Introduction

Equinor 2023 Integrated Annual Report 1

Introduction

Equinor 2023 Integrated Annual Report 2

2023

Integrated annual report

Introduction

Equinor 2023 Integrated Annual Report 3

Chapter overview

About us

An introduction to who we are, our business and our strategy.

Group performance

Group financial and sustainability performance, and our research and innovation activities.

Reporting segment performance

Financial, operational and sustainability performance review and strategic update by our reporting segments.

Financial statements

Consolidated financial statements of the Equinor group and parent company financial statements of Equinor ASA.

Additional information

Complementary sections supporting the total report.

Introduction

Equinor 2023 Integrated Annual Report 4

Report overview

Introduction

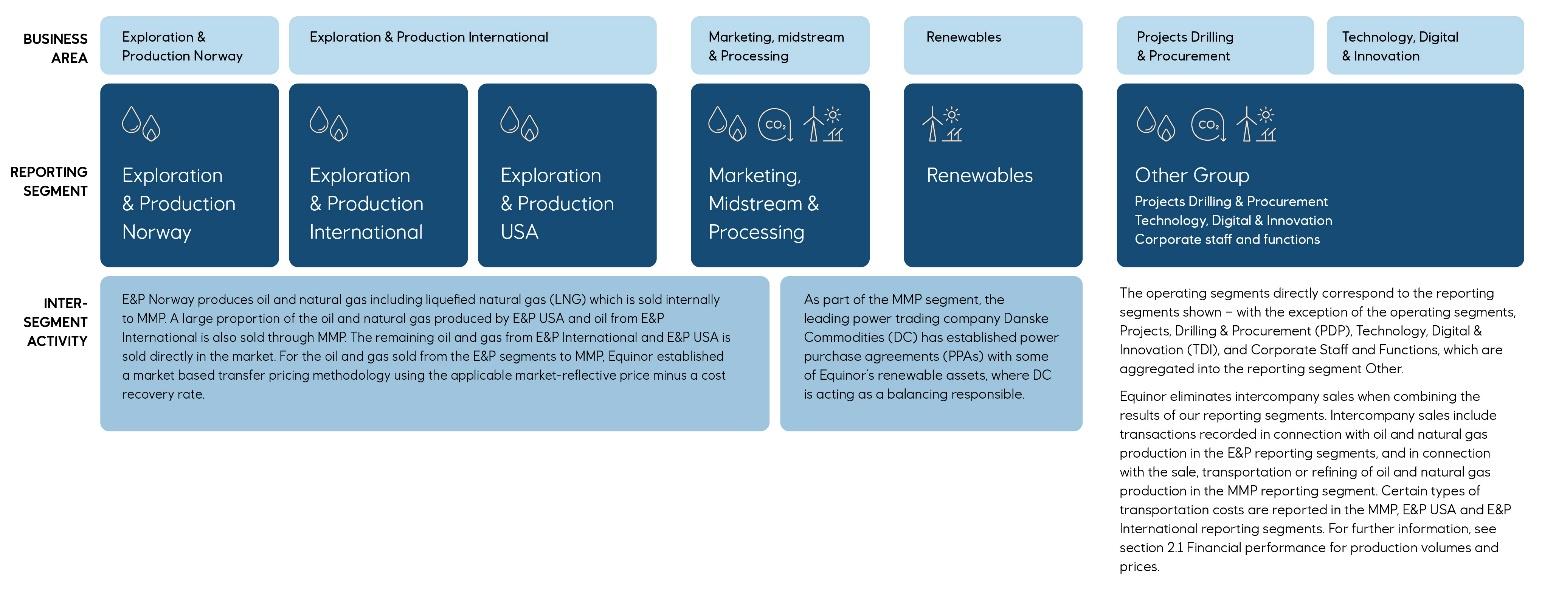

Reporting segment performance

Report overview

Introduction to segmental reporting

Key figures

3.1

Exploration & Production Norway

Key events

3.2

Exploration & Production International

Message to stakeholders

3.3

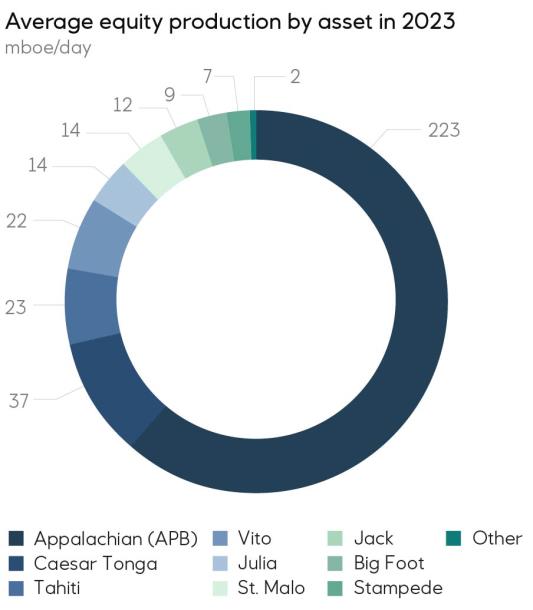

Exploration & Production USA

About the report

3.4

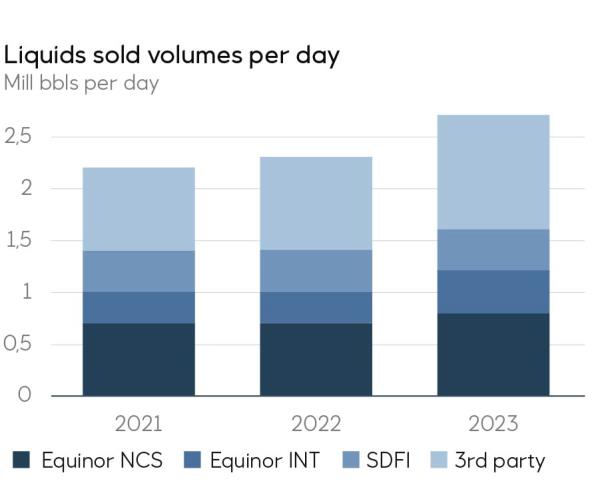

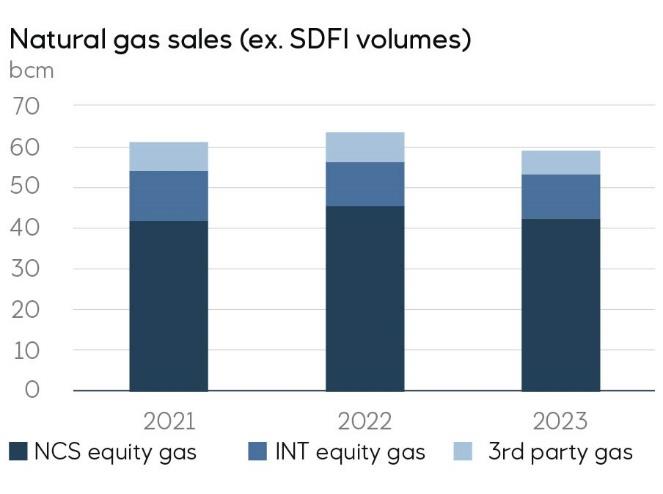

Marketing, Midstream and Processing

3.5

Renewables

3.6

Other group

About us

1.1

We are Equinor

Financial statements and notes

1.2

Our history

4.1

Consolidated financial statements of the Equinor group

1.3

Our business

4.2

Parent company financial statements

1.4

The world in which we operate

1.5

Our strategy

Additional information

1.6

Progress on our Energy transition plan

5.1

Shareholder information

1.7

Our people

5.2

Risk factors

1.8

Engaging with stakeholders

5.3

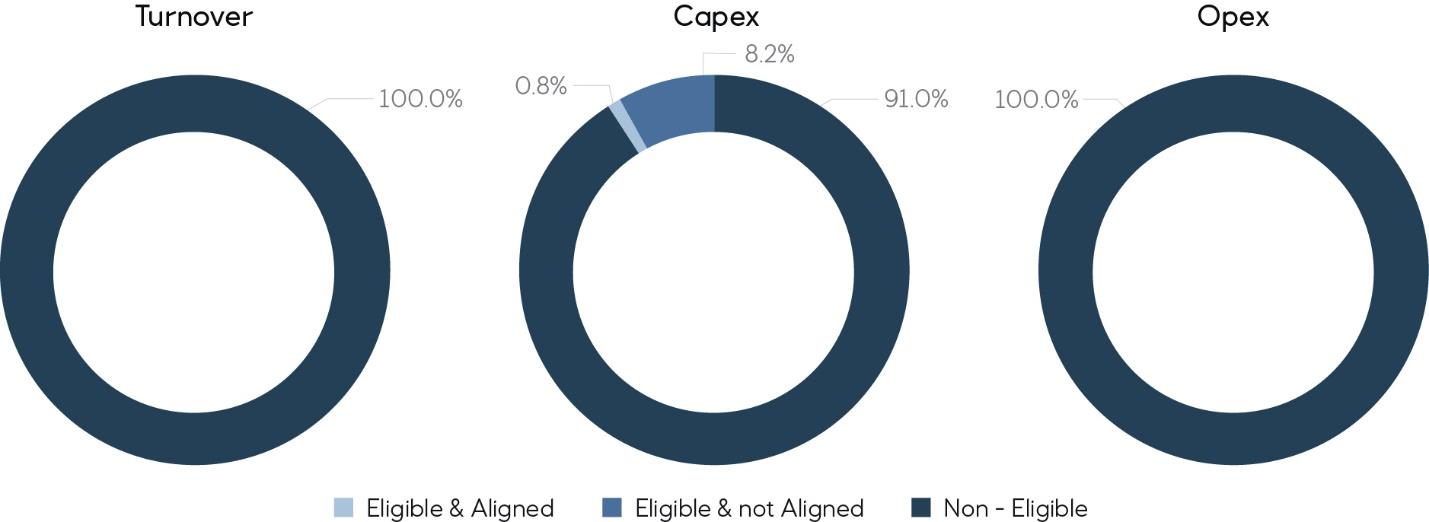

EU taxonomy

1.9

Governance and risk management

5.4

Additional sustainability information

5.5

Statements on this report incl. independent auditor reports

Group performance

5.6

Use and reconciliation of non-GAAP financial measures

Our 2023 performance

5.7

Terms and abbreviations

2.1

Financial performance

5.8

Forward-looking statements

Strategic financial framework

Our market perspective

Group financial performance

Oil and gas reserves

2.2

Sustainability performance

Sustainability approach

Materiality assessment

Material topics' performance

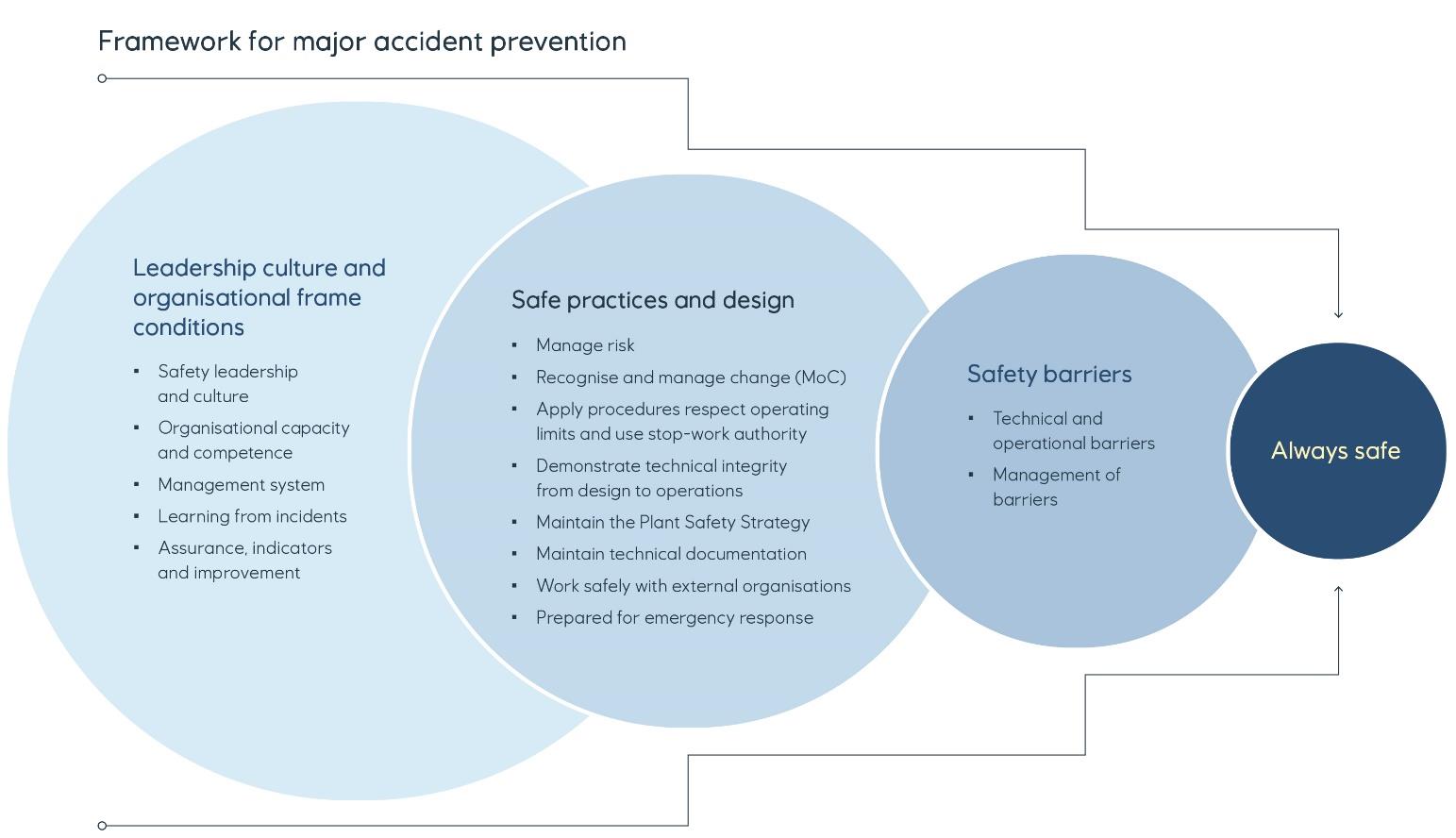

Always safe

Safe and secure operations

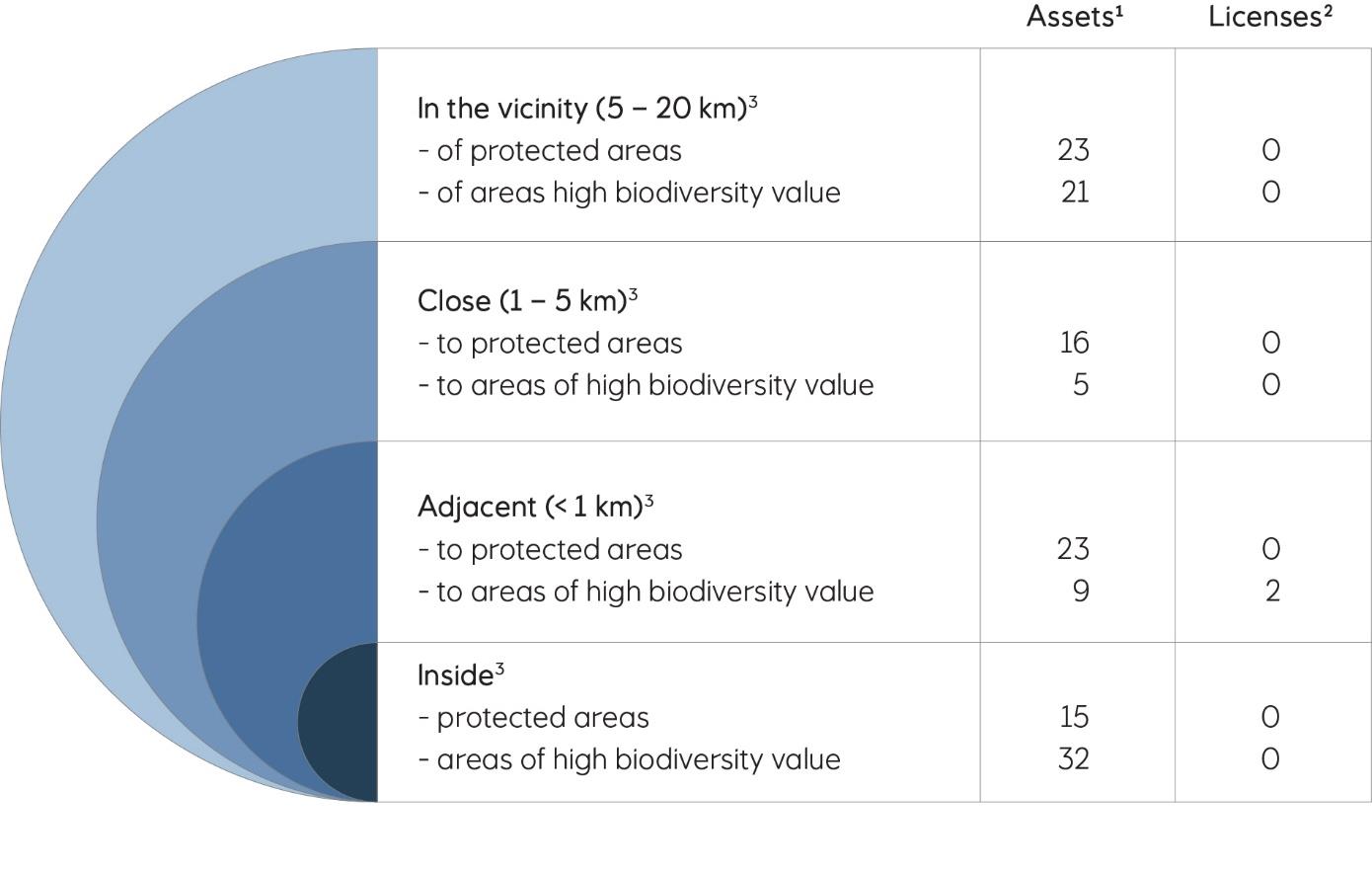

Protecting nature

Respecting human rights

Workforce for the future

High value

Profitable portfolio

Energy provision and value creation for society

Integrity and anti-corruption

Low carbon

Net zero pathway

2.3

Fuelling innovation

Introduction

Equinor 2023 Integrated Annual Report 5

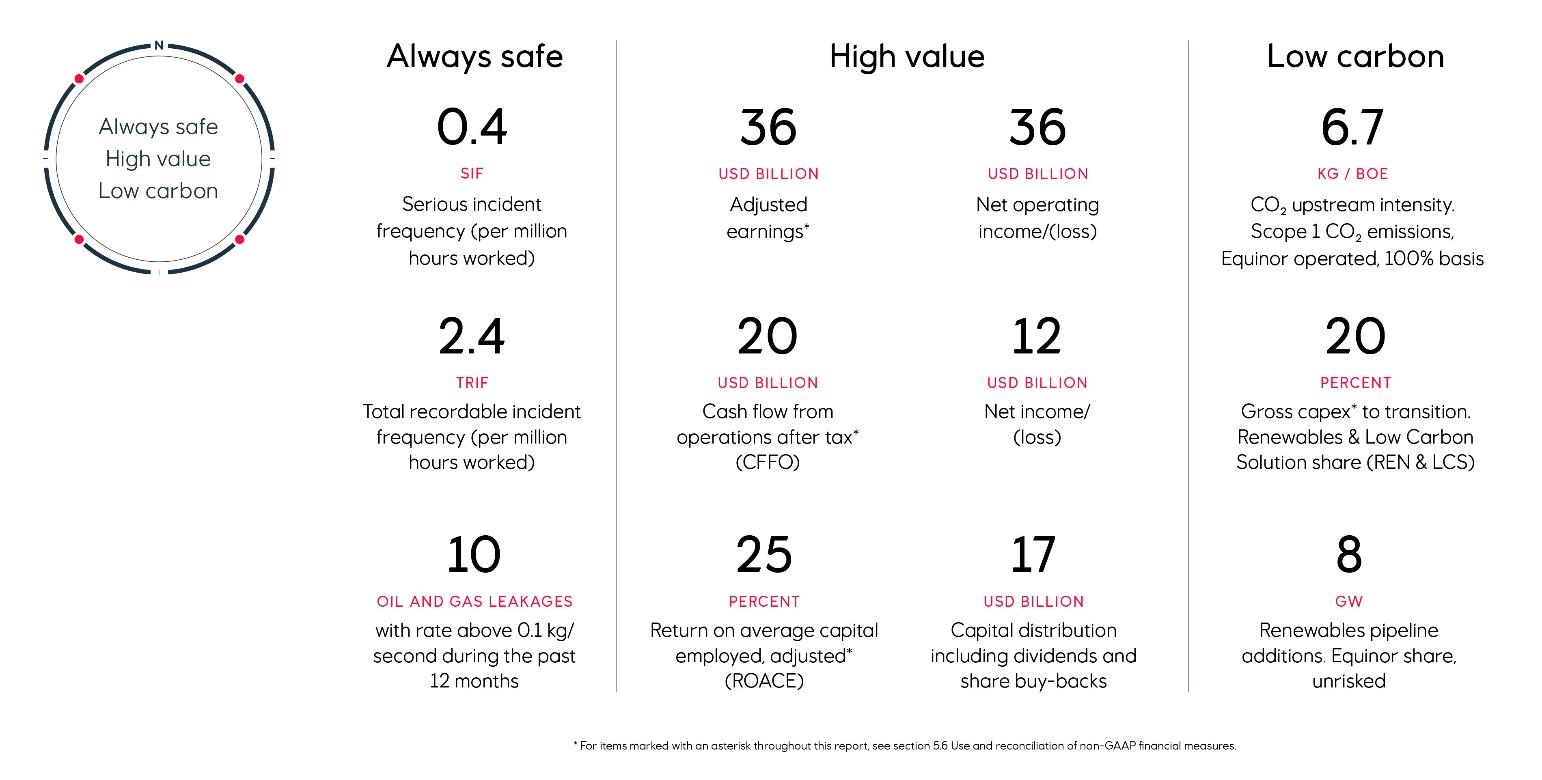

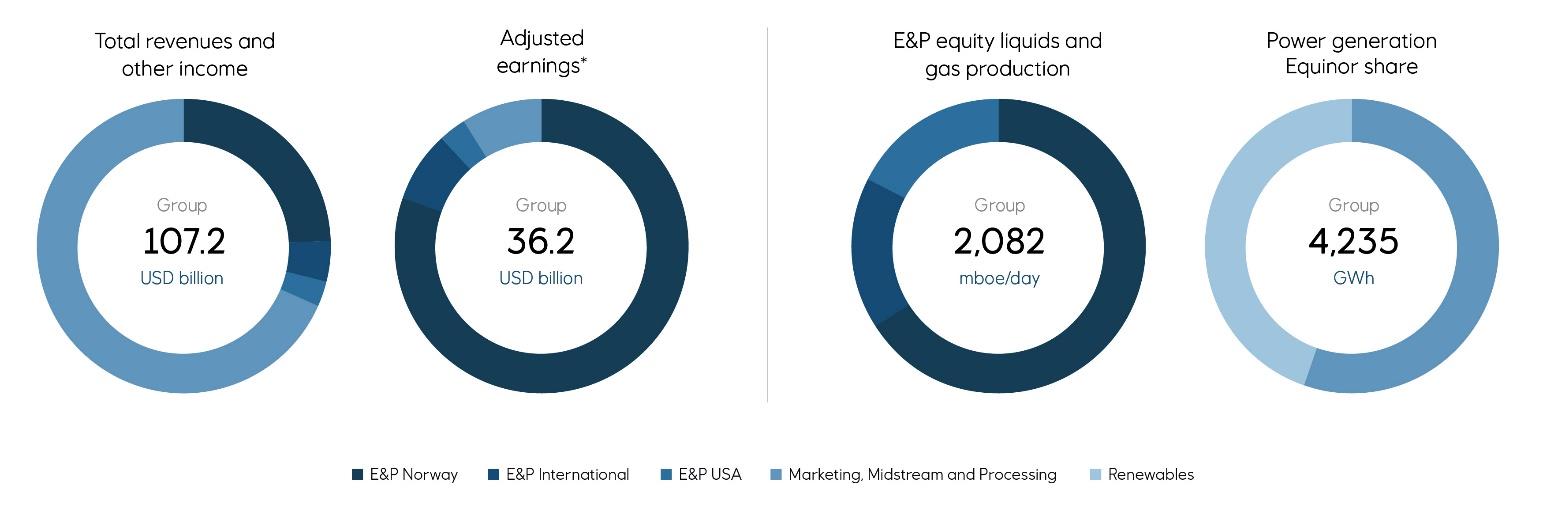

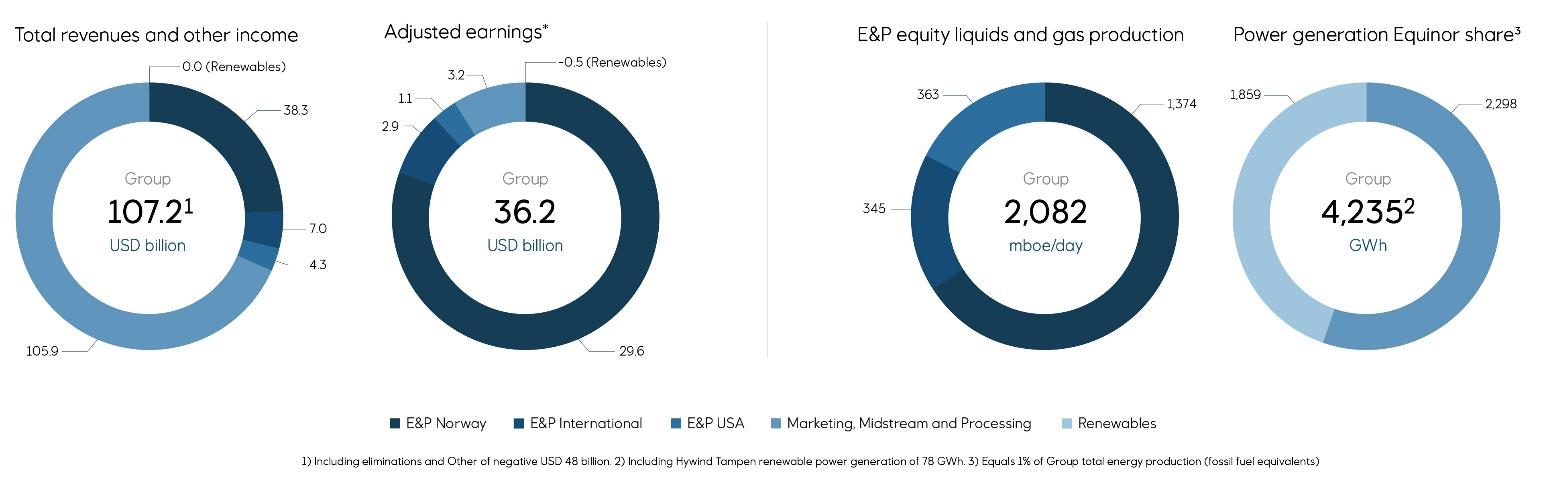

Key figures for 2023

Key figures by segment

* For items marked with an asterisk throughout this report, see section 5.6 Use and reconciliation of non-GAAP financial measures.

Introduction

Equinor 2023 Integrated Annual Report 6

January

Equinor

RWE

develop large-scale value chains for low carbon

hydrogen.

Equinor

26

the NCS, of which

18

February

Equinor

makes a new oil discovery close to the Troll

Field in the North Sea.

March

Equinor

Suncor

Energy UK Limited

.

EU Commission President

NATO Secretary General

Jens Stoltenberg and

Norwegian Prime Minister

Troll A platform in the North Sea.

April

Production starts from the

Bauge

Norwegian Sea.

May

Equinor

decision for the

Raia

Official opening of the

Njord

The

Johan Sverdrup

at increased plateau of 750,000 boe per day.

June

Equinor

with

Cheniere

. The deliveries will start in 2027 and is

expected to reach 1.75 million tonnes per year

towards the end of this decade.

July

Equinor

company

Rio Energy

.

Rio

Energy

is a leading onshore renewables company in

Brazil.

August

Hywind Tampen,

the world’s largest floating offshore wind farm

officially opens.

Gullfaks

Snorre

in the world to receive power from offshore wind.

Equinor

acquires stake in the

Bayou Bend

September

Equinor

Itacha

Energy

progress the

Rosebank

October

Dogger Bank

, the world’s largest offshore wind farm, produces

power for the first time, marking a major milestone in the

development of the industry and the transition to a cleaner, more

secure energy system.

Breidablikk

in the North Sea comes on stream ahead of schedule.

Equinor

signs new supply agreement for natural gas with

Germany’s major energy company

RWE

.

November

Equinor

Gina

Krog

Equinor

enters into agreement to sell its Nigerian interests to

Chappal Energies.

December

Equinor

enters into an agreement to acquire

Shell’s

equity and

operatorship of the

Linnorm

Equinor

SEFE

agreements and pursue large scale hydrogen supplies.

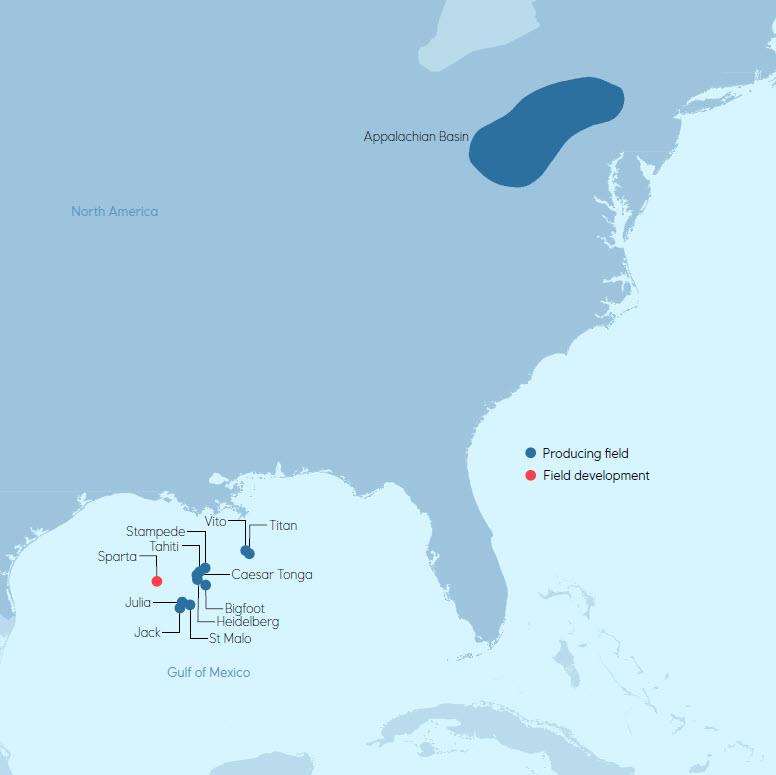

Equinor

and operating co-owner,

Shell Offshore Inc

, reach the

final investment decision for Sparta, an oil field in the US Gulf of

Mexico.

Equinor

signs an agreement to sell its interests in Azerbaijan to

SOCAR

.

Key events

Introduction

Equinor 2023 Integrated Annual Report 7

Message to stakeholders

2023 was marked by energy markets becoming more complex and less predictable. Against the backdrop of geopolitical

instability, supply chain bottlenecks and inflation, energy companies face difficult trade-offs in delivering reliable,

affordable and sustainable energy. As the largest energy provider to Europe, Equinor continues to develop its broad

portfolio to contribute to energy security. Our ambition is to be a leading company in the energy transition.

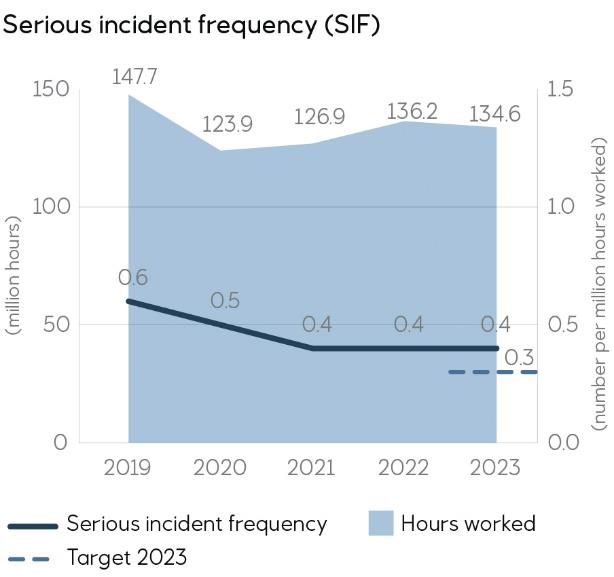

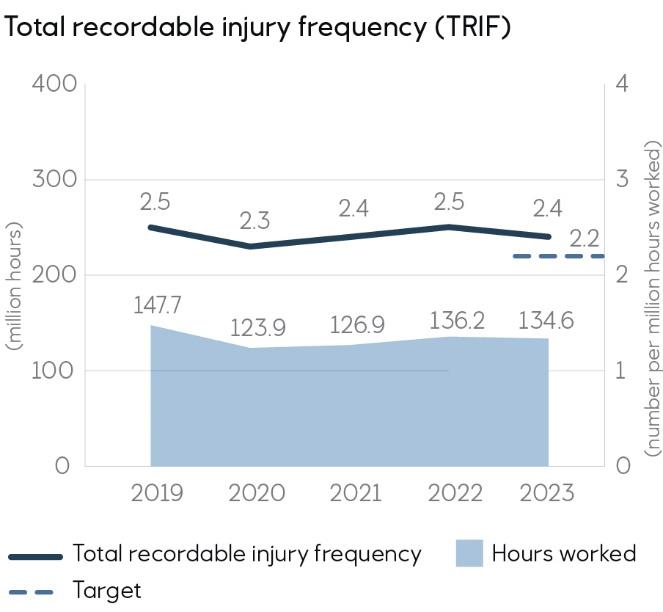

Safety is our number one priority. Over the years, our safety performance has seen a positive trend. In 2023, the

serious incident frequency per million hours worked (SIF) was 0.4. The number of serious incidents were measured at

the lowest level so far. Tragically, however, we had a fatality on a contracted tanker in Malaysia. We also recorded two

incidents with major accident potential. This is a stark reminder of the importance of our continuous improvement effort

to ensure that all our people return safely home from work. To safeguard our people and to meet increased geopolitical

tensions and security risks, we have further reinforced the protection of assets and operations.

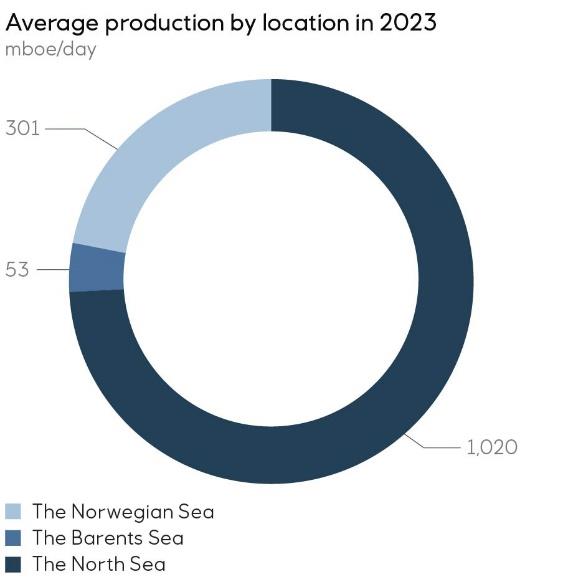

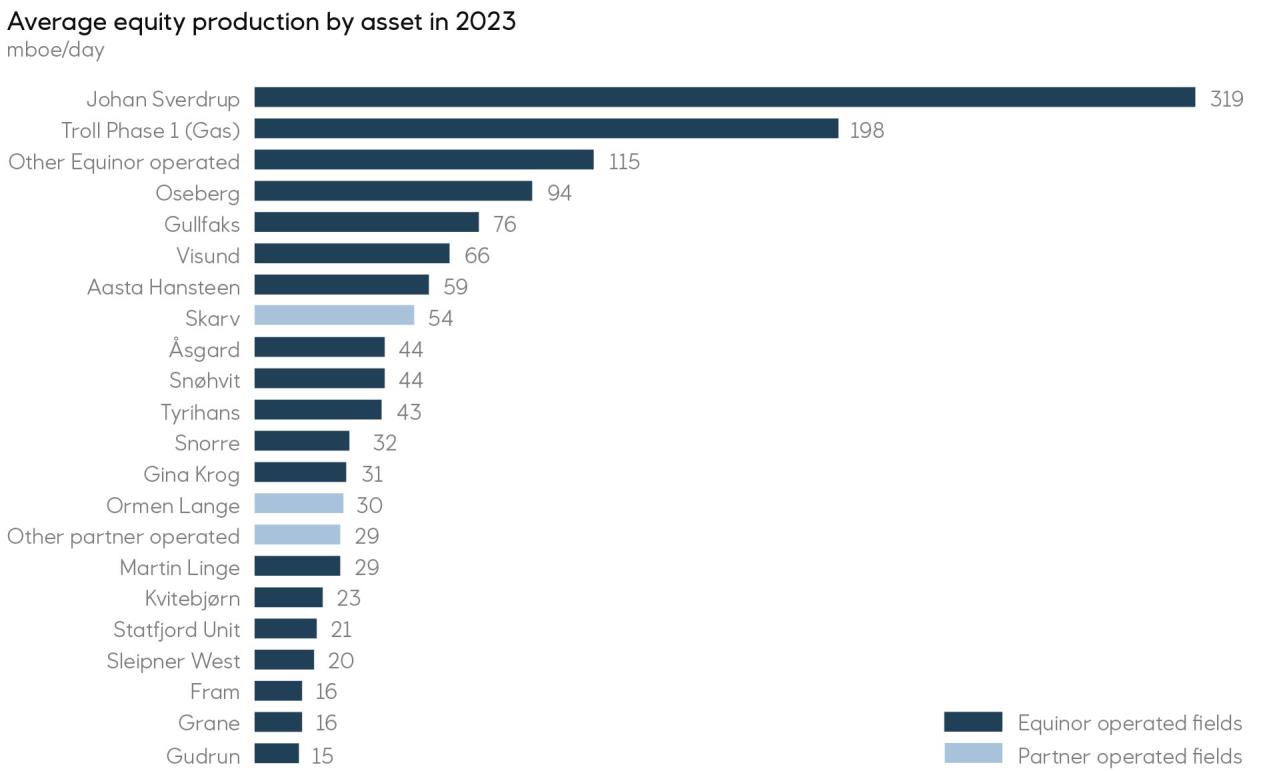

In 2023, we delivered strong financial results, with adjusted earnings* of USD 36 billion before tax. This is the second-

best result in the history of the company, only beaten by the record results of 2022. The delivery of a solid global

operational performance in 2023 resulted in a total liquids and gas production of around 2,100 mboe per day, a 2.1%

growth from 2022. The strong cash flow and competitive capital distribution in the year of USD 17 billion, including share

buy backs, support our goal of creating shareholder value.

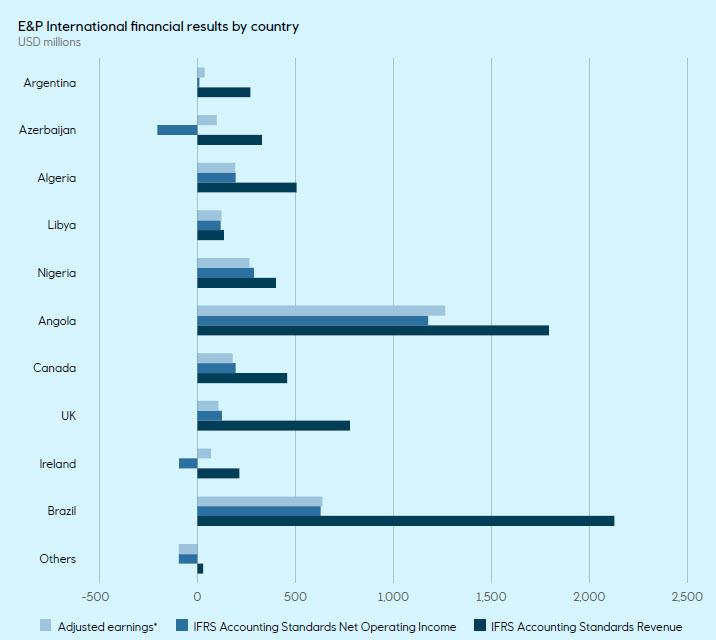

We continued to optimise the oil and gas portfolio, both in Norway and internationally, delivering strong results. Equinor

expects to deliver above 5% production growth for oil and gas from 2023 – 2026 and maintain production of around 2

million barrels per day in 2030. The outlook for Norwegian continental shelf is extended, expecting around 1.2 million

barrels a day in 2035. With major projects under development, the cash flow from the international portfolio is expected

to increase by 50% by 2030. With a robust financial position, we are well positioned for growth and transition.

The year included several milestones for the company. The investment decisions on Raia and Rosebank, and the

increased ownership in the Linnorm discovery, show how we continued to optimise our oil and gas portfolio. The

acquisition of an interest in Bayou Bend and continued maturation of carbon capture and storage projects shows how

we create new market opportunities in low carbon solutions. The long-term gas sales agreement with SEFE (Germany’s

state-owned energy company) is one of the largest gas sales agreements that we have made, demonstrating the long-

term attractiveness of natural gas to Europe. Finally, first power from Dogger Bank, the world’s biggest offshore wind

farm, and the opening of the floating wind farm Hywind Tampen, demonstrate our capabilities to create high value

growth in renewables.

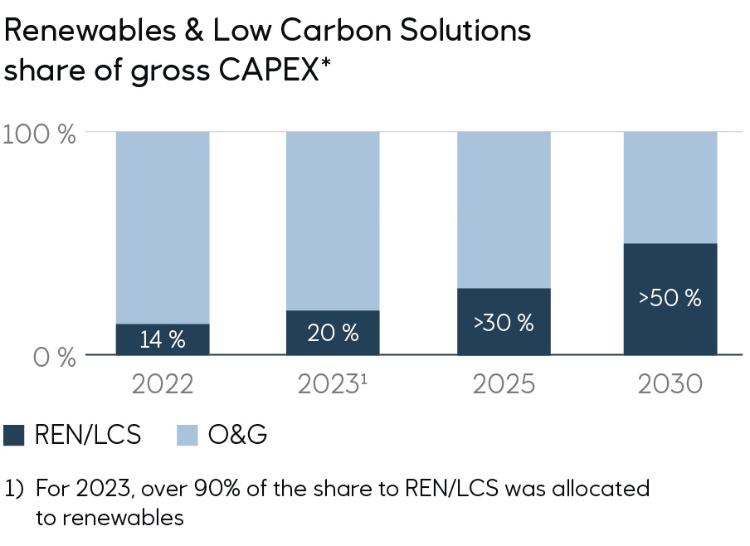

For Equinor’s energy transition, 2023 was marked by a focus on capacity building. Last year, 20% of our investments

were directed towards renewables and low carbon solutions. We are on track to reach our ambition to invest more than

50% in profitable renewables and low carbon solutions by 2030. We also strengthened our renewables portfolio, adding

8 GW to our renewables pipeline. Important milestones were the acquisitions of onshore renewables platforms BeGreen

and Rio Energy. In the short term, we will see an increase in oil and gas production, but the company will alongside

provide a broader energy offering.

Oil and gas will continue to be the foundation for our value creation,

supplying the energy needed and contributing to

energy security. We will continue to reduce emissions from the production of oil and gas and developing a pipeline of

renewable and low carbon projects. With this we will increase both the production of low carbon energy and our

capacity for CO

2

solutions for tomorrow.

In 2023, we welcomed over 2,000 new employees to the company, renewing competence and replacing retirement. The

energy transition requires skills and dedication, and we are proud of the strong efforts made across Equinor to deliver

our results. We would also like to thank Equinor’s shareholders for their continued investments and commitment.

Jon Erik Reinhardsen, Chair of the board

Anders Opedal, President and CEO

Introduction

Equinor 2023 Integrated Annual Report 8

About the report

Equinor Integrated annual report for 2023

We release for the second time an integrated annual report for the full year of 2023, combining financial and sustainability reporting

into a single report. The integration reflects the increasing importance of sustainability for the company's operational and financial

performance. This format aligns reporting with Taskforce on Climate-related Financial Disclosure (TCFD) and requirements from the

European Union (EU) under the Corporate Sustainability Reporting Directive (CSRD).

This report presents the

●

Board of director’s report (Chapters 0-3 and Chapter 5 excluding sections 5.4, 5.7, 5.8)

●

Consolidated financial statements of the Equinor group (section 4.1)

●

Parent company financial statements of Equinor ASA (section 4.2)

●

The company’s sustainability reporting, prepared in accordance with the Global Reporting Initiative (GRI) Standards.

●

Communication on Progress to the UN Global Compact (advanced reporting level)

●

Statement on equality and anti-discrimination (section 2.2 Workforce for the future, Diversity and inclusion)

Other 2023 Reporting published on equinor.com/reports

●

Remuneration report, incl. 2021 Remuneration policy

●

Oil and gas reserves report

●

Payments to governments

●

Board statement on Corporate governance

●

Annual report on Form 20-F

●

Integrated annual report – Norwegian (XBRL data ESEF)

●

Human rights statement

●

GRI and WEF index

●

UK modern slavery statement

●

Equinor datahub (ESG reporting centre)

This publication constitutes the Statutory annual report in accordance with Norwegian requirements for Equinor ASA for the year

ended 31 December 2023. The Integrated annual report is filed with the Norwegian Register of company accounts. The version

prepared in accordance with the European Single Electronic Format (“ESEF”), filed with Oslo Børs, is the official version of the

Company’s Integrated Annual report, and the ESEF version prevails in case of any questions or conflicts to other versions. Further

information on the boundary conditions for sustainability data can be found in section 5.4 Additional sustainability information.

This report should be read in conjunction with the cautionary statement in section 5.8 Forward-looking statements.

The Integrated annual report may be downloaded from Equinor’s website at www.equinor.com/reports. References in this document

or other documents to Equinor’s website are included as an aid to their location and are not incorporated by reference into this

document.

About us

Equinor 2023 Integrated Annual Report 9

About us

1.1

1.2

1.3

1.4

1.5

1.6

1.7

1.8

1.9

We are Equinor

Our history

Our business

The world in which we operate in

Our strategy

Progress on our Energy transition plan

Our people

Engaging with stakeholders

Governance and risk management

About us

Equinor 2023 Integrated Annual Report 10

1.1 We are Equinor

We are an international energy company, headquartered in Stavanger, Norway. Our portfolio encompasses oil and

gas, renewables and low carbon solutions.

Around 23,000

employees in

around 30

countries.

A leading offshore

oil and gas

operator.

The largest single

supplier of energy

to Europe.

A competitive

developer and

operator in offshore

and onshore

renewables.

Driven by our

purpose

Turning natural resources into energy for people and progress for society

Deliver on our

ambition

To be a leading company in the energy transition

Guided by our

values

●

●

●

●

About us

Equinor 2023 Integrated Annual Report 11

1.2 Our history

1970s

A foundation for the future

Equinor, formerly Statoil, was founded on 18 September 1972. Our role was to be the state’s financial, commercial

and industrial instrument in the development of the Norwegian oil and gas resources. In the early years, our

operations were focused on the exploration, development and production of oil and gas assets on the NCS. By 1979,

the Statfjord field was discovered in the North Sea and production commenced.

1980s

An offshore pioneer

The 1980s was a decade of strong growth, with discoveries and the development of large fields on the NCS. In 1981,

we gained operatorship of the Gullfaks development in the North Sea, as the first Norwegian operator. In 1987

Equinor took over the operatorship of Statfjord.

1990s

An international player

In the 1990s Equinor grew internationally. We became a major supplier to the European gas market, entering large-

sales contracts for the development and operation of gas transport systems and terminals. In 1992 Equinor entered

an alliance with BP to grow internationally. We expanded manufacturing and marketing across Scandinavia and

established a comprehensive network of service stations. Statoil fuel and retail was later listed and fully divested in

2012.

2000s

An ambitious and innovative operator

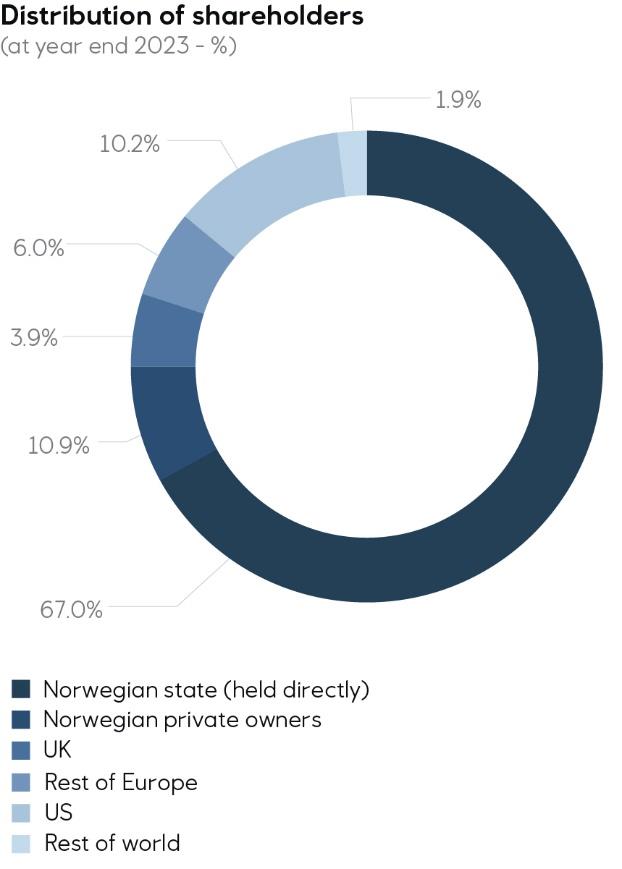

In 2001, we were listed on Oslo Børs and New York Stock Exchange under the name Statoil ASA, with the

Norwegian State retaining a 67% stake. In 2007, Statoil merged with Norsk Hydro's oil and gas division. By the end

of the decade, Equinor’s international exploration and partnerships included Angola, Algeria, Brazil, Canada,

Tanzania and onshore and offshore in the US.

2010s

An eye to the future

The 2010s started with international growth, with acquisitions leading to a large position in the growing production

onshore in the US and the start-up of the Peregrino field in 2011, making us an operator in Brazil. Later, we began

positioning ourselves for the energy transition, announcing a strategy to become a broader energy company in 2017.

At the AGM in 2018 Statoil ASA became Equinor ASA, reflecting the strategic direction. In October 2019 the Johan

Sverdrup field came on stream – powered by electricity from shore, it is one of the world’s most carbon-efficient

fields.

2020s

A leading company in the energy transition

For the 2020s, Equinor set out its ambition to become a net-zero company by 2050. In 2022, Equinor presented its

Energy transitional plan. This action plan includes the short- and medium-term actions necessary to realise our

ambition of becoming a net zero company. The plan was endorsed with 97.5% shareholder vote at our annual

general meeting in 2022.

About us

Equinor 2023 Integrated Annual Report 12

1.3

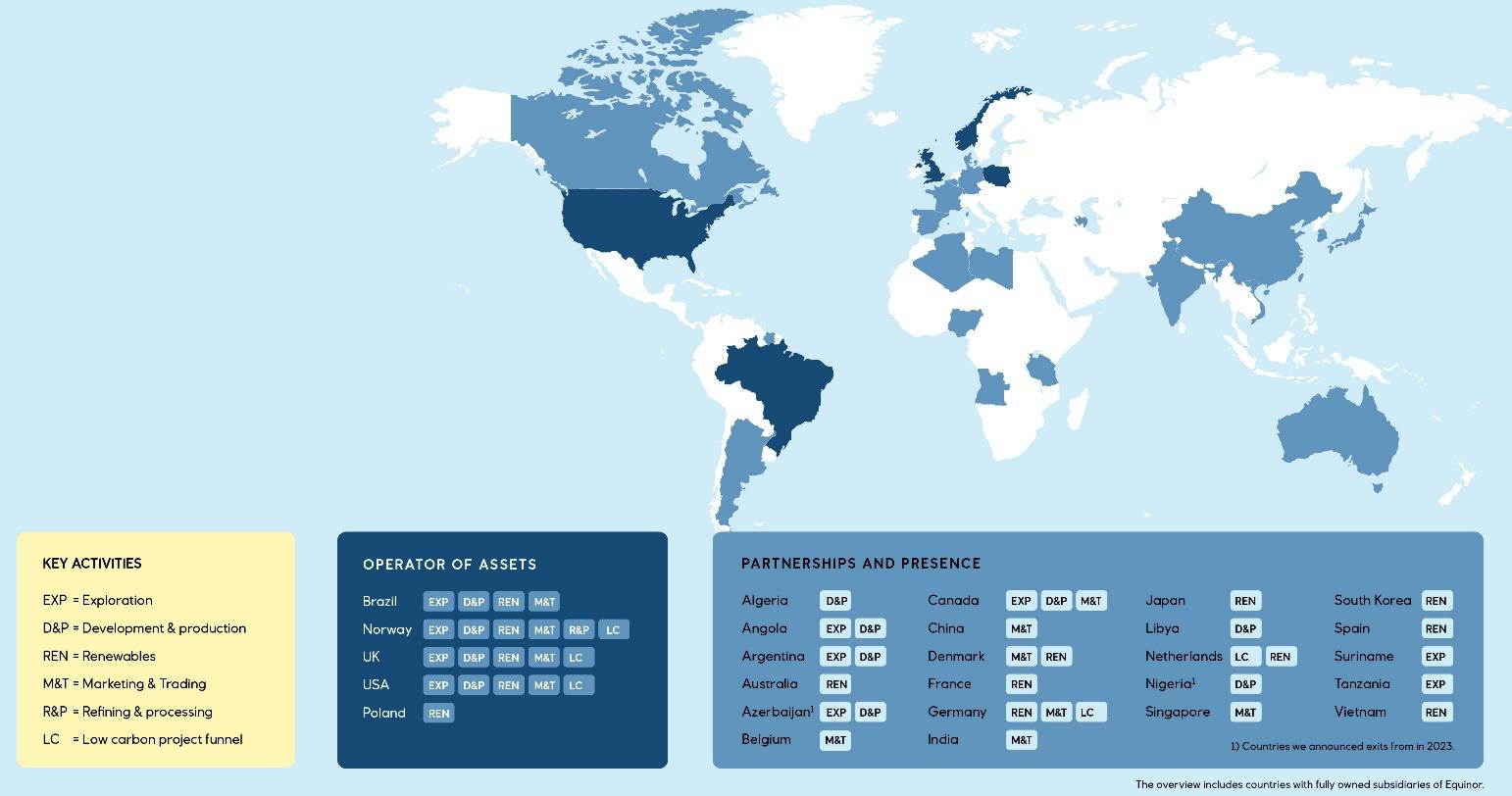

Equinor is present in around 30 countries around the world.

A broader energy offering – our current and future value chains

opportunities in low carbon solutions. This is a non-exhaustive illustration of Equinor’s current and future value chains. The aim is to

illustrate our business activities that deliver the energy needed today while developing a broader energy offering for tomorrow.

About us

Equinor 2023 Integrated Annual Report 13

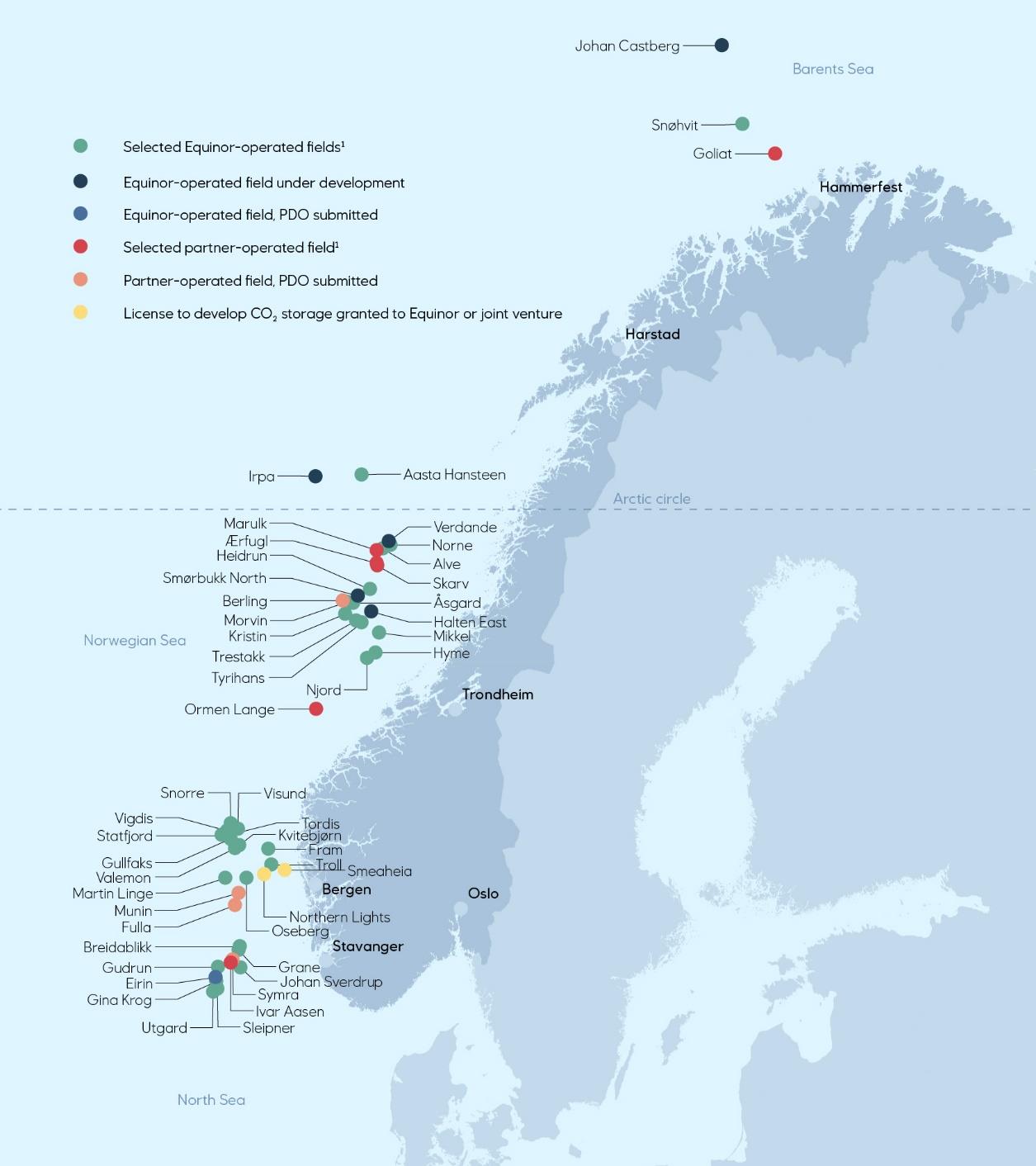

Four main areas of operation

Oil and gas

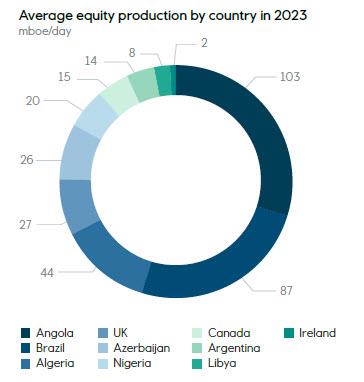

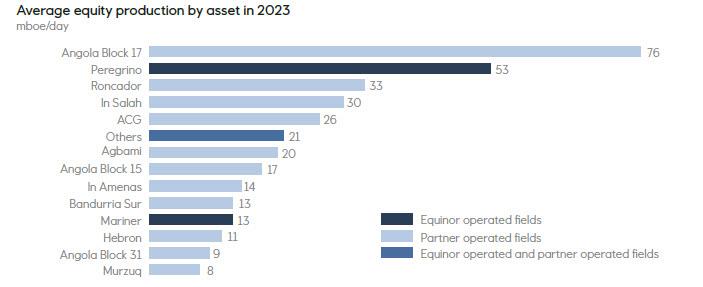

We produce around two million barrels of oil equivalent daily. Two thirds of our equity

production comes from the NCS. Equinor operates around 70% of the total Norwegian oil

and gas production. One third of the equity production comes from outside of Norway, a

share that is expected to increase over the coming years. The Peregrino field in Brazil and

the Mariner field in the UK are our largest operatorships outside of Norway.

Refining, processing

and marketing

Our refinery, processing plants and terminals transform crude oil and natural gas into

everyday commodities such as petrol, diesel, heating oil and consumer-ready natural gas.

The transportation, marketing, and trading of our products maximises value creation. Most of

our output is exported to continental Europe, but we also export to the UK, North America

and Asia.

Equinor also markets and sells the Norwegian State’s share of the natural gas and crude oil

produced on the NCS. Danske Commodities is a leading energy trading house fully owned

by Equinor.

Renewable energy

Equinor currently provides more than one million European homes with renewable power.

We develop some of the world's largest offshore wind farms, located in Europe and the US,

and are in the process of building positions within onshore renewable and energy storage in

the UK, the US, Poland, Denmark and Brazil. By 2030, we aim to have grown our installed

renewables capacity from 2023’s 0.9 GW to 12-16 GW.

Carbon capture and

storage (CCS)

Equinor is pursuing new business models to make carbon capture, transport and storage

commercially viable. We have decades of experience from CCS projects of various sizes,

successfully maturing the technology from the Research & Development (R&D) stage to

operations. We are progressing on the CO

2

and Smeaheia in Norway and Bayou Bend in the US.

A strong competitive position

A technology leader

We have a strong and proven ability to develop and apply new technologies and digital

solutions. As we pursue our ambition to be a leading company in the energy transition,

technology leadership will be a key enabler.

An offshore pioneer

Our fifty years of experience of building the oil and gas industry in Norway represents a

competitive advantage for the company today. Examples of our work include piped gas

infrastructure network, and the world’s first subsea gas compression plant. Equinor is a

global offshore wind major and the world’s leading floating offshore wind developer and

operator.

An early mover and

industry shaper

We seek to create value as an early mover and industry shaper. Examples of our approach

include the development of CCS at the Sleipner field in the 1990s and the testing of floating

offshore wind for the Hywind demo in the 2000s – which have contributed to our latest

technology developments of Northern Lights and Hywind Tampen.

About us

Equinor 2023 Integrated Annual Report 14

Six business areas

Exploration &

Production Norway

(EPN)

EPN is responsible for the exploration and extraction of crude oil, natural gas, and natural

gas liquids on the Norwegian continental shelf. As operator and partner, EPN aims to

manage resources in a safe and efficient manner, creating value for our owners, suppliers,

and Norwegian society. EPN is applying digital technologies and solutions to achieve higher

recovery rates, energy efficiency, lower costs and reduced emissions.

Exploration &

Production International

(EPI)

EPI is responsible for our international exploration and production activities and manages

upstream activities in countries outside of Norway. It has operations across five continents,

covering offshore and onshore exploration and extraction of crude oil, natural gas, and

natural gas liquids, and implements rigorous safety, security and sustainability standards,

alongside technological innovations. EPI intends to build a competitive international portfolio,

including through partner-operated activities.

Renewables (REN)

REN is responsible for Equinor’s offshore and onshore wind farms, solar plants, other forms

of renewable energy, green hydrogen and energy storage. Equinor is evolving into an

integrated power producer with a diversified power portfolio by combining Equinor’s wider

energy expertise, project delivery capabilities, and ability to integrate technological solutions.

Marketing, Midstream. &

Processing (MMP)

MMP aims to maximise value creation in Equinor’s global midstream and downstream

positions. It is responsible for the global marketing and trading of crude oil, petroleum

products, natural gas, electric power and green certificates, including marketing of the

Norwegian State’s natural gas and crude oil resources from the NCS. It also manages

onshore plants and transportation, and the development of value chains to ensure flow

assurance for Equinor’s upstream production. Low-carbon solutions, such as carbon capture

and storage and hydrogen and marketing of these services are also a part of MMP’s remit.

Projects, Drilling &

Procurement (PDP)

PDP is responsible for the global project portfolio, well deliveries, and procurement and

supply chain management across Equinor. It aims to deliver safe, secure, and efficient

project development and well construction, founded on world-class project execution and

technology excellence. PDP utilises innovative technologies, digital solutions, and carbon-

efficient concepts to shape a competitive project portfolio at the forefront of the energy

transition. Value is created through a simplified and standardised fit-for-purpose approach to

project delivery.

Technology, Digital &

Innovation (TDI)

TDI is responsible for developing technology to help Equinor reach its business targets and

ambitions within oil and gas, renewables and low carbon solutions. In addition, TDI is

identifying, testing and scaling new business opportunities supporting the energy transition

through venturing and strategic partnerships. It also has the corporate digital and IT

responsibility for daily operations and for enabling the company to onboard innovative

solutions to digitise and automate operations. Research and collaboration with universities

and external innovation hubs is part of TDI.

About us

Equinor 2023 Integrated Annual Report 15

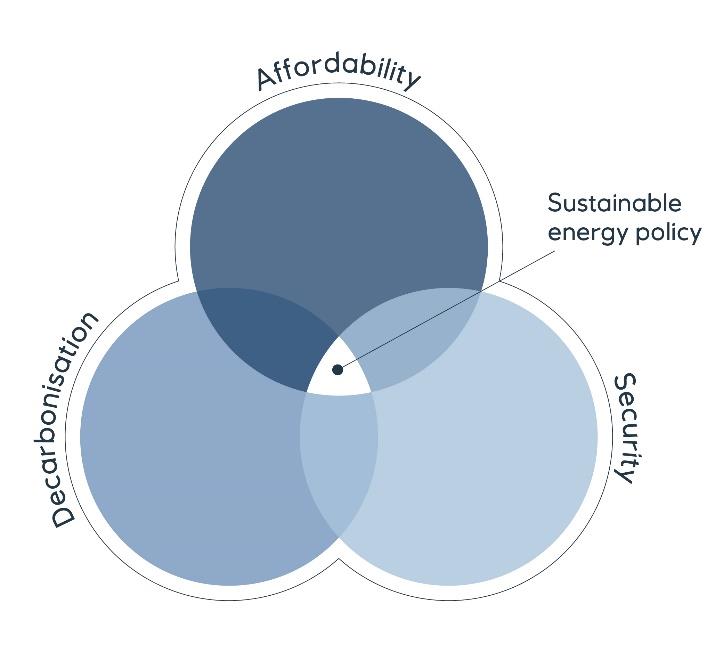

1.4 The world in which we operate

In recent years, energy markets have become significantly more complex and less predictable. Although society

continues to take major steps forward in the transition towards lower carbon energy sources, recent geopolitical

uncertainty and economic headwinds present new challenges to delivering energy security, energy affordability

and energy sustainability. Solving this “energy trilemma” (see diagram) requires that policy makers, industries and

consumers work together to find the best short and long-term balance between its three dimensions.

As countries look to find the best balance across these three dimensions, they are pushed to make trade-offs

between them. For example, in 2022 and 2023, the war in Ukraine demanded trade-offs from sustainability

towards security and affordability. It is therefore necessary for energy companies, including Equinor, to adapt

accordingly, while pursuing a resilient long-term business strategy on the journey towards a low-carbon future.

Key considerations include:

●

A need to respond to a challenging geopolitical situation

The turbulent geopolitical environment including wars in Ukraine and the Middle East, and the increased

tensions between the US and China has led to a somewhat reprioritised focal point in the trilemma. The

weaponisation of energy means that energy projects and assets require additional physical and cybersecurity,

as well as alternative supply sources. The urgency for Europe to rapidly replace Russian oil and gas has

necessitated increased supply from producers in other regions, but also impacted emissions, industrial activity

and economic growth.

●

A lack of stable decarbonisation policies and commercial frameworks

Whilst the energy transition creates business opportunities for new technologies and value chains, the

supporting policies and frameworks needed to drive large scale investment are lagging in many countries and

regions. Choosing where to invest and how fast to transition therefore pose significant strategic risk which

must be balanced with needs for financial stability, resilience, and shareholder value.

●

An added incentive to accelerate renewables growth

In parallel with meeting short-term energy supply needs, and to increase energy security, there is an

accelerated drive to transition into renewable energy. This presents long-term business opportunities for

energy companies, but the faster pace may increase reliance on currently non-diversified supply chains with

lower standards of social and environmental practices (e.g. human rights).

●

An acute cost-of-living crisis could have broad fallout

Energy affordability remains a key concern for many, potentially leading to social unrest and policy

backtracking on decarbonisation ambitions, and poses uncertainties for investors in terms of future political

The energy trilemma

Energy affordability

domestic and commercial use

Energy security

– capacity to meet current and future energy

demand while maintaining resilience to system shocks

Energy decarbonisation

energy systems through substituting use of fossil fuels and

increase energy efficiency.

About us

Equinor 2023 Integrated Annual Report 16

intervention. Inflation levels were high in most regions in 2023 and growing activity across the energy industry

means that many sectors are capacity constrained and experiencing supply chain pressures.

Despite global challenges, Equinor’s strategic beliefs stand firm. The energy industry has a key role to play in

the energy transition, and oil and gas will continue to be needed for while the transition happens on the back

of massive investments.

About us

Equinor 2023 Integrated Annual Report 17

1.5 Our strategy

The world’s energy systems are in a transition to meet the challenge of climate change. As Equinor transforms, we must strike

the right balance between being a safe and reliable provider of energy and generating cash flow to enable the energy

transition, while supporting our purpose of providing energy and progress to society and continuing to be an attractive

investment for our shareholders. We have a strong financial position and a solid balance sheet. This enables us to seize

opportunities provided by the energy transition. Despite the current turbulence, our strategic beliefs - the foundation of our

strategy - remain firm.

Our strategic beliefs

Creating value through

the energy transition

Net-zero ambition gives

rise to new industry

opportunities

Technological excellence

and innovation will define

winners.

The emerging market

dynamics put margins

under pressure.

Fast, structural changes

can create new localised

business models and

offer new ways for

consumers to access

energy. Oil and gas will

stay in our long-term

energy mix, but only the

most robust upstream

projects can be expected

to be developed, and

carbon considerations will

continue to influence all

our portfolio choices. For

renewables and low

carbon solutions, close

collaboration with

customers, regulators and

industry will be key to

develop new markets and

lay the foundation for

future value creation.

Climate change and the

energy transition have

become mainstream

concerns for

governments, societies

and investors. Therefore,

functioning markets for

low carbon solutions will

emerge and new

opportunities will arise for

developers of these

solutions. As policy and

regulations shape energy

markets, the social

licence to operate and the

ability to run a profitable

business will be closely

tied to how companies act

on their net-zero

ambitions.

As the magnitude and

speed of change intensify,

technology, digitisation

and innovation will be key

enablers. New ways of

working will evolve. We

will continue to build on

our existing competence

and experience and

develop capabilities in

new areas. A culture of

innovation, learning and

empowerment is needed

to stay competitive.

Worldwide energy

demand is expected to

grow in the short to

medium term. However,

an abundance of energy

from intermittent sources

could lead to an

increased volatility in

energy prices, exposing

the industry to new

competition and

increasing the pressure

on margins. The energy

landscape is

transforming, with

innovative technologies,

new customers, new

competitors, and new

ways of creating value.

Our strategic pillars – embedded in everything we do

Always safe

High value

Low carbon

●

●

●

transition

●

●

transition

●

●

renewables and low

carbon solutions

About us

Equinor 2023 Integrated Annual Report 18

How we will get there – our strategic focus areas

Optimised oil & gas portfolio

High-value growth in renewables

New market opportunities in low-

carbon solutions

We expect our oil and gas portfolio

to continue to provide strong free

cash flow for many years. Equinor

will pursue activities where we have

the competence, experience, scale,

and an overall competitive

advantage to secure a leadership

position.

We are focusing on high-value

growth in renewables, both onshore

and offshore, aiming to deliver

above 65 TWh from renewables

power generation by 2035.

We are actively contributing to

maturing CCS and hydrogen

markets, aiming for a market share

of 25% for storage and 10% for

hydrogen by 2030.

About us

Equinor 2023 Integrated Annual Report 19

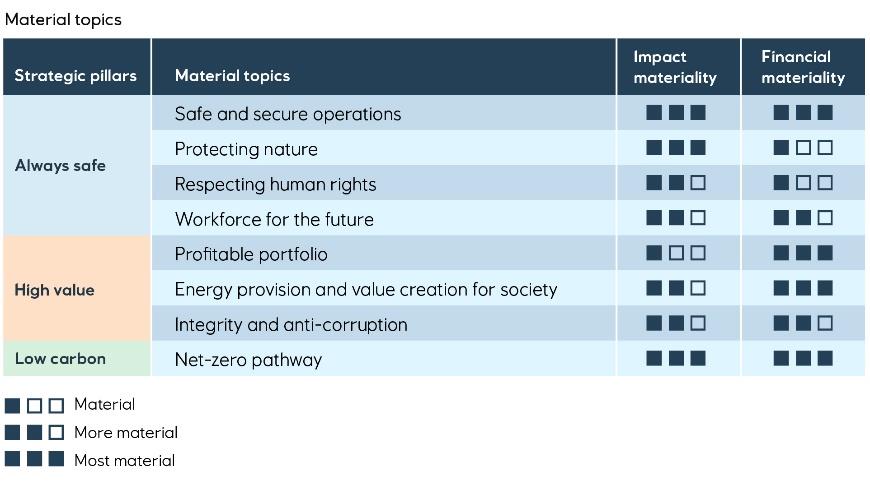

Equinor’s 2023 material topics

Our material topics are linked to our strategic pillars: always safe, high value and low carbon. We have identified eight material topics

that we believe are key to delivering on our strategy. In line with the concept of double materiality, these are topics that may

significantly affect our financial or operational performance, or that may significantly impact societies and ecosystems in which we

operate. In section 2.2, we provide more detail on each of these eight topics, their significance for Equinor and our stakeholders, the

way we manage them, the metrics we use to monitor progress, and our performance in 2023.

Profitable portfolio:

management of current asset base

.

Energy provision and value creation for society:

Securing energy supply and generating revenue, job opportunities and

economic prosperity through local employment, procurement and taxes.

Integrity and anti-corruption:

Net zero pathway

:

products.

Safe and secure operations:

Protecting nature:

Preventing the loss of and enhancing biodiversity in areas where Equinor operates.

Respecting human rights:

Respecting human rights in Equinor’s own activities and supply chain.

Workforce for the future:

Building a future-resilient, diverse and inclusive workplace with equal opportunities and human

capital development, and where people can unlock their potential.

About us

Equinor 2023 Integrated Annual Report 20

1.6 Progress on our Energy transition plan

Our Energy transition plan, published in 2022, outlines the measures that will allow us to deliver on our

net-zero ambition. It includes ambitions and actions for how to reduce emissions, build a

renewables portfolio and develop low carbon solutions. Each year, we provide an update on the

company’s progress.

For our Energy transition plan, 2023 was a year of execution and capacity building against a backdrop of

continuing energy security concerns and new market challenges.

Status on our Energy transition plan in 2023

On an annual basis, we saw mixed progress towards our main climate ambitions. Operational factors and market

dynamics negatively affected our metrics for emissions reductions and progress toward net zero, while increased

gross capital expenditure* towards renewables and low carbon solutions shows continued progress on the leading

indicator of investment. As we simultaneously deliver on the energy needs of today and work on building the

energy system of the future, it is important to maintain a multiyear perspective. Our transition journey will not be

linear, but the direction is clear. The ambitions in our Energy transition plan remain firm and we remain focused on

delivering on our strategic aim to be a net zero company by 2050.

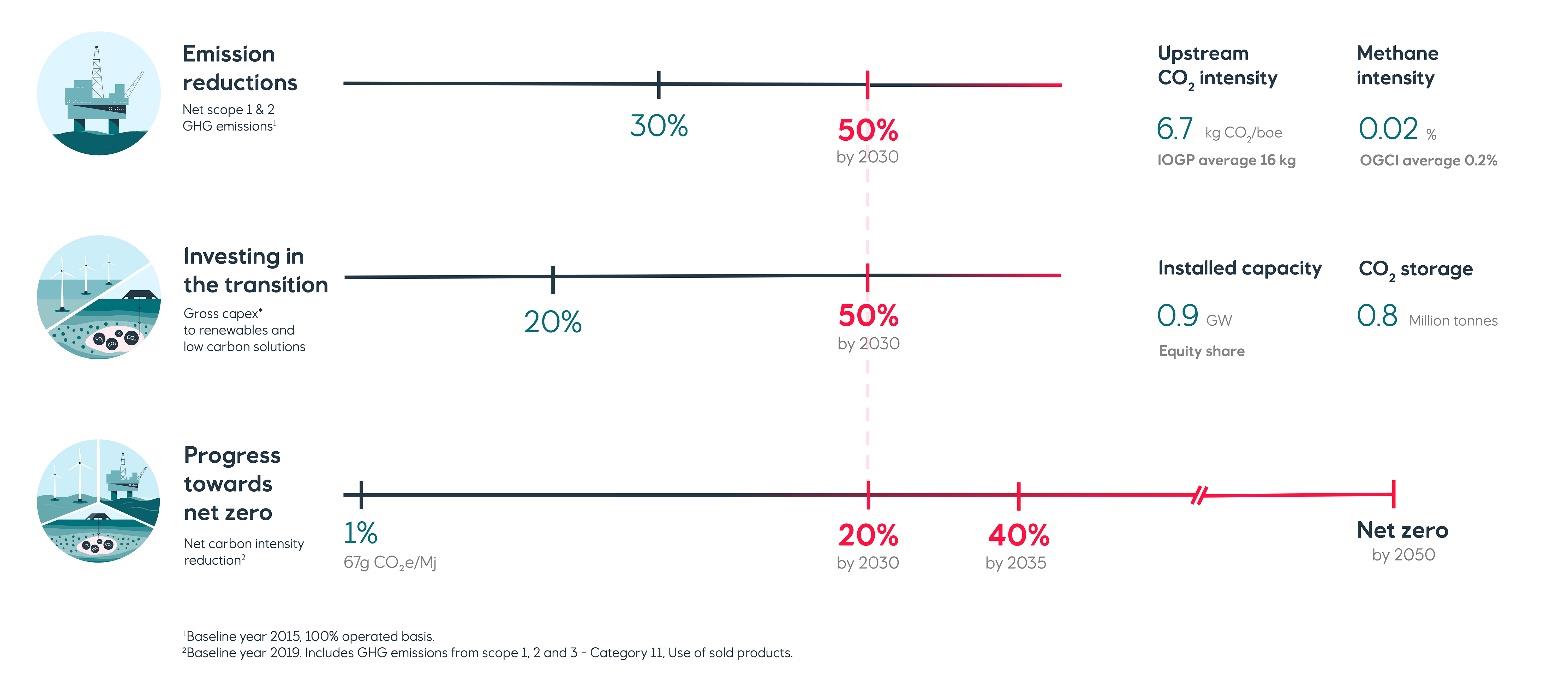

Acting on our emissions

Our ambition is to reduce emissions from our own operations by 50% by 2030 compared to 2015 levels.

We aim for at least 90% of this ambition to be realised by absolute emission reductions.

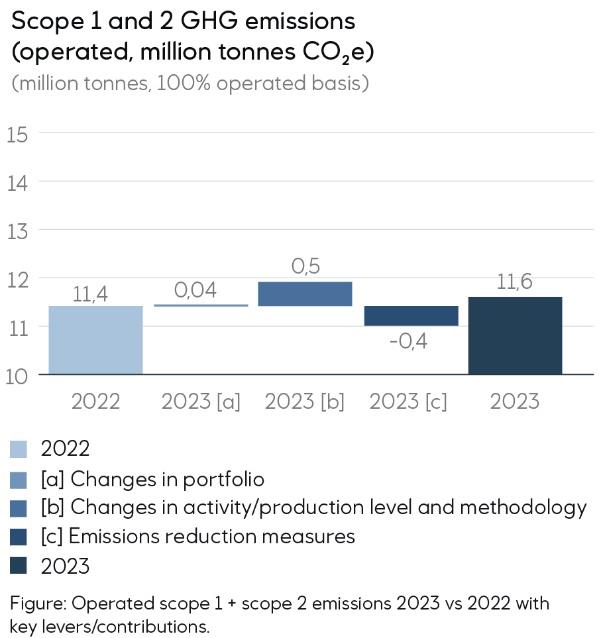

In 2023, our total scope 1 and 2 operated greenhouse gas (GHG) emissions were 11.6 million tonnes CO2e,

which is 30% lower than in base year 2015 and 0.2 million tonnes higher than in 2022. The resumption of the

Hammerfest LNG facility in Norway and the return to normal full-year production at the Peregrino oil field in Brazil

were the main contributors to the increase in operated emissions.

Notable achievements toward emissions reductions from the operated portfolio included the start-up of Hywind

Tampen, the world's first floating wind installation in the Norwegian North Sea, which supplies energy to the

Gullfaks A and Snorre fields, and the electrification of the Gina Krog field with power from shore. Additionally, the

approval of the Snøhvit Future project by the Norwegian government was a major milestone. The project aims to

fully electrify the Hammerfest LNG facility by 2030, resulting in an approximate annual reduction of 850,000

About us

Equinor 2023 Integrated Annual Report 21

tonnes of CO2 emissions. As outlined in our Energy transition plan, rapid reductions in operated emissions from

our oil and gas activities in Norway depend on the availability of, and access to, electricity supplies.

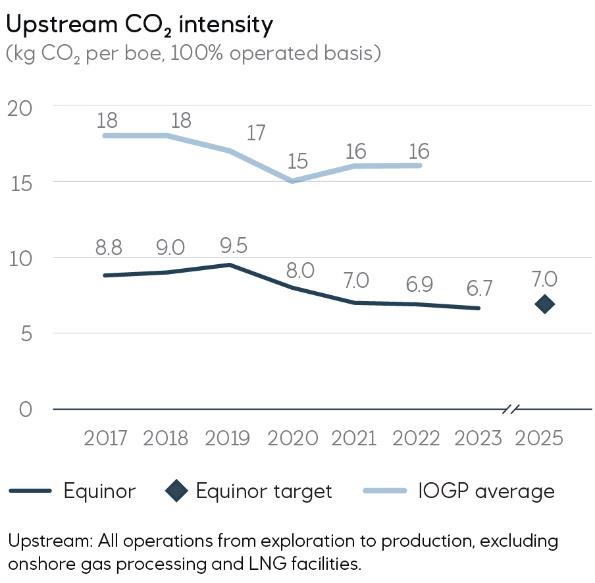

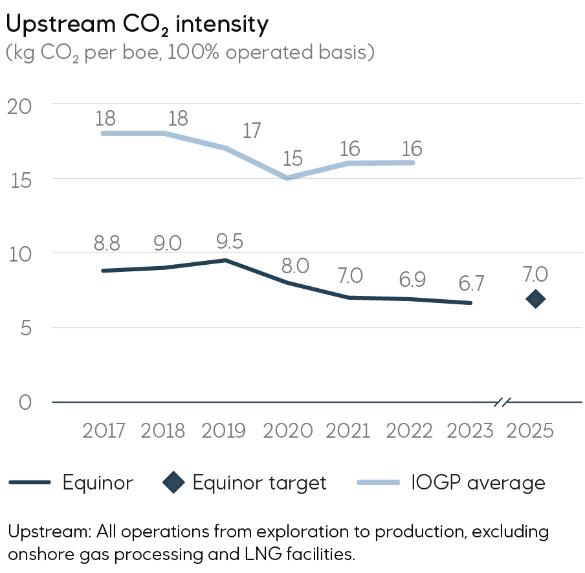

In 2023, we maintained our focus on the carbon efficiency of our upstream production. Upstream CO2 intensity

was 6.7kg CO2/boe, which is a slight improvement from the level achieved in 2022 and below our target of 7.0kg

CO2/boe for 2025. We remain on track to achieve our ambition of 6.0kg CO2/boe in 2030. The average methane

intensity of our operated assets held steady at 0.02%, roughly one-tenth of the OGCI (Oil and Gas Climate

Imitative) industry average of 0.2%.

Key figures

6.7 KG/BOE

CO2 upstream intensity. Scope 1 CO2 emissions, Equinor operated, 100% basis

30 PERCENT

Reduction in scope 1 + 2 operated emissions since 2015

Investing in the transition

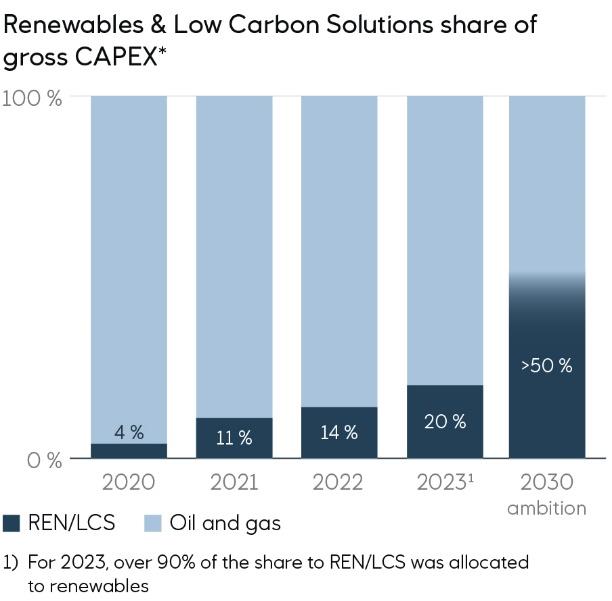

We are targeting high-value growth in renewables. Our ambition is that over 50% of our annual gross

capex will be invested in renewables and low carbon solution by 2030, and 30% by 2025, subject to

availability of robust projects.

In 2023 we invested 20% of our gross capex* into renewable energy and low carbon solutions, which is a 50%

increase from the previous year. The majority of these investments were allocated to renewables, with the

remainder allocated to our Northern Lights Carbon Capture and Storage (CCS) project. The figure does not

include investments into abatement projects for the decarbonisation of our oil and gas production. As Equinor

grows and transforms, we expect to invest more to renewables and low carbon solutions, subject to an attractive

sufficient access to opportunities and to deliver profitable growth.

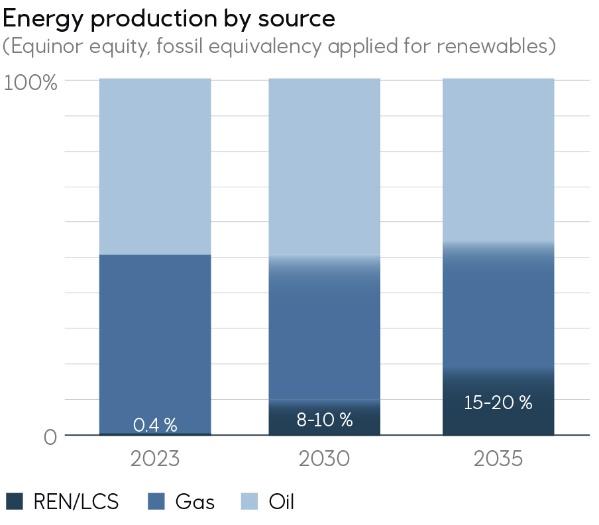

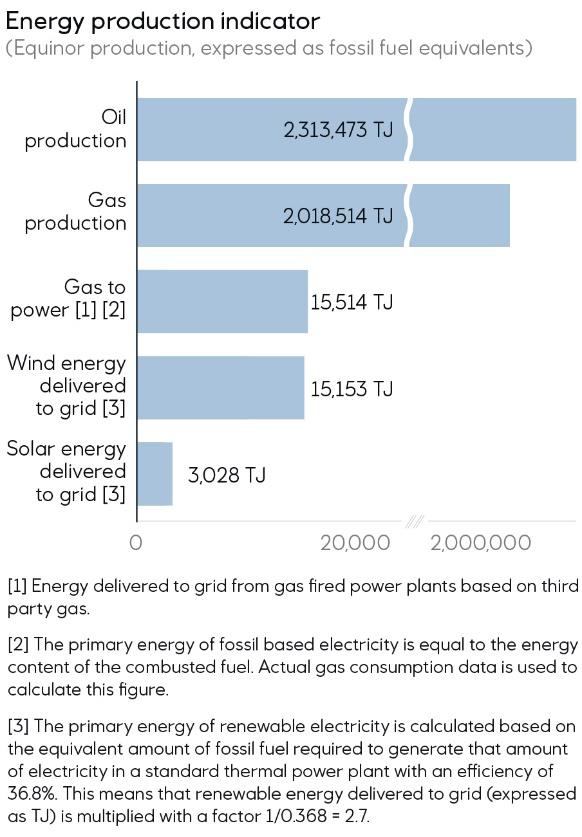

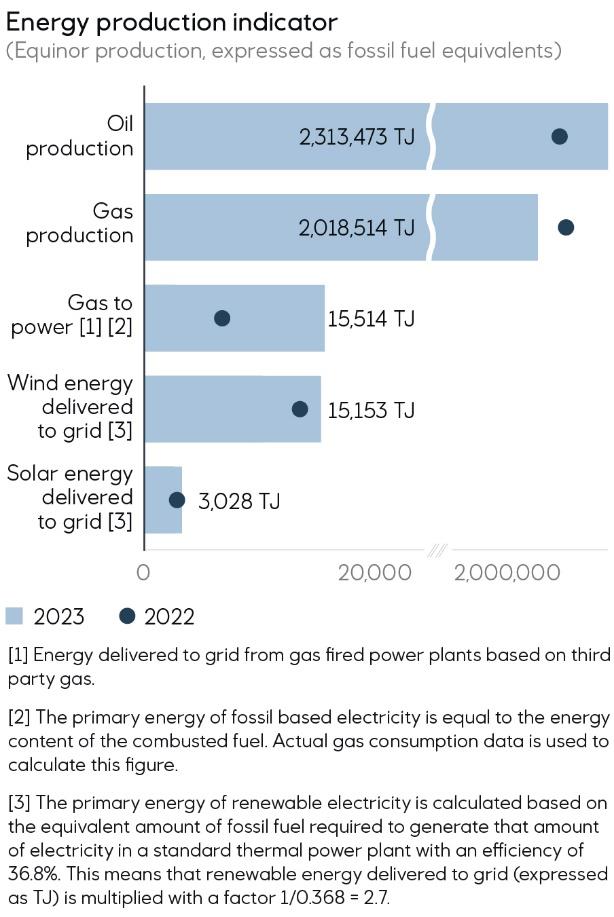

Our investment strategy paves the way to a broader energy mix for the company. While less than one percent of

the total energy we delivered in 2023 was from renewables and low carbon solutions such as hydrogen, this figure

is estimated to reach between 8-10% in 2030 and between 15-20% in 2035

1

.

Advancing towards net zero

Our ambition is to reduce the net carbon intensity (NCI) of the energy we provide by 20% by 2030. This

ambition includes scope 3 emissions from the use of sold products.

In 2023, the NCI of the energy provided by Equinor was 67gCO2e/ MJ, which is a one percentage point increase

compared to 2022 and a 1% decrease compared to the 2019 baseline year. The year-on-year rise is attributable

to an increase in the ratio of oil to gas in our production portfolio as the energy security crisis in Europe stabilised

and the extraordinary increase in demand for Equinor’s gas seen in 2022 subsided. An increase in the overall oil

and gas production from 2,039 thousand barrels of oil equivalent per day (mboe/d) in 2022 to 2,082 (mboe/d) in

2023, resulted in a 3 % increase in absolute scope 3 emissions to 250 million tonnes.

1

About us

Equinor 2023 Integrated Annual Report 22

Key figures

8 GW

Renewables pipeline additions Equinor share, unrisked

9 MTPA

CCS storage volumes added, equity to Equinor

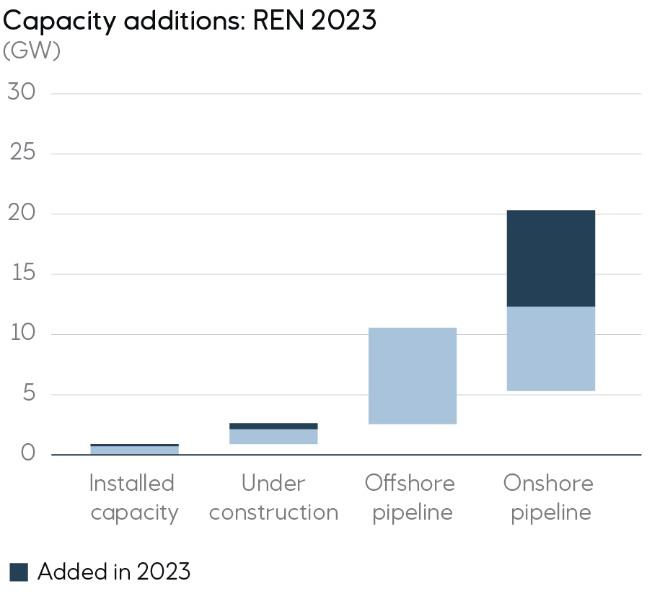

While renewables represented a small fraction of our total energy output in 2023, we made progress in building a

foundation for these sources to play an increasingly important role in our future portfolio as a broad energy

company. In October, we achieved a significant milestone in the UK, with the first power delivery from Dogger

Bank, which is set to become the world's largest offshore wind farm when all phases of the project are complete.

Our acquisition of Rio Energy, a leading onshore renewables company in Brazil, and the closing of the acquisition

of Danish solar company BeGreen, added around 8 GW of capacity to our pipeline in 2023.

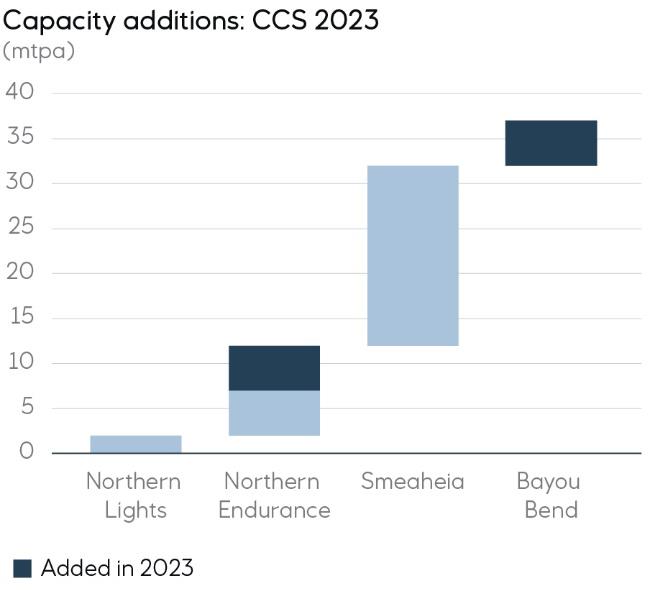

In addition to progress on renewables, we saw an increase in the volume of CO2 stored from our operated assets

Snøhvit and Sleipner in 2023 to 0.8 million tonnes, up from 0.5 million tonnes in 2022. Accumulated, Equinor has

stored 27.1 million tonnes of CO2 on the NCS since 1996. We saw two major developments in our CCS portfolio

in 2023. Our acquisition of a 25% stake in Bayou Bend, a major CCS project in the US Gulf Coast with gross

potential storage resources of more than a billion metric tonnes, provides us with an opportunity to engage in the

decarbonisation of a key industrial region and adds 5 million tonnes per annum (mtpa) of transport and storage to

our portfolio. In the UK, Equinor and its partners secured additional CCS storage licenses in the Northern

Endurance Partnership, adding up to 4mtpa to our annual storage capacity in the project, which comprises six

CO2 storage sites in the southern North Sea. These projects will be important contributors to our increased

ambition of 30-50mtpa of transport and CO2 storage by 2035.

About us

Equinor 2023 Integrated Annual Report 23

As deployment of renewables and CCS accelerates in the coming years, we expect to see greater progress in

NCI reductions, with the majority of progress towards the 20% reduction ambition in 2030 expected in the second

half of this decade.

As outlined in our Energy transition plan, the transition will require an approach that takes account of impacts on

our employees, nature, and society. In this respect, 2023 was also a year of capacity building. The launch of our

new renewables organisation in May, aimed at focusing the competence and capacity needed to maximise value

creation in our fastest growing business area, resulted in a 94% increase in the number of colleagues formally

working in renewables, with most reallocated from roles in other parts of the company. On nature, we continued to

expand our activities, including implementation of site-specific inventories of key biodiversity features for 35

existing sites. In 2023, we also continued to integrate human rights practices into the way we work, including

engagement with peers and suppliers to address systemic issues, the development of new internal monitoring

indicators for forced labour in our supply chain, and adoption of global Equinor working requirements for human

rights due diligence.

Relevant information:

● The energy transition plan

● Biodiversity position

● Human Rights Policy

● A just energy transition

About us

Equinor 2023 Integrated Annual Report 24

1.7 Our people

At Equinor, our people are our most valued resource. Every individual makes a difference by contributing their skills, experiences,

ideas, and perspectives to the common goals of delivering reliable energy and reaching net zero by 2050.

Our culture is firmly rooted in a shared understanding that safety is our number one priority. Our values guide us in how we work and

deliver on our goals together. We have clear requirements and expectations towards our employees to ensure that our company

culture continues to develop and thrive.

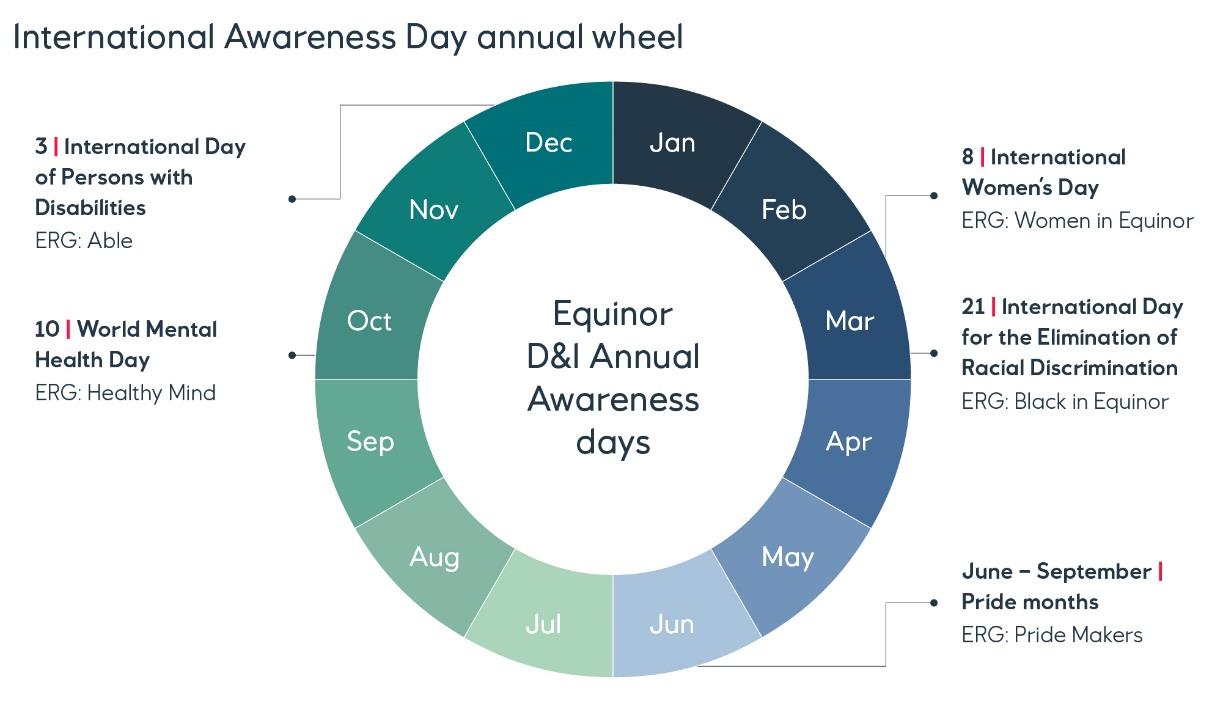

We work systematically to integrate diversity and inclusion (D&I) in our human resources (HR) processes, from recruitment, career

development, and succession planning to leadership deployment.

Developing our people capabilities

In 2023, we further strengthened our workforce planning process in collaboration with leaders and employee representatives. The

reinforced framework aims to ensure a robust connection between our strategy, business plans, and the development of people’s

capabilities. We continuously address gaps between current and future workforce needs using various tools and new technologies.

Our recruitment strategies comply with statutory requirements for the use of temporary hires.

Focusing on both short-term and long-term development planning, we enable employees to cultivate the necessary skills to meet

present and future objectives. Our ongoing performance development process, based on continuous feedback, allows leaders and

employees to prioritise and align their expectations throughout the year.

Building and utilising our collective competence

Our collective competence is a key enabler for Equinor to deliver on current and future ambitions. Employees have opportunities to

learn and grow through our Equinor university courses, partnerships with top universities for training and research, and our internal job

market. We monitor the participation of all formal learning to secure continuous management focus and a relevant learning portfolio.

Creating a great place to work

In Equinor, everyone is involved in the development of the company. This includes internal cross-functional collaboration, liaising with

union representatives and safety delegates according to local law and practice, and following up on the results from our annual global

people survey (GPS). We respect employees’ rights to organise and to voice their opinions, and we have the same clear expectations

for our suppliers and partners. In 2023, union representatives and safety delegates were involved in discussions on the further

optimisation of our operating model, the hire-in regulations in Norway, and model for career development in the company.

In 2023, we worked further on implementing our flexible work principles. Our continuous goal is to achieve a good balance in

supporting the diverse needs of our people in their daily working lives and ensuring that time and effort are directed to prioritised

activities.

Performance and reward framework

results, and rewards individual performance in a holistic way, attributing equal weight to business delivery and behaviour. The

performance of the CEO, his direct reports and Equinor’s broader leadership is assessed based on results within a wide range of

behavioral, financial, operational and sustainability topics.

A comprehensive set of performance indicators and monitoring reports are made available to all employees in Equinor’s management

information system. The performing indicators are reported on a regular basis from operational levels to the governing bodies to

ensure transparency in risk and performance management – this is how we keep employees accountable for the development of our

company.

About us

Equinor 2023 Integrated Annual Report 25

1.8 Engaging with stakeholders

Throughout 2023, we regularly engaged with stakeholders, such as governments, regulators, business partners, suppliers and local

communities. Broadly, the aim is to help us build support for policies that align with our strategy, as well as to create value in

collaboration with partners, suppliers and local communities.

Engaging with policymakers

Equinor engages with policymakers to ensure our license to operate, to express our position on important industry issues, and to

promote policies in line with our strategy and our Energy transition plan. We have a dialogue with government through our Chairman,

Chief Executive Officer and other senior leaders – as well as through consultation responses and cross-industry initiatives.

We work

with key government entities to reach common goals in line with our ambitions, promote adequate framework conditions that drive

investments in necessary energy sources and technologies - and deliver projects necessary for the transition.

In Equinor, our political and public affairs team manages relationships with governments and

policymakers. We engage primarily with

decision makers in countries where we have significant operations, such as Norway, Brazil, the UK and the US, as well as with

regional structures like the European Union. These interactions are mainly related to developing competitive, stable and predictable

industry framework conditions, taxes and legislation that affect our activities. We also collaborate on developing new value chains

needed in a low carbon future, such as hydrogen and CCS.

Our public policy work covers a wide territory, including oil and gas, low carbon solutions and renewables. Achieving the necessary

decarbonisation and political will to ensure affordability, and at the same time maintain security of supply will be a key political and

industrial challenge going forward. To achieve our corporate strategic priorities for the energy transition it is important to work with

policymakers in key markets. Further information on our sustainability governance activities can be found in section 2.2 Sustainability

Performance.

Our partners and suppliers

The values we create are to a large extent dependent on our relationships with business partners and suppliers. We believe our

efforts to ensure close collaboration and active engagement has the potential to impact health and safety standards, supplier diversity

and inclusion and promote responsible supply among others. We regularly engage in meetings with our partners to support safe and

efficient operations and drive potential to improve efficiencies. Our suppliers constitute a key part of our value chain, for example in

engineering, construction and installation of plants and platforms. We aim for fair competition and enabling efficient and sustainable

supply chains in support of both their and our own performance.

Local communities

We believe that we can bring a range of positive benefits to the societies where we operate, when these are pursued in collaboration

and based on good communication with those potentially impacted by our planned or ongoing activities.

About us

Equinor 2023 Integrated Annual Report 26

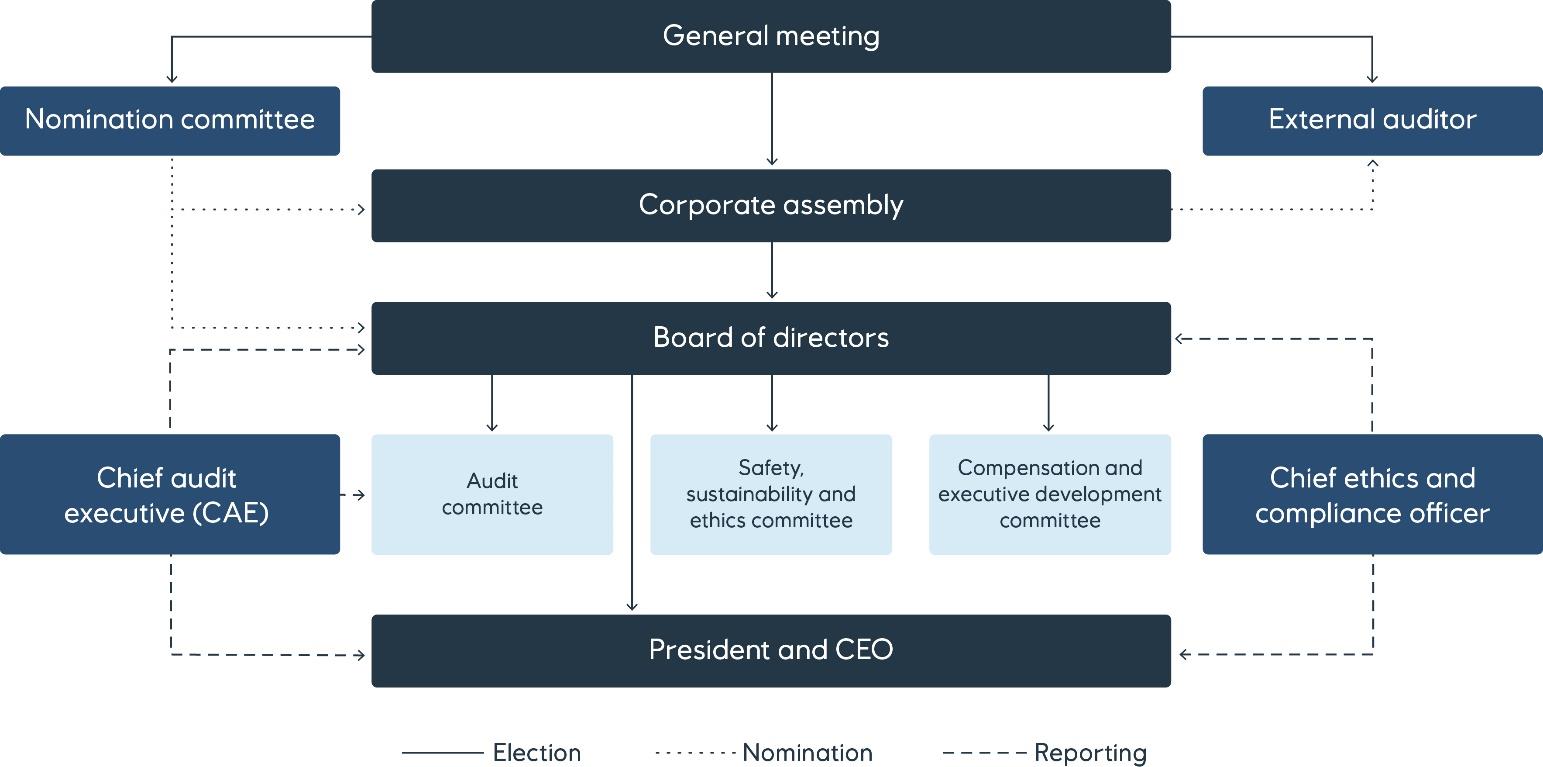

1.9 Governance and risk management

Corporate governance

Our corporate governance framework and processes are formed to promote transparency and accountability in decision-making and

day-to-day operations. Good corporate governance is a prerequisite for a sound and sustainable company, and to ensure that we run

our business in a justifiable and profitable manner for the benefit of employees, shareholders, partners, customers and society.

As a public limited liability company with shares listed in Oslo and New York, Equinor adheres to relevant regulations and applicable

corporate governance codes, including the Norwegian Code of Practice for Corporate Governance.

For a comprehensive account of our corporate governance framework, please refer to the Board statement on corporate governance

report.

Governing bodies

The general meeting

interaction between the company’s shareholders, the board of directors (BoD) and management. At Equinor's AGM on 11 May 2023,

78.02% of the share capital was represented.

The

corporate assembly

is Equinor’s body for supervision of the BoD and the management of the company. They represent a broad

cross-section of the company’s shareholders and stakeholders, and one of their main duties is to elect the company’s BoD. The

corporate assembly consists of 18 members and three observers, of which 12 members are nominated by the nomination committee

and elected by the general meeting, while six members and the observers are elected by and among employees in Equinor ASA or a

subsidiary in Norway. More information on the corporate assembly can be found in the Board statement on corporate governance

report.

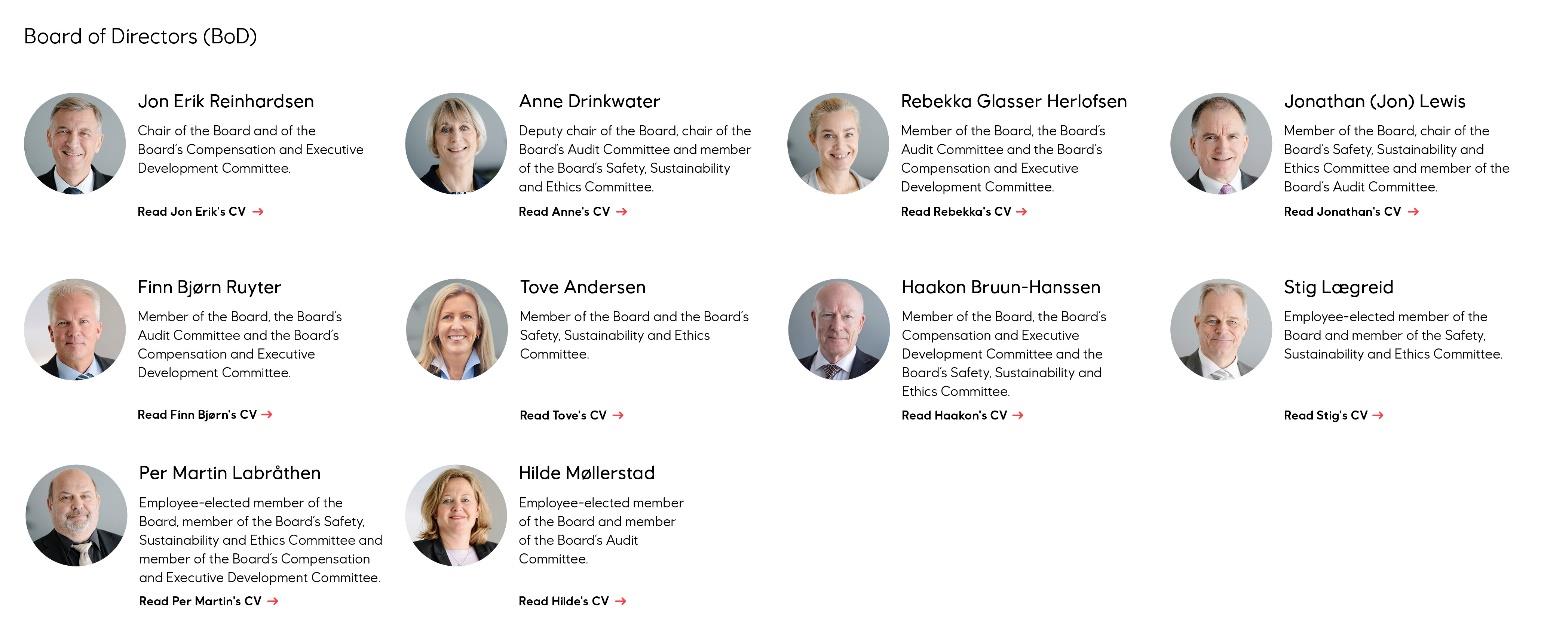

The BoD

The work of the BoD is based on its rules of procedures and applicable legislation describing its responsibility, duties and

administrative procedures. This includes a duty to decide the company’s strategy, ensure adequate control of the company’s overall

risk management and to appoint the chief executive officer (CEO). For a more detailed description, see the rules of procedures

available at www.equinor.com/board

The BoD shall consist of nine to eleven board members and as of 31 December 2023 had ten members of which seven were

shareholder representatives and three were employee representatives. Of the board members six are men, four are women and two

About us

Equinor 2023 Integrated Annual Report 27

are non-Norwegians resident outside of Norway. The nomination committee nominates the shareholder-representatives, and all board

members are elected by the corporate assembly. The BoD has determined that, in its judgment, all the shareholder representatives on

the board are considered independent as under Norwegian law.

The BoD has adopted an annual plan for its work which is revised with regular intervals. Recurring items on the board's annual plan

are: safety, security, sustainability and climate, corporate strategy, business plans and targets, quarterly and annual results, annual

reporting, ethics and compliance, management's performance reporting, management leadership assessment and compensation and

succession planning, project status review, people and organisation strategy and priorities, and an annual review of the board's

governing documentation. The board has dedicated strategy and risk sessions twice a year where the corporate executive committee

presents, and they align on the strategy going forward. The board discusses climate change and the energy transition in all ordinary

board meetings either as integral parts of strategy and investment discussions or as separate topics.

The work of the board is set out in detail in the Board statement on corporate governance report.

The BoD’s three sub-committees act as preparatory bodies:

The audit committee (BAC)

The

sustainability reporting. In particular, the BAC assists the board in exercising its oversight responsibilities in relation to:

●

The financial reporting process and the integrity of the financial statements

●

The sustainability reporting process and the integrity of the sustainability reporting

●

The company’s internal control, internal audit and risk management systems and practices including the enterprise risk

management framework.

●

The election of and qualifications, independence and oversight of the work of the external auditors

●

Business integrity, including handling of complaints and reports.

For a more detailed description of the objective and duties of the committee, see the instructions available at

www.equinor.com/auditcommittee.

The safety, sustainability, and ethics committee (SSEC)

SSEC

in matters regarding safety, security, ethics, sustainability and climate.

This includes review of the company’s policies, risk, practices and performance related to

●

●

●

●

●

●

●

For a more detailed description of the objective and duties of the committee, see the instructions available at

www.equinor.com/ssecommittee.

The compensation and executive development committee

The BCC acts as a preparatory body for the board and assists in matters relating to management compensation and leadership

development.

The BCC gives recommendation to the board in matters relating to principles and framework for

About us

Equinor 2023 Integrated Annual Report 28

●

●

●

●

BCC also oversees and advises the company's management in its work on Equinor's remuneration strategy and remuneration policies

for senior executives.

For a more detailed description of the objective and duties of the committee, see the instructions available at

www.equinor.com/compensationcommittee.

The BoD considers its composition to be competent with respect to the expertise, capacity and diversity appropriate to attend to the

company's strategy, goals, main challenges, and the common interest of all shareholders. The BoD also deems its composition to

consist of individuals who are willing and able to work as a team, resulting in an efficient and collegiate board.

The BoD develops its knowledge and competence and among others had sessions in the following topics in 2023;

●

●

●

●

●

Furthermore, external speakers presented to the BoD their view on the energy transition in a geopolitical and a financial context.

Reports from the committees are given on each board meeting to update the board on matters handled by each committee. The BAC

had two competence days with deep-dives into different topics such as data governance, structure for trading mandates, internal

control over financial reporting framework, EU ESRS reporting requirements, material topics for sustainability reporting, and inflation

pressure impact on the portfolio. The SSEC had deep-dives on topics within human rights, compliance, cyber security, net-zero and

safety. The BCC attended a yearly session on development and trends within executive talent market.

The BoD conducts an annual self-evaluation of its work and competence, which generally is externally facilitated. Climate change

capabilities, and the oversight of Equinor’s human rights policy are included as key components in the annual board evaluation. The

evaluation report is discussed in a board meeting and is made available to the nomination committee.

The board members have experience from inter alia oil, gas, renewables, shipping, telecom and Norwegian defense forces.

Equinor ASA has purchased and maintains a Directors and Officers Liability Insurance on behalf of the members of the board of

directors and the CEO. The insurance also covers any employee acting in a managerial capacity and includes controlled subsidiaries.

The insurance policy is issued by a reputable insurer with an appropriate rating.

More information about the BoD can be found in the Board statement on corporate governance report.

About us

Equinor 2023 Integrated Annual Report 29

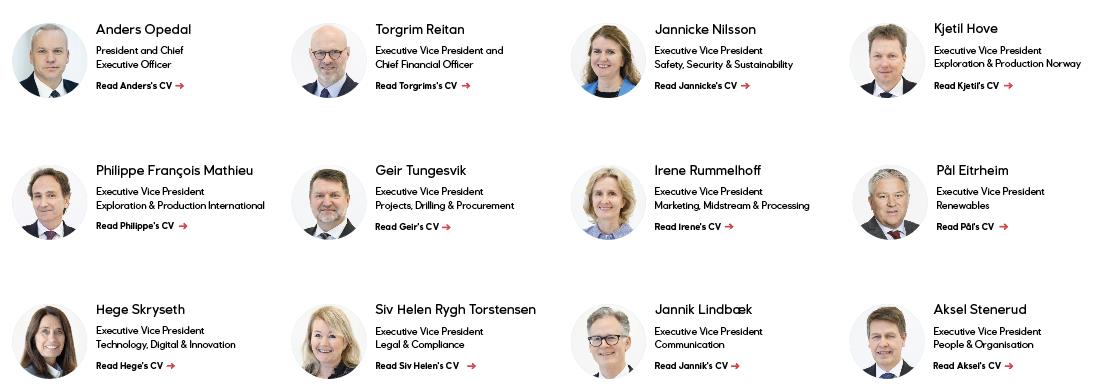

Corporate executive committee (CEC)

The president and chief executive officer (CEO) has the overall responsibility for day-to-day operations in Equinor. The CEO appoints

the corporate executive committee, which considers proposals for strategy, goals, financial statements, as well as important

investments prior to submission to the BoD. The purpose of the CEC is to set direction, drive prioritisation and execution, build

capabilities and ensure compliance. The CEC works to safeguard and promote the corporate interests of the company through

developing the management system and securing adequate risk management and control systems. The CEC includes the CEO, the

chief financial officer (CFO), the executive vice presidents of the business areas and the executive vice presidents for Safety, Security

& Sustainability, Legal & Compliance, People & Organisation and Communication.

The CEC ensures proactive management and control of sustainability-related impacts through the safety, security and sustainability

committee which is held on a quarterly basis. Risk, performance, and mitigating actions are key topics for the work in the committee.

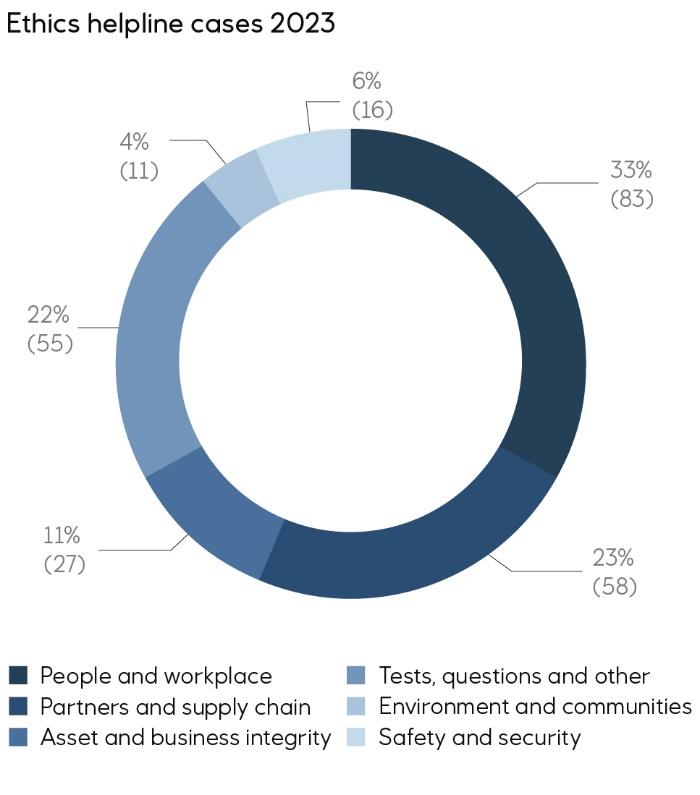

Ethical and reputational issues such as anti-corruption are monitored and mitigated through the CEC ethics committee. The ethics

committee meets as needed and at least three times a year.

In addition, through the corporate risk committee the CEC manages Equinor’s overall risk exposure, and material topics related to

health and safety, human rights, corruption, climate and environment is assessed as part of the overall risk management. The

corporate risk committee functions as an advisory body to the CEO and CFO, and the work of the corporate risk committee is

presented to the CEC on a regular basis.

In 2023, the CEC, as well as the BAC, and the SSEC were involved in the assessment, prioritisation and articulation of Equinor’s

material sustainability topics.

Corporate executive committee (CEC)

Remuneration of BoD

The remuneration of the BoD is decided by the corporate assembly annually, following a recommendation from the nomination

committee. Remuneration for board members is not linked to performance, and board members do not receive any shares or similar

as part of their remuneration. The board members receive an annual fixed fee. Deputy members, who are only elected for employee-

elected board members, receive remuneration per meeting attended. The employee-elected members of the board receive the same

remuneration as the shareholder-elected members.

Remuneration of the corporate executive committee

The BoD is responsible for preparing and implementing a remuneration policy for the members of the corporate executive committee.

The policy is effective for a period of four years, subject to any proposed material changes by the BoD requiring adoption by the

annual general meeting before the four-year term concludes.

The policy shall contribute to attracting and retaining executives and motivate them to drive the success of the company. A key

principle for Equinor’s remuneration policy is moderation. The reward should be competitive, but not market-leading, and aligned with

the markets that the company recruits from, maintaining an overall sustainable cost level. Equinor places a high focus on fostering

alignment between the interests of its executive management and those of its owners and other stakeholders. Variable remuneration

is aimed at driving performance in line with the company’s strategy and securing long-term commitment and retention with the

company.

About us

Equinor 2023 Integrated Annual Report 30

The receipt of variable remuneration depends on individual and company performance and is subject to a holding period requirement

for some elements. Performance-based variable remuneration has been capped in accordance with the relevant Norwegian state

guidelines.

All KPIs and behaviour goals applicable for an executive are weighted equally when setting the individual bonus level. One of the

common KPIs used to decide the annual variable pay (bonus) component of variable pay for all executives is “Upstream C02 intensity:

<= 8 kg/boe”.

In the behaviour part of the assessment there is a common goal to transform own organisation to deliver on our purpose and become

a leading company in the energy transition.

Executive remuneration policy

The executive remuneration policy which was approved by the 2021 annual general meeting serves as the basis for the 2023

remuneration report. This policy can be found in an appendix to the 2023 remuneration report at equinor.com.

A revised policy was presented for a binding vote and approved at the annual general meeting in 2023. The approved policy came

into effect on 1 January 2024 and is available on Equinor’s website.

Risk management

Enterprise risk management (ERM) relates to managing uncertainties in order to deliver Equinor’s purpose in line with our core values.

Risk, which refers to both threats and opportunities, is assessed as part of strategy selection and managed through execution to

deliver the strategic pillars and objectives throughout the company. The constantly changing internal and external business context

means that risks can emerge and evolve quickly, underpinning the need for well-designed, adaptive and effective risk management

approaches. The current most material enterprise risks and risk factors are described in section 5.2 Risk factors.

Equinor’s ERM framework is integrated across all our business activities with a focus on creating value and avoiding unwanted

incidents. We consider risks in shorter and longer-term perspectives, and across enduring risks, dynamic risks as well as more

immature or emerging risk issues that can impact our business ambitions. Through BAC the BoD oversees the ERM framework and

reviews its effectiveness.

The ERM approach enables risk-informed decisions and risk response in a way that supports delivering value in a sustainable frame.

This means that we consider the overall value upside or downside of risks for Equinor, whilst ensuring we live up to our principles for

avoiding safety, security, sustainability, human rights and business integrity incidents, such as accidents, fraud and corruption.

In general, risks are managed in the business line as an integral part of employee and manager tasks. The business areas and

corporate functions regularly identify and evaluate risk using established procedures, assess the need for risk-adjusting actions, and

review overall risk management performance. Some risks, such as oil and natural gas price risks and interest and currency risks, are

managed at the corporate level to provide optimal solutions. A holistic corporate risk perspective is also applied in strategy

development, portfolio prioritisation processes, and capital structure discussions. Throughout the year, the CEO and the Board Audit

Committee maintain oversight of the risk management framework, processes, top enterprise risks and the overall risk picture. Areas of

particular risk oversight currently include IT and cyber security, progress on net-zero, low-carbon value proposition, political and

regulatory frameworks, human rights, and capacity and capability constraints.

Equinor’s risk management process is based on ISO 31000 risk management and seeks to ensure that risks are identified, analysed,

evaluated, and appropriately managed. A standardised risk process across Equinor supports consistency and efficiency that informs

key decisions. Risk is integrated into the company’s management information system (IT tool), where it is linked with Equinor’s

purpose, vision and strategy and associated strategic objectives and KPIs. This tool is used to capture risks, follow up risk-adjusting

actions and related assurance activities, and supports a risk-based approach in the context of a three lines model

(https://www.equinorbook.com/brandcenter/en/equinorbook/component/default/82415).

Whilst our approach includes continuous improvement of risk management practices, Equinor has recognised a need to strengthen

resilience to global uncertainty and volatility that affect our business. With support from the CEO, CFO and BAC, Equinor has initiated

focused activities to strengthen a future-fit ERM framework. This includes further development of the corporate risk appetite

framework supported by strengthened governance for executive follow-up of the top enterprise risks.

Equinor risk management can be broadly considered across the following enterprise impact areas. More detail on specific themes is

provided in relevant material topics sections of this report.

About us

Equinor 2023 Integrated Annual Report 31

Strategic and commercial risks:

Equinor needs to navigate uncertainty and manage risk to

deliver value, transition its portfolio, and remain financially

robust through the changing energy context. Climate and

other sustainability-related factors influence many aspects

of our strategy selection and execution. Global, regional

and national political developments can change the

operating environment and economic outcomes. Market

conditions related to supply and demand, technological

change, customer preferences and global economic

conditions can significantly impact company financial

performance. Our ability to deliver value from projects and

operations can be impacted by factors related to partners,

contractors, global supply chains as well as public

stakeholders and regulatory frameworks. Digital and cyber

threats are constantly evolving and can cause major

disruption across our value chains.

Strategic and commercial risk factors:

● Prices and markets

● Hydrocarbon resource base and renewable and low

carbon opportunities

● Climate change and transition to a lower carbon

economy

● International politics and geopolitical change

● Digital and cyber security

● Project delivery and operations

● Joint arrangements and contractors

● Competition and technological innovation

● Ownership and actions by the Norwegian State

● Policies and legislation

● Financial risks, liquidity and capital management

● Trading and commercial supply activities

● Workforce capabilities and organisational change

● Crisis management, business continuity and

insurance coverage

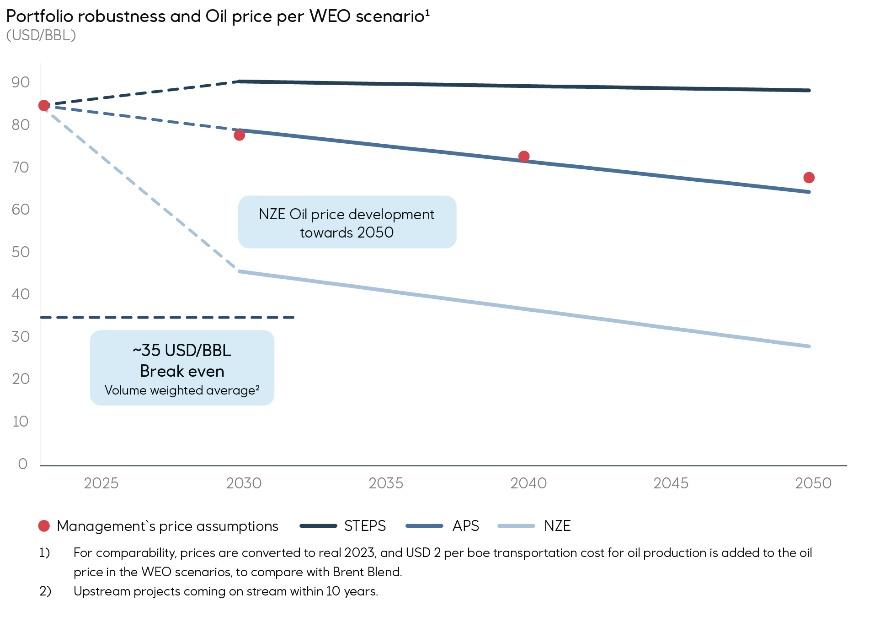

Strategic and commercial risk management

Overall, Equinor manages risk through portfolio selection, robust financial framework, stress-testing and business

planning, investment, and review processes. We take a long-term view of energy supply and demand, ensuring

robustness of our oil and gas portfolio, developing and investing in low carbon businesses of the future whilst seeking to

safeguard shareholder returns.

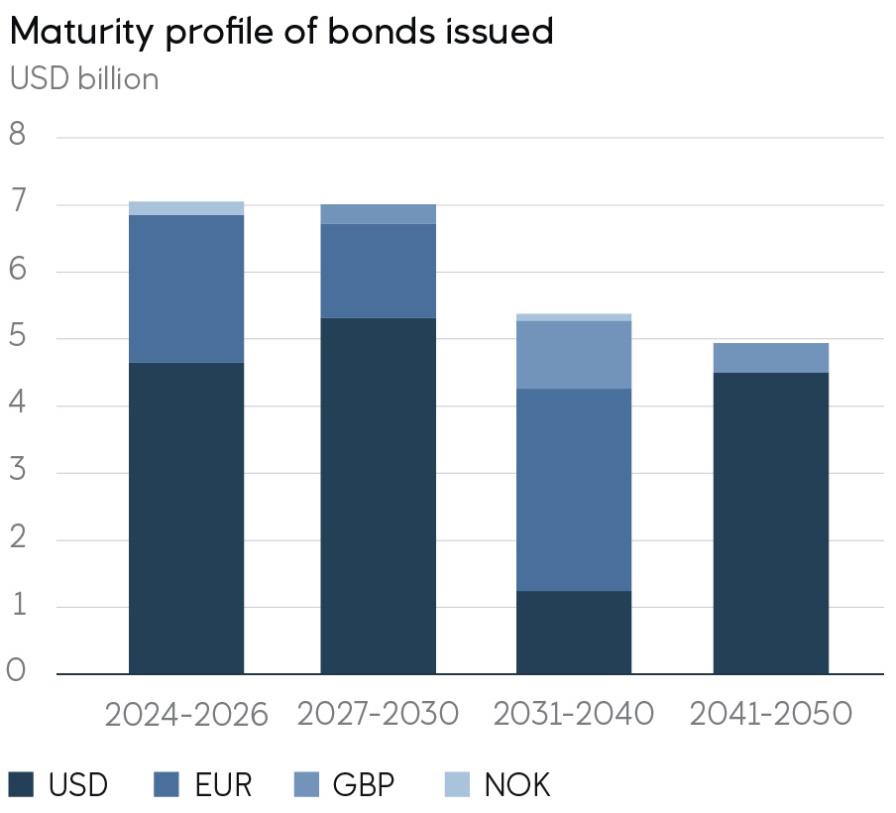

The company is exposed to oil and gas market price levels. Corporate hedges may be entered into to reduce the cash

flow volatility generated from the price levels risk. Equinor has an insurance-based approach to this hedging, securing

downside protection only while keeping the upside in price exposure open. For the trading business, derivatives risk is

managed through Value at Risk and trader mandates, loss limitation systems and daily monitoring of trading profit and

loss. Equinor’s liquidity framework is based on a forward-looking risk management approach to assure that Equinor’s

strategic liquidity reserve will cover both expected and unexpected cash outflows over the subsequent six months,

including a potential crisis event and significant collateral needs.

Risks related to low carbon solutions, climate change and transition to a lower carbon economy, workforce and

organisation, cyber security, and actions by the Norwegian State are included within top enterprise risks and have direct

follow-up at the executive level. Top enterprise risks are assessed in relation to risk appetite statements that represent

the company’s willingness to take on risk exposure. Actions to manage exposure are implemented and assessed based

on their effectiveness. Risks are reviewed by both the first line (risk owner) and second line (Corporate risk) with regards

to risk management and followed up by the CEC and the BoD.

We recognise the importance of ESG matters in our current and future business, and seek to be open around ESG

matters related to our activities through recognised ESG reporting methodologies. To support portfolio resilience in

multiple energy pathways, we have a financial framework in place addressing climate-related risks, we stress test our

portfolio across different energy scenarios, and assess climate-related physical risks. Risks relating to policies and

regulatory frameworks, international politics and geopolitical change, together with competition and technological

innovation are regularly assessed, monitored and managed to improve outcomes for the company as part of the

Equinor’s risk update.

Risks related to projects and operations are managed at many levels, including through quality assurance processes

(competence area reviews, e.g., facilities, safety and security, environment, commercial and country risk) within the

investment phase, quality and risk management within the project execution risk phase, and continuous improvement

programs in operations. Crisis management, business continuity and insurance coverage are included in the evaluation of

actions to reduce the impact of unwanted incidents. Digital security and cyber security remain in high focus through a

cyber security improvement programme to maintain and strengthen cyber security capability and reduce cyber risk.

About us

Equinor 2023 Integrated Annual Report 32

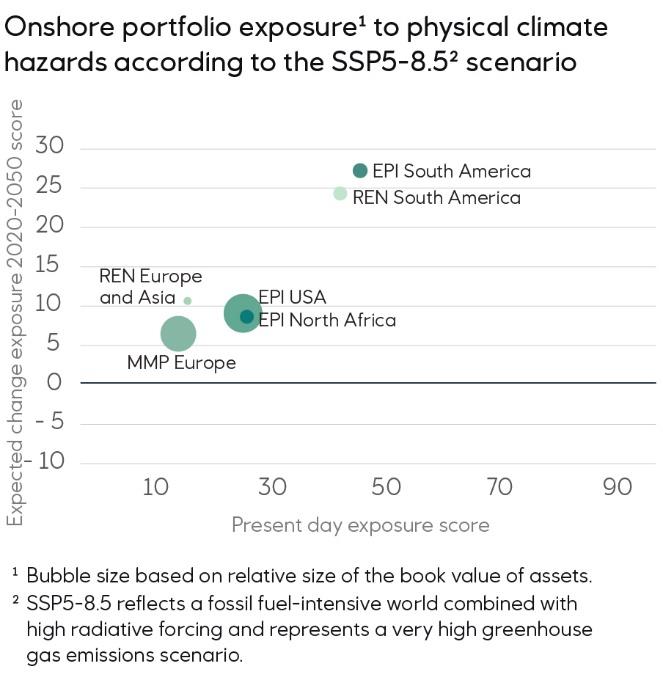

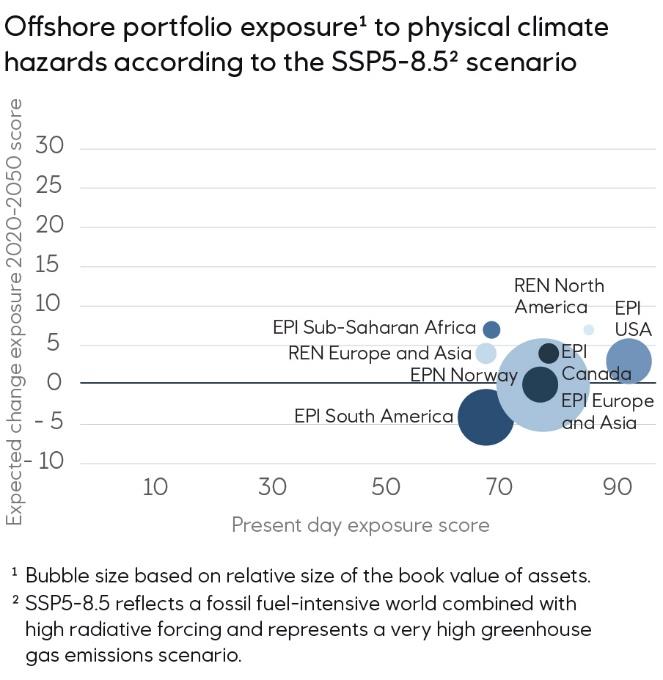

Security, safety and environmental risks

We undertake business activities globally that expose

Equinor to a wide range of factors that can impact the

health and safety of people, the integrity of facilities, and

nature. Our activities could be exposed to risk from the

physical effects of climate change, and Equinor could be

subject to hostile acts that cause harm and disrupt

operations. Incidents may include release of health

hazardous substances, fire, explosions, and environmental

contamination.

Security, safety and environment risk factors

● Health, safety and environmental factors

● Security breaches

Security, safety and environment risk management

Ensuring low and tolerable levels of security, safety and environmental risks is a central aspect of our investment

decisions and operations processes. We regularly assess our performance through indicators, reviews and assurance

activities and, when needed, instigate improvements. In the current business context, we have a specific focus on top

enterprise risks related to major accidents, security incidents and human rights breaches, as well as following up on

aspects of our ambitions to net zero (under strategic and commercial risks). Mitigation of the major accident risk is

through continued focus on our I am Safety Roadmap and rollout of major accident prevention training across the

company. We continue to deepen understanding and potential mitigation of physical climate risk to our business activities.

We consider latest scientific understanding and environmental data to inform risk management when planning and

executing our projects. Risk exposure to human rights is addressed through a specific action plan that prioritises key

actions to prevent forced labour in the supply chain and establish new working requirements for human rights due

diligence. We maintain high focus on security risk management in light of the European security situation, and work to

mitigate state actor threats through safeguarding physical security, including offshore and onshore facilities and pipelines,

and to further develop the management of cyber security.

Threats associated with third parties are consistently assessed

and addressed as an integral part of cyber risk management. Cyber risk assessments and risk management services are

delivered by internal experts. External assessors are engaged to benchmark security discipline maturity levels.

Compliance and control risks

Breaches of laws, regulations or guidelines or ethical

misconduct can lead to public or regulatory responses that

affect our reputation, operating results, shareholder value

and continued licence to operate. Failure to control risks

related to trading processes and transactions can result in

fines and monetary losses and potentially affect Equinor’s

licence to trade.

Compliance and control risk factors

● Supervisions, regulatory reviews and reporting

● Business integrity and ethical misconduct

Compliance and control risk management

Equinor’s Code of Conduct sets out our commitment and requirements for how we do business at Equinor. We train our

employees on how to apply the Code of Conduct in their daily work and require annual confirmation that all employees

understand and will comply with requirements. We require our suppliers to act in a way that is consistent with our Code of

Conduct and engage with them to help them understand our ethical requirements and how we do business. Equinor

operates a Compliance Programme with the aim to ensure that anti-bribery and corruption risks are identified, reported,

and mitigated, and have a network of compliance officers who support the business areas globally.

Group performance

Equinor 2023 Integrated Annual Report 33

Group performance

2.1

2.2

2.3

Our 2023 performance

Financial performance

Strategic financial framework

Our market perspective

Group financial performance

Oil and gas reserves

Sustainability performance

Sustainability approach

Materiality assessment

Material topics’ performance

Always safe

Safe and secure operations

Protecting nature

Respecting human rights

Workforce for the future

High value

Profitable portfolio

Energy provision and value creation for society

Integrity and anti

-

corruption

Low carbon

Net-

zero pathway

Fuelling innovation

Group performance