As filed with the U.S. Securities and Exchange Commission on December 23, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact name of Registrant as specified in its charter)

| 6770 | Not Applicable | |||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification No.) |

Wilayah

Persekutuan,

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies of communications to: | ||

Jenny Chen-Drake, Esq. The

Law Offices of Jenny Chen-Drake (310) 358-0880 |

Ying Li, Esq. Guillaume de Sampigny, Esq. Hunter Taubman Fischer & Li LLC 950 Third Avenue, 19th Floor New York, NY 10022 (212) 530-2206 | |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement and the satisfaction or waiver of all other conditions under the Merger Agreement described herein.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction: ☐

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act.

| ____________ |

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

SCHEDULE A —TABLE OF ADDITIONAL REGISTRANTS

Name |

State

or Other Jurisdiction of Incorporation or Organization |

I.R.S.

Employer Identification Number |

Address and Telephone Number of Registrant’s Principal Executive Offices | |||

| Alps Life Sciences Inc | The Cayman Islands | Not Applicable | Unit E-18-01 & E-18-02, Level 18, Icon Tower (East) No. 1, Jalan 1/68F, Jalan Tun Razak 50400 Kuala Lumpur Wilayah Persekutuan, Malaysia +603-2163 1113 |

(1) The agent for service for the Co-Registrant is:

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(212) 947-7200

The information in this proxy statement/prospectus is not complete and may be changed. We may not sell these securities until the U.S. Securities and Exchange Commission declares our registration statement effective. This proxy statement/prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction or state where the offer or sale is not permitted.

PRELIMINARY PROXY STATEMENT/PROSPECTUS

SUBJECT TO COMPLETION DATED DECEMBER 23, 2024

|

|

PROXY STATEMENT FOR SPECIAL MEETING OF

GLOBALINK INVESTMENT INC.

AND PROSPECTUS FOR UP TO 218,964,511 ORDINARY SHARES (INCLUDING SHARES

UNDERLYING WARRANTS) AND 6,035,000 WARRANTS OF

ALPS GLOBAL HOLDING PUBCO

To the Stockholders of Globalink Investment Inc.:

You are cordially invited to attend the special meeting of the stockholders (the “Special Meeting”) of Globalink Investment Inc., (“Globalink”, “we”, “our”, or “us”), which will be held at , Eastern Time, on , 2025. We will be holding the Special Meeting in a virtual meeting format at . Stockholders will NOT be able to attend the Special Meeting in person. This proxy statement/prospectus includes instructions on how to access the Special Meeting and how to listen, vote, and submit questions from home or any remote location with Internet connectivity. You or your proxy holder will be able to attend and vote at the Special Meeting by visiting https://www.cstproxy.com/ and using a control number assigned by Continental Stock Transfer & Trust Company. To register and receive access to the Special Meeting, registered stockholders and beneficial stockholders (those holding shares through a stock brokerage account or by a bank or other holder of record) will need to follow the instructions applicable to them provided in this proxy statement/prospectus.

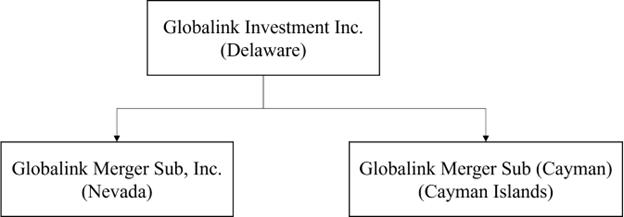

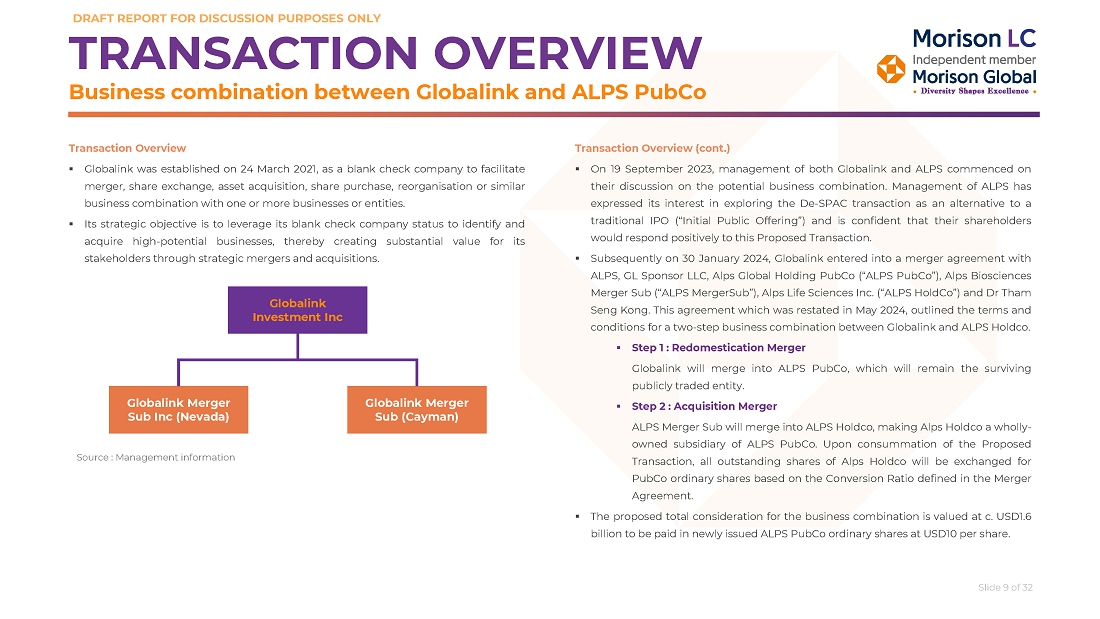

Globalink is a Delaware company incorporated as a blank check company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities. The business combination will be completed through a two-step process consisting of the Redomestication Merger (as defined below) and the Acquisition Merger (as defined below). The Redomestication Merger and the Acquisition Merger are collectively referred to herein as the “Business Combination.”

On January 30, 2024, Globalink entered into a merger agreement (as amended and restated on May 20, 2024 and as may be further amended, restated or supplemented from time to time, the “Merger Agreement”), by and among Globalink, GL Sponsor LLC, a Delaware limited liability company, in the capacity as the representative from and after the effective time of the Acquisition Merger (as defined below) (the “Effective Time”) in accordance with the terms and conditions of the Merger Agreement (the “Parent Representative” or the “Sponsor”), Alps Global Holding Pubco, a Cayman Islands exempted company (“PubCo”), Alps Biosciences Merger Sub, a Cayman Islands exempted company and wholly-owned subsidiary of PubCo (“Merger Sub”), Alps Life Sciences Inc, a Cayman Islands exempted company (“Alps Holdco”) and Dr. Tham Seng Kong, an individual, in the capacity as the representative from and after the Effective Time for the shareholders of Alps Holdco as of immediately prior to the Effective Time in accordance with the terms and conditions of the Merger Agreement (the “Seller Representative”).

Pursuant to the terms of the Merger Agreement, the Business Combination between Globalink and Alps Holdco will be effected in two steps: (i) subject to the approval and adoption of the Merger Agreement by the stockholders of Globalink, Globalink will be merged with and into PubCo, with PubCo remaining as the surviving publicly traded entity (the “Redomestication Merger”); and (ii) Merger Sub will merge with and into Alps Holdco, resulting in Alps Holdco remaining as the surviving entity and being a wholly-owned subsidiary of PubCo (the “Acquisition Merger”). PubCo after the Business Combination is referred to in this proxy statement/prospectus as the “Combined Company.”

As a result of and upon the Closing, pursuant to the terms of the Merger Agreement, all of the outstanding shares of Alps Holdco will be cancelled in exchange for the right to receive PubCo ordinary shares equal to the Conversion Ratio (as defined in the Merger Agreement). The aggregate consideration for the Business Combination is US$1.6 billion, payable at the Closing in the form of newly issued PubCo ordinary shares, at $10.00 per share, of US$0.0001 par value each (the “Merger Consideration Shares”). The Merger Consideration Shares will be allocated pro rata with each shareholder of Alps Holdco receiving a number of PubCo ordinary shares determined in accordance with the terms of the Merger Agreement. Moreover, Alps Holdco’s shareholders will be eligible to receive up to an aggregate of 48,000,000 additional ordinary shares (the “Earnout Shares”) of the Combined Company upon the completion of certain milestones relating to the consolidated revenue of the Combined Company for five fiscal years following the Closing in accordance with the terms set forth in the Merger Agreement.

Subsequent to the execution of the Merger Agreement and as a condition and an inducement to Globalink and Alps Holdco to consummate the Business Combination, PubCo, Globalink and Alps Holdco have entered into subscription agreements (collectively, the “Subscription Agreements”) with certain investors (the “PIPE Investors”) dated June 4, 2024, June 5, 2024 and August 27, 2024, for an aggregate subscription amount of US$40.2 million in PubCo ordinary shares in a private placement to be consummated substantially concurrently with the Closing (the “PIPE Investment”). The purpose of the PIPE Investment is to raise additional capital for the business operations of the Combined Company. The obligations to consummate the transactions contemplated by the Subscription Agreements are conditioned upon, among other things, customary closing conditions and the consummation of the transactions contemplated by the Merger Agreement. The PIPE Investors have not received any payments from the Sponsor in connection with the PIPE Investment.

At the Closing of the Business Combination, such number of ordinary shares the Combined Company representing five percent (5%) of the Merger Consideration Shares are to be issued and held in escrow to satisfy any indemnification obligations incurred under the Merger Agreement (the “Escrow Shares”).

At the Special Meeting, Globalink stockholders will also be asked to consider and vote upon the following proposals:

| ● | to approve the Redomestication Merger. This proposal is referred to as the “Redomestication Merger Proposal;” | |

| ● | to approve the Acquisition Merger, the Merger Agreement and such other transactions contemplated by the Merger Agreement. This proposal is referred to as the “Acquisition Merger Proposal;” |

| ○ | to approve separate proposals, for purposes of complying with the Nasdaq Listing Rule 5635 (the “Nasdaq Listing Rule”), to issue (i) up to 208,000,000 PubCo ordinary shares pursuant to the Merger Agreement (including the ordinary shares issuable pursuant to certain earnout provisions in the Merger Agreement), and (ii) up to 4,020,000 PubCo ordinary shares to the PIPE Investors. These proposals are referred to as the “Nasdaq Proposals;” and |

| ○ | to approve the adjournment of the Special Meeting by the chairman thereof to a later date, if necessary, under certain circumstances, including for the purpose of soliciting additional proxies in favor of the foregoing proposals, in the event that Globalink does not receive the requisite stockholder vote to approve the proposals. This proposal is referred to as the “Adjournment Proposal” and, together with the Redomestication Merger Proposal, the Acquisition Merger Proposal, and the Nasdaq Proposals, the “Proposals.” |

Globalink’s units, common stock, public warrants and public rights are traded on the OTC Pink under the symbols “GLLIU,” “GLLI,” “GLLIW,” and “GLLIR,” respectively. On , 2025, the record date for the Special Meeting, the closing sale prices of Globalink’s units, common stock, public warrants and public rights was $ , $ , $ and $ , respectively.

If the Globalink stockholders approve the Redomestication Merger Proposal and the Acquisition Merger Proposal, immediately prior to the consummation of the Business Combination, all outstanding units of Globalink will separate into their individual components of Globalink common stock, Globalink rights and Globalink warrants and will cease separate existence and trading.

Upon the consummation of the Business Combination the current equity holdings of the Globalink stockholders shall be exchanged as follows:

| (i) | Each share of Globalink common stock, par value $0.001 per share, issued and outstanding immediately prior to the effective time of the Redomestication Merger (other than any redeemed shares), will automatically be cancelled and cease to exist and for each share of Globalink common stock, PubCo shall issue to its holder (other than Globalink stockholders who exercise their redemption rights in connection with the Business Combination) one validly issued PubCo ordinary share, which shall be fully paid; | |

| (ii) | Each Globalink warrant to purchase one-half (1/2) of one share of Globalink common stock issued and outstanding immediately prior to effective time of the Redomestication Merger will convert into one warrant to purchase one-half (1/2) of one PubCo ordinary share (“PubCo warrant”) (or equivalent portion thereof). The PubCo warrants will have substantially the same terms and conditions as set forth in the Globalink warrants; and |

| (iii) | The holders of Globalink rights (convertible into one-tenth (1/10) of one share of Globalink common stock) issued and outstanding immediately prior to the effective time of the Redomestication Merger will obtain the right to receive one-tenth (1/10) of one PubCo ordinary share (“PubCo right”) in exchange for the cancellation of each Globalink right; provided, however, that no fractional shares will be issued and all fractional shares will be rounded to the nearest whole share. |

It is anticipated that upon completion of the Business Combination, assuming no redemptions, Globalink’s public stockholders would retain an ownership interest of approximately 0.2% in PubCo, Globalink public rights holders would retain an ownership interest of approximately 0.8% in PubCo for a total ownership interest held by Globalink’s public stockholders of 0.8%, the PIPE Investors will own approximately 2.4% of PubCo, assuming the PIPE Investors will hold 4,020,000 PubCo ordinary shares, the Parent Representative and officers and directors of Globalink will retain an ownership interest of approximately 2.4% of PubCo, Public Gold Marketing Sdn. Bhd., a Malaysian private limited company and an affiliate of the Sponsor (“PGM”), the holder of 570,000 private units, which include an aggregate of 627,000 shares of Globalink common stock, will retain an ownership interest of approximately 0.4% of PubCo, IBDC Asia Sdn. Bhd., an advisory firm to Alps, will own approximately 0.9% of PubCo, representing finder’s fees payable in PubCo ordinary shares with value equal to 1% of the aggregate consideration for the Business Combination of US$1.6 billion, and the Alps Holdco’ shareholders will own approximately 93.8% of PubCo. These percentages are calculated based on a number of assumptions (described in the accompanying proxy statement/prospectus) and are subject to adjustment in accordance with the terms of the Merger Agreement. If the actual facts are different from these assumptions (which they are likely to be), the percentage ownership retained by the respective parties will be different. See “Frequently Used Terms — Share Calculations and Ownership Percentages” and “Unaudited Pro Forma Condensed Combined Financial Information and Notes.”

PubCo intends to apply for the listing of its ordinary shares and warrants on the Nasdaq under the symbols “ALPS” and “ALPSW”, respectively, in connection with the closing of the Business Combination. We cannot assure you that the PubCo ordinary shares and PubCo warrants will be approved for listing on Nasdaq.

The approval of the Redomestication Merger Proposal, the Acquisition Merger Proposal, the Nasdaq Proposals, and the Adjournment Proposal each require the affirmative vote of the holders of a majority of the shares of Globalink common stock cast by the stockholders represented in person by virtual attendance or by proxy and entitled to vote thereon at the Special Meeting. If either of the Redomestication Merger Proposal or the Acquisition Merger Proposal is not approved, the Nasdaq Proposals will not be presented to the Globalink stockholders for a vote. The approval of the Redomestication Merger Proposal and the Acquisition Merger Proposal are preconditions to the consummation of the Business Combination.

Only holders of record of shares of Globalink common stock at the close of business on , 2025 (the “Record Date”), are entitled to notice of the Special Meeting and the right to vote and have their votes counted at the Special Meeting and any adjournments or postponements of the Special Meeting. Pursuant to the Globalink Charter, Globalink is providing its public stockholders with the opportunity to redeem, upon the closing of the Business Combination, shares of Globalink common stock then held by them for cash equal to their pro rata share of the aggregate amount on deposit (as of two business days prior to the closing of the Business Combination) in the trust account maintained by Continental Stock Transfer & Trust Company for Globalink’s public stockholders (the “Trust Account”) that holds the proceeds (including interest but less franchise and income taxes payable) of the initial public offering of Globalink consummated on December 9, 2021 (the “IPO”). For illustrative purposes, based on funds in the Trust Account of approximately $3.33 million as of December 6, 2024, the estimated per share redemption price would have been approximately $11.98.

Public stockholders may elect to redeem their shares regardless of whether they vote for, against or abstain on the Redomestication Merger Proposal or the Acquisition Merger Proposal. A public stockholder, together with any of his, her or its affiliates or any other person with whom it is acting in concert or as a “group” (as defined under Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), will be restricted from redeeming in the aggregate 20% or more of his, her or its shares of common stock or, if part of such a group, the group’s shares of common stock included in the units sold in the IPO of Globalink. Holders of outstanding units must separate the underlying securities prior to exercising redemption rights with respect to the public shares.

The Sponsor hold an aggregate of 2,835,000 shares of Globalink common stock as of the date of this proxy statement/prospectus. The Sponsor will receive a positive rate of return so long as the market price of the common stock is at least $0.01 per share, even if public stockholders experience a negative rate of return in the Combined Company. The Sponsor, its affiliates and promoters are not receiving compensation in connection with the Business Combination and the PIPE Investment. The Sponsor, its affiliates and promoters will not receive any securities of Globalink or PubCo in connection with the Business Combination and the PIPE Investment. However, the Sponsor is expected to own an equity interest of approximately 1.7% in the Combined Company after the consummation of the Business Combination. For an illustration of the dilutive effect the Business Combination, the PIPE Investment, and related transactions would have on the holders of public shares who hold the securities until the consummation of the Business Combination, see “Summary of the Proxy Statement/Prospectus — Ownership of the Combined Company After the Closing.” As of the date hereof, the deadline that Globalink has to consummate its initial business combination has been extended for a total of eighteen times, and a total of US$1,950,000 has been deposited into the Trust Account in connection with the previous extensions. In connection with funding the extensions, Globalink has issued an aggregate of US$3.85 million in promissory notes to PGM, which are payable upon the Closing. In the event of a liquidation, PGM has waived its rights to any liquidation distributions through the Insider Letter. PGM is an affiliate of the Sponsor as its 95% equity holder has a familial relationship with the control person of the Sponsor. As a result, the Sponsor has an additional interest in causing Globalink to consummate its initial business combination due to its familial relationship with PGM.

Upon the consummation of an initial business combination by Globalink, other than the PubCo ordinary shares that the Initial Stockholders are entitled to upon conversion of their shares of Globalink common stock at the completion of the Redomestication Merger, no additional compensation will be awarded to, earned by, or paid to the Sponsor, its affiliates or any promoters for all services rendered or to be rendered to Globalink and its affiliates. The Sponsor is expected to own an equity interest of approximately 1.7% in the Combined Company after the consummation of the Business Combination. See “The Special Meeting — Recommendation of the Board.”

To induce Chardan Capital Markets, LLC (“Chardan”), the representative of the underwriters for the initial public offering of Globalink (the “IPO”) to proceed with the IPO, and recognizing the economic benefit the IPO would confer upon the Sponsor, officers and directors of Globalink (the “Initial Stockholders”) and PGM, through a letter agreement dated December 6, 2021, by and among Globalink Investment Inc., the Sponsor, PGM and each of Globalink’s directors and officers (the “Insider Letter”), each of the Initial Stockholders and PGM have agreed to waive their redemption rights with respect to any shares of Globalink common stock they may hold in connection with the consummation of the Business Combination, and such shares will be excluded from the pro rata calculation used to determine the per-share redemption price. Currently, the Sponsor, the directors and officers of Globalink and PGM collectively own an aggregate of 92.6% of the issued and outstanding shares of Globalink common stock. The Sponsor and the directors and officers of Globalink have agreed to vote any shares of common stock owned by them in favor of the Redomestication Merger Proposal and the Acquisition Merger Proposal.

Globalink is providing the accompanying proxy statement/prospectus to its stockholders in connection with the solicitation of proxies to be voted at the Special Meeting and at any adjournments or postponements of the Special Meeting. Whether or not you plan to attend the Special Meeting, Globalink urges you to read the accompanying proxy statement/prospectus (and any documents incorporated into the accompanying proxy statement/prospectus by reference) carefully. Please pay particular attention to the section entitled “Risk Factors” beginning on page 52 for a discussion of information that should be considered in connection with an investment in the Combined Company’s securities.

After careful consideration, Globalink’s board of directors has unanimously approved the Merger Agreement and unanimously recommends that Globalink’s stockholders vote “FOR” approval of each of the Proposals. When you consider the recommendation by Globalink’s board of directors of these Proposals, you should keep in mind that the Sponsor and Globalink’s directors and officers have interests in the Business Combination that may conflict or differ from your interests as a stockholder of Globalink. See the section titled “The Acquisition Merger Proposal (Proposal 2) — Interests of Certain Persons in the Business Combination.” Additionally, directors and officers of Alps Holdco have interests that may conflict or differ from your interests as a stockholder of Globalink as certain directors and officers of Alps Holdco are expected to receive certain number of PubCo ordinary shares issued as part of the Merger Consideration Shares. The Globalink Board does not plan to obtain a final fairness opinion related to the Business Combination. The Board has unanimously determined that the Business Combination is in the best interests of, and advisable to, the Globalink stockholders and recommends that the Globalink stockholders adopt the Merger Agreement and approve the Business Combination.

As of the date of this proxy statement/prospectus, a total of 3,445,000 shares of common stock, or approximately 92.6% of the outstanding shares, were subject to the Insider Letter and the Globalink Support Agreements. The approval of the Redomestication Merger Proposal and the Acquisition Merger Proposal does not require the votes from at least a majority of unaffiliated security holders of Globalink. As such, as the vote to approve the Redomestication Merger Proposal and the Acquisition Merger Proposal is a majority of the then outstanding shares of common stock present and entitled to vote at the Special Meeting, assuming only the minimum number of shares of common stock to constitute a quorum is present, no public stockholder must vote in favor of the Redomestication Merger Proposal or the Acquisition Merger Proposal for them to be approved.

Your vote is very important. To ensure your representation at the Special Meeting, please complete and return the enclosed proxy card or submit your proxy by following the instructions contained in the accompanying proxy statement/prospectus and on your proxy card. Please submit your proxy promptly whether or not you expect to participate in the meeting. Submitting a proxy now will NOT prevent you from being able to vote online during the virtual Special Meeting. If you hold your shares in “street name,” you should instruct your broker, bank or other nominee how to vote in accordance with the voting instruction form you receive from your broker, bank or other nominee. If you return your proxy card signed and without indicating how you wish to vote, your proxy will be voted in favor of each of the Proposals presented at the Special Meeting and for the election of each of the directors proposed by Globalink for election. If you fail to return your proxy card or fail to submit your proxy by telephone or over the Internet, or fail to instruct your bank, broker or other nominee how to vote, and do not attend the Special Meeting in person online, the effect will be that your shares will not be counted for purposes of determining whether a quorum is present at the Special Meeting, and, if a quorum is present, will have no effect on the Proposals. If you are a stockholder of record and you attend the Special Meeting and wish to vote during the Special Meeting, you may withdraw your proxy and vote during the Special Meeting.

TO EXERCISE YOUR REDEMPTION RIGHTS, YOU MUST (1) IF YOU HOLD SHARES OF GLOBALINK COMMON STOCK THROUGH UNITS, SEPARATE YOUR UNITS INTO THE UNDERLYING SHARES OF GLOBALINK COMMON STOCK, WARRANTS AND RIGHTS PRIOR TO EXERCISING YOUR REDEMPTION RIGHTS WITH RESPECT TO THE PUBLIC SHARES, (2) SUBMIT A WRITTEN REQUEST, INCLUDING THE LEGAL NAME, PHONE NUMBER AND ADDRESS OF THE BENEFICIAL OWNER OF THE SHARES FOR WHICH REDEMPTION IS REQUESTED, TO THE TRANSFER AGENT AT LEAST TWO BUSINESS DAYS PRIOR TO THE DATE OF THE SPECIAL MEETING, THAT YOUR PUBLIC SHARES BE REDEEMED FOR CASH AND (3) DELIVER YOUR STOCK CERTIFICATES (IF ANY) AND OTHER REDEMPTION FORMS TO THE TRANSFER AGENT, PHYSICALLY OR ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT/WITHDRAWAL AT CUSTODIAN) SYSTEM, IN EACH CASE, IN ACCORDANCE WITH THE PROCEDURES AND DEADLINES DESCRIBED IN THE PROXY STATEMENT/PROSPECTUS. IF THE BUSINESS COMBINATION IS NOT CONSUMMATED, THEN THE PUBLIC SHARES WILL NOT BE REDEEMED FOR CASH. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK, BROKER OR OTHER NOMINEE TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS. SEE “THE SPECIAL MEETING — REDEMPTION RIGHTS” IN THE PROXY STATEMENT /PROSPECTUS FOR MORE SPECIFIC INSTRUCTIONS.

PubCo will be a “foreign private issuer” as defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and will be exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, PubCo’s officers, directors and principal shareholders will be exempt from the reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act. Moreover, PubCo will not be required to file periodic reports and financial statements with the U.S. Securities and Exchange Commission as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

PubCo will be an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and is therefore eligible to take advantage of certain reduced reporting requirements otherwise applicable to other public companies.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the Business Combination or otherwise or passed upon the adequacy or accuracy of the accompanying proxy statement/prospectus. Any representation to the contrary is a criminal offense.

The accompanying proxy statement/prospectus is dated , 2025, and is first being mailed to stockholders of Globalink on or about , 2025.

On behalf of Globalink’s board of directors, I thank you for your support and we look forward to the successful consummation of the Business Combination.

| Sincerely, | |

Say Leong Lim | |

| Chief Executive Officer and Chairman of the Board of Directors | |

| Globalink Investment Inc. |

Globalink Investment Inc.

200 Continental Drive, Suite 401

Newark, Delaware

+6012 405 0015

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON , 2025

To the Stockholders of Globalink Investment Inc.:

NOTICE IS HEREBY GIVEN that a special meeting of stockholders of Globalink Investment Inc., a Delaware corporation (“Globalink,” “we”, “our,” or “us”), will be held virtually on , 2025 at Eastern Time in a virtual meeting format at (the “Special Meeting”). The Globalink Board of Directors has determined to convene and conduct the Special Meeting in a virtual meeting format at . Stockholders will NOT be able to attend the Special Meeting in person. The accompanying proxy statement/prospectus includes instructions on how to access the virtual Special Meeting and how to listen and vote from home or any remote location with Internet connectivity. You or your proxy holder will be able to attend and vote at the Special Meeting by visiting https://www.cstproxy.com/ and using a control number assigned by Continental Stock Transfer & Trust Company. The Special Meeting will be held for the purpose of considering and voting on the proposals (the “Proposals”) described below and in the accompanying proxy statement/prospectus. To register and receive access to the virtual meeting, registered stockholders and beneficial stockholders of Globalink (those holding shares through a stock brokerage account or by a bank or other holder of record) will need to follow the instructions applicable to them provided in the accompanying joint proxy statement/consent solicitation statement/prospectus.

On January 30, 2024, Globalink entered into a merger agreement (as amended and restated on May 20, 2024 and as may be further amended, restated or supplemented from time to time, the “Merger Agreement”), by and among Globalink, GL Sponsor LLC, a Delaware limited liability company, in the capacity as the representative from and after the effective time of the Acquisition Merger (as defined below) (the “Effective Time”) in accordance with the terms and conditions of the Merger Agreement (the “Parent Representative” or the “Sponsor”), Alps Global Holding Pubco, a Cayman Islands exempted company (“PubCo”), Alps Biosciences Merger Sub, a Cayman Islands exempted company and wholly-owned subsidiary of PubCo (“Merger Sub”), Alps Life Sciences Inc, a Cayman Islands exempted company (“Alps Holdco”) and Dr. Tham Seng Kong, an individual, in the capacity as the representative from and after the Effective Time for the shareholders of Alps Holdco as of immediately prior to the Effective Time in accordance with the terms and conditions of the Merger Agreement (the “Seller Representative”).

Pursuant to the terms of the Merger Agreement, the Business Combination between Globalink and Alps Holdco will be effected in two steps: (i) subject to the approval and adoption of the Merger Agreement by the stockholders of Globalink, Globalink will be merged with and into PubCo, with PubCo remaining as the surviving publicly traded entity (the “Redomestication Merger”); and (ii) Merger Sub will merge with and into Alps Holdco, resulting in Alps Holdco remaining as the surviving entity and being a wholly-owned subsidiary of PubCo (the “Acquisition Merger”). PubCo after the Business Combination is referred to in this proxy statement/prospectus as the “Combined Company.”

As a result of and upon the Closing, pursuant to the terms of the Merger Agreement, all of the outstanding shares of Alps Holdco will be cancelled in exchange for the right to receive PubCo ordinary shares equal to the Conversion Ratio (as defined in the Merger Agreement). The aggregate consideration for the Business Combination is US$1.6 billion, payable at the Closing in the form of newly issued PubCo ordinary shares, at $10.00 per share (the “Merger Consideration Shares”). The Merger Consideration Shares will be allocated pro rata with each shareholder of Alps Holdco receiving a number of PubCo ordinary shares determined in accordance with the terms of the Merger Agreement. Moreover, Alps Holdco’s shareholders will be eligible to receive up to an aggregate of 48,000,000 additional ordinary shares (the “Earnout Shares”) of the Combined Company upon the completion of certain milestones relating to the consolidated revenue of the Combined Company for five fiscal years following the Closing in accordance with the terms set forth in the Merger Agreement.

Subsequent to the execution of the Merger Agreement and as a condition and an inducement to Globalink and Alps Holdco to consummate the Business Combination, PubCo, Globalink and Alps Holdco have entered into subscription agreements (collectively, the “Subscription Agreements”) with certain investors (the “PIPE Investors”) dated June 4, 2024, June 5, 2024 and August 27, 2024, for an aggregate subscription amount of US$40.2 million in ordinary shares of PubCo in a private placement to be consummated substantially concurrently with the Closing (the “PIPE Investment”). The purpose of the PIPE Investment is to raise additional capital for the business operations of the Combined Company. The obligations to consummate the transactions contemplated by the Subscription Agreements are conditioned upon, among other things, customary closing conditions and the consummation of the transactions contemplated by the Merger Agreement. The PIPE Investors have not received any payments from the Sponsor in connection with the PIPE Investment.

At the Closing of the Business Combination, such number of ordinary shares the Combined Company representing five percent (5%) of the Merger Consideration Shares are to be issued and held in escrow to satisfy any indemnification obligations incurred under the Merger Agreement (the “Escrow Shares”).

At the Special Meeting, Globalink’s stockholders will be asked to consider and vote upon the following Proposals):

| I. | The Redomestication Merger Proposal (Proposal 1) — To consider and vote upon a proposal to approve the merger of Globalink with and into PubCo, a Cayman Islands exempted company (“PubCo”), with PubCo remaining as the surviving publicly traded entity. This Proposal is referred to as the “Redomestication Merger Proposal.” | |

| II. | The Acquisition Merger Proposal (Proposal 2) — To consider and vote upon a proposal to approve and adopt the merger agreement dated January 30, 2024 (as amended and restated on May 20, 2024 and may be further amended, restated or supplemented from time to time, the “Merger Agreement”), by and among (i) Globalink, (ii) GL Sponsor LLC, a Delaware limited liability company, in the capacity as the representative from and after the effective time of the Business Combination (as defined below) (the “Effective Time”) in accordance with the terms and conditions of the Merger Agreement (the “Parent Representative” or the “Sponsor”), (iii) Alps Global Holding Pubco, a Cayman Islands exempted company (“PubCo”), (iv) Alps Biosciences Merger Sub, a Cayman Islands exempted company and wholly-owned subsidiary of PubCo (“Merger Sub”), (v) Alps Life Sciences Inc, a Cayman Islands company (“Alps Holdco”) and (vi) Dr. Tham Seng Kong, an individual, in the capacity as the representative from and after the Effective Time for the shareholders of Alps Holdco as of immediately prior to the Effective Time in accordance with the terms and conditions of the Merger Agreement (the “Seller Representative”) and (b) the transactions contemplated thereunder, including the merger of Merger Sub with and into Alps Holdco, with Alps Holdco continuing as the surviving company and as a wholly-owned subsidiary of PubCo, and the issuance of PubCo ordinary shares as merger consideration thereunder, as described in more detail in the accompanying proxy statement/prospectus (together with the Redomestication Merger and the other transactions contemplated by the Merger Agreement, the “Business Combination” and PubCo after the Business Combination, the “Combined Company”).

The Acquisition Merger Proposal is described in more detail in the accompanying proxy statement/prospectus under the heading “The Acquisition Merger Proposal (Proposal 2).” A copy of the Merger Agreement is attached to the accompanying proxy statement /prospectus as Annex A.

After the consummation of the Business Combination, |

| ● | Globalink shall merge with and into PubCo and Globalink, the Delaware corporation, shall cease to exist and PubCo shall be the surviving company and the name of the surviving company will be “ALPS Group;” | |

| ● | the authorized shares of the surviving company shall change from 500,000,000 shares of Globalink Common Stock and 5,000,000 shares of Globalink preferred stock to 495,000,000 PubCo ordinary shares of US$0.0001 par value each and 5,000,000 PubCo preferred shares of US$0.0001 par value each; | |

| ● | provisions specific to the Combined Company’s status as a special purpose acquisition company shall be eliminated making the Combined Company’s corporate existence of unlimited duration; and | |

| ● | certain other changes that our board of directors deems appropriate for a public operating company will be made. |

A summary of certain material differences between the amended and restated certificate of incorporation, as amended and currently in effect (the “Globalink Charter”) and the PubCo A&R Memorandum and Articles is presented separately and set forth in the section of this proxy statement/prospectus entitled “Comparison of Corporate Governance and Stockholders’ / Shareholders’ Rights.” A complete copy of the PubCo A&R Memorandum and Articles is attached to the proxy statement/prospectus as Annex B. You are encouraged to read them in their entirety.

| III. | The Nasdaq Proposals (Proposals 3) — To consider and approve upon separate proposals, for purposes of complying with the Nasdaq Listing Rule, to issue (i) up to 208,000,000 PubCo ordinary shares pursuant to the Merger Agreement and (ii) up to 4,020,000 PubCo ordinary shares to the PIPE Investors. The Nasdaq Proposals are described in more detail in the accompanying proxy statement/prospectus under the heading “The Nasdaq Proposals (Proposals 3).” | |

| IV. | The Adjournment Proposal (Proposal 4) — To consider and approve the adjournment of the Special Meeting to a later date, if necessary. We refer to this proposal as the “Adjournment Proposal.” The Adjournment Proposal is described in more detail in the accompanying proxy statement/prospectus under the heading “The Adjournment Proposal (Proposal 4).” |

Only holders of record of shares of Globalink common stock at the close of business on , 2025 (the “Record Date”), are entitled to notice of the Special Meeting and the right to vote and have their votes counted at the Special Meeting and any adjournments or postponements of the Special Meeting. Pursuant to the Globalink Charter, Globalink is providing its public stockholders with the opportunity to redeem, upon the closing of the Business Combination, shares of Globalink common stock then held by them for cash equal to their pro rata share of the aggregate amount on deposit (as of two business days prior to the closing of the Business Combination) in the Trust Account that holds the proceeds (including interest but less franchise and income taxes payable) of the IPO of Globalink. For illustrative purposes, based on funds in the Trust Account of approximately $3.33 million as of December 6, 2024, the estimated per share redemption price would have been approximately $11.98.

Public stockholders may elect to redeem their shares regardless of whether they vote for, against or abstain on the Redomestication Merger Proposal or the Acquisition Merger Proposal. A public stockholder, together with any of his, her or its affiliates or any other person with whom it is acting in concert or as a “group” (as defined under Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), will be restricted from redeeming in the aggregate 20% or more of his, her or its shares or, if part of such a group, the group’s shares of common stock included in the units sold in the IPO of Globalink. Holders of outstanding units must separate the underlying securities prior to exercising redemption rights with respect to the public shares. To induce Chardan, the representative of the underwriters for Globalink’s IPO to proceed with the IPO, and recognizing the economic benefit the IPO would confer upon the Initial Stockholders and PGM, through the Insider Letter, each of the Initial Stockholders and PGM have agreed to waive their redemption rights with respect to any shares of Globalink common stock they may hold in connection with the consummation of the Business Combination, and such shares will be excluded from the pro rata calculation used to determine the per-share redemption price. Currently, the Sponsor and the directors and officers of Globalink collectively own an aggregate of 92.6% of the issued and outstanding shares of Globalink common stock. The Sponsor, the directors and officers of Globalink, and PGM have agreed to vote any shares of common stock owned by them in favor of the Redomestication Merger Proposal, the Acquisition Merger Proposal, and the other Proposals.

Approval of the Redomestication Merger Proposal, the Acquisition Merger Proposal, the Nasdaq Proposals and the Adjournment Proposal will each require the affirmative vote of the holders of a majority of the issued and outstanding shares of common stock present in person by virtual attendance or represented by proxy and entitled to vote at the Special Meeting or any adjournment thereof. The Redomestication Merger Proposal and the Acquisition Merger Proposal are dependent upon each other. It is important for you to note that if either of the Redomestication Merger Proposal or the Acquisition Merger Proposal is not approved, Globalink will not consummate the Business Combination. If either the Redomestication Merger Proposal or the Acquisition Merger Proposal is not approved, the Redomestication Merger Proposal, and the Nasdaq Proposals will not be presented to the Globalink stockholders for a vote. It is important for you to note that, in the event that either of the Redomestication Merger Proposal or the Acquisition Merger Proposal is not approved, Globalink will not consummate the Business Combination.

Globalink currently has until January 9, 2025 to complete its initial business combination, or it will be required to dissolve and liquidate. If Globalink anticipates that it may not be able to consummate its initial business combination in time, Globalink may, by resolutions of its board of directors, if requested by the Sponsor, extend the period of time to consummate a business combination on a monthly basis to until June 9, 2025, subject to the Sponsor depositing additional funds into the Trust Account.

On December 10, 2024, Globalink received a delisting determination letter from the Nasdaq Stock Market (“Nasdaq”) as the 36-month anniversary from its IPO has passed on December 9, 2024, and Globalink are no longer in compliance with Nasdaq Listing Rule IM 5101-2(b). Globalink’s securities were suspended from trading and delisted from Nasdaq on December 17, 2024. As of the same date, Globalink’s securities started trading on OTC Pink. There could be substantial risks to Globalink and PubCo the as a result of Globalink’s non-compliance with this rule. See “Risk Factors — Risks Related to Globalink’s Business and the Business Combination — Our securities were suspended from trading and delisted from Nasdaq on December 17, 2024, following receipt of a delisting determination letter from Nasdaq on December 10, 2024. This could have significant material adverse consequences on us and our securities, including that it will negatively impact our ability to complete a business combination, will limit investors’ ability to make transactions in our securities and could subject us to additional trading restrictions.”

Investing in Globalink’s securities involves a high degree of risk. See “Risk Factors” beginning on page 52 for a discussion of information that should be considered in connection with an investment in Globalink’s securities.

YOUR VOTE IS VERY IMPORTANT. PLEASE VOTE YOUR SHARES PROMPTLY.

Whether or not you plan to participate in the virtual Special Meeting, please complete, date, sign and return the enclosed proxy card without delay, or submit your proxy through the internet or by telephone as promptly as possible in order to ensure your representation at the Special Meeting no later than the time appointed for the Special Meeting or adjourned meeting. Voting by proxy will not prevent you from voting your shares of common stock online if you subsequently choose to participate in the virtual Special Meeting. Please note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote at the Special Meeting, you must obtain a proxy issued in your name from that record. Only stockholders of record at the close of business on the record date may vote at the Special Meeting or any adjournment or postponement thereof. If you fail to return your proxy card or fail to instruct your bank, broker or other nominee how to vote, and do not participate in the virtual Special Meeting, your shares will not be counted for purposes of determining whether a quorum is present at, and the number of votes voted at, the Special Meeting.

You may revoke a proxy at any time before it is voted at the Special Meeting by executing and returning a proxy card dated later than the previous one, by participating in the virtual Special Meeting and casting your vote by hand or by ballot (as applicable) or by submitting a written revocation to Continental Stock Transfer & Trust Company, that is received by the proxy agent before we take the vote at the Special Meeting. If you hold your shares through a bank or brokerage firm, you should follow the instructions of your bank or brokerage firm regarding revocation of proxies.

Globalink’s board of directors has unanimously approved the Merger Agreement and unanimously recommends that Globalink’s stockholders vote “FOR” approval of each of the Proposals. When you consider the recommendation by Globalink’s board of directors of these Proposals, you should keep in mind that the Sponsor and Globalink’s directors and officers have interests in the Business Combination that may conflict or differ from your interests as a stockholder. See the section titled “The Acquisition Merger Proposal (Proposal 2) — Interests of Certain Persons in the Business Combination.”

On behalf of the Board of Directors of Globalink, I thank you for your support and we look forward to the successful consummation of the Business Combination.

| By order of the Board of Directors, | |

Say Leong Lim |

|

| Chief Executive Officer of Globalink Investment Inc. | |

| , 2025 |

IF YOU RETURN YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS.

TO EXERCISE YOUR REDEMPTION RIGHTS, YOU MUST PRIOR TO P.M., EASTERN TIME, ON , 2025, (A) SUBMIT A WRITTEN REQUEST TO THE TRANSFER AGENT THAT GLOBALINK REDEEM YOUR PUBLIC SHARES FOR CASH AND (B) DELIVER YOUR PUBLIC SHARES TO THE TRANSFER AGENT, PHYSICALLY OR ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT WITHDRAWAL AT CUSTODIAN) SYSTEM, IN EACH CASE, IN ACCORDANCE WITH THE PROCEDURES DESCRIBED IN THE PROXY STATEMENT/PROSPECTUS. IF THE BUSINESS COMBINATION IS NOT CONSUMMATED, THEN THE PUBLIC SHARES WILL NOT BE REDEEMED FOR CASH. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS. SEE “THE SPECIAL MEETING — REDEMPTION RIGHTS” IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS FOR MORE SPECIFIC INSTRUCTIONS.

TABLE OF CONTENTS

| i |

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This document, which forms part of a registration statement on Form F-4 filed with the U.S. Securities and Exchange Commission (the “SEC”) by PubCo, constitutes a prospectus of PubCo under Section 5 of the Securities Act, with respect to the issuance of (i) the PubCo ordinary shares to Globalink stockholders, (ii) the PubCo warrants to holders of Globalink warrants in exchange for the Globalink warrants, (iii) the PubCo ordinary shares underlying the PubCo warrants, (iv) PubCo ordinary shares in exchange for Globalink rights, if the Business Combination is consummated, and (v) PubCo ordinary shares to existing shareholders of Alps Holdco. This document also constitutes a notice of meeting and a proxy statement under Section 14(a) of the Exchange Act, with respect to the Special Meeting at which Globalink stockholders will be asked to consider and vote upon the Proposals, including the Proposals approve the Redomestication Merger and the Acquisition Merger.

If you would like additional copies of this proxy statement/prospectus or if you have questions about the Redomestication Merger Proposal, the Acquisition Merger Proposal, or the Proposals to be presented at the Special Meeting, you should contact Globalink by telephone or in writing:

Globalink Investment Inc.

200 Continental Drive, Suite 401

Newark, Delaware 19713

+6012 405 0015

You may also obtain these documents by requesting them in writing or by telephone from Globalink’s proxy solicitor, Okapi Partners LLC, at 1212 Avenue of the Americas, 17th Floor, New York, New York 10036, or at (855) 305-0857, or banks and brokers can call collect at (212) 297-0720, or by emailing info@okapipartners.com.

If you are a stockholder of Globalink and would like to request documents, please do so by , 2025 to receive them before the Special Meeting. If you request any documents from Globalink, Globalink will mail them to you by first class mail, or another equally prompt means.

You should rely only on the information contained in this proxy statement/prospectus in deciding how to vote on the Redomestication Merger Proposal, the Acquisition Merger Proposal and other Proposals presented at the Special Meeting. Neither Globalink nor Alps Holdco has authorized anyone to give any information or to make any representations other than those contained in this proxy statement/prospectus. Do not rely upon any information or representations made outside of this proxy statement/prospectus. The information contained in this proxy statement/prospectus may change after the date of this proxy statement/prospectus. Do not assume after the date of this proxy statement/prospectus that the information contained in this proxy statement/prospectus is still correct.

Information contained in this proxy statement/prospectus regarding Globalink and its business, operations, management and other matters has been provided by Globalink, and information contained in this proxy statement/prospectus regarding Alps and its business, operations, management and other matters has been provided by Alps.

This proxy statement/prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities, or the solicitation of a proxy or consent, in any jurisdiction to or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction.

MARKET AND INDUSTRY DATA

Certain information contained in this document relates to or is based on studies, publications, surveys and other data obtained from third-party sources and Globalink’s and Alps’ own internal estimates and research. While Globalink and Alps believe these third-party sources to be reliable as of the date of this proxy statement/prospectus, they have not independently verified the market and industry data contained in this proxy statement/prospectus or the underlying assumptions relied on therein. Finally, while Globalink and Alps believe their own internal research is reliable, such research has not been verified by any independent source. While Globalink and Alps are not aware of any misstatements regarding the industry data and internal research presented herein, these data and research are subject to assumptions and estimates and involve high degree of uncertainty and risk due to a variety of factors, including those discussed under the headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Alps” in this proxy statement/prospectus.

| 1 |

TRADEMARKS AND SERVICE MARKS

This document contains references to trademarks, trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred to in this proxy statement/prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

FREQUENTLY USED TERMS

Unless otherwise stated or unless the context otherwise requires, the terms “we,” “us,” “our,” and the “Company” refer PubCo, and if the context requires, to the Combined Company following consummation of the Business Combination.

In this document:

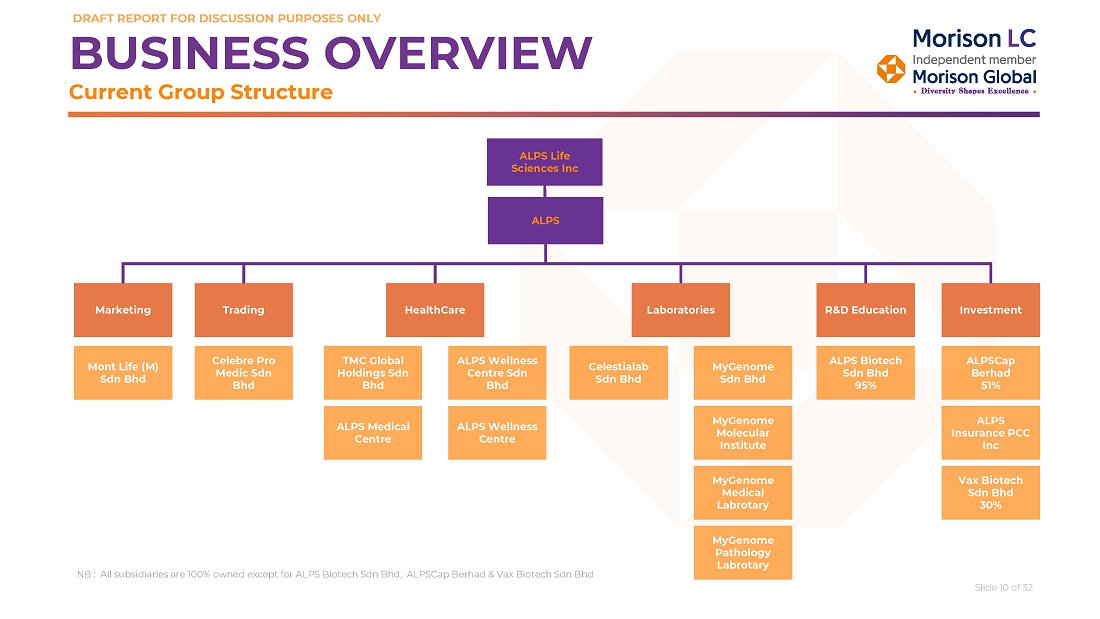

| ● | “Alps” means Alps Global Holding Berhad, a Malaysian company. After the date of the Merger Agreement and prior to the Closing, Alps will become a subsidiary of Alps Holdco. When describing financial information, also includes Alps Holdco and Alps’ subsidiaries; | |

| ● | “Alps Holdco” means Alps Life Sciences Inc, a Cayman Islands exempted company; | |

| ● | “Alps Holdco Board” means the board of directors of Alps Holdco; | |

| ● | “Alps Holdco Ordinary Shares” means the ordinary shares of Alps Holdco of par value US$0.00001 each; | |

| ● | “Alps Holdco Group” means Alps Holdco, Alps and their subsidiaries; | |

| ● | “Alps Holdco Shareholders” means holders of Alps Holdco Ordinary Shares; | |

| ● | “Alps Holdco Support Agreements” means the agreements entered into after the execution of the Merger Agreement pursuant to which Alps Holdco, Globalink, and certain shareholders of Alps Holdco agreed to vote all of the Alps Holdco Ordinary Shares beneficially owned by them in favor of the Business Combination; | |

| ● | “APC” means Annual Practising Certificate. A certificate issued by the MMC for practitioner to legally practice medicine and has to be renewed every year. | |

| ● | “Authority” means any federal, state, local or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority exercising executive, legislative, judicial, regulatory or administrative functions (to the extent that the rules, regulations or orders of such organization or authority have the force of Law), or any arbitrator, court or tribunal of competent jurisdiction; | |

| ● | “Amended and Restated Registration Rights Agreement” means the Amended and Restated Registration Rights Agreement to be entered at the Closing by Globalink, certain stockholders of Globalink and certain shareholders of Alps Holdco; | |

| ● | “Board” or “Globalink Board” means the board of directors of Globalink; |

| 2 |

| ● | “Business Combination” means the Redomestication Merger and the Acquisition Merger as contemplated by the Merger Agreement; | |

| ● | “cGCP” means current good clinical practice, an international ethical and scientific quality standard for designing, conducting, recording, and reporting clinical trials that involve the participation of human subjects; | |

| ● | “cGMP” means current good manufacturing practice, a system for ensuring that products are consistently produced and controlled according to quality standards; | |

| ● | “Chardan” means Chardan Capital Markets, LLC, the representative of the underwriters for the IPO of Globalink; | |

| ● | “Closing” means the consummation of the Business Combination; | |

| ● | “Closing Date” means the date on which the Business Combination is consummated; | |

| ● | “Code” means the Internal Revenue Code of 1986, as amended; | |

| ● | “Combined Company” means the PubCo and its consolidated subsidiaries after the Business Combination; | |

| ● | “Combined Company Board” means the board of directors of the Combined Company; | |

| ● | “Companies Act” means the Companies Act (Revised) of the Cayman Islands; | |

| ● | “common stock” or “Globalink common stock” means the Globalink common stock; | |

| ● | “Continental” means Continental Stock Transfer & Trust Company, Globalink’s transfer agent, warrant agent, rights agent and trustee; | |

| ● | “COVID-19” means the worldwide novel coronavirus disease pandemic; | |

| ● | “CTIL” means the Clinical Trial Import License in Malaysia; | |

| ● | “CTX” means the Clinical Trial Exemption in Malaysia; | |

| ● | “Globalink Charter” means Globalink’s amended and restated certificate of incorporation, as amended, currently in effect; | |

| ● | “DGCL” means the General Corporation Law of the State of Delaware, as amended; | |

| ● | “DWAC” means The Depository Trust Company’s deposit withdrawal at custodian; | |

| ● | “Earnout Shares” means an aggregate of maximum 48,000,000 additional PubCo ordinary shares issuable to Alps Holdco Shareholders upon the completion of certain milestones set forth in the Merger Agreement; | |

| ● | “Effective Time” means the time at which the Business Combination becomes effective; | |

| ● | “Escrow Account” means the segregated escrow account in which the Escrow Property is maintained; | |

| ● | “Escrow Agent” means Continental or such other escrow agent mutually acceptable to Globalink, PubCo and Alps Holdco; | |

| ● | “Escrow Agreement” means an escrow agreement to be entered into by and among PubCo, Globalink, and the Escrow Agent, effective as of the Effective Time, in form and substance reasonably satisfactory to PubCo and Alps Holdco, pursuant to which PubCo shall issue to the Escrow Agent a number of PubCo ordinary shares (with each share valued at $10.00) equal to five percent (5%) of the Merger Consideration Shares; |

| 3 |

| ● | “Escrow Property” means Escrow Shares along with any other dividends, distributions or other income on the Escrow Shares; | |

| ● | “Escrow Shares” means a number of PubCo ordinary shares (with each share valued at $10.00) equal to five percent (5%) of the Merger Consideration Shares and any equity securities paid as dividends or distributions with respect to such shares or into which such shares are exchanged or converted; | |

| ● | “Exchange Act” means the Securities Exchange Act of 1934, as amended; | |

| ● | “FDA” means the U.S. Food and Drug Administration; | |

| ● | “Founder Shares” means the 2,875,000 outstanding shares of Globalink common stock held by the Sponsor and Globalink’s directors and officers; | |

| ● | “Fully Diluted Alps Holdco Shares” means all ordinary shares of Alps Holdco that are issued and outstanding immediately prior to the Effective Time; | |

| ● | “Globalink” means Globalink Investment Inc., a Delaware corporation or the reference to the current corporation as a special purpose acquisition corporation prior to the Business Combination; | |

| ● | “Globalink stockholders” means the holders of shares of Globalink common stock; | |

| ● | “Globalink Support Agreements” means the agreement entered into in connection with execution of the Merger Agreement pursuant to which Alps Holdco, Globalink, and certain stockholders of Globalink agreed to vote all of the shares of Globalink common stock beneficially owned by them in favor of the Business Combination; | |

| ● | “Initial Stockholders” means the Sponsor and Globalink’s directors and officers who are initial holders of the Founder Shares; | |

| ● | “Insider Letter” means the letter agreement dated December 6, 2021, by and among Globalink Investment Inc., the Sponsor, PGM and each of Globalink’s directors and officers; | |

| ● | “IPO” means the initial public offering of Globalink consummated on December 9, 2021; | |

| ● | “IRS” means the United States Internal Revenue Service; | |

| ● | “ISO” means the International Organization of Standardization; | |

| ● | “Law” means any domestic or foreign, federal, state, municipality or local law, statute, ordinance, code, rule, or regulation; | |

| ● | “LCP” means Letter of Credentialing and Privileging Medical Practice; | |

| ● | “Lock-Up Agreements” means the agreements to be entered into prior to the Closing, pursuant to which certain Alps Holdco Shareholders and certain Globalink stockholders agreed to certain restrictions on transfer of PubCo ordinary shares for a period of six months to fifteen months after the Closing Date. | |

| ● | “MAB” means Medicine Advertisements Board; | |

| ● | “Merger Agreement” means the Merger Agreement by and among Globalink, Alps Holdco, the Sponsor, PubCo, Merger Sub and Dr. Tham Seng Kong, dated January 30, 2024, as amended and restated on May 20, 2024 and may be further amended, restated or supplemented from time to time; |

| 4 |

| ● | “Merger Consideration Shares” means 160,000,000 PubCo ordinary shares, subject to the withholding of the Escrow Shares deposited in the Escrow Account, and after the Closing are subject to reduction for the indemnification obligations of the Indemnifying Parties set forth in the Merger Agreement; | |

| ● | “Merger Sub” means Alps Biosciences Merger Sub, a Cayman Islands exempted company and a wholly-owned subsidiary of PubCo; | |

| ● | “MMC” means Malaysian Medical Council; | |

| ● | “MOH” means Ministry of Health, Malaysia; | |

| ● | “MS” means Malaysian Standard; | |

| ● | “NPRA” means National Pharmaceutical Regulatory Agency, Malaysia; | |

| ● | “PGM” means Public Gold Marketing Sdn. Bhd., a Malaysian private limited company, an investor who purchased 570,000 private units in the private placement simultaneously with the consummation of the IPO. PGM is an affiliate of the Sponsor as its 95% equity holder has a familial relationship with the control person of the Sponsor; | |

| ● | “PIPE Investment” means the private placement contemplated by the subscription agreements dated June 4, 2024, June 5, 2024 and August 27, 2024, entered into by and between PubCo, Globalink, Alps Holdco, and certain investors for an aggregate of $40,200,000 for 4,020,000 PubCo ordinary shares, to be consummated simultaneously with the closing of the Business Combination; | |

| ● | “POC” means proof-of-concept; | |

| ● | “private rights” means the rights of Globalink included in the private units; | |

| ● | “private units” mean the 570,000 Globalink units issued to Public Gold Marketing Sdn. Bhd., a Malaysian private limited company, in a private placement; | |

| ● | “private warrants” means warrants of Globalink included in the private units, each entitling the holder thereof to purchase one-half (1/2) share of Globalink common stock at a purchase price of $11.50 per whole share; | |

| ● | “PubCo” means Alps Global Holding Pubco, a Cayman Islands exempted company; | |

| ● | “PubCo A&R Memorandum and Articles” means the Amended and Restated Memorandum and Articles of Association of PubCo to take effect at or immediately prior to the Effective Time, in the form included as Annex B to this proxy statement/prospectus, as further described in the “Comparison of Corporate Governance and Stockholders’/Shareholders’ Rights” section of this proxy statement/prospectus; | |

| ● | “PubCo Board” means the board of directors of PubCo; | |

| ● | “PubCo ordinary shares” means the ordinary shares of PubCo of par value US$0.0001 each; | |

| ● | “PubCo warrants” means warrants of PubCo each entitling the holder thereof to purchase one-half (1/2) of one PubCo ordinary share at a purchase price of $11.50 per whole share; | |

| ● | “public rights” means the rights which were sold as part of the Globalink units in the IPO; | |

| ● | “public shares” means shares of Globalink common stock underlying the Units sold in the IPO, including any overallotment securities acquired by Globalink’s underwriters; | |

| ● | “public stockholders” means the holders of Globalink public shares; | |

| ● | “public units” means the units of Globalink sold in the IPO, whether they were purchased in the IPO or thereafter in the open market, each consisting of one share of common stock, $0.001 par value, one right to receive one-tenth (1/10) of a share of common stock upon the consummation of an initial business combination and one redeemable warrant entitling the holder thereof to purchase one-half (1/2) of a share of common stock at a price of $11.50 per whole share; |

| 5 |

| ● | “public warrants” means warrants of Globalink included in the public units, each entitling the holder thereof to purchase one-half (1/2) share of Globalink common stock at a purchase price of $11.50 per whole share; | |

| ● | “R&D” means research and development; | |

| ● | “rights” or “Globalink rights” means the rights of Globalink included in the units, each entitling its holder to receive one-tenth (1/10) of a share of Globalink common stock upon the consummation of the Business Combination; | |

| ● | “RM” or “Ringgit Malaysia” means the lawful currency of Malaysia; | |

| ● | “SEC” means the U.S. Securities and Exchange Commission; | |

| ● | “Securities Act” means the Securities Act of 1933, as amended; | |

| ● | “Seller Representative” means Dr. Tham Seng Kong, an individual; | |

| ● | “Special Meeting” means the special meeting of the stockholders of Globalink, which will be held at , Eastern time, on , 2025; | |

| ● | “Sponsor” or “Parent Representative” means GL Sponsor LLC, a Delaware limited liability company; | |

| ● | “Subscription Agreements” means the subscription agreements with investors (the “PIPE Investors”) dated June 4, 2024, June 5, 2024 and August 27, 2024 in the PIPE Investment; | |

| ● | “Trust Account” means Globalink’s trust account maintained by Continental; | |

| ● | “units” or “Globalink units” means public units and private units, collectively; | |

| ● | “U.S. Dollars,” “US Dollars,” “$,” or “US$” means the legal currency of the United States; | |

| ● | “U.S. GAAP” or “GAAP” means accounting principles generally accepted in the United States; | |

| ● | “warrants” or “Globalink warrants” means private warrants and public warrants, collectively; and | |

| ● | “ZAR” means the legal currency of the Republic of South Africa. |

Share Calculations and Ownership Percentages

Unless otherwise specified (including in the sections entitled “Unaudited Pro Forma Condensed Combined Financial Information and Notes” and “Security Ownership of Certain Beneficial Owners and Management”), the share calculations and ownership percentages set forth in this proxy statement/prospectus with respect to shareholders of the Combined Company are for illustrative purposes only and assume the following (certain capitalized terms below are defined elsewhere in this proxy statement/prospectus):

| 1. | No public stockholders exercise their redemption rights in connection with the Closing of the Business Combination, and the balance of the Trust Account as of the Closing is the same as its balance on December 6, 2024 of approximately $3.33 million. Please see the section entitled “The Special Meeting — Redemption Rights.” | |

| 2. | There are no transfers by the Sponsor, or any of the officers and directors of Globalink of Globalink securities held by the Sponsor or any officer or director of Globalink on or prior to the Closing Date. | |

| 3. | The PIPE Investment is consummated in accordance with the terms of the Subscription Agreements for aggregated proceeds of $40,200,000, with PubCo issuing 4,020,000 ordinary shares to the PIPE Investors, in connection with which the PIPE Investors will own up to approximately 4,020,000 PubCo ordinary shares. Please see the section entitled “The Acquisition Merger Proposal (Proposal 2) — Related Agreements — Subscription Agreements; Lock-up Agreements.” | |

| 4. | There are no issuances of equity securities of Globalink prior to or in connection with the Closing. | |

| 5. | No Earnout Shares are issued and Alps Holdco Shareholders will receive 160,000,000 PubCo ordinary shares. | |

| 6. | That none of the Alps Holdco Shareholders exercises appraisal rights in connection with the Closing. | |

| 7. | That, the number of PubCo ordinary shares to be issued in connection with conversion of Globalink’s public and private rights is 1,207,000. Currently, PGM owns 570,000 private rights, or all of the outstanding private rights of Globalink. |

| 6 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement/prospectus contains forward-looking statements, including statements about the parties’ ability to close the Business Combination, the anticipated benefits of the Business Combination, and the financial condition, results of operations, earnings outlook and prospects of Globalink and/or Alps Holdco and may include statements for the period following the consummation of the Business Combination. Forward-looking statements appear in several places in this proxy statement/prospectus including, without limitation, in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Alps” and “Information about Alps”. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of Globalink and Alps Holdco as applicable and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve several risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors,” those discussed and identified in public filings made with the SEC by Globalink and the following:

| ● | actual results may vary from expectations regarding Alps Holdco and Alps Holdco’s ability to meet expectations related to its business prospects; | |

| ● | the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; | |

| ● | the outcome of any legal proceedings that may be instituted against Globalink, Alps Holdco and others following announcement of the Merger Agreement and transactions contemplated therein; | |

| ● | the inability to complete the Business Combination due to the failure to obtain Globalink stockholders’ approval; | |

| ● | Alps Holdco’s failure to achieve or maintain profitability in the future; | |

| ● | Alps Holdco’s ability to execute its anticipated business plans and strategy; | |

| ● | Alps Holdco faces significant competition and expects to face increasing competition in many aspects of its business, which could cause its operating results to suffer; | |

| ● | the healthcare market is a new and rapidly changing industry and it is uncertain whether Alps Holdco’s business will be adversely affected by the changing industry and the development of technology and medical research; | |

| ● | the ability of the Combined Company following the Business Combination to receive listing approval from Nasdaq and maintain the listing of the Combined Company’s securities on Nasdaq; | |

| ● | the risk that the proposed Business Combination disrupts current plans and operations of Alps Holdco as a result of the announcement and consummation of the Business Combination; | |

| ● | the inability to recognize the anticipated benefits of the Business Combination; | |

| ● | the inability to consummate the PIPE Investment; |

| 7 |

| ● | the failure to satisfy the conditions to the consummation of the Business Combination, including the approval of the Merger Agreement by the stockholders of Globalink and the requirement, following any redemptions by Globalink’s public stockholders, Globalink have cash or cash equivalents equal to the aggregate subscriptions by investors in the PIPE Investment; | |

| ● | unexpected costs related to the proposed Business Combination; | |

| ● | the amount of any redemptions by existing Globalink stockholders being greater than expected; | |

| ● | the management and board composition of the Combined Company following the proposed Business Combination; | |

| ● | geopolitical risk and changes in applicable laws or regulations; | |

| ● | the possibility that Globalink and/or Alps Holdco may be adversely affected by other economic, business, and/or competitive factors; | |

| ● | litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands on the Combined Company’s resources; | |

| ● | the risks that the consummation of the Business Combination is substantially delayed or does not occur; | |

| ● | the impact from future regulatory, judicial, and legislative changes in Alps Holdco’s industry; | |

| ● | the uncertain effects of the COVID-19 pandemic; and | |

| ● | those factors set forth in documents of Globalink filed, or to be filed, with the SEC. |

All subsequent written and oral forward-looking statements concerning the Business Combination or other matters addressed in this proxy statement/prospectus and attributable to Globalink, Alps Holdco, or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this proxy statement/prospectus. There may be additional risks that neither Globalink nor Alps Holdco presently know or that Globalink and Alps Holdco currently believe are immaterial that could also cause actual results to differ materially from those contained in the forward-looking statements. In addition, forward-looking statements reflect Globalink’s and Alps Holdco’s expectations, plans or forecasts of future events and views as of the date of this proxy statement/prospectus. Globalink and Alps Holdco’s anticipate that subsequent events and developments may cause Globalink’s and Alps Holdco’s assessments to change. However, while we may elect to update these forward-looking statements at some point in the future, Globalink and Alps Holdco specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Globalink’s and Alps Holdco’s assessments as of any date subsequent to the date of this proxy statement/prospectus. Accordingly, undue reliance should not be placed upon the forward-looking statements.