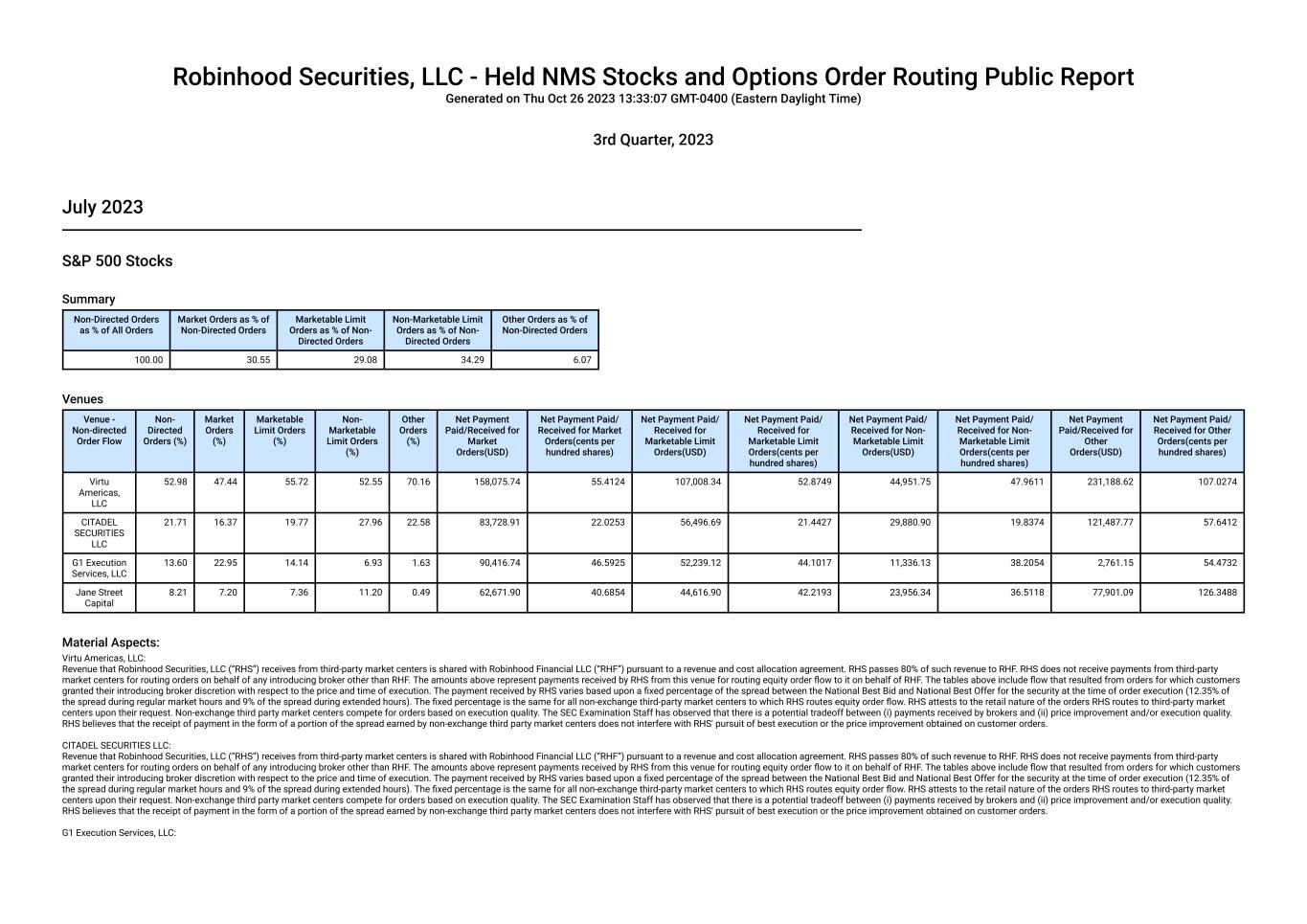

Robinhood Securities, LLC - Held NMS Stocks and Options Order Routing Public Report Generated on Thu Oct 26 2023 13:33:07 GMT-0400 (Eastern Daylight Time) 3rd Quarter, 2023 July 2023 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 30.55 29.08 34.29 6.07 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 52.98 47.44 55.72 52.55 70.16 158,075.74 55.4124 107,008.34 52.8749 44,951.75 47.9611 231,188.62 107.0274 CITADEL SECURITIES LLC 21.71 16.37 19.77 27.96 22.58 83,728.91 22.0253 56,496.69 21.4427 29,880.90 19.8374 121,487.77 57.6412 G1 Execution Services, LLC 13.60 22.95 14.14 6.93 1.63 90,416.74 46.5925 52,239.12 44.1017 11,336.13 38.2054 2,761.15 54.4732 Jane Street Capital 8.21 7.20 7.36 11.20 0.49 62,671.90 40.6854 44,616.90 42.2193 23,956.34 36.5118 77,901.09 126.3488 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC:

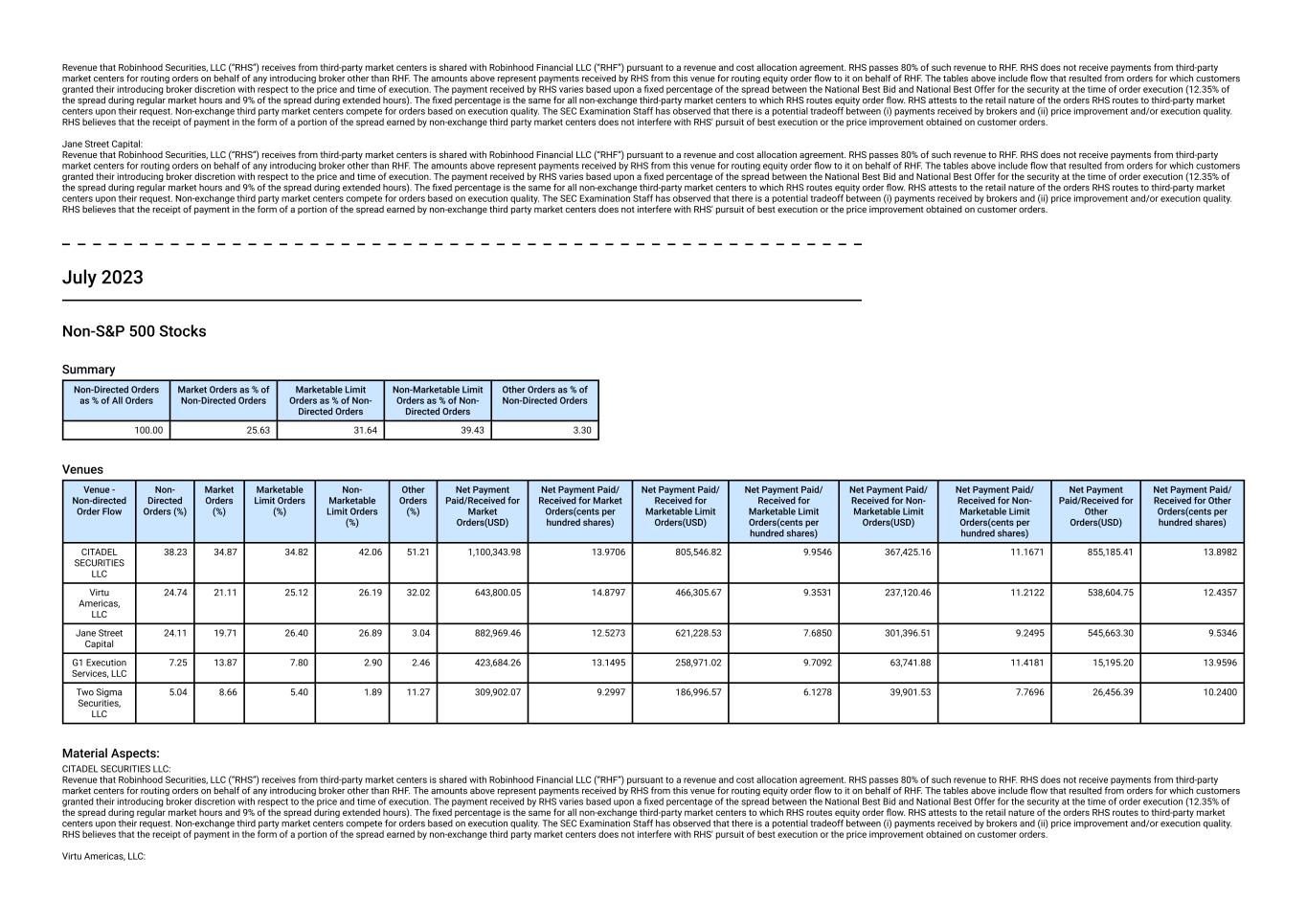

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. July 2023 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 25.63 31.64 39.43 3.30 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 38.23 34.87 34.82 42.06 51.21 1,100,343.98 13.9706 805,546.82 9.9546 367,425.16 11.1671 855,185.41 13.8982 Virtu Americas, LLC 24.74 21.11 25.12 26.19 32.02 643,800.05 14.8797 466,305.67 9.3531 237,120.46 11.2122 538,604.75 12.4357 Jane Street Capital 24.11 19.71 26.40 26.89 3.04 882,969.46 12.5273 621,228.53 7.6850 301,396.51 9.2495 545,663.30 9.5346 G1 Execution Services, LLC 7.25 13.87 7.80 2.90 2.46 423,684.26 13.1495 258,971.02 9.7092 63,741.88 11.4181 15,195.20 13.9596 Two Sigma Securities, LLC 5.04 8.66 5.40 1.89 11.27 309,902.07 9.2997 186,996.57 6.1278 39,901.53 7.7696 26,456.39 10.2400 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Virtu Americas, LLC:

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Two Sigma Securities, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. July 2023 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.01 35.21 46.30 18.48 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Wolverine Execution Services, LLC 33.39 34.92 34.13 29.92 40.64 1,126.85 44.8765 6,275,149.36 39.6034 3,620,433.74 45.7373 1,634,437.40 44.3496 CITADEL SECURITIES LLC 30.53 23.14 28.14 29.78 36.97 861.10 48.8706 7,940,063.85 40.5239 4,604,088.91 49.0652 1,859,569.77 43.2949 Morgan Stanley & Co., LLC 19.69 27.44 22.58 24.63 1.78 603.73 42.6363 5,936,472.57 40.5885 3,749,198.07 48.3514 69,569.08 40.9040

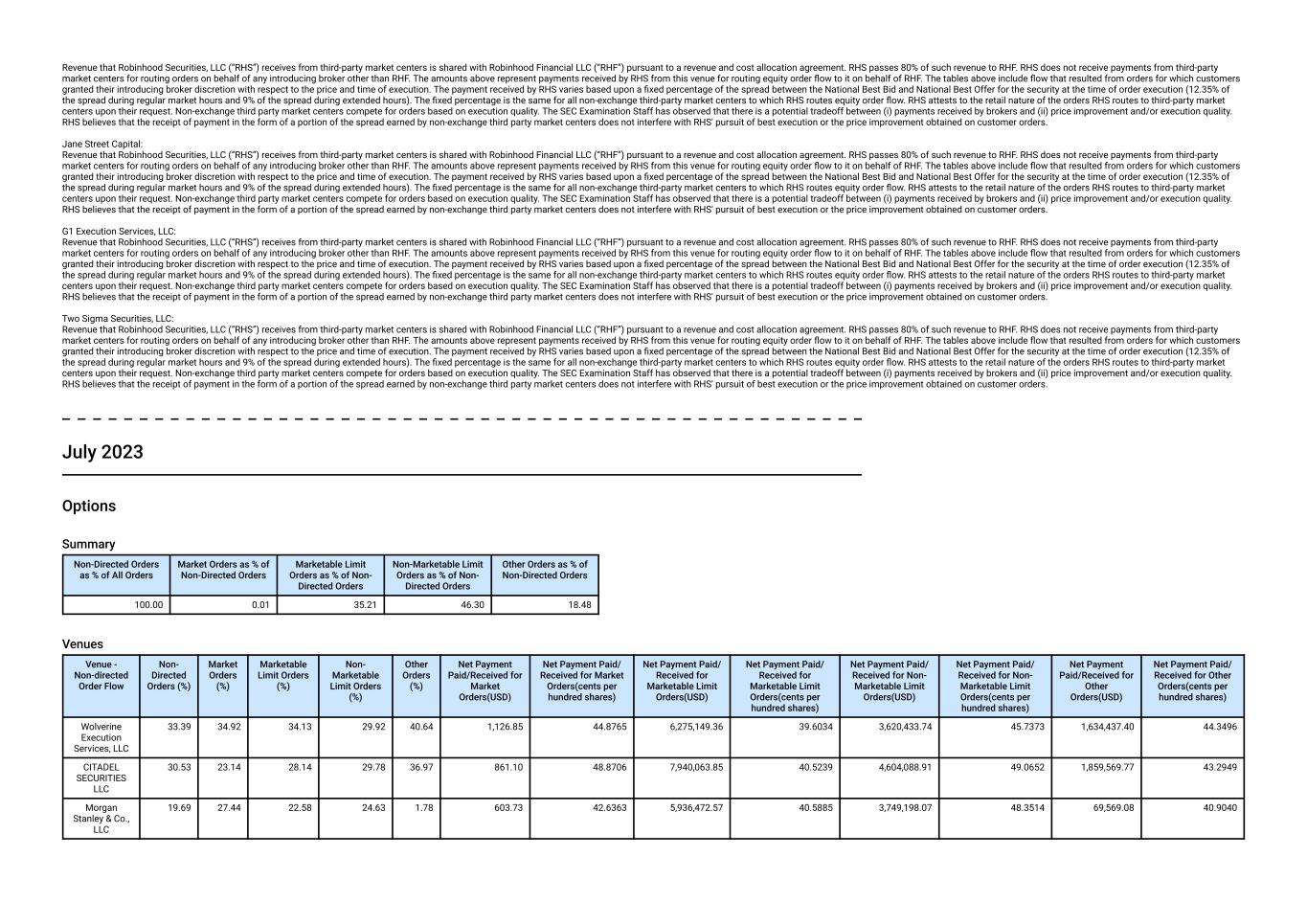

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Dash/IMC Financial Markets 16.39 14.49 15.14 15.66 20.61 751.10 41.3601 4,592,271.26 37.2208 2,600,485.05 44.1000 1,278,663.09 44.6928 Material Aspects: Wolverine Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $.30, $.35, $.45, or $.55 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.70 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.10 for all other symbols. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.18, $0.23, or $0.28 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.35 for other symbols that can be quoted and traded in minimum increments of $0.01, and $0.55 for all other symbols. For multi-leg orders, RHS received a per contract rate of $0.30, $0.40, $0.40, or $0.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $0.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $.30, $.35, $.45, or $.55 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.70 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.10 for all other symbols. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.18, $0.23, or $0.28 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.35 for other symbols that can be quoted and traded in minimum increments of $0.01, and $0.55 for all other symbols. For multi-leg orders, RHS received a per contract rate of $0.30, $0.40, $0.40, or $0.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $0.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Morgan Stanley & Co., LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $.30, $.35, $.45, or $.55 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.70 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.10 for all other symbols. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.18, $0.23, or $0.28 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.35 for other symbols that can be quoted and traded in minimum increments of $0.01, and $0.55 for all other symbols. For multi-leg orders, RHS received a per contract rate of $0.30, $0.40, $0.40, or $0.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $0.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Dash/IMC Financial Markets: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $.30, $.35, $.45, or $.55 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.70 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.10 for all other symbols. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.18, $0.23, or $0.28 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.35 for other symbols that can be quoted and traded in minimum increments of $0.01, and $0.55 for all other symbols. For multi-leg orders, RHS received a per contract rate of $0.30, $0.40, $0.40, or $0.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $0.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Dash utilizes relationships with multiple unaffiliated liquidity providers, including IMC Financial Markets, to facilitate liquidity provision and price improvement opportunities. Through these relationships, Dash routes RHS’ retail equity option orders to exchanges and preferences the liquidity providers consistent with the exchange sponsored programs referenced on the fee schedules of the exchanges. These liquidity providers provide Dash with remuneration in connection with RHS’ retail equity option orders, including reciprocal order flow arrangements and/or payment per contract. RHS receives revenue based on the per contract rates specified above for retail equity option orders executed by any such liquidity provider; RHS receives such amounts from DASH, which in turn receives those amounts from the liquidity provider. August 2023 S&P 500 Stocks

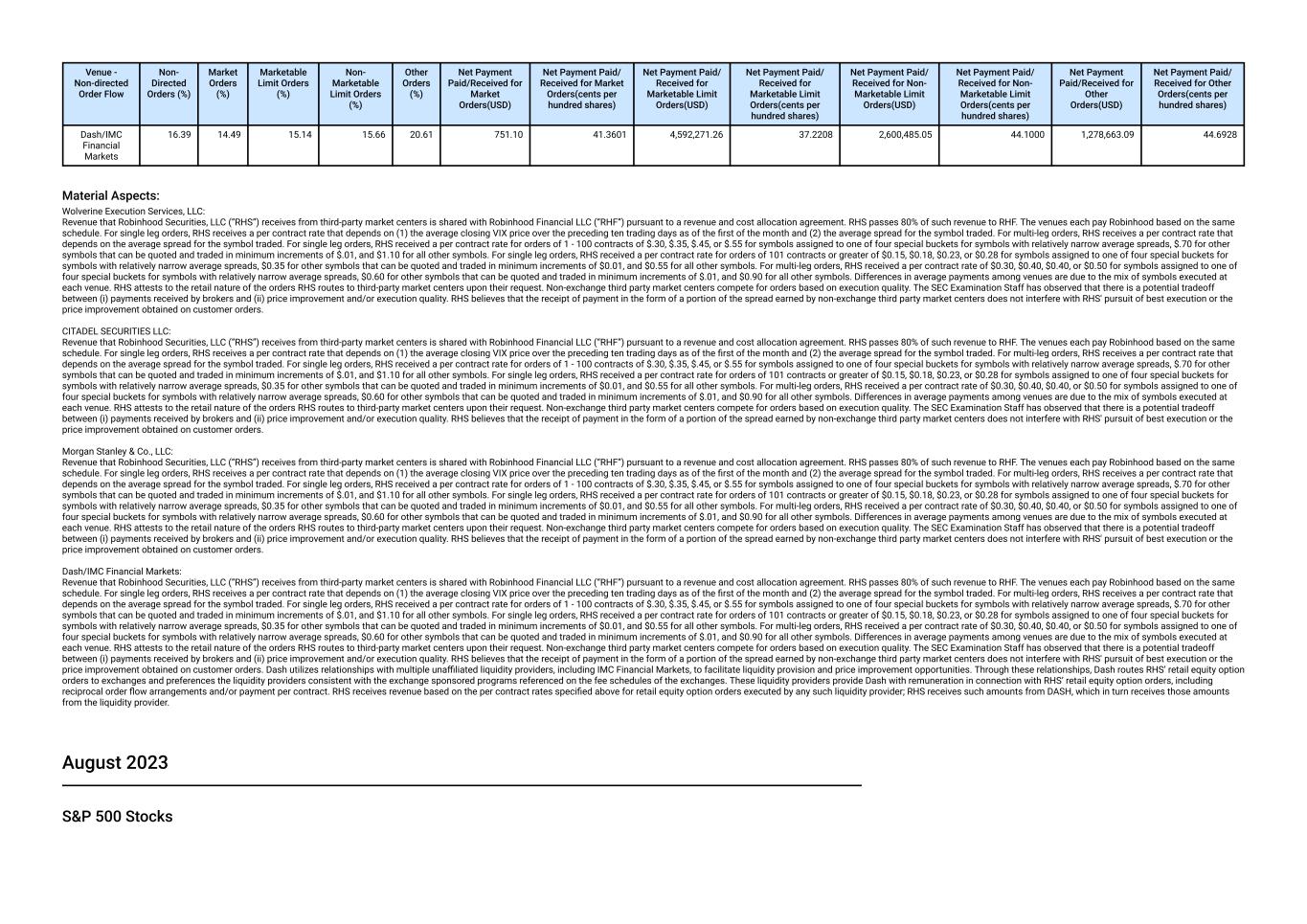

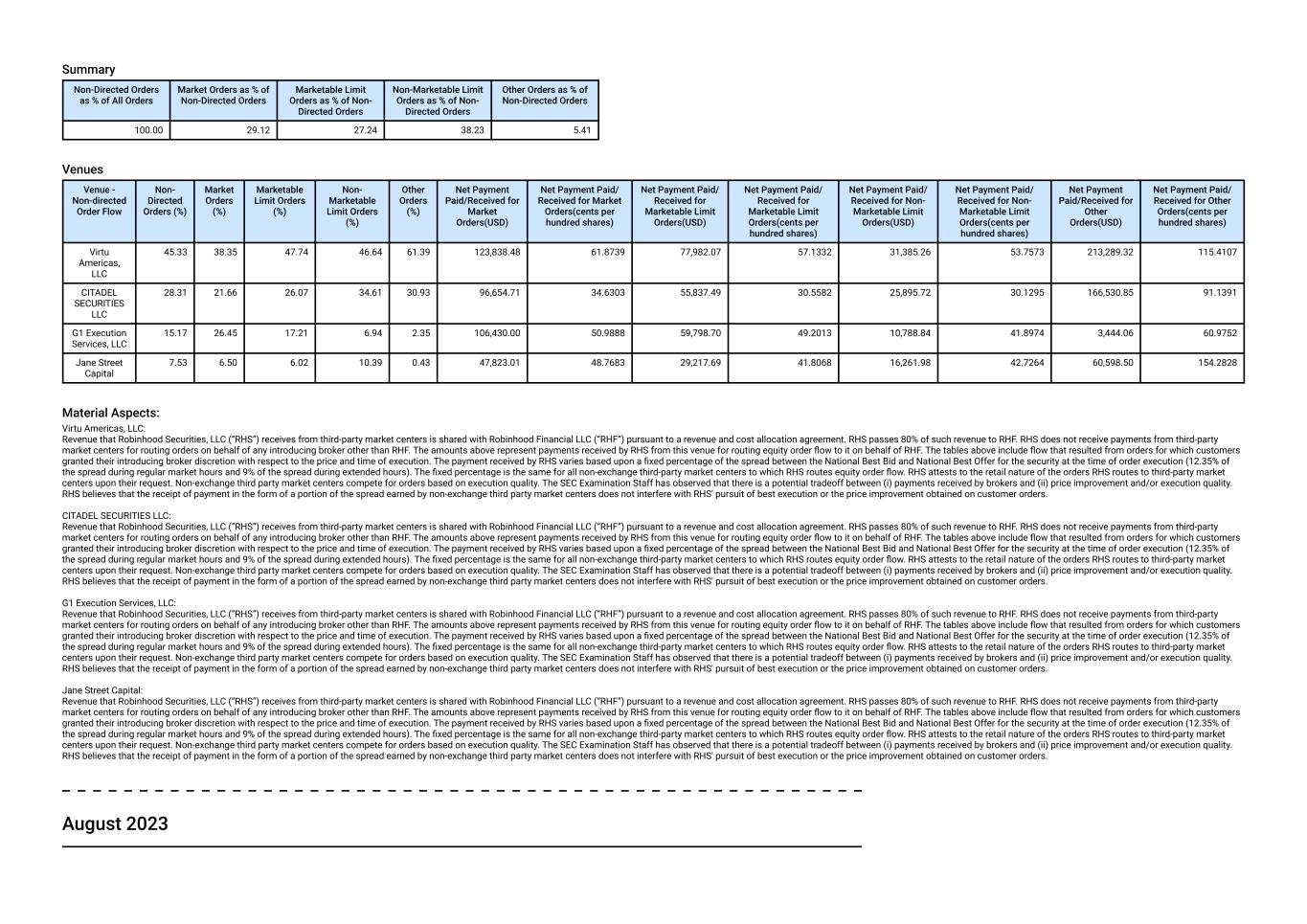

Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 29.12 27.24 38.23 5.41 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 45.33 38.35 47.74 46.64 61.39 123,838.48 61.8739 77,982.07 57.1332 31,385.26 53.7573 213,289.32 115.4107 CITADEL SECURITIES LLC 28.31 21.66 26.07 34.61 30.93 96,654.71 34.6303 55,837.49 30.5582 25,895.72 30.1295 166,530.85 91.1391 G1 Execution Services, LLC 15.17 26.45 17.21 6.94 2.35 106,430.00 50.9888 59,798.70 49.2013 10,788.84 41.8974 3,444.06 60.9752 Jane Street Capital 7.53 6.50 6.02 10.39 0.43 47,823.01 48.7683 29,217.69 41.8068 16,261.98 42.7264 60,598.50 154.2828 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. August 2023

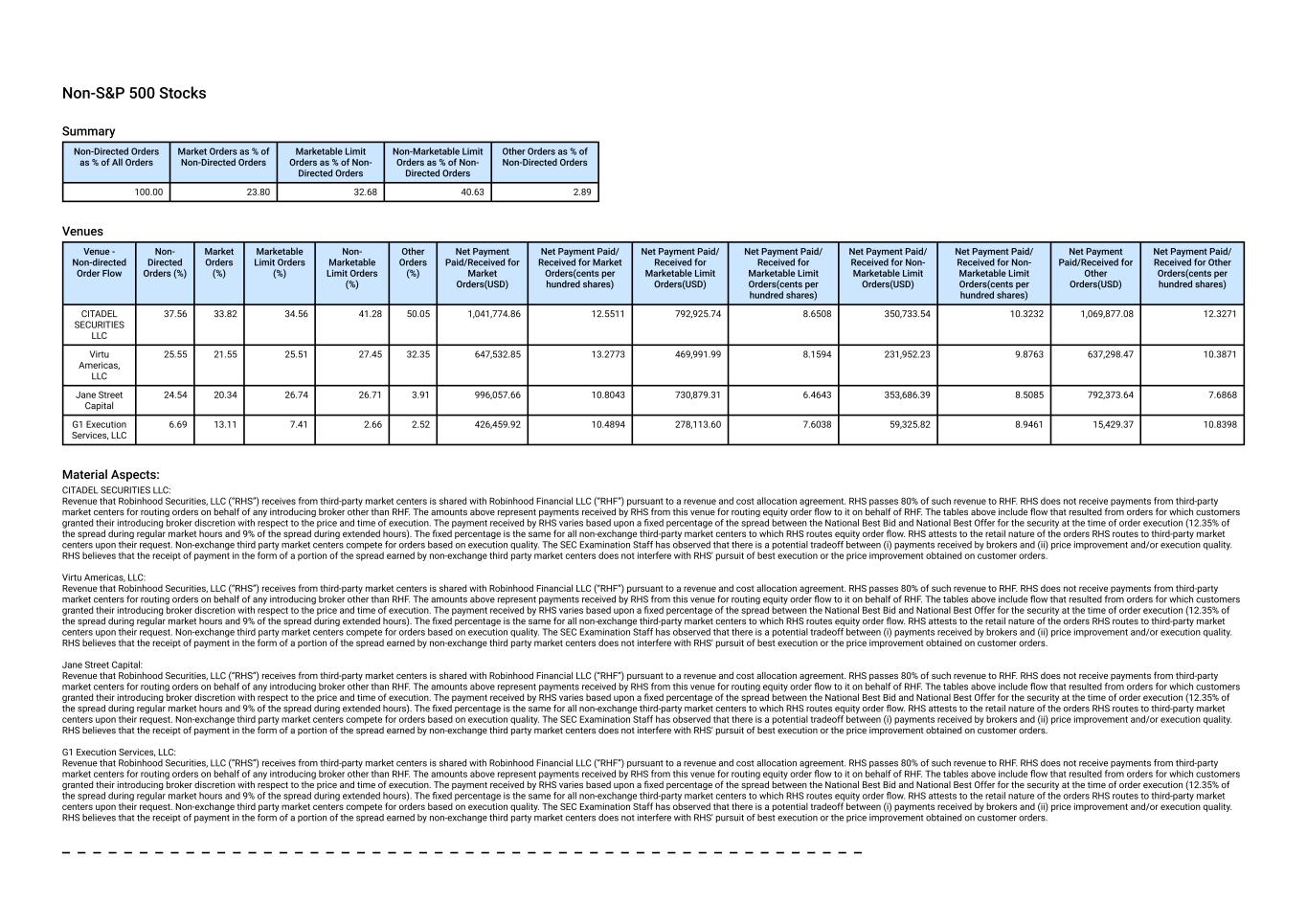

Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 23.80 32.68 40.63 2.89 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 37.56 33.82 34.56 41.28 50.05 1,041,774.86 12.5511 792,925.74 8.6508 350,733.54 10.3232 1,069,877.08 12.3271 Virtu Americas, LLC 25.55 21.55 25.51 27.45 32.35 647,532.85 13.2773 469,991.99 8.1594 231,952.23 9.8763 637,298.47 10.3871 Jane Street Capital 24.54 20.34 26.74 26.71 3.91 996,057.66 10.8043 730,879.31 6.4643 353,686.39 8.5085 792,373.64 7.6868 G1 Execution Services, LLC 6.69 13.11 7.41 2.66 2.52 426,459.92 10.4894 278,113.60 7.6038 59,325.82 8.9461 15,429.37 10.8398 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.

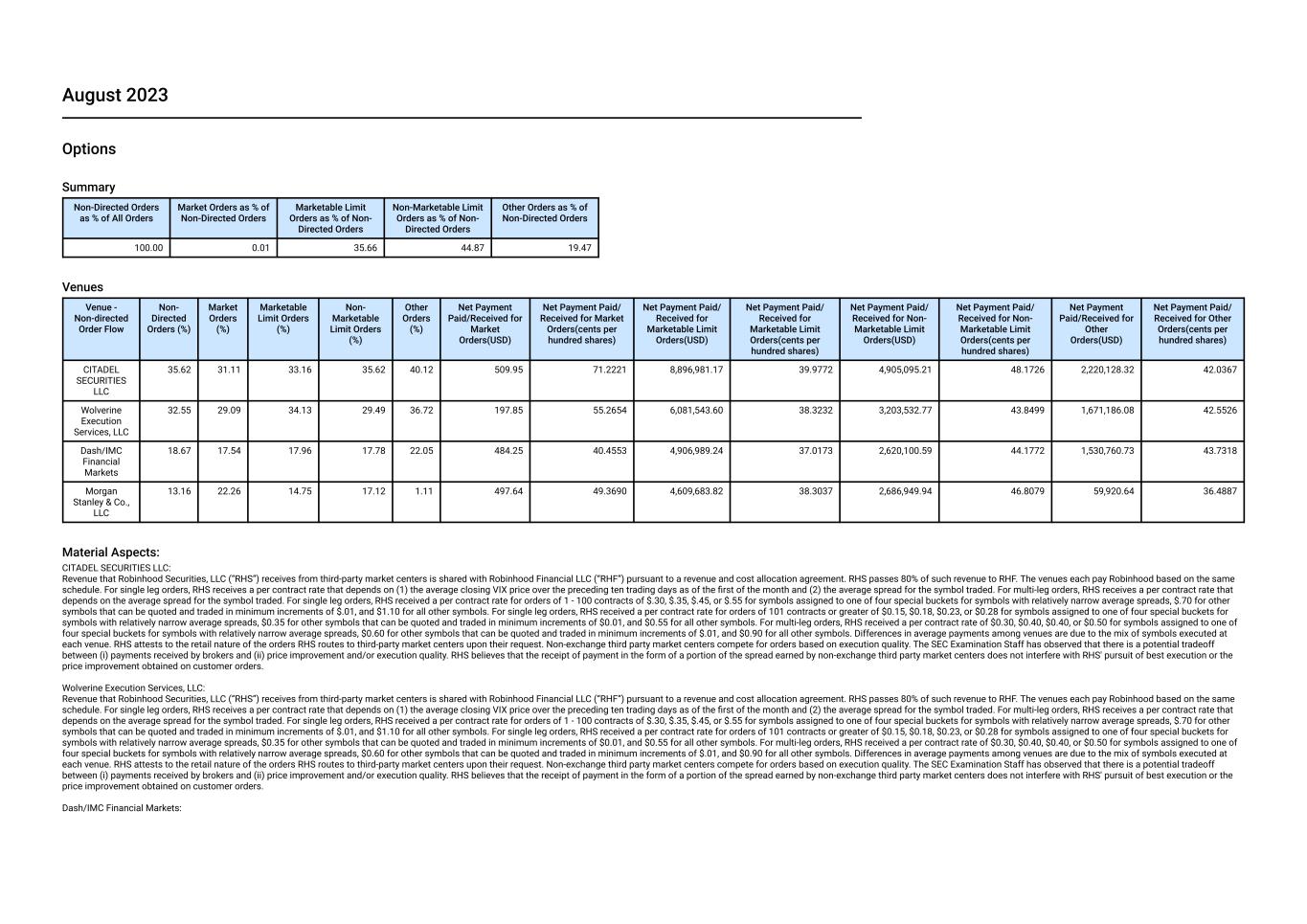

August 2023 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.01 35.66 44.87 19.47 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 35.62 31.11 33.16 35.62 40.12 509.95 71.2221 8,896,981.17 39.9772 4,905,095.21 48.1726 2,220,128.32 42.0367 Wolverine Execution Services, LLC 32.55 29.09 34.13 29.49 36.72 197.85 55.2654 6,081,543.60 38.3232 3,203,532.77 43.8499 1,671,186.08 42.5526 Dash/IMC Financial Markets 18.67 17.54 17.96 17.78 22.05 484.25 40.4553 4,906,989.24 37.0173 2,620,100.59 44.1772 1,530,760.73 43.7318 Morgan Stanley & Co., LLC 13.16 22.26 14.75 17.12 1.11 497.64 49.3690 4,609,683.82 38.3037 2,686,949.94 46.8079 59,920.64 36.4887 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $.30, $.35, $.45, or $.55 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.70 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.10 for all other symbols. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.18, $0.23, or $0.28 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.35 for other symbols that can be quoted and traded in minimum increments of $0.01, and $0.55 for all other symbols. For multi-leg orders, RHS received a per contract rate of $0.30, $0.40, $0.40, or $0.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $0.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Wolverine Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $.30, $.35, $.45, or $.55 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.70 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.10 for all other symbols. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.18, $0.23, or $0.28 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.35 for other symbols that can be quoted and traded in minimum increments of $0.01, and $0.55 for all other symbols. For multi-leg orders, RHS received a per contract rate of $0.30, $0.40, $0.40, or $0.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $0.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Dash/IMC Financial Markets:

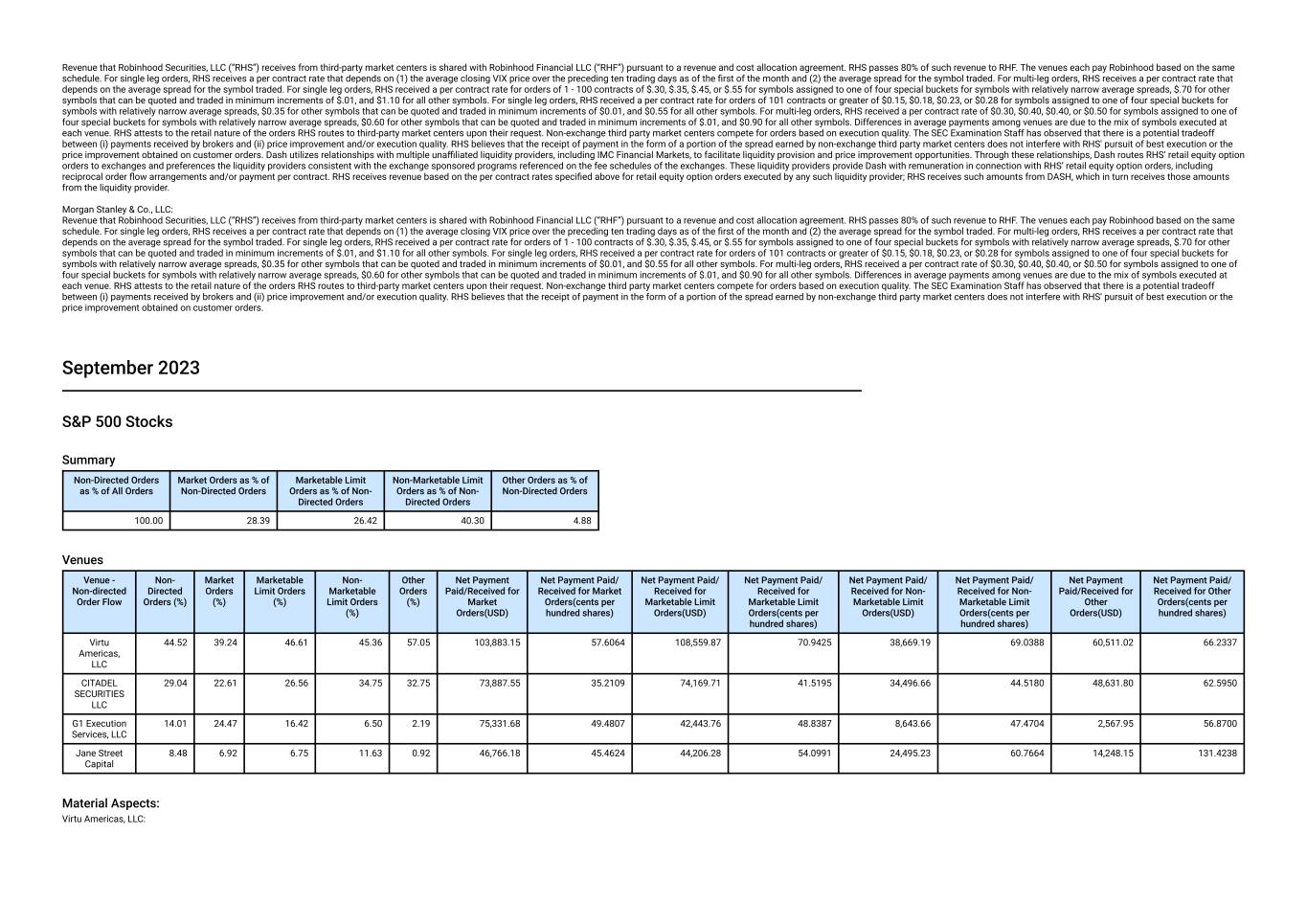

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $.30, $.35, $.45, or $.55 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.70 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.10 for all other symbols. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.18, $0.23, or $0.28 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.35 for other symbols that can be quoted and traded in minimum increments of $0.01, and $0.55 for all other symbols. For multi-leg orders, RHS received a per contract rate of $0.30, $0.40, $0.40, or $0.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $0.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Dash utilizes relationships with multiple unaffiliated liquidity providers, including IMC Financial Markets, to facilitate liquidity provision and price improvement opportunities. Through these relationships, Dash routes RHS’ retail equity option orders to exchanges and preferences the liquidity providers consistent with the exchange sponsored programs referenced on the fee schedules of the exchanges. These liquidity providers provide Dash with remuneration in connection with RHS’ retail equity option orders, including reciprocal order flow arrangements and/or payment per contract. RHS receives revenue based on the per contract rates specified above for retail equity option orders executed by any such liquidity provider; RHS receives such amounts from DASH, which in turn receives those amounts from the liquidity provider. Morgan Stanley & Co., LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $.30, $.35, $.45, or $.55 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.70 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.10 for all other symbols. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.18, $0.23, or $0.28 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.35 for other symbols that can be quoted and traded in minimum increments of $0.01, and $0.55 for all other symbols. For multi-leg orders, RHS received a per contract rate of $0.30, $0.40, $0.40, or $0.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $0.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $0.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. September 2023 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 28.39 26.42 40.30 4.88 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 44.52 39.24 46.61 45.36 57.05 103,883.15 57.6064 108,559.87 70.9425 38,669.19 69.0388 60,511.02 66.2337 CITADEL SECURITIES LLC 29.04 22.61 26.56 34.75 32.75 73,887.55 35.2109 74,169.71 41.5195 34,496.66 44.5180 48,631.80 62.5950 G1 Execution Services, LLC 14.01 24.47 16.42 6.50 2.19 75,331.68 49.4807 42,443.76 48.8387 8,643.66 47.4704 2,567.95 56.8700 Jane Street Capital 8.48 6.92 6.75 11.63 0.92 46,766.18 45.4624 44,206.28 54.0991 24,495.23 60.7664 14,248.15 131.4238 Material Aspects: Virtu Americas, LLC:

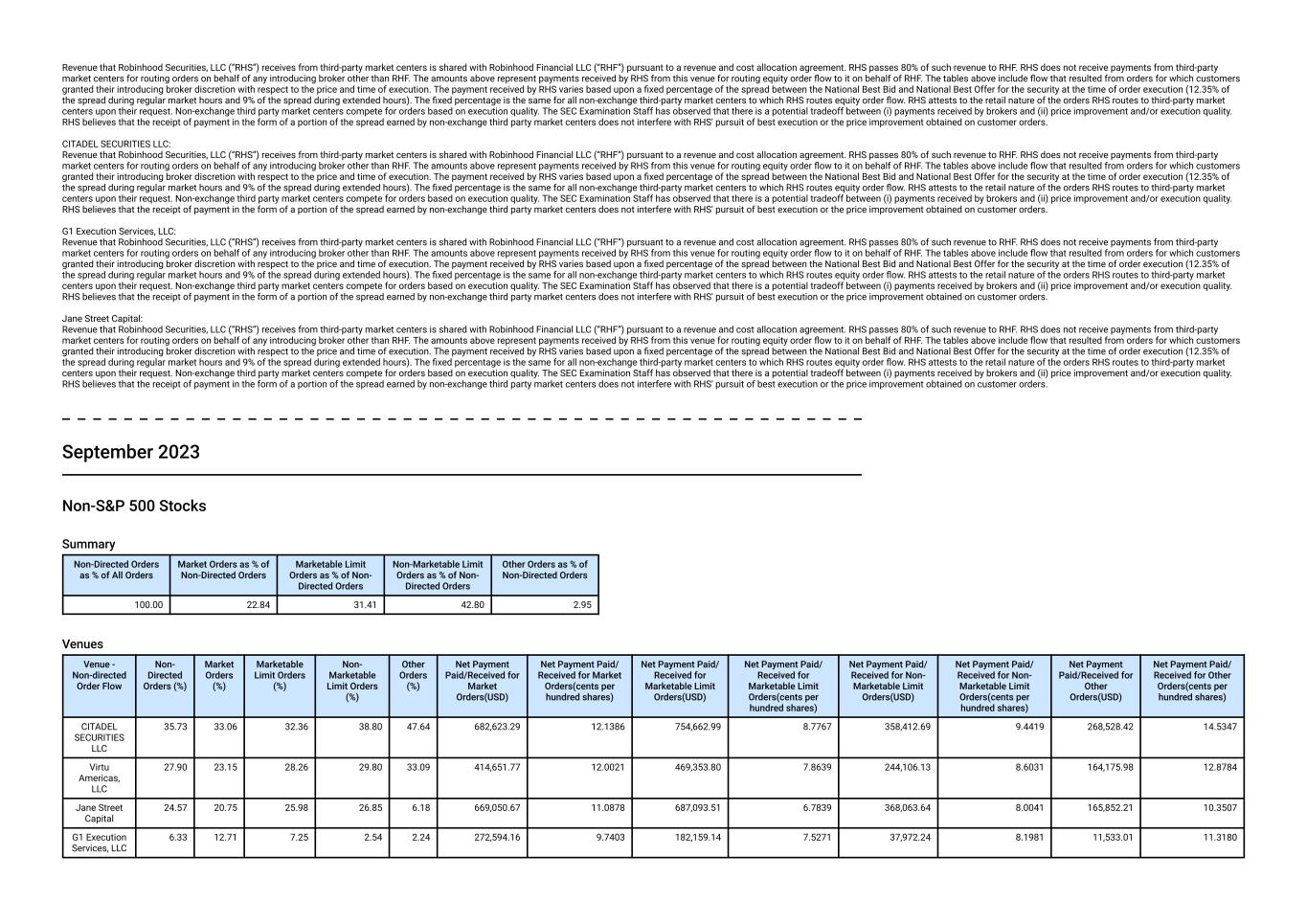

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. September 2023 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 22.84 31.41 42.80 2.95 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 35.73 33.06 32.36 38.80 47.64 682,623.29 12.1386 754,662.99 8.7767 358,412.69 9.4419 268,528.42 14.5347 Virtu Americas, LLC 27.90 23.15 28.26 29.80 33.09 414,651.77 12.0021 469,353.80 7.8639 244,106.13 8.6031 164,175.98 12.8784 Jane Street Capital 24.57 20.75 25.98 26.85 6.18 669,050.67 11.0878 687,093.51 6.7839 368,063.64 8.0041 165,852.21 10.3507 G1 Execution Services, LLC 6.33 12.71 7.25 2.54 2.24 272,594.16 9.7403 182,159.14 7.5271 37,972.24 8.1981 11,533.01 11.3180

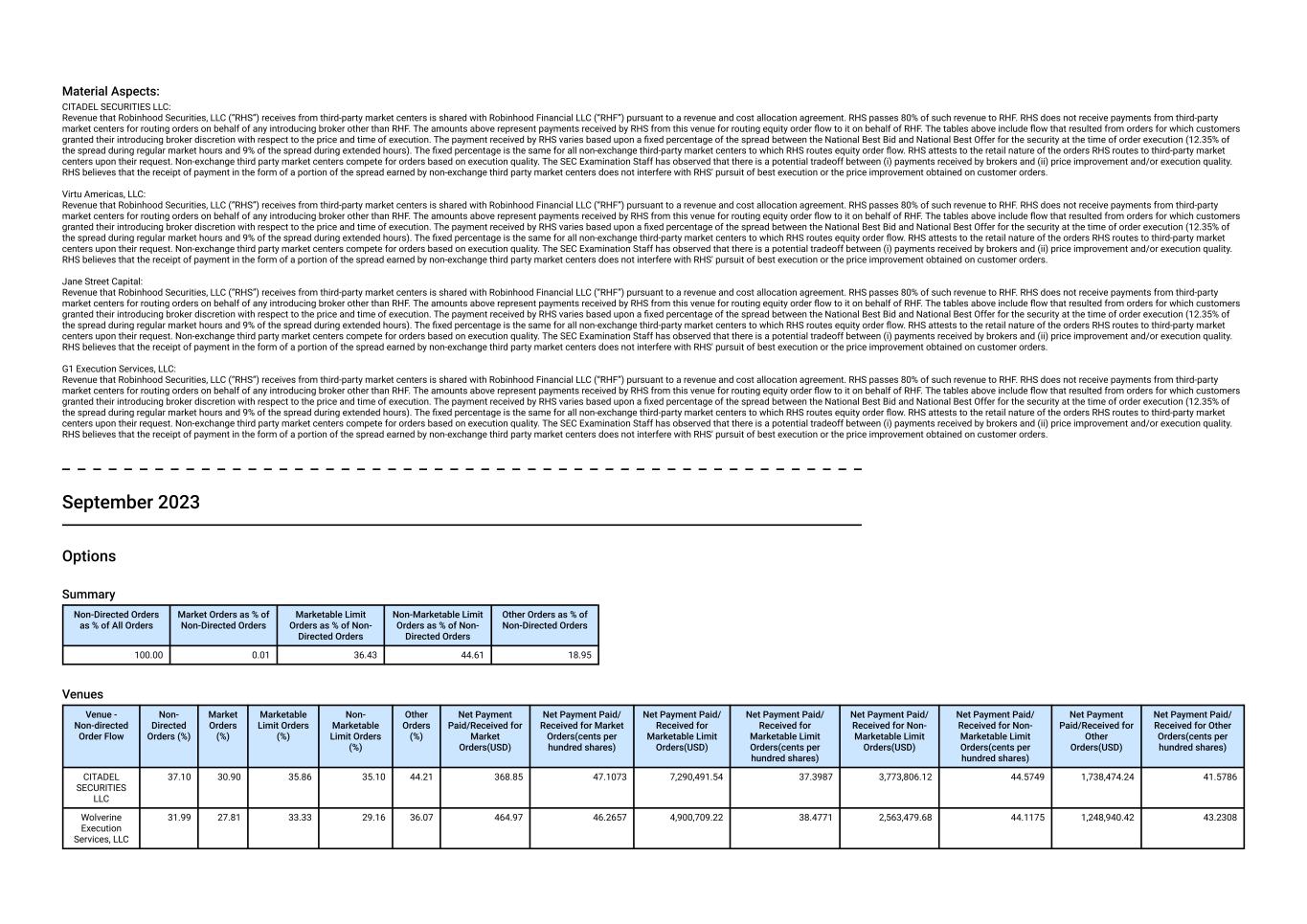

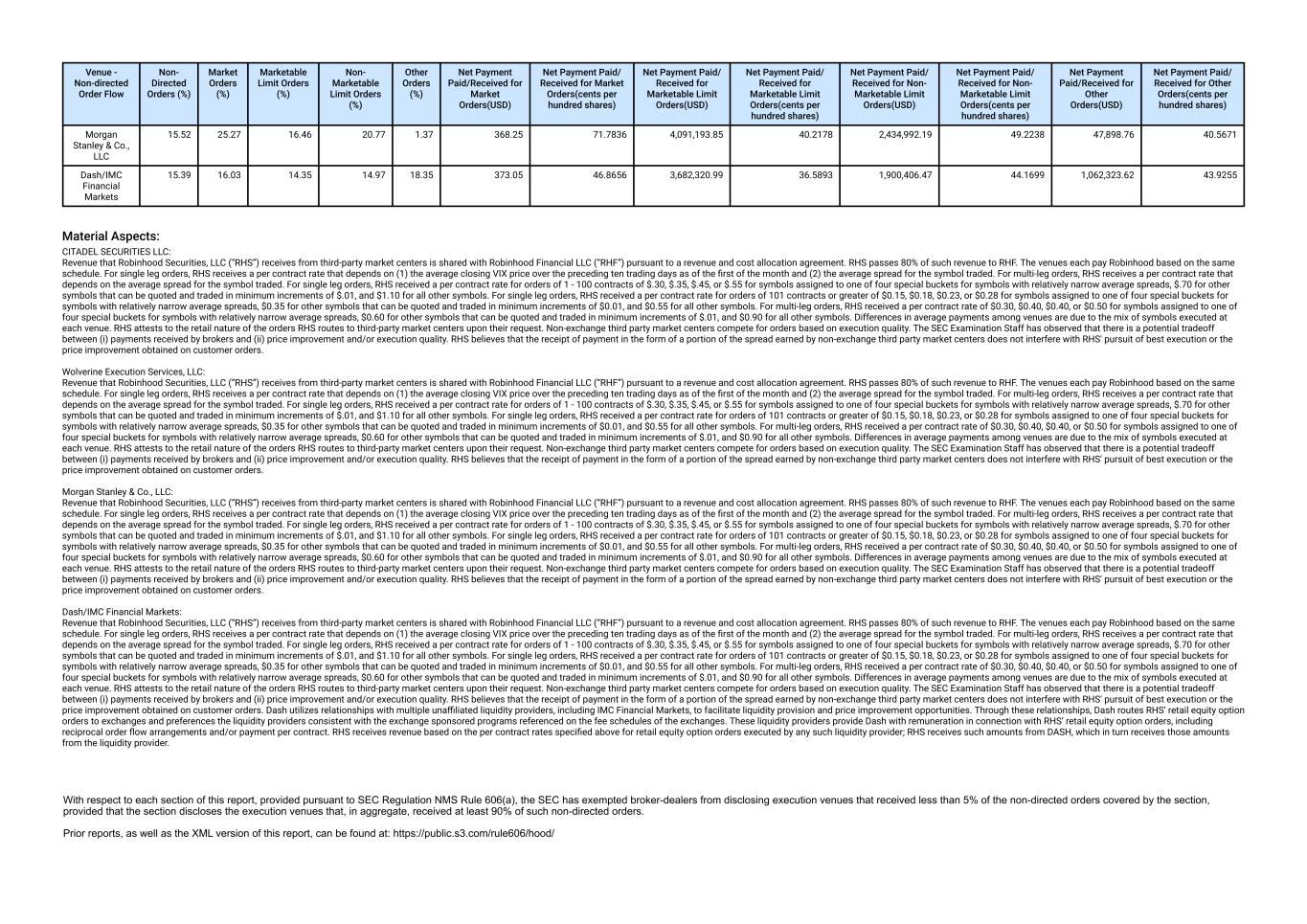

Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. September 2023 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.01 36.43 44.61 18.95 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 37.10 30.90 35.86 35.10 44.21 368.85 47.1073 7,290,491.54 37.3987 3,773,806.12 44.5749 1,738,474.24 41.5786 Wolverine Execution Services, LLC 31.99 27.81 33.33 29.16 36.07 464.97 46.2657 4,900,709.22 38.4771 2,563,479.68 44.1175 1,248,940.42 43.2308