AVRUPA MINERALS LTD.

(An Exploration Stage Company)

MANAGEMENT’S DISCUSSION AND ANALYSIS – QUARTERLY HIGHLIGHTS

FOR THE SIX MONTHS ENDED JUNE 30, 2024

OVERVIEW AND INTRODUCTORY COMMENT

Avrupa Minerals Ltd. (“Avrupa” or the “Company”) is a growth-oriented junior exploration and development company listed on the TSX Venture Exchange under the trading symbol “AVU”. The Company is currently focusing on discovering economic mineral deposits, using a hybrid prospect generator model (getting other partners to fund our properties to minimize dilution as well as funding our own exploration programs on our top projects), in politically stable and prospective regions of Europe, including Portugal, Kosovo and Finland.

Over the course of 14 years, Avrupa has brought in partners on its exploration projects that have invested approximately $32.75 million in exploration in addition to funds spent by Avrupa. That exploration has led to two discoveries – one gold deposit in Kosovo and one deposit of polymetallic VMS mineralization in the prolific Iberian Pyrite Belt famous for large copper-zinc deposits in southern Portugal.

While Avrupa has been focused on advancing its exploration projects with funds from partners who can earn an interest in its projects by spending exploration funds thereby reducing dilution for shareholders, the Company completed its own exploration program at the Alvalade property. This resulted in the Company entering into an Earn-in Joint Venture Agreement for the Alvalade project with Minas de Aguas Teñidas, S.A. (“Sandfire MATSA” or “MATSA”) and its wholly-owned subsidiary Sandfire Mineira Portugal, Unipessoal Lda. (“SMP”), formerly Emisurmin Unipessoal Lda. (“EUL”) in November 2019.

On December 14, 2021, the Company signed a binding letter agreement (the “Letter Agreement”) with Dutch holding company, Akkerman Exploration B.V. (“AEbv”) to acquire 100% ownership of Akkerman Finland OY (“AFOy”). AFOy owns three mineral reservations in the past-producing and highly prospective Vihanti-Pyhäsalmi VMS district in central Finland and one gold project in the Oijarvi greenstone belt Finland. On February 25, 2022, the Letter Agreement was superseded by the Share Purchase Agreement. The Company currently owns 49% of AFOy.

Avrupa continues to upgrade its precious and base metal targets to JV-ready status in a variety of districts, with the idea of attracting potential partners to project-specific and/or regional exploration programs, and to look for new projects in certain mineral belts in Europe, or nearby.

This MD&A is dated August 27, 2024 and discloses specified information up to that date. Unless otherwise noted, all currency amounts are expressed in Canadian dollars. The following information should be read in conjunction with the unaudited condensed consolidated interim financial statements and the related notes for the six months ended June 30, 2024 and the Company’s audited consolidated financial statements for the year ended December 31, 2023 and the related notes thereto.

Additional information relevant to the Company and the Company’s activities can be found on SEDAR+ www.sedarplus.ca, and/or on the Company’s website at www.avrupaminerals.com.

MAJOR QUARTERLY OPERATING MILESTONES

Alvalade Project (Portugal):

Highlight of the 2023 drilling program

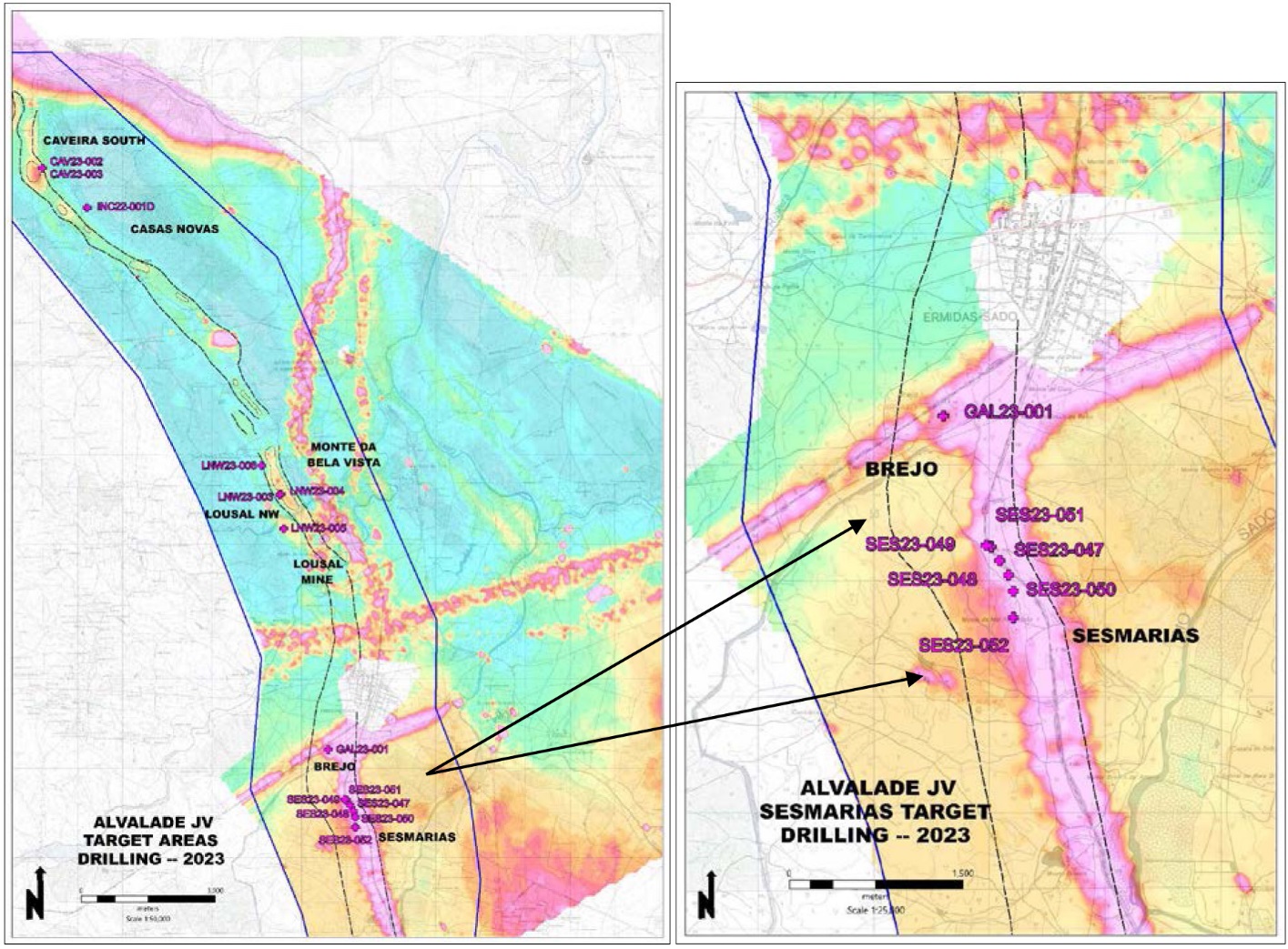

On February 21, 2024, the Company reported that drilling continued throughout the year around the Alvalade pre-exploitation license in several target areas, including Caveira South, Casas Novas, Lousal Northwest, Brejo, and Sesmarias. The Company drilled 14 holes totaling 6,530 meters in 2023: two at Caveira South, one at Casas Novas, four in the Lousal Northwest area, one at Brejo, and six in the Sesmarias massive sulfide VMS deposit area.

Figures 1, 1a. 2023 drilling along trend of Pyrite Belt mineralization within the Alvalade JV license, with Sesmarias enlargement. Background data from 2020-21 helicopter-supported VTEM project. Intense electromagnetic response to railroad tracks and power lines in linear purple colors.

The highlight of the 2023 drilling program was the re-discovery of the high-grade copper-zinc-lead-silver mineralization at Sesmarias in SES23-047 (see AVU news release June 12, 2023). Follow-up drilling at Sesmarias confirmed potential for more high-grade massive sulfide and stockwork mineralization in the Central Zone at Sesmarias (see AVU news release November 28, 2023). The success of the Sesmarias drilling underlies potential for the next phase of drilling there, tentatively commencing in Q2 of 2024. This phase will be aimed at defining the high-grade mineralization located in/around the hinge of the Sesmarias Synform, particularly along strike between the 250 South and 800 South section lines, noted in the figures below. Plans for the next phase are underway.

To enhance targeting at Sesmarias, The Company performed an IP-Resistivity survey at the end of 2023 covering Sesmarias Central and Northern Zones and the Brejo target area just north of Sesmarias. Results were equivocal and not easy to interpret, and remain under evaluation, particularly for the North area and for the Brejo area where we have less historic drilling information. The level of success in the coming phase of drilling will determine how best to move towards a mining license application which will be necessary in the first half of 2025.

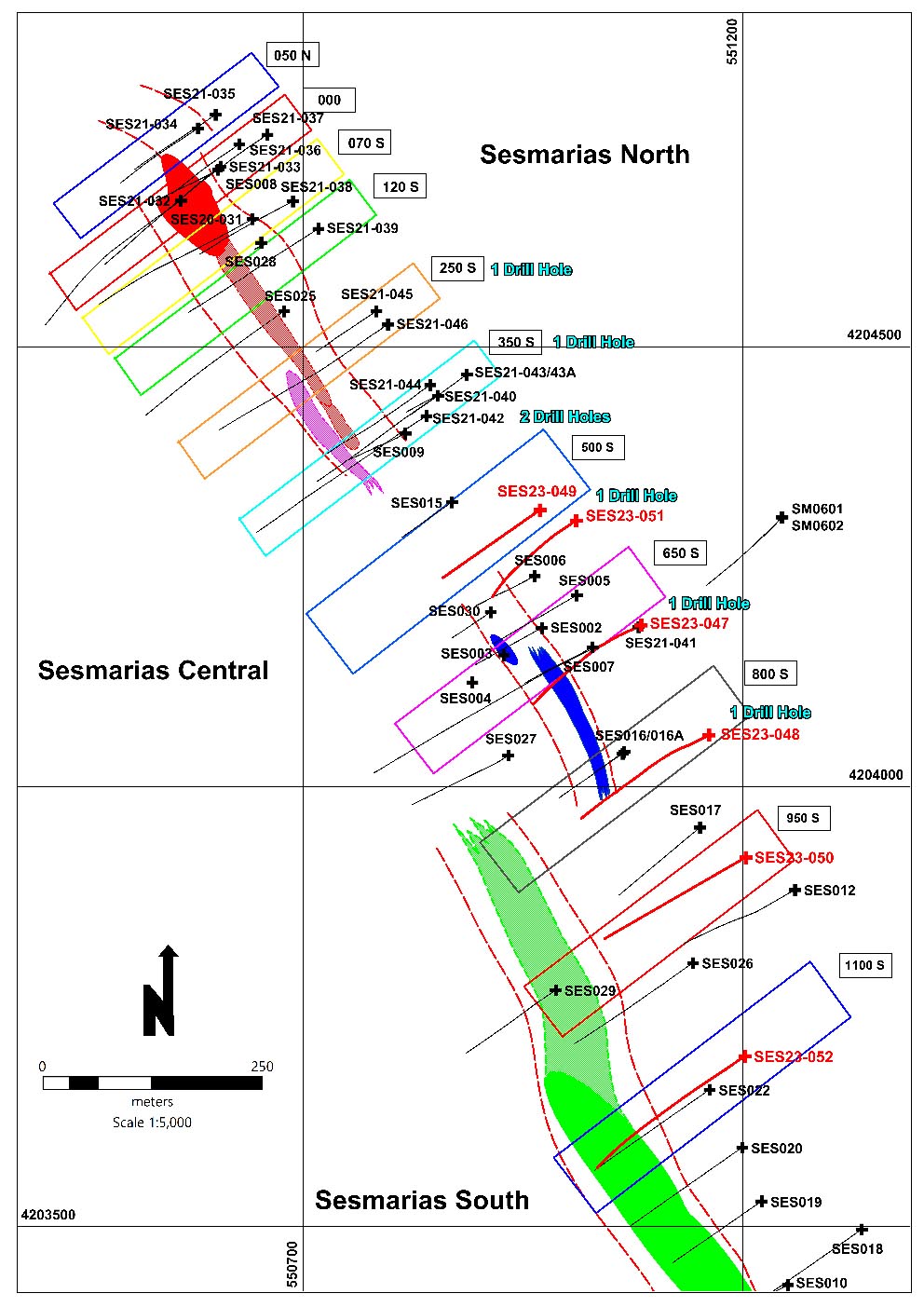

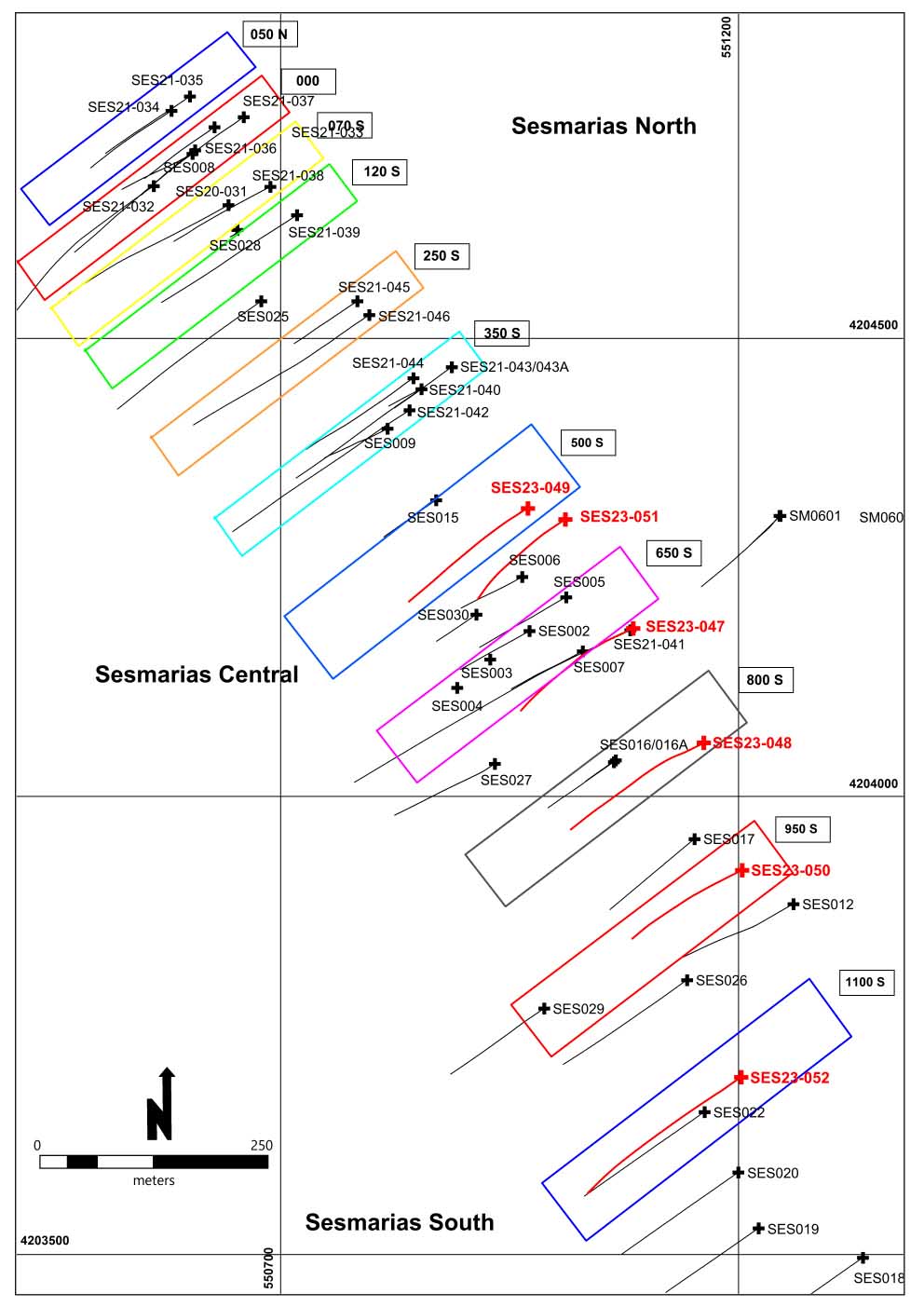

Figure 2. Sesmarias section lines, AVU generated. Drillholes in red were completed during 2023 drilling program. Coordinate system, UTM Zone 29 (ED50).

Drilling in the northern target areas of the Alvalade license was less successful than at Sesmarias. Drilling intersected narrow lenses of polymetallic sulfide mineralization in both Caveira South drill holes and wispy, distal facies, replacement sulfide mineralization in the Casas Novas drill hole. The Company hopes to do follow-up drilling in both areas at some point in the future, but there are no plans for this in the up-coming drilling phase. Drilling at Lousal Northwest intercepted the mineral horizon black shales, but no significant sulfide mineralization.

Further to this report, at this time, the Company has completed planning for the upcoming drilling program at Sesmarias to test the potential for more significant massive sulfide mineralization in the central and northern sectors of the deposit. The Company expects to drill about at least 4,200 meters in the upcoming program.

On June 3, 2024, the Company announced that planning was nearly completed for a new phase of drilling at the Sesmarias copper-zinc volcanogenic massive sulfide prospect within the Alvalade Joint Venture Project. The Company planned to drill seven 600-meter holes along a strike length of 550-600 meters in the Central and Northern sectors of the Sesmarias mineralization (Sections 250S through 800S), potentially followed by two more 600-meter holes that will be collared where necessary, for a possible total of 5,400 meters. The new program follows on a successful 6-hole campaign completed during Q3-Q4 2023.

Starting from the north and moving south, in physical location order, we anticipate the following drill holes:

·Section 250S – one drill hole behind (to the NE) of SES21-045/046;

·Section 350S – one drill hole behind (steeper) SES21-043/043A;

·Along strike, in the never-been-tested area and depth between Sections 350S and 500S and behind SES015 – two holes at different inclinations;

·Between Sections 500S and 650S – one drill hole behind (steeper) SES23-051;

·Section 650S – one drill hole from SES23-047/041 location at an intermediate- inclination between high grade SES23-047 and SES21-041;

·Section 800S – one hole behind SES23-048 (to the NE);

·Possibly two more holes, collar location to be determined on basis of results.

·Exact collar locations will be determined closer to the time of drilling.

The following map summarizes the work completed and planned at Sesmarias:

Figure 3. History of drilling at Sesmarias. In the Central Zone, the blue shape between Sections 650S and 800S represents the surface projection of the potential high-grade hinge zone, while the blue area intersected by the discovery holes, SES002 and SES003, is thought to be a faulted-off block from the hinge in that area. In the North Zone, the red area is the projection of the east limb of the synform, while purple is the west limb. In the South Zone, green represents the surface projection of the west limb of the synform, while no drill holes, to date, have targeted the east limb in the South Zone. There is a long, completely untested strike length of potential mineralization between 350S and 500S. Drill hole locations in red represent drilling from last year’s 6-hole program, and notations in turquoise highlight the sections where the upcoming program will test the mineralized massive sulfide body.

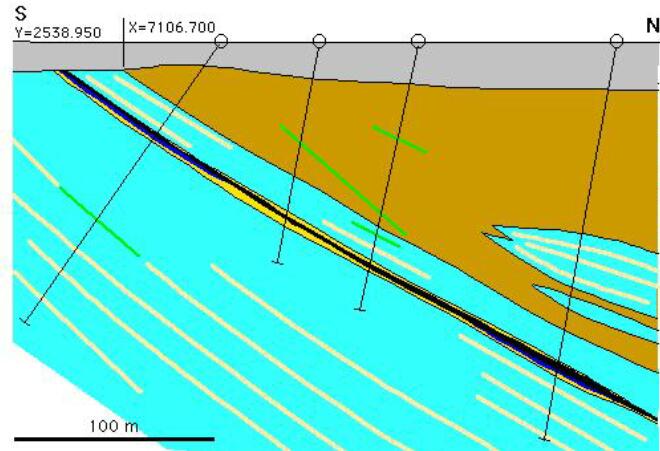

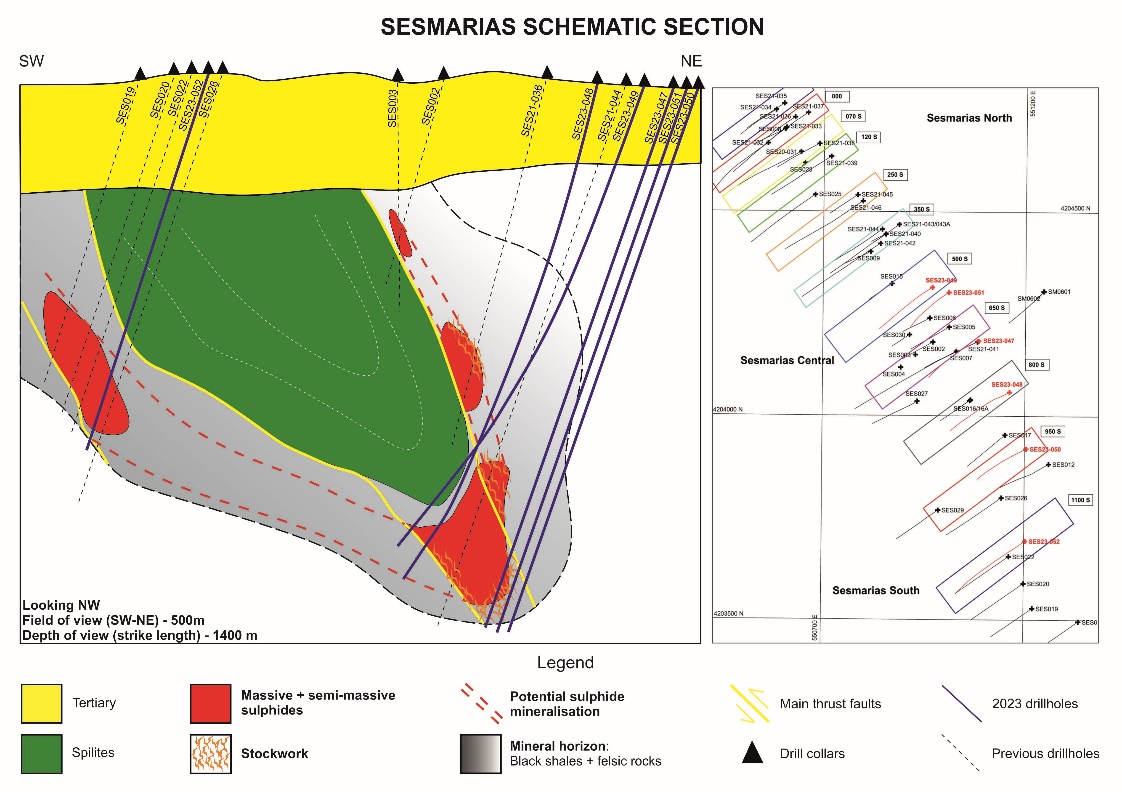

The following conceptual cross section summarizes the geology and location of massive sulfide mineralization hosted in the Sesmarias synformal structure:

Figure 4. Compilation of geological results from drilling in the Northern and Central sectors at Sesmarias, courtesy of PorMining staff. The field of view is 500 meters left to right, and approximately 1,400 meters of depth (strike length) SE to NW. The interpretation demonstrates potential for more massive and stockwork mineralization in both limbs of the synform and in the hinge area along a significant strike distance. The expectation is to find higher grades in and around the hinge of the synform in the Central Zone, and also to the north into the Northern Zone. Drilling in the upcoming campaign will target the hinge zone and environs of the fold along a strike length of 500-600 meters NW to SE.

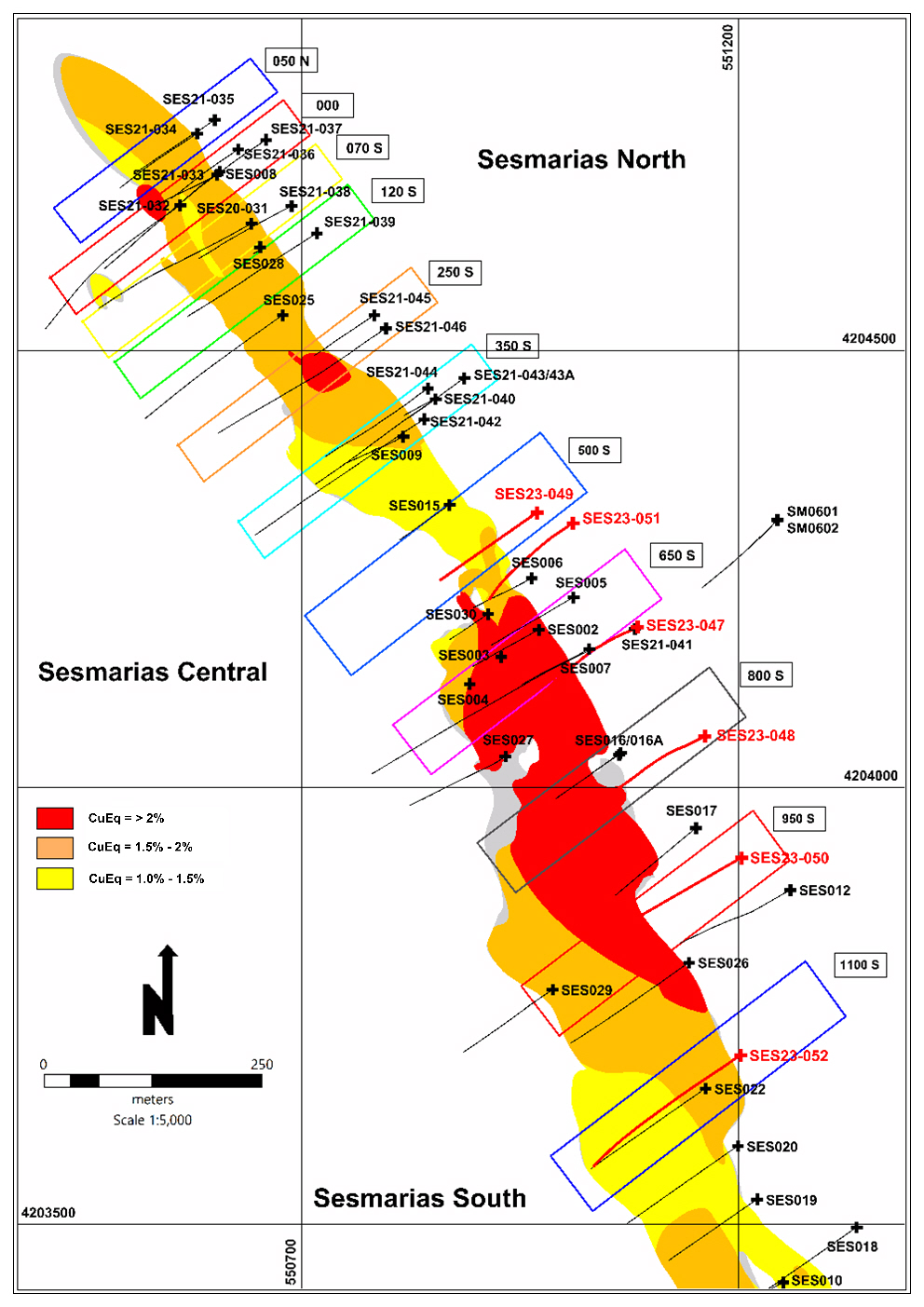

Figure 5. Contour map showing inferred massive sulfide mineralization, using copper equivalents (CuEq) as an exploration targeting tool.

Note: We use CuEq strictly as a proxy for total metal content, and as such, simply as an exploration targeting tool. In no way, are we commenting on a possible resource size or value. When reporting drill results, we utilize only individual metals’ values, as reported by an accredited laboratory.

For exploration purposes, using the results from Sesmarias drilling, 2014 to present, we calculate the total amount of copper, lead, zinc, silver, and gold, without respect or indication of any/all further downstream activities, followed by calculating the value of said total metal content (in this case, as of April 3, 2024, using: Cu = US$ 4.11/lb.; Pb = US$ 0.92/lb.; Zn = US$ 1.13/lb.; Ag = US$ 26.25/oz.; and Au = US$ 2273/oz.). Finally, we calculate the equivalent content of copper, or CuEq, by dividing the value of the total contained metals by the price of copper at that time. The shape and contouring of the inferred Sesmarias mineralization, using Leapfrog geological modeling software, is courtesy of the Sandfire Portugal geological team. While metals’ prices have increased sharply since the original CuEq calculations, the shape of the VMS target area remains much the same.

We have designed the upcoming drill program to upgrade the +2% CuEq zone in the SES Central sector and expand the potential +2% CuEq domain into the SES North sector where historic drilling is less concentrated. Yellow and gray zones generally indicate areas where historic drilling missed the target and/or recent, better-targeted drilling is sparse.

On August 13, 2024, the Company announced that drilling at Sesmarias commenced at the end of June. Drilling is designed to upgrade and enhance the body of higher grade, hinge zone, copper-zinc mineralization intersected in previous holes drilled in 2021 and during last year’s successful program (see previous AVU news releases: June 12, 2023; November 28, 2023; and June 3, 2024).

Slivova Project (Kosovo)

Work continued at the Slivova gold-silver project in Kosovo during 2023, undertaken by partner Western Tethyan Resources (WTR), and supported by 70%-owner Ariana Resources. Highlights of the work included the completion of a NI 43-101 Preliminary Economic Assessment (PEA) study that included a significant mineral resources’ upgrade. The full PEA document, which includes the NI 43-101 Mineral Resource Estimate, may be accessed on SEDAR+ or via the Avrupa Minerals website: Slivova PEA.

Western Tethyan also commenced environmental and social baseline studies in the project area, committing to a strong and positive social relationship with the communities around the project area, and performed exploration rock and soil sampling around the license to help identify satellite deposits. The government issued trenching and drilling permits for this year, and Western Tethyan is in the midst of planning and budgeting for the 2024 program. Work planned, in addition to continued environmental and social licensing, includes trenching over several untested targets and exploration drilling outside of the main deposit in efforts to increase the mineral resources. Eventually, there may be some infill drilling completed in 2024, as well. We anticipate that Western Tethyan will perform the necessary work to reach the 51% ownership level of the license during 2024, as required by the JV agreement.

On August 13, 2024, the Company updated its drilling program at the Slivova Project. WTR plans to drill ~3,000 meters at the Slivova deposit beginning later this summer. While WTR is presently completing trenching and property-wide soil sampling to upgrade potential satellite deposits to Slivova, the Company expects that most of the upcoming work will be directed towards resource development in the main Slivova deposit. Further information concerning the work plans is expected in the coming weeks.

In June 2024, the Company and WTR extended the completion date for the Stage 1 expenditure of €650,000 at the Slivova Project from September 1, 2024 to December 31, 2024.

Finland

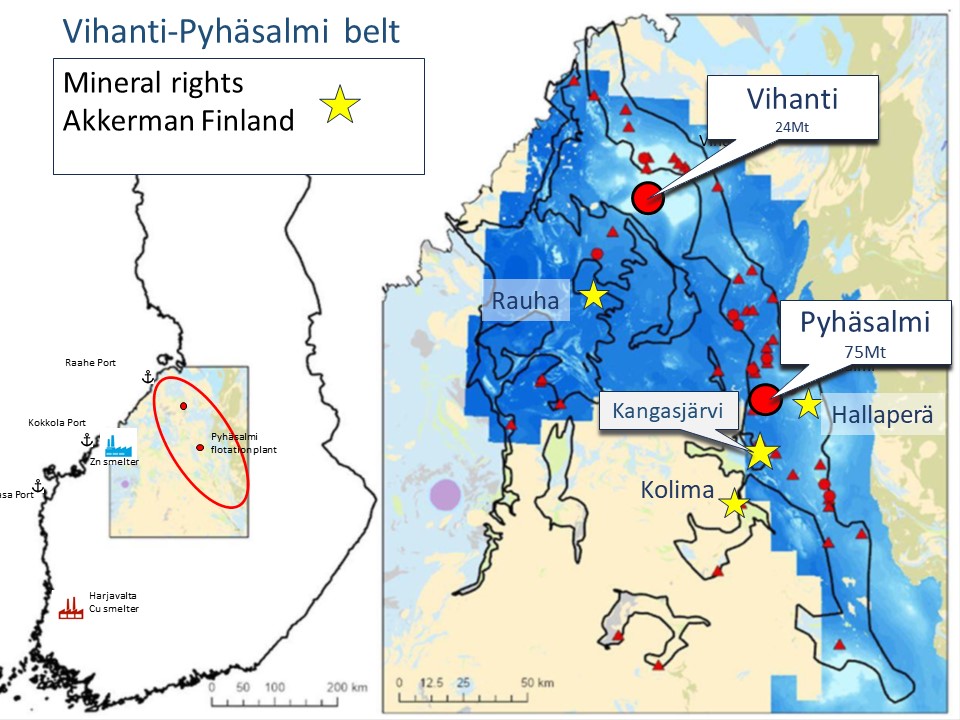

During 2023, Avrupa’s 49%-held Akkerman Finland Oy (AFOy) continued to advance the exploration program in the Vihanti-Pyhäsalmi VMS District of central Finland. The joint venture now holds two exploration permits covering known massive sulfide deposits (Kangasjärvi and Hallaperä), an application over a massive sulfide deposit (Rauhala), and an exploration permit covering a massive sulfide target (Kolima) that has been approved by the mining bureau, but not yet issued due to appeals court handling of the process.

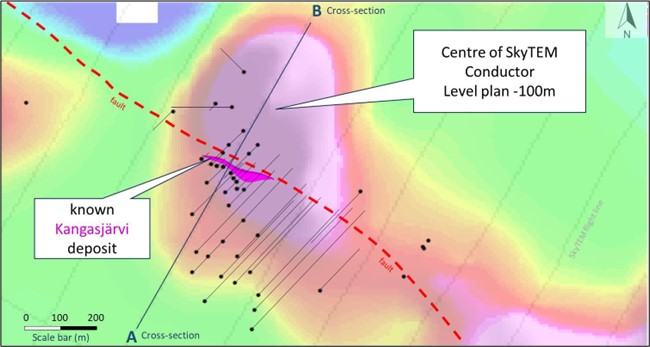

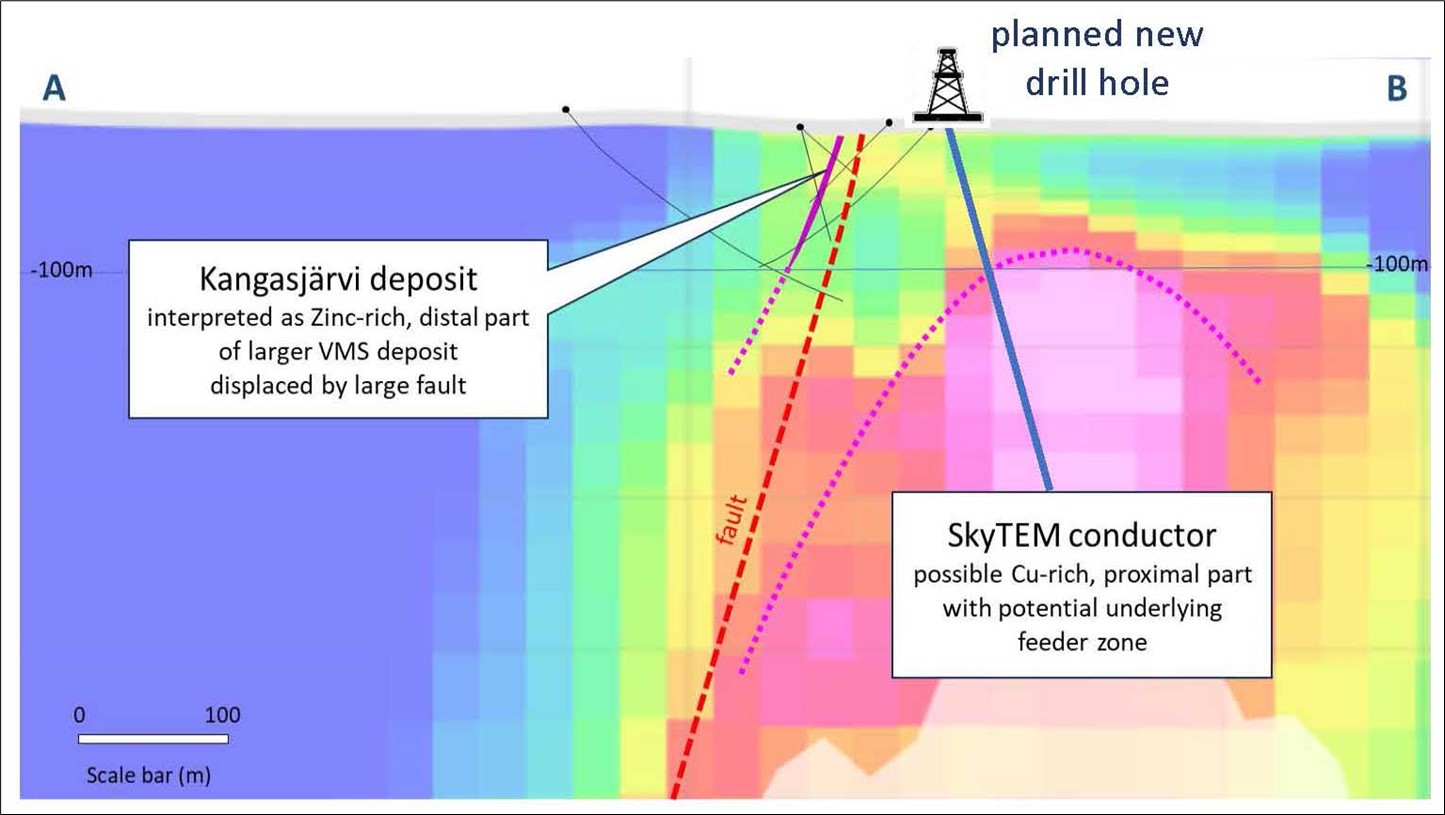

Basic exploration work, continued review of historic core and geophysical data, and modeling of SkyTEM data from the Kangasjärvi license suggest an outstanding un-drilled target close to the old Kangasjärvi Mine. The joint venture is making plans for drilling at the target in 2024. There are further SkyTEM anomalies that may rate drilling after planned exploration work during the up-coming field season.

Figure 1. Map of Vihanti-Pyhäsalmi VMS District with AFOy-AVU holdings and location of the two major mines, Pyhäsalmi and Vihanti.

Figure 2. Plan view of the Kangasjärvi SkyTEM drill target, showing a strong conductor northwest and across a major area fault from the historic Kangasjärvi Mine. Most of the conductor has never been drilled.

Figure 3. Kangasjärvi SkyTEM drill target, section view. The joint venture plans three diamond drill holes totaling 1000 meters later this year. There are other SkyTEM anomalies around the license that may become drill-ready later this year.

AFOy officially acquired the Hallaperä exploration license in the past year. The license covers a known massive sulfide deposit discovered by Outokumpu in 1967. The deposit is 1,500 meters long and ranges from two to 18 meters thick. It remains open at depth below 200 meters from the surface. The most recent drilling, in 1990, cut 1.85 meters @ 1.72% Cu, 1.7 g/t Au, and 44 g/t Ag, with no further work completed since that time.

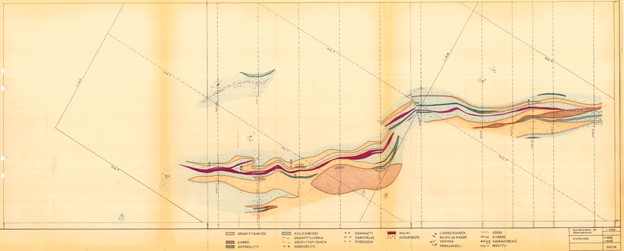

Figure 4. Copy of the original geological map of the Hallaperä VMD deposit.

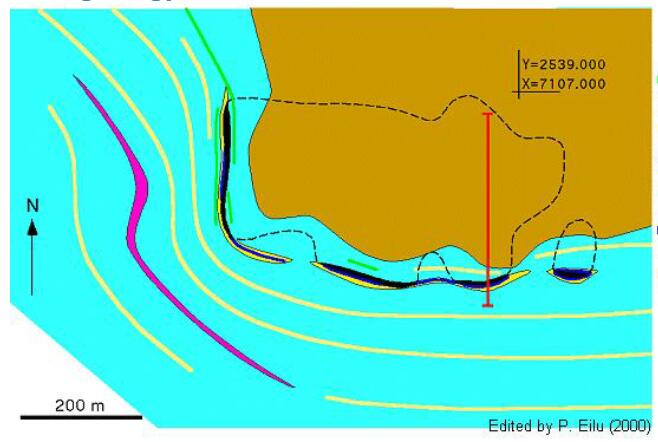

The Finnish mining bureau recently awarded an exploration permit to AFOy for another license covering a massive sulfide deposit near the historic Vihanti Mine. The Rauhala deposit was discovered in 1985 by the Finnish Geological Survey (GTK), and later worked by Outokumpu Oy. It measures nearly 600 meters long and 350 meters wide and averages about 2 meters thick, as presently known. Virtually no work on the deposit has been completed in the past 20-25 years.

Figure 5. Plan view of the Rauha Deposit (blue/black/yellow lenticular outline). The deposit was discovered via a zinc anomaly in till material, and is covered by 2-20 meters of till at its closest point to the surface.

Figure 6. Section view of the sediment-hosted Rauhala Deposit, sub-cropping under 2 to 20 meters of till.

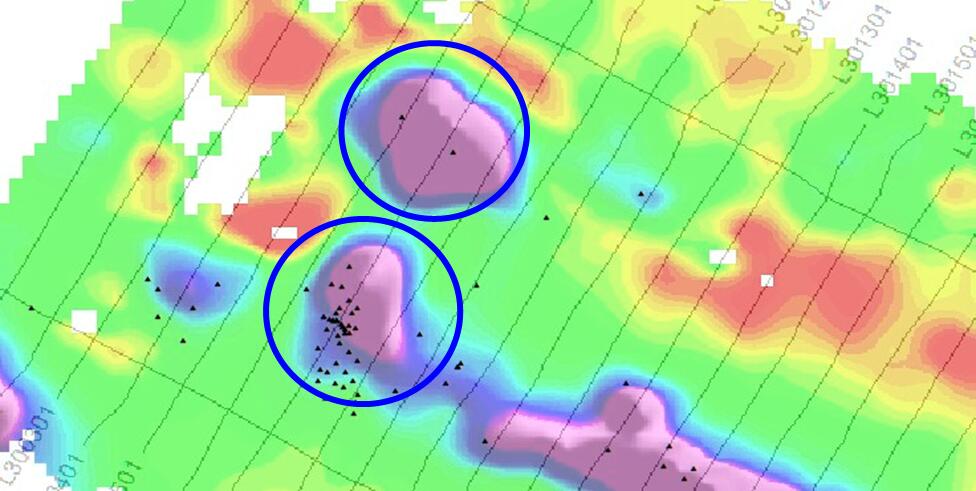

On August 13, 2024, the Company updated its drilling program at the Kangasjärvi Zinc-Copper Prospect. Detailed work carried out at Kangasjärvi over the past three years has led to the discovery of exciting new targets close to the historic deposit. The targets consist of strong electromagnetic (EM) anomalism detected by a deep-penetrating, helicopter EM survey. The intense electric conductivity may reflect the presence of an undiscovered center of massive mineralization, including copper-rich sulfides and a stockwork feeder zone. Modelling points to a possible mineral body measuring 500m by 600m, starting at a depth of 100m and continuing down to more than 500m at both the Kangas Main and Kangas North targets. Neither target has been drilled previously.

Figure 7. Location of the two Kangas EM targets, along with historic drilling locations.

The Company and partner Akkerman Exploration are planning three drill holes, totalling 1,000 meters, in the two targets at Kangas Main and Kangas North. The Company plans to start during early Q4, depending on drill rig availability. More information will be distributed as plans coalesce and the drilling company is locked into a time slot during October.

QUARTERLY FINANCIAL CONDITION

Capital Resources

On August 14, 2024, the Company announced that it intends to complete a non-brokered private placement by issuing 10,000,000 units (“Unit”) at a price of $0.035 per Unit for gross proceeds of $350,000. Each Unit consists of one common share and one common share purchase warrant. Each warrant entitles the holder to purchase one additional common share of the Company at an exercise price of $0.10 per common share, for a period of 36 months from the date of closing of the offering. Finders' fees of 7.0% in cash will be paid to eligible parties.

The proceeds from the issuance of the Units will be used by the Company to fund drilling and exploration programs in Finland, to fund ongoing operations in Portugal and Kosovo, and for general corporate purposes.

The Company is aware of the current conditions in the financial markets and has planned accordingly. The Company’s current treasury and the future cash flows from warrants and options, along with the planned developments within the Company as well as with its JV partner might not be sufficient to carry out its activities throughout 2024. The Company might have to raise additional financing under difficult financial conditions. If the market conditions prevail or improve, the Company will make adjustment to budgets accordingly.

Liquidity

As at June 30, 2024, the Company had a working capital of $34,254 (December 31, 2023 – $132,571). With respect to working capital, $21,515 was held in cash (December 31, 2023 - $121,745). The decrease in cash was due to (a) the general administrative expenses and exploration work expenses totaling $26,481; (b) advance to Akkerman Finland OY of $98,156; (c) purchase of equipment of $593; while being offset by (d) proceeds from share subscription of $25,000.

Operations

For the three months ended June 30, 2024 compared with the three months ended June 30, 2023:

Excluding the non-cash depreciation of $364 (2023 - $514) and bad debt recovery of $3,966 (2023 - $Nil), the Company’s second quarter general and administrative expenses amounted to $123,672 (2023 - $112,378), an increase of $11,294 mainly due to investor relations of $27,576 (2023 - $14,862) as the Company has been promoting its exploration programs; (b) rent of $9,199 (2023 - $2,550); while being offset by the decrease in (c) professional fees of $26,214 (2023 - $38,795) as the Company has been closely monitoring its use of cash.

During the three months ended June 30, 2024, the Company incurred exploration costs totaling $11,809 including $9,223 on Alvalade in Portugal and $2,586 on Slivova in Kosovo. During the three months ended June 30, 2023, the Company incurred exploration costs totaling $11,872 including $5,450 on Alvalade in Portugal and $6,422 on Slivova in Kosovo.

During the three months ended June 30, 2024, the Company recorded a loss of investment in AFOy of $34,217 (2023 - $41,475) for its share of operating loss in AFOy.

During the three months ended June 30, 2024, the Company reported a loss of $54,333 (2023 – $72,430), a decrease of $18,097.

For the six months ended June 30, 2024 compared with the six months ended June 30, 2023:

Excluding the non-cash depreciation of $726 (2023 - $1,023) and bad debt recovery of $16,939 (2023 - $Nil), the Company’s general and administrative expenses amounted to $221,353 (2023 - $227,663), a decrease of $6,310 mainly due to professional fees of $45,129 (2023 - $63,057) as the Company has been closely monitoring its use of cash.

During the six months ended June 30, 2024, the Company incurred exploration costs totaling $20,638 including $15,124 on Alvalade in Portugal and $5,514 on Slivova in Kosovo. During the six months ended June 30, 2023, the Company incurred exploration costs totaling $27,420 including $11,215 on Alvalade in Portugal and $16,205 on Slivova in Kosovo.

During the six months ended June 30, 2024, the Company recorded a loss of investment in AFOy of $39,309 (2023 - $52,940) for its share of operating loss in AFOy.

During the six months ended June 30, 2024, the Company reported a loss of $64,709 (2023 – $78,633), a decrease of $13,924.

SIGNIFICANT RELATED PARTY TRANSACTIONS

During the quarter, there was no significant transaction between related parties.

COMMITMENTS, EXPECTED OR UNEXPECTED, OR UNCERTAINTIES

As of the date of the MD&A, the Company has no outstanding commitments.

Tax deposits:

In November 2018, MAEPA paid €56,505 ($88,201) in lieu of bank guarantees of €77,918 ($121,625) to the Directora de Finanças de Braga in Portugal. This amount was comprised of €51,920 ($81,044) in respect of stamp tax and €4,585 ($7,157) in respect of VAT. The stamp tax portion relates to the interpretation that intercompany advances received by MAEPA are financing loans and, accordingly, are subject to stamp tax. The VAT portion relates to certain invoices for vehicle usage and construction services. As of December 31, 2019, the Company estimated that the judicial review process would take approximately one year for the VAT claim and three to five years for the stamp tax claim and that the likelihood of success for each was 50%. As a result, tax deposits were written down by $41,200 (€28,252) during the year ended December 31, 2019. During 2020, the judicial review ruled that approximately €1,971 VAT remained to be paid while the rest were annulled. The Company accepted this ruling. The Company is still waiting for a trial date regarding the stamp tax and it is estimated that the process can take another two to three years.

Other than disclosed in this MD&A – Quarterly Highlights, the Company does not have any commitments, expected or unexpected, or uncertainties.

RISK FACTORS

In our MD&A filed on SEDAR April 29, 2024 in connection with our annual financial statements (the “Annual MD&A”), we have set out our discussion of the risk factors Exploration risks, Market risks and Financing risk which we believe are the most significant risks faced by Avrupa. An adverse development in any one risk factor or any combination of risk factors could result in material adverse outcomes to the Company’s undertakings and to the interests of stakeholders in the Company including its investors. Readers are cautioned to take into account the risk factors to which the Company and its operations are exposed. To the date of this document, there have been no significant changes to the risk factors set out in our Annual MD&A.

DISCLOSURE OF OUTSTANDING SHARE DATA

The authorized share capital of the Company consists of an unlimited number of common shares without par value. The following is a summary of the Company’s outstanding share data as at June 30, 2024:

| Issued and Outstanding | ||

| June 30, 2024 |

| August 27, 2024 |

|

|

|

|

Common shares outstanding | 54,674,754 |

| 54,674,754 |

Stock options | 1,575,000 |

| 1,575,000 |

Warrants | 16,666,667 |

| 16,666,667 |

Fully diluted common shares outstanding | 72,916,421 |

| 72,916,421 |

Cautionary Statements

This document contains “forward-looking statements” within the meaning of applicable Canadian securities regulations. All statements other than statements of historical fact herein, including, without limitation, statements regarding exploration results and plans, and our other future plans and objectives, are forward-looking statements that involve various risks and uncertainties. Such forward-looking statements include, without limitation, our estimates of exploration investment, the scope of our exploration programs, and our expectations of ongoing administrative costs. There can be no assurance that such statements will prove to be accurate, and future events and actual results could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from our expectations are disclosed in the Company’s documents filed from time to time via SEDAR with the Canadian regulatory agencies to whose policies we are bound. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made, and we do not undertake any obligation to update forward-looking statements should conditions or our estimates or opinions change, except as required by law. Forward-looking statements are subject to risks, uncertainties and other factors, including risks associated with mineral exploration, price volatility in the mineral commodities we seek, and operational and political risks. Readers are cautioned not to place undue reliance on forward-looking statements.