CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2023

(unaudited)

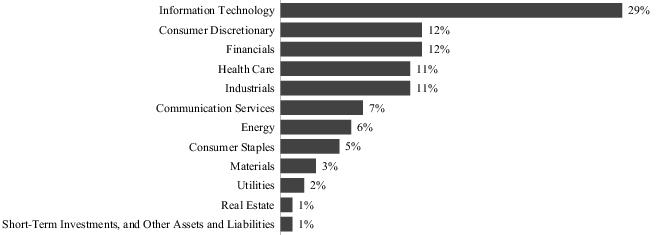

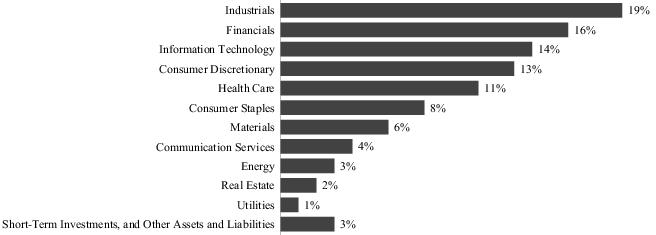

Clearwater Core Equity Fund Portfolio

Diversification

(as a percentage of net assets)

| 10 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Common Stocks: | ||||||||

| Communication Services: | ||||||||

| 10,603 | ACTIVISION BLIZZARD, INC. | $471,997 | 992,759 | |||||

| 130,692 | ALPHABET, INC., CLASS A(b) | 5,031,789 | 17,102,355 | |||||

| 84,721 | ALPHABET, INC., CLASS C(b) | 3,743,298 | 11,170,464 | |||||

| 39,517 | AT&T, INC. | 467,394 | 593,545 | |||||

| 1,429 | CHARTER COMMUNICATIONS, INC., CLASS A(b) | 491,189 | 628,503 | |||||

| 67,600 | COMCAST CORP., CLASS A | 1,026,668 | 2,997,384 | |||||

| 8,300 | ELECTRONIC ARTS, INC. | 116,945 | 999,320 | |||||

| 3,300 | FOX CORP., CLASS A | 102,157 | 102,960 | |||||

| 200 | FOX CORP., CLASS B | 5,710 | 5,776 | |||||

| 3,574 | INTERPUBLIC GROUP OF (THE) COS., INC. | 55,609 | 102,431 | |||||

| 183 | LIBERTY GLOBAL PLC, CLASS A(b)(c) | 1,707 | 3,133 | |||||

| 1,900 | LIVE NATION ENTERTAINMENT, INC.(b) | 130,373 | 157,776 | |||||

| 4,649 | MATCH GROUP, INC.(b) | 171,640 | 182,125 | |||||

| 48,955 | META PLATFORMS, INC., CLASS A(b) | 4,873,957 | 14,696,780 | |||||

| 5,874 | NETFLIX, INC.(b) | 1,261,830 | 2,218,022 | |||||

| 2,675 | NEWS CORP., CLASS A | 12,252 | 53,660 | |||||

| 2,595 | OMNICOM GROUP, INC. | 81,950 | 193,276 | |||||

| 58,107 | PLAYTIKA HOLDING CORP.(b)(c) | 532,056 | 559,570 | |||||

| 2,000 | TAKE-TWO INTERACTIVE SOFTWARE, INC.(b) | 216,815 | 280,780 | |||||

| 13,937 | T-MOBILE U.S., INC.(b) | 1,097,267 | 1,951,877 | |||||

| 37,683 | VERIZON COMMUNICATIONS, INC. | 1,158,463 | 1,221,306 | |||||

| 24,418 | WALT DISNEY (THE) CO.(b) | 477,665 | 1,979,079 | |||||

| 24,502 | WARNER BROS. DISCOVERY, INC.(b) | 280,834 | 266,092 | |||||

| 21,809,565 | 58,458,973 | 7.45% | ||||||

| Consumer Discretionary: | ||||||||

| 100 | AIRBNB, INC., CLASS A(b) | 13,229 | 13,721 | |||||

| 147,230 | AMAZON.COM, INC.(b) | 10,288,053 | 18,715,878 | |||||

| 3,400 | APTIV PLC(b)(c) | 303,982 | 335,206 | |||||

| 23,316 | AUTONATION, INC.(b) | 2,768,302 | 3,530,042 | |||||

| 1,324 | AUTOZONE, INC.(b) | 1,581,870 | 3,362,947 | |||||

| 34,097 | BATH & BODY WORKS, INC. | 939,271 | 1,152,479 | |||||

| 16,989 | BEST BUY CO., INC. | 931,199 | 1,180,226 | |||||

| 1,289 | BOOKING HOLDINGS, INC.(b) | 2,757,890 | 3,975,212 | |||||

| 9,521 | BORGWARNER, INC. | 233,852 | 384,363 | |||||

| 1,248 | BRUNSWICK CORP. | 99,725 | 98,592 | |||||

| 2,168 | CARMAX, INC.(b) | 58,264 | 153,343 | |||||

| 12,700 | CARNIVAL CORP.(b) | 108,019 | 174,244 | |||||

| 400 | CHIPOTLE MEXICAN GRILL, INC.(b) | 558,552 | 732,732 | |||||

| 4,000 | D.R. HORTON, INC. | 410,275 | 429,880 | |||||

| 1,700 | DARDEN RESTAURANTS, INC. | 112,210 | 243,474 | |||||

| 17,100 | EBAY, INC. | 602,970 | 753,939 | |||||

| 12,508 | EXPEDIA GROUP, INC.(b) | 1,162,573 | 1,289,200 | |||||

| 22,663 | FORD MOTOR CO. | 78,732 | 281,474 | |||||

| 13,928 | GAP (THE), INC. | 139,153 | 148,055 | |||||

| 2,200 | GARMIN LTD.(c) | 40,557 | 231,440 | |||||

| 132,229 | GENERAL MOTORS CO. | 4,373,760 | 4,359,590 | |||||

| 3,450 | GENUINE PARTS CO. | 102,425 | 498,111 | |||||

| 10,855 | H&R BLOCK, INC. | 368,543 | 467,416 | |||||

| 426 | HASBRO, INC. | 12,602 | 28,176 | |||||

| 1,600 | HILTON WORLDWIDE HOLDINGS, INC. | 115,613 | 240,288 | |||||

| 20,826 | HOME DEPOT (THE), INC. | 4,023,383 | 6,292,784 | |||||

| 2,535 | LAS VEGAS SANDS CORP. | 21,685 | 116,204 | |||||

| 945 | LEAR CORP. | 129,908 | 126,819 | |||||

| 15,427 | LENNAR CORP., CLASS A | 1,684,172 | 1,731,372 | |||||

| 16,820 | LKQ CORP. | 476,562 | 832,758 | |||||

| 12,647 | LOWE'S COS., INC. | 2,405,676 | 2,628,552 | |||||

| 93,033 | MACY'S, INC. | 1,008,716 | 1,080,113 | |||||

| 2,938 | MARRIOTT INTERNATIONAL, INC., CLASS A | 61,838 | 577,493 | |||||

| 7,902 | MCDONALD'S CORP. | 949,776 | 2,081,703 | |||||

| 6 | MGM RESORTS INTERNATIONAL | 186 | 221 | |||||

| 3,600 | MOHAWK INDUSTRIES, INC.(b) | 282,562 | 308,916 | |||||

| 2,715 | NEWELL BRANDS, INC. | 25,274 | 24,516 | |||||

| 16,567 | NIKE, INC., CLASS B | 987,686 | 1,584,137 | |||||

| 518 | NVR, INC.(b) | 2,038,923 | 3,088,989 | |||||

| 8,786 | PENSKE AUTOMOTIVE GROUP, INC. | 1,159,421 | 1,467,789 | |||||

| 40 | PHINIA, INC. | 880 | 1,072 | |||||

| 0 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Consumer Discretionary (Cont'd): | ||||||||

| 870 | POOL CORP. | $187,171 | 309,807 | |||||

| 55,929 | PULTEGROUP, INC. | 3,478,737 | 4,141,542 | |||||

| 1,233 | PVH CORP. | 90,881 | 94,337 | |||||

| 2,443 | ROSS STORES, INC. | 224,440 | 275,937 | |||||

| 22,087 | ROYAL CARIBBEAN CRUISES LTD.(b) | 860,666 | 2,035,096 | |||||

| 23,500 | STARBUCKS CORP. | 154,545 | 2,144,845 | |||||

| 16,078 | TAPESTRY, INC. | 511,795 | 462,242 | |||||

| 47,353 | TESLA, INC.(b) | 10,314,713 | 11,848,668 | |||||

| 3,202 | THOR INDUSTRIES, INC. | 252,565 | 304,606 | |||||

| 8,583 | TJX (THE) COS., INC. | 36,625 | 762,857 | |||||

| 51,725 | TOLL BROTHERS, INC. | 3,032,997 | 3,825,581 | |||||

| 600 | TRACTOR SUPPLY CO. | 111,014 | 121,830 | |||||

| 34,547 | TRAVEL + LEISURE CO. | 1,262,960 | 1,268,911 | |||||

| 700 | ULTA BEAUTY, INC.(b) | 244,098 | 279,615 | |||||

| 6,725 | VF CORP. | 80,995 | 118,831 | |||||

| 700 | WHIRLPOOL CORP. | 91,112 | 93,590 | |||||

| 15,254 | WILLIAMS-SONOMA, INC. | 1,830,184 | 2,370,472 | |||||

| 1,554 | WYNN RESORTS LTD. | 31,066 | 143,605 | |||||

| 66,214,833 | 95,325,838 | 12.14% | ||||||

| Consumer Staples: | ||||||||

| 82,723 | ALTRIA GROUP, INC. | 3,631,837 | 3,478,502 | |||||

| 13,712 | ARCHER-DANIELS-MIDLAND CO. | 451,070 | 1,034,159 | |||||

| 9,900 | CAMPBELL SOUP CO. | 413,479 | 406,692 | |||||

| 10,068 | CHURCH & DWIGHT CO., INC. | 241,887 | 922,531 | |||||

| 100 | CLOROX (THE) CO. | 13,042 | 13,106 | |||||

| 69,073 | COCA-COLA (THE) CO. | 1,562,344 | 3,866,707 | |||||

| 10,780 | COLGATE-PALMOLIVE CO. | 731,660 | 766,566 | |||||

| 1,900 | CONAGRA BRANDS, INC. | 26,152 | 52,098 | |||||

| 1,823 | CONSTELLATION BRANDS, INC., CLASS A | 251,171 | 458,175 | |||||

| 4,852 | COSTCO WHOLESALE CORP. | 909,621 | 2,741,186 | |||||

| 3,089 | DOLLAR GENERAL CORP. | 207,226 | 326,816 | |||||

| 1,924 | DOLLAR TREE, INC.(b) | 23,650 | 204,810 | |||||

| 12,400 | GENERAL MILLS, INC. | 277,056 | 793,476 | |||||

| 1,642 | HERSHEY (THE) CO. | 60,568 | 328,531 | |||||

| 4,800 | HORMEL FOODS CORP. | 43,206 | 182,544 | |||||

| 1,300 | J M SMUCKER (THE) CO. | 60,305 | 159,783 | |||||

| 3,300 | KELLOGG CO. | 195,316 | 196,383 | |||||

| 15,702 | KEURIG DR. PEPPER, INC. | 431,401 | 495,712 | |||||

| 3,750 | KIMBERLY-CLARK CORP. | 334,238 | 453,188 | |||||

| 3,705 | KRAFT HEINZ (THE) CO. | 26,475 | 124,636 | |||||

| 78,178 | KROGER (THE) CO. | 2,289,741 | 3,498,465 | |||||

| 1,833 | LAMB WESTON HOLDINGS, INC. | 73,271 | 169,479 | |||||

| 1,400 | MCCORMICK & CO., INC. (NON VOTING) | 21,613 | 105,896 | |||||

| 12,521 | MOLSON COORS BEVERAGE CO., CLASS B | 669,435 | 796,210 | |||||

| 17,969 | MONDELEZ INTERNATIONAL, INC., CLASS A | 803,237 | 1,247,049 | |||||

| 2,272 | MONSTER BEVERAGE CORP.(b) | 64,265 | 120,302 | |||||

| 21,713 | PEPSICO, INC. | 2,335,657 | 3,679,051 | |||||

| 18,202 | PHILIP MORRIS INTERNATIONAL, INC. | 1,410,895 | 1,685,141 | |||||

| 32,478 | PROCTER & GAMBLE (THE) CO. | 1,716,094 | 4,737,241 | |||||

| 126 | SEABOARD CORP. | 460,948 | 472,878 | |||||

| 7,100 | SYSCO CORP. | 110,707 | 468,955 | |||||

| 3,667 | TARGET CORP. | 313,207 | 405,460 | |||||

| 7,680 | TYSON FOODS, INC., CLASS A | 284,043 | 387,763 | |||||

| 29,450 | WALGREENS BOOTS ALLIANCE, INC. | 466,301 | 654,968 | |||||

| 45,743 | WALMART, INC. | 5,379,202 | 7,315,678 | |||||

| 26,290,320 | 42,750,137 | 5.45% | ||||||

| Energy: | ||||||||

| 33,566 | BAKER HUGHES CO. | 1,027,747 | 1,185,551 | |||||

| 978 | CHENIERE ENERGY, INC. | 147,347 | 162,309 | |||||

| 9,305 | CHESAPEAKE ENERGY CORP. | 759,853 | 802,370 | |||||

| 42,676 | CHEVRON CORP. | 2,866,282 | 7,196,027 | |||||

| 22,923 | CONOCOPHILLIPS | 557,203 | 2,746,175 | |||||

| 8,000 | COTERRA ENERGY, INC. | 157,673 | 216,400 | |||||

| 6,026 | DEVON ENERGY CORP. | 160,507 | 287,440 | |||||

| 100 | DIAMONDBACK ENERGY, INC. | 15,307 | 15,488 | |||||

| 12,584 | EOG RESOURCES, INC. | 894,171 | 1,595,148 | |||||

| 200 | EQT CORP. | 7,794 | 8,116 | |||||

| 1 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Energy (Cont'd): | ||||||||

| 99,987 | EXXON MOBIL CORP. | $7,732,036 | 11,756,471 | |||||

| 32,529 | HALLIBURTON CO. | 1,319,081 | 1,317,425 | |||||

| 2,600 | HESS CORP. | 90,342 | 397,800 | |||||

| 66,777 | HF SINCLAIR CORP. | 2,982,246 | 3,801,615 | |||||

| 17,112 | KINDER MORGAN, INC. | 150,868 | 283,717 | |||||

| 9,400 | MARATHON OIL CORP. | 110,346 | 251,450 | |||||

| 21,074 | MARATHON PETROLEUM CORP. | 1,875,712 | 3,189,339 | |||||

| 6,935 | OCCIDENTAL PETROLEUM CORP. | 82,433 | 449,943 | |||||

| 5,800 | ONEOK, INC. | 148,297 | 367,894 | |||||

| 7,168 | PHILLIPS 66 | 509,833 | 861,235 | |||||

| 3,156 | PIONEER NATURAL RESOURCES CO. | 417,339 | 724,460 | |||||

| 27,009 | SCHLUMBERGER N.V. | 1,142,844 | 1,574,625 | |||||

| 2,900 | TARGA RESOURCES CORP. | 189,675 | 248,588 | |||||

| 33,793 | VALERO ENERGY CORP. | 3,211,310 | 4,788,806 | |||||

| 11,500 | WILLIAMS (THE) COS., INC. | 124,134 | 387,435 | |||||

| 26,680,380 | 44,615,827 | 5.68% | ||||||

| Financials: | ||||||||

| 4,579 | AFLAC, INC. | 225,517 | 351,438 | |||||

| 8,300 | ALLSTATE (THE) CORP. | 197,623 | 924,703 | |||||

| 7,933 | AMERICAN EXPRESS CO. | 715,083 | 1,183,524 | |||||

| 36,540 | AMERICAN INTERNATIONAL GROUP, INC. | 1,839,014 | 2,214,324 | |||||

| 3,596 | AMERIPRISE FINANCIAL, INC. | 287,239 | 1,185,529 | |||||

| 2,548 | AON PLC, CLASS A | 406,718 | 826,113 | |||||

| 3,211 | ARCH CAPITAL GROUP LTD.(b) | 104,134 | 255,949 | |||||

| 2,300 | ARTHUR J. GALLAGHER & CO. | 80,002 | 524,239 | |||||

| 4,900 | ASSURANT, INC. | 218,575 | 703,542 | |||||

| 12,758 | AXIS CAPITAL HOLDINGS LTD. | 735,528 | 719,168 | |||||

| 93,602 | BANK OF AMERICA CORP. | 689,814 | 2,562,823 | |||||

| 10,000 | BANK OF NEW YORK MELLON (THE) CORP. | 206,454 | 426,500 | |||||

| 40,366 | BERKSHIRE HATHAWAY, INC., CLASS B(b) | 7,928,396 | 14,140,210 | |||||

| 1,600 | BLACKROCK, INC. | 1,020,493 | 1,034,384 | |||||

| 100 | BLACKSTONE, INC. | 10,595 | 10,714 | |||||

| 8,148 | BRIGHTHOUSE FINANCIAL, INC.(b) | 346,933 | 398,763 | |||||

| 1,700 | BROWN & BROWN, INC. | 88,516 | 118,728 | |||||

| 7,747 | CAPITAL ONE FINANCIAL CORP. | 241,908 | 751,846 | |||||

| 18,308 | CHARLES SCHWAB (THE) CORP. | 211,335 | 1,005,109 | |||||

| 5,185 | CHUBB LTD.(c) | 608,428 | 1,079,413 | |||||

| 200 | CINCINNATI FINANCIAL CORP. | 20,055 | 20,458 | |||||

| 73,536 | CITIGROUP, INC. | 3,001,351 | 3,024,536 | |||||

| 10,800 | CITIZENS FINANCIAL GROUP, INC. | 280,751 | 289,440 | |||||

| 4,794 | CME GROUP, INC. | 685,657 | 959,855 | |||||

| 1,800 | COMERICA, INC. | 71,996 | 74,790 | |||||

| 6,500 | DISCOVER FINANCIAL SERVICES | 564,628 | 563,095 | |||||

| 2,828 | EVEREST RE GROUP LTD. | 1,041,344 | 1,051,083 | |||||

| 469 | FAIRFAX FINANCIAL HOLDINGS LTD.(c) | 86,576 | 384,088 | |||||

| 7,900 | FIDELITY NATIONAL INFORMATION SERVICES, INC. | 142,948 | 436,633 | |||||

| 10,565 | FIFTH THIRD BANCORP | 109,297 | 267,611 | |||||

| 9,784 | FISERV, INC.(b) | 172,685 | 1,105,201 | |||||

| 300 | FLEETCOR TECHNOLOGIES, INC.(b) | 52,039 | 76,602 | |||||

| 4,743 | GLOBAL PAYMENTS, INC. | 413,168 | 547,295 | |||||

| 100 | GLOBE LIFE, INC. | 11,345 | 10,873 | |||||

| 7,579 | GOLDMAN SACHS GROUP (THE), INC. | 807,418 | 2,452,337 | |||||

| 1,200 | HARTFORD FINANCIAL SERVICES GROUP (THE), INC. | 26,940 | 85,092 | |||||

| 43,846 | HUNTINGTON BANCSHARES, INC. | 221,602 | 455,998 | |||||

| 7,140 | INTERCONTINENTAL EXCHANGE, INC. | 634,550 | 785,543 | |||||

| 5,900 | INVESCO LTD. | 83,166 | 85,668 | |||||

| 1,000 | JACK HENRY & ASSOCIATES, INC. | 147,550 | 151,140 | |||||

| 50,092 | JPMORGAN CHASE & CO. | 2,064,862 | 7,264,342 | |||||

| 20,104 | KEYCORP | 178,289 | 216,319 | |||||

| 32,300 | LINCOLN NATIONAL CORP. | 703,014 | 797,487 | |||||

| 7,377 | MARSH & MCLENNAN COS., INC. | 675,052 | 1,403,843 | |||||

| 17,433 | MASTERCARD, INC., CLASS A | 4,589,692 | 6,901,899 | |||||

| 1,300 | MERCURY GENERAL CORP. | 38,019 | 36,439 | |||||

| 5,731 | METLIFE, INC. | 201,149 | 360,537 | |||||

| 85,959 | MGIC INVESTMENT CORP. | 1,219,723 | 1,434,656 | |||||

| 2,100 | MOODY'S CORP. | 584,215 | 663,957 | |||||

| 1,000 | MSCI, INC. | 462,200 | 513,080 | |||||

| 2 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Financials (Cont'd): | ||||||||

| 5,100 | NASDAQ, INC. | $42,534 | 247,809 | |||||

| 1,476 | PAYPAL HOLDINGS, INC.(b) | 59,127 | 86,287 | |||||

| 7,114 | PNC FINANCIAL SERVICES GROUP (THE), INC. | 273,331 | 873,386 | |||||

| 10,575 | POPULAR, INC. | 728,404 | 666,331 | |||||

| 1,800 | PRINCIPAL FINANCIAL GROUP, INC. | 37,586 | 129,726 | |||||

| 7,588 | PROGRESSIVE (THE) CORP. | 837,867 | 1,057,008 | |||||

| 5,900 | PRUDENTIAL FINANCIAL, INC. | 182,566 | 559,851 | |||||

| 1,050 | RAYMOND JAMES FINANCIAL, INC. | 89,754 | 105,451 | |||||

| 6,699 | REGIONS FINANCIAL CORP. | 27,215 | 115,223 | |||||

| 9,764 | REINSURANCE GROUP OF AMERICA, INC. | 1,439,746 | 1,417,635 | |||||

| 1,739 | RENAISSANCERE HOLDINGS LTD. | 356,711 | 344,183 | |||||

| 4,500 | S&P GLOBAL, INC. | 1,430,397 | 1,644,345 | |||||

| 4,100 | STATE STREET CORP. | 270,194 | 274,536 | |||||

| 5,920 | STIFEL FINANCIAL CORP. | 350,271 | 363,725 | |||||

| 80,501 | SYNCHRONY FINANCIAL | 2,086,548 | 2,460,916 | |||||

| 3,549 | T. ROWE PRICE GROUP, INC. | 106,978 | 372,184 | |||||

| 2,620 | TRAVELERS (THE) COS., INC. | 93,128 | 427,872 | |||||

| 51,594 | TRUIST FINANCIAL CORP. | 1,332,829 | 1,476,104 | |||||

| 83,381 | UNUM GROUP | 3,606,135 | 4,101,511 | |||||

| 20,385 | US BANCORP | 410,978 | 673,928 | |||||

| 29,861 | VISA, INC., CLASS A | 5,759,145 | 6,868,329 | |||||

| 11,782 | W R BERKLEY CORP. | 230,551 | 748,039 | |||||

| 51,027 | WELLS FARGO & CO. | 729,863 | 2,084,963 | |||||

| 278,903 | WESTERN UNION (THE) CO. | 3,098,238 | 3,675,942 | |||||

| 1,300 | WILLIS TOWERS WATSON PLC(c) | 274,247 | 271,648 | |||||

| 2,700 | ZIONS BANCORP N.A. | 52,466 | 94,203 | |||||

| 59,360,395 | 93,978,051 | 11.97% | ||||||

| Health Care: | ||||||||

| 32,234 | ABBOTT LABORATORIES | 2,223,601 | 3,121,863 | |||||

| 39,933 | ABBVIE, INC. | 3,671,317 | 5,952,413 | |||||

| 845 | AGILENT TECHNOLOGIES, INC. | 54,611 | 94,488 | |||||

| 1,653 | ALIGN TECHNOLOGY, INC.(b) | 406,027 | 504,694 | |||||

| 5,700 | AMERISOURCEBERGEN CORP. | 95,209 | 1,025,829 | |||||

| 17,957 | AMGEN, INC. | 3,491,240 | 4,826,123 | |||||

| 38 | AVANOS MEDICAL, INC.(b) | 563 | 768 | |||||

| 6,600 | BAXTER INTERNATIONAL, INC. | 246,350 | 249,084 | |||||

| 3,809 | BECTON, DICKINSON AND CO. | 586,445 | 984,741 | |||||

| 895 | BIOGEN, INC.(b) | 233,503 | 230,024 | |||||

| 32,800 | BOSTON SCIENTIFIC CORP.(b) | 182,160 | 1,731,840 | |||||

| 25,280 | BRISTOL-MYERS SQUIBB CO. | 811,175 | 1,467,251 | |||||

| 3,392 | CARDINAL HEALTH, INC. | 183,682 | 294,493 | |||||

| 200 | CATALENT, INC.(b) | 8,298 | 9,106 | |||||

| 11,143 | CENTENE CORP.(b) | 641,692 | 767,530 | |||||

| 700 | CHARLES RIVER LABORATORIES INTERNATIONAL, INC.(b) | 136,115 | 137,186 | |||||

| 11,337 | CIGNA GROUP (THE) | 2,397,193 | 3,243,176 | |||||

| 16,630 | CVS HEALTH CORP. | 746,454 | 1,161,107 | |||||

| 10,860 | DANAHER CORP. | 1,071,927 | 2,694,366 | |||||

| 5,332 | DENTSPLY SIRONA, INC. | 141,306 | 182,141 | |||||

| 6,000 | DEXCOM, INC.(b) | 87,312 | 559,800 | |||||

| 2,556 | ELEVANCE HEALTH, INC. | 775,579 | 1,112,934 | |||||

| 13,651 | ELI LILLY & CO. | 1,771,513 | 7,332,362 | |||||

| 32,791 | EXELIXIS, INC.(b) | 544,681 | 716,483 | |||||

| 3,782 | GE HEALTHCARE TECHNOLOGIES, INC. | 169,994 | 257,327 | |||||

| 53,978 | GILEAD SCIENCES, INC. | 2,960,067 | 4,045,111 | |||||

| 200 | HCA HEALTHCARE, INC. | 47,486 | 49,196 | |||||

| 500 | HENRY SCHEIN, INC.(b) | 37,265 | 37,125 | |||||

| 5,008 | HOLOGIC, INC.(b) | 81,572 | 347,555 | |||||

| 3,559 | HUMANA, INC. | 1,525,371 | 1,731,525 | |||||

| 1,000 | IDEXX LABORATORIES, INC.(b) | 257,727 | 437,270 | |||||

| 2,300 | ILLUMINA, INC.(b) | 98,233 | 315,744 | |||||

| 900 | INSULET CORP.(b) | 143,370 | 143,541 | |||||

| 4,700 | INTUITIVE SURGICAL, INC.(b) | 872,295 | 1,373,763 | |||||

| 100 | IONIS PHARMACEUTICALS, INC.(b) | 3,269 | 4,536 | |||||

| 3,773 | IQVIA HOLDINGS, INC.(b) | 448,528 | 742,338 | |||||

| 23,161 | JOHNSON & JOHNSON | 1,405,650 | 3,607,326 | |||||

| 500 | LABORATORY CORP. OF AMERICA HOLDINGS | 10,088 | 100,525 | |||||

| 9,286 | MCKESSON CORP. | 1,334,109 | 4,038,017 | |||||

| 3 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Health Care (Cont'd): | ||||||||

| 28,500 | MEDTRONIC PLC(c) | $2,349,138 | 2,233,260 | |||||

| 42,378 | MERCK & CO., INC. | 1,366,535 | 4,362,815 | |||||

| 200 | METTLER-TOLEDO INTERNATIONAL, INC.(b) | 220,864 | 221,614 | |||||

| 4,215 | MODERNA, INC.(b) | 428,306 | 435,367 | |||||

| 4,100 | MOLINA HEALTHCARE, INC.(b) | 997,794 | 1,344,349 | |||||

| 3,547 | ORGANON & CO. | 39,446 | 61,576 | |||||

| 48,566 | PFIZER, INC. | 615,682 | 1,610,934 | |||||

| 1,308 | REGENERON PHARMACEUTICALS, INC.(b) | 682,034 | 1,076,432 | |||||

| 18 | REPLIGEN CORP.(b) | 2,766 | 2,862 | |||||

| 4,000 | RESMED, INC. | 81,990 | 591,480 | |||||

| 1,600 | REVVITY, INC. | 174,301 | 177,120 | |||||

| 1,200 | STERIS PLC | 207,491 | 263,304 | |||||

| 1,800 | STRYKER CORP. | 439,036 | 491,886 | |||||

| 500 | TELEFLEX, INC. | 103,815 | 98,205 | |||||

| 5,122 | THERMO FISHER SCIENTIFIC, INC. | 2,002,198 | 2,592,603 | |||||

| 10,973 | UNITED THERAPEUTICS CORP.(b) | 2,460,635 | 2,478,471 | |||||

| 13,997 | UNITEDHEALTH GROUP, INC. | 3,643,489 | 7,057,147 | |||||

| 2,838 | UNIVERSAL HEALTH SERVICES, INC., CLASS B | 257,448 | 356,822 | |||||

| 7,305 | VERTEX PHARMACEUTICALS, INC.(b) | 1,872,538 | 2,540,241 | |||||

| 165,202 | VIATRIS, INC. | 1,561,641 | 1,628,892 | |||||

| 700 | WATERS CORP.(b) | 16,422 | 191,947 | |||||

| 3,374 | ZIMMER BIOMET HOLDINGS, INC. | 135,863 | 378,630 | |||||

| 6,047 | ZOETIS, INC. | 858,592 | 1,052,057 | |||||

| 50,421,001 | 86,878,715 | 11.07% | ||||||

| Industrials: | ||||||||

| 6,987 | 3M CO. | 417,187 | 654,123 | |||||

| 1,400 | A O SMITH CORP. | 72,742 | 92,582 | |||||

| 18,995 | ACUITY BRANDS, INC. | 3,090,908 | 3,235,038 | |||||

| 14,500 | AGCO CORP. | 1,754,849 | 1,715,060 | |||||

| 1,700 | ALASKA AIR GROUP, INC.(b) | 62,642 | 63,036 | |||||

| 1,100 | ALLEGION PLC(c) | 112,309 | 114,620 | |||||

| 66,661 | ALLISON TRANSMISSION HOLDINGS, INC. | 2,823,584 | 3,936,999 | |||||

| 8,800 | AMERICAN AIRLINES GROUP, INC.(b) | 126,329 | 112,728 | |||||

| 5,175 | AMETEK, INC. | 73,221 | 764,658 | |||||

| 6,766 | AUTOMATIC DATA PROCESSING, INC. | 361,211 | 1,627,764 | |||||

| 500 | AXON ENTERPRISE, INC.(b) | 94,810 | 99,495 | |||||

| 5,087 | BOEING (THE) CO.(b) | 553,526 | 975,076 | |||||

| 2,213 | BROADRIDGE FINANCIAL SOLUTIONS, INC. | 89,066 | 396,238 | |||||

| 27,796 | BUILDERS FIRSTSOURCE, INC.(b) | 2,108,800 | 3,460,324 | |||||

| 500 | C.H. ROBINSON WORLDWIDE, INC. | 44,875 | 43,065 | |||||

| 10,840 | CARRIER GLOBAL CORP. | 64,437 | 598,368 | |||||

| 14,635 | CATERPILLAR, INC. | 1,167,890 | 3,995,355 | |||||

| 2,100 | CERIDIAN HCM HOLDING, INC.(b) | 121,209 | 142,485 | |||||

| 4,200 | CINTAS CORP. | 616,293 | 2,020,242 | |||||

| 8,000 | COPART, INC.(b) | 143,195 | 344,720 | |||||

| 36,272 | CSX CORP. | 810,618 | 1,115,364 | |||||

| 1,600 | CUMMINS, INC. | 317,297 | 365,536 | |||||

| 3,193 | DEERE & CO. | 101,416 | 1,204,974 | |||||

| 11,440 | DELTA AIR LINES, INC. | 343,866 | 423,280 | |||||

| 16,778 | DONALDSON CO., INC. | 1,048,827 | 1,000,640 | |||||

| 125 | DOVER CORP. | 13,234 | 17,439 | |||||

| 11,904 | EATON CORP. PLC | 223,705 | 2,538,885 | |||||

| 7,080 | EMCOR GROUP, INC. | 1,431,957 | 1,489,561 | |||||

| 1,600 | EQUIFAX, INC. | 275,443 | 293,088 | |||||

| 13,507 | EXPEDITORS INTERNATIONAL OF WASHINGTON, INC. | 1,369,219 | 1,548,307 | |||||

| 200 | FASTENAL CO. | 9,916 | 10,928 | |||||

| 2,856 | FEDEX CORP. | 262,842 | 756,612 | |||||

| 7,076 | FORTIVE CORP. | 372,199 | 524,756 | |||||

| 40,600 | GATES INDUSTRIAL CORP. PLC(b) | 476,896 | 471,366 | |||||

| 900 | GENERAC HOLDINGS, INC.(b) | 92,907 | 98,064 | |||||

| 3,451 | GENERAL DYNAMICS CORP. | 652,822 | 762,568 | |||||

| 42,701 | GENERAL ELECTRIC CO. | 4,243,233 | 4,720,596 | |||||

| 9,288 | HONEYWELL INTERNATIONAL, INC. | 284,831 | 1,715,865 | |||||

| 25,039 | HOWMET AEROSPACE, INC. | 299,194 | 1,158,054 | |||||

| 8,007 | HUBBELL, INC. | 1,849,446 | 2,509,474 | |||||

| 800 | HUNTINGTON INGALLS INDUSTRIES, INC. | 160,336 | 163,664 | |||||

| 1,371 | IDEX CORP. | 119,804 | 285,195 | |||||

| 4 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Industrials (Cont'd): | ||||||||

| 4,824 | ILLINOIS TOOL WORKS, INC. | $155,812 | 1,111,015 | |||||

| 2,100 | INGERSOLL RAND, INC. | 102,096 | 133,812 | |||||

| 8,859 | JOHNSON CONTROLS INTERNATIONAL PLC | 448,126 | 471,387 | |||||

| 7,852 | L3HARRIS TECHNOLOGIES, INC. | 1,174,546 | 1,367,190 | |||||

| 3,593 | LANDSTAR SYSTEM, INC. | 632,676 | 635,745 | |||||

| 3,369 | LOCKHEED MARTIN CORP. | 1,271,213 | 1,377,786 | |||||

| 11,762 | MANPOWERGROUP, INC. | 914,601 | 862,390 | |||||

| 2,063 | MASCO CORP. | 53,990 | 110,267 | |||||

| 17,915 | MASTERBRAND, INC.(b) | 133,945 | 217,667 | |||||

| 20,759 | MSC INDUSTRIAL DIRECT CO., INC., CLASS A | 1,813,898 | 2,037,496 | |||||

| 677 | NORFOLK SOUTHERN CORP. | 12,958 | 133,322 | |||||

| 3,271 | NORTHROP GRUMMAN CORP. | 397,418 | 1,439,862 | |||||

| 3,900 | OLD DOMINION FREIGHT LINE, INC. | 666,125 | 1,595,646 | |||||

| 5,320 | OTIS WORLDWIDE CORP. | 90,693 | 427,249 | |||||

| 28,767 | OWENS CORNING | 2,660,172 | 3,924,107 | |||||

| 45,465 | PACCAR, INC. | 3,288,062 | 3,865,434 | |||||

| 4,628 | PARKER-HANNIFIN CORP. | 350,966 | 1,802,699 | |||||

| 3,285 | PAYCHEX, INC. | 328,672 | 378,859 | |||||

| 1,553 | PAYCOM SOFTWARE, INC. | 217,948 | 402,646 | |||||

| 2,719 | PENTAIR PLC(c) | 57,667 | 176,055 | |||||

| 200 | QUANTA SERVICES, INC. | 29,452 | 37,414 | |||||

| 13,328 | RAYTHEON TECHNOLOGIES CORP. | 243,616 | 959,216 | |||||

| 682 | RB GLOBAL, INC.(c) | 35,812 | 42,625 | |||||

| 1,617 | REPUBLIC SERVICES, INC. | 65,855 | 230,439 | |||||

| 1,400 | ROBERT HALF INTERNATIONAL, INC. | 100,238 | 102,592 | |||||

| 9,842 | ROLLINS, INC. | 237,243 | 367,402 | |||||

| 17,901 | RYDER SYSTEM, INC. | 1,534,307 | 1,914,512 | |||||

| 48,190 | SCHNEIDER NATIONAL, INC., CLASS B | 1,271,962 | 1,334,381 | |||||

| 8,300 | SOUTHWEST AIRLINES CO. | 220,494 | 224,681 | |||||

| 2,057 | STANLEY BLACK & DECKER, INC. | 58,948 | 171,924 | |||||

| 8,554 | TEXTRON, INC. | 551,135 | 668,410 | |||||

| 10,505 | TRANE TECHNOLOGIES PLC(c) | 490,333 | 2,131,570 | |||||

| 600 | TRANSDIGM GROUP, INC.(b) | 296,945 | 505,878 | |||||

| 5,902 | UNION PACIFIC CORP. | 369,465 | 1,201,824 | |||||

| 2,500 | UNITED AIRLINES HOLDINGS, INC.(b) | 106,363 | 105,750 | |||||

| 9,457 | UNITED PARCEL SERVICE, INC., CLASS B | 1,131,941 | 1,474,063 | |||||

| 3,660 | UNITED RENTALS, INC. | 357,777 | 1,627,126 | |||||

| 494 | VERISK ANALYTICS, INC. | 83,738 | 116,703 | |||||

| 8,650 | WASTE MANAGEMENT, INC. | 135,675 | 1,318,606 | |||||

| 899 | WESCO INTERNATIONAL, INC. | 129,785 | 129,294 | |||||

| 1,200 | WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORP. | 21,945 | 127,524 | |||||

| 2,300 | XYLEM, INC. | 89,663 | 209,369 | |||||

| 50,993,367 | 85,038,129 | 10.83% | ||||||

| Information Technology: | ||||||||

| 13,372 | ACCENTURE PLC, CLASS A(c) | 2,608,625 | 4,106,675 | |||||

| 17,214 | ADOBE, INC.(b) | 4,232,617 | 8,777,419 | |||||

| 24,373 | ADVANCED MICRO DEVICES, INC.(b) | 272,579 | 2,506,032 | |||||

| 100 | AKAMAI TECHNOLOGIES, INC.(b) | 10,626 | 10,654 | |||||

| 1,099 | AMDOCS LTD. | 95,664 | 92,855 | |||||

| 6,700 | AMPHENOL CORP., CLASS A | 490,411 | 562,733 | |||||

| 5,951 | ANALOG DEVICES, INC. | 369,802 | 1,041,961 | |||||

| 1,200 | ANSYS, INC.(b) | 324,664 | 357,060 | |||||

| 294,711 | APPLE, INC. | 19,872,498 | 50,457,470 | |||||

| 13,205 | APPLIED MATERIALS, INC. | 1,025,431 | 1,828,232 | |||||

| 47,075 | APPLOVIN CORP., CLASS A(b) | 620,345 | 1,881,117 | |||||

| 3,300 | ARISTA NETWORKS, INC.(b) | 346,079 | 606,969 | |||||

| 25,802 | ARROW ELECTRONICS, INC.(b) | 2,951,251 | 3,231,442 | |||||

| 5,955 | AUTODESK, INC.(b) | 953,618 | 1,232,149 | |||||

| 25,946 | AVNET, INC. | 1,082,080 | 1,250,338 | |||||

| 10,155 | BROADCOM, INC. | 4,470,494 | 8,434,540 | |||||

| 9,400 | CADENCE DESIGN SYSTEMS, INC.(b) | 407,205 | 2,202,420 | |||||

| 7,000 | CDW CORP. | 292,424 | 1,412,320 | |||||

| 156,655 | CISCO SYSTEMS, INC. | 5,695,074 | 8,421,773 | |||||

| 6,994 | COGNIZANT TECHNOLOGY SOLUTIONS CORP., CLASS A | 283,349 | 473,774 | |||||

| 15,600 | CORNING, INC. | 85,176 | 475,332 | |||||

| 4,689 | CRANE NXT CO. | 221,457 | 260,568 | |||||

| 954 | EPAM SYSTEMS, INC.(b) | 163,143 | 243,928 | |||||

| 5 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Information Technology (Cont'd): | ||||||||

| 100 | F5, INC.(b) | $14,240 | 16,114 | |||||

| 3,851 | FAIR ISAAC CORP.(b) | 1,733,363 | 3,344,709 | |||||

| 100 | FIRST SOLAR, INC.(b) | 16,140 | 16,159 | |||||

| 27,615 | FORTINET, INC.(b) | 393,491 | 1,620,448 | |||||

| 357 | GARTNER, INC.(b) | 91,624 | 122,669 | |||||

| 22,781 | GEN DIGITAL, INC. | 207,695 | 402,768 | |||||

| 373 | GODADDY, INC., CLASS A(b) | 26,125 | 27,781 | |||||

| 216,189 | HEWLETT PACKARD ENTERPRISE CO. | 2,829,886 | 3,755,203 | |||||

| 44,411 | HP, INC. | 1,011,384 | 1,141,363 | |||||

| 43,850 | INTEL CORP. | 758,140 | 1,558,867 | |||||

| 11,723 | INTERNATIONAL BUSINESS MACHINES CORP. | 1,192,830 | 1,644,737 | |||||

| 3,680 | INTUIT, INC. | 523,933 | 1,880,259 | |||||

| 24,332 | JABIL, INC. | 1,916,929 | 3,087,487 | |||||

| 9,500 | KEYSIGHT TECHNOLOGIES, INC.(b) | 1,219,888 | 1,256,945 | |||||

| 5,476 | KLA CORP. | 1,781,428 | 2,511,622 | |||||

| 4,493 | LAM RESEARCH CORP. | 421,510 | 2,816,078 | |||||

| 32,216 | MICROCHIP TECHNOLOGY, INC. | 1,950,391 | 2,514,459 | |||||

| 33,760 | MICRON TECHNOLOGY, INC. | 669,074 | 2,296,693 | |||||

| 145,894 | MICROSOFT CORP. | 15,733,467 | 46,066,030 | |||||

| 500 | MONOLITHIC POWER SYSTEMS, INC. | 180,141 | 231,000 | |||||

| 1,900 | MOTOROLA SOLUTIONS, INC. | 402,783 | 517,256 | |||||

| 58,474 | NCR CORP.(b) | 1,333,890 | 1,577,044 | |||||

| 49,266 | NVIDIA CORP. | 5,154,382 | 21,430,217 | |||||

| 3,825 | NXP SEMICONDUCTORS N.V.(c) | 327,712 | 764,694 | |||||

| 25,247 | ON SEMICONDUCTOR CORP.(b) | 1,808,033 | 2,346,709 | |||||

| 19,877 | ORACLE CORP. | 1,256,311 | 2,105,372 | |||||

| 2,400 | PTC, INC.(b) | 82,674 | 340,032 | |||||

| 1,300 | QORVO, INC.(b) | 123,264 | 124,111 | |||||

| 7,515 | QUALCOMM, INC. | 758,389 | 834,616 | |||||

| 700 | ROPER TECHNOLOGIES, INC. | 94,318 | 338,996 | |||||

| 13,390 | SALESFORCE, INC.(b) | 939,415 | 2,715,224 | |||||

| 5,500 | SEAGATE TECHNOLOGY HOLDINGS PLC | 51,728 | 362,725 | |||||

| 2,647 | SERVICENOW, INC.(b) | 529,253 | 1,479,567 | |||||

| 24,755 | SKYWORKS SOLUTIONS, INC. | 2,431,455 | 2,440,595 | |||||

| 5,300 | SYNOPSYS, INC.(b) | 438,338 | 2,432,541 | |||||

| 10,207 | TD SYNNEX CORP. | 913,031 | 1,019,271 | |||||

| 600 | TELEDYNE TECHNOLOGIES, INC.(b) | 226,008 | 245,148 | |||||

| 18,255 | TERADATA CORP.(b) | 685,204 | 821,840 | |||||

| 6,600 | TERADYNE, INC. | 274,405 | 663,036 | |||||

| 27,783 | TEXAS INSTRUMENTS, INC. | 936,448 | 4,417,775 | |||||

| 7,049 | TRIMBLE, INC.(b) | 94,849 | 379,659 | |||||

| 500 | TYLER TECHNOLOGIES, INC.(b) | 190,425 | 193,070 | |||||

| 1,176 | VERISIGN, INC.(b) | 200,718 | 238,175 | |||||

| 5,145 | WESTERN DIGITAL CORP.(b) | 87,708 | 234,766 | |||||

| 600 | ZEBRA TECHNOLOGIES CORP., CLASS A(b) | 88,190 | 141,918 | |||||

| 98,975,222 | 224,343,509 | 28.58% | ||||||

| Materials: | ||||||||

| 3,094 | AIR PRODUCTS AND CHEMICALS, INC. | 525,323 | 876,840 | |||||

| 1,600 | ALBEMARLE CORP. | 110,503 | 272,064 | |||||

| 13,770 | AMCOR PLC(c) | 60,200 | 126,133 | |||||

| 4,165 | AVERY DENNISON CORP. | 371,149 | 760,821 | |||||

| 4,200 | BALL CORP. | 214,268 | 209,076 | |||||

| 11,110 | BERRY GLOBAL GROUP, INC. | 614,155 | 687,820 | |||||

| 1,400 | CELANESE CORP. | 139,561 | 175,728 | |||||

| 30,437 | CF INDUSTRIES HOLDINGS, INC. | 2,140,761 | 2,609,668 | |||||

| 183 | CHEMOURS (THE) CO. | 5,265 | 5,133 | |||||

| 9,262 | CORTEVA, INC. | 236,362 | 473,844 | |||||

| 8,062 | DOW, INC. | 185,436 | 415,677 | |||||

| 7,362 | DUPONT DE NEMOURS, INC. | 218,512 | 549,132 | |||||

| 4,214 | EASTMAN CHEMICAL CO. | 315,742 | 323,298 | |||||

| 3,991 | ECOLAB, INC. | 236,070 | 676,075 | |||||

| 19,000 | FREEPORT-MCMORAN, INC. | 286,861 | 708,510 | |||||

| 14,771 | HUNTSMAN CORP. | 356,079 | 360,412 | |||||

| 221 | INTERNATIONAL FLAVORS & FRAGRANCES, INC. | 4,754 | 15,066 | |||||

| 9,341 | INTERNATIONAL PAPER CO. | 310,484 | 331,325 | |||||

| 6,465 | LINDE PLC | 1,521,181 | 2,407,243 | |||||

| 6,607 | LOUISIANA-PACIFIC CORP. | 378,476 | 365,169 | |||||

| 6 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Materials (Cont'd): | ||||||||

| 20,732 | LYONDELLBASELL INDUSTRIES N.V., CLASS A | $1,355,517 | 1,963,320 | |||||

| 700 | MARTIN MARIETTA MATERIALS, INC. | 27,965 | 287,336 | |||||

| 18,188 | MOSAIC (THE) CO. | 699,110 | 647,493 | |||||

| 7,800 | NEWMONT CORP. | 153,062 | 288,210 | |||||

| 9,103 | NUCOR CORP. | 1,252,497 | 1,423,254 | |||||

| 1,000 | PACKAGING CORP. OF AMERICA | 114,697 | 153,550 | |||||

| 5,172 | PPG INDUSTRIES, INC. | 123,888 | 671,326 | |||||

| 10,609 | RELIANCE STEEL & ALUMINUM CO. | 2,557,143 | 2,781,998 | |||||

| 32,100 | SEALED AIR CORP. | 1,008,007 | 1,054,806 | |||||

| 18,743 | STEEL DYNAMICS, INC. | 1,970,796 | 2,009,625 | |||||

| 29,586 | UNITED STATES STEEL CORP. | 933,576 | 960,953 | |||||

| 2,100 | VULCAN MATERIALS CO. | 63,441 | 424,242 | |||||

| 8,135 | WESTLAKE CORP. | 856,316 | 1,014,190 | |||||

| 3,358 | WESTROCK CO. | 99,509 | 120,216 | |||||

| 19,446,666 | 26,149,553 | 3.33% | ||||||

| Real Estate: | ||||||||

| 2,129 | ALEXANDRIA REAL ESTATE EQUITIES, INC. | 110,363 | 213,113 | |||||

| 2,880 | AMERICAN TOWER CORP. | 179,676 | 473,616 | |||||

| 1,934 | AVALONBAY COMMUNITIES, INC. | 225,956 | 332,145 | |||||

| 3,388 | BOSTON PROPERTIES, INC. | 169,359 | 201,518 | |||||

| 1,400 | CAMDEN PROPERTY TRUST | 72,220 | 132,412 | |||||

| 4,300 | CBRE GROUP, INC., CLASS A(b) | 306,057 | 317,598 | |||||

| 100 | COSTAR GROUP, INC.(b) | 7,631 | 7,689 | |||||

| 4,600 | CROWN CASTLE, INC. | 151,615 | 423,338 | |||||

| 457 | DIGITAL REALTY TRUST, INC. | 20,856 | 55,306 | |||||

| 952 | EQUINIX, INC. | 131,626 | 691,400 | |||||

| 5,516 | EQUITY RESIDENTIAL | 179,921 | 323,844 | |||||

| 675 | ESSEX PROPERTY TRUST, INC. | 73,174 | 143,161 | |||||

| 900 | FEDERAL REALTY INVESTMENT TRUST | 47,642 | 81,567 | |||||

| 70 | GAMING AND LEISURE PROPERTIES, INC. | 2,718 | 3,189 | |||||

| 57,500 | HEALTHPEAK PROPERTIES, INC. | 994,833 | 1,055,700 | |||||

| 10,322 | HOST HOTELS & RESORTS, INC. | 73,056 | 165,875 | |||||

| 7,700 | INVITATION HOMES, INC. | 228,811 | 244,013 | |||||

| 2,300 | IRON MOUNTAIN, INC. | 103,977 | 136,735 | |||||

| 6,972 | KIMCO REALTY CORP. | 66,465 | 122,637 | |||||

| 4,900 | MID-AMERICA APARTMENT COMMUNITIES, INC. | 537,238 | 630,385 | |||||

| 12,118 | PROLOGIS, INC. | 352,040 | 1,359,761 | |||||

| 1,735 | PUBLIC STORAGE | 227,274 | 457,207 | |||||

| 4,002 | REALTY INCOME CORP. | 83,178 | 199,860 | |||||

| 3,900 | REGENCY CENTERS CORP. | 85,344 | 231,816 | |||||

| 680 | REXFORD INDUSTRIAL REALTY, INC. | 33,593 | 33,558 | |||||

| 3,800 | SBA COMMUNICATIONS CORP. | 554,352 | 760,646 | |||||

| 4,134 | SIMON PROPERTY GROUP, INC. | 304,125 | 446,596 | |||||

| 33 | SUN COMMUNITIES, INC. | 2,773 | 3,905 | |||||

| 4,100 | UDR, INC. | 63,318 | 146,247 | |||||

| 4,700 | VENTAS, INC. | 206,398 | 198,011 | |||||

| 4,265 | VICI PROPERTIES, INC. | 59,215 | 124,111 | |||||

| 6,400 | WELLTOWER, INC. | 407,634 | 524,288 | |||||

| 4,916 | WEYERHAEUSER CO. | 22,140 | 150,725 | |||||

| 6,084,578 | 10,391,972 | 1.32% | ||||||

| Utilities: | ||||||||

| 55,300 | AES (THE) CORP. | 863,461 | 840,560 | |||||

| 2,000 | ALLIANT ENERGY CORP. | 24,835 | 96,900 | |||||

| 2,900 | AMEREN CORP. | 143,805 | 217,007 | |||||

| 5,900 | AMERICAN ELECTRIC POWER CO., INC. | 372,550 | 443,798 | |||||

| 5,800 | CENTERPOINT ENERGY, INC. | 66,308 | 155,730 | |||||

| 10,200 | CMS ENERGY CORP. | 135,756 | 541,722 | |||||

| 4,975 | CONSOLIDATED EDISON, INC. | 318,863 | 425,512 | |||||

| 3,500 | CONSTELLATION ENERGY CORP. | 137,851 | 381,780 | |||||

| 8,873 | DOMINION ENERGY, INC. | 285,022 | 396,357 | |||||

| 2,300 | DTE ENERGY CO. | 71,502 | 228,344 | |||||

| 9,251 | DUKE ENERGY CORP. | 427,582 | 816,493 | |||||

| 4,325 | EDISON INTERNATIONAL | 135,088 | 273,729 | |||||

| 464 | ENTERGY CORP. | 10,276 | 42,920 | |||||

| 2,974 | EVERGY, INC. | 67,407 | 150,782 | |||||

| 19,661 | EVERSOURCE ENERGY | 1,003,308 | 1,143,287 | |||||

| 10,500 | EXELON CORP. | 342,581 | 396,795 | |||||

| 7 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Utilities (Cont'd): | ||||||||

| 5,500 | FIRSTENERGY CORP. | $150,953 | 187,990 | |||||

| 105,674 | HAWAIIAN ELECTRIC INDUSTRIES, INC. | 1,393,618 | 1,300,847 | |||||

| 16,354 | NEXTERA ENERGY, INC. | 192,414 | 936,921 | |||||

| 6,900 | NISOURCE, INC. | 43,973 | 170,292 | |||||

| 10,300 | PG&E CORP.(b) | 139,468 | 166,139 | |||||

| 13,100 | PINNACLE WEST CAPITAL CORP. | 782,497 | 965,208 | |||||

| 700 | PPL CORP. | 10,384 | 16,492 | |||||

| 1,200 | PUBLIC SERVICE ENTERPRISE GROUP, INC. | 51,552 | 68,292 | |||||

| 7,400 | SEMPRA ENERGY | 239,277 | 503,422 | |||||

| 13,300 | SOUTHERN (THE) CO. | 486,970 | 860,776 | |||||

| 3,500 | WEC ENERGY GROUP, INC. | 263,727 | 281,925 | |||||

| 8,161,028 | 12,010,020 | 1.53% | ||||||

| Sub-total Common Stocks: | 434,437,355 | 779,940,724 | 99.35% | |||||

| Escrows: | ||||||||

| Communication Services: | ||||||||

| 1,360 | GCI LIBERTY, INC., CLASS A(b)(d) | - | - | |||||

| - | - | 0.00% | ||||||

| Sub-total Escrows: | - | - | 0.00% | |||||

| Rights: | ||||||||

| Health Care: | ||||||||

| 300 | ABIOMED, INC. (CONTINGENT VALUE RIGHTS)(b)(d) | - | - | |||||

| - | - | 0.00% | ||||||

| Sub-total Rights: | - | - | 0.00% | |||||

| Short-Term Investments: | ||||||||

| 5,300,460 | NORTHERN INSTITUTIONAL FUNDS - U.S. GOVERNMENT SELECT PORTFOLIO, INSTITUTIONAL SHARES, 5.22%(e) | 5,300,460 | 5,300,460 | |||||

| Sub-total Short-Term Investments: | 5,300,460 | 5,300,460 | 0.68% | |||||

| Grand total | $439,737,815 | 785,241,184 | 100.03% | |||||

| Notes to Schedule of Investments: | |

| (a) | Investments in U.S. and foreign equity securities are valued at the last sales price or the regular trading session closing price on the principal exchange or market where the securities are traded. Foreign security values are stated in U.S. dollars. |

| (b) | Non-income producing assets. |

| (c) | Foreign security values are stated in U.S. dollars. As of September 30, 2023, the value of foreign stocks or depositary receipts of companies based outside of the United States represented 1.60% of net assets. |

| (d) | Security has been deemed worthless and is a Level 3 investment. |

| (e) | The short-term investment is a money market portfolio of the investment company, Northern Institutional Funds. At December 31, 2022, the value of the Clearwater Core Equity Fund's investment in the U.S. Government Select Portfolio of the Northern Institutional Funds was $4,611,528 with net purchases of $688,932 during the nine months ended September 30, 2023. |

| 8 | (Continued) |

| • | Level 1 – Unadjusted quoted market prices in active markets for identical securities on the measurement date. |

| • | Level 2 – Other significant observable inputs including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc. or quoted prices for identical or similar assets in markets that are not active. Inputs that are derived principally from or corroborated by observable market data are also considered Level 2 measurements. An adjustment to any observable input that is significant to the fair value may render the measurement a Level 3 measurement. |

| • | Level 3 – Valuations based on unobservable inputs, which may include the Clearwater Management Co., Inc.'s (the “Adviser”) own assumptions in determining the fair value of an investment. |

| Level 1 | Level 2 | Level 3 | Total | ||||

| Common Stocks | $779,940,724 | $— | $— | $779,940,724 | |||

| Escrows | — | — | —* | — | |||

| Rights | — | — | —* | — | |||

| Short-Term Investments | 5,300,460 | — | — | 5,300,460 | |||

| Total | $785,241,184 | $— | $— | $785,241,184 |

| * Security has been deemed worthless and is a Level 3 investment. |

| 9 | (Continued) |

| 10 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Common Stocks: | ||||||||

| Communication Services: | ||||||||

| 6,100 | AMC NETWORKS, INC., CLASS A(b) | $75,828 | 71,858 | |||||

| 3,500 | CARS.COM, INC.(b) | 42,390 | 59,010 | |||||

| 400 | CINEMARK HOLDINGS, INC.(b) | 6,595 | 7,340 | |||||

| 2,400 | COGENT COMMUNICATIONS HOLDINGS, INC. | 128,057 | 148,560 | |||||

| 27,000 | DISH NETWORK CORP., CLASS A(b) | 159,710 | 158,220 | |||||

| 83,622 | EVENTBRITE, INC., CLASS A(b) | 672,479 | 824,513 | |||||

| 400 | GANNETT CO., INC.(b) | 922 | 980 | |||||

| 128,702 | NEW YORK TIMES (THE) CO., CLASS A | 5,383,373 | 5,302,522 | |||||

| 34,069 | OOMA, INC.(b) | 600,763 | 443,238 | |||||

| 16,405 | SCHOLASTIC CORP. | 632,408 | 625,687 | |||||

| 600 | SHENANDOAH TELECOMMUNICATIONS CO. | 11,024 | 12,366 | |||||

| 17,502 | SHUTTERSTOCK, INC. | 1,171,326 | 665,951 | |||||

| 12,195 | TECHTARGET, INC.(b) | 511,498 | 370,240 | |||||

| 3,500 | TELEPHONE AND DATA SYSTEMS, INC. | 24,522 | 64,085 | |||||

| 151,687 | THUNDERBIRD ENTERTAINMENT GROUP, INC.(b)(c) | 536,158 | 238,992 | |||||

| 88,477 | WARNER MUSIC GROUP CORP., CLASS A | 2,713,038 | 2,778,178 | |||||

| 3,804 | YELP, INC.(b) | 111,139 | 158,208 | |||||

| 12,781,230 | 11,929,948 | 3.19% | ||||||

| Consumer Discretionary: | ||||||||

| 31,727 | 1-800-FLOWERS.COM, INC., CLASS A(b) | 961,928 | 222,089 | |||||

| 1,558 | ABERCROMBIE & FITCH CO., CLASS A(b) | 25,016 | 87,824 | |||||

| 2,046 | ACADEMY SPORTS & OUTDOORS, INC. | 82,840 | 96,714 | |||||

| 55,864 | ADIENT PLC(b) | 2,047,887 | 2,050,209 | |||||

| 24,800 | ADVANCE AUTO PARTS, INC. | 1,789,117 | 1,387,064 | |||||

| 837 | AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.(b) | 5,969 | 6,077 | |||||

| 122,110 | AMERICAN EAGLE OUTFITTERS, INC. | 2,036,201 | 2,028,247 | |||||

| 400 | AMERICA'S CAR-MART, INC.(b) | 24,862 | 36,396 | |||||

| 500 | ASBURY AUTOMOTIVE GROUP, INC.(b) | 84,891 | 115,035 | |||||

| 4,763 | BLOOMIN' BRANDS, INC. | 93,604 | 117,122 | |||||

| 1,295 | BOOT BARN HOLDINGS, INC.(b) | 77,565 | 105,141 | |||||

| 1,900 | BRINKER INTERNATIONAL, INC.(b) | 49,107 | 60,021 | |||||

| 200 | BUCKLE (THE), INC. | 6,390 | 6,678 | |||||

| 700 | CALERES, INC. | 16,331 | 20,132 | |||||

| 89,643 | CARPARTS.COM, INC.(b) | 484,279 | 369,329 | |||||

| 99,794 | CENTURY CASINOS, INC.(b) | 1,418,206 | 511,943 | |||||

| 1,929 | CENTURY COMMUNITIES, INC. | 86,775 | 128,819 | |||||

| 5,608 | CHUY'S HOLDINGS, INC.(b) | 117,797 | 199,533 | |||||

| 131,462 | DANA, INC. | 1,573,541 | 1,928,548 | |||||

| 15,487 | DENNY'S CORP.(b) | 249,246 | 131,175 | |||||

| 124 | DORMAN PRODUCTS, INC.(b) | 9,593 | 9,394 | |||||

| 67,838 | DREAM FINDERS HOMES, INC., CLASS A(b) | 1,164,702 | 1,508,039 | |||||

| 300 | ETHAN ALLEN INTERIORS, INC. | 6,708 | 8,970 | |||||

| 7,800 | FOOT LOCKER, INC. | 132,332 | 135,330 | |||||

| 4,500 | FRONTDOOR, INC.(b) | 94,527 | 137,655 | |||||

| 103,115 | FULL HOUSE RESORTS, INC.(b) | 871,209 | 440,301 | |||||

| 214,571 | GAP (THE), INC. | 2,870,602 | 2,280,890 | |||||

| 51,255 | GEN RESTAURANT GROUP, INC.(b) | 670,841 | 596,608 | |||||

| 28,735 | GENESCO, INC.(b) | 848,158 | 885,613 | |||||

| 79,519 | GENTEX CORP. | 2,347,052 | 2,587,548 | |||||

| 1,300 | GENTHERM, INC.(b) | 65,622 | 70,538 | |||||

| 987 | G-III APPAREL GROUP LTD.(b) | 14,210 | 24,596 | |||||

| 87,928 | GILDAN ACTIVEWEAR, INC.(c) | 2,096,537 | 2,462,863 | |||||

| 1,300 | GREEN BRICK PARTNERS, INC.(b) | 28,259 | 53,963 | |||||

| 900 | GROUP 1 AUTOMOTIVE, INC. | 129,981 | 241,839 | |||||

| 1,900 | GUESS?, INC. | 28,931 | 41,116 | |||||

| 230,130 | HANESBRANDS, INC. | 2,562,859 | 911,315 | |||||

| 800 | HAVERTY FURNITURE COS., INC. | 20,316 | 23,024 | |||||

| 27,031 | HELEN OF TROY LTD.(b) | 4,124,213 | 3,150,733 | |||||

| 47,911 | HOOKER FURNISHINGS CORP. | 1,123,840 | 931,869 | |||||

| 601 | INSTALLED BUILDING PRODUCTS, INC. | 45,818 | 75,059 | |||||

| 2,100 | KONTOOR BRANDS, INC. | 72,197 | 92,211 | |||||

| 600 | LA-Z-BOY, INC. | 13,860 | 18,528 | |||||

| 700 | LCI INDUSTRIES | 79,807 | 82,194 | |||||

| 700 | LGI HOMES, INC.(b) | 57,078 | 69,643 | |||||

| 1,500 | M/I HOMES, INC.(b) | 57,345 | 126,060 | |||||

| 33,020 | MALIBU BOATS, INC., CLASS A(b) | 1,881,329 | 1,618,640 | |||||

| 11 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Consumer Discretionary (Cont'd): | ||||||||

| 575 | MARINEMAX, INC.(b) | $13,007 | 18,872 | |||||

| 3,500 | MDC HOLDINGS, INC. | 99,518 | 144,305 | |||||

| 1,348 | MERITAGE HOMES CORP. | 96,515 | 164,982 | |||||

| 300 | MONARCH CASINO & RESORT, INC. | 18,189 | 18,630 | |||||

| 169,284 | NEWELL BRANDS, INC. | 1,567,061 | 1,528,635 | |||||

| 2,300 | ODP (THE) CORP.(b) | 82,462 | 106,145 | |||||

| 36,344 | OVERSTOCK.COM, INC.(b) | 1,190,529 | 574,962 | |||||

| 800 | OXFORD INDUSTRIES, INC. | 67,825 | 76,904 | |||||

| 6,878 | PATRICK INDUSTRIES, INC. | 511,414 | 516,263 | |||||

| 154,471 | PELOTON INTERACTIVE, INC., CLASS A(b) | 2,866,204 | 780,079 | |||||

| 3,600 | PERDOCEO EDUCATION CORP. | 37,564 | 61,560 | |||||

| 21,629 | PVH CORP. | 1,050,702 | 1,654,835 | |||||

| 1,400 | SHAKE SHACK, INC., CLASS A(b) | 65,264 | 81,298 | |||||

| 21,890 | SHOE CARNIVAL, INC. | 575,442 | 526,017 | |||||

| 2,100 | SIGNET JEWELERS LTD. | 118,747 | 150,801 | |||||

| 4,000 | SIX FLAGS ENTERTAINMENT CORP.(b) | 73,577 | 94,040 | |||||

| 28,885 | SKYLINE CHAMPION CORP.(b) | 1,767,337 | 1,840,552 | |||||

| 10,414 | SLEEP NUMBER CORP.(b) | 781,027 | 256,080 | |||||

| 823 | SONIC AUTOMOTIVE, INC., CLASS A | 28,187 | 39,306 | |||||

| 100 | STANDARD MOTOR PRODUCTS, INC. | 3,250 | 3,362 | |||||

| 1,777 | STEVEN MADDEN LTD. | 50,250 | 56,455 | |||||

| 83,405 | STONERIDGE, INC.(b) | 1,705,555 | 1,673,938 | |||||

| 1,200 | STRATEGIC EDUCATION, INC. | 69,846 | 90,300 | |||||

| 48,216 | STRIDE, INC.(b) | 1,706,528 | 2,171,166 | |||||

| 5,500 | TRI POINTE HOMES, INC.(b) | 86,442 | 150,425 | |||||

| 2,100 | UPBOUND GROUP, INC. | 46,462 | 61,845 | |||||

| 822 | URBAN OUTFITTERS, INC.(b) | 17,875 | 26,871 | |||||

| 72,578 | VF CORP. | 1,475,450 | 1,282,453 | |||||

| 2,000 | VISTA OUTDOOR, INC.(b) | 48,955 | 66,240 | |||||

| 57,468 | WINNEBAGO INDUSTRIES, INC. | 2,623,516 | 3,416,473 | |||||

| 3,600 | WOLVERINE WORLD WIDE, INC. | 27,599 | 29,016 | |||||

| 45,511 | WYNDHAM HOTELS & RESORTS, INC. | 2,595,020 | 3,164,835 | |||||

| 700 | XPEL, INC.(b) | 44,646 | 53,977 | |||||

| 54,161,443 | 49,074,257 | 13.13% | ||||||

| Consumer Staples: | ||||||||

| 1,800 | ANDERSONS (THE), INC. | 56,519 | 92,718 | |||||

| 400 | CENTRAL GARDEN & PET CO., CLASS A(b) | 13,784 | 16,036 | |||||

| 30,694 | CHEFS' WAREHOUSE (THE), INC.(b) | 942,401 | 650,099 | |||||

| 233 | EDGEWELL PERSONAL CARE CO. | 8,656 | 8,612 | |||||

| 1,900 | ELF BEAUTY, INC.(b) | 71,657 | 208,677 | |||||

| 60,200 | FLOWERS FOODS, INC. | 1,586,718 | 1,335,236 | |||||

| 1,300 | FRESH DEL MONTE PRODUCE, INC. | 30,767 | 33,592 | |||||

| 119,186 | GROCERY OUTLET HOLDING CORP.(b) | 3,504,266 | 3,438,516 | |||||

| 27,300 | HALOWS CO. LTD.(c) | 656,515 | 766,736 | |||||

| 74,163 | HILTON FOOD GROUP PLC(c) | 516,228 | 644,856 | |||||

| 2,126 | HOSTESS BRANDS, INC.(b) | 43,386 | 70,817 | |||||

| 13,130 | INGREDION, INC. | 1,203,344 | 1,291,992 | |||||

| 900 | INTER PARFUMS, INC. | 68,995 | 120,906 | |||||

| 700 | J & J SNACK FOODS CORP. | 91,908 | 114,555 | |||||

| 744 | JOHN B. SANFILIPPO & SON, INC. | 55,342 | 73,507 | |||||

| 161,194 | MAMAMANCINI'S HOLDINGS, INC.(b) | 478,880 | 704,418 | |||||

| 1,000 | NATIONAL BEVERAGE CORP.(b) | 39,795 | 47,020 | |||||

| 1,300 | PRICESMART, INC. | 76,855 | 96,759 | |||||

| 4,357 | SIMPLY GOOD FOODS (THE) CO.(b) | 146,160 | 150,404 | |||||

| 27,924 | SPECTRUM BRANDS HOLDINGS, INC. | 1,804,599 | 2,187,845 | |||||

| 1,814 | TREEHOUSE FOODS, INC.(b) | 75,897 | 79,054 | |||||

| 45,602 | UNIVERSAL CORP. | 2,437,199 | 2,152,870 | |||||

| 28,434 | USANA HEALTH SCIENCES, INC.(b) | 2,604,724 | 1,666,517 | |||||

| 5,100 | VECTOR GROUP LTD. | 45,813 | 54,264 | |||||

| 300 | WD-40 CO. | 59,193 | 60,972 | |||||

| 12,652 | WINFARM SAS(b)(c) | 518,360 | 107,071 | |||||

| 17,137,961 | 16,174,049 | 4.33% | ||||||

| Energy: | ||||||||

| 7,300 | ARCHROCK, INC. | 48,773 | 91,980 | |||||

| 7,490 | BAYTEX ENERGY CORP.(c) | 23,594 | 33,031 | |||||

| 2,100 | CALLON PETROLEUM CO.(b) | 72,871 | 82,152 | |||||

| 362 | CHEVRON CORP. | 35,198 | 61,040 | |||||

| 12 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Energy (Cont'd): | ||||||||

| 2,000 | CIVITAS RESOURCES, INC. | $114,995 | 161,740 | |||||

| 1,017 | CONSOL ENERGY, INC. | 57,529 | 106,693 | |||||

| 1,800 | CORE LABORATORIES, INC. | 33,948 | 43,218 | |||||

| 1,061 | CVR ENERGY, INC. | 28,107 | 36,106 | |||||

| 88,937 | DMC GLOBAL, INC.(b) | 3,253,916 | 2,176,288 | |||||

| 1,700 | DORIAN LPG LTD. | 24,290 | 48,841 | |||||

| 1,900 | DRIL-QUIP, INC.(b) | 39,103 | 53,523 | |||||

| 2,200 | GREEN PLAINS, INC.(b) | 64,124 | 66,220 | |||||

| 3,180 | HELIX ENERGY SOLUTIONS GROUP, INC.(b) | 19,514 | 35,521 | |||||

| 200 | HELMERICH & PAYNE, INC. | 7,654 | 8,432 | |||||

| 41,597 | HIGHPEAK ENERGY, INC.(d) | 469,244 | 702,157 | |||||

| 332 | NABORS INDUSTRIES LTD.(b) | 37,057 | 40,883 | |||||

| 3,300 | NORTHERN OIL AND GAS, INC. | 103,014 | 132,759 | |||||

| 134,834 | NOV, INC. | 1,634,007 | 2,818,031 | |||||

| 3,994 | OCEANEERING INTERNATIONAL, INC.(b) | 50,619 | 102,726 | |||||

| 1,100 | OIL STATES INTERNATIONAL, INC.(b) | 5,060 | 9,207 | |||||

| 2,902 | PAR PACIFIC HOLDINGS, INC.(b) | 45,626 | 104,298 | |||||

| 21,962 | PATTERSON-UTI ENERGY, INC. | 250,429 | 303,954 | |||||

| 580 | PBF ENERGY, INC., CLASS A | 19,990 | 31,047 | |||||

| 3,446 | PROPETRO HOLDING CORP.(b) | 24,164 | 36,631 | |||||

| 774 | REX AMERICAN RESOURCES CORP.(b) | 16,958 | 31,517 | |||||

| 2,600 | RPC, INC. | 20,213 | 23,244 | |||||

| 3,209 | SM ENERGY CO. | 87,806 | 127,237 | |||||

| 1,300 | TALOS ENERGY, INC.(b) | 17,956 | 21,372 | |||||

| 2,000 | US SILICA HOLDINGS, INC.(b) | 24,573 | 28,080 | |||||

| 740 | VITAL ENERGY, INC.(b) | 34,720 | 41,011 | |||||

| 6,665,052 | 7,558,939 | 2.02% | ||||||

| Financials: | ||||||||

| 28,717 | AFC GAMMA, INC. | 616,672 | 337,138 | |||||

| 19,504 | A-MARK PRECIOUS METALS, INC. | 577,271 | 572,052 | |||||

| 27,585 | AMERICAN EQUITY INVESTMENT LIFE HOLDING CO. | 796,377 | 1,479,659 | |||||

| 400 | AMERISAFE, INC. | 18,734 | 20,028 | |||||

| 1,100 | APOLLO COMMERCIAL REAL ESTATE FINANCE, INC. | 9,512 | 11,143 | |||||

| 20,500 | ARGO GROUP INTERNATIONAL HOLDINGS LTD. | 515,873 | 611,720 | |||||

| 119,510 | ASSOCIATED BANC-CORP | 2,084,499 | 2,044,816 | |||||

| 300 | ASSURED GUARANTY LTD. | 14,439 | 18,156 | |||||

| 1,800 | AVANTAX, INC.(b) | 34,988 | 46,044 | |||||

| 49,287 | AXIS CAPITAL HOLDINGS LTD. | 2,539,237 | 2,778,308 | |||||

| 31,614 | AXOS FINANCIAL, INC.(b) | 1,550,220 | 1,196,906 | |||||

| 700 | B RILEY FINANCIAL, INC. | 26,474 | 28,693 | |||||

| 2,400 | BANCORP (THE), INC.(b) | 53,353 | 82,800 | |||||

| 3,900 | BANK OF HAWAII CORP. | 184,962 | 193,791 | |||||

| 27,399 | BREAD FINANCIAL HOLDINGS, INC. | 820,363 | 937,046 | |||||

| 800 | BRIGHTSPHERE INVESTMENT GROUP, INC. | 12,484 | 15,512 | |||||

| 29,135 | CALIFORNIA BANCORP(b) | 555,019 | 585,613 | |||||

| 29,600 | CAPITOL FEDERAL FINANCIAL, INC. | 145,861 | 141,192 | |||||

| 600 | CITY HOLDING CO. | 53,184 | 54,210 | |||||

| 147,339 | CNO FINANCIAL GROUP, INC. | 2,726,779 | 3,496,354 | |||||

| 168,038 | COLUMBIA BANKING SYSTEM, INC. | 3,928,832 | 3,411,171 | |||||

| 35,698 | COMMERCE BANCSHARES, INC. | 1,673,529 | 1,712,790 | |||||

| 8,000 | CUSTOMERS BANCORP, INC.(b) | 139,005 | 275,600 | |||||

| 41,791 | DONNELLEY FINANCIAL SOLUTIONS, INC.(b) | 1,946,827 | 2,351,997 | |||||

| 6,600 | EAGLE BANCORP, INC. | 153,548 | 141,570 | |||||

| 700 | ELLINGTON FINANCIAL, INC. | 8,085 | 8,729 | |||||

| 400 | EMPLOYERS HOLDINGS, INC. | 13,746 | 15,980 | |||||

| 500 | ENCORE CAPITAL GROUP, INC.(b) | 22,889 | 23,880 | |||||

| 1,800 | ENOVA INTERNATIONAL, INC.(b) | 54,842 | 91,566 | |||||

| 28,551 | ESQUIRE FINANCIAL HOLDINGS, INC. | 854,172 | 1,304,495 | |||||

| 50,710 | ESSENT GROUP LTD. | 1,910,505 | 2,398,076 | |||||

| 2,259 | EVERTEC, INC. | 68,287 | 83,990 | |||||

| 116,237 | EZCORP, INC., CLASS A(b) | 869,913 | 958,955 | |||||

| 14,237 | FEDERAL AGRICULTURAL MORTGAGE CORP., CLASS C | 1,865,580 | 2,196,769 | |||||

| 130,084 | FIDUCIAN GROUP LTD.(c) | 760,862 | 474,916 | |||||

| 9,275 | FIRST HAWAIIAN, INC. | 174,544 | 167,414 | |||||

| 27,609 | FIRST WESTERN FINANCIAL, INC.(b) | 521,286 | 501,103 | |||||

| 11,733 | FIRSTCASH HOLDINGS, INC. | 713,810 | 1,177,759 | |||||

| 2,200 | FRANKLIN BSP REALTY TRUST, INC. | 24,406 | 29,128 | |||||

| 13 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Financials (Cont'd): | ||||||||

| 19,868 | GENWORTH FINANCIAL, INC., CLASS A(b) | $71,184 | 116,426 | |||||

| 75,634 | GLACIER BANCORP, INC. | 3,077,407 | 2,155,569 | |||||

| 8,800 | HANNON ARMSTRONG SUSTAINABLE INFRASTRUCTURE CAPITAL, INC. | 184,849 | 186,560 | |||||

| 17,127 | HCI GROUP, INC. | 924,383 | 929,825 | |||||

| 4,121 | HERITAGE FINANCIAL CORP. | 71,163 | 67,213 | |||||

| 2,500 | HILLTOP HOLDINGS, INC. | 66,017 | 70,900 | |||||

| 4,200 | HOPE BANCORP, INC. | 38,242 | 37,170 | |||||

| 909 | HUNTINGTON BANCSHARES, INC. | 9,494 | 9,454 | |||||

| 24,236 | I3 VERTICALS, INC., CLASS A(b) | 546,637 | 512,349 | |||||

| 200 | INDEPENDENT BANK CORP. | 9,914 | 9,818 | |||||

| 700 | INDEPENDENT BANK GROUP, INC. | 26,939 | 27,685 | |||||

| 1,462 | INVESCO MORTGAGE CAPITAL, INC. | 15,267 | 14,635 | |||||

| 52,230 | JDC GROUP A.G.(b)(c) | 1,191,985 | 954,639 | |||||

| 67,875 | KINGSWAY FINANCIAL SERVICES, INC.(b) | 606,551 | 512,456 | |||||

| 10,600 | KKR REAL ESTATE FINANCE TRUST, INC. | 125,870 | 125,822 | |||||

| 800 | LAKELAND FINANCIAL CORP. | 44,136 | 37,968 | |||||

| 209,029 | LENDINGCLUB CORP.(b) | 2,982,514 | 1,275,077 | |||||

| 800 | LINCOLN NATIONAL CORP. | 19,208 | 19,752 | |||||

| 8,638 | LPL FINANCIAL HOLDINGS, INC. | 1,660,201 | 2,052,821 | |||||

| 8,585 | MARKETAXESS HOLDINGS, INC. | 2,286,419 | 1,834,099 | |||||

| 2,100 | MERCURY GENERAL CORP. | 60,597 | 58,863 | |||||

| 82,238 | MORTGAGE ADVICE BUREAU HOLDINGS LTD.(c) | 1,053,801 | 532,853 | |||||

| 2,600 | MR COOPER GROUP, INC.(b) | 103,966 | 139,256 | |||||

| 2,539 | NATIONAL WESTERN LIFE GROUP, INC., CLASS A | 705,076 | 1,110,787 | |||||

| 3,590 | NEW YORK COMMUNITY BANCORP, INC. | 28,581 | 40,711 | |||||

| 10,100 | NEW YORK MORTGAGE TRUST, INC. | 85,793 | 85,749 | |||||

| 2,724 | NMI HOLDINGS, INC., CLASS A(b) | 39,406 | 73,793 | |||||

| 8,300 | NORTHWEST BANCSHARES, INC. | 85,460 | 84,909 | |||||

| 995 | OFG BANCORP | 22,845 | 29,711 | |||||

| 157,249 | OLD NATIONAL BANCORP | 2,300,391 | 2,286,400 | |||||

| 8,430 | PACIFIC PREMIER BANCORP, INC. | 180,370 | 183,437 | |||||

| 19,100 | PACWEST BANCORP | 148,753 | 151,081 | |||||

| 1,700 | PALOMAR HOLDINGS, INC.(b) | 85,370 | 86,275 | |||||

| 1,100 | PATHWARD FINANCIAL, INC. | 36,415 | 50,699 | |||||

| 20,100 | PAYONEER GLOBAL, INC.(b) | 89,952 | 123,012 | |||||

| 500 | PIPER SANDLER COS. | 52,300 | 72,655 | |||||

| 7,300 | PRA GROUP, INC.(b) | 138,795 | 140,233 | |||||

| 2,100 | PROG HOLDINGS, INC.(b) | 33,764 | 69,741 | |||||

| 2,100 | RADIAN GROUP, INC. | 49,135 | 52,731 | |||||

| 3,700 | READY CAPITAL CORP. | 36,013 | 37,407 | |||||

| 2,300 | REDWOOD TRUST, INC. | 13,958 | 16,399 | |||||

| 10,030 | RENAISSANCERE HOLDINGS LTD. | 1,610,066 | 1,985,138 | |||||

| 40,849 | RYAN SPECIALTY HOLDINGS, INC.(b) | 1,629,866 | 1,977,092 | |||||

| 500 | SAFETY INSURANCE GROUP, INC. | 37,195 | 34,095 | |||||

| 2,800 | SERVISFIRST BANCSHARES, INC. | 124,031 | 146,076 | |||||

| 1,310 | SIMMONS FIRST NATIONAL CORP., CLASS A | 21,676 | 22,218 | |||||

| 1,903 | SIRIUSPOINT LTD.(b)(c) | 10,615 | 19,354 | |||||

| 24,707 | SKYWARD SPECIALTY INSURANCE GROUP, INC.(b) | 530,034 | 675,984 | |||||

| 31,210 | STEWART INFORMATION SERVICES CORP. | 1,311,025 | 1,366,998 | |||||

| 1,182 | STONEX GROUP, INC.(b) | 72,388 | 114,559 | |||||

| 30,910 | SYNOVUS FINANCIAL CORP. | 857,377 | 859,298 | |||||

| 2,800 | TOMPKINS FINANCIAL CORP. | 136,519 | 137,172 | |||||

| 800 | TRIUMPH FINANCIAL, INC.(b) | 46,438 | 51,832 | |||||

| 1,000 | TRUPANION, INC.(b) | 26,610 | 28,200 | |||||

| 500 | UNIVERSAL INSURANCE HOLDINGS, INC. | 4,870 | 7,010 | |||||

| 57,749 | UNIVEST FINANCIAL CORP. | 1,067,701 | 1,003,678 | |||||

| 200 | VIRTUS INVESTMENT PARTNERS, INC. | 32,442 | 40,398 | |||||

| 78 | WALKER & DUNLOP, INC. | 5,251 | 5,791 | |||||

| 50,457 | WEBSTER FINANCIAL CORP. | 2,111,257 | 2,033,922 | |||||

| 6,000 | WISDOMTREE, INC. | 28,964 | 42,000 | |||||

| 91,459 | WSFS FINANCIAL CORP. | 4,083,552 | 3,338,253 | |||||

| 62,097,967 | 62,243,077 | 16.66% | ||||||

| Health Care: | ||||||||

| 9,921 | ADDUS HOMECARE CORP.(b) | 825,410 | 845,170 | |||||

| 7,500 | AGILITI, INC.(b) | 49,318 | 48,675 | |||||

| 25,147 | AMICUS THERAPEUTICS, INC.(b) | 167,175 | 305,787 | |||||

| 14 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Health Care (Cont'd): | ||||||||

| 2,400 | AMN HEALTHCARE SERVICES, INC.(b) | $193,049 | 204,432 | |||||

| 2,100 | AMPHASTAR PHARMACEUTICALS, INC.(b) | 60,514 | 96,579 | |||||

| 700 | ANI PHARMACEUTICALS, INC.(b) | 22,511 | 40,642 | |||||

| 600 | ARCUS BIOSCIENCES, INC.(b) | 9,822 | 10,770 | |||||

| 10,600 | AVID BIOSERVICES, INC.(b) | 105,265 | 100,064 | |||||

| 120,047 | BIOCRYST PHARMACEUTICALS, INC.(b) | 936,390 | 849,933 | |||||

| 9,600 | BIOLIFE SOLUTIONS, INC.(b) | 134,933 | 132,576 | |||||

| 88,914 | BIOMERICA, INC.(b) | 277,205 | 76,297 | |||||

| 113,272 | BIOTE CORP., CLASS A(b) | 418,992 | 579,953 | |||||

| 32,801 | BIO-TECHNE CORP. | 1,980,770 | 2,232,764 | |||||

| 6,961 | CHARLES RIVER LABORATORIES INTERNATIONAL, INC.(b) | 1,528,134 | 1,364,217 | |||||

| 4,289 | COMMUNITY HEALTH SYSTEMS, INC.(b) | 10,209 | 12,438 | |||||

| 17,007 | COMPUTER PROGRAMS AND SYSTEMS, INC.(b) | 628,404 | 271,092 | |||||

| 1,100 | CONMED CORP. | 90,438 | 110,935 | |||||

| 3,494 | CORCEPT THERAPEUTICS, INC.(b) | 69,996 | 95,194 | |||||

| 400 | CORVEL CORP.(b) | 55,868 | 78,660 | |||||

| 27,065 | CROSS COUNTRY HEALTHCARE, INC.(b) | 664,211 | 670,941 | |||||

| 61,340 | DENTSPLY SIRONA, INC. | 1,956,573 | 2,095,374 | |||||

| 1,200 | DYNAVAX TECHNOLOGIES CORP.(b) | 13,631 | 17,724 | |||||

| 2,735 | EMBECTA CORP. | 55,535 | 41,162 | |||||

| 2,225 | ENSIGN GROUP (THE), INC. | 171,080 | 206,769 | |||||

| 50,162 | ERGOMED PLC(b)(c) | 690,902 | 818,247 | |||||

| 15,497 | ESTABLISHMENT LABS HOLDINGS, INC.(b)(c) | 1,102,045 | 760,438 | |||||

| 93,616 | EVOLUS, INC.(b) | 849,867 | 855,650 | |||||

| 1,200 | FULGENT GENETICS, INC.(b) | 36,187 | 32,088 | |||||

| 841 | GLAUKOS CORP.(b) | 48,882 | 63,285 | |||||

| 92,963 | HARROW HEALTH, INC.(b) | 1,270,162 | 1,335,878 | |||||

| 300 | HEALTHSTREAM, INC. | 6,462 | 6,474 | |||||

| 78,462 | INFUSYSTEM HOLDINGS, INC.(b) | 809,634 | 756,374 | |||||

| 22,169 | INMODE LTD.(b)(c) | 834,684 | 675,268 | |||||

| 57,999 | INOTIV, INC.(b) | 1,103,928 | 178,637 | |||||

| 7,111 | INSMED, INC.(b) | 127,319 | 179,553 | |||||

| 107,949 | INSTEM PLC(b)(c) | 1,268,530 | 1,096,038 | |||||

| 27,945 | INTEGER HOLDINGS CORP.(b) | 2,186,526 | 2,191,726 | |||||

| 41,570 | INTEGRA LIFESCIENCES HOLDINGS CORP.(b) | 2,210,916 | 1,587,558 | |||||

| 76,877 | IOVANCE BIOTHERAPEUTICS, INC.(b) | 723,488 | 349,790 | |||||

| 3,800 | ITEOS THERAPEUTICS, INC.(b) | 42,622 | 41,610 | |||||

| 47,116 | KINIKSA PHARMACEUTICALS LTD., CLASS A(b) | 655,380 | 818,405 | |||||

| 34,884 | LEMAITRE VASCULAR, INC. | 1,823,586 | 1,900,480 | |||||

| 16,507 | LIGAND PHARMACEUTICALS, INC.(b) | 1,575,241 | 989,099 | |||||

| 22,257 | MASIMO CORP.(b) | 3,236,774 | 1,951,494 | |||||

| 3,012 | MERIT MEDICAL SYSTEMS, INC.(b) | 176,915 | 207,888 | |||||

| 10,610 | MIRUM PHARMACEUTICALS, INC.(b) | 237,204 | 335,276 | |||||

| 7,677 | MOLINA HEALTHCARE, INC.(b) | 2,215,295 | 2,517,212 | |||||

| 5,100 | NEOGENOMICS, INC.(b) | 44,444 | 62,730 | |||||

| 12,135 | NEXUS A.G.(c) | 1,029,221 | 663,219 | |||||

| 164,103 | OCUPHIRE PHARMA, INC.(b) | 426,845 | 549,745 | |||||

| 5,286 | OMNIAB, INC.(b)(e) | - | - | |||||

| 5,286 | OMNIAB, INC.(b)(e) | - | - | |||||

| 184,095 | OMNIAB, INC. (NASDAQ GLOBAL MARKET EXCHANGE)(b) | 1,133,819 | 955,453 | |||||

| 76,701 | OPTIMIZERX CORP.(b) | 1,793,424 | 596,734 | |||||

| 126,067 | OPTINOSE, INC.(b) | 256,243 | 155,062 | |||||

| 2,400 | ORASURE TECHNOLOGIES, INC.(b) | 9,502 | 14,232 | |||||

| 18,128 | ORTHOPEDIATRICS CORP.(b) | 1,001,801 | 580,096 | |||||

| 500 | OWENS & MINOR, INC.(b) | 7,800 | 8,080 | |||||

| 164,973 | PACIFIC BIOSCIENCES OF CALIFORNIA, INC.(b) | 2,009,804 | 1,377,525 | |||||

| 38,486 | PACIRA BIOSCIENCES, INC.(b) | 1,584,267 | 1,180,750 | |||||

| 57,370 | PENNANT GROUP (THE), INC.(b) | 725,731 | 638,528 | |||||

| 65,520 | PERRIGO CO. PLC(c) | 2,502,232 | 2,093,364 | |||||

| 62,055 | PHIBRO ANIMAL HEALTH CORP., CLASS A | 1,583,227 | 792,442 | |||||

| 9,000 | PREMIER, INC., CLASS A | 196,880 | 193,500 | |||||

| 2,500 | PRESTIGE CONSUMER HEALTHCARE, INC.(b) | 110,887 | 142,975 | |||||

| 34,117 | PUMA BIOTECHNOLOGY, INC.(b) | 133,408 | 89,728 | |||||

| 26,280 | REVANCE THERAPEUTICS, INC.(b) | 356,766 | 301,432 | |||||

| 31,189 | RHYTHM PHARMACEUTICALS, INC.(b) | 358,270 | 715,008 | |||||

| 15,354 | ROCKET PHARMACEUTICALS, INC.(b) | 302,659 | 314,603 | |||||

| 9,401 | SCHOLAR ROCK HOLDING CORP.(b) | 288,155 | 66,747 | |||||

| 15 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Health Care (Cont'd): | ||||||||

| 17,288 | SCPHARMACEUTICALS, INC.(b) | $179,065 | 123,091 | |||||

| 4,000 | SELECT MEDICAL HOLDINGS CORP. | 91,586 | 101,080 | |||||

| 52,695 | STAAR SURGICAL CO.(b) | 2,658,935 | 2,117,285 | |||||

| 40,252 | SUPERNUS PHARMACEUTICALS, INC.(b) | 1,363,923 | 1,109,748 | |||||

| 600 | TANDEM DIABETES CARE, INC.(b) | 12,504 | 12,462 | |||||

| 15,554 | TRAVERE THERAPEUTICS, INC.(b) | 465,890 | 139,053 | |||||

| 14,883 | UROGEN PHARMA LTD.(b) | 280,381 | 208,511 | |||||

| 418 | US PHYSICAL THERAPY, INC. | 32,458 | 38,343 | |||||

| 15,716 | UTAH MEDICAL PRODUCTS, INC. | 1,802,857 | 1,351,576 | |||||

| 148,734 | VAREX IMAGING CORP.(b) | 3,338,564 | 2,794,712 | |||||

| 1,100 | VERADIGM, INC.(b) | 13,571 | 14,454 | |||||

| 2,500 | VERICEL CORP.(b) | 60,043 | 83,800 | |||||

| 5,130 | VERONA PHARMA PLC ADR(b)(c)(f) | 85,761 | 83,619 | |||||

| 110,353 | VIEMED HEALTHCARE, INC.(b) | 575,900 | 742,676 | |||||

| 15,517 | VIR BIOTECHNOLOGY, INC.(b) | 229,939 | 145,394 | |||||

| 18,183 | Y-MABS THERAPEUTICS, INC.(b) | 405,812 | 99,097 | |||||

| 5,673 | ZYNEX, INC.(b) | 49,463 | 45,384 | |||||

| 61,160,019 | 50,838,854 | 13.61% | ||||||

| Industrials: | ||||||||

| 2,550 | AAON, INC. | 92,593 | 145,019 | |||||

| 500 | AAR CORP.(b) | 18,655 | 29,765 | |||||

| 8,700 | ACUITY BRANDS, INC. | 1,293,694 | 1,481,697 | |||||

| 29,351 | ADENTRA, INC.(c) | 744,094 | 662,977 | |||||

| 62,451 | AIR LEASE CORP. | 2,223,469 | 2,461,194 | |||||

| 310 | ALAMO GROUP, INC. | 40,969 | 53,587 | |||||

| 700 | ALBANY INTERNATIONAL CORP., CLASS A | 55,495 | 60,396 | |||||

| 600 | ALLEGIANT TRAVEL CO. | 44,820 | 46,116 | |||||

| 17,551 | ALLIED MOTION TECHNOLOGIES, INC. | 580,569 | 542,677 | |||||

| 60,321 | AMERICAN WOODMARK CORP.(b) | 4,431,276 | 4,560,871 | |||||

| 34,470 | API GROUP CORP.(b) | 731,709 | 893,807 | |||||

| 200 | APOGEE ENTERPRISES, INC. | 7,740 | 9,416 | |||||

| 1,460 | APPLIED INDUSTRIAL TECHNOLOGIES, INC. | 152,746 | 225,731 | |||||

| 1,766 | ARCBEST CORP. | 104,075 | 179,514 | |||||

| 1,800 | ARCOSA, INC. | 108,698 | 129,420 | |||||

| 56,051 | ARIS WATER SOLUTIONS, INC., CLASS A | 828,583 | 559,389 | |||||

| 18,970 | ARMSTRONG WORLD INDUSTRIES, INC. | 1,726,196 | 1,365,840 | |||||

| 1,100 | ASTEC INDUSTRIES, INC. | 35,388 | 51,821 | |||||

| 700 | AZZ, INC. | 25,907 | 31,906 | |||||

| 2,800 | BARNES GROUP, INC. | 88,428 | 95,116 | |||||

| 1,177 | BOISE CASCADE CO. | 67,222 | 121,278 | |||||

| 26,182 | BOWMAN CONSULTING GROUP LTD.(b) | 347,120 | 733,881 | |||||

| 2,600 | BRADY CORP., CLASS A | 111,195 | 142,792 | |||||

| 118,890 | BRIGHTVIEW HOLDINGS, INC.(b) | 1,410,582 | 921,398 | |||||

| 24,526 | BWX TECHNOLOGIES, INC. | 1,329,318 | 1,838,959 | |||||

| 700 | CIRCOR INTERNATIONAL, INC.(b) | 11,638 | 39,025 | |||||

| 18,937 | CLEAN HARBORS, INC.(b) | 2,602,058 | 3,169,296 | |||||

| 1,100 | COMFORT SYSTEMS U.S.A., INC. | 105,717 | 187,451 | |||||

| 35,707 | CONSTRUCTION PARTNERS, INC., CLASS A(b) | 1,045,056 | 1,305,448 | |||||

| 1,639 | CSG SYSTEMS INTERNATIONAL, INC. | 64,966 | 83,786 | |||||

| 12,058 | DUCOMMUN, INC.(b) | 570,259 | 524,644 | |||||

| 843 | DXP ENTERPRISES, INC.(b) | 19,189 | 29,454 | |||||

| 800 | ENCORE WIRE CORP. | 91,748 | 145,968 | |||||

| 74,205 | ENERPAC TOOL GROUP CORP. | 1,507,973 | 1,961,238 | |||||

| 900 | ENPRO INDUSTRIES, INC. | 77,086 | 109,071 | |||||

| 4,400 | ENVIRI CORP.(b) | 19,868 | 31,768 | |||||

| 26,623 | ESAB CORP. | 1,031,392 | 1,869,467 | |||||

| 1,000 | ESCO TECHNOLOGIES, INC. | 74,760 | 104,440 | |||||

| 3,316 | FEDERAL SIGNAL CORP. | 119,424 | 198,065 | |||||

| 37,328 | FRANKLIN COVEY CO.(b) | 1,722,893 | 1,602,118 | |||||

| 169,940 | GATES INDUSTRIAL CORP. PLC(b) | 2,363,036 | 1,973,003 | |||||

| 1,400 | GIBRALTAR INDUSTRIES, INC.(b) | 56,403 | 94,514 | |||||

| 24,010 | GLOBAL INDUSTRIAL CO. | 823,990 | 804,335 | |||||

| 26,805 | GMS, INC.(b) | 1,226,640 | 1,714,716 | |||||

| 25,840 | GORMAN-RUPP (THE) CO. | 792,796 | 850,136 | |||||

| 34,842 | GRACO, INC. | 2,134,929 | 2,539,285 | |||||

| 37,649 | GRAHAM CORP.(b) | 373,116 | 624,973 | |||||

| 2,431 | GRANITE CONSTRUCTION, INC. | 64,987 | 92,427 | |||||

| 16 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Industrials (Cont'd): | ||||||||

| 2,600 | GREENBRIER (THE) COS., INC. | $70,680 | 104,000 | |||||

| 27,983 | HEXCEL CORP. | 2,012,617 | 1,822,813 | |||||

| 3,809 | HILLENBRAND, INC. | 146,006 | 161,159 | |||||

| 53,079 | HOWMET AEROSPACE, INC. | 1,811,128 | 2,454,904 | |||||

| 1,973 | HUB GROUP, INC., CLASS A(b) | 129,965 | 154,959 | |||||

| 9,707 | ICF INTERNATIONAL, INC. | 855,829 | 1,172,703 | |||||

| 131,145 | INTERFACE, INC. | 1,042,609 | 1,286,532 | |||||

| 144,146 | JELD-WEN HOLDING, INC.(b) | 1,344,786 | 1,925,791 | |||||

| 8,139 | JOHN BEAN TECHNOLOGIES CORP. | 1,023,617 | 855,734 | |||||

| 412,772 | JOHNSON SERVICE GROUP PLC(c) | 782,509 | 677,427 | |||||

| 2,979 | KADANT, INC. | 640,748 | 671,913 | |||||

| 33,271 | KARAT PACKAGING, INC. | 672,154 | 767,229 | |||||

| 1,900 | KELLY SERVICES, INC., CLASS A | 26,974 | 34,561 | |||||

| 411,012 | KNIGHTS GROUP HOLDINGS PLC(c) | 535,385 | 468,870 | |||||

| 7,606 | KORNIT DIGITAL LTD.(b)(c) | 205,113 | 143,829 | |||||

| 44,208 | MASONITE INTERNATIONAL CORP.(b) | 4,207,008 | 4,121,070 | |||||

| 99,843 | MASTERBRAND, INC.(b) | 883,434 | 1,213,092 | |||||

| 1,500 | MATSON, INC. | 98,158 | 133,080 | |||||

| 2,100 | MATTHEWS INTERNATIONAL CORP., CLASS A | 48,981 | 81,711 | |||||

| 2,400 | MILLERKNOLL, INC. | 35,057 | 58,680 | |||||

| 1,500 | MOOG, INC., CLASS A | 111,928 | 169,440 | |||||

| 272,361 | MRC GLOBAL, INC.(b) | 2,432,452 | 2,791,700 | |||||

| 600 | MYR GROUP, INC.(b) | 57,948 | 80,856 | |||||

| 63,873 | NOW, INC.(b) | 705,804 | 758,173 | |||||

| 100 | NV5 GLOBAL, INC.(b) | 9,537 | 9,623 | |||||

| 6,300 | OPENLANE, INC.(b) | 74,444 | 93,996 | |||||

| 96,313 | PGT INNOVATIONS, INC.(b) | 1,591,219 | 2,672,686 | |||||

| 3,800 | PITNEY BOWES, INC. | 9,567 | 11,476 | |||||

| 400 | QUANEX BUILDING PRODUCTS CORP. | 7,672 | 11,268 | |||||

| 98,053 | RADIANT LOGISTICS, INC.(b) | 633,746 | 553,999 | |||||

| 164,470 | RESIDEO TECHNOLOGIES, INC.(b) | 2,835,286 | 2,598,626 | |||||

| 139,290 | REV GROUP, INC. | 1,480,838 | 2,228,640 | |||||

| 42,945 | RUSH ENTERPRISES, INC., CLASS A | 814,245 | 1,753,444 | |||||

| 14,458 | RXO, INC.(b) | 230,373 | 285,256 | |||||

| 15,311 | SITEONE LANDSCAPE SUPPLY, INC.(b) | 1,891,034 | 2,502,583 | |||||

| 2,700 | SKYWEST, INC.(b) | 45,446 | 113,238 | |||||

| 1,600 | SPX TECHNOLOGIES, INC.(b) | 88,269 | 130,240 | |||||

| 600 | STANDEX INTERNATIONAL CORP. | 52,056 | 87,414 | |||||

| 435,229 | STEELCASE, INC., CLASS A | 5,449,286 | 4,861,508 | |||||

| 13,734 | STERLING INFRASTRUCTURE, INC.(b) | 299,035 | 1,009,174 | |||||

| 1,100 | SUN COUNTRY AIRLINES HOLDINGS, INC.(b) | 15,521 | 16,324 | |||||

| 8,500 | SUNPOWER CORP.(b) | 51,898 | 52,445 | |||||

| 38,390 | TECNOGLASS, INC.(c) | 1,640,643 | 1,265,334 | |||||

| 124 | TENNANT CO. | 7,135 | 9,195 | |||||

| 14,846 | TEREX CORP. | 386,298 | 855,427 | |||||

| 3,000 | TRINITY INDUSTRIES, INC. | 65,630 | 73,050 | |||||

| 96,258 | TRUEBLUE, INC.(b) | 1,519,965 | 1,412,105 | |||||

| 400 | VERITIV CORP. | 48,032 | 67,560 | |||||

| 2,100 | WABASH NATIONAL CORP. | 33,108 | 44,352 | |||||

| 22,511 | WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORP. | 2,043,210 | 2,392,244 | |||||

| 28,685 | WILLDAN GROUP, INC.(b) | 1,154,105 | 586,035 | |||||

| 22,490 | WOODWARD, INC. | 2,084,826 | 2,794,607 | |||||

| 77,943,779 | 88,001,270 | 23.55% | ||||||

| Information Technology: | ||||||||

| 3,600 | A10 NETWORKS, INC. | 52,187 | 54,108 | |||||

| 800 | ADEIA, INC. | 6,456 | 8,544 | |||||

| 14,444 | ADTRAN HOLDINGS, INC. | 128,091 | 118,874 | |||||

| 1,342 | ADVANCED ENERGY INDUSTRIES, INC. | 101,891 | 138,387 | |||||

| 900 | AGILYSYS, INC.(b) | 47,400 | 59,544 | |||||

| 700 | ALARM.COM HOLDINGS, INC.(b) | 34,067 | 42,798 | |||||

| 200 | ALPHA & OMEGA SEMICONDUCTOR LTD.(b) | 4,954 | 5,968 | |||||

| 216,394 | ARLO TECHNOLOGIES, INC.(b) | 1,328,819 | 2,228,858 | |||||

| 13,330 | ARROW ELECTRONICS, INC.(b) | 1,312,456 | 1,669,449 | |||||

| 16,242 | ASPEN TECHNOLOGY, INC.(b) | 3,097,227 | 3,317,591 | |||||

| 1,312 | AVID TECHNOLOGY, INC.(b) | 29,931 | 35,253 | |||||

| 51,756 | AVNET, INC. | 1,933,626 | 2,494,122 | |||||

| 67 | AXCELIS TECHNOLOGIES, INC.(b) | 3,800 | 10,924 | |||||

| 17 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Information Technology (Cont'd): | ||||||||

| 1,636 | BADGER METER, INC. | $154,127 | 235,371 | |||||

| 22,568 | BELDEN, INC. | 769,805 | 2,178,940 | |||||

| 2,504 | BENCHMARK ELECTRONICS, INC. | 50,443 | 60,747 | |||||

| 77,810 | BIGCOMMERCE HOLDINGS, INC., CLASS 1(b) | 685,316 | 767,985 | |||||

| 13,159 | BILL HOLDINGS, INC.(b) | 1,005,987 | 1,428,673 | |||||

| 45,781 | CAMBIUM NETWORKS CORP.(b) | 1,045,297 | 335,575 | |||||

| 110,415 | CELESTICA, INC.(b)(c) | 797,231 | 2,707,376 | |||||

| 1,917 | CERENCE, INC.(b) | 31,514 | 39,049 | |||||

| 25,781 | CEVA, INC.(b) | 1,164,879 | 499,894 | |||||

| 520 | CLIMB GLOBAL SOLUTIONS, INC. | 21,801 | 22,365 | |||||

| 49,846 | CODA OCTOPUS GROUP, INC.(b) | 396,328 | 309,045 | |||||

| 2,700 | COHU, INC.(b) | 73,544 | 92,988 | |||||

| 14,860 | CONSENSUS CLOUD SOLUTIONS, INC.(b) | 621,372 | 374,175 | |||||

| 1,900 | CORSAIR GAMING, INC.(b) | 22,922 | 27,607 | |||||

| 3,300 | CTS CORP. | 98,658 | 137,742 | |||||

| 27,632 | DIGI INTERNATIONAL, INC.(b) | 685,171 | 746,064 | |||||

| 80,921 | DIGITAL TURBINE, INC.(b) | 1,467,052 | 489,572 | |||||

| 1,700 | DIODES, INC.(b) | 111,873 | 134,028 | |||||

| 17,721 | DOLBY LABORATORIES, INC., CLASS A | 1,363,572 | 1,404,566 | |||||

| 400 | DOUBLEVERIFY HOLDINGS, INC.(b) | 10,984 | 11,180 | |||||

| 34,091 | ELASTIC N.V.(b) | 3,389,738 | 2,769,553 | |||||

| 1,000 | EPLUS, INC.(b) | 41,490 | 63,520 | |||||

| 6,749 | EXTREME NETWORKS, INC.(b) | 89,817 | 163,393 | |||||

| 100 | FABRINET(b)(c) | 16,791 | 16,662 | |||||

| 29,254 | FD TECHNOLOGIES PLC(b)(c) | 664,314 | 522,405 | |||||

| 63,925 | GRID DYNAMICS HOLDINGS, INC.(b) | 994,426 | 778,607 | |||||

| 74,839 | HARMONIC, INC.(b) | 964,622 | 720,700 | |||||

| 1,500 | ICHOR HOLDINGS LTD.(b) | 40,593 | 46,440 | |||||

| 14,066 | IMPINJ, INC.(b) | 823,908 | 774,052 | |||||

| 1,700 | INSIGHT ENTERPRISES, INC.(b) | 143,345 | 247,350 | |||||

| 1,700 | INTERDIGITAL, INC. | 73,063 | 136,408 | |||||

| 2,500 | ITRON, INC.(b) | 110,376 | 151,450 | |||||

| 50,667 | ITURAN LOCATION AND CONTROL LTD.(c) | 1,337,049 | 1,514,943 | |||||

| 25,784 | KIMBALL ELECTRONICS, INC.(b) | 616,253 | 705,966 | |||||

| 5,000 | KNOWLES CORP.(b) | 64,124 | 74,050 | |||||

| 3,100 | KULICKE & SOFFA INDUSTRIES, INC.(c) | 123,108 | 150,753 | |||||

| 139,774 | LANTRONIX, INC.(b) | 733,334 | 621,994 | |||||

| 13,044 | LATTICE SEMICONDUCTOR CORP.(b) | 840,437 | 1,120,871 | |||||

| 15,300 | LIVEPERSON, INC.(b) | 54,397 | 59,517 | |||||

| 2,600 | LIVERAMP HOLDINGS, INC.(b) | 48,085 | 74,984 | |||||

| 67,971 | LUNA INNOVATIONS, INC.(b) | 515,093 | 398,310 | |||||

| 7,720 | MAXLINEAR, INC.(b) | 177,753 | 171,770 | |||||

| 18,520 | MKS INSTRUMENTS, INC. | 1,726,317 | 1,602,721 | |||||

| 20,275 | NAPCO SECURITY TECHNOLOGIES, INC. | 431,239 | 451,119 | |||||

| 23,811 | OKTA, INC.(b) | 1,404,983 | 1,940,835 | |||||

| 1,700 | ONESPAN, INC.(b) | 15,193 | 18,275 | |||||

| 4,469 | ONTO INNOVATION, INC.(b) | 287,013 | 569,887 | |||||

| 800 | OSI SYSTEMS, INC.(b) | 59,840 | 94,432 | |||||

| 214,973 | PARK CITY GROUP, INC. | 1,185,108 | 1,883,164 | |||||

| 1,000 | PDF SOLUTIONS, INC.(b) | 24,850 | 32,400 | |||||

| 2,200 | PHOTRONICS, INC.(b) | 32,884 | 44,462 | |||||

| 140 | POWER INTEGRATIONS, INC. | 8,400 | 10,683 | |||||

| 12,654 | PROGRESS SOFTWARE CORP. | 566,039 | 665,347 | |||||

| 63,116 | RADWARE LTD.(b)(c) | 2,129,717 | 1,067,923 | |||||

| 1,800 | RAMBUS, INC.(b) | 46,397 | 100,422 | |||||

| 20,410 | RAPID7, INC.(b) | 770,620 | 934,370 | |||||

| 39,896 | RED VIOLET, INC.(b) | 1,059,826 | 798,319 | |||||

| 3,248 | SANMINA CORP.(b) | 119,288 | 176,301 | |||||

| 70,627 | SCANSOURCE, INC.(b) | 2,654,116 | 2,140,704 | |||||

| 10,112 | SITIME CORP.(b) | 1,259,111 | 1,155,296 | |||||

| 6,223 | SOLARWINDS CORP.(b) | 52,445 | 58,745 | |||||

| 25,154 | SOUNDTHINKING, INC.(b) | 728,600 | 450,257 | |||||

| 1,168 | SPS COMMERCE, INC.(b) | 143,291 | 199,273 | |||||

| 5,905 | TTM TECHNOLOGIES, INC.(b) | 68,078 | 76,056 | |||||

| 145 | ULTRA CLEAN HOLDINGS, INC.(b) | 3,816 | 4,302 | |||||

| 86,020 | UPLAND SOFTWARE, INC.(b) | 936,635 | 397,412 | |||||

| 37,811 | VEECO INSTRUMENTS, INC.(b) | 836,325 | 1,062,867 | |||||

| 18 | (Continued) |

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Information Technology (Cont'd): | ||||||||

| 58,654 | WALKME LTD.(b)(c) | $543,164 | 556,040 | |||||

| 91,666 | WEAVE COMMUNICATIONS, INC.(b) | 477,440 | 747,078 | |||||

| 36,596 | WIX.COM LTD.(b)(c) | 5,537,073 | 3,359,513 | |||||

| 53,628,705 | 54,069,263 | 14.47% | ||||||

| Materials: | ||||||||

| 735 | ADVANSIX, INC. | 21,577 | 22,844 | |||||

| 123,523 | ASPEN AEROGELS, INC.(b) | 896,805 | 1,062,298 | |||||

| 4,785 | ATI, INC.(b) | 128,941 | 196,903 | |||||

| 50,716 | AXALTA COATING SYSTEMS LTD.(b) | 1,234,484 | 1,364,260 | |||||

| 62 | BALCHEM CORP. | 7,550 | 7,690 | |||||

| 1,800 | CARPENTER TECHNOLOGY CORP. | 58,388 | 120,978 | |||||

| 33,558 | FMC CORP. | 3,969,694 | 2,247,379 | |||||

| 156,130 | FORAN MINING CORP.(b)(c) | 441,951 | 426,462 | |||||

| 1,800 | FUTUREFUEL CORP. | 10,948 | 12,906 | |||||

| 16,810 | H.B. FULLER CO. | 871,400 | 1,153,334 | |||||

| 14,230 | HAYNES INTERNATIONAL, INC. | 554,264 | 661,980 | |||||

| 15,772 | INGEVITY CORP.(b) | 787,495 | 750,905 | |||||

| 1,387 | INNOSPEC, INC. | 121,931 | 141,751 | |||||

| 900 | KAISER ALUMINUM CORP. | 59,411 | 67,734 | |||||

| 22,680 | KOPPERS HOLDINGS, INC. | 523,575 | 896,994 | |||||

| 700 | MATERION CORP. | 55,545 | 71,337 | |||||