Exhibit 99.6

CORPORATE STRUCTURE AND DESCRIPTION OF THE BUSINESS OF DAMON INC.

Name, Address and Incorporation

Damon Inc. (the “Company” or “Damon”) was incorporated under the laws of British Columbia on October 17, 2023. The Company’s head office is located at 704 Alexander Street, Vancouver, BC V6A 1E3 and its registered office is located at 510 West Georgia Street, Suite 1800, Vancouver, BC V6B 0M3 Canada.

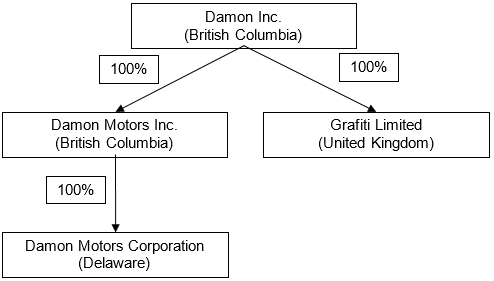

Intercorporate Relationships

The following organization chart indicates the intercorporate relationships of the Company and its material subsidiaries, together with the jurisdiction of formation, incorporation or continuance of each entity.

Description of Business

Damon Motors

The material business of the Company operates through “Damon Surviving Company” (formerly Damon Motors Inc. prior to the amalgamation under the Business Combination). Damon Surviving Company is a British Columbia based motorcycle manufacturing company aiming to building a smart and technologically advanced motorcycle with zero emissions while still maintain performance and safety while also incorporating connectivity and artificial intelligence. References to the “Company” and the description of the business of the Company includes Damon Surviving Company.

Business of the Company

Damon is a motorcycle manufacturing company that aims to transform the motorcycle industry by building a smart and technologically advanced motorcycle. Damon is developing the technology and investing in the capabilities to lead the industry transformation in the high-performance electric motorcycle market. With over 200 years of combined management and engineering experience across the team’s careers, and a commitment to low carbon personal mobility solutions, Damon is introducing existing enthusiasts to high-performance electric products while bringing new riders to the motorcycle community with first of its kind advances in zero emissions motorcycle performance, safety, connectivity and AI.

Founded in 2017, Damon started reimagining the future of motorcycling by means of advanced safety design, electric vehicle powertrain technology and user experience. In 2019, Damon took its first alpha prototype motorcycles and safety systems into the field to test the concept. In 2021, Damon expanded its operations and expertise with an R&D facility in San Rafael, California to accelerate the engineering and development of its HyperDrive platform drive unit and the HyperSport motorcycle. Through core technology advancements, Damon electric motorcycles are in prototype phase of product validation. The Company does not expect any material changes to its business will occur during the current financial year.

Damon’s Market

EV Growth Worldwide

According to the International Energy Agency’s April 2023 Global EV Outlook, global electric car markets are seeing rapid growth as sales exceed 10 million units in 2022. A total of 16% of all new cars sold were electric in 2022, up from around 9% in 2021 and less than 5% in 2020. Three geographic markets dominated global sales. China was the frontrunner, accounting for around 60% of global electric car sales. More than half of the electric cars on roads worldwide are now in China and the country has already exceeded its 2025 target for new energy vehicle sales. In Europe, the second largest market, electric car sales increased by over 15% in 2022, meaning that more than one in every five cars sold was electric. Electric car sales in the United States – the third largest market – increased 55% in 2022, reaching a sales share of 8%. The rest of the world accounts for about 2%.

EV Growth in the North American and European Markets

As reported by Silas Smith of way.com, in North America, the percentage of electric cars hit a new high in early 2022. During the first quarter of 2022, the number of EV registrations increased by 60% despite the generally slow performance of the overall market. During the initial nine months of 2022, a total of 530,577 electric cars were sold in the US. These numbers are only for BEVs. The figures do not include plug-in HEV and Hybrid Electric Vehicles. Almost 65% of these percentage of electric cars were Tesla. As early as 2026, S&P Global Mobility expects the total of new EV models available to break 200 in the US market, as the ICE new model count continues a steady decline. In late 2027/early 2028, the total model count should be at its apex — with the number of options across all propulsion system designs approaching 650. The situation is expected to be similar in Europe. S&P Global Mobility forecasts that the three propulsion system designs — EV, hybrid, and ICE — will each account for between 29% and 36% of the market by the end of this decade. After that, EV share is expected to continue to grow while hybrid plateaus and then joins ICE in a continuous, but slow, decline.

Motorcycle Market Today

The global motorcycle industry is a $144B industry, according to data from Motorcycles Data 2022 Global Industry Sales Report, and there are more than 180M motorcycles and scooters produced per year, which exceeds the number of passenger cars and light trucks produced per year on a combined basis.

Damon’s strategy is to provide premium and high-technology electric motorcycle offerings for each highway-capable motorcycle segment, priced competitively with the other available options with the goal of becoming a leading motorcycle manufacturer with electric motorcycles that outperform comparable gas bikes.

The relevant electric vehicle markets for Damon includes:

| ● | small and large scooters |

| ● | light, medium and heavy motorcycles |

| ● | small and large three-wheelers |

- 2 -

Damon’s current core capabilities are in the light, medium and heavy motorcycle segments. Motorcycles Data 2022 Global Industry Sales Report reported $32.1 billion in light motorcycle sales in 2022, which skewed towards the markets in Asia and Europe, while the sales of medium and heavy motorcycles totaled $11.2 billion, growing at a CAGR of 7.2% and concentrated in North America and Europe, where customers more often choose heavier models.

The North American market accounts for the majority of the market’s profits, whereas the majority of volume is accounted for in Southeast Asia, albeit with significantly lower margins than the North American market. That said, according to Motorcycles Data 2022 Global Industry Sales Report, the average priced motorcycle purchased in Southeast Asia has risen above $2,400, with the fastest growing segment now priced at $3,000. This increase in price is driven mainly by the increasing middle-class incomes across a younger population, where 1 out of every 2 people is now under the age of 40.

Competitive Landscape

The motorcycle market is highly competitive, and Damon expects it will become even more so in the future. Currently, Damon’s competition for its vehicles comes principally from manufacturers of motorcycles with internal combustion engines powered by gasoline, including in the premium and other segments of its business. Although Damon intends to strategically enter the premium electric vehicle segment, it similarly expects this segment will become more competitive in the future as a result of new entrants, both from established brands and start-up companies from various regions of the globe.

Many of Damon’s current and potential competitors have significantly greater financial, technical, manufacturing, marketing and other resources than Damon and may be able to devote greater resources to the design, development, manufacturing, distribution, promotion, sale and support of their products. Based on publicly available information, a number of Damon’s competitors already have displayed prototype electric motorcycles and have announced target availability and production timelines, while others have launched pilot programs or full commercial offerings in certain markets.

Notably, Damon expects competition in its industry to intensify in the future, considering increased demand and regulatory push for alternative fuel vehicles, continuing globalization and consolidation in the worldwide motorcycle industry. Factors affecting competition include, among others, product quality and features, innovation and development time, pricing, reliability, safety, fuel and energy economy, customer service (including breadth of service network) and financing terms. Damon’s ability to successfully compete in the motorcycle industry will be fundamental to its future success in existing and new markets and its market share. There can be no assurance that Damon will be able to compete successfully in the markets in which it operates. If Damon’s competitors introduce new models or services that successfully compete with or surpass the quality, price, performance or availability of Damon’s vehicles or services, it may be unable to satisfy existing customers or attract new customers at the prices and levels that would allow it to generate attractive rates of return on its investment. Increased competition could result in lower vehicle unit sales, price reductions and revenue shortfalls, loss of customers and loss of market share, which may materially adversely affect Damon’s business, financial condition, operating results and prospects.

Damon’s expects competition from two primary segments:

| ● | First, from leading traditional ICE-focused companies including BMW, Honda, Ducati and Triumph. These companies have the ability to scale manufacturing and leverage global distribution capabilities, but do not currently offer a premium electric motorcycle in market. However, some of these companies are beginning to explore entering the electric motorcycle market, albeit typically they do so first with the lowest cost motorcycles and scooters, lower technological know-how required and reduced cannibalization of their high-margin products necessary to enter the bottom segments of the market. |

| ● | Second, electric vehicle-focused companies, including LiveWire, Zero and Energica that have product in market today. Damon’s focus is to provide higher performing motorcycles with enhanced safety features relative to these current products. Unlike LiveWire, which is majority owned by Harley Davidson, Zero and Energica have motorcycles in the market today but lack the global manufacturing and distribution capabilities of the major ICE players. |

- 3 -

While Damon expects competition to grow as the market shifts to electric and more players begin to make serious investments, Damon believes it is well-positioned with its combination of commitment, capabilities and advanced technology to lead the growing electric motorcycle market.

Damon’s Competitive Strengths

We expect to drive continued growth and strong financial performance by leveraging our distinct competitive strengths, each of which we believe provide unique competitive advantages. These include:

Highly qualified and knowledgeable management team

Damon has assembled a top team of innovative electric vehicle and ADAS safety system engineers and management team members with backgrounds spanning design, development and manufacturing who have developed a wide array of electric vehicles, from buses, to cars, motorcycles, VTOL’s and transport trucks across world class companies such as Apple, BMW, Daimler, Uber Elevate, and many others.

Best-in-class strategic partners and suppliers

Damon’s world class strategic partners and suppliers, such as Continental, Fukuta, Brembo, Ohlins, Pirelli, Auteco, Indika Energy and many others, are among the leaders in their respective fields, and Damon believes that such relationships will allow Damon to successfully pursue a competitive position in the global electric motorcycle market.

Head start in the market

Damon believes it has a significant competitive advantage stemming from the coordinated application of multiple new technologies. With more than $75M invested to date, Damon’s products have advanced vehicle range and power at a reduced overall mass and are developed to solve fundamental problems that motorcyclists frequently experience that have long been poorly addressed. These include noise, emissions, range, safety, comfort and digital connectivity.

Patents and trade secrets

Damon’s patent portfolio of 34 national and international parents awarded or filed and collection of trade secrets will further protect this new class of motorcycles. With more than 10 billion media impressions and 1200 original earned articles in 2022, as measured by unique visitors and reach based on BPA audited publications using databases such as Muckrack, Cision and Google Analytics, Damon believes its technological competitive advantage is well infused into its brand, which will continue to provide a market advantage, even as heritage brands look on.

Direct to customer distribution

Unlike its competitors, Damon is one of a few motorcycle manufacturers selling direct to consumers. Selling over the internet, shipping direct and owning and eventually operating its own Damon experience centers is perhaps the most important sales and distribution advantage the Company has over established players, allowing for high margin retention and a vital information feedback loop from its customers that goes straight into manufacturing and vehicle design, while also providing considerably higher profit margins and lower customer acquisition costs over time. The ability to sell motorcycles directly to consumers has shown to be viable in the electric car space; however, it is uncommon in motorcycles. Damon has enjoyed significant success with the direct sales model to date. Damon’s expects to continue to generate an evangelistic brand and following, with a growing backlog currently extending into 2025/2026.

- 4 -

Our Products

Electric Motorcycles

Damon’s electric vehicles are developed with a set of proprietary design principles that elevate the brand, deliver differentiated riding experiences and bring emotion to electric propulsion. The initial product portfolio of motorcycle models will be built upon and utilize a single powertrain platform called HyperDrive™. As a patented, monocoque-constructed battery-chassis, HyperDrive houses a proprietary 150 kW 6-phase liquid cooled IPM motor-gearbox and proprietary electronics. This platform approach establishes a capital-efficient path to grow the product line to meet a wide range of future segments and price points, while also supporting a wide range of future motorcycle models and power sizes that share as much as 85 percent common parts. By using the frame of the battery as the motorcycle’s chassis, HyperDrive also achieves valuable weight and cost reduction advantages. With 150 kW of power at its disposal, HyperDrive has been specifically designed to compete with the performance of market leaders in the high-performance motorcycle market, whether internal combustion or electric. Thanks to the energy modularity designed into it, HyperDrive-based motorcycles can be detuned in power, energy and thus cost to support 500 – 1500cc power equivalent classes of motorcycles in both the North American and European markets, with price points ranging from $20,000 - $80,000.

The HyperDrive platform is contrasted by the smaller, less powerful and lower cost HyperLite platform, currently in its early design phase. HyperLite will be developed using a very similar design architecture as HyperDrive, enabling the production of a range of light weight, low to medium cost motorcycles and scooters with milder levels of horsepower that are more common in overseas and developing markets. With these two platforms paired with Damon’s three patented cornerstone technologies, CoPilot™, Shift™ and its AI-enabled cloud platform. Damon’s long-term objective is to build a premium, high-tech, electric motorcycle company that rivals the largest incumbents in both profit and annual volume, by providing a technologically enhanced riding experience that is not currently available from any other manufacturer.

CoPilot provides a novel rider assistance and warning system integrated into the motorcycle. Shift allows the handlebars and foot pegs to mechatronically adjust on the fly, addressing issues of ergonomic comfort and allowing users to select different riding positions for changing conditions such as a lower, more aerodynamic position for highway use or a more upright position for urban use. Its AI-enabled cloud collects environmental and situational data that, paired with over-the-air software updates, drives a continual loop of collision warning improvements, with an aim to further reduce accident probability over time.

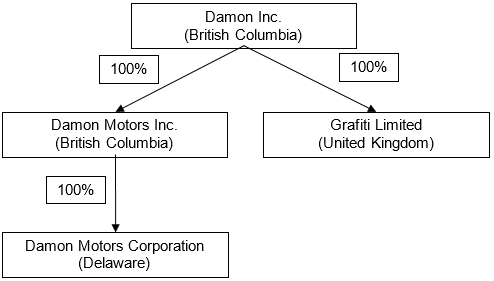

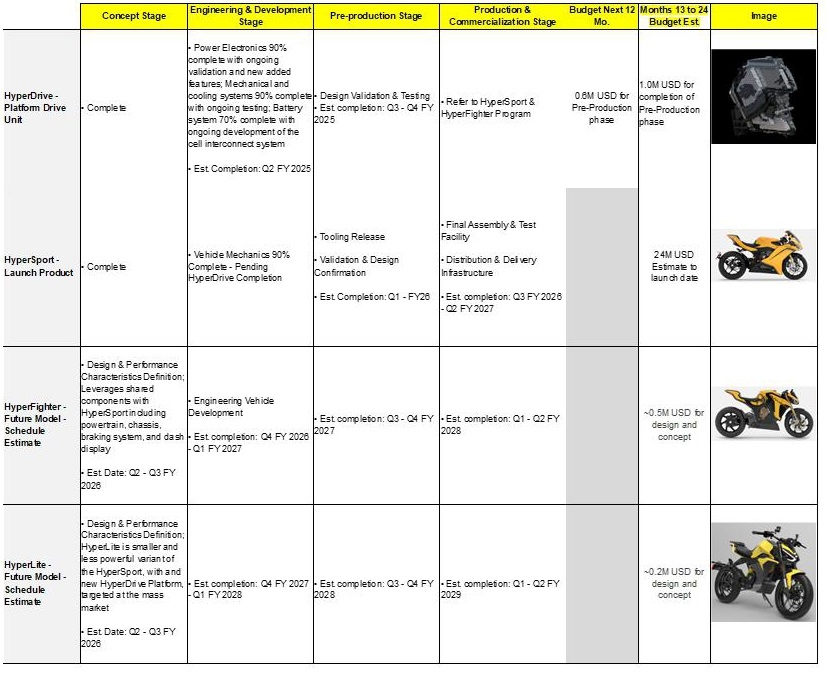

The commercial production of Damon’s motorcycles is expected to commence after passing various internal and external tests and undergoing a self-certification process required for US-bound vehicle homologation. These tests include: the completion of Damon’s ride quality and long-term durability testing, completion of FCC Title 47 certification for the onboard charger, completion of UN 38.3 battery testing, completion of Damon’s internal battery testing, extreme temperature operation verification, brake testing per FMVSS, and an internal and external review of FMVSS compliance with Damon engineering subcontractor TUV of Germany. The following is a further description on the timing and stage of research and development:

| ● | HyperDrive: The HyperDrive serves as a common powertrain platform for both the HyperSport and HyperFighter models. Damon leverages a combination of in-house research and development alongside subcontracting to external experts to advance this project. Currently, in the engineering & development stage, the power electronics are 90% complete, with ongoing validation and the integration of new features. Similarly, the mechanical and cooling systems are 90% complete, with continued testing, while the battery system is 70% complete, with efforts focused on the development of the cell interconnect system. This stage is expected to be completed by Q2 FY 2026. Subsequently, the project will progress to the pre-production stage, which will emphasize design validation and testing, with an anticipated completion by Q3 - Q4 FY 2025. The budget allocated for the next 12 months is $0.6 million and $1.0 million for the next 13 to 18 months, which proposed use of funds is disclosed in the table under the heading “Research and Development” in this Prospectus. |

- 5 -

| ● | HyperSport: The Engineering & Development of the HyperSport is mostly complete, with vehicle mechanics 90% finalized, pending the completion of the HyperDrive platform. The pre-production stage is set to commence, with tooling release as a critical milestone, followed by validation and design confirmation, with an estimated completion by Q1 FY 2026. The Production & Commercialization Stage is ongoing in parallel, focusing on the establishment of the final assembly and test facility, along with the development of distribution and delivery infrastructure. This stage is expected to conclude between Q3 FY 2026 and Q2 FY 2027. The estimated budget for this program for the next 24 months is $24 million. |

| ● | HyperFighter: The HyperFighter shares its powertrain platform with the HyperSport, along with other key components such as the chassis, braking system, and dash display. Currently in the concept stage, the design and performance characteristics of the HyperFighter are being defined, leveraging these shared components, with an estimated completion date in Q2 - Q3 FY 2026. The engineering & development stage will follow with an anticipated completion in Q4 FY 2026 - Q1 FY 2027, and subsequently, the pre-production stage is expected to be completed by Q3 - Q4 FY 2027. The Production & Commercialization Stage is projected to conclude by Q1 - Q2 FY 2028. The budget allocated for the next 24 months is $0.5 million for design and concept. |

| ● | HyperLite: The HyperLite is currently in the concept stage, where the design and performance characteristics are being meticulously defined. This model is envisioned as a smaller and less powerful variant of the HyperSport, featuring a new powertrain platform, and is targeted at the mass market. The concept stage, including simulation and 3D design programs, is expected to be completed by Q2 - Q3 FY 2026. The subsequent engineering & development stage is projected to conclude by Q4 FY 2027 - Q1 FY 2028. Following this, the pre-production stage is anticipated to be completed by Q3 - Q4 FY 2028. The estimated budget for the next 24 months is $0.2 million, allocated for design and concept development. |

- 6 -

| ● | Additional Steps and Estimated Costs: As per the following table: |

Damon is starting the product portfolio with the HyperSport, the launch product sets a premium and high technology nature of the brand, which currently is responsible for more than half of Damon’s 3400+ reservations. Damon plans to launch additional models made possible by reusing the same HyperDrive powertrain platformcore vehicle chassis and powertrain system to address various market segmentation opportunities while reducing new product and platform development investments. Over time, Damon intends to launch additional, lower cost commuter motorcycles, offered with Damon’s advanced features such as CoPilot, Shift, and connectivity to further expand global appeal.

Damon’s strategy is to commercialize and refine costly new technology with a premium family of products in the ‘Hyper’ family of motorcycles for the western market first. This market allows Damon to establish the brand and command the highest margins while ramping up volume. For the large markets in India, Southeast Asia, Asia, Africa and South America, some of the key challenges include price sensitivity, brand appeal, customer credit and financing options, import tax levies, trade tariffs and challenges relating manufacturing as a foreign entity.

Building a successful western brand is the first step to addressing the brand awareness and reputation gap in emerging markets.

To address price sensitivities, a scaled down, smaller powertrain platform called HyperLite will be introduced following the initial HyperDrive motorcycles. Using similar battery technology and a smaller multi-variant battery design as the HyperDrive platform, it will support several models that meet the needs of the 125cc to 400cc market segments in emerging markets such as India, SE Asia, Latin America and Africa. These vehicles are planned to be final assembled, distributed and sold by partners in market, such as Damon’s partnership with Auteco and Indika.

- 7 -

Damon’s HyperLite-based vehicles intend to compete by offering enhanced safety features, technology, or performance. Coupled with cost competitive subscription plans proven in western markets, Damon intends to capture considerable market share by offering a low friction price model with exceptional safety, noise and emissions benefits.

One way to determine the size of an emerging market is by conducting early market validation and testing through online pre-sales campaigns, similar to how Damon has built its order book to date. This will be achieved by conducting early web-based marketing to establish appetite for the HyperLite platform. This web-based marketing will be achieved with local language websites that link to sections of the main Damon website. In addition, Damon will look for strategic business-to-business opportunities, such as sales to other motorcycle manufacturers, last mile and other delivery applications that would allow Damon to establish a beachhead in new regions.

Software and Connectivity

As software-defined vehicles, all of Damon’s cloud backend and control for Damon’s vehicle electronic control unit is an internal development. This approach helps Damon to ensure high compatibility and functionality, integrating critical electric vehicle systems and vehicle functions into one vehicle-cloud-to-vehicle proprietary system. This allows Damon to be responsive to changing consumer needs, to remotely update software and prioritize feature development identified through analysis of Damon’s data sets. This approach will apply to both its HyperLite and HyperDrive line of vehicles.

Damon’s cloud vision is to revolutionize the transportation landscape through its connected vehicle strategy, empowering end users with unrivaled vehicle optimization and supervision capabilities, supporting increasingly better efficiency, safety, and performance.

Damon’s CoPilot system interfaces with the rider via vibrating handlebars for forward collision warning, and via a proprietary 7” touchscreen display. The display includes integrated GPS, 4G-LTE, Bluetooth, high-speed video processing and 500 GB of onboard data storage. With its 1080P resolution, the display enables the following novel features to enhance rider awareness:

| ● | LED forward collision warning to complement the handlebar vibration-based warning; |

| ● | LED blind spot warning; |

| ● | a digital rearview of traffic behind the motorcyclist; |

| ● | charging status via the ‘Dragon’ logo on the back side of the display; and |

| ● | full system control of the motorcycle’s features and functions. |

The Damon app allows riders to interact with the electric motorcycle, providing location-based services, charging stations and vehicle control functions via an integrated user profile. Damon’s app remotely bridges the rider to the bike using built-in cellular connectivity and GPS, providing status, notifications, and alerts. In combination with the cloud system, the mobile app will enable an ecosystem of services provided to Damon riders.

Operations

Sources and Availability of Raw Materials

As a vehicle designer and manufacturer, Damon designs, develops and tests functional vehicle components such as the motor-gearbox, inverter, electronic control unit, rider display interface, battery pack, cooling system and more. It has also designed and developed the bodywork and chassis system. These components are manufactured by world class suppliers such as Fukuta, Sinbon, Inventec and Wistron. Other specialized components such as brakes, suspension, ABS systems and tires are supplied by major brand names such as Brembo, Ohlins, Continental and Dunlop. All final components and subassemblies and shipped for hand assembly by Damon staff. Damon does not procure any raw materials.

- 8 -

Distribution Methods

Damon is positioned to modernize the way electric motorcycles are brought to market, combining online and in-person touchpoints to yield a superior customer experience with greater cost efficiency. With a meaningful gap between the pace at which vehicle retailing has evolved over the past two decades relative to other sectors, Damon believes there is tremendous upside potential for a model that incorporates direct-to-consumer online practices with pull-based vehicle assembly. This significantly lowers on-hand inventory costs, creates a continuous customer order backlog that generates ongoing demand and eliminates the ability for end customers to negotiate on price.

Most Damon customers begin their journey online, with many utilizing a mobile device interfacing via its mobile website or through the Damon app. Damon is investing in digital development to bring those customers to a single front end to address the early stages of their journey and to continue through to purchase.

In North America and Europe, Damon intends to offer interested customers the opportunity for a test ride before making a purchase. In addition, Damon plans to open pop-up locations and brand installations to provide customers to interact with Damon products in key locations.

Beyond North America and Europe, Damon has agreed to a partnership with Auteco Mobility (“Auteco”), for the final assembly, distribution, and sales of Damon’s HyperLite, its lower-cost global electric motorcycle platform.

Damon’s agreement with Auteco is for the development of the Latin American Market, which also includes a provision for technology licensing. Damon intends to make a depopulated variant of its CoPilot technology to provide safety on lower cost vehicles. In its discussion with Auteco, they proposed installing CoPilot on all their bikes and providing the customers with the ability to unlock the safety features for an additional $10/month. The details of these and other licensing opportunities are still to be finalized, but there appears to be strong demand for Damon’s safety technology. For manufacturing, Damon intends to work with Auteco on the assembly, distribution, and sales of Damon branded motorcycles into the LATAM countries where Auteco has an established network.

In addition to Auteco, Damon has received a $5 million investment from, and established a strategic partnership with, PT Ilectra Motor Group and PT Solusi Mobilitas Indonesia for final assembly and distribution in Indonesia with the ability to expand that partnership to all of Southeast Asia. Damon has entered into a relationship agreement with PT Ilectra Motor Group and PT Solusi Mobilitas Indonesia that establishes the strategic partnership and a provided for the purchase of an unsecured promissory note by PT Solusi Mobilitas Indonesia from Damon for $5,000,000. In addition, Damon agreed to invest an aggregate amount of $1,000,000 in PT Ilectra Motor Group.

Intellectual Property

Damon’s intellectual property is a core asset and an important tool to drive value and differentiation in its products and services. Damon protects, uses and defends its intellectual property in support of its business objectives to increase return on investment, enhance competitive position, and create stockholder value. Through strategic and business assessments of its intellectual property, Damon relies on a combination of patents, trade secrets, copyrights, service marks, trademarks, domains, contractual terms and enforcement mechanisms across various international jurisdictions to establish and protect intellectual property related to its current and future business and operations.

As of October 4, 2024, Damon held 14 utility patents and 0 design patents, and had filed an additional 11 utility patent applications and 1 design patent applications in the U.S. Damon also held 2 patents and 10 patent applications that are foreign counterparts of some of its U.S. patents and patent applications with foreign patent offices. Damon does not view any individual patent as being material to its business. Subject to required payments of annuities or maintenance fees, U.S. design patents have a term of 15 years from the date of issuance, and U.S. utility patents have a term of 20 years from the priority application date. Accordingly, Damon’s U.S. patents that have already been issued will expire between 2037 and 2043. Damon’s foreign patents generally have similar expiration dates, but may vary from country to country, the duration being set according to the laws of the jurisdiction that issued the patent. Damon’s trademarks, logos, domain names, and service marks are used to establish and maintain its reputation with its customers, and the goodwill associated with its business. As of October 4, 2024, Damon had 12 registered trademarks and had an additional 2 pending trademark applications with U.S. and foreign trademark offices. The duration of trademark registrations varies from country to country, but it is typically for ten years with unlimited ten-year renewal terms, subject to the payment of maintenance and renewal fees and the laws of the jurisdiction in which the trademark is registered. The below chart sets out a summary of the intellectual property of Damon and the current registration status, as applicable.

- 9 -

| Notes | Type | Country | Status | Application Number | Filing Date | Priority Date | Patent Number | Issue Date | ||||||||

| Battery pack body | Design | United States | Pending | 29/810,362 | 2021-10-04 | 2021-10-04 | ||||||||||

| Haptic feedback | Utility: Non-Provisional | United States | Issued | 16/644,458 | 2020-03-04 | 2017-09-06 | 10,926,780 | 2021-02-23 | ||||||||

| Haptic feedback | Utility: Continuation | United States | Issued | 17/180,739 | 2021-02-20 | 2017-09-06 | 11,528,027 | 2022-12-13 | ||||||||

| Haptic feedback | Utility: Continuation | United States | Issued | 17/992,695 | 2022-11-22 | 2017-09-06 | 11,848,665 | 2023-12-19 | ||||||||

| Haptic feedback | Utility: Continuation | United States | Published | 18/525,077 | 2023-11-30 | 2017-09-06 | ||||||||||

| Rider’s state | Utility: Non-Provisional | United States | Issued | 16/644,451 | 2020-11-18 | 2017-09-06 | 10,994,739 | 2021-05-04 | ||||||||

| Rider’s state | Utility: Continuation | United States | Issued | 17/230,917 | 2021-04-14 | 2017-09-06 | 11,305,778 | 2022-04-19 | ||||||||

| Anticipatory safety | Utility: Non-Provisional | United States | Issued | 16/761,176 | 2020-05-01 | 2017-11-02 | 11,189,166 | 2021-11-30 | ||||||||

| Docked smart device | Utility: Non-Provisional | United States | Issued | 16/972,771 | 2020-12-07 | 2018-06-07 | 11,351,960 | 2022-06-07 | ||||||||

| Docked smart device | Utility: Continuation | United States | Issued | 17/716,486 | 2022-04-08 | 2018-06-07 | 11,731,583 | 2023-08-22 | ||||||||

| Parallel charging | Utility: Non-Provisional | United States | Published | 17/866,443 | 2022-07-15 | 2022-07-15 | ||||||||||

| Monocoque housing batteries | Utility: National Phase | European Patent Office | Published | 21764529.0 | 2022-04-19 | 2020-03-04 | ||||||||||

| Monocoque housing batteries | Utility: National Phase | India | Issued | 2022-17041358 | 2022-07-19 | 2020-03-04 | 514858 | 2024-02-23 | ||||||||

| Monocoque housing batteries | Utility: Non-Provisional | United States | Issued | 16/936,306 | 2020-07-22 | 2020-03-04 | 11,390,349 | 2022-07-19 | ||||||||

| Cell holder | Utility: National Phase | European Patent Office | Published | 21763215.7 | 2022-04-13 | 2020-03-04 | ||||||||||

| Cell holder | Utility: National Phase | India | Issued | 2022-17041359 | 2022-07-19 | 2020-03-04 | 504157 | 2024-01-29 | ||||||||

| Cell holder | Utility: Non-Provisional | United States | Issued | 17/144,131 | 2021-01-07 | 2020-03-04 | 11,594,778 | 2023-02-28 | ||||||||

| Cell holder | Utility: Continuation | United States | Published | 17/994,321 | 2022-11-26 | 2020-03-04 | ||||||||||

| Cell holder | Utility: Continuation-in-Part | United States | Published | 17/984,021 | 2022-11-09 | 2020-03-04 | ||||||||||

| Busbar holder | Utility: National Phase | European Patent Office | Published | 21764466.5 | 2022-04-14 | 2020-03-04 | ||||||||||

| Busbar holder | Utility: Non-Provisional | United States | Issued | 17/146,335 | 2021-01-11 | 2020-03-04 | 11,532,858 | 2022-12-20 | ||||||||

| Multi-modal monocoque | Utility: National Phase | European Patent Office | Published | 21815887.1 | 2022-10-21 | 2020-06-03 | ||||||||||

| Multi-modal monocoque | Utility: National Phase | Indonesia | Pending | P00202215100 | 2022-12-20 | 2020-06-03 | ||||||||||

| Multi-modal monocoque | Utility: National Phase | India | Published | 2022-17070605 | 2022-12-07 | 2020-06-03 | ||||||||||

| Multi-modal monocoque | Utility: Non-Provisional | United States | Issued | 17/243,475 | 2021-04-28 | 2020-06-03 | 11,685,460 | 2023-06-27 | ||||||||

| Multi-modal monocoque | Utility: Continuation | United States | Issued | 17/501,776 | 2021-10-14 | 2020-06-03 | 11,292,548 | 2022-04-05 | ||||||||

| Locking device | Utility: National Phase | European Patent Office | Unfiled | 2020-08-12 | ||||||||||||

| Locking device | Utility: National Phase | Indonesia | Unfiled | 2020-08-12 | ||||||||||||

| Locking device | Utility: Non-Provisional | United States | Issued | 17/495,111 | 2021-10-06 | 2021-10-06 | 11,577,798 | 2023-02-14 | ||||||||

| Locking device | Utility: PCT | World Intellectual Property Organization | Pending | PCT/CA21/51844 | 2021-12-18 | 2021-10-06 |

- 10 -

| Notes | Type | Country | Status | Application Number | Filing Date | Priority Date | Patent Number | Issue Date | ||||||||

| Structural busbar | Utility: Divisional | United States | Published | 18/184,211 | 2023-03-15 | 2021-01-20 | ||||||||||

| Blind spot detector | Utility: Non-Provisional | United States | Allowed | 17/535,519 | 2021-11-24 | 2021-11-24 | ||||||||||

| Blind spot detector | Utility: PCT | World Intellectual Property Organization | Published | PCT/CA22/51696 | 2022-11-16 | 2021-11-24 | ||||||||||

| Lean-compensated | Utility: Non-Provisional | United States | Published | 17/688,862 | 2022-03-07 | 2022-03-07 | ||||||||||

| Lean-compensated | Utility: PCT | World Intellectual Property Organization | Pending | PCT/CA2023/051035 | 2023-08-02 | 2023-08-02 | ||||||||||

| Inductive power accessories | Utility: Non-Provisional | United States | Pending | 17/978,046 | 2022-10-31 | 2022-10-31 | ||||||||||

| Cold-temp brake warning | Utility: Non-Provisional | United States | Published | 17/839,130 | 2022-06-13 | 2022-06-13 | ||||||||||

| Monocoque cooling plate | Utility: Non-Provisional | United States | Published | 17/939,437 | 2022-09-07 | 2022-09-07 | ||||||||||

| Monocoque cooling plate | Utility: PCT | World Intellectual Property Organization | Pending | PCT/CA2023/051519 | 2023-11-14 | 2023-11-14 | ||||||||||

| Cell connectors | Utility: Non-Provisional | United States | Published | 17/902,144 | 2022-09-02 | 2022-09-02 | ||||||||||

| Cell connectors | Utility: PCT | World Intellectual Property Organization | Pending | PCT/CA23/51167 | 2023-09-05 | 2022-09-02 | ||||||||||

| Headlight control | Utility: Non-Provisional | United States | Pending | 17/966,795 | 2022-10-15 | 2022-10-15 | ||||||||||

| Headlight control | Utility: PCT | World Intellectual Property Organization | Pending | PCT/CA2023/051371 | 2023-10-15 | 2022-10-15 | ||||||||||

| DAMON (word) | Trademark | Canada | Issued | 2021474 | 2020-04-08 | 2020-04-08 | 1,148,884 | 2022-11-02 | ||||||||

| DAMON (word) | Trademark | European Union Trademark and Designs Office | Issued | 18517111 | 2021-07-20 | 2021-07-20 | 18517111 | 2021-11-25 | ||||||||

| DAMON (word) | Trademark | United Kingdom | Issued | 00003742431 | 2022-01-12 | 2022-01-12 | 00003742431 | 2022-12-01 | ||||||||

| DAMON (word) | Trademark | United States | Issued | 88865755 | 2020-04-09 | 2020-04-08 | 7,255,418 | 2023-12-26 | ||||||||

| HYPERSPORT (word) | Trademark | United States | Issued | 90563366 | 2021-03-05 | 2021-03-05 | 7,327,923 | 2024-03-12 | ||||||||

| HYPERCROSS (word) | Trademark | Canada | Issued | 2089752 | 2021-03-05 | 2021-03-05 | 1,180,381 | 2023-05-17 | ||||||||

| HYPERCROSS (word) | Trademark | United States | Allowed | 90563413 | 2021-03-05 | 2021-03-05 | ||||||||||

| HYPERFIGHTER (word) | Trademark | Canada | Issued | 2089754 | 2021-03-05 | 2021-03-05 | 1,180,382 | 2023-05-17 | ||||||||

| HYPERFIGHTER (word) | Trademark | United States | Issued | 90563418 | 2021-03-05 | 2021-03-05 | 7,327,924 | 2024-03-12 | ||||||||

| HYPERLITE (word) | Trademark | United States | Allowed | 90563498 | 2021-03-05 | 2021-03-05 | ||||||||||

| SHIFT (word) | Trademark | Canada | Pending | 2096877 | 2021-04-01 | 2021-04-01 | ||||||||||

| SHIFT (word) | Trademark | United States | Allowed | 90619414 | 2021-04-01 | 2021-04-01 | ||||||||||

| COPILOT (word) | Trademark | Canada | Pending | 2096874 | 2021-04-01 | 2021-04-01 | ||||||||||

| DAMON (Design) | Trademark | Canada | Issued | 2120121 | 2021-07-12 | 2021-07-12 | 1,195,702 | 2023-08-30 | ||||||||

| DAMON (Design) | Trademark | European Union Trademark and Designs Office | Issued | 018518682 | 2021-07-20 | 2021-07-20 | 018518682 | 2021-11-25 | ||||||||

| DAMON (Design) | Trademark | United Kingdom | Issued | 00003742424 | 2022-12-01 | 2021-07-12 | 00003742424 | 2022-12-01 | ||||||||

| DAMON (Design) | Trademark | United States | Allowed | 90827971 | 2021-07-14 | 2021-07-12 | ||||||||||

| DAMON (Design) | Trademark | United States | Allowed | 90980794 | 2021-07-14 | 2021-07-12 |

- 11 -

Facilities

Damon entered into a two year and four-month lease on September 12, 2022, for a facility in San Rafael, California, USA. The 18,110 square foot office, manufacturing and warehouse space houses part of the Company’s research and development group, including battery and powertrain development. The majority of this space is for research and development labs, prototype manufacturing, vehicle test and validation, and material storage. The Company’s intention is to begin commercial assembly from the San Rafael location.

Employees

The Company has a total of 24 employees and contractors. Of the 24 employees, 21 are full-time employees, 3 contractors. By location, 14 team members are based in Canada, 7 in the USA, and 3 are based in France and Germany. None of its employees are members of any unions.

Distribution Methods

The Company intends on combining online and in-person approaches to sell its products. The Company believes there is significant potential for a model that incorporates direct-to-consumer online practices with pull-based vehicle assembly. This significantly lowers on-hand inventory costs, creates a continuous customer order backlog that generates ongoing demand and eliminates the ability for end customers to negotiate on price. In North America and Europe, the Company intends to offer interested customers the opportunity for a test ride before making a purchase. In addition, the Company plans to open pop-up locations and brand installations to provide customers to interact with the Company’s products in key locations.

Regulatory Overview

United States

NHTSA Safety and Self-Certification Obligations

As a manufacturer of electric vehicles, Damon’s electric vehicles are subject to, and must comply with, numerous regulatory requirements established by National Highway Traffic Safety Administration (“NHTSA”), including all applicable United States Federal Motor Vehicle Safety Standards (“Safety Standards”). As set forth by the National Traffic and Motor Vehicle Safety Act, Damon must certify that its electric vehicles meet all applicable Safety Standards. At the time of production, Damon intends for its motorcycles to be fully compliant with all such Safety Standards without the need for any exemptions.

Damon is also required to comply with, or demonstrate exemptions from, other requirements of federal laws administered by NHTSA, including the consumer information labeling and owner’s manual requirements and various reporting requirements, such as “early warning” reports regarding warranty claims and field incidents, death and injury reports, foreign recall reports and safety defects reports. In addition, Damon’s products are also subject to certain laws and regulations that have been enacted or proposed, e.g., “Right to Repair,” laws, that could require Damon to provide third-party access to its network and/or vehicle systems.

- 12 -

EPA Certificate of Conformity

The Clean Air Act requires that Damon obtain an Environmental Protection Agency-issued Certificate of Conformity with respect to emissions from its electric vehicles and include labeling providing consumer information such as miles per gallon of gas-equivalent ratings and maximum range on a single charge. The Certificate of Conformity is required each model year for electric vehicles sold in states covered by the Clean Air Act’s standards and is also required each model year for vehicles sold in states that have sought and received a waiver from the Environmental Protection Agency to utilize California standards.

Battery Safety and Testing

Damon’s battery packs are tested in accordance with industry safety standards, including selected tests specified in the SAE J2464 and J2929 standards as well as tests defined by other standards and regulatory bodies and Damon’s own internal safety and quality tests. These tests evaluate battery function and performance as well as resilience to conditions including immersion, humidity, fire and other potential hazards. Damon is still in the process of testing the vehicle battery pack. Testing has taken place at a battery cell and submodule level with the next phase planned for battery module and full pack abuse testing.

European Union

Europe Type Approval

Damon intends to export electric vehicles to Europe. Unlike the United States, once Damon starts operating in this market, it must obtain pre-approval from regulators to import and sell its electric vehicles into the EU and countries that recognize EU certification or have regulatory regimes aligned with the EU (collectively referred to as “Europe”). The process for certification in Europe is known as “Type Approval” and requires Damon to demonstrate to a regulatory agency in the EU, referred to as a “Competent Authority”, that its electric vehicles meet all EU safety and emission standards.

Type Approval is accomplished through witness testing of vehicles as well as inspection of a representative vehicle intended for production and sale. Once the vehicle type is approved, all vehicles manufactured based on the approved type of vehicle may be produced or imported and sold in Europe.

Any changes to an approved vehicle type, including substantial software changes, must go through updated Type Approval by the Competent Authority.

EU Emissions Regulations

Damon believes Europe’s regulatory environment is generally conducive to the development, production and sale of electric vehicles. Through emission legislation, tax incentives and direct subsidies, EU and non-EU countries in Europe are taking a progressive stance in reducing carbon emissions in the transport sector which may lead to increasing demand for electric vehicles.

This is reflected in the EU-wide target of a 90% reduction in greenhouse gas emissions from the transport sector by 2050 (compared to 1990 levels), as part of an economy-wide carbon-neutral target. Moving forward, the European Commission has proposed legislation that would (i) introduce a “cap and trade” carbon pricing system that would apply to the transport sector from 2026; and (ii) require increased levels of national greenhouse gas reduction commitments (which include the transport sector) pursuant to a revision of the Effort Sharing Regulation, as part of efforts to reduce EU emissions by 55% by 2030 (compared to 1990 levels).

- 13 -

Environmental, Health and Safety Regulations

Certain of Damon’s operations, properties and products are subject to stringent and comprehensive international, federal, state and local laws and regulations governing matters including environmental protection, occupational health and safety, and the release or discharge of materials into the environment (including air emissions and wastewater discharges). Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of investigatory and remedial obligations, and the issuance of orders enjoining some or all of Damon’s operations in affected areas.

Damon is also subject to permitting, registration, and other government approval requirements under environmental, health and safety laws and regulations applicable in the jurisdictions in which Damon operates. Those requirements obligate Damon to obtain permits, registrations, and other government approvals from one or more governmental agencies to conduct its operations and sell its products. The requirements vary depending on the location where Damon’s regulated activities are conducted.

The following summarizes certain existing environmental, health and safety laws and regulations applicable to Damon’s operations.

United States

Hazardous Substances

Damon is subject to regulations governing the proper handling, storage, transportation and disposal of products containing hazardous substances. Transportation of its battery packs (and of equipment containing them) is governed by regulations that address risks posed during different modes of transport (e.g.¸ air, rail, ground, ocean). Governing transportation regulations in the U.S., issued by the Pipeline and Hazardous Materials Safety Administration (“PHMSA”), are based on the United Nations (“UN”) Recommendations and Model Regulations on the Transport of Dangerous Goods as well as related UN Manual Tests and Criteria. Damon plans to test our battery pack against the applicable UN Manual tests for its production battery packs, and the test results demonstrate Damon’s compliance with the PHMSA regulations in the following phases of industrialization.

Damon currently uses transition metal oxide cells in its high-voltage battery packs. Damon battery packs include certain packaging materials that contain trace amounts of hazardous chemicals whose use, storage and disposal is regulated under U.S. federal law. As a result, Damon’s battery packs are subject to federal and state environmental laws and regulations that govern the handling and disposal of waste, including, in some instances, the remanufacture, recycling and disposal of hazardous waste.

The laws governing hazardous substances and hazardous waste also may impose strict, joint and several liability for the investigation and remediation of areas where hazardous substances may have been released or disposed. In the course of ordinary operations, Damon, directly and through third parties and contractors, may handle hazardous substances within the meaning of the Comprehensive Environmental Response, Compensation, and Liability Act and similar U.S. federal and state statutes and, as a result, may be jointly and severally liable for all or part of the costs required to clean up sites at which any such hazardous substances have been released into the environment.

European Union

Hazardous Substances

Should Damon expand manufacturing into the EU, it would also be subject to regulations governing the proper handling, and disposal of products containing hazardous substances in the EU, including the EU Waste Framework Directive. In relation to Damon’s batteries, disposal would be governed by the Batteries Directive, which imposes, among other obligations, certain requirements in relation to the disposal of batteries, such as that producers of batteries and producers of other products that incorporate a battery are responsible for the waste management of batteries that they place on the market, in particular the financing of collection and recycling schemes.

- 14 -

In December 2020, the EU proposed a new Batteries Regulation, which, if passed, would include obligations with respect to the amount of recycled content required in batteries placed on the EU market and would introduce mandatory supply chain due diligence obligations with respect to the materials used in its batteries.

Manufacturer and Dealer Regulation in the United States

State laws regulate the manufacture, distribution, sale, and service (including delivery) of motorcycles, and generally require vehicle manufacturers and dealers to be licensed in order to sell vehicles directly to customers in the state. Some states, however, do not permit motorcycle manufacturers to be licensed as dealers or to act in the capacity of a dealer. To sell vehicles directly to residents of these states, Damon must conduct the sale out of state over the internet or telephonically.

In addition, certain states and territories require service facilities to be available for vehicles sold in the state or territory, which may be interpreted to require service facilities to be available for vehicles sold over the internet or telephonically to residents of the state or territory. Puerto Rico, for example, is one such jurisdiction. Such laws could limit Damon’s ability to sell vehicles in states where Damon either does not maintain service facilities or where Damon does not have retail partners licensed to act as dealers who maintain service facilities within these states.

Damon believes that, as a matter of interstate commerce, it may sell an electric vehicle to any consumer in any state in the United States from a Damon retail partner that is duly licensed as a dealer by a state in the United States. That customer may contact a licensed Damon retail partner through the internet, by telephone or visiting the location directly. However, states that prohibit direct sales also restrict traditional sales activities. Accordingly, in order to test drive an electric vehicle or have an in-person discussion with a Damon salesperson regarding issues such as price, financing, trade-ins, options or similar purchase-related topics, a consumer residing in a direct sales-prohibited state would be required to either contact Damon through electronic means (e.g., Internet or telephone) or by traveling out of their home state to visit a licensed Damon retail partner in another state. With respect to service, vehicle manufacturers are prohibited from providing warranty service from an established location within several states. Service for customers residing in those states may in the future be provided by a mobile unit dispatched from a licensed service location in a nearby state where warranty service is allowed or by that customer driving their Damon vehicle (or having it towed) to a state which allows Damon or a licensed Damon retail partner to have a physical service location and perform warranty service activities.

Data Privacy and Cybersecurity Laws and Regulations

Damon’s business collects, uses, handles, stores, receives, transmits and otherwise processes different types of information about a range of individuals, including its customers, riders of its electric vehicles, website visitors, users of its mobile application, its employees and job applicants, and employees of companies it does business with (such as vendors and suppliers). As a result, Damon is and may become subject to existing and emerging federal, state, local and international laws and regulations related to the privacy, security and protection of such information.

The following is an overview of the legal and regulatory framework by jurisdiction that the Company may be subject to.

United States

Within the United States there are numerous data privacy and cybersecurity laws and regulations that the Company may be subject to. Example of these laws and regulations include the Federal Trade Commission (“FTC”) Act, the Gramm-Leach-Bliley Act, the Telephone Consumer Protection Act, the CAN-SPAM Act, California Consumer Privacy Act (“CCPA”), the California Privacy Rights Act (“CPRA”), the Virginia Consumer Data Protection Act (“VCDPA”), the Colorado Privacy Act (“CPA”), the Connecticut Data Privacy Rights Act (“CTDPA”) and the Utah Consumer Privacy Act (“UCPA”).

- 15 -

In the United States, while there is not a single generally applicable federal law governing the processing of personal information, there are federal laws that apply to the processing of certain types of information, or the processing of personal information by certain types of entities, and the Federal Trade Commission and state attorneys general may bring enforcement actions against companies that engage in processing of personal information in a manner that constitutes an “unfair” or “deceptive” trade practice.

In addition, certain states have enacted laws relating to data privacy and the processing of information about residents in those states. The CCPA, which went into effect on January 1, 2020, and applies to Damon’s business, imposes obligations and restrictions on businesses that handle personal information of California residents and provides new and enhanced data privacy rights to California residents, including the right to know, the right to delete and the right to opt out of the sale of personal information as well as additional protections for minors. Certain requirements in the CCPA remain uncertain due to ambiguities in the drafting of or incomplete guidance. Adding to the uncertainty, in November 2020, California voters also passed the CPRA, which amends and expands upon the CCPA, imposes additional obligations and sets forth additional privacy rights for California residents. Additional states, Virginia, Colorado, Connecticut and Utah, also recently enacted comprehensive data privacy laws. Virginia passed the VCDPA, Colorado passed the CCPA, Connecticut passed the CTDPA and Utah passed the UCPA. The CPRA and VCDPA become effective on January 1, 2023, the CPA and CTDPA become effective on July 1, 2023, and the UCPA becomes effective on December 31, 2023. There are currently draft CPRA regulations and draft CPA rules that, when passed, will supplement the CPRA and CCPA. Additionally, laws, regulations, and standards covering marketing and advertising activities conducted by telephone, email, mobile devices, and the Internet, may be applicable to Damon’s business, such as the TCPA, the CAN-SPAM Act and similar state and federal consumer protection laws. Damon is also subject to certain laws and regulations that have been enacted or proposed, such as “Right to Repair” laws, that could require it to provide third-party access to its network and/or vehicle systems.

European Union and the United Kingdom

By expanding into Europe and the United Kingdom, Damon will also become subject to laws, regulations and standards covering data protection and marketing and advertising, including the EU General Data Protection Regulation (“GDPR”) and the United Kingdom data protection regime, consisting primarily of the UK General Data Protection Regulation and the UK Data Protection Act (together referred to as the UK GDPR). The GDPR and UK GDPR regulate the processing of data relating to an identifiable individual (personal data) and impose stringent data protection requirements on organizations with significant penalties for noncompliance. The European Data Protection Board has also released data guidelines for connected vehicles, and the upcoming ePrivacy Regulation is in its final stages.

Rest of World

Regulators and legislators in jurisdictions around the world continue to propose and enact more stringent data protection and privacy laws. New laws as well as any significant changes to applicable laws, regulations, interpretations of laws or regulations, or market practices regarding privacy and data protection or regarding the manner in which Damon seeks to comply with applicable laws and regulations could require Damon to make modifications to its products, services, policies, procedures, notices and business practices. Many large geographies which may become important to Damon’s future success, including Australia, Brazil, Canada, China and India, have passed or are considering comparable data privacy legislation or regulations. Until prevailing compliance practices standardize, the impact of worldwide privacy regulations on Damon’s business and, consequently, its revenue, could be negatively impacted.

Damon prioritizes the trust of its customers and employees and places great emphasis on systems and product security, cybersecurity, and privacy. To earn this trust and comply with the above legal and regulatory framework, Damon is adopting and implementing a variety of technical and organizational security measures, procedures, and protocols designed to protect its systems, products and data, in accordance with the National Institute of Standards and Technology (“NIST”) Cybersecurity Framework.

- 16 -

Utilizing the NIST Cybersecurity Framework, Damon has instituted a cybersecurity program designed to address the evolving cyber-threat landscape. This includes a company-wide risk management structure with capabilities to assess direct and indirect vendors and an enterprise Secure Software Development Lifecycle to ensure that Damon reduces its attack surface by remediating vulnerabilities in the development process itself. Additionally, Damon’s identity and access management procedures and controls are consistent with the NIST Cybersecurity Framework, including measures to validate and authenticate the identity of its corporate users.

Damon maintains a vulnerability management program that includes periodic scans designed to identify security vulnerabilities and implement remediations for potential customer-impacting issues that are found. In addition, Damon conducts penetration tests, receives threat intelligence, follows incident response procedures, and remediates vulnerabilities according to severity and risk. Further, seeking to implement effective management, control, and protection, Damon has established a centralized, organization-wide view of information assets.

Damon’s cloud security program seeks to enable secure cloud architecture deployments and extend security capabilities to the edge of Damon’s network where it interacts with customers. Damon works to increase cybersecurity awareness throughout its organization through education. Damon’s cloud-hosted website and mobile application software services are developed using industry-standard SecDevOps practices and are rigorously tested before deployment. Damon’s product software plan to utilize a zero-trust approach that employs signed certificates, encryption keys, authentication schemes, and cryptography algorithms, and Damon has deployed these measures as appropriate as part of its efforts to secure products’ communications and data transfers, vehicles and their components, including firmware over-the-air (“FOTA”) updates. Additionally, Damon utilizes pre-condition checks, sequence and dependency execution, failure detection, and rollback and recovery when performing updates during the FOTA process.

Damon has also commenced a corporate-wide data privacy program with dedicated cross-functional resources. The objective of Damon’s data privacy program is to facilitate beneficial uses of data to improve its products and services while preserving its customers’ privacy expectations and complying with applicable law. Global data privacy laws and practices are continually evolving, and will continue to guide the operational design, controls, procedures, and policies for Damon’s program. Damon’s strategy accounts for increased risk as its business scales by addressing appropriate security and access controls for customer and employee information. A core tenet of Damon’s privacy program is to implement privacy-by-design principles in both software and hardware development throughout the organization. Damon’s privacy program will continue to evolve and adapt, utilizing industry practices and tailored risk management frameworks, to allow for close collaboration across the organization, particularly between Damon’s information technology and legal functions.

- 17 -