This semi-annual shareholder report contains important information about BNY Mellon Balanced Opportunity Fund (the “Fund”) for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at im.bnymellon.com/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bnymellon.com.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class A* | $114 | 1.14% |

* | During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

KEY FUND STATISTICS (AS OF 5/31/24)

Fund Size (Millions) | Number of Holdings | Portfolio Turnover |

$282 | 527 | 26.14% |

Portfolio Holdings (as of 5/31/24)

Sector Allocation (Based on Net Assets)

![HoldingsByIndustrySectorData(Other:-0.9,Asset Backed Securities:1.2,Basic Materials:1.7,Utilities:2.3,[Consumer, Cyclical]:3.4,Energy:4.4,Investment Companies:7.2,Industrial:8.4,Government:10.3,Communications:10.3,Mortgage Securities:10.8,[Consumer, Non-cyclical]:13.5,Financial:13.6,Technology:13.8) HoldingsByIndustrySectorData(Other:-0.9,Asset Backed Securities:1.2,Basic Materials:1.7,Utilities:2.3,[Consumer, Cyclical]:3.4,Energy:4.4,Investment Companies:7.2,Industrial:8.4,Government:10.3,Communications:10.3,Mortgage Securities:10.8,[Consumer, Non-cyclical]:13.5,Financial:13.6,Technology:13.8)](img_0a47f038daaf4f2.jpg)

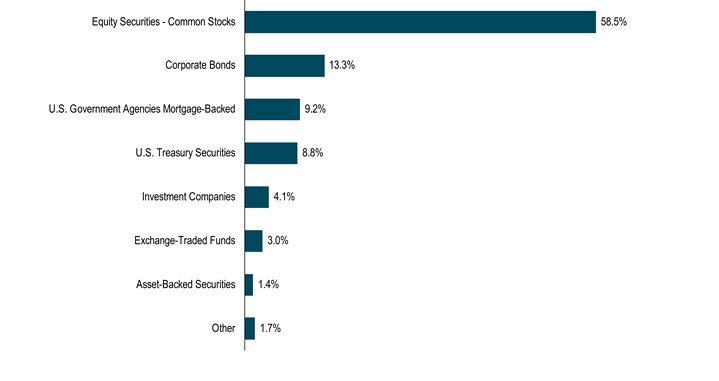

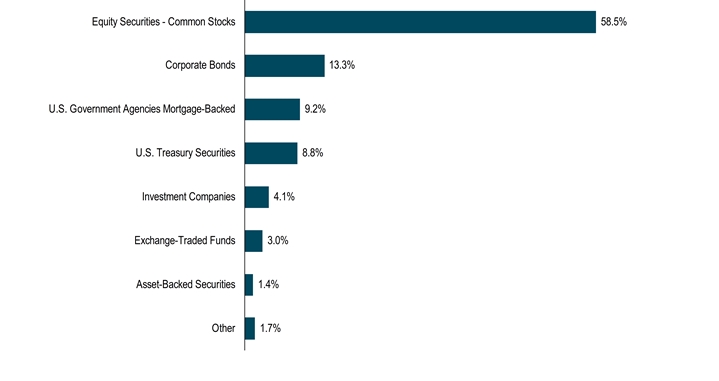

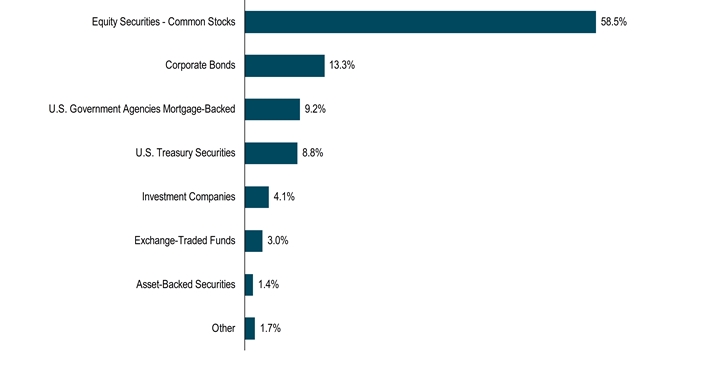

Allocation of Holdings (Based on Net Assets)

This semi-annual shareholder report contains important information about BNY Mellon Balanced Opportunity Fund (the “Fund”) for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at im.bnymellon.com/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bnymellon.com.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class C* | $189 | 1.89% |

* | During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

KEY FUND STATISTICS (AS OF 5/31/24)

Fund Size (Millions) | Number of Holdings | Portfolio Turnover |

$282 | 527 | 26.14% |

Portfolio Holdings (as of 5/31/24)

Sector Allocation (Based on Net Assets)

![HoldingsByIndustrySectorData(Other:-0.9,Asset Backed Securities:1.2,Basic Materials:1.7,Utilities:2.3,[Consumer, Cyclical]:3.4,Energy:4.4,Investment Companies:7.2,Industrial:8.4,Government:10.3,Communications:10.3,Mortgage Securities:10.8,[Consumer, Non-cyclical]:13.5,Financial:13.6,Technology:13.8) HoldingsByIndustrySectorData(Other:-0.9,Asset Backed Securities:1.2,Basic Materials:1.7,Utilities:2.3,[Consumer, Cyclical]:3.4,Energy:4.4,Investment Companies:7.2,Industrial:8.4,Government:10.3,Communications:10.3,Mortgage Securities:10.8,[Consumer, Non-cyclical]:13.5,Financial:13.6,Technology:13.8)](img_8fbb92dbeda14f2.jpg)

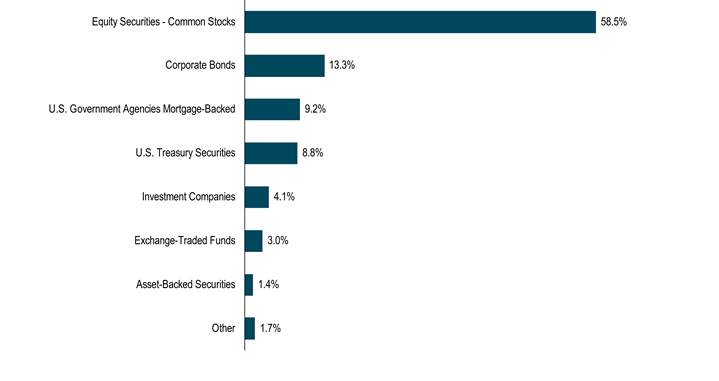

Allocation of Holdings (Based on Net Assets)

This semi-annual shareholder report contains important information about BNY Mellon Balanced Opportunity Fund (the “Fund”) for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at im.bnymellon.com/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bnymellon.com.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class I* | $89 | 0.89% |

* | During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

KEY FUND STATISTICS (AS OF 5/31/24)

Fund Size (Millions) | Number of Holdings | Portfolio Turnover |

$282 | 527 | 26.14% |

Portfolio Holdings (as of 5/31/24)

Sector Allocation (Based on Net Assets)

![HoldingsByIndustrySectorData(Other:-0.9,Asset Backed Securities:1.2,Basic Materials:1.7,Utilities:2.3,[Consumer, Cyclical]:3.4,Energy:4.4,Investment Companies:7.2,Industrial:8.4,Government:10.3,Communications:10.3,Mortgage Securities:10.8,[Consumer, Non-cyclical]:13.5,Financial:13.6,Technology:13.8) HoldingsByIndustrySectorData(Other:-0.9,Asset Backed Securities:1.2,Basic Materials:1.7,Utilities:2.3,[Consumer, Cyclical]:3.4,Energy:4.4,Investment Companies:7.2,Industrial:8.4,Government:10.3,Communications:10.3,Mortgage Securities:10.8,[Consumer, Non-cyclical]:13.5,Financial:13.6,Technology:13.8)](img_5fa982f6fa644f2.jpg)

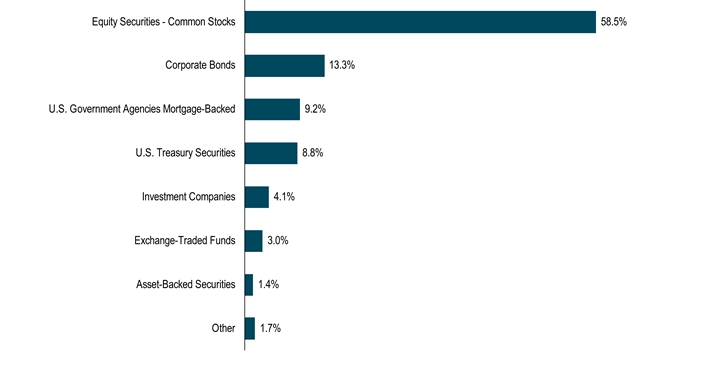

Allocation of Holdings (Based on Net Assets)

This semi-annual shareholder report contains important information about BNY Mellon Balanced Opportunity Fund (the “Fund”) for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at im.bnymellon.com/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bnymellon.com.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class J* | $89 | 0.89% |

* | During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

KEY FUND STATISTICS (AS OF 5/31/24)

Fund Size (Millions) | Number of Holdings | Portfolio Turnover |

$282 | 527 | 26.14% |

Portfolio Holdings (as of 5/31/24)

Sector Allocation (Based on Net Assets)

![HoldingsByIndustrySectorData(Other:-0.9,Asset Backed Securities:1.2,Basic Materials:1.7,Utilities:2.3,[Consumer, Cyclical]:3.4,Energy:4.4,Investment Companies:7.2,Industrial:8.4,Government:10.3,Communications:10.3,Mortgage Securities:10.8,[Consumer, Non-cyclical]:13.5,Financial:13.6,Technology:13.8) HoldingsByIndustrySectorData(Other:-0.9,Asset Backed Securities:1.2,Basic Materials:1.7,Utilities:2.3,[Consumer, Cyclical]:3.4,Energy:4.4,Investment Companies:7.2,Industrial:8.4,Government:10.3,Communications:10.3,Mortgage Securities:10.8,[Consumer, Non-cyclical]:13.5,Financial:13.6,Technology:13.8)](img_7bcb60ab60ce4f2.jpg)

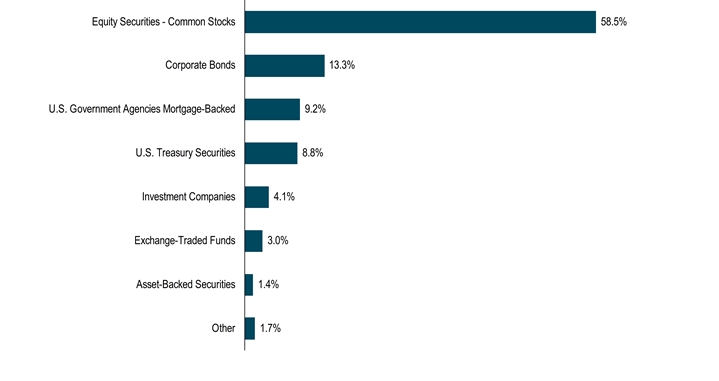

Allocation of Holdings (Based on Net Assets)

This semi-annual shareholder report contains important information about BNY Mellon Balanced Opportunity Fund (the “Fund”) for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at im.bnymellon.com/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bnymellon.com.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class Y* | $89 | 0.89% |

* | During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

KEY FUND STATISTICS (AS OF 5/31/24)

Fund Size (Millions) | Number of Holdings | Portfolio Turnover |

$282 | 527 | 26.14% |

Portfolio Holdings (as of 5/31/24)

Sector Allocation (Based on Net Assets)

![HoldingsByIndustrySectorData(Other:-0.9,Asset Backed Securities:1.2,Basic Materials:1.7,Utilities:2.3,[Consumer, Cyclical]:3.4,Energy:4.4,Investment Companies:7.2,Industrial:8.4,Government:10.3,Communications:10.3,Mortgage Securities:10.8,[Consumer, Non-cyclical]:13.5,Financial:13.6,Technology:13.8) HoldingsByIndustrySectorData(Other:-0.9,Asset Backed Securities:1.2,Basic Materials:1.7,Utilities:2.3,[Consumer, Cyclical]:3.4,Energy:4.4,Investment Companies:7.2,Industrial:8.4,Government:10.3,Communications:10.3,Mortgage Securities:10.8,[Consumer, Non-cyclical]:13.5,Financial:13.6,Technology:13.8)](img_0c8462320f144f2.jpg)

Allocation of Holdings (Based on Net Assets)

This semi-annual shareholder report contains important information about BNY Mellon Balanced Opportunity Fund (the “Fund”) for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at im.bnymellon.com/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bnymellon.com.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class Z* | $96 | 0.96% |

* | During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

KEY FUND STATISTICS (AS OF 5/31/24)

Fund Size (Millions) | Number of Holdings | Portfolio Turnover |

$282 | 527 | 26.14% |

Portfolio Holdings (as of 5/31/24)

Sector Allocation (Based on Net Assets)

![HoldingsByIndustrySectorData(Other:-0.9,Asset Backed Securities:1.2,Basic Materials:1.7,Utilities:2.3,[Consumer, Cyclical]:3.4,Energy:4.4,Investment Companies:7.2,Industrial:8.4,Government:10.3,Communications:10.3,Mortgage Securities:10.8,[Consumer, Non-cyclical]:13.5,Financial:13.6,Technology:13.8) HoldingsByIndustrySectorData(Other:-0.9,Asset Backed Securities:1.2,Basic Materials:1.7,Utilities:2.3,[Consumer, Cyclical]:3.4,Energy:4.4,Investment Companies:7.2,Industrial:8.4,Government:10.3,Communications:10.3,Mortgage Securities:10.8,[Consumer, Non-cyclical]:13.5,Financial:13.6,Technology:13.8)](img_de94740fe2ac4f2.jpg)

Allocation of Holdings (Based on Net Assets)