NOTICE OF 2025 ANNUAL MEETING

AND PROXY STATEMENT

FOR MAY 28, 2025

☑ | Filed by the Registrant | |

¨ | Filed by a party other than the Registrant | |

CHECK THE APPROPRIATE BOX: | ||

¨ | Preliminary Proxy Statement | |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☑ | Definitive Proxy Statement | |

¨ | Definitive Additional Materials | |

¨ | Soliciting Material under §240.14a-12 | |

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||||

☑ | No fee required. | |||

¨ | Fee paid previously with preliminary materials. | |||

¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

Sincerely, | |

Phillip M. Eyler Incoming Chair of the Board of Directors | |

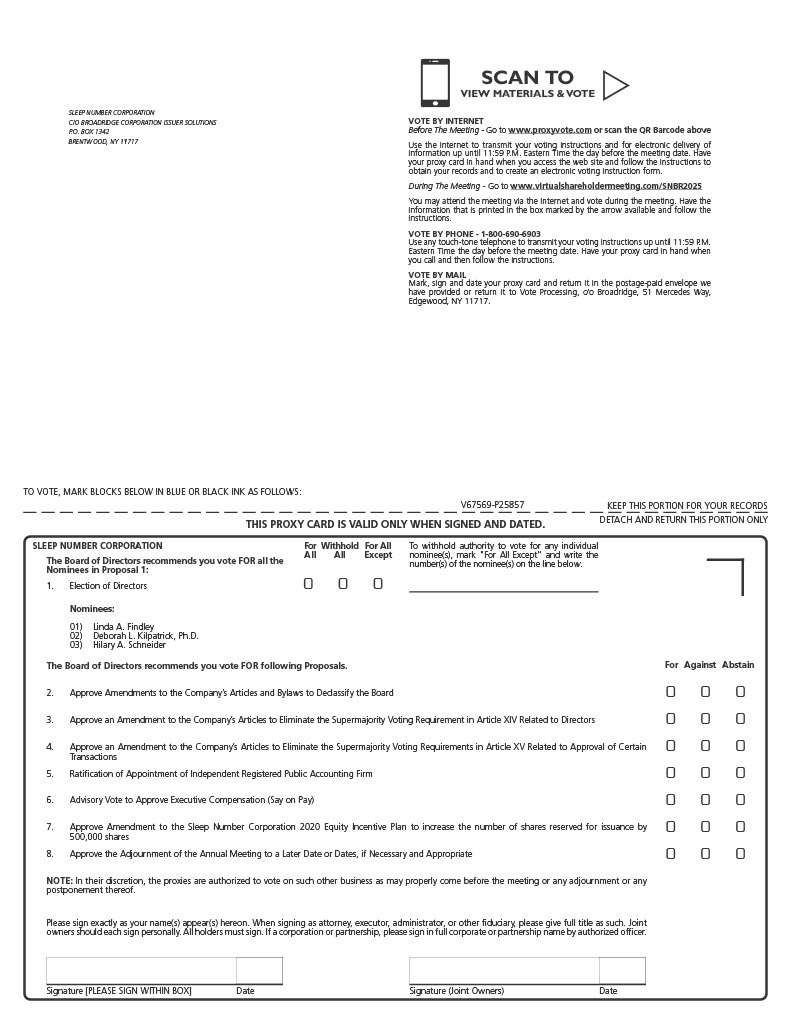

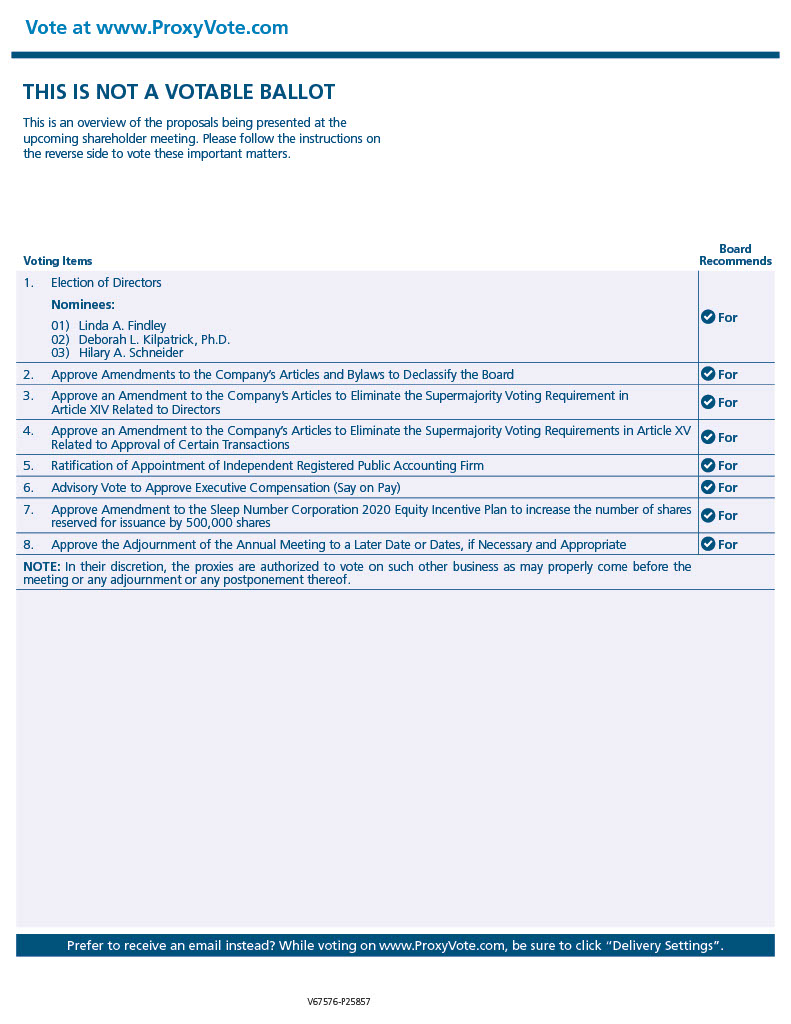

Our Board of Directors Recommends You Vote: | |||||

1.To elect as Directors the three persons named in the Proxy Statement, each to serve for a term of three years until the 2028 Annual Meeting | FOR the election of each Director nominee | ||||

2. To approve amendments to our Third Restated Articles of Incorporation, as amended, (Articles), and our Restated Bylaws (Bylaws) to declassify the Board of Directors (Board) | FOR the approval of amendments to our Articles and Bylaws to declassify the Board | ||||

3. To approve an amendment to our Articles to eliminate the supermajority voting requirement in Article XIV related to Directors | FOR the approval of an amendment to our Articles to eliminate the supermajority voting requirement in Article XIV | ||||

4. To approve an amendment to our Articles to eliminate the supermajority voting requirements in Article XV related to approval of certain transactions | FOR the approval of an amendment to our Articles to eliminate the supermajority voting requirements in Article XV | ||||

5. To ratify the appointment of Deloitte & Touche LLP as our independent auditors for the 2025 fiscal year ending January 3, 2026 | FOR the ratification of the appointment | ||||

6. To approve, on an advisory basis, our executive compensation (Say on Pay) | FOR approval, on an advisory basis, our executive compensation | ||||

7. To approve the amendment to the Sleep Number Corporation 2020 Equity Incentive Plan (2020 Plan) to increase the number of shares reserved for issuance by 500,000 shares | FOR the approval of the amendment to the 2020 Plan | ||||

8. To approve the adjournment of the Annual Meeting to a later date or dates, if necessary or appropriate, including to solicit additional proxies if there are insufficient votes for, or otherwise in connection with, one or more of the other proposals to be voted on at the Annual Meeting | FOR the approval of the adjournment of the Annual Meeting to a later date or dates, if necessary or appropriate | ||||

9. To conduct any other business properly brought before the Annual Meeting | |||||

By Order of the Board of Directors, | |

| |

Samuel R. Hellfeld | |

Chief Legal and Risk Officer and Secretary |

Page | |

1 | |

Who We Are | |

How We Are Selected, Elected and Evaluated | |

How We Are Governed and Govern | |

How You Can Communicate With The Board | |

How We Are Paid | |

OUR COMPANY | |

What We Do | |

Who We Are | |

How We Do It | |

Compensation Committee Report | |

Proposal 6 - Advisory Vote to Approve Executive Compensation (Say on Pay) | |

Proposal 7 - Amendment to the Sleep Number Corporation 2020 Equity Incentive Plan, as amended | |

Shareholder Proposals for 2026 Annual Meeting | |

Proposal 8 - Vote to Approve Adjournment of the Annual Meeting to a Later Date or Dates, if Necessary and Appropriate | |

Other Matters | |

Copies of 2024 Annual Report | |

How To Receive Proxy Materials | |

How To Receive Future Proxy Materials Electronically | |

The Company Bears The Proxy Solicitation Costs |

1 | 2025 PROXY STATEMENT | OUR BOARD | |

2 | 2025 PROXY STATEMENT | PROPOSAL 1 - ELECTION OF DIRECTORS | |

EXPERIENCE | ||||

2025 - Present | Appointed President, Chief Executive Officer and Director, Sleep Number Corporation, effective April 7, 2025 President, Chief Executive Officer and Director, Blue Apron Holdings, Inc., an ingredient and recipe meal kit company Chief Operating Officer, Etsy, Inc.. an e-commerce company Various senior executive roles at Evernote Corp., a software company, including most recently as Chief Operating Officer Various roles at Alibaba.com Ltd., an e-commerce, retail, internet and technology company | |||

2019 - 2024 | ||||

2016 - 2018 | ||||

2012 - 2015 | ||||

2009 - 2012 | ||||

PUBLIC AND PRIVATE COMPANY BOARDS | ||||

Sleep Number (since 2025) Ralph Lauren (since 2018) PRIOR PUBLIC BOARD Blue Apron Holdings, Inc. (formerly Nasdaq: APRN) (2019 – 2023) PRIVATE BOARD HeliosX (since 2025) | ||||

QUALIFICATIONS AND EXPERTISE | ||||

•Accomplished senior executive leading consumer brands that combine digital and physical products, with specific expertise in operations management, organizational transformation, marketing strategy, and global expansion •At Blue Apron, spearheaded a turnaround strategy that culminated in the company’s sale to a strategic buyer •At Etsy, oversight for global operations, product, marketing and brand strategy, customer support, and international expansion | ||||

3 | 2025 PROXY STATEMENT | PROPOSAL 1 - ELECTION OF DIRECTORS | |

| EXPERIENCE | |||

2024 - Present | Venture Partner at Sonder Capital, a venture capital firm | |||

2014 - 2024 | Executive Chair of the Board, and Chief Executive Officer, Evidation Health, a digital health company VP, Market Development and Chief Commercial Officer, CardioDx, a molecular diagnostics company Director of R&D, Director of New Ventures, and Research Fellow, Guidant Corporation (acquired by Boston Scientific, NYSE BSX), a medical device company | |||

2006 - 2014 | ||||

1998 - 2006 | ||||

PUBLIC AND PRIVATE COMPANY AND NONPROFIT BOARDS | ||||

Sleep Number (since 2018) PRIVATE AND NONPROFIT BOARDS NextGen Jane (private for profit) (since 2019) Sutter Health (not for profit integrated healthcare delivery system in California) (since 2024) Jupiter Endovascular (private, medical device company in California) (since 2024) College of Engineering Advisory Board, Georgia Tech (former Chair) (since 2004) | ||||

QUALIFICATIONS AND EXPERTISE | ||||

•Medical device, molecular diagnostic and digital health expertise and experience •At Evidation Health, commercialized a new technology platform built to refine large-scale sensor data for new digital measures of individual health •At CardioDX, commercialized a novel gene expression test in cardiovascular disease •Multiple patents in medical devices, drug delivery implant technologies •Fellow, American Institute of Medical and Biological Engineering •Digital Health Hall of Fame (UCSF); Engineering Hall of Fame (Georgia Tech) | ||||

| EXPERIENCE | |||

2020 - 2024 | Chief Executive Officer, Shutterfly, Inc., a photography, photography products and image sharing company Chief Executive Officer, WagQ Group Co., a leading on-demand mobile dog walking and dog care service Various leadership roles, including Chief Executive Officer, LifeLock, Inc., an identity theft protection company | |||

2018 - 2019 | ||||

2010 - 2017 | ||||

PUBLIC COMPANY BOARDS | ||||

Sleep Number (since 2023) DigitalOcean Holdings (since 2020) Getty Images Holdings (since 2020) Vail Resorts (since 2010) | ||||

QUALIFICATIONS AND EXPERTISE | ||||

•More than two decades of experience leading consumer technology companies •Significant digital and innovation expertise and a track record of delivering superior customer experiences •Led LifeLock through its public listing to its sale to Symantec for $2.3 billion, driving meaningful revenue growth | ||||

4 | 2025 PROXY STATEMENT | PROPOSAL 1 - ELECTION OF DIRECTORS | |

| EXPERIENCE | |||

2017 - Present | Advisor, Gentherm, a global thermal management technologies company (Dec. 2024 to Present), immediately prior President, Chief Executive Officer and board member, Gentherm (2017 to Dec. 2024) Various leadership roles culminating as President, Connected Car division, Harman International, an audio electronics company | |||

1997 - 2017 | ||||

Phillip M. Eyler Age 53 Sleep Number® setting 40 | PUBLIC COMPANY BOARDS | |||

Sleep Number (since 2022) Sensata Technologies (since 2024) PRIOR PUBLIC BOARDS Gentherm Incorporated (2017 – 2014) | ||||

QUALIFICATIONS AND EXPERTISE | ||||

•Visionary and purpose-driven leader with significant global experience in developing connected solutions that meet the needs of the increasingly digital consumer •As CEO of Gentherm, driving transformational growth in thermal and battery technology solutions for automotive and medical consumers across the globe •Served in a series of escalating leadership roles for over 20 years at Harman International, an $8 billion audio electronics company, culminating in a two-year tenure as President of its Connected Car Division | ||||

| EXPERIENCE | |||

2021 - 2023 | Most recently Chief Executive Officer, Riveron, a national accounting, finance, technology and operations company Numerous positions at Navigant Consulting, Inc., a publicly traded global professional services firm, most recently as Chief Executive Officer (2012 to 2019) and Chairman of the Board (2014 to 2019) | |||

2000 - 2019 | ||||

Julie M. Howard Age 62 Sleep Number® setting 40 | PUBLIC COMPANY BOARDS | |||

Sleep Number (since 2020) ManpowerGroup, Inc. (since 2016) PRIOR PUBLIC BOARDS Kemper Corporation (2010 – 2015) Navigant Consulting, Inc. (2012 – 2019) InnerWorkings, Inc. (2012 – 2020) | ||||

QUALIFICATIONS AND EXPERTISE | ||||

•As former CEO of Riveron and Navigant, she provides the board with significant managerial, transactional, business transformation and operational experience •Has expertise in developing global growth strategies and expansion into adjacent markets, leveraging technology and innovation •Considerable background in investor relations matters | ||||

5 | 2025 PROXY STATEMENT | PROPOSAL 1 - ELECTION OF DIRECTORS | |

| EXPERIENCE | |||

2020 - Present | Executive Chairman, LevaData, an artificial intelligence company Executive Vice President and Chief Operation Officer, HERE Technologies, a multi-national mapping, location intelligence and data services platform company Senior executive at Cisco. Prior senior supply chain, global procurement and executive roles at Palm, Inc., Gateway, Inc., Citigroup, Allied Signal Aerospace and GE | |||

2016 - 2020 | ||||

2005 - 2015 | ||||

Angel L. Mendez Age 64 Sleep Number® setting 45 | ||||

PUBLIC COMPANY BOARDS | ||||

Sleep Number (since 2022) Kinaxis, Inc. (since 2016) Peloton Interactive (since 2022) | ||||

QUALIFICATIONS AND EXPERTISE | ||||

•Decades of experience managing complex digital supply chains for large consumer technology companies •At Cisco Systems, was responsible for the company’s enterprise transformation program that reinvented the company’s business model and drove significant revenue growth and shareholder value creation •Led HERE’s core business, global operations, product management and corporate transformation | ||||

EXPERIENCE | ||||

1996 - 2008 | Various executive positions at Wolverine World Wide, Inc., a branded footwear wholesale and retailer, most recently as Executive Vice President and President of Global Operations and prior to that, Executive Vice President, Chief Financial Officer and Treasurer. | |||

PUBLIC COMPANY BOARDS | ||||

Sleep Number (since 2005) Independent Bank Corporation (since 2004) | ||||

QUALIFICATIONS AND EXPERTISE | ||||

•Spent two decades in senior financial roles of a large, publicly-traded consumer products company, where he was responsible for financial and risk management, reporting, investor relations and M&A •During his tenure as CFO of Wolverine World Wide, delivered consistent growth, margin expansion, and record earnings per share | ||||

6 | 2025 PROXY STATEMENT | PROPOSAL 1 - ELECTION OF DIRECTORS | |

| EXPERIENCE | |||

1995 - 1998 | President, Retail and Wholesale Group for Nine West Group, Inc., a designer and marketer of women’s footwear and accessories Prior roles include President of Wholesale and Manufacturing for US Shoe Corporation and 18 years in senior merchandising at Target Corporation | |||

Brenda J. Lauderback Age 74 Sleep Number® setting 70 | PUBLIC COMPANY BOARDS | |||

Sleep Number (since 2004) Denny’s Corporation (since 2005) Wolverine World Wide, Inc. (since 2003) PRIOR PUBLIC BOARDS Big Lots, Inc. (1997 – 2015) Louisiana-Pacific Corporation (2004 – 2005) Irwin Financial Corporation (1996 – 2010) Jostens, Inc. (1999 – 2000) | ||||

QUALIFICATIONS AND EXPERTISE | ||||

•Deep experience with consumer products companies, having held leadership roles in manufacturing, wholesale and merchandising at Nine West and Target •Decades of public company board experience, including in board leadership roles •Recognized by the National Association of Corporate Directors as one of the Top 100 Directors in 2017 | ||||

| EXPERIENCE | |||

2008 - 2019 | President and Chief Executive Officer, EnPro Industries, Inc., a manufacturer and provider of precision industrial components, solutions and services Chief Executive Officer, Bluelinx Holdings, Inc., a wholesale distributor of building and industrial products | |||

2005 - 2008 | ||||

Stephen E. Macadam Age 64 Sleep Number® setting 60 | PUBLIC COMPANY AND NONPROFIT BOARDS | |||

Sleep Number (since 2023) Atmus Filtration Technologies (since 2023) Louisiana-Pacific Corporation (since 2019) PRIOR PUBLIC BOARDS Veritiv Corporation (2020 – 2023) NONPROFIT BOARDS University of Kentucky, College of Engineering – Dean’s Advisory Board (since 2015) Purpose Built Communities (Nonprofit) (since 2020) | ||||

QUALIFICATIONS AND EXPERTISE | ||||

•Deep understanding of product manufacturing, distribution and procurement •Extensive leadership and operations experience growing and transforming businesses in the U.S. and globally •At EnPro, led the company’s strategic and portfolio transformation to create a more streamlined, higher-margin business | ||||

7 | 2025 PROXY STATEMENT | PROPOSAL 1 - ELECTION OF DIRECTORS | |

Michael J. Harrison Age 64 Sleep Number® setting 40 | EXPERIENCE | |||

2020 - Present | Non-Executive Chairman, Seasalt Holdings, Ltd. UK-based designer and retailer of apparel and accessories President and Chief Operating Officer of Grand Circle Corporation, overseas group leader for travelers 50+ Interim Chief Executive Officer OOFOS, recovery footwear for athletes, then as advisor on international business Various roles at Timberland including Chief Brand Officer, Co-President and SVP of Worldwide Sales and Marketing and SVP International. Prior marketing, operations and management experience at Procter & Gamble in Europe, Australia, Asia and the US | |||

2016 - 2017 | ||||

2014 - 2016 | ||||

2003 - 2012 | ||||

PUBLIC AND PRIVATE COMPANY BOARDS | ||||

Sleep Number (since 2011) PRIVATE BOARDS OOFOS (since 2016) Seasalt Holdings, Ltd. (since 2020) | ||||

QUALIFICATIONS AND EXPERTISE | ||||

•Accomplished senior executive and global brand builder in the footwear and consumer goods industries •At OOFOS, oversaw a doubling in total brand sales (US and international) during his tenure •At Timberland, was responsible for all product creation, global marketing and licensed business and led the company’s international business including expansion into China •At Procter & Gamble, led the turnaround of an acquired Japanese cosmetics subsidiary | ||||

| EXPERIENCE | |||

2008 - Present | Chair of the Board since 2022 and former President and Chief Executive Officer, Sleep Number Corporation 2012 to 2025 Prior roles at Sleep Number include EVP and Chief Operating Officer and EVP and President of Sales & Merchandising Over 25 years of prior senior executive experience at Macy’s Inc. and Target Corporation | |||

Pre-2008 | ||||

Shelly R. Ibach Age 65 Sleep Number® setting 40 | PUBLIC COMPANY AND NONPROFIT BOARDS | |||

Sleep Number (since 2012) NONPROFIT BOARD Chairperson, Minnesota chapter of American Cancer Society CEOs Against Cancer (since 2020) | ||||

QUALIFICATIONS AND EXPERTISE | ||||

•More than three decades of consumer innovation and brand leadership •Disrupted the commoditized mattress industry with smart beds and transformed Sleep Number to a sleep wellness company •Led development of the Company’s purpose-driven brand and vertically integrated business model with strong cash flow generation | ||||

8 | 2025 PROXY STATEMENT | PROPOSAL 1 - ELECTION OF DIRECTORS | |

| EXPERIENCE | |||

2013 - 2016 | Chairman, Leveraged Finance, Citigroup Global Markets Head of Leveraged Finance, Citigroup Global Markets Various leadership positions in High Yield Capital Markets at Salomon Brothers, Salomon Smith Barney and Citicorp | |||

2006 - 2013 | ||||

1985 - 2006 | ||||

Barbara R. Matas Age 64 Sleep Number® setting 30 | PUBLIC AND PRIVATE COMPANY BOARDS | |||

Sleep Number (since 2016) MidCap Financial Investment Corporation (since 2017) BRP Group (Baldwin Risk Partners) (since 2020) PRIVATE BOARD Middle Market Apollo Institutional Private Lending BDC (MMAIPL) a registered investment company under the ’40 Act (since 2024) | ||||

QUALIFICATIONS AND EXPERTISE | ||||

•More than three decades of experience advising public and private companies on corporate finance, capital allocation and capital structure •Secured and executed numerous ground-breaking transactions at Citigroup in leveraged finance and high yield capital markets •Serves on three audit committees and has extensive experience in financial reporting, accounting, risk management and internal and external audit functions | ||||

9 | 2025 PROXY STATEMENT | OUR BOARD | |

10 | 2025 PROXY STATEMENT | OUR BOARD | |

Angel Mendez | Barbara Matas(2) | Brenda Lauderback | Deb Kilpatrick | Hilary Schneider | Julie Howard | Linda Findley(1) | Michael Harrison(2) | Phillip Eyler | Shelly Ibach(2) | Stephen Gulis, Jr. | Stephen Macadam | |

CEO Experience | X | X | X | X | X | X | X | X | ||||

Executive Leadership | X | X | X | X | X | X | X | X | X | X | X | |

Current Public Company Boards (incl. Sleep Number) | 3 | 3 | 3 | 1 | 4 | 2 | 2 | 1 | 2 | 1 | 2 | 3 |

Retail and Digital Commerce | X | X | X | X | X | X | ||||||

Marketing & Brand Building | X | X | X | X | X | X | X | X | ||||

Product Innovations | X | X | X | X | X | X | X | X | ||||

Technology | X | X | X | X | X | X | X | X | ||||

Finance | X | X | X | X | X | X | X | X | X | |||

Supply Chain, Manufacturing, Logistics, Delivery | X | X | X | X | X | X | ||||||

Human Capital and Diversity, Equity & Inclusion (DEI) | X | X | X | X | X | X | X | X | X | X | ||

Information Technology and Privacy | X | X | X | X | X | X | ||||||

Cybersecurity | X | X | ||||||||||

Environmental, Social and Governance (ESG) | X | X | X | X | X | X | X | X | X | X | ||

Risk Management | X | X | X | X | X | X | X | X | X | |||

Gender Diversity | X | X | X | X | X | X | X | |||||

Racial or Ethnic Diversity | X | X |

11 | 2025 PROXY STATEMENT | OUR BOARD | |

12 | 2025 PROXY STATEMENT | OUR BOARD | |

13 | 2025 PROXY STATEMENT | OUR BOARD | |

14 | 2025 PROXY STATEMENT | OUR BOARD | |

Director* | Audit Committee | Capital Allocation and Value Enhancement Committee | Management Development and Compensation Committee | Corporate Governance and Nominating Committee | ||||

Phillip M. Eyler | X | X | ||||||

Stephen L. Gulis, Jr. | Chair | X | ||||||

Michael J. Harrison | X | |||||||

Julie M. Howard | X | X | ||||||

Deborah L. Kilpatrick, Ph.D. | X(1) | X | ||||||

Brenda J. Lauderback | Chair | |||||||

Barbara R. Matas | X | Co-Chair | X | |||||

Stephen E. Macadam | X(2) | Co-Chair | X | |||||

Angel L. Mendez | X | Chair | ||||||

Hilary A. Schneider | X | X(3) |

15 | 2025 PROXY STATEMENT | OUR BOARD | |

16 | 2025 PROXY STATEMENT | OUR BOARD | |

17 | 2025 PROXY STATEMENT | OUR BOARD | |

18 | 2025 PROXY STATEMENT | OUR BOARD | |

19 | 2025 PROXY STATEMENT | PROPOSAL 2 - VOTE TO APPROVE AN AMENDMENT TO THE COMPANY’S ARTICLES AND BYLAWS TO DECLASSIFY THE BOARD | |

20 | 2025 PROXY STATEMENT | PROPOSAL 3 - VOTE TO APPROVE AN AMENDMENT TO THE COMPANY’S ARTICLES AND BYLAWS TO ELIMINATE THE SUPERMAJORITY VOTING REQUIREMENT IN ARTICLE XIV RELATED TO DIRECTORS | |

21 | 2025 PROXY STATEMENT | PROPOSAL 4 - VOTE TO APPROVE AN AMENDMENT TO THE COMPANY’S ARTICLES TO ELIMINATE THE SUPERMAJORITY VOTING REQUIREMENT IN ARTICLE XV RELATED TO APPROVAL OF CERTAIN TRANSACTIONS | |

22 | 2025 PROXY STATEMENT | OUR BOARD | |

23 | 2025 PROXY STATEMENT | OUR BOARD | |

Name | Fees Earned or Paid in Cash ($) | Stock Awards(1) ($) | Option Awards(2) ($) | All Other Compensation ($) | Total ($) |

Daniel I. Alegre(5)(6) | $47,500 | — | — | — | $47,500 |

Phillip M. Eyler(3) | $96,500 | $83,656 | — | — | $180,156 |

Stephen L. Gulis, Jr.(3) | $115,000 | $83,656 | — | — | $198,656 |

Michael J. Harrison | $147,500 | $83,656 | — | — | $231,156 |

Julie M. Howard(3)(4) | $97,000 | $83,656 | — | — | $180,656 |

Deborah L. Kilpatrick, Ph.D.(3)(4)(5) | $96,500 | $83,656 | — | — | $180,156 |

Brenda J. Lauderback | $117,500 | $83,656 | — | — | $201,156 |

Stephen E. Macadam(3)(4) | $105,000 | $83,656 | — | — | $188,656 |

Barbara R. Matas(3)(4) | $105,000 | $83,656 | — | — | $188,656 |

Angel L. Mendez(3) | $115,000 | $83,656 | — | — | $198,656 |

Hilary A. Schneider | $97,000 | $83,656 | — | — | $180,656 |

Jean-Michel Valette(7) | — | — | — | — | — |

24| 2025 PROXY STATEMENT | OUR COMPANY | |

25| 2025 PROXY STATEMENT | OUR COMPANY | |

26| 2025 PROXY STATEMENT | OUR COMPANY | |

27 | 2025 PROXY STATEMENT | OUR COMPANY | |

28 | 2025 PROXY STATEMENT | PROPOSAL 5 - RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

29| 2025 PROXY STATEMENT | OUR COMPANY | |

2024 | 2023 | |||

Audit fees | $923,000 | $898,478 | ||

Audit-related fees | 58,520 | 1,895 | ||

Audit and audit-related fees | 981,520 | 900,373 | ||

Tax fees | 132,931 | 137,766 | ||

All other fees | — | — | ||

Total | $1,114,451 | $1,038,139 |

30 | 2025 PROXY STATEMENT | OUR PAY | |

31 | 2025 PROXY STATEMENT | OUR PAY | |

32 | 2025 PROXY STATEMENT | OUR PAY | |

Category | Description of Changes |

Proxy Statement Disclosure | We redesigned our proxy statement, including our “Compensation Discussion and Analysis” to facilitate clear and concise disclosure. |

Peer Group | Our peer group was updated in 2024 to ensure it continues to reflect our scale, industry and strategic direction as a sleep wellness company. |

Annual Incentive Plan (AIP) | We remain committed to defined and measurable AIP goals and metrics. The mid-year progress payment was been removed for the NEOs to emphasize full-year performance. A Shared Strategic Objective modifier was added to the plan to incentivize the expense reduction actions needed. These changes are described in more detail in the AIP section. |

Equity Award Mix | We eliminated the use of stock options in 2024 to reduce the dilutive impact to our equity plan. |

33 | 2025 PROXY STATEMENT | OUR PAY | |

Full-year financial results include: •Net sales of $1.7 billion (-11% vs. 2023) •Net operating profit (NOP) of $22.9 million (flat vs. 2023) •Total Operating Expense reduction of $85.7 million •Adjusted EBITDA of $119.6 million (-6% vs. 2023) •Diluted loss per share of $0.90 down from diluted loss per share of $0.68 last year •Cash provided by operating activities of $27.1 million and cash used in purchases of capital expenditures of $23.5 million •Adjusted return on invested capital (ROIC) of 7.6% •Net leverage ratio of 4.2x EBITDAR (adjusted EBITDA plus consolidated rent expense) at the end of 2024 vs. covenant maximum of 4.8x; $123.8 million of liquidity remained against current credit facility at the end of 2024 | Performance metrics in our compensation program: | |||

Long-term Incentive Plan | ||||

Net Sales growth | ||||

NOP growth | ||||

Adjusted ROIC | ||||

Share price | ||||

Annual Incentive Plan | ||||

Adjusted EBITDA | ||||

Shared Strategic Objective | ||||

34 | 2025 PROXY STATEMENT | OUR PAY | |

Element | Performance Achieved | Payout Earned |

2022 PSUs (performance period of fiscal years 2022 through 2024) | Annual growth rate achieved: - 2022: net sales -3.2% and NOP -64.9% - 2023: net sales -10.7% and NOP -58.2% - 2024: net sales -10.9% and NOP -76.4% Average difference between adjusted ROIC and WACC was 200 basis points | No payout was earned (compared to 43.1% of target for the 2021 PSUs). The 2022 PSU payout was an average of the percent of target earned by year. - 2021: 0% - 2022: 0% - 2023: 0% The ROIC modifier did not apply since no payout was earned. |

2024 AIP | Adjusted EBITDA for 2024 was $119.6 million, which was 85% of the goal for target payout. Shared Strategic Objective performance goal was exceeded and resulted in a 120% modifier. | A payout of 59.8% of target was earned. |

35 | 2025 PROXY STATEMENT | OUR PAY | |

The Aaron’s Company, Inc. Arlo Technologies, Inc. Conn’s Inc. Dolby Laboratories, Inc. Ethan Allen Interiors, Inc. HNI Corporation Inspire Medical Systems, Inc. iRobot Corporation | La-Z-Boy Incorporated Leggett & Platt, Incorporated Miller Knoll Peloton Interactive, Inc. RH Steelcase Inc. Sonos, Inc. Somnigroup International Inc. (formerly Tempur Sealy International, Inc.) |

36 | 2025 PROXY STATEMENT | OUR PAY | |

Compensation Practice | Sleep Number Policy or Practice | |

Pay for performance | Yes | A significant percentage of the total direct compensation package is performance based. |

Robust stock ownership guidelines | Yes | Executive officers and Directors are subject to stock ownership guidelines. |

Annual shareholder “Say on Pay” | Yes | We value our shareholders’ input on our executive compensation programs. Our Board of Directors seeks an annual non-binding advisory vote from shareholders to approve the executive compensation disclosed in our CD&A, tabular disclosures and related narrative of this Proxy Statement. |

Annual compensation risk assessment | Yes | A risk assessment of our compensation programs is performed on an annual basis. |

Clawback provisions | Yes | We adopted a Nasdaq-compliant Executive Clawback and Forfeiture Policy, replacing our prior clawback and forfeiture policy, that requires the Compensation Committee to seek recoupment, forfeiture or cancellation of certain compensation of our Section 16 officers, as identified by us under Item 401(b) of Regulation S-K, in the event of an accounting restatement due to the material noncompliance of the Company with any financial reporting requirements under the securities law, including any required accounting restatement to correct an error in previously issued financial statements. There is also a clawback provision in the both the time- based (RSU) and performance-based (PSU) LTI award agreements that allows for the forfeiture and recovery of LTI granted, earned, vested or paid out if the participant violates a confidentiality agreement that must be accepted as a condition of receiving the LTI award. |

Independent compensation consultant | Yes | The Compensation Committee retains an independent compensation consultant to advise on the executive compensation program and practices and assist in the benchmarking of compensation levels. |

Double-trigger vesting | Yes | If outstanding LTI grants are assumed or substituted upon a change-in-control, the vesting of the LTI grants will only be accelerated if the executive is terminated without cause or terminates with good reason within two years of the change-in- control (i.e., “double trigger vesting”). |

Hedging of Company stock | No | Directors, executive officers, director-level and above team members, and other team members designated by the Company from time to time as insiders may not directly or indirectly engage in transactions intended to hedge or offset the market value of Sleep Number common stock (Company securities) owned by them, including, but not limited to, the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds. Insiders are also prohibited from engaging in short sales of Company securities and from trading in any form of publicly traded options, such as puts, calls or other derivatives of the Company’s securities. |

Pledging of Company stock | No | Directors, executive officers, director-level and above team members, and other team members designated by the Company from time-to-time as insiders may not directly or indirectly pledge Company securities as collateral for any obligation, including purchasing Company securities on margin, holding Company securities in any account which has a margin debt balance, borrowing against any account in which Company securities are held or pledging Company securities as collateral for a loan. |

Tax gross-ups | No | We do not provide tax gross-ups to our executive officers, other than for relocation benefits that are applied consistently for all team members. |

37 | 2025 PROXY STATEMENT | OUR PAY | |

Compensation Practice | Sleep Number Policy or Practice | |

Option Award Grant Timing | No | In 2024, we adjusted our equity plan design for our executive officers in an effort to conserve shares available under the plan. Therefore, during the last completed fiscal year no options, SARs or similar option-like instruments were awarded to our executive officers or any other team member. In the past when we have granted option awards, we granted those options annually on March 15 which is generally within two weeks of when we publicly announce our financial results for the fourth quarter and full fiscal year. Our interim equity grants during the year (for example, to newly hired or promoted team members) usually occurs on the 15th day of the month following their hire. We have not intentionally timed any prior option, SARs or similar option-like equity awards to coincide with the release of material non- public information. |

LTI Grant Practices and Procedures Policy | Yes | We have a policy that documents the practices and procedures for making LTI grants to eligible team members including executive officers. This policy specifies approval procedures, timing of awards and the award formulas that determine the number of options or RSUs granted. |

Repricing of stock options | No | Our equity incentive plan does not permit repricing of stock options without shareholder approval or the granting of stock options with an exercise price below fair market value. |

Employment contracts | No | None of our NEOs has an employment contract that provides for continued employment for any period of time. |

38 | 2025 PROXY STATEMENT | OUR PAY | |

Other NEO Compensation Mix | |||

30% Base Salary | 21% Target Short-Term Incentive | 24% Target Performance Based PSUs | 24% Target Time Based RSUs |

2024 CEO Compensation Mix | |||

15% Base Salary | 21% Target Short-Term Incentive | 32% Target Performance Based PSUs | 32% Target Time Based RSUs |

39 | 2025 PROXY STATEMENT | OUR PAY | |

Name | Base Salary at March 19, 2023 (Annualized) | Base Salary at April 14, 2024 (Annualized) |

Shelly R. Ibach | $1,200,000 | $1,200,000 |

Francis Lee | $625,000 | $631,250 |

Andrea L. Bloomquist | $606,375 | $623,354 |

Melissa Barra | $595,140 | $614,482 |

Samuel R. Hellfeld | $525,000 | $549,938 |

40 | 2025 PROXY STATEMENT | OUR PAY | |

Base Salary Earned | X | AIP Target Incentive (% of Base Salary) | X | % of Target Payout (earned for adjusted EBITDA performance vs. goals) | X | Shared Strategic Objective Modifier (earned for benefits realized vs. goals) | = | AIP Annual Payout Earned |

Name | AIP Target Incentive for 2024 (% of actual base salary earned) |

Shelly R. Ibach | 140% |

Other NEOs | 70% |

41 | 2025 PROXY STATEMENT | OUR PAY | |

AIP Payout Earned (% of Target) | Annual Adjusted EBITDA Goals (in millions) | % of AOP Achieved | |

Threshold | 25% | $109.0 | 77% |

Target | 100% | $141.0 | 100% |

Maximum | 200% | $183.0 | 130% |

Run Rate Benefits Achieved | <$100M | $100-112.5M | $112.5-131M | $131-150M | $150M+ |

Modifier | 100% | 110% | 115% | 120% | 125% |

Name | 2024 Base Salary Earned | 2024 AIP Target (% of Salary) | 2024 AIP Target Incentive Opportunity | 2024 AIP Actual Payout Earned $ | 2024 Actual Payout Earned % |

Shelly R. Ibach | $1,200,000 | 140.0% | $1,680,000 | $1,004,640 | 59.8% |

Francis Lee | $629,327 | 70.0% | $440,529 | $263,436 | 59.8% |

Andrea L. Bloomquist | $618,130 | 70.0% | $432,691 | $258,749 | 59.8% |

Melissa Barra | $608,531 | 70.0% | $425,971 | $254,731 | 59.8% |

Samuel R. Hellfeld | $542,265 | 70.0% | $379,585 | $226,992 | 59.8% |

42 | 2025 PROXY STATEMENT | OUR PAY | |

Total LTI Grant Value | X | 50% | = | PSUs (Target Grant Value) | } | PSU grants only have payout value if Company performance goals are achieved; RSU value is directly tied to stock price performance |

X | 50% | = | RSUs (Grant Value) |

43 | 2025 PROXY STATEMENT | OUR PAY | |

Net Sales | NOP | ||||

2024 | Net sales annual growth each year | % of target payout earned for net sales each year | 2024 | NOP annual growth each year | % of target payout earned for NOP each year |

2025 | 2025 | ||||

2026 | 2026 | ||||

Three-year average % of target earned for net sales | Three-year average % of target earned for NOP | ||||

Overall payout: | Average of the % of target payout earned for net sales and NOP each year (equal weighting) times the target number of PSUs granted; then subject to a potential reduction of up to 20% if the difference between adjusted ROIC and WACC is below a certain threshold |

44 | 2025 PROXY STATEMENT | OUR PAY | |

Name | Annual LTI Grants during 2024 (Granted March 15, 2024) | ||||

PSU Grant Value at Target | RSU Grant Value | Total LTI Grant Value (Shares Determined Using 2023 Avg Share Price of $24.74) | Grant Date Fair Market Value (Based on Grant Date Share Price of $13.53) | ||

Shelly R. Ibach | $2,250,000 | $2,250,000 | $4,500,000 | $2,460,998 | |

Francis Lee | $600,000 | $600,000 | $1,200,000 | $656,286 | |

Andrea L. Bloomquist | $500,000 | $500,000 | $1,000,000 | $546,910 | |

Melissa Barra | $500,000 | $500,000 | $1,000,000 | $546,910 | |

Samuel R. Hellfeld(1) | $412,500 | $412,500 | $825,000 | $451,198 | |

% of Target Payout Earned | Annual Growth in Net Sales | Annual Growth in NOP | Average Difference in Basis Points Between Adjusted ROIC and WACC | % Reduction in Target Number of PSUs | ||

Threshold | 50% | 3% | 4% | 300 or more | No reduction | |

Target | 100% | 5% | 8% | 200 to 299 | -5% | |

Maximum | 200% | 12% | 16% | 100 to 199 | -10% | |

1 to 99 | -15% | |||||

0 or less | -20% |

45 | 2025 PROXY STATEMENT | OUR PAY | |

Net Sales ($M) | % Annual Growth | % of Target Earned | NOP ($M)(1) | % Annual Growth(2) | % of Target Earned | Average % of Target Earned | |

2022 | $2,114 | -3.2% | 0% | $67.9 | -64.9% | 0% | 0% |

2023 | $1,887 | -10.7% | 0% | $38.7 | -58.2% | 0% | 0% |

2024 | $1,682 | -10.9% | 0% | $22.9 | -76.4% | 0% | 0% |

Three-year average: | —% | Three-year average: | —% | —% | |||

Adjusted ROIC | WACC | Adjusted ROIC Premium in Basis Points vs. WACC | |

2022 | 17.6% | 10.1% | 750 |

2023 | 7.8% | 9.1% | -130 |

2024 | 7.6% | 7.8% | -20 |

Three-year average: | 200 | ||

46 | 2025 PROXY STATEMENT | OUR PAY | |

47 | 2025 PROXY STATEMENT | OUR PAY | |

Grant Date Fair Value of 2024 Stock and Option Awards (i.e., Summary Compensation Table Pay) | Modification Date Fair Value of Awards Modified Under Transition and Advisory Agreement | Ms. Ibach’s Total 2024 Summary Compensation Table Pay | Summary Compensation Table Pay excluding Modification Date Fair Value of Awards Modified | Difference |

$4,340,130 | $1,879,132 | $6,583,409 | $4,704,277 | (29)% |

Compensation Element | Description | Rationale |

Base Salary | Annual base salary of $1,200,000 | Provides a predictable level of income |

Annual Incentive Award | 125% of base salary (target); 25% of target (threshold); 200% of target (maximum) | Ties upside earning opportunity to Company and individual performance results |

48 | 2025 PROXY STATEMENT | OUR PAY | |

Compensation Element | Description | Rationale |

Annual Long-Term Incentive Award | Annual equity awards with a target value of $5,000,000, with normal annual grants commencing in 2026. The current mix of the annual award is comprised of performance stock units (50%) and time vested restricted stock units (50%). | Aligns Ms. Findley’s interests with those of our shareholders and motivates and rewards exceptional performance. |

Inducement Equity Grant – Time-Based RSUs with Performance Modifier | One-time RSU with Performance Modifier award of 362,057 shares. •Award vests ratably over 3 years •The final number of shares vesting may be modified based on the average closing share price for the 20-days prior to the vesting, with 100% vesting if the average share price is at or below $13.81, 125% vesting if the average share price is $30.00 and 200% vesting if the average share price is greater than or equal to $50.00. Payouts will be interpolated between the points noted above. | Aligns Ms. Findley’s interests with those of our shareholders and motivates and rewards exceptional performance. Aligns Ms. Findley’s awards with that of all other team members and the Directors by basing the number of shares granted on the share price of $13.81, the average closing price in 2024. Necessary to attract and retain a qualified leader like Ms. Findley. |

Inducement Equity Grant – Performance Share Units | 2025 PSU award of 181,028 shares. •Award cliff vests in 3 years. •Performance metrics include Net Sales and Net Operating Profit in fiscal years 2025, 2026, and 2027. •The final number of shares vesting may be modified based on the Company’s relative Total Shareholder Return (rTSR) versus the S&P 1500 Specialty Retail Index such that the award may be increased by 20% if the Company’s rTSR is within the top 25th percentile of the index, and may be decreased | |

Inducement Equity Grant – Time-Based RSUs | 2025 RSU award of 181,029 shares. •Award vests ratably over 3 years. |

49 | 2025 PROXY STATEMENT | OUR PAY | |

Compensation Element | Description | Rationale |

Inducement Cash Award | Sign-on cash bonus of $2,500,000 to be paid in three installments: first installment of $1,250,000 on April 15, 2025, the second installment of $625,000 on April 15, 2026, and the third installment of $625,000 on April 15, 2027; Ms. Findley will use the after-tax proceeds from the first installment to buy, or enter into a trading plan to buy, common stock in the open market in the Company’s next open trading window, subject to the Insider Trading Policy. | Aligns Ms. Findley’s interests with those of shareholders by requiring Ms. Findley to use the after-tax proceeds from the first installment to buy, or enter into a trading plan to buy, shares of the Company’s common stock in the open market. Necessary to attract and retain a qualified leader like Ms. Findley. |

Benefits and Perquisites | Company-provided medical dental, basic life, short-term disability, long-term disability, matched 401(k) plan, non-qualified deferred compensation plan, financial counseling, executive physical and relocation assistance. | Benefits are substantially similar to what are provided to other company employees Necessary to attract and retain a qualified leader like Ms. Findley. |

50 | 2025 PROXY STATEMENT | OUR PAY | |

51 | 2025 PROXY STATEMENT | OUR PAY | |

52 | 2025 PROXY STATEMENT | OUR PAY | |

53 | 2025 PROXY STATEMENT | OUR PAY | |

Ownership Guideline | Current Ownership(1) | |

CEO | 5 x annual base salary | 5.6 x |

Average of NEOs (other than CEO) | 3 x annual base salary | 1.6 x |

Average of Non-employee Directors | 5 x annual cash retainer | 6.4 x |

54 | 2025 PROXY STATEMENT | OUR PAY | |

Name And Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards(1)(2) ($) | Option Awards(1)(3) ($) | Non- Equity Incentive Plan Compensation(4) ($) | All Other Compensation(5) ($) | Total ($) |

Shelly R. Ibach Former President and CEO(8) | 2024 | $1,200,000 | — | $3,357,129 | $983,001 | $1,004,640 | $38,639 | $6,583,409 |

2023 | $1,200,000 | — | $3,444,144 | $1,165,494 | $420,000 | $119,553 | $6,349,191 | |

2022 | $1,189,615 | — | $4,037,198 | $1,382,187 | $— | $93,614 | $6,702,614 | |

Francis K. Lee EVP and CFO(6) | 2024 | $629,327 | — | $656,286 | $— | $263,436 | $22,298 | $1,571,347 |

2023 | $228,365 | $300,000 | $1,431,245 | $1,194,801 | $— | $10,488 | $3,164,899 | |

Andrea L. Bloomquist EVP and Chief Innovation Officer | 2024 | $618,130 | — | $546,910 | $— | $258,749 | $18,201 | $1,441,990 |

2023 | $599,712 | — | $823,038 | $278,483 | $103,783 | $18,468 | $1,823,484 | |

2022 | $571,154 | — | $750,094 | $257,343 | $0 | $17,751 | $1,596,342 | |

Melissa Barra EVP and Chief Sales and Services Officer | 2024 | $608,530 | — | $546,910 | $— | $254,731 | $26,240 | $1,436,411 |

2023 | $589,858 | — | $823,038 | $278,483 | $102,301 | $24,889 | $1,818,569 | |

2022 | $565,962 | — | $750,094 | $257,343 | $— | $20,725 | $1,594,124 | |

Samuel R. Hellfeld EVP and Chief Legal and Risk Officer(7) | 2024 | $542,265 | — | $519,552 | $— | $226,992 | $19,484 | $1,308,293 |

2023 | $519,231 | — | $685,817 | $232,112 | $89,856 | $20,243 | $1,547,259 | |

2022 | $488,115 | — | $714,639 | $196,101 | $— | $18,394 | $1,417,249 | |

55 | 2025 PROXY STATEMENT | OUR PAY | |

Name | Grant Date | Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | Estimated Future Payouts Under Equity Incentive Plan Awards | All Other Stock Awards: Number of Shares of Stock or Units (#) | All Other Option Awards: Number of Securities Under- lying Options (#) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards ($)(16) | ||||

Thresh- old ($) | Target ($) | Maxi- mum ($) | Thresh- old (#) | Target (#) | Maxi- mum (#) | ||||||

Shelly R. Ibach | $420,000 | $1,680,000 | $4,200,000 | ||||||||

3/15/24(2) | 7,549 | 90,946 | 181,892 | $1,230,499 | |||||||

3/15/24(3) | 90,946 | $1,230,499 | |||||||||

10/24/24(4)(5) | 2,645 | 31,856 | 42,465 | $146,603 | |||||||

10/24/24(4)(6) | 54,235 | $749,528 | |||||||||

10/24/24(4)(7) | 53,720 | $23.61 | $35,241 | ||||||||

10/24/24(4)(8) | 51,095 | $34.35 | $118,428 | ||||||||

10/24/24(4)(9) | 40,405 | $47.00 | $127,845 | ||||||||

10/24/24(4)(10) | 10,045 | $43.91 | $32,133 | ||||||||

10/24/24(4)(11) | 67,325 | $35.68 | $219,237 | ||||||||

10/24/24(4)(12) | 21,880 | $146.97 | $40,463 | ||||||||

10/24/24(4)(13) | 40,550 | $61.66 | $119,822 | ||||||||

10/24/24(4)(14) | 4,340 | $41.95 | $13,966 | ||||||||

10/24/24(4)(15) | 68,490 | $28.41 | $275,866 | ||||||||

Francis K. Lee | $110,132 | $440,539 | $1,101,322 | ||||||||

3/15/24(2) | 2,013 | 24,253 | 48,506 | $328,143 | |||||||

3/15/24(3) | 24,253 | $328,143 | |||||||||

Andrea L. Bloomquist | $108,173 | $432,691 | $1,081,727 | ||||||||

3/15/24(2) | 1,678 | 20,211 | 40,422 | $273,455 | |||||||

3/15/24(3) | 20,211 | $273,455 | |||||||||

Melissa Barra | $106,493 | $425,971 | $1,064,929 | ||||||||

3/15/24(2) | 1,678 | 20,211 | 40,422 | $273,455 | |||||||

3/15/24(3) | 20,211 | $273,455 | |||||||||

Samuel R. Hellfeld | $94,896 | $379,585 | $948,964 | ||||||||

3/15/24(2) | 1,384 | 16,674 | 33,348 | $225,599 | |||||||

3/15/24(3) | 21,726 | $293,953 | |||||||||

56 | 2025 PROXY STATEMENT | OUR PAY | |

57 | 2025 PROXY STATEMENT | OUR PAY | |

Option Awards | Stock Awards | |||||||

Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($)(11) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(11) |

Shelly R. Ibach | 36,575 | — | $18.81 | 3/22/2026 | — | — | — | — |

53,720 | — | $23.61 | 3/21/2027 | — | — | — | — | |

51,095 | — | $34.35 | 3/21/2028 | — | — | — | — | |

40,405 | — | $47.00 | 3/29/2029 | — | — | — | — | |

10,045 | — | $43.91 | 9/18/2029 | — | — | — | — | |

67,325 | — | $35.68 | 3/15/2030 | — | — | — | — | |

21,880 | — | $146.97 | 3/15/2031 | — | — | — | — | |

27,033 | 13,517(1) | $61.66 | 3/15/2032 | — | — | — | — | |

2,893 | 1,447(2) | $41.95 | 5/16/2032 | — | — | — | — | |

22,830 | 45,660(4) | $28.41 | 3/15/2033 | — | — | — | — | |

— | — | — | — | — | — | 121,230(5) | $1,842,696 | |

90,946(9) | $1,382,379 | |||||||

— | — | — | — | — | — | 90,946(10) | $1,382,379 | |

Francis K. Lee | 24,002 | 48,003(6) | $27.28 | 8/15/2033 | — | — | — | — |

— | — | — | — | 16,460(7) | $250,192 | — | — | |

— | — | — | — | — | — | 27,775(8) | $422,180 | |

— | — | — | — | 24,253(9) | $368,646 | — | — | |

— | — | — | — | — | — | 24,253(10) | $368,646 | |

Andrea L. Bloomquist | 2,555 | — | $34.35 | 3/21/2028 | — | — | — | — |

4,346 | — | $47.00 | 3/29/2029 | — | — | — | — | |

10,260 | — | $35.68 | 3/15/2030 | — | — | — | — | |

3,585 | — | $146.97 | 3/15/2031 | — | — | — | — | |

5,407 | 2,703(1) | $61.66 | 3/15/2032 | — | — | — | — | |

5,455 | 10,910(4) | $28.41 | 3/15/2033 | — | — | — | — | |

— | — | — | — | — | — | 28,970(5) | $440,344 | |

— | — | — | — | 20,211(9) | $307,207 | — | — | |

— | — | — | — | — | — | 20,211(10) | $307,207 | |

Melissa Barra | 3,315 | — | $33.32 | 3/16/2025 | — | — | — | — |

2,128 | — | $34.35 | 3/21/2028 | — | — | — | — | |

4,563 | — | $47.00 | 3/29/2029 | — | — | — | — | |

9,940 | — | $35.68 | 3/15/2030 | — | — | — | — | |

3,490 | — | $146.97 | 3/15/2031 | — | — | — | — | |

5,407 | 2,703(1) | $61.66 | 3/15/2032 | — | — | — | — | |

5,455 | 10,910(4) | $28.41 | 3/15/2033 | — | — | — | — | |

— | — | — | — | — | — | 28,970(5) | $440,344 | |

— | — | — | — | 20,211(9) | $307,207 | — | — | |

— | — | — | — | — | — | 20,211(10) | $307,207 | |

58 | 2025 PROXY STATEMENT | OUR PAY | |

Option Awards | Stock Awards | |||||||

Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($)(11) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(11) |

Samuel R. Hellfeld | 735 | — | $33.32 | 3/16/2025 | — | — | — | — |

2,615 | — | $18.81 | 3/22/2026 | — | — | — | — | |

1,955 | — | $23.61 | 3/21/2027 | — | — | — | — | |

1,535 | — | $34.35 | 3/21/2028 | — | — | — | — | |

3,420 | — | $36.81 | 9/20/2028 | — | — | — | — | |

4,565 | — | $47.00 | 3/29/2029 | — | — | — | — | |

5,130 | — | $35.68 | 3/15/2030 | — | — | — | — | |

2,265 | — | $146.97 | 3/15/2031 | — | — | — | — | |

4,120 | 2,060(1) | $61.66 | 3/15/2032 | — | — | — | — | |

— | — | — | — | 2,320(3) | $34,406 | — | — | |

4,547 | 9,093(4) | $28.41 | 3/15/2033 | — | — | — | — | |

— | — | — | — | — | — | 24,140(5) | $366,928 | |

— | — | — | — | 21,726(9) | $330,235 | — | — | |

— | — | — | — | — | — | 16,674(10) | $253,445 | |

59 | 2025 PROXY STATEMENT | OUR PAY | |

Option Awards | Stock Awards | |||

Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($)(1) | Number of Shares Acquired on Vesting (#)(2) | Value Realized on Vesting ($)(4) |

Shelly R. Ibach | — | — | 14,146 | $191,395 |

Francis K. Lee | — | — | 8,230 (3) | $100,159 |

Andrea L. Bloomquist | — | — | 2,319 | $31,376 |

Melissa Barra | — | — | 2,257 | $30,537 |

Samuel R. Hellfeld | — | — | 1,464 | $19,807 |

Name | Executive Contributions in Last Fiscal Year ($) | Registrant Contributions in Last Fiscal Year ($) | Aggregate Earnings (Losses) in Last Fiscal Year(1) ($) | Aggregate Withdrawals/ Distributions ($) | Aggregate Balance at Last Fiscal Year-End(2) ($) |

Shelly R. Ibach | — | — | $946,143 | — | $11,253,862 |

Francis Lee | — | — | — | — | — |

Andrea L. Bloomquist | — | — | $45,434 | $(293,321) | $345,171 |

Melissa Barra | — | — | — | — | — |

Samuel R. Hellfeld | — | — | — | — | — |

60 | 2025 PROXY STATEMENT | OUR PAY | |

61 | 2025 PROXY STATEMENT | OUR PAY | |

Triggering Events | ||||||

Name | Type of Payment | Voluntary Termination ($) | For Cause Termination ($) | Involuntary Termination (No Change in Control) ($) | Involuntary Termination (Following Change in Control)(1) ($) | Death or Disability ($) |

Shelly R. Ibach | Cash Severance(2) | — | — | $5,778,000 | $8,658,000 | — |

Option Award Acceleration(3) | — | — | — | — | — | |

Stock Award Acceleration(4) | $2,187,782 | — | $2,187,782 | $3,993,846 | $3,993,846 | |

Benefit Reimbursement(5) | — | — | $13,811 | $13,811 | — | |

Total | $2,187,782 | — | $7,979,593 | $12,665,657 | $3,993,846 | |

Francis K. Lee | Cash Severance(2) | — | — | $1,085,625 | $2,158,750 | — |

Option Award Acceleration(3) | — | — | — | — | — | |

Stock Award Acceleration(4) | — | — | — | $1,269,078 | $1,269,078 | |

Benefit Reimbursement(5) | — | — | $19,093 | $19,093 | — | |

Total | — | — | $1,104,718 | $3,446,921 | $1,269,078 | |

Andrea L. Bloomquist | Cash Severance(2) | — | — | $1,072,202 | $2,131,904 | — |

Option Award Acceleration(3) | — | — | — | — | — | |

Stock Award Acceleration(4) | $585,975 | — | $585,975 | $908,124 | $908,124 | |

Benefit Reimbursement(5) | — | — | — | — | — | |

Total | $585,975 | — | $1,658,177 | $3,040,028 | $908,124 | |

Melissa Barra | Cash Severance(2) | — | — | $1,057,119 | $2,101,739 | — |

Option Award Acceleration(3) | — | — | — | — | — | |

Stock Award Acceleration(4) | — | — | — | $908,124 | $908,124 | |

Benefit Reimbursement(5) | — | — | $13,563 | $13,563 | — | |

Total | — | — | $1,070,682 | $3,023,426 | $908,124 | |

Samuel R. Hellfeld | Cash Severance(2) | — | — | $947,395 | $1,882,289 | — |

Option Award Acceleration(3) | — | — | — | — | — | |

Stock Award Acceleration(4) | — | — | — | $863,694 | $863,694 | |

Benefit Reimbursement(5) | — | — | $19,191 | $19,191 | — | |

Total | — | — | $966,586 | $2,765,174 | $863,694 | |

62 | 2025 PROXY STATEMENT | OUR PAY | |

63 | 2025 PROXY STATEMENT | OUR PAY | |

Year | Summary Compensation Table Total for CEO(1) | Compensation Actually Paid to CEO(2) | Average Summary Compensation Table Total for Other NEOs(1)(3) | Average Compensation Actually Paid to Other NEOs(2)(3) | Value of Initial Fixed $100 Investment Based On:(4) | Net (Loss) Income ($ millions)(5) | Net Sales Growth(6) | |

Sleep Number Total Shareholder Return | S&P 400 Specialty Stores Index Total Shareholder Return | |||||||

2024 | $ | $ | $ | $ | $ | $ | $( | ( |

2023 | $ | $ | $ | $ | $ | $ | $( | ( |

2022 | $ | $( | $ | $( | $ | $ | $ | ( |

2021 | $ | $ | $ | $ | $ | $ | $ | |

2020 | $ | $ | $ | $ | $ | $ | $ | |

64 | 2025 PROXY STATEMENT | OUR PAY | |

Year | Summary Compensation Table Total | Deduct: Amounts Reported in the Summary Compensation Table for Stock and Option Awards | Add: Value of Awards Granted During the Year, Outstanding and Unvested at Year-end | Add: Change in Value of Awards Granted in Any Prior Year, Outstanding and Unvested at Year- End | Add: Value of Awards Granted and Vested in the Same Year | Add: Change in Value of Awards Granted in Any Prior Year, Vested During the Year | Estimated Compensation Actually Paid (CAP)(1) |

CEO | |||||||

2024 | $ | $( | $ | $( | $ | $( | $ |

2023 | $ | $( | $ | $( | $ | $ | $ |

2022 | $ | $( | $ | $( | $ | $( | $( |

2021 | $ | $( | $ | $( | $ | $ | $ |

2020 | $ | $( | $ | $ | $ | $( | $ |

Average for Other NEOs | |||||||

2024 | $ | $( | $ | $( | $ | $( | $ |

2023 | $ | $( | $ | $( | $ | $ | $ |

2022 | $ | $( | $ | $( | $ | $( | $( |

2021 | $ | $( | $ | $( | $ | $ | $ |

2020 | $ | $( | $ | $ | $ | $( | $ |

65 | 2025 PROXY STATEMENT | OUR PAY | |

Metric | How This Metric Influences Pay |

This is one of two key measures in our PSU design. Half of the PSU payout opportunity is to tied to our achievement of annual growth goals for net sales over a three year period. | |

This is one of two key measures in our PSU design. Half of the PSU payout opportunity is tied to our achievement of annual growth goals for NOP over a three year period. | |

There is an ROIC modifier in our PSU design. This potential reduction in the number of target PSUs applies if the average difference between Adjusted ROIC and WACC is below a certain threshold. | |

This is the only measure in our AIP design. The AIP payout opportunity is tied to our achievement of fiscal year goals for Adjusted EBITDA. | |

Stock options require share price appreciation above the exercise price in order to have any value. The value of PSUs earned and paid out also depends on share price. |

66 | 2025 PROXY STATEMENT | PROPOSAL 6 - ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION | |

67 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

68 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

69 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

70 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

(all data as of March 17, 2025) | |

New Shares Requested | 500,000 |

Shares Remaining Available for Issuance Under 2020 Plan | 1,021,916 |

Common Shares Outstanding | 22,567,075 |

Stock Options/SARs Outstanding | 927,064 |

Weighted-Average Exercise Price of Outstanding Stock Options/SARs | $40.99 |

Weighted-Average Remaining Term of Outstanding Stock Options/SARS | 5.4 |

Total Stock-Settled Full-Value Awards Outstanding | 2,242,748 |

2024 | 2023 | 2022 | 3-Year Average | |

Stock Options/Stock Appreciation Rights (SARs) Granted | — | 305,000 | 148,000 | |

Stock-Settled Time-Vested Restricted Shares/Units Granted | 674,000 | 304,000 | 189,000 | |

Stock-Settled Performance-Based Shares/ Units Vested | 45,000 | 201,000 | 251,000 | |

Weighted-Average Basic Common Shares Outstanding | 22,606,000 | 22,429,000 | 22,396,000 | |

Share Usage Rate | 3.2% | 3.6% | 2.6% | 3.1% |

Stock Options/SARs Outstanding | 942,102 |

Weighted-Average Exercise Price of Outstanding Stock Options/SARs | $40.85 |

Weighted-Average Remaining Term of Outstanding Stock Options/SARS | 5.6 years |

Total Stock-Settled Full-Value Awards Outstanding | 1,685,285 |

Share reserve under the 2020 Plan | 4,740,000 |

Proposed Amended Share reserve under the 2020 Plan | 5,240,000 |

71 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

72 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

73 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

74 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

75 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

76 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

77 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

78 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

79 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

80 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

Name and Position | Number of Shares Underlying Stock Options | Target Number of PSUs | Number of Shares Underlying RSUs |

Shelly Ibach, President and CEO | 135,260 | 312,656 | 90,946 |

Francis Lee, EVP, CFO | 72,005 | 52,028 | 48,943 |

Andrea Bloomquist, EVP, Chief Innovation Officer | 28,060 | 66,726 | 20,211 |

Melissa Barra, EVP, Chief Sales and Services Officer | 27,965 | 66,581 | 20,211 |

Samuel Hellfeld, EVP, Chief Legal and Risk Officer | 22,085 | 53,479 | 24,046 |

Executive Group | 357,000 | 704,983 | 255,287 |

Non-Employee Director Group | 63,996 | — | 163,418 |

All Other Employee Group | 112,910 | 265,042 | 862,320 |

81 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

82 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

83 | 2025 PROXY STATEMENT | PROPOSAL 7 - VOTE TO APPROVE AMENDMENT TO 2020 EQUITY INCENTIVE PLAN, AS AMENDED | |

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights(1) (a) | Weighted average exercise price of outstanding options, warrants and rights(3) (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))(4) (c) | ||

Equity compensation plans approved by security holders | 2,627,387 | (2) | $40.85 | 2,191,695 | |

Equity compensation plans not approved by security holders | None | Not applicable | None | ||

Total | 2,627,387 | $40.85 | 2,191,695 |

84 | 2025 PROXY STATEMENT | OUR SHAREHOLDERS | |

Title of Class | Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership(2)(3) | Percent of Class |

Common Stock | Melissa Barra | 113,578 | * |

Common Stock | Andrea L. Bloomquist | 134,121 | * |

Common Stock | Phillip M. Eyler(4) | 11,500 | * |

Common Stock | Stephen L. Gulis, Jr.(4) | 90,547 | * |

Common Stock | Michael J. Harrison | 63,595 | * |

Common Stock | Samuel R. Hellfeld | 74,494 | * |

Common Stock | Julie M. Howard(4) | 35,928 | * |

Common Stock | Shelly R. Ibach | 781,634 | 3.4% |

Common Stock | Deborah L. Kilpatrick, Ph.D.(4) | 35,747 | * |

Common Stock | Brenda J. Lauderback(4) | 54,638 | * |

Common Stock | Francis K. Lee | 37,317 | * |

Common Stock | Stephen E. Macadam(4) | 105,861 | * |

Common Stock | Barbara R. Matas(4) | 60,561 | * |

Common Stock | Angel L. Mendez(4) | 11,500 | * |

Common Stock | Hilary A. Schneider | 6,645 | * |

Common Stock | All Directors and executive officers as a group (18 persons)(5) | 1,757,658 | 7.5% |

Common Stock | Stadium Capital Management LLC(6) 199 Elm Street New Canaan, CT 06840 | 2,616,459 | 11.7% |

Common Stock | BlackRock, Inc.(7) 55 East 52nd Street New York, New York 10055 | 1,705,239 | 7.6% |

Common Stock | The Vanguard Group, Inc.(8) 100 Vanguard Blvd. Malvern, Pennsylvania 19355 | 1,246,460 | 5.6% |

85 | 2025 PROXY STATEMENT | OUR SHAREHOLDERS | |

86 | 2025 PROXY STATEMENT | OUR SHAREHOLDERS | |

87 | 2025 PROXY STATEMENT | PROPOSAL 8 - VOTE TO APPROVE ADJOURNMENT OF THE ANNUAL MEETING | |

88 | 2025 PROXY STATEMENT | OUR ANNUAL MEETING AND VOTING | |

89 | 2025 PROXY STATEMENT | OUR ANNUAL MEETING AND VOTING | |

90 | 2025 PROXY STATEMENT | OUR ANNUAL MEETING AND VOTING | |

91 | 2025 PROXY STATEMENT | OUR ANNUAL MEETING AND VOTING | |

92 | 2025 PROXY STATEMENT | OUR ANNUAL MEETING AND VOTING | |

Proposal | Votes Required | Effect of Votes Withheld / Abstentions | Effect of Broker Non-Votes | |||

Proposal 1: Election of Directors | For uncontested elections, affirmative vote of the holders of a majority of the shares of common stock represented and entitled to vote in person or by proxy on such action. | In this contested election, votes withheld will have no effect. | Broker non-votes will have no effect. | |||

Proposal 2: Amendments of our Articles and Bylaws to Declassify the Board | Affirmative vote of two- thirds of the shares of common stock outstanding as of the Record Date for the Annual Meeting. | Abstentions will have the effect of a vote against the proposal. | Broker non-votes will have the effect of a vote against the proposal. | |||

Proposal 3: Amendment to our Articles to Eliminate the Supermajority Voting Requirements in Article XIV | Affirmative vote of two- thirds of the shares of common stock outstanding as of the Record Date for the Annual Meeting. | Abstentions will have the effect of a vote against the proposal. | Broker non-votes will have the effect of a vote against the proposal. | |||

Proposal 4: Amendment to our Articles to Eliminate the Supermajority Voting Requirements in Article XIV | Affirmative vote of two- thirds of the shares of common stock outstanding as of the Record Date for the Annual Meeting. | Abstentions will have the effect of a vote against the proposal. | Broker non-votes will have the effect of a vote against the proposal. | |||

Proposal 5: Appointment of Independent Auditors(1) | Affirmative vote of the holders of a majority of the shares of common stock represented and entitled to vote in person or by proxy on such action. | Abstentions will have the effect of a vote against the proposal. | We do not expect any broker non-votes on this proposal. | |||

Proposal 6: Executive Compensation(1) | Affirmative vote of the holders of a majority of the shares of common stock represented and entitled to vote in person or by proxy on such action. | Abstentions will have the effect of a vote against the proposal. | Broker non-votes will have no effect. | |||

Proposal 7: Amendment to the 2020 Plan | Affirmative vote of the holders of a majority of the shares of common stock represented and entitled to vote in person or by proxy on such action. | Abstention will have the effect of a vote against the proposal. | Broker non-votes will have no effect. | |||

Proposal 8: Adjournment of the Annual Meeting to a later date or dates, if necessary or appropriate | Affirmative vote of the holders of a majority of the shares of common stock represented and entitled to vote in person or by proxy on such action. | Abstentions will have the effect of a vote against the proposal. | We do not expect any broker non-votes on this proposal. |

93 | 2025 PROXY STATEMENT | OUR ANNUAL MEETING AND VOTING | |

94 | 2025 PROXY STATEMENT | OUR ANNUAL MEETING AND VOTING | |

95 | 2025 PROXY STATEMENT | OUR ANNUAL MEETING AND VOTING | |

By Order of the Board of Directors | |

| |

Samuel R. Hellfeld | |

Chief Legal and Risk Officer and Secretary |

96 | 2025 PROXY STATEMENT | APPENDIX A | |

97 | 2025 PROXY STATEMENT | APPENDIX A | |

98 | 2025 PROXY STATEMENT | APPENDIX B | |

99 | 2025 PROXY STATEMENT | APPENDIX C | |

100 | 2025 PROXY STATEMENT | APPENDIX D | |