UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended

Commission File Number

Petróleo Brasileiro S.A. — Petrobras

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation — Petrobras

(Translation of registrant’s name into English)

The Federative Republic of Brazil

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Chief Financial Officer and Chief Investor Relations Officer

(55

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class: |

Trading Symbol(s): |

Name of each exchange on which registered: |

| Petrobras Common Shares, without par value* | PBR/PBRA | New York Stock Exchange* |

(evidenced by American Depositary Receipts, or ADRs), each representing two Common Shares |

||

| Petrobras Preferred Shares, without par value* | PBR/PBRA | New York Stock Exchange* |

| Petrobras American Depositary Shares (as evidenced by American Depositary Receipts), each representing two Preferred Shares |

PBR/PBRA | New York Stock Exchange |

| 8.750% Global Notes due 2026, issued by PGF | PBR | New York Stock Exchange |

| 7.375% Global Notes due 2027, issued by PGF | PBR | New York Stock Exchange |

| 5.999% Global Notes due 2028, issued by PGF | PBR | New York Stock Exchange |

| 5.750% Global Notes due 2029, issued by PGF | PBR | New York Stock Exchange |

| 5.093% Global Notes due 2030, issued by PGF | PBR | New York Stock Exchange |

|

5.600% Global Notes due 2031, issued by PGF 6.500% Global Notes due 2033, issued by PGF |

PBR |

New York Stock Exchange New York Stock Exchange |

| 6.000% Global Notes due 2035, issued by PGF | PBR | New York Stock Exchange |

| 6.875% Global Notes due 2040, issued by PGF (successor to PifCo) | PBR | New York Stock Exchange |

| 6.750% Global Notes due 2041, issued by PGF (successor to Pifco) | PBR | New York Stock Exchange |

| 5.625% Global Notes due 2043, issued by PGF | PBR | New York Stock Exchange |

| 7.250% Global Notes due 2044, issued by PGF | PBR | New York Stock Exchange |

| 6.900% Global Notes due 2049, issued by PGF | PBR | New York Stock Exchange |

| 6.750% Global Notes due 2050, issued by PGF | PBR | New York Stock Exchange |

| 5.500% Global Notes due 2051, issued by PGF | PBR | New York Stock Exchange |

| 6.850% Global Notes due 2115, issued by PGF | PBR | New York Stock Exchange |

_________________

| * | Not for trading, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the New York Stock Exchange. |

Securities registered or to be registered

pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section

15(d) of the Act: None

The number of outstanding

shares of each class of stock as of December 31, 2024 was:

Petrobras Common Shares, without par value

5,446,501,379 Petrobras Preferred Shares, without par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. ☐

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation

to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the

Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check

mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued

financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐

No

Table of Contents

| Disclaimer | 6 |

| Glossary | 9 |

| About us | 24 |

| About us | 25 |

| Overview | 26 |

| 2024 Highlights | 29 |

| Risks | 31 |

| Risks | 32 |

| Cybersecurity Framework and Risk Management | 57 |

| Our Business | 61 |

| Exploration & Production | 62 |

| Refining, Transportation & Marketing | 101 |

| Gas & Low Carbon Energies | 124 |

| Mergers and Acquisitions | 143 |

| External Business Environment | 146 |

| Strategic and Business Plans | 152 |

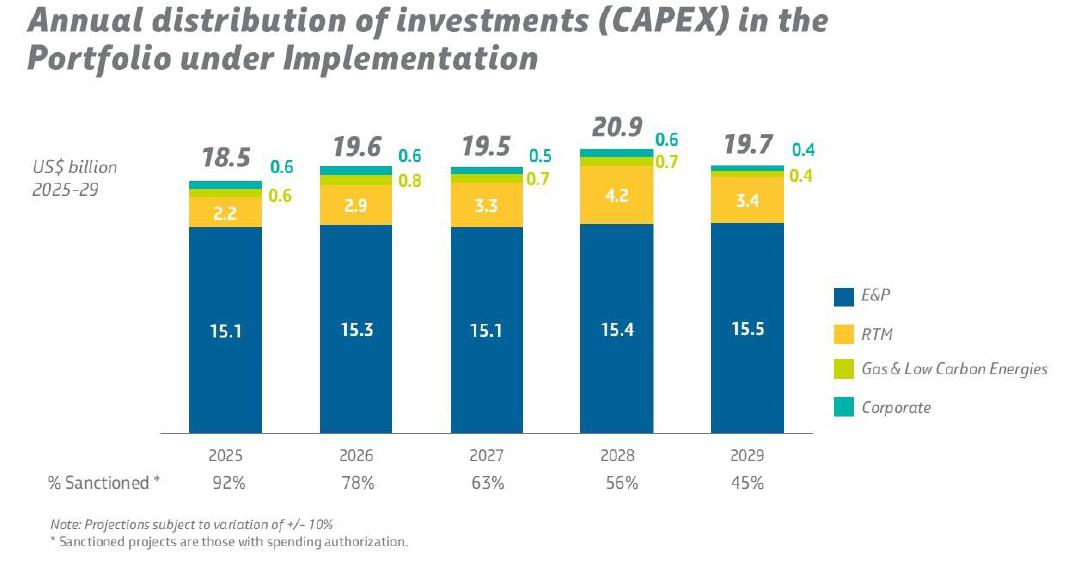

| Strategic Plan 2050 and Business Plan 2025-2029 | 153 |

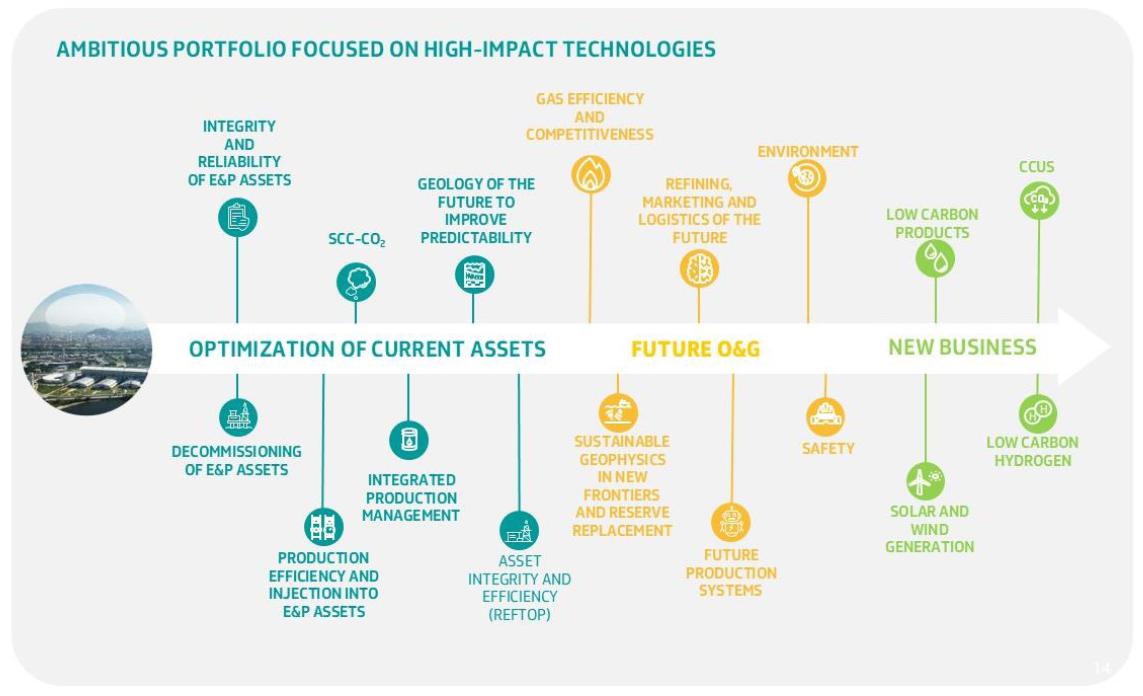

| Research, Development and Innovation | 164 |

| Environment, Social and Governance | 167 |

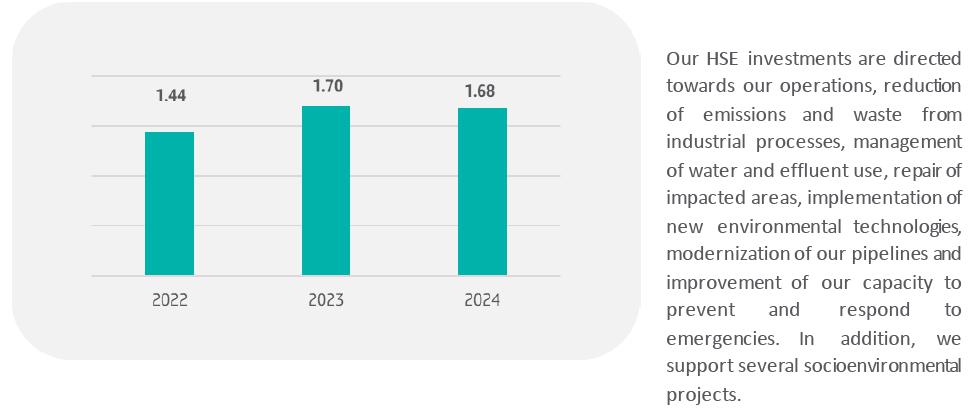

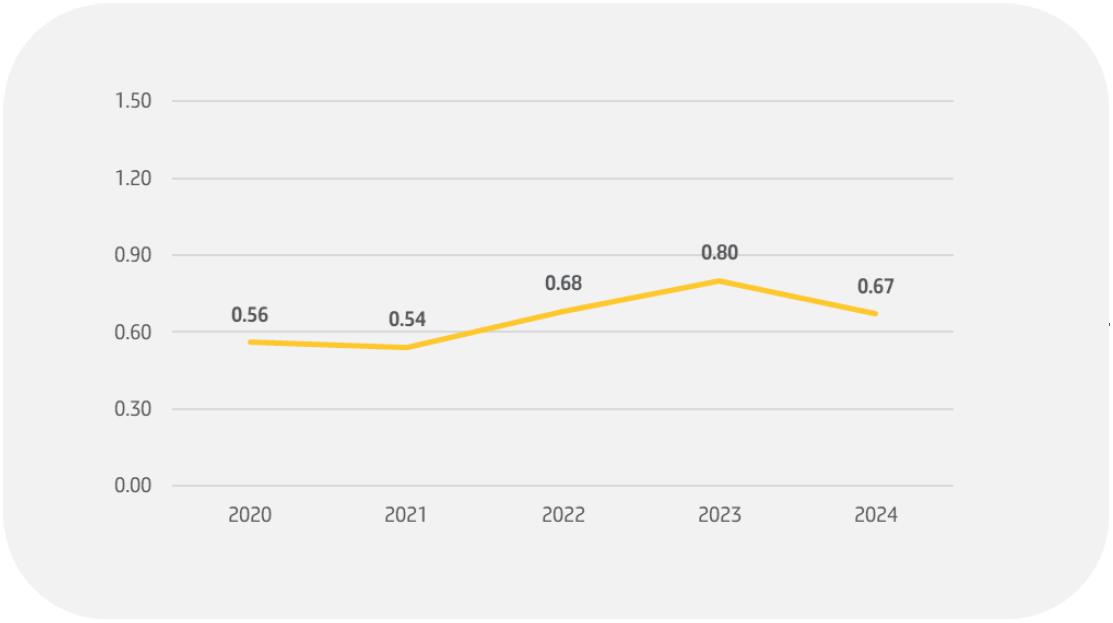

| Environment | 168 |

| Social Responsibility | 175 |

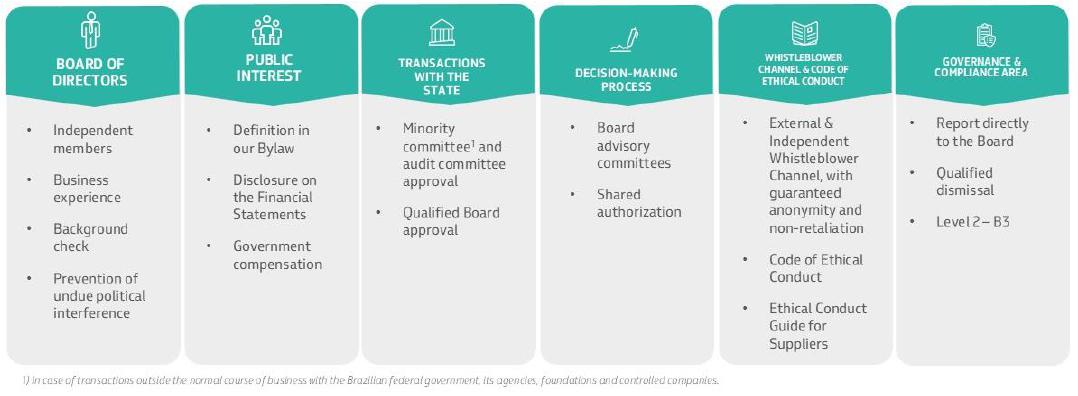

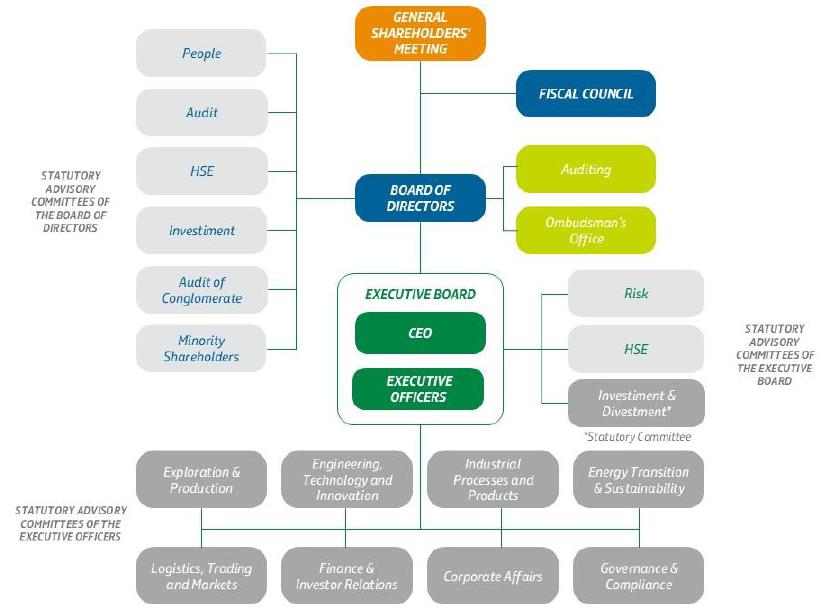

| Corporate Governance | 182 |

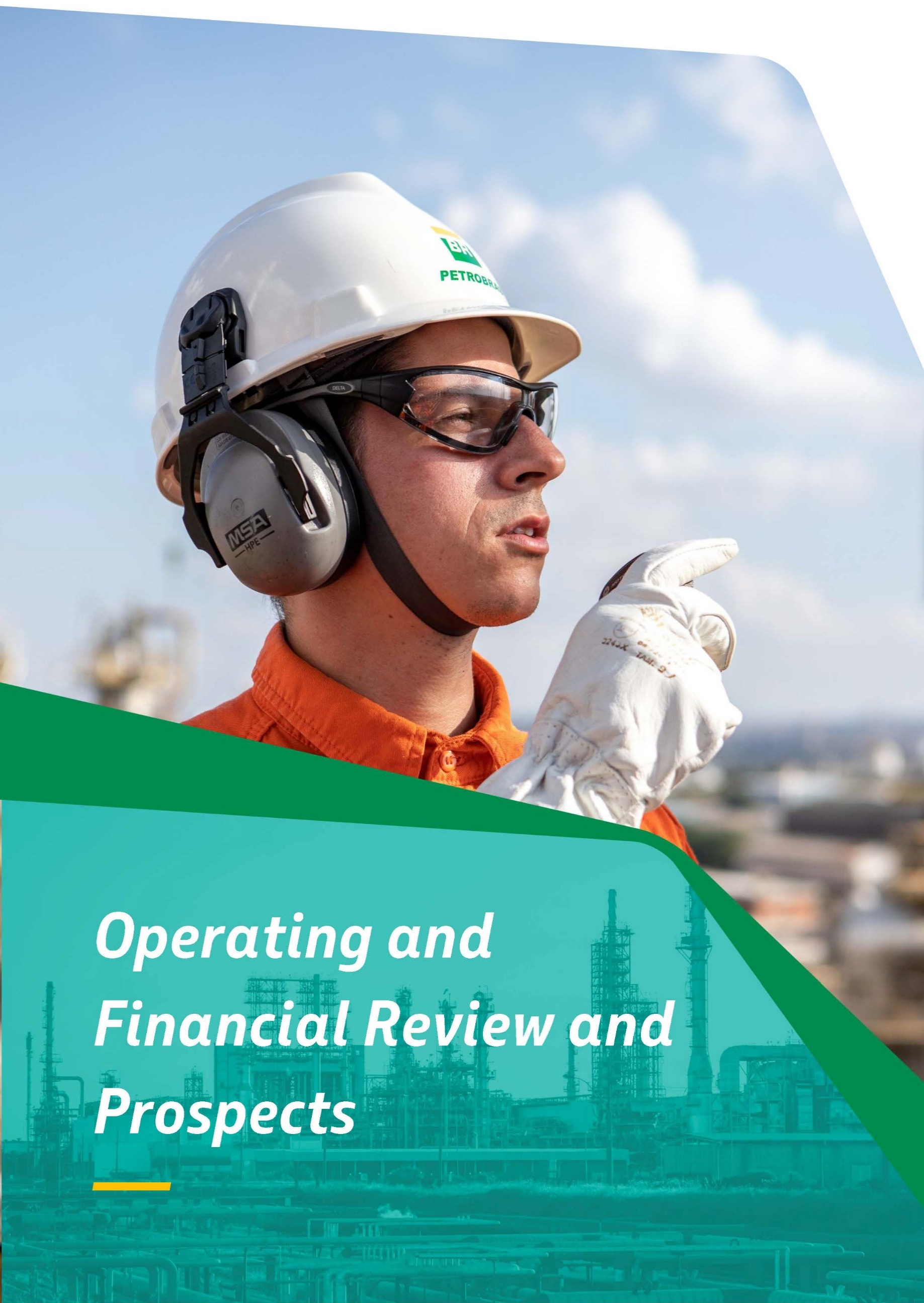

| Operating and Financial Review and Prospects | 189 |

| Consolidated Financial Performance | 190 |

| Financial Performance by Business Segment | 197 |

| Liquidity and Capital Resources | 199 |

| Annual Report and Form 20-F 2024 I 4 |

|

| Management and Employees | 213 |

| Management | 214 |

| Employees | 236 |

| Compliance and Internal Controls | 245 |

| Compliance | 246 |

| Related Party Transactions | 250 |

| Controls and Procedures | 252 |

| Ombudsman and Internal Investigations | 253 |

| Shareholder Information | 254 |

| Listing | 255 |

| Shares and Shareholders | 256 |

| Shareholders’ Rights | 263 |

| Shareholder Remuneration | 268 |

| Additional Information for Non-Brazilian Shareholders | 273 |

| Legal and Tax | 276 |

| Regulation | 277 |

| Material Contracts | 283 |

| Legal Proceedings | 287 |

| Tax | 294 |

| Additional Information | 315 |

| List of Exhibits | 316 |

| Signatures | 322 |

| Abbreviations | 323 |

| Conversion table | 325 |

| Cross-Reference to Form 20-F | 326 |

| Financial Statements | 329 |

| Consolidated Financial Statements | 329 |

| Annual Report and Form 20-F 2024 I 5 |

|

Disclaimer

We have presented the information in this annual report and Form 20-F in a manner consistent with how we view our business. In order to facilitate your review, this annual report and Form 20-F for the year ended December 31, 2024 (referred to herein as our “annual report”) has a cross-reference guide to SEC Form 20-F under “Cross-Reference to Form 20-F”.

Unless the context otherwise indicates, please consider this report the annual report of Petróleo Brasileiro S.A. – Petrobras. Unless the context otherwise requires, the terms “Petrobras,” “the Company,” “our company,” “we,” “us” and “our” refer to Petróleo Brasileiro S.A. – Petrobras and its consolidated subsidiaries, joint operations and structured entities.

Our audited consolidated financial statements, presented in U.S. dollars, included in this annual report and the financial information contained in this annual report that is derived therefrom are prepared in accordance with the IFRS Accounting Standards, as issued by the International Accounting Standards Board (“IASB”).

Our functional currency and the functional currency of all of our Brazilian subsidiaries is the Brazilian real and the functional currency of most of our entities that operate outside Brazil, such as Petrobras Global Finance B.V. or PGF, is the U.S. dollar. We have selected the U.S. dollar as our presentation currency to facilitate a more direct comparison to other oil and gas companies.

In this annual report, references to “real,” “reais” or “R$” are to Brazilian reais and references to “U.S. dollars” or “US$” are to United States dollars.

The information available on our website, or on any website referenced herein, is not and shall not be deemed to be incorporated by reference to this annual report.

The 2024 GHG emissions performance results presented in this annual report will be subject to third party verification, and although we do not expect significant differences, the audited results may differ from the results presented herein.

Forward-Looking Statements

This annual report includes forward-looking statements that are not based on historical facts and are not assurances of future results. The forward-looking statements contained in this annual report, which address our expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” “potential” and similar expressions (which are not the exclusive means of identifying such forward-looking statements).

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur.

We have made forward-looking statements that address, among other things:

| – | Our marketing and expansion strategy; |

| – | Our exploration and production activities, including drilling; |

| – | Our activities related to refining, import, export, transportation of oil, natural gas and oil products, petrochemicals, power generation, biofuels and other sources of renewable energy; |

| – | Our commitment with respect to ESG practices and low carbon and environmental sustainability; |

| – | Our projected and targeted capital expenditures, commitments and revenues; |

| Annual Report and Form 20-F 2024 I 6 |

|

| – | Our liquidity and sources of funding; |

| – | Our pricing strategy and development of additional revenue sources; and |

| – | The impact, including cost, of acquisitions and divestments. |

Our forward-looking statements are not guarantees of future performance and are subject to assumptions that may prove incorrect and to risks and uncertainties that are difficult to predict. Our actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following:

| – | Our ability to obtain financing; |

| – | General economic and business conditions, including crude oil and other commodity prices, refining margins and prevailing exchange rates; |

| – | Global economic conditions; |

| – | Our ability to find, acquire or gain access to additional reserves and to develop our current reserves successfully; |

| – | Uncertainties inherent in making estimates of our oil and gas reserves, including recently discovered oil and gas reserves; |

| – | Competition; |

| – | Technical difficulties in the operation of our equipment and the provision of our services; |

| – | Changes in, or failure to comply with, laws or regulations, including with respect to fraudulent activity, corruption and bribery; |

| – | Receipt of governmental approvals and licenses; |

| – | International and Brazilian political, economic and social developments, including the role of the Brazilian government, as our controlling shareholder, in our business; |

| – | Natural disasters, accidents, military operations, acts of sabotage, wars or embargoes; |

| – | Cybersecurity threats, breaches, and disruptions; |

| – | Global health crises, such as the COVID-19 pandemic; |

| – | The impact of expanded regional or global conflict, including the conflict between Russia and Ukraine, and the conflict in the Middle East; |

| – | The cost and availability of adequate insurance coverage; |

| – | Our ability to successfully implement acquisitions, partnerships or asset sales in our portfolio management program; |

| – | Our ability to successfully implement our Strategic Plan 2050 and Business Plan 2025-2029, whether those strategic and business plans remains in place, and the direction of any subsequent strategic and business plans; |

| – | The outcome of ongoing corruption investigations and any new facts or information that may arise in relation to past investigations related to alleged irregularities or corruption; |

| – | The effectiveness of our risk management policies and procedures, including operational risk; |

| – | Potential changes to the composition of our Board of Directors and our management team; and |

| – | Litigation, such as class actions or enforcement or other proceedings brought by governmental and regulatory agencies. |

| Annual Report and Form 20-F 2024 I 7 |

|

For additional information on factors that could cause our actual results to differ from expectations reflected in forward-looking statements, see “Risks” in this annual report.

All forward-looking statements attributed to us or a person acting on our behalf are qualified in their entirety by this cautionary statement. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The crude oil and natural gas reserve data presented or described in this annual report are only estimates, which involve some degree of uncertainty, and our actual production, revenues and expenditures with respect to our reserves may materially differ from these estimates.

|

Documents on Display |

|

We are subject to the information requirements of the Exchange Act. For further information about obtaining copies of our public filings at the NYSE, please call +1 (212) 656-4050. Our SEC filings are available to the public at the SEC’s website at www.sec.gov and at our website at www.petrobras.com.br/ir. You may also inspect our reports and other information at the offices of the New York Stock Exchange, or NYSE, at 11 Wall Street, New York, New York 10005, on which our ADSs are listed. We also furnish reports on Form 6-K to the SEC containing our unaudited consolidated interim financial statements and other financial information of our company. We also file audited consolidated financial statements, unaudited consolidated interim financial information and other periodic reports with the CVM. |

| Annual Report and Form 20-F 2024 | 8 |

|

Glossary

Glossary of Certain Terms used in this Annual Report

Unless the context indicates otherwise, the following terms are defined as follows:

| ACL |  |

Ambiente de Comercialização Livre (Free Market Environment). Market segment in which the purchase and sale of electrical energy are the subject of freely negotiated bilateral agreements, according to specific market rules and procedures. |

| ACR |  |

Ambiente de Comercialização Regulado (Regulated Market Environment). Market segment in which the purchase and sale of electrical energy between selling agents and distribution agents is preceded by a bidding process, except for cases provided by law, according to specific market rules and procedures. |

| ADR |  |

American Depositary Receipt. |

| ADS |  |

American Depositary Share. |

| AIP |  |

The Acordo de Individualização da Produção (Productions Individualization Agreement). The AIP applies in situations where the reservoirs extend beyond the areas granted or contracted, as regulated by ANP. |

| AMS |  |

The AMS (Assistência Multidisciplinar de Saúde) Plan, that continues as the registered name in the Agência Nacional de Saúde (National Health Agency) in Brazil, is the official name of our health care plan. |

| ANA |  |

The Agência Nacional de Águas e Saneamento Básico (National Water and Sanitation Agency). |

| ANEEL |  |

The Agência Nacional de Energia Elétrica (Brazilian Electricity Regulatory Agency). |

| ANM |  |

The Agência Nacional de Mineração (National Mining Agency). |

| ANP |  |

The Agência Nacional de Petróleo, Gás Natural e Biocombustíveis (Brazilian National Petroleum, Natural Gas and Biofuels Agency) is the federal agency that regulates the oil, natural gas and renewable fuels industry in Brazil. |

| Annual Report and Form 20-F 2024 | 9 |

|

| ANPD |  |

The Autoridade Nacional de Proteção de Dados (National Data Protection Authority). |

| ANTAQ |  |

The Agência Nacional de Transportes Aquaviários (Brazilian National Agency of Waterway Transportation). |

| ANVISA |  |

The Agência Nacional de Vigilância Sanitária (Brazilian National Agency of Health Surveillance). |

| API GRAVITY |  |

Standard measure of oil density developed by the American Petroleum Institute. |

| APS or Saúde Petrobras |  |

The Associação Petrobras de Saúde (Petrobras Health Association), a non-profit association that operates our supplementary health care plan (Saúde Petrobras) since 2021, whose trade name is Saúde Petrobras. |

| B3 |  |

Brasil, Bolsa, Balcão, the Brazilian Stock Exchange. |

| Barrels |  |

Standard measure of crude oil volume. |

| Biofuel |  |

Any fuel derived from the conversion of biomass as raw material (vegetable oils, algae material, crops or animal wastes, etc.) and/or produced through biological processes, such as fermentation and others. |

| BioQav |  |

Aviation turbine fuel used to power aircraft, produced from several biomass sources in different production processes, also known as “biojet”, “biokerosine” or “SAF” (sustainable aviation fuel) and named by the ANP as “Alternative Jet Fuel”, which must be added to conventional jet fuel up to a maximum limit that varies from 10% to 50% by volume depending on the production process, as defined in ASTM (American Society for Testing and Materials) Annex D-7566 and ANP Resolution 778/2019. |

| BNDES |  |

Banco Nacional de Desenvolvimento Econômico e Social (Brazilian National Development Bank). |

| Business Plan 2025-29 |  |

Business Plan 2025-2029. |

| Annual Report and Form 20-F 2024 | 10 |

|

| Braskem |  |

Braskem S.A. is currently the largest producer of thermoplastic resins in the Americas and the largest producer of polypropylene in the United States. Its production focuses on polyethylene (PE), polypropylene (PP) and polyvinylchloride (PVC) resins, in addition to basic chemical inputs such as ethylene, propylene, butadiene, benzene, toluene, chlorine, soda, and solvents, among others. Together, they make up one of the most comprehensive portfolios in the industry, by also including the green polyethylene produced from sugarcane from 100% renewable sources. |

| Brazilian Treasury |  |

The Tesouro Nacional (Brazilian National Treasury) is a Secretariat of the Ministry of Finance, responsible for financial programming, accounting, management of the federal public debt, federal financial and securities assets and the Brazilian federal government’s financial relationship with states and municipalities in Brazil. The Brazilian National Treasury's mission is to seek fiscal balance through efficient, proactive and transparent management of public accounts and act in the structuring of financing channels that can make sustainable public interest policies viable, contributing to Brazil's intertemporal economic and social development. |

| Brent Crude Oil |  |

A major trading classification of light crude oil that serves as a major benchmark price for commercialization of crude oil worldwide. |

| CADE |  |

Conselho Administrativo de Defesa Econômica (Administrative Council for Economic Defense). |

| Câmara de Arbitragem do Mercado |  |

An arbitration chamber governed and maintained by B3. |

| Capital Expenditures or CAPEX |  |

Capital expenditures based on the cost assumptions and financial methodology adopted in our Strategic Plan, which includes acquisition of PP&E and intangible assets, acquisition of equity interests, as well as other items that do not necessarily qualify as cash flows used in investing activities, comprising geological and geophysical expenses, research and development expenses, pre-operating charges, purchase of property, plant and equipment on credit and borrowing costs directly attributable to works in progress. |

| Carbon Intensity in E&P |  |

E&P GHG Emissions Intensity. GHG emissions, in terms of CO₂e, from E&P activities in relation to the total oil and gas operated production (wellhead) registered in the same period. Scope 1 and 2 GHG emissions are considered. This indicator represents the rate of GHG emissions per barrel of oil equivalent produced. It covers oil and gas exploration and production activities under operational control, and is used to analyze the carbon performance of the assets in our current and future portfolio. |

| Carbon Intensity in Refining |  |

Refining GHG Emissions Intensity represents GHG emissions, in terms of CO₂e, from Refining activities in relation to Complexity Weighted Tone (CWT). This indicator covers refining activities with operational control and composes the analysis of the carbon performance of the assets in our current and future portfolio. |

| CBA |  |

Acordo Coletivo de Trabalho (Collective Bargaining Agreement). |

| CCUS |  |

Carbon Capture, Utilization and Storage. |

| Annual Report and Form 20-F 2024 | 11 |

|

| Central Bank of Brazil |  |

The Banco Central do Brasil. |

| Central Depositária |  |

The Central Depositária de Ativos e de Registro de Operações do Mercado, which serves as the custodian of our common and preferred shares (including those represented by ADSs) on behalf of our shareholders. |

| CEO |  |

Chief Executive Officer. |

| CFO |  |

Chief Financial Officer. |

| CMN |  |

The Conselho Monetário Nacional (National Monetary Council) is the highest authority of the Brazilian financial system, responsible for the formulation of the Brazilian currency, exchange and credit policy, and for the supervision of financial institutions. |

| CNODC |  |

CNODC Brasil Petróleo e Gás Ltda., a subsidiary in Brazil of the China National Petroleum Corporation (CNPC). |

| CNOOC |  |

China National Offshore Oil Corporation (CNOOC), or its subsidiary that operates in Brazil, CNOOC Petroleum Brasil Ltda. |

| CNPC |  |

China National Petroleum Corporation (CNPC). |

| CNPE |  |

The Conselho Nacional de Política Energética (National Energy Policy Council), chaired by the Minister of Mines and Energy, is an advisory body to the Brazilian President for the formulation of energy policies and guidelines. |

| CONAMA |  |

Conselho Nacional do Meio Ambiente (National Council for the Environment in Brazil). |

| Condensate |  |

Hydrocarbons that are in the gaseous phase at reservoir conditions but condense into liquid as they travel up the wellbore and reach separator conditions. |

| CVM |  |

The Comissão de Valores Mobiliários (Brazilian Securities and Exchange Commission). |

| CWT |  |

Complexity Weighted Tone, which represents a measure of activity, similar to UEDC (Utilized Equivalent Distillation Capacity), which considers the potential for GHG emissions, equivalent to distillation, per process unit, allowing better comparability between refineries of different complexities. |

| Annual Report and Form 20-F 2024 | 12 |

|

| D&M |  |

DeGolyer and MacNaughton, an independent petroleum engineer consulting firm that conducts reserves evaluation of part of our proved crude oil, Condensate and natural gas reserves. |

| Deepwater |  |

Between 300 and 1,500 meters (984 and 4,921 feet) deep. |

| Depositary |  |

JPMorgan. |

| Digital Twin |  |

Digital representation of a physical asset, system or process. It uses real-time data, AI and simulations to mirror the physical counterpart's behavior and performance, allowing for monitoring, analysis and optimization. This technology is widely used in various industries to improve efficiency, predict maintenance needs and enhance decision-making. |

| Distillation |  |

Physical process involving vaporization and condensation, whereby petroleum is separated (refined) into oil products. |

| E&P or Exploration & Production |  |

Exploration & Production is our business segment that covers the activities of exploration, development and production of crude oil, NGL and natural gas in Brazil and abroad. |

| EPCI |  |

Engineering, Procurement, Construction and Installation, a form of contracting arrangement common within the offshore industry. |

| ESG |  |

Environmental, Social and Governance. |

| ESI |  |

Energy Sustainability Index recognizes the impact of these low carbon energy sources, at a regional or country-level, without losing sight of the consumption-side efficiency of refinery process units which refiners understand is key for long term carbon reduction worldwide. |

| EWT |  |

Extended well test. |

| Exchange Act |  |

Securities Exchange Act of 1934, as amended. |

| Fitch |  |

Fitch Ratings Inc., a credit rating agency. |

| FPSO |  |

Floating production, storage and offloading unit. |

| Annual Report and Form 20-F 2024 | 13 |

|

| G&LCE or Gas & Low Carbon Energies |  |

Gas & Low Carbon Energies is our business segment that covers the activities of logistics and trading of natural gas and electricity, the transportation and trading of LNG, the generation of electricity by means of thermoelectric power plants, as well as natural gas processing. It also includes renewable energy businesses, low carbon services (carbon capture, utilization and storage) and the production of biodiesel and its co-products. |

| BOAVENTURA or BOAVENTURA Cluster (formerly GASLUB) |  |

Located in southeastern Brazil (Itaboraí, in the state of Rio de Janeiro), the BOAVENTURA Cluster, formerly GASLUB, is comprised of the UPGNs and other underlying utilities. |

| GASBOL |  |

The 557 km gas pipeline system in the Bolivian section of the Bolivia-Brazil gas pipeline. |

| Gaspetro |  |

Petrobras Gás S.A., or Gaspetro, was our subsidiary from which we divested in July 2022, in which we had a 51% equity interest and a holding company with equity interests in 18 Brazilian local gas distribution companies, with Mitsui holding the remaining 49% interest. |

| GHG |  |

Greenhouse gas. |

| Gross revenues |  |

Gross revenues represent Sales revenues plus sales taxes, which mainly includes the following taxes imposed in Brazil: Contribution for Intervention in the Economic Domain (CIDE), social contributions PIS and COFINS, and tax over services and goods (ICMS). |

| GSA |  |

Long-term Gas Supply Agreement entered into with the Bolivian state-owned company Yacimientos Petroliferos Fiscales Bolivianos. |

| GTB or Gas Transboliviano S.A. |  |

Gas Transboliviano S.A. is a company operating in the natural gas transportation industry, responsible for the administration and operation of the 557 km gas pipeline system in GASBOL, with an installed capacity of 30 million m³/d. GTB is connected to TBG on the Bolivia-Brazil border in the state of Mato Grosso do Sul. |

| HDT or Hydrotreating |  |

Process widely used in the oil refining industry to remove heteroatoms such as sulfur and nitrogen from gasoline, kerosene and/or diesel in the presence of specific catalysts, hydrogen and adequate conditions of temperature and pressure. The aim is to adjust composition to comply with fuel specifications. |

| HSE |  |

Health, Safety and Environment. |

| IAGEE |  |

Índice de Atendimento às Metas de Gases do Efeito Estufa (Greenhouse Gas Emissions Target Achievement Indicator). The indicator of compliance with the Greenhouse Gas Emissions Targets. |

| Annual Report and Form 20-F 2024 | 14 |

|

| IASB |  |

International Accounting Standards Board. |

| IBAMA |  |

The Instituto Brasileiro do Meio Ambiente e dos Recursos Naturais Renováveis (Brazilian Institute of the Environment and Renewable Natural Resources). |

| Ibovespa or IBOV |  |

The gross total return index weighted by free float market cap and comprised of the most liquid stocks traded on the B3. It was created in 1968. |

| ICMBio |  |

The Instituto Chico Mendes de Conservação da Biodiversidade (Chico Mendes Institute for Biodiversity Conservation). |

| ICMS |  |

Brazilian tax over services and goods. |

| IPHAN |  |

The Instituto do Patrimônio Histórico e Artístico Nacional (National Institute of Historic and Artistic Heritage). |

| IFRS Accounting Standards |  |

IFRS Accounting Standards as issued by the International Accounting Standards Board. |

| IOF |  |

Imposto sobre Operações Financeiras (Brazilian taxes over financial transactions). |

| IPCA |  |

The Índice Nacional de Preços ao Consumidor Amplo (National Consumer Price Index). |

| JPMorgan |  |

JPMorgan Chase Bank, N.A. |

| Just energy transition |  |

A just energy transition is an energy transition committed to promoting equity and social participation, minimizing negative impacts on communities, workers, companies and social segments vulnerable to transformations in the energy system and maximizing opportunities for socioeconomic development, increasing the competitiveness of the productive sector and combating inequality and poverty, at international, regional and local levels. |

| KPI |  |

Key Performance Indicators. |

| Lava Jato |  |

Operação Lava Jato (Lava Jato Operation), as detailed in “Legal and Tax – Legal Proceedings – Lava Jato Investigation” in this annual report. |

| Annual Report and Form 20-F 2024 | 15 |

|

| LIBOR |  |

The London Interbank Offered Rate was a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans until June 30, 2023. |

| Lifting Cost |  |

An indicator that represents the unit lifting cost of an equivalent barrel, considering the relationship between costs and production. It includes expenses for the execution and maintenance of production processes. Costs related to the chartering of third-party platforms, production taxes, depreciation, depletion, and amortization are not considered in this indicator. |

| LNG |  |

Liquefied natural gas. |

| LPG |  |

Liquefied petroleum gas, which is a mixture of hydrocarbons with up to four carbon atoms. |

| LUBNOR |  |

Refinery Lubrificantes e Derivados de Petróleo do Nordeste. |

| Partially state-owned Company |  |

Means a mixed joint stock corporation (public and private shareholders). |

| MME |  |

The Ministério de Minas e Energia (Ministry of Mines and Energy) of Brazil. |

| Moody’s |  |

Moody’s Investors Service, Inc., a credit rating agency. |

| MTF |  |

Euro Multilateral trading Facility. |

| Natural Gasoline (C5+) |  |

Natural Gasoline C5+ is a NGL produced at natural gas processing plants with a vapor pressure intermediate between Condensate and LPG, which may compose a gasoline blend. |

| Nelson Complexity Index or NCI |  |

The Nelson Complexity Index or NCI is a measure of the sophistication of an oil refinery, where more complex refineries are able to process heavier oils and produce lighter and more valuable products from a barrel of oil. The NCI is measured on a scale of one to 20, where higher numbers correspond to more complex and expensive refineries. |

| New frontier areas |  |

Geographic areas that have not yet been widely explored for the production of oil and natural gas. |

| NGL |  |

Natural Gas Liquids (NGL), the liquid resulting from the processing of natural gas and containing the heavier gaseous hydrocarbons. |

| Annual Report and Form 20-F 2024 | 16 |

|

| NTS |  |

Nova Transportadora do Sudeste S.A. |

| NYSE |  |

The New York Stock Exchange. |

NYSE Arca Oil Index or Arca Oil (formerly AMEX Oil Index) |

|

The NYSE Arca Oil Index, formerly the AMEX Oil Index, ticker symbol XOI, is a price-weighted index of the leading companies involved in petroleum exploration, production and development. It measures the oil industry’s performance through changes in the sum of the prices of component stocks. The index was developed with a base level of 125 as of August 27, 1984. |

| OCF |  |

Operating Cash Flow (net cash provided by operating activities). |

| Oil |  |

Crude oil, including NGLs and Condensates. |

| Oil Products |  |

Petroleum products, produced through processing in refineries (diesel, gasoline, LPG and other products). |

| ONS |  |

The Operador Nacional do Sistema Elétrico (National Electric System Operator) of Brazil. |

| Operated Production |  |

Production of a gas or oil field, including Petrobras’ and partners’ respective shares. |

| Operating Income |  |

Equivalent to the caption income before net finance expense, results of equity-accounted investments and income taxes derived in our audited consolidated financial statements. |

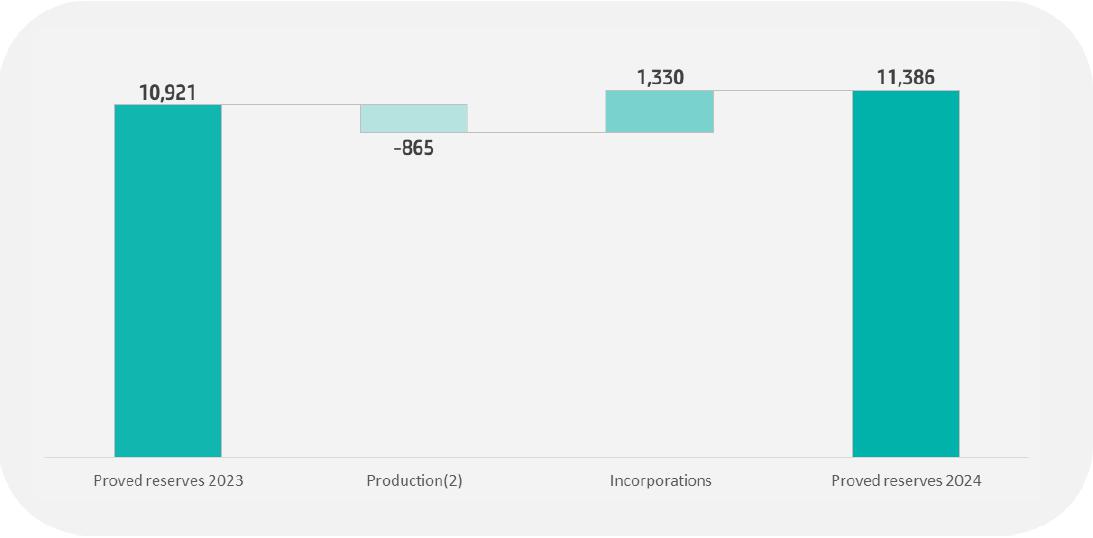

| Organic Reserves Replacement Ratio or Organic RRR |  |

Measures the amount of Proved Reserves added to a company’s reserve base during the year, excluding disposals and acquisitions of Proved Reserves, relative to the amount of oil and gas produced. |

| OSRL |  |

Oil Spill Response Limited. |

| PDV |  |

Programa de Desligamento Voluntário (Voluntary Severance Program). |

| Petrochemicals |  |

Chemicals mainly obtained from oil and natural gas (as opposed to fuels) such as ethane, ethylene, propane, propylene, benzene, xylenes, polypropylene, polyethylene and others. Renewable resources can also be used as raw materials. |

| Annual Report and Form 20-F 2024 | 17 |

|

| Petros |  |

Fundação Petros de Seguridade Social, Petrobras’ employee pension fund. |

| PGF |  |

Petrobras Global Finance B.V. |

| PifCo |  |

Petrobras International Finance Company S.A. |

| PLR |  |

The Participação nos Lucros e Resultados (Profit Sharing Program) is a remuneration model based on the division of profits with our employees. Our PLR is governed by Brazilian Law 10,101/2000 and follows the guidelines of the SEST. These annual guidelines define various aspects of this type of reward, such as format, flow, governance, financial and remuneration limits. |

| PLSV |  |

Pipe laying support vessel. |

| Post-salt |  |

A geological formation containing oil or natural gas deposits located above a salt layer. |

| PP&E |  |

Property, plant and equipment. |

| PPP |  |

The Prêmio por Performance (Performance Award Program) is part of our Variable Remuneration Program, exclusive to members of the Executive Board (Officers) 5. |

| PPSA |  |

Pré-Sal Petróleo S.A. |

| PRD |  |

The Prêmio por Desempenho – PRD (Accomplishment Award) is part of our Variable Remuneration Program |

| Pre-salt Polygon |  |

Underground region formed by a vertical prism of undetermined depth, with a polygonal surface defined by the geographic coordinates of its vertices established by Law No. 12,351/2010, as well as other regions that may be delimited by the Brazilian federal government, according to the evolution of geological knowledge. |

| Pre-salt |  |

A geological formation containing oil or natural gas deposits located beneath a salt layer. |

| Annual Report and Form 20-F 2024 | 18 |

|

| Proved Developed Reserves |  |

Reserves that can be expected to be recovered through: (i) existing wells with existing equipment and operating methods or for which the cost of the required equipment is relatively minor compared to the cost of a new well; and (ii) installed extraction equipment and infrastructure operational at the time of the reserve estimate if the extraction is by means not involving a well. |

| Proved Reserves |  |

Consistent with the definitions of Rule 4-10(a) of Regulation S-X, proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible – from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations. Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price is the unweighted arithmetic average of the first-day-of-the-month price during the twelve- month period prior to December 31, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions. The project to extract the hydrocarbons must have commenced or we must be reasonably certain that we will commence the project within a reasonable time. Reserves that can be produced economically through application of improved recovery techniques (such as fluid injection) are included in the “proved” classification when successful testing by a pilot project, or the operation of an installed program in the reservoir or an analogous reservoir, provides support for the engineering analysis on which the project or program was based. |

| Proved Undeveloped Reserves |  |

Reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required. Reserves on undrilled acreage are limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances. Undrilled locations are classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances justify a longer time. Proved undeveloped reserves do not include reserves attributable to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir or by other evidence using reliable technology establishing reasonable certainty. |

| Production Sharing Contract or PSC |  |

Production Sharing Contract regulates the rights and obligations under the exploration and production regime for oil, natural gas, and other fluid hydrocarbons, where the contractor undertakes exploration, appraisal, development, and production activities at its own risk and expense. In the event of a commercial discovery, the contractor is entitled to recover cost oil, the production volume corresponding to royalties due, and a share of profit oil, as per the proportions, conditions, and terms established in the contract, in accordance with Law No. 12.351/2010. |

| REFAP |  |

Refinery Alberto Pasqualini. |

| REGAP |  |

Refinery Gabriel Passos. |

| REMAN |  |

Refinery de Manaus. |

| Annual Report and Form 20-F 2024 | 19 |

|

| REPAR |  |

Refinery Presidente Getúlio Vargas. |

| RD&I |  |

Research, Development and Innovation. |

| RLAM |  |

Refinery Landulpho Alves. |

| RNEST |  |

Refinery do Nordeste Abreu e Lima. |

| Reserves Replacement Ratio or RRR |  |

Measures the amount of Proved Reserves added to a company’s reserve base during the year relative to the amount of oil and gas produced. |

| Reserves to production ratio or R/P |  |

Calculated as the amount of Proved Reserves of the year relative to the amount of oil and gas produced during the year, indicating the number of years reserves would last if production remains constant. |

| RT&M or Refining, Transportation & Marketing |  |

Refining, Transportation & Marketing is our business segment that covers the activities of refining, logistics, transport, acquisition and exports of crude oil, as well as trading of oil products, in Brazil and abroad. This segment also includes the petrochemical operations (which includes holding interests in petrochemical companies in Brazil), and fertilizer production. |

| S&P |  |

Standard & Poor’s Financial Services LLC, a credit rating agency. |

| SCC-CO2 production losses |  |

Measures the absolute production loss resulting from stress corrosion cracking, induced by CO2 in production pipelines. |

| SEC |  |

The United States Securities and Exchange Commission. |

| SELIC |  |

The Central Bank of Brazil base interest rate. |

| SEST |  |

The Secretaria de Coordenação e Governança das Empresas Estatais (Secretary of Coordination and Governance of State-Owned Companies). |

| Sete Brasil |  |

Sete Brasil Participações, S.A. |

| Annual Report and Form 20-F 2024 | 20 |

|

| Shell |  |

Shell Plc, or its subsidiary that operate in Brazil, Shell Brasil Petróleo Ltda. |

| SIX |  |

Shale Industrialization Unit. |

| SOFR |  |

The Secured Overnight Financing Rate is a benchmark interest rate based on transactions in the Treasury repurchase marketing, for dollar-denominated derivatives and loans that replaced the LIBOR. |

| SPE |  |

Society of Petroleum Engineers. |

| Strategic Plan or SP 2050 |  |

Strategic Plan 2050. |

| Synthetic Oil and Synthetic Gas |  |

A mixture of hydrocarbons derived by upgrading (i.e., chemically altering) natural bitumen from oil sands, kerogen from oil shales, or processing of other substances such as natural gas or coal. Synthetic Oil may contain sulfur or other non-hydrocarbon compounds and has many similarities to crude oil. |

| TAG |  |

Transportadora Associada de Gás S.A. |

| TBG |  |

Transportadora Brasileira Gasoduto Bolívia-Brasil S.A. is a company operating in the natural gas transportation industry, in which we have a 51% equity interest, owner of 2,593 km gas pipeline system, located mainly in the South and Southeast regions of Brazil, with installed capacity of 30 million m³/d. TBG is connected to GTB, which is responsible for the Bolivian side of the gas pipeline, which permits access to Bolivian natural gas, and is connected to Nova Transportadora do Sudeste S.A.’s (NTS) gas pipeline, which permits access to Brazilian natural gas. |

| TCU |  |

The Tribunal de Contas da União (Federal Auditor’s Office) is a constitutionally established body linked to the Brazilian Congress, responsible for assisting it in matters related to the supervision of the Brazilian federal government and its resources with respect to accounting, finance, budget, operational and public property (patrimônio público) matters. |

| TJLP |  |

The Taxa de Juros de Longo Prazo (Brazil’s long-term interest rate) is set quarterly by the CMN (as defined above). The rate is one of the benchmark rates used by BNDES in its loans to companies. |

| ToR Surplus |  |

Volume that exceeds what has been contracted under the Transfer of Rights agreement in specified Pre-salt areas. See “Legal and Tax —Material Contracts” in this annual report. |

| Annual Report and Form 20-F 2024 | 21 |

|

| TotalEnergies |  |

TotalEnergies SE, or its subsidiary that operates in Brazil, Total E&P do Brasil Ltda. |

| Transfer of Rights Agreement or ToR |  |

An agreement under which the Brazilian federal government assigned to us the right to explore and produce up to five billion barrels of oil equivalent (bnboe) in specified Pre-salt areas in Brazil. See “Legal and Tax —Material Contracts” in this annual report. |

| Transpetro |  |

Petrobras Transporte S.A. |

| TRIR |  |

Total recordable injury per million man-hour frequency rate. Number of fatal accidents, lost-time injuries, injuries involving substitute work and medical treatment injuries per million hours worked. It is a performance indicator used by the industry to measure occupational safety performance. This indicator is analyzed at all management levels, including the board of directors. |

| Ultra-deepwaters |  |

Over 1,500 meters (4,921 feet) deep. |

| UPGN |  |

Unidade de Processamento de Gás Natural (Natural-gas processing Units). A natural gas processing plant is a facility designed to process raw natural gas from the offshore production fields by separating impurities and various non-methane hydrocarbons and fluids through different technologies to produce specified natural gas for final consumption. Through the process, a gas processing plant can also recover natural gas liquids (condensate, natural gasoline and liquefied petroleum gas) with higher added value. |

| UTE |  |

Usina Termoelétrica (Thermal Power Plant). A thermoelectric plant is a power generation plant in which heat energy is converted to electrical energy. |

| Utilization of Refining Capacity |  |

Measures how much crude oil refineries are processing or "running" as a percentage of their maximum capacity. |

| VAZO Indicator |  |

Oil and Oil Products Spilled Volume indicator. The total volume of oil or oil products spilled in events of leakages individually greater than 1 bbl (0.159 m³) that reached water bodies or soil that wasn’t made impermeable. This volumetric criterion (>1 barrel) is aligned with the ANP Manual for reporting incidents for E&P activities. Sabotage and theft-related spills are not considered. |

| Vibra |  |

Vibra Energia S.A., formerly “Petrobras Distribuidora.” |

| Annual Report and Form 20-F 2024 | 22 |

|

| Well Connection Cost |  |

Measures the evolution of the average connection cost of production development wells. This KPI represents the sum of the total cost of well connections concluded in the corresponding year over the total cost of well connections planned in the strategic plan for the same well connections. Additionally, this KPI only includes Pre-salt wells. |

| Well Construction Cost |  |

Measures the evolution of the average cost of wells construction. This KPI represents the sum of the average cost of drilling and completion concluded in the corresponding year. The reference database includes only production development wells drilling and completion in the corresponding year, excluding exploratory and reservoir data acquisition wells. |

| Well Construction Duration |  |

Measures the evolution of the average duration of well construction. This KPI represents the sum of the average duration of drilling and completion concluded in the corresponding year. The reference database includes only production development well drilling and completion in the corresponding year, excluding exploratory and reservoir data acquisition wells. |

| Wildcat Well |  |

An exploration well that is drilled in areas with no oil and gas production history. Wildcat wells face a substantial risk of being dry holes. |

| YPF |  |

YPF Sociedad Anónima or YPF S.A. |

| YPFB |  |

Yacimientos Petroliferos Fiscales Bolivianos. |

| Annual Report and Form 20-F 2024 | 23 |

|

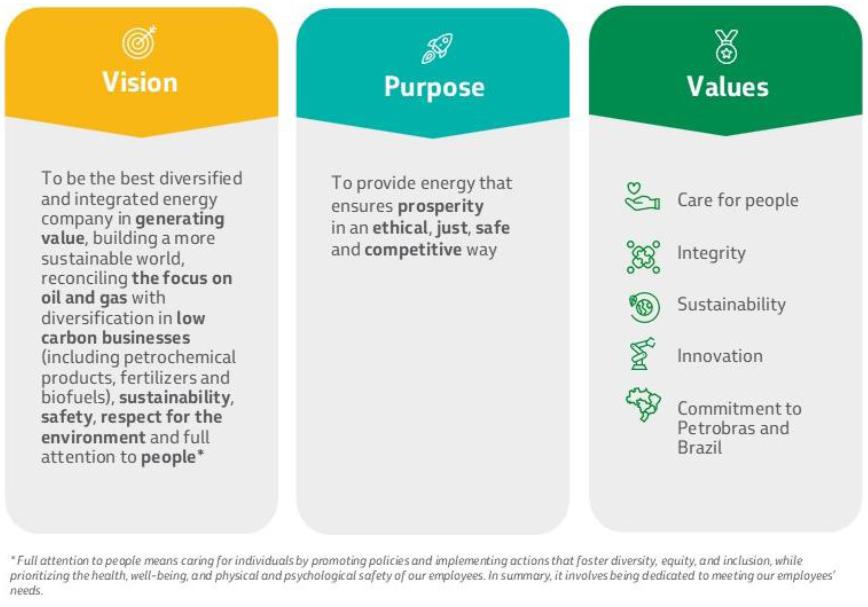

About us

We are a Brazilian partially state-owned company, one of the largest producers of oil and gas in the world according to Bloomberg, primarily engaged in exploration and production, refining, energy generation and trading. We have expertise in exploration and production in deep and Ultra-deepwaters as a result of almost 50 years of developing Brazil’s offshore basins, a leader worldwide in this segment.

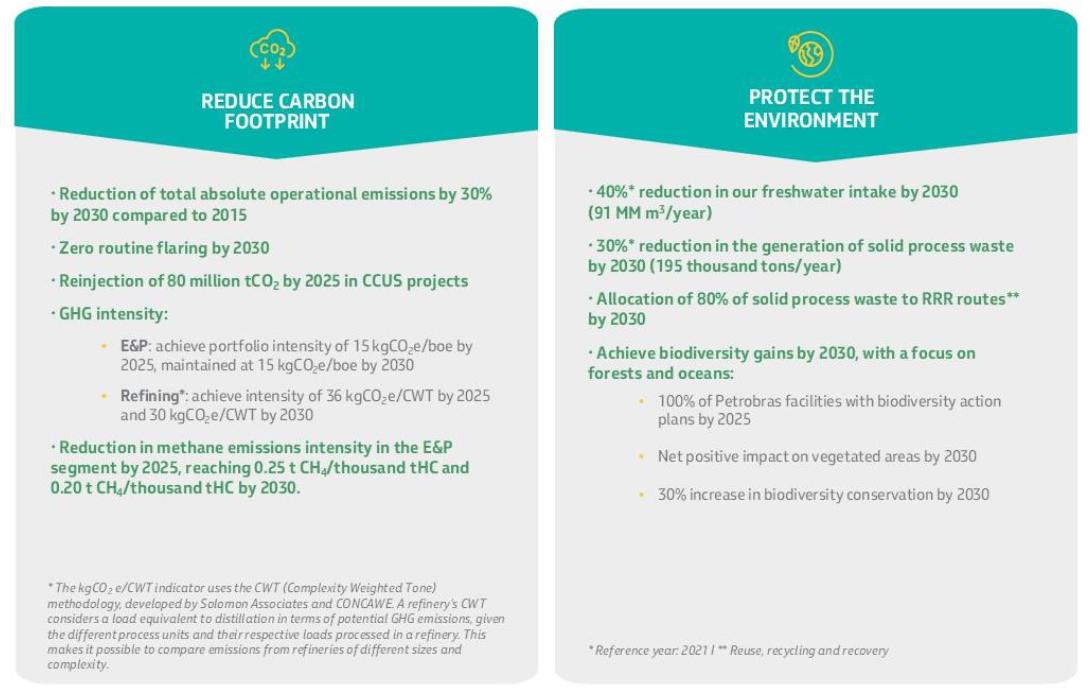

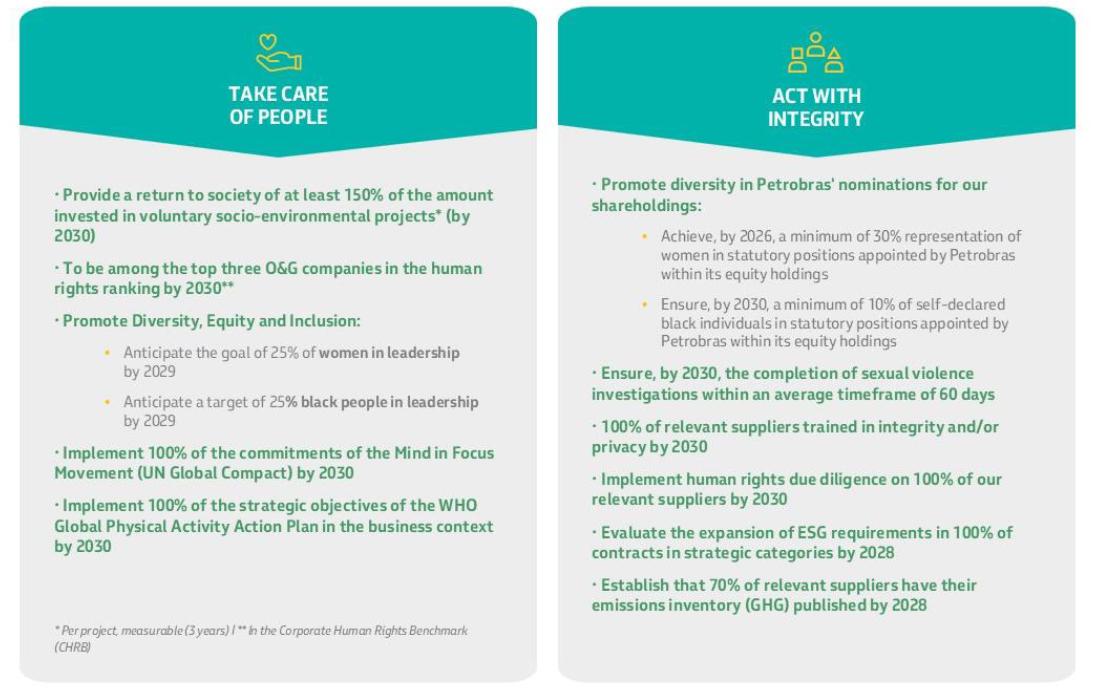

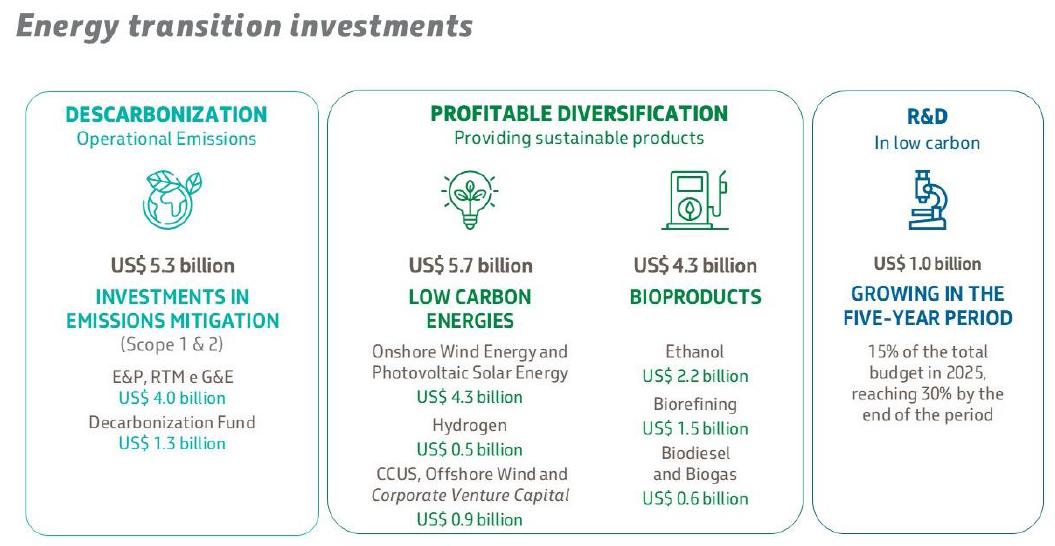

We are committed to being the best energy company in terms of diversification, integration and value generation, reconciling the focus on oil and gas with low carbon businesses. Accordingly, we are adopting different strategies for the specific segments in which we operate, investing in the decarbonization of our operations, in the generation of renewable energy, and in sustainable fuels. Furthermore, we are expanding our research in the field of low carbon businesses.

We seek to build a more sustainable world, with the principles of safety, respect for the environment, and full attention to people’s needs, such as: policies and implementation actions to promote diversity, equity and inclusion, in the countries where we operate, as well as the health, well-being and physical and psychological safety of employees.

We are one of the largest companies in market capitalization in Latin America according to Bloomberg, with a market capitalization of US$81.0 billion as of December 31, 2024. We have over 49 thousand employees (including subsidiaries in Brazil and abroad).

|

Datasheet |

|

Name of the company: Petróleo Brasileiro S.A. – Petrobras Date of Incorporation: 1953 Country of Incorporation: Brazil Registration number at the CVM: 951-2 Central Index Key (CIK) at the SEC: 0001119639 Address of principal executive office: Avenida Henrique Valadares, 28, 20231-030, Rio de Janeiro, RJ, Brazil Telephone number: (55 21) 3224 2401 Corporate and investor relations websites: www.petrobras.com and www.petrobras.com.br/ir. Corporate purpose established in our Bylaws: research, extraction, refining, processing, trading and the transport of oil, its by-products, natural gas and other fluid hydrocarbons from wells, shale and other rocks, in addition to energy-related activities, and the research, development, production, transport, distribution, sale and trading of all forms of energy, and other related activities or similar purposes.

|

| Annual Report and Form 20-F 2024 | 25 |

|

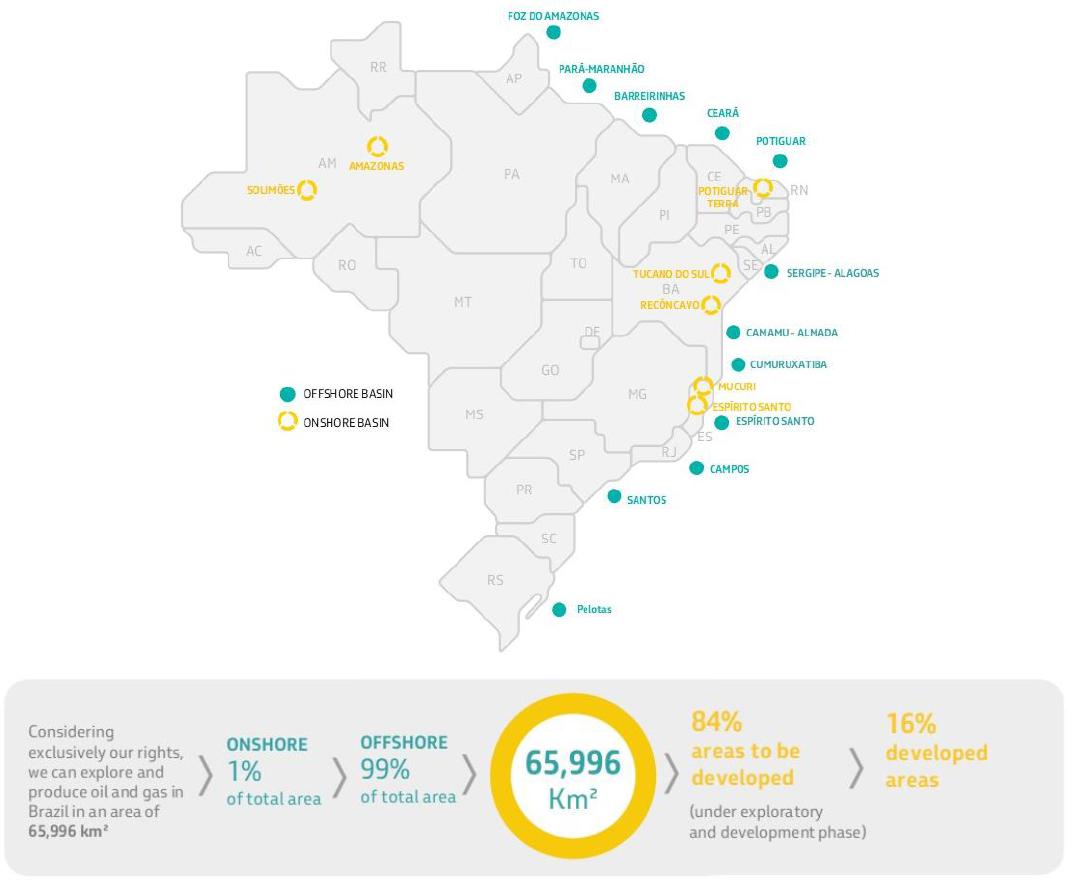

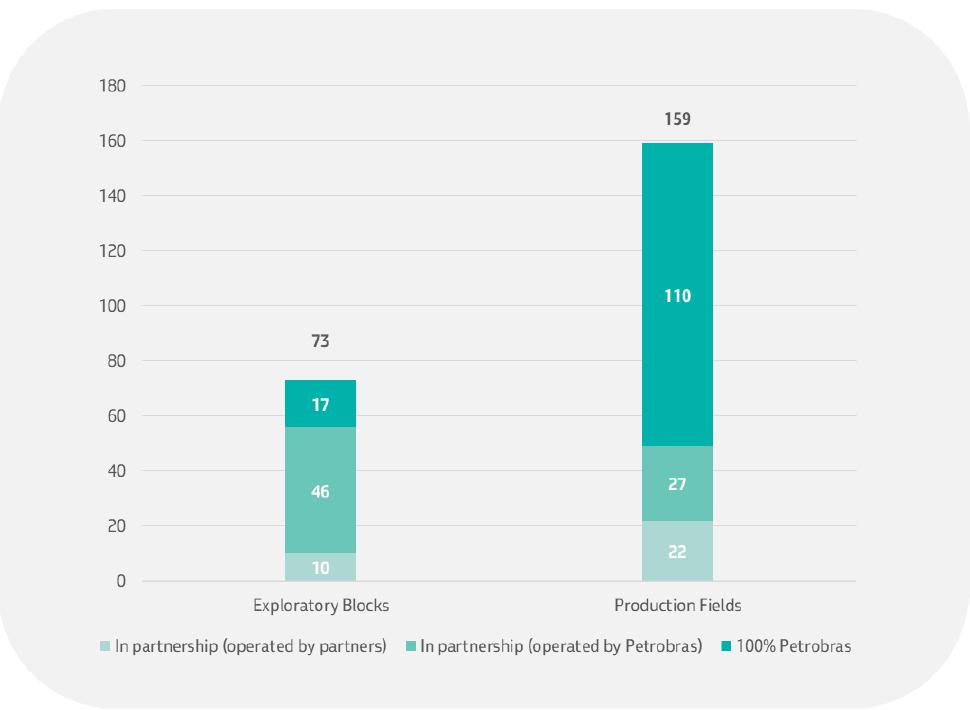

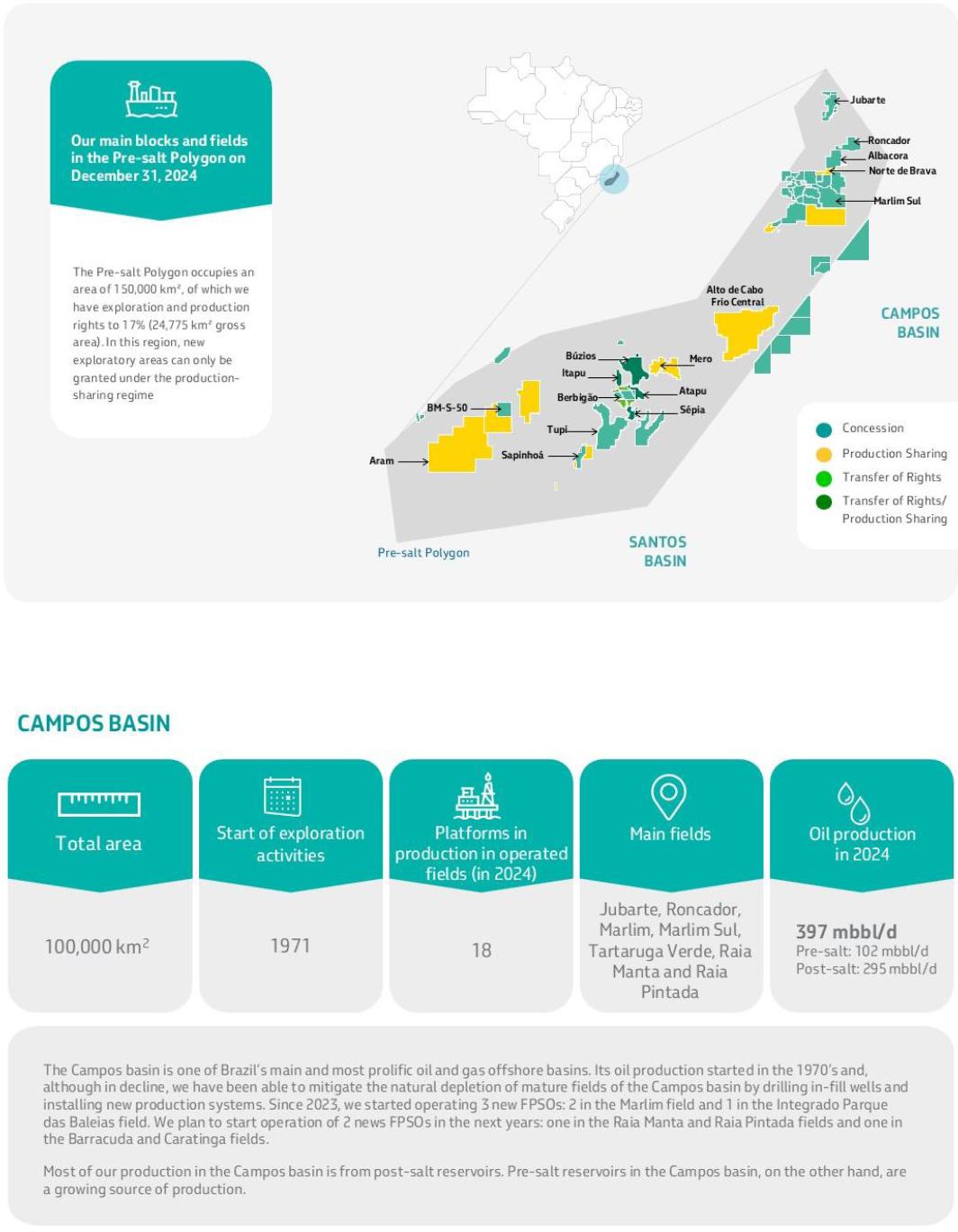

Overview

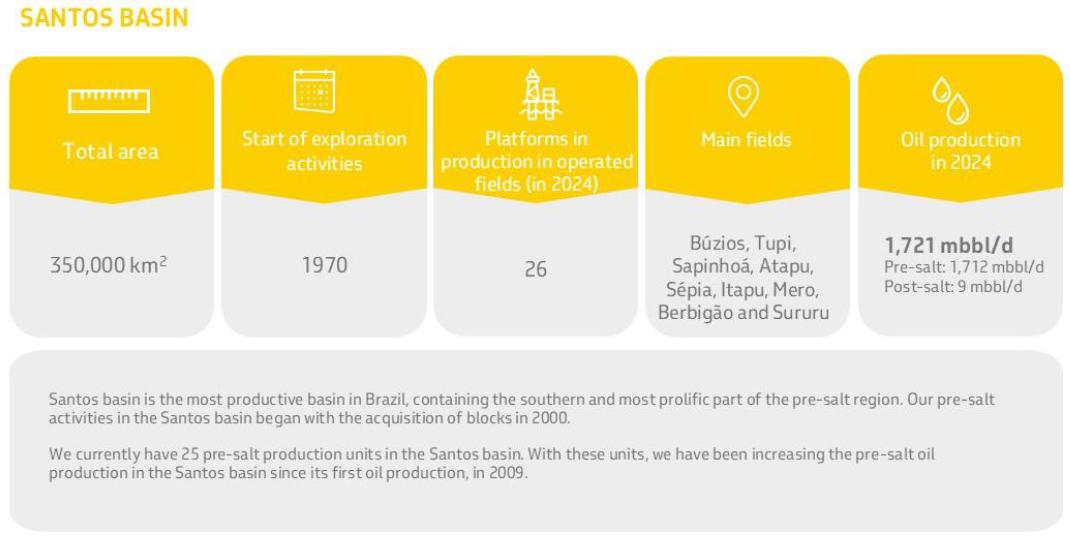

We have a large base of Proved Reserves and operate and produce most of Brazil’s oil and gas. The most significant part of our Proved Reserves is located in the adjacent offshore Campos and Santos basins in southeast Brazil. Their proximity allows us to optimize our infrastructure and our costs of exploration, development and production. The Campos and Santos basins are expected to remain an important source of Proved Reserves and oil and gas production.

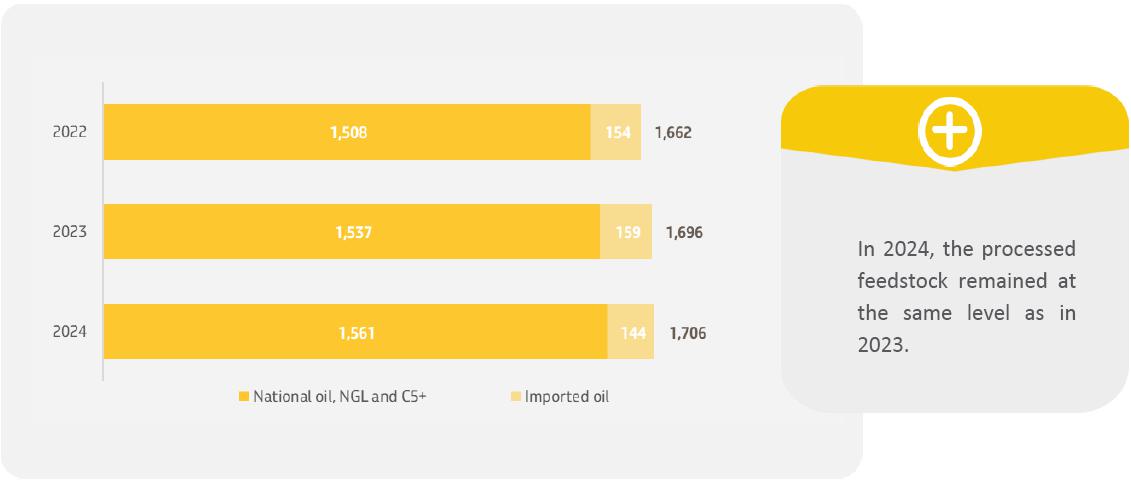

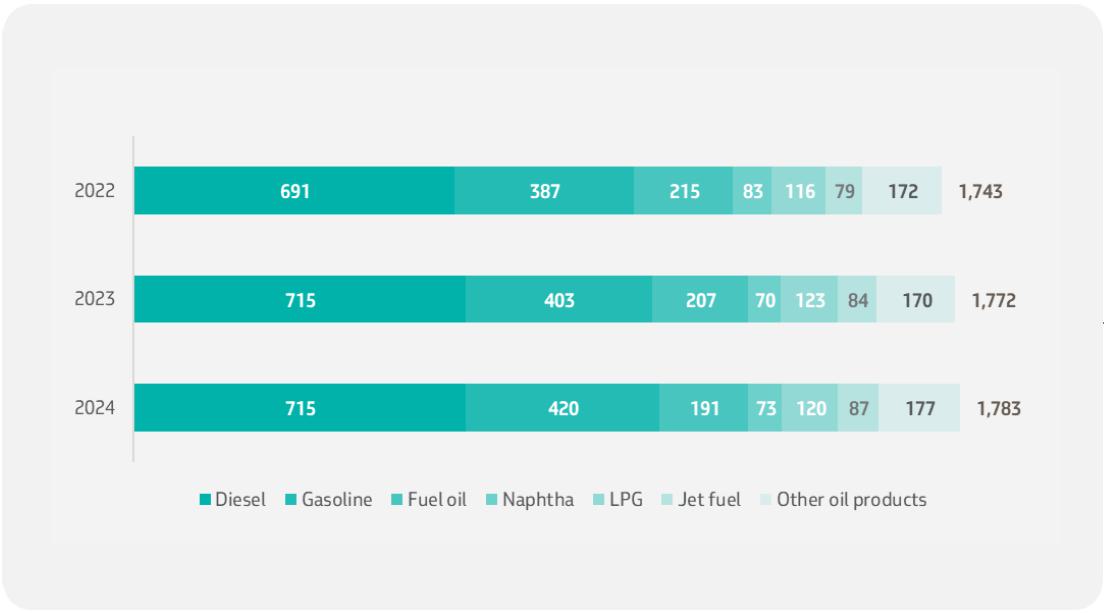

Our business, however, goes beyond oil and gas exploration and production. It entails a long process through which we get the oil and gas to our refineries and gas treatment units, which are themselves in constant evolution to supply the best products.

We operate the majority of the refining capacity in Brazil. Our refining capacity is distributed throughout the southeast, south and northeast regions of Brazil, reaching the largest market share in these and other regions of the country through direct deliveries, pipelines and also cabotage. We mostly meet our demand for oil products by domestic refining of crude oil, as defined in a periodic process of integrated operational planning which constantly seeks to maximize value for the company. We are also involved in the production of petrochemicals and biofuels through interests in some companies. We distribute oil products through wholesalers, retailers and direct sales.

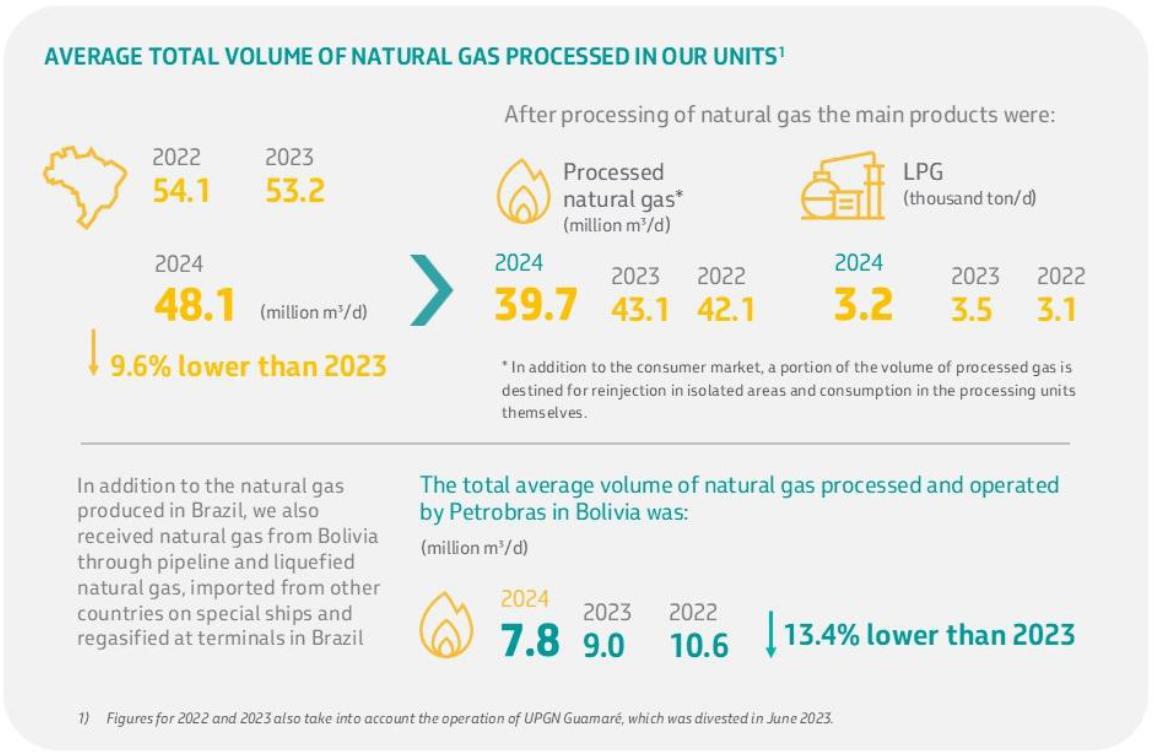

We also participate in the Brazilian natural gas market, including the logistics and processing of natural gas.

To meet our clients’ and our own internal demand, we process natural gas derived from our onshore and offshore production (mainly from fields of the Campos, Espírito Santo and Santos basins), import natural gas from Bolivia and import LNG through our regasification terminals. We also participate in the domestic power market primarily through our investments in gas-fired thermoelectric power plants.

| Annual Report and Form 20-F 2024 | 26 |

|

We currently divide our business into three main segments:

| _ | Exploration & Production (E&P): this segment covers the activities of exploration, development and production of crude oil, NGL and natural gas in Brazil and abroad, for the primary purpose of supplying our domestic refineries. This segment also operates through partnerships with other companies, including holding interests in non-Brazilian companies in this segment. |

| _ | Refining, Transportation & Marketing (RT&M): this segment covers the activities of refining, logistics, transport, acquisition and exports of crude oil, as well as trading of oil products in Brazil and abroad. This segment also includes petrochemical operations (which involves holding interests in petrochemical companies in Brazil), and fertilizer production. |

| _ | Gas & Low Carbon Energies (G&LCE): this segment covers the activities of logistics and trading of natural gas and electricity, the transportation and trading of LNG, the generation of electricity by means of thermoelectric power plants, as well as natural gas processing. It also includes renewable energy businesses, low carbon services (carbon capture, utilization and storage) and the production of biodiesel and its co-products. |

Activities that are not attributed to business segments are classified as “Corporate and Other Businesses,” including general corporate matters, in addition to distribution businesses. Corporate items mainly include those related to corporate financial management, overhead central administration, and other expenses, including actuarial costs associated with pension and health plans for beneficiaries. The other businesses cover the distribution of oil products throughout South America.

For further information regarding our business segments, see Note 13 to our audited consolidated financial statements, as well as “Operating and Financial Review and Prospects” in this annual report.

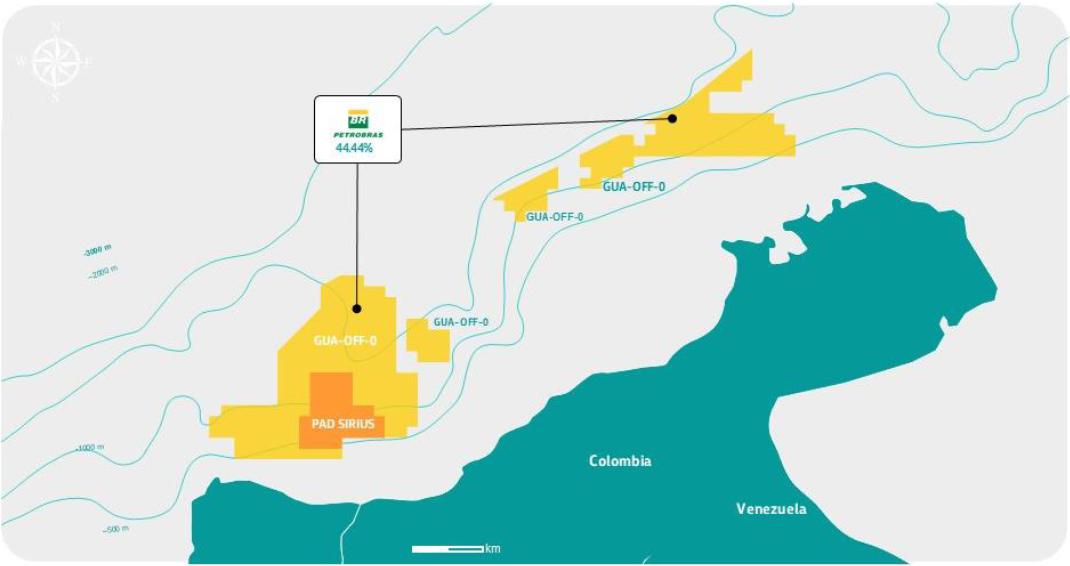

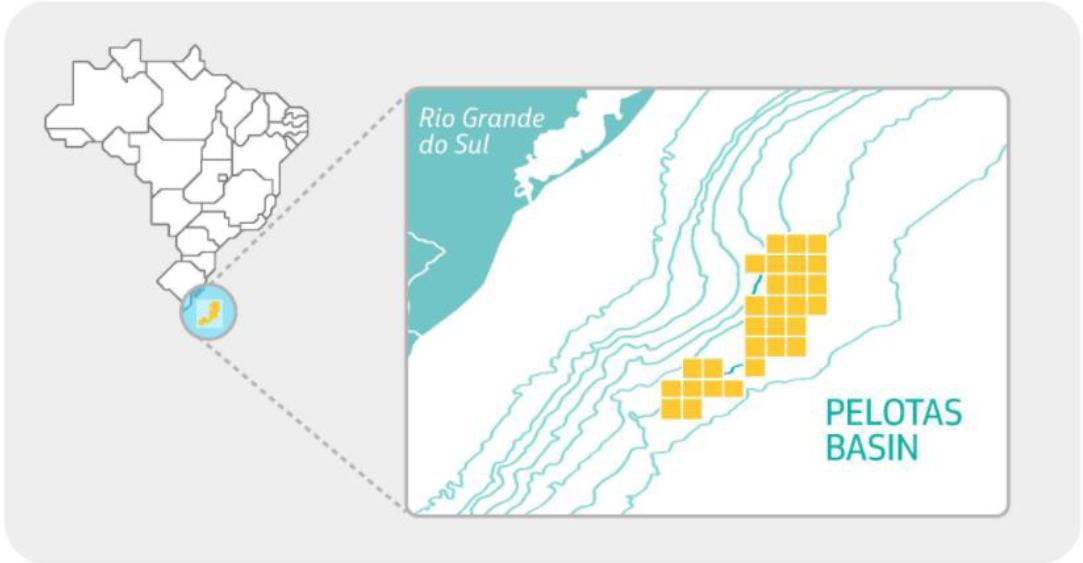

In 2024, we had activities, as described below, in seven countries besides Brazil (i.e., Argentina, Bolivia, Colombia, the U.S., the Netherlands, Democratic Republic of São Tomé and Príncipe, and Singapore).

In Latin America, our operations include upstream, marketing and retail services. In North America, we produce oil and gas through an interest in a joint venture. We have subsidiaries that support our trading and financial activities in Rotterdam, Houston, Buenos Aires and Singapore. These companies act as complete and active trading desks for markets worldwide and are responsible for market intelligence and trading of oil, oil products, natural gas, biofuels, commodity derivatives and shipping. In Africa, we have exploratory operations in the Democratic Republic of São Tomé and Príncipe.

We operate through 13 direct subsidiaries (11 incorporated under the laws of Brazil and two incorporated abroad) and one direct joint operation as listed below. We also have indirect subsidiaries, including Petrobras Global Trading B.V., Petrobras Global Finance B.V., Petrobras America Inc. and Petrobras Netherlands B.V.

| Annual Report and Form 20-F 2024 | 27 |

|

Companies |

Location | Our shareholding | Other shareholders |

| Petrobras Transporte S.A. – Transpetro | Brazil | 100.00% | — |

| Petrobras Logística de Exploração e Produção S.A. – PB-LOG | Brazil | 100.00% | — |

| Petrobras Biocombustível S.A. | Brazil | 100.00% | — |

| Transportadora Brasileira Gasoduto Bolívia-Brasil S.A. – TBG | Brazil | 51.00% |

BBPP Holdings Ltda. (29%) YPFB Transporte S.A. (19.88%) Corumba Holding S.À.R.L. (0.12%) |

| Procurement Negócios Eletrônicos S.A. | Brazil | 72.00% |

SAP Brasil Ltda. (17%) Accenture do Brasil S.A. (11%) |

| Araucária Nitrogenados S.A. | Brazil | 100.00% | — |

| Termomacaé S.A. | Brazil | 100.00% | — |

| Termobahia S.A. | Brazil | 98.85% | Petros (1.15%) |

| Baixada Santista Energia S.A. | Brazil | 100.00% | — |

| Fundo de Investimento Imobiliário RB Logística – FII | Brazil | 99.15% | Pentágono SA DTVM (0.85%) |

| Petrobras Comercializadora de Gás e Energia e Participações S.A. – PBEN-P | Brazil | 100.00% | — |

| Fábrica Carioca de Catalisadores S.A. – FCC(1) | Brazil | 50.00% | Ketjen Brazil Holding Ltda. (50%)(2) |

| Petrobras International Braspetro – PIB BV | Abroad | 100.00% | Petrobras Comercializadora de Gás e Energia e Participações S.A. (antiga 5283 Participações S.A.) (0.0007%) |

| Braspetro Oil Services Company – Brasoil | Abroad | 100.00% | — |

| Associação Petrobras de Saúde - APS(3) | Brazil | 93.12% |

Transpetro (6.34%) TBG (0.35%) Pbio (0.14%) Termobahia (0.05%) |

| (1) | Joint operations. |

| (2) | Former Albemarie Brazil Holding Ltda |

| (3) | A non-profit association that operates our supplementary health care plan (AMS - Saúde Petrobras) since 2021. The percentage variation of each company is due to changes in the beneficiary base (retirees, pensioners, dependents and active employees), including additions and dismissals, over the period analyzed. |

For an extended list of our subsidiaries and joint operations, including each of their full names, jurisdictions of incorporation and our percentage of equity interest, see Exhibit 8.1 to this annual report and Note 28 to our Financial Statements. Additionally, we participate in consortia that engage in the exploration of blocks and the production of oil fields in Brazil – see “Our Business — Exploration & Production — Overview” for more details.

| Annual Report and Form 20-F 2024 | 28 |

|

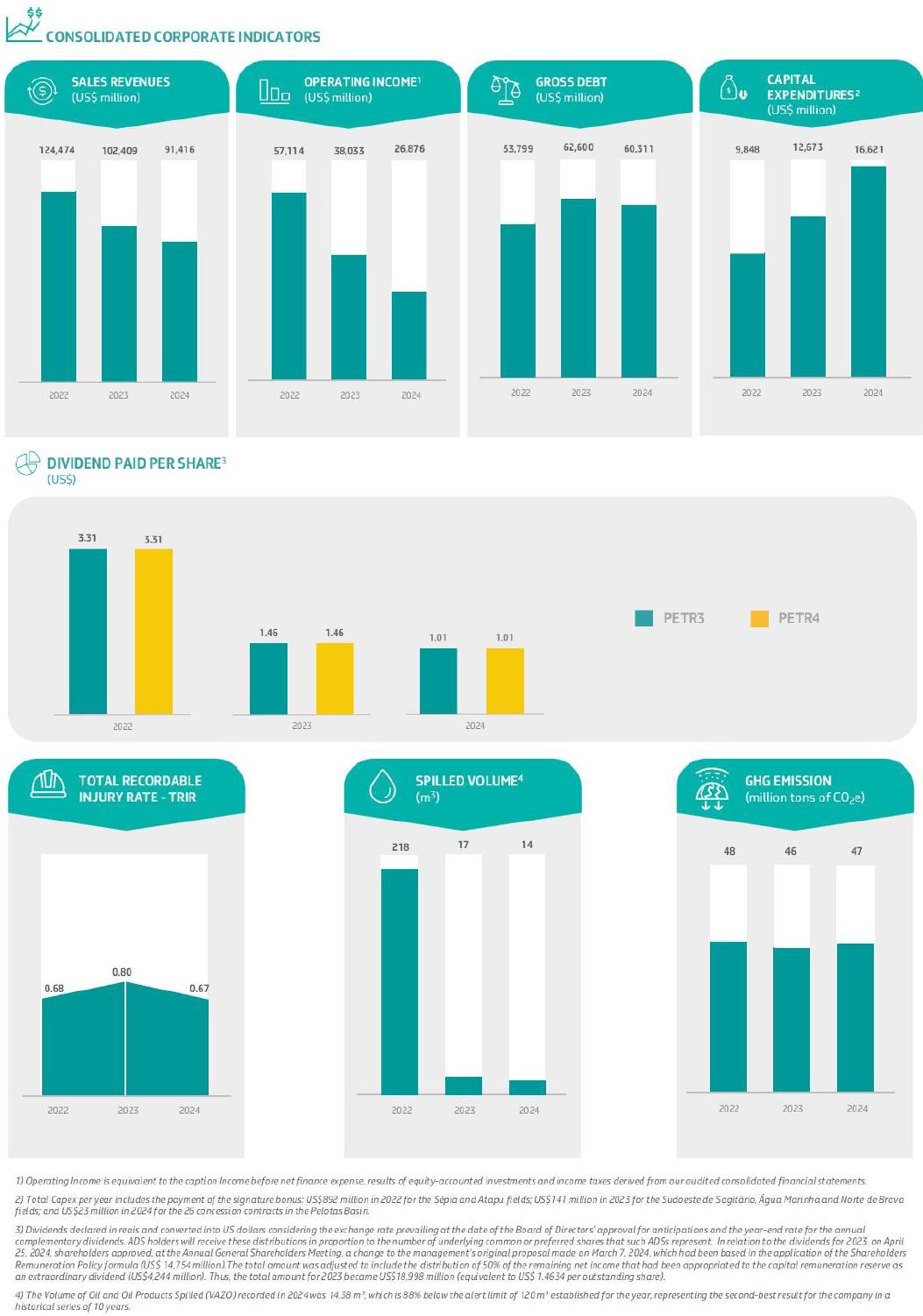

2024 Highlights

| Annual Report and Form 20-F 2024 | 29 |

|

| Annual Report and Form 20-F 2024 | 30 |

|

Risks

We are exposed to a number of risks that, individually or jointly, may have an effect on our business and/or financial performance. The risk factors are presented in the following groups:

Risks related to (1) our company; (2) our shareholders, in particular our controlling shareholders; (3) our directors; (4) our suppliers; (5) our customers; (6) the sectors of the economy in which we act; (7) the regulation of the sectors in which we are involved; (8) foreign countries where we are involved; (9) social issues; (10) environmental issues; (11) climate issues, including physical and transition risks; (12) the use of our trademark; and (13) our shares and debt securities.

Risk Factors

1) Risks related to our company

1.a) We are exposed to health, safety and environmental risks in our operations, which may lead to accidents, significant losses, administrative proceedings and legal liabilities.

Activities related to the oil and gas business present high risks, generally because they involve high temperatures and pressures. In particular, deepwater and Ultra-deepwater activities, and refining and petrochemicals, performed by us, our subsidiaries or our affiliate companies present several risks, such as oil and product leakage, collapses, aeronautical accidents, fires, and explosions in refineries and exploration and production units, including platforms, ships, pipelines, mines, terminals, laboratories, and losses of containment in dams, among other assets owned or operated by us, our subsidiaries or our affiliate companies. These events can occur due to technical or human failures or natural disasters, among other factors. The occurrence of one of these events, or other related incidents, may result in health impacts on our workforce and/or surrounding communities, fatalities, and environmental damage. They can cause material damage, production losses, financial losses and, in certain circumstances, liability in civil, labor, criminal, environmental and administrative proceedings. As a result, we may incur expenses related to mitigation, recovery and/or compensation for the damages caused.

We are also exposed to corporate security risks arising from acts of intentional interference by third parties in our pipelines and nearby areas, especially illegal taps (thefts) of oil and oil products, mainly in the states of São Paulo and Rio de Janeiro. Despite our efforts and the actions of public authorities to combat illegal taps, if this interference continues, it may result in accidents of small or large proportions, including leaks or damage to our facilities and to communities near our facilities, which may affect the continuity of our operations and lead to the payment of fines and indemnities to the affected parties, all of which may negatively impact our results.

Finally, due to risks such as those mentioned above, we may face difficulties in obtaining or maintaining operating licenses and may suffer damages to our image and reputation.

1.b) Failures in our information technology systems, information security systems (cybersecurity) and telecommunications systems and services can adversely impact our operations and reputation.

Our operations are highly dependent on information technology and telecommunications systems and services, as well as the degree of technological protection and the strength of the associated internal controls. Interruptions or malfunctions affecting these systems and/or their infrastructure, caused by obsolescence, technical failures, deliberate acts, or even arising from geopolitical factors or derived from third-party systems, digital infrastructure and the cloud may harm or even paralyze our business and adversely impact our operations and reputation. These situations may also lead to unforeseen costs for the recovery of information and assets, in addition to the imposition of fines or legal sanctions.

| Annual Report and Form 20-F 2024 | 32 |

|

Failures in information security (including industrial and automation systems), whether external, intentional or not (e.g., malware, hackers, cyberterrorism) or internal (e.g., neglect or misuse of IT assets by employees or contractors who are in a hybrid work environment working on-site and remotely), may also impact our business and reputation, our relationship with stakeholders and external agents (government, regulatory bodies, partners, suppliers, among others), our strategic positioning towards our competitors and our operational and financial results. Additionally, the use of artificial intelligence (AI) in cyberattacks or in decision-making systems and processes may amplify existing risks and create new threats that may impact our businesses.

Artificial intelligence systems can demonstrate disparities among subgroups or languages due to biased training data or may be subject to risks such as data poisoning, which can compromise the integrity of the model, or hallucination, which can generate incorrect or misleading information. Biased training data, data poisoning and hallucination may all negatively impact internal decision-making processes based on AI. Moreover, AI may be used by external agents to automate and escalate already known cyber-attacks, making them more efficient and difficult to detect in a timely manner.

Additionally, we are subject to increasing regulations related to AI, cybersecurity and information security, including among other aspects, adequate protection of data and digital assets, supervision of cyber risks, and incident reporting. Failure to comply with these regulations at the national and international levels may result in legal sanctions, as well as impacts on our image and reputation, and affect our operational and financial results.

1.c) Maintaining our long-term oil production objectives depends on our ability to successfully incorporate and develop our reserves.

Our ability to incorporate additional reserves depends on exploration activities, which expose us to its inherent risks and may not lead to the discovery of commercially viable oil or natural gas reserves.

In addition, competition in the oil and gas sector in Brazil or difficulties in obtaining environmental licensing in New Frontier areas, both in Brazil or abroad, may make it more difficult or costly to (i) obtain additional acreage in bidding rounds for new contracts, and (ii) develop existing contracted areas.

Adding new reserves depends on our ability to conceive and implement development projects. Exploration and development activities in deepwater and Ultra-deepwater require significant capital investments and involve several factors that are beyond our control, such as significant changes in economic conditions, climate and environmental regulations and obtaining and/or renewing environmental permits, supply market capacity, and unexpected operating conditions, including equipment failures or incidents, which may restrict, delay or cancel our operations.

1.d) We may incur losses and spend time and financial resources defending pending litigations and arbitrations.

We are currently party to several administrative, legal and arbitration proceedings related to civil, administrative, tax, labor, environmental and corporate claims filed against us. These claims involve substantial amounts of money and other resources, and the total cost of unfavorable decisions can have a material adverse effect on our results and financial condition.

These legal, administrative and arbitration proceedings can have a negative impact on our results in the event of unfavorable outcomes, such as contracts’ termination and/or revision of governmental authorizations. Depending on the outcome, litigation can result in restrictions on our operations and have a material adverse effect on some of our business.

We can be affected by changes in rules, regulations and jurisprudence that can have a material adverse effect on our financial condition and results.

| Annual Report and Form 20-F 2024 | 33 |

|

1.e) The selection and development of our investment projects have risks that may affect our expected results.

We constantly evaluate new project opportunities for our investment portfolio. As most projects are characterized by a long period of development and maturation, we may face changes in market conditions, such as fluctuations in input and finished product prices, new regulatory requirements, consumer preferences, and demand profile, exchange and interest rates, and financing conditions that may jeopardize our expected rates of return. We may also adjust our project approval criteria, increasing our focus on those aimed at decarbonizing operations, resulting in different risk and return profiles.

We face specific risks for oil and gas projects. Despite our experience in deepwater and Ultra-deepwater oil exploration and production and the continuous development of studies during the planning stages, the quantity and quality of oil and gas produced in a certain field will only be fully known in the production phase, which may require adjustments throughout the project life cycle and its expected rate of return.

There are also risks related to potential delays in the execution of oil and gas projects, which may result in the mismatch of required dates between upstream and downstream projects (e.g., delay in onshore infrastructure, impacting offshore oil and gas flow, and onshore gas transportation). We, along with part of our supply chain, also face risks associated with international conflicts, wars or unplanned unavailability of critical assets and/or resources (such as drilling rigs, special vessels, and the natural gas and LNG chains) that may also impact the offshore and onshore flow and may compromise the continuity of our business production chain. Additionally, our failure to meet obligations established by the regulatory agencies may generate fines and liabilities.

Moreover, despite our expertise in exploration and production and refining, we may face new technical challenges as we move closer to the technological frontier.

Our Strategic Plan and our Business Plan include initiatives related to climate change, as such commitments are becoming increasingly relevant in the oil and gas business. Climate change risks include physical risks, such as extreme weather events and their impact on our operations, as well as risks inherent in the energy transition to a low-carbon economy, including political and/or regulatory changes and shifting market demands. To address these risks, we may need to increase our investments in climate change mitigation and adaptation measures, which may result in increased capital expenditures and significantly impact our Strategic Plan and our Business Plan. For further information on how climate change could impact our results and strategy, please see risk factor "11.a) Climate change could impact our results and strategy” in this section.

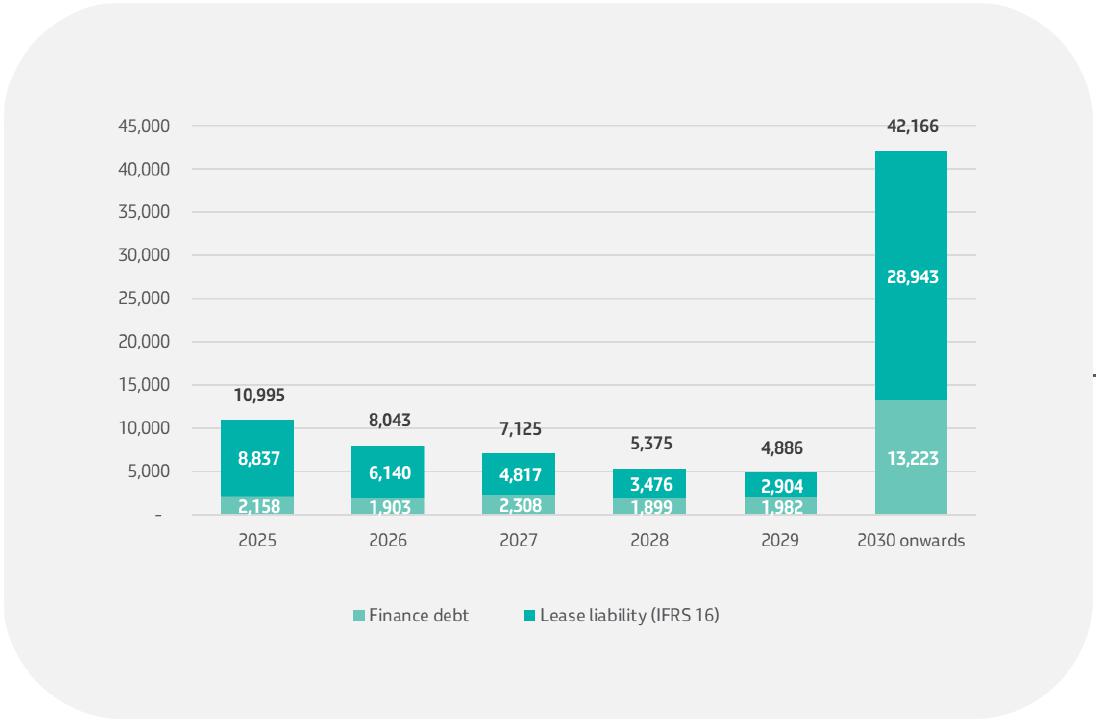

1.f) We have substantial liabilities and may be exposed to significant liquidity constraints in the short and medium term, which may materially and adversely affect our financial condition and results.

We have substantially reduced the level of our debt in recent years. However, our liabilities are still relevant and could potentially weaken our liquidity in adverse times. Considering that there may be liquidity constraints on the debt market to finance our planned investments, pay principal and interest obligations in contracted terms, and honor our financial commitments, any difficulty in raising significant amounts of debt capital in the future may affect our results and the ability to fulfill our Business Plan or any subsequent plan adopted.

Our lack of investment grade credit rating and any lowering of our credit ratings may have adverse consequences on our ability to obtain financing in the market through debt or equity securities, or may affect our financing cost, making it more difficult and/or costly to refinance maturing obligations. The impact on our ability to obtain resources and the cost of such resources may adversely affect our results and financial condition.

In addition, our credit rating is sensitive to any change in the credit rating of the Brazilian federal government. Any lowering in the credit ratings of the Brazilian federal government may have additional adverse consequences on our ability to obtain financing and/or on the cost of our financing and, consequently, on our results and financial condition.

| Annual Report and Form 20-F 2024 | 34 |

|

1.g) Differing interpretations of tax regulation or changes in tax policies may have an adverse effect on our financial condition and results.

We and our Brazilian and foreign subsidiaries are subject to tax rules and regulations that may, over time, result in different interpretations between us, our subsidiaries and tax authorities (including federal, state and municipal authorities), which do not have uniform interpretations. As a result of such divergences, we and our subsidiaries may have to assume unanticipated provisions and charges. In some cases, when we and/or our subsidiaries exhaust all administrative remedies related to a tax contingency, further appeals may be filed in the judicial courts, which may require guarantees, such as the deposit of an amount equal to the amount of the charge. In some of these cases, the settlement of such charges through tax transactions or incentivized regularization programs may be a more favorable option for us and our subsidiaries, in which case we evaluate the alternatives, and make an informed decision on whether to proceed with the settlement of charges.

In addition, the Brazilian Congress may approve tax law changes that could substantially alter the Brazilian tax framework and impact our business. The tax authorities of Brazil (including the federal, state and municipal) and foreign tax authorities may also publish new legislation and/or regulation that impacts the fulfillment of tax obligations (primary and ancillary) requiring relevant efforts (human and systemic resources) by taxpayers to implement the obligations within the legal deadline. The obligation to adapt the taxpayer’s processes to the new legislation in a short time may have an adverse effect on our results and the results of our subsidiaries.

Any of these occurrences may have a material adverse effect on our financial condition and results.

1.h) Our crude oil and natural gas reserve estimates involve some degree of uncertainty, which could adversely affect our ability to generate income.

Our proved crude oil and natural gas reserves set forth in this annual report are the estimated quantities of crude oil and natural gas that geoscience and engineering data demonstrate with reasonable certainty to be economically producible from a given date forward from known reservoirs under existing economic and operating conditions according to SEC Regulation S-X, and other applicable regulations.

The reserve estimates presented are prepared based on assumptions and interpretations that are subject to risks and uncertainties. The geoscience and engineering data that we use to estimate our reserves present uncertainties that may result in differences between the expected productions in the reported reserves and those actually produced. In addition, reserve estimates may be affected by significant changes in economic conditions and climate regulations.

Technical, economic, and climate regulations uncertainties may lead to reductions in our reserve estimates and lower future productions, which may have an adverse effect on our results and financial condition.

1.i) Decommissioning projects have become more relevant in our portfolio, in addition to being subject to increasing regulatory requirements and stakeholder expectations, which may result in damage to our image and increased costs.

Decommissioning projects have become more relevant to our portfolio as concession contracts expire or production systems lose economic viability. Despite the publication of ANP Resolution 817/2020 establishing the rules for conducting the decommissioning of production systems, we may face some difficulties in defining the scope of these projects and in meeting regulatory requirements, especially due to our and the industry’s learning curve in this area, as well as the evolution of applicable regulations. Closure of operations and decommissioning can negatively impact the environment and the surrounding communities of the sites due to the processes of dismantling structures and facilities. Although our decommissioning plans have been developed in compliance with applicable law, it is possible that these plans will also face scrutiny or fail to meet stakeholder demands or expectations regarding environmental, social and governance practices. As a result, the resource demands for the projects may increase, as well as the total project and operational costs. In addition, our image and reputation may be adversely affected.

| Annual Report and Form 20-F 2024 | 35 |

|

1.j) Obligations relating to Petros and health care benefits are annually revised estimates and may diverge from future obligations due to changes in market and economic conditions, as well as changes in actuarial assumptions, which may require additional contributions to rebalance the plans.

The calculation of actuarial obligations, both for our pension plans and for our health care plan benefits, is based on estimates and actuarial assumptions, as well as on the modeling of business rules, observing the applicable regulations of each plan and the applicable law. Thus, the value of the obligations corresponds to an estimate that may change over time, as the assumptions and estimates are not confirmed.

In addition, we and Petros face risks related to supplementary pension, including a gradual increase in the longevity of the population covered, legal risks accentuating the level of benefits and risks that affect the financial assets held by Petros to cover obligations of the benefit plans sponsored by us, which may not generate the necessary returns to cover the relevant liabilities, in which case additional contributions from us and participants may be necessary, subject to the constitutional contributory parity rule.

Regarding health benefits, projected cash flows may also be impacted by the following factors:

| – | higher increase in medical costs than expected; |