As filed with the Securities and Exchange Commission on March 28, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended

OR

OF THE SECURITIES EXCHANGE ACT OF 1934

OR

OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number:

(Exact Name of Registrant as Specified in its Charter)

| N/A | The Federative Republic of Brazil |

| (Translation of Registrant’s Name into English) | (Jurisdiction of Incorporation or Organization) |

Butantã –

(Address of Principal Executive Offices)

Braskem S.A.

Butantã –

Telephone: +

Fax: +

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on which Registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

The total number of issued shares of each class of stock of Braskem S.A. as of December 31, 2024 was:

Common Shares, without par value

Preferred Shares, Class A, without par value

Preferred Shares, Class B, without par value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Accelerated filer ☐ | Non-accelerated filer ☐ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of

its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public

accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ |

|

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No

TABLE OF CONTENTS

Page

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

All references herein to “real,” “reais” or “R$” are to the Brazilian real, the official currency of the Federative Republic of Brazil, or Brazil. All references to “U.S. dollars,” “dollars” or “US$” are to U.S. dollars, the official currency of the United States. All references to “CHF” are to Swiss francs, the official currency of Switzerland.

The selling rate was R$6.1923 to US$1.00 as of December 31, 2024, R$4.8413 to US$1.00 as of December 31, 2023, and R$5.2177 to US$1.00 as of December 31, 2022, as reported by the Central Bank. The real/U.S. dollar exchange rate fluctuates widely, and these selling rates may not be indicative of future selling rates.

Solely for the convenience of the reader we have translated, to the extent applicable, real amounts in this annual report into U.S. dollars at the selling rate as reported by the Central Bank as of December 31, 2024, of R$6.1923 to US$1.00. These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or at any other exchange rate.

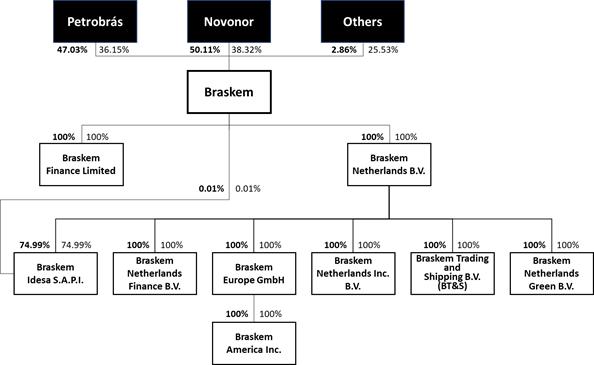

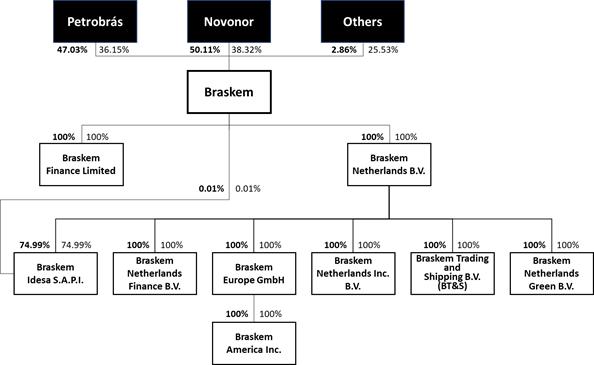

All references herein to (1) “we,” “us,” “the Company” or “our Company” are references to Braskem S.A., its consolidated subsidiaries and jointly controlled entities, and (2) “Braskem” are references solely to Braskem S.A. All references herein to “Braskem Europe” are to Braskem Europe GmbH and its consolidated subsidiaries, including Braskem America, Inc., or Braskem America.

Financial Statements

Braskem Financial Statements

We maintain our books and records in reais. Our consolidated financial statements as of December 31, 2024, and 2023 and for the three years ended December 31, 2024, have been audited, as stated in the report appearing therein, and are included in this annual report. These financial statements and related notes included elsewhere in this annual report are collectively referred to as our audited consolidated financial statements herein and throughout this annual report.

We have prepared our consolidated financial statements in accordance with IFRS Accounting Standards, as issued by the International Accounting Standards Board (“IFRS Accounting Standards”).

Market Share and Other Information

We make statements in this annual report about our market share in the petrochemical industry in Brazil and our production capacity relative to that of other petrochemical producers in Brazil, other countries in Latin America, the United States and the world. We have made these statements on the basis of information obtained from third-party sources that we believe are reliable. We have calculated our Brazilian market share with respect to specific products by dividing our domestic net sales volumes of these products by the total Brazilian domestic consumption of these products. We derive information regarding the production capacity of other companies in the global petrochemical industry, international market prices for petrochemicals products and per capita consumption in certain geographic regions principally from reports published by Chemical Market Analytics by OPIS, a Dow Jones Company (“CMA”). We derive information relating to Brazilian imports and exports from ComexStat, produced by the Brazilian Ministry of Development, Industry, Trade and Services (Ministério do Desenvolvimento, Indústria, Comércio e Serviços, the “MDIC”). We also derive information from reports published by Brazilian Association of the Alkali, Chlorine and Derivatives Industry (Associação Brasileira da Indústria de Álcalis, Cloro e Derivados, the “Abiclor”). We also include information and statistics regarding economic growth in emerging economies obtained from the International Monetary Fund (“IMF”), and statistics regarding gross domestic product, growth in Brazil, the United States, Europe and Mexico obtained from independent public sources, such as the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística); the U.S. Bureau of Economic Analysis of the U.S. Department of Commerce; the statistical office of the European Union (Eurostat); and the Mexican Institute of Statistics and Geography (Instituto Nacional de Estadística y Geografía).

We provide information regarding domestic apparent consumption of some of our products based on information available from ComexStat, produced by the MDIC and reports published by Abiclor. Domestic apparent consumption is equal to domestic production plus imports minus exports. Domestic apparent consumption for any period may differ from actual consumption because this measure does not give effect to variations of inventory levels in the petrochemical supply chain.

| i |

We have no reason to believe that any of this information is inaccurate in any material respect. However, we have not independently verified the production capacity, market share, market size or similar data provided by third parties or derived from industry or general publications.

Certain Industry Terms

Glossary of Selected Terms in the Petrochemical Industry and in the Context of Our Business

|

Term |

Meaning |

Main uses |

In the context of our business |

| Aliphatics | Aliphatics are open-chain hydrocarbons that contain no stable rings connecting their atoms, in contrast to aromatics. | Used as fuels, solvents and as basic chemicals in the petrochemical industry. | We produce aliphatics, such as ethylene and propylene, in our Brazil Segment. |

| Aromatics | Aromatics are cyclic hydrocarbons with stable bonds connecting their carbon atoms. | Used as fuel additives, solvents, and basic chemicals in the petrochemical industry. | We produce aromatics, such as benzene, toluene and xylenes, as co-products in our Brazil Segment. |

| Benzene | An aromatic hydrocarbon. It is a natural constituent of crude oil. | Used primarily for the manufacture of chemicals with more complex structure, such as ethylbenzene and cumene. | We produce benzene as a by-product in our Brazil Segment. |

| BTX products | A mixture of benzene, toluene and the three xylene isomers (ortho, meta and para), all of which are aromatic hydrocarbons. | Used as fuel additives, solvents, and basic chemicals in the petrochemical industry. | We produce benzene, toluene and xylenes as BTX by-products in our Brazil Segment. |

| Butadiene | An organic compound and a colorless gas. | Used industrially as a monomer in the production of synthetic rubber. | We produce butadiene as a by-product in our Brazil Segment. |

| ii |

| Butene | A colorless gas present in crude oil. | Used as a monomer in the production of polymers, as well as a petrochemical intermediate. | We use butene for the production of high-density polyethylene (“HDPE”) and linear low-density polyethylene (“LLDPE”) in our Brazil Segment. Butene is supplied by our chemicals operations that are part of our Brazil Segment. |

| Caustic soda | Caustic soda, or sodium hydroxide, is an inorganic compound. A colorless crystalline solid, caustic soda is toxic, corrosive and highly soluble in water. | Used in the manufacture of pulp and paper, textiles, drinking water, soaps and detergents, and as a drain cleaner. | We produce caustic soda in our Brazil Segment. Caustic soda is a by-product of chlorine production required to produce Polyvinyl chloride (“PVC”). |

| Chlor-alkali | Electrolysis process used in the manufacture of chlorine, hydrogen and sodium hydroxide (caustic soda). | Main industrial process for the production of caustic soda. | We operate chlor-alkali plants in Brazil. |

| Chlorine | Chlorine is a chemical element (Cl), a toxic, greenish yellow gas at room temperature. It has a pungent suffocating odor. | Used in the production of paper products, antiseptics, plastics, dyes, textiles, medicines, insecticides, solvents and to treat swimming pools. | We use salt to produce chlorine in our Brazil Segment. |

| Condensate | Condensate, or natural gas condensate, is a low-density mixture of hydrocarbon liquids that are present as gaseous components in the raw natural gas. | Condensate is used as an input for petrochemical plants, burned for heat and cooking, and blended into vehicle fuel. | We use condensate as a raw material in our Brazil Segment. |

| iii |

| Cumene | An organic compound based on an aromatic hydrocarbon with an aliphatic substitution, cumene is a colorless liquid constituent of crude oil and refined fuels. | Used for the production of phenol and acetone. | We produce cumene as a by-product in our Brazil Segment. | |

| Dicyclopentadiene | Dicyclopentadiene, or DCPD, is a yellow liquid with an acrid odor. | Used in polyester resins, inks, adhesives and paint. | We produce DCPD in our Brazil Segment. | |

| Ethane | A type of natural gas liquid (NGL), ethane is a colorless, odorless gas in standard temperature and pressure, extracted from natural gas in liquid form. | Used as a feedstock for ethylene production. | Ethane is one of the main raw materials that we use to produce ethylene in our Brazil Segment. | |

| Ethanol | A simple alcohol, produced by the fermentation of sugars by yeasts or via petrochemical processes. | Used as a fuel for vehicles, as a disinfectant and as a chemical intermediate. | We use ethanol as a raw material to produce PE I’m green™ bio-based in our Brazil Segment, which are located in Triunfo, Brazil. | |

| Ethyl tertiary-butyl ether (ETBE) |

ETBE is a colorless liquid manufactured by the acid etherification of isobutylene with ethanol. | Used commonly as an additive in the production of gasoline. | We produce ETBE in our Brazil Segment. | |

| Ethylene | A hydrocarbon, colorless gas and the most widely used organic compound in the chemical industry. Produced mainly via steam cracking of raw materials such as naphtha and NGLs. | Used mainly for the production of polyolefins, primarily polyethylene, the most used thermoplastic resin in the world. | We produce ethylene in our Brazil Segment, as a main product of the steam cracking of raw materials. | |

| iv |

| EVA | Ethylene-vinyl acetate, or EVA, is a co-polymer of ethylene and vinyl acetate. | Used to produce rubber-like materials, with applications in adhesives, packaging, molding, and membranes for electronic devices. | We produce EVA in our Brazil Segment. | ||

| Gasoline | A flammable liquid obtained by refining crude oil. | Used primarily as a fuel in combustion engines. | We produce gasoline as a by-product in our Brazil Segment. | ||

| GHG emissions | Emissions of the six gases listed in the Kyoto Protocol: carbon dioxide (CO2); Methane (CH4); Nitrous Oxide (N2O); Hydrofluorocarbons (HFCs); Perfluorocarbons (PFCs); and Sulfur hexafluoride (SF6). | Used as a metric for our management and in accordance with applicable laws to measure GHG emissions. | We use the metric to assess our performance and define a strategy for reducing GHG emissions. | ||

| Green ethylene | A hydrocarbon derived from renewable feedstock | Used mainly for the production of polyolefins, primarily polyethylene. | We produce green ethylene from ethanol made by sugarcane in our Brazil Segment in order to produce PE I’m green™ bio-based, EVA I’m green™ bio-based and I’m green™ bio-based PE wax. We are also leading a project in Thailand which will add 200 kt of capacity of green ethylene. | ||

| HDPE | High-density polyethylene, or HDPE, is a thermoplastic resin produced by the polymerization of ethylene. | Used in a variety of industries, to produce plastic bottles, toys, chemical containers, pipe systems, and other plastic products. | We produce HDPE in our polyolefins operations that are part of our Brazil Segment. | ||

| Hexene | An aliphatic, hexane is a clear, colorless liquid with a petroleum-like odor. | Used as a solvent, paint thinner, and chemical reaction medium. Also used as a co-monomer for the production of HDPE. | We use hexene in our Mexico Segment as a raw material to produce HDPE. | ||

| v |

| Hydrocarbon resins | Also called petroleum resins, they are produced from the polymerization of aromatic hydrocarbons. | Generally used together with other kinds of resins, in the paint, ink, adhesive and rubber industry. | We produce hydrocarbon resins in our Brazil Segment. |

| Hydrogen | A chemical element, hydrogen is a colorless, odorless gas. | Used to make ammonia in the production of fertilizers and as an intermediate chemical in the production of plastics and pharmaceuticals. | We produce hydrogen in our Brazil Segment. |

| Hydrogenated solvents | Odorless, colorless solvents treated with hydrogen. | Used in the manufacture of paints. | We produce hydrogenated solvents in our Brazil Segment. |

| Isoprene | A common organic compound that is a component of natural rubber. Also a by-product of oil refining. | Used to produce synthetic rubber. | We produce isoprene in our Brazil Segment. |

| LDPE | Low-density polyethylene, or LDPE, is a thermoplastic resin made from the polymerization of ethylene. | Used for manufacturing containers, dispensing bottles, wash bottles, tubing, plastic bags and molded laboratory equipment. | We produce LDPE in our Brazil Segment. |

| Liquefied petroleum gas (LPG) | Liquefied petroleum gas, or LPG, is a mixture of propane and butane, which are two natural gas liquids. | Used in fuel heating appliances, cooking equipment, vehicle fuel, aerosol propellant, and as a refrigerant. | We produce LPG in our Brazil Segment. |

| LLDPE | Linear low-density polyethylene, or LLDPE, is a linear polymer made by the copolymerization of ethylene with longer-chain olefins. | Used in plastic bags and sheets, plastic wrap, stretch wrap, pouches, toys, covers, lids, pipes, buckets and containers, covering of cables and flexible tubing, among others. | We produce LLDPE in our Brazil Segment. |

| vi |

| Methanol | Methanol is the simplest alcohol, a liquid produced industrially by hydrogenation of carbon monoxide. | Used as a precursor to other commodity chemicals, including formaldehyde, acetic acid and MTBE. | We use methanol as a raw material to produce MTBE in our Brazil Segment. |

| Methyl tertiary-butyl ether (MTBE) | An intermediate hydrocarbon liquid stream derived mainly from the refining of crude oil | Used almost exclusively as a fuel additive in gasoline to raise the oxygen content. | We produce MTBE in our Brazil Segment. |

| Naphtha | An intermediate hydrocarbon liquid stream derived mainly from the refining of crude oil. | Used as a solvent, fuel additive and as a raw material in the petrochemical industry. | We use naphtha as a raw material for the production of petrochemical products in our Brazil Segment. |

| Natural gas | A naturally occurring hydrocarbon gas mixture, consisting primarily of methane. | Used as a source of energy for heating, cooking and electricity generation, as a fuel for vehicles and as a chemical feedstock. | We use natural gas for electricity generation in our production processes. |

| Natural gas liquids (NGL) | A mixture of hydrocarbon components of natural gas, primarily ethane, propane and butane, which are separated from the raw natural gas in the form of liquids. | Used as raw materials in the petrochemical industry, as fuel and in applications for heating and cooking. | We use NGLs such as ethane and propane as raw materials at our plants in Rio de Janeiro and Mexico. |

| N-hexane | A hydrocarbon, obtained by refining crude oil. | Used mixed with other solvents, to extract vegetable oils from crops, and as a cleaning agent in the printing, textile, furniture, and shoemaking industries. | We use n-hexane in our Brazil Segment as a raw material in the production of HDPE and LLDPE. |

| Nonene | A hydrocarbon, nonene is a colorless liquid with an odor reminiscent of gasoline. | Used as a plasticizer to make rigid plastics flexible, and to produce chemical intermediates. | We produce nonene in our Brazil Segment. |

| vii |

| Olefins | Unsaturated hydrocarbons that contain at least one carbon–carbon double bond, such as ethylene, propylene and butene. Obtained from steam cracking of raw materials. | Used as chemical intermediates for the production of other chemicals and resins. | We produce olefins in our Brazil Segment. |

| Para-xylene | An aromatic hydrocarbon, para-xylene is produced mainly in refineries and during the steam cracking of naphtha. | Used as a chemical feedstock in the production of polymers, especially PET. | We produce para-xylene as a by-product in our Brazil Segment. |

| PDH | Propane dehydrogenation, or PDH, is an on-purpose technology used for conversion of propane into propylene. | Industrial process for the production of propylene. | We use propylene from PDH units as a raw material in our plants in the United States. |

| PE I’m green™ bio-based | Thermoplastic resin made from a renewable source (sugar cane) that is 100% segregated | Used in segments such as toys, agro, packaging, artificial turf, and healthcare among others. | PE I’m green™ bio-based is produced in our Brazil Segment, at our plant located in Triunfo, Rio Grande do Sul, Brazil |

| Piperylene | A volatile, flammable hydrocarbon in liquid form, obtained as a by-product of ethylene production. | Used as a monomer in the manufacture of plastics, adhesives and resins. | We produce piperylene in our Brazil Segment. |

| Polyethylene (PE) | PE is the most common type of thermoplastic resin. It is lightweight and durable, and is obtained from the polymerization of ethylene. | PE has a large number of applications, such as: packaging, consumer goods, fibers, textiles, pipes, automotive, wiring, cables, construction, among others. | We produce PE in our Brazil Segment. |

| viii |

| Polyisobutylene (PIB) | PIB is a gas-permeable synthetic rubber produced by the polymerization of isobutylene with isoprene. | Used as a fuel and lubricant additive, in explosives, as the base for chewing gum, and to improve the environmental stress-cracking resistance of polyethylene. | We produce PIB in our Brazil Segment. |

| Polyolefins | Macromolecules formed by the polymerization of olefin monomer units. The most common are polypropylene (PP) and polyethylene (PE). | Used in a broad range of consumer and industrial applications. | We produce polyolefins in our Brazil Segment. |

| Polypropylene (PP) | PP is a thermoplastic resin and the second most widely produced commodity plastic, after PE. Obtained by the polymerization of propylene, PP is generally harder and more heat resistant than PE. | Widely used in the automotive and furniture industry, in consumer goods, for packaging and labeling, and in other industrial applications. | We produce PP in our Brazil Segment. |

| Polyvinyl chloride (PVC) | PVC is the world’s third-most widely produced synthetic plastic polymer, after PE and PP, obtained by the polymerization of vinyl chloride monomer (VCM), a monomer generally made of ethylene and chlorine. | Used mainly in infrastructure and construction for pipes and profile applications, such as doors and windows, and also in plumbing, electrical cables, flooring, and as a replacement for rubber. | We produce PVC in our Brazil Segment. |

| ix |

| Propane | A type of natural gas liquid (NGL), propane is a gas in standard temperature and pressure, and is extracted from natural gas in liquid form. | Commonly used together with butane in heating and cooking applications, and also as a raw material in the petrochemical industry. | We use propane together with ethane as a raw materials to produce petrochemical products in our Brazil Segment. |

| Propylene | A hydrocarbon, propylene is a colorless gas, and the second most widely used olefin in the chemical industry, after ethylene. It can be obtained as a co-product of steam cracking or refining, and from on-purpose production. | Used mainly to produce polypropylene resins and a wide variety of other chemicals, such as propylene oxide and acrylonitrile. | We produce propylene in our Brazil Segment as a by-product of steam cracking. Propylene is also the main raw material that we use to produce polypropylene in our Brazil Segment, and United States and Europe Segment. |

| Refinery off gas | Gas that is produced as a by-product of the refining of crude oil. It is a mixture of methane, ethane, hydrogen and other gases. | Used as a feedstock in the petrochemical industry. | We use refinery off gas as a raw material in our Brazil Segment to produce ethylene. |

| Salt | Salt is a mineral composed primarily of sodium chloride. | Used in a wide variety of industries, mainly in the chlor-alkali process to produce caustic soda and chlorine, and as a food additive. | We use salt to produce chlorine and caustic soda in our Brazil Segment. |

| Sodium hypochlorite | Sodium hypochlorite is a chlorine compound. | Used as a disinfectant or a bleaching agent and to produce other chemicals. | We produce sodium hypochlorite in our Brazil Segment. |

| Tetramer | Tetramer, or propylene tetramer, is an olefin. | Used as a plasticizer, surfactant, lubricating oil additive and polymerization agent. | We produce propylene tetramer in our Brazil Segment. |

| Thermoplastic resins | Raw, unshaped polymers, such as PE, PP and PVC. | Used in the plastic industry and other industries. | We produce thermoplastic resins in our Brazil Segment. |

| x |

| Toluene | An aromatic hydrocarbon. | Used predominantly as an industrial feedstock and a solvent. | We produce toluene in our Brazil Segment. |

| UHMWPE | Ultra-high molecular weight polyethylene, or UHMWPE, is a special type of thermoplastic polyethylene. | Used in industrial applications that require durability, low friction, and chemical resistance, including wear strips, chain guides, and marine dock fender pads, among others. | We produce UHMWPE in our Unites States and Europe Segment. |

| Vinyls | Vinyls, or vinyl polymers, are a group of polymers derived from vinyl monomers. The most common type of vinyl is PVC. | Used in the plastic industry and other industries. | We produce vinyls in our Brazil Segment. |

Certain Other Selected Terms Used in This Annual Report

As used in this annual report:

| · | “first generation products” means basic petrochemical products such as ethylene and propylene produced from naphtha, natural gas, and ethane. These basic petrochemical products are used as feedstocks for the production of second generation products. We also sell certain first generation products to our customers; |

| · | “second generation products” means thermoplastics resins, such as polyethylene, polypropylene and polyvinyl chloride; |

| · | “third generation” means plastics converters; |

| · | “third generation products” means finished plastic products produced by molding thermoplastic resins into end-use applications; |

| · | “annual production capacity” means the annual nominal capacity for a particular facility, as of the last day of the fiscal year to which it relates, calculated based on operations during the 24 hours of the day for an entire year; |

| · | “production capacity” means the annual projected capacity for a particular facility, calculated based upon operations for 24 hours each day of a year and deducting scheduled downtime for regular maintenance; |

| · | “kton” means a kiloton, which is equal to 1,000 tons, or 2,204,622.62 pounds; and |

| · | “ton” means a metric ton, which is equal to 1,000 kilograms or 2,204.62 pounds. |

Rounding

We have made rounding adjustments to some of the amounts included in this annual report. As a result, numerical figures shown as totals in some tables may not be arithmetic aggregations of the amounts that precede them.

| xi |

CAUTIONARY STATEMENT WITH RESPECT TO FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. Some of the matters discussed concerning our business operations and financial performance include forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended (the “Securities Act”), or the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and similar expressions are forward-looking statements. Although we believe that these forward-looking statements are based upon reasonable assumptions, these statements are subject to several risks and uncertainties and are made in light of information currently available to us.

Our forward-looking statements may be influenced by numerous factors, including, without limitation, the following:

| · | the cyclical and volatile nature of the global petrochemical industry and its adverse effects, which may have negative impacts on our business; |

| · | prices of naphtha, ethane, ethanol, propane, propylene and other raw materials as well as the terms and conditions of related supply agreements; |

| · | international prices of petrochemical and bio-based products; |

| · | our ability to implement our financing strategy and secure financing on satisfactory terms; |

| · | the adverse effects of the geological event in Alagoas, including unfavorable judicial or regulatory outcomes; |

| · | global macroeconomic conditions, including possible increased tariffs imposed by the United States on our supply chain, which may affect our product margins; |

| · | the adverse effect of war and other armed conflicts, such as the conflict involving Russia and Ukraine and tensions in the Middle East, on our operations and the global petrochemical industry; |

| · | a slowdown in the world economy and its potential adverse effect on demand for petrochemicals and thermoplastic products; |

| · | any adverse effect of China’s economy deceleration on global demand and on our operations; |

| · | the adverse effect of inflation globally on our business; |

| · | the adverse effect of a more contractionary monetary policy globally on our business; |

| · | demand for our petrochemical products, the availability and pricing of raw materials, global logistics and the stability of supply chains; |

| · | general economic, political and business conditions in key markets, including governmental and electoral changes, and fluctuation in demand, supply, and prices of petrochemicals and thermoplastic products; |

| xii |

| · | interest rate fluctuations, inflation and exchange rate movements, particularly of the Brazilian real against the U.S. dollar and other currencies; |

| · | our ability to execute our sustainable strategy and implement climate adaptation and mitigation initiatives; |

| · | competition in the global petrochemical and biopolymer industry; |

| · | our ability to successfully develop our innovation projects, particularly with respect to renewable and recycling initiatives; |

| · | actions taken by Novonor, our controlling shareholder, and Petrobras; |

| · | inherent risks related to any change of our corporate control; |

| · | our progress in integrating the operations of companies or assets that we may acquire in the future, so as to achieve the anticipated benefits of these acquisitions; |

| · | changes in laws and regulations, including, among others, those related to tax, environmental policies, and import tariffs in key markets; |

| · | political conditions in the countries where we operate, particularly in Brazil and Mexico; |

| · | future changes in governmental policies, including new environmental regulations and related governmental actions; |

| · | unfavorable decisions in major tax, labor, environmental and other legal proceedings; and |

| · | other factors identified or discussed under “Item 3. Key Information—Risk Factors.” |

Our forward-looking statements are not a guarantee of future performance, and our actual results of operations or other developments may differ materially from the expectations expressed in our forward-looking statements. As for forward-looking statements that relate to future financial results and other projections, actual results will be different due to the inherent uncertainty of estimates, forecasts and projections. Because of these uncertainties, readers should not rely on these forward-looking statements.

All forward-looking statements attributed to us or a person acting on our behalf are qualified in their entirety by this cautionary statement, and you should not place undue reliance on any forward-looking statement included in this annual report. Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them as a result of new information or future developments.

For additional information on factors that could cause our actual results of operations to differ from expectations reflected in forward-looking statements, please see “Item 3. Key Information—Risk Factors.”

| xiii |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

Exchange Rates

The current laws and regulations governing the Brazilian foreign exchange system allow the purchase and sale of foreign currency and the international transfer of reais by any person or legal entity, regardless of the amount, subject to certain regulatory procedures. Since 1999, the Central Bank has allowed the U.S. dollar-real exchange rate to float freely, and, since then, the U.S. dollar-real exchange rate has fluctuated considerably.

In the past, the Central Bank has intervened occasionally to control unstable movements in foreign exchange rates. We cannot predict whether the Central Bank or the Brazilian government will continue to permit the real to float freely or will intervene in the exchange rate market through the return of a currency band system or otherwise. The real may depreciate or appreciate against the U.S. dollar substantially. Furthermore, Brazilian law provides that, whenever there is a serious imbalance in Brazil’s balance of payments or there are serious reasons to foresee a serious imbalance, temporary restrictions may be imposed on remittances of foreign capital abroad. We cannot assure you that such measures will not be taken by the Brazilian government in the future. See “—Risk Factors—Risks Relating to Brazil—Brazilian government exchange control policies could increase the cost of servicing our foreign currency-denominated debt, adversely affect our ability to make payments under our foreign currency-denominated debt obligations and impair our liquidity” and “—Risk Factors—Risks Relating to Our Equity and Debt Securities—If holders of the ADSs exchange them for class A preferred shares, they may risk temporarily losing, or being limited in, the ability to remit foreign currency abroad and certain Brazilian tax advantages.”

ITEM 3.A (Reserved)

ITEM 3.B CAPITALIZATION AND INDEBTEDNESS

Not applicable.

ITEM 3.C REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

ITEM 3.D RISK FACTORS

Summary of Risk Factors

Below is a summary of certain factors that make an investment in our securities speculative or risky. Importantly, this summary does not address all of the risks and uncertainties that we face. This summary is qualified in its entirety by a more complete discussion of such risks and uncertainties. In evaluating an investment in our securities, investors should carefully read the risks described below, as well as other risks and uncertainties that we face, which can be found under “—Risk Factors” in this section of this annual report. If any of the following events occur, our business, financial condition, and operating results may be materially adversely affected. In that event, the trading price of our securities could decline, and you could lose all or part of your investment. Such risks include, but are not limited to:

| 1 |

Risks Relating to Our Business and the Petrochemical Industry

| · | The cyclical and volatile nature of the petrochemical industry may reduce our net revenue and gross margin. |

| · | Adverse conditions in the petrochemical industry may adversely affect demand for our products. |

| · | Structural overcapacity in the petrochemical industry, particularly in Asia and the Middle East, could drive down global prices, negatively affecting our margins. |

| · | Global macroeconomic factors have had, and may continue to have, adverse effects on the margins that we realize on our products. |

| · | Higher costs for the acquisition of raw materials may increase the cost of the products we sell, and may reduce our gross margin and negatively affect our overall financial performance. |

| · | We may be affected by instability in the global economy and by financial turmoil, including as a result of military conflicts such as those between Russia and Ukraine, and the conflicts involving Hamas, Israel and Hezbollah, and other conflicts in the Middle East. |

| · | We face competition from suppliers of polyethylene, polypropylene, PVC, and other products. |

| · | We may face competition from producers of substitutes for our products as a result of evolving technology, consumer and industry trends and preferences, and regulatory changes. |

| · | We depend on Petrobras to supply us with a substantial portion of our naphtha, ethane, propane, light refinery hydrocarbon, and propylene needs, and also on logistics services. |

| · | We depend on ethane supplied by Pemex in Mexico. |

| · | We may be materially adversely affected if there is an imbalance in global logistics, which may cause disruptions to our transport, storage, and distribution operations, negatively impacting the costs related thereto. |

| · | We rely on access to third-party licensed technology and related intellectual property, and if such rights cease to be available to us on commercially reasonable terms, or at all, or if any such third party ceases to provide us with technical support under license or technical services agreements, certain of our production plants, our operating results and financial condition could be adversely affected. |

| · | Some of our shareholders may have the ability to determine the outcome of corporate actions or decisions, which could affect the holders of our class A preferred shares and the ADSs. |

| · | We may be subject to attempts to acquire our control, which may lead to significant changes in management, the strategies that we are currently pursuing, or in our current corporate governance practices. |

| · | We may face conflicts of interest in transactions with related parties. |

| · | Under our growth strategy, we may pursue strategic acquisitions, investments, and investments in new businesses. The failure of an acquisition, investment, or investments in new businesses to produce the anticipated results, or the inability to integrate an acquired company, could adversely affect our business's financial condition and results of operations. |

| · | Adjustments in tariffs on imports that compete with our products could cause us to lower our prices. |

| · | Changes in U.S. and global trade policies and other factors beyond our control may adversely impact our business, financial condition, and results of operations. |

| · | Failure to comply with export control or economic sanctions laws and regulations could have a material adverse impact on our results of operations, financial condition, and reputation. |

| · | Our business and operations are inherently subject to environmental, health, and safety risks. As a result, our business is also subject to several stringent regulations, including environmental regulations. |

| · | Unfavorable outcomes in pending or future litigation may reduce our liquidity and negatively affect our financial performance and financial condition, including potential new claims related to the geological event in Alagoas. |

| · | We could be materially affected by violations of the FCPA, the Brazilian Anti-Corruption Law, and similar anti-corruption laws. |

| 2 |

| · | Climate change may negatively affect our business, financial condition, results of operations, and cash flow. |

| · | If we are unable to comply with the restrictions and covenants in the agreements governing our indebtedness, there could be a default under the terms of these agreements, which could result in an acceleration of payment of funds that we have borrowed and could affect our ability to make principal and interest payments on our debt obligations. |

| · | Unauthorized disclosure or loss of intellectual property, sensitive confidential or personal information, or disruption to information technology systems by cyberattacks or other security breaches, as well as our failure to comply with data protection laws and information security requirements may subject us to significant penalties or liability and may adversely impact our operations, reputation, and financial results. |

| · | There can be no assurance that Novonor will remain our controlling shareholder. Novonor and Petrobras may enter into transactions or other arrangements that may result in us not having a controlling shareholder. If no single shareholder or group of shareholders holds more than 50% of our voting stock or exercises a controlling interest, there may be increased opportunities for alliances between shareholders and conflicts between them. |

| · | The intended corporate reorganization communicated by Novonor and Petrobras to us may not be approved or implemented, and the migration to the Novo Mercado listing segment of the B3 may not occur. |

| · | We have lost the right of preference set forth in the current shareholders’ agreement with respect to new business opportunities in the petrochemical sector, and as result, Petrobras, which is our largest supplier of raw materials in Brazil, will be able to invest in the petrochemical sector independently from us and without first giving us a preference to do so. |

| · | Changes in tax laws may result in increases in certain direct and indirect taxes, which could reduce our gross margin and negatively affect our overall financial performance. |

Risks Relating to Brazil

| · | Brazilian political, economic, and business conditions, as well as the Brazilian government’s economic and other policies, may negatively affect demand for our products as well as our net revenue and overall financial performance. |

| · | Fluctuations in the real/U.S. dollar exchange rate could increase inflation in Brazil, raise the cost of servicing our foreign currency-denominated debt, and negatively affect our overall financial performance. |

| · | Fluctuations or changes in, or the replacement of, interest rates could impact the cost of servicing our debt or reduce our financial revenue, affecting our financial performance. |

Risks Relating to Mexico

| · | A renegotiation of commercial treaties or changes in foreign policy among Mexico, Canada, and the United States may negatively affect our business, financial condition, results of operations, and prospects. |

| · | Political events in Mexico could affect the Mexican economic policy and our business, financial condition and results of operations. |

| · | We rely on limited or sole-source suppliers for our raw materials, inputs, and energy, including transportation thereof. |

| · | We source part of our ethane feedstock from Pemex in Mexico, which we expect to be our primary main source of ethane until the Ethane Import Terminal is operational. |

Risks Relating to Our Equity and Debt Securities

| · | All of the shares issued by Braskem and owned by NSP Inv. are secured for the benefit of certain secured creditors of the Novonor Group. |

| · | Holders of our class A preferred shares or the ADSs may not receive any dividends or interest on shareholders’ equity. |

| 3 |

| · | If holders of the ADSs exchange them for class A preferred shares, they may risk temporarily losing, or being limited in, the ability to remit foreign currency abroad and certain Brazilian tax advantages. |

| · | The relative volatility and liquidity of the Brazilian securities markets may adversely affect holders of our class A preferred shares and ADSs. |

| · | Brazilian insolvency laws may be less favorable to holders of our shares, ADSs, and outstanding debt securities than bankruptcy and insolvency laws in other jurisdictions. |

Risk Factors

Risks Relating To Our Business And The Petrochemical Industry

The cyclical and volatile nature of the petrochemical industry may reduce our net revenue and gross margin.

The petrochemical industry, including the global markets in which we compete, is cyclical and sensitive to changes in global supply and demand. This cyclicality may reduce our net revenue, increase our costs, and decrease our gross margin, including as follows:

| · | downturns in general business and global economic activity may cause demand for our products to decline; |

| · | when global demand falls, the industry may face competitive pressures to lower its prices, and so may we; |

| · | lead to increases in prices of the raw materials we use, including naphtha, ethane, ethanol and propylene; and |

| · | if we decide to expand our plants or construct new plants, we may do so based on an estimate of future demand that may never materialize or may materialize at levels lower than we predicted. |

Historically, the international petrochemical markets have experienced alternating periods of limited supply, which have caused prices and profit margins to increase, followed by expansion of production capacity worldwide, which has resulted in oversupply and reduced prices and profit margins. Prices in the petrochemical industry follow the global petrochemical industry, and we establish the prices for the products we sell in Brazil, other countries in Latin America, the United States, Europe, and the world with reference to international market prices. Therefore, our net revenue, feedstock costs, and gross margin are linked to global industry conditions that we cannot control, and which may adversely affect our results of operations and financial position.

Moreover, relevant events or changes in the cycle and in the petrochemical industry, including technological innovations, and regulatory changes including related to climate change, may materially affect the future profitability of our business and consequently reduce the recoverable value of our assets, which is reviewed by the annual impairment test, which may adversely affect the profit attributable to our shareholders.

Adverse conditions in the petrochemical industry may adversely affect demand for our products.

Sales of our petrochemical and chemical products are tied to global production levels and demand, which can be affected by macro-economic factors such as interest rates, international oil prices, energy prices, shifts to alternative products, consumer confidence, employment trends, regulatory and legislative oversight requirements, trade agreements, regulatory developments including related to climate change, as well as regional disruptions, armed conflicts, natural disasters, epidemics, pandemics, or other global events. Therefore, our net revenue, feedstock costs, and gross margin are linked to global conditions that we cannot control, and which may adversely affect our results of operations and financial position. For example, the persistence of the geopolitical conflicts, such as the war involving Russia and Ukraine, and the conflicts involving Hamas, Israel and Hezbollah, and other conflicts in the Middle East (including economic sanctions and other regulations imposed by the United States and other international countries as a result thereof) could negatively impact supply chains worldwide and demand for our products and the raw materials we use. Should the conflict in Ukraine or other international locations further escalate, it is difficult to anticipate the extent to which the consequences of such conflict, including without limitation effects on the price of oil and current or future sanctions, could increase our costs, disrupt our supplies, reduce our sales, or otherwise affect our operations.

| 4 |

We face competition from suppliers of polyethylene, polypropylene, PVC, and other products.

We face strong competition across all of our products. Some of our foreign competitors are substantially larger and have greater financial, manufacturing, technological, and/or marketing resources than us. Our U.S. operations face competition in the United States from other North American suppliers that serve the North American market. Our European operations face competition in Europe and the other export markets that it serves from European and other foreign suppliers of polypropylene. Our Mexico operations face competition from Mexican and U.S. producers of polyethylene. Competitors from South America may export to Brazil with reduced or no import duties, including through the Manaus Free Trade Zone (“Zona Franca de Manaus”). In addition, suppliers of almost all continents have regular or specific sales to trading companies and direct customers in Brazil for our products, including resins.

We generally follow the international markets with respect to the prices for our products sold in Brazil. The domestic price is determined by the import parity, which is based on converters’ imports into Brazil and typically represents spot market price, including but not limited to exchange rate fluctuations and import tariffs that the Brazilian government uses to implement economic policies. Adjustments of tariffs could lead to increased competition from imports, causing us to lower our domestic prices and impact the demand for our products, which would likely result in lower net revenue and could negatively affect our overall financial performance. This effect combined would have a negative impact on our gross margins and overall financial performance. We have no control over the import tax rate policy in Brazil or Mercosur (the Southern Common Market, or Mercosur in Spanish), a common market that serves as a regional integration process and was initially established by Argentina, Brazil, Paraguay, and Uruguay, and subsequently joined by Venezuela and Bolivia. Petrochemical import taxes that are currently in place have changed in the past and may change in the future, including as a result of decisions of the Brazil government or Mercosur. We generally set the prices for our products exported from Brazil based on international market prices. We set the prices for products sold in the United States and Europe based on market pricing in such regions. The price for polyethylene in Mexico is based on prices in the U.S. Gulf Coast region.

As a result of the commissioned fractioned gas-based ethylene and new polyethylene capacities and of the expected new capacities for the production of resins and petrochemicals, coupled with the competitive pricing of feedstock for petrochemicals production such as ethane, we anticipate that we may experience increased competition from producers of thermoplastic resins, especially from North American, Middle Eastern, and Chinese producers, in the markets in which we sell our products. In addition, the Chinese government has exercised, and continues to exercise, significant influence over the Chinese economy, including governmental actions to incentivize and achieve self-sufficiency production in some specific chains, such as PE and PP. Those new capacities could lead to a rebalancing of global export flows and an increase in global competition from our competitors, some of which are larger and have greater competitive advantages than us.

In addition, exchange rate variations may affect the competitiveness dynamics in different regions in which we operate. For instance, the appreciation of the real against the U.S. dollar may increase the competitiveness of imported products, which may increase the competition from resins producers in Brazil. Also, (i) the appreciation of the Euro against the U.S. dollar may increase the competitiveness of imported products and, as a consequence, increase competition from imports, and (ii) the appreciation of the Mexican peso against the U.S. dollar may increase the competition from other resins producers in Mexico.

We may face competition from producers of substitutes for our products as a result of evolving technology, consumer and industry trends and preferences, and regulatory changes.

We compete in a market that relies on technological innovation and the ability to adapt to evolving consumer and global industry trends and preferences. Petrochemical products and other products produced with our petrochemical products, such as consumer plastic items, are subject to changing consumer and industry trends, demands, and preferences, as well as stringent and constantly evolving regulatory and environmental requirements. Therefore, products once favored may, over time, become disfavored by consumers or industries or no longer be perceived as the best option, which may, therefore, affect our results of operations and financial position.

| 5 |

Plastic waste and climate change are global environmental concerns that receive growing attention from society in general, national and local governments, private companies, trendsetters, and consumers worldwide. There has been a growing trend to attempt to move away from the use of plastic products, which has been backed by governmental and lawmaking initiatives.

In 2019, the European Union approved regulations banning as of 2021 single-use plastic items such as plates, cutlery, straws, and cotton bud sticks and adopting a strategy for the disposal of plastic products in a circular economy that aims to increase recycling significantly and targets the plastic products most often found on beaches and in seas. The European Union is now currently revising such rules to increase recycling and recycled content targets, as well as to establish new regulations on the design and labeling of plastic products. In addition, state and local governments in other countries, for example in China and in Brazil, have also proposed or implemented bans on single-use plastic products. Regarding regulatory issues related to plastic for single use in Brazil, proposed regulations are being discussed at the federal, state, and municipal levels.

Additionally, legislative proposals on carbon border adjustment mechanisms aiming at preventing carbon leakage have been under discussion in several countries. So far, none of the proposals have yet affected chemicals and plastic resins, but this might change in the future. Recently, the United Nations Environment Programme (“UNEP”) has started conversations to negotiate an international legally binding instrument aiming at eliminating plastics pollution. These rounds of negotiations were expected to end by 2024, but are still ongoing, and a new session of negotiations is scheduled for August 2025. Some of the proposals include reducing and even prohibiting the production of certain plastic products considered “problematic” and “chemicals of concern.” Production caps are also under negotiation. The expansion of regulation or the prohibition of the use and sale of plastic products could increase the costs incurred by our customers or otherwise limit the application of these products and could lead to a decrease in demand for resins and other products we make. Such a decrease in demand could adversely affect our business, results of operations, and financial condition. A part of our strategy is to grow our bio-based and recycling business. We are supporting several initiatives to foster a low-carbon circular economy (reusing and repurposing resources within the economy), including, but not limited to (i) partnerships to develop new products and applications to improve efficiency and promote recycling and reuse (circular design); (ii) development of a portfolio of innovative products with recycled and bio-based contents; and (iii) development of recycling technology, supporting the advancement of studies and tests, for both chemical and mechanical recycling. We cannot predict the outcome of such initiatives since there still are many objectives to be accomplished to reduce plastic waste and marine litter, which may lead to a decrease in interest in our products by our customers and consumers, impacting our results of operations and financial condition. Moreover, we may not be able to successfully implement our strategy to grow our bio-based and recycling business, which could adversely affect our financial condition and results of operations.

Also, new competitors may develop new technologies to offer less carbon-intensive products, which could result in a loss of our competitiveness and a reduction of our revenues.

In addition, regulations may be amended or enacted in the future that could make it more difficult to appeal to our customers, end consumers, or market the products that we produce. For example, failure to comply with applicable policies could lead to lower demand for our products, banning of plastic products without allowing the search for alternatives employing efficient solutions, including resins produced by us, could have a material adverse effect on our business, results of operations and financial condition. Also, even if we are able to continue promoting our products, there can be no assurance that our competitors, including producers of substitutes, will not be successful in persuading consumers of our products to switch to their products. Some of our competitors may have greater access to financial or other resources than we do, which may better position them to react and adapt to evolving trends, preferences, and regulatory changes. Any loss of interest in our products or consumer products produced with our products may have a material adverse effect on our business, results of operations, and financial condition.

| 6 |

Our revenue from certain of our customers may be significant, and the credit risks associated with these customers could adversely affect the results of our operations and increase expected credit losses.

We engage in several transactions where counterparty credit risk is a relevant factor, including transactions with certain of our customers and those businesses we work with to provide services, among others. These risks are dependent upon market conditions and also the real and perceived viability of the counterparty. The failure or perceived weakness of any of our counterparties has the potential to expose us to risk of loss in certain situations. Our revenue from certain of our customers may be significant, and the credit risks associated with these customers could adversely affect our results of operations.

Additionally, if the viability of the business of certain of our customers deteriorates, these customers seek bankruptcy protection, or our credit policies are ineffective in reducing our exposure to credit risk relating to such customers, our ability to collect our receivables may be adversely affected, and additional increases in expected credit losses accounts may be necessary, which could have a material adverse effect on our cash flows and results of operations. We record expected credit losses in an amount we consider sufficient to cover estimated losses on the realization of our trade accounts receivable, considering our loss experience and the average aging of our accounts receivable, but we cannot assure you that these amounts will be sufficient to cover eventual losses. In addition, delays in payment cycles by significant customers may adversely affect our liquidity and ability to obtain financing for working capital, such as sales of receivables.

Higher raw materials costs would increase our cost of products sold and may reduce our gross margin and negatively affect our overall financial performance.

Naphtha, propylene, ethane, condensate, light refinery hydrocarbon, and propane are the main raw materials used in our operations. For the year ended December 31, 2024, these raw materials accounted for an aggregate of 63% of our consolidated cost of products sold. Comparatively, they represented 61% in 2023.

Naphtha, a crude oil derivative, is the principal raw material in the Brazil Segment that we use to produce our basic petrochemical products in our petrochemical complexes located in Bahia, São Paulo and Rio Grande do Sul, and represents the principal production and operating cost of such complexes.

In addition, Ethane and propane are the principal raw materials that we use to produce our basic petrochemical products in our petrochemical complex located in Duque de Caxias, in the State of Rio de Janeiro, or the Rio de Janeiro Complex, and represent the principal production and operating cost of such complex. Propylene is the principal raw material that we use to produce polypropylene in the United States and Europe and represents the principal production and operating cost of our United States and Europe Segment. We also purchase propylene in the Brazilian market for certain of our Brazilian polypropylene plants.

Ethane is the principal raw material that we use to produce ethylene in the Braskem Idesa’s industrial site (“Mexico Complex”) and represents its principal production and operating costs.

In Brazil, we purchase naphtha at prices based on the Amsterdam-Rotterdam-Antwerp naphtha price, or the ARA price, and ethane and propane based on United States market references. We purchase ethane used by our Mexico Segment at prices based on Mont Belvieu ethane reference price. We purchase the propylene used in Brazil and United States plants at prices based on the U.S. Gulf (“USG”) reference price. We purchase the propylene used in our European plants as reported by international references based on the monthly contract price for propylene for Europe. We purchase light refinery hydrocarbon used in the São Paulo petrochemical complex at a price related to imported natural gas price.

The ARA price of naphtha fluctuates primarily based on Brent crude oil but also follows the markets of fuels and petrochemicals.

The price of naphtha, condensate, ethane, propane, and propylene in the international market has been, and may continue to be, volatile. In addition, fluctuations in the U.S. dollar in the future may effectively increase our naphtha, ethane, propane, and propylene costs in reais. Any increase in naphtha, ethane, propane, or propylene costs would reduce our gross margin and negatively affect our overall financial performance to the extent we are unable to pass on these increased costs to our customers and could result in reduced sales volumes of our products.

| 7 |

We do not hedge against price changes in our raw materials and, as a result, we are exposed to such fluctuations.

Currently, we do not hedge our exposure to feedstock price changes beyond transit periods when buying cargoes from foreign sources. We believe there is a natural hedge in the petrochemical industry dynamic, mainly due to the historical correlation observed between naphtha, the principal feedstock of a marginal producer in the global market and with higher production costs, and its final products (PE, PP, PVC, and others). Historically, naphtha price fluctuations show a high correlation with changes in first- and second-generation petrochemical products. Therefore, any hedge solely with respect to naphtha’s price would break this natural protection, most likely making our results more volatile. Compared to naphtha and propylene, ethane and propane prices show a lower correlation to the prices of our products in the international market. As a result, final consumer prices may not reflect feedstock cost fluctuations.

We depend on Petrobras to supply us with a substantial portion of our naphtha, ethane, propane, light refinery hydrocarbon and propylene needs, and also on logistics services.

Petrobras is a relevant Brazilian supplier of naphtha for us and has historically supplied up to 70% of the naphtha consumed by our Brazil Segment. Currently, Petrobras is also our primary supplier of ethane, propane, propylene, and light refinery hydrocarbon and has historically supplied the ethane, propane, and light refinery hydrocarbon that we consume in our Brazil Segment operations.

We are a party to several propylene contracts with Petrobras refineries, which have historically supplied approximately 40% of our propylene needs to produce polypropylene in Brazil at prices based on international references. As a result of the limited infrastructure in Brazil to allow the importation of propylene in large quantities and substantial costs associated with the storage and transportation of the product, we depend on propylene supplied by Petrobras to operate our PP plants at optimal operational levels.

We have five propylene supply agreements with Petrobras that will expire between 2026 and 2029 and one contract for light refinery hydrocarbon that will expire in 2028. We cannot assure that these agreements will be renewed and, if renewed, whether we will be able to keep the same terms and conditions currently in force, including with respect to pricing, volume, pipeline and other infrastructure access. We also have the possibility to make spot propylene purchases from Petrobras in order to seize opportunities in the PP market, in case there are positive margins.

In June 2020, we entered into new agreements with Petrobras for the supply of petrochemical naphtha to our petrochemical complexes in Bahia and Rio Grande do Sul. The agreements, with a term of five years following the expiration of the prior agreement with Petrobras, establish the supply of a minimum annual volume of 650 kton and, at the option of Petrobras, an additional volume of up to 2.85 million tons per year, at the price formula linked to the international reference ARA. In addition, to guarantee access to the naphtha logistics system in Rio Grande do Sul, we also renewed the storage agreement with Petrobras until December 2025 at REFAP located in the city of Canoas and until June 2024 for the storage at TEDUT located in the city of Osório. The agreement for the storage at TEDUT was renewed in June 2024 with a term expiring in June 2028.

In Brazil we have feedstock supply agreements with Petrobras until 2025 for the supply of petrochemical naphtha to our industrial unit in São Paulo and ethane and propane to our industrial unit in Rio de Janeiro. The agreements, establish the supply of up to 2.0 million tons per year of petrochemical naphtha to our industrial unit in São Paulo and up to 580,000 tons of ethylene equivalent (volume of ethylene per ton of ethane and propane) per year to our industrial unit in Rio de Janeiro, with prices based on international reference.

Petrobras controls a substantial portion of the pipeline infrastructure used to transport naphtha across Brazil and is our primary supplier of naphtha, ethane, propane, propylene, and light refinery hydrocarbon. A failure to renew or extend our existing agreements for the supply of raw materials or pipeline infrastructure use or termination of such agreements with Petrobras could lead to difficulties in accessing Petrobras’ pipeline infrastructure. The alternative would be to access pipeline infrastructure by negotiating with Transpetro and, if necessary, the National Petroleum Agency, or the ANP, which would grant access to the pipeline infrastructure at a cost defined by the ANP.

| 8 |

Therefore, our production volumes and net revenue would likely decrease, while our costs would likely increase, and adversely affect our overall financial performance in the event of the occurrence of one or more of the following:

| · | significant damage to Petrobras’ supply infrastructure through which Petrobras and Braskem import naphtha, or to any of the pipelines connecting our plants to Petrobras’ plants, whether as a result of an accident, natural disaster, fire, or otherwise; |

| · | termination by Petrobras of the naphtha, ethane, propane, propylene, and light refinery hydrocarbon supply contracts with us, which provide that Petrobras may terminate the contracts for certain reasons; |

| · | considering that Petrobras (and/or its subsidiaries) controls a substantial portion of the logistics infrastructure of our raw material across Brazil and our existing agreements for using its assets and their operation over certain Braskem’s assets, we could also assume that we would face difficulties to import and ensure access of raw material to our crackers in a scenario that these agreements are terminated by Petrobras (and/or its subsidiaries) and therefore with a substantial impact on the infrastructure that we currently access; or |

| · | failure to renew or extend our existing agreements for the supply of raw materials or pipeline infrastructure use, considering that Petrobras is conducting a divestment plan of its assets that also includes certain refineries that supply naphtha and propylene to us and some logistic infrastructure assets. |

If the supply agreements are terminated or not renewed, our production volumes and net revenue would likely decrease, while our costs would likely increase, and adversely affect our overall financial performance.

In addition, although regulatory changes have ended Petrobras’ monopoly in the Brazilian naphtha market and have allowed us to import naphtha, any restrictions imposed on the importation of naphtha into Brazil could increase our production costs, which would reduce our gross margin and negatively affect our overall financial performance.

We depend on propylene and ethylene supplied by third parties in the United States and Europe.

Our reliance on third-party suppliers poses significant risks to our results of operations, business, and prospects. We rely upon third parties to supply our plants with propylene and ethylene. We acquire propylene and ethylene for our polypropylene plants in the United States under long-term supply agreements and through the spot market. As of December 31, 2024, we had 23 propylene supply agreements and two ethylene supply agreements with several suppliers. The pricing formulas for propylene and ethylene under these supply agreements are generally based on market prices. We cannot assure you that these agreements will be renewed and, if renewed, whether we will be able to keep the same terms and conditions currently in force, including with respect to pricing, volume, pipeline, and other infrastructure access.

We acquire propylene for our polypropylene plants in Germany under long-term supply agreements that provide approximately 90% of the propylene requirements of these plants. We have two main supply agreements in Germany. The first has an initial five-year term effective as of 2021 and the second has a current validity term of 2 years. The price quotation for propylene under these long-term supply agreements are related to the monthly contract price for propylene for Europe (as reported by ICIS-LOR), varying their discounts and/or formula rational according to each supplier.

| 9 |

We cannot assure you that these agreements will be renewed and, if renewed, whether we will be able to keep the same terms and conditions currently in force, including with respect to pricing, volume, pipeline, and other infrastructure access.

Delays in the availability of acceptable quality propylene or our inability to obtain such acceptable propylene in the quantities we need over what has been contracted or at all may adversely affect our revenue and results of operations.

We depend on ethane supplied by Pemex in Mexico.

We currently source a significant portion of our supply of ethane, which is the primary feedstock used in our polyethylene production process, from Pemex, under competitive commercial conditions at prices that reference the Mont Belvieu ethane reference price, a U.S. dollar-based international reference price. As a result, our production volumes, net revenue, and profit margins would likely decrease and materially adversely affect our overall financial performance in case one or more of the following events occur:

| · | significant damage to Pemex’s gas processing centers or to any of the pipelines connecting our complex to Pemex ’s facilities, whether as a consequence of an accident, natural disaster, fire, or otherwise; |

| · | in 2024, published plans for Pemex consider the reactivation of its ethane derivatives plants in Coatzacoalcos, Veracruz, decreasing the volume of ethane delivered by Pemex to Braskem Idesa; |

| · | any further decrease in the amount of ethane currently being delivered by Pemex to our petrochemical complex; |

| · | any dispute with Pemex, related to the ethane supply agreement, including the non-recognition or non-payment of shortfall penalties and the decrease or failure to supply the contracted volume of ethane; |

| · | any material default by us or by Pemex to supply/receive ethane in the contractually agreed volumes or qualities under the ethane supply agreement; |

| · | any material breach or termination by Pemex or by us of the ethane supply agreement, or any material breach or termination by other Mexican state-owned companies of related supply (including those for the transportation of supplies) agreements. As of the date hereof, the term has been extended through February 2026 or until the ethane import terminal is constructed, commissioned and commercially operational; or |

| · | delays in the availability of ethane of acceptable quality, or our inability to obtain acceptable ethane in the quantities and quality that we need, or at all, or at reasonable prices. |

Under the ethane supply agreement with Pemex, if Pemex fails to deliver the contracted minimum daily volume during a given quarter, it may offset this shortfall by delivering additional quantities of ethane during the two immediately subsequent quarters. If it does not do so, Pemex will be required to pay Braskem Idesa a penalty equivalent to the average price of the ethane that was not delivered in the period in question. On the other hand, if Braskem Idesa fails to purchase the contracted minimum daily volume, we may be able to offset this deficit by purchasing additional amounts of ethane during the two immediately subsequent quarters. If it does not do so, Braskem Idesa will be required to pay a penalty to Pemex equivalent to the average price of ethane that was not purchased during the period in question.

Furthermore, the ethane supply agreement could also be impacted by changes in laws and regulations, terminated or modified by Pemex as a result of political pressure or be subject to expropriation or other adverse measures by the Mexican government or government entities. Braskem Idesa may also renegotiate the terms of the ethane supply agreement, voluntarily or as a result of changes in laws and regulations, or otherwise.

| 10 |

The provisions for early termination by Pemex under the Ethane Supply Agreement include: (i) failure by Braskem Idesa to pay that continues for more than six months after notice; or (ii) an emergency stoppage in operations or force majeure event due to which Braskem Idesa’s insurers consider the complex to be a total loss, or after which Braskem Idesa cannot or does not resume operations for 48 months.

If Pemex (i) delivers less than an average of 75% of the agreed volume over a six-month period; (ii) reaches the annual limit in respect of shortfall penalties owed by Pemex to Braskem Idesa and such limit is not waived by Braskem Idesa; or (iii) materially breaches any of its obligations related to the supply of ethane thereunder; Braskem Idesa has the right to notify Pemex through a notice of breach. If such breach continues for more than six months after notice, or an extended period if the parties agree, Braskem Idesa has the right to terminate the ethane supply agreement and require Pemex to repay certain outstanding debt and compensate Braskem and Idesa according to an agreed valuation formula including the repayment of certain of our debt in the form of a put option right under the ethane supply agreement.

On September 27, 2021, Braskem Idesa entered into: (i) an amendment to the ethane supply agreement (the “amendment to the ethane supply agreement”) with Pemex with presence of Pemex Exploración y Producción to settle certain prior contractual outstanding issues; and (ii) an agreement with Pemex, Pemex Logística with presence of other Mexican government entities, establishing certain support measures to the project to build an ethane import terminal with the capacity to meet all of Braskem Idesa’s feedstock requirements (the “Ethane Import Terminal Agreement”).

The amendment to the ethane supply agreement changed the minimum volume commitment to 30,000 barrels per day until February 2025, and such term may be extended in the event of a delay of obtaining permits not attributable to Braskem Idesa or TQPM (Terminal Química Puerto Mexico, S.A.P.I.). As of the date hereof, the term has been extended until February 2026 or until the ethane import terminal is constructed, commissioned and commercially operational.