DELIVERING GOODS for THE GOOD of ALL TRINITY INDUSTRIES, INC. Investor Contact: TrinityInvestorRelations@trin.net Website: www.trin.net Q4 2023 – Earnings Conference Call Supplemental Materials February 22, 2024 – based on financial results as of December 31, 2023 Exhibit 99.3

DELIVERING GOODS for THE GOOD of ALL /// 2 Some statements in this presentation, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Trinity's estimates, expectations, beliefs, intentions or strategies for the future, and the assumptions underlying these forward-looking statements, including, but not limited to, future financial and operating performance, future opportunities and any other statements regarding events or developments that Trinity believes or anticipates will or may occur in the future. Trinity uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “projected,” “outlook,” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this release, and Trinity expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Trinity’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based, except as required by federal securities laws. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to risks and uncertainties regarding economic, competitive, governmental, and technological factors affecting Trinity’s operations, markets, products, services and prices, and such forward-looking statements are not guarantees of future performance. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and “Forward-Looking Statements” in Trinity’s Annual Report on Form 10-K for the most recent fiscal year, as may be revised and updated by Trinity’s Quarterly Reports on Form 10-Q, and Trinity’s Current Reports on Form 8-K. Forward Looking Statements

DELIVERING GOODS for THE GOOD of ALL /// Key Messages from Q4-23 Conference Call 3 Full year revenue up 51% year over year, reflecting significantly stronger performance Introducing 2024 EPS guidance of $1.30 to $1.50, reflecting revenue and margin improvement * See appendix for reconciliation of non-GAAP measures Full year adjusted EPS from continuing operations of $1.38*, up $0.44 year over year Continued strength in lease rates; FLRD +23.7%, utilization 97.5%

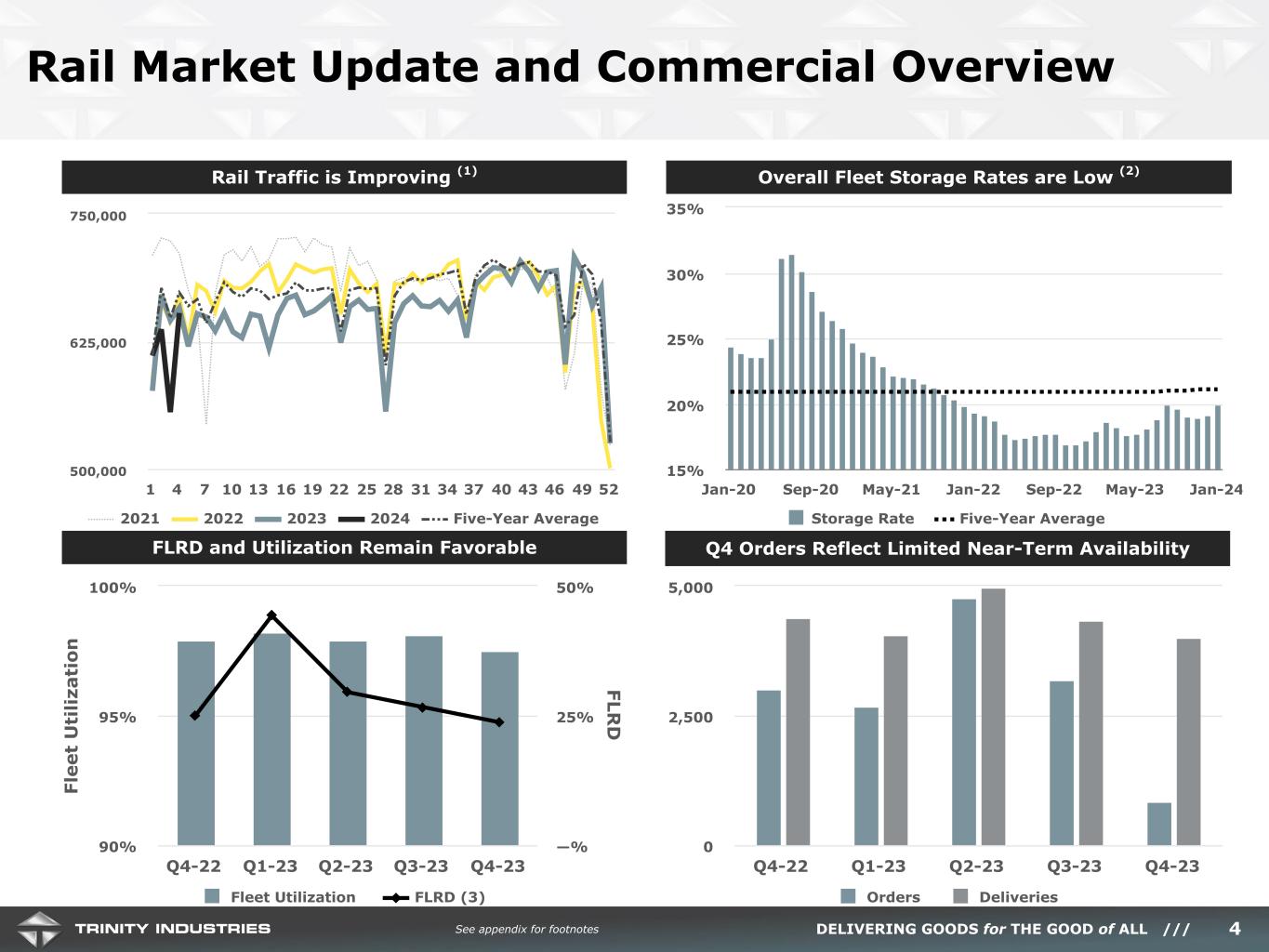

DELIVERING GOODS for THE GOOD of ALL /// Rail Market Update and Commercial Overview 4 Rail Traffic is Improving (1) Overall Fleet Storage Rates are Low (2) FLRD and Utilization Remain Favorable Q4 Orders Reflect Limited Near-Term Availability Fl ee t U ti liz at io n FLR D Fleet Utilization FLRD (3) Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 90% 95% 100% —% 25% 50% Orders Deliveries Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 0 2,500 5,000 See appendix for footnotes 2021 2022 2023 2024 Five-Year Average 1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52 500,000 625,000 750,000 Storage Rate Five-Year Average Jan-20 Sep-20 May-21 Jan-22 Sep-22 May-23 Jan-24 15% 20% 25% 30% 35%

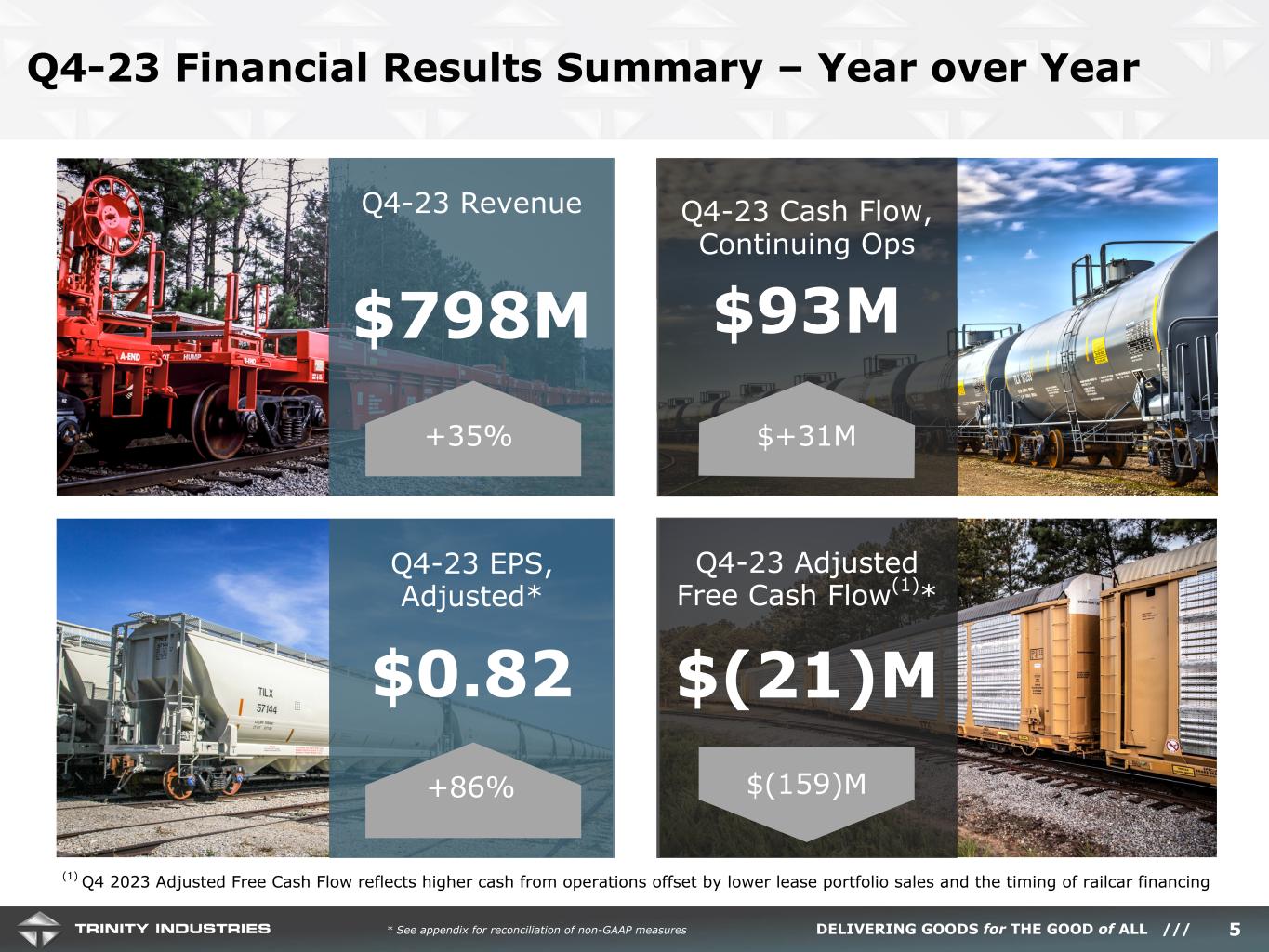

DELIVERING GOODS for THE GOOD of ALL /// Q4-23 Financial Results Summary – Year over Year 5 Q4-23 Revenue $798M Q4-23 Cash Flow, Continuing Ops $93M Q4-23 EPS, Adjusted* $0.82 Q4-23 Adjusted Free Cash Flow(1)* $(21)M * See appendix for reconciliation of non-GAAP measures +35% $+31M $(159)M +86% (1) Q4 2023 Adjusted Free Cash Flow reflects higher cash from operations offset by lower lease portfolio sales and the timing of railcar financing

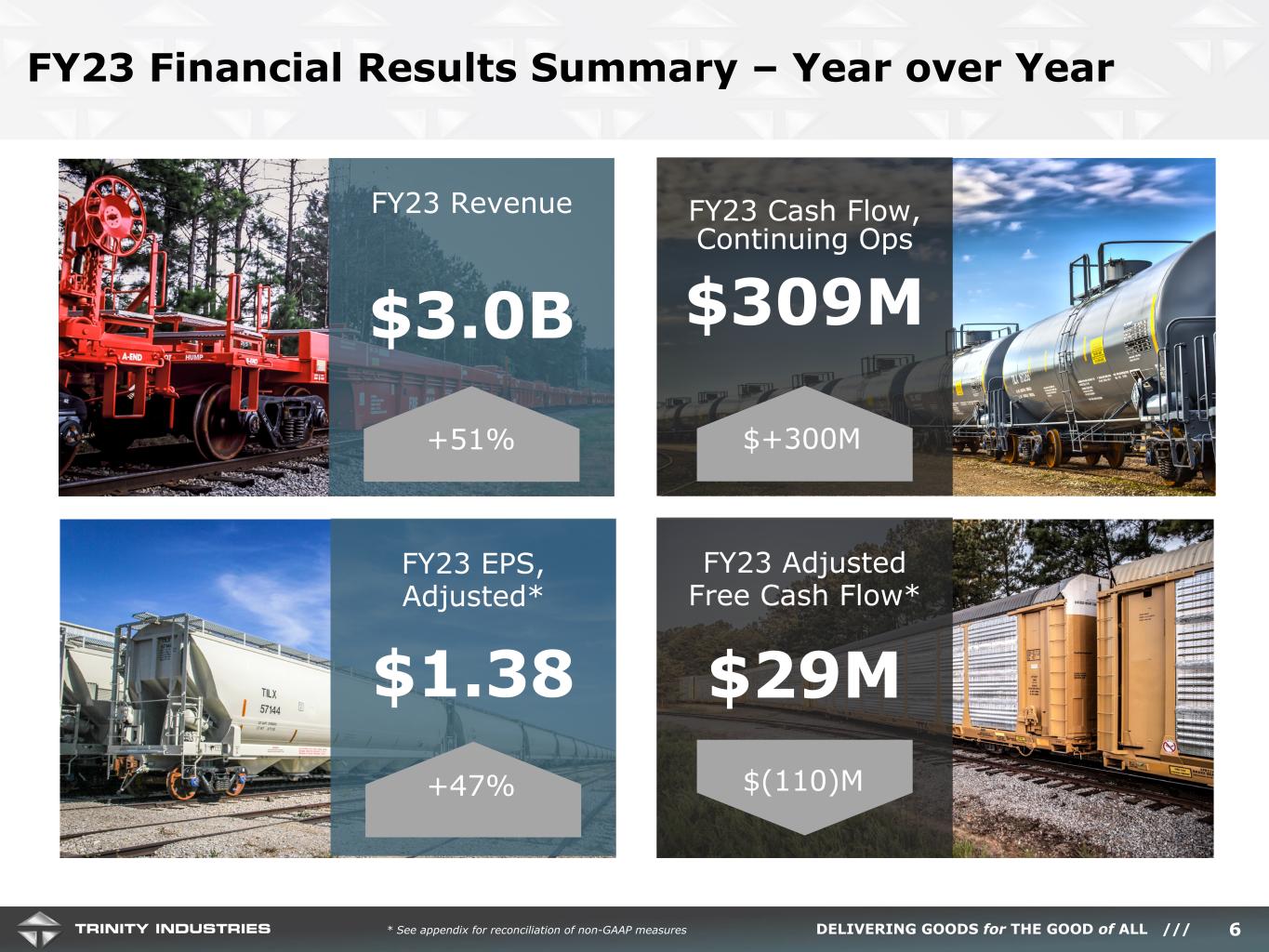

DELIVERING GOODS for THE GOOD of ALL /// FY23 Financial Results Summary – Year over Year 6 FY23 Revenue $3.0B FY23 Cash Flow, Continuing Ops $309M FY23 EPS, Adjusted* $1.38 FY23 Adjusted Free Cash Flow* $29M * See appendix for reconciliation of non-GAAP measures +51% $+300M $(110)M+47%

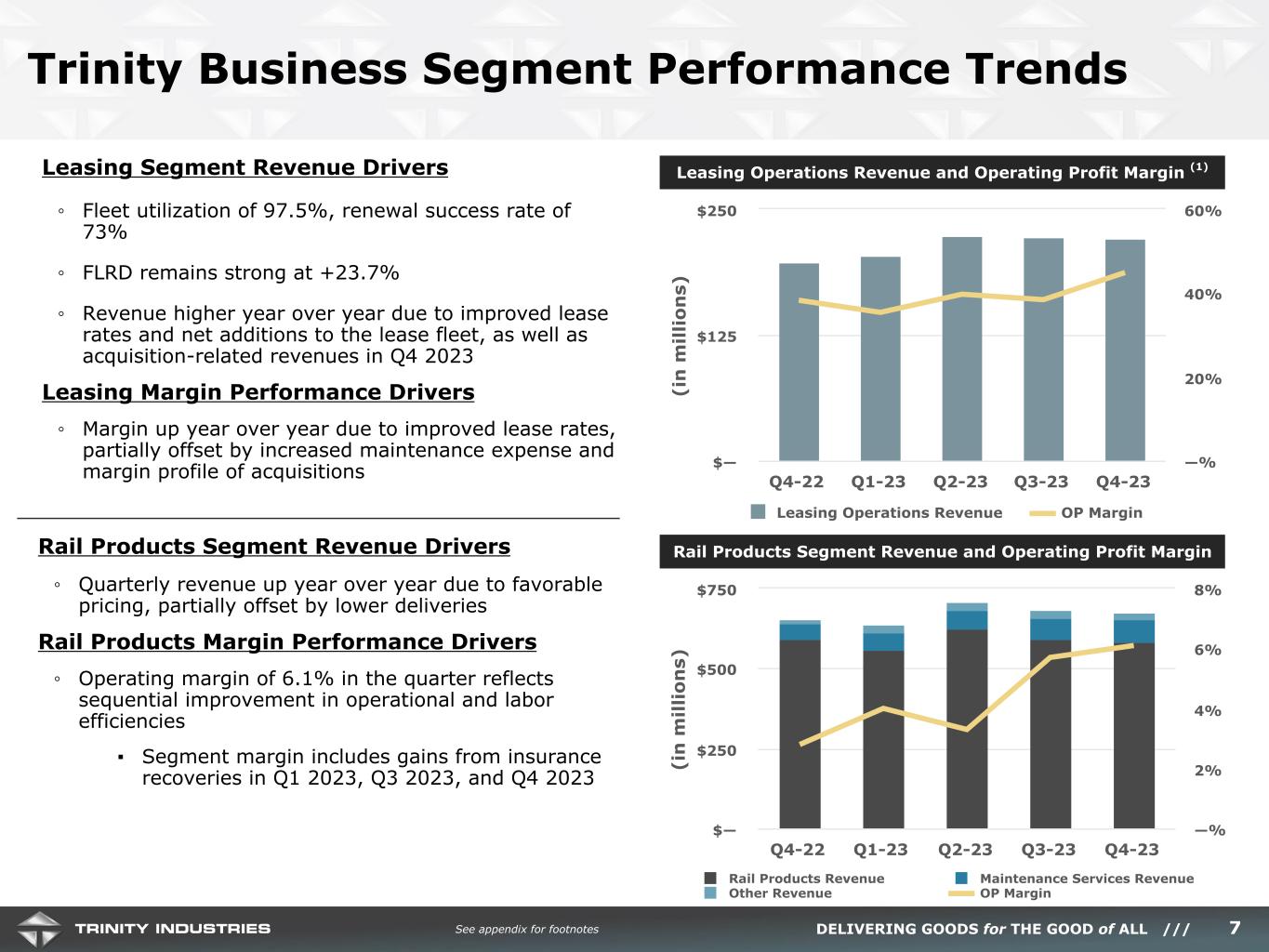

DELIVERING GOODS for THE GOOD of ALL /// Trinity Business Segment Performance Trends 7 Rail Products Segment Revenue Drivers ◦ Quarterly revenue up year over year due to favorable pricing, partially offset by lower deliveries Rail Products Margin Performance Drivers ◦ Operating margin of 6.1% in the quarter reflects sequential improvement in operational and labor efficiencies ▪ Segment margin includes gains from insurance recoveries in Q1 2023, Q3 2023, and Q4 2023 Leasing Operations Revenue and Operating Profit Margin (1) Rail Products Segment Revenue and Operating Profit Margin See appendix for footnotes (i n m ill io n s) Leasing Operations Revenue OP Margin Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $— $125 $250 —% 20% 40% 60% (i n m ill io n s) Rail Products Revenue Maintenance Services Revenue Other Revenue OP Margin Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $— $250 $500 $750 —% 2% 4% 6% 8% Leasing Segment Revenue Drivers ◦ Fleet utilization of 97.5%, renewal success rate of 73% ◦ FLRD remains strong at +23.7% ◦ Revenue higher year over year due to improved lease rates and net additions to the lease fleet, as well as acquisition-related revenues in Q4 2023 Leasing Margin Performance Drivers ◦ Margin up year over year due to improved lease rates, partially offset by increased maintenance expense and margin profile of acquisitions

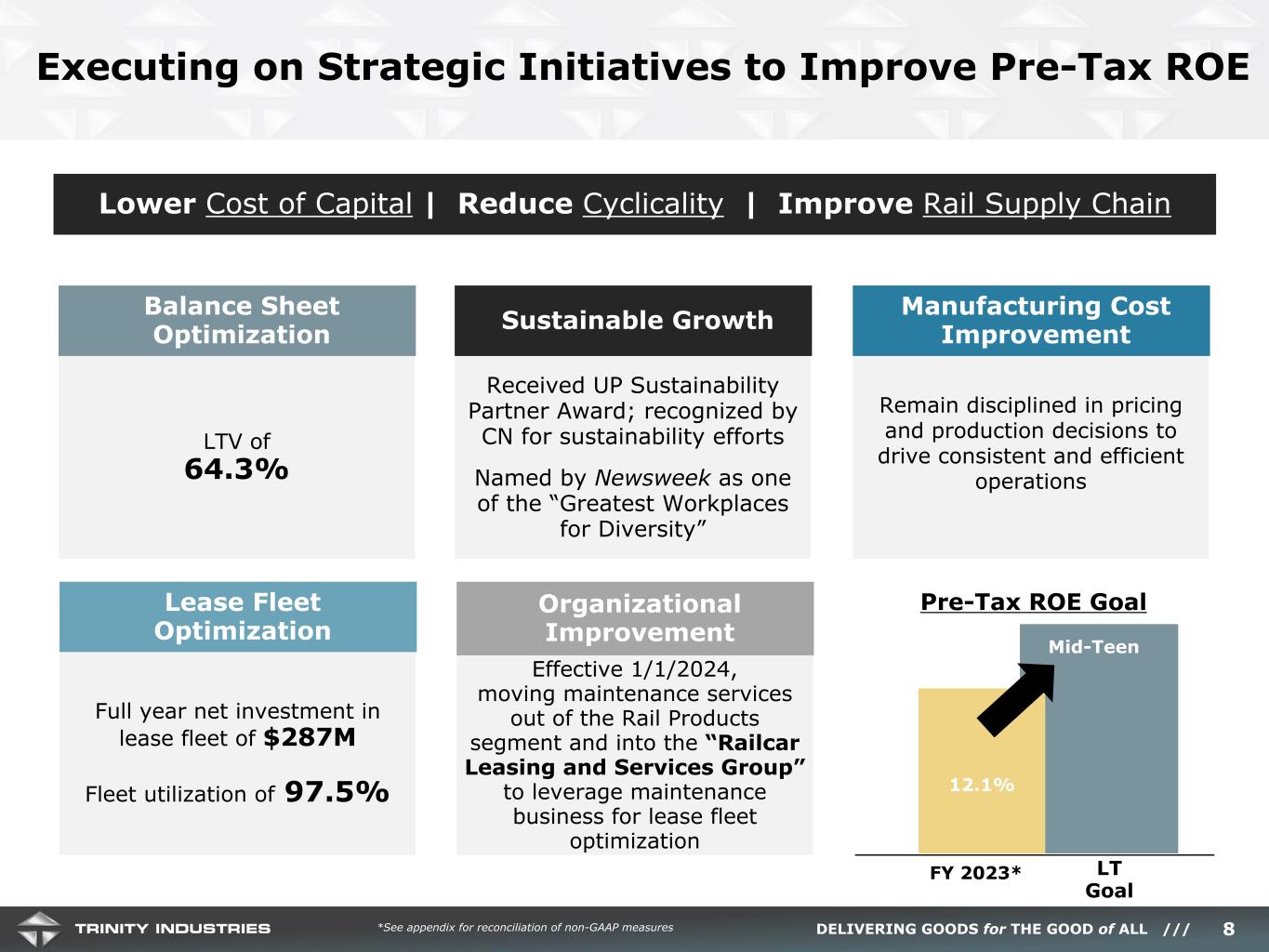

DELIVERING GOODS for THE GOOD of ALL /// Executing on Strategic Initiatives to Improve Pre-Tax ROE 8 LTV of 64.3% Balance Sheet Optimization Organizational Improvement Remain disciplined in pricing and production decisions to drive consistent and efficient operations Manufacturing Cost Improvement Received UP Sustainability Partner Award; recognized by CN for sustainability efforts Named by Newsweek as one of the “Greatest Workplaces for Diversity” Sustainable Growth Full year net investment in lease fleet of $287M Fleet utilization of 97.5% Lease Fleet Optimization *See appendix for reconciliation of non-GAAP measures Lower Cost of Capital | Reduce Cyclicality | Improve Rail Supply Chain FY 2023* LT Goal 9.6% 12.1% Mid-Teen Pre-Tax ROE Goal Effective 1/1/2024, moving maintenance services out of the Rail Products segment and into the “Railcar Leasing and Services Group” to leverage maintenance business for lease fleet optimization

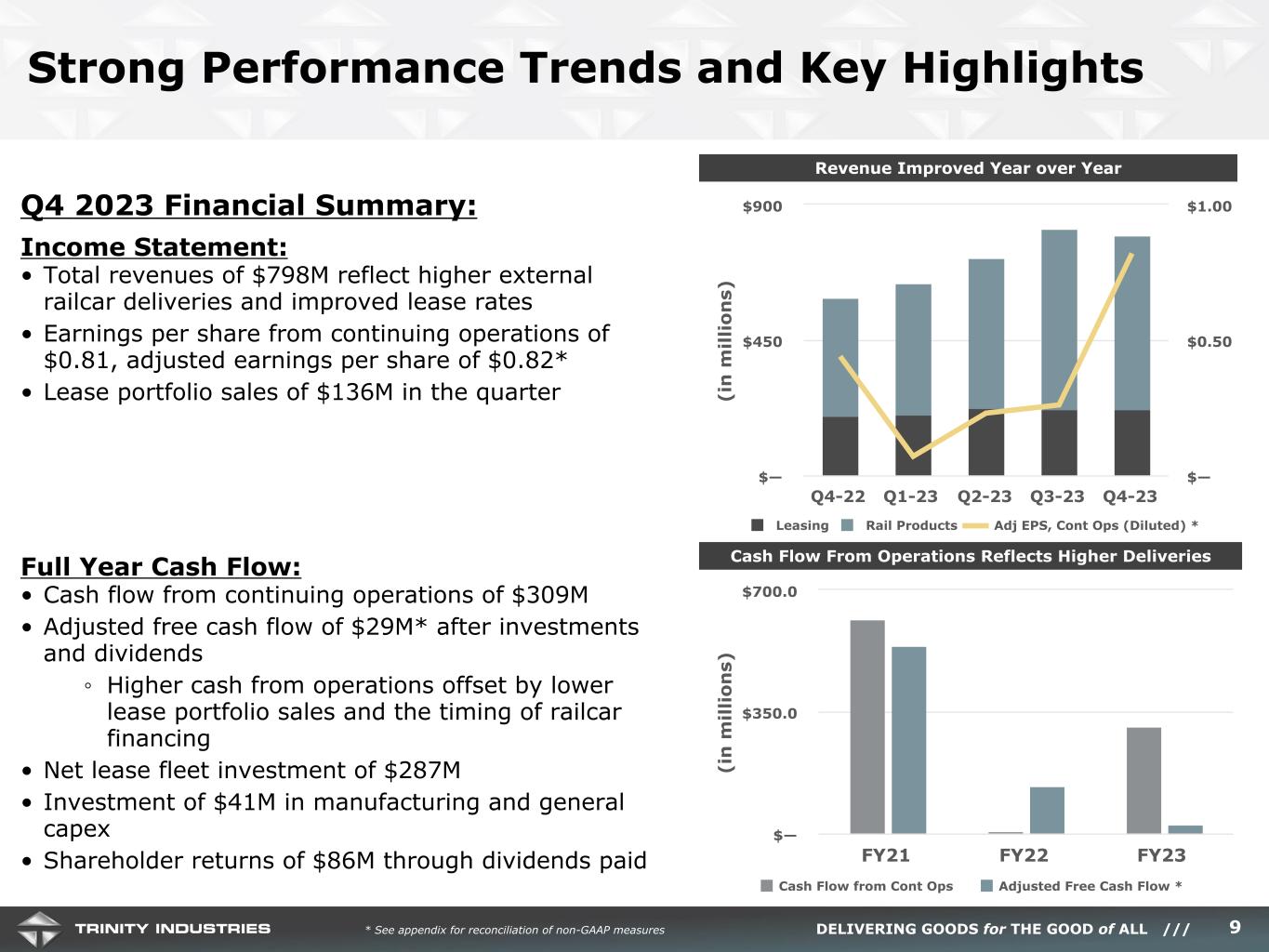

DELIVERING GOODS for THE GOOD of ALL /// Revenue Improved Year over Year Q4 2023 Financial Summary: Income Statement: • Total revenues of $798M reflect higher external railcar deliveries and improved lease rates • Earnings per share from continuing operations of $0.81, adjusted earnings per share of $0.82* • Lease portfolio sales of $136M in the quarter Full Year Cash Flow: • Cash flow from continuing operations of $309M • Adjusted free cash flow of $29M* after investments and dividends ◦ Higher cash from operations offset by lower lease portfolio sales and the timing of railcar financing • Net lease fleet investment of $287M • Investment of $41M in manufacturing and general capex • Shareholder returns of $86M through dividends paid Strong Performance Trends and Key Highlights 9 Cash Flow From Operations Reflects Higher Deliveries * See appendix for reconciliation of non-GAAP measures (i n m ill io n s) Leasing Rail Products Adj EPS, Cont Ops (Diluted) * Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $— $450 $900 $— $0.50 $1.00 (i n m ill io n s) Cash Flow from Cont Ops Adjusted Free Cash Flow * FY21 FY22 FY23 $— $350.0 $700.0

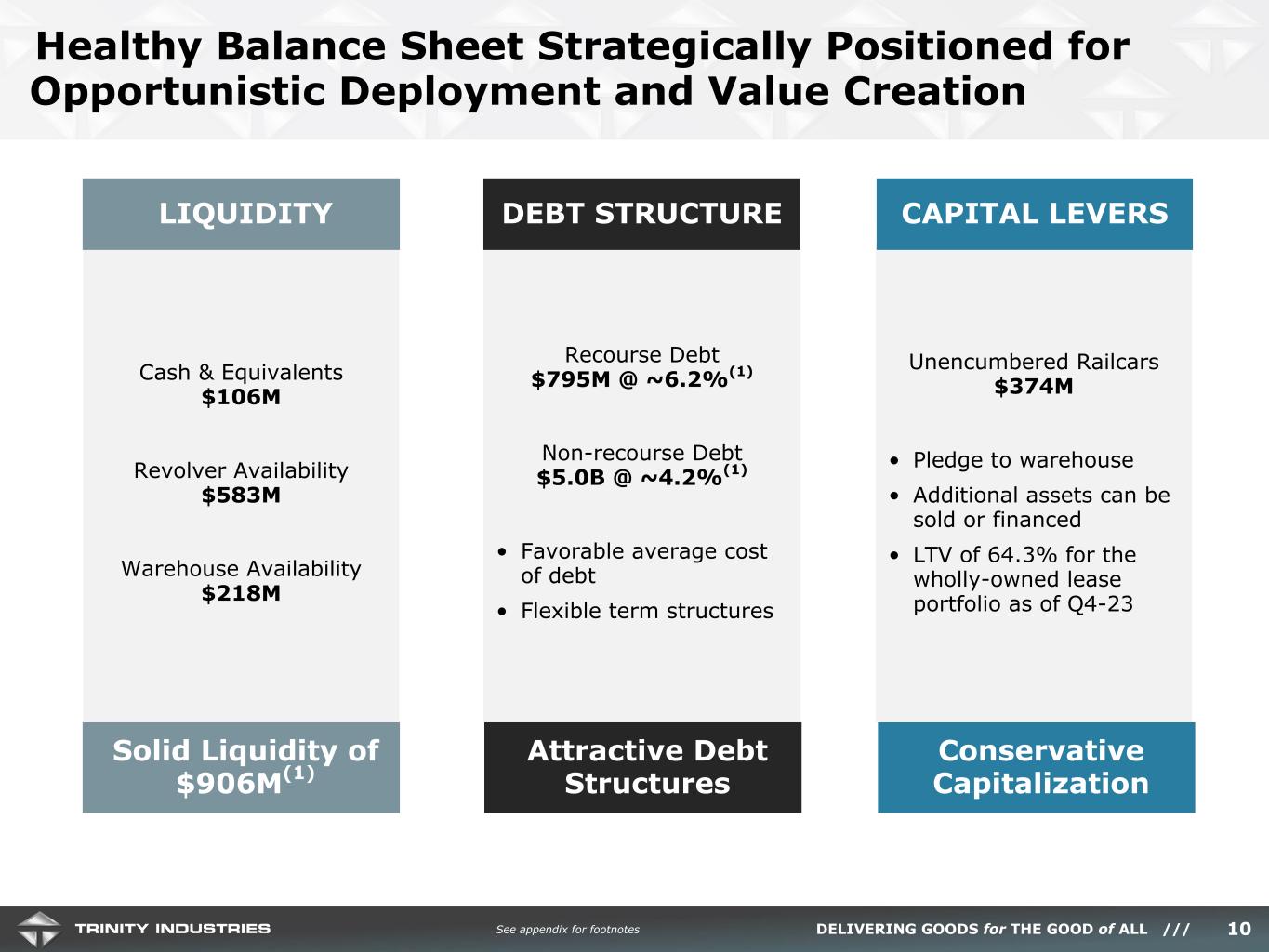

DELIVERING GOODS for THE GOOD of ALL /// 10 Unencumbered Railcars $374M • Pledge to warehouse • Additional assets can be sold or financed • LTV of 64.3% for the wholly-owned lease portfolio as of Q4-23 CAPITAL LEVERS Recourse Debt $795M @ ~6.2%(1) Non-recourse Debt $5.0B @ ~4.2%(1) • Favorable average cost of debt • Flexible term structures DEBT STRUCTURE Cash & Equivalents $106M Revolver Availability $583M Warehouse Availability $218M LIQUIDITY Solid Liquidity of $906M(1) Attractive Debt Structures Conservative Capitalization See appendix for footnotes Healthy Balance Sheet Strategically Positioned for Opportunistic Deployment and Value Creation

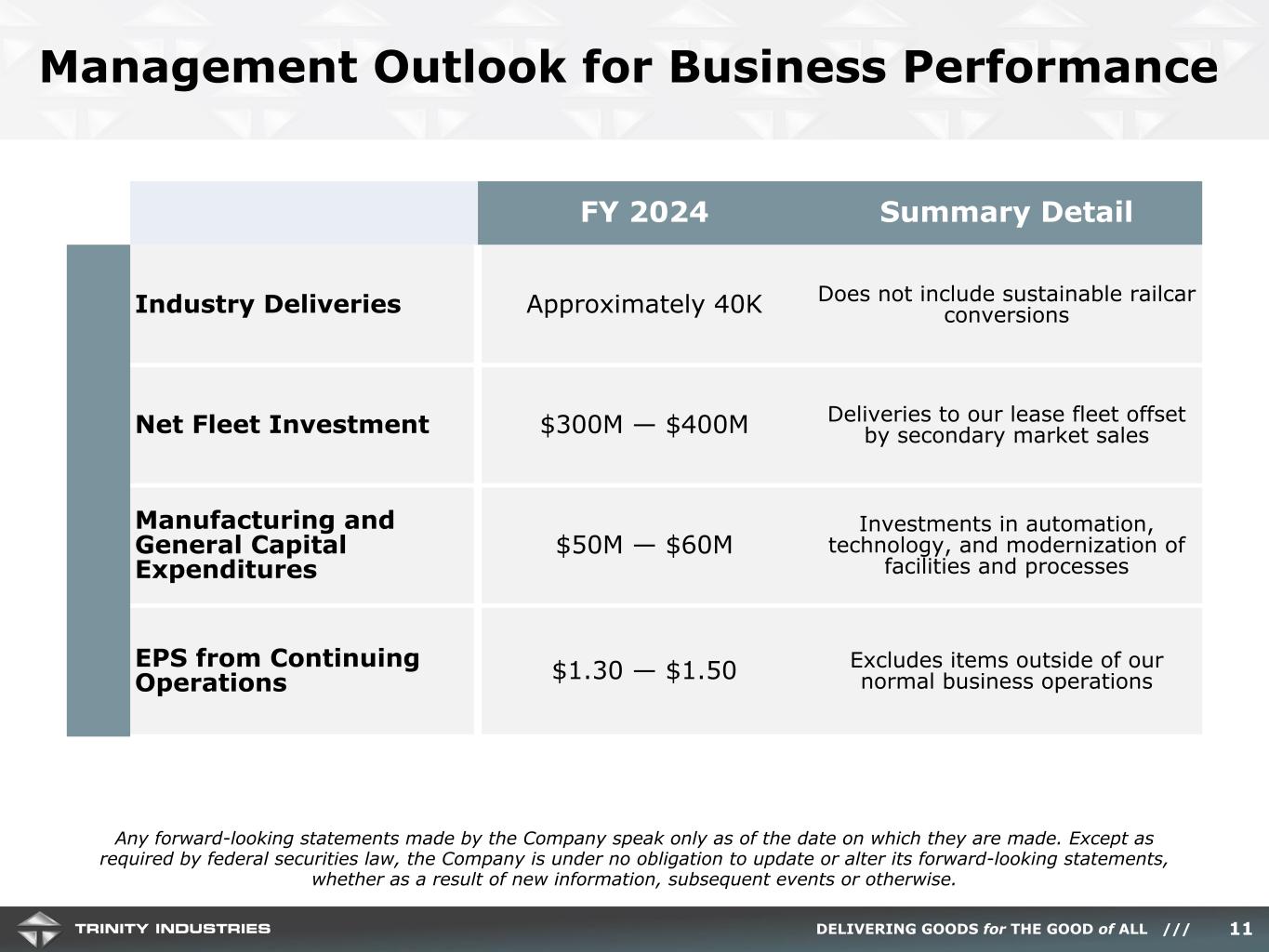

DELIVERING GOODS for THE GOOD of ALL /// Management Outlook for Business Performance 11 C ap it al A llo ca ti on FY 2024 Summary Detail Industry Deliveries Approximately 40K Does not include sustainable railcar conversions Net Fleet Investment $300M — $400M Deliveries to our lease fleet offset by secondary market sales Manufacturing and General Capital Expenditures $50M — $60M Investments in automation, technology, and modernization of facilities and processes EPS from Continuing Operations $1.30 — $1.50 Excludes items outside of our normal business operations Any forward-looking statements made by the Company speak only as of the date on which they are made. Except as required by federal securities law, the Company is under no obligation to update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise.

DELIVERING GOODS for THE GOOD of ALL /// Key Messages from Q4-23 Conference Call 12* See appendix for reconciliation of non-GAAP measures Continued strength in lease rates; FLRD +23.7%, utilization 97.5% Full year revenue up 51% year over year, reflecting significantly stronger performance Full year adjusted EPS from continuing operations of $1.38*, up $0.44 year over year Introducing 2024 EPS guidance of $1.30 to $1.50, reflecting revenue and margin improvement

DELIVERING GOODS for THE GOOD of ALL /// Trinity Q4-23 Earnings Conference Call 13 Q&A

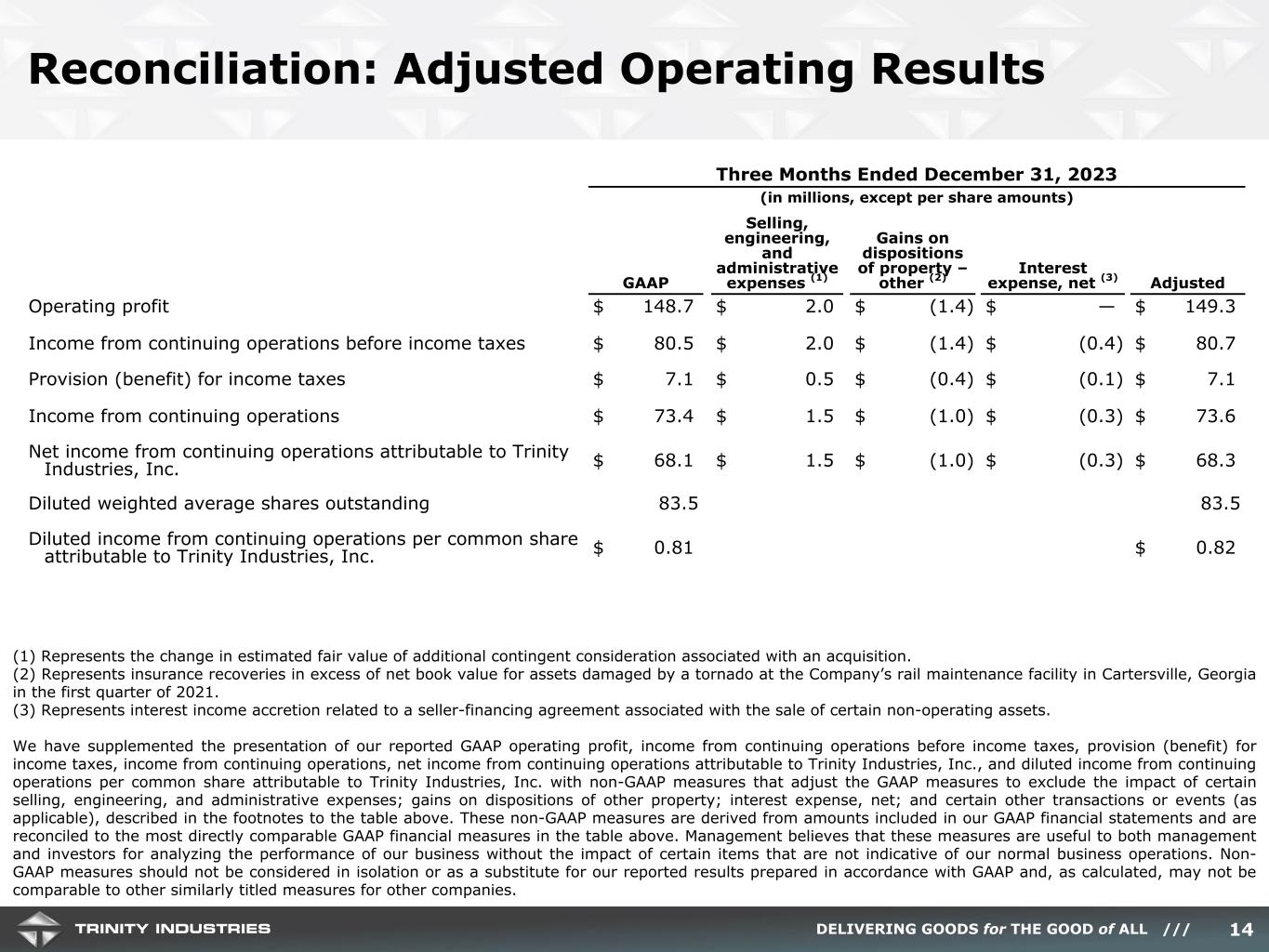

DELIVERING GOODS for THE GOOD of ALL /// Reconciliation: Adjusted Operating Results 14 Three Months Ended December 31, 2023 (in millions, except per share amounts) GAAP Selling, engineering, and administrative expenses (1) Gains on dispositions of property – other (2) Interest expense, net (3) Adjusted Operating profit $ 148.7 $ 2.0 $ (1.4) $ — $ 149.3 Income from continuing operations before income taxes $ 80.5 $ 2.0 $ (1.4) $ (0.4) $ 80.7 Provision (benefit) for income taxes $ 7.1 $ 0.5 $ (0.4) $ (0.1) $ 7.1 Income from continuing operations $ 73.4 $ 1.5 $ (1.0) $ (0.3) $ 73.6 Net income from continuing operations attributable to Trinity Industries, Inc. $ 68.1 $ 1.5 $ (1.0) $ (0.3) $ 68.3 Diluted weighted average shares outstanding 83.5 83.5 Diluted income from continuing operations per common share attributable to Trinity Industries, Inc. $ 0.81 $ 0.82 (1) Represents the change in estimated fair value of additional contingent consideration associated with an acquisition. (2) Represents insurance recoveries in excess of net book value for assets damaged by a tornado at the Company’s rail maintenance facility in Cartersville, Georgia in the first quarter of 2021. (3) Represents interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. We have supplemented the presentation of our reported GAAP operating profit, income from continuing operations before income taxes, provision (benefit) for income taxes, income from continuing operations, net income from continuing operations attributable to Trinity Industries, Inc., and diluted income from continuing operations per common share attributable to Trinity Industries, Inc. with non-GAAP measures that adjust the GAAP measures to exclude the impact of certain selling, engineering, and administrative expenses; gains on dispositions of other property; interest expense, net; and certain other transactions or events (as applicable), described in the footnotes to the table above. These non-GAAP measures are derived from amounts included in our GAAP financial statements and are reconciled to the most directly comparable GAAP financial measures in the table above. Management believes that these measures are useful to both management and investors for analyzing the performance of our business without the impact of certain items that are not indicative of our normal business operations. Non- GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies.

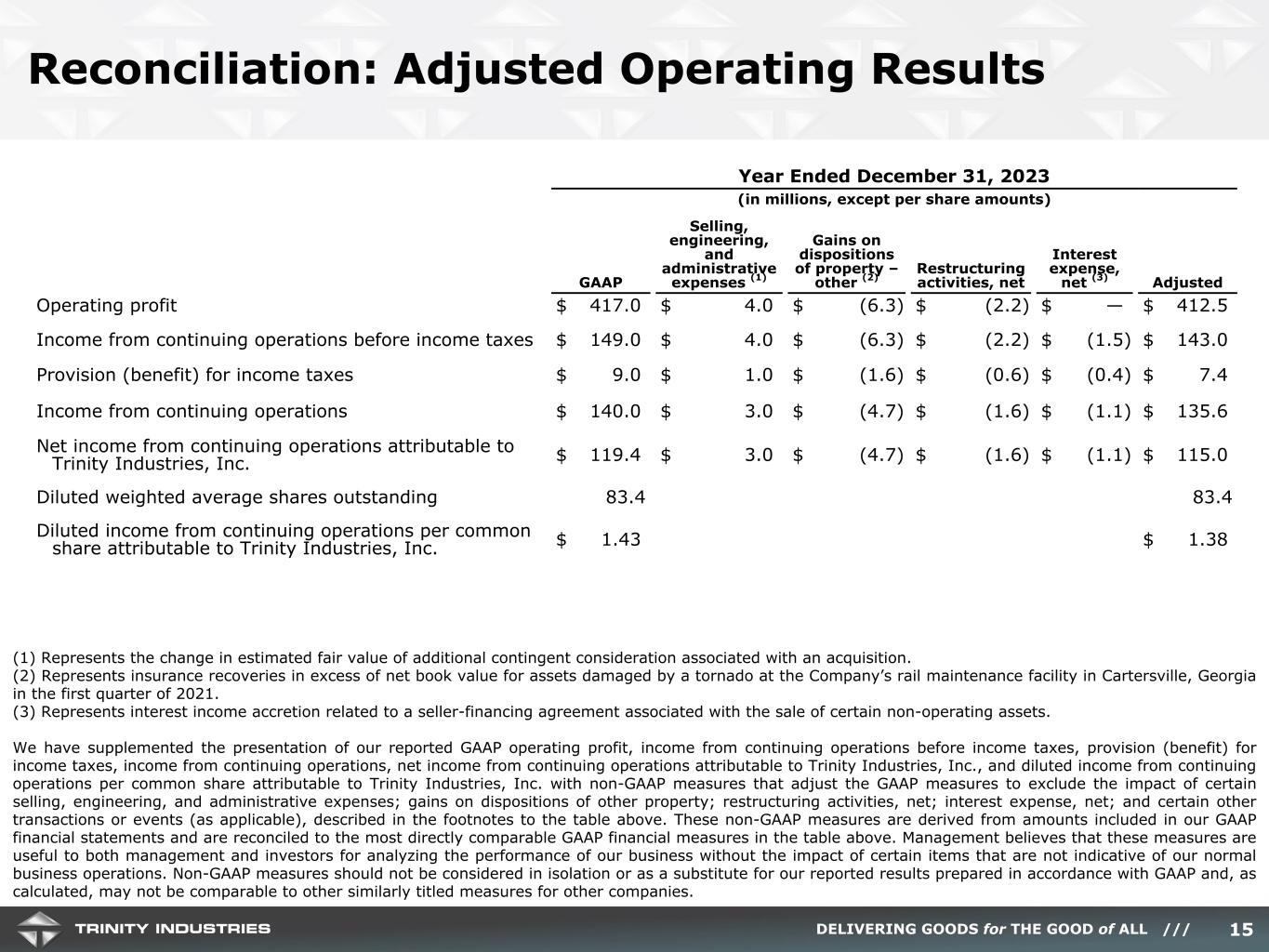

DELIVERING GOODS for THE GOOD of ALL /// Reconciliation: Adjusted Operating Results 15 (1) Represents the change in estimated fair value of additional contingent consideration associated with an acquisition. (2) Represents insurance recoveries in excess of net book value for assets damaged by a tornado at the Company’s rail maintenance facility in Cartersville, Georgia in the first quarter of 2021. (3) Represents interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. We have supplemented the presentation of our reported GAAP operating profit, income from continuing operations before income taxes, provision (benefit) for income taxes, income from continuing operations, net income from continuing operations attributable to Trinity Industries, Inc., and diluted income from continuing operations per common share attributable to Trinity Industries, Inc. with non-GAAP measures that adjust the GAAP measures to exclude the impact of certain selling, engineering, and administrative expenses; gains on dispositions of other property; restructuring activities, net; interest expense, net; and certain other transactions or events (as applicable), described in the footnotes to the table above. These non-GAAP measures are derived from amounts included in our GAAP financial statements and are reconciled to the most directly comparable GAAP financial measures in the table above. Management believes that these measures are useful to both management and investors for analyzing the performance of our business without the impact of certain items that are not indicative of our normal business operations. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. Year Ended December 31, 2023 (in millions, except per share amounts) GAAP Selling, engineering, and administrative expenses (1) Gains on dispositions of property – other (2) Restructuring activities, net Interest expense, net (3) Adjusted Operating profit $ 417.0 $ 4.0 $ (6.3) $ (2.2) $ — $ 412.5 Income from continuing operations before income taxes $ 149.0 $ 4.0 $ (6.3) $ (2.2) $ (1.5) $ 143.0 Provision (benefit) for income taxes $ 9.0 $ 1.0 $ (1.6) $ (0.6) $ (0.4) $ 7.4 Income from continuing operations $ 140.0 $ 3.0 $ (4.7) $ (1.6) $ (1.1) $ 135.6 Net income from continuing operations attributable to Trinity Industries, Inc. $ 119.4 $ 3.0 $ (4.7) $ (1.6) $ (1.1) $ 115.0 Diluted weighted average shares outstanding 83.4 83.4 Diluted income from continuing operations per common share attributable to Trinity Industries, Inc. $ 1.43 $ 1.38

DELIVERING GOODS for THE GOOD of ALL /// FY 2021 FY 2022 Q4-23 FY 2023 (in millions) Net cash provided by operating activities – continuing operations (1) $ 615.6 $ 9.2 $ 93.2 $ 309.0 Proceeds from lease portfolio sales 454.3 750.7 136.0 381.8 Capital expenditures – manufacturing and other (23.6) (38.0) (11.9) (41.3) Dividends paid to common shareholders (88.5) (76.9) (21.3) (86.0) Equity CapEx for leased railcars (from table below) (418.9) (506.7) (217.0) (535.0) Adjusted Free Cash Flow After Investments and Dividends $ 538.9 $ 138.3 $ (21.0) $ 28.5 Capital expenditures – lease fleet $ 547.2 $ 928.8 $ 185.5 $ 668.8 Less: Payments to retire debt (2,315.8) (1,578.5) (239.9) (1,518.9) Proceeds from issuance of debt 2,444.1 2,000.6 208.4 1,652.7 Net proceeds from (repayments of) debt 128.3 422.1 (31.5) 133.8 Equity CapEx for leased railcars $ 418.9 $ 506.7 $ 217.0 $ 535.0 Reconciliation: Walking Adjusted FCF Beyond Lease Investment 16 (1) Amounts for the year ended December 31, 2021 include the collection of approximately $438 million of income tax refunds associated with the loss carryback provisions included in the CARES Act. Adjusted Free Cash Flow After Investments and Dividends (“Adjusted Free Cash Flow”) is a non-GAAP financial measure. Adjusted Free Cash Flow is defined as net cash provided by operating activities from continuing operations as computed in accordance with GAAP, plus cash proceeds from lease portfolio sales, less capital expenditures for manufacturing, dividends paid, and Equity CapEx for leased railcars. Equity CapEx for leased railcars is defined as capital expenditures for our lease fleet, adjusted to exclude net proceeds from (repayments of) recourse and non-recourse debt. We believe Adjusted Free Cash Flow is useful to both management and investors as it provides a relevant measure of liquidity and a useful basis for assessing our ability to fund our operations and repay our debt. Adjusted Free Cash Flow is reconciled to net cash provided by operating activities from continuing operations, the most directly comparable GAAP financial measure, in the table above. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies.

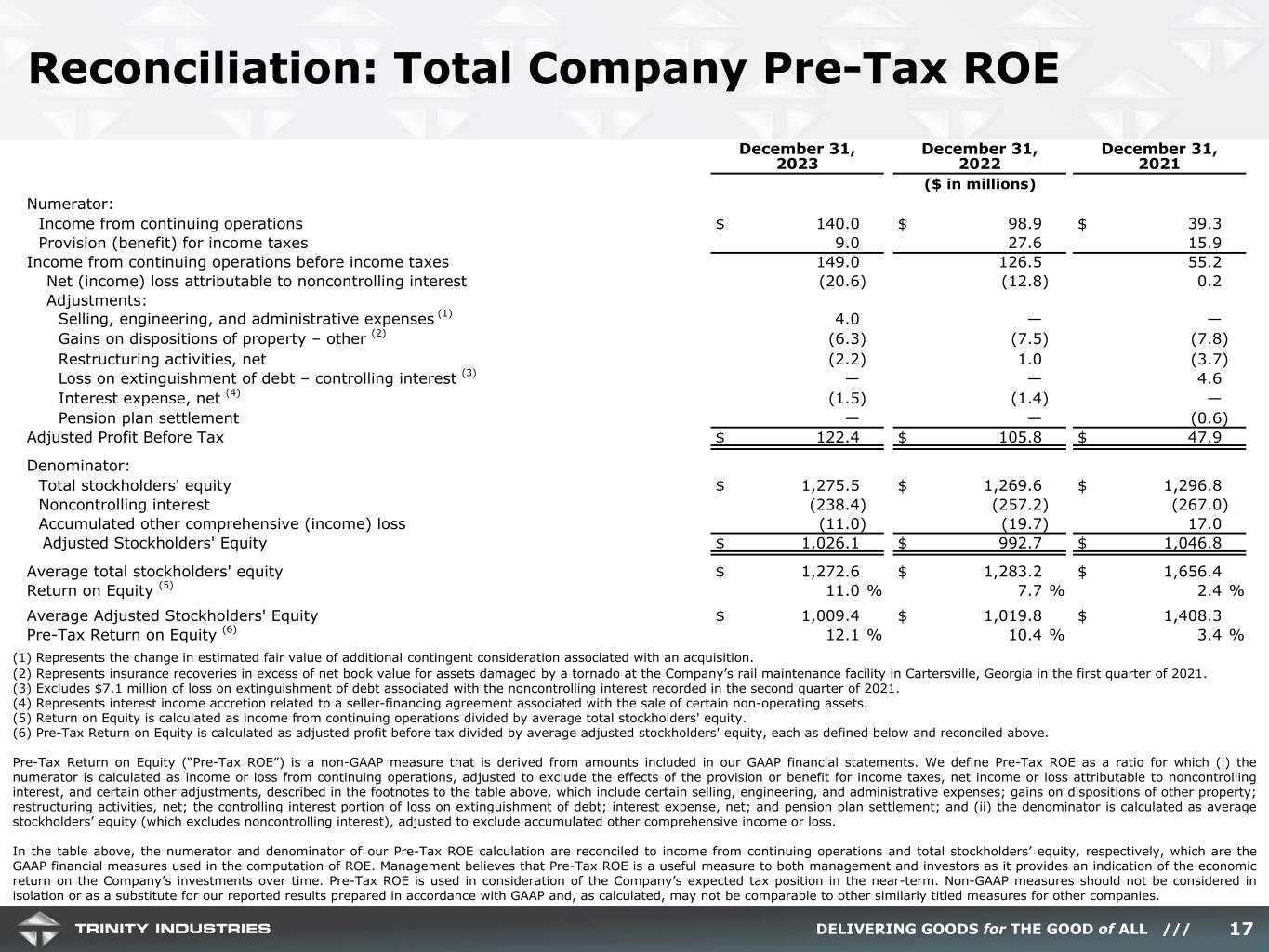

DELIVERING GOODS for THE GOOD of ALL /// Reconciliation: Total Company Pre-Tax ROE 17 (1) Represents the change in estimated fair value of additional contingent consideration associated with an acquisition. (2) Represents insurance recoveries in excess of net book value for assets damaged by a tornado at the Company’s rail maintenance facility in Cartersville, Georgia in the first quarter of 2021. (3) Excludes $7.1 million of loss on extinguishment of debt associated with the noncontrolling interest recorded in the second quarter of 2021. (4) Represents interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. (5) Return on Equity is calculated as income from continuing operations divided by average total stockholders' equity. (6) Pre-Tax Return on Equity is calculated as adjusted profit before tax divided by average adjusted stockholders' equity, each as defined below and reconciled above. Pre-Tax Return on Equity (“Pre-Tax ROE”) is a non-GAAP measure that is derived from amounts included in our GAAP financial statements. We define Pre-Tax ROE as a ratio for which (i) the numerator is calculated as income or loss from continuing operations, adjusted to exclude the effects of the provision or benefit for income taxes, net income or loss attributable to noncontrolling interest, and certain other adjustments, described in the footnotes to the table above, which include certain selling, engineering, and administrative expenses; gains on dispositions of other property; restructuring activities, net; the controlling interest portion of loss on extinguishment of debt; interest expense, net; and pension plan settlement; and (ii) the denominator is calculated as average stockholders’ equity (which excludes noncontrolling interest), adjusted to exclude accumulated other comprehensive income or loss. In the table above, the numerator and denominator of our Pre-Tax ROE calculation are reconciled to income from continuing operations and total stockholders’ equity, respectively, which are the GAAP financial measures used in the computation of ROE. Management believes that Pre-Tax ROE is a useful measure to both management and investors as it provides an indication of the economic return on the Company’s investments over time. Pre-Tax ROE is used in consideration of the Company’s expected tax position in the near-term. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. December 31, 2023 December 31, 2022 December 31, 2021 ($ in millions) Numerator: Income from continuing operations $ 140.0 $ 98.9 $ 39.3 Provision (benefit) for income taxes 9.0 27.6 15.9 Income from continuing operations before income taxes 149.0 126.5 55.2 Net (income) loss attributable to noncontrolling interest (20.6) (12.8) 0.2 Adjustments: Selling, engineering, and administrative expenses (1) 4.0 — — Gains on dispositions of property – other (2) (6.3) (7.5) (7.8) Restructuring activities, net (2.2) 1.0 (3.7) Loss on extinguishment of debt – controlling interest (3) — — 4.6 Interest expense, net (4) (1.5) (1.4) — Pension plan settlement — — (0.6) Adjusted Profit Before Tax $ 122.4 $ 105.8 $ 47.9 Denominator: Total stockholders' equity $ 1,275.5 $ 1,269.6 $ 1,296.8 Noncontrolling interest (238.4) (257.2) (267.0) Accumulated other comprehensive (income) loss (11.0) (19.7) 17.0 Adjusted Stockholders' Equity $ 1,026.1 $ 992.7 $ 1,046.8 Average total stockholders' equity $ 1,272.6 $ 1,283.2 $ 1,656.4 Return on Equity (5) 11.0 % 7.7 % 2.4 % Average Adjusted Stockholders' Equity $ 1,009.4 $ 1,019.8 $ 1,408.3 Pre-Tax Return on Equity (6) 12.1 % 10.4 % 3.4 %

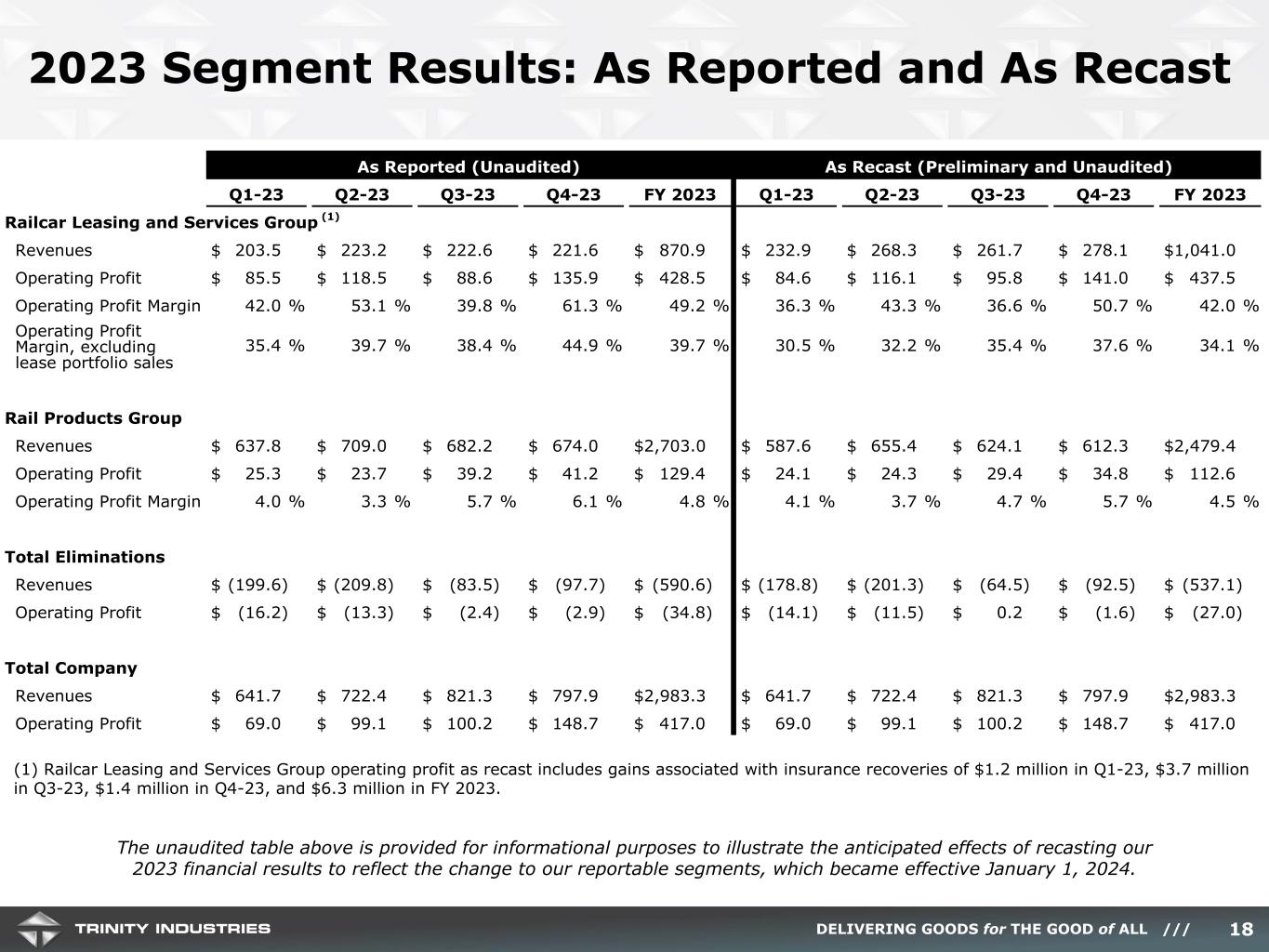

DELIVERING GOODS for THE GOOD of ALL /// 18 As Reported (Unaudited) As Recast (Preliminary and Unaudited) Q1-23 Q2-23 Q3-23 Q4-23 FY 2023 Q1-23 Q2-23 Q3-23 Q4-23 FY 2023 Railcar Leasing and Services Group (1) Revenues $ 203.5 $ 223.2 $ 222.6 $ 221.6 $ 870.9 $ 232.9 $ 268.3 $ 261.7 $ 278.1 $ 1,041.0 Operating Profit $ 85.5 $ 118.5 $ 88.6 $ 135.9 $ 428.5 $ 84.6 $ 116.1 $ 95.8 $ 141.0 $ 437.5 Operating Profit Margin 42.0 % 53.1 % 39.8 % 61.3 % 49.2 % 36.3 % 43.3 % 36.6 % 50.7 % 42.0 % Operating Profit Margin, excluding lease portfolio sales 35.4 % 39.7 % 38.4 % 44.9 % 39.7 % 30.5 % 32.2 % 35.4 % 37.6 % 34.1 % Rail Products Group Revenues $ 637.8 $ 709.0 $ 682.2 $ 674.0 $ 2,703.0 $ 587.6 $ 655.4 $ 624.1 $ 612.3 $ 2,479.4 Operating Profit $ 25.3 $ 23.7 $ 39.2 $ 41.2 $ 129.4 $ 24.1 $ 24.3 $ 29.4 $ 34.8 $ 112.6 Operating Profit Margin 4.0 % 3.3 % 5.7 % 6.1 % 4.8 % 4.1 % 3.7 % 4.7 % 5.7 % 4.5 % Total Eliminations Revenues $ (199.6) $ (209.8) $ (83.5) $ (97.7) $ (590.6) $ (178.8) $ (201.3) $ (64.5) $ (92.5) $ (537.1) Operating Profit $ (16.2) $ (13.3) $ (2.4) $ (2.9) $ (34.8) $ (14.1) $ (11.5) $ 0.2 $ (1.6) $ (27.0) Total Company Revenues $ 641.7 $ 722.4 $ 821.3 $ 797.9 $ 2,983.3 $ 641.7 $ 722.4 $ 821.3 $ 797.9 $ 2,983.3 Operating Profit $ 69.0 $ 99.1 $ 100.2 $ 148.7 $ 417.0 $ 69.0 $ 99.1 $ 100.2 $ 148.7 $ 417.0 The unaudited table above is provided for informational purposes to illustrate the anticipated effects of recasting our 2023 financial results to reflect the change to our reportable segments, which became effective January 1, 2024. 2023 Segment Results: As Reported and As Recast (1) Railcar Leasing and Services Group operating profit as recast includes gains associated with insurance recoveries of $1.2 million in Q1-23, $3.7 million in Q3-23, $1.4 million in Q4-23, and $6.3 million in FY 2023.

DELIVERING GOODS for THE GOOD of ALL /// Footnotes and Reconciliations 19 Slide 4 - Rail Market Update and Commercial Overview (1) Association of American Railroads (AAR) Weekly Railcar Loadings (2) AAR Rail Time Indicators – February 1, 2024 (3) Future Lease Rate Differential (FLRD) calculates the implied change in lease rates for railcar leases expiring over the next four quarters. The FLRD assumes that these expiring leases will be renewed at the most recent quarterly transacted lease rates for each railcar type. We believe the FLRD is useful to both management and investors as it provides insight into the near-term trend in lease rates. The FLRD is calculated as follows: (New Lease Rates — Expiring Lease Rates) x Expiring Railcar Leases (Expiring Lease Rates x Expiring Railcar Leases) Slide 7 - Trinity Business Segment Performance Trends (1) Leasing Operations Profit Margin calculated using only revenues and operating profit from Leasing Operations including partially-owned subsidiaries and excluding lease portfolio sales. Leasing Operations is specific to revenue and operating profit reported under “Leasing and management” within the Railcar Leasing and Management Services Group. Slide 9 - Strong Performance Trends and Key Highlights Adjusted EPS includes the following adjustments reported by the Company (each per common diluted share): ◦ Reported Q4-22 GAAP EPS was $0.46; Adjusted EPS excludes $0.01 of interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets and $0.01 related to prior year carryback claims as permitted under recent tax legislation. ◦ Reported Q1-23 GAAP EPS was $0.09; Adjusted EPS excludes $0.01 related to the insurance recoveries in excess of net book value for assets damaged by a tornado at the Company’s rail maintenance facility in Cartersville, Georgia in the first quarter of 2021 and $0.01 from interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets and restructuring activities. ◦ Reported Q2-23 GAAP EPS was $0.23; Adjusted EPS excludes $0.02 related to the change in estimated fair value of additional contingent consideration associated with an acquisition and $0.02 related to gains associated with restructuring activities. ◦ Reported Q3-23 GAAP EPS was $0.29; Adjusted EPS excludes $0.03 related to the insurance recoveries in excess of net book value for assets damaged by a tornado at the Company’s rail maintenance facility in Cartersville, Georgia in the first quarter of 2021. ◦ Reported Q4-23 GAAP EPS was $0.81; Adjusted EPS excludes $0.02 related to the change in estimated fair value of additional contingent consideration associated with an acquisition and $0.01 related to the insurance recoveries in excess of net book value for assets damaged by a tornado at the Company’s rail maintenance facility in Cartersville, Georgia in the first quarter of 2021. Slide 10 - Healthy Balance Sheet Strategically Positioned for Opportunistic Deployment and Value Creation (1) Balances and blended average interest rate as of December 31, 2023