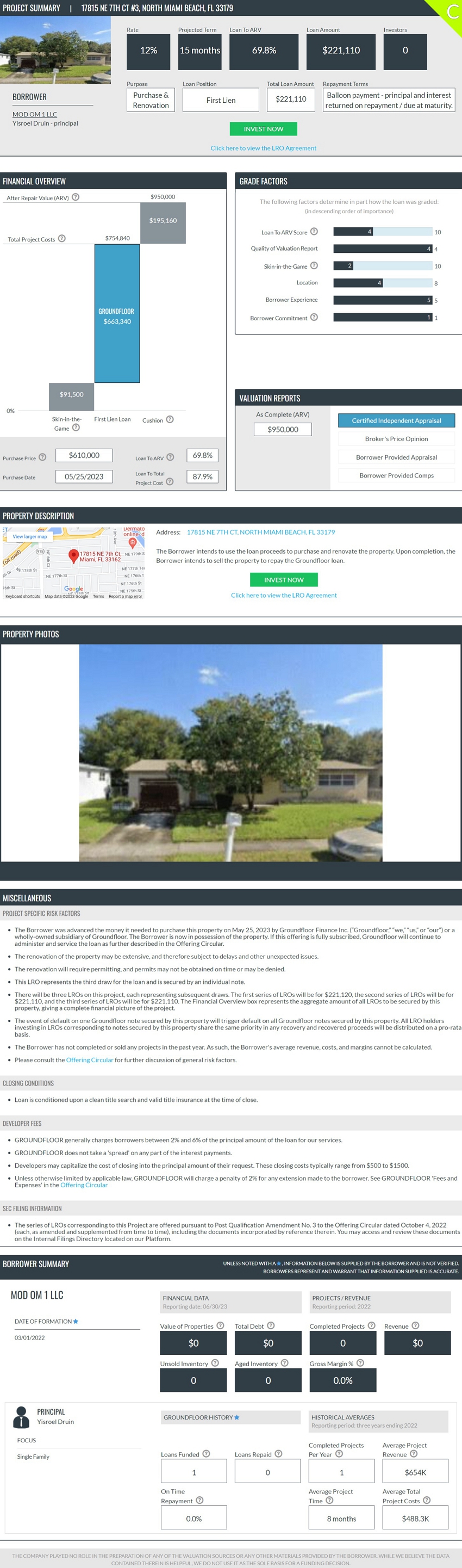

| 17815 NE 7TH CT #3, NORTH MIAMI BEACH, FL 33179 | $ | 221,110 | ||

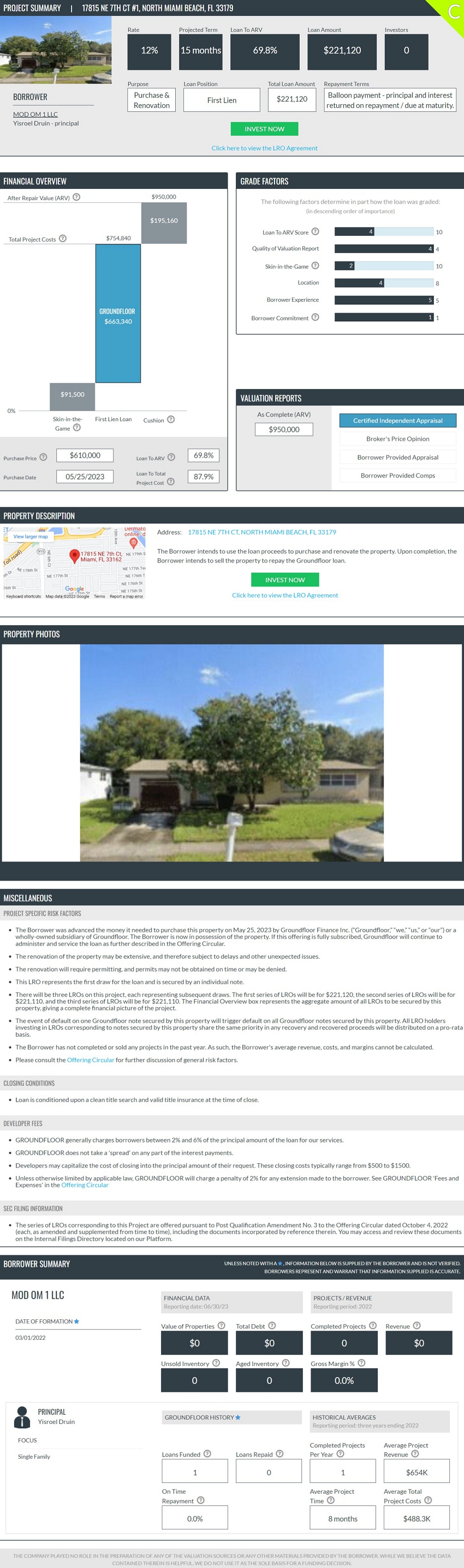

| 17815 NE 7TH CT #1, NORTH MIAMI BEACH, FL 33179 | $ | 221,120 | ||

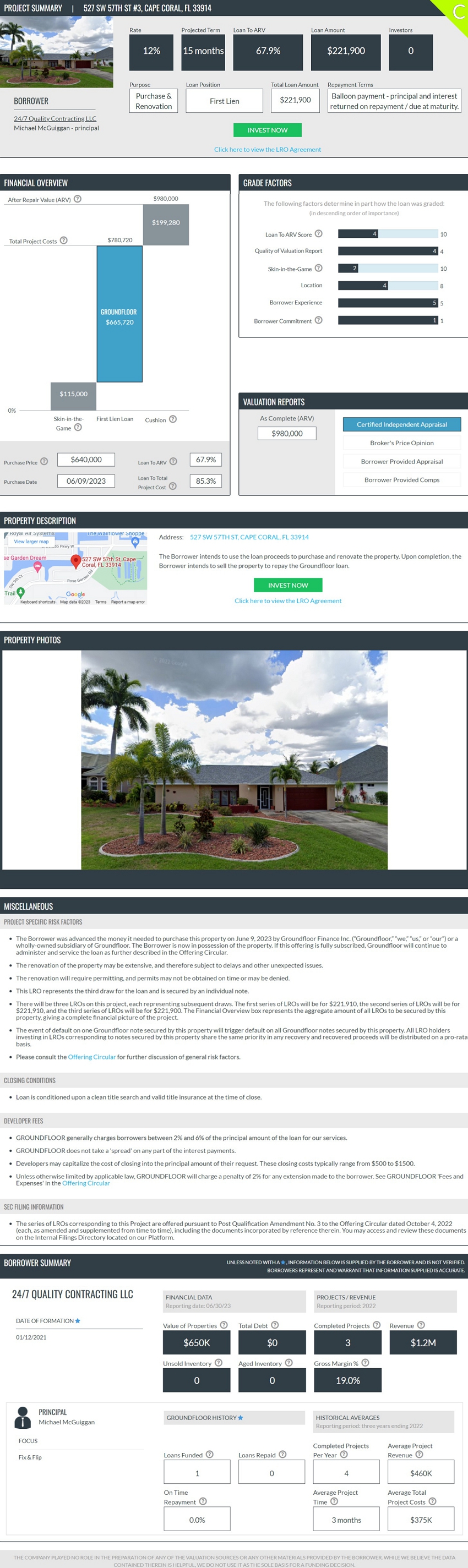

| 527 SW 57TH ST #3, CAPE CORAL, FL 33914 | $ | 221,900 | ||

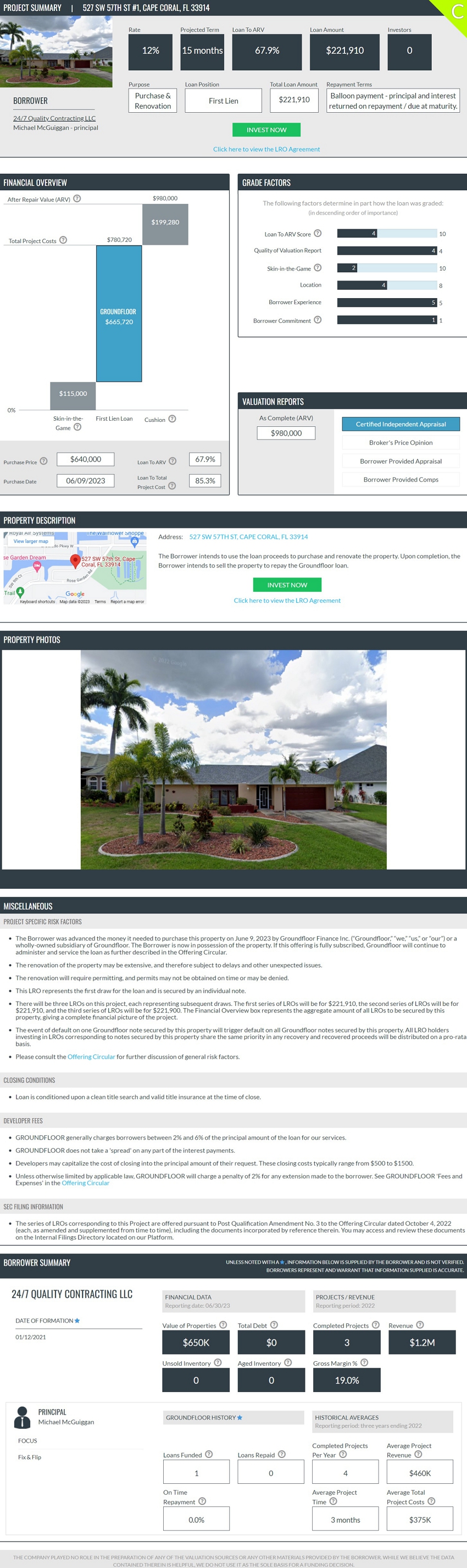

| 527 SW 57TH ST #1, CAPE CORAL, FL 33914 | $ | 221,910 | ||

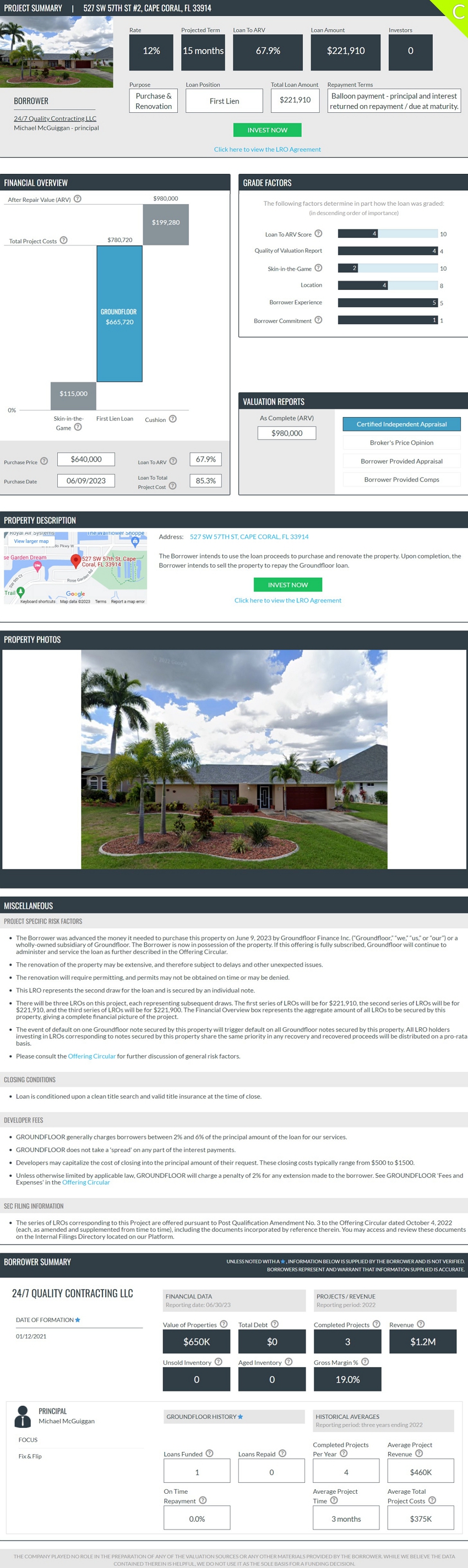

| 527 SW 57TH ST #2, CAPE CORAL, FL 33914 | $ | 221,910 | ||

| 6412 N PACKWOOD AVE, TAMPA, FL 33604 | $ | 227,510 |

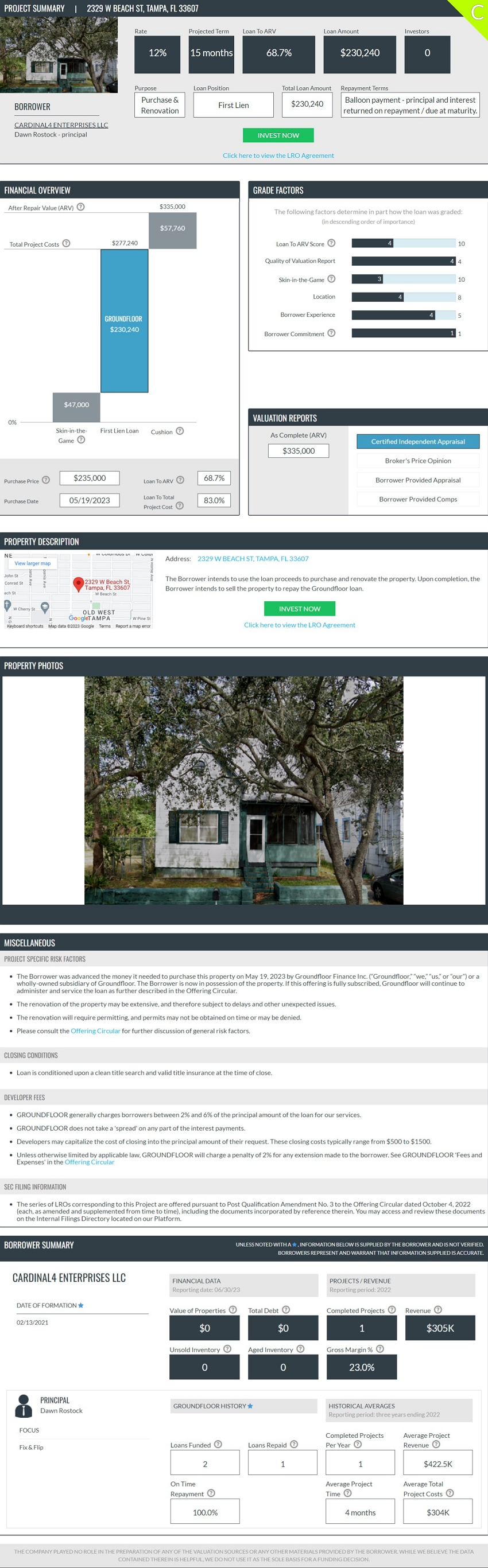

| 2329 W BEACH ST, TAMPA, FL 33607 | $ | 230,240 | ||

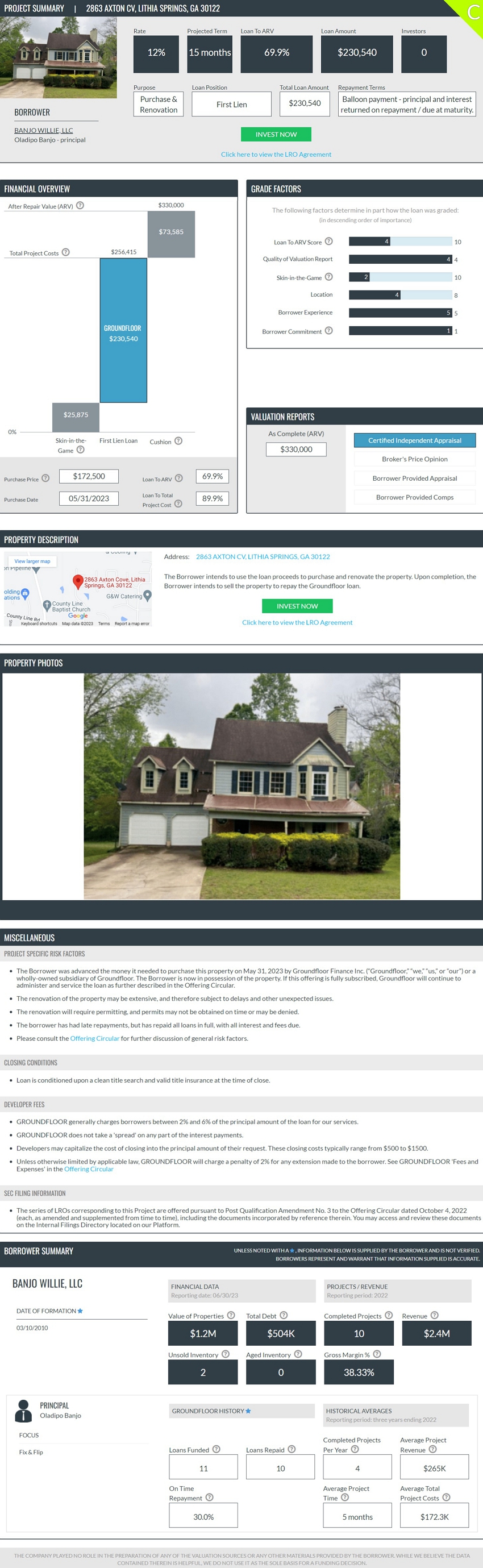

| 2863 AXTON CV, LITHIA SPRINGS, GA 30122 | $ | 230,540 | ||

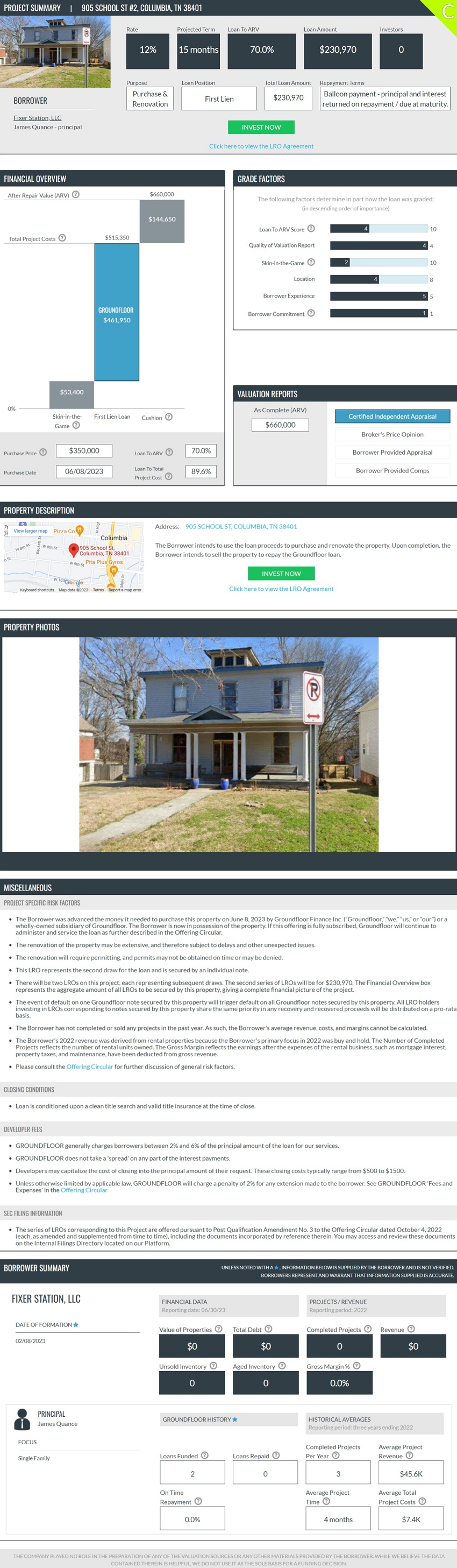

| 905 SCHOOL ST #2, COLUMBIA, TN 38401 | $ | 230,970 | ||

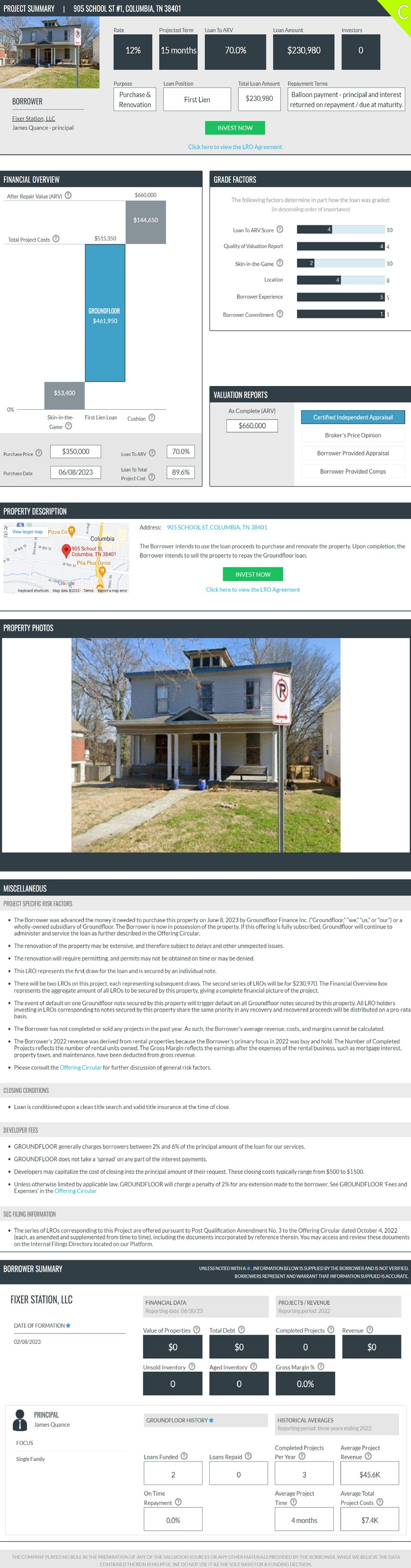

| 905 SCHOOL ST #1, COLUMBIA, TN 38401 | $ | 230,980 | ||

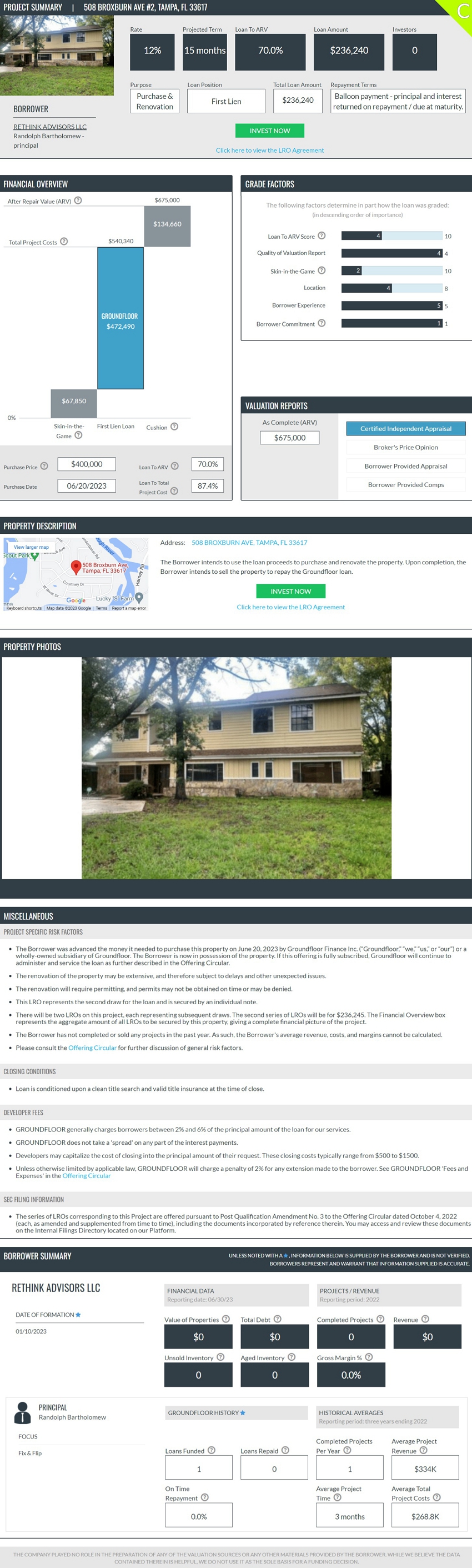

| 508 BROXBURN AVE #2, TAMPA, FL 33617 | $ | 236,240 | ||

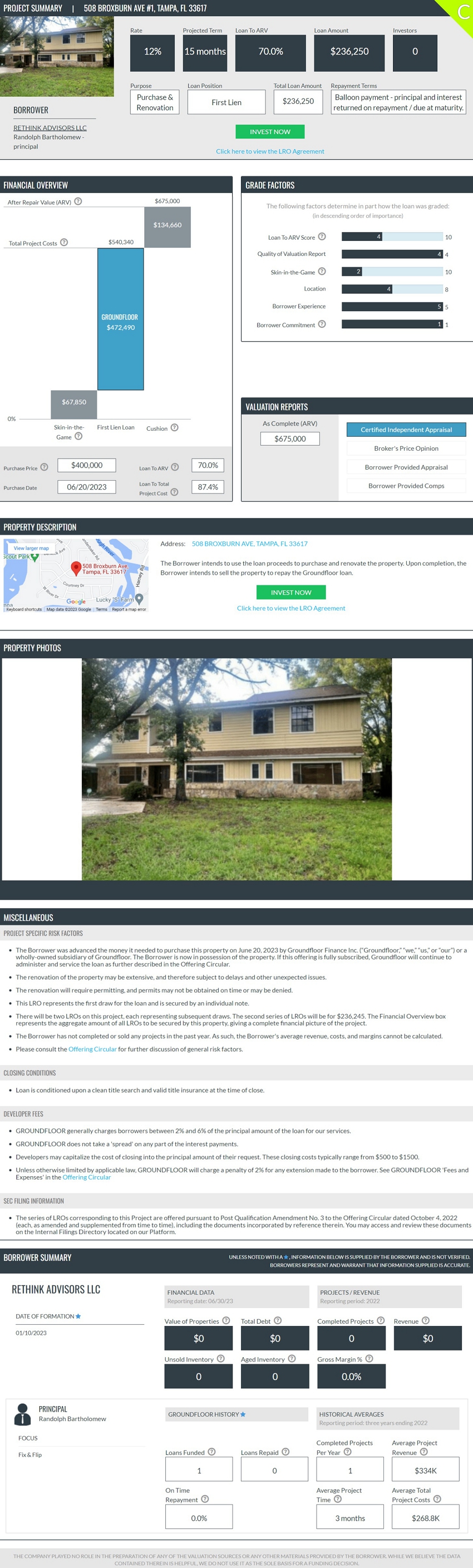

| 508 BROXBURN AVE #1, TAMPA, FL 33617 | $ | 236,250 | ||

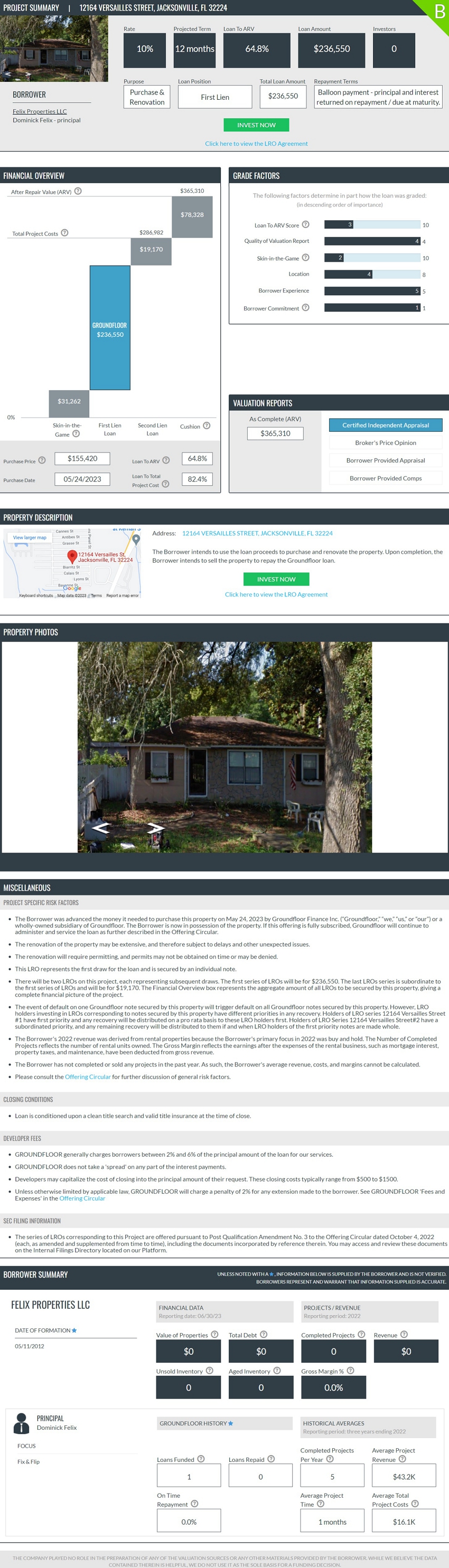

| 12164 VERSAILLES STREET, JACKSONVILLE, FL 32224 | $ | 236,550 | ||

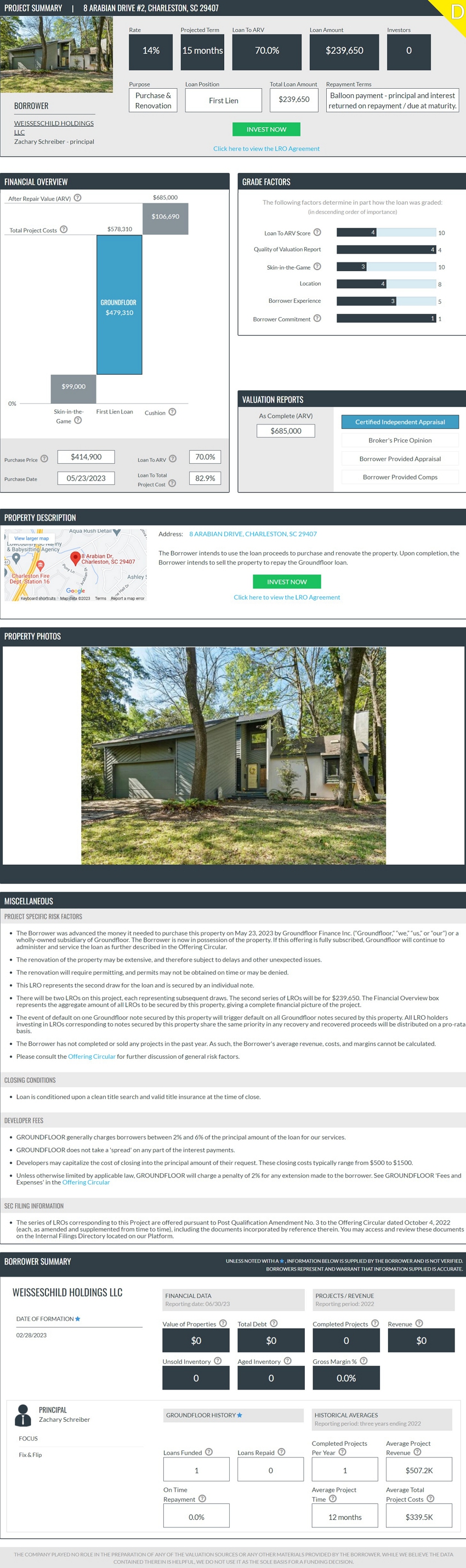

| 8 ARABIAN DRIVE #2, CHARLESTON, SC 29407 | $ | 239,650 | ||

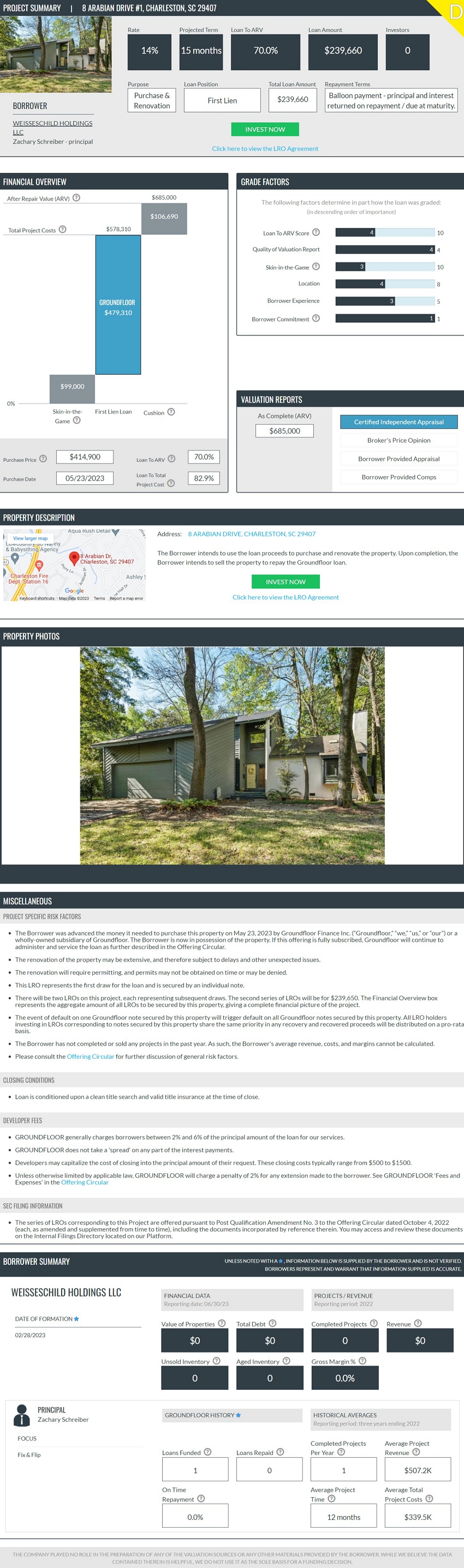

| 8 ARABIAN DRIVE #1, CHARLESTON, SC 29407 | $ | 239,660 | ||

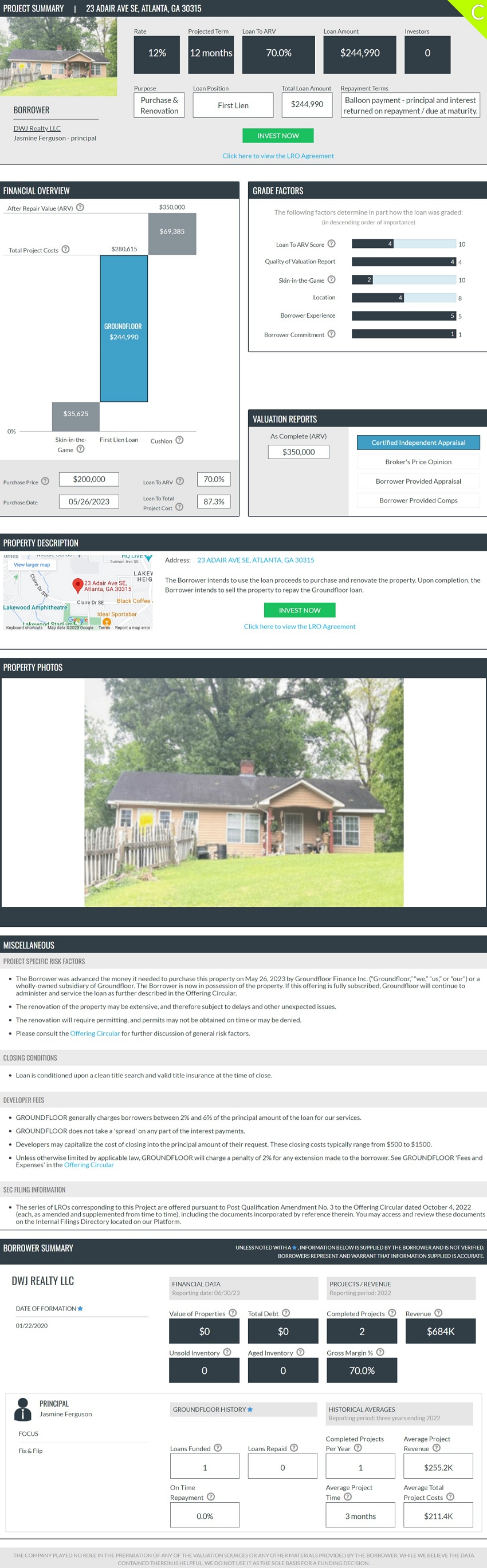

| 23 ADAIR AVE SE, ATLANTA, GA 30315 | $ | 244,990 | ||

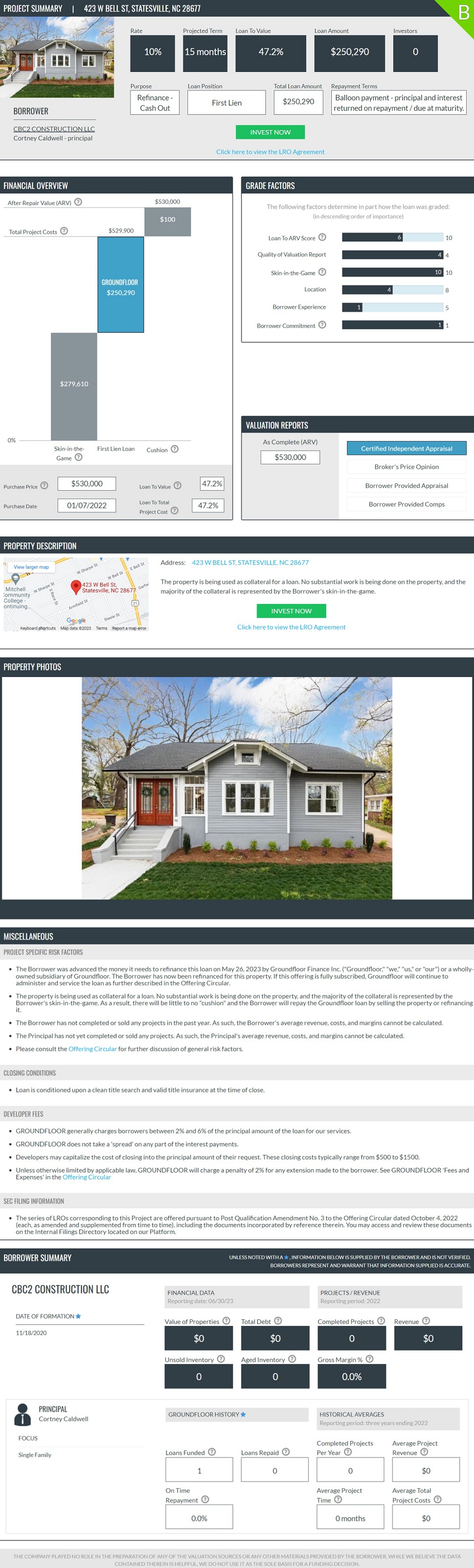

| 423 W BELL ST, STATESVILLE, NC 28677 | $ | 250,290 | ||

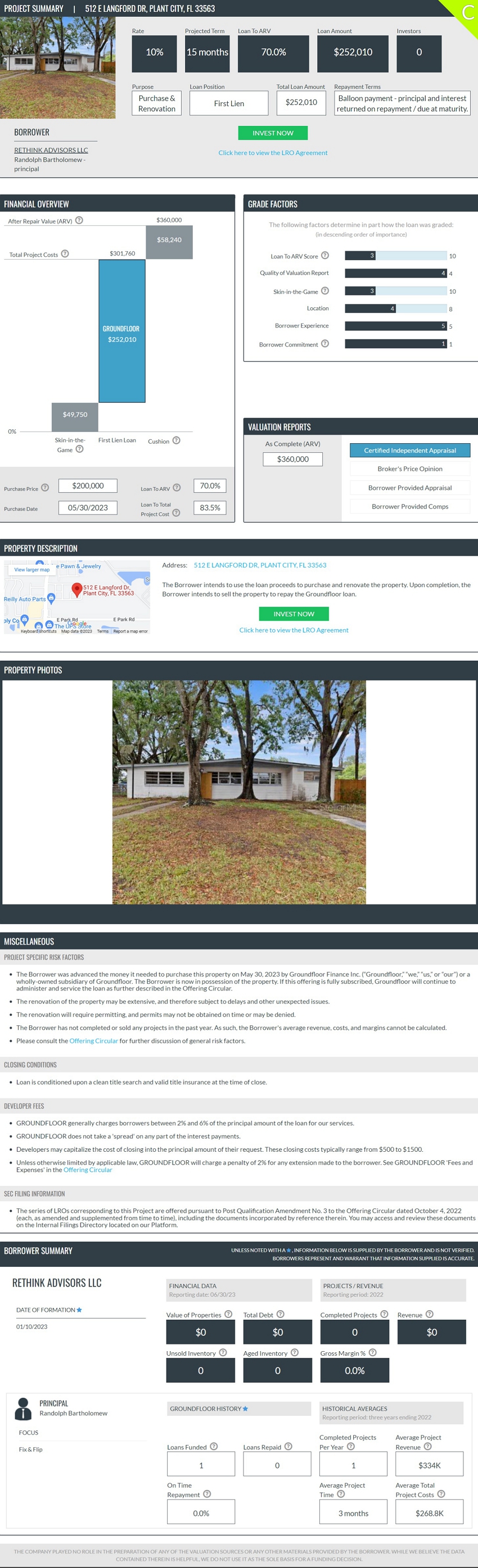

| 512 E LANGFORD DR, PLANT CITY, FL 33563 | $ | 252,010 | ||

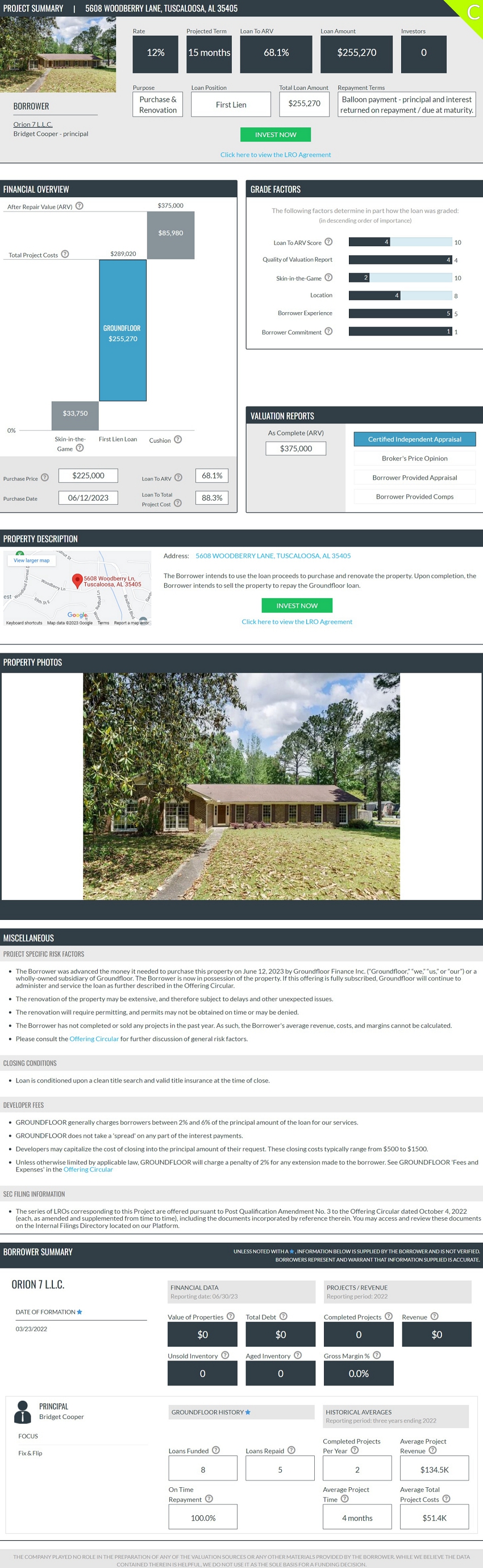

| 5608 WOODBERRY LANE, TUSCALOOSA, AL 35405 | $ | 255,270 | ||

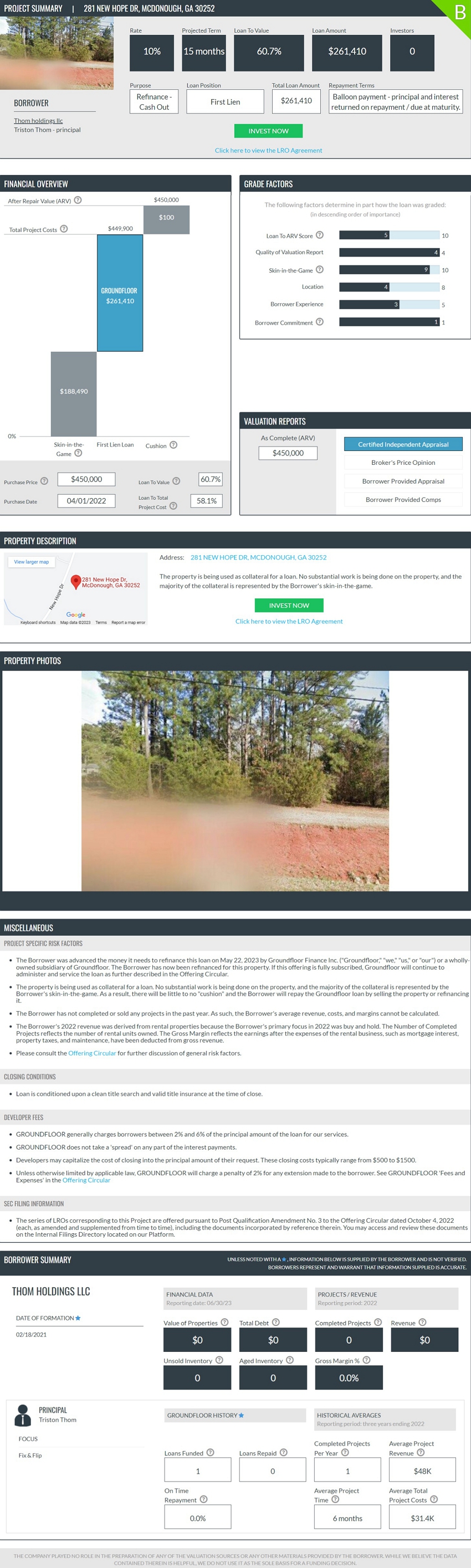

| 281 NEW HOPE DR, MCDONOUGH, GA 30252 | $ | 261,410 | ||

| 3102 WILLIAMS RD, BRANDON, FL 33510 | $ | 264,330 | ||

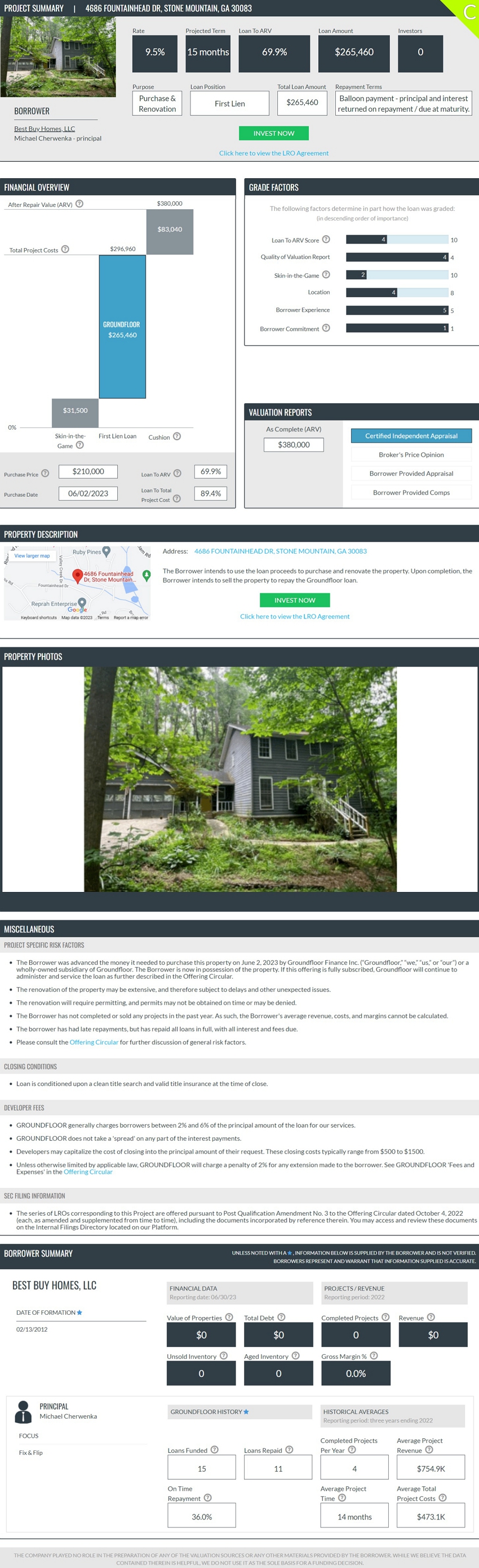

| 4686 FOUNTAINHEAD DR, STONE MOUNTAIN, GA 30083 | $ | 265,460 | ||

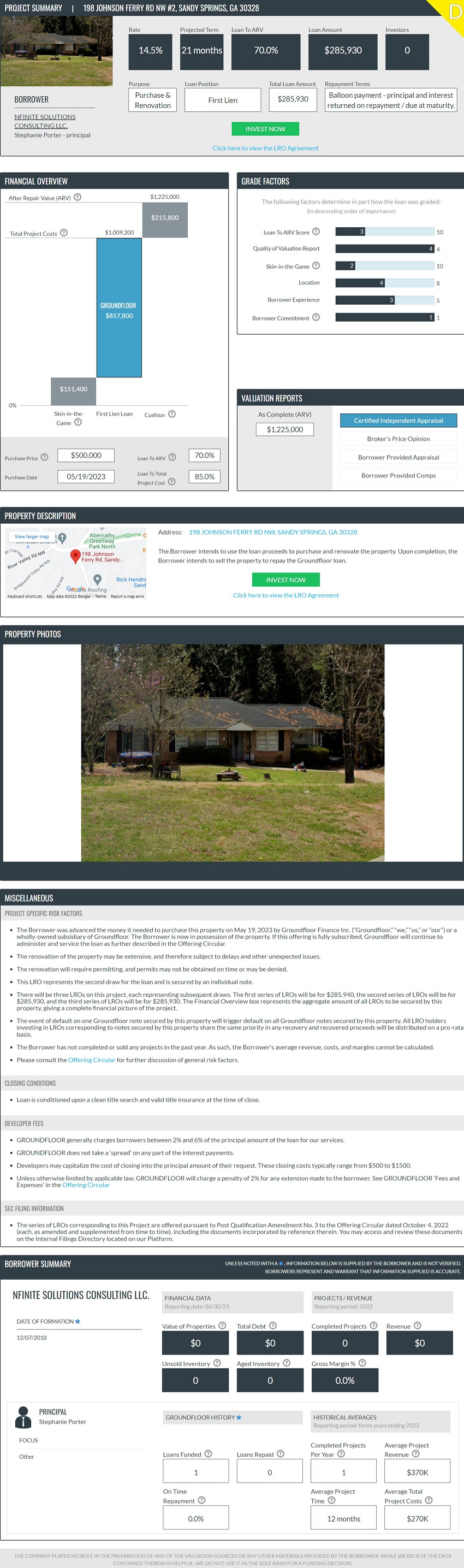

| 198 JOHNSON FERRY RD NW #2, SANDY SPRINGS, GA 30328 | $ | 285,930 | ||

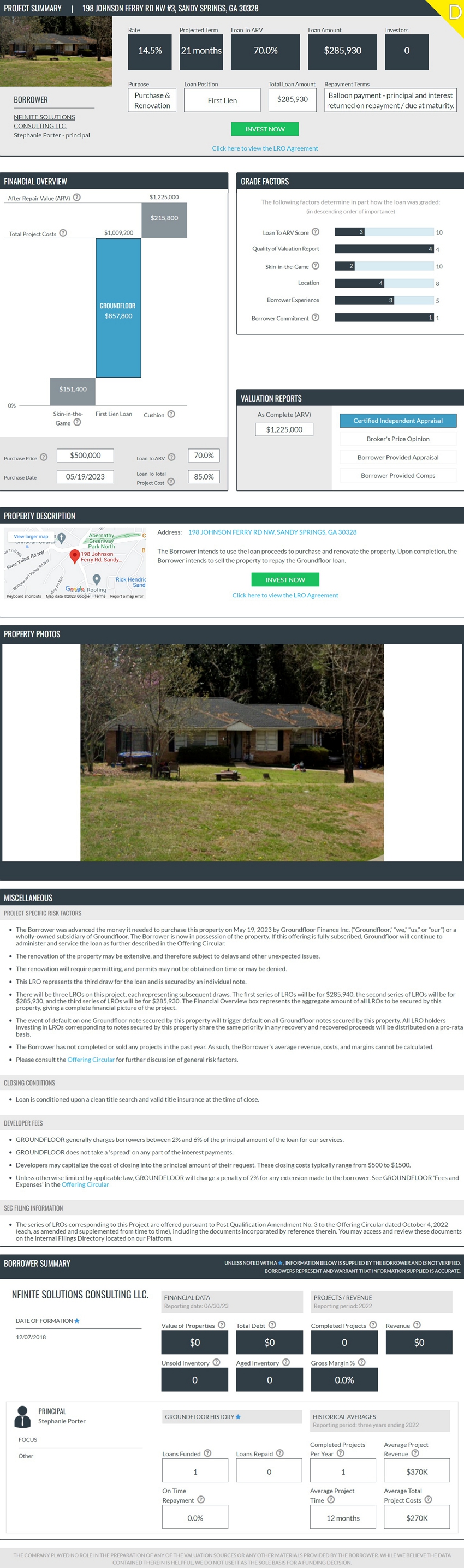

| 198 JOHNSON FERRY RD NW #3, SANDY SPRINGS, GA 30328 | $ | 285,930 | ||

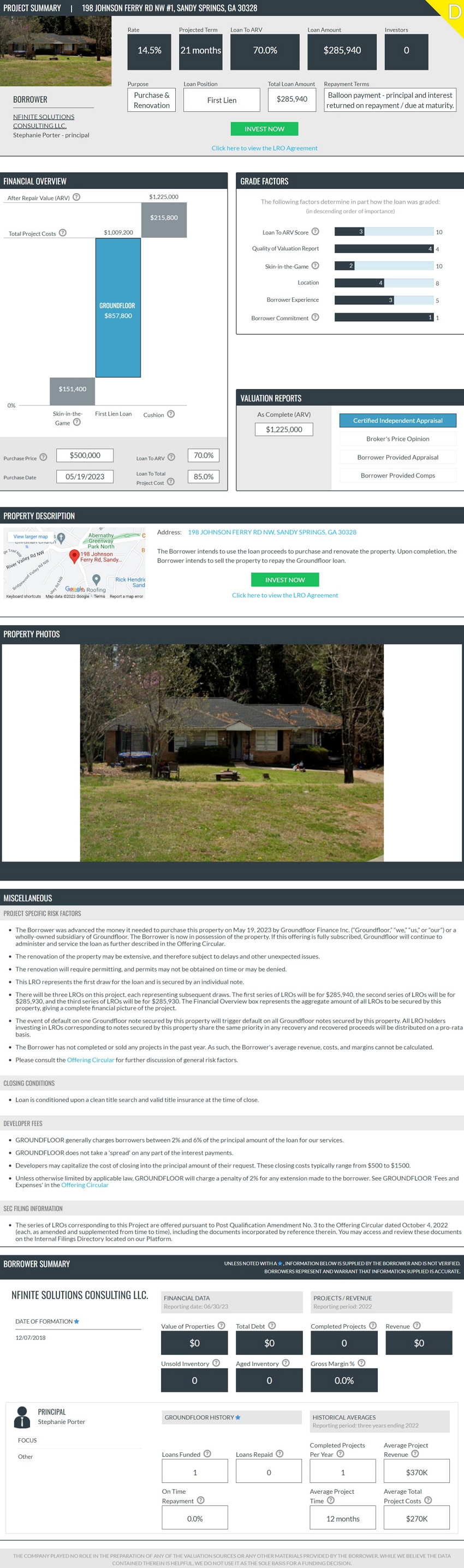

| 198 JOHNSON FERRY RD NW #1, SANDY SPRINGS, GA 30328 | $ | 285,940 | ||

| 853 BARKLEY SQUARE, ST. LOUIS, MO 63130 | $ | 290,630 | ||

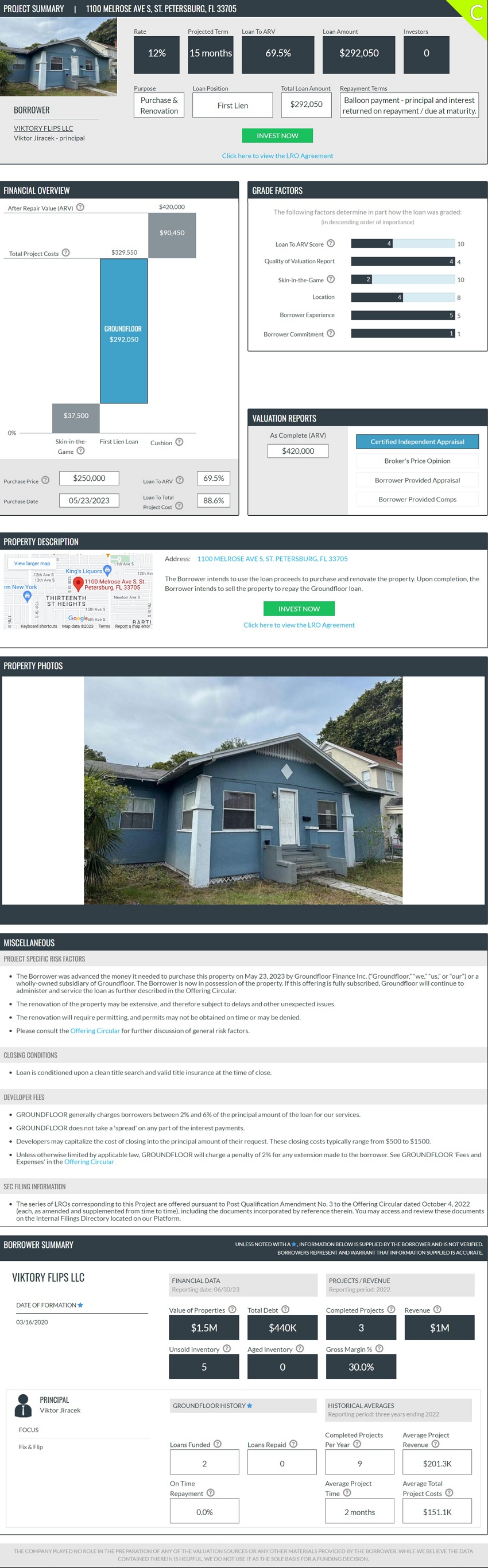

| 1100 MELROSE AVE S, ST. PETERSBURG, FL 33705 | $ | 292,050 | ||

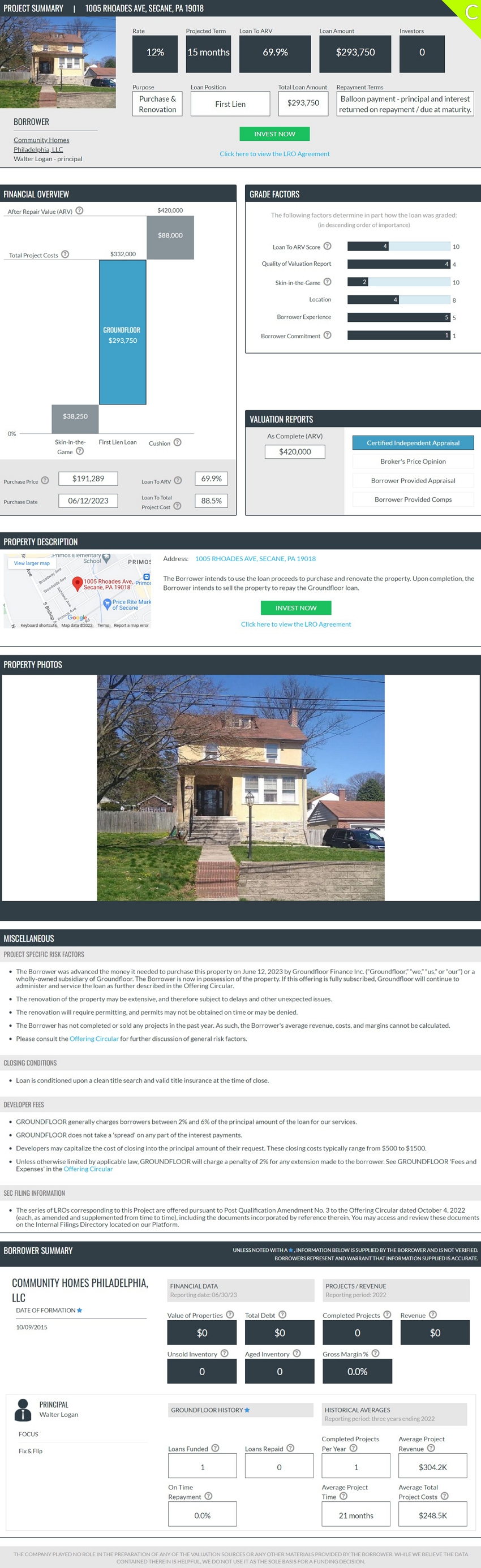

| 1005 RHOADES AVE, SECANE, PA 19018 | $ | 293,750 | ||

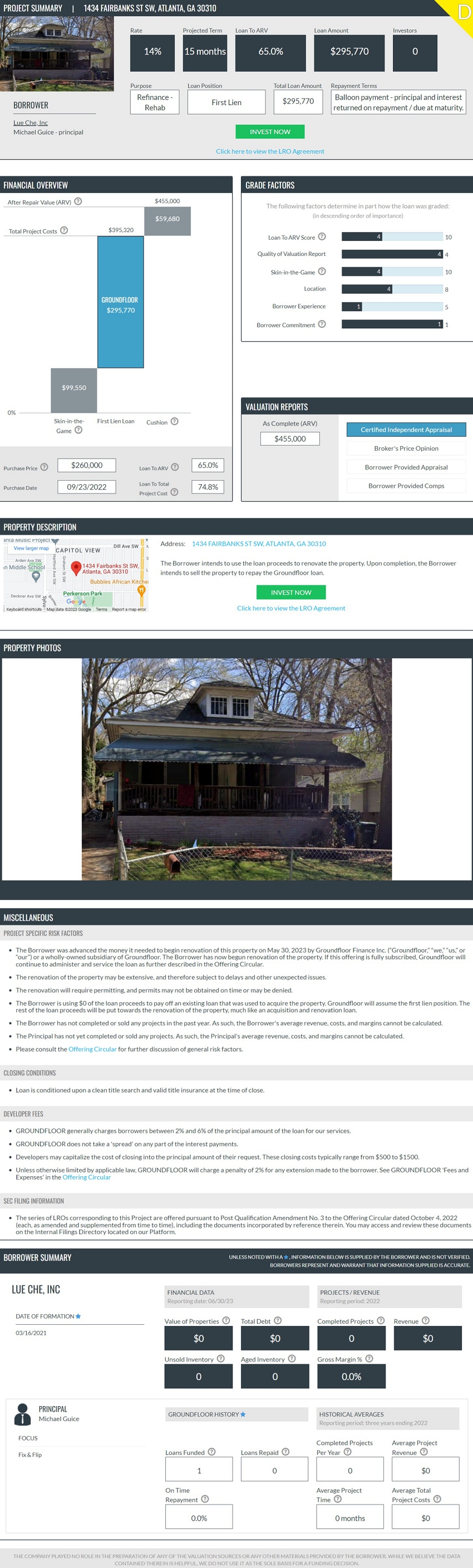

| 1434 FAIRBANKS ST SW, ATLANTA, GA 30310 | $ | 295,770 | ||

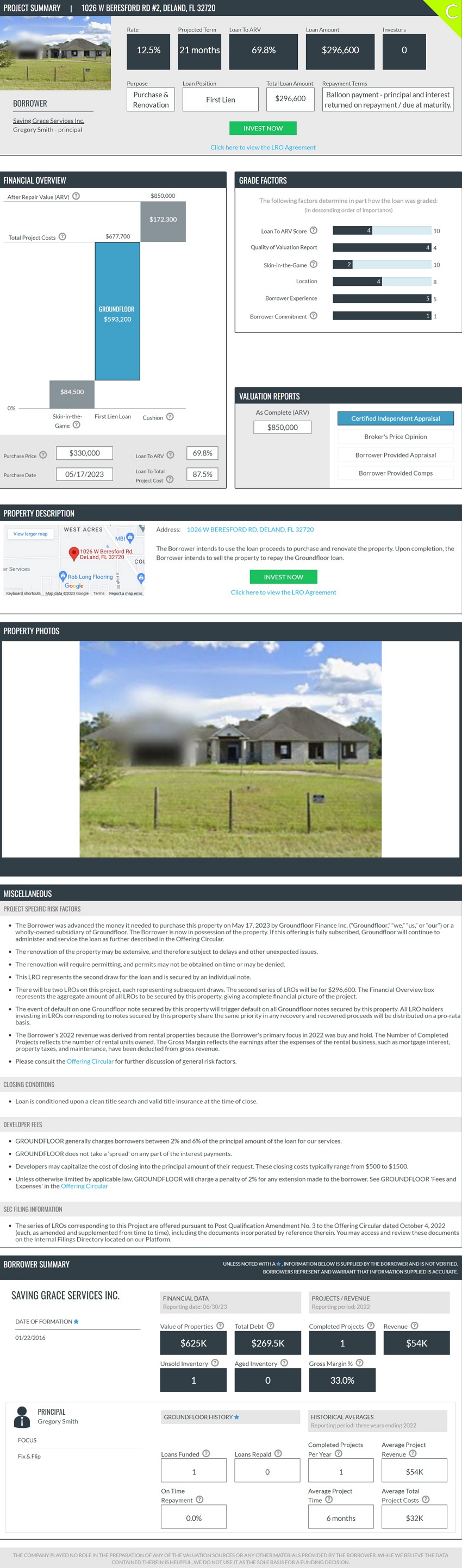

| 1026 W BERESFORD RD #2, DELAND, FL 32720 | $ | 296,600 | ||

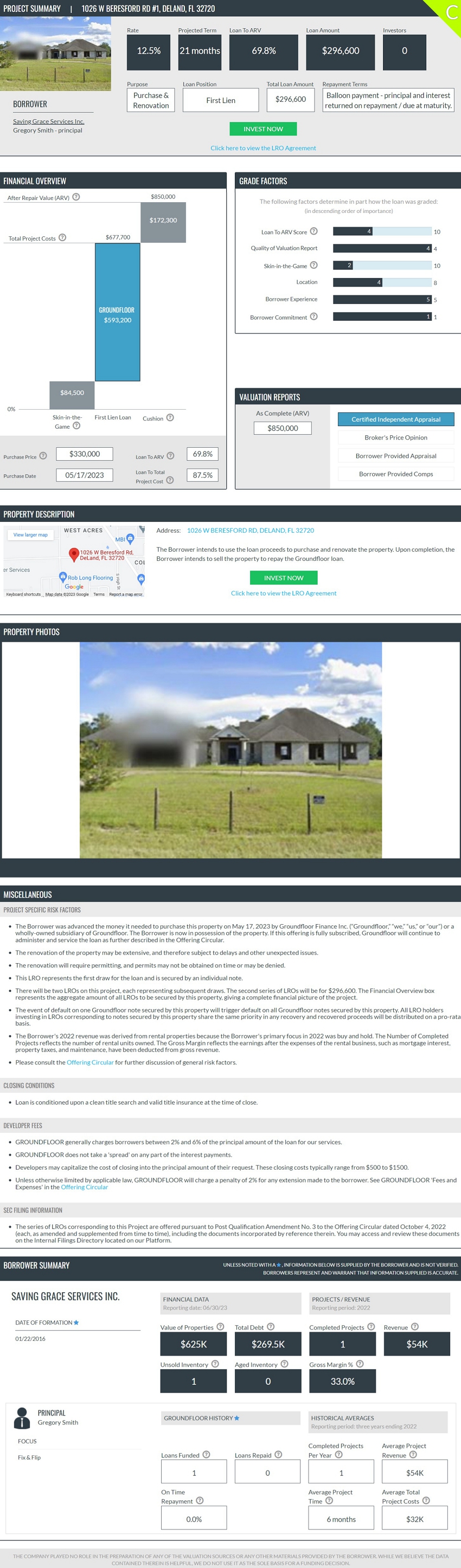

| 1026 W BERESFORD RD #1, DELAND, FL 32720 | $ | 296,600 | ||

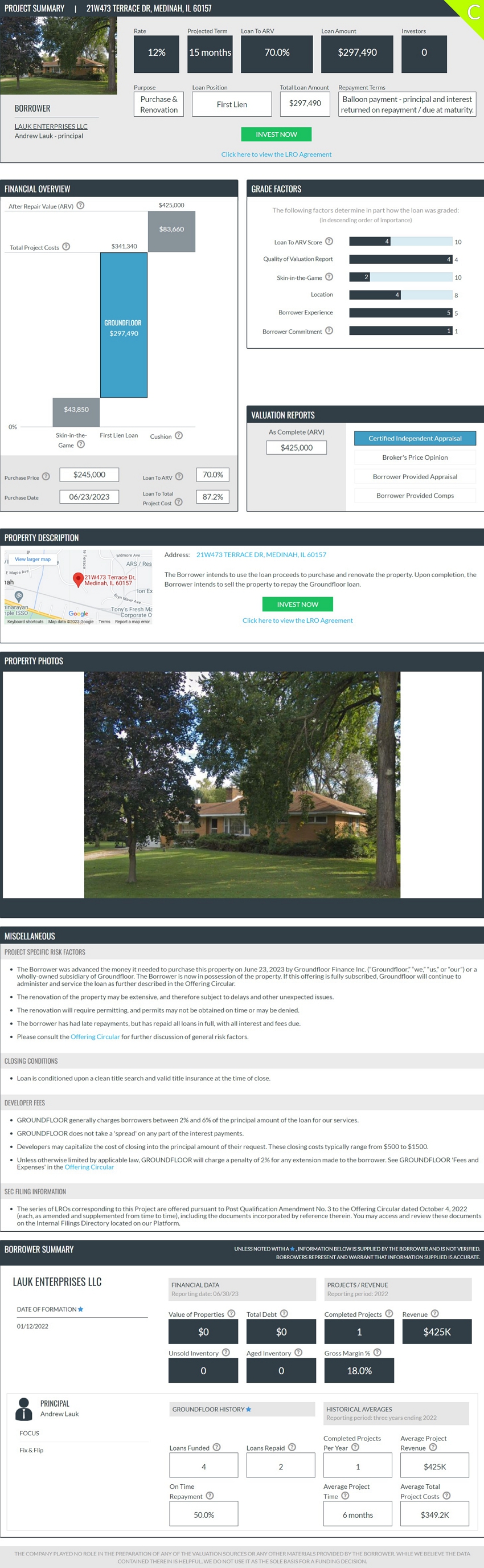

| 21W473 TERRACE DR, MEDINAH, IL 60157 | $ | 297,490 | ||

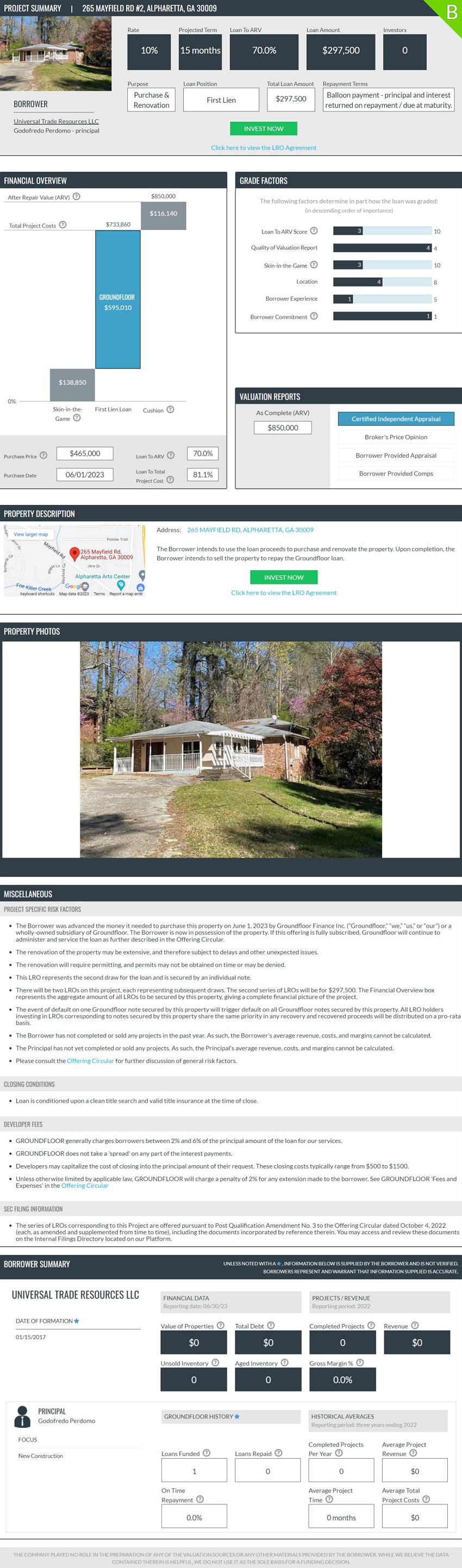

| 265 MAYFIELD RD #2, ALPHARETTA, GA 30009 | $ | 297,500 | ||

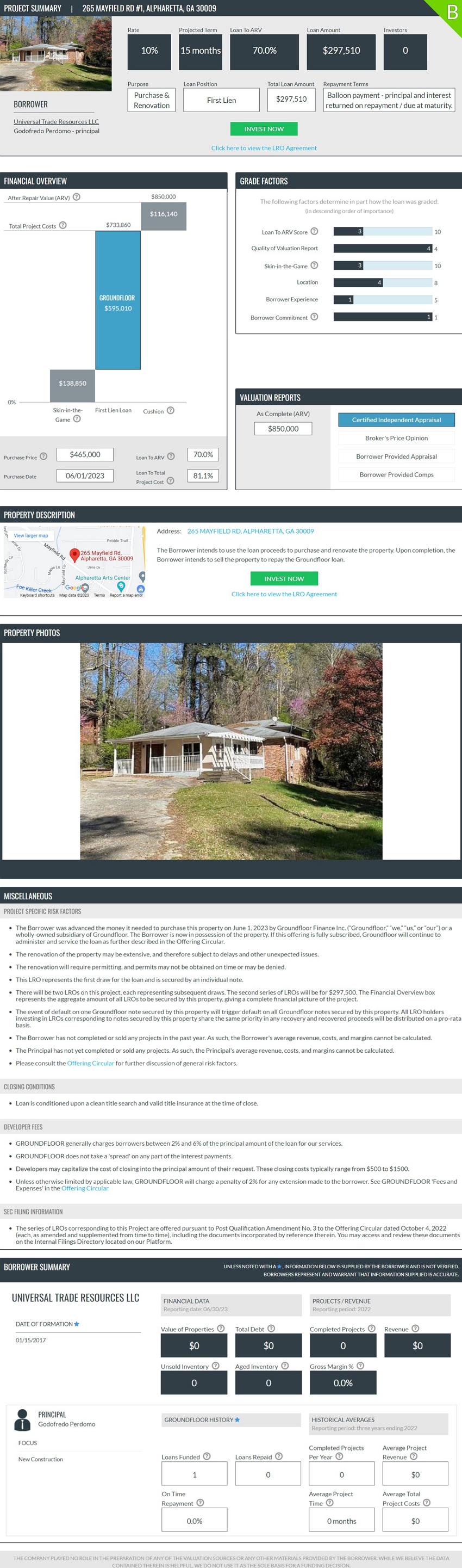

| 265 MAYFIELD RD #1, ALPHARETTA, GA 30009 | $ | 297,510 | ||

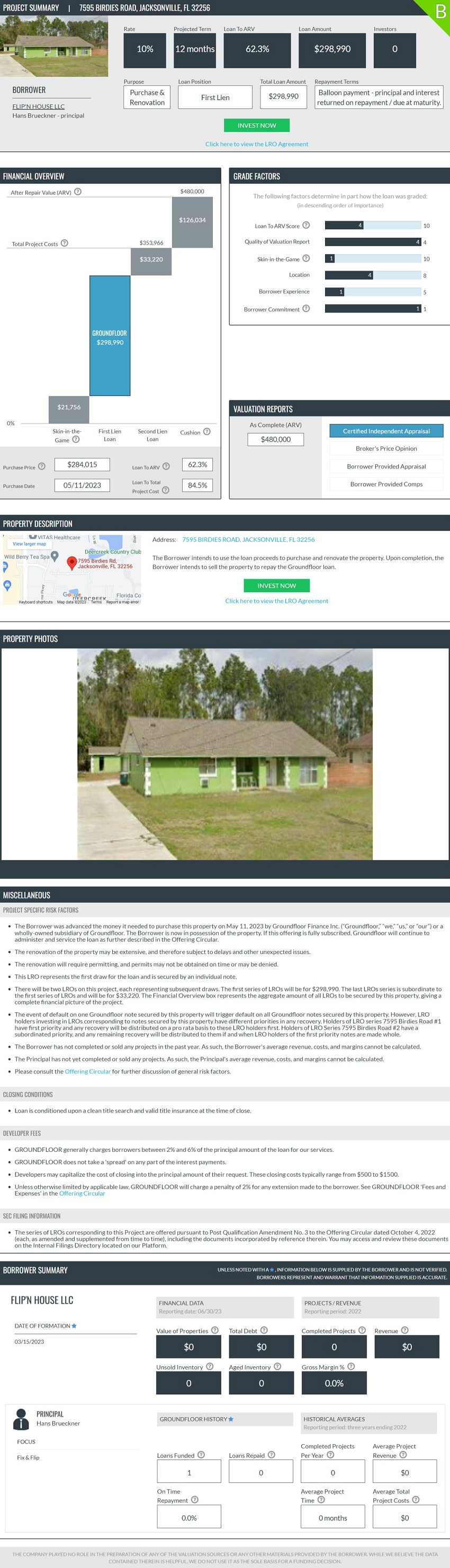

| 7595 BIRDIES ROAD, JACKSONVILLE, FL 32256 | $ | 298,990 | ||

| Total | $ | 19,999,110 |

Project Summaries

Each Project Summary attached below is included in the Offering Circular following page PS-1915.

PROJECT SUMMARIES FOR PQA NO. 3

PS-1915

PS-1916

PS-1917

PS-1918

PS-1919

PS-1920

PS-1921

PS-1922

PS-1923

PS-1924

PS-1925

PS-1926

PS-1927

PS-1928

PS-1929

PS-1930

PS-1931

PS-1932

PS-1933

PS-1934

PS-1935

PS-1936

PS-1937

PS-1938

PS-1939

PS-1940

PS-1941

PS-1942

PS-1943

PS-1944

PS-1945

PS-1946

PS-1947

PS-1948

PS-1949

PS-1950

PS-1951

PS-1952

PS-1953

PS-1954

PS-1955

PS-1956

PS-1957

PS-1958

PS-1959

PS-1960

PS-1961

PS-1962

PS-1963

PS-1964

PS-1965

PS-1966

PS-1967

PS-1968

PS-1969

PS-1970

PS-1971

PS-1972

PS-1973

PS-1974

PS-1975

PS-1976

PS-1977

PS-1978

PS-1979

PS-1980

PS-1981

PS-1982

PS-1983

PS-1984

PS-1985

PS-1986

PS-1987

PS-1988

PS-1989

PS-1990

PS-1991

PS-1992

PS-1993

PS-1994

PS-1995

PS-1996

PS-1997

PS-1998

PS-1999

PS-2000

PS-2001

PS-2002

PS-2003

PS-2004

PS-2005

PS-2006

PS-2007

PS-2008

PS-2009

PS-2010

PS-2011

PS-2012

PS-2013

PS-2014

PS-2015

PS-2016

PS-2017

PS-2018

PS-2019

PS-2020

PS-2021

PS-2022

MANAGEMENT DISCUSSION AND ANALYSIS

You should read the following discussion in conjunction with Groundfloor’s audited Consolidated Financial Statements and the related notes thereto.

Overview

Groundfloor Finance Inc. (“Groundfloor” or “Groundfloor Finance”) maintains and operates the Groundfloor Platform for use by us and Groundfloor subsidiaries to provide real estate development investment opportunities to the public. Groundfloor was originally organized as a North Carolina limited liability company under the name of Fomentum Labs LLC on January 28, 2013. Fomentum Labs LLC changed its name to Groundfloor LLC on April 26, 2013, and converted into a North Carolina corporation on July 26, 2013. In connection with this conversion, all equity interests in Groundfloor LLC were converted into shares of our common stock. In August 2014, Groundfloor converted into a Georgia corporation and changed its name to Groundfloor Finance Inc. The audited Consolidated Financial Statements include Groundfloor’s wholly-owned subsidiaries Groundfloor Properties GA LLC was created for the purpose of financing real estate in Georgia. Groundfloor Real Estate 1 LLC, Groundfloor Real Estate 2 LLC, Groundfloor Real Estate 3 LLC, and Groundfloor Yield LLC were created for the purpose of financing real estate in any state. Groundfloor Real Estate, LLC and Groundfloor Holdings GA, LLC are currently inactive and management does not have plans to use this entity in the near future.

Investment in Joint Ventures

In November 2021, the Company entered into a limited liability company agreement with two independent third-parties, to form a joint venture, Groundfloor Jacksonville, LLC (“Jacksonville JV” or “the JV”). The joint venture was formed to scale origination and investor activity in the fix-and-flip/buy-and-hold sector of the Jacksonville, Florida market by increasing the production of existing loan products offered by Groundfloor and its Affiliates and potentially developing new products.

The Jacksonville JV commenced operations on January 1, 2022. The results of the Jacksonville JV are consolidated within our financial statements, as the JV has been determined to be a Variable Interest Entity (“VIE”), for which Groundfloor is the primary beneficiary.

As of December 31, 2022, Groundfloor has invested $12,000 in the Jacksonville JV in the form of their initial capital contribution, as well as $43.6 million of loan financing under the terms of the Jacksonville JV Credit Facility Agreement.

For the twelve months ended December 31, 2022, the Jacksonville JV recorded net income of $2.6 million and the non-controlling interest in the Jacksonville JV was $1.6 million. See Note 3, Variable Interest Entities, to the accompanying Notes to the Consolidated Financial Statements for additional information.

Funding Loan Advances

To date, the Company has entered into the following financial arrangements designed to facilitate Loan advances.

Starting in November 2018 and continuing through December 31, 2022, Groundfloor entered into various GROUNDFLOOR Notes, secured promissory notes, with accredited investors. The GROUNDFLOOR Notes are used for the purpose of the Company to originate, buy, and service loans for the purpose of building, buying, or rehabilitating single family and multifamily structures, or buying land for commercial purposes. The principal outstanding as of December 31, 2022, was $65.5 million.

Starting in January 2021 and continuing through December 31, 2022, Groundfloor entered into various Stairs Notes, secured promissory notes, with Investors. Investors in Stairs Notes do not directly invest in Loans held by the Company; rather, the Stairs Notes are general obligations of the Company, and the proceeds thereof are used primarily to continually expand and replenish the portfolio of Loans owned by the Company. The use of the funds generated by the Stairs Notes offering can be adjusted at the discretion of the business as business needs change. The principal outstanding as of December 31, 2022, was $44.3 million.

Financial Position and Operating History

In connection with their audit for the year ended December 31, 2022, our auditors expressed substantial doubt about our ability to continue as a going concern due to our losses and cash outflows from operations. To strengthen our financial position, Groundfloor have continued to raise additional funds through convertible debt and equity offerings.

Groundfloor has a limited operating history and have incurred a net loss since our inception. Our net loss was $5.3 million for the twelve months ended December 31, 2022. To date, Groundfloor has earned limited revenues from origination and servicing fees charged to borrowers in connection with the loans made by the Company and its wholly-owned subsidiaries GRE 1 and Groundfloor GA corresponding to the LROs and Georgia Notes. Groundfloor has funded our operations primarily with proceeds from our convertible debt and preferred stock issuances, which are described below under “Liquidity and Capital Resources”. Over time, Groundfloor expects that the number of borrowers and lenders, and the volume of loans originated through the Groundfloor Platform, will increase and generate increased revenue from borrower origination and servicing fees.

The proceeds from the sale of LROs described in our Consolidated Financial Statements will not be used to directly finance our operations. Groundfloor will use the proceeds from sales of LROs exclusively to originate the Loans that correspond to the corresponding series of LROs sold to investors. However, Groundfloor collects origination and servicing fees on Loans Groundfloor is able to make to Developers, which Groundfloor recognizes as revenue. The more Loans Groundfloor is able to fund through the proceeds of our offerings, the more fee revenue Groundfloor will make. With increased fee revenue, our financial condition will improve. However, Groundfloor does not anticipate this increased fee revenue to be able to fully support our operations through the next twelve months.

Groundfloor’s operating plan calls for a continuation of the current strategy of raising equity and, in limited circumstances, debt financing to finance its operations until Groundfloor reach profitability and become cash-flow positive, which Groundfloor does not expect to occur before 2023. Groundfloor’s operating plan calls for significant investments in website development, security, investor sourcing, loan processing and marketing, and for several rounds of equity financing before Groundfloor reaches profitability.

To date, the company has raised funds for operations through multiple common stock, preferred stock, and convertible note fundraising rounds. In 2022, the company raised approximately $9.4 million in new operating capital through a combination of common stock and preferred stock offerings during the year. See “Liquidity and Capital Resources” below for additional detail of the Company’s capital raises.

Critical Accounting Policies and Estimates

This discussion and analysis of our financial condition and results of operations are based on our Consolidated Financial Statements, which Groundfloor has prepared in accordance with generally accepted accounting principles. The preparation of these Consolidated Financial Statements requires us to make estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities and the reported amounts of revenues and expenses. Management bases its estimates on historical experience and on various other factors it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities. Actual results may differ from these estimates. Our significant accounting policies are more fully described in Note 1 to our audited Consolidated Financial Statements.

Software and Website Development Costs

Internal use software and website development costs are capitalized when preliminary development efforts are successfully completed, and it is probable that the project will be completed and the software will be used as intended. Internal use software and website development costs are amortized on a straight-line basis over the project’s estimated useful life, generally three years. Capitalized internal use software development costs consist of fees paid to third-party consultants who are directly involved in development efforts. Costs related to preliminary project activities and post implementation activities, including training and maintenance, are expensed as incurred. Costs incurred for upgrades and enhancements that are considered to be probable to result in additional functionality are capitalized. Development costs of our website incurred in the preliminary stages of development are expensed as incurred. Once preliminary development efforts are successfully completed, internal and external costs, if direct and incremental, are capitalized until the software is substantially complete and ready for its intended use.

Share Based Compensation

Groundfloor accounts for share-based compensation using the fair value method of accounting which requires all such compensation to employees and nonemployees, including the grant of employee stock options, restricted stock, and performance-based awards, to be recognized in the income statement based on its fair value at the measurement date (generally the grant date). The expense associated with share-based compensation is recognized on a straight-line basis over the service period of each award.

Allowance for Current Expected Credit Losses

For the year ended December 31, 2021, the Company adopted the current expected credit loss (“CECL Standard”) on January 1, 2021. The CECL Standard replaced the incurred loss model under existing guidance with an expected loss model for instruments measured at amortized cost, including loan receivables and off-balance sheet credit exposures not accounted for as insurance (loan commitments, standby letters of credit, financial guarantees, and other similar instruments). The Company now records an allowance for credit losses in accordance with the CECL Standard on the loan portfolio on a collective basis by assets with similar risk characteristics. Where assets cannot be classified with other assets due to dissimilar risk characteristics, the Company assessed these assets on an individual basis. With the adoption of CECL, the definition of impaired loans was removed from accounting guidance.

The CECL Standard requires an entity to consider historical loss experience, current conditions, and a reasonable and supportable forecast of the economic environment. The Company utilizes a loss-rate approach for estimating current expected credit losses. In accordance with the loss-rate method, an adjusted historical loss rate is applied to the amortized cost of an asset or pool of assets at the balance sheet date.

In determining the CECL allowance, we considered various factors including (i) historical loss experience in our portfolio (ii) current performance of the US residential housing market, (iii) future expectations of the US residential housing market, and (iv) future expectations of short-term macroeconomic environment. Management estimates the allowance for credit losses using relevant information, from internal and external sources, relating to past events, current conditions, and reasonable and supportable forecasts. We utilize a reasonable and supportable forecast period of 12 months. The allowance for credit losses is maintained at a level sufficient to provide for expected credit losses over the life of the loan based on evaluating historical credit loss experience and making adjustments to historical loss information applied to the current loan portfolio. Refer to Note 4 of the audited Consolidated Financial Statements for further information regarding the CECL allowance.

The Company made an accounting policy election to exclude “Interest receivable on loans to developers” from the amortized cost basis of loans in determining the CECL allowance, as any uncollected accrued interest receivable is written off in a timely manner. Refer to “Nonaccrual and Past Due Loans” section below for a description of the Company’s policies established to write-off interest.

Payments to holders of Georgia Notes or LROs, as applicable, depend on the payments received on the corresponding Loans; a reduction or increase of the expected future payments on Loans will decrease or increase the reserve for the associated Georgia Notes or LROs. The allowance calculated for loans is accordingly applied as the reserve for Georgia Notes and LROs. The allowance for expected credit losses on “Loans to developers” is presented separately in the audited Consolidated Balance Sheets as “Allowance for loans to developers”, while the allowance for “Limited recourse obligations” is presented separately on the audited Consolidated Balance Sheet as “Allowance for limited recourse obligations”.

Nonaccrual and Past Due Loans

Accrual of interest on “Loans to developers” and corresponding “Limited recourse obligations” is discontinued when, in management’s opinion, the collection of the interest income appears doubtful. “Interest income” and “Interest expense” on the “Loans to developers” and the corresponding “Limited recourse obligations” are discontinued and placed on nonaccrual status at the time the Loan is 90 days delinquent unless the Loan is well secured and in process of collection. A Loan may also be placed on nonaccrual status when, in management’s judgment, the collection of the interest income appears doubtful based on the status of the underlying development project, even if the Loan is not yet 90 days delinquent. Loans may be returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured.

The “Loans to developers” and corresponding “Limited recourse obligations” are charged off to the extent principal or interest is deemed uncollectible. All interest accrued but later charged off for “Loans to developers” and “Limited recourse obligations” is reversed against “Interest income” and the corresponding LROs recorded “Interest expense”.

Provision for Income Taxes

Groundfloor accounts for income taxes using the asset and liability method. Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amount of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. A valuation allowance is recorded to reduce deferred tax assets to the amount that is more likely than not to be realized.

Results of Operations

Twelve Months Ended December 31, 2022, and 2021

| Twelve Months Ended December 31, | ||||||||

| 2022 | 2021 | |||||||

| Non-interest revenue: | ||||||||

| Origination fees | $ | 11,162,166 | $ | 4,769,504 | ||||

| Loan servicing revenue | 3,200,879 | 2,887,096 | ||||||

| Total non-interest revenue | 14,363,045 | 7,656,600 | ||||||

| Net interest income: | ||||||||

| Interest income | 28,234,268 | 15,731,444 | ||||||

| Interest expense | (20,804,590 | ) | (12,167,945 | ) | ||||

| Net interest income | 7,429,678 | 3,563,499 | ||||||

| Net revenue | 21,792,723 | 11,220,099 | ||||||

| Cost of revenue | (2,040,488 | ) | (1,363,150 | ) | ||||

| Gross profit | 19,752,235 | 9,856,949 | ||||||

| Operating expenses: | ||||||||

| General and administrative | 9,181,673 | 4,417,525 | ||||||

| Sales and customer support | 4,487,185 | 3,404,287 | ||||||

| Development | 4,282,870 | 1,638,327 | ||||||

| Regulatory | 674,149 | 378,911 | ||||||

| Marketing and promotions | 4,915,342 | 4,251,831 | ||||||

| Total operating expenses | 23,541,219 | 14,090,881 | ||||||

| Loss from operations | (3,788,984 | ) | (4,233,932 | ) | ||||

| Other income (expense): | ||||||||

| Interest expense on corporate debt instruments | (840,684 | ) | (543,942 | ) | ||||

| Gain on loan extinguishment | 829,000 | 829,100 | ||||||

| Total other income | (11,684 | ) | 285,158 | |||||

| Net income (loss) | (3,880,668 | ) | (3,948,774 | ) | ||||

| Less: Net income attributable to non-controlling interest in consolidated VIE | 1,570,250 | - | ||||||

| Net loss | $ | (5,370,918 | ) | $ | (3,948,774 | ) | ||

Net Revenue

Net revenue for the twelve months ended December 31, 2022, and 2021 was $21.8 million and $11.2 million, respectively, an increase of $10.6 million or 94%. The Company facilitated the origination of 1,167 and 1,118 developer loans during the twelve months ended December 31, 2022 and 2021, respectively. Origination fees and loan servicing revenue were earned related to the origination of these developer loans. Origination fees are determined by the term and credit risk of the developer loan and range from 1.0% to 6.0%. The fees are deducted from the loan proceeds at the time of issuance. Loan servicing revenue are fees incurred in servicing the developer’s loan. Additionally, Groundfloor incurred net interest income during the loan advance period. The increase in net interest income is due to the increase in the overall portfolio size. Groundfloor expects operating revenue to continue to increase as its loan application and processing volume increases.

Gross Profit

Gross profit for the twelve months ended December 31, 2022, and 2021 was $19.8 million and $9.9 million, respectively, an increase of $9.9 million or 100%. The increase in gross profit was due to an increase in origination and servicing revenues, as the Company originated a greater amount of loans in both units and total loan volume relative to the prior year, combined with an increase in net interest income. Cost of revenue consists primarily of payment processing and vendor costs associated with facilitating and servicing loans. Groundfloor expects gross profit to increase as its loan application and processing volume increases.

General and Administrative Expense

General and administrative expense for the twelve months ended December 31, 2022, and 2021, were $9.2 million and $4.4 million, respectively, an increase of $4.8 million or 108%. General and administrative expenses consists primarily of employee compensation cost, professional fees, consulting fees and rent expense. The increase was driven primarily by an increase in both employee and non-employee compensation costs and professional fees. Groundfloor expects general and administrative expense will continue to increase due to the planned investment in business infrastructure required to support its growth.

Sales and Customer Support

Sales and customer support expense for the twelve months ended December 31, 2022, and 2021, were $4.5 million and $3.4 million, respectively, an increase of $1.1 million or 32%. Sales and customer support expense consists primarily of employee compensation cost and asset management costs. The increase was primarily due to the increase in compensation related to headcount growth experienced in the lending operations, asset management, and sales departments, combined with an increase in asset management servicing costs. Groundfloor expect sales and customer support expense will continue to increase due to the planned investment in customer acquisition and support required to support its growth.

Development Expense

Development expense for the twelve months ended December 31, 2022, and 2021, were $4.3 million and $1.6 million, respectively, an increase of $2.6 million or 161%. Development expense consists primarily of employee compensation cost and the cost of subcontractors who work on the development and maintenance of our website and lending platform. The increase was attributable to an increase in compensation cost as a result of new hiring and compensation adjustments, including additions of key personnel. Groundfloor expects development expense will continue to increase due to the planned investments in our website and lending platform required to support our technology infrastructure as Groundfloor grows.

Regulatory Expense

Regulatory expense for the twelve months ended December 31, 2022, and 2021, were $0.7 million and $0.4 million, respectively, and increase of $0.3 million or 78%. Regulatory expense primarily consists of legal fees and compensation cost required to maintain SEC and other regulatory compliance. The increase was primarily attributable to an increase in stock-based compensation expense for regulatory employees. Groundfloor expects regulatory expense may increase due to the additional expense related to qualifying our offerings with the SEC, including our transition to Tier 2 under Regulation A, which will require complying with ongoing reporting requirements with the SEC and certain filing fees with applicable state regulatory authorities.

Marketing and Promotions Expense

Marketing and promotions expense for the twelve months ended December 31, 2022, and 2021, were $4.9 million and $4.3 million, respectively, an increase of $0.7 million or 16%. Marketing and promotions expense consists primarily of promotional and advertising expense as well as consulting expense and compensation cost. The increase is primarily attributable to the Company launching an extensive online marketing campaign aimed to increase investor acquisition. The increase in investor marking spend in the current year was an initiative executed by Management to drive increased investing activity on the Groundfloor platform and to acquire new investors.

Interest Expense

Interest expense for the twelve months ended December 31, 2022, and 2021, excluding interest paid on limited recourse obligations, GROUNDFLOOR Notes and Yield Notes, was $0.8 million and $0.5 million, respectively, an increase of $0.3 million or 55%. Interest expense related to the 2019 Subordinated Convertible Notes of $0 and $0.3 million was recognized during the twelve months ended December 31, 2022, and 2021, respectively. Interest expense related to the 2021 Subordinated Convertibles Notes of $0.8 million and $0.2 million was recognized during the twelve months ended December 31, 2022, and 2021, respectively.

Net Loss

Net loss for the twelve months ended December 31, 2022, and 2021 was $5.3 million and $3.9 million, respectively, an increase in net loss of $1.3 million or 33%. The increase in the net loss was primarily attributable to an increase in operating costs from $14.1 million to $23.5 million, or 67%.

Liquidity and Capital Resources

The audited Consolidated Financial Statements included herein have been prepared assuming that Groundfloor will continue as a going concern; however, the conditions discussed below raise substantial doubt about our ability to continue as a going concern. The audited Consolidated Financial Statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result should Groundfloor be unable to continue as a going concern.

Groundfloor incurred a net loss for the twelve months ended December 31, 2022, and 2021, and has an accumulated deficit as of December 31, 2022, of $35.6 million. Since our inception, Groundfloor has financed our operations through debt and equity financing from various sources. Groundfloor is dependent upon raising additional capital or seeking additional equity financing to fund our current operating plans for the foreseeable future. Failure to obtain sufficient equity financing and, ultimately, to achieve profitable operations and positive cash flows from operations could adversely affect our ability to achieve its business objectives and continue as a going concern. Further, there can be no assurance as to the availability or terms upon which the required financing and capital might be available.

| For the twelve months ended December 31, 2022 | For the twelve months ended | |||||||

| Operating activities | $ | (8,999,571 | ) | $ | (3,079,871 | ) | ||

| Investing activities | (68,643,496 | ) | (113,830,996 | ) | ||||

| Financing activities | 79,467,255 | 118,123,645 | ||||||

| Net increase in cash | $ | 1,824,188 | $ | 1,212,778 | ||||

Net cash flows used in operating activities for the twelve months ended December 31, 2022, and 2021 was $9.0 million $3.1, respectively. Net cash used in operating activities funded salaries, expense for contracted marketing, development and other professional service providers and expense related to sales and marketing initiatives.

Net cash flows used in investing activities for the twelve months ended December 31, 2022, and 2021 was $68.6 million and $113.8 million, respectively. Net cash used in investing activities primarily represents loan payments to developers offset by the repayment of loans to developers.

Net cash flows from financing activities for the twelve months ended December 31, 2022, and 2021 was $79.5 million and $118.1 million, respectively. Net cash provided by financing activities primarily represents proceeds from the issuance of GROUNDFLOOR Notes, Stairs Notes, and LROs to investors through the Groundfloor Platform, and proceeds from equity offerings, offset by repayments of GROUNDFLOOR Notes, Stairs Notes, and LROs to investors.

On October 30, 2017, Groundfloor filed an offering statement on Form 1-A with the SEC for a proposed offering of its common stock. On February 9, 2018, Groundfloor’s offering statement on Form 1-A was qualified to issue Groundfloor common stock.

From September 2019 to December 2019, the Company issued subordinated convertible notes (the “2019 Subordinated Convertible Notes”) to Investors for total proceeds of $3.6 million. The 2019 Subordinated Convertible Notes bear interest at the rate of 10% per annum. The outstanding principal and all accrued but unpaid interest was due and payable on the earlier of August 30, 2021, or the consummation of a sale of the Company by consolidation, merger, change of majority ownership, or sale or other disposition of all or substantially all of the assets of the Company (the “Maturity Date”). In the event of a closing of a preferred stock financing with gross proceeds of at least $8.0 million (“Qualified Preferred Financing”) prior to the Maturity Date, the outstanding principal and all accrued but unpaid interest may be converted into shares of preferred stock issued in the financing at a price per share equal to 90% of the offering price per share in the Qualified Preferred Financing. At any time after six-months after the issuance of a 2019 Subordinated Convertible Note, the investor may convert all or a portion of the outstanding principal and accrued interest into shares of common stock at 90% of the per share price of common stock at the time of conversion, as reasonably determined by the Board. The indebtedness represented by the 2019 Subordinated Convertible Notes is subordinated in all respects to the principal of (and premium, if any), unpaid interest on and amounts reimbursable, fees, expenses, costs of enforcement, and other amounts due in connection with the Revolver.

Because of the contractual right of noteholders to convert their holdings to common stock at a discount to fair value, the Company determined that the 2019 Subordinated Convertible Notes contain a beneficial conversion feature. The Company recognized this beneficial conversion feature as a debt discount and component of additional paid-in capital at the in-the-money amount of $0.4 million at the time of issuance. The discount is being amortized to interest expense until the earlier of maturity or exercise of the conversion option.

In February 2020, the Company launched an offering of its common stock under Tier 2 of Regulation A pursuant to an offering statement on Form 1-A qualified by the SEC (the “2020 Common Stock Offering”). Participation in the 2020 Common Stock Offering was limited to existing shareholders. The Company offered shares of common stock at $17.50 per share, with a minimum investment of $175, or 10 shares of common stock. As a result of the offering, the Company received gross proceeds of approximately $0.5 million in exchange for the issuance of 30,794 shares of common stock.

In April 2020, the Company obtained an $829,100 loan (“First PPP Loan”) under the Paycheck Protection Program (“PPP”). The Company used the First PPP Loan proceeds to cover payroll costs, rent and utilities in accordance with the relevant terms and conditions of the CARES Act. In January 2021, the Company applied for forgiveness of the First PPP Loan with the Secretary of the Treasury and Small Business Administration (SBA). In March 2021, the Company received notice that the request for forgiveness was approved, and our First PPP Loan principal and interest were deemed paid in full.

In July 2020, the Company launched an offering of 548,546 shares of Series B Preferred Stock at $18.23 per share (“Series B Preferred Stock Offering”). The offering closed July 2021. As a result of the offering, the Company has received gross proceeds of approximately $6.7 million in exchange for the issuance of 396,724 shares of Series B preferred stock as of December 31, 2022.

In April 2021, the Company obtained a new loan under the PPP (“Second PPP Loan”) for $829,000 and used the proceeds consistent with the First PPP Loan. In January 2022, the Company applied for forgiveness of the Second PPP Loan with the SBA. In May 2022, the Company received notice that the request for forgiveness was approved, and our Second PPP Loan principal and interest were deemed paid in full.

During 2021, certain holders of the 2019 Subordinated Convertible Notes converted their holdings into common stock, or Series B preferred stock, at the discretion of the noteholder. Additionally, noteholders were repaid $1.7 million in principle and $0.3 million in accrued interest at the maturity date. As an incentive to convert, the Company granted all noteholders a time-limited option to convert their holdings on more favorable terms than those specified in the contractual agreement. Pursuant to these terms, Noteholders converted $0.15 million in principle and approximately $0.03 million in accrued interest into 7,463 shares of common stock at a conversion price of $15.75, a 10% discount to the per share price of common stock at the time of conversion, and into 3,759 shares of common stock at a conversion of $17.50, the fair value the common stock at conversion. Noteholders also converted $0.3 in principal and approximately $0.04 million in accrued interest into 16,928 shares of Series B preferred stock at a conversion price of $18.23, a 0% discount to the price per share of Series B preferred stock at the time of conversion.

In August 2021, the Company issued promissory notes (the “2021 Promissory Notes”) to investors for total proceeds of $0.6 million. The 2021 Promissory Notes bear interest at the rate of 14% per annum. The outstanding principal and all accrued but unpaid interest is due and payable on the earlier of August 30, 2022, or the date the Company raises at least an aggregate $4.0 million of new cash from any debt or financing closing after September 1, 2021. In December 2021, as a result of cash financing received from other debt instruments, and pursuant the 2021 Promissory Note purchase agreement the Company repaid all principle and accrued interest.

In November 2021, the Company repaid the remaining principal of $0.7 and accrued but unpaid interest of $0.14 million related to the notes related to the 2019 Subordinated Convertible Notes.

From August 2021 to November 2021, the Company issued subordinated convertible notes (the “2021 Subordinated Convertible Notes”) to Investors for total proceeds of $5.0 million. The 2021 Subordinated Convertible Notes bear interest at the rate of 12% per annum. The outstanding principal and all accrued but unpaid interest are due and payable on the earlier of August 31, 2023, or the consummation of a sale of the Company by consolidation, merger, change of majority ownership, or sale or other disposition of all or substantially all of the assets of the Company (the “Maturity Date”). In the event of a closing of a preferred stock financing with gross proceeds of at least $20.0 million (“Qualified Preferred Financing”) prior to the Maturity Date, the outstanding principal and all accrued but unpaid interest may be converted into shares of preferred stock issued in the financing at a price per share equal to 90% of the offering price per share in the Qualified Preferred Financing. At any time after six months after the issuance of a 2021 Subordinated Convertible Note, the investor may convert all or a portion of the outstanding principal and accrued interest into shares of common stock at 90% of the per share price of common stock at the time of conversion, as reasonably determined by the Board.

Because of the contractual right of noteholders to convert their holdings to common stock at a discount to fair value, the Company determined that the 2021 Subordinated Convertible Notes contain a beneficial conversion feature. The Company recognized this beneficial conversion feature as a debt discount and component of additional paid-in capital at the in-the-money amount of approximately $0.6 million. The discount is being amortized to interest expense until the earlier of maturity or exercise of the conversion option.

In January 2022, the Company amended and restated its article of incorporation to increase the authorized number of Preferred Stock shares to 2,001,457 and to designate 243,348 of the newly authorized shares as Series B-2 Preferred Stock (“Series B-2 Stock”). Pursuant to this offering, the Company has received gross proceeds of approximately $5.8 million in exchange for the issuance of 189,270 shares of Series B-2 Stock from a single, third-party investor. In conjunction with the purchase of shares of the Company’s newly issued Series B-2 Preferred Stock, the third-party investor executed an additional purchase of 60,765 shares of the Company’s common stock through direct, secondary transfer of shares owned by existing shareholders.

In January 2022, certain existing shareholders converted 14,758 shares of Series Seed stock, with a cost basis of $5.205 per share, into 14,758 shares of the Company’s common stock. These shares of Series Seed converted into common stock, were then transferred by the shareholder to an independent third-party investor through direct, secondary transfer of the shares, as discussed in above.

Accordingly, the common stock transfers between existing shareholders and the third-party investor did not result in any cash proceeds received or issuance costs incurred by the Company. As such, the transfer of shares between the existing shareholders and third-party investor resulted in no impact to the Company’s gross capitalization at December 31, 2022.

In January 2022, in conjunction with the Series B-2 Preferred stock issuance, the Company issued warrants to purchase 30,000 shares of the Company’s common stock at an exercise price of $19.20 per share. The warrants were exercisable immediately at $19.20 with a contractual term of fifteen years.

In March 2022, the Company launched an offering of its common stock under Tier 2 of Regulation A pursuant to an offering statement on Form 1-A qualified by the SEC (the “2022 Common Stock Offering”). Participation in the 2022 Common Stock Offering was limited to existing shareholders. The Company offered shares of common stock at $30.82 per share. As a result of the offering, the Company received gross proceeds of approximately $1.5 million in exchange for the issuance of 49,700 shares of common stock.

In April 2022, the Company issued warrants to purchase 21,000 shares of the Company’s common stock at an exercise price of $19.20 per share. The warrants were exercisable immediately at $19.20 with a contractual term of fifteen years.

In August 2022, the Company further amended and restated its article of incorporation to increase the authorized number of Preferred Stock shares to 2,231,457 and to designate 230,000 of the newly authorized shares as Series B-3 Preferred Stock (“Series B-3 Stock”). The offering closed November 2022. Pursuant to this offering, the Company has received gross proceeds of approximately $2.3 million in exchange for the issuance of 52,265 shares of Series B-3 Stock.

During the 2022, certain holders of 2021 Subordinated Convertible Notes converted their holdings into common stock, at the discretion of the noteholder. Pursuant to the terms of the contractual agreement, Noteholders converted approximately $1.26 million in principal and $0.08 million in accrued interest into 48,394 shares of common stock at a conversion price of $27.74, a 10% discount to the per share price of common stock at the time of conversion.

Groundfloor has incurred losses since its inception, and Groundfloor expects it will continue to incur losses for the foreseeable future. Groundfloor requires cash to meet its operating expenses and for capital expenditures. To date, Groundfloor has funded its cash requirements with proceeds from its convertible note and preferred stock issuances. Groundfloor anticipate that it will continue to incur substantial net losses as it grows the Groundfloor Platform. Groundfloor does not have any committed external source of funds, except as described above. To the extent our capital resources are insufficient to meet its future capital requirements, Groundfloor will need to finance its cash needs through public or private equity offerings or debt financings. Additional equity or debt financing may not be available on acceptable terms, if at all.

Plan of Operation

Prior to September 2015, Groundfloor’s operations were limited to issuing Georgia Notes solely in Georgia to Georgia residents pursuant to an intrastate crowdfunding exemption from registration under the Securities Act and qualification under Georgia law. On September 7, 2015, the SEC qualified Groundfloor’s first offering statement on Form 1-A covering seven separate series of LROs corresponding to the same number of Projects in eight states and the District of Columbia. Subsequently, Groundfloor has not issued, and do not intend to issue in the future, any additional Georgia Notes. Since that time, Groundfloor has qualified two additional offering statements on Form 1-A in addition to an offering statement on Form 1-A qualified for GRE 1, its wholly-owned subsidiary, in each case under Tier 1 of Regulation A. In January 2018, Groundfloor’s offering statement relating to the offer and sale of limited recourse obligations (the “LRO Offering Circular”) was qualified by the SEC under Tier 2 of Regulation A, raising the annual aggregate amount of LROs which Groundfloor may offer and sell to $50 million, less any other securities sold by Groundfloor under Regulation A. Groundfloor has filed, and intends to continue to file, post-qualification amendments to the LRO Offering Circular on a regular basis to include additional series of LROs. Groundfloor expect to expand the number of states in which Groundfloor offers and sells LROs during the next 12 months. With this increased geographic footprint, Groundfloor expects that the number of borrowers and corresponding investors, and the volume of loans originated through the Groundfloor Platform, will increase and generate increased revenue from borrower origination and servicing fees.

As the volume of Groundfloor loans and corresponding offerings increase, Groundfloor plans to continue the current strategy of raising equity and, in limited circumstances, debt financing to finance our operations until Groundfloor reaches profitability and becomes cash-flow positive, which Groundfloor does not expect to occur before 2023. Future equity or debt offerings by Groundfloor will be necessary to fund the significant investments in website development, security, investor sourcing, loan processing and marketing necessary to reach profitability.

Off-Balance Sheet Arrangements

We did not maintain any relationships with unconsolidated entities or financial partnerships, such as entities often referred to as structured finance or special purpose entities, established for the purpose of facilitating off-balance sheet arrangements or other contractually narrow or limited purposes. Further, we have not guaranteed any obligations of unconsolidated entities, nor do we have any commitment or intent to provide funding to any such entities.

GROUNDFLOOR FINANCE INC.

AND SUBSIDIARIES

Consolidated Financial Statements

December 31, 2022 and 2021

GROUNDFLOOR FINANCE INC. AND SUBSIDIARIES

Table of Contents

December 31, 2022 and 2021

To the Board of Directors

Groundfloor Finance, Inc. and Subsidiaries

Atlanta, Georgia

Opinion

We have audited the accompanying consolidated financial statements of Groundfloor Finance, Inc. and Subsidiaries (the “Company”), which comprise the consolidated balance sheets as of December 31, 2022 and 2021 and the related statements of operations, stockholders’ equity (deficit), and cash flows for the years then ended, and the related notes to the consolidated financial statements.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the consolidated financial statements are available to be issued.

Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with generally accepted auditing standards will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements.

F-1

In performing an audit in accordance with generally accepted auditing standards, we:

| · | Exercise professional judgment and maintain professional skepticism throughout the audit. |

| · | Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. |

| · | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. |

| · | Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. |

| · | Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. |

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit.

Substantial Doubt about the Company’s Ability to Continue as a Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company has incurred losses and cash outflows from operations since its inception which result in substantial doubt about the ability of the Company to continue as a going concern. Management’s evaluation of the events and conditions and management’s plans regarding those matters also are described in Note 1. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our opinion is not modified with respect to that matter.

Atlanta, Georgia

March 6, 2023

F-2

GROUNDFLOOR FINANCE INC. AND SUBSIDIARIES

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash (1) | $ | 4,466,138 | $ | 2,641,950 | ||||

| Loans to developers (1) | 240,494,116 | 176,431,710 | ||||||

| Allowance for loans to developers (1) | (6,046,819 | ) | (3,164,650 | ) | ||||

| Interest receivable on loans to developers (1) | 21,646,364 | 11,790,202 | ||||||

| Other current assets | 5,503,935 | 3,580,237 | ||||||

| Total current assets | 266,063,734 | 191,279,449 | ||||||

| Property, equipment, software, website, and intangible assets, net | 3,086,790 | 1,645,617 | ||||||

| Other assets | 71,302 | 71,302 | ||||||

| Total assets | $ | 269,221,826 | $ | 192,996,368 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses (1) | $ | 4,335,534 | $ | 5,147,829 | ||||

| Limited recourse obligations | 139,296,385 | 111,982,315 | ||||||

| Allowance for limited recourse obligations | (7,363,829 | ) | (3,636,146 | ) | ||||

| Accrued interest on limited recourse obligations | 10,068,526 | 6,943,896 | ||||||

| Short-term notes payable | 87,460,880 | 67,911,273 | ||||||

| Convertible notes, net of discount of $142,636 and $490,783 | 3,596,195 | 4,509,217 | ||||||

| Total current liabilities | 237,393,691 | 192,858,384 | ||||||

| Long-term notes payable | 22,325,700 | - | ||||||

| Other liabilities | 23,857 | 134,865 | ||||||

| Total liabilities | 259,743,248 | 192,993,249 | ||||||

| Commitments and contingencies (See Note 13) | ||||||||

| Stockholders’ equity: | ||||||||

| Series B-2 convertible preferred stock, no par, 243,348 shares designated, 189,270 shares issued and outstanding (liquidation preference of $5,833,301) | 5,754,564 | - | ||||||

| Series B convertible preferred stock, no par, 441,940 shares designated, 441,940 shares issued and outstanding (liquidation preference of $8,056,566) | 7,429,483 | 7,429,483 | ||||||

| Series A convertible preferred stock, no par, 747,373 shares designated, 747,373 shares issued and outstanding (liquidation preference of $4,999,925) | 4,962,435 | 4,962,435 | ||||||

| Series Seed convertible preferred stock, no par, 568,796 shares designated, 554,038 shares issued and outstanding (liquidation preference of $2,883,678) | 2,537,150 | 2,609,091 | ||||||

| Series B-3 convertible preferred stock, no par, 230,000 shares designated, 52,265 shares issued and outstanding (liquidation preference of $2,294,434) | 2,137,320 | - | ||||||

| Common stock, no par, 30,000,000 shares authorized, 2,345,402 issued and outstanding | 14,867,107 | 11,895,593 | ||||||

| Additional paid-in capital | 5,776,928 | 3,310,258 | ||||||

| Accumulated deficit | (35,574,099 | ) | (30,203,181 | ) | ||||

| Stock subscription receivable | (560 | ) | (560 | ) | ||||

| Company’s stockholders’ equity | 7,890,328 | 3,119 | ||||||

| Non-controlling interest in consolidated variable interest entities | 1,588,250 | - | ||||||

| Total stockholders’ equity | 9,478,578 | 3,119 | ||||||

| Total liabilities and stockholders’ equity | $ | 269,221,826 | $ | 192,996,368 | ||||

| (1) | Includes amounts of the consolidated variable interest entity (VIE), presented separately in Note 3 below. |

See accompanying notes to consolidated financial statements

F-3

GROUNDFLOOR FINANCE INC. AND SUBSIDIARIES

Consolidated Statements of Operations

| Year Ended December 31, | ||||||||

| 2022 | 2021 | |||||||

| Non-interest revenue: | ||||||||

| Origination fees | $ | 11,162,166 | $ | 4,769,504 | ||||

| Loan servicing revenue | 3,200,879 | 2,887,096 | ||||||

| Total non-interest revenue | 14,363,045 | 7,656,600 | ||||||

| Net interest income: | ||||||||

| Interest income | 28,234,268 | 15,731,444 | ||||||

| Interest expense | (20,804,590 | ) | (12,167,945 | ) | ||||

| Net interest income | 7,429,678 | 3,563,499 | ||||||

| Revenue | 21,792,723 | 11,220,099 | ||||||

| Cost of revenue | (2,040,488 | ) | (1,363,150 | ) | ||||

| Gross profit | 19,752,235 | 9,856,949 | ||||||

| Operating expenses: | ||||||||

| General and administrative | 9,181,673 | 4,417,525 | ||||||

| Sales and customer support | 4,487,185 | 3,404,287 | ||||||

| Development | 4,282,870 | 1,638,327 | ||||||

| Regulatory | 674,149 | 378,911 | ||||||

| Marketing and promotions | 4,915,342 | 4,251,831 | ||||||

| Total operating expenses | 23,541,219 | 14,090,881 | ||||||

| Loss from operations | (3,788,984 | ) | (4,233,932 | ) | ||||

| Other (expense) income: | ||||||||

| Interest expense on corporate debt instruments | (840,684 | ) | (543,942 | ) | ||||

| Gain on loan extinguishment | 829,000 | 829,100 | ||||||

| Total other (expense) income, net | (11,684 | ) | 285,158 | |||||

| Net loss | (3,800,668 | ) | (3,948,774 | ) | ||||

| Less: Net income attributable to non-controlling interest in consolidation VIE | 1,570,250 | - | ||||||

| Net loss attributable to Groundfloor Finance, Inc. | $ | (5,370,918 | ) | $ | (3,948,774 | ) | ||

See accompanying notes to consolidated financial statements

F-4

GROUNDFLOOR FINANCE INC. AND SUBSIDIARIES

Consolidated Statements of Stockholders’ Equity (Deficit)

| Convertible | Company | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred Stock | Additional | Stock | Stockholders’ | Non-Controlling | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series B-2 | Series A | Series B | Series Seed | Series B-3 | Common Stock | Paid-in | Accumulated | Subscription | Equity | Interest in | Stockholders’ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Receivable | (Deficit) | Consolidated VIE | Equity (Deficit) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders’ equity (deficit) as of December 31, 2020 | - | $ | - | 747,373 | $ | 4,962,435 | 188,036 | $ | 3,145,092 | 568,796 | $ | 2,609,091 | - | $ | - | 2,165,923 | $ | 11,596,087 | $ | 2,336,551 | $ | (26,254,407 | ) | $ | (560 | ) | $ | (1,605,711 | ) | $ | - | $ | (1,605,711 | ) | ||||||||||||||||||||||||||||||||||||||

| Issuance of Series B preferred shares, net of offering costs | - | - | - | - | 236,976 | 3,975,794 | - | - | - | - | - | - | - | - | - | 3,975,794 | - | 3,975,794 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Conversion of convertible notes | - | - | - | - | 16,928 | 308,597 | - | - | - | - | 11,222 | 183,325 | - | - | - | 491,922 | - | 491,922 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exercise of stock options | - | - | - | - | - | - | - | - | - | - | 7,825 | 68,180 | - | - | 68,180 | - | 68,180 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation expense | - | - | - | - | - | - | - | - | - | - | - | - | 418,151 | - | - | 418,151 | - | 418,151 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Conversion of Warrants | - | - | - | - | - | - | - | - | - | - | 7,175 | 48,001 | - | - | - | 48,001 | - | 48,001 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Beneficial conversion feature | - | - | - | - | - | - | - | - | - | - | - | - | 555,556 | - | - | 555,556 | - | 555,556 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | - | - | - | - | - | - | (3,948,774 | ) | - | (3,948,774 | ) | - | (3,948,774 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders’ equity as of December 31, 2021 | - | $ | - | 747,373 | $ | 4,962,435 | 441,940 | $ | 7,429,483 | 568,796 | $ | 2,609,091 | - | $ | - | 2,192,145 | $ | 11,895,593 | $ | 3,310,258 | $ | (30,203,181 | ) | $ | (560 | ) | $ | 3,119 | $ | - | $ | 3,119 | ||||||||||||||||||||||||||||||||||||||||

| Issuance of Series B-2 preferred shares, net of offering costs | 189,270 | 5,754,564 | - | - | - | - | - | - | - | - | - | - | - | - | - | 5,754,564 | - | 5,754,564 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of Series B-3 preferred shares, net of offering costs | - | - | - | - | - | - | - | - | 52,265 | 2,137,320 | - | - | - | - | - | 2,137,320 | - | 2,137,320 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance in the 2022 Common Stock Offering, net of offering costs | - | - | - | - | - | - | - | - | - | - | 49,700 | 1,531,754 | - | - | - | 1,531,754 | - | 1,531,754 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Conversion of convertible notes | - | - | - | - | - | - | - | - | - | - | 48,394 | 1,342,579 | - | - | - | 1,342,579 | - | 1,342,579 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exercise of stock options and warrants | - | - | - | - | - | - | - | - | - | - | 33,461 | 25,240 | - | - | 25,240 | - | 25,240 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Conversion of Series Seed Shares to Common Stock | - | - | - | - | - | - | (14,758 | ) | (71,941 | ) | - | - | 14,758 | 71,941 | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of restricted stock units | - | - | - | - | - | - | - | - | - | - | 6,944 | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation expense | - | - | - | - | - | - | - | - | - | - | - | - | 2,466,670 | - | - | 2,466,670 | - | 2,466,670 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Increase in non-controlling interest related to initial consolidation of VIE | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 18,000 | 18,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | - | - | - | - | - | - | (5,370,918 | ) | - | (5,370,918 | ) | 1,570,250 | (3,800,668 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders’ equity as of December 31, 2022 | 189,270 | $ | 5,754,564 | 747,373 | $ | 4,962,435 | 441,940 | $ | 7,429,483 | 554,038 | $ | 2,537,150 | 52,265 | $ | 2,137,320 | 2,345,402 | $ | 14,867,107 | $ | 5,776,928 | $ | (35,574,099 | ) | $ | (560 | ) | $ | 7,890,328 | $ | 1,588,250 | $ | 9,478,578 | ||||||||||||||||||||||||||||||||||||||||

See accompanying notes to consolidated financial statements

F-5

GROUNDFLOOR FINANCE INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

| Year Ended December 31, | ||||||||

| 2022 | 2021 | |||||||

| Cash flows from operating activities | ||||||||

| Net loss | $ | (3,800,668 | ) | $ | (3,948,774 | ) | ||

| Adjustments to reconcile net loss to net cash flows from operating activities: | ||||||||

| Depreciation and amortization | 1,226,991 | 760,380 | ||||||

| Share-based compensation | 2,466,670 | 418,151 | ||||||

| Noncash interest expense | 348,147 | 191,125 | ||||||

| (Gain) Loss on sale of real estate owned | - | (96,000 | ) | |||||

| Origination of loans held for sale | - | (3,201,856 | ) | |||||

| Proceeds from sales of loans held for sale | - | 5,524,200 | ||||||

| Gain on forgiveness of PPP loan | (829,000 | ) | (829,100 | ) | ||||

| Changes in operating assets and liabilities: | ||||||||

| Other assets | (838,287 | ) | (719,370 | ) | ||||

| Interest receivable on loans to developers | (9,856,162 | ) | (8,244,747 | ) | ||||

| Accounts payable and accrued expenses | (841,892 | ) | 2,954,208 | |||||

| Accrued interest on limited recourse obligations | 3,124,630 | 4,111,912 | ||||||

| Net cash flows from operating activities | (8,999,571 | ) | (3,079,871 | ) | ||||

| Cash flows from investing activities | ||||||||

| Loan payments to developers | (266,090,771 | ) | (198,289,297 | ) | ||||

| Repayments of loans from developers | 197,068,620 | 81,885,591 | ||||||

| Proceeds from sale of properties held for sale | 2,995,188 | 3,767,091 | ||||||

| Payments of software and website development costs | (2,668,163 | ) | (1,247,488 | ) | ||||

| Purchases of computer equipment and furniture and fixtures | - | (101,933 | ) | |||||

| Other investing activities | 21,630 | 155,040 | ||||||

| Cash received from initial consolidation of VIE | 30,000 | - | ||||||

| Net cash flows from investing activities | (68,643,496 | ) | (113,830,996 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from limited recourse obligations | 187,412,229 | 142,331,517 | ||||||

| Repayments of limited recourse obligations | (160,098,160 | ) | (79,937,095 | ) | ||||

| Proceeds from GROUNDFLOOR Notes | 151,536,470 | 106,252,110 | ||||||

| Repayments on GROUNDFLOOR Notes | (132,171,910 | ) | (79,133,490 | ) | ||||

| Proceeds from Stairs Notes | 23,339,748 | 20,985,833 | ||||||

| Repayments of 2019 convertible notes | - | (2,296,205 | ) | |||||

| Proceeds from issuance of 2021 convertible notes | - | 5,000,000 | ||||||

| Proceeds from issuance of Series B convertible preferred stock, net of offering costs | - | 3,975,794 | ||||||

| Proceeds from issuance of Series B-2 convertible preferred stock, net of offering costs | 5,754,564 | - | ||||||

| Proceeds from issuance of Series B-3 convertible preferred stock, net of offering costs | 2,137,320 | - | ||||||

| Proceeds from issuance of common stock, net of offering costs | 1,531,754 | - | ||||||

| Proceeds from loan under Paycheck Protection Program | - | 829,000 | ||||||

| Proceeds from the exercise of stock options and warrants | 25,240 | 116,181 | ||||||

| Net cash flows from financing activities | 79,467,255 | 118,123,645 | ||||||

| Net increase (decrease) in cash | 1,824,188 | 1,212,778 | ||||||

| Cash as of beginning of the year | 2,641,950 | 1,429,172 | ||||||

| Cash as of end of the year | $ | 4,466,138 | $ | 2,641,950 | ||||

| Supplemental cash flow disclosures: | ||||||||

| Cash paid for interest | $ | 7,050,256 | $ | 2,788,431 | ||||

| Supplemental disclosure of noncash investing and financing activities: | ||||||||

| Loans to developers transferred to other real estate owned | $ | 4,960,000 | $ | 4,239,270 | ||||

| Write-down of loans to developers and limited recourse obligations | 367,699 | 544,595 | ||||||

| Write-down of interest receivable on loans to developers and accrued interest on limited recourse obligations | 751,351 | 190,897 | ||||||

| Noncash exercise of warrants | 52,442 | - | ||||||

| Cashless vesting of restricted stock | 133,325 | - | ||||||

| Conversion of convertible notes payable and accrued interest into common stock or Series B convertible preferred stock | 1,342,580 | 491,922 | ||||||

| Increase (decrease) in allowance for loan to developers | 2,882,169 | (195,350 | ) | |||||