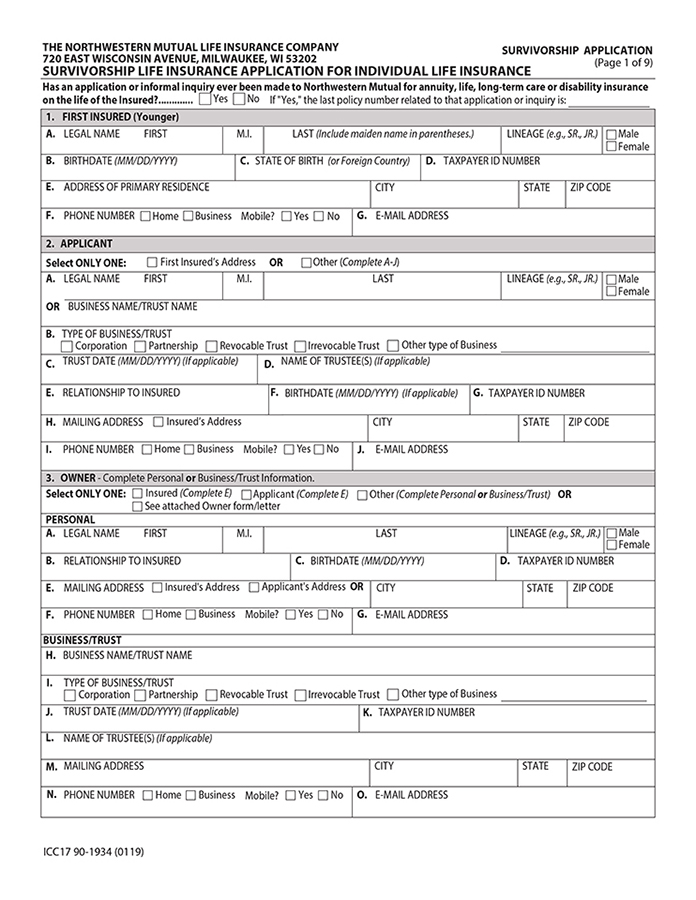

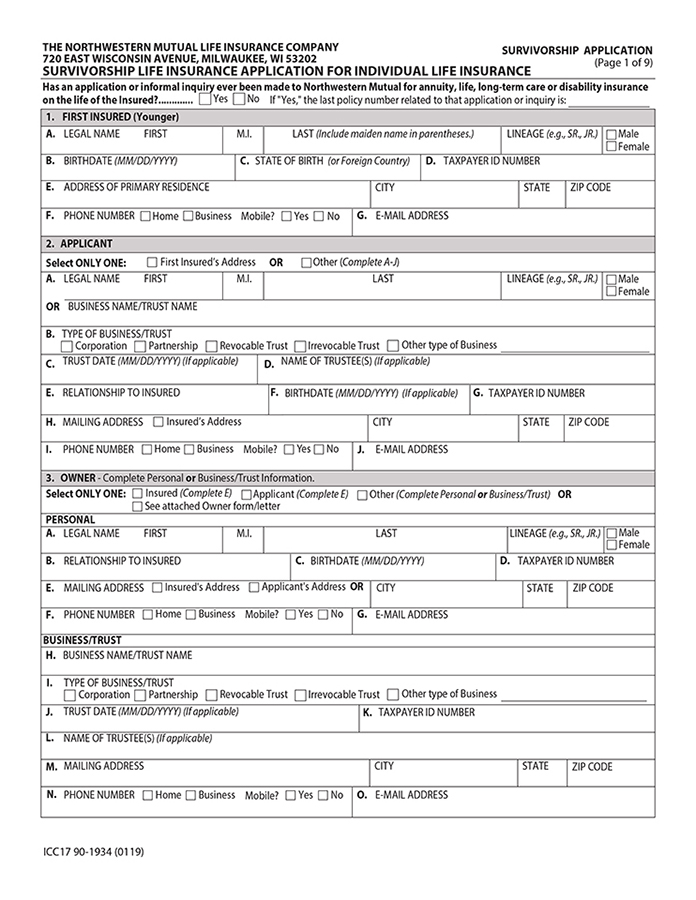

THE NORTHWESTERN MUTUAL LIFE INSURANCE COMPANY SURVIVORSHIP APPLICATION 720 EAST WISCONSIN AVENUE, MILWAUKEE, WI 53202 (Page 1 of 9) SURVIVORSHIP LIFE INSURANCE APPLICATION FOR INDIVIDUAL LIFE INSURANCE Has an application or informal inquiry ever been made to Northwestern Mutual for annuity, life, long-term care or disability insurance on the life of the Insured? Yes No If “Yes,” the last policy number related to that application or inquiry is: 1. FIRST INSURED (Younger) A. LEGAL NAME FIRST M.I. LAST (Include maiden name in parentheses.) LINEAGE (e.g., SR., JR.) Male Female B. BIRTH DATE (MM/DD/YYYY) C. STATE OF BIRTH (or Foreign Country) D. TAXPAYER ID NUMBER E. ADDRESS OF PRIMARY RESIDENCE CITY STATE ZIP CODE F. PHONE NUMBER Home Business Mobile? Yes No G. E-MAIL ADDRESS 2. APPLICANT Select ONLY ONE: First Insured’s Address OR Other (Complete A-J) A. LEGAL NAME FIRST M.I. LAST LINEAGE (e.g., SR., JR.) Male Female OR BUSINESS NAME/TRUST NAME B. TYPE OF BUSINESS/TRUST Corporation Partnership Revocable Trust Irrevocable Trust Other type of Business C. TRUST DATE (MM/DD/YYYY) (If applicable) D. NAME OF TRUSTEE(S) (If applicable) E. RELATIONSHIP TO INSURED F. BIRTHDATE (MM/DD/YYYY) (If applicable) G. TAXPAYER ID NUMBER H. MAILING ADDRESS Insured’s Address CITY STATE ZIP CODE I. PHONE NUMBER Home Business Mobile? Yes No J. E-MAIL ADDRESS 3. OWNER—Complete Personal or Business/Trust Information. Select ONLY ONE: Insured (Complete E) Applicant (Complete E) Other (Complete Personal or Business/Trust) OR See attached Owner form/letter PERSONAL A. LEGAL NAME FIRST M.I. LAST LINEAGE (e.g., SR., JR.) Male Female B. RELATIONSHIP TO INSURED C. BIRTHDATE (MM/DD/YYYY) D. TAXPAYER ID NUMBER E. MAILING ADDRESS Insured’s Address Applicant’s Address OR CITY STATE ZIP CODE F. PHONE NUMBER Home Business Mobile? Yes No G. E-MAIL ADDRESS BUSINESS/TRUST H. BUSINESS NAME/TRUST NAME I. TYPE OF BUSINESS/TRUST Corporation Partnership Revocable Trust Irrevocable Trust Other type of Business J. TRUST DATE (MM/DD/YYYY) (If applicable) K. TAXPAYER ID NUMBER L. NAME OF TRUSTEE(S) (If applicable) M. MAILING ADDRESS CITY STATE ZIP CODE N. PHONE NUMBER Home Business Mobile? Yes No O. E-MAIL ADDRESS ICC17 90-1934 (0119)

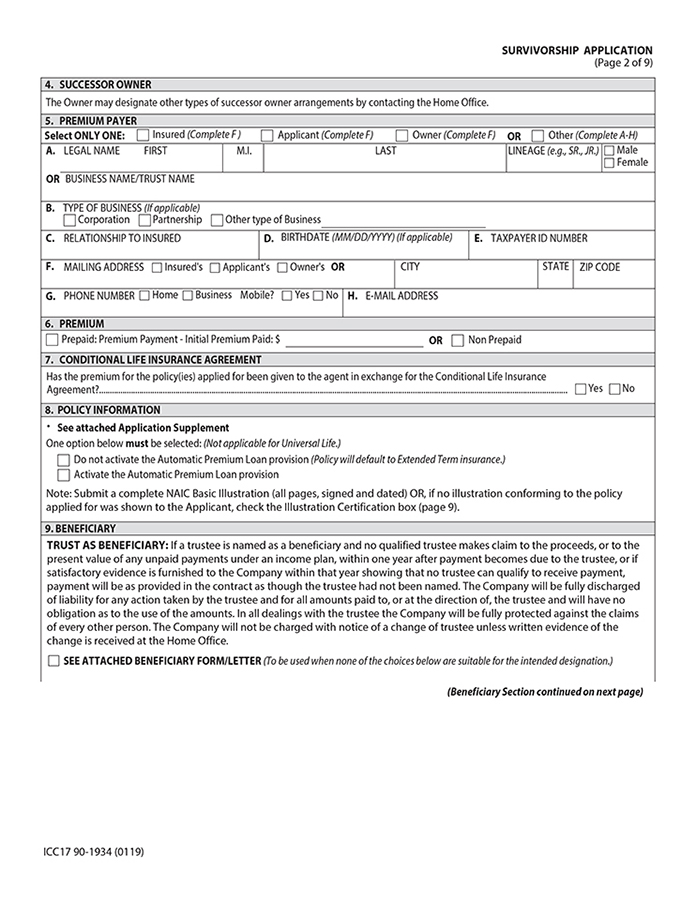

SURVIVORSHIP APPLICATION (Page 2 of 9) 4. SUCCESSOR OWNER The Owner may designate other types of successor owner arrangements by contacting the Home Office. 5. PREMIUM PAYER Select ONLY ONE: Insured (Complete F ) Applicant (Complete F) Owner (Complete F) OR Other (Complete A-H) A. LEGAL NAME FIRST M.I. LAST LINEAGE (e.g., SR., JR.) Male Female OR BUSINESS NAME/TRUST NAME B. TYPE OF BUSINESS (If applicable) Corporation Partnership Other type of Business C. RELATIONSHIP TO INSURED D. BIRTHDATE (MM/DD/YYYY) (If applicable) E. TAXPAYER ID NUMBER F. MAILING ADDRESS Insured’s Applicant’s Owner’s OR CITY STATE ZIP CODE G. PHONE NUMBER Home Business Mobile? Yes No H. E-MAIL ADDRESS 6. PREMIUM Prepaid: Premium Payment—Initial Premium Paid: $ OR Non Prepaid 7. CONDITIONAL LIFE INSURANCE AGREEMENT Has the premium for the policy(ies) applied for been given to the agent in exchange for the Conditional Life Insurance Agreement? Yes No 8. POLICY INFORMATION • See attached Application Supplement One option below must be selected: (Not applicable for Universal Life.) Do not activate the Automatic Premium Loan provision (Policy will default to Extended Term insurance.) Activate the Automatic Premium Loan provision Note: Submit a complete NAIC Basic Illustration (all pages, signed and dated) OR, if no illustration conforming to the policy applied for was shown to the Applicant, check the Illustration Certification box (page 9). 9. BENEFICIARY TRUST AS BENEFICIARY: If a trustee is named as a beneficiary and no qualified trustee makes claim to the proceeds, or to the present value of any unpaid payments under an income plan, within one year after payment becomes due to the trustee, or if satisfactory evidence is furnished to the Company within that year showing that no trustee can qualify to receive payment, payment will be as provided in the contract as though the trustee had not been named. The Company will be fully discharged of liability for any action taken by the trustee and for all amounts paid to, or at the direction of, the trustee and will have no obligation as to the use of the amounts. In all dealings with the trustee the Company will be fully protected against the claims of every other person. The Company will not be charged with notice of a change of trustee unless written evidence of the change is received at the Home Office. SEE ATTACHED BENEFICIARY FORM/LETTER (To be used when none of the choices below are suitable for the intended designation.) (Beneficiary Section continued on next page) ICC17 90-1934 (0119)

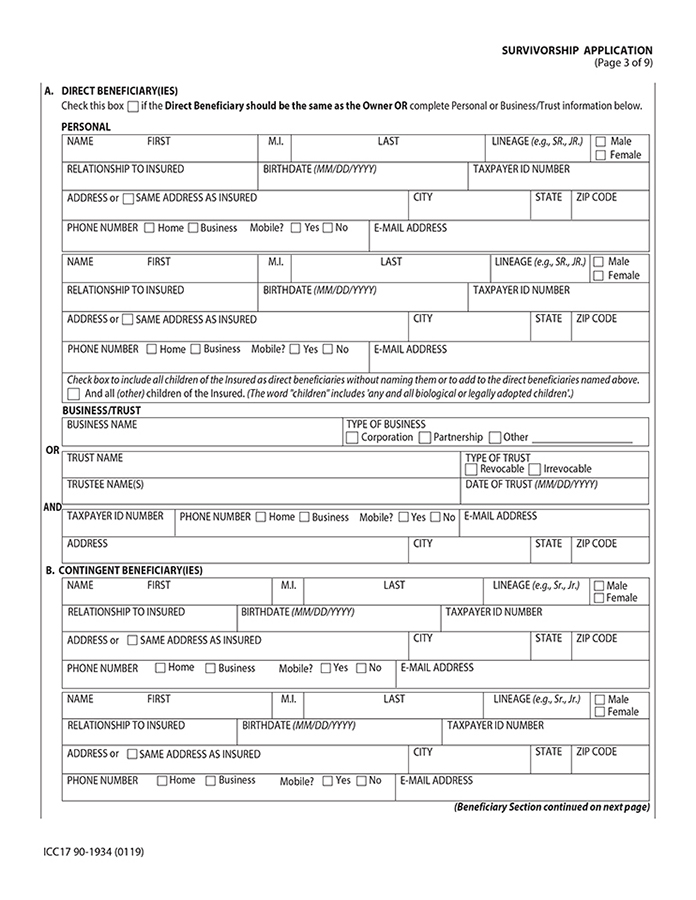

SURVIVORSHIP APPLICATION (Page 3 of 9) A. DIRECT BENEFICIARY(IES) Check this box if the Direct Beneficiary should be the same as the Owner OR complete Personal or Business/Trust information below. PERSONAL NAME FIRST M.I. LAST LINEAGE (e.g., SR., JR.) Male Female RELATIONSHIP TO INSURED BIRTHDATE (MM/DD/YYYY) TAXPAYER ID NUMBER ADDRESS or SAME ADDRESS AS INSURED CITY STATE ZIP CODE PHONE NUMBER Home Business Mobile? Yes No E-MAIL ADDRESS NAME FIRST M.I. LAST LINEAGE (e.g., SR., JR.) Male Female RELATIONSHIP TO INSURED BIRTHDATE (MM/DD/YYYY) TAXPAYER ID NUMBER ADDRESS or SAME ADDRESS AS INSURED CITY STATE ZIP CODE PHONE NUMBER Home Business Mobile? Yes No E-MAIL ADDRESS Check box to include all children of the Insured as direct beneficiaries without naming them or to add to the direct beneficiaries named above. And all (other) children of the Insured. (The word “children” includes ‘any and all biological or legally adopted children’.) BUSINESS/TRUST BUSINESS NAME TYPE OF BUSINESS Corporation Partnership Other OR TRUST NAME TYPE OF TRUST Revocable Irrevocable TRUSTEE NAME(S) DATE OF TRUST (MM/DD/YYYY) AND TAXPAYER ID NUMBER PHONE NUMBER Home Business Mobile? Yes No E-MAIL ADDRESS ADDRESS CITY STATE ZIP CODE B. CONTINGENT BENEFICIARY(IES) NAME FIRST M.I. LAST LINEAGE (e.g., Sr., Jr.) Male Female RELATIONSHIP TO INSURED BIRTHDATE (MM/DD/YYYY) TAXPAYER ID NUMBER ADDRESS or SAME ADDRESS AS INSURED CITY STATE ZIP CODE PHONE NUMBER Home Business Mobile? Yes No E-MAIL ADDRESS NAME FIRST M.I. LAST LINEAGE (e.g., Sr., Jr.) Male Female RELATIONSHIP TO INSURED BIRTHDATE (MM/DD/YYYY) TAXPAYER ID NUMBER ADDRESS or SAME ADDRESS AS INSURED CITY STATE ZIP CODE PHONE NUMBER Home Business Mobile? Yes No E-MAIL ADDRESS (Beneficiary Section continued on next page) ICC17 90-1934 (0119)

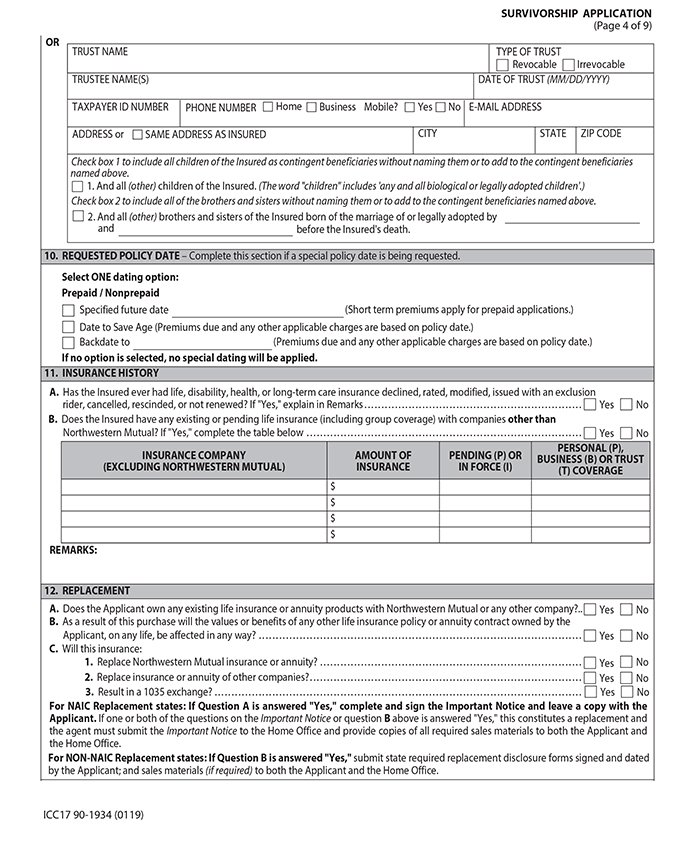

SURVIVORSHIP APPLICATION (Page 4 of 9) OR TRUST NAME TYPE OF TRUST Revocable Irrevocable TRUSTEE NAME(S) DATE OF TRUST (MM/DD/YYYY) TAXPAYER ID NUMBER PHONE NUMBER Home Business Mobile? Yes No E-MAIL ADDRESS ADDRESS or SAME ADDRESS AS INSURED CITY STATE ZIP CODE Check box 1 to include all children of the Insured as contingent beneficiaries without naming them or to add to the contingent beneficiaries named above. 1. And all (other) children of the Insured. (The word “children” includes ‘any and all biological or legally adopted children’.) Check box 2 to include all of the brothers and sisters without naming them or to add to the contingent beneficiaries named above. 2. And all (other) brothers and sisters of the Insured born of the marriage of or legally adopted by and before the Insured’s death. 10. REQUESTED POLICY DATE – Complete this section if a special policy date is being requested. Select ONE dating option: Prepaid / Nonprepaid Specified future date (Short term premiums apply for prepaid applications.) Date to Save Age (Premiums due and any other applicable charges are based on policy date.) Backdate to (Premiums due and any other applicable charges are based on policy date.) If no option is selected, no special dating will be applied. 11. INSURANCE HISTORY A. Has the Insured ever had life, disability, health, or long-term care insurance declined, rated, modified, issued with an exclusion rider, cancelled, rescinded, or not renewed? If “Yes,” explain in Remarks Yes No B. Does the Insured have any existing or pending life insurance (including group coverage) with companies other than Northwestern Mutual? If “Yes,” complete the table below Yes No PERSONAL (P), INSURANCE COMPANY AMOUNT OF PENDING (P) OR BUSINESS (B) OR TRUST (EXCLUDING NORTHWESTERN MUTUAL) INSURANCE IN FORCE (I) (T) COVERAGE $ $ $ $ REMARKS: 12. REPLACEMENT A. Does the Applicant own any existing life insurance or annuity products with Northwestern Mutual or any other company? Yes No B. As a result of this purchase will the values or benefits of any other life insurance policy or annuity contract owned by the Applicant, on any life, be affected in any way? Yes No C. Will this insurance: 1. Replace Northwestern Mutual insurance or annuity? Yes No 2. Replace insurance or annuity of other companies? Yes No 3. Result in a 1035 exchange? Yes No For NAIC Replacement states: If Question A is answered “Yes,” complete and sign the Important Notice and leave a copy with the Applicant. If one or both of the questions on the Important Notice or question B above is answered “Yes,” this constitutes a replacement and the agent must submit the Important Notice to the Home Office and provide copies of all required sales materials to both the Applicant and the Home Office. For NON-NAIC Replacement states: If Question B is answered “Yes,” submit state required replacement disclosure forms signed and dated by the Applicant; and sales materials (if required) to both the Applicant and the Home Office. ICC17 90-1934 (0119)

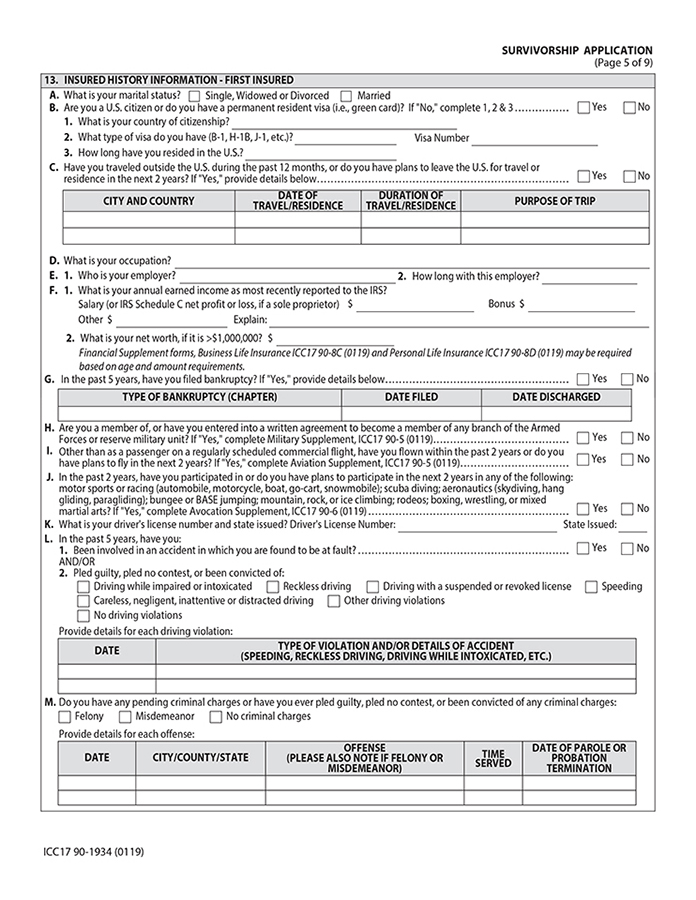

SURVIVORSHIP APPLICATION (Page 5 of 9) 13. INSURED HISTORY INFORMATION—FIRST INSURED A. What is your marital status? Single, Widowed or Divorced Married B. Are you a U.S. citizen or do you have a permanent resident visa (i.e., green card)? If “No,” complete 1, 2 & 3 Yes No 1. What is your country of citizenship? 2. What type of visa do you have (B-1, H-1B, J-1, etc.)? Visa Number 3. How long have you resided in the U.S.? C. Have you traveled outside the U.S. during the past 12 months, or do you have plans to leave the U.S. for travel or residence in the next 2 years? If “Yes,” provide details below Yes No DATE OF DURATION OF CITY AND COUNTRY PURPOSE OF TRIP TRAVEL/RESIDENCE TRAVEL/RESIDENCE D. What is your occupation? E. 1. Who is your employer? 2. How long with this employer? F. 1. What is your annual earned income as most recently reported to the IRS? Salary (or IRS Schedule C net profit or loss, if a sole proprietor) $ Bonus $ Other $ Explain: 2. What is your net worth, if it is >$1,000,000? $ Financial Supplement forms, Business Life Insurance ICC17 90-8C (0119) and Personal Life Insurance ICC17 90-8D (0119) may be required based on age and amount requirements. G. In the past 5 years, have you filed bankruptcy? If “Yes,” provide details below Yes No TYPE OF BANKRUPTCY (CHAPTER) DATE FILED DATE DISCHARGED H. Are you a member of, or have you entered into a written agreement to become a member of any branch of the Armed Forces or reserve military unit? If “Yes,” complete Military Supplement, ICC17 90-5 (0119) Yes No I. Other than as a passenger on a regularly scheduled commercial flight, have you flown within the past 2 years or do you have plans to fly in the next 2 years? If “Yes,” complete Aviation Supplement, ICC17 90-5 (0119) Yes No J. In the past 2 years, have you participated in or do you have plans to participate in the next 2 years in any of the following: motor sports or racing (automobile, motorcycle, boat, go-cart, snowmobile); scuba diving; aeronautics (skydiving, hang gliding, paragliding); bungee or BASE jumping; mountain, rock, or ice climbing; rodeos; boxing, wrestling, or mixed martial arts? If “Yes,” complete Avocation Supplement, ICC17 90-6 (0119) Yes No K. What is your driver’s license number and state issued? Driver’s License Number: State Issued: L. In the past 5 years, have you: 1. Been involved in an accident in which you are found to be at fault? Yes No AND/OR 2. Pled guilty, pled no contest, or been convicted of: Driving while impaired or intoxicated Reckless driving Driving with a suspended or revoked license Speeding Careless, negligent, inattentive or distracted driving Other driving violations No driving violations Provide details for each driving violation: DATE TYPE OF VIOLATION AND/OR DETAILS OF ACCIDENT (SPEEDING, RECKLESS DRIVING, DRIVING WHILE INTOXICATED, ETC.) M. Do you have any pending criminal charges or have you ever pled guilty, pled no contest, or been convicted of any criminal charges: Felony Misdemeanor No criminal charges Provide details for each offense: OFFENSE DATE OF PAROLE OR DATE CITY/COUNTY/STATE (PLEASE ALSO NOTE IF FELONY OR TIME PROBATION SERVED MISDEMEANOR) TERMINATION ICC17 90-1934 (0119)

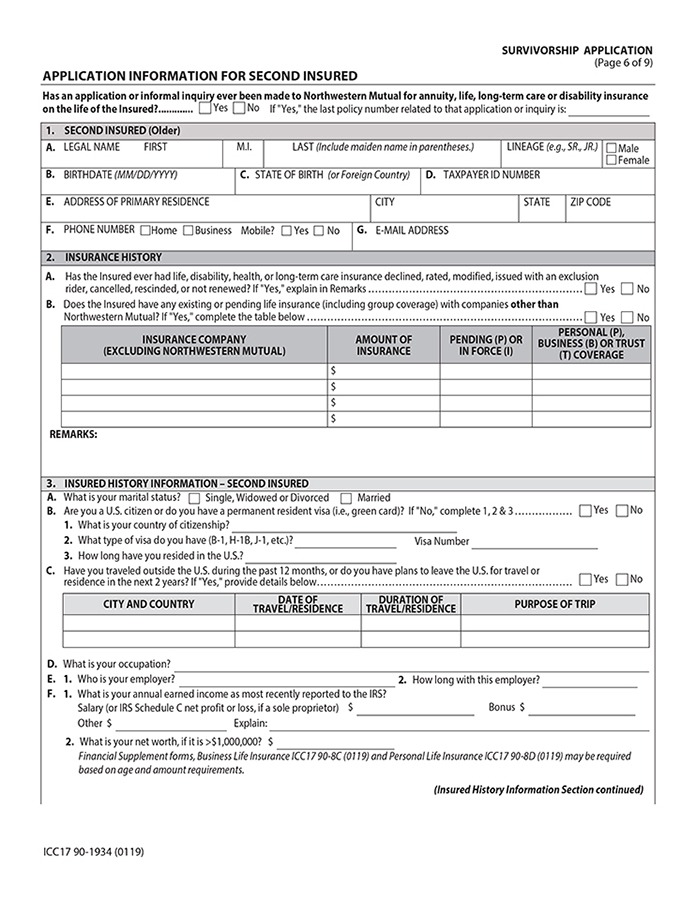

SURVIVORSHIP APPLICATION (Page 6 of 9) APPLICATION INFORMATION FOR SECOND INSURED Has an application or informal inquiry ever been made to Northwestern Mutual for annuity, life, long-term care or disability insurance on the life of the Insured?............. Yes No If “Yes,” the last policy number related to that application or inquiry is: 1. SECOND INSURED (Older) A. LEGAL NAME FIRST M.I. LAST (Include maiden name in parentheses.) LINEAGE (e.g., SR., JR.) Male Female B. BIRTHDATE (MM/DD/YYYY) C. STATE OF BIRTH (or Foreign Country) D. TAXPAYER ID NUMBER E. ADDRESS OF PRIMARY RESIDENCE CITY STATE ZIP CODE F. PHONE NUMBER Home Business Mobile? Yes No G. E-MAIL ADDRESS 2. INSURANCE HISTORY A. Has the Insured ever had life, disability, health, or long-term care insurance declined, rated, modified, issued with an exclusion rider, cancelled, rescinded, or not renewed? If “Yes,” explain in Remarks Yes No B. Does the Insured have any existing or pending life insurance (including group coverage) with companies other than Northwestern Mutual? If “Yes,” complete the table below Yes No PERSONAL (P), INSURANCE COMPANY AMOUNT OF PENDING (P) OR BUSINESS (B) OR TRUST (EXCLUDING NORTHWESTERN MUTUAL) INSURANCE IN FORCE (I) (T) COVERAGE $ $ $ $ REMARKS: 3. INSURED HISTORY INFORMATION – SECOND INSURED A. What is your marital status? Single, Widowed or Divorced Married B. Are you a U.S. citizen or do you have a permanent resident visa (i.e., green card)? If “No,” complete 1, 2 & 3 Yes No 1. What is your country of citizenship? 2. What type of visa do you have (B-1, H-1B, J-1, etc.)? Visa Number 3. How long have you resided in the U.S.? C. Have you traveled outside the U.S. during the past 12 months, or do you have plans to leave the U.S. for travel or residence in the next 2 years? If “Yes,” provide details below Yes No DATE OF DURATION OF CITY AND COUNTRY PURPOSE OF TRIP TRAVEL/RESIDENCE TRAVEL/RESIDENCE D. What is your occupation? E. 1. Who is your employer? 2. How long with this employer? F. 1. What is your annual earned income as most recently reported to the IRS? Salary (or IRS Schedule C net profit or loss, if a sole proprietor) $ Bonus $ Other $ Explain: 2. What is your net worth, if it is >$1,000,000? $ Financial Supplement forms, Business Life Insurance ICC17 90-8C (0119) and Personal Life Insurance ICC17 90-8D (0119) may be required based on age and amount requirements. (Insured History Information Section continued) ICC17 90-1934 (0119)

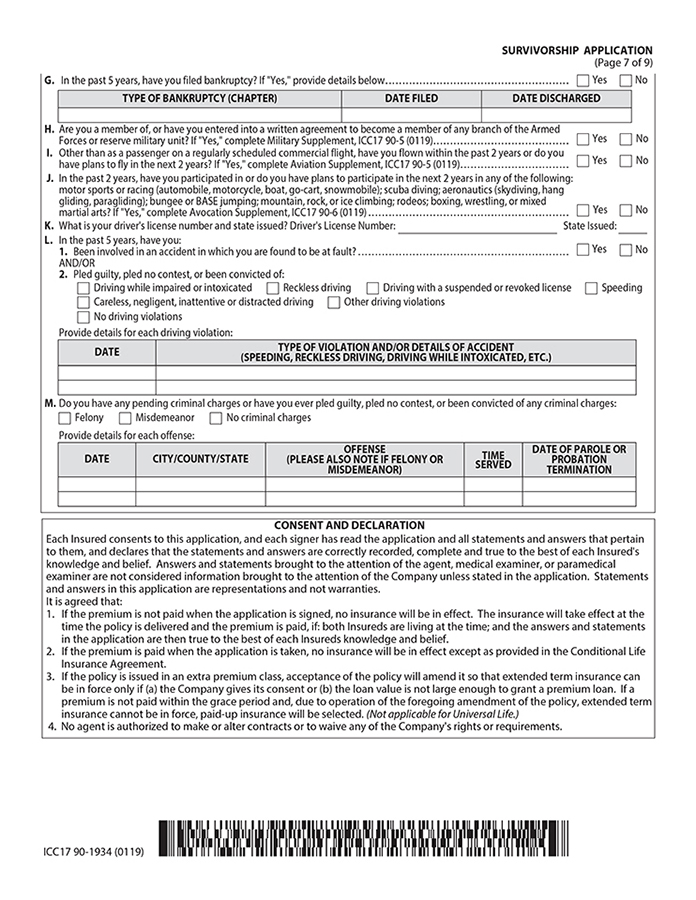

SURVIVORSHIP APPLICATION (Page 7 of 9) G. In the past 5 years, have you filed bankruptcy? If “Yes,” provide details below Yes No TYPE OF BANKRUPTCY (CHAPTER) DATE FILED DATE DISCHARGED H. Are you a member of, or have you entered into a written agreement to become a member of any branch of the Armed Forces or reserve military unit? If “Yes,” complete Military Supplement, ICC17 90-5 (0119) Yes No I. Other than as a passenger on a regularly scheduled commercial flight, have you flown within the past 2 years or do you have plans to fly in the next 2 years? If “Yes,” complete Aviation Supplement, ICC17 90-5 (0119) Yes No J. In the past 2 years, have you participated in or do you have plans to participate in the next 2 years in any of the following: motor sports or racing (automobile, motorcycle, boat, go-cart, snowmobile); scuba diving; aeronautics (skydiving, hang gliding, paragliding); bungee or BASE jumping; mountain, rock, or ice climbing; rodeos; boxing, wrestling, or mixed martial arts? If “Yes,” complete Avocation Supplement, ICC17 90-6 (0119) Yes No K. What is your driver’s license number and state issued? Driver’s License Number: State Issued: L. In the past 5 years, have you: 1. Been involved in an accident in which you are found to be at fault? Yes No AND/OR 2. Pled guilty, pled no contest, or been convicted of: Driving while impaired or intoxicated Reckless driving Driving with a suspended or revoked license Speeding Careless, negligent, inattentive or distracted driving Other driving violations No driving violations Provide details for each driving violation: DATE TYPE OF VIOLATION AND/OR DETAILS OF ACCIDENT (SPEEDING, RECKLESS DRIVING, DRIVING WHILE INTOXICATED, ETC.) M. Do you have any pending criminal charges or have you ever pled guilty, pled no contest, or been convicted of any criminal charges: Felony Misdemeanor No criminal charges Provide details for each offense: OFFENSE DATE OF PAROLE OR DATE CITY/COUNTY/STATE (PLEASE ALSO NOTE IF FELONY OR TIME PROBATION SERVED MISDEMEANOR) TERMINATION CONSENT AND DECLARATION Each Insured consents to this application, and each signer has read the application and all statements and answers that pertain to them, and declares that the statements and answers are correctly recorded, complete and true to the best of each Insured’s knowledge and belief. Answers and statements brought to the attention of the agent, medical examiner, or paramedical examiner are not considered information brought to the attention of the Company unless stated in the application. Statements and answers in this application are representations and not warranties. It is agreed that: 1. If the premium is not paid when the application is signed, no insurance will be in effect. The insurance will take effect at the time the policy is delivered and the premium is paid, if: both Insureds are living at the time; and the answers and statements in the application are then true to the best of each Insureds knowledge and belief. 2. If the premium is paid when the application is taken, no insurance will be in effect except as provided in the Conditional Life Insurance Agreement. 3. If the policy is issued in an extra premium class, acceptance of the policy will amend it so that extended term insurance can be in force only if (a) the Company gives its consent or (b) the loan value is not large enough to grant a premium loan. If a premium is not paid within the grace period and, due to operation of the foregoing amendment of the policy, extended term insurance cannot be in force, paid-up insurance will be selected. (Not applicable for Universal Life.) 4. No agent is authorized to make or alter contracts or to waive any of the Company’s rights or requirements. ICC17 90-1934 (0119)

SURVIVORSHIP APPLICATION (Page 8 of 9) AUTHORIZATION We, the Insureds, authorize The Northwestern Mutual Life Insurance Company, its agents, employees, reinsurers, insurance support organizations and their representatives to obtain information about us to evaluate this application, to verify information in this application, and for other purposes as allowed by law. This information will include: (a) age; (b) medical history, condition and care; (c) physical and mental health; (d) occupation; (e) income and financial history; (f) foreign travel; (g) avocations; (h) driving record; (i) other personal characteristics; and (j) other insurance. This authorization extends to information on the use of alcohol, drugs and tobacco; the diagnosis or treatment of HIV (AIDS virus) infection and sexually transmitted diseases; and the diagnosis and treatment of mental illness. During the time this authorization is valid it extends to information required to determine eligibility for benefits under any policy issued as a result of this application. We authorize any person, including any physician, health care professional, hospital, clinic, medical facility, government agency including the Veterans and Social Security Administrations, the MIB, Inc., employer, business associates, consumer reporting agency, banker, accountant, tax preparer, or other insurance company, to release information about us to The Northwestern Mutual Life Insurance Company or its representatives on receipt of this authorization. The Northwestern Mutual Life Insurance Company or its representatives may release this information about us to translators, to reinsurers, to the MIB, Inc., or to another insurance company to whom we have applied or to who a claim has been made. No other release may be made except as allowed by law or as we further authorize. We have received a copy of the MIB, Inc. and Fair Credit Reporting Act notices. We authorize The Northwestern Mutual Life Insurance Company to obtain an investigative consumer report on me. We request to be interviewed if an investigative consumer report is done. This authorization is valid for 24 months from the date it is signed or for the time limit, if any, permitted by applicable law in the state where the policy is delivered or issued for delivery, whichever period is shorter. A copy of this authorization is as valid as the original and will be provided on request. ICC17 90-1934 (0119)

SURVIVORSHIP APPLICATION (Page 9 of 9) ILLUSTRATION CERTIFICATION The undersigned Applicant and Agent acknowledge that no illustration conforming to the policy applied for was available for the Applicant to review and sign. The Applicant understands that an illustration conforming to the policy exactly as issued will be provided to the Policyowner, by the Company or Agent, no later than at the time the policy is delivered. TAXPAYER IDENTIFICATION NUMBER (TIN) CERTIFICATION Under penalties of perjury, the Owner (and/or payee) certifies that: (1) the number shown on this form is the Owner’s correct taxpayer identification number (or is waiting for a number to be issued), and (2) the Owner is not subject to backup withholding because: (a) the Owner is exempt from backup withholding, or (b) the Owner has not been notified by the Internal Revenue Service (IRS) that they are subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified the Owner that they are no longer subject to backup withholding, and (3) the Owner is a U.S. person, which includes: a U.S. citizen or U.S. resident alien; a partnership, corporation, company, or association created or organized in the United States or under the laws of the United States; an estate (other than a foreign estate); or a domestic trust (as defined in 26 CFR § 301.7701-7), and (4) the Owner is exempt from FATCA reporting because the Owner is not a foreign entity. Check this box if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. Item 2 does not apply if this box is checked. SIGNATURE(S) The signatures below apply to the application, the Application Supplement, Consent and Declaration, Authorization, Illustration Certification (if checked), and the Taxpayer Identification Number Certification. The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding. Signature of FIRST INSURED Signature of SECOND INSURED Signature of APPLICANT Signature of OWNER (If other than Applicant, First or Second Insured) STATE where APPLICANT signed DATE signed by APPLICANT (MM/DD/YYYY) Signature of LICENSED AGENT Any person who knowingly presents a false statement in an application for insurance may be guilty of a criminal offense and subject to penalties under state law. ICC17 90-1934 (0119)

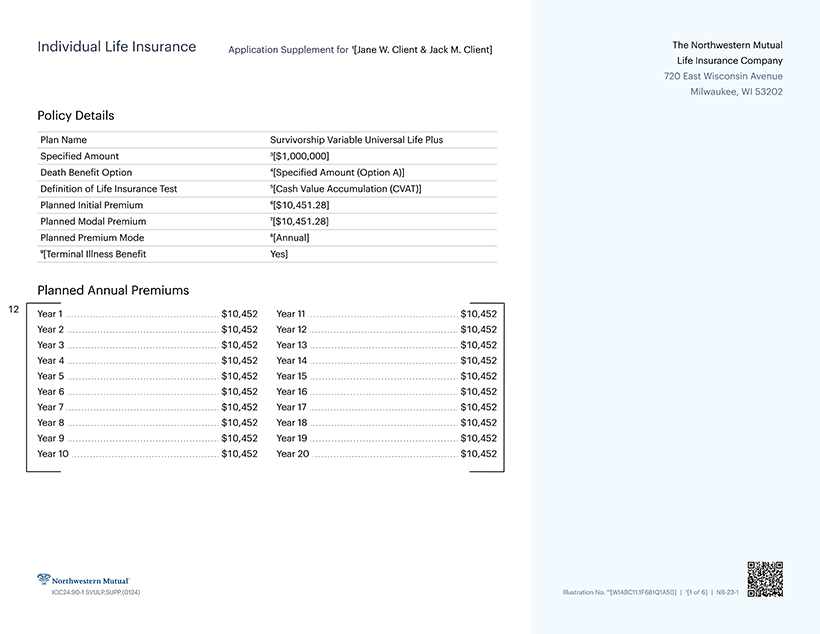

Individual Life Insurance Application Supplement for 1[Jane W. Client & Jack M. Client] The Northwestern Mutual Life Insurance Company 720 East Wisconsin Avenue Milwaukee, Wl 53202 Policy Details Plan Name Survivorship Variable Universal Life Plus Specified Amount 3[$1,000,000] Death Benefit Option 4[Specified Amount (Option A)] Definition of Life Insurance Test 5[Cash Value Accumulation (CVAT)] Planned Initial Premium 6[$10,451.28] Planned Modal Premium 7[$10,451.28] Planned Premium Mode 8[Annual] 9[Terminal Illness Benefit Yes] Planned Annual Premiums 12 Year 1 $10,452 Year 11 $10,452 Year 2 $10,452 Year 12 $10,452 Year 3 $10,452 Year 13 $10,452 Year 4 $10,452 Year 14 $10,452 Year 5 $10,452 Year 15 $10,452 Year 6 $10,452 Year 16 $10,452 Year 7 $10,452 Year 17 $10,452 Year 8 $10,452 Year 18 $10,452 Year 9 $10,452 Year 19 $10,452 Year 10 $10,452 Year 20 $10,452 Northwestern Mutual ICC24.90-1 SVULP.SUPP.(0124) Illustration No. 10[WIABC11.1F681Q1A50] | 2[1 of 6] | NB-23-1

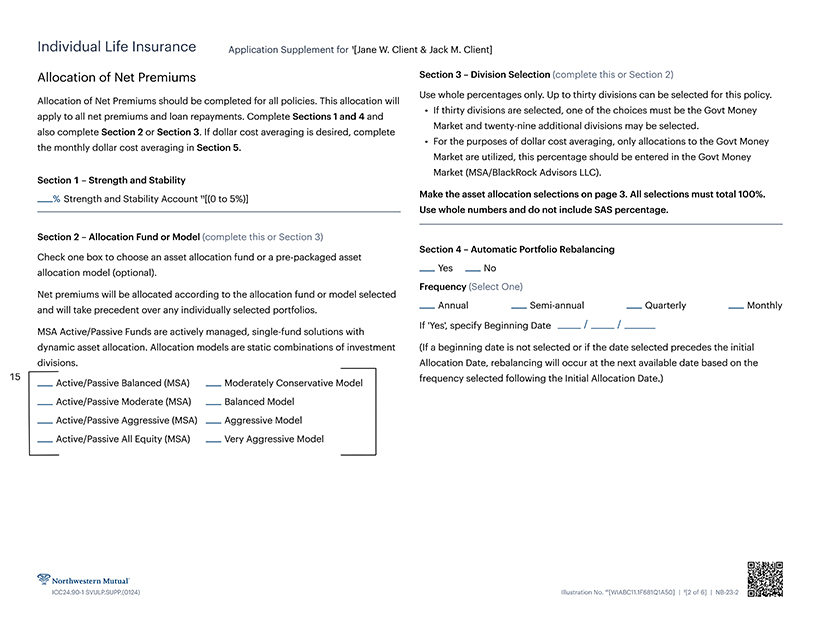

Individual Life Insurance Application Supplement for 1[Jane W. Client & Jack M. Client] Allocation of Net Premiums Section 3—Division Selection (complete this or Section 2) Use whole percentages only. Up to thirty divisions can be selected for this policy. Allocation of Net Premiums should be completed for all policies. This allocation will ... . .. • If thirty divisions are selected, one of the choices must be the Govt Money apply to all net premiums and loan repayments. Complete Sections 1 and 4 and Market and twenty-nine additional divisions may be selected. also complete Section 2 or Section 3. If dollar cost averaging is desired, complete • For the purposes of dollar cost averaging, only allocations to the Govt Money the monthly dollar cost averaging in Section 5. Market are utilized, this percentage should be entered in the Govt Money Market (MSA/BlackRock Advisors LLC). Section 1—Strength and Stability % strength and Stability Account 11[(0 to 5%)] Make the asset allocation selections on page 3. All selections must total 100%. Use whole numbers and do not include SAS percentage. Section 2—Allocation Fund or Model (complete this or Section 3) Section 4—Automatic Portfolio Rebalancing Check one box to choose an asset allocation fund or a pre-packaged asset allocation model (optional). Yes No Frequency (Select One) Net premiums will be allocated according to the allocation fund or model selected and will take precedent over any individually selected portfolios. Annual Semi-annual Quarterly Monthly if Yes’, specify Beginning Date // MSA Active/Passive Funds are actively managed, single-fund solutions with dynamic asset allocation. Allocation models are static combinations of investment (If a beginning date is not selected or if the date selected precedes the initial divisions. Allocation Date, rebalancing will occur at the next available date based on the 15 Active/Passive Balanced (MSA) Moderately Conservative Model I frequency selected following the Initial Allocation Date.) Active/Passive Moderate (MSA) Balanced Model Active/Passive Aggressive (MSA) Aggressive Model Active/Passive All Equity (MSA) Very Aggressive Model

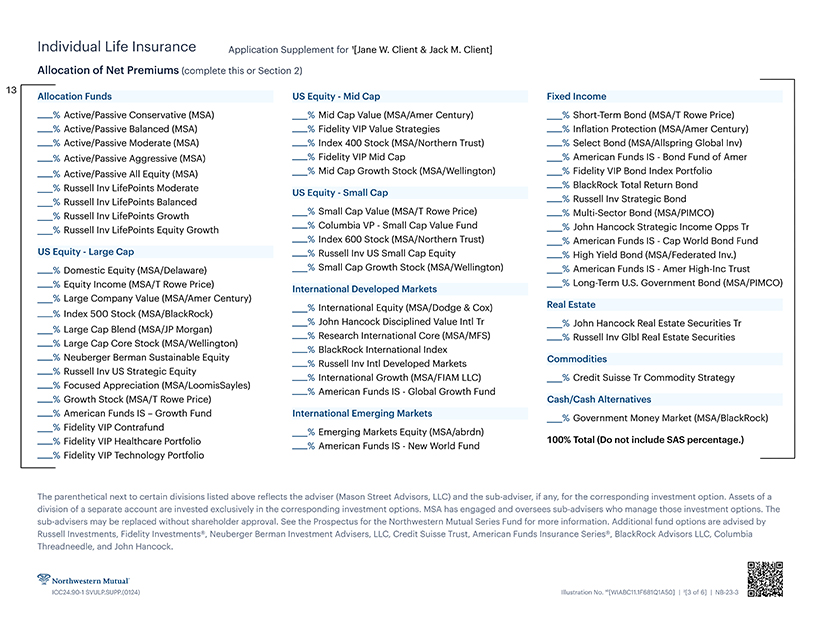

Individual Life Insurance Application Supplementfor1[Jane W. Client & Jack M. Client] Allocation of Net Premiums (complete this or Section 2) 13Allocation Funds US Equity—Mid Cap Fixed Income % Active/Passive Conservative (MSA) % Mid Cap Value (MSA/Amer Century) % Short-Term Bond (MSA/T Rowe Price) % Active/Passive Balanced (MSA) % Fidelity VIP Value Strategies % Inflation Protection (MSA/Amer Century) % Active/Passive Moderate (MSA) % Index 400 Stock (MSA/Northern Trust) % Select Bond (MSA/Allspring Global Inv) % Active/Passive Aggressive (MSA) % Fidelity VIP Mid Cap % American Funds IS—Bond Fund of Amer % Active/Passive All Equity (MSA) % Mid Cap Growth Stock (MSA/Wellington) % Fidelity VIP Bond Index Portfolio % Russell Inv LifePoints Moderate% BlackRock Total Return Bond Russell Inv LifePoints Balanced Russell Inv Strategic Bond % Russell Inv LifePoints Growth Smal1 Cap Value (MSA/T Rowe Price) % Multi-Sector Bond (MSA/PIMCO) % Russell Inv LifePoints Equity Growth Columbia vp Small CaP Value Fund % John Hancock Strategic Income Opps Tr % Index 600 Stock (MSA/Northern Trust) % American Funds IS—Cap World Bond Fund US Equity—Large Cap % Russell Inv US Small Cap Equity % High Yield Bond (MSA/Federated Inv.) % Domestic Equity (MSA/Delaware) % Small Cap Growth Stock (MSA/Wellington) % American Funds IS—Amer High-Inc Trust _% Equity Income (MSA/T Rowe Price) International Developed Markets —% Long Term us Government Bond (MSA/PIMCO) % Large Company Value (MSA/Amer Century) % International Equity (MSA/Dodge & Cox) Real Estate % Index 500 Stock (MSA/BlackRock) % John Hancock DIsciplined VaIue IntI Tr % John Hancock Real Estate Securities Tr % Large Cap Blend (MSA/JP Morgan % Research International Core (MSA/MFS) % Russell Inv Glbl Real Estate Securities % Large Cap Core Stock MSA/Wellington BlackRock International Index % Neuberger Berman Sustainable Equity Commodities % Russell Inv Inti Developed Markets % Russell Inv US Strategic Equity o % International Growth (MSA/FIAM LLC) % Credit Suisse Tr Commodity Strategy % Focused Appreciation (MSA/LoomisSayles) % American Funds IS—Global Growth Fund . % Growth Stock (MSA/T Rowe Price) Cash/Cash Alternatives % American Funds IS—Growth Fund International Emerging Markets _% Government Money Market (MSA/BlackRock) Fidelity VIP Contrafund % Emerging Markets Equity (MSA/abrdn) _% Fidelity VIP Healthcare Portfolio _% American Funds |s New Wor|d Fund 100% Total (Do not include SAS percentage.) % Fidelity VIP Technology Portfolio The parenthetical next to certain divisions listed above reflects the adviser (Mason Street Advisors, LLC) and the sub-adviser, if any, for the corresponding investment option. Assets of a division of a separate account are invested exclusively in the corresponding investment options. MSA has engaged and oversees sub-advisers who manage those investment options. The sub-advisers may be replaced without shareholder approval. See the Prospectus for the Northwestern Mutual Series Fund for more information. Additional fund options are advised by Russell Investments, Fidelity Investments®, Neuberger Berman Investment Advisers, LLC, Credit Suisse Trust, American Funds Insurance Series®, BlackRock Advisors LLC, Columbia Threadneedle, and John Hancock.

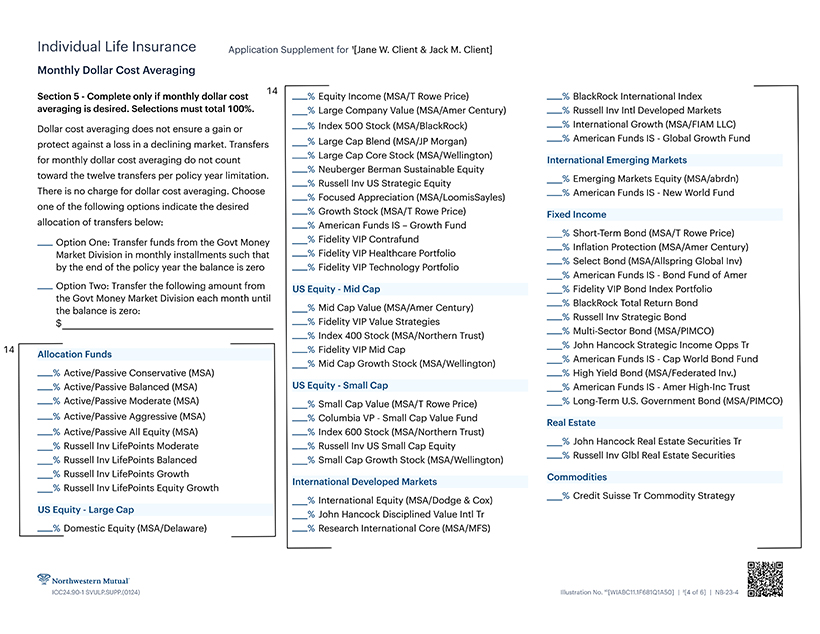

Individual Life Insurance Application Supplementfor 1[JaneW. Client & Jack M. Client] Monthly Dollar Cost Averaging Section 5—Complete only if monthly dollar cost % Equity Income (MSA/T Rowe Price) % BlackRock International Index averaging is desired. Selections must total 100%. % Large Company Value (MSA/Amer Century) % Russell Inv Inti Developed Markets Dollar cost averaging does not ensure a gain or —% Index 500 Stock (MSA/BlackRock) —% International Growth (MSA/FIAM LLC) protect against a loss in a declining market. Transfers % Large Cap Blend (MSA/JP Morgan) American Funds IS Global Growth Fund for monthly dollar cost averaging do not count Lagre Cap Core Stock (MSA/Wellington) International Emerging Markets % Neuberger Berman Sustainable Equity toward the twelve transfers per policy year limitation. % Strategjc Equity % Emerging Markets Equity (MSA/abrdn) There is no charge for dollar cost averaging. Choose Focused Appreciation (MSA/LoomisSay|es) —% American Funds IS—New World Fund one of the following options indicate the desired _ Growth stock (MSA/T Rowe price) Fixed allocation of transfers below: % American Funds IS—Growth Fund % Short-Term Bond (MSA/T Rowe Price) _ Option One: Transfer funds from the Govt Money —P Contrafund _% |nflation protection (MSA/Amer Century) Market Division in monthly installments such that Fidelity VIP Healthcare Portfolio by the end of the policy year the balance is zero % Fidelity VIP Technology Portfolio % American Funds IS—Bond Fund of Amer Option Two: Transfer the following amount from US Equity—Mid Cap % Fidelity VIP Bond Index Portfolio the Govt Money Market Division each month until % BlackRock Total Return Bond the balance is zero- % Cap Value (MSA/Amer Century) $ _%Fidelity VIP Value Strategies —% Russell Inv Strategic Bond % Index 400 Stock (MSA/Northern Trust) Bond (MSA/PIMCO) Fidelity VIP Mid Cap _% John Hancock Strategic Income Opps Tr Allocation Funds _”/. Mid Cap Growth Stock (MSA/Wellington) % Active/Passive Conservative (MSA) % High Yield Bond (MSA/Federated Inv.) % Active/Passive Balanced (MSA) US Equity—Small Cap % American Funds IS—Amer High-Inc Trust % Active/Passive Moderate (MSA) % small Cap Value (MSA/T Rowe Price) % Long-Term U.S. Government Bond (MSA/PIMCO) % Active/Passive Aggressive (MSA) % Columbia VP—Small Cap Value Fund % Active/Passive All Equity (MSA) % Index 600 Stock (MSA/Northern Trust) _% Russell Inv LifePoints Moderate Russell Inv US Small Cap Equity % John Hancock Real Estate Securities Tr % Russell Inv LifePoints Balanced % Small Cap Growth Stock (MSA/Wellington) Russell Inv Glbl Real Estate Securities % Russell Inv LifePoints Growth International Developed Markets commodities % Russell Inv LifePoints Equity Growth _% International Equity (MSA/Dodge & Cox) —% Credit Suisse Tr Commodity Strategy US Equity—Large Cap % John Hancock Disciplined Value Inti Tr % Domestic Equity (MSA/Delaware) % Research International Core (MSA/MFS)

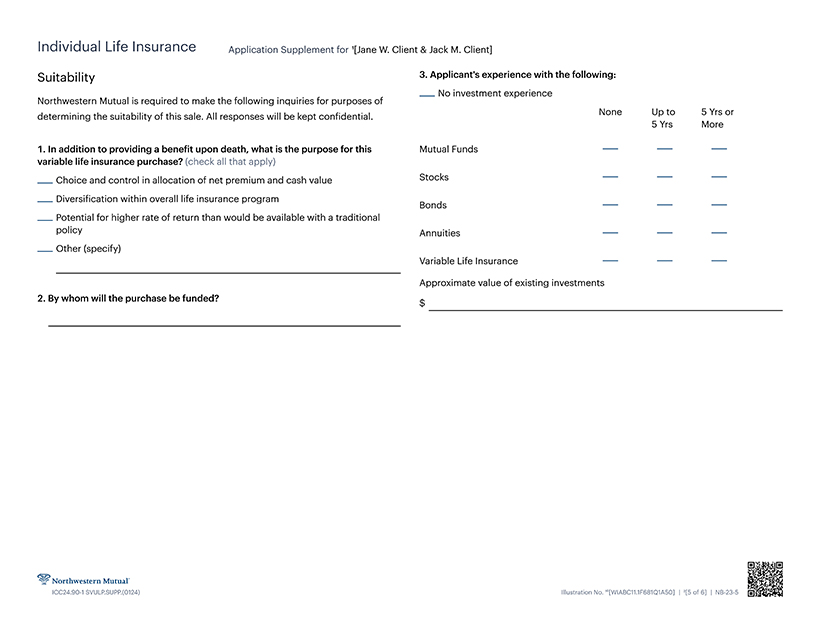

Individual Life Insurance Application Supplementfor 1[Jane W. Client & Jack M. Client] Suitability 3. Applicant’s experience with the following: No investment experience Northwestern Mutual is required to make the following inquiries for purposes of determining the suitability of this sale. All responses will be kept confidential. None Upto 5 Yrs or 5 Yrs More In addition to providing a benefit upon death, what is the purpose for this Mutual Funds variable life insurance purchase? (check all that apply) Choice and control in allocation of net premium and cash value Stocks Diversification within overall life insurance program Potential for higher rate of return than would be available with a traditional Annuities Other (specify) Variable Life Insurance Approximate value of existing investments By whom will the purchase be funded? $

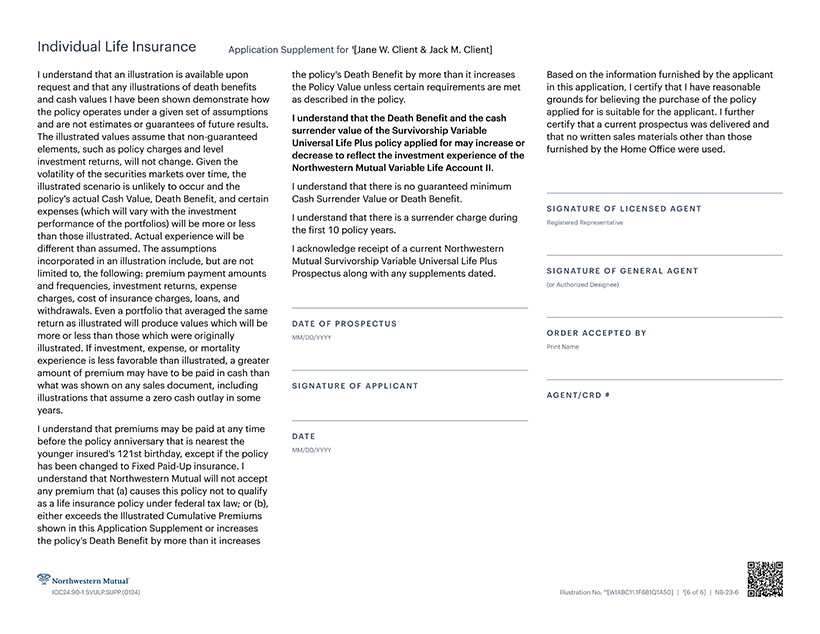

Individual Life Insurance Application Supplement for 1[Jane W. Client & Jack M. Client] I understand that an illustration is available upon the policy’s Death Benefit by more than it increases Based on the information furnished by the applicant request and that any illustrations of death benefits the Policy Value unless certain requirements are met in this application, I certify that I have reasonable and cash values I have been shown demonstrate how as described in the policy. grounds for believing the purchase of the policy the policy operates under a given set of assumptions applied for is suitable for the applicant. I further I understand that the Death Benefit and the cash and are not estimates or guarantees of future results. certify that a current prospectus was delivered and surrender value of the Survivorship Variable The illustrated values assume that non-guaranteed ... that no written sales materials other than those Universal Life Plus policy applied for may increase or elements, such as policy charges and level furnished by the Home Office were used. . ... decrease to reflect the investment experience of the investment returns, will not change. Given the ...... Northwestern Mutual Variable Life Account II. volatility of the securities markets over time, the illustrated scenario is unlikely to occur and the I understand that there is no guaranteed minimum policy’s actual Cash Value, Death Benefit, and certain Cash Surrender Value or Death Benefit. expenses (which will vary with the investment signature of licensed agent I understand that there is a surrender charge during performance of the portfolios) Will be more or less Registered Representative the first 10 policy years, than those illustrated. Actual experience will be different than assumed. The assumptions I acknowledge receipt of a current Northwestern incorporated in an illustration include, but are not Mutual Survivorship Variable Universal Life Plus limited to, the following: premium payment amounts Prospectus along with any supplements dated. signature of general agent and frequencies, investment returns, expense (or Authorized Designee) charges, cost of insurance charges, loans, and withdrawals. Even a portfolio that averaged the same return as illustrated will produce values which will be date of prospectus more or less than those which were originally mm/dd/yyyy order accepted by illustrated. If investment, expense, or mortality print Name experience is less favorable than illustrated, a greater amount of premium may have to be paid in cash than what was shown on any sales document, including signature of applicant illustrations that assume a zero cash outlay in some agent/crd # years. I understand that premiums may be paid at any time before the policy anniversary that is nearest the younger insured’s 121st birthday, except if the policy mm/dd/yyyy has been changed to Fixed Paid-Up insurance. I understand that Northwestern Mutual will not accept any premium that (a) causes this policy not to qualify as a life insurance policy under federal tax law; or (b), either exceeds the Illustrated Cumulative Premiums shown in this Application Supplement or increases the policy’s Death Benefit by more than it increases