Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Dec. 31, 2023 |

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

| Pay vs Performance Disclosure |

|

|

|

|

| Pay vs Performance Disclosure, Table |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year (a) | | Summary

Compensation

Table Total for

PEO

(b)(1)(2) | | Compensation

Actually Paid

to PEO

(c)(3) | | Average

Summary

Compensation

Table Total for

Non-PEO NEOs

(d)(1)(2) | | Average

Compensation

Actually Paid

to Non-PEO NEOs

(e)(4) | Value of Initial Fixed $100

Investment Based on: | Net Income (Loss)

(h)(7) | | Company-Selected

Measure: Revenue

(i)(8) | | | | | Total

Shareholder

Return

(f)(5) | | Peer Group

Total

Shareholder

Return

(g)(6) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (in thousands) | | 2023 | | $ | 8,570,853 | | | $ | 13,736,333 | | | $ | 3,051,458 | | | $ | 4,358,810 | | | $ | 51 | | | $ | 211 | | | $ | (9,109) | | | $ | 758,740 | | | 2022 | | 9,836,606 | | | 2,854,125 | | | 4,048,809 | | | 1,835,658 | | | 38 | | | 135 | | | (929,413) | | | 719,367 | | | 2021 | | 23,576,716 | | | 17,991,135 | | | 4,482,514 | | | 1,644,792 | | | 57 | | | 190 | | | (51,408) | | | 718,632 | | | 2020 | | 25,488,862 | | | 2,386,691 | | | 7,907,678 | | | 3,883,965 | | | 81 | | | 142 | | | 158,475 | | | 716,770 | |

|

|

|

|

| Company Selected Measure Name |

revenue

|

|

|

|

| Named Executive Officers, Footnote |

Sudhakar Ramakrishna served as our Principal Executive Officer (“PEO”) for the entirety of 2021, 2022 and 2023 and Kevin B. Thompson served as our PEO for the entirety of 2020. Our Non-PEO NEOs for each covered fiscal year were as follows: •2023: J. Barton Kalsu, Jason W. Bliss, Rohini Kasturi, Andrea Webb •2022: J. Barton Kalsu, Jason W. Bliss, Rohini Kasturi, Andrea Webb •2021: J. Barton Kalsu, David Gardiner, Jason W. Bliss, John Pagliuca •2020: J. Barton Kalsu, David Gardiner, Jason W. Bliss, John Pagliuca, Woong Joseph Kim

|

|

|

|

| Peer Group Issuers, Footnote |

The TSR Peer Group reflects an assumed $100 investment in the S&P 500 Information Technology Index consistent with the time frame that SolarWinds’ TSR is measured.

|

|

|

|

| PEO Total Compensation Amount |

$ 8,570,853

|

$ 9,836,606

|

$ 23,576,716

|

$ 25,488,862

|

| PEO Actually Paid Compensation Amount |

$ 13,736,333

|

2,854,125

|

17,991,135

|

2,386,691

|

| Adjustment To PEO Compensation, Footnote |

The dollar amounts reported in column (c) represent the “compensation actually paid” to Sudhakar Ramakrishna and Kevin B. Thompson, as calculated in accordance with Item 402(v) of Regulation S-K for each covered fiscal year. The dollar amounts do not reflect the actual amount of compensation earned or received by or paid to each of our PEOs during the applicable fiscal year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to our PEOs’ total compensation for each covered fiscal year to determine the “compensation actually paid” to each such PEO for such year.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | PEO | | K. Thompson | | S. Ramakrishna | | | | 2020 | | 2021 | | 2022 | | 2023 | | Summary Compensation Table - Total Compensation | (a) | $ | 25,488,862 | | | $ | 23,576,716 | | | $ | 9,836,606 | | | $ | 8,570,853 | | | — | Grant Date Fair Value of Stock Awards and Option Awards Granted in Fiscal Year | (b) | 23,902,462 | | | 21,699,121 | | | 9,074,406 | | | 6,772,653 | | | + | Fair Value at Fiscal Year End of Outstanding and Unvested Stock Awards and Option Awards Granted in Fiscal Year | (c) | — | | | 16,113,540 | | | 5,989,876 | | | 8,642,630 | | | + | Change in Fair Value of Outstanding and Unvested Stock Awards and Option Awards Granted in Prior Fiscal Years | (d) | (94,946) | | | — | | | (3,085,167) | | | 2,082,799 | | | + | Fair Value at Vesting of Stock Awards and Option Awards Granted in Fiscal Year That Vested During Fiscal Year | (e) | 3,149,427 | | | — | | | — | | | 746,841 | | | + | Change in Fair Value as of Vesting Date of Stock Awards and Option Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year | (f) | (2,254,190) | | | — | | | (812,783) | | | 465,863 | | | — | Fair Value as of Prior Fiscal Year End of Stock Awards and Option Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year | (g) | — | | | — | | | — | | | — | | | = | Compensation Actually Paid | | $ | 2,386,691 | | | $ | 17,991,135 | | | $ | 2,854,125 | | | $ | 13,736,333 | |

(a) Represents Total Compensation as reported in the Summary Compensation Table for the indicated fiscal year. (b) Represents the aggregate grant date fair value of the stock awards granted to Sudhakar Ramakrishna or Kevin B. Thompson, as applicable, during the indicated fiscal year, computed in accordance with FASB ASC Topic 718. Amounts shown are the amounts reported in the Summary Compensation Table. The grant date fair value for 2021 reflects the new hire CEO compensation package of Sudhakar Ramakrishna. (c) Represents the aggregate fair value as of the indicated fiscal year-end of Sudhakar Ramakrishna’s or Kevin B. Thompson’s, as applicable, outstanding and unvested stock awards granted during such fiscal year, computed in accordance with FASB ASC Topic 718. (d) Represents the aggregate change in fair value during the indicated fiscal year (from the end of the prior fiscal year) of the outstanding and unvested stock awards held by Sudhakar Ramakrishna or Kevin B. Thompson, as applicable, as of the last day of the indicated fiscal year granted in any prior fiscal year, computed in accordance with FASB ASC Topic 718. (e) Represents the fair value as of the vesting of the stock awards granted to Sudhakar Ramakrishna or Kevin B. Thompson, as applicable, that were granted and vested in the same indicated fiscal year, as computed in accordance with FASB ASC Topic 718. (f) Represents the aggregate change in fair value, measured from the prior fiscal year-end to the vesting date, of each stock award held by Sudhakar Ramakrishna or Kevin B. Thompson, as applicable, that was granted in a prior fiscal year and which satisfied all applicable vesting conditions during the indicated fiscal year, computed in accordance with FASB ASC Topic 718. (g) Represents the aggregate fair value as of the last day of the prior fiscal year of each stock award held by Sudhakar Ramakrishna or Kevin B. Thompson, as applicable, that was granted in a prior fiscal year and which failed to meet the applicable vesting conditions in the indicated fiscal year, computed in accordance with FASB ASC Topic 718.

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 3,051,458

|

4,048,809

|

4,482,514

|

7,907,678

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 4,358,810

|

1,835,658

|

1,644,792

|

3,883,965

|

| Adjustment to Non-PEO NEO Compensation Footnote |

The dollar amounts reported in column (e) represent the “compensation actually paid” to our Non-PEO NEOs as a group, as calculated in accordance with Item 402(v) of Regulation S-K for each covered fiscal year. The dollar amounts do not reflect the actual amount of compensation earned or received by or paid to Non-PEO NEOs as a group during the applicable fiscal year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to the total compensation of our NEOs as a group for each covered fiscal year to determine the average “compensation actually paid” to our NEOs for such year: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Non-PEO NEO Average | | | | | | | | | | 2020 | | 2021 | | 2022 | | 2023 | | Summary Compensation Table - Total Compensation | (a) | $ | 7,907,678 | | | $ | 4,482,514 | | | $ | 4,048,809 | | | $ | 3,051,458 | | | — | Grant Date Fair Value of Stock Awards and Option Awards Granted in Fiscal Year | (b) | 7,151,877 | | | 3,775,015 | | | 3,603,067 | | | 2,239,333 | | | + | Fair Value at Fiscal Year End of Outstanding and Unvested Stock Awards and Option Awards Granted in Fiscal Year | (c) | 3,895,246 | | | 2,937,742 | | | 2,378,329 | | | 2,473,086 | | | + | Change in Fair Value of Outstanding and Unvested Stock Awards and Option Awards Granted in Prior Fiscal Years | (d) | (609,634) | | | (2,110,807) | | | (749,254) | | | 596,768 | | | + | Fair Value at Vesting of Stock Awards and Option Awards Granted in Fiscal Year That Vested During Fiscal Year | (e) | — | | | — | | | — | | | 246,939 | | | + | Change in Fair Value as of Vesting Date of Stock Awards and Option Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year | (f) | (157,448) | | | 110,360 | | | (239,159) | | | 229,893 | | | — | Fair Value as of Prior Fiscal Year End of Stock Awards and Option Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year | (g) | — | | | — | | | — | | | — | | | = | Compensation Actually Paid | | $ | 3,883,965 | | | $ | 1,644,792 | | | $ | 1,835,658 | | | $ | 4,358,810 | |

See note (1) above for the NEOs included in the average for each applicable covered fiscal year.

(a) Represents the average Total Compensation as reported in the Summary Compensation Table for our Non-PEO NEOs as a group in the indicated fiscal year. (b) Represents the average aggregate grant date fair value of the stock awards and option awards granted to our Non-PEO NEOs as a group during the indicated fiscal year, computed in accordance with FASB ASC Topic 718. Amounts shown are the amounts reported in the Summary Compensation Table. (c) Represents the average aggregate fair value as of the indicated fiscal year-end of the outstanding and unvested stock awards and option awards of our Non-PEOs NEOs as a group granted during such fiscal year, computed in accordance with FASB ASC Topic 718. (d) Represents the average aggregate change in fair value during the indicated fiscal year (from the end of the prior fiscal year) of the outstanding and unvested stock awards and option awards held by our Non-PEO NEOs as a group as of the last day of the indicated fiscal year granted in any prior fiscal year, computed in accordance with FASB ASC Topic 718. (e) Represents the average aggregate fair value as of the vesting of the stock awards and option awards that were granted to our Non-PEO NEOs as a group that were granted and vested in the same indicated fiscal year, computed in accordance with FASB ASC Topic 718. (f) Represents the average aggregate change in fair value, measured from the prior fiscal year-end to the vesting date, of each stock award and option award held by our Non-PEO NEOs as a group that was granted in a prior fiscal year and which satisfied all applicable vesting conditions during the indicated fiscal year, computed in accordance with FASB ASC Topic 718. (g) Represents the average aggregate fair value as of the last day of the prior fiscal year of the stock awards and option awards held by our Non-PEO NEOs as a group that were granted in a prior fiscal year and which failed to meet the applicable vesting conditions in the indicated fiscal year, computed in accordance with FASB ASC Topic 718.

|

|

|

|

| Equity Valuation Assumption Difference, Footnote |

In 2021 and 2020 modifications were made to the annual equity awards to account for uncertainty in our business from external factors, each of which are referenced in the “Executive Compensation—Compensation Discussion and Analysis” section of our proxy statement for the applicable year. In June 2020, as a result of the impacts of the COVID-19 pandemic, the compensation committee made modifications to outstanding equity awards to remove the performance-based conditions of outstanding equity awards such that the awards would be subject solely to time-based vesting schedules. The Company recognized incremental fair value on the date of such modifications. In July 2021, connection with the spin-off of the N-able business in all of our outstanding equity awards were equitably adjusted, to reflect the impact of the spin-off and preserve the value of the awards. Outstanding SolarWinds RSUs were adjusted by a conversion ratio of 1.5744 per 1 RSU then held. Although the spin-off adjustment was a modification for accounting purposes, it did not result in the recognition of any incremental fair value on the date of the modification. Effective as of July 30, 2021, we effected a reverse stock split of the issued and outstanding shares of our common stock, at a ratio of one share for two shares. Pursuant to the 2018 Plan, all outstanding equity awards were adjusted to give effect to such reverse split. On July 30, 2021, our Board declared a special cash dividend of $1.50 per share which was paid on August 24, 2021 to stockholders of record at the close of business on August 9, 2021. In connection with the special dividend and in accordance with the terms of the 2018 Plan, all outstanding equity awards were equitably adjusted to reflect the impact of the special dividend and preserve the value of the awards. Outstanding RSUs awards were adjusted by a conversion ratio of 1.0862 per 1 RSU then held. The Company recognized incremental fair value on the date of the special dividend adjustment.

|

|

|

|

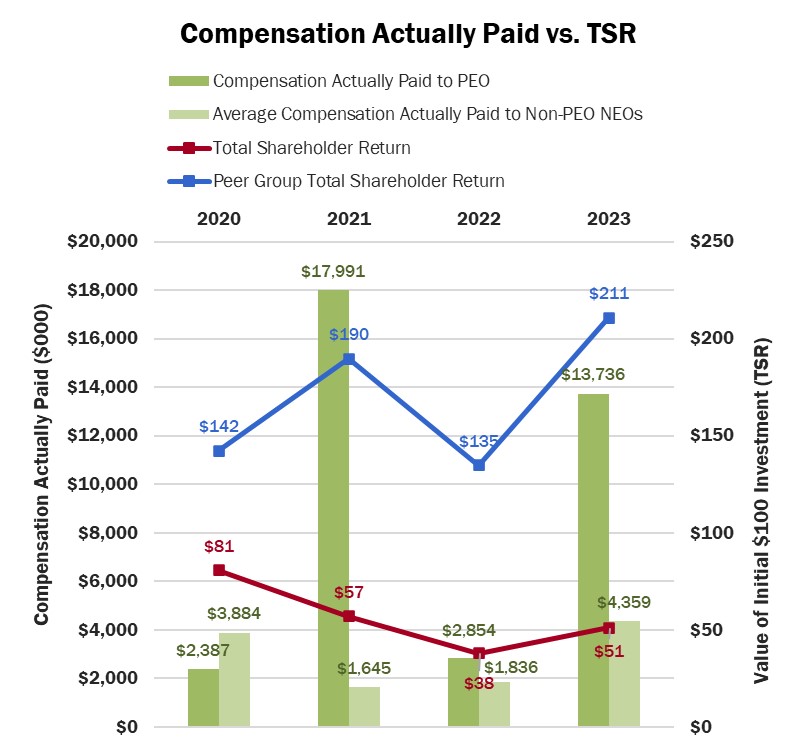

| Compensation Actually Paid vs. Total Shareholder Return |

Relationship Between Compensation Paid to the PEO and Average Other NEOs and the Company’s Cumulative TSR Our PEO’s “compensation actually paid” was generally impacted by our TSR performance, given the leverage of our compensation program towards equity compensation. However, “compensation actually paid” to our PEO for 2021 was anomalously greater as a result of one-time new hire equity awards granted to Sudhakar Ramakrishna. The average “compensation actually paid” for our other NEOs was also similarly impacted by our TSR performance.

|

|

|

|

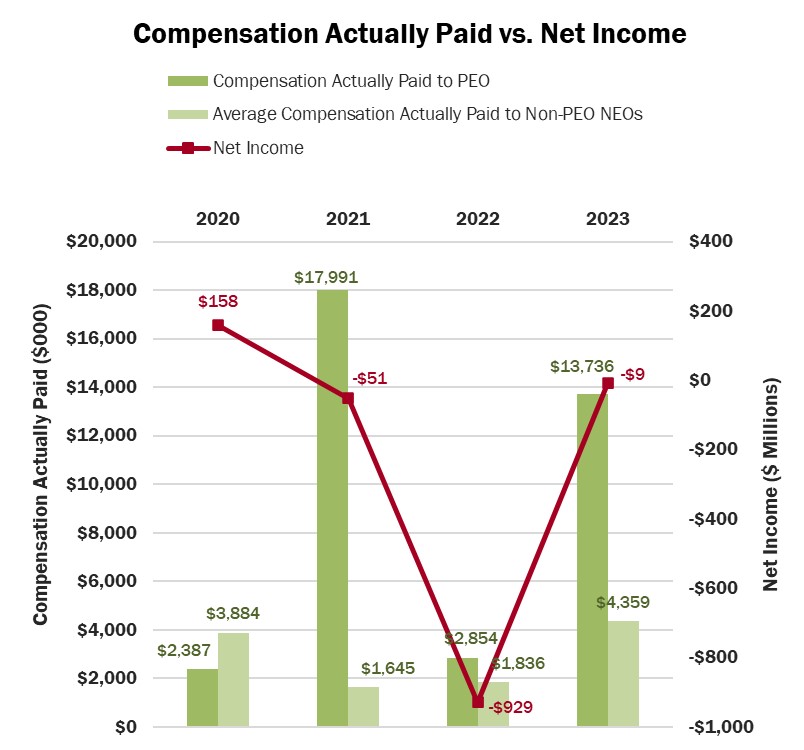

| Compensation Actually Paid vs. Net Income |

Relationship Between Compensation Paid to the PEO and Average Other NEOs and the Company’s Net Income (Loss) We do not use GAAP or non-GAAP net income (loss) as a financial performance measure in our overall executive compensation program. Please refer to our 2203 Annual Report for further information on our net income.

|

|

|

|

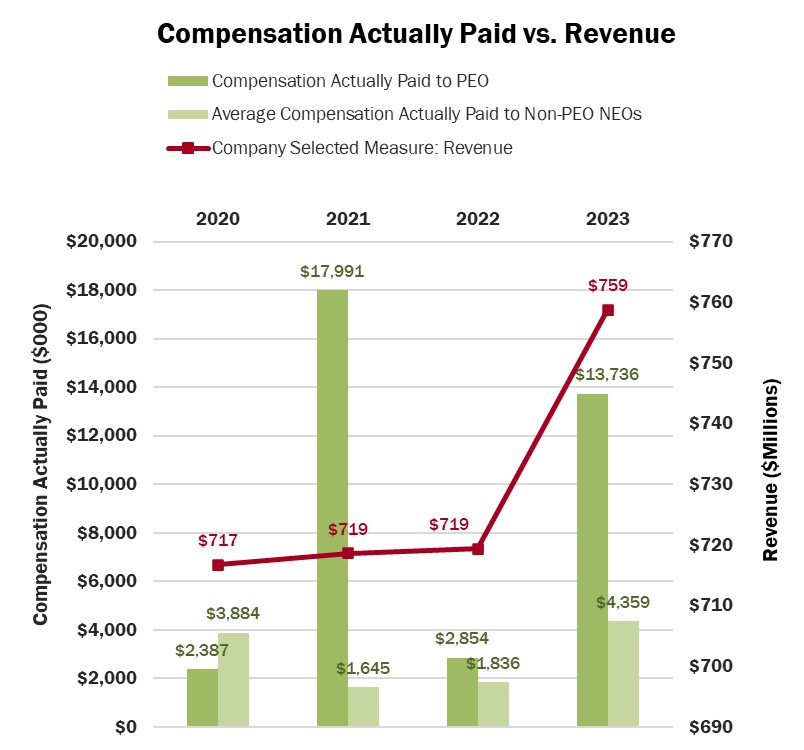

| Compensation Actually Paid vs. Company Selected Measure |

Relationship Between Compensation Paid to the PEO and Average Other NEOs and the Company’s Revenue As described further above, revenue is a key driver of the Company’s performance and stockholder value creation and represented an important part of the corporate performance component of our 2023 Incentive Plan (50% of the overall plan payout) and is a performance component for vesting of our 2023 PSUs.

|

|

|

|

| Tabular List, Table |

Revenue •Adjusted EBITDA •Subscription Annual Recurring Revenue

|

|

|

|

| Total Shareholder Return Amount |

$ 51

|

38

|

57

|

81

|

| Peer Group Total Shareholder Return Amount |

211

|

135

|

190

|

142

|

| Net Income (Loss) |

$ (9,109,000)

|

$ (929,413,000)

|

$ (51,408,000)

|

$ 158,475,000

|

| Company Selected Measure Amount |

758,740,000

|

719,367,000

|

718,632,000

|

716,770,000

|

| PEO Name |

Sudhakar Ramakrishna

|

Sudhakar Ramakrishna

|

Sudhakar Ramakrishna

|

Kevin B. Thompson

|

| Additional 402(v) Disclosure |

The dollar amounts reported in columns (b) and (d) represent (i) the total compensation reported in the Summary Compensation Table for the applicable fiscal year in the case of Sudhakar Ramakrishna and Kevin B. Thompson and (ii) the average of the total compensation reported in the Summary Compensation Table for the applicable fiscal year for our Non-PEO NEOs as a group.Pursuant to Item 402(v) of Regulation S-K, the comparison assumes $100 was invested in our common stock on December 31, 2019, using the closing stock price of the end of the day. Cumulative total stockholder return “TSR” is calculated by dividing the sum of the cumulative amount of dividends during the measurement period, assuming dividend reinvestment, and the difference between our share price at the end of the applicable measurement period and the beginning of the measurement period (December 31, 2019) by our share price at the beginning of the measurement period.The dollar amounts reported represent the amount of GAAP net income (loss) reflected in our audited financial statements for each covered fiscal year.The Company’s revenue is a key driver of the Company’s performance and stockholder value creation and represented 50% of our corporate performance component of our 2023 Incentive Plan and is also a performance component for vesting of our 2023 PSUs. The other 50% of the corporate performance of our 2023 Incentive Plan was based on adjusted EBITDA.

|

|

|

|

| Measure:: 1 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Revenue

|

|

|

|

| Measure:: 2 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Adjusted EBITDA

|

|

|

|

| Measure:: 3 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Subscription Annual Recurring Revenue

|

|

|

|

| Adjustment, Grant Date Fair Value of Stock Awards and Option Awards Granted in Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

$ 2,239,333

|

$ 3,603,067

|

$ 3,775,015

|

$ 7,151,877

|

| Adjustment, Fair Value at Fiscal Year End of Outstanding and Unvested Stock Awards and Option Awards Granted in Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

2,473,086

|

2,378,329

|

2,937,742

|

3,895,246

|

| Adjustment, Change in Fair Value of Outstanding and Unvested Stock Awards and Option Awards Granted in Prior Fiscal Years [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

596,768

|

(749,254)

|

(2,110,807)

|

(609,634)

|

| Adjustment, Fair Value at Vesting of Stock Awards and Option Awards Granted in Fiscal Year That Vested During Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

246,939

|

0

|

0

|

0

|

| Adjustment, Change in Fair Value as of Vesting Date of Stock Awards and Option Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

229,893

|

(239,159)

|

110,360

|

(157,448)

|

| Adjustment, Fair Value as of Prior Fiscal Year End of Stock Awards and Option Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

| Kevin B. Thompson [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| PEO Total Compensation Amount |

|

|

|

25,488,862

|

| PEO Actually Paid Compensation Amount |

|

|

|

2,386,691

|

| Kevin B. Thompson [Member] | Adjustment, Grant Date Fair Value of Stock Awards and Option Awards Granted in Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

23,902,462

|

| Kevin B. Thompson [Member] | Adjustment, Fair Value at Fiscal Year End of Outstanding and Unvested Stock Awards and Option Awards Granted in Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

0

|

| Kevin B. Thompson [Member] | Adjustment, Change in Fair Value of Outstanding and Unvested Stock Awards and Option Awards Granted in Prior Fiscal Years [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

(94,946)

|

| Kevin B. Thompson [Member] | Adjustment, Fair Value at Vesting of Stock Awards and Option Awards Granted in Fiscal Year That Vested During Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

3,149,427

|

| Kevin B. Thompson [Member] | Adjustment, Change in Fair Value as of Vesting Date of Stock Awards and Option Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

(2,254,190)

|

| Kevin B. Thompson [Member] | Adjustment, Fair Value as of Prior Fiscal Year End of Stock Awards and Option Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

$ 0

|

| Sudhakar Ramakrishna [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| PEO Total Compensation Amount |

8,570,853

|

9,836,606

|

23,576,716

|

|

| PEO Actually Paid Compensation Amount |

13,736,333

|

2,854,125

|

17,991,135

|

|

| Sudhakar Ramakrishna [Member] | Adjustment, Grant Date Fair Value of Stock Awards and Option Awards Granted in Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

6,772,653

|

9,074,406

|

21,699,121

|

|

| Sudhakar Ramakrishna [Member] | Adjustment, Fair Value at Fiscal Year End of Outstanding and Unvested Stock Awards and Option Awards Granted in Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

8,642,630

|

5,989,876

|

16,113,540

|

|

| Sudhakar Ramakrishna [Member] | Adjustment, Change in Fair Value of Outstanding and Unvested Stock Awards and Option Awards Granted in Prior Fiscal Years [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

2,082,799

|

(3,085,167)

|

0

|

|

| Sudhakar Ramakrishna [Member] | Adjustment, Fair Value at Vesting of Stock Awards and Option Awards Granted in Fiscal Year That Vested During Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

746,841

|

0

|

0

|

|

| Sudhakar Ramakrishna [Member] | Adjustment, Change in Fair Value as of Vesting Date of Stock Awards and Option Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

465,863

|

(812,783)

|

0

|

|

| Sudhakar Ramakrishna [Member] | Adjustment, Fair Value as of Prior Fiscal Year End of Stock Awards and Option Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

$ 0

|

$ 0

|

$ 0

|

|