Shareholder Report

|

12 Months Ended |

|

Sep. 30, 2024

USD ($)

shares

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Northeast

Investors Trust

|

| Entity Central Index Key |

0000072760

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Sep. 30, 2024

|

| Northeast Investors Trust |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Northeast Investors Trust

|

| Class Name |

Northeast Investors Trust

|

| Trading Symbol |

NTHEX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Northeast Investors Trust (the "Fund") for the period of October 1, 2023 to September 30, 2024.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.northeastinvestors.com/downloads. You can also request this information by contacting us at 1-800-225-6704.

|

| Material Fund Change Notice [Text Block] |

This report describes material changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-225-6704

|

| Additional Information Website |

www.northeastinvestors.com/downloads

|

| Expenses [Text Block] |

| Northeast Investors Trust |

$225 |

2.14% |

|

| Expenses Paid, Amount |

$ 225

|

| Expense Ratio, Percent |

2.14%

|

| Factors Affecting Performance [Text Block] |

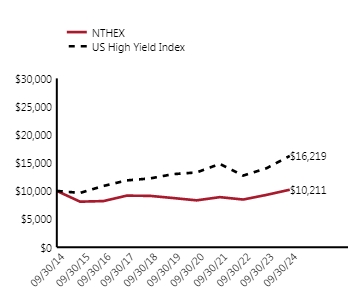

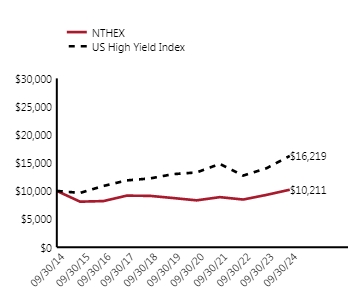

During fiscal year 2024 ended on September 30, Northeast Investors Trust posted a total return of 9.91% which compares with the total return of the ICE Bank of America US High Yield Index (US High Yield Index) of 15.68%. Relative performance was hindered by the effective shorter-duration of the Trust's portfolio, which reduced its sensitivity to interest rate changes. The results were also affected by base effects emanating from the weak relative performance of the Index in September 2023, which served to set up the Index for a strong rally in the period from September-December 2023. Our results for the trailing three years remain favorable compared to the Index. At the individual security level, results were helped by a rise in the price of Pyxus International's bonds, while the bonds of Altice France slumped after the company announced its desire to undertake debt reduction. In general, our underweight position in CCC securities – the riskiest part of the high yield market --- caused a drag in relative performance. There was mixed performance from the out-of-index securities. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

NTHEX |

9.91%

|

3.17%

|

0.21%

|

|

US High Yield Index |

15.68%

|

4.54%

|

4.95%

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 131,746,323

|

| Holdings Count | shares |

50

|

| Advisory Fees Paid, Amount |

$ 665,640

|

| Investment Company, Portfolio Turnover |

29.83%

|

| Additional Fund Statistics [Text Block] |

| Net Assets ($) |

$131,746,323 |

| Number of Portfolio Holdings |

50 |

| Portfolio Turnover Rate (%) |

29.83% |

| Total Trustee Fees Paid ($) |

$665,640 |

|

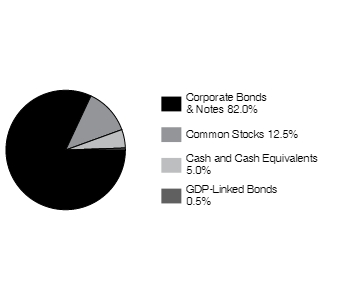

| Holdings [Text Block] |

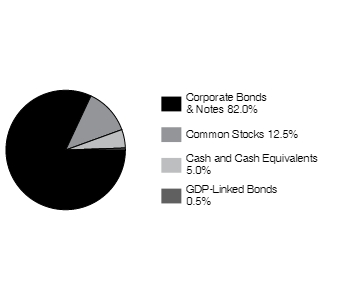

Asset Allocation (% of Total Investments)

|

Corporate Bonds & Notes

|

82.0% |

|

Common Stocks

|

12.5% |

|

Cash and Cash Equivalents

|

5.0% |

|

GDP-Linked Bonds

|

0.5% |

Top Ten Holdings (% of Net Assets)

|

Pyxus Holdco, Inc., 8.5%, 12/31/27

|

6.8% |

|

Brinker International, Inc., 5%, 10/1/24

|

4.6% |

|

Fortress Transportation and Infrastructure Investors LLC, 9.75%, 8/1/27

|

4.3% |

|

Spirit Aerosystems, Inc., 9.375%, 11/30/29

|

4.1% |

|

KB Home, 7.25%, 7/15/30

|

4.0% |

|

Alteryx, Inc., 8.75%, 3/15/28

|

3.9% |

|

Vector Group Ltd, 10.5%, 11/1/26

|

3.8% |

|

Nustar Energy LP, 5.75%, 10/1/25

|

3.8% |

|

Western Digital Corp., 4.75%, 2/15/26

|

3.8% |

|

Delta Air Lines, Inc., 4.5%, 10/20/25

|

3.8% |

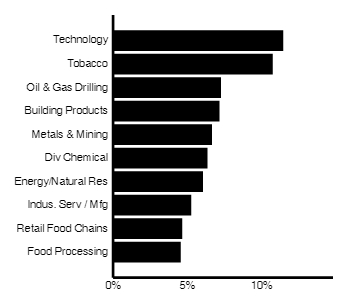

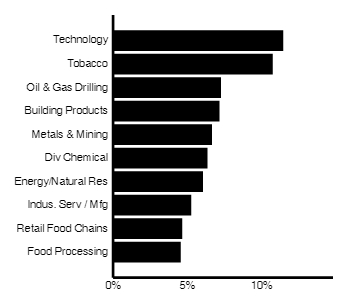

Top Ten Sector Breakdown (% of Net Assets)

|

Technology

|

11.4% |

|

Tobacco

|

10.7% |

|

Oil & Gas Drilling

|

7.2% |

|

Building Products

|

7.1% |

|

Metals & Mining

|

6.6% |

|

Div Chemical

|

6.3% |

|

Energy/Natural Res

|

6.0% |

|

Indus. Serv / Mfg

|

5.2% |

|

Retail Food Chains

|

4.6% |

|

Food Processing

|

4.5% |

|

| Largest Holdings [Text Block] |

Top Ten Holdings (% of Net Assets)

|

Pyxus Holdco, Inc., 8.5%, 12/31/27

|

6.8% |

|

Brinker International, Inc., 5%, 10/1/24

|

4.6% |

|

Fortress Transportation and Infrastructure Investors LLC, 9.75%, 8/1/27

|

4.3% |

|

Spirit Aerosystems, Inc., 9.375%, 11/30/29

|

4.1% |

|

KB Home, 7.25%, 7/15/30

|

4.0% |

|

Alteryx, Inc., 8.75%, 3/15/28

|

3.9% |

|

Vector Group Ltd, 10.5%, 11/1/26

|

3.8% |

|

Nustar Energy LP, 5.75%, 10/1/25

|

3.8% |

|

Western Digital Corp., 4.75%, 2/15/26

|

3.8% |

|

Delta Air Lines, Inc., 4.5%, 10/20/25

|

3.8% |

|

| Material Fund Change [Text Block] |

A Special Meeting of Shareholders of Northeast Investors Trust (the "Trust") was held on February 26, 2024 for the purpose of electing Trustees. Each of the nominees for Trustee, including Independent Trustees, received the affirmative vote of a majority of the shares of the Trust represented in person or by proxy at the Special Meeting and were declared duly elected. |