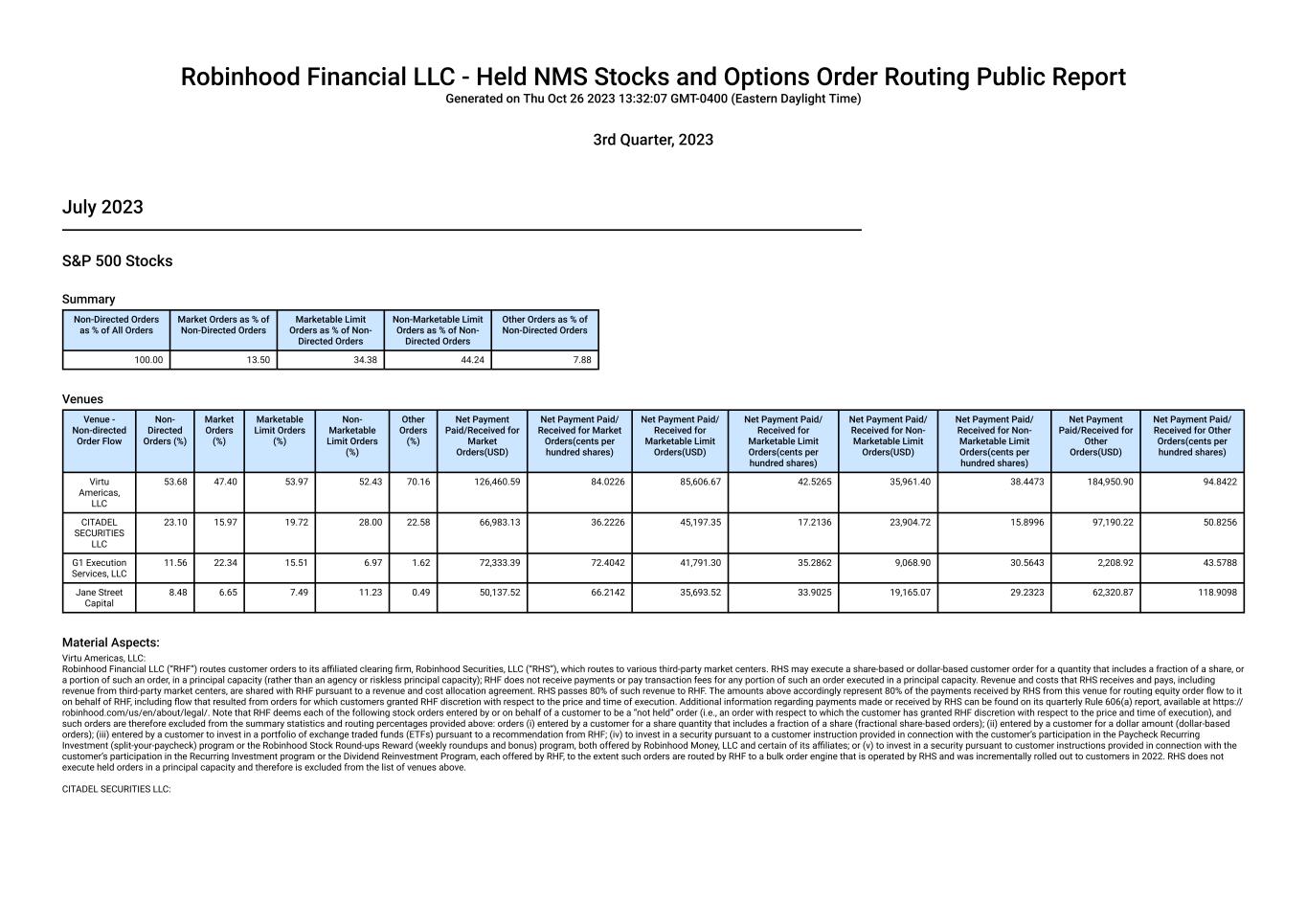

Robinhood Financial LLC - Held NMS Stocks and Options Order Routing Public Report Generated on Thu Oct 26 2023 13:32:07 GMT-0400 (Eastern Daylight Time) 3rd Quarter, 2023 July 2023 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 13.50 34.38 44.24 7.88 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 53.68 47.40 53.97 52.43 70.16 126,460.59 84.0226 85,606.67 42.5265 35,961.40 38.4473 184,950.90 94.8422 CITADEL SECURITIES LLC 23.10 15.97 19.72 28.00 22.58 66,983.13 36.2226 45,197.35 17.2136 23,904.72 15.8996 97,190.22 50.8256 G1 Execution Services, LLC 11.56 22.34 15.51 6.97 1.62 72,333.39 72.4042 41,791.30 35.2862 9,068.90 30.5643 2,208.92 43.5788 Jane Street Capital 8.48 6.65 7.49 11.23 0.49 50,137.52 66.2142 35,693.52 33.9025 19,165.07 29.2323 62,320.87 118.9098 Material Aspects: Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. CITADEL SECURITIES LLC:

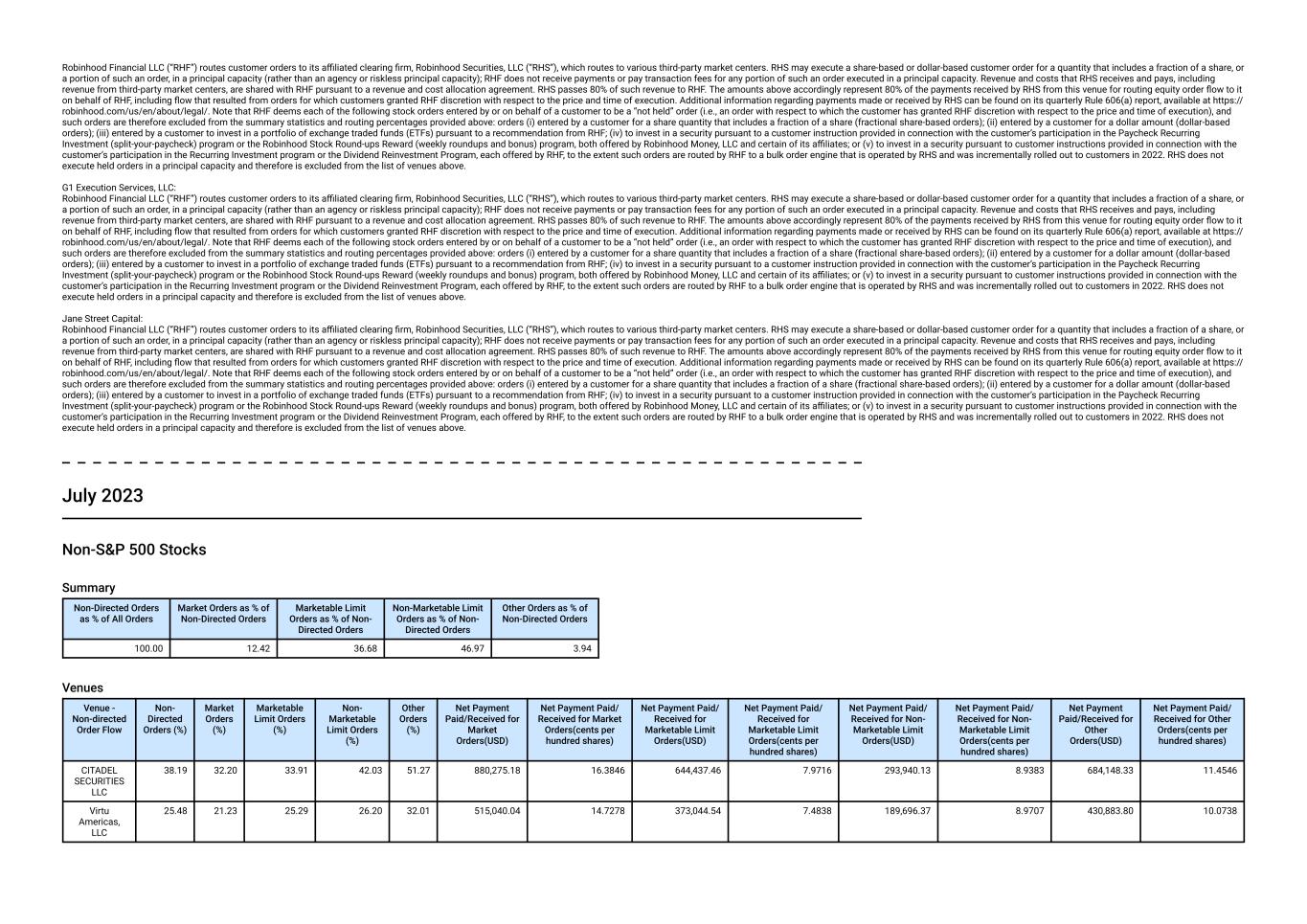

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. July 2023 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 12.42 36.68 46.97 3.94 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 38.19 32.20 33.91 42.03 51.27 880,275.18 16.3846 644,437.46 7.9716 293,940.13 8.9383 684,148.33 11.4546 Virtu Americas, LLC 25.48 21.23 25.29 26.20 32.01 515,040.04 14.7278 373,044.54 7.4838 189,696.37 8.9707 430,883.80 10.0738

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Jane Street Capital 25.27 21.83 26.73 26.90 3.00 706,375.57 13.2908 496,982.82 6.1501 241,117.21 7.4026 436,530.64 7.7577 G1 Execution Services, LLC 6.04 13.11 8.03 2.91 2.45 338,947.41 14.4364 207,176.82 7.7674 50,993.50 9.1344 12,156.16 11.1887 Material Aspects: CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. July 2023

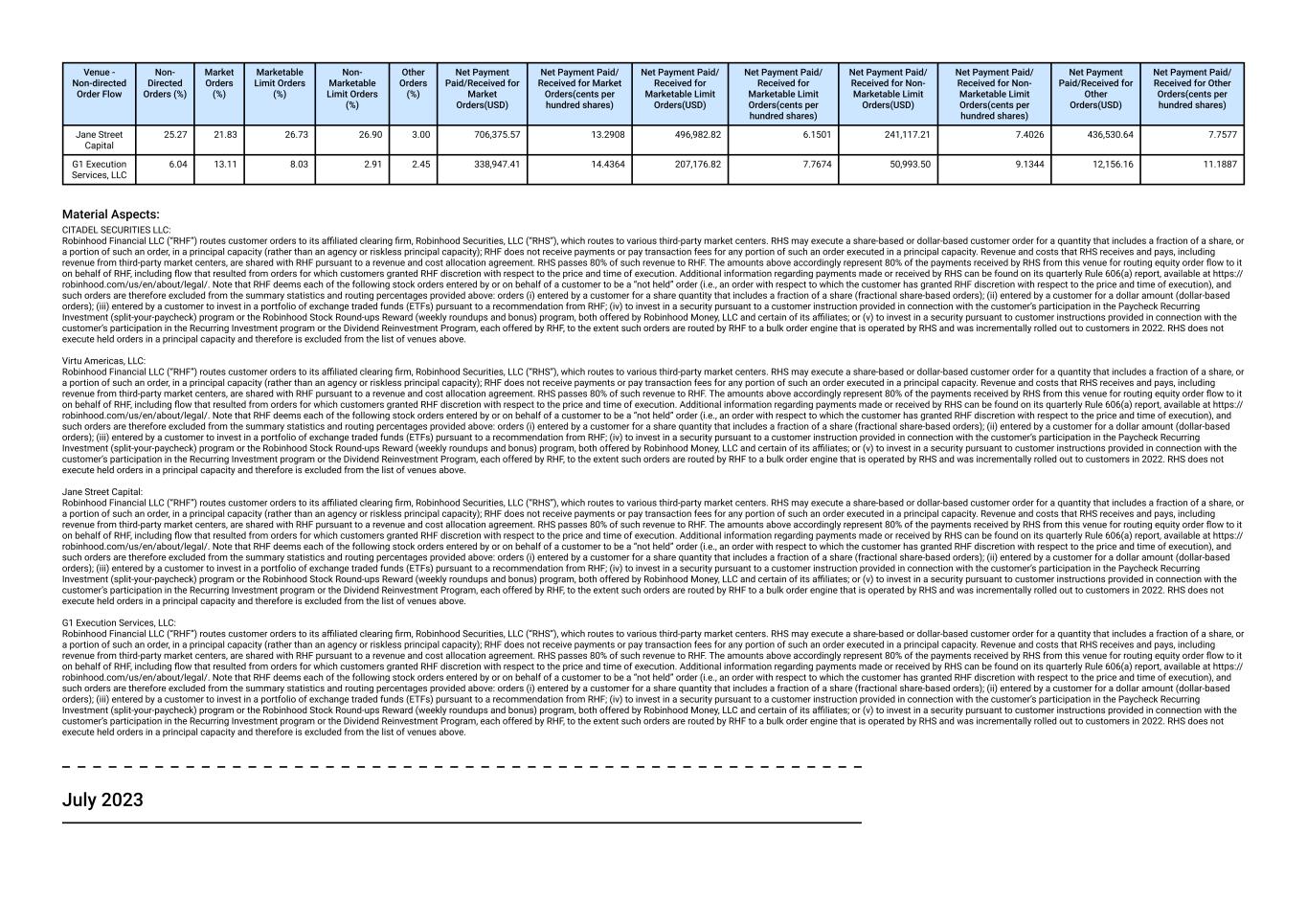

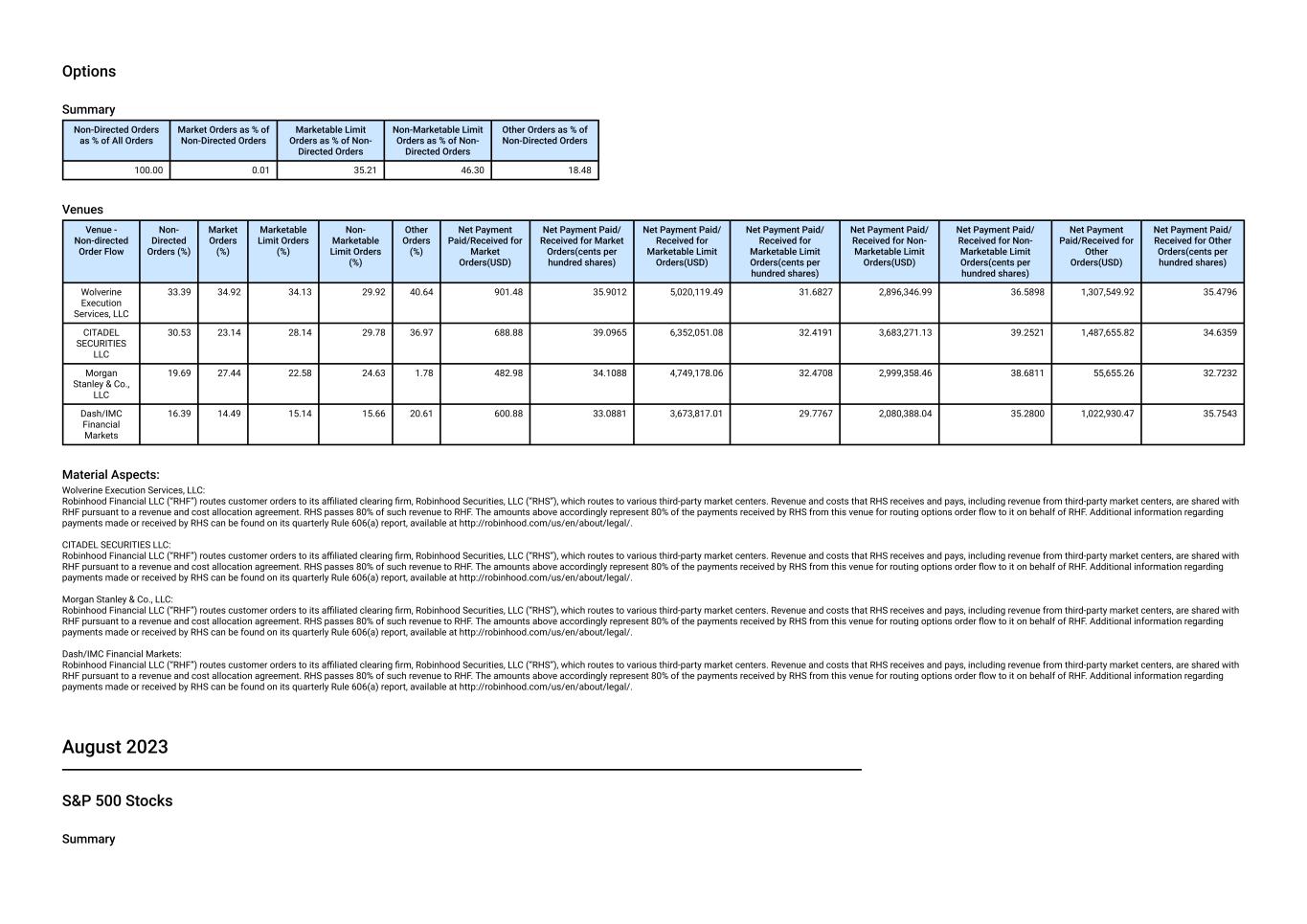

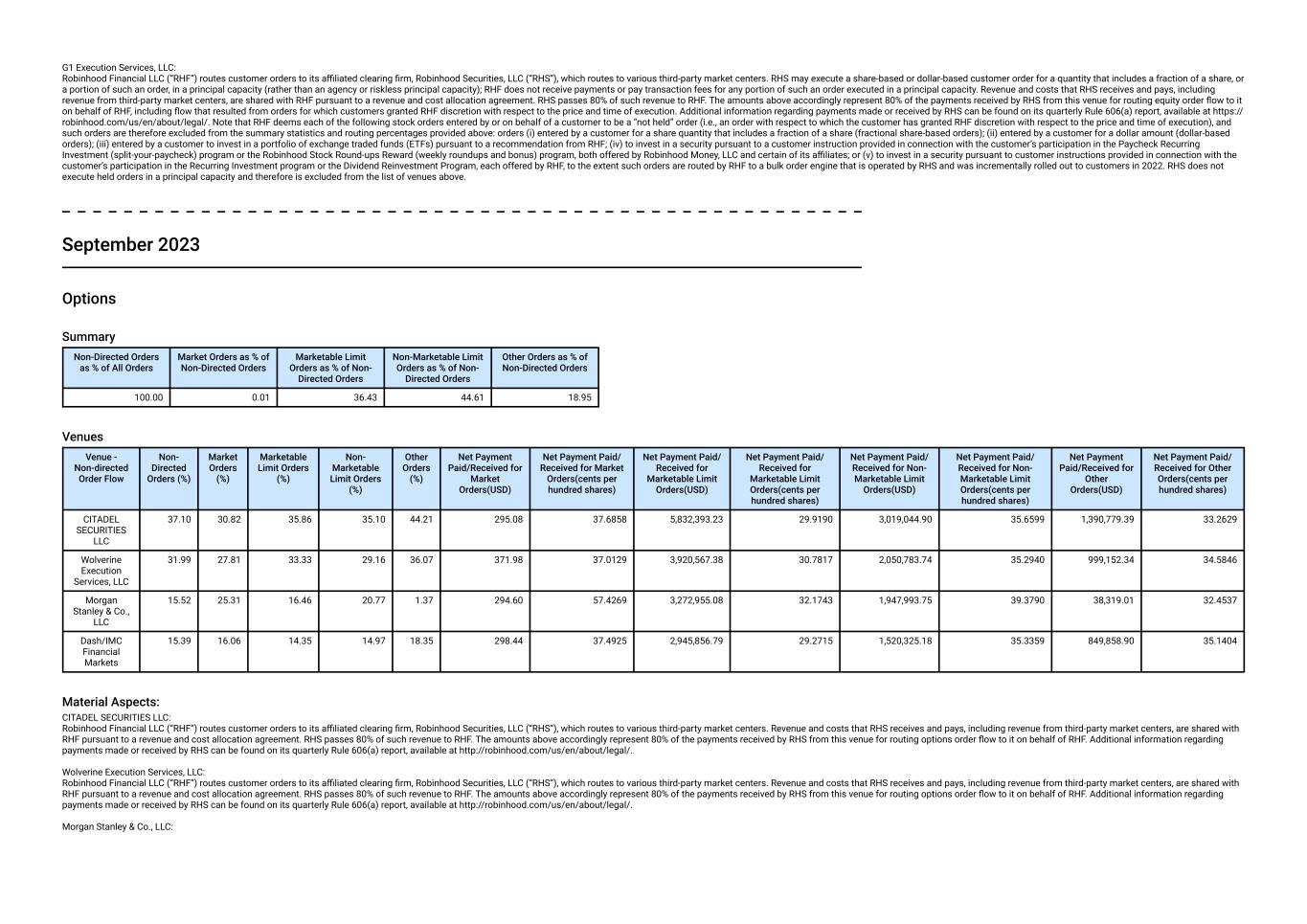

Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.01 35.21 46.30 18.48 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Wolverine Execution Services, LLC 33.39 34.92 34.13 29.92 40.64 901.48 35.9012 5,020,119.49 31.6827 2,896,346.99 36.5898 1,307,549.92 35.4796 CITADEL SECURITIES LLC 30.53 23.14 28.14 29.78 36.97 688.88 39.0965 6,352,051.08 32.4191 3,683,271.13 39.2521 1,487,655.82 34.6359 Morgan Stanley & Co., LLC 19.69 27.44 22.58 24.63 1.78 482.98 34.1088 4,749,178.06 32.4708 2,999,358.46 38.6811 55,655.26 32.7232 Dash/IMC Financial Markets 16.39 14.49 15.14 15.66 20.61 600.88 33.0881 3,673,817.01 29.7767 2,080,388.04 35.2800 1,022,930.47 35.7543 Material Aspects: Wolverine Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Morgan Stanley & Co., LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Dash/IMC Financial Markets: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. August 2023 S&P 500 Stocks Summary

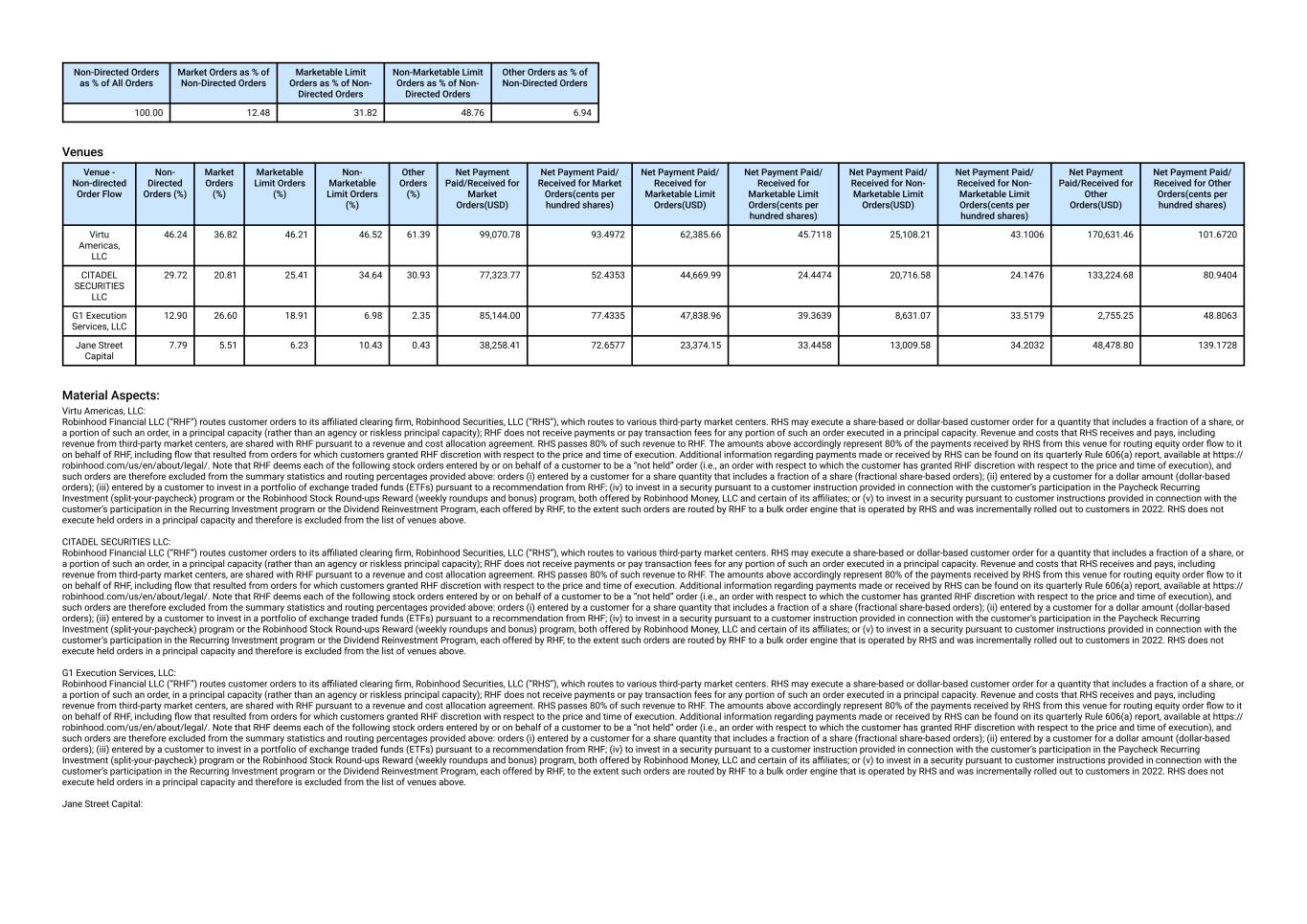

Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 12.48 31.82 48.76 6.94 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 46.24 36.82 46.21 46.52 61.39 99,070.78 93.4972 62,385.66 45.7118 25,108.21 43.1006 170,631.46 101.6720 CITADEL SECURITIES LLC 29.72 20.81 25.41 34.64 30.93 77,323.77 52.4353 44,669.99 24.4474 20,716.58 24.1476 133,224.68 80.9404 G1 Execution Services, LLC 12.90 26.60 18.91 6.98 2.35 85,144.00 77.4335 47,838.96 39.3639 8,631.07 33.5179 2,755.25 48.8063 Jane Street Capital 7.79 5.51 6.23 10.43 0.43 38,258.41 72.6577 23,374.15 33.4458 13,009.58 34.2032 48,478.80 139.1728 Material Aspects: Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital:

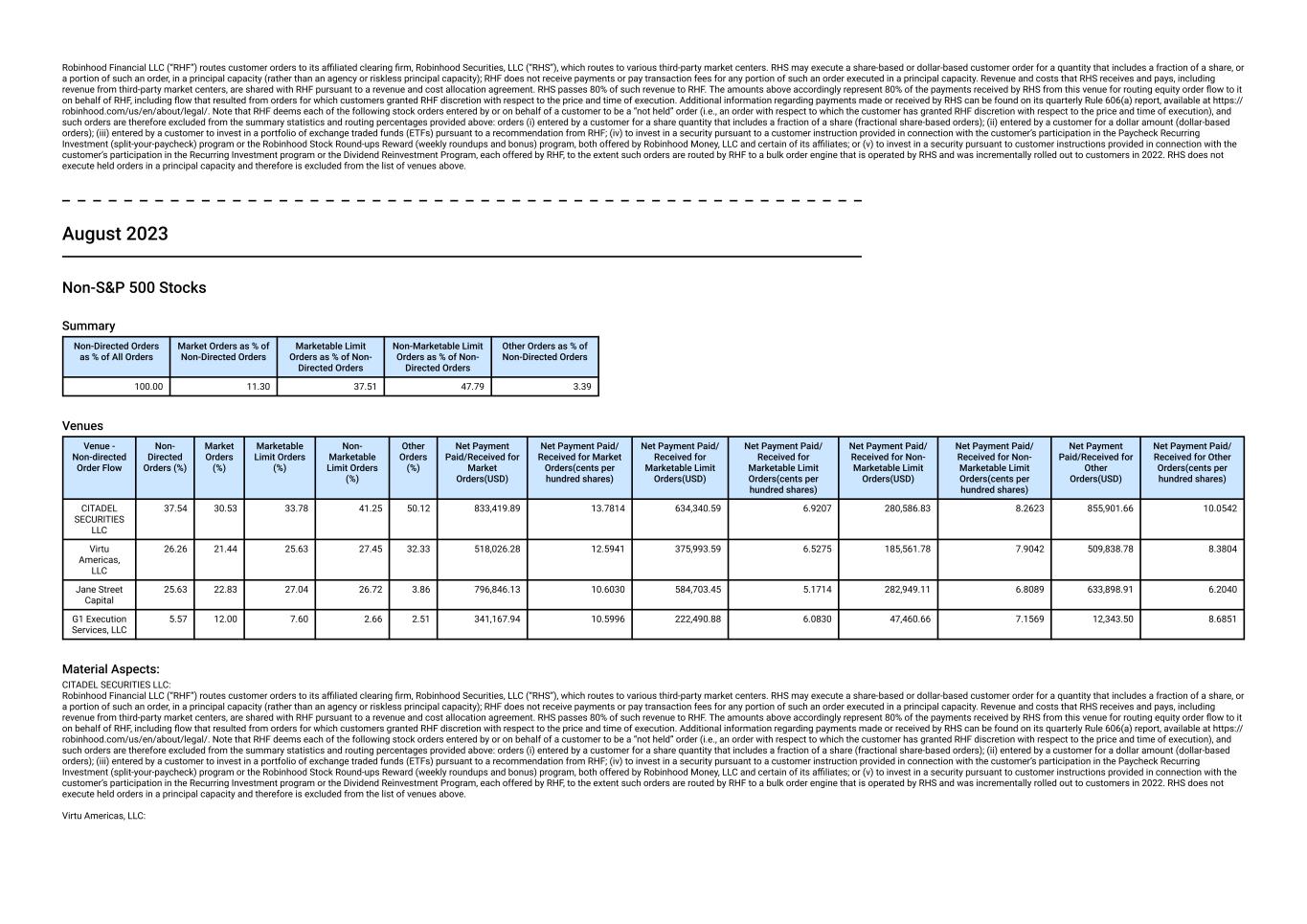

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. August 2023 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 11.30 37.51 47.79 3.39 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 37.54 30.53 33.78 41.25 50.12 833,419.89 13.7814 634,340.59 6.9207 280,586.83 8.2623 855,901.66 10.0542 Virtu Americas, LLC 26.26 21.44 25.63 27.45 32.33 518,026.28 12.5941 375,993.59 6.5275 185,561.78 7.9042 509,838.78 8.3804 Jane Street Capital 25.63 22.83 27.04 26.72 3.86 796,846.13 10.6030 584,703.45 5.1714 282,949.11 6.8089 633,898.91 6.2040 G1 Execution Services, LLC 5.57 12.00 7.60 2.66 2.51 341,167.94 10.5996 222,490.88 6.0830 47,460.66 7.1569 12,343.50 8.6851 Material Aspects: CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Virtu Americas, LLC:

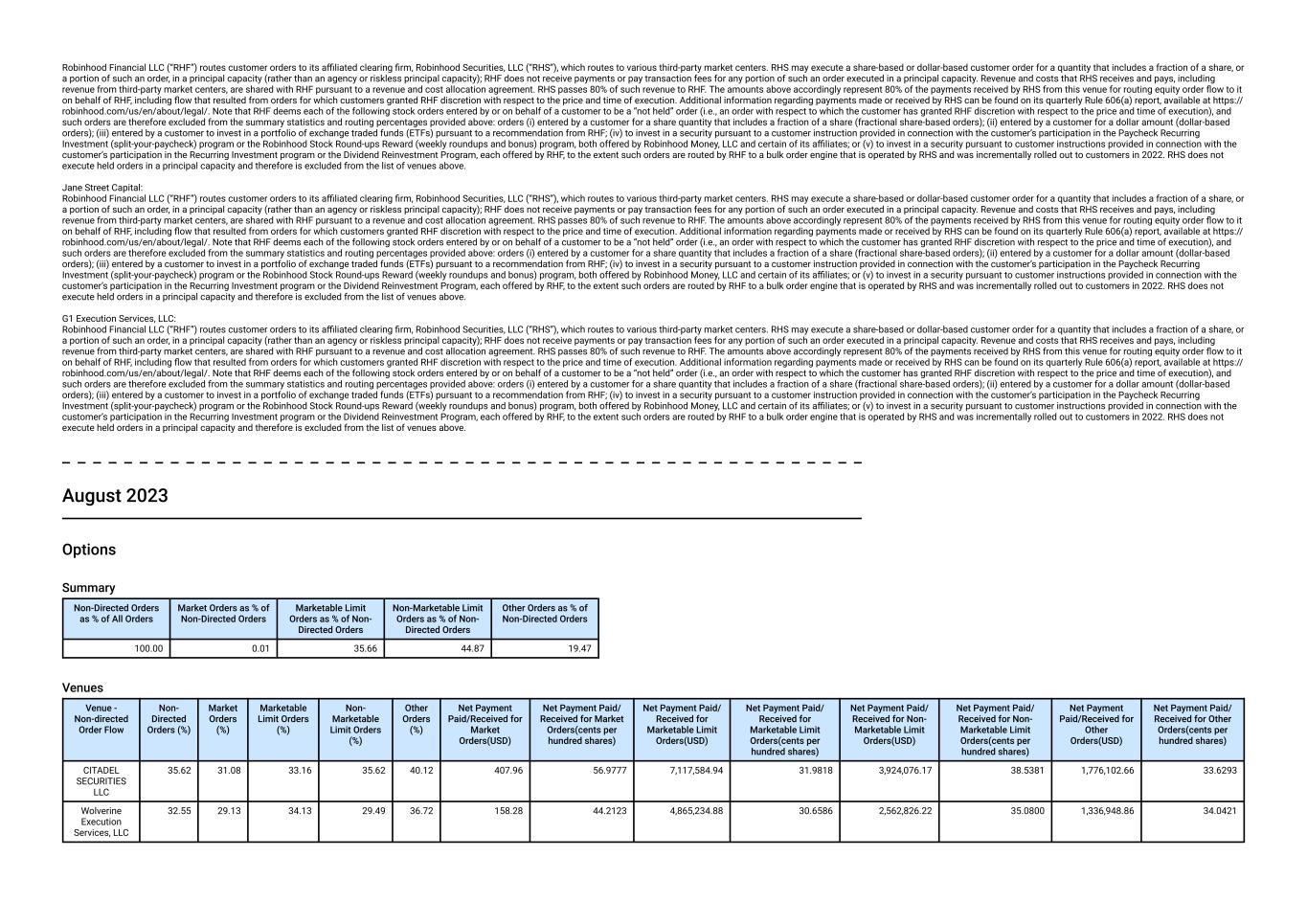

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. August 2023 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.01 35.66 44.87 19.47 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 35.62 31.08 33.16 35.62 40.12 407.96 56.9777 7,117,584.94 31.9818 3,924,076.17 38.5381 1,776,102.66 33.6293 Wolverine Execution Services, LLC 32.55 29.13 34.13 29.49 36.72 158.28 44.2123 4,865,234.88 30.6586 2,562,826.22 35.0800 1,336,948.86 34.0421

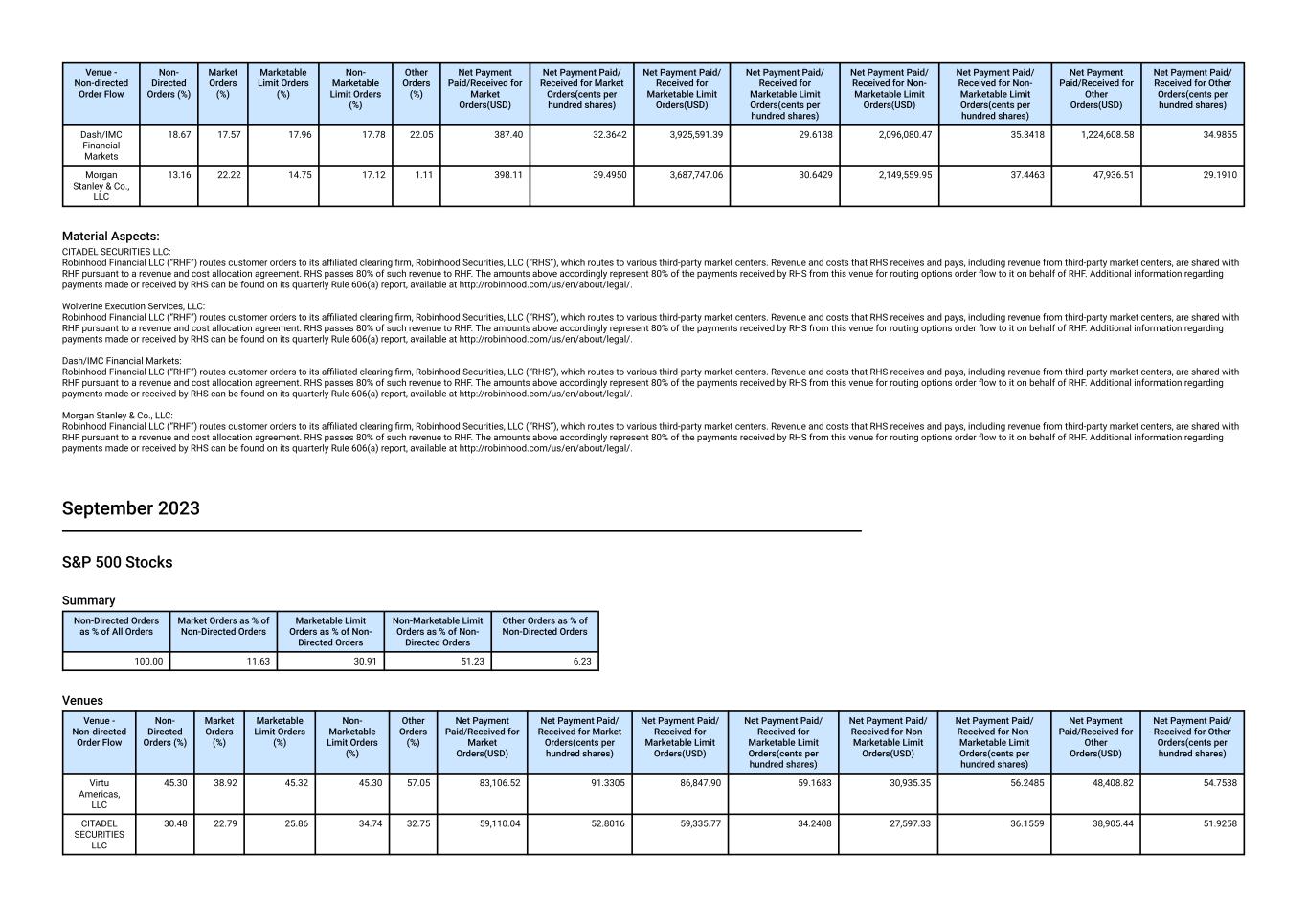

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Dash/IMC Financial Markets 18.67 17.57 17.96 17.78 22.05 387.40 32.3642 3,925,591.39 29.6138 2,096,080.47 35.3418 1,224,608.58 34.9855 Morgan Stanley & Co., LLC 13.16 22.22 14.75 17.12 1.11 398.11 39.4950 3,687,747.06 30.6429 2,149,559.95 37.4463 47,936.51 29.1910 Material Aspects: CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Wolverine Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Dash/IMC Financial Markets: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Morgan Stanley & Co., LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. September 2023 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 11.63 30.91 51.23 6.23 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 45.30 38.92 45.32 45.30 57.05 83,106.52 91.3305 86,847.90 59.1683 30,935.35 56.2485 48,408.82 54.7538 CITADEL SECURITIES LLC 30.48 22.79 25.86 34.74 32.75 59,110.04 52.8016 59,335.77 34.2408 27,597.33 36.1559 38,905.44 51.9258

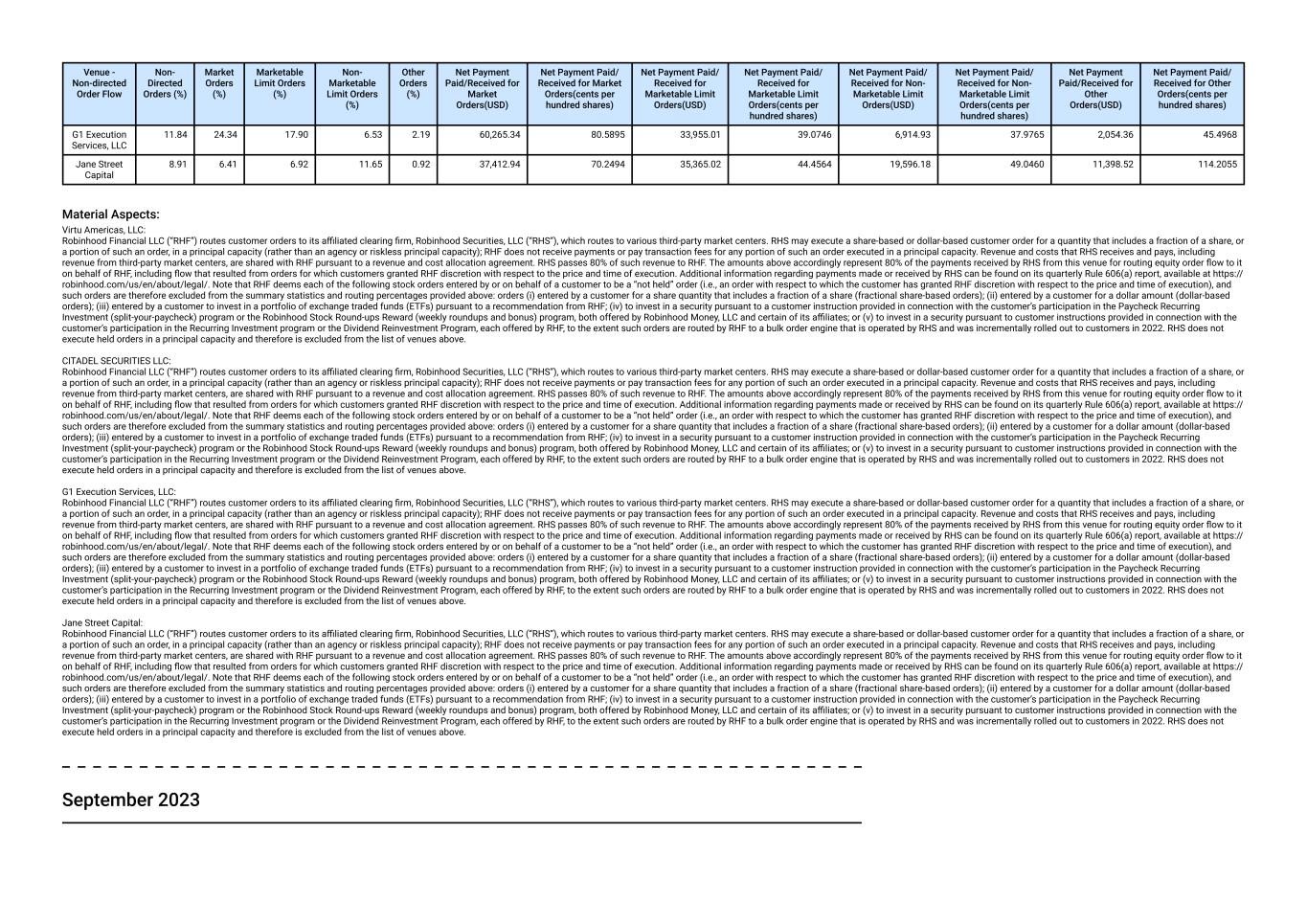

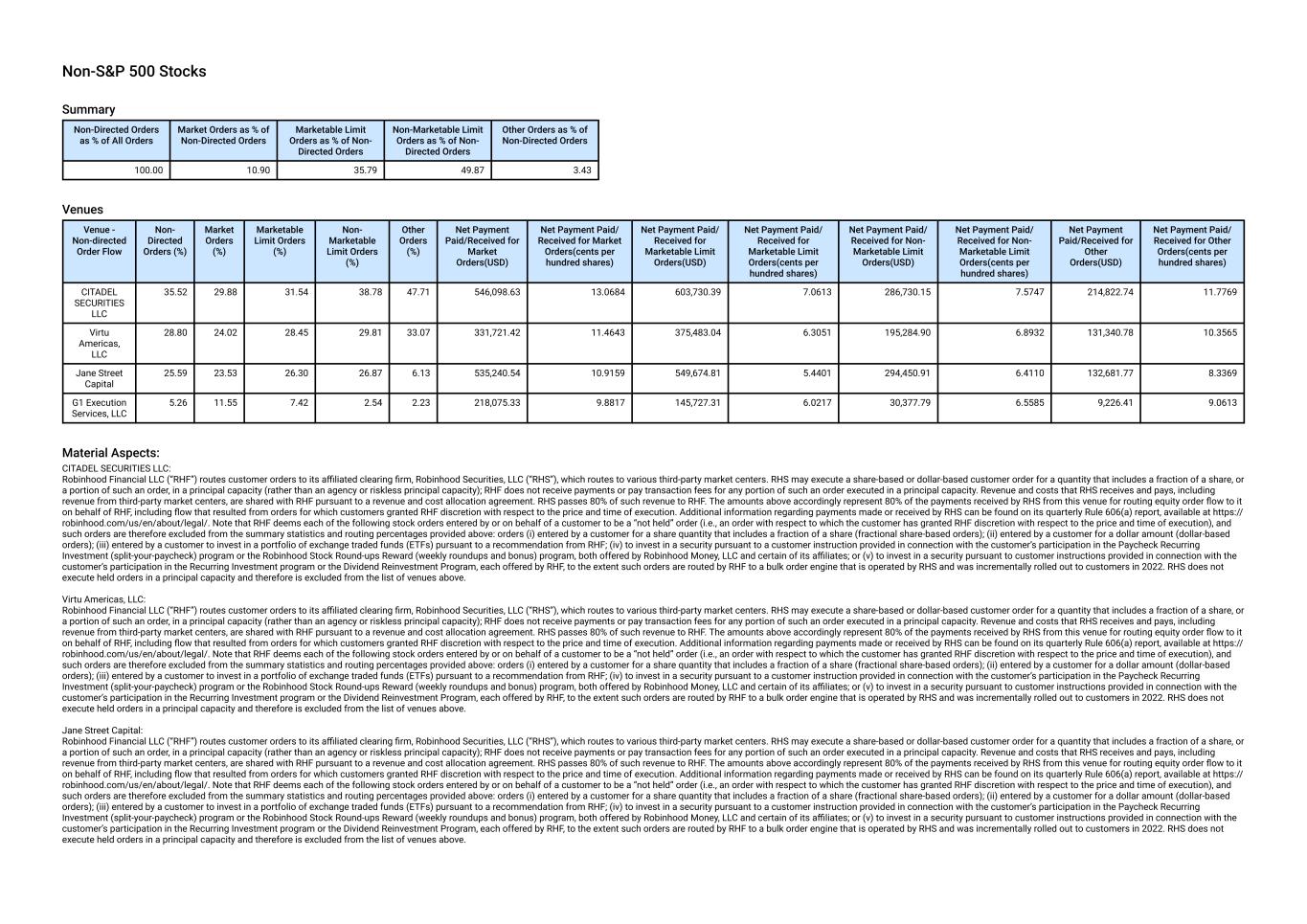

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) G1 Execution Services, LLC 11.84 24.34 17.90 6.53 2.19 60,265.34 80.5895 33,955.01 39.0746 6,914.93 37.9765 2,054.36 45.4968 Jane Street Capital 8.91 6.41 6.92 11.65 0.92 37,412.94 70.2494 35,365.02 44.4564 19,596.18 49.0460 11,398.52 114.2055 Material Aspects: Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups Reward (weekly roundups and bonus) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (v) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. September 2023