DISCLAIMER

PT Telkom Indonesia (Persero) Tbk has published this Report as a form of transparency and accountability to present material data and information for our stakeholders. In general, the contents of this Report are derived from internal analysis as well as credible document sources and trustworthy sources. Some parts of this Report contain data and information that are forward-looking statements such as targets, expectations, forecasts, estimates, prospects, or projections of Telkom's future operational performance and business conditions. Before being presented in this Report, Telkom has carefully considered the data and information.

However, Telkom understands that risks and uncertainties that are caused by several factors, such as changes in the economic, social, and political conditions in Indonesia may affect future operational performance and business conditions. Consequently, Telkom would like to remind readers that Telkom cannot guarantee that the data and information that comprise this Report’s forward-looking statements are true, accurate, and can be fulfilled entirely.

In addition to publishing this Report, Telkom as a company listed on the New York Stock Exchange (NYSE) is also required to submit SEC Form 20-F as Annual Report to the Securities and Exchange Commission (SEC). Therefore, some of the information in the 2024 Annual Report can also be found in the SEC Form 20-F, although the two Reports are not the same.

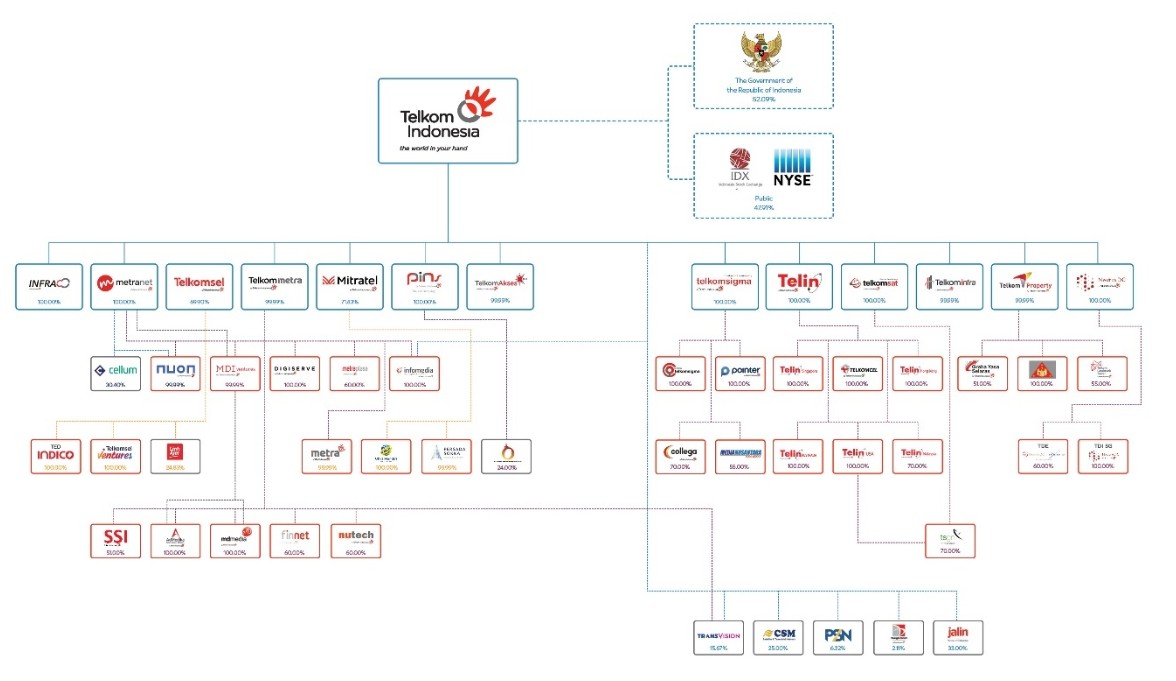

The terms of “Telkom” and Company in this Report refer to the parent entity, while the terms of “Telkom and Subsidiaries” or “Telkom and Subsidiaries” or “TelkomGroup” refer to the parent company and its subsidiaries and affiliated entities together. However, the use of the term “Telkom” does not exclude subsidiaries and affiliates from the scope of the contents and discussion of the Report. For the convenience of stakeholders, the electronic document of this 2024 Annual Report can be accessed and downloaded through http://www.telkom.co.id or by scanning the following QR code:

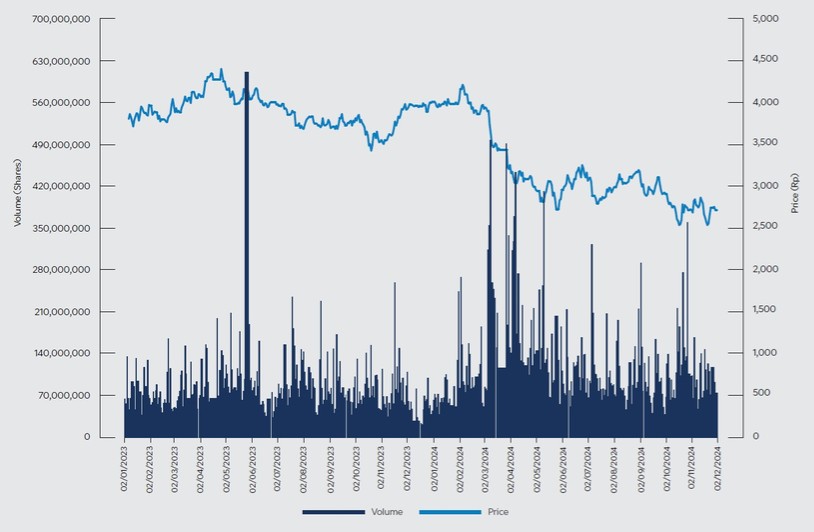

IDX Ticker | : TLKM |

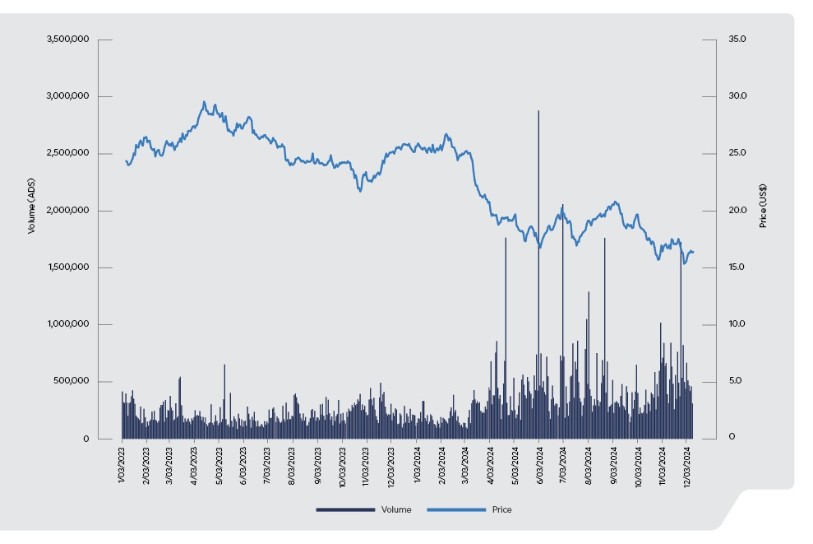

NYSE Ticker | : TLK |

Telkom stakeholders can submit questions and suggestions to:

Investor Relations Unit

PT Telkom Indonesia (Persero) Tbk

The Telkom Hub, Telkom Landmark Tower 51st Floor

Jl. Jend. Gatot Subroto Kav. 52, Jakarta 12710, Indonesia

Phone | : (6221) 521 5109 |

Facsimile | : (6221) 522 0500 |

: investor@telkom.co.id | |

: TelkomIndonesia | |

: telkomindonesia | |

Twitter/X | : @telkomindonesia |

4

[

[